Analysis of Feature Importance Based on Random Forest for Stock

Selection

Yiru Wang

School of Economics, London School of Economics and Political Science, Houghton Street, London, U.K.

Keywords: Technical Indicators, Semiconductor, Public Utility, Information Gain.

Abstract: As a matter of fact, feature importances are quite crucial for stock selection. This study investigates the

application of feature importance analysis using a random forest model for stock price prediction, focusing

on the semiconductor and public utility sectors. Given the inherent volatility and complexity of stock markets,

traditional linear models often fall short in capturing non-linear relationships and interactions among variables.

This research leverages machine learning techniques, particularly random forests, to identify key technical

indicators that significantly influence stock performance. By analysing data from Yahoo Finance, the study

incorporates a diverse set of factors, including momentum and volatility indicators, to assess their predictive

power. The findings reveal that volatile sectors like semiconductors benefit from indicators such as short-term

trends and volatility, while stable sectors like public utilities are more influenced by sector-specific conditions.

These results provide a comprehensive framework for factor selection in stock analysis, highlighting the

importance of a tailored approach based on sector characteristics. Future research should expand this analysis

to include macroeconomic conditions and sentiment indicators, offering a more holistic view of the factors

driving stock prices and enhancing investment strategies.

1 INTRODUCTION

Stock price prediction is crucial for investors and

financial institutions to facilitate informed decision-

making and optimize portfolio management

techniques. By accurately predicting future trends,

investors are able to make informed financial

decisions and optimize their returns. The inherent

volatility and complexity of stock values present

considerable obstacles to attaining accurate

predictions. This is particularly crucial in short-term

forecasting, because even little inaccuracies can lead

to significant economic losses (Rapach & Zhou,

2021). Conventional statistical models frequently fail

to accurately represent stock price movements

because of their significant nonlinearity and non-

stationarity (Feng et al., 2020). Furthermore, the

performance of models can be adversely affected by

the substantial disturbance present in stock price data

(Nti et al., 2019). Unlike conventional linear pricing

models, such as the Capital Asset Pricing Model

(CAPM) and the Fama-French factor model, the

incorporation of machine learning in this domain

mitigates the curse of dimensionality and provides

novel insights into the determinants affecting the

market. Machine learning techniques, such as

decision trees and neural networks, are successful

because they can capture nonlinear relationships and

interactions among factors that conventional models

frequently fail to capture (Gu et al., 2020).

In the context of stock selection, various efforts

have been made to apply machine learning techniques

for maximizing portfolio returns. One notable

approach involves automated stock selection using

random forests, which assess future returns based on

outperformance probabilities (Breitung, 2023).

Additionally, Yang et al. compared different machine

learning methods using mean squared error to

evaluate the top 20% of stocks for portfolio formation

(Yang et al., 2018). However, these models typically

require the pre-selection of factor groups before the

price prediction process, which can introduce

additional complexity. In addition to the challenges

of identifying contextual and nonlinear interactions,

selecting meaningful factors is crucial for effective

decision-making in stock selection. A factor refers to

a quality or attribute believed to influence a stock's

performance and potential return (Leippold et al.,

2022). Investors often rely on various groups of

factors, each serving different functions in the stock

374

Wang, Y.

Analysis of Feature Importance Based on Random Forest for Stock Selection.

DOI: 10.5220/0013233500004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 374-379

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

selection process. Key factors include firm

fundamentals, equity factors, and technical indicators,

all of which should be considered when evaluating

stock performance (Wolff & Echterling, 2023).

However, it remains uncertain which of these factors

will exert the most significant quantitative impact on

stock evaluation (Rasekhschaffe & Jones, 2019).

The purpose of this study is to utilize the random

forest model to assess the impact of various technical

factors on stock price predictions and to evaluate their

performance based on feature importance. The

research aims to provide insights into stock selection

and explain variations between sectors. The

remainder of the paper is organized as follows.

Section 2 describes the data and the data cleaning

methods, as well as the model selection process and

evaluation criteria. Section 3 presents the results of

the analysis, discusses their implications, and

addresses the limitations of the findings along with

future prospects for factor analysis. Finally, Section 4

summarizes the paper.

2 DATA AND METHOD

In this paper, data was collected from Yahoo Finance,

focusing on the semiconductor and public utility

sectors. The dataset includes key variables such as

open, close, high, and low prices, as well as trading

volume for the selected stocks. To ensure the integrity

of the dataset, any missing values were either

replaced with average values or removed, thereby

maintaining clean and reliable input features.

