Enhancing Stock Price Forecasting with Social Media Text: A

Comparative Study of Machine Learning Approaches

Bingchang Li

a

Faculty of Business and Management, Beijing Normal University-Hong Kong

Baptist University United International College, Tangjiawan Town, Zhuhai, China

Keywords: Stock Price Forecasting, Machine Learning, Social Media, Nature Language Processing.

Abstract: With the power to influence investment decisions and provide market stability, stock price forecasting is

essential to financial research. The use of machine learning techniques for prediction has gained popularity

as technology has progressed. Researchers have proposed incorporating social media textual data to improve

prediction accuracy. However, the efficacy of this strategy is still debatable because different kinds of textual

information might produce varied results. Certain texts cause predictability to rise dramatically, while others

cause it to fall. This research explores the use of machine learning techniques to predict stock prices using

text data from social media platforms. Using Bag of Words (BOW) and Term Frequency-Inverse Document

Frequency (TF-IDF) text representations, it assesses the effectiveness of Random Forest and Multinomial

Naive Bayes classifiers. According to the investigation, Random Forest surpasses Multinomial Naive Bayes

in terms of accuracy and robustness across a variety of datasets and text volumes, whereas TF-IDF

consistently exceeds BOW. The analysis also reveals that Reddit's social media data has the most predictive

value. These findings emphasize how important data quality and advanced text representation are to

enhancing stock price forecasting models.

1 INTRODUCTION

Since stock price forecasting affects investors,

financial institutions, and market stability

significantly, it is essential to financial research. For

risk management, portfolio optimization and strategic

investing to be successful, accurate projections are

necessary. They help institutional and ordinary

investors navigate the intricacies of today's financial

markets. Accurate stock forecasts also improve

capital allocation, balance supply and demand, and

stimulate economic growth, all of which contribute to

increased market efficiency. In today's fast-paced

financial environment, forecasting is no longer just a

competitive advantage but rather a need.

Traditional forecasting methods rely on historical

price data and fundamental financial indicators.

While these methods provide valuable insights, they

often need to capture intricate, non-linear patterns and

rapid market changes. The rise of machine learning

represents a significant advancement in forecasting

(Sun et al., 2024). Machine learning offers

a

https://orcid.org/0009-0001-2876-9562

sophisticated tools to analyze large and diverse

datasets, uncovering complex patterns that traditional

techniques may overlook (Whig et al., 2024).

With the use of cutting-edge techniques that

increase prediction accuracy, machine learning has

completely transformed the forecasting of stock

prices. Large volumes of data are easily managed and

analyzed using machine learning, in contrast to

traditional models that mostly rely on historical data

and basic indications. Time series modeling,

regression analysis, and neural networks are among

the crucial techniques for identifying connections that

traditional approaches could overlook.

One important advancement in this sector is the

incorporation of social media data into forecasting

algorithms (Ferdus et al., 2024). Unstructured data

representing market rumors, public opinion, and

emerging patterns is produced via platforms such as

Reddit, Twitter, and financial news forums (Choi et

al., 2024). This real-time data offers insights that

cannot be obtained from past price data alone. The

attitudes and beliefs of investors can be revealed

Li, B.

Enhancing Stock Price Forecasting with Social Media Text: A Comparative Study of Machine Learning Approaches.

DOI: 10.5220/0013225200004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 331-336

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

331

through social media sentiment analysis, which

regularly affects short-term market swings. Though

different kinds of textual content can produce distinct

outcomes, the usefulness of this idea is still up for

debate. Predictability may be greatly increased or

decreased by certain texts.

One of the main tasks in machine learning is text

vectorization, which is converting unstructured text

into a numerical format. Popular techniques include

the Bag of Words (BOW) model and the Term

Frequency-Inverse Document Frequency (TF-IDF)

combination. With the BOW model, word

frequencies are counted by treating text as a set of

distinct words. It often produces sparse feature

vectors that may overlook subtleties in meaning,

despite its effectiveness. In contrast, TF-IDF gives

each phrase a weight based on how important it is

inside a document in comparison to the entire corpus.

By emphasizing key phrases and reducing the

prominence of common, uninformative terms, it

offers a more advanced representation.

