Forecast Analysis of Urban Housing Prices in China Based on

Multiple Models

Zelin Qu

a

School of Information Management and Engineering, Shanghai University of Finance and Economics, Shanghai, China

Keywords: Housing Prices Prediction, Machine Learning.

Abstract: Social attention has long been focused on the cost of housing in China. Rising urbanization and quick

economic growth have made housing costs crucial to social stability and the standard of living for locals. This

study compared the performance of four machine learning models - eXtreme Gradient Boosting (XGBoost),

Support Vector Regression (SVR), Multi-Layer Perceptron (MLP), and Long Short-Term Memory network

(LSTM) - in detail in order to increase the accuracy of housing price prediction. The models were then

combined with nominal GDP data to forecast housing price. The experimental findings demonstrate that the

XGBoost model, which is used to forecast future home prices, performs well across a range of evaluation

indices. In addition, this study predicts that housing prices in Chinese cities will show a slight upward trend

in 2024-2025. This study fills the gap of the existing research in comparing and integrating multiple models

and provides a reference for the government to make more accurate real estate policies and investors' decisions.

1 INTRODUCTION

China’s housing price problem has always been a

focus of social attention. The swift advancement of

the economy and the quickening pace of urbanization

have made housing costs a crucial element

influencing social stability and the standard of living

of inhabitants. China's housing market has been

booming recently; the majority of residents bring a

heavy burden with them, and housing expenses are

still high. Therefore, in order to maintain social order

and foster the healthy expansion of the real estate

sector, it is imperative to investigate the trends and

fluctuations in China's home prices. The changes in

housing prices in different cities exhibit significant

heterogeneity due to the different levels of economic

development and policy orientation in different

regions of China. As a result, it is challenging for a

traditional single forecasting model to accurately

predict the housing price trend in other regions.

Existing housing price forecasting models usually use

a single machine learning model, such as multiple

linear regression, but these models often face the

problem of insufficient forecasting accuracy. In

addition, most studies do not profoundly explore the

comparison and integration between different models,

a

https://orcid.org/0009-0008-0410-4460

so it isn't easy to fully use the advantages of various

models to deal with regional differences. In order to

address this issue, this study will compare the

effectiveness of four machine learning models -

Support Vector Regression (SVR), Multi-Layer

Perceptron (MLP), eXtreme Gradient Boosting

(XGBoost), and Long Short-Term Memory network

(LSTM)—in predicting housing prices. The goal is to

identify the best model through experimental

comparison. The final study shows that the XGBoost

model performs best on various evaluation indicators

and uses this model to forecast future housing prices.

By comparing several models, this work not only

closes the gap in the body of research on housing

price forecasting but also makes an effort to expand

the use of machine learning in economic forecasting.

The research results will provide a reference for the

government to make more accurate real estate

policies and also offer a more reliable basis for real

estate investors to make decisions. The study

background and pertinent literature are reviewed in

the second section of this paper. The data

preprocessing procedure is presented in the third

section. The fourth section introduces comparison

and model selection approaches. The fifth section

examines the findings of the prediction process and

Qu, Z.

Forecast Analysis of Urban Housing Prices in China Based on Multiple Models.

DOI: 10.5220/0013214400004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 257-262

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

257

the experimental setup. The last section contains the

overview and recommendations for future work.

2 RESEARCH AND LITERATURE

REVIEW

2.1 Research Premise

At the Central Economic Work Conference held in

Beijing from December 14 to 16, 2016, the "house is

for living in, not for speculation" policy was proposed,

clarifying the residential attributes of China's real

estate and aimed to curb speculative property

purchases. At that time, China's real estate market

faced an out-of-control situation, and many

speculators unquestioningly speculated on real estate.

The proposal of this policy laid the foundation for the

formulation of subsequent real estate control policies.

Measures like purchase restrictions, lending

restrictions, and price caps are just a few of the laws

and guidelines that the Chinese and local

governments have successfully implemented since

2016 to control and regulate housing prices

nationwide. Many cities have steadily adopted the

policies restricting purchases and loans over time.

