Prediction and Analysis of Bitcoin Prices Using Diverse Regression

Models

Tianze Li

a

College of Science and Engineering, The University of Edinburgh,

Edinburgh, U.K.

Keywords: Bitcoin, Prediction, Regression Models.

Abstract: Accurate prediction of cryptocurrency prices is crucial for investors and analysts due to the instability and

complexity of the trading market. This study explores the effectiveness of diverse predictive models - Long

Short-Term Memory (LSTM), eXtreme Gradient Boosting (XGBoost), and Random Forest (RF) - in

forecasting Bitcoin prices. The inclusion of these diverse models, each representing different approaches to

regression and machine learning, allows for a more comprehensive analysis of predictive accuracy.

Simulations are conducted using historical Bitcoin price data from Yahoo Finance, evaluating the models

based on their performance metrics: R-squared (R²) score, Mean Absolute Error (MAE), and Root Mean

Squared Error (RMSE). The LSTM model demonstrated superior performance with an R² score of 0.955, an

MAE of 0.04, and an RMSE of 0.0508, showing its ability to capture complex temporal dependencies. RF

also performed well, achieving an R² of 0.936, MAE of 0.0459, and RMSE of 0.0604. In contrast, XGBoost

lagged with an R² of 0.654, MAE of 0.1009, and RMSE of 0.1406. This study highlights the strengths of using

diverse regression models for predicting Bitcoin prices, with LSTM emerging as the most effective model,

while also providing insights into real-market transactions.

1 INTRODUCTION

Bitcoin has been one of the most prevalent

cryptocurrencies in the volatile trading market since

the 21st century (Wątorek et al., 2021). It is an

aggregation of concepts and technologies that form

the basis of the digital economic system, and users

can transfer Bitcoin over the internet as they handle

the conventional currencies (Wątorek et al., 2021). As

a result, the emergence of Bitcoin symbolizes not

only a technological innovation but also a

revolutionary shift in the financial world.

Before Bitcoin, the double spending problem - a

challenge where a token could be spent more than one

time - bothers the financial market to a large degree

(John et al., 2022). This problem is notable in a setting

without a centralized entity since a single transaction

should transfer ownership of the currency, preventing

the original owner from making additional

transactions with the same currency (John et al.,

2022). However, Bitcoin solved the problem by

defining a new mechanism for obtaining consensus in

a decentralized background (John et al., 2022).

a

https://orcid.org/0009-0007-5479-8029

Given the unique characteristics and the growing

role of Bitcoin, it is critical to comprehend its

significance and predict its price movements.

However, due to various factors in the turbulent

trading market, whether economic, social, or

technical - accurately forecasting the price of Bitcoin

is still a challenge. Previous studies on stock market

predictions mainly utilize daily and high-frequency

data (Madan et al., 2015). These studies are divided

into two categories: analysis of empirical studies and

analysis of machine learning algorithms (Chen et al.,

2020). According to historical results, the latter

performs the prediction task better in accuracy,

consistency, and the ability to produce the underlying

pattern of the data (Chen et al., 2020). Therefore, by

exploring a set of diverse regression models (Long

Short-Term Memory (LSTM), eXtreme Gradient

Boosting (XGBoost), and Random Forest(RF)), this

paper aims to provide several insightful opinions and

contributive understandings to the prediction of

Bitcoin prices in the cryptocurrency trading market.

This paper is structured with a brief exploratory

data analysis in the first place, delivering a

286

Li, T.

Prediction and Analysis of Bitcoin Prices Using Diverse Regression Models.

DOI: 10.5220/0013215000004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 286-291

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

comprehensive view of the original data and basic

information. Then, three machine learning models are

introduced with quick elaborations, and the results

and analysis of this study are presented with detailed

illustrations and explanations. After that, this paper

discusses the real-life significance of conducting this

experiment and provides several suggestions for

increasing the accuracy of the results. Finally, it

concludes with a summary of key findings and

potential directions for future research.

2 EXPERIMENTAL DATA

The dataset used in this simulation was sourced from

Yahoo Finance, a popular platform that provides

financial news and stock information. The dataset

includes historical data on Bitcoin (BTC), with daily

information on the opening, closing, high, and low

prices, and trading volumes. It spans from September

17th, 2014, to February 19th, 2022, providing an

exhaustive view of Bitcoin's market behavior over

time.

