Analysis of the Prediction and Influencing Mechanism for Bitcoin

Price

Minglei Lyu

Department of Applied Economics, Beijing Normal University-Hong Kong

Baptist University United International College, Zhuhai, China

Keywords: Cryptocurrency, Blockchain, Bitcoin Price.

Abstract: As a matter of fact, with the rapid development of information technology, cryptocurrency has become a

common tool for investment. Under the dramatically fluctuations markets globally, the cryptocurrency prices

have been changed with a huge volatility. Among which, Bitcoin is the currency with the largest assets, also

fluctuate significantly. With this in mind, this study will evaluate and estimate the influencing factors for

Bitcoin prices. To be specific, the hedge and support mechanism for price of Bitcoin will be discussed and

evaluated. In the meantime, the Autoregressive Integrated Moving Average (ARIMA) model is adopted in

order to show the price trend prediction. In addition, the correlation analysis is adopted in order to find the

intrinsic connections between other issues and cases. At the same time, the limitations and prospects will be

demonstrated as well according to the analysis. Overall, these results shed light on guiding further exploration

of Bitcoin pricing as well as provide a guideline for analysis of the inherit price for Bitcoin.

1 INTRODUCTION

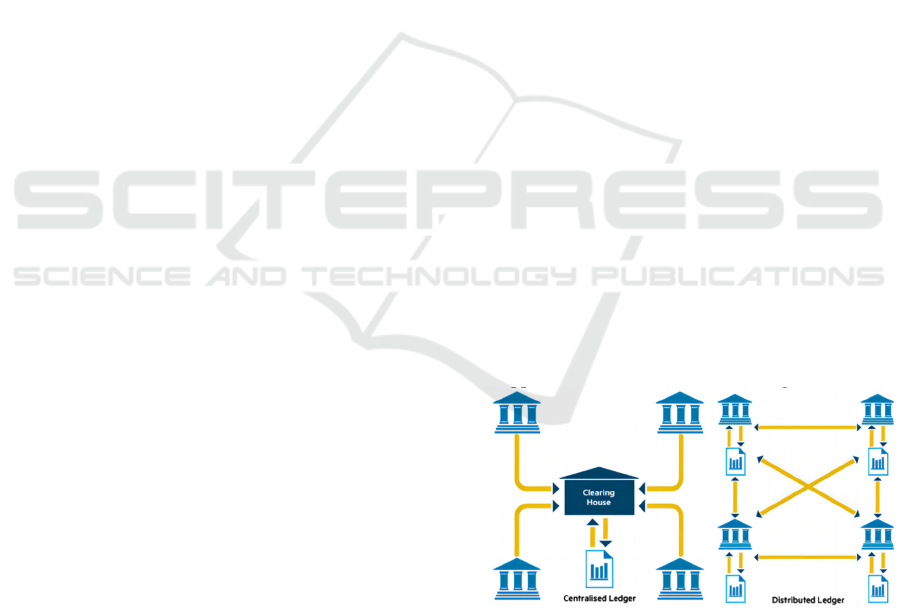

Cryptocurrency, including Bitcoin, is constructed

based on the blockchain system, and the blockchain

system has also evolved since its inception, now

serving as the foundation of various decentralized

applications beyond cryptocurrency. Blockchain is a

distributed and decentralized ledger technology (DLT)

to record and memorize the transactions across

networks, in a transparent, secure, and immutable

way. Every block inside the blockchain system

contain a series of transactions, these blocks are

cryptographically linked, ensuring its data integrity.

This contributes to the protection of information

transactions' confidentiality and integrity, which form

the basis of the Blockchain system. Because

blockchain systems are inherently decentralized,

there is no longer a need for middlemen, which

lowers costs and improves transaction efficiency and

speed (Wang et al., 2019).

Blockchain's progress has improved its adaptability to

smart contract applications in recent years, this

ensures the possibility of decentralized autonomous

organizations (DAOs), which function without

centralized control (Buterin, 2014). This

development highlights blockchain's potential in trust

less settings, where codes take the role of

conventional centralized organizations (Swan, 2015).