The deleveraging and monetary resettlement aspects

of the shed reform have also been executed

successfully. In 2020, the People's Bank of China and

the Ministry of Housing and Urban-Rural

Development jointly launched the "three red lines"

policy. These regulations, which were put into place

gradually, have successfully stopped the major cities'

real estate markets from overheating. Apart from the

execution of policies, China's economy has

experienced a transition from rapid expansion to

moderate expansion since 2016. As a result, there is

now less demand for real estate on the market.

However, a mismatch in the supply and demand

structure has allowed several first and second tier

cities to maintain the increase in real estate prices. In

contrast, third - and fourth-tier cities have declined

due to oversupply. Many studies often choose a single

model for the existing research on Chinese housing

price forecasting, ignoring the possibility of multi-

model comparison and integration, resulting in

insufficient forecasting accuracy. In addition, most

existing studies focus on a city or a province and do

not fully consider the impact of regional differences

in housing price changes in different regions across

the country. Therefore, this study focuses on the

changes in housing prices in other areas in China and

comprehensively considers the differences between

various regions to analyze and forecast. To improve

the accuracy and reliability of home price estimates,

the research combines GDP and housing price data

from multiple Chinese regions with a variety of

machine learning models. Four models - XGBoost,

SVR, MLP, and LSTM - are compared in order to

identify which performs best in predicting the trend

of property prices in various regions over the

following few years. The findings of this study have

the potential to be useful in regional planning, real

estate investment, and policy formation. They also

contribute to the improvement of the national housing

price projection.

2.2 Literature Review

In the past, scholars have created many outstanding

results in studying machine learning housing price

prediction. The suitability of the random forest model

for predicting housing prices was confirmed by

Adetunji et al. (2020). According to Chen et al.

(2021), Bayes, support vector machines, and

backpropagation neural networks are better options

for predicting home prices. According to Goel et al.

(2023), the LSSVM model outperforms SVM, CNN,

and other models in predicting home prices.

Henriksson and Werlinder (2021) discovered that

random forests, which take a long time to train and

infer, fared worse on small and big data sets than

XGBoost. After analysing and contrasting the SVM,

random forest, and GBM algorithms, Ho et al. (2020)

came to the conclusion that while SVM can yield

remarkably accurate predictions, random forest and

GBM perform better. The random forest model can

fully capture the complexity and nonlinearity of the

actual housing market, as demonstrated by the study

by Hong et al. (2020), which shows that the average

percentage deviation between the predicted and

actual market prices is only 5.5%, and that the

probability that the expected price is within 5% of the

actual market price is 72%. In order to create a home

price evaluation and prediction model based on

factors influencing prices, Manasa et al. (2020) took

inspiration from the multiple linear regression models,

the Lasso regression model, the Ridge regression

model, the support vector machine model, and the

XGBoost model. By contrasting the model mistakes,

they were able to choose the best model. Ming et al.

(2020) investigated rent prices in Chengdu, China,

using three machine learning models, and discovered

that XGBoost was the most accurate in forecasting

them. According to Sheng and Yu (2020), the

comprehensive learning algorithm predicts more

accurately than a linear regression model, and the

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

258

PSO-XGBoost model has the best effect overall. It

also has the highest prediction accuracy. In their 2020

study, Truong et al. examined a variety of housing

price prediction models, encompassing two

regression techniques, stacking generalization

regression and mixed regression, as well as three

machine learning approaches: Random Forest,

XGBoost, and LightGBM. They discovered that the

mixed regression approach performs well, the random

forest error is low but prone to overfitting, and

stacking generalized regression is the best option for

the greatest accuracy requirements—but at an

excessively high time complexity. In order to forecast

property prices in 100 cities over a ten-year period,

Xu and Zhang (2021) investigated a basic neural

network with just four delays and three hidden

neurons. The neural network worked remarkably well.

3 DATA ACQUISITION AND

PREPROCESSING

This paper adopts and processes the housing price

data of various prefecture-level cities in China from

2016 to 2023 and introduces the corresponding

annual nominal GDP data as an auxiliary variable. In

most scholars' studies, housing price forecasting

always uses existing housing prices to predict future

prices. At the same time, the author introduces

nominal GDP as an auxiliary variable for housing

price forecasting. Nominal GDP reflects the overall

development level of the local economy.