Normalization is applied before the simulation to

scale the features of the dataset to a standard range

(typically between 0 and 1). This step is crucial for

any machine learning algorithm to ensure that all the

features contribute equally to the performance of the

model. Also, the missing values/null values are

checked during the preprocessing of the data to

ensure data integrity and completeness, allowing for

accurate and reliable analysis.

The predicted target (output) of the experiment is

the close price of Bitcoin, while the input contains

more complex information like RSI (relative strength

index) transformed from the basic features of the

Bitcoin data frame.

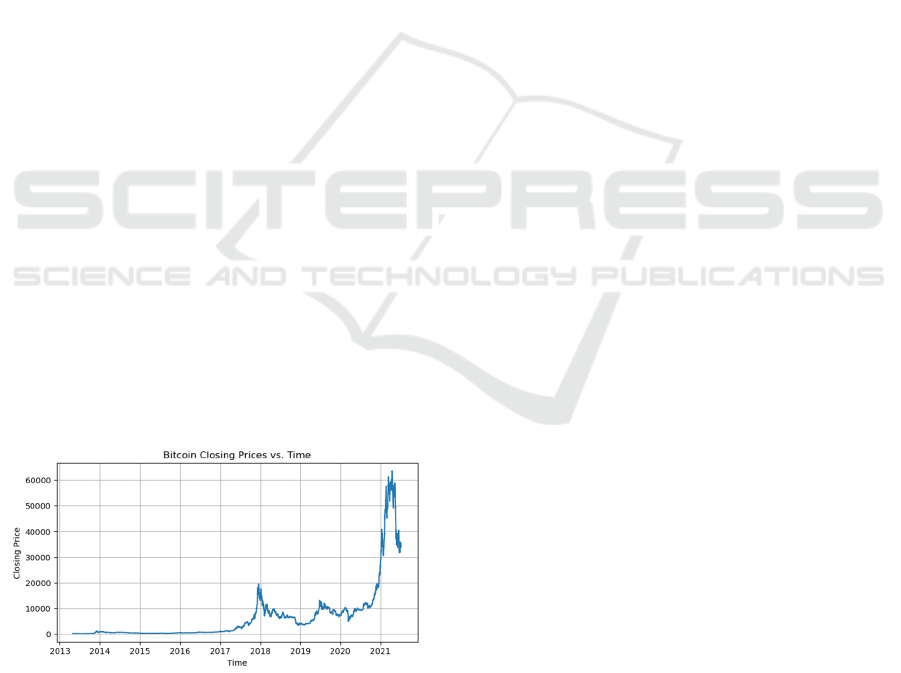

Figure 1: Time series visualization of the Bitcoin close

prices (Photo/Picture credit: Original).

Figure 1 offers the time series visualization of

Bitcoin prices from September 17th, 2014, to

February 19th, 2022. The sudden boom of the close

prices around the year 2021 indicates a significant

surge in market investment in Bitcoin, reflecting

substantial volatility in the cryptocurrency trading

market. To reduce the computations of the models

and leverage the performances, the study was

conducted using data in one year from February 19th,

2021, to February 19th, 2022.

3 REGRESSION MODELS

There are various regression models in the machine

learning area, specifically, 3 models are chosen to

handle this relatively complex dataset of Bitcoin

which are LSTM, XGBoost, and RF. Each model

possesses unique strengths but also holds its flaws.

3.1 Long Short-Term Memory

LSTM is a type of recurrent neural network (RNN).

Recurrent neural networks are widely utilized in

sequential data, but they cannot learn pertinent

information when the disparity of the series is large

(Yu et al., 2019). By adding the gate function into the

cell structure, LSTM is effective in capturing the time

series pattern of complicated datasets like

cryptocurrencies well (Yu et al., 2019). LSTM also

acquires the ability to maintain information over a

long time series while limiting the effect of vanishing

gradient problems (Yu et al., 2019). This advantage

helps to gain a more stable performance during the

simulation than normal RNNs do.