A sketch is shown in Figure. 1 (Santander, 2015).

Blockchain is therefore developing into the essential

infrastructure for the digital economy, driving

innovation in fields that demand efficiency, safety,

and transparency (Yermack, 2017). This accelerates

the application of blockchain technologies.

Figure 1: Blockchain Operation Process (Santander, 2015).

Web3 is the next generation of the internet,

transitioning from centralized control to a

decentralized and user-centric model. In this system,

the users can control their digital identities, assets and

data facilitated by decentralized applications (dApps).

The fundamental principles of Web3 include

decentralization, privacy, and interoperability, which

476

Lyu, M.

Analysis of the Prediction and Influencing Mechanism for Bitcoin Price.

DOI: 10.5220/0013269000004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 476-483

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

is highly connected to the spirit of blockchain. Web3

is the future shape of internet, breaking the monopoly

of information and resources, fostering, and

promoting a more inclusive and equitable internet

where the users are the core of this system.

Bitcoin operates on blockchain, consensus

mechanisms such as Proof of Work (PoW) or Proof

of Stake (PoS) are utilized to validate transactions.

PoW, particularly, is important to Bitcoin’s operation,

as it requires miners to solve mathematical puzzles to

validate transactions, known as mining for this

process. The miners compete to solve the puzzles and

the first to do so will be rewarded newly minted

Bitcoin. This process requires energy especially

electricity, so the costs of mining may fluctuate

significantly. The fluctuations in mining costs could

be affected by energy cost and technology

advancement, the overall changes directly impact the

prices of Bitcoins. So, knowing exactly how mining

costs evolve is crucial for analysing Bitcoin's cost-

support price.

This study is based on the existing research, using

the Bitcoin mining output model to forecast the future

mining cost and its impacts for Bitcoin’s pricing. The

halving event of Bitcoin mining output in 2024 is a

pivotal moment in the cryptocurrency’s economic

cycle. The Block Reward for miners will be reduced

from 6.25 per block to 3.125 per block. Historically,

each halving event can cause significant increase in

Bitcoin’s price, driven by the reduction in supply and

increase in demand (Narayanan et al., 2016). For

instance, in 2012, the first halving caused a price

increase of 8000% in a span of 12 months, while the

second and third halving led to price increases of

2900% and 600%, respectively. These trends

demonstrated the robust relationship between Bitcoin

price increases and halving, which gave this study

considerable inspiration. By examining the potential

changes in mining output and costs, this study aims to

make contribution to the existing literature on

Bitcoin’s economic model. In addition, this study

similarly seeks to explore the correlation between

Bitcoin and traditional assets such as stocks and gold,

and thus explore the broader implications of these

changes to provide more informed recommendations

for diversification and asset allocation in conjunction

with changes in the cost of Bitcoin.

The framework for this study will involve two key

analytical approaches. First, an Autoregressive

Integrated Moving Average (ARIMA) time series

model is employed to predict future bitcoin mining

output, considering factors such as network difficulty

and hash rates. The model is well suited to capturing

the temporal dynamics of bitcoin mining and provides

a solid basis for predicting future changes in output.

Second, Spearman rank correlation coefficients will

be used to assess the relationship between Bitcoin and

traditional assets, providing more insight into how

Bitcoin's price movements align or deviate from more

mature markets. By integrating these methods and

validating the data, this study aims to

comprehensively analyse the future status and role of

Bitcoin, especially in the context of 2024 halving

event.

2 DATA AND METHOD

This part illustrates all the models used in this paper,

including Bitcoin mining output model; ARIMA

model and Spearman's rank correlation coefficient.

Previous scholars have developed a model of Bitcoin

mining output, his research established a model of

Bitcoin mining output (Hayes, 2015). By measuring

the relationship between various factors and time that

affect Bitcoin mining output, a more accurate cost-

support price could be predicted:

𝐵𝑇𝐶 𝑚𝑖𝑛𝑖𝑛𝑔 𝑜𝑢𝑡𝑝𝑢𝑡 / 𝐷𝑎𝑦 = 𝜃(

) (1)

Here, β is the block reward in BTC/block; δ is the

mining difficulty in GH/block; ρ is the hash rate used

by miners in TH/s and θ is a constant used to convert

hash arithmetic to expected daily bitcoin production.

