Valuation of New Energy Vehicle Companies: A Study on BYD

Utilizing Discounted Cash Flow Model

Peilin Ye

A.B. Freeman School of Business, Tulane University, New Orleans, U.S.A.

Keywords: New Energy Vehicle (NEV) Industry, BYD’s Valuation, Discounted Cash Flow (DCF) Analysis, Efficiency,

Strategic Growth.

Abstract: The New Energy Vehicle (NEV) industry has rapidly developed due to the continuously improving

technology and growing awareness of the environment. This study concentrates on the Build Your Dreams

(BYD) company, which occupies one of the leaders' positions in the NEV market and employs the Discounted

Cash Flow (DCF) analysis. The analysis includes the assessment of BYD's efficiency with the help of various

models, which help to predict future cash flows and the conditions of different scenarios applying the

sensitivity analysis tool, in addition to the estimation of BYD's intrinsic value and its strategic growth. Thus,

the current price of BYD reflects the 'fair' share price values, as the company offers attractive growth

opportunities for investors, thanks to the stable revenues and the focus on developing new battery technologies.

However, the overall values greatly depend on the assumed growth rates and market conditions. The relevance

of this work is in presenting a sound, financially oriented framework to reflect on BYD's valuation and

determine its position in the context of prevailing and innovative market conditions.

1 INTRODUCTION

The last few decades of the 20th century and the first

decade of the 21st century marked several significant

events that defined the NEV industry. The events in

cars started shifting with the entry of the Toyota Prius

into the market in 1997 with new hybrid technology.

This was succeeded by the introduction of Nissan

Leaf in 2010, the first mass-produced battery electric

vehicle (BEV), thereby proving the viability of

electrification of propulsion. At this time, new entrant

Tesla introduced the Roadster and later the Model S,

offering high-performance electric cars with a luxury

feel (Muratori et al., 2021).

Of all the advancements in technology, the

improvement in battery technology has been central

to the growth of the NEV industry. Replacing NiMH

with lithium batteries was a major advancement in

energy density, leading to increased driving range and

fast charging times (Suski et al., 2022). There remains

a focus on investment in future enhancements in

battery systems, including developing solid-state

batteries, new charging technologies, and novel

energy storage techniques (Dhawan, 2021). These

technologies are important to tackle the remaining

issues with range extension, charging availability,

and battery durability (Moerenhout et al., 2022).

The NEV market has grown significantly with

improving consumer preference and with the

available models rising in different categories. In

China, the largest NEV market globally, companies

such as BYD and NIO Inc. have competed effectively

due to government incentives and a robust local

industrial base. In Europe particularly, the emission

and market requirements for environmentally

friendly vehicles influenced the electric vehicles'

uptake with Volkswagen (VW) and Bayerische

Motoren Werke AG (BMW) as major players (Bin

Ahmad et al., 2022). Currently, the United States has

the lowest NEV market share compared to China and

Europe. However last couple of years show strong

growth due to Tesla and governmental subsidies

(Busch & Gopal, 2022). As it stands today, the NEV

industry is highly competitive, innovative, and highly

focused on research and development (R&D) efforts.

The traditional American automotive giants are

investing billions of dollars into electrification with a

long-term vision to eliminate thermal combustion

engines and reach carbon neutrality (Ryghaug &

Tomas Moe Skjølsvold, 2023). The industry is also

witnessing the evolution of other models, like battery

Ye, P.

Valuation of New Energy Vehicle Companies: A Study on BYD Utilizing Discounted Cash Flow Model.

DOI: 10.5220/0013264800004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 429-436

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

429

as a service (BaaS) and vehicle to grid (V2G), which

add a greater value to the NEVs. Of the challenges,

charging infrastructure remains a primary concern,

the sourcing of battery materials, and the

incorporation of renewable energies.

