Predicting the Gold Price Based on XGBoost

Yixian Li

a

Ulink College of Shanghai, Zhejiang, China

Keywords: Gold Price, XGBoost, Price Forecasting, MSE.

Abstract: In recent years, accurate gold price forecasting has become increasingly important for investors, economists,

and policymakers. To enhance the accuracy of such predictions, various machine learning models have been

explored. This paper aims to explore the validity and practicability of using eXtreme Gradient Boosting

(XGBoost) to predict gold prices. XGBoost is widely used for supervised learning problems and, as an

excellent gradient boosting algorithm, it performs exceptionally well in processing structured data and time

series prediction. This study constructs a prediction model based on XGBoost through historical gold price

datasets, combined with market indicators and economic factors, and assesses its predictive power and

stability. By evaluating the model's performance, the research seeks to determine whether XGBoost offers a

reliable and efficient tool for gold price forecasting, potentially influencing financial and investment strategies.

The results show that XGBoost is a robust and effective model for forecasting gold prices, providing valuable

insights for informed decision-making in financial markets.

1 INTRODUCTION

Gold is a precious metal that has demonstrated

immense significance and has assumed diverse roles

within the financial market, encompassing risk

mitigation, a medium of exchange, a store of value,

and an indicator of interest rate sensitivity, among

others. Beyond historical contexts, gold has long been

synonymous with wealth and authority. Additionally,

it serves as a prudent investment option, offering risk

hedging and asset diversification capabilities. The

primary sources of gold supply stem from mining and

recycling, both of which are labor-intensive

endeavors, contributing to gold's scarcity and

reinforcing its recyclability (Beckmann et al., 2019;

Cotty et al., 2023).

As a result of gold's multifaceted functions and

uses, numerous factors influence its price. These

diverse influences encompass economic indicators

such as changes in Gross Domestic Product, inflation

rates, and prevailing monetary policies, as well as the

demand and supply dynamics of gold itself and the

exchange rate of international trading currencies

(Qian et al., 2019; Erdoğdu, 2017; Lili & Chengmei,

2013).

a

https://orcid.org/0009-0006-7854-9994

Several studies have shown that eXtreme

Gradient Boosting (XGBoost) performs well in gold

price forecasting. For example, Jabeur et al. (2024)

study combines XGBoost and shapley additive

explanations (SHAP) values to provide an in-depth

analysis of the effects of different characteristics on

gold prices. The results show that economic data

(such as inflation rates, interest rates) and market

sentiment (such as investor sentiment indices) play an

important role in the forecasting model.

However, in many of the past research, many of

the researchers chose to use the long-short term

memory (LSTM) model to reasonably predict future

price changes. Amini and Kalantari (2024) in their

study proposed a model combining convolutional

neural network (CNN) and bidirectional Long Short-

Term memory network (Bi-LSTM) for gold price

prediction. The aim of this research is to improve the

prediction performance of the model by introducing

automatic parameter tuning methods to adapt to the

dynamic nature of the gold market.

Compared with other prediction methods,

XGBoost shows high accuracy and stability. For

example, Shi (2023) compared the performance of

XGBoost and LSTM in bitcoin price prediction,

pointing out that XGBoost can provide better

Li, Y.

Predicting the Gold Price Based on XGBoost.

DOI: 10.5220/0013230700004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 355-359

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

355

Figure 1: gold price variation during 2014 – 2024 (Photo/Picture credit: Original).

prediction results in some cases. Similar studies in

gold price forecasting also found that XGBoost

outperformed LSTM when dealing with nonlinear

features and complex patterns.

The author discovered that quite a few would use

other machine learning models such as XGBoost

which is also a very effective model in regression and

prediction. Basically, this article will make use of

XGBoost, which is one of the machine learning

models, to observe and predict the gold price, making

use of decision trees and regressions and making use

of mean square error (MSE) to evaluate whether the

model the author produced is effective.

Through further discussion of the methodologies

to be used to predict future price changes, hopefully,

this study could help provide brand new

understandings about prediction and machine

learning methods, in order to help future researchers

to achieve predictions more accurately and

effectively.

2 MANUSCRIPT PREPARATION

2.1 Data and Method

2.1.1 Data Collection and Description

This passage mainly collects the table data from a

machine learning website and sets the name of the

data as goldsock.csv. The dataset this article has used

is the history of gold price data from 2014 to 2024.

The author has pressed the data and plotted the data

into a broken line graph shown in Figure 1. From

2014 to 2024, generally speaking, the global gold

price showed a rising trend but with some

fluctuations.

