Stock Price Prediction Using Technical Indicators: A

CNN+LSTM+Multi-Head Attention Approach

Juncheng Long

College of Letters & Science, University of Wisconsin-Madison, Madison, U.S.A.

Keywords: Stock Price Prediction, Technical Indicators, CNN+LSTM+Multi-Head Attention, Financial Forecasting.

Abstract: As a matter of fact, on account of the inherent volatility and complexity of financial markets, predicting stock

prices has always been a highly challenging task especially under the complex situation in recent years. With

this in mind, this study explores the application of advanced machine learning models, particularly the

CNN+LSTM+multi head attention model, to predict stock prices based on a comprehensive set of technical

indicators. Based on evaluating the effectiveness of the model through various trading strategies and

comparing its performance with other models, the results show that the CNN+LSTM+multi head attention

model is significantly superior to other models in capturing market trends and achieving cumulative returns.

At the same time, the current limitations for the models as well as improvements proposals for further study

have been discussed at the same time. Overall, this study highlights the practical application value of the

model in financial forecasting, providing a powerful tool for optimizing trading strategies.

1 INTRODUCTION

Predicting stock prices has always been one of the

most challenging tasks in financial markets, mainly

due to the inherent volatility, complex

interdependence, and the influence of numerous

factors ranging from microeconomic indicators to

macroeconomic events. Although traditional time

series models such as Autoregressive Integrated

Moving Average (ARIMA) and Generalized

Autoregressive Conditional Heteroskedasticity

(GARCH) have been widely used in financial

forecasting, they often perform poorly in capturing

common nonlinear and dynamic patterns in financial

data, especially during periods of market instability

(Bollerslev, 1986; Sezer et al., 2020). As research

deepens, new methods gradually enter the field of

vision. In recent years, the rise of deep learning

techniques, especially Long Short-Term Memory

(LSTM) networks, has made significant progress in

processing sequential data and modelling complex

dependencies in time series (Graves, 2012; Greff et

al., 2016), provided a new direction for financial

forecasting.

In addition, technical indicators play a crucial role

in financial forecasting, providing valuable insights

into market trends, volatility, and potential price

reversals. These indicators, ranging from moving

averages to momentum oscillations, help traders and

analysts better grasp market sentiment and make

wiser decisions (Kim & Kim, 2019). Therefore, by

integrating a comprehensive set of technical

indicators, not only can the multidimensional

characteristics of the financial market be reflected,

but the predictive accuracy of the model can also be

significantly improved (Thakkar & Chaudhari, 2021).

This method provides an effective supplement to the

shortcomings of traditional models and marks an

important progress in the field of financial forecasting.

In recent years, significant progress in the field of

deep learning has driven the development of hybrid

models, which significantly improve the performance

of financial market forecasting by integrating the

advantages of different architectures. LSTM

networks are widely used in stock price prediction

due to their powerful ability to model long-term

dependencies and have shown better performance

than traditional statistical methods in multiple studies

(Siami et al., 2018). Based on this, the hybrid model

integrating Convolutional Neural Networks (CNN)

and LSTM demonstrates significant potential in

capturing local and temporal features in financial data.

Specifically, CNN excels at extracting features from

short-term patterns, while LSTM performs well in

handling sequence dependencies (Kim & Kim, 2019).

This hybrid architecture enhances the ability to model

Long, J.

Stock Price Prediction Using Technical Indicators: A CNN+LSTM+Multi-Head Attention Approach.

DOI: 10.5220/0013264900004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 437-446

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

437

the complexity of financial markets by synergistically

utilizing the advantages of two models.

On this basis, the introduction of self-attention

mechanisms, especially in Transformer models,

marks another important progress in this field. This

mechanism allows the model to dynamically focus on

the most relevant parts of the input sequence, thereby

further improving the accuracy of predictions

(Vaswani, 2017). The hybrid model combining CNN,

LSTM, and self-attention mechanism demonstrates

excellent ability in balancing short-term feature

capture and long-term dependency modelling,

significantly improving the accuracy of stock price

prediction (Li et al., 2019). This multi model fusion

method not only expands the application prospects of

deep learning in financial market prediction, but also

lays a solid foundation for building more accurate and

robust prediction models. A significant innovation in

this domain is the optimization of multi-head self-

attention mechanisms. In traditional self-attention, all

heads treat the sequence data similarly, potentially

overlooking critical time-specific information. The

optimized multi-head self-attention mechanism,

however, allows each attention head to specialize in

capturing different temporal aspects of the data. This

not only enhances the model's ability to focus on

relevant information at various time scales but also

improves its robustness in volatile market conditions

(Jialin et al., 2022). Integrating this optimized

attention mechanism with a comprehensive set of

technical indicators ensures that the model can

effectively process a diverse range of market signals,

leading to more accurate and reliable predictions

(Fischer & Krauss, 2018; Zhang, et al., 2023).

Although existing models have made significant

progress in predicting stock prices, there are still

many challenges in dealing with the complexity and

multidimensionality of financial time series data. The

main objective of this study is to explore the potential

of a hybrid model that combines CNN, LSTM, and

optimized multi head self-attention mechanism in

stock price prediction, particularly by

comprehensively utilizing a wide range of technical

indicators to improve prediction accuracy and model

robustness. The research object selected Apple Inc.

