Governance Reform after Financial Fraud and Its Efficacy on

Luckin Coffee: A Comprehensive Analysis

Chenyi Liu

Nottingham University Business School China, University of Nottingham Ningbo China, Ningbo 315100, China

Keywords: Luckin Coffee, Corporate Governance, Internal Control, Market Strategies.

Abstract: Based on the revival of Luckin Coffee after the financial fraud scandal, it is essential to analyse the corporate

governance reform and offer suggestions to firms that want to avoid the performance dilemma. This paper

will focus on the post financial fraud reformation and its effectiveness on Luckin Coffee. A case study of

Luckin Coffee will be used in this paper to evaluate the weaknesses of management before the financial fraud

and analyse the governance reform after the scandal; Data analysis will be applied to assess the efficacy of

the governance reform; A SWOT analysis of Luckin Coffee will be conducted to examine the competitive

power in the coffee market. The research finds that the corporate governance reform concerning internal

administration, the implementation of blockchain technology, and creative marketing strategies have a close

connection with the rise in financial activities and transactions, expansion of retail outlets, and competition

within the coffee industry. It also provides some suggestions: improving internal control is significant rather

than just creating regulations; it is preferable to use associated technologies to monitor the functionality of

control system; and the distinct orientation of market is necessary for firms to grab more market share.

1 INTRODUCTION

Established in the year of 2017 and launched in

Xiamen, China, Luckin Coffee aims at including

coffee into every individual’s daily routine and

constantly providing customers with the access to

superior quality and high cost-performance coffee

(Luckin Coffee, 2024). With the assistance of

sophisticated retailing networks and upgraded AI

algorithms, Luckin coffee surpassed Starbucks with

4,507 physical locations and became the swiftest firm

from the foundation to IPO (Luckin Coffee, 2024; Li

et al., 2022). Nonetheless, after the acknowledgement

of financial fraud scandal in April 2020, Luckin

Coffee rapidly fell into the quagmire of public

criticism. There was over a 75% drop of Luckin

Coffee’s closing price following the proclamation of

financial fraud (Wei, 2023). What was not anticipated

was that after suffering substantial financial losses

and losing investors’ and consumers’ confidence,

Luckin Coffee has achieved a miraculous revival. By

the end of 2021, Luckin Coffee announced that 868

new locations had been built and net revenue had

increased by around 97.48% from 2020 – the year

Luckin Coffee admitted financial fraud (Huang,

2021). Moreover, the number of Luckin Coffee stores

continued to grow sustainably and stably, rising

approximately 19.4% from December 2021 to June

2022 (Luckin Coffee, 2022). The temporary success

in expanding market scales and increasing net sales is

inextricably linked with Luckin Coffee’s effective

governance reform and tactical marketing strategies.

Meanwhile, the case might serve as some inspiration

for certain struggling businesses. This paper will

argue the effectiveness of corporate governance in

terms of internal control management, the blockchain

technology, and creative marketing strategies. It will

first use the case study of Luckin Coffee to assess

vulnerabilities that existed in the corporate

governance prior to the financial fraud. Then it will

analyse measures that Luckin Coffee has made on

transforming corporate governance. Finally, it will

use data analysis and SWOT analysis to evaluate the

performance of governance reform, as evidenced by

rising stock prices, expanding retail locations, and

competitiveness in the coffee market.

2 LITERATURE REVIEW

From the 21st century, corporate governance reform

292

Liu, C.

Governance Reform after Financial Fraud and Its Efficacy on Luckin Coffee: A Comprehensive Analysis.

DOI: 10.5220/0013215100004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 292-298

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

has drawn a lot of attention and progressed rapidly.

Solomon et al. have mentioned the concept and

framework of internal control and risk management

(Solomon et al., 2000). Hochberg et al. have assessed

how the Sarbanes-Oxley Act (SOX) affects

shareholders (Hochberg, 2009). Reed has provided a

framework of how to deal with the issue related to

governance reform for developing countries (Reed,

2002). Enriques and Volpin have analysed the

corporate governance reform in EU area, which are

improving disclosure standards, enhancing internal

control and enabling power to shareholders (Enriques

and Volpin, 2007). After the incident of financial

fraud scandal involving Luckin Coffee, Feng and

Chen claim that the financial risks of Luckin Coffee

may rise due to the loss of corporate reputation (Feng

and Chen,2021). Gu et al. indicate that Luckin Coffee

needs to do a lot of work to restore its image and gain

profits (Gu et al., 2021). Peng et al. use GONE theory

to evaluate Luckin Coffee’s financial fraud and offer

suggestions to firms in a similar field (Peng et al.,

2024).

