Predicting the U.S. Stock Market Index Using LSTM with Different

Financial Factors

Tingxi Zhang

a

Shenzhen Audencia Financial Technology Institute, Shenzhen University, Guangdong, China

Keywords: Index Prediction, Long Short-Term Memory, Financial Factors.

Abstract: The complexity and dynamic nature of financial markets demand advanced tools for accurate forecasting.

This is vital for investors, portfolio managers, and policymakers to make informed decisions regarding asset

allocation and risk management. This study explores the potential of Long Short-Term Memory (LSTM)

networks in predicting the S&P 500 index, augmented by a diverse set of financial factors including the Cboe

Volatility Index (VIX), Effective Federal Funds Rate (EFFR), U.S. Dollar Index (USDX), and various U.S.

Treasury rates. The research employs an approach involving data collection spanning from June 2010 to June

2023, preprocessing to ensure data suitability, and LSTM model development tailored to capture long-term

dependencies. This article starts from two tasks, classification and regression, and focuses on predicting the

S&P 500 index across varying time horizons. The study reveals that LSTM models augmented with relevant

financial factors effectively predict short-term movements in the S&P 500 index, with low Root Mean Square

Error (RMSE) and Mean Absolute Error (MAE) values for 1-day predictions. However, prediction errors

increase significantly for longer horizons, particularly for variables highly sensitive to market volatility and

interest rate changes. The findings contribute to developing more accurate forecasting tools for the financial

industry, enhancing decision-making capabilities for various stakeholders.

1 INTRODUCTION

Expanding the potential of Long Short-Term Memory

(LSTM) networks in predicting the S&P 500,

research delves into the intricacies of applying this

model & rationale for selecting financial factors (Lee

& Kang, 2020). As a subclass of Recurrent Neural

Networks (RNNs), LSTMs overcome vanishing

exploding gradient issues, enabling them to retain

past information effectively, ideal for capturing

complex, nonlinear relationships and long-term

dependencies in financial data (Wang et al., 2022).

Integrating factors like the Cboe Volatility Index

(VIX), Effective Federal Funds Rate (EFFR), U.S.

Dollar Index (USDX), and U.S. Treasury rates

enhances predictive power. VIX insights into investor

sentiment & market volatility aid in capturing

sentiment impacts during uncertainty. EFFR, a

monetary policy tool, influences borrowing costs and

stock market movements. USDX reflects currency

fluctuations, impacting international competitiveness

and stock prices (Bhandari et al., 2022). Treasury

a

https://orcid.org/0009-0004-7252-6834

rates offer insights into interest rates, economic

growth, and inflation expectations, which are crucial

for investment and financing decisions.

This research aims to improve S&P 500

forecasting accuracy for investors, managers, and,

policymakers. Accurate forecasts inform asset

allocation, risk management, & policy formulation.

LSTM's pattern recognition & long-term dependency

capture enable insights into U.S. equity market trends

(Michańków et al., 2022).

Experimental approaches include data collection,

preprocessing (cleaning, normalization, feature

engineering), model development, and evaluation are

used. Focusing on 1-day, 5-day, and 20-day forecasts,

models undergo rigorous testing with regression

(Root Mean Square Error (RMSE), Mean Absolute

Error (MAE)) and classification (confusion matrix)

metrics. This aims to develop models accurately

forecasting S&P 500 changes and classifying market

movements, guiding investments, risk management,

and policy.

Zhang, T.

Predicting the U.S. Stock Market Index Using LSTM with Different Financial Factors.

DOI: 10.5220/0013214300004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 251-256

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

251

2 LITERATURE REVIEW

The literature concerning utilizing machine learning

and deep learning methodologies for forecasting

stock market trends is continually expanding and

advancing. Early studies employed traditional

statistical methods like Autoregressive Integrated

Moving Average (ARIMA) models and exponential

smoothing techniques (Vo & Ślepaczuk, 2022).

However, these approaches struggled to capture the

nonlinearities and complexities inherent in financial

time series.