(AAPL) stock, which is an ideal choice for verifying

the effectiveness of advanced predictive models due

to its high liquidity and extensive market analysis. By

integrating multiple technical indicators and applying

the innovative CNN+LSTM+Multi-Head self-

attention architecture, this study not only aims to

provide more accurate stock price predictions, but

also hopes to bring new insights to the field of

financial forecasting and promote its development.

The structure of this paper is organized as follows:

The next section discusses the data collection and

preprocessing methods, followed by a detailed

description of feature engineering and model

construction. Subsequent sections evaluate the

model's performance and conduct back testing

through various trading strategies. Finally, the paper

concludes with a summary of the key findings and

suggestions for future research.

2 DATA AND METHOD

2.1 Data

In data analysis projects, data collection and

preprocessing are the foundation of the entire analysis

process. The accuracy and completeness of time

series data in financial markets are crucial. The data

analysed this time comes from the stock trading

records of AAPL (Apple Inc.), covering multiple

features such as dates and closing prices. The data

mainly comes from various technical indicators

provided by Yahoo Finance and ta lib library. The

data range is from December 31, 2010 to December

31, 2022. It is hoped to predict daily returns and

capture fluctuations in stock returns. In order to

effectively demonstrate the characteristics of the data,

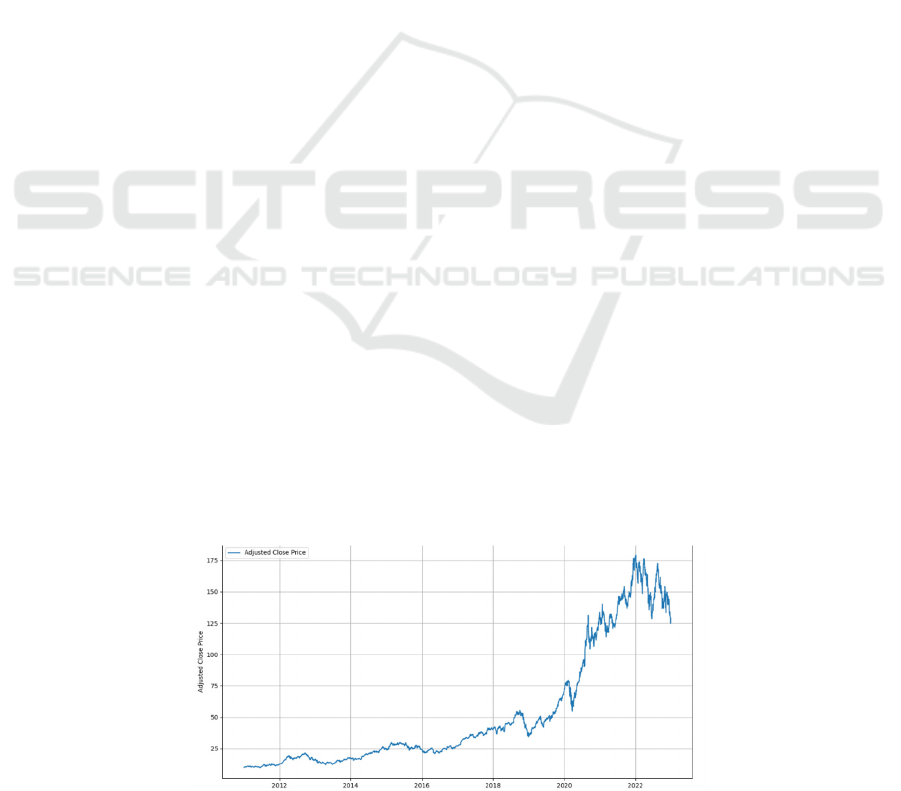

one draws the closing price time series in Figure. 1

Figure 1: Closing price time series chart (Photo/Picture credit: Original).