3 CASE STUDY OF LUCKIN

COFFEE

3.1 Background Information of Luckin

Coffee’s Financial Fraud

Having opened its initial shop for only around 17

months, Luckin Coffee made an achievement of the

fastest-listing firm on NASDAQ (Chen, 2022).

However, in January 2020, Luckin Coffee was

accused of counterfeiting earnings by Muddy Waters

Research, which instantly brought Luckin Coffee to

public attention (Chen, 2022). Three months after the

accusation, Luckin Coffee admitted to falsifying

transactions and June 2020 witnessed Luckin

Coffee’s delisting from NASDAQ as a result of

financial fraud (Chen, 2022).

3.2 The Revival of Luckin Coffee

In July 2020, a large portion of Luckin Coffee’s

internal investigation was complete, involving the

review of around 55,000 documents and the

interrogation of over 60 people (Luckin Coffee,

2022). Luckin Coffee found new investments from

Joy Capital and Centurium Capital in April

2021(Luckin Coffee, 2022). By December 2021,

Luckin Coffee claimed that Centurium Capital’s

investment had been finished, with an equity

investment which was valued at US$240 million

(Luckin Coffee, 2022). A month later, Luckin Coffee

accomplished the debt restructuring, and in August

2022, the company reported more than 72% year-

over-year growth in proceeds(Luckin Coffee, 2022).

3.3 Weaknesses in the Former

Management Structure of Luckin

Coffee

3.3.1 Loss of Internal Control

One of the reasons for the existence of financial fraud

at Luckin Coffee is the lack of internal control and

supervision. Luckin Coffee used to publish an article

in April 2019 which was themed at corporate

governance charter (Luckin Coffee, 2019). It was

evident that the charter did not constrain the act of

financial fraud or the blurry distribution of power and

responsibilities made it difficult for overseers to

execute supervisory powers. In addition, regulators

did not fully fulfil the obligation to prevent potential

risks such as financial fraud.

3.3.2 Loss of Supervision in Auditing Field

Chen indicates that firms conducting financial frauds

may fabricate the sales volumes by exaggerating the

number of goods sold. For instance, coffee labels can

be randomly assigned (Chen, 2022). Furthermore,

consumers’ unwillingness to request receipts makes it

difficult for auditors to obtain adequate and typical

samples, thereby reducing the accuracy of audits

(Chen, 2022). The lack of audit samples and

supervision provides opportunities for financial

frauds to exploit vulnerabilities. In addition to the

insufficient samples, the carelessness of Ernst &

Young – Luckin Coffee’s external auditor, was one of

the reasons why the financial fraud was not found in

time (He, 2024).

3.3.3 The Erroneous Motivation

In order to attract greater interest from investors and

general public, Luckin Coffee exaggerated a

significant amount of income and expenses by using

fake transactions, which was an unrealistic pursuit of

short-term performance (He, 2024).

Governance Reform after Financial Fraud and Its Efficacy on Luckin Coffee: A Comprehensive Analysis

293

4 THE CORPORATE

GOVERNANCE REFORM

AFTER THE FINANCIAL

FRAUD

4.1 Enhance the Internal Control and

Transparent Communication

Luckin Coffee takes immediate action to create a

corporate image of integrity by enhancing internal

control, risk management control and facilitating

transparent communication in order to stimulate the

effective corporate internal management.

In terms of management issues, Luckin Coffee

revamps the internal management structure and two

mechanisms have been established (Luckin Coffee,

2022). The new supervision mechanism may prevent

the power from centralization and balance rights from

governance, management to execution. Additionally,

the report mechanism may strengthen internal control

and the new management structure would rebuild a

clear allocation of rights and responsibilities.