This model takes Block reward, mining difficulty

and hash rates as the factors of Bitcoin mining

production, these factors serve as vital tools for

understanding the dynamic nature of Bitcoin mining,

especially in a volatile market environment. In the

following calculation process, this study will use this

model to estimate the daily output of Bitcoin mining,

then calculate and fit the future change in mining

support costs with the Bitcoin halving cycle. The

ARIMA model, is a commonly used in time featured

analysis. Its general form can be expressed as:

𝑌

= 𝑐 + 𝜑

𝑌

+ 𝜑

𝑌

+ ⋯ + 𝜑

𝑌

+

𝜃

𝜖

+ 𝜃

𝜖

+ ⋯ + 𝜃

𝜖

+ 𝜖

(2)

This research uses an ARIMA model to analyze

datasets on Bitcoin mining costs. The model is used

to understand historical trends and make predictions

about future mining costs. The model using process

involves:

Selecting a simplified ARIMA model based on

data characteristics and preprocessing results

Determining model parameters through analysis

of ACF and PACF

Estimating parameters using maximum

likelihood and confirming significance through

statistical tests

Analysis of the Prediction and Influencing Mechanism for Bitcoin Price

477

Assessing model fit using AIC and BIC criteria

Verifying residual white noise properties with

the Ljung-Box Q test

Generating forecasts for future Bitcoin mining

output

The Spearman's rank correlation coefficient,

denoted by the Greek letter ρ, is a non-parametric

measure used to assess the strength and direction of

association between two ranked variables. The

formula can be expressed as:

𝜌

=1−

(

)

(3)

Spearman's correlation is chosen for its ability to

capture monotonic relationships without assuming

linearity. So, this research utilizes Spearman's rank

correlation coefficient to assess the relationship

between Bitcoin and traditional assets (NASDAQ and

Gold). This analysis is conducted over the entire

study period and examine how correlations evolve

over time.

This study collected two distinct datasets to

investigate Bitcoin mining costs changes through

time and the relationship between Bitcoin prices with

traditional assets like gold and stocks. The quarterly

data from January 2016 to July 2024 are collected,

containing 35 datasets spanning 8 years. For each

quarterly data, there is less variation in internal

changes, so one collects data every three months to

ensure the continuity and reliability of the relevant

data. The datasets include the following variables

including block reward; Hash Rate (TH/S); Mining

Difficulty (GH/S); Bitcoin price ($); Actual Mining

cost of Bitcoin ($); Actual Total Cost; Estimated

Mining Cost; Ratio (Mining cost/Price) and Error

Ratio (Estimated/Real Cost). Data sources include

coinwards.com for hash rate, mining difficulty and

block reward, Binance.com for Bitcoin price, and

macromicro.com for actual mining cost of Bitcoin

and the actual mining output of Bitcoin. This dataset

will be used to examine the model of (Hayes, 2015),

and then to predict the Bitcoin mining cost in the

future, trying to provide supportive data for Bitcoin

price analysis.

