Hybrid Deep Learning Model for Stock Price Prediction: Evidence

from Guizhou Moutai Stock

Jingyi Lu

School of Electronics Engineering and Computer Science, Peking University, Beijing, China

Keywords: Hybrid Deep Learning, Stock Price Prediction, CNN, BiLSTM, Attention Mechanism.

Abstract: Research on stock price prediction has been increasingly important, particularly as financial markets get more

complicated. This study evaluates the execution of various hybrid deep learning models for stock price

prediction using data from Guizhou Moutai, a leading Chinese company, from January 5, 2015, to September

6, 2024. The models compared include MLP, RNN, CNN, LSTM, BiLSTM, CNN-LSTM, CNN-BiLSTM

and CNN-BiLSTM-AM. In contrast to alternative approaches, the CNN BiLSTM-AM method is better suited

for stock price prediction and offers investors a dependable means of making stock investing selections. CNN,

BiLSTM, and AM make up this technique. It achieves the lowest RMSE (21.273) and MAPE (0.944%) while

maintaining the highest R² value (0.9580), highlighting its superior predictive accuracy. This study provides

a more reliable tool for data-driven decision-making in the financial market, which not only helps improve

the accuracy of investors' decisions, but also encourages the use of deep learning in the finance industry.

Furthermore, this study offers a valuable reference for further investigations into maximizing model

performance, cutting down on computational expenses, and integrating external macroeconomic variables.

1 INTRODUCTION

The stock market is seen to be a good indicator of the

financial and economic health of a nation. The 1990s

saw the establishment of the Chinese stock market.

However, the Chinese stock market is comparable to

the Western one in terms of size and structure. One of

the most significant things for investors is the stock

trend. Stock price fluctuations are seldom linear.

Predicting future movements in stock prices has

always been important to economists (Xiao et al,

2020; Yu & Yan, 2020). The risk of investment will

be greatly decreased if the prediction is considerable

and accurate. In order to maximize revenue, the

investor will adjust their approach based on the

anticipated stock price.

Stock price prediction has been a key area of

financial research for many decades. The early

models like ARMA and ARIMA very good at

expressing linear relationships and are widely used

for their simplicity and interpretability (Box &

Jenkins, 1970). However, they can’t explain the

nonlinear and volatile nature of financial markets. As

the financial system becomes more and more

complex, the need for high-level models becomes

increasingly evident. In the late 20th century, the

crucial change in stock forecasting arrived with the

development of machine learning. Neural networks,

particularly feedforward networks, have been among

the earliest machine learning models employed to

model complex, nonlinear relationships in various

domains, including financial data (Haykin, 1999).

With the increase in computing ability and the

popularity of huge datasets, researchers began to

explore deep learning models. For example, one can

use CNN to capture features from the data. LSTM can

avoid the gradient vanishing or gradient explosion

problems caused by RNN. BiLSTM is a good method

to discover the interdependency of time series data.

AM can measure the effect of historical feature states

of time series data on the price of stocks.

Recently, Machine Learning has witnessed the

advancement of increasingly intricate stock

prediction techniques. The combination of the

attention mechanism (AM) and traditional neural

networks has attracted broad attention. Models can

perform better on tasks like machine translation by

focusing on the most important segments of the input

process thanks to the attention mechanism (Vaswani

et al, 2017). For example, the combination of CNN

with BiLSTM, enhanced by an attention mechanism,

has demonstrated increases in prediction accuracy by

Lu, J.

Hybrid Deep Learning Model for Stock Price Prediction: Evidence from Guizhou Moutai Stock.

DOI: 10.5220/0013214200004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 243-250

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

243

successfully capturing temporal relationships both

forward and backward (Qin et al, 2018). Despite these

improvements, there are still challenges, especially in

terms of balancing the complexity of the models and

calculating efficiency. While advanced models

improve predictive performance, they require

significant computational resources, limiting their

application in real-time scenarios (Luo & Zhang,

2022). Thus, the research should not only focus on the

improvement of accuracy but also emphasize

efficiency and practicability in the market condition.

