Study on the Economic Consequences of Environmental Information

Disclosure of Heavy Industry Enterprises: Taking Sany International

Heavy Industry Holdings Limited as an Example

Yangmiwen Yu

School of Accounting, Zhejiang University of Finance & Economics, Hangzhou, Zhejiang Province 310000, China

Keywords: Information Disclosure, ESG Reporting, Economic Consequences, Sany Group.

Abstract: Under the new economic normal, China is paying more and more attention to the environmental disclosure

of listed companies. In 2024, Shanghai, Beijing and Shenzhen Stock Exchanges announced guidelines for

mandatory disclosure of sustainability reports by listed companies. However, the call for mandatory

disclosure has not received the echo it deserves. Some companies still pay little attention to information

disclosure, or even avoid environmental information disclosure. In addition, there are problems such as

falsification and irregularities in the disclosure information of disclosed companies that need to be addressed

urgently. This study examines and analyses the short-term and long-term economic consequences of re-

disclosure for a Hong Kong-listed company that has disclosed Environmental Social and Governance (ESG)

reports for four consecutive years. The study starts in terms of the positive, neutral, and negative impacts of

financing, share price, stakeholders, and so on. It aims to change the mentality of the enterprise and to make

them more focused on long-term benefits while facing the short-term negative impacts. It could promote listed

companies to pay attention to, standardize and completely disclose of environmental information. While

enabling listed companies to fulfill their social responsibilities, non-listed companies are encouraged to

actively disclose environmental information.

1 INTRODUCTION

1.1 Background

In recent years, environmental information disclosur

e has attracted much attention from the international

community. As an effective means of promoting the

implementation of the main responsibility of ecologi

cal and environmental protection by enterprises, Env

ironmental information disclosure also plays a role in

allowing the public to participate in and supervise th

at environmental pollution control of enterprises and

is committed to promoting the soundness of the ecol

ogical environment governance system.

The State Environmental Protection Administrati

on (SEPA) took the notice on Disclosure of Environ

mental Information of Enterprises issued in 2003 as

a starting point.

In 2008, the Measures on Disclosure of Environment

al Information (for Trial Implementation) promulgat

ed to extend the subject of information disclosure to

enterprises. It is a milestone in improving the govern

ance and monitoring of environmental information. S

ubsequently, in 2014, the newly revised Environmen

tal Protection Law set up a special chapter, requiring

that the information disclosure of heavy polluting en

terprises was changed from voluntary to mandatory.

Then, in 2021, the Ministry of Ecology and Environ

ment launched the "Reform Program for the Legal D

isclosure of Environmental Information". It graduall

y improved the linkage construction of the informati

on disclosure system. In April 2024, under the unifie

d deployment of the China Securities Regulatory Co

mmission, Shanghai, Beijing and Shenzhen Stock Ex

changes officially issued guidelines for the sustainab

ility reporting of listed companies, making it mandat

ory for listed companies to disclose sustainability rep

orts. At the same time, other companies are encourag

ed to make voluntary disclosures. They disclosed inf

ormation through publishing Environmental, Social a

nd Governance (abbreviated as ESG) report.

In the past two decades, China has successively a

nnounced relevant laws on environmental informatio

n disclosure. It was from the beginning of the indepe

380

Yu, Y.

Study on the Economic Consequences of Environmental Information Disclosure of Heavy Industry Enterprises: Taking Sany International Heavy Industry Holdings Limited as an Example.

DOI: 10.5220/0013263600004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 380-386

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

ndent formulation of departments to the current mult

i-department joint formulation, from voluntary to ma

ndatory. Environmental legislation gradually adapts t

o economic development with the continuous refine

ment of content and the gradual improvement of law

s and regulations.

1.2 Purpose and Significance of the

Study

Due to some effects of multiple factors such as spont

aneity or market orientation, such as the negative im

pact of some surpluses and costs in disclosure, the qu

ality of environmental information disclosure is not h

igh. It does not play the role that the environmental i

nformation disclosure system should have.