Theoretically, the higher the nominal GDP, the better

the economic development, and the higher the

housing price. Therefore, introducing nominal GDP

data may help improve model prediction accuracy,

especially in cities with stable economic development

or large fluctuations, where there may be a stronger

influence of GDP fluctuations on housing prices. The

original housing price data set came from anjuke.com,

a Chinese property rental and sales service, while the

original GDP data came from data.stats.gov.cn, a

website run by the National Bureau of Statistics. The

data sets used in this article and some actual data are

shown in Table 1 and Table 2.

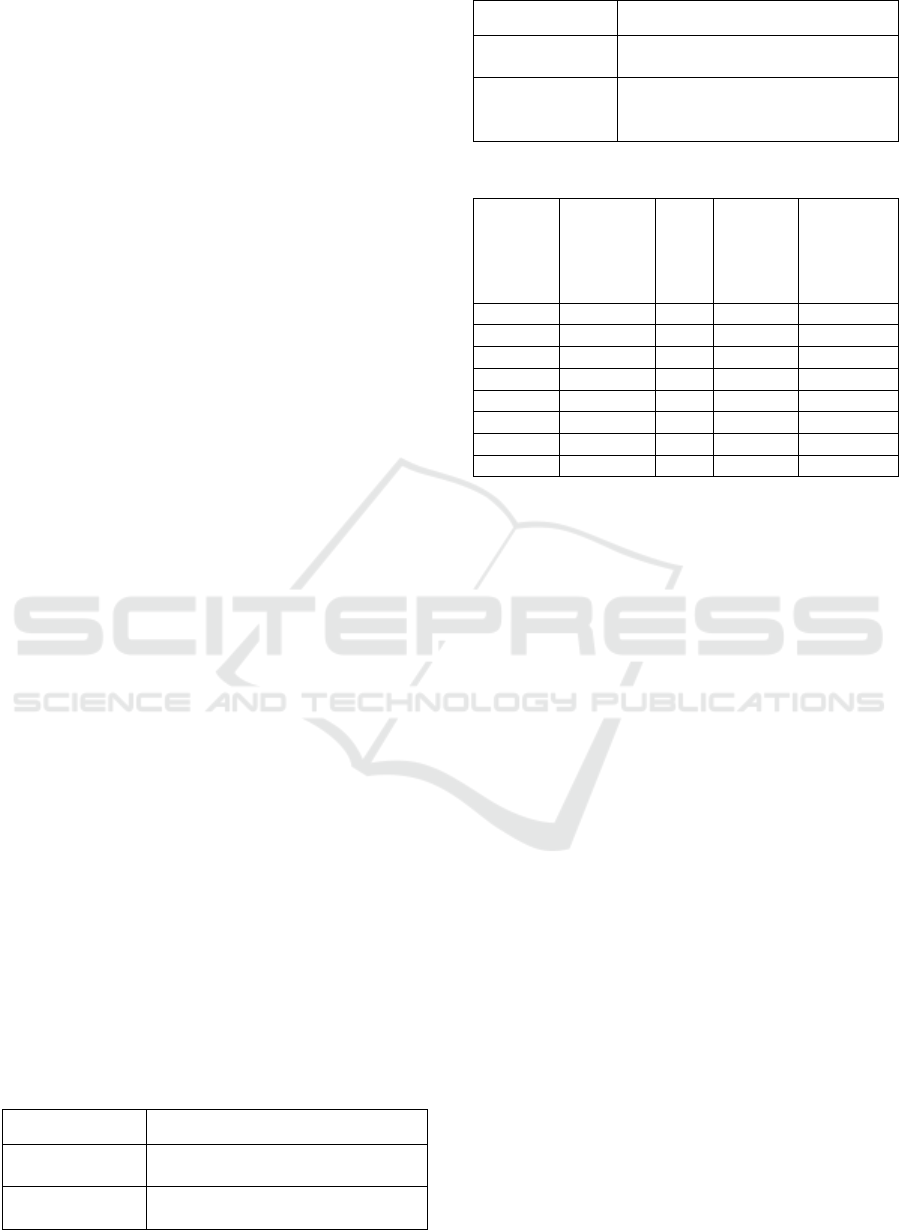

Table 1: Data labels and descriptions.