The purpose of this research is to assess and

contrast several hybrid deep learning models for stock

price prediction. Assessing the models' performance

under identical conditions is crucial for the

development of learning models. This study aims to

conduct carry out a thorough analysis of eight distinct

models, ranging from simpler models to more

advanced models such as CNN, LSTM, and hybrid

models like CNN-LSTM, CNN-BiLSTM, and CNN-

BiLSTM-AM. The format of this document is as

follows. Sec. 2 outlines the data and techniques

employed in this research. This part introduces the

structure and functions of each model in detail. Sec. 3

compares the results of the models and provides a

detailed analysis of the results. This part highlights

the benefits and drawbacks of every model, discusses

the limitations, and suggests directions for future

work. Sec. 4 summarizes the conclusion of the study

and explains the research significance and future

expectations.

2 DATA AND METHOD

Lecun et al. proposed the CNN network model in

1998. CNN is a type of feed-forward neural network

with strong image and natural language processing

(NLP) capabilities. Time series prediction is one area

in which it works well (Wang et al, 2021; Zhang et al,

2023). CNN has several advantages. One of them is

that it canenhance the learning models' efficacy. This

is realized by lowering the quantity of variables

through weight sharing and local perception. CNN is

mainly composed of five parts: input layer,

convolutional layer, pooling layer, fully connected

layer, and output layer (Luo & Zhang, 2022). The

convolutional layer and pooling layer are essential

because they are in charge of feature extraction and

dimensionality reduction. There are several kernels in

each convolutional layer. They are used to operate on

the input data to extract features. The features of the

data are recovered after the convolution procedure.

On the other hand, the features could have fairly large

dimensions. To reduce the dimensionality and

training costs, a pooling layer is added after each

convolutional layer in order to address this issue. The

pooling layer then compress the feature map and keep

the most crucial information. This will increase the

efficiency and accuracy in tasks like time series

prediction and classification.This procedure can be

stated as follows:

lt=tanh(xt*kt+bt) (1)

where xt is the input vector, tanh is the activation

function, lt is the output value following convolution,

kt is the convolution kernel's weight, and bt is the

kernel's bias.