In addition, the foundation of “Three Lines of

Defence”, which contains each business department

in the first line, four departments related to control in

the second line and two independent regulators in the

third line, reduces the risk of management (Luckin

Coffee, 2022). Meanwhile, Luckin Coffee puts

emphasis on the examination of actual

implementation and hires qualified advisors to test

internal controls and assist with the restoration of

internal management. Luckin Coffee states that with

the help of the evaluation in 2021, the test has found

64 risks at the enterprise level, 118 programs to be

recognized and 567 control procedures to be built

(Luckin Coffee, 2022). The ingenious design of three

lines and inspection mechanism shows the

effectiveness of preventing potential risks.

Furthermore, Luckin Coffee is committed to

enhancing transparent communication and

information disclosure to present the image of

integrity. Luckin Coffee’s disclosure schedule

became more regular after delivering the annual

report for 2021 in accordance with related rules

(Luckin Coffee, 2022). Additionally, a

whistleblowing policy has been developed which

aims to identify weaknesses of manage systems and

report violations of policies or laws (Luckin Coffee,

2022). The regulated disclosure of management

reports and multiple channels of communication and

whistleblowing may increase the transparency of the

management. It shows that Luckin Coffee puts effort

into the corporate internal management, including

internal control, risk management control, tests of the

performance of management, and transparency of

information.

4.2 The Implementation of Blockchain

Technology and Information

Management System

The application of blockchain technology and

security system are two cornerstones of Luckin

Coffee’s reform, which guarantee the safety of

financial systems and effectively reduce the

possibility of financial fraud.

Blockchain technology, which trails the financial

data by utilizing encryption theory and other tools,

can provide supervisors with reliable information

(Chen, 2022). After the adoption of blockchain

technology, the possibility of the financial fraud may

drop to a low level. According to Chen, different from

the previous system, the way blockchain collects data

makes it more costly for insiders to manipulate

information than the potential profits because data is

stored in a series of networked computers (Chen,

2022). The use of blockchain may prevent financial

fraud and reduce the motivation of profiteers, while

reducing the workload of auditors as well. In order to

make up for the creditability that Luckin Coffee lost

previously, blockchain technology has been

implemented in the data management part. The data

connection between Luckin Coffee and its

partnerships was completed in September 2022

(Luckin Coffee, 2022). The introduction of

blockchain technology can play a significant role in

information transparency, as financial data, sales data

and supply chain data can be traced and documented.

Consequently, Luckin Coffee can regain reputation

from investors and consumers. In addition, the

comprehensive information security system has been

established to safeguard proprietary information,

which may reduce the risk of information leakage

(Luckin Coffee, 2022).

Additionally, around 27,000 employees have been

trained on information security protection and Luckin

Coffee is committed to the development of

information security (Luckin Coffee, 2022). Luckin

Coffee has acquired several certifications related to

the construction of information management systems

(Luckin Coffee, 2022). The use of blockchain

technology and the construction of information

security systems are two major factors that enhance

Luckin Coffee’s credibility and information clarity.

The reform in the external control area is one of the

factors why Luckin Coffee recovered within two

years.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

294

4.3 Well-Positioned and Tactical

Marketing Strategies

Luckin Coffee enacts tactical marketing strategies by

having precise orientation of the target market and

cooperating with other brands to increase advantages

in the competitive coffee market.

Luckin Coffee has a clear target of coffee market

and customer base. In order to prevent overlap in the

coffee market, Luckin Coffee focuses on offering

high-quality and relatively cheap coffee to attract

consumer groups (Cao, 2022). The clever market

position effectively avoids directly competing with

other superior coffee brands like Starbucks.

According to Cao, through the method of providing

coupons for customers, the price of a cup of Luckin

Coffee is relatively cheaper than other competitors

(Cao, 2022). However, due to the initially price of

coffee, consumers may unconsciously associate

Luckin Coffee and other noble coffee brands of the

same caliber, which invisibly boosts the sales of

Luckin Coffee and gains a large number of loyal

consumers. The discount strategy captures the

psychology of some consumers who prefer affordable

coffee. Furthermore, the rapid introductions of new

products and new flavours of coffee is another reason

why Luckin Coffee can attract customers. Luckin

Coffee indicates that from January 2022 to September

2022, as many as 92 new products were launched

(Luckin Coffee, 2022). Coconut Milk Latte sold more

than 100 million cups annually among these coffee

types, while the Coconut Cloud Latte sold over 4.95

million cups in the first week after its launch (Luckin

Coffee, 2022). The constant discounts, cost-effective

coffee and continuous penetration have increased the

market share of Luckin Coffee, which is an essential

reason why Luckin Coffee recovered in a short time.