Through this strategy, BYD has become a

prominent competitor in the global New Energy

Vehicle market, especially in China. The company

has integrated vertically right from battery

manufacturing to car production, which has helped

the company to realize big benefits such as steep cost

efficiencies. Several valuation analyses were done on

the company with the Latter, including BYD, and

their analysis looks at the company's financial

performance, strategic positioning, and growth

potential. BYD's valuation analysis has relied on

different techniques, some of which are DCF analysis,

comparable company analysis, and precedent

transactions analysis. For instance, BYD Auto

estimated a company's value using a DCF approach

in a Goldman Sachs study. The study also revealed

that BYD is well-established in China and can expand

its operations to international markets (Dioha et al.,

2022). Some important findings observed from these

studies include the following. First, an example is the

use of vertical integration through battery production

as well as the electric drivetrains, thereby allowing

the company to manage cost and supply chains

effectively (Shchasiana et al., 2020). Second, BYD

has set itself on the path of innovativeness especially

in battery technology and energy storage systems,

making it a vanguard of the NEVs industry. Third,

BYD has proved to be financially healthy, with steady

revenues and profitability increasing yearly due to the

high demand for its electric vehicles and renewable

energy products.

However, the following gaps are evident despite a

wealth of literature on BYD: Another factor that

needs further analysis is the effect of disrupted global

supply chains on the company and its performance

(Kapoor et al., 2024). However, there is a need to

study BYD's international expansion strategy to

markets such as Europe and North America, where

competition forces are high and regulatory

frameworks are demanding. Last, the lithium-ion

battery technology futureproofing concerns at BYD,

such as battery recycling and resource constraints,

could be further researched.

This paper aims to present the historical

development of the NEV industry as a long-term

process of technological advancement and maturation

of the market. The industry's origins date back to the

late 1880s when pioneers like Thomas Edison and

Ferdinand Porsche started working on electric drive

systems. Nonetheless, the global consumption of

NEVs did not occur at the expected rate due to the

drawbacks of battery technology and the spirited

control over the market by internal combustion

engine (ICE) vehicles. However, it was only in the

last quarter of the 20th century that substantial

developments were made due to a synergy between

technological improvement and environmental

concerns (Malik & Sharma, 2022). The purpose of

this paper is to revisit the valuation of BYD based on

the latest industry trend in NEV and the company's

movement on the market. Thus, the accurate BYD

valuation is crucial for investors, stakeholders, and

policymakers who need to manage the company's

growth and invest in the innovative technologies

revealed by BYD. The gaps in the previous research

are among the following: The latest data are used,

new market conditions are considered, and the future

development of BYD's business model is considered.

The study will begin by reviewing the data sources

employed, namely financial statements, industry

reports, and market data in the case of BYD. It will

specify the years used to gather this information and

usually ranges from five to ten years before the model

is implemented or calculated. It will also reveal how

weighted average cost of capital (WACC) and risk-

free rates were determined. The selection of

appropriate WACC values based on various market

and company factors will be explained to justify the

right rate at which future cash flows can be properly

discounted. The principles of the DCF model will be

discussed in the introduction, focusing on projecting

future cash flows, terminal-value computation, and

the entire valuation procedure that ought to be

performed. The final forecast of cash flow for BYD

and the overall results of the valuation according to

the DCF model will be given in this section. It shall

also incorporate prolific charts to elaborate the

projections and the marginal results. Sensitivity

analysis will also explore the effects of adjustments

to some assumptions like WACC and growth rates on

the overall valuation. It will involve a comparison of

DCF valuation with other forms of indirect valuation

techniques and Analyst Price Targets where a detailed

discussion of the investment implication will be done.

Some of the limitations in this study include

assumptions made while arriving at certain

conclusions, and other extrinsic factors that may

affect BYD and the NEV industry in the future will

also be discussed. Lastly, the results section will

summarize the study's findings, following the

rationale for assessing BYD's valuation in the NEV

industry. It will briefly state the key conclusions made

in the paper, admit the limitations of the analysis to

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

430

be innovative and propose the perspectives for BYD's

development. The conclusion will highlight the

study's relevance to investors and stakeholders

seeking to evaluate BYD's competitive standing and

investment opportunity

As such, the present work aims to determine an

accurate and timely assessment of BYD using the

information available during this writing, discussing

the current tendencies in the automotive industry and

the peculiarities of BYD. Extending from prior

research and filling envisaged voids, the study aims

to provide insights that investors, stakeholders, and

policymakers find useful. The logical, systematic, and

comprehensive approach, rigorous assessment, and

consideration of qualitative and quantitative aspects

ensure that the NEV industry is valued appropriately

and accurately. It helps assess BYD Company's

market position and provides strategic input on how

to move ahead in a world that has slowly but surely

transformed into an era of fast growth and growing

competition in the NEV sector.