Hochreiter and Schmidhuber first proposed Long

Short-Term Memory networks (LSTM) in 1997 as a

Recurrent Neural Network (RNN) variant

(Hochreiter & Schmidhuber, 1997). LSTM is usually

used to deal with data with long-term dependencies,

such as time series, audio or text. LSTM employs a

gating unit mechanism to enhance the structure of the

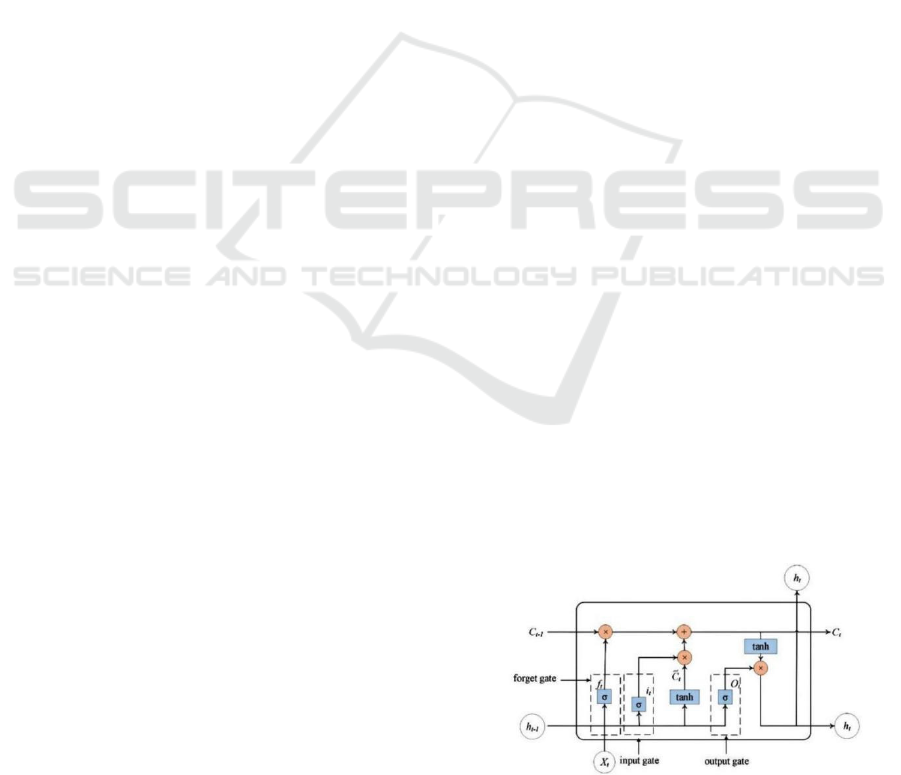

concealed layer of RNN. As seen in Fig. 1, this

system is composed of three gates: the forget gate, the

input gate, and the output gate. The information that

has to be deleted from the model neuron is decided by

the forgetting gate. The unit state is updated by the

input gate. Additionally, the output gate controls the

neuron's output at the subsequent moment (Sun et al,

2022).

The outputs of the previous cell and the current

cell are shown in the figure as h(t-1) and ht,

respectively. The current unit's input is represented by

xt, its activation functions are σ and tanh, and the

arithmetic rules connecting the vectors are indicated

by the circles in Fig. 1. Ct is the current state of the

neuron. The forgetting threshold, ft, determines how

information should be discarded by the cell using the

σ activation function. The information that the σ

function needs to update is determined by the input.

The σ function then uses the tanh activation function

Ct to produce a new memory, eventually controlling

the amount of new information added to the neuronal

state (Lu et al, 2020).

Figure 1: LSTM memory cell (Photo/Picture credit:

Original).

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

244

AM was proposed by Treisman et al. in 1980

(Treisman & Gelade, 1980). The AM theory

optimizes conventional models by selecting

important input from a vast amount of data and

emphasizing it. The primary idea stems from how

people pay attention to images. Human vision can

rapidly identify the important regions and concentrate

on them to gather data. In a similar vein, AM

selectively attends to and disregards less crucial

information. Typically, the AM calculating method is

broken down into three steps:

Step 1: Determine the correlation or similarity

between the input and output features using:

st=tanh(Whht+bh) (2)

where ht is the input vector, Wh is the weight of

AM and bh is its bias.

Step 2: Normalize the score from the first stage.

Then transform the attention score using the

softmax function, as indicated by:

a

∑

(3)

with v representing the attention value.

Step 3: Calculate the weighted summation of the

values to get the last attention value based on the

weight coefficients:

s

∑

a

h

(4)

BiLSTM is an expansion of the conventional

LSTM network. It enhances the ability to capture

information from both history and future states.

Different from LSTM, which only uses past

information to predict future outcomes, BiLSTMs

utilize two LSTM layers: separate for processing in

both directions (forward and backward).

In a BiLSTM network, the hidden states from both

directions are connected. This allows the model to

have a deeper comprehension of the sequence context.

This structure is especially beneficial in tasks where

the relationship between different time steps is crucial,

such as stock price prediction. The BiLSTM

equations are as follows with forward LSTM:

ℎ

⃑

𝐿𝑆𝑇𝑀ℎ

⃑

, 𝑥

(5)

and backward LSTM:

ℎ

⃐

𝐿𝑆𝑇𝑀ℎ

⃐

, 𝑥

(6)

and combined output:

ℎ

ℎ

⃑

; ℎ

⃐

(7)

With this method, the model is guaranteed access to

both previous and subsequent data at every time step.