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

438

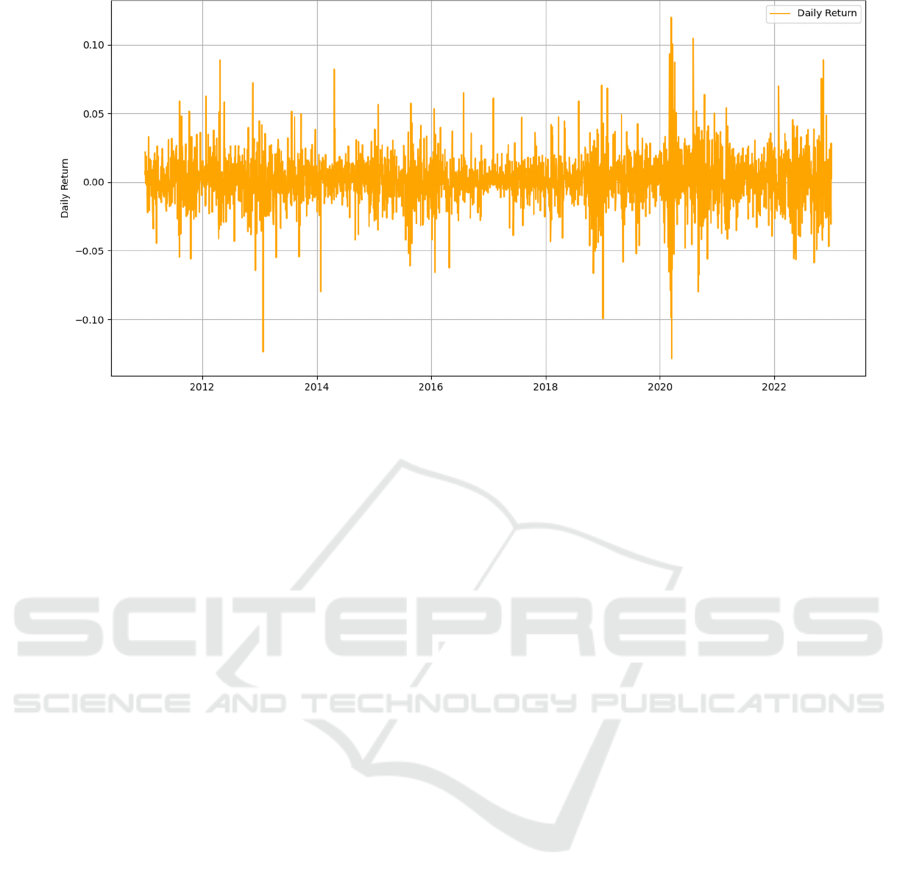

Figure 2: Daily Yield Time Series Chart (Photo/Picture credit: Original).

As shown in Figure. 1, AAPL's stock price

experienced significant growth from 2010 to 2022. At

the beginning of 2010, AAPL's closing price was

relatively low, close to $20. In the following years,

AAPL's stock price experienced a steady increase,

especially after 2019, when the stock price rapidly

climbed and reached its peak at around $180 in late

2021 and early 2022. The significant growth during

this period reflects Apple's success in the global

market and the widespread acceptance of its products

and services. However, in 2022, one can observe a

slight decline in AAPL's stock price, showing

significant volatility. From Figure. 2, the daily return

changes of AAPL stocks. Daily return reflects the

percentage change in stock prices relative to the

previous day and is an important indicator for

measuring stock volatility. The chart shows that the

daily returns of AAPL are mostly concentrated

between -0.05 and 0.05, indicating that the price

fluctuations of AAPL are relatively small on most

trading days. However, there were also some extreme

fluctuations, especially during the periods of 2014

and 2020, where there were significant periods of

high volatility, with yields reaching above 0.1 or

below -0.1. These extreme fluctuations are usually

related to major market events or important news

released by companies. Overall, the distribution of

daily returns indicates that AAPL stocks experienced

multiple periods of high volatility between 2010 and

2022, but overall maintained a relatively stable

growth trend, which is why chose AAPL stocks.

2.2 Variables,

Cleaning

and Selection

In the original dataset, AAPL stock data consisted of

3021 rows and 284 columns, with some features

containing missing values. One addressed this by

removing features with over 10% missing data and

using interpolation to fill the remaining gaps,

resulting in a cleaned dataset with 276 features. For

constructing the predictive target variable, one

converted the annual risk-free rate into a daily return,

calculated the daily stock return, and labelled it as 1

if it exceeded the risk-free rate, and 0 otherwise. The

target variable was then lagged by one day to predict

future trends. Furthermore, this study visualizes the

distribution of the target variable in Figure. 3. It can

be seen that the distribution of the constructed target

variables is relatively balanced. The number of

samples marked as 0 (daily returns less than or equal

to the risk-free rate) is slightly higher than the number

marked as 1 (daily returns exceeding the risk-free

rate). This distribution indicates that during the

selected time period, the returns of most trading days

did not exceed the risk-free rate, but there were still a

considerable number of trading days with returns

exceeding this benchmark. This distribution feature is

beneficial for model training, as an excessively

imbalanced distribution of target variables may lead

to the model's preference for a certain class, thereby

affecting predictive performance. The relative

balance of target variables will help improve the

generalization ability of the model.

Stock Price Prediction Using Technical Indicators: A CNN+LSTM+Multi-Head Attention Approach

439

Figure 3: Distribution diagram of target variables (Photo/Picture credit: Original).

In time series prediction tasks, especially in

financial data analysis, class imbalance is a common

phenomenon. The number of days that AAPL stocks

rise and fall may not be balanced, which can cause the

model to be more inclined to predict more frequent

categories during training (for example, the number

of days that fall may be more than the number of days

that rise). To address this issue, one performed the

following operations to balance the class distribution

of the target variable and improve the predictive

performance of the model. One first calculated the

sample size for each category in the target variable.

Category 0 represents daily returns less than or equal

to the risk-free rate, while Category 1 represents daily

returns exceeding the risk-free rate. Calculating the

weight of each category using the following formula:

𝜔

𝑁

𝑛

𝐾

1

Among them, N is the total number of all samples in

the dataset, 𝑛

is the number of samples in i-th

category, and K is the total number of categories.

When training the LSTM model, this study passes

these weights as class Weight parameters to the

model. In this way, the model will adjust the learning

of each category based on weights during each

iteration, thus balancing the problem of imbalanced

categories. After calculation, the weights are shown

in the Table 1.

Table 1: Target variable weight table.