But risks and opportunities could exist at the sam

e period. The purpose of this study is to make enterp

rises face up to the short-term negative impact of sta

ndardized environmental information disclosure. Co

mpany should attach more importance to long-term b

enefits and actively assist in completing the company

's mentality change from "Be wanted to disclose" to

"I want to disclose". From another perspective, the st

udy can gain the positive green transformation of so

me high-energy-consuming enterprises proposed by

Zeng Xianglan(2024).They also strengthen surplus m

anagement. They would like to use environmental in

formation disclosure to let investors see the company

's reflections to environmental protection and the pro

spects for sustainable development.

1.3 Study Methodology

1.3.1 Case-Study Method

This study adopts the case study method and selects

Sany International Heavy Equipment Holdings Com

pany Limited (hereinafter referred to as Sany Interna

tional). This study compared and summarized its eco

nomic situation before and after the disclosure of env

ironmental information and over a period of time.

1.3.2 Documentary Research Method

Through searching and reading some literature relate

d to environmental disclosure information of heavy p

ollution and heavy industry, this study could provide

an in-depth understanding of environmental informa

tion disclosure. It organized and analysed the status q

uo of environmental information disclosure from var

ious aspects. This provided a theoretical basis for res

earching a single case and comparing it with the mar

ket.

1.4 Literature Review

Gao Tiantian (2024) believes that the impact of gene

ral corporate environmental accounting disclosure on

firm performance was positive. The reason was to in

crease the transparency of information. Lu Taiheng e

t al. (2024) concluded that voluntary environmental i

nformation disclosure regulation could promote the h

igh-quality development of firms by reducing inform

ation asymmetry and minimizing the risk of corporat

e greenwashing. Meanwhile, Yao Yuanyuan (2024)

mentioned that accelerating the system of informatio

n disclosure could help boost the high-quality develo

pment of enterprises. However, heavily polluting ind

ustries have disadvantages in environmental informa

tion disclosure. The state of disclosure in the field is

not optimistic on a voluntary basis. The introduction

of the mandatory disclosure system has pushed the si

tuation of inaccurate environmental information disc

losure to a higher level.

From the environmental basis, Shi Jiawei (2024)

mentioned that in the context of dual-carbon, the pra

ctical disclosure of environmental information can b

etter observe the carbon emission situation and solve

the problems therein.

From the financial level, Li Tao et al. (2023) beli

eved that some firms use information asymmetry to r

educe or whitewash the concerns of investors and sta

keholders. Tong Youxia (2024) summarized based o

n some studies that corporate executives will engage

in short-sighted behaviors in order to increase their c

ompensation, thus manipulate enterprises to increase

selective disclosure.

From the investor level, Cui Haitao et al. (2024) s

aid that so far, research shows that China is still dom

inated by neutral investors. They care more about pr

ofitability than a series of improvements that drought

about by corporate environmental disclosures, and o

f course, the consequences. Instead of environmental

disclosures being geared toward investors, they are

more geared toward regulation to gain sympathy.

2 RELEVANT CONCEPTS AND

THEORISE

2.1 ESG Information Disclosure in the

Context of Sustainable

Development

Liu Zhao (2024) argued that ESG information is an i

nfluencing factor in determining whether a firm is su

stainable or not. At the same time, the disclosure of i

Study on the Economic Consequences of Environmental Information Disclosure of Heavy Industry Enterprises: Taking Sany International

Heavy Industry Holdings Limited as an Example

381

nformation could also reflect the transparency of the

firm's decision-making. In the context of sustainable

development, ESG reporting is a way for companies

to do their part to protect the environment and social

responsibility while ensuring economic benefits.

2.2 ESG under the Theory of

Information Symmetry

The theory of information symmetry says that under

market conditions, in order to reach a fair transaction

, the information held by both parties to the transacti

on must be symmetrical. But so far, this is a kind of i

deal situation in the trading environment. Most trans

actions are still the seller with the most information a

nd the buyer with a small amount of information. In

formation asymmetry still exists. The disclosure of E

SG reports can provide a platform for enterprises to

disclose information. If the information disclosure is tr

ansparent, standardized and completed, it will enable t

he buyers to have the same information. This behavior

could make the market gradually move closer to the s

ymmetry of information between buyers and sellers.