Additionally, Luckin Coffee vigorously searches

for opportunities to collaborate with other renowned

brands to increases its reputation. For instance, Huang

claims that an innovative coffee product, which

combines Moutai wine and coffee, has been launched

as a result of the partnership between Luckin Coffee

and well-known Chinese liquor firm Moutai (Huang,

2024). The coffee, which is called “liquor-laced

latte”, soon increased the performance of Luckin

Coffee’s market sales. After the release of the new

product, about 2,437 net stores were achieved along

with 23.1% store profit (Huang, 2024). As the well-

known liquor brand in China, Moutai has

accumulated a reputation among consumers. The

cooperation between Luckin and Moutai can attract

customers due to the scarceness of co-branded goods,

which may stimulate customers’ curiosity and

motivate them to make an immediate purchase. As

this is supported by Shin and Kim, who claim that

unique and novel items tend to grab people’s interest

more easily and humans are naturally fascinated by

new and unknown things (Shin and Kim, 2019). The

joint brand strategy captures the consumer’s curiosity

and represents a tactically effective transformation in

market strategy.

5 RESULT OF THE CORPORATE

GOVERNANCE REFORM

5.1 The Increasing Stock Price after

the Corporate Governance Reform

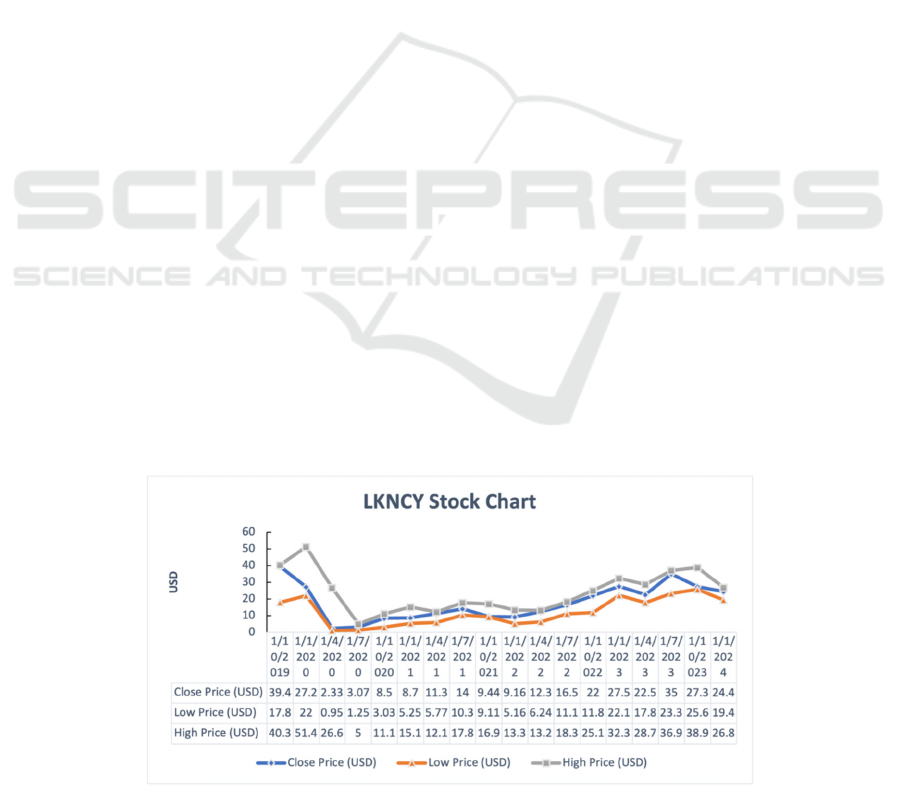

From Figure 1, after the decreasing stock price in

2020, there has been a stable increase in the price of

Luckin Coffee’s stock, from 2.33 USD in Apr. 2020

to 24.44 USD in Jan. 2024 (closing price). The

ascending stock prices prove that Luckin Coffee has

recovered capital flows and active transactions,

making it more competitive in the coffee market.