1 0

Weight 1.0833 0.9286

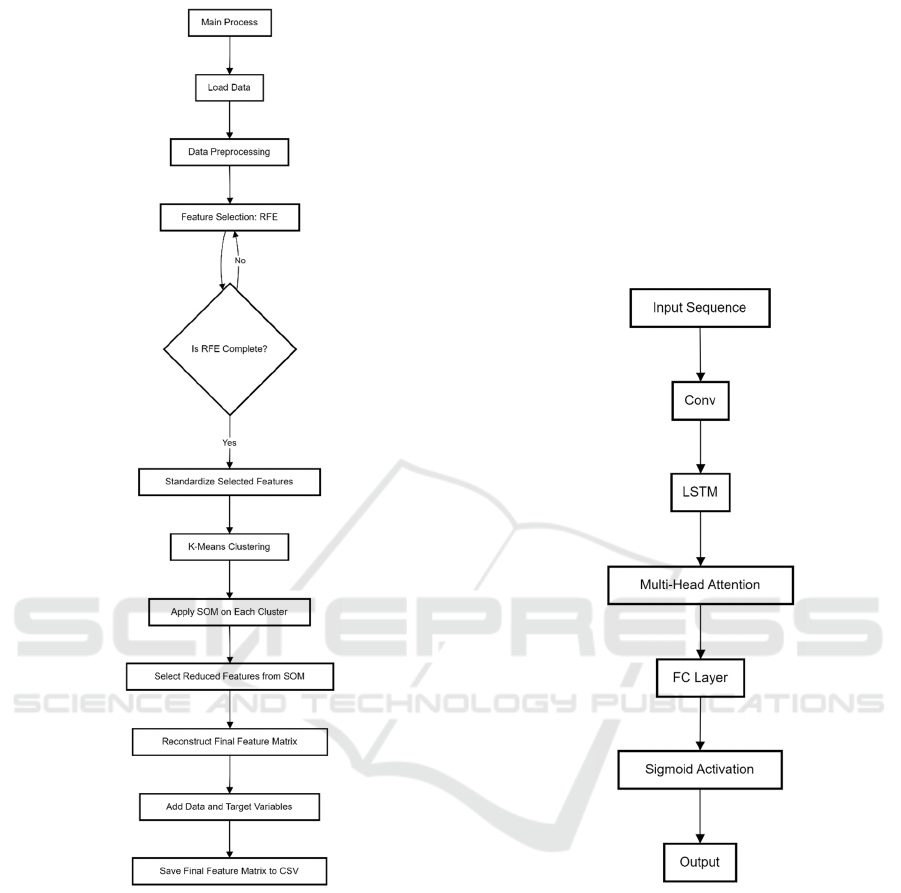

This study applied a series of feature selection and

dimensionality reduction techniques aimed at

extracting the most informative parts from a large

number of features to improve the predictive

performance and efficiency of the model. The entire

process combines Recursive Feature Elimination

(RFE), K-Means clustering, and Self Organizing

Mapping (SOM) to gradually optimize the feature set

through a phased approach. The following is a

detailed algorithm description. Recursive Feature

Elimination (RFE) is an iterative feature selection

method that selects the most useful features for model

prediction by recursively training the model and

gradually eliminating the least important features. In

this project, one uses Random Forest as the base

model and use RFE to filter out 64 of the most

important features from the original feature set. This

step ensures that results are processing the filtered

important features in subsequent steps, reducing the

dimensionality and complexity of the data. After

feature selection, one applied K-Means clustering to

the selected features. K-Means clustering is an

unsupervised learning algorithm that divides features

into several clusters and groups similar features

together. One selected 5 clustering centres and

divided 64 features into 5 categories. The purpose of

clustering is to identify feature groups with similar

patterns or characteristics, in order to facilitate further

processing. Within each K-Means clustering group,

one further applied self-organizing maps (SOM) for

feature dimensionality reduction. SOM is an

unsupervised learning algorithm based on neural

networks that can map high-dimensional features to

low dimensional space while maintaining the

topological structure of the data. Through SOM, one

selected the most representative features within each

cluster group, further reducing the number of features

and retaining the most valuable information for model

prediction. The flowchart of the feature selection

method is shown in Figure. 4.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

440

Figure 4: Feature selection flowchart (Photo/Picture credit:

Original).

2.3 Prediction Model

The CNN+LSTM+multi head attention model is a

powerful hybrid architecture designed specifically for

time series forecasting, particularly suitable for

applications such as stock price prediction. This

model combines the advantages of convolutional

neural networks (CNN), long short-term memory

networks (LSTM), and multi head attention

mechanisms, and can simultaneously capture local

and global dependencies in sequence data, thereby

improving prediction performance.

The CNN layer is responsible for extracting short-

term patterns from the input time series data by

applying convolutional filters. These filters help to

identify local trends and fluctuations, which are

critical for understanding immediate market

movements. The output from the CNN layer is then

passed to the LSTM layer, which is adept at capturing

long-term dependencies and temporal relationships.

LSTM networks are particularly effective in retaining

information across different time steps, allowing the

model to learn and predict future trends based on past

data.

Figure 5: Structure diagram of CNN+LSTM+SA model

(Photo/Picture credit: Original).

To further enhance the model's predictive power,

a Multi-Head Attention mechanism is incorporated.

This attention mechanism allows the model to

dynamically focus on different parts of the input

sequence, weighing the importance of various time

steps. By doing so, the model can prioritize the most

relevant information, improving the accuracy and

robustness of the predictions. Finally, the processed

information is passed through an output layer to

generate the final prediction, such as the likelihood of

a stock price increase or decrease. This combination

of CNN, LSTM, and Multi-Head Attention makes the

Stock Price Prediction Using Technical Indicators: A CNN+LSTM+Multi-Head Attention Approach

441

model highly effective in capturing the complexities

of financial time series data, leading to more accurate

and reliable forecasts. The schematic diagram is

illustrated in Figure. 5.

2.4 Model Evaluation

In this study, two main metrics were used to evaluate

the performance of the CNN+LSTM+multi head

attention model: confusion matrix and receiver

operating characteristic (ROC) curve. The confusion

matrix is a commonly used tool in classification tasks,

used to summarize the prediction results of the model

in detail. It generates a table by comparing the actual

results with the predicted results of the model, which

includes the following four key sections:

True Positive (TP): The number of samples

correctly predicted as positive.