With the advent of artificial neural networks,

researchers began exploring their potential for stock

market forecasting. While standard feedforward

neural networks showed some promise, they were

limited by their inability to handle sequential data

effectively. In 2009, an extensive review

encompassing over 100 scholarly articles by the

authors revealed that neural networks (NNs)

demonstrate a superior capacity for enhancing market

forecasting when juxtaposed against conventional

methodologies (Atsalakis & Valavanis, 2009). This

finding underscores the potential advantages of

adopting NNs in predictive analytics within the

market context. Exploring the Influence of Financial

Ratios and Technical Analysis on Stock Price

Forecasting Leveraging Random Forests,with an

Emerging Trend in AI-assisted and Human Insight-

Integrated Prediction Frameworks (Pramod & Pm,

2020).

The introduction of RNNs, and subsequently

LSTM networks, revolutionized the field by enabling

the models to retain information from previous time

steps, making them particularly suited for time-series

analysis. Several studies have utilized LSTM

networks for stock market prediction, demonstrating

their effectiveness in capturing the dynamic behavior

of stock prices and indices. These models have been

found to outperform traditional statistical and even

other machine learning methods in predicting stock

market trends. Besides using some financial news,

economic indicators, or sentiment data from social

media (Vargas et al., 2017), the inclusion of financial

factors as input features has further enhanced the

predictive accuracy of LSTM models, as they provide

a more comprehensive view of the market's

underlying dynamics. In particular, the VIX index, as

a measure of market uncertainty and expected

volatility, has been widely used in stock market

forecasting models (Roszyk & Ślepaczuk, 2024). Its

predictive power stems from its ability to capture

investor sentiment and risk appetite, which are crucial

factors influencing stock prices. The EFFR, a key

interest rate that influences the cost of borrowing and

lending, also holds considerable sway in shaping the

overall economic well-being and, consequently, the

performance of the stock market (Bhandari et al.,

2022).

Similarly, the USDX and U.S. Treasury rates are

essential indicators of the dollar's strength and the

country's debt market conditions, respectively. Their

inclusion in stock market prediction models provides

valuable insights into global macroeconomic trends

and their potential impact on the U.S. equity market.

By synthesizing the insights from previous

research and incorporating a diverse set of financial

factors, this study aims to advance the field of stock

market prediction using LSTM networks and

contribute to a more nuanced understanding of the

relationships between these factors and the S&P 500

index.

3 DATA AND METHOD

3.1 Dataset Introduction

This study employs a comprehensive methodology to

forecast the future value of the S&P 500 index using

daily market data and various financial factors. The

dataset, sourced from Kaggle, spans from June 29,

2010, to June 27, 2023, encompassing 3271 days of

information. It includes closing prices for the S&P

500 index, alongside selected financial indicators

such as the VIX, EFFR, USDX, and a range of U.S.

Treasury rates.

Data processing begins with acquiring the daily

S&P 500 market data and relevant financial factors,

followed by data cleaning to rectify errors,

standardize date formats, and filter for the desired

date range. The cleaned datasets are then integrated

into a single CSV file. Before analysis, preprocessing

steps include feature scaling using MinMaxScaler to

normalize values between 0 and 1, merging processed

feature columns with the target column into a

DataFrame, defining key parameters such as

timesteps and forecast horizon, and converting the

DataFrame into a NumPy array for integration into

the model. Then preprocessed data is partitioned into

training and testing sets at an 80:20 ratio for model

evaluation.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

252

3.2 Method

3.2.1 Algorithm

LSTM is a specialized RNN, that utilizes gates and a

cell state to alleviate gradient issues in long

sequences, enabling it to capture long-term

dependencies. It has the advantage of long-term

memory capacity in requiring sequence prediction.

The core of the model is an LSTM layer that

processes the input sequence. In this case, the hidden

size is set to 128 and there are 3 layers. The batch first

parameter is set to True to indicate that the input

tensor's first dimension corresponds to the batch

size. This layer is used to capture the temporal

dependencies within the input sequence. Following

the LSTM layer, a linear layer is used as the Fully

Connected Layer (FC) to map the output of the LSTM

to the desired output size, which corresponds to the

forecast horizon in this case. The output of the LSTM

layer's last time step is passed through this layer to

produce the final predictions. During the forward

pass, the LSTM layer initializes its hidden state (h0)

and cell state (c0) to zero tensors of appropriate sizes,

ensuring that the model's initial state is clean for each

new input sequence (Mehtab et al., 2021).