Figure 1: Luckin Coffee’s stock chart from Oct 2019 to Jan 2024

.

Data source: https://investor.lkcoffee.com/stock-quote-chart

Governance Reform after Financial Fraud and Its Efficacy on Luckin Coffee: A Comprehensive Analysis

295

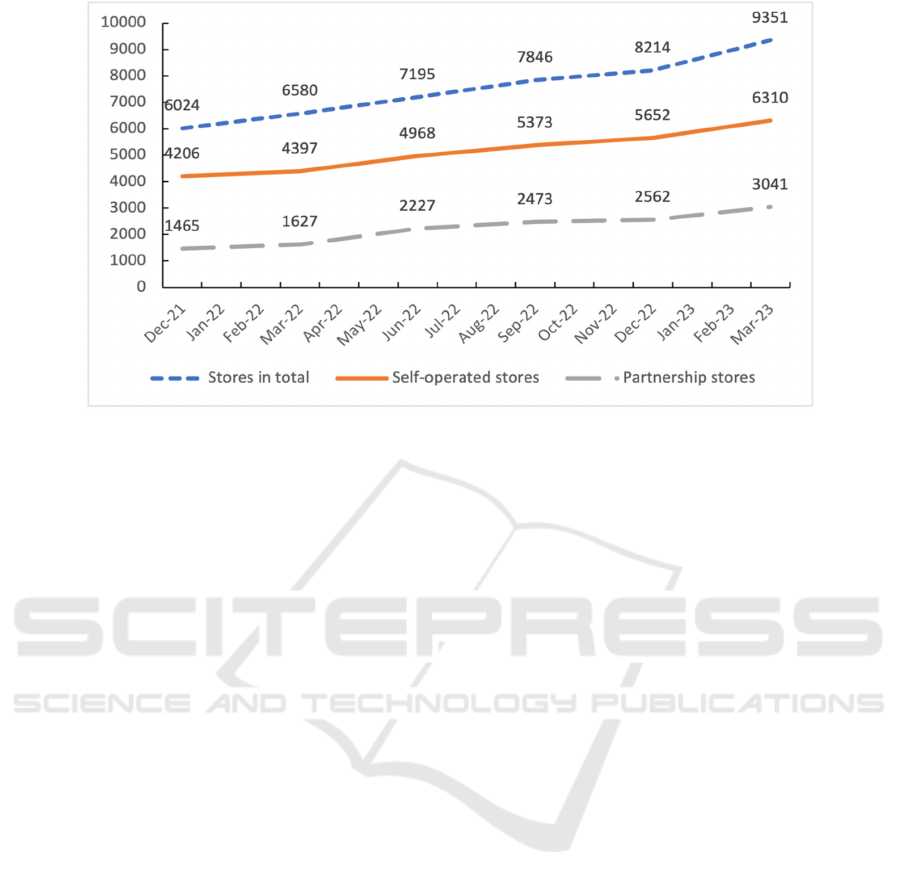

Figure 2: Luckin Coffee’s Stores from Dec 2021 to Mar 2023.

Data source: https://investor.lkcoffee.com/news-releases/news-release-details/luckin-coffee-inc-announces-first-quarter-

2023-financial-results

5.2 Constant Increase in Stores of

Luckin Coffee

According to Figure 2, the steady rise in the number

of self-operated stores and partnership stores reveals

Luckin Coffee’s expansion and close cooperation

with other partners. By the end of March 2023, stores

in total had reached 9,351. The growth reflects

Luckin Coffee’s commitment to expanding its

customer base and the effective execution of market

strategies.

5.3 Enhanced Competitiveness of

Luckin Coffee Through SWOT

Analysis

Conducting a SWOT analysis can evaluate the

internal conditions and external environment of

Luckin Coffee. In terms of strengths, Luckin Coffee

has a stable supply of coffee beans from different

continents, including Ethiopia, Yunnan province in

China and Brazil (Luckin Coffee, 2022). More than

15,000 tons beans were imported in 2021 and this

figure doubled in the next year (Yu, 2024).