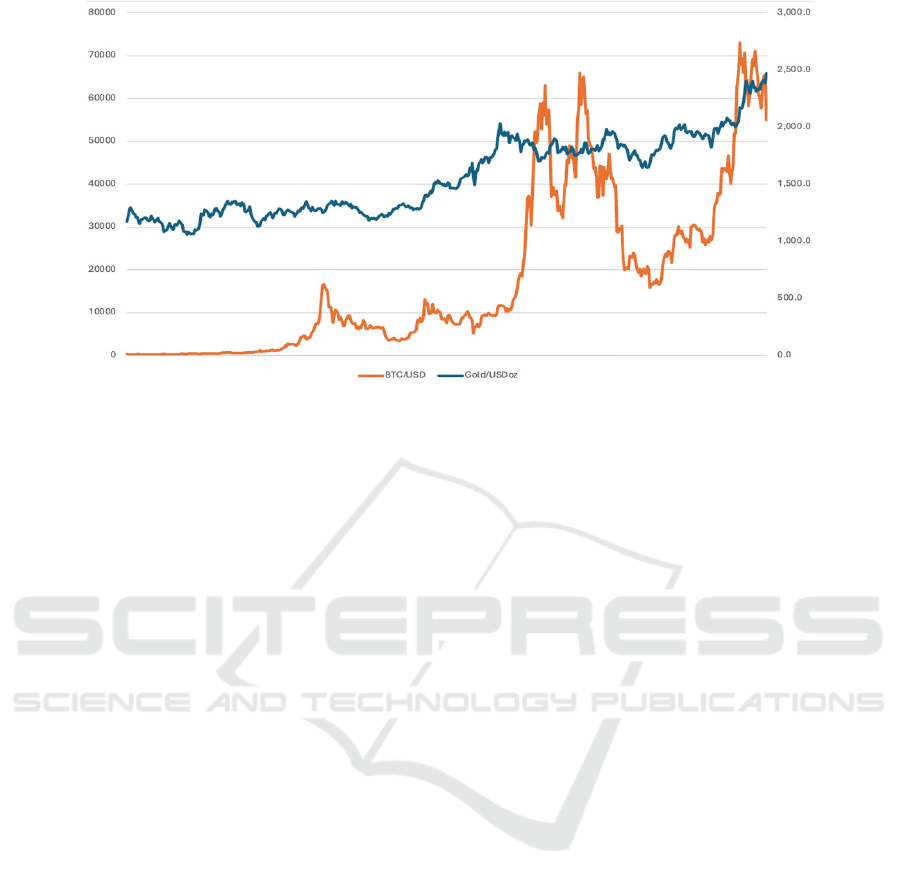

To analyze the relationship between Bitcoin and

traditional assets, one collected weekly data from

January 2015 to July 2014, encompassing Bitcoin

Price ($); NASDAQ Composite Index and Gold Spot

Price ($/oz). The data was sourced from

Yahoofinance.com for Bitcoin/USD prices and

NASDAQ Composite Index and World Gold Council

for Gold prices. These datasets comprise

approximately 500 weekly observations. Figure. 2

and Figure. 3 show the normalized weekly price

trends of Bitcoin, NASDAQ, and Gold, sourced from

Tradingview.com. These datasets will be used for

Spearman correlation analysis to find the relationship

of Bitcoin and traditional assets and trying to find

opportunities for Bitcoin to hedge and to inform asset

allocation recommendations.

Figure 2: BTC & NASDAQ (Photo/Picture credit: Original).

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

478

Figure 3: BTC&GOLD (Photo/Picture credit: Original).

