Analysis of Problems and Countermeasures in the Application of Big

Data Technology in Finance

Yukun Tang

a

School of Mathematical Science, Dalian University of Technology, Dalian, China

Keywords: Big Data Technology, Finance, Business Economy.

Abstract: With the increasing degree of informatization in the financial industry, customer demand and market

environment are becoming increasingly complex, and big data technology applications in the financial sector

are now a major factor driving the industry's growth. Based on this, the article analyzes the problems and

countermeasures in the application of big data technology in finance. The application of big data technology

in the financial field faces four problems, namely, data quality problems, data privacy and security problems,

data silos and collaboration challenges, data analysis and use restrictions, and this article obtains four

countermeasures through discussion. The countermeasures are as follows, improving data quality, enhancing

data privacy protection, connecting data silos and reducing data analysis and utilization limitations. In addition

to offering solutions to some of the issues encountered in its implementation, the study presented in this article

serves as a reference for the use of big data technologies in the financial sector.

1 INTRODUCTION

From a macro perspective, big data technology has

become a key driver of economic, social,

technological and even global development. It has not

only improved the efficiency and effectiveness of

various fields but is also profoundly changing the way

human society operates. Therefore, the advancement

of modern society will inevitably need the

understanding and application of big data technology.

Big data technology has numerous applications.

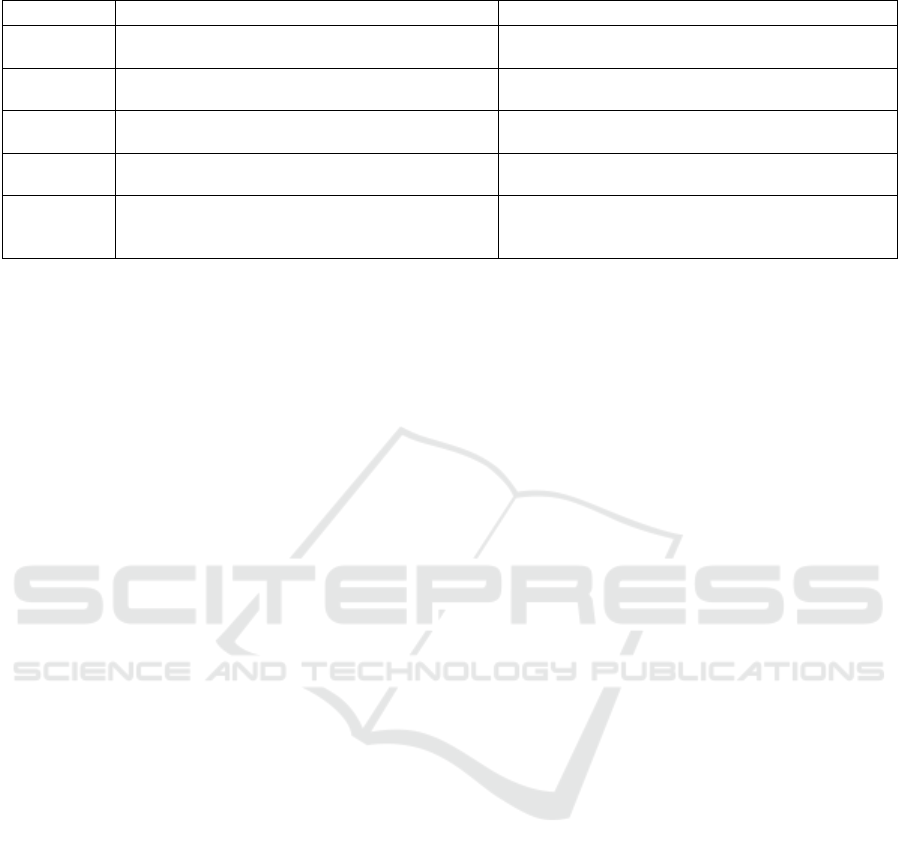

Table 1 shows the applications of big data

technologies in specific areas.

In particular, the special characteristics of the use

of big data technology in the financial sector is that it

accentuates the high accuracy and performance of the

data in real time, risk management and compliance of

the data, and privacy and data security.

Nowadays, there have been a number of studies

that have analyzed in depth the application of big data

technologies in finance. To meet the challenges of

data quality and processing efficiency, financial

institutions should fundamentally optimize their data

processing processes (Zhang & Liu, 2024).