Furthermore, the wide variety of coffee types can

satisfy different consumer needs and attract many

loyal consumers. The co-branding strategies can

enhance the popularity of Luckin Coffee, while

effective internal management ensures the smooth

operation of the firm. Additionally, the implantation

of blockchain technology can supervise the

transparency of information. The strengths of Luckin

Coffee can be summarized as follows: three stable

suppliers from different continents, the

implementation of blockchain technology, various of

flavours and types of coffee, effective internal control

and risk management, a good orientation of coffee

market and successful collaboration with famous

brand Moutai.

Regarding the weaknesses of Luckin Coffee, the

previous instance of financial fraud may negatively

influence potential investors and consumers (Huang,

2021). Furthermore, new products may not satisfy the

tastes of all consumers. For instance, a survey on

whether liquor latte is enjoyable to drink received

4,234 votes in support and 4,517 votes in opposition

(Huang, 2024). Therefore, the weaknesses of Luckin

Coffee include the past financial fraud scandal and

the possibility that new products may not suit every

consumer’s taste.

For opportunities, the vast coffee market in China

presents all coffee firms with chances to make profits.

The purchasing power of Chinese consumers enables

firms to explore a variety of products, offering Luckin

Coffee the opportunity to provide a range of options

for consumers (Huang, 2021). In addition, the

implementation of blockchain technology and

corporate governance reforms in internal control and

management may inject vitality in the operation of the

firm.

For threats, the development of the tea market

may pose competition to the coffee market. Milk tea

culture was quite popular in the previous year and

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

296

plenty of milk tea brands may compete with Luckin

Coffee for the limited market share (Huang, 2021).

Furthermore, competition within the coffee market is

another threat for Luckin Coffee. For example,

Starbucks has also implemented several reform

actions to increase its advantage (Huang, 2021).

Therefore, a table of SWOT analysis can be created

below (see Table 1).

Table 1: SWOT Analysis of Luckin Coffee

Strengths

Three stable suppliers

from different continents

The implementation of

blockchain technology

Various types of coffee

Effective corporate

internal control and risk

management

A good orientation of

coffee market and

successful collaboration

with famous brand Moutai.

Weakness

The formal financial

fraud scandal

New products may

not suit every consumer’s

taste

Opportunity

The vast coffee market

in China

Effective corporate

governance reform

Threat

Competition with tea

market

Competition within

coffee market

Although some drawbacks and threats exist for

Luckin Coffee, the corporate governance reform

brings more financial transactions to the coffee

market, expands the number of stores, and increases

competitiveness in the coffee market.

6 CONCLUSIONS

This paper has highlighted that the corporate

governance focusing on internal controls, the

utilization of blockchain technology and the

implementation of related information security

system, as well as approaches to marketing, are

productive. These are evident in the growing number

of active transactions, the expansion of retail

presence, and competitive power in the coffee market.

It first conducted a case study on Luckin Coffee and

analysed deficiencies in the previous management

structures. It then examined the changes in corporate

governance reform at internal management, new

technology and market strategy levels. Efficient

internal control and risk management systems, the

security systems and blockchain technology, the

market focus and brand collaboration have enabled

Luckin Coffee to recover from its financial losses.

Finally, it discussed the result of the corporate

governance reform of Luckin Coffee. The rising

financial activities and transactions, the increasing

price of stocks, the expanding retail footprints and the

competitiveness in the coffee market indicate that the

strategies implemented by Luckin Coffee have had

positive effects. The reform of Luckin Coffee can

provide some approaches for other firms that are

eager to reform their governance frameworks. Firms

need to focus on enhancing internal controls rather

than merely establishing regulations. If firms have

adequate capital and technical support, it is advisable

for firms to utilize relevant technologies to monitor

and assess the effectiveness of control systems.

Secondly, firms still need to maintain a relatively

transparent environment not only in terms of regular

information disclosure but also in communication,

which could earn the trust of investors and

consumers. In addition, establishing whistleblowing

policies may assist firms to identify potential risks

earlier. Thirdly, firms need to have a clear orientation

of target customers. Releasing coupons and

cooperating with other well-known brands may be

two methods to enhance a firm’s sales and popularity.