3 RESULTS AND DISCUSSION

3.1 ARIMA MODEL

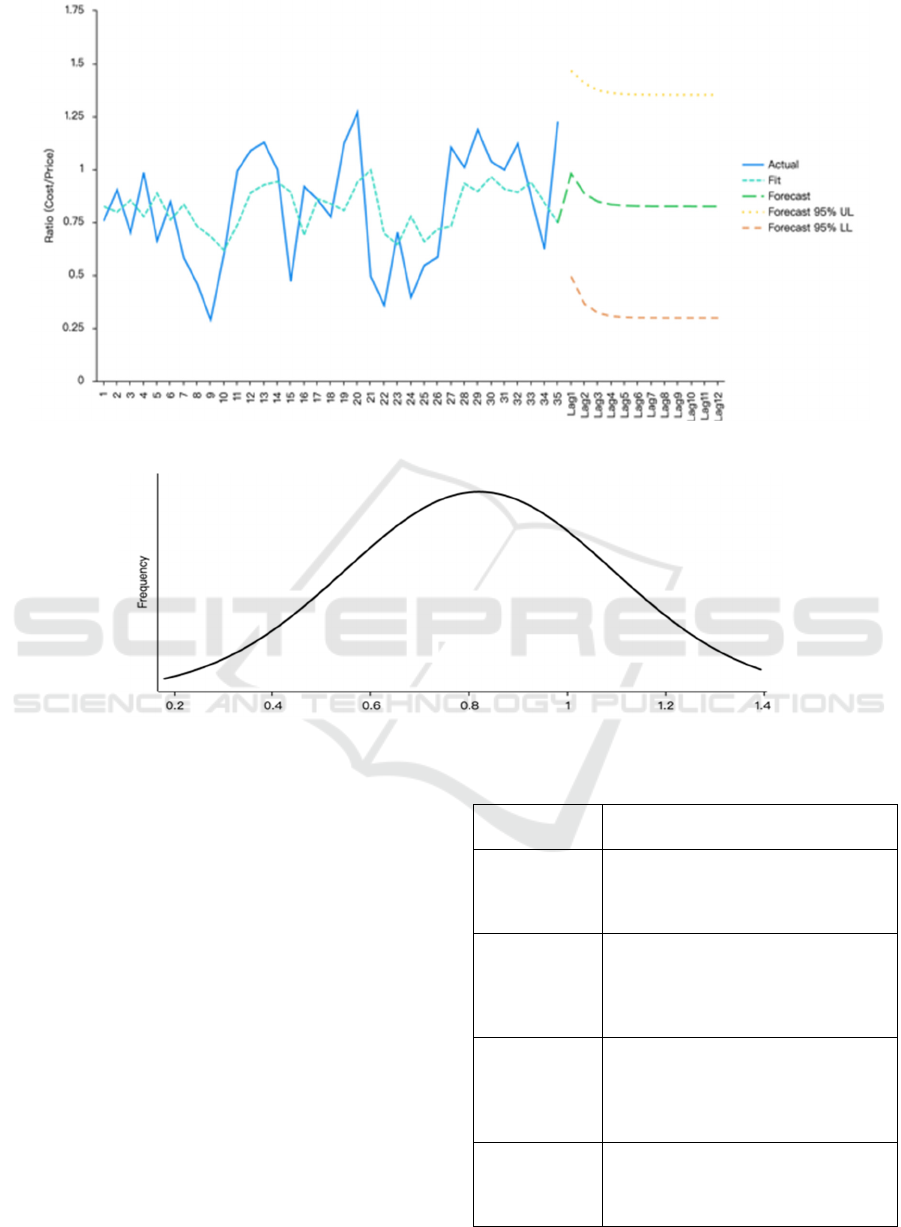

This part will present the results of the ARIMA model

applied to the quarterly Bitcoin mining output data

collected from January 2016 to July 2024. Then

examine and compare it with the real mining cost and

output. Using the estimated mining output and real

total mining cost, one could get the estimated mining

cost of each Bitcoin. Then, this study will divide the

estimated mining cost by real mining cost to get the

error ratio, which could test the accuracy of the

prediction of the model.

In this research, an ARIMA (0,1,1) model was

selected on the data characteristics, which shows a

noticeable trend without a clear seasonal pattern.

When determining the values of p and q, one analyzed

the ACF and PACF plots of the post differential data.

The ACF plots showed a rapid decay after lagging by

order 1, while the PACF plots did not show a clear

truncated tail pattern. These features suggest that the

MA (1) term may be suitable for the data without the

AR term. Therefore, one chose the ARIMA (0,1,1)

model, and preprocessing results with the following

specific formula:

𝑌

= −53.822 − 0.411𝜖

(4)

The ARIMA model parameters were determined

through the analysis of the ACF and PACF. Model

selection was based on minimizing the AIC and BIC.

These parameters were obtained by maximum

likelihood estimation and their significance was

confirmed by statistical tests. The specific

significance test results are as shown in Table 1.