Another difficulty is choosing the right machine

learning model. The efficacy of a model depends on

its capacity to handle the particularities of social text

data, such as slang, informal language, and different

levels of information. For problems involving text

classification and prediction, models like Random

Forests and Multinomial Naive Bayes

(MultinomialNB) offer clear advantages. As different

models may perform better with different text

properties and circumstances, selecting the best

model requires thorough experimentation and

validation.

Social media data from RedditNews, Asea Brown

Boveri Ltd. (ABB), Google LLC (GOOG), Apple Inc.

(APPL), and Exxon Mobil Corporation (XOM) are

used in this analysis. Bag of Words (BoW) and Term

Frequency-Inverse Document Frequency (TF-IDF)

are two text vectorization techniques that are used in

this paper. In the tests, stock prediction performance

is evaluated across different text volumes using

Random Forest and MultinomialNB models (AAPL5,

for example, stands for five randomly picked Apple

news items). Based on the data from RedditNews, the

results indicate that Random Forest and TF-IDF

perform better than BoW and MultinomialNB in

general.

Further analysis of the data's textual

characteristics in this research revealed that

prediction accuracy is strongly influenced by the

association between textual data and the stock market.

Text from RedditNews, for example, that shows a

strong association with the market typically produces

more amazing accuracy.

2 METHODS

In order to forecast stock movements using social text

data, this article uses machine learning algorithms

and text processing methodology. With a focus on the

Random Forest and Multinomial Naive Bayes

classifiers as well as the Bag of Words and Term

Frequency-Inverse Document Frequency (TF-IDF)

representations for text data, this section provides a

thorough review of the techniques used.

2.1 Random Forest

For problems involving regression and classification,

Random Forest is an ensemble learning technique

(Sun et al., 2024). During training, it builds a large

number of decision trees. In terms of classification, it

outputs the mode of the classes; in terms of regression,

it outputs the mean prediction of each individual tree.

By replacing the samples in the training dataset, the

system generates multiple decision trees. Predictions

are combined to produce the final output after each

tree is trained on a distinct bootstrap sample. Splitting

is done on a random subset of characteristics at each

node in the tree. By doing so, the resilience of the

model is increased and the correlation between

individual trees is decreased. The random selection of

training data and attributes used to build each tree

promotes variation among the trees.

2.2 Multinomial Naïve Bayes

Using the Bayes theorem, Multinomial Naive Bayes

calculates the posterior probability of a class given

the feature vector (Terentyeva et al., 2024). The

conditional probabilities of the features that are

assigned to each class are multiplied to estimate the

probability of each class. Features are independent

when conditioned on the class, according to the

"naive" assumption. When features like word

frequencies in text documents represent counts,

Multinomial Naive Bayes is the best option. The

distribution of words within each class is modeled

using the multinomial distribution.

2.3 Bag of Words

Text is converted into numerical features using the

Bag of Words (BoW) technique, which is a crucial

text representation technique. While keeping the

frequency of each word, it ignores word order and

syntax. BoW breaks the text up into discrete words,

or tokens. A distinct index is given to every token in

a vocabulary. Next, the text is segmented into discrete

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

332

words or tokens. In a vocabulary, each token is given

a distinct index. Despite its inability to retain the text's

semantic content or word order, BoW's simple design

makes it simple to use and computationally efficient.

2.4 Term Frequency-Inverse Document

Frequency

The BoW model can be improved by using TF-IDF,

which shows a word's importance in a document in

relation to its frequency in all papers. Frequency

Term (TF). This metric counts the number of times a

word occurs in a document. The ratio of a word's total

number of occurrences to its frequency of

occurrences in a document is used to compute it. The

frequency of inverse documents (IDF). Throughout

the entire corpus, this measure estimates a word's

significance. The logarithm of the total number of

documents divided by the number of documents that

contain the word is how it is calculated. Lower IDF

ratings for words that are often used in documents

indicate that these words have less discriminating

power. TF-IDF Score. The product of TF and IDF is

the TF-IDF score. It rises when a word appears more

frequently in a document and falls when a word

appears more frequently in all documents combined.