Technical features were calculated using the

stockstats package in Python. To enrich the feature set

for the random forest model, this research

incorporated a subset of Alpha 101 factors. These

factors, which encompass various signals based on

price movements, trading volume, and volatility,

were derived from historical stock price data

(Kakushadze, 2016). The features generated from

these Alpha factors were combined with traditional

technical indicators in the model.

The semiconductor and public utility sectors were

chosen for this study due to their distinct

characteristics and roles in the U.S. economy. The

semiconductor sector is known for its rapid

innovation and significant impact on technology-

driven industries, making it a critical area for

investors seeking high growth potential. The sector

experiences considerable volatility, influenced by

factors such as technological advancements, market

demand, and global supply chain dynamics. In

contrast, the public utility sector is characterized by

its stability and consistent demand, driven by

essential services such as electricity, water, and

natural gas. This sector typically offers lower

volatility and more predictable returns, appealing to

risk-averse investors. By analyzing both sectors, this

research aims to provide a comprehensive

understanding of how technical indicators perform

across different market environments, thereby

offering valuable insights for diverse investment

strategies.

The choice of the random forest model for feature

importance analysis in stock selection is driven by its

robust capability to handle high-dimensional data and

its inherent mechanism for evaluating feature

importance. Unlike many traditional models, random

forests operate as an ensemble of decision trees,

which allows them to capture complex nonlinear

relationships among variables without extensive

preprocessing. One of the key advantages of this

model is its ability to rank features based on their

contribution to the predictive accuracy of the

ensemble. This is achieved through metrics such as

mean decrease in impurity and permutation

importance, providing clear insights into which

technical indicators significantly influence stock

selection. Furthermore, random forests are less prone

to overfitting compared to single decision trees,

making them a reliable choice for financial data,

which often exhibit noise and volatility. This

combination of robustness, interpretability, and

effective feature ranking makes random forests

particularly suitable for this analysis.

The model was trained on the preprocessed

dataset, which was divided into training and testing

subsets to ensure robust evaluation. During the

training process, the model was fitted to the selected

technical indicators, identified as features through

their Information Gain values. Various

hyperparameters, including maximum tree depth and

minimum samples per split, were systematically

adjusted to optimize the model's performance. After

each adjustment, the accuracy score was assessed to

evaluate the impact of the changes, guiding further

modifications. Upon completing the training, the

model automatically calculated the importance of

each feature based on its effectiveness in reducing

model impurity. This resulted in a straightforward

matrix that highlighted which technical indicators

were most influential in the stock selection process

and which had minimal contribution, thereby

providing valuable insights for further analysis.

Analysis of Feature Importance Based on Random Forest for Stock Selection

375

3 RESULTS AND DISCUSSION

3.1 Factors Selection

In this analysis, several technical indicators were

selected from the StockStats package in Python to

enhance the stock selection process, focusing on

various market functions such as momentum, trend,

and volatility. The Average True Range (ATR) was

chosen to assess volatility, calculating the average

range between high and low prices over a specified

period, thereby providing insights into market

fluctuations. The Average Directional Index (ADX)

was included to measure trend strength, indicating

whether a market is trending and the intensity of that

trend. Additionally, the Money Flow Index (MFI)

was utilized as a momentum indicator, incorporating

both price and volume to assess overbought or

oversold conditions. Other indicators, such as

Bollinger Bands, gauged price volatility relative to its

moving average, while the Exponential Moving

Average (EMA) provided a responsive measure of

price trends. Together, these indicators offer a

comprehensive view of market behavior, aiding in the

identification of profitable trading opportunities.