3.2 Extreme Gradient Boosting

XGBoost regression model is primarily based on the

gradient boosting framework, and it works by

combining the predictions of multiple weak learners

to form a strong predictive model (Chen & Guestrin,

2016). It is extensively utilized by data scientists to

achieve cutting-edge results in numerous machine

learning challenges and is particularly appropriate for

handling structured data based on its scalability,

which can effectively capture non-linear relationships

in the dataset (Chen & Guestrin, 2016). The ability to

reduce overfitting is highly appreciated, so it is

selected to be applied in the experiment to predict

Bitcoin prices.

3.3 Random Forest

RF is a powerful prediction tool that combines

multiple tree predictors, each relying on a randomly

Prediction and Analysis of Bitcoin Prices Using Diverse Regression Models

287

sampled vector (Breiman, 2001). By incorporating

the right kind of randomness and adhering to the Law

of Large Numbers, they avoid overfitting and become

highly accurate classifiers and regressors (Breiman,

2001). Forests produce results that are as effective as

boosting and adaptive bagging, but they don't modify

the training set over time, which reduces the volatility

and fluctuations during the simulation (Breiman,

2001). Previous studies have shown that random

inputs and random features yield strong results in

classification but act less effectively in regression,

which may provide some preconceptions about the

upcoming results of the study on the price prediction

of Bitcoin.

4 RESULTS AND ANALASIS

4.1 Evaluation Metrics

There are several important metrics to help assess the

performance of this experiment using different

models, with 𝑛 representing the total number of the

sample and 𝑦 representing the value.

𝑀𝐴𝐸

1

𝑛

|

𝑦

𝑦

|

1

Equation (1) measures the average value of the

prediction error and provides an intuitive sense of the

gap between the true values and the prediction values.

𝑅𝑀𝑆𝐸

1

𝑛

𝑦

𝑦

2

Equation (2) shares the same units with the target

variable compared to mean squared error (MSE). It is

generally used to evaluate and report the performance

of the model rather than train the model as MSE does.

𝑅

1

∑

𝑦

𝑦

∑

𝑦

𝑦

3

Equation (3), the coefficient of determination,

measures the proportion of the variation in the

dependent variable that is explained by the

independent variables in the model. It is indeed an

explanatory indicator of the overall effectiveness of

the model.