Additionally, enterprises can establish big data

a

https://orcid.org/0009-0006-9161-7605

platforms for data sharing (Zhou, 2024; Zhu, 2023).

At the same time, in the quantitative investment

process, machine learning algorithms in big data

technology can be utilized to construct machine

learning models with computer support (Guo, 2024).

In terms of asset allocation, asset allocation founded

on big data technologies is establishing a set of

customer-centric intelligent asset allocation system

by analyzing customers' investment behavior and

financial situation (Zhao, 2024). However, the

application of big data analytics in the financial sector

still faces four problems, issues with data quality,

issues with data safety and confidentiality, data silos

and collaboration challenges, data analysis and use

restrictions, so this study analyzes these issues in

depth and proposes responses accordingly.

412

Tang, Y.

Analysis of Problems and Countermeasures in the Application of Big Data Technology in Finance.

DOI: 10.5220/0013264400004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 412-416

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

Table 1: Applications of big data technologies.

Field Big Data Applications Key influence

financial Risk management, precision marketing, credit

scorin

g

, anti-fraud monitorin

g

Enhanced risk control, increased customer

conversion, reduced bad debt ris

k

healthcare Disease prediction, personalized treatment,

healthcare resource optimization

Improved healthcare efficiency, personalized

treatment plans, reduced healthcare costs

government Smart city development, public safety

mana

g

ement, resource allocation

Improved city management efficiency, enhanced

p

ublic safet

y

, o

p

timized resource allocation

energy Smart grids, energy demand forecasting, renewable

ener

gy

mana

g

ement

Increased energy efficiency, reduced waste, promoted

g

reen ener

gy

education Personalized learning paths, educational resource

optimization, academic research data analysis

Improved teaching effectiveness, equitable

distribution of educational resources, accelerated

research

p

ro

g

ress

2 PROBLEMS

2.1 Data Quality Issues

Because financial data is often collected from a

variety of sources, it may contain inconsistencies,

redundancies, or incomplete errors. Data quality

directly affects the accuracy of big data analyses.

(Xiao, 2024). Studies on big data technology's

application in the finance sector. Firstly, the financial

sector involves multiple data sources such as market

data, trading data and customer data, and these

different data can lead to inconsistencies in data

quality. Second, each type of data is affected to

varying degrees, with market data being affected by

market fluctuations and trading activities, while

customer data is subject to quality uncertainty due to

irregularities in information entry or inaccuracies in

the information provided by customers. Third,

financial institutions may be affected by factors such

as network fluctuations and system failures when

collecting data, all of which may lead to

inconsistencies in the data collection process. Finally,

due to the dynamic nature of financial markets, delays

in data transmission and processing can result in an

inability to ensure real-time availability, for example,

in a rapidly fluctuating market environment, where

delays in transmission and processing times can result

in the unavailability of data at critical moments,

thereby affecting the ability of financial institutions to

respond to market conditions.

2.2 Data Privacy and Security Concerns

Financial data contains a large amount of sensitive

information about individuals and businesses.

Information may be exchanged wirelessly between

people, computers, and the surrounding environment

thanks to widely used large data transfer technologies

as wireless sensor and actuator networks (Zhang,

2020). While this improves the convenience and

efficiency of data collection, it also increases the risk

of data breaches. For example, in 2017, Equifax, one

of the main three American credit reporting

companies, suffered a serious data leak. Hackers

exploited an unpatched cyber vulnerability in Equifax

to illegally access the company's database. About 147

million American consumers' personal information,

including Social Security numbers, dates of birth,

addresses, and driver's license numbers, were

compromised in the hack. This example underscores

data security's significance and privacy to the banking

industry, especially when dealing with large amounts

of sensitive data. Data breaches can not only cause

significant harm to individuals, but also pose serious

financial and reputational risks to financial

institutions.

2.3 Data Silos and Collaboration

Challenges

The data in different parts of the financial institution

is usually closed, so that there are many data silos,

limiting the effect of big data application.

For example, the risk management department has

its own risk data, while the marketing department has

independent customer data, which leads to the

inability to share data between departments,

hindering the establishment of an overall data view

and affecting the comprehensive analysis of the

overall business. Different departments use different

data standards, making it necessary to spend a lot of

effort on standardization in the data integration

process. Standardization involves consistency in data

naming, units, formats, etc. Inconsistency leads to

confusion in data integration, and the lack of

standardization increases the difficulty of integration,

leading to misleading conclusions in the analysis

Analysis of Problems and Countermeasures in the Application of Big Data Technology in Finance

413

process. At the same time, financial institutions rely

on multiple third-party data providers, and different

providers use different data formats, which

complicates the integration of data from different

providers, further increasing the difficulty of

integration and creating challenges for financial

institutions to utilize third-party data.