3.2.2 Parameter Introduction

In this work, the input size is different for two types

of groups. For the blank group (only Close price), it

is set to be 2; for the experimental group, it is set to

be 3. Then the hidden size is fixed at 128, balancing

model complexity and computational efficiency.

Three layers are stacked to capture intricate temporal

patterns in the input sequence. The output size

corresponds to the forecast horizon, tailored to the

specific prediction task.

Adam optimizer is used and the learning rate is

chosen to be 0.001 for the complexity of the data.

Then Mean Squared Error (MSE) is used to be the

Loss Function. There are 300 epochs to ensure

thorough training and performance monitoring. The

model with the lowest test loss is chosen to prevent

overfitting and ensure good generalization as the best

model.

3.2.3 Evaluation

In this work, the evaluation is RMSE and MAE for

the regression part and accuracy for the classification

part. The regression is evaluated by using the RMSE

and MAE to the changing value but not the index

value itself between the predicted value and real value.

Then a threshold of 0 is applied to define binary labels

(Decrease or Increase) based on changes in the target

variable (Ding & Qin, 2020). After that, classification

performance is evaluated using accuracy. Also, a

classification report and a confusion matrix can help

to further evaluate the model. (For example, if the

recall of increase or decrease is lower than 0.5, the

accuracy of this group will be marked in italic in

Table 4). The assessment metrics give a further

insight into the efficacy of the model, highlighting

areas for improvement and ensuring its practical

significance in investment prediction.

4 EXPERIMENTAL RESULTS

4.1 Model Performance

This model's performance exhibits notable variations

across diverse time horizons and financial indicators.

After predicting, the figure of the target (S&P500

index) value and the change of target value can be

drawn. The input is the target and different features

that vary from groups. After using the model

mentioned above, a regression evaluation can be used

and the output is shown in the pictures. All the

pictures in Figure 1 show the best model in their

horizon. The regression evaluation metrics are

calculated by the change value of the predicted value

and the true value of the target (Avoiding evaluating

the index value itself). The RMSE and MAE metrics

offer valuable insights into the predictive prowess of

this model. Table 1 and Table 2 show the results of

RMSE and MAE.

Table 1: RMSE of the change value in different groups.

RMSE blank USDX EFFR VIX US30Y US20Y US10Y US7Y

1-day 47.7831 48.7075 47.9827 49.3035 47.8874 47.8192 47.9292 48.1814

5-day 92.2823 95.7983 91.9878 99.1853 157.5846 133.8851 152.5618 126.2125

20-day 183.9919 173.7341 302.0017 188.2947 396.0349 296.6774 758.4307 571.4574

RMSE US5Y US3Y US2Y US1Y US6M US3M US1M

1-day 48.3179 47.9508 47.7837 47.4222 47.5952 48.1978 47.7664

5-day 168.6958 136.6147 151.8824 136.541 110.0165 117.7768 96.0132

20-day 389.5934 426.5298 398.0085 261.923 301.5459 314.9735 299.2177

Predicting the U.S. Stock Market Index Using LSTM with Different Financial Factors