4.2 Performance Evaluation

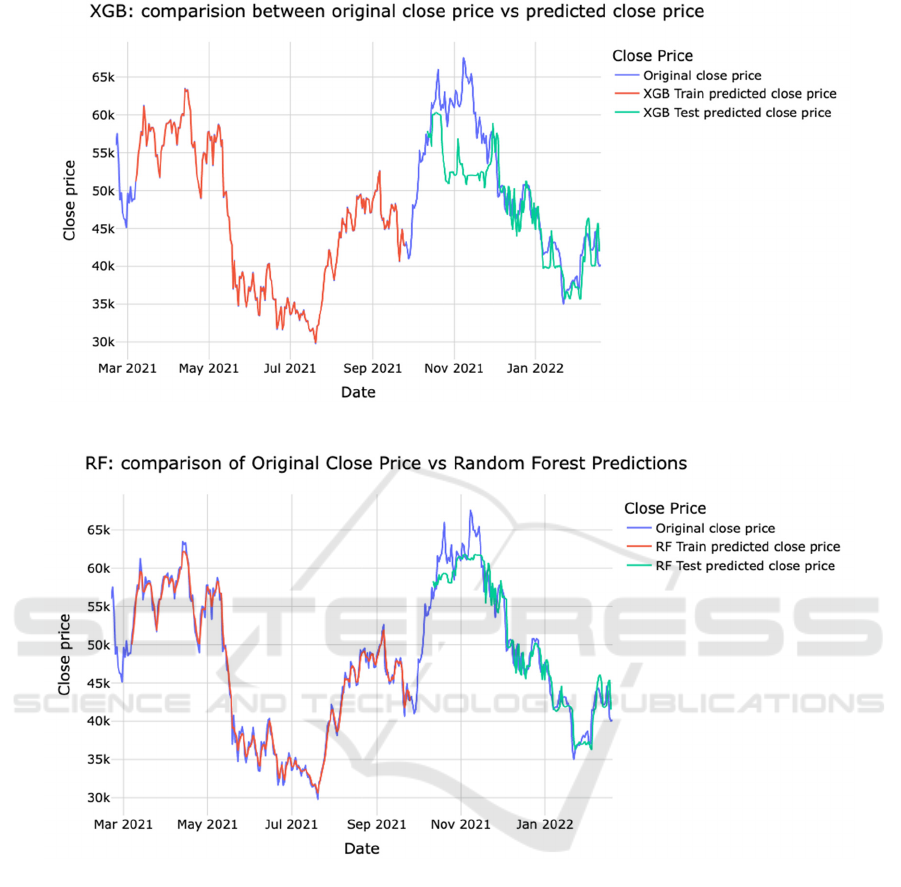

It is obvious from Figure 3 that XGBoost predictions

deviate significantly from the main trend of the original

close prices, especially in the fluctuations around

November 2021; According to Figure 2 and Figure 4,

LSTM and RF models fit relatively well with only a few

lines being misaligned with the original stock trend. On one

hand, even though the prediction of LSTM looks a bit ahead

of time when compared to the original close price, it still

stands out of the pack with its extraordinary capability by

simulating each tiny movement of the original trend. RF, on

the other hand, did not capture the price movement as

accurately as LSTM did around November 2021, which

symbolizes its weakness in simulating extremely

complicated fluctuations.

Figure 2: Comparison of prediction close prices with LSTM model vs. original close prices (Photo/Picture credit: Original).

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

288

Figure 3: Comparison of prediction close prices with XGB model vs. original close prices (Photo/Picture credit: Original).

Figure 4: Comparison of prediction close prices with RF model vs. original close prices (Photo/Picture credit: Original).

4.3 Experimental Results and

Comparisons

From the results in Table 1, all three models showcase

their ability to predict the Bitcoin prices in different

ways: LSTM outperforms the other two methods with

the highest R-squared (R

2

) value and the lowest Mean

Absolute Error (MAE) and Root Mean Squared Error

(RMSE), which proves that it is a relatively effective

method in predicting the Bitcoin prices. XGBoost,

conversely, fell behind the other two methods by a

large degree with nearly 30 percent loss in the R2

value and twice the error generated during the

experiment. This phenomenon reveals the

incompatibility of this model and the prediction of

complicated Bitcoin prices, and it may need further

tuning or additional features to help increase its

performance. RF is still reliable with a high R2 value

and comparatively low errors, rejecting the

presumption that it acts less effectively in regression.

However, it may not be able to capture the tiny

information with high accuracy in the Bitcoin close

prices as LSTM does.

Prediction and Analysis of Bitcoin Prices Using Diverse Regression Models

289

Table 1: Metrics of the three models.

LSTM XGBoost RF

𝑅

0.9548 0.6541 0.9362

MAE 0.0400 0.1009 0.0459

RMSE 0.0509 0.1407 0.0604

Since normalization has been applied, the

numbers in the table shown above are in the range

between 0 and 1 to enhance direct comparison

between different metrics and models. However, this

excellent performance of the LSTM model may be

attributed to overfitting due to the large noise under

the Bitcoin close prices. This is nearly unavoidable

when fitting the price of cryptocurrencies since the

market is volatile. Cross-validation could be utilized

to mitigate this problem by splitting the dataset into

multiple folds and evaluating it.

The data quality itself also determines the

reliability of the procedure data preprocessing and

eliminates null values. Hence, it is crucial to have a

relatively clear dataset to perform the experiment,

which will make the whole experimental process

more stable and reduce noise to a certain level.

These results provide valuable insights for

cryptocurrency investors and market analysts, with

LSTM shown to be a preferred model experimentally.

However, it is imperative to note the fact that there

are significant differences between the simulation and

the trading market in real life: real transactions in the

market are unexpected and may involve various

unknown complexities that are not simulated by the

models. As a result, people should be more rational

when facing the near-perfect alignment of the model

simulation and considering firm orders. Also, risk

management and legal problems in the financial

market should be realized. Apart from those sides, the

results still possess significant implications in

analyzing the cryptocurrency trading market.

5 DISCUSSIONS

According to the results presented in the study,

researchers should continue to develop new

techniques to improve the accuracy of the predictions.