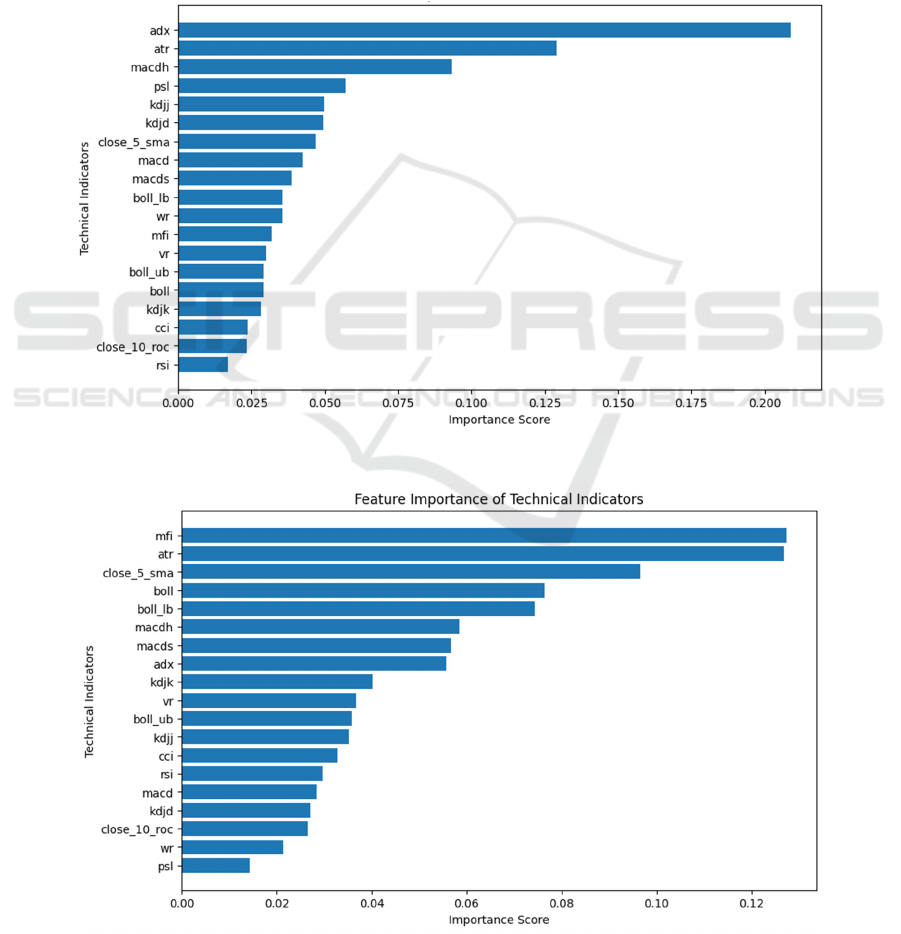

Figure 1:

Ranking

of feature importance for semiconductor (Photo/Picture credit: Original).

Figure 2: Ranking of feature importance for public utility (Photo/Picture credit: Original).

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

376

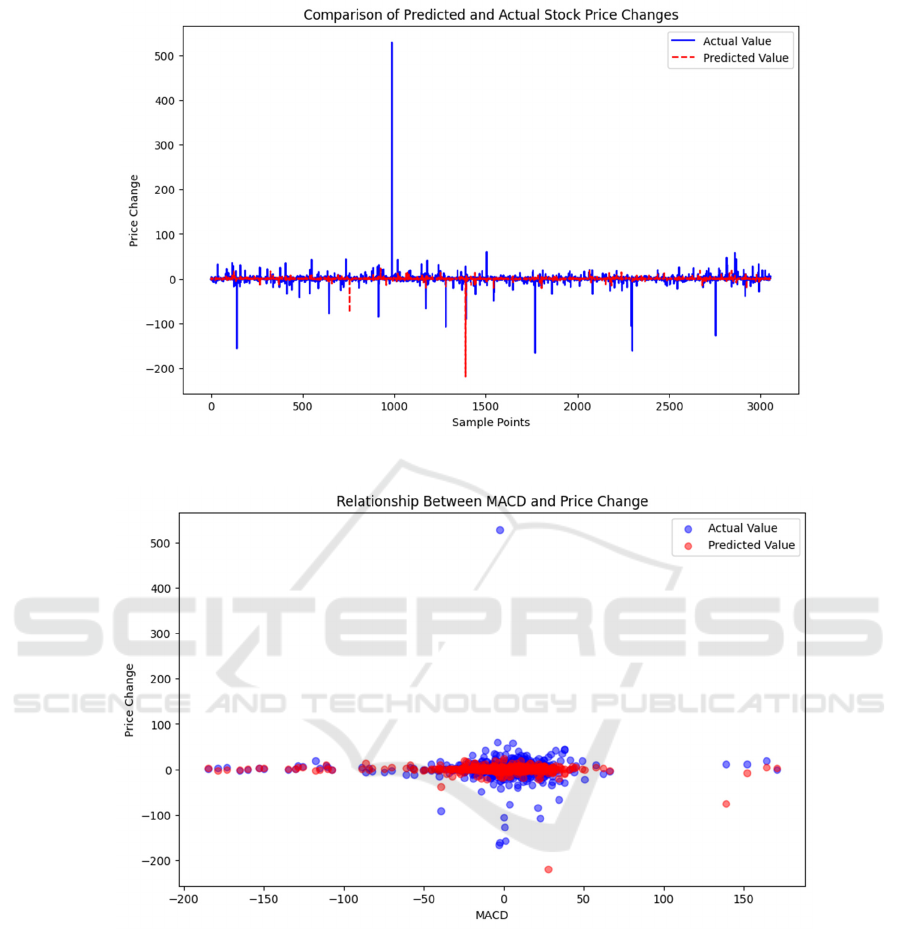

Figure 3: Comparison for prediction values for semiconductor (Photo/Picture credit: Original).