Label

Description

Province

The province where the data is

located

City

Prefecture-level city corresponding

to the data

Year

Year of data statistics

Nominal GDP

Nominal GDP data of the city for

the corresponding year

Average Annual

Housing price

The city's average annual home

price information for the relevant

year

Table 2: Excerpts from data instances.

Province

City

Year

Nominal

GDP

(×10

6

CNY)

Average

Annual

Housing

price

(CNY/m

2

)

Zhejiang

Hangzhou

2016

11710

17,301

Zhejiang

Hangzhou

2017

13161

23,693

Zhejiang

Hangzhou

2018

14307

25,007

Zhejiang

Hangzhou

2019

15419

23,515

Zhejiang

Hangzhou

2020

16207

24,590

Zhejiang

Hangzhou

2021

18247

21,393

Zhejiang

Hangzhou

2022

18753

22,305

Zhejiang

Hangzhou

2023

20059

23,185

The author used the Anjuke website to gather 37,874

monthly average home prices for 350 perfection-level

Chinese cities between January 2010 and July 2024,

and the national data website to gather GDP

information for 296 perfection-level cities. After

preliminary processing, the author selected the data

from 2016 to 2023. The author also summarized

monthly housing prices into annual housing prices

and then screened and merged the two data sets to

obtain the "housing price-nominal GDP" data set of

prefecture-level cities, including data from 244 cities.

The author processed 29 missing values in data

cleaning, accounting for about 1.2% of the total data.

The author chose the linear interpolation method to

fill in these missing values. Still, for the missing data

of some cities throughout the year, the author decided

to delete these data. The authors use Z-score to detect

outliers and filter out rows with absolute Z-score

values greater than 3.

4 MODEL INTRODUCTION

Four models were used in this paper's experiment.

The following is the introduction of these models.

4.1 eXtreme Gradient Boosting

eXtreme Gradient Boosting (XGBoost) is an

optimization implementation based on the Gradient

Boosting Decision Tree (GBDT). Gradient lifting is

an iterative technique for ensemble learning that

Forecast Analysis of Urban Housing Prices in China Based on Multiple Models

259

combines several weak learners to gradually optimize

model performance. The main notion is that the errors

of the preceding model are corrected by the latter

model in each training round. Boosting is a sequential

training procedure where each model is trained one

after the other, trying to adjust for the residual of the

model that came before it. Overfitting is avoided by

XGBoost by regularizing the model's complexity.

XGBoost allows custom loss functions. XGBoost

automatically handles missing values. XGBoost

implements parallel computing through a column-

based block structure. XGBoost weights the

contribution of each tree. XGBoost selects the best-

split point through pre-sorting and approximation

algorithms. XGBoost offers significant advantages

over traditional GBDT.

4.2 Support Vector Regression

Support Vector Regression (SVR) is a regression

model based on the Support Vector Machine (SVM)

algorithm. SVR fits around as many data points as

possible by constructing a nonlinear function but

ignores some errors within a specific range. SVR

introduces a ε- insensitive loss function where ε is an

artificially set threshold. Prediction errors within this

threshold range are ignored, and only prediction

errors over ε will contribute to the loss function. This

gives SVR a certain tolerance, i.e., minor errors do

not affect model optimization. SVR aims to find a

smooth function within the range of error ε. This

function consists of minimizing model complexity

and minimizing errors beyond ε. In SVR, only points

with errors more significant than ε become support

vectors. SVR is good at dealing with high-

dimensional data and linear indivisible problems and

is often used in nonlinear regression scenarios.

4.3 Multilayer Perceptron

Multilayer Perceptron (MLP) is a feedforward neural

network model consisting of multiple layers of

neurons capable of processing both linear and non-

linear data. It gradually extracts higher-order data

features through hidden layers to build complex

mapping relationships between inputs and outputs.

An MLP's fundamental structure consists of an input

layer, one or more hidden layers, and an output layer.

Weighted connections link the nodes in each layer to

the corresponding layer's nodes. MLP works through

Forward Propagation, loss function calculation,

Backpropagation, and iterative updating. MLP has

the characteristics of nonlinear modeling, multi-layer,

and fully connected.