One of the most prevalent methods for this aim is

called feature engineering, which is to include more

relevant features of the Bitcoin prices and weight

them in different ratios. This includes adding

technical indicators or economic factors to increase

the level of fitting and reduce the error. However, it

is hard to identify the level of priority of the features

in the dataset, and the dynamic trading market may

change the importance of each feature, which requires

consistent updates of peoples’ own feature sets.

Another method of improving the precision is to

incorporate deep learning algorithms such as

Convolutional Neural Networks (CNNs) or

Generative Adversarial Networks (GANs) to

simulate the data precisely (Kattenborn et al., 2021).

Because of the introduction of non-linearity, the

activation functions inherited in CNNs enhance the

versatility and capability of the networks to model a

broad range of complicated tasks exhibited in reality

(Krichen, 2023).

Cross-sectional predictions are also an alternative

approach to predicting the price of cryptocurrencies:

instead of predicting the close price of the target

currency directly, they focus on analyzing the market

variables of the currency at a specific moment

(Hanauer & Kalsbach, 2023). This method could limit

the effect of the outliers and address the impact of

differences in the characteristics of the target

(Hanauer & Kalsbach, 2023). Thus, prediction

accuracy and profitability can be enhanced by

applying non-linear combinations through deep

learning techniques, rather than relying merely on

linear regression to combine various factors (Abe &

Nakagawa, 2020).

6 CONCLUSIONS

In this study, the Bitcoin price is predicted by LSTM,

XGBoost, and RF models. The paper initially selected

the close price as the target variable and chose a

specific period from the data time. Then the three

models carried out the task with different

performances shown above. Finally, they are assessed

by multiple metrics and graphs, which demonstrate

the best comprehensive quality of the LSTM model.

Generally, people have been dedicated to reforming

various methods of predicting cryptocurrency prices

these years, which implies the importance of accurate

forecasting in both commercial and scientific areas.

Other methods or refinements should be explored to

optimize the actual capability of the models and to

achieve more reliable predictions in the dynamic

trading market.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

290

REFERENCES

Abe, M., Nakagawa, K., 2020. Cross-sectional stock price

prediction using deep learning for actual investment

management. In Proceedings of the 2020 Asia Service

Sciences and Software Engineering Conference (pp. 9-

15).

Breiman, L., 2001. Random forests. Machine learning, 45,

5-32.

Chen, T., Guestrin, C., (2016) Xgboost: A scalable tree

boosting system. In Proceedings of the 22nd acm

sigkdd international conference on knowledge

discovery and data mining (pp. 785-794).

Chen, Z., Li, C., Sun, W., 2020. Bitcoin price prediction

using machine learning: An approach to sample

dimension engineering. Journal of Computational and

Applied Mathematics, 365, 112395.

Hanauer, M. X., Kalsbach, T., 2023. Machine learning and

the cross-section of emerging market stock returns.

Emerging Markets Review, 55, 101022.

John, K., O'Hara, M., Saleh, F., 2022. Bitcoin and beyond.

Annual Review of Financial Economics, 14(1), 95-115.

Kattenborn, T., Leitloff, J., Schiefer, F., Hinz, S., 2021.

Review on Convolutional Neural Networks (CNN) in

vegetation remote sensing. ISPRS journal of

photogrammetry and remote sensing, 173, 24-49.

Krichen, M., 2023. Convolutional neural networks: A

survey. Computers, 12(8), 151.

Madan, I., Saluja, S., Zhao, A., 2015. Automated bitcoin

trading via machine learning algorithms. URL:

http://cs229. stanford. edu/proj2014/Isaac% 20Madan,

20.

Wątorek, M., Drożdż, S., Kwapień, J., Minati, L.,

Oświęcimka, P., Stanuszek, M., 2021. Multiscale

characteristics of the emerging global cryptocurrency

market. Physics Reports, 901, 1-82.

Yu, Y., Si, X., Hu, C., Zhang, J., 2019. A review of

recurrent neural networks: LSTM cells and network

architectures. Neural computation, 31(7), 1235-1270.

Prediction and Analysis of Bitcoin Prices Using Diverse Regression Models

291