253

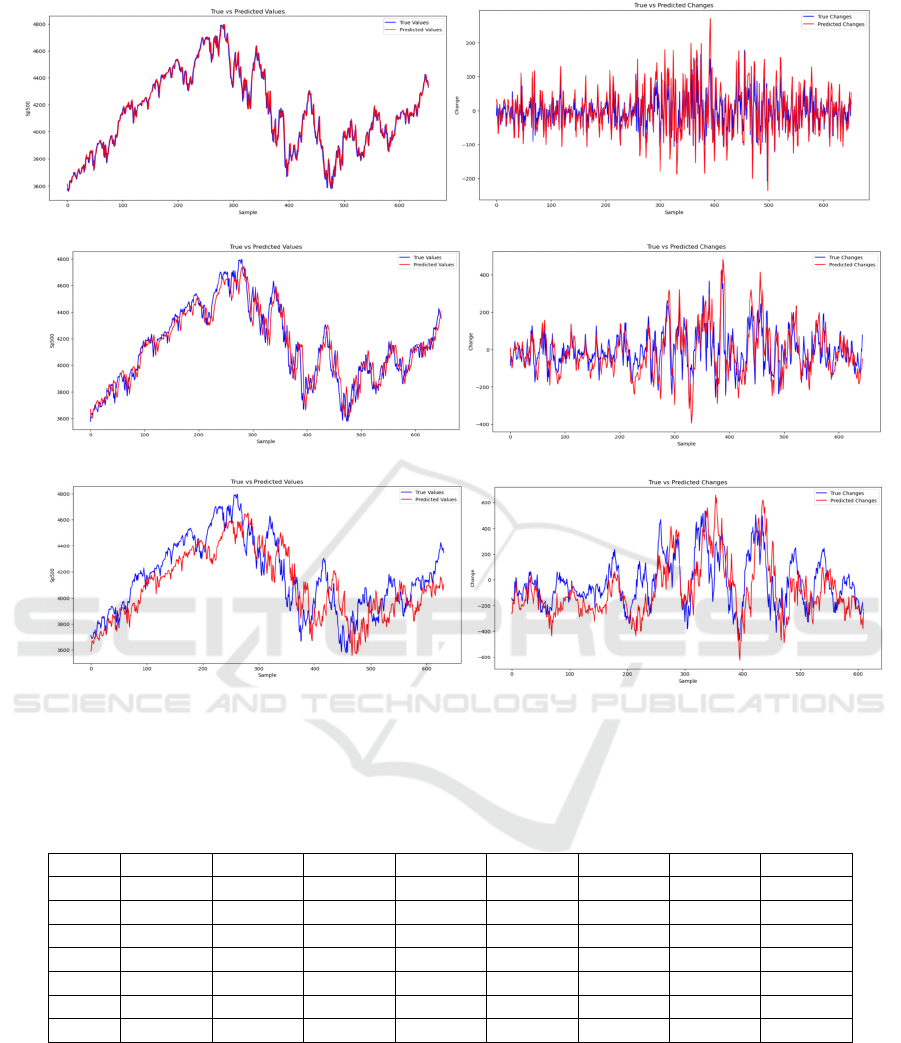

(a) (b)

(c) (d)

(e) (f)

Figure 1: Figure of regression. (a) is True vs Predicted values of 1-day horizon (Close+US1Y), (b) is True vs Predicted

changes of the 1-day horizon (Close+US1Y), (c) is True vs Predicted values of the 5-day horizon (Close), (d) is True vs

Predicted changes of the 5-day horizon (Close), (e) is True vs Predicted values of the 20-day horizon (Close+USDX), (f) is

True vs Predicted changes of the 20-day horizon (Close+USDX) (Photo/Picture credit : Original).

Table 2: MAE of the change value in different groups.

MAE blank USDX EFFR VIX US30Y US20Y US10Y US7Y

1-day 36.2807 36.2915 35.9285 37.6879 36.0179 35.9536 36.0336 36.3091

5-day 71.0963 72.8989 70.2543 77.3336 132.9187 111.5851 127.9587 103.846

20-day 148.1766 139.2767 256.1971 143.1215 346.526 250.634 718.5778 523.7565

MAE US5Y US3Y US2Y US1Y US6M US3M US1M

1-day 36.4255 36.3041 36.0454 35.6879 35.7133 36.3581 35.8566

5-day 143.9013 112.3368 124.6026 110.7712 86.4111 93.9518 74.5086

20-day 348.5007 384.4366 339.1228 223.5755 259.2718 268.1143 261.8683

4.1.1 RMSE Analysis

1-Day Prediction RMSE: The RMSE values for 1-day

predictions are generally low, ranging from 47.4222

for the 1-month U.S. Treasury yield (US1Y) to

49.3035 for the Volatility Index (VIX). The model

demonstrates its proficiency in effectively capturing

short-term fluctuations in a wide array of financial

indicators.

5-Day Prediction RMSE: As the prediction

horizon increases to 5 days, the RMSE values

increase significantly, particularly for longer-term

interest rates (e.g., US30Y: 157.5846, US20Y:

133.8851) and the VIX (99.1853). This highlights the

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

254

model's difficulty in accurately predicting longer-

term trends, especially for volatile indicators.

20-Day Prediction RMSE: For 20-day

predictions, the RMSE values surge even further,

with the highest value recorded for the 10-year U.S.

Treasury yield (US10Y) at 758.4307. This

emphasizes the model's limited ability to anticipate

trends over extended periods, particularly for highly

sensitive indicators.