4.4 Long Short-term Memory

Long Short-term Memory Network (LSTM) is a

Recurrent Neural Network (RNN) variant designed

explicitly for processing and predicting time series

data. Long- and short-term time dependencies are

both captured by LSTM. The Memory Cell, which is

the central component of the LSTM, is equipped with

three gates to regulate the information flow in

addition to a Cell State. These systems decide what

should be stored in memory, what should be deleted,

and how fresh input data should modify the state of

the cell. There are three different kinds of gates: input,

output, and forget gates. To determine which

memories to retain and which to trash, the LSTM

initially employs the oblivion gate. The input gate

decides how the data being entered should be stored

in memory. Based on the output of the input gate and

the forgetting gate, the cell state is updated. The

output gate ascertains the hidden state output at that

precise moment by combining the cell state with the

current time step LSTM output.

5 EXPERIMENTAL PRACTICE,

PREDICTION AND ANALYSIS

This research builds a regression model to forecast

the average yearly home prices of Chinese cities in

2024 and 2025 utilizing the four models discussed in

the preceding section. Three sets of pre-processed

data—a training set, a verification set, and a test set—

represent 60%, 20%, and 20% of the total data in the

third section. Data standardization was done by the

author to satisfy the model's needs. The

StandardScaler was used to normalize the feature and

target variables, and the subsequent model

predictions were reversed and normalized. On

XGBoost and SVR, GridSearchCV tunes

hyperparameters for grid search. The input layer, five

hidden layers, and output layer are the several levels

of fully connected neural networks that the

experiment builds into a model on the MLP. Leaky

ReLU is the activation function used in each layer,

while a linear activation function is used in the output

layer. The model is trained using the Adam optimizer,

and overfitting is avoided by using the EarlyStopping

and ReduceLROnPlateau callback methods. The

housing price prediction problem is treated as a time

series prediction problem on LSTM in this

experiment. Multiple Bidirectional LSTM layers,

Conv1D convolution, and Dropout layers make up

the model. The learning rate is adjusted dynamically

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

260

by using the CyclicalLearningRate callback function.

Mean square error (MSE), mean absolute error

(MAE), and coefficient of determination (𝑅

2

) were

used to assess each model's prediction outcomes in

the validation and test sets. The results are shown in

Table 3.

Table 3: Evaluation results of each model.

XGBoost

SVR

MLP

LSTM

𝑅

2

0.9543

0.7269

0.7133

0.7212

MSE

1.926×10

6

1.394×10

7

1.464×10

7

1.430×10

7

MA

E

898

2061

2149

2418

It is evident from the evaluation findings that

XGBoost performs noticeably better than the other

three models. XGBoost effectively handles high-

dimensional data and can capture complex nonlinear

relationships, while SVR and MLP struggle to handle

highly nonlinear parts of the data. XGBoost uses L1

and L2 regularization to prevent model overfitting,

whereas MLP and LSTM rely on manually adjusting

regularization parameters to avoid overfitting.

XGBoost's feature importance analysis automatically

selects the most valuable features for optimization, a

critical factor in its superior performance. XGBoost

uses second-order Taylor expansion to accelerate the

gradient calculation and improve convergence speed.

This allows it to find the optimal solution faster while

training. In contrast, an MLP or LSTM takes longer

to adjust the weights and perform gradient descent,

making it sensitive to the selection of

hyperparameters. If there are noise or outliers in the

price data, XGBoost can handle these noise and

outliers better due to its robustness. These advantages

give XGBoost certain predictive advantages. The four

models used by the author predict are shown in Table

4.

Table 4: Prediction of future urban housing prices by each

model (excerpt).