2.3 Signaling Theory and Cohort

Effects

Shao Peng et al. (2023) mentioned that signaling the

ory refers to the fact that firms will choose to activel

y disclose information to the outside in order to avoi

d adverse selection caused by information asymmetr

y. It could as a way to reduce the disadvantages of bu

yer and investor decision-making due to insufficient

understanding of the business.

The cohort effect refers to the fact that under the

condition that all firms disclose environmental infor

mation, companies that disclose more will be under g

reater pressure than those that disclose less. Compan

ies which disclosed are under more pressure than tho

se that do not.

2.4 The Moral Responsibility

Hypothesis and the Opportunism

Hypothesis

Cui Haitao (2024) argues that the ethical responsibili

ty hypothesis means that there is a significant positiv

e relationship between the transparency of corporate

environmental information and surplus management.

In addition, the disclosure of environmental informa

tion by enterprises demonstrated that they have a sen

se of social responsibility and abides by social ethics

. Such firms have less manipulation of surpluses. Th

e quality and reliability of accounting information ha

ve dramatically improved. The opportunism hypothe

sis refers to the fact that firms disclose environmenta

l information in order to conceal their own opportuni

stic behavior. On the one hand is to make investors p

ay more attention to environmental disclosures, so as

to reduce or even ignore the concern on earnings. O

n the other hand is to make the regulators think that e

nterprises have a high level of social morality, thus r

elaxing the focus on corporate earnings management

3 MOTIVATION ANALYSIS

3.1 Objective Reasons

According to the existing theories and laws, environ

mental information disclosure is not fully regulated.

Some enterprises still exist problems such as disclos

ure falsification, non-standard disclosure, poor qualit

y of accounting information disclosure, inactive discl

osure and other issues.

3.2 Subjective Reasons

After the implementation of the Mandatory Disclosu

re Ordinance, the time limit is one year. However, th

e number of ESG reports that can be publicly availab

le on the official website within half a year is limited

. It reflects that the disclosure of sustainability report

s is not active. And there may be a lack of attention i

nternally or at a high level.

4 RESEARCH RESULTS

Sany International is the second largest core enterpri

se of Sany Group, established in the Cayman Islands

on July 23, 2009.On November 25, 2009, it was offi

cially listed on the main board of the Stock Exchang

e of Hong Kong Limited. Sany Group has a number

of patented technologies and is committed to the rese

arch and development of large-scale coal machinery

equipment, with a wide range of products and many t

ypes. At present, Sany International occupies an imp

ortant position in the industry as a leading heavy ene

rgy equipment supplier and a large-scale logistics eq

uipment manufacturing enterprise. Three major strat

egies being implemented by Sany are globalization,

digital intelligence, and low-carbonization.

Up to now, Sany International has released corpo

rate ESG reports for four consecutive years. It is one

of the few listed companies that has started to publis

h ESG reports since voluntary disclosure. According

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

382

to the relevant data of Eastmoney, the study found t

he following economic consequences.