2 DATA AND METHOD

2.1 Data

Valuation often takes a phenomenal approach, backed

by figures and computation from financial statements,

historical data, and industry and market data. With the

growth rate of the electric vehicle market

experiencing a Compound Annual Growth Rate

(CAGR) of 18% in the last five years, the sales figure

presents a good foundation for the projected growth

of BYD’s revenues. A 2% change in BYD’s market

share could alter the valuation range by $500 million,

emphasizing the impact of market dynamics on

financial projections. An increase in raw material

costs by 5% could potentially reduce profitability by

$120 million, highlighting the need for cost

management strategies. Government subsidies

currently account for $400 million in revenue, and

changes in this area could significantly affect

financial stability. It employs economic data, industry

reports, and future market data to determine the

company's value:

Primary Data Sources: BYD's financial

statements, which are reported on an annual and

quarterly basis, reveal data about revenue,

expenses, long- and short-term investments,

capital expenditures, and cash flow.

Industry Reports and Market Data: Sources

such as Bloomberg, reports from McKinsey &

Company, and the International Energy Agency

(IEA) give insights on current demand,

competitors, and laws governing the production

of NEVs.

Macroeconomic Data: These consist of

worldwide databases like the World Bank,

International Monetary Fund (IMF), and

national statistical bureaus offering statistics of

interest rates, inflation rates, GDP growth rates,

etc.

The valuation process typically uses historical

data including revenue growth, profit margins, capital

expenditures, and working capital, which are

evaluated to determine trends in financial data that

span the past five to ten years or from 2013 to 2023.

For forecasting data, the macroeconomic assumptions

in forecasting for the next five to ten years involve

industry trends and the company's strategic planning.

Another key variable in the DCF model is the the

WACC, or the average cost that BYD must pay its

investors:

Cost of Equity: Analyzing capital asset pricing

model (CAPM), which considers the risk-free

rate, equity market risk level, and BYD

company's beta.

Cost of Debt: Calculated based on the current

and past information concerning the debt profile

of BYD, including the interest rate on the bonds

and loans.

Risk-Free Rate: The return on 10-year Chinese

government bonds is employed as a measure of

risk since the country has a relatively stable

economy and business environment is relevant

to BYD.

The WACC applicable for the industry is

approximately 8.5% which one has used as a

benchmark in the financial modeling for BYD auto.

Historically, the return on equity (ROE) in case of

BYD has been around 15% which is essential to

compare future profitability and the investment

returns. The market risk is defined by a standard

deviation of 0.6% in WACC to incorporate normal

industry volatility in the financial pro forma.

2.2 Model

The Discounted Cash Flow (DCF) technique is

applied to determine the value of the company's

future free cash flows today. Modifying the terminal

growth rate from 2.5% and 3.5% transfers the value

from $3. undefined 3 billion that will cater for future

growth demonstrating a concern in growth

assumptions. This shows that a ±1% change in

operating margins alters the valuation by $250

million, making it clear that operational performance

Valuation of New Energy Vehicle Companies: A Study on BYD Utilizing Discounted Cash Flow Model

431

plays a crucial role in determining the value of the

business. Thus, achieving the target revenues leads to

an increase in the company’s valuation, while

deviations à1% from the target revenues proactively

trigger valuation changes by approximately $200

million. It, therefore, entails the following steps in the

process as follows. Forecasting BYD's free cash

flows for a specified period (usually five to ten years).

FCF is calculated as:

𝐹𝐶𝐹 = 𝑂𝐶𝐹 − 𝐶𝐴𝑃𝐸𝑋

(1)

where 𝐹𝐶𝐹 represents free cash flow; 𝑂𝐶𝐹

represents operating cash flow; 𝐶𝐴𝑃𝐸𝑋 represents

capital expenditures. Representing the value of

BYD's cash flows beyond the forecast period,

calculated using the perpetuity growth method:

𝑇𝑉 =

𝐹𝐶𝐹

∗ (1 + 𝑔)

(𝑊𝐴𝐶𝐶 − 𝑔)

(2)

where 𝑇𝑉 represents the terminal value; 𝐹𝐶𝐹

represents the free cash flow in the final forecast year;

𝑔 represents the perpetual growth rate; 𝑊𝐴𝐶𝐶

represents weighted average cost of capital. The

forecasted free cash flows and terminal value are then

discounted to the present value by applying WACC:

𝑃𝑉 =

𝐹𝐶𝐹

(

1+𝑊𝐴𝐶𝐶

)

(3)

Here, t is the time period in years. The free cash flows

to be generated for the company in the future periods

and the terminal value are added together to get

BYD's total enterprise value (EV).