As the graph has shown, the gold price first

experienced a small drop from 2014 to the beginning

of 2016, remarkably, the gold price even reached the

lowest price by the end of 2015, ever since the past 6

years. However, the gold price started to rebound in

2016, and continued to increase slowly, which then

reached a peak value in 2020 has begun. Noteworthy,

the gold price started to fluctuate between 2021 and

2023. For the gold price data in 2024, the author

consider that it still needs observation, as 2024 has

not passed through.

2.1.2 Data Pre-processing

This article mainly makes use of the machine learning

model XGBoost, which is an effective model in

regression. Collect the dataset at the very beginning,

and name the file as goldstock. Before the model is

built up, there is an acquire to pre-process the data,

which includes data cleaning, dealing with missing

and non-numeric value and feature engineering. Data

cleaning means dealing with missing and non-

numerical values like column Date, which need to be

eliminated, or missing values which could be filled by

averaging. The author first removed the Date column

in the dataset, as string data types cannot be processed

and calculated, d other columns with numerical data

like Open, Close, High, and Low are stored in a

created feature matrix and named X. After that, the

passage included choosing one of the most significant

columns as main research targeted variable named as

Y.

Then, the feature matrix X and the targeted

variable Y are divided into X_train, X_test, Y_train,

Y_test, by simply using the function train_test_split

in the model selection module from the sklearn

library. At this stage, various algorithm models are

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

356

trained and validated. At the same time, the test set

size is the 20% size of the whole dataset, in addition

to this, a kind reminder that the order of the data

should not be changed. Then, the researcher needs to

build up feature engineering, which includes feature

choosing, transmitting, and setting. Feature of the is

chosen through analyzing the data’s correlation and

importance of the feature, and transformation could

be finished if the grouped data is standardized and

normalized, in order to fit the demand for specified

models. (which is XGBoost in this passage); settings

of features will include originally existing features

which majorly are statistical variables like mean and

standard deviation. Last but not least, the researchers

need to ensure that the format of the processed data

could fit the model, for example, XGBoost needs the

data to be transformed into DMatrix. After all these

steps, the raw data is fully processed and is suitable

for private model to utilize, in order to increase the

model performance and the accuracy and precision of

predicted value.

2.2.1 Applying XGBoost Model

This article makes use of the XGBoost model to

predict future gold price changes. XGBoost is a kind

of machine learning model based on gradient lifting

decision trees, it builds up a strong learner through

combining several weak learners, in order to achieve

a prediction with high precision. XGBoost uses

newtonian methods to solve optimization problems

within the function space, allowing users to

customize the objective function according to their

specific needs. To be more specific, the steps used

will be described and shown in this article. Firstly,

create an XG-Regressor model and adjust the

objective parameter as reg:squarederror, the model

will make use of an initialized prediction model

(which is always a simple form of the model, like

predicting the mean). Secondly, to define a loss

function, the author set a specified regression task

using the MSE as the loss function, this function

calculates and stores the difference between the real

value and the predicted value created by the model;

the value of this function decides whether this

function is meaningful or not, lower value of the loss

function, greater accuracy and precision. Thirdly,

configure the number of base learners in the model to

100 By arranging the parameter n_estimators as 100.

After that, make use of training sets X_train and

Y_train to fit and apply the model.

2.2 Results and Discussion

2.2.1 Evaluation and MSE

𝑀𝑆𝐸 =

1

𝑛

𝑦

−𝑦

1

In Equation (1), 𝑛 refers to the number of the sample,

𝑦

refers to the actual observed value, 𝑦

refers to the

predicted value, which is the predicted value of the

model for the 𝑖 th sample.

MSE is a metric used to evaluate the performance

of regression models by measuring the average

squared difference between predicted and actual

values. Specifically, MSE calculates the average of

the squared errors, providing a measure of how close

the predictions are to the actual outcomes. A lower

MSE indicates better model accuracy. Due to its

sensitivity to large errors, MSE is useful in scenarios

where controlling prediction accuracy is crucial.

Calculating MSE is an important step for

evaluating the ability of the regression model like

XGBoost it could help researchers to understand

further the precision and accuracy of the prediction

model, and provide evidence for further model

adjusting.

2.2.2 Results for Predicted Value

Predicting gold prices is a complex task due to

various determinants of gold, including inflation,

monetary policy, etc. In this passage, the author

makes use of broken line graph and scattered

diagrams. Broken line graphs could help in

identifying the trend and comparing between datasets

by exhibiting several lines on a graph in order to

analyze the difference or relationship between the sets

of data. Broken line graph could be used to show

continuous data or data with data type float, which is

not independent and discrete. The scattered diagram

is always used to show the correlation between 2

values, whether they have a strong correlation or

stuff, also it can be used to show whether there is a

missing value as every digit in the data is shown on

the graph as a point.