4.1 Financing Perspective

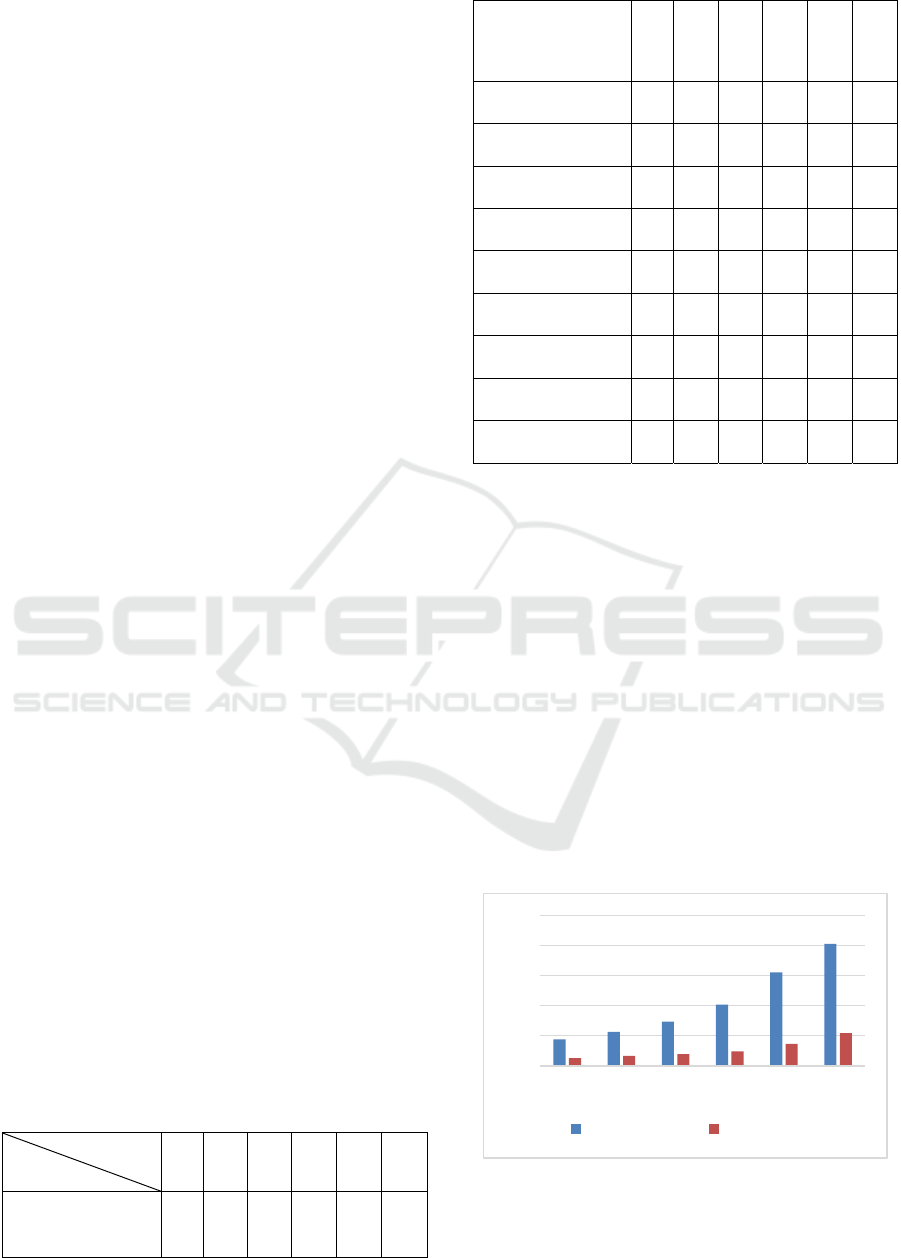

As Table 1 follows, the composition of Sany Internati

onal's shareholders and directors has hardly changed

in the past four years. According to the Table 1, dire

ctor Zhang* did withdraw during the environmental i

nformation disclosure period. However, since Sany I

nternational has not yet made environmental disclosu

res, director Zhang* has gradually reduced his share

holdings. Therefore, the impact of this behavior on t

he disclosure of information is almost zero. Equity h

olders did not lose confidence in Sany International b

ecause of its disclosure of ESG reports. Thus conclus

ions can be drawn that the disclosure of ESG reports

did not have a material impact on Sany International'

s financing apart from natural fluctuations.

In the ESG report disclosed on the official websit

e of Sany International, it is shown that they adopted

energy-saving and emission-reduction technologies

and attached importance to resource recycling. And t

hey actively presented this advantage to investors to

demonstrate the response to China's advocacy of env

ironmental protection. This is conducive to Sany Inte

rnational to enhance its corporate image. It could ma

ke investors believe that it has sustainable prospects

and are willing to provide financial support for it. Th

is behavior also attracted more margin trading. At th

e same time, the information symmetry brought abou

t by good environmental performance and adequate i

nformation disclosure can reduce financing risks. In

addition, the financial institution will give a lower fi

nancing interest rate at the time of assessment.