This draws attention to words that are common in one

document but uncommon in the entire corpus.

3 EXPERIMENTAL RESULTS

AND ANALYSIS

This research explores how different text

representations and classification techniques perform

and work when used to predict stocks using data from

social media. The analysis examines various text

volumes for AAPL, contrasts the performance of TF-

IDF and RandomForest classifiers, assesses the

influence of BoW versus TF-IDF representations, and

compares the results across various companies and

data sources, such as AAPL, XOM, GOOG, ABB,

and RedditNews.

3.1 Dataset Description

The dataset consists of historical news headlines and

stock price data, as shown in Table 1.

Table 1: The overview of dataset.

Data ran

g

e Label

RedditNews 2008-06-08 to

2016-07-01

1: Adj Close

value rose or

stayed the

same

0: Adj Close

value

decreased

ABB1 2014-02-011 to

2015-12-25

APPL1 2014-01-02 to

2015-12-09

APPL5

APPL8

GOOG1 2014-01-02 to

2015-10-09

XOM1 2014-01-02 to

2015-12-09

3.2 Experimental Setting

Three measures are used in this research to evaluate

our model for stock prediction using social text data:

Precision (P), Recall (R), and the F1 Score (F). These

measures evaluate how well the model forecasts

changes in stock price in response to news headlines

(Krasnodębska et al., 2024). The percentage of

accurate positive predictions the model makes is

measured by weighted precision. Predicting whether

a stock price will climb or stay stable indicates how

accurate the model is. The model's ability to

recognize every true positive example is shown by its

weighted recall. It displays the number of times the

model accurately predicted when the stock price

actually increased or remained unchanged. Precision

and Recall are balanced by the Weighted F1 Score.

The integration of both measures into a solitary score

facilitates the assessment of overall performance,

particularly in the context of unbalanced datasets.

The data used in this experiment is split 80/20

between a training set and a testing set. With this

method, the model can be trained efficiently on a

large subset of the data while its performance is

assessed on a different, hidden subset. By ensuring

that the assessment takes into account the model's

performance on fresh, real-world data, this technique

helps to clarify the model's applicability.

3.3 Analysis

3.3.1 Comparison of AAPL with Different

Text Volumes

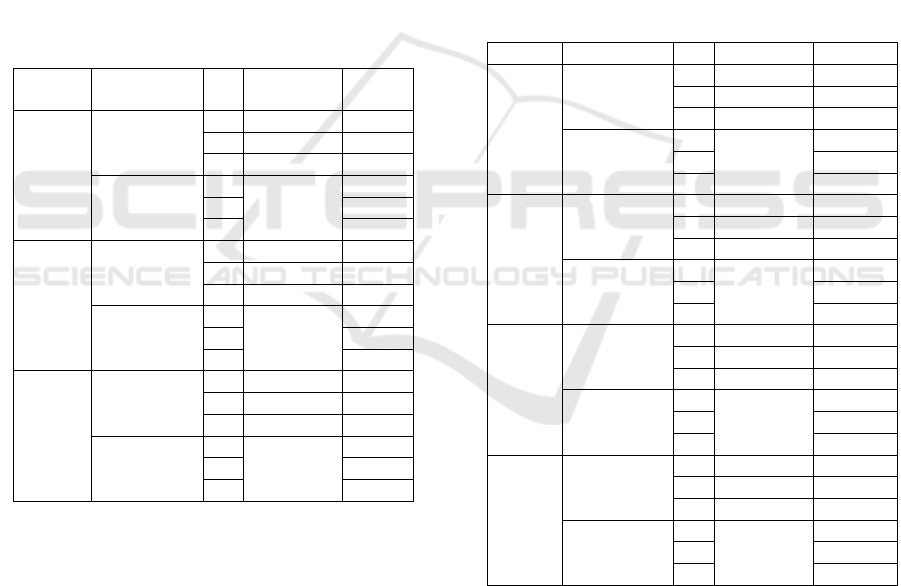

When analyzing AAPL (Apple Inc.) stock predictions

using different volumes of textual data, Table 2 shows

varying performance metrics for both RandomForest

and MultinomialNB classifiers across different text

volumes: AAPL1, AAPL5, and AAPL8.