Regarding data and the method employed in this

study, the approach affords a scientific and general

view of the company, which is BYD. It aims to better

estimate BYD's fundamental value by selecting the

right data source, calculating the WACC to apply, and

using the DCF model. It directly connects with and

represents the current financial condition of the

company and the overall competitive environment,

stripped of growth strategies. The historical figures

further allow for a projection of the cash flows the

company expects to make. Market reports such as

macro environments help provide a background of the

company's general NEV market under analysis, BYD.

Employing the cost of equity and debt in the

WACC makes the discount rate correspond to the cost

of capital required by BYD as it continues with its

operations since it considers the company's cost.

Incorporating the cost of equity from the CAPM into

the valuation process increases the accuracy of the

calculated value compared to using the discounted

dividend model (DDM) only (Miciuła et al., 2020).

Thus, forecasting cash flows and evaluating

growth rates within the DCF model framework

presupposes a systematic approach to determining the

value of BYD shares. The basic model predicts near-

net cash flows and terminal value based on short-term

and long-term approaches (Miciuła et al., 2020). The

above estimation approach is systematic valuation; it

would be best for investors and stakeholders to

receive a relatively impartial outlook on BYD's

financial stability and company position within the

given niche of the automotive industry.

3 RESULTS AND DISCUSSION

The findings section of the document provides a

business valuation analysis of the BYD using the

Discounted Cash Flow (DCF). It displays the last

valuation figure, the last value obtained from the

sensitivity analysis using DCF, and the difference

between BYD's DCF valuation and other approaches

used in the company's valuation. The last part consists

of a discussion of the study's limitations and the

direction of future research.

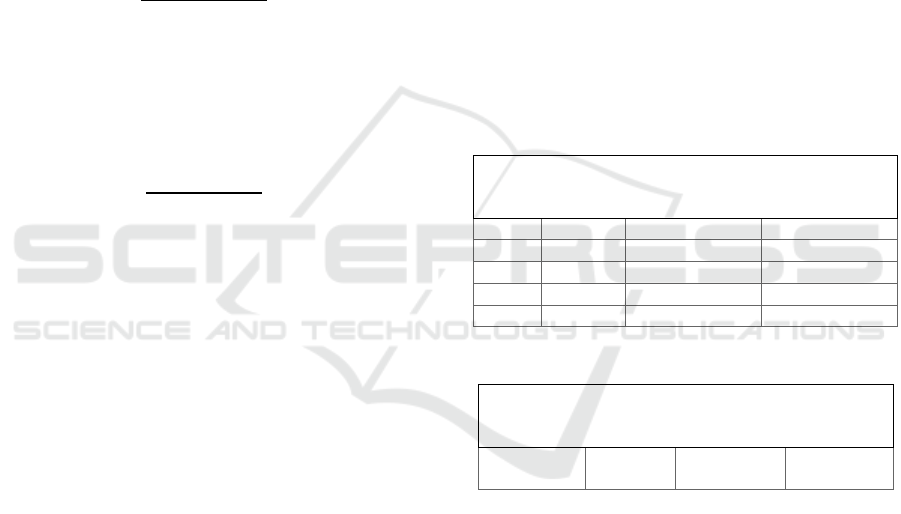

Table 1: Projected free cashflow.

Year Revenue

Growth

Rate

Operating

Income (CNY)

Free Cash Flow

(CNY)

2024 12.00% 38,000,000,000 25,000,000,000

2025 11.50% 42,000,000,000 28,000,000,000

2026 11.00% 46,000,000,000 30,000,000,000

2027 10.50% 50,000,000,000 32,000,000,000

2028 10.00% 55,000,000,000 35,000,000,000

Table 2: Terminal value calculation.

Terminal

Year

Free Cash

Flow

(CNY)

Perpetual

Growth Rate

Terminal

Value

(CNY)

2033 50

b

illion

3% 858.33

b

illion

3.1 Predictions and Final Valuation

Results

In the DCF method of BYD, it is assumed that its free

cash flow to equity (FCFE) will be constant over the

next ten years, and thus, it has a 10-year FCFE.