However, for small and medium-sized enterprise

s (SEMs), environmental information disclosure nee

ds to invite professionals. Hiring a professional agen

cy to collect and collating reporting data may put a c

ertain burden on SMEs. As a result, the profitability

of the enterprise will be affected. The pressure on the

enterprise will increase when financing. Heavy poll

uting enterprises also have the problem of exposing e

nvironmental risks. If there are problems with the res

ults of the disclosure, it can cause concern for invest

ors and suspicion from regulators.

Table 1: Sany International's 2018-2023 Shareholder and

Director Holding Ratio.

Year

Shareholde

r

2018 2019 2020 2021 2022 2023

Sany Hong Kong

Group Limited

(Shareholder)

85.9

7%

83.2

1%

82.4

8%

81.7

4%

81.5

1%

80.5

4%

Sany Heavy

Equipment

Investment Co.,

Ltd. (Shareholder)

85.9

7%

83.2

1%

82.4

8%

81.7

4%

81.5

1%

80.5

4%

Liang*

(

Shareholder

)

86.3

3%

83.5

6%

82.8

3%

82.0

9%

81.8

6%

80.8

8%

Fu* (Director) 0.20

%

0.10

%

0.05

%

0.02

%

0.13

%

0.11

%

Qi* (Director) 0.20

%

0.10

%

0.08

%

0.04

%

0.21

%

0.28

%

Zhang* (Director) 0.14

%

0.07

%

0.04

%

Xiang* (Director) 0.09

%

0.09

%

0.09

%

0.09

%

0.09

%

0.09

%

Tang* (Director) 0.07

%

0.07

%

0.07

%

0.11

%

0.11

%

0.17

%

Pan* (Director) 0.03

%

0.03

%

0.04

%

0.03

%

0.03

%

0.03

%

Hu* (Director) 0.03

%

0.03

%

0.03

%

0.03

%

0.03

%

0.03

%

Wu* (Director) 0.03

%

0.03

%

0.03

%

0.03

%

0.03

%

0.03

%

The data is taken from Eastmoney.