True negatives (TN): The number of samples

correctly predicted as negative classes.

False Positive (FP): The number of negative

class samples incorrectly predicted as positive.

False negatives (FN): The number of positive

class samples incorrectly predicted as negative.

This metric helps in understanding not only the

accuracy of the model but also the types of errors it

tends to make.

The Receiver Operating Characteristic (ROC)

curve is a graphical representation that illustrates the

diagnostic ability of a binary classification model by

plotting the true positive rate (sensitivity) against the

false positive rate (1-specificity) at various threshold

settings. The ROC curve provides insight into how

well the model can distinguish between the two

classes across different decision thresholds. The Area

Under the Curve (AUC) is a single scalar value that

summarizes the overall performance of the model.

The AUC ranges from 0 to 1, with a value closer to 1

indicating better model performance. The AUC

provides a clear measure of the model’s ability to

classify outcomes correctly across all possible

thresholds.

3 RESULTS AND DISCUSSION

3.1 Feature Engineering

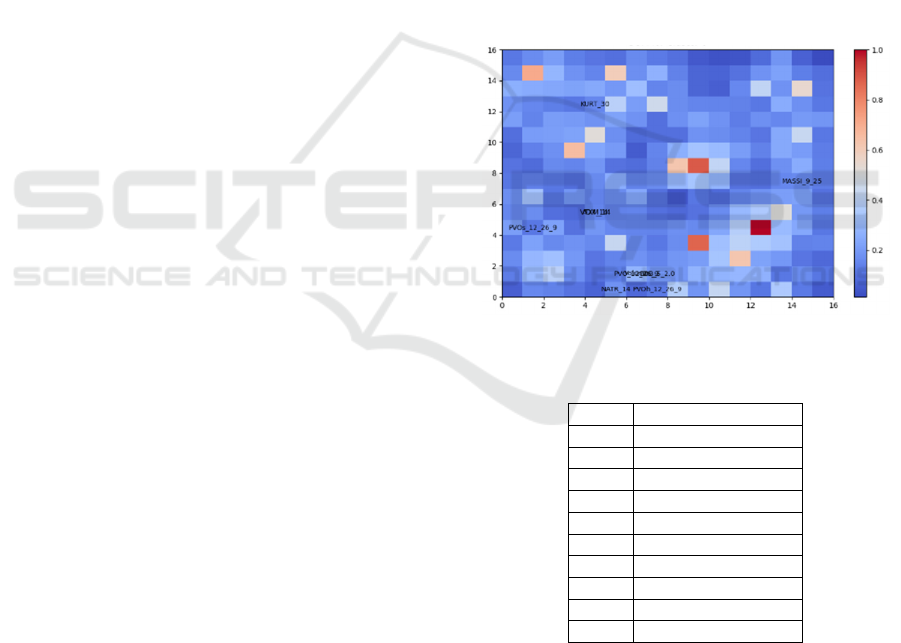

After performing Recursive Feature Elimination

(RFE), one used K-Means clustering to group the

features. The Elbow Method indicated that 5 clusters

were optimal, as the sum of squared errors (SSE)

began to flatten out at this point, balancing detail

retention with model complexity. Within each cluster,

the Self-Organizing Map (SOM) algorithm was

applied to project high-dimensional features into a

two-dimensional space, maintaining the topological

structure between features. On the SOM map, darker

colors indicated greater differences between features.

To select the most representative features, one

prioritized feature mapped to denser nodes, chose the

most central or relevant feature when multiple

features were mapped to the same node, and ensured

the total number of selected features was around 10.

As shown in Figure. 6, the SOM distribution of the

features helped us in selecting the most appropriate

ones. This approach enabled us to select the 10 most

representative features, balancing model efficiency

with high predictive accuracy. In the end, this method

helped us select the 10 most representative features

from high-dimensional features, enabling the model

to run efficiently while maintaining high predictive

ability and accuracy. The Table 2 list the final

selected features.

Figure 6: Som map (Photo/Picture credit: Original).

Table 2: Optimal feature.