One used a significance level of 0.05. The p-value

of 0.047 for the constant term is just below the 0.05

level of significance, which suggests that this

parameter may have some importance in the model,

but its effect may not be as significant as that of the

MA parameter. The p-value of 0.013 for the MA

parameter is significantly lower than 0.05, which

suggests that this parameter plays an vital role in the

model. The goodness of fit of the model was assessed

by AIC and BIC with the following values: Akaike

Information Criterion (AIC): 471.355 and Bayesian

Information Criterion (BIC): 475.934. The AIC and

BIC values were minimized, further supporting the

model’s adequacy.

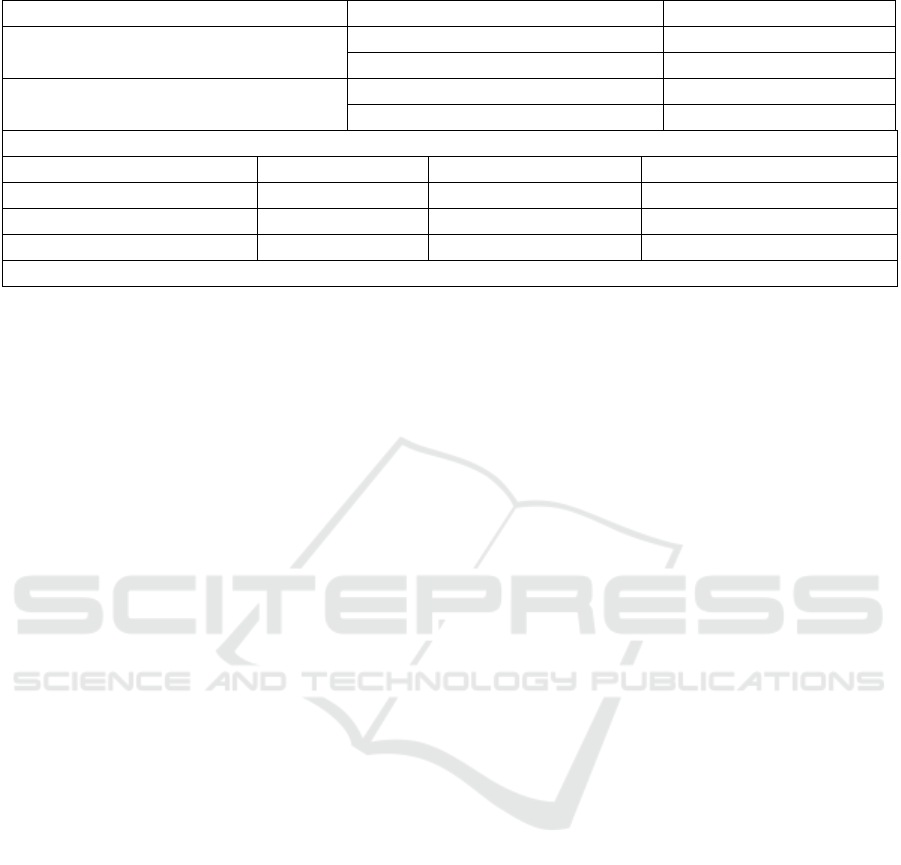

The model Q statistic data, namely the Ljung-Box

Q test statistic, is displayed in Table 2 together with

the p-value and statistic value. The Q statistic test for

white noise may be used to verify if the model

residuals are white noise, the original hypothesis is:

the residuals are white noise). Q6 will be used to test

the residuals of the first 6 orders to meet the white

noise, commonly, the p-value is greater than 0.1

means it meets the white noise test. Usually, only Q6

need to be examined. The p-value of Q6 is larger than

0.1, so the original hypothesis cannot be rejected, at

the significance level of 0.1, so these residuals are

white noise, the model could meet the requirements.

Then, using the fitted ARIMA (0,1,1) model,

forecasts for Bitcoin mining output were generated

for the period from Q3 2024 to Q1 2026, the forecasts

indicate a continuous decreasing trend in mining

output. The results are shown in Figure. 4 and Figure.

5.

Analysis of the Prediction and Influencing Mechanism for Bitcoin Price

479

Table 1: ARIMA prediction results.