Figure 4: Relationship between MACD and

price

change for semiconductor (Photo/Picture credit: Original).

3.2 Feature Importance, Explanation

and Implications

The factors are ranked based on information gain as

the valuation method for feature importance. The

results are listed in Fig. 1 and Fig. 2. The adx and mfi

show great importances for semiconductor and public

utility, respectively. In the semiconductor sector,

ADX is used to assess whether the sector is in a strong

upward or downward trend. For example, if ADX is

above 20 and rising, it indicates a strong trend,

suggesting that semiconductor stocks are

experiencing significant movement, potentially due

to market events like earnings reports or

technological advancements. ATR provides insights

into how much semiconductor stocks are likely to

move in a given timeframe. In times of high volatility

(high ATR), traders might anticipate larger price

movements, which can be critical for decision-

making. When ADX indicates a strong trend (above

20) and ATR is also high, this combination can

suggest that the semiconductor sector is not only

trending but also experiencing significant price

Analysis of Feature Importance Based on Random Forest for Stock Selection

377

movement. This might indicate heightened investor

interest or reactions to news affecting the sector. In

such scenarios, unexpected company policies or

technological breakthroughs can further amplify

these dynamics, presenting favorable investment

opportunities (seen from Fig. 3 and Fig. 4).

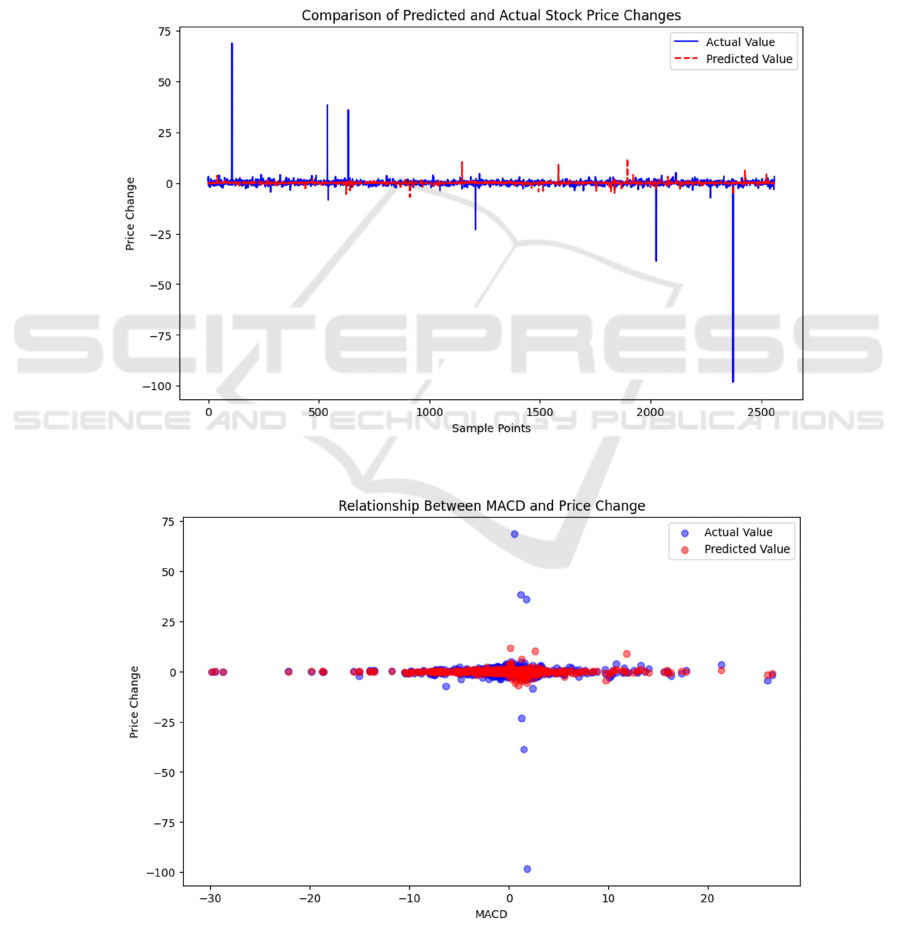

In the public utility sector, MFI can help

determine when stocks are overbought or oversold.

For instance, if MFI exceeds 80, it might signal that

utility stocks are overbought due to factors such as

regulatory changes or interest rate fluctuations,

prompting a potential price correction. Conversely, if

MFI falls below 20, it may indicate that stocks are

oversold, potentially signaling a buying opportunity,

especially if the sector is experiencing stable demand.