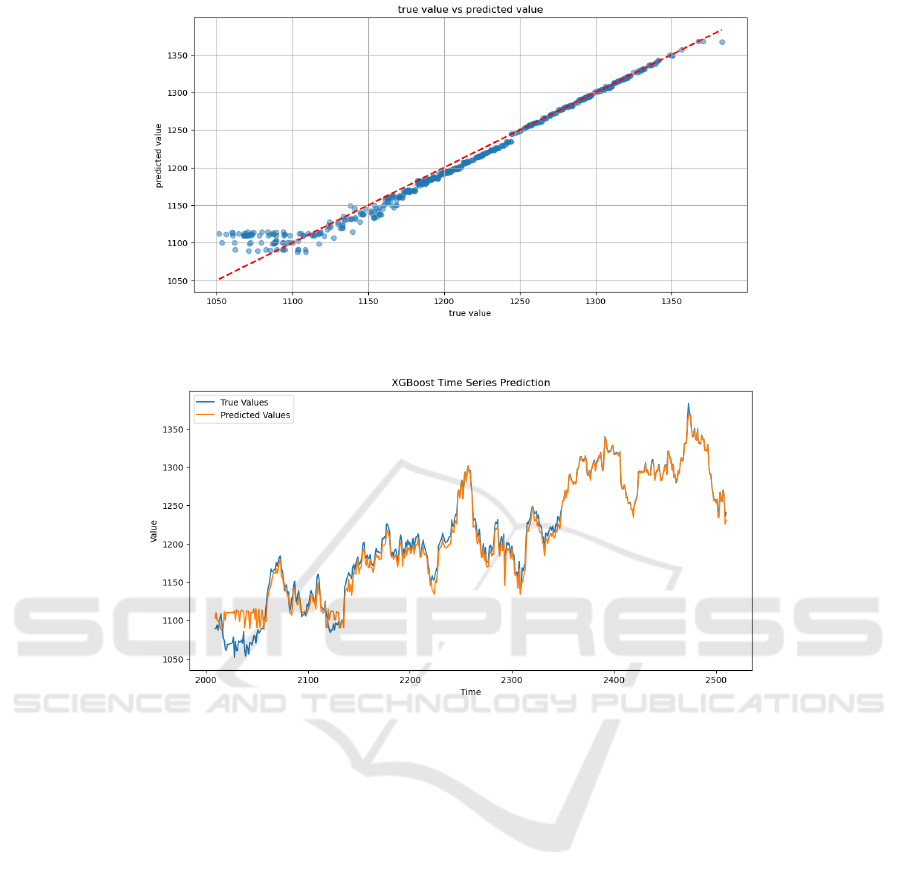

From the two graphs can see that as time goes on,

the model predicts more accurately. Generally

speaking, the gold price will show an increasing trend

in the next five centuries. To be more specific, the

gold price will increase in the 21st and 24th centuries.

However, the predicted data shows that in the 22nd

and 25th centuries, the price will be relatively stable

with a bit of fluctuation. Remarkably, in the 23rd

century, the gold price will experience a big rise and

a dramatic drop.

Predicting the Gold Price Based on XGBoost

357

Figure 2: scattered diagram showing the correlation between true and predicted value (Photo/Picture credit: Original).

Figure 3: broken line graph showing the trend in the difference between true and predicted value (Photo/Picture credit:

Original).

Firstly, the author chose to use scattered and

correlation diagrams to visualize the error (Figure 2).

Producing a scattered diagram of true value and

predicted value, blue spots show every data and the

red broken line shows the correlation, which

represents the ideal state of the value (predicted value

equals true value). The graph output by the code show

a generally increasing trend for future gold price

changes. At the same time, these spots shown that

there is a strong correlation between the true value

and the predicted value produced by XGBoost, which

means the model is effective in predicting gold price

and then gold price data is meaningful.

By producing a broken line graph (Figure 3) and

putting both the true value and predicted value on the

same graph in the same scale, the changes could be

shown more directly. As the scattered diagram shows

the correlation between the true value and the

predicted ones, the broken line graph shows how

significant the difference is between the two values.

3 LIMITATIONS AND FUTURE

OUTLOOKS

In this passage, the author mainly used XGBoost to

predict the future gold price changes, thou the model

is a machine learning model with a strong ability to

predict, it has several limitations. To deal with this,

the researchers need to be careful about the

evaluation, to ensure the model performed correctly

and effectively, and ensure whether the dataset used

fits the existing model.

Although XGBoost provides the rankings about

the importance of every feature, it is challenging for

researchers to explain one specified feature.