It is important to note that retaining loyal customers

is one of the reasons for the increasing number of

retail outlets. Therefore, firms need to prioritize

strategies aimed at retaining and expanding the base

of loyal customers.

REFERENCES

Cao, X., 2022. Research on Marketing Innovation of

Luckin Coffee. In 2022 7th International Conference on

Financial Innovation and Economic Development

(ICFIED 2022) (pp. 3047-3052). Atlantis Press.

Chen, T., 2022. Blockchain and Accounting Fraud

Prevention: A Case Study on Luckin Coffee. In 2022

7th International Conference on Social Sciences and

Economic Development (ICSSED 2022) (pp. 44-49).

Atlantis Press.

Enriques, L., Volpin, P., 2007. Corporate Governance

Reforms in Continental Europe. Journal of Economic

Perspectives, 21(1), 117-140.

Feng, Y., Chen, C., 2021. The Impact of Financial Fraud on

Financial Risks: A Case Study of Luckin Coffee. In

2021 International Conference on Financial

Management and Economic Transition (FMET 2021)

(pp. 525-530). Atlantis Press.

Gu, Z., Qi, B., Zhao, Y., 2021. Why Luckin Coffee

Survived After its Scandal? In 2021 3rd International

Conference on Economic Management and Cultural

Industry (ICEMCI 2021) (pp. 2521-2528). Atlantis

Press.

Governance Reform after Financial Fraud and Its Efficacy on Luckin Coffee: A Comprehensive Analysis

297

He, J., 2024. The Analysis of Luckin Coffee’s Accounting

Scandal. Highlights in Business, Economics and

Management, 24, 2572-2576.

Huang, J., 2024. Analysis of Co-branding Strategies of

Luckin Coffee and Moutai. Highlights in Business,

Economics and Management, 27, 305-311.

Huang, Y., 2021. A market strategy analysis of Luckin

Coffee. Chulalongkorn University Theses and

Dissertations (Chula ETD), 7631.

Hochberg, Y.V., Sapienza, P., Vissing-Jørgensen, A., 2009.

A Lobbying Approach to Evaluating the Sarbanes-

Oxley Act of 2002. Journal of Accounting Research,

47(2), 519-583.

Li, K., Liu, Y., Wang, J., Zhu Y., 2022. Influence of

Financial Fraud Scandal on Listed Companies-Take

Luckin Coffee as an Example. Highlights in Business,

Economics and Management, 2, 38-50.

Luckin Coffee Official Website., 2019. Corporate

Governance, Committee Charters, Nominating and

Corporate governance Committee Charter. Available at

https://investor.luckincoffee.com/corporate-

governance/governance

Luckin Coffee Official Website., 2022. Corporate

Governance Report, Transformation and Reinvention –

Luckin Coffee 2020-2022 Corporate Governance

Report. Available at https://investor.luckincoffee.

com/corporate-governance/governance

Luckin Coffee Official Website., 2024. Company

overview. Available at https://investor.luckincoffee.com

Peng, X., Yang, C., Yang, L. 2024. Study on Financial Fraud

Based on the GONE theory: A case study of Luckin

Coffee. Frontiers in Business, Economics and

Management, 14(3), 146-151.

Reed, D., 2002. Corporate Governance Reforms in

Developing Countries. Journal of Business Ethics, 37,

223-247.

Shin, D.D., Kim, S.I., 2019. Homo Curious: Curious or

Interested? Educational Psychology Review, 31(4),

853-874.

Solomon, J.F., Solomon, A., Narton, S.D., Joseph, N.L.,

2000. A Conceptual Framework for Corporate Risk

Disclosure Emerging from the Agenda for Corporate

Governance Reform. The British Accounting Review,

32(4), 447-478.

Wei, D., 2023. Luckin Coffee Financial Fraud Case

Analysis. Financial Engineering and Risk Management,

6(7), 125-128.

Yu, M., 2024. From Financial Crisis to Supply Chain

Advantage: An Analysis of Luckin Coffee’s Strategic

Transformation. In 2023 2nd International Conference

on Public Service, Economic Management and

Sustainable Development (PESD 2023) (pp. 371-379).

Atlantis Press.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

298