Enhancing Stock Price Forecasting with Social Media Text: A Comparative Study of Machine Learning Approaches

333

AAPL1: The performance shows a slight

improvement with TF-IDF, yielding a precision of

0.51 and an F1 score of 0.47.

AAPL5: For AAPL5, there is a notable decline in

all metrics compared to AAPL1, which is unexpected.

AAPL8: In the case of AAPL8, the data falls

roughly between APPL1 and APPL5, making it

challenging to ascertain the relationship between text

volume and predicted performance due to fluctuating

results.

When examining the effect of varying text

amounts (1, 5, and 8) on AAPL stock prediction, it

becomes evident that the amount of text significantly

influences the performance of prediction models.

However, as the text quantity increases to AAPL5 and

AAPL8, the results demonstrate an unusual drop

compared to AAPL1. Notably, the prediction

performance strongly declines when transitioning

from AAPL1 to AAPL5, as the Table 2 shows.

Table 2: Comparison of AAPL with different text volumes.

BOW TF-

IDF

AAPL5 Random

Forest

P 0.22 0.39

R 0.46 0.46

F 0.29 0.31

Multinomial

NB

P - 0.45

R 0.45

F 0.39

AAPL8 Random

Forest

P 0.22 0.53

R 0.47 0.49

F 0.30 0.40

Multinomial

NB

P - 0.40

R 0.43

F 0.34

AAPL1 Random

Forest

P 0.48 0.51

R 0.47 0.49

F 0.42 0.47

Multinomial

NB

P - 0.46

R 0.45

F 0.43

3.3.2 Comparison of Random Forest and

MultinomialNB

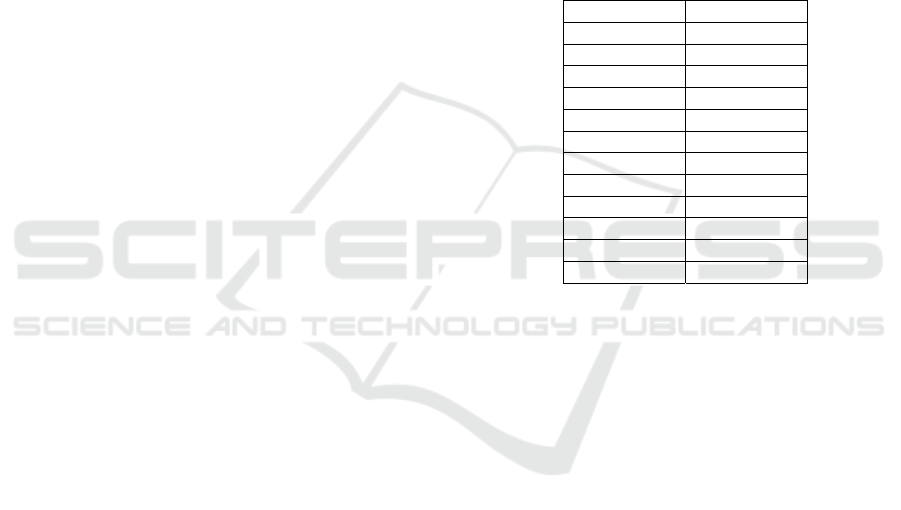

As shown in Table 3, the performance of the Random

Forest and MultinomialNB classifiers varies

significantly across different datasets and text

representations.

All datasets show persistent good performance

with Random Forest, especially when combined with

TF-IDF. This suggests that it is efficient at handling a

variety of textual characteristics and identifying

intricate patterns. Bag of Words achieves

substantially lower precision than Random Forest

with TF-IDF for all text amounts. This implies that

Random Forest is better at utilizing the deeper feature

representation that TF-IDF offers.

MultinomialNB displays a variety of strengths.

According to the statistics, Random Forest may be

able to better capture the intricacies of social text data

than MultinomialNB. The dataset it is used with

determines how well it performs; occasionally, TF-

IDF yields very good results. Nevertheless,

MultinomialNB has constraints in certain scenarios,

particularly with relation to handling smaller text

volumes or employing Bag of Words.