4.2 Cost Perspective

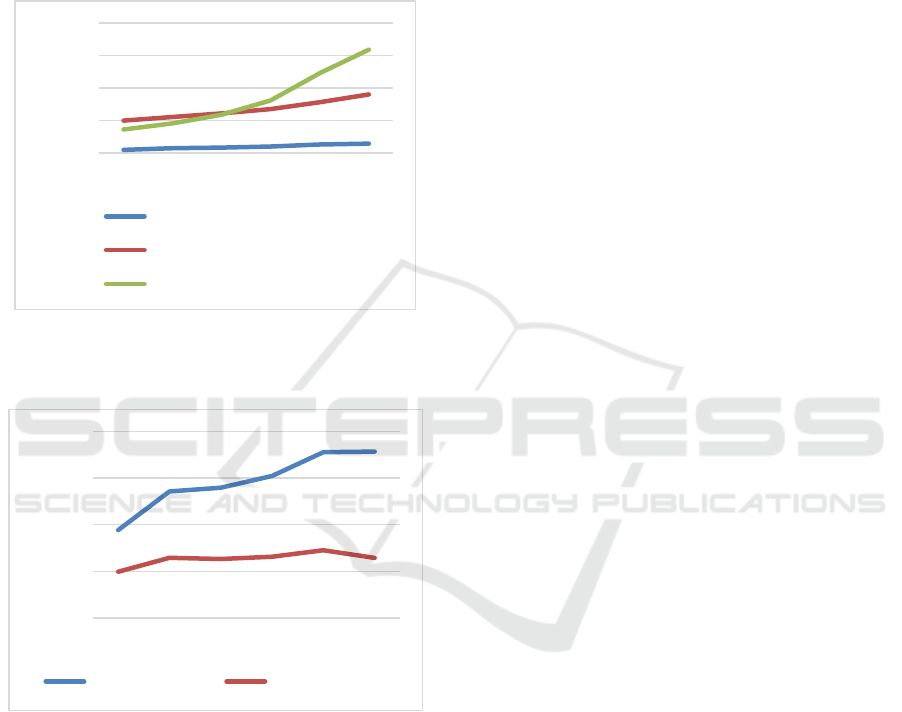

Figure 1 shows the relationship between Sany Intern

ational's operating income and gross profit. It can ind

irectly represent the profitability of Sany Internation

al, Since the disclosure of ESG reports in 2019. Sany

International's profit data has been still impressive, s

howing an upward trend year by year. The productio

n cost of its input has been also rising year by year. I

t is not excluded that the influence brought by the po

sition in the industry and the normal trend will impro

ve the sales situation, The ESG report disclosed on it

s official website mentions that Sany International is

increasing the automation rate. In order to reduce the

harm caused by noise and vibration, and ensure the s

afety of staff.

The data is taken from Eastmoney.

Figure 1: Sany International's profitability index chart (unit:

100 million RMB).

0

50

100

150

200

250

2018 2019 2020 2021 2022 2023

gross revenue gross profit

Study on the Economic Consequences of Environmental Information Disclosure of Heavy Industry Enterprises: Taking Sany International

Heavy Industry Holdings Limited as an Example

383

Although in the short term, enterprises will introd

uce advanced new materials, machinery and technolo

gies due to transformation which will increase costs.

But in the long run, enterprises will reduce consumpt

ion and waste because of advanced production mode

ls. The production efficiency will also continue to im

prove in the process of exploration. And there is no n

eed for additional equipment for pollution control an

d discharge. These in turn reduce operating costs in t

he long run. In addition, it can also reduce the potent

ial risk of being questioned. It is easier to leave a goo

d impression on investors, Sany International indepe

ndently updates and optimizes the production model.

It can also reduce the probability of being punished

by relevant departments for pollution and other probl

ems, and thus need to pay compensation. It is also a

way to save costs for enterprises.

But neither sustainable development nor environ

mental governance can be achieved overnight. In ord

er to show a better look of the enterprise to the outsid

e world, in addition to the costs of data collection an

d analysis by professionals and institutions mentione

d above, companies also need to establish a sound en

vironmental management system. And the constructi

on of system work is a big project. Not only does it n

eed to be invested at the beginning, but it also needs

to be regularly maintained and updated in the subseq

uent development. This is a challenge for small and

medium-sized enterprises and companies that are not

optimistic about their profitability and those who are

inherently cost-sensitive.

4.3 Competitiveness Perspective

The data is taken from Eastmoney.

Figure 2: Total operating income of Sany International

(unit: 100 million RMB).

Figure 2 shows that Sany International's operating in

come has not had a side effect due to environmental i

nformation disclosure, but has increased. It is not exc

luded that the impact of increasing popularity and ex

panding the scale of enterprises will be excluded.

Sany International actively fulfills its social respo

nsibilities and enhances its corporate image to the pu

blic through the release of ESG reports. From the fou

r years of the annual update of the data and rectificati

on of the module, combined with its profitability. Th

e accumulation of these favorability points will also i

ncrease Sany International's market share in the indu

stry. At the same time, this kind of active cooperatio

n with the environmental protection policies issued b

y the state will enhance the credibility of enterprises.

It will also allow it to be given extra points when pa

rticipating in government large-scale project bidding

and other cooperation links with the state. They coul

d get more opportunities and attract more green inve

stors and partners.

However, companies that are not optimistic abou

t the results of environmental information disclosure

will still have an impact. Exposing a company's envi

ronmental problems can damage the reputation of so

me companies. As a result, the company has fallen in

to a disadvantaged position in public opinion or risk

evaluation. The core of it is still to self-examine and

carry out sustainable development operations before

disclosing. It is not advisable to demand only results

without taking action.