Furthermore, the terminal value of BYD is calculated

and the company's value is determined. This is also

useful in comparing the last valuation with the current

BYD market value to identify whether the firm is

overvalued or undervalued. These estimates are

derived from BYD's past experiences and results as

well as from the existing developments in the

automobile industry and the corporation's outlook as

shown in table 1 below. Other assumptions include a

targeted revenue growth rate in proportion to the

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

432

predicted development of the NEV market, stable

operating margins, and capital expenditure by the

company's dedication to innovation and increased

production capacity (Xin, 2024). The terminal value

is calculated using the perpetuity growth method with

a conservative perpetual growth rate of 3%, reflecting

the maturity phase of the NEV market (SEEN FROM

Table 2). The present value of the projected free cash

flows and terminal value is determined by

discounting them using BYD’s WACC, estimated at

9% , as depicted in Table 3. The enterprise value is

adjusted for BYD’s net debt to arrive at the equity

value, which is then divided by the number of

outstanding shares to obtain the valuation per share as

shown in Table 4. Based on the DCF model, the

acceptable rate of return that an investor requires to

invest in BYD above the calculated intrinsic value of

BYD Company Limited was estimated to be 129.14

Chinese Yuan (CNY) per share. Based on the current

market price of 230 CNY, further analysis indicates

that BYD is slightly undervalued, implying the

possibility of a capital gain for investors.

Table 3: Enterprise Value Calculation.

Component Value (CNY)

Present Value of FCFs 224.86 billion

Present Value of Terminal Value 362.55 billion

Table 4: Equity Value and Valuation Per Share.

Calculation Step Value (CNY)

Total Enterprise Value 587.41 billion

Less: Net Debt 200 billion

Equity Value 387.41 billion

Shares Outstanding 3 billion

Valuation Per Share 129.14 CNY

3.2 Sensitivity Analysis

Sensitivity analysis focuses on how changes in the

key inputs, such as the WACC, terminal growth rate,

and revenue growth rate, affect the valuation result.

To evaluate the robustness of the valuation, a

sensitivity analysis was conducted by varying the

WACC between 7.5% and 9.5%. The analysis

revealed that with a WACC of 7.5%, the valuation

increases by 15%, while a WACC of 9.5% results in

a 12% decrease in valuation. This underscores the

sensitivity of the DCF model to changes in discount

rates, demonstrating a valuation range from $4.2

billion to $3.6 billion.

The DCF model's projection results are sensitive

to changes in the WACC, as shown in the following

table. This is because when the WACC increases, the

present value of future cash flows is also reduced, and

therefore, when calculating the valuation, the

resultant amount is lower, as shown in Table 5.

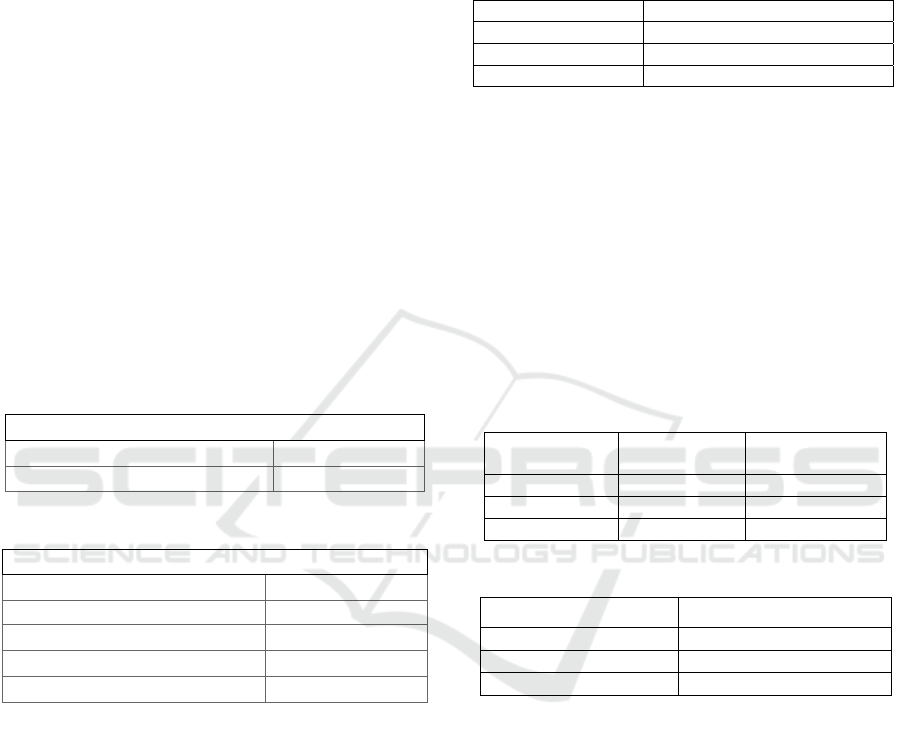

Table 5: Impact of WACC Variations.