Year

City

XGBo

ost

SVR

MLP

LST

M

2024

Sanmi

ng

10271

8428

9127

10736

2025

Sanmi

ng

10273

8798

9018

11350

2024

Sanm

enxia

5948

7171

8697

9701

2025

Sanm

enxia

6408

7606

8481

9776

2024

Shang

hai

56344

49496

74049

43372

2025

Shang

hai

56344

42038

79407

39481

2024

Shang

rao

8476

8827

9240

7266

2025

Shang

rao

8521

9269

9204

7034

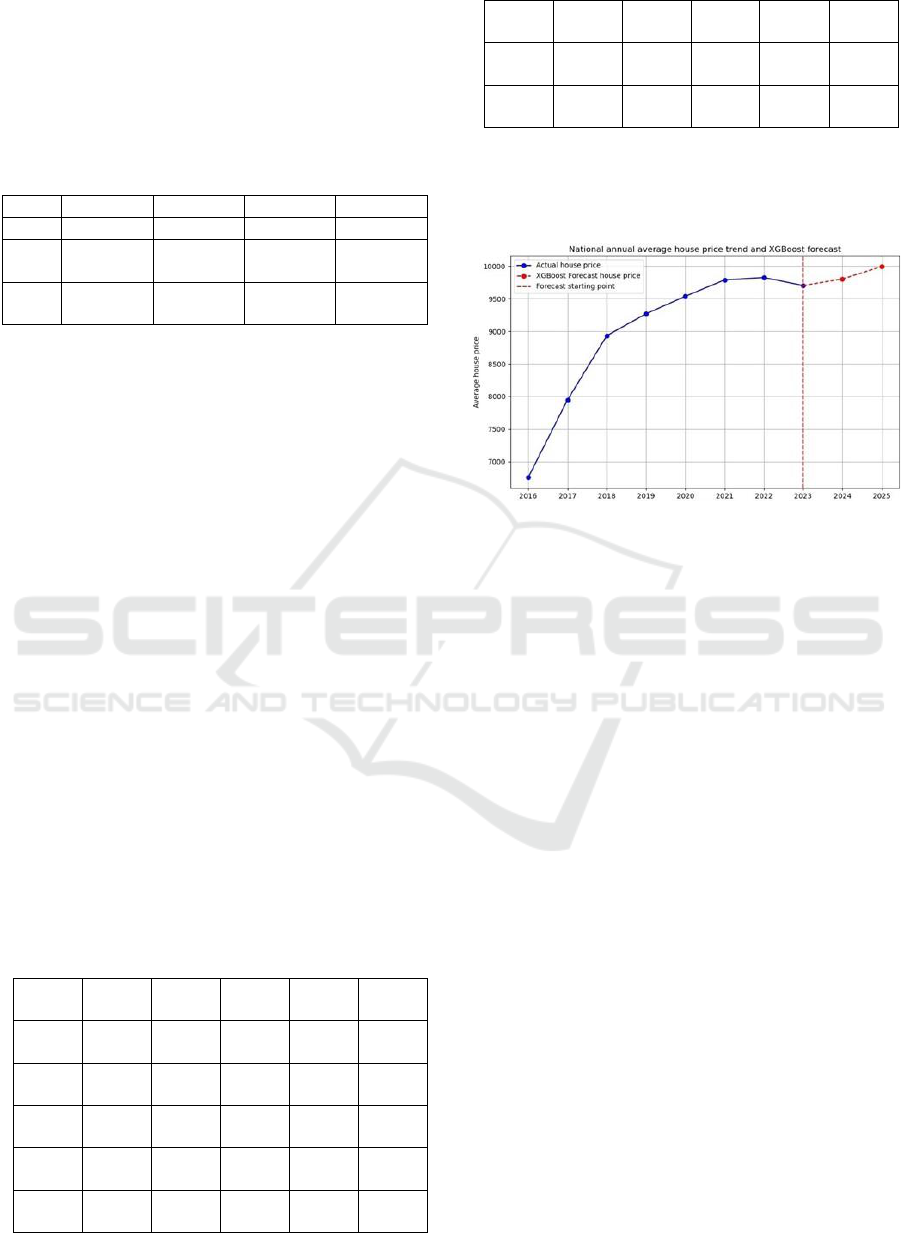

In addition, the author uses the XGBoost forecast of

China's urban housing price forecast (2024-2025) to

compare with the overall housing price over the years

(2016-2023) and shown in Figure 1.

Figure 1: Average annual housing price trends combined

with XGBoost forecasts (Photo/Picture credit : Original).