For a given dataset and text representation,

Random Forest typically performs better and more

reliably. However, MultinomialNB struggles with

complex or nuanced data and performs well in some

cases.

Table 3: Comparison of RandomForest and

MultinomialNB.

BOW TF-IDF

XOM1 Random

Forest

P 0.21 0.21

R 0.45 0.42

F 0.29 0.28

Multinomial

NB

P - 0.48

R 0.46

F 0.36

ABB1 Random

Forest

P 0.21 0.21

R 0.45 0.42

F 0.29 0.28

Multinomial

NB

P - 0.48

R 0.46

F 0.36

GOOG

1

Random

Forest

P 0.44 0.48

R 0.43 0.48

F 0.41 0.8

Multinomial

NB

P - 0.47

R 0.47

F 0.47

Random

Forest

P 0.87 0.88

R 0.85 0.88

F 0.84 0.88

Multinomial

NB

P - 0.89

R 0.85

F 0.85

3.3.3 Comparison of BoW and TF-IDF

The contrast between TF-IDF and BoW highlights

how feature extraction and text representation affect

prediction accuracy.

Word presence and absence are recorded by BoW,

but word importance and document-specific

distinctiveness are not taken into account. This

constraint may reduce its capacity to discern between

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

334

pertinent and extraneous phrases when predicting

stocks. Generally, BoW produces poorer precision

and F1 scores than TF-IDF, as has been seen in

several datasets. BoW performs poorly in stock

prediction tests that call on contextual comprehension

and term relevance recognition since it just uses word

frequency to represent text.

According to Wan et al. (2024), TF-IDF provides

more complex text representations by allocating

weights according to the significance of words in a

given document in relation to the corpus as a whole.

By using this strategy, forecast accuracy is improved

and significant phrases are identified. Metrics

showing superior F1 scores, recall, and precision with

TF-IDF over BoW are consistently higher across

datasets. This demonstrates that TF-IDF produces

better predictions by capturing more significant

patterns in text data.

To sum up, in most situations, TF-IDF

outperforms BoW in prediction performance because

it provides a more illuminating text representation.

The results of this investigation show that there

are a lot of chances for incorporating social media text

into stock price forecasting, especially when using

complex text representations like TF-IDF and

cutting-edge machine learning methods like Random

Forest. Compared to simpler approaches like BoW,

TF-IDF improves feature representation by

highlighting the significance of phrases across

documents, improving prediction accuracy.

Higher text volumes, like AAPL5 and AAPL8, do

not always improve performance and may even

decrease accuracy, according to the research. Given

that higher volume may bring noise, this shows that

text data quality and relevancy are crucial.

When utilizing TF-IDF, Random Forest performs

more robustly than Multinomial Naive Bayes in

handling complicated text features, consistently

outperforming it in a variety of circumstances. In

contrast, there are drawbacks to Multinomial Naive

Bayes, especially when dealing with simpler

representations and smaller text volumes.

4 DISCUSSIONS

This section compares the performance of

RedditNews, AAPL, XOM, GOOG, and ABB in

terms of social media text predicting. RedditNews

stands out for having the best predictive accuracy,

with precision and F1-scores over 0.84 and 0.88,

respectively. Reddit performs better than other

platforms because of its user-driven platform and

abundant content, which highlights the importance of

social emotion in financial forecasts.

By comparison, AAPL performs well at first but

metrics deteriorate as text volume rises, especially in

AAPL5, which had the lowest F1 score, recall, and

precision. This shows that quality data is more

important than quantity when it comes to producing

superior results. With a precision of about 0.21 and an

F1 score of about 0.28, both companies exhibit low-

performance metrics for XOM and ABB. The reason

for their poor performance could be attributed to less

educational writing and common industry traits that

restrict the depth of public conversation.

Table 4: The top 10 (frequence) words of XOM1 and

RedditNews.

XOM1 RedditNews

Xom US

URL China

USER EU

Exxon U

K

Mobil India

Oil Countr

y

Stoc

k

ISIS

Cvx Police

Stoc

k

Brexit

Corp Worl

d

A

pp

l Government

ener

gy

Russia

GOOG outperforms both XOM and ABB,

benefiting from the practical application of TF-IDF,

which enhances its predictive accuracy. The

correlation between text features and stock prices is

moderate for AAPL but stronger for RedditNews,

illustrating the differing impacts of industry volatility

and social sentiment.