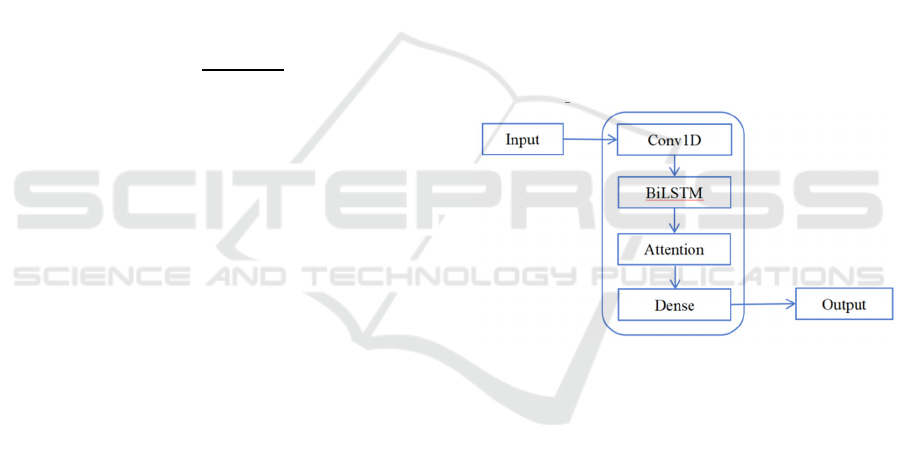

The CNN-BiLSTM-AM model combines the

strengths of CNN, BiLSTM, and the Attention

Mechanism. It forms a powerful predictive

framework. This hybrid model is particularly

effective in tasks involving complex temporal

sequences, like forecasting stock prices. The flow of

this method is as follows:

Step 1: Normalize the gathered stock data. The

data will be divided into the training set and the

test set.

Step 2: First, one uses CNN to extract the

internal characteristic. CNN comprises a

convolution layer, a pooling layer, and a

dropout layer. After that, the BiLSTM layer will

then be trained to identify internal dynamic

change patterns using the local characteristics

that CNN extracted. Lastly, the BiLSTM

outputs are subjected to the attention

mechanism in order to emphasize the most

important features. Next, as seen in Fig. 2, the

output passes through a dense layer.

Step 3: Normalize the forecast result and obtain

the expected value.

Figure 2: CNN-BiLSTM-AM neural network

(Photo/Picture credit: Original).

This paper selected the data of Guizhou Moutai

from January 5, 2015, to September 6, 2024,

estimating the closing price and stock price for a

period of 3274 trading days. Guizhou Moutai is one

of China's most prominent publicly traded companies.

Daily records of the stock's initial price, highest price,

lowest price, closing price, adjusted closing price, and

volume are among the aspects that have been chosen.

These variables provide a comprehensive overview of

the stock's trading activity and are crucial for accurate

prediction. The training and test sets of data were

used at an 8:2 ratio. This data, characterized by its

high frequency and non-linear nature, is particularly

suitable for testing the effectiveness of various

predictive models, including CNN, LSTM, and other

hybrid approaches. The extensive period and detailed

daily records allow for a thorough examination of the

Hybrid Deep Learning Model for Stock Price Prediction: Evidence from Guizhou Moutai Stock

245

capacity of the model to represent and forecast

intricate changes in stock prices.

Three important error indicators are used to assess

the prediction models' efficacy: Mean Absolute

Percentage Error (MAPE), Root Mean Square Error

(RMSE), and the coefficient of determination (R²).