4.1.2 MAE Analysis

1-Day Prediction MAE: Similar to RMSE, 1-day

MAE values are relatively low, ranging from 35.6879

for US1Y to 37.6879 for VIX. This underscores the

model's effectiveness in short-term forecasting.

5-Day Prediction MAE: The MAE values

increase for 5-day predictions, particularly for interest

rates and VIX, indicating larger average prediction

deviations over a longer horizon. However, the

increases are less pronounced compared to RMSE,

suggesting MAE may be a more stable metric for

assessing prediction performance.

20-Day Prediction MAE: For 20-day predictions,

MAE values continue to rise, with the highest being

718.5778 for US10Y. This trend aligns with the

RMSE analysis, confirming the model's reduced

accuracy in long-term forecasting.

4.2 Classification Results

After using a threshold of 0 to define binary labels

(Decrease or Increase) based on changes in the target

variable, the accuracy and classification report can be

shown. Although the best model has the highest

accuracy, the RMSE and MAE may not be the lowest

but their value is fairly low compared with other

groups (The classification report of the best model in

different forecast horizons is shown in Table 3.

According to the result of each group, the

accuracy is shown in Table 4 while some values are

marked in italic because in this group the recall of

increase type or decrease type is lower than 0.5 which

does not have realistic investment meanings.

1-Day Accuracy: For 1-day predictions, the

highest accuracy of 0.7730 is observed for US1Y,

followed closely by the USDX and several other yield

curves. This suggests that the model performs best in

predicting short-term market movements, particularly

for the 1-month Treasury yield.

5-Day Accuracy: In the 5-day forecasts, the

accuracy decreases significantly across all indicators,

with the lowest scores observed for the longer-term

Treasury yields (US30Y, US20Y, and US10Y). This

decline indicates that predicting market movements

over a longer horizon (5 days) introduces more

uncertainty and complexity, leading to reduced

accuracy.

However, the 1-month Treasury yield again

shows relatively higher accuracy (0.736),

highlighting the model's potential for short-term

predictions.

20-Day Accuracy: For the 20-day forecasts, the

accuracy levels are further diluted, with most

indicators falling below 0.7. The highest accuracy of

0.7774 is recorded for USDX, suggesting a somewhat

stable performance for the currency index over a

longer period. However, the significant drops in

accuracy for the yield curves indicate that predicting

longer-term market trends is challenging.

Table 3: Best model in different forecast horizon.

1 day (Close+US1Y) 5 days (Close) 20 days (Close+USDX)

precision recall f1 precision recall f1 precision recall f1

Decrease 0.79 0.74 0.76 Decrease 0.74 0.7 0.72 Decrease 0.82 0.56 0.67

Increase 0.76 0.8 0.78 Increase 0.78 0.81 0.8 Increase 0.76 0.92 0.83

accuracy 0.77 accuracy 0.76 accuracy 0.78

Table 4: Accuracy of each group.

accuracy blank USDX EFFR VIX US30Y US20Y US10Y US7Y

1-day 0.7623 0.7699 0.7638 0.7638 0.7699 0.7669 0.7623 0.7623

5-day 0.764 0.7593 0.7236 0.7345 0.6848 0.6863 0.6863 0.6957

20-day 0.7641 0.7774 0.7021 0.7643 0.6825 0.7038 0.6105 0.6301

accuracy US5Y US3Y US2Y US1Y US6M US3M US1M

1-day 0.7638 0.7638 0.7638 0.773 0.7653 0.7623 0.7592

5-day 0.6491 0.6941 0.6817 0.6879 0.7283 0.7236 0.736

20-day 0.6432 0.6694 0.653 0.7021 0.7021 0.7087 0.6939

Predicting the U.S. Stock Market Index Using LSTM with Different Financial Factors

255

5 LIMITATIONS AND FUTURE

OUTLOOKS

The present study, while demonstrating the potential

of LSTM networks in predicting the S&P 500 index

with the augmentation of financial factors, is not

without its limitations. One key limitation lies in the

reliance on a simple LSTM architecture. As the

financial forecasting landscape evolves rapidly,

exploring alternative LSTM variants, such as stacked

or bidirectional LSTMs, or hybrid architectures

combining LSTMs with CNNs or attention

mechanisms, could potentially enhance predictive

capabilities. Additionally, the evaluation framework,

utilizing RMSE, MAE, and classification accuracy,

provides valuable insights but may be further refined

by incorporating metrics like R-squared for

regression or F1-score for imbalanced classification

problems.