Word frequency analysis indicates that industry-

specific terms significantly influence predictive

capabilities. For example, according to Table 4, they

show a sharp contrast. RedditNews has the highest

Precision, Recall, F1-score, so the prediction effect is

good. Among which the high-frequency words are

mostly the names of countries and regions, related

To political and economic events. While XOM

with the worst prediction effect, are more focused on

a small range and the disclosed events are often

difficult to affect the stock market.

Enhanced data quality and multimodal techniques

should be the focus of future study (Poojitha et al.,

2024). Deep learning and other advanced machine

learning approaches could improve predictions,

especially for datasets with lesser performance (Xu et

al., 2024; Kang et al., 2024). To properly use social

Enhancing Stock Price Forecasting with Social Media Text: A Comparative Study of Machine Learning Approaches

335

media data for financial forecasting, ongoing

improvement is necessary.

5 CONCLUSIONS

Prediction accuracy is considerably increased when

social media text is included into stock price forecasts.

The use of TF-IDF and Random Forest proves to be

the most effective. The above findings indicate that

while increasing text volume does not consistently

improve performance, sophisticated text

representations and robust classifiers such as Random

Forest result in more reliable predictions. Notably,

Reddit's social media data provides considerable

predictive value. This underscores the importance of

data quality and relevance in forecasting models.

REFERENCES

Sun, Y., Mutalib, S., Omar, N., & Tian, L. (2024). A novel

integrated approach for stock prediction based on

modal decomposition technology and machine

learning. IEEE Access.

Whig, P., Sharma, P., Bhatia, A. B., Nadikattu, R. R., &

Bhatia, B. (2024). Machine Learning and its Role in

Stock Market Prediction. Deep Learning Tools for

Predicting Stock Market Movements, 271-297.

Ferdus, M. Z., Anjum, N., Nguyen, T. N., Jisan, A. H., &

Raju, M. A. H. (2024). The Influence of Social Media

on Stock Market: A Transformer-Based Stock Price

Forecasting with External Factors. Journal of

Computer Science and Technology Studies, 6(1), 189-

194.

Choi, M., Lee, H. J., Park, S. H., Jeon, S. W., & Cho, S.

(2024). Stock price momentum modeling using social

media data. Expert Systems with Applications, 237,

121589.

Sun, Z., Wang, G., Li, P., Wang, H., Zhang, M., & Liang,

X. (2024). An improved random forest based on the

classification accuracy and correlation measurement of

decision trees. Expert Systems with Applications, 237,

121549.

Terentyeva, Y. (2024). Sentiment Analysis, InSet Lexicon,

SentiStrength Lexicon, Naive Bayes, Multinomial

Naive Bayes, TF-IDF, Machine

Learning. International Journal of Open Information

Technologies, 12(7), 32-37.

Wan, Q., Xu, X., & Han, J. (2024). A dimensionality

reduction method for large-scale group decision-

making using TF-IDF feature similarity and

information loss entropy. Applied Soft Computing, 150,

111039.

Krasnodębska K, Goch W, Verstegen J A, et al. Advancing

Precision, Recall, F-Score, and Jaccard Index: An

Approach for Continuous Gridded Data[J]. Recall, F-

Score, and Jaccard Index: An Approach for Continuous

Gridded Data, 2024.

Poojitha K, Rao L V K, Kumar K T D, et al. Predicting

Stock Price Movements in Volatile Markets: A Multi-

Model Fusion Approach[C]//2024 Third International

Conference on Distributed Computing and Electrical

Circuits and Electronics (ICDCECE). IEEE, 2024: 1-6.

Xu Z, Yu G. A Time Series Forecasting Approach Based

on Meta-Learning for Petroleum Production under

Few-Shot Samples[J]. Energies, 2024, 17(8): 1947.

Kang M. Stock Price Prediction with Heavy-Tailed

Distribution Time-Series Generation Based on WGAN-

BiLSTM[J]. Computational Economics, 2024: 1-20.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

336