No. Features

1 Volume

2 ADX

_

14

3 BBB_5_2.0

4 KURT_30

5 MASSI_9_25

6 NATR

_

14

7 PVO

_

12

_

26

_

9

8 PVOh

_

12

_

26

_

9

9 PVOs_12_26_9

10 VTXM_14

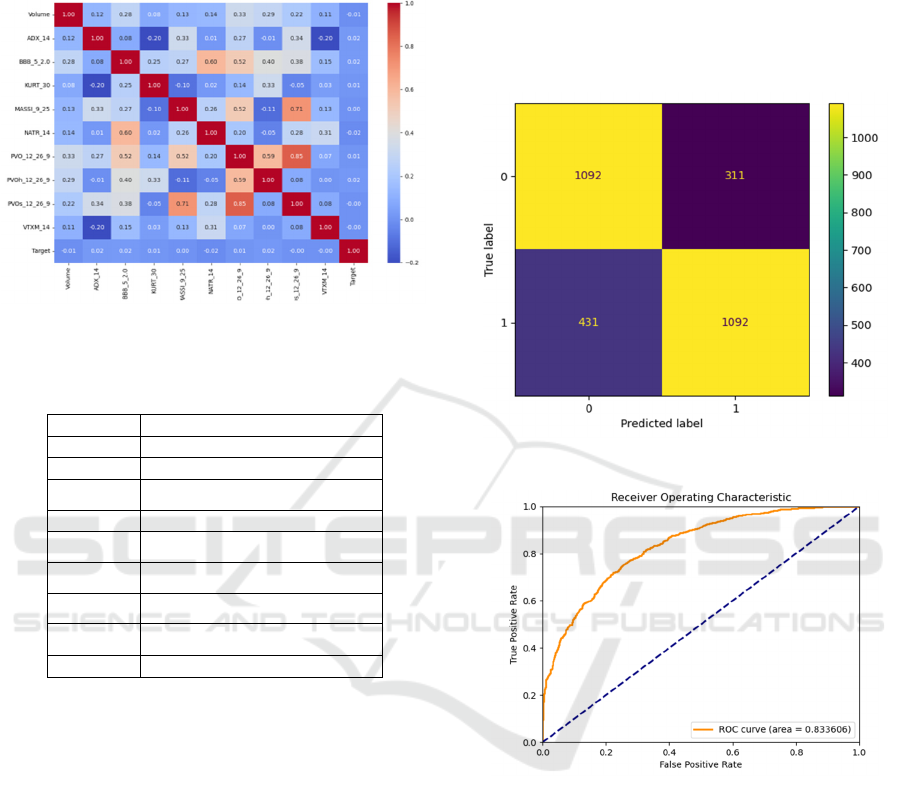

In the correlation analysis, as shown in Figure. 7,

the correlation between PVO12_26_9 and

PVOs_112:26_9 exceeded 0.8. This high correlation

may introduce multicollinearity, which in turn affects

the interpretability and predictive performance of the

model. To avoid this issue, one chose to retain

PVO12_26_9 and remove PVOs_112:26_9,

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

442

simplifying the model and improving its stability.

After exploratory data analysis, the selected features

are given in Table 3.

Figure 7: Correlation heat map (Photo/Picture credit:

Original).

Table 3 Optimal feature table.

No. Features

1 Volume

2 ADX

_

14

3 BBB_5_2.0

4 KURT_30

5 MASSI_9_25

6 NATR_14

7 PVO_12_26_9

8 PVOh_12_26_9

9 VTXM

_

14

3.2 Prediction Results

In the evaluation of the CNN+LSTM+Multi-Head

Attention model, the confusion matrix (as shown in

Figure. 8) shows that the model performs consistently

well in predicting both positive and negative classes.

Specifically, the model correctly predicted 1092 true

negatives and 1092 true positives, demonstrating its

strong capability to distinguish between upward and

downward trends. Although the model still

encountered some false positives (311) and false

negatives (431), its overall performance is robust.

The ROC curve (as depicted in Figure. 9) further

highlights the model's effectiveness, with the AUC

value reaching 0.833606. This indicates that the

CNN+LSTM+Multi-Head Attention model is highly

effective in processing time-series data and extracting

relevant features, enabling it to capture underlying

patterns in the data and improve classification

performance. In summary, the model demonstrates

high prediction accuracy and a low false positive rate,

making it a reliable choice for stock price prediction

tasks. The combination of CNN’s local feature

extraction, LSTM’s temporal dependency modelling,

and the Multi-Head Attention mechanism’s focused

feature selection ensures strong performance and

practicality in this application.

Figure 8: Confusion matrix (Photo/Picture credit: Original).

Figure 9: ROC plot of model (Photo/Picture credit:

Original).

3.3 Trading Strategy

This study has designed two trading strategies to test

the actual performance of the model predictions.

Trend following strategy is a trading method based on

price trends, aimed at trading by following the

direction of market trends. In this study, the LSTM

model and its variants were used to predict stock price

trends. Specifically, one determines the trading

behavior for the day based on the prediction results of

the previous day's model. If the model predicts that

the price will rise the next day, one holds or buys the

stock; if the model predicts that the price will fall the

next day, sell the stock at the market opening. This

Stock Price Prediction Using Technical Indicators: A CNN+LSTM+Multi-Head Attention Approach

443

strategy aims to generate profits by closely following

short-term market trends. The core idea of the trend

following strategy is to trade based on the predicted

results of stock price trends by the model. Firstly, this

study uses trained LSTM and its variant models to

predict the daily rise or fall of stock prices. If the

previous day's forecast result is an increase (1), then

buy or hold the stock at the opening of the day; if the

previous day's forecast result is a decline (0), sell or

maintain a short position at the opening of the day.

The daily earnings are calculated by the difference

between the closing price of the current day and the

previous day's closing price, while the cumulative

earnings are the sum of daily earnings. The results are

shown in the Table 4 and Figure. 10.