ARIMA (0,1,1) Model Parameter List

Term Symbol Coefficient Standard Error z-value p-value 95% CI

Constant

Term

c -53.822 27.112 -1.985 0.047

-

106.960 ~ -

0.684

MA

parameters

β

1

-0.411 0.165 -2.489 0.013

-0.734 ~

-0.087

AIC value = 471.355

BIC value = 475.934

Table 2: Q statistical Table.

Item Statistic p-value

Q6 0.561 0.454

Q12 0.735 0.693

Q18 0.740 0.864

Q24 2.922 0.571

Figure 4: Bitcoin Mining Output Forecast (Photo/Picture credit: Original).

Figure 5: Error Ratio Normal Distribution (Photo/Picture credit: Original).

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

480

Figure 6: Ratio Forecast (Photo/Picture credit: Original).

Figure 7: Ratio Normal Distribution (Photo/Picture credit: Original).

The data visualization in Figure. 6 and Figure. 7

shows the data for Error Ratio (Estimated mining

cost/Real Cost), examining the last 35 issues of the

dataset: The 35 measurements of accuracy on the

dataset consistently centered around 0.85, with a

distribution that closely follows a normal distribution.

The distribution is bell-shaped, which is

approximately normal, with the mean around 0.85,

which demonstrate the accuracy of the model’s

predictions.

Reviewing historical data, the ratio of bitcoin

mining costs to the true price of bitcoin ranges from

0.5 to 1.2, which shows the profitability of miners as

well as the volatility of the bitcoin price. Based on this

data and the multiplier relationship with the mining

price, over a four-year timeframe (the timeframe of

each halving) after the 2024 Bitcoin mining halving

event, one can get the critical support price on Bitcoin

as presntend in Table 3.

Table 3: Price supporting analysis.

Important

Support Price

Explanation

$30000

Shutdown

Price

Historically, there has been no

instance where mainstream or flagship

models have shut down under relatively

moderate electricity prices.

$48000 Black

Swan Support

Price

(Shutdown price * 160%) No

Black Swan events have ever occurred

where the market price fell below 160%

of the electricity cost during the current

cycle.

$52000 Cost

Support Price

When the price falls below this

level, the risk of buying a BTC on the

secondary market is significantly lower

than the risks undertaken by miners who

invest tens of millions or more to mine.

$60000 Bear

Market

Support Price

In most cases during a bear market,

the market price fluctuates around

200% of the shutdown price, which is

around $60,000.

Analysis of the Prediction and Influencing Mechanism for Bitcoin Price

481

Table 4: Spearman correlation analysis.

BTC/USD

Gold/USDoz

Coefficient 0.882**

p value 0.000

NASDAQ INDEX

Coefficient -0.489**

p value 0.000

Spearman Correlation Matrix

BTC/USD Gold/USDoz NASDAQ Index

BTC/USD 1

Gold/USDoz 0.882** 1

NASDAQ INDEX -0.489** -0.571** 1

* p<0.05 ** p<0.01

3.2 Correlation Analysis

The Spearman correlation analysis was conducted to

assess the relationship between Bitcoin (BTC/USD)

Gold (Gold/USD per oz) and NASDAQ Index. The

results are given in Table 4. The BTC/USD and

Gold/USD per oz correlation coefficient is 0.882, and

it is at the 0.01 significance level, meaning that there

is a significant positive correlation between the two.

The NASDAQ INDEX and BTC/USD have a -0.489

correlation coefficient, at the 0.01 significance level.

The value of correlation coefficient between

BTC/USD and NASDAQ INDEX is -0.489 and

shows 0.01 level of significance, thus indicating that

there is a moderate negative relationship Between

BTC/USD and NASDAQ Index.

The result for Bitcoin and gold demonstrates a

strong positive correlation suggests that Bitcoin and

gold tend to move in the same direction, which means

the price of Bitcoin could possibly increase while the

price of gold increasing. This implies that Bitcoin

may be seen as a digital store of value by investors,

which is like gold (Dyhrberg, 2016). However, a

moderate negative correlation between Bitcoin and

NASDAQ Index are found, this negative relationship

means potential hedging opportunity against stock

market movements may exist, by using Bitcoin as a

tool, particularly in the tech-heavy NASDAQ.