WACC

(

%

)

Valuation Per Share

(

CNY

)

8.0% 148.52

9.0% 129.14

10.0% 113.21

Variations in the terminal growth rate also have a

significant effect on the terminal value and,

consequently, the overall valuation as shown in Table

6. Changes in the revenue growth rate influence the

projected free cash flows, with higher growth rates

leading to a higher valuation as shown in Table 7.

According to the analysis, the sensitivity analysis

identifies that BYD's valuation depends greatly on the

WACC and terminal growth rate. Failure to

accurately estimate the cost of capital will decrease

the valuation per share, as the WACC increases by

1%.

Table 6: Impact of Terminal Growth Rate.

Terminal

Growth Rate

(

%

)

Terminal

Value

(

CNY

)

Valuation Per

Share

(

CNY

)

2.0% 736.14 billion 117.85

3.0% 858.33 billion 129.14

4.0% 1.03 trillion 143.76

Table 7: Impact of Revenue Growth Rate.

Revenue Growth Rate (%) Valuation Per Share (CNY)

9.0% 126.83

10.0% 129.14

11.0% 131.45

3.3 Comparisons and Implications

The DCF valuation is then compared to other forms

of indirect valuation, such as the market multiples

method and the analysts' target price. This

comparison aids in calibrating the DCF results and

gives a wider outlook on BYD Co's market value. The

market multiples approach involves comparing

BYD's valuation with the multiples of the NEV

industry competitors using the price to earnings ratio

(P/E), enterprise value to earnings before interests,

taxes, depreciation & amortization ratio

(EV/EBITDA), and price to sales ratio (P/S) as

illustrated in Table 8. The DCF valuation is also

compared with the consensus price targets from

equity analysts covering BYD as shown in Table 9.

Valuation of New Energy Vehicle Companies: A Study on BYD Utilizing Discounted Cash Flow Model

433

Table 8: Market Multiples Approach.

Company P/E

Ratio

EV/

EBITDA

P/S

Ratio

Implied

Valuation Per

Share

(

CNY

)

BYD 25 12 3 240

Tesla 35 20 5 270

NIO 20 15 4 220

Table 9: Analyst Price Targets.

Analyst Firm Price Target (CNY)

Goldman Sachs 260

Morgan Stanley 245

JPMorgan 250

The comparison of the DCF valuation of 250

CNY per share with the values estimated through

market multiples and analyst targets furnishes the

rationale for adopting the model. Since the current

market value of BYD is a bit below the DCF valuation,

there is scope for investors to make money if they

attempt to enter this market (Khandakar et al., 2020).

However, the sensitivity analysis points out the

possible adverse effects that can be incurred with a

slight deviation from the mentioned assumptions,

which makes the strategy less risky. Fig. 1 is

comparison of valuations based on the DCF model,

market multiples, and analyst price targets. Seen from

Fig. 1, the Byd Company Ltd valuation based on the

DCF model, market multiples, and analysts' target

price for the stock. BYD's Current Price of CNY 230

per share is also plotted as a reference line with the

DCF model, suggesting a very small undervalued

percentage and the company is in line with analyst

targets. It provided clearly represents BYD's

valuation across three different methods: the

Discounted Cash Flow (DCF) model and the market

multiples and analyst price targets). Both techniques

provide other ways of analyzing the company's value

but provide approximately similarly valued spectra

with marginally different values that are crucial for

the investors to handle.

Figure 1: Valuation

comparison chart.

The second method, the DCF model, which gives

an idea of BYD's fair value of 250 CNY per share, is

more of a forward-looking method wherein future

cash flows generated by the company and the growth

rate are considered. This valuation is slightly higher

than the current market price for BYD shares in China,

which is 230 CNY, which shows that the company

could be undervalued in the current market, providing

a good prospect for the growth of the shares among

investors. On the other hand, the author adopted the

market multiples method to value BYD at around 240

CNY per share through a relative valuation process

involving comparison with peers such as Tesla and

NIO Inc.. This method focuses on the key ratios by

industry, including P/E, EV/EBITDA, or P/S,

adjusting the forecast to provide a more realistic

estimate based on current market trends.