2.4 Data Analysis and Utilization

Limitation

In the big data era, some enterprises encounter certain

problems in data analysis and utilization (Qiu, 2024).

These issues are primarily evident in the following

two areas. Firstly, although most enterprises have

accumulated a huge amount of data, they have not

been able to explore the intrinsic value of these data

in depth. This is mainly due to the general lack of

professional big data analysis team, especially the

lack of data scientists and engineers who master

advanced technologies such as data mining and

machine learning. Secondly, there is also a significant

lack of data infrastructure construction in enterprises,

such as the lack of data warehouses and data

middleware. This lack of infrastructure makes it

difficult for in-house data teams to take on the

complex tasks of data integration, storage, processing,

and model building. This not only limits the depth and

breadth of big data analytics and applications, but also

affects an organization's ability to make data-based

decisions and the possibility of guiding business

strategy based on data insights.

3 SOLUTIONS

3.1 Increase the Data Quality

Data quality will be improved through the

implementation of a reliable data governance

framework, including steps such as data cleansing,

data standardization, and data integration. Meanwhile,

the development of technology utilizing artificial

intelligence to automate the identification and repair

of errors in data is also a way to enhance data quality.

Between the industry with the formation of data self-

contained system, from within the financial industry,

to be in accordance with the content of the data of

banks, securities, insurance, etc., effectively solving

the problem of non-uniformity of the standard

specification. If you want to effectively use big data

to carry out analysis work, then it is essential to make

sure the standardization of data recording methods

and methods, but also need to develop the content of

the specification is closely related to the protection of

data quality. By comprehensively considering the

different ways of recording data, mastering various

types of accounting processing methods, and starting

from within financial institutions, within the industry,

and between industries, it gradually realizes the basic

goals of data openness and sharing, and promotes the

establishment of a platform for sharing basic data on

comprehensive statistics in the financial industry

(Chang, 2024).

Companies can use machine learning algorithms

to automatically identify and fix errors in data,

especially effective when dealing with large-scale

data. Companies can also use AI models to predict

possible data quality issues and take steps to prevent

them in advance.

3.2 Strengthen Data Privacy Protection

Financial institutions can strengthen data privacy and

security through a variety of measures such as data

encryption, patching network vulnerabilities, and

blockchain technology to prevent data leakage and

misuse and ensure compliance in a strict legal and

regulatory environment, while improving customer

trust and corporate reputation.

Enterprises need to save accounting information

and establish a more complete confidentiality system

and authorize it. More advanced network key

technology can be utilized for encryption, so that the

security of accounting information has been

improved. At the same time, enterprises can

strengthen the protection of computer hardware and

software for recording accounting information, and

effectively implement the confidentiality of

information.

By patching network vulnerabilities, the

unscrupulous elements can be prevented from

attempting to steal company data and information

through illegal means. At the same time, by installing

patches in a timely manner, conducting regular

vulnerability scans, and strengthening access control

and encryption measures, the security of the system

can be enhanced, thus effectively protecting data

privacy and preventing the leakage of sensitive data

Blockchain technology protects data privacy

through mechanisms such as decentralization,

encryption and hashing, anonymity, tamper-proof

ledgers, smart contracts and selective disclosure. It

enables users to conduct secure transactions and share

data without revealing their personal identity, while

ensuring data integrity and control and reducing the

risk of privacy breaches.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

414

3.3 Bridge the Data Silos

Data silos can be bridged through the establishment

of a unified data platform, the use of data warehouses

and data lakes, and the use of integration techniques

and tools. These measures can help to consolidate

dispersed data resources and facilitate the flow of data

across different departments and systems, thereby

improving data availability and the efficiency of

business decision-making.

Enterprises can establish a unified data-sharing

policy framework, clarify the data-sharing standards

for each department's business area, promote data

openness and integration, avoid information silos,

and promote the full utilization of data resources by

all parties. A data lake has been constructed to store

data from different data sources in their original form,

forming a centralized and scalable data storage

architecture, which facilitates flexible data extraction

by various business sectors as needed and improves

data availability. At the same time, enterprises can

also develop unified data standards to reduce the

difficulty of data integration, improve data

interoperability between different systems,

standardize data naming, format, units and other

aspects of the standard, simplify the process of data

integration, to ensure that the data can be in the

smooth flow between different systems.