Looking ahead, the dynamic nature of financial

markets necessitates mechanisms for model

retraining and adaptation to maintain predictive

accuracy over time. Continuous monitoring of market

dynamics and regular updating of model parameters

are crucial. Moreover, there may be other relevant

variables, such as financial news, economic

indicators, or sentiment data from social media, that

could be incorporated to improve predictive

power. Future research should aim to address these

limitations by exploring alternative architectures,

refining evaluation metrics, incorporating additional

data sources, and implementing mechanisms for

continuous model updating.

6 CONCLUSIONS

This study has shown the potential ability of LSTM

networks to predict the S&P 500 index, particularly

when augmented with financial factors. The findings

underscore the effectiveness of LSTM models in

capturing short-term market fluctuations, evidenced

by their relatively low RMSE and MAE values for 1-

day predictions. However, as the study also

highlights, predicting longer-term trends remains a

challenge, with errors increasing for 5-day and 20-

day horizons, especially for variables sensitive to

market volatility and interest rate changes. Looking

toward the future, it is crucial to acknowledge that the

dynamic nature of financial markets necessitates

ongoing efforts to maintain predictive accuracy. This

includes exploring alternative LSTM variants and

hybrid architectures, refining evaluation metrics,

incorporating additional information sources

encompassing financial updates, economic metrics,

and public opinion reflected on social media

platforms, and implementing mechanisms for

continuous model updating and adaptation. By

addressing these limitations and harnessing the full

potential of LSTM networks, the model can further

enhance the ability to forecast the S&P 500 index

while providing valuable insights for investors,

portfolio managers, policymakers, and so on.

REFERENCES

Atsalakis, G. S., Valavanis, K. P., 2009. Surveying stock

market forecasting techniques–Part II: Soft computing

methods. Expert Systems with applications,36(3),

5932-5941.

Bhandari, H. N., Rimal, B., Pokhrel, N.R., Rimal, R.,

Dahal, K. R., & Khatri, R. K., 2022. Predicting stock

market index using LSTM. Machine Learning with

Applications,9, 100320.

Ding, G., Qin, L., 2020. Study on the prediction of stock

price based on the associated network model of LSTM.

International Journal of Machine Learning and

Cybernetics, 11(6), 1307-1317.

Lee, J., Kang, J., 2020. Effectively training neural networks

for stock index prediction: Predicting the S&P 500

index without using its index data. PloS one, 15(4),

e0230635.

Michańków, J., Sakowski, P., Ślepaczuk, R., 2022. LSTM

in algorithmic investment strategies on BTC and

S&P500 index. Sensors, 22(3), 917.

Mehtab, S., Sen, J., Dutta, A., 2021. Stock price prediction

using machine learning and LSTM-based deep learning

models. In Machine Learning and Metaheuristics

Algorithms, and Applications: Second Symposium,

SoMMA 2020, Chennai, India, October 14–17, 2020,

Revised Selected Papers 2 (pp.88-106). Springer

Singapore.

Pramod, B. S., Pm, M. S., 2020. Stock price prediction

using LSTM.Test Engineering and Management, 83,

5246-5251.

Roszyk, N., Ślepaczuk, R., 2024. The Hybrid Forecast of

S&P 500 Volatility ensembled from VIX, GARCH and

LSTM models.arxiv preprint arxiv:2407.16780.

Vargas, M. R., De Lima, B. S., Evsukoff, A. G., 2017. Deep

learning for stock market prediction from financial

news articles. In 2017 IEEE international conference on

computational intelligence and virtual environments for

measurement systems and applications (CIVEMSA)

(pp. 60-65). IEEE.

Vo, N., Ślepaczuk, R., 2022. Applying hybrid ARIMA-

SGARCH in algorithmic investment strategies on

S&P500 index. Entropy, 24(2), 158.

Wang, C., Chen, Y., Zhang, S., Zhang, Q., 2022. Stock

market index prediction using deep Transformer model.

Expert Systems with Applications, 208, 118128.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

256