Compared with other simple models using linear

regression like AutoRegressive Integrated Moving

Average (ARIMA), the explanation for XGBoost

features is much more complex, as the model does not

only have one dimension. It is hard to understand and

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

358

has higher complexity. At the same time, the higher

complexity of the model will strengthen the burden

on calculation and the computer. XGBoost needs a

great amount of storage and resources for calculation,

this may cause overheat of the computer due to a long

period and high-intense workload if the hardware is

not perfect enough.

Because of the complexity of the model, it is able

to produce a model concluded from the huge amount

of data. However, overfitting might occur if the scale

of the data is not big enough or the noise is too much.

Although normalization and standardization probably

could solve this problem, they need to be debugged

seriously and constantly. It takes a long time and is

challenging but produces similar results to other

machine learning models.

Though with these disadvantages, XGBoost is

still an effective model that could produce quite

complex and accurate results, as it could catch non-

linear relations (Ji et al., 2022; Yaswanth &

Jaisharma, 2024). Hopefully, in the future,

researchers could explore more the adjusting of the

hyperparameters and model optimizing, in order to

increase the precision and accuracy of the model

stability and the model prediction. At the same time,

the author hopes that further majorization of the

model could increase the ability of XGBoost to

perform real-time predictions. Which could lead to

the popularization of the model and better ability to

suit the changes in the market.

4 CONCLUSIONS

This passage built up a predictive model applied in

gold price prediction based on the XGBoost

algorithm. XGBoost makes use of decision trees to

achieve regressions. Through the prediction results of

previous data, the intelligent portfolio optimization

model proposed in this paper uses the model to weigh

the transaction cost and the income obtained in the

transaction to decide whether to trade, and combines

the traditional portfolio model with the algorithm of

machine learning to better apply to the portfolio

research. A regression tree is a type of decision tree

used in machine learning that is designed to predict

continuous target variables based on multiple input

features. It uses a tree model that describes decisions

and their possible consequences, especially target

predictions, to translate observations about a project

into target value conclusions for that project. The

results show that the gold price prediction model

based on the XGBoost algorithm performed

excellently at capturing short-term market

fluctuations and long-term trends. Compared with

traditional time series models, XGBoost can better

deal with complex non-linear relationships and large-

scale feature sets, at the same time, it could improve

the accuracy and stability of the prediction. Although

the XGBoost itself is a black box model, through

feature engineering and data visualization, the

research is able to understand which factors have a

decisive impact on the price of gold. This capability

provides decision-makers with deeper market insight

and helps them develop more precise investment

strategies and risk management programs.

REFERENCES

Amini, A., Kalantari, R., 2024. Gold price prediction by a

CNN-Bi-LSTM model along with automatic parameter

tuning. Plos one, 19(3), e0298426.

Beckmann, J., Berger, T., Czudaj, R., 2019. Gold price

dynamics and the role of uncertainty. Quantitative

Finance, 19(4), 663-681.

Cotty, S. R., Kim, N., Su, X., 2023. Electrochemically

mediated recovery and purification of gold for

sustainable mining and electronic waste recycling. ACS

Sustainable Chemistry & Engineering, 11(9), 3975-

3986.

Erdoğdu, A., 2017. The most significant factors influencing

the price of gold: An empirical analysis of the US

market. Economics, 5(5), 399-406.

Jabeur, S. B., Mefteh-Wali, S., Viviani, J. L., 2024.

Forecasting gold price with the XGBoost algorithm and

SHAP interaction values. Annals of Operations

Research, 334(1), 679-699.

Ji, S., Wang, X., Lyu, T., Liu, X., Wang, Y., Heinen, E.,

Sun, Z., 2022. Understanding cycling distance

according to the prediction of the XGBoost and the

interpretation of SHAP: A non-linear and interaction

effect analysis. Journal of Transport Geography, 103,

103414.

Lili, L., Chengmei, D., 2013. Research of the influence of

macro-economic factors on the price of gold. Procedia

Computer Science, 17, 737-743.

Qian, Y., Ralescu, D. A., Zhang, B., 2019. The analysis of

factors affecting global gold price. Resources Policy,

64, 101478.

Shi, J., 2023. Examine Bitcoin price predictability with

machine learning algorithms. In Third International

Conference on Intelligent Computing and Human-

Computer Interaction (ICHCI 2022) (Vol. 12509, pp.

621-628).

Yaswanth, V., Jaisharma, K., 2024. Prediction of thyroid

nodules using novel optimized XGBoost machine

learning algorithm based on its size compared with non-

linear machine learning algorithm. In AIP Conference

Proceedings (Vol. 2853, No. 1). AIP Publishing.

Predicting the Gold Price Based on XGBoost

359