Although Bitcoin and gold price is strongly

correlated, the unique risk-return features and the

negative correlation with the stock market shows its

possibility to play a role in portfolio diversification.

Brière et al. found that including even a small

proportion of Bitcoin in a diversified portfolio

significantly improved its risk-return characteristics

(Brière et al., 2015). The negative correlation with the

NASDAQ Index suggests that Bitcoin could

potentially server as a hedge against downturns in the

technology sector. This aligns with findings by

Guesmi et al., who found that Bitcoin can perform

effective diversifier in various financial markets

(Guesmi et al., 2019). During stock market downturns,

one needs to increase Bitcoin allocation to potentially

offset losses in equity positions.

During periods of economic uncertainty: Consider

allocating both Bitcoin and gold, as they showed

similar features, but also takes a dynamic hedging

strategy, the investors could adjust the proportion of

Bitcoin and other assets in their portfolios. One

research stressed that dynamic strategies involving

Bitcoin outperformed static approaches. (Platanakis

et al., 2020)

4 CONCLUSIONS

To sum up, this study investigates the price prediction

of bitcoin and analyse the inherit influencing

mechanisms. While this study provides valuable

insights into the measurement and prediction of

bitcoin mining costs, as well as exploring the

relationship between bitcoin and traditional assets,

there are undeniably still some limitations. Bitcoin's

time horizon as a mainstream investment target is less

than ten years, and the amount of historical data is

relatively limited, so this may limit the reliability of

back testing based on Bitcoin's historical data. The

cryptocurrency market is in a state of rapid change

and development, so limited historical data is one of

the major limitations of this paper. The mining cost

model used in this study, although validated by data

back testing and highly accurate, may not fully

capture the latest technological advances in mining

equipment and technology. Therefore, more accurate

and efficient mining-related models are necessary.

The correlation analysis does not analyse global

macroeconomic factors much, but only price

movements, which may miss the impact of some

policy shifts and major economic events. Future

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

482

research could improve these limitations in these

ways, i.e., using more accurate models of bitcoin

mining output and costs; analysing the impact of

specific macro policy and regulatory changes in

conjunction with the bitcoin and cryptocurrency

markets in a more comprehensive manner.

REFERENCES

Brière, M., Oosterlinck, K., Szafarz, A., 2015. Virtual

currency, tangible return: Portfolio diversification with

bitcoin. Journal of Asset Management, 16(6), 365-373.

Buterin, V., 2014. Ethereum Whitepaper. Ethereum.org.

Retrieved from: https://ethereum.org/en/whitepaper/

Dyhrberg, A. H., 2016. Bitcoin, gold and the dollar–A

GARCH volatility analysis. Finance Research Letters,

16, 85-92.

Guesmi, K., Saadi, S., Abid, I., Ftiti, Z., 2019. Portfolio

diversification with virtual currency: Evidence from

bitcoin. International Review of Financial Analysis, 63,

431-437.

Hayes, A., 2015. A Cost of Production Model for Bitcoin.

Available at SSRN 2580904.

Narayanan, A., Bonneau, J., Felten, E., Miller, A.,

Goldfeder, S., 2016. Bitcoin and Cryptocurrency

Technologies. Princeton University Press.

Platanakis, E., Urquhart, A., 2020. Should investors include

Bitcoin in their portfolios? A portfolio theory approach.

The British Accounting Review, 52(4), 100837.

Santander, I., 2015, The Fintech 2.0 Paper: rebooting

financial services.

Swan, M., 2015. Blockchain : blueprint for a new economy.

O’Reilly.

Wang, Y., Han, J. H., Beynon-Davies, P., 2019.

Understanding Blockchain Technology for Future

Supply chains: a Systematic Literature Review and

Research Agenda. Supply Chain Management: An

International Journal, 24(1), 62–84.

Yermack, D., 2017. Corporate Governance and

Blockchains. Review of Finance, 21(1), 7–31.

Analysis of the Prediction and Influencing Mechanism for Bitcoin Price

483