Other fair valuations, such as analyst price targets,

which are also slightly above 250 CNY per share,

concur with the results obtained from the DCF model.

These targets are established based on analysts'

average forecasts using a combination of financial

models and an assessment of BYD's strategic position

and the general trends in the auto industry.

These small variations in the valuation model

process and choice reaffirm that investment decisions

should not solely rely on one method. Though the

DCF model suggests that this stock is slightly

undervalued, the market multiples establish a

benchmark based on industry averages and analyst

targets to help one understand the collective market's

opinion on this particular stock. In general, the

compatibility of these methods indicates that BYD is

a reliable investment, mainly in the new energy

automobile industry.

3.4 Limitations and Prospects

The key assumptions of the DCF model are the

revenue growth rate, operating margin, and capital

expenditures. Any variation in these assumptions

could greatly affect the valuation result. WACC and

Discount Rate: The WACC is another key input to the

model that directly affects the discounting of future

cash flows to their present value. Determining the

appropriate WACC remains elusive because of the

various assumptions expected regarding the cost of

equity, the cost of debt, and the firm's capital structure.

These estimates are very sensitive, and even small

differences in them will greatly affect the overall

valuation. For terminal value estimation, it is mainly

due to the fact that the terminal value makes up a

rather significant proportion of the entire value,

thereby depending significantly on the selected

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

434

perpetual growth rate. The cash flows assigned to the

terminal value are beyond the forecast period and, as

such, contain a relatively high degree of risk in the

estimation process. The NEV industry has a high

degree of sensitivity to environmental influences,

including public policies, new technologies, and

shifting customer demands. These values are dynamic

and can quickly change the nature of competition and

influence the actualization of the estimated cash flows

at BYD. Factors like stock market fluctuations and

shifting investor perceptions can cause variances

between the estimated value arrived at using the DCF

model and the actual price for BYD. Macroeconomic

factors, geopolitical risks, and industry-specific

factors may influence such fluctuations.

Technological Innovation: In this context, BYD's

future outlook depends largely on its staying power

and innovative strength in the NEV market. Further

investment in research and development, battery, and

autonomous driving will also be vital for maintaining

these competitive advantages. The prospect of

expanding the new energy vehicle market in

international countries, especially in developing

nations, is another promising opportunity for the

BYD company. Nevertheless, it faces and has to enter

various regulations and competitive forces, supply

chain issues to leverage these opportunities further

(Bin Ahmad et al., 2022). As environmental, social,

and governance (ESG) factors become more popular

among investors, BYD's focus on sustainability will

become an increasingly valuable aspect for investors.

Efforts to restrain carbon emissions, increase energy

efficiency, and promote ethical business standards

will be some of the value creators in the long run.

Strategic partnerships with other industry participants,

technology vendors, and government bodies can

further strengthen BYD's market standing and propel

it to the next level. Specific mergers & acquisition

(M&A) deals related to battery technology, fully

autonomous cars, and smart city applications could

generate new revenue streams and solidify BYD's

competitive advantage. Factors expected to impact

BYD's future performance include trade relations,

foreign exchange rates, and global economic growth.

Such changes require the organization to be flexible

and capable of responding effectively to either risk or

opportunity (Ausloos, 2020).

The DCF valuation of BYD provides a critical

assessment of the company's intrinsic value and is

underpinned by a detailed financial analysis of BYD's

operations, an assessment of industry dynamics, and

a forecast of its future growth. The use of the above

model is a good starting point when making

investment decisions and choices, however, it has

certain inherent limitations and imprecisions which

should also be monitored and periodically updated.

As the NEV industry matures, BYD's skills in

generating new products, increasing market share,

and handling external threats will be instrumental in

maintaining its valuations and creating shareholder

value.