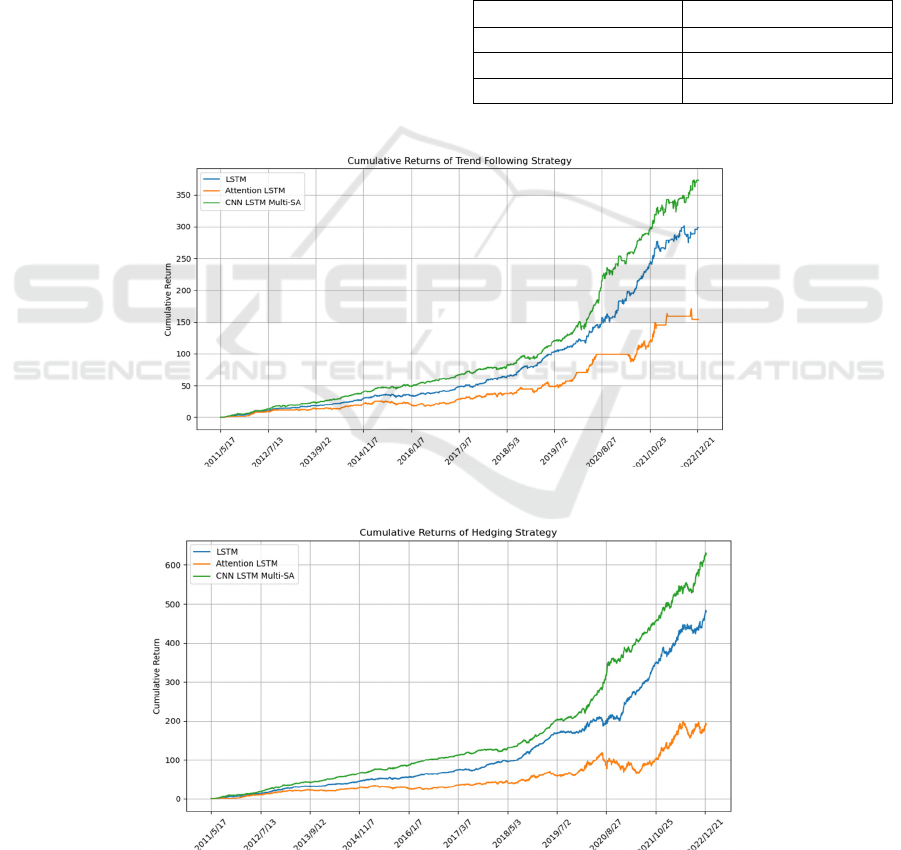

There are significant differences in the

performance of the three different models in the

cumulative return curve of Strategy 1, as shown in

Figure. 10. The cumulative returns of the ordinary

LSTM and CNN+LSTM+Multi-Head Attention

models showed a stable upward trend throughout the

back testing period, with the CNN+LSTM+Multi-

Head Attention model performing particularly well,

achieving the highest cumulative return. This

indicates its strong ability to capture market trends.

The ordinary LSTM model comes second, with

relatively robust performance. The LSTM+self-

attention mechanism model's performance is slightly

inferior; although it showed good revenue growth in

the early stage, there were fluctuations and declines

in revenue performance in the later stage. Overall, the

CNN+LSTM+Multi-Head Attention model performs

Table 4: Cumulative income statement of trend strategy.

Model Cumulative rate of return

LSTM 298.68%

LSTM+SA 153.81%

LSTM+CNN+ Multi-SA 372.77%

Figure 10: Comparison chart of cumulative returns of trend strategy (Photo/Picture credit: Original).

Figure 11: Comparison chart of cumulative returns of long and short strategies (Photo/Picture credit: Original).

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

444

the best in trend following strategies, demonstrating

its superiority in complex market environments.

The long-short strategy is a two-way trading

strategy that allows for long positions (buying stocks)

when the market rises and short positions (selling

stocks or holding reverse positions) when the market

falls, thereby gaining potential returns across

different market trends. In this study, the LSTM

model and its variants were used to predict the daily

rise and fall of stock prices, and corresponding long

or short operations were carried out based on the

prediction results. Strategy 2 adopts a long-short

approach, conducting daily trades based on the

model's predicted results. When the model predicts

that the stock price will rise the next day, the stock is

bought at the opening of the day and held until the

closing. Conversely, when the model predicts that the

price will fall the next day, the stock is shorted at the

opening and the position is closed at the end of the

day. The daily profit is calculated based on the

position: for long positions, the profit is the closing

price minus the opening price; for short positions, the

profit is the opening price minus the closing price.

Finally, by accumulating daily returns, the

cumulative rate of return for the strategy is calculated

to evaluate its performance in the market. The results

are shown in the Table 5 and Figure. 11.

Table 5: Accumulated income statement of long short

strategy.

Model Cumulative rate of return

LSTM 479.10%

LSTM+SA 189.36%

LSTM+CNN+Multi-SA 627.28%

The results showed that all models significantly

improved their cumulative returns under this strategy,

with the CNN+LSTM+Multi-Head Attention model

achieving notably better cumulative returns than the

other models. As shown in Figure. 11, throughout the

entire trading period, the revenue growth of the

CNN+LSTM+Multi-Head Attention model remained

relatively stable, demonstrating strong growth

momentum, particularly in the later stages. Compared

to Strategy 1, Strategy 2 takes advantage of market

volatility by going long when predicting an uptrend

and short when predicting a downtrend, thereby

enhancing trading flexibility and potential returns.

This approach allows the model to capitalize on profit

opportunities under varying market conditions.

However, the performance of the LSTM with self-

attention mechanism remains relatively weaker,

suggesting that the self-attention mechanism may

require further refinement to better capture trend

signals. Overall, Strategy 2 outperforms Strategy 1 in

terms of revenue performance, particularly when

employing the CNN+LSTM+Multi-Head Attention

model. This model exhibits more stable and robust

revenue growth, making it especially suitable for

markets with high volatility.

3.4 Comparison and Implications

The comparison of the cumulative returns from the

different models demonstrates distinct variations in

performance. The CNN+LSTM+Multi-Head

Attention model outperformed the other models,

showing the highest cumulative returns across both

trend-following and long-short strategies. This

model's ability to capture both local and global

dependencies in the data through convolutional layers,

LSTM layers, and the multi-head attention

mechanism allowed it to adapt more effectively to

market conditions, leading to superior predictive

accuracy and trading outcomes.