4.4 Stock Price Perspective

After Sany International disclosed its ESG report for

the first time in 2020, the stock price showed an upw

ard trend in Figure 3 and Figure 4. It is also not ruled

out that the impact of the epidemic will become sma

ller, the scale of enterprises will expand and the mark

et will recover.

Sany International's positive environmental infor

mation disclosure gives investor confidence. It is clo

sely related to the specification of its disclosure cont

ent and the fact that the situation is true. Sany Interna

tional is one of the few listed companies that actively

publishes ESG reports during the voluntary disclosu

re period. Four consecutive years of release and long

er rectification and optimization have made Sany Int

ernational achieve tangible results in environmental

protection. It boosts investor confidence. The uncerta

inty caused by information asymmetry is reduced. A

nd it drives the stock price up and increases the comp

any's market capitalization.

Sany Group's long-term, continuous and transparent

environmental information disclosure is conducive to

cultivating and attracting long-term investors. Even

if there is inevitably some volatility, equity holders d

o not withdraw their capital hastily. Instead, they wil

l be thoughtful and allow time for companies to retai

n investors.

However, at the same time, enterprises will also f

ace market doubts about the adequacy and accuracy

of the disclosed information, which will attract the at

0

100

200

300

2018 2019 2020 2021 2022 2023

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

384

tention of the regulatory authorities. Serious cases m

ay face the risk of legal action, regulatory penalties.

Enterprises with environmental problems in their ori

ginal bodies, after rectification, may bring long-term

doubts from the market and public opinion. The stoc

k price will not only be affected in the short term, bu

t also suppressed in the long term. Until something m

ore excessive attracts the attention of the market.

The data is taken from Eastmoney.

Figure 3: Sany International's per share index chart (unit:

RMB).

The data is taken from Eastmoney.

Figure 4: Sany International's return on investment index.

4.5 Stakeholder Perspective

The disclosure of environmental information breaks

the information gap. While reducing the impact of in

formation asymmetry on enterprises, it also allows in

vestors to put forward development suggestions for e

nterprises based on the disclosed information. Sany I

nternational's active disclosure will strengthen the rel

ationship between investors and the company. It coul

d carry out more targeted update and optimization. T

o a certain extent, it will reduce the pressure of publi

c opinion and reduce the resistance to development. I

t will make the regulator feel that the company respe

cts and values environmental protection laws. This m

ethod reduces regulatory costs while building a good

image.

While the market and enterprises guide green con

sumption, consumers may have concerns about the a

uthenticity of corporate information disclosure. How

ever, in reality, some companies may exaggerate thei

r efforts and contributions to environmental protectio

n in order to establish a good brand image, or use suc

h information to cover up a larger scandal, such as pr

evious financial fraud. Even if the disclosure is certif

ied by the regulatory authorities, consumers may fin

d it difficult to understand and make accurate decisio

ns. It causes the complexity of the terminology of en

vironmental indicators.

5 CONCLUSIONS

Compared with Nanjing Sembcorp Waters evasion o

f information disclosure, eventually, they paid a high

penalty and faced reputational damage. Sany Interna

tional's positive disclosure of its ESG reports is in sta

rk contrast. At present, ESG reports have drawn a re

d line for environmental protection. Breaking the law

comes with a terrible cost. The economic consequen

ces of Sany International can clearly reflect that the b

enefits of environmental information disclosure outw

eigh the disadvantages in general. It's critical for com

panies to make the mindset shift from what they are

wanted to disclose to what they want to disclose. It s

hould also be made clear that only accurate and com

prehensive environmental information disclosure can

achieve sustainable development, improve efficienc

y and attract more margin financing and securities le

nding. Instead of generating resistance to ESG report

disclosure, companies should pay enough attention t

o it in order to achieve a win-win situation. At the sa

me time, investors and corporate executives should p

ay more attention to the future development direction

of enterprises and determine the path of sustainable

development of enterprises. Investors should also un

derstand the content of environmental information as

soon as possible so that they can make more accurat

e decisions. Nor should the granting body and the reg

ulator relax their careful scrutiny of the enterprise be

cause of proactive or optimistic disclosure.