If MFI shows oversold conditions while ATR is low,

it may indicate a stable environment where utility

stocks could rebound, suggesting a potential buying

opportunity for investors looking for safer, long-term

investments. Combined with decreasing interest rates

and steady growth prospects in the public utility

sector, this scenario can attract increased investor

interest, further enhancing the appeal of these stocks

(seen from Fig. 5 and Fig. 6).

Figure 5: Comparison for prediction values for public utility (Photo/Picture credit: Original).

Figure 6: Relationship between MACD and price change for public utility (Photo/Picture credit: Original).

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

378

3.3 Limitations and Prospects

The selection of technical indicators in this study is

primarily driven by the availability of data sourced

from Yahoo Finance; however, this reliance may

limit the comprehensiveness of the analysis. As a

result, the chosen indicators might not fully capture

all essential market dynamics, potentially

overlooking critical signs that could inform

investment decisions. While the focus on technical

indicators offers quantifiable and straightforward

metrics for model integration, it inherently narrows

the scope of the analysis. Other influential factors,

such as macroeconomic conditions—like interest

rates, inflation, and GDP growth—and investor

sentiment, which can be gleaned from social media

and news sources, are significant drivers of stock

market behavior. To enhance the model's predictive

accuracy and factor identification capabilities, it is

imperative to explore and incorporate these additional

parameters. For instance, integrating macroeconomic

indicators could provide a more holistic view of the

market context, allowing for better understanding of

how external economic factors impact stock

performance. Furthermore, incorporating sentiment

analysis could help capture the emotional and

psychological dimensions of investor behavior,

which often play a crucial role in market movements.

By expanding the range of indicators and factors

considered, future studies can develop a more robust

framework for stock prediction, ultimately leading to

improved investment strategies. This comprehensive

approach would not only enrich the analytical model

but also align it more closely with the multifaceted

nature of financial markets, increasing its

applicability and relevance to real-world trading

scenarios.

4 CONCLUSIONS

In summary, feature importance analysis provides

essential statistical support for factor selection in

stock selection. The results demonstrate that sectors

with distinct characteristics should assess tailored

groups of technical factors for achieving more

accurate price predictions. In volatile sectors, such as

semiconductors, short-term trends and volatility

emerge as critical indicators for effective decision-

making. Conversely, in more stable sectors like

public utilities, emphasis should be placed on broader

sector conditions to capture essential dynamics. As

the field evolves, the identification of more

meaningful and relevant factors that influence the

stock selection process is vital. A comprehensive

analysis that incorporates a wider array of related

factors can achieve deeper insights into stock

performance and selection strategies. This paper

presents a robust framework for determining which

factors to integrate into models for stock price

prediction and selection. Future research should focus

on quantifying additional factors, including

macroeconomic conditions, industry-specific trends,

and fundamental indicators, to further enhance this

feature importance analysis. On this basis, investors

can develop a more comprehensive understanding of

the factors driving stock prices, ultimately leading to

more informed and strategic investment decisions.

REFERENCES

Breitung, C., 2023. Automated stock picking using random

forests. Journal of Empirical Finance, 72, 532–556.

Feng, G., Giglio, S., Xiu, D., 2020. Taming the Factor Zoo:

A Test of New Factors. The Journal of Finance, 75(3),

1327–1370.

Gu, S., Kelly, B., Xiu, D., 2020. Empirical Asset Pricing

via Machine Learning. Review of Financial Studies,

33(5), 2223–2273.

Kakushadze, Z., 2016. 101 Formulaic Alphas. Wilmott,

2016(84), 72–81.

Leippold, M., Wang, Q., Zhou, W., 2022. Machine learning

in the Chinese stock market. Journal of Financial

Economics, 145(2), 64–82.

Nti, I. K., Adekoya, A. F., Weyori, B. A., 2019. Random

Forest Based Feature Selection of Macroeconomic

Variables for Stock Market Prediction. American

Journal of Applied Sciences, 16(7), 200–212.

Rapach, D., Zhou, G., 2021. Asset Pricing: Time-Series

Predictability. SSRN Electronic Journal, 3941499

Rasekhschaffe, K. C., Jones, R. C., 2019. Machine

Learning for Stock Selection. Financial Analysts

Journal, 75(3), 70–88.

Wolff, D., Echterling, F., 2023. Stock picking with machine

learning. Journal of Forecasting, 43(1), 81–102.

Yang, H., Liu, X., Wu, Q., 2018. A Practical Machine

Learning Approach for Dynamic Stock

Recommendation. SSRN Electronic Journal, 3302088.

Analysis of Feature Importance Based on Random Forest for Stock Selection

379