The ordinary LSTM model also performed well,

but it lacked the robustness of the

CNN+LSTM+Multi-Head Attention model,

especially in more volatile market environments. The

inclusion of CNN and multi-head attention in the

latter model provided additional layers of insight,

enabling it to better recognize and act on subtle

market signals that the LSTM alone might miss.

The implications of these findings suggest that

hybrid models like CNN+LSTM+Multi-Head

Attention, which combine different neural network

architectures, offer significant advantages in financial

time-series forecasting. By integrating convolutional

layers, which excel at capturing spatial patterns, with

LSTM layers for temporal dependencies and multi-

head attention for enhanced feature selection, this

model demonstrates a comprehensive approach to

understanding and predicting market behavior. As

financial markets continue to grow in complexity, the

use of such advanced models will likely become more

prevalent, offering more accurate tools for traders and

investors.

3.5 Limitations and Prospects

While the CNN+LSTM+Multi-Head Attention

model has demonstrated strong performance, there

are inherent limitations to this study that must be

acknowledged. First, the model's effectiveness is

contingent on the quality and breadth of the input data.

Any bias or gaps in the data could affect the model's

predictions, potentially leading to suboptimal trading

decisions. Additionally, the model is trained on

Stock Price Prediction Using Technical Indicators: A CNN+LSTM+Multi-Head Attention Approach

445

historical data, which may not fully capture future

market conditions, especially during unprecedented

events or structural changes in the market.

Looking ahead to the future, there are several

research directions worth further exploration in

response to these challenges. Firstly, by further

optimizing the attention mechanism, the model's

ability to capture market signals can be enhanced. In

addition, considering integrating alternative data

sources such as sentiment analysis data extracted

from news reports or social media will provide richer

background information for the model's predictions.

Finally, extending the model to more asset classes or

operating across multiple markets not only helps

improve its robustness, but also enhances its

applicability under different market conditions.

4 CONCLUSIONS

To sum up, this study evaluated the effectiveness of

CNN+LSTM+Multi-Head Attention model in stock

price prediction and trading strategy execution. The

research results indicate that the hybrid model

significantly outperforms traditional simple models

in terms of cumulative returns, especially in situations

of high market volatility. By integrating multiple

neural network architectures, this model is able to

effectively capture complex patterns in financial data,

providing traders with powerful support tools.

However, the study also exposed some limitations,

e.g., dependence on historical data and high

computational complexity of the model. Future

research should focus on further optimizing the model

structure and exploring more data sources to enhance

the predictive ability of the model. Overall, the

CNN+LSTM+Multi-Head Attention model

demonstrates broad application prospects in the field

of financial forecasting, with the potential to improve

trading strategies and decision-making processes in

complex market environments.

REFERENCES

Bollerslev, T., 1986. Generalized autoregressive

conditional heteroskedasticity. Journal of econometrics,

31(3), 307-327.

Fischer, T. Krauss, C., 2018. Deep learning with long short-

term memory networks for financial market predictions.

European journal of operational research, 270(2), 654-

669.

Graves, A., 2012. Long short-term memory. Supervised

sequence labelling with recurrent neural networks, 37-

45.

Greff, K., Srivastava, R. K., Koutník, J., Steunebrink, B. R.

Schmidhuber, J., 2016. LSTM: A search space odyssey.

IEEE transactions on neural networks and learning

systems, 28(10), 2222-2232.

Jialin, L., Shanwen, Q., Zhikai, Z., Keyao, L., Jiayong, M.

Toe, T. T., 2022, July. CNN-LSTM Model Stock

Forecasting Based on an Integrated Attention

Mechanism. 2022 3rd International Conference on

Pattern Recognition and Machine Learning (PRML) pp.

403-408.

Kim, T. Kim, H. Y., 2019. Forecasting stock prices with a

feature fusion LSTM-CNN model using different

representations of the same data. PloS one, 14(2),

e0212320.

Li, C., Zhang, X., Qaosar, M., Ahmed, S., Alam, K. M. R.

Morimoto, Y., 2019. Multi-factor based stock price

prediction using hybrid neural networks with attention

mechanism. 2019 IEEE intl conf on dependable,

autonomic and secure computing, intl conf on pervasive

intelligence and computing, intl conf on cloud and big

data computing, intl conf on cyber science and

technology congress

(DASC/PiCom/CBDCom/CyberSciTech), 961-966.

Sezer, O. B., Gudelek, M. U. Ozbayoglu, A. M., 2020.

Financial time series forecasting with deep learning: A

systematic literature review: 2005–2019. Applied soft

computing, 90, 106181.

Siami-Namini, S., Tavakoli, N. Namin, A. S., 2018,

December. A comparison of ARIMA and LSTM in

forecasting time series. 2018 17th IEEE international

conference on machine learning and applications

(ICMLA), 1394-1401.

Thakkar, A. Chaudhari, K., 2021. A comprehensive survey

on deep neural networks for stock market: The need,

challenges, and future directions. Expert Systems with

Applications, 177, 114800.

Vaswani, A., 2017. Attention is all you need. Advances in

Neural Information Processing Systems, 1

Zhang, J., Ye, L. Lai, Y., 2023. Stock price prediction using

CNN-BiLSTM-Attention model. Mathematics, 11(9),

1985.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

446