Among them, in particular, its own environmenta

lly sensitive enterprises should plan well in the proce

ss of environmental information disclosure. They sho

uld change and update their own first, and then choo

se the agency to review the disclose. Sustainable dev

0,0000

2,0000

4,0000

6,0000

8,0000

2018 2019 2020 2021 2022 2023

basic earnings per share

net asset value per share

revenue per share

0,00%

5,00%

10,00%

15,00%

20,00%

2018 2019 2020 2021 2022 2023

Return on Equity Return on Assets

Study on the Economic Consequences of Environmental Information Disclosure of Heavy Industry Enterprises: Taking Sany International

Heavy Industry Holdings Limited as an Example

385

elopment is a long-term front. Environmental inform

ation disclosure will become more and more transpar

ent in the future. Firms don't choose to make inaccur

ate disclosures because of interests. In addition, firm

s should take care not to conceal major environmenta

l pollution accidents during disclosing information.

However, the measurement of environmental indicat

ors of heavy industry enterprises is difficult to quanti

fy and cannot be compared with each other. While fo

rmulating relevant laws and regulations, the regulato

ry authorities should pay attention to improving and

updating. It is also a long-term front to establish and

improve regulations related to environmental inform

ation monitoring. While enterprises should be cautio

us and attach great importance to deal with environm

ental risks, the authorities should also set up multiple

checking mechanisms to prevent the occurrence of o

missions and errors.

REFERENCES

Cui Haitao, Feng Jiahao & Zhang Yanliang., (2024). How

Does Mandatory Environmental Information Disclosur

e Affect the Earnings Management of Heavily Pollutin

g Enterprises? —— An Examination from the Perspect

ive of Political Cost and Financing Cost. Investment R

esearch (06),140-159.

Gao Tiantian., (2024). The Impact of Environmental Acco

unting Information Disclosure on Financial Performan

ce of Heavy Industry Enterprises. Chinese Market (23)

,115-118.doi:10.13939/j.cnki.zgsc.2024.23.029.

Shi Jiawei., (2024-08-08). Research on the Current Status

of Carbon Information Disclosure of Chinese Listed C

ompanies Under the "Dual Carbon" Goal. Henan Econ

omic News ,011.doi:10.28362/n.cnki.nhncx.2024.0008

15.

Shao Peng & Yi Wei., (2023). The Impact of Environment

al Information Disclosure on Firms' Green Innovation

Performance: Motivation or Pressure? ——Based on t

he data of 648 heavily polluting A-share listed compan

ies. Innovative technology(07),29-40.doi:10.19345/j.c

xkj.1671-0037.2023.7.003.

Tong Youxia., (2024). Research on the Impact of Executiv

e Compensation on Firms' Selective Information Discl

osure from the Perspective of Firm Heterogeneity. Ope

ration and Management (08),203-209.doi:10.16517/j.c

nki.cn12-1034/f.2024.08.014.

Lu Taiheng, Song Qinghua &Zheng Linlin., (2024). Volun

tary Environmental Regulation and High-quality Devel

opment of Enterprises. Economic Review(04),38-52.d

oi:10.19361/j.er.2024.04.03.

Li Tao, Ma Yuze, Song Zhicheng, Wang Yongli & Zheng

Xinyuan., (2023). Public Environmental Concern, Env

ironmental Performance and Environmental Informatio

n Disclosure Level: Evidence Based on China's Energy

-Consuming Industries,Research on Technology, Eco

nomics and Management. Issue 5,85-89。

Liu Zhao., (2024). The Institutional Dilemma and Alleviati

on of Corporate ESG Information Disclosure. Qinghai

Finance (08),26-33.

Yao Yuanyuan., (2024). Research on the Impact of ESG In

formation Disclosure on the High-quality Developmen

t of Enterprises. Business Watch(23),43-46+51.

Zeng Xianglan., (2024). A Study on the Impact of Environ

mental Disclosure on Green Innovation —— Based on

Evidence from Energy-Intensive Industries in China.

Economist (08),11-13.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

386