Another way to address this issue is to consolidate

these data silos using integration techniques and

tools. There are a variety of frameworks and tools for

data integration. Integrating these data silos is a costly

and time-consuming process, but big data integration

is focused because of its long-term benefits (Peter,

2019).

3.4 Decrease Data Analysis and

Utilization Limitation

Businesses that develop talent should focus on their

employees' computer skills training, so that the

financial management work and big data combined to

help enterprises quickly make the right decisions,

thus prompting leaders to fully recognize the

importance of financial work, to enhance the

environment that supports the growth of the

enterprise's plans. In addition, businesses, educational

institutions, and universities can cooperate with each

other, the enterprise appointed professional financial

management personnel to colleges and universities

for further study, you can also hire outstanding

graduates of universities to form a more professional

team. During the course of management team,

enterprises should try to enrich some Internet

professionals, only in this way can make the

combination between financial management and big

data more closely, so that the enterprise to get more

quality services.

While data warehouses are mainly used to

integrate and store structured historical data to

support reporting and decision analysis, a data middle

office is a more flexible architecture that integrates

structured and unstructured data, supports real-time

processing and diversified data applications, and

helps companies break down data silos to promote

data sharing and business innovation. By adding data

warehouse and data center, in-enterprise data teams

can take on the complex task of integrating, storing,

processing, and modeling data, as well as delving into

the value inherent in that data.

4 CONCLUSIONS

The financial business is becoming more and more

information-driven, which has complicated the

market and client demands. As a result, big data

technology is being used in the financial sector, which

is helping to drive the industry's growth. Based on this,

the paper examines the issues and solutions pertaining

to the application of big data technologies in the

financial industry. Four issues arise when using big

data technologies in the financial sector: issues with

data quality; issues with data safety and privacy;

issues with data silos and collaboration; and issues

with data analysis and use limits. This article

discusses these issues and provides four solutions.

The following countermeasures include lowering

data analysis and utilization restrictions, linking data

silos, strengthening data privacy protection, and

improving data quality. In addition to offering

solutions to some of the issues encountered in its

implementation, the study presented in this article

serves as a reference for the use of big data

technologies in the financial sector.

The future research direction related to this thesis

is the deep integration of Artificial Intelligence and

Big Data in finance. The deep integration of Big Data

and Artificial Intelligence has a broad research

prospect in the field of finance, especially in the areas

of intelligent investment advisor, financial risk

management, anti-fraud system, personalised service

for customers, high-frequency trading and

quantitative investment, as well as financial product

innovation. Enterprises can significantly improve the

efficiency of financial decision-making, the accuracy

of risk management and the personalised level of

customer service by combining the rich information

Analysis of Problems and Countermeasures in the Application of Big Data Technology in Finance

415

of big data with the powerful analytical capabilities

of AI, thus promoting the further development of

fintech.

REFERENCES

Chang, L. (2024). Applications and issues of big data

analytics in financial investments. Finance and

Economics (11), 12-14.

Guo, Z. Y. (2024). Application of big data technology in

financial industry. Industrial Innovation Research (03),

132-134.

Patel, J. (2019). Bridging data silos using big data

integration. International Journal of Database

Management Systems, 11(3), 01-06.

Qiu, T. T. (2024). Problems and solutions of enterprise

financial management in the era of big data. Investment

and Entrepreneurship (13), 125-127.

Xiao, J. T. (2024). Research on the application of big data

technology in financial industry. Metallurgical

Management (05), 70-72.

Zhang, B. (2020). The application of big data technology in

the financial sector and its regulation. Journal of Beijing

Economic Management Vocational College (01), 16-

23+33.

Zhang, S., & Liu, Z. (2024). Exploring the application of

big data technology in fintech. Communication World

(03), 190-192.

Zhao, F. L. (2024). Case analysis of financial industry

based on big data technology[J]. Digital

Communication World (02), 81-83.

Zhou, H. (2024). Discussion on the application of big data

in agricultural economic management. Shanxi

Agricultural Economy (05), 137-139.

Zhu, H. Q. (2023). Discussion on financial investment risk

and its countermeasures in enterprise financial

management. Financial Literature Forum (04), 115-

117.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

416