The figure shows that China's housing prices

continued to increase from 2016 to 2021 and slowed

down or declined from 2022 to 2023. The forecast

suggests that housing prices will rise slightly in 2024-

2025. The changes in the historical data are consistent

with the actual economic situation. China's slowing

economy and aging population have gradually

weakened the upward trend in property prices. The

real estate market regulations implemented by the

state have also contributed to a decrease in home

prices. Due to the substantial decline in home demand

brought about by the COVID-19 pandemic, China's

housing prices are expected to decline in 2022–2023.

The experiment's gradual increase in property prices

is partially explained by the Chinese government's

July 2024 easing of the housing purchase policy and

the anticipated rebound of the Chinese economy.

Therefore, the predicted results of this experiment are

reasonable from the economic and policy

perspectives.

The contribution of this experiment is to

demonstrate the excellent performance of XGBoost

in processing large-scale complex data, providing a

comparative analysis of multiple models, and

providing a decision-making basis for policymakers

and investors. In addition, this experiment has

numerous flaws, including inadequate generalization

due to the exclusion of numerous other significant

variables (such as population migration) and an

Forecast Analysis of Urban Housing Prices in China Based on Multiple Models

261

incomplete understanding of the effect of

emergencies on future home prices. More

macroeconomic variables, deep learning model

optimization, and the use of external risk prediction

models, like Monte Carlo simulations, to increase

robustness are examples of future research directions

that might be consulted.

6 CONCLUSIONS

This study compares the performance of four machine

learning models (XGBoost, SVR, MLP, and LSTM)

to predict property prices in Chinese cities. The

XGBoost model is ultimately determined to be the

best model. The experimental results show that

XGBoost performs better than other models in terms

of prediction accuracy. Concurrently, adding nominal

GDP as an auxiliary variable improves the accuracy

of home price forecasts, especially in areas where

significant shifts in economic development have

occurred. Projecting home prices for 2024 and 2025,

this study validates the applicability of machine

learning technologies in home price forecasting. It

provides a scientific resource for decision-making to

legislators and real estate investors. In order to

improve forecast accuracy over the long run, future

research might look into how other economic

variables affect property values or use more

sophisticated deep learning models.

REFERENCES

Adetunji, A. B., Akande, O. N., Ajala, F. A., Oyewo, O.,

Akande, Y. F., Oluwadara, G., 2022. House price

prediction using Random Forest machine learning

technique. Procedia Computer Science, 199:806-813.

Chen, Y., Xue, R., Zhang, Y., 2021. House price prediction

based on machine learning and deep learning methods.

2021 International Conference on Electronic

Information Engineering and Computer Science, 699-

702.

Goel, Y. K., Swaminathen, A. N., Yadav, R., Kanthamma,

B., Kant, R., Chuahan, A., 2023. An innovative method

for housing price prediction using Least Square – SVM.

2023 4th International Conference on Electronic and

Sustainable Communication Systems, 928-933.

Henriksson, E., Werlinder, K., 2021. Housing price

prediction over countrywide data: A comparison of

XGBoost and Random Forest regressor models. KTH

Royal Institute of Technology, Stockholm, Sweden.

Ho, W. K. O., Tang, B. S., Wong, S. W., 2020. Predicting

property prices with machine learning algorithms.

Journal of Property Research, 38(1):48–70.

Hong, J., Choi, H., Kim, W., 2020. A house price valuation

based on the Random Forest approach: The mass

appraisal of residential property in South Korea.

International Journal of Strategic Property Management,

24(3):140-152.

Manasa, J., Gupta, R., Narahari, N. S., 2020. Machine

learning based predicting house prices using regression

techniques. International Conference on Innovative

Mechanisms for Industry Applications, 2020(2):624-

630.

Ming, Y., Zhang, J., Qi, J., Liao, T., Wang, M., Zhang, L.,

2020. Prediction and analysis of Chengdu housing rent

based on XGBoost algorithm. Proceedings of the 3rd

International Conference on Big Data Technologies, 1-

5.

Sheng, C., Yu, H., 2022. An optimized prediction algorithm

based on XGBoost. International Conference on

Networking and Network Applications, 2022:1-6.

Truong, Q., Nguyen, M., Dang, H., Mei, B., 2020. Housing

price prediction via improved machine learning

techniques. Procedia Computer Science, 174:433-442.

Xu, X., Zhang, Y., 2021. House price forecasting with

neural networks. Intelligent Systems with Applications,

12.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

262