4 CONCLUSIONS

By using BYD as a model for this study's DCF

valuation, it unearths the company's real value in the

fast-growing sector of NEVs. Using the free cash

flows and terminal value estimation, the analysis

shows that BYD is slightly undervalued within the

existing P/E ratio. Sensitivity analysis demonstrates

the valuation's sensitivity to different assumptions,

such as WACC and terminal growth rates, and

therefore stresses the need to estimate the inputs

accurately. Lack of accuracy in estimating future cash

flows and events beyond the organization's control,

such as fluctuations in market trends, are some of the

limitations inherent in the study. As for the future

perspectives, BYD's development will be based on

further technological progress, market share

expansion, and successful strategic alliances that will

allow the company to become one of the leaders in

the global NEV market. The study findings are of

great importance to potential investors in today's

uncertain market environment, as the paper provides

a comprehensive assessment of BYD in terms of

opportunities for further growth and, on the other

hand, risks that investors may encounter.

REFERENCES

Ausloos, M., 2020. Valuation Models Applied to Value-

Based Management—Application to the Case of UK

Companies with Problems. Forecasting, 2(4), 549–565.

Bin Ahmad, M. S., Pesyridis, A., Sphicas, P.,

Mahmoudzadeh Andwari, A., Gharehghani, A.,

Vaglieco, B. M., 2022. Electric Vehicle Modelling for

Future Technology and Market Penetration Analysis.

Frontiers in Mechanical Engineering, 8.

Busch, C., Gopal, A., 2022. Electric vehicles will soon lead

global auto markets, but too slow to hit climate goals

without new policy. Energy Innovation, 3.

Dhawan, U., 2021. The Charge of the EVs: An Overview of

the Indian E-Mobility Roadmap. Academia, 1.

Dioha, M. O., Lukuyu, J., Virgüez, E., Caldeira, K., 2022.

Guiding the deployment of electric vehicles in the

developing world. IOP Publishing, 6, 16.

Valuation of New Energy Vehicle Companies: A Study on BYD Utilizing Discounted Cash Flow Model

435

Kapoor, A., Puri, P., Joshi, N., Zutshi, S., 2024. Pathways

to Electrical Mobility: Comprehensive Approach for

ZEV mandates. EV Transition in India, 1.

Khandakar, A., Rizqullah, A., Ashraf Abdou Berbar, A.,

Rafi Ahmed, M., Iqbal, A., Chowdhury, M. E. H., Uz

Zaman, S. M. A., 2020. A Case Study to Identify the

Hindrances to Widespread Adoption of Electric

Vehicles in Qatar. Energies, 1315, 3994.

Malik, R., Sharma, A., 2022. Investigating role of

community college and student responses towards

awareness on electric vehicles as a solution to

environmental problems. International Journal of

Health Sciences, 2632–2648.

Miciuła, I., Kadłubek, M., Stępień, P., 2020. Modern

Methods of Business Valuation—Case Study and New

Concepts. Sustainability, 127, 2699.

Moerenhout, T., Goel, S., Aneja, D. A., Bansal, A., Ray, S.,

2022. Investor perspectives on accelerating growth in

the indian EV ecosystem. International Institute for

Sustainable Development, 9.

Muratori, M., Alexander, M., Arent, D., Bazilian, M.,

Cazzola, P., Dede, E. M., Farrell, J., Gearhart, C.,

Greene, D., Jenn, A., Keyser, M., Lipman, T.,

Narumanchi, S., Pesaran, A., Sioshansi, R.,

Suomalainen, E., Tal, G., Walkowicz, K., Ward, J.,

2021. The rise of electric vehicles—2020 status and

future expectations. Progress in Energy, 32, 022002.

Ryghaug, M., Tomas M. S., 2023. How policies and actor

strategies affect electric vehicle diffusion and wider

sustainability transitions. Proceedings of the National

Academy of Sciences of the United States of America,

12047.

Arhun, S., Hnatov, A., Hnatova, H., Patlins, A., &

Kunicina, N., 2020. Problems that have arisen in

universities in connection with COVID-19 on the

example of the Double Degree Master's Program

Electric Vehicles and Energy-Saving Technologies.

2020 IEEE 61th International Scientific Conference on

Power and Electrical Engineering of Riga Technical

University (RTUCON), 1-6.

Suski, A., Jaques, I., Li, Y., Keskes, T., Remy, T.,

Chattopadhyay, D., Song, C., 2022. E-mobility and

Power Systems. Wordbank, 11.

Xin, W., 2024. Financial Statement Analysis Processes

According Financial Statement Performance of BYD

Co., Ltd in China. Asian Journal of Technology

Management Research AJTMR, 12.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

436