Every metric offers a different viewpoint on the

effectiveness of the model:

𝑀𝐴𝑃𝐸 Σ

|𝑦

𝑦

|/𝑦

100% (8)

𝑅𝑀𝑆𝐸

Σ

𝑦

𝑦

(9)

𝑅

1 Σ

𝑦

𝑦

/Σ

𝑦𝑦

(10)

Where 𝑦

is the predicted value, 𝑦

is the actual value,

𝑦 is the mean of the actual values, and n is the total

number of observations. Better predictive accuracy is

shown by a lower MAPE, with values nearer zero

denoting more accurate forecasts. Lower RMSE

values denote better performance, with smaller

numbers reflecting more accurate predictions. A

model's fit to the data is better when the R

2

value is

closer to 1, and less well when it is closer to 0. These

metrics offer a thorough assessment of the models'

functionality, ensuring that the predictions are

accurate and reliable for the given stock price data.

3 RESULTS AND DISCUSSION

3.1 Model Performance

This section uses a Guizhou Moutai stock price

dataset to assess how well each of eight stock price

prediction models. MLP, RNN, CNN, LSTM, CNN-

LSTM, BiLSTM, CNN-BiLSTM, and CNN-

BiLSTM-AM are the models taken into consideration.

Performance is assessed based on three metrics:

RMSE, MAPE, and R

2

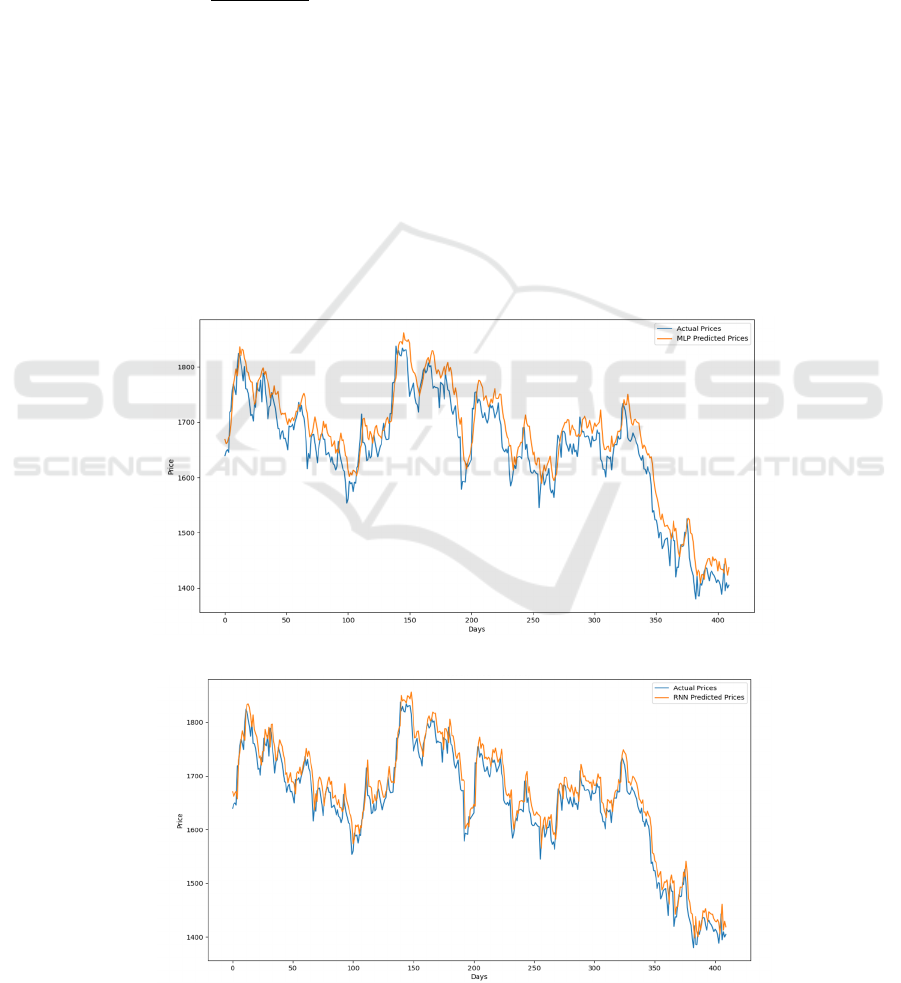

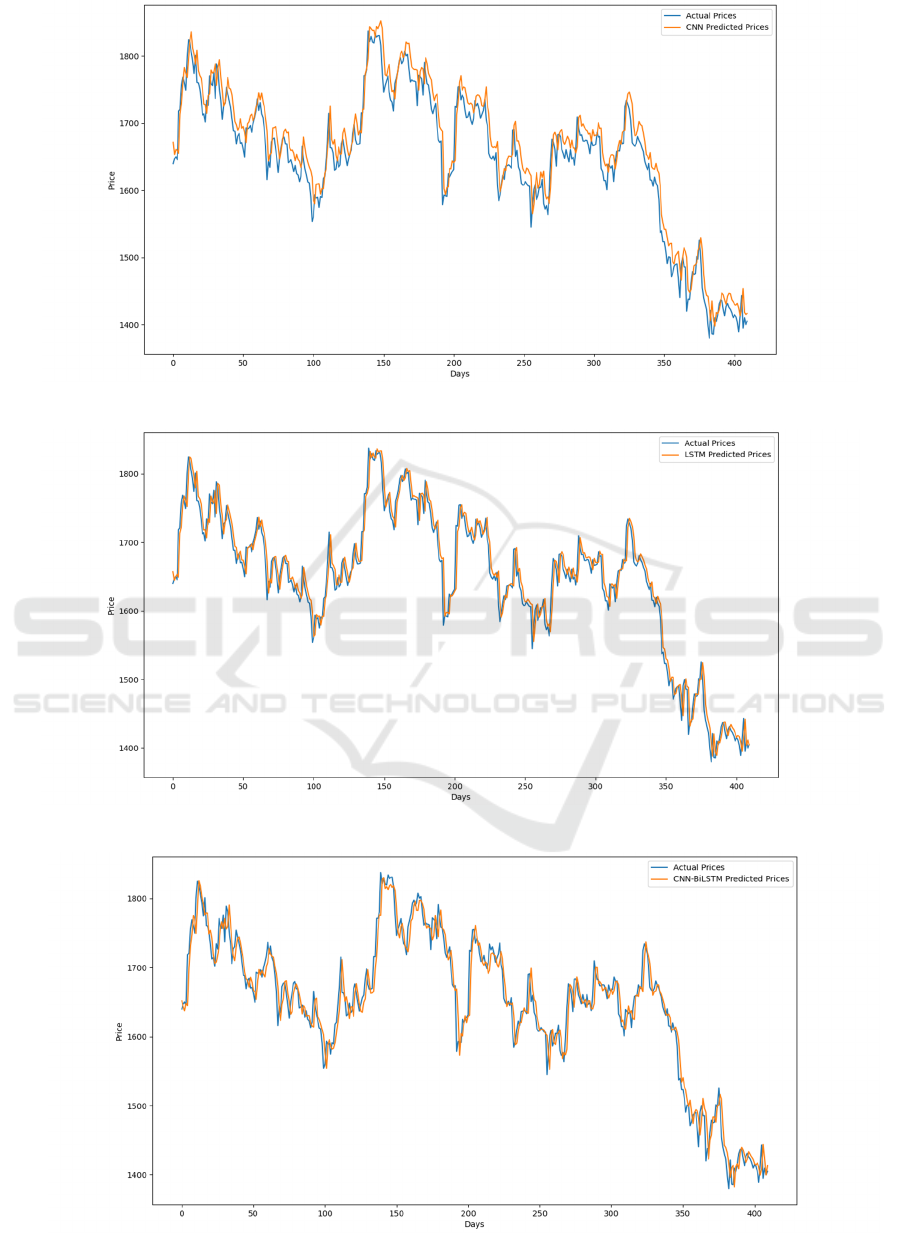

. Fig. 3 to Fig. 10 display the

predictions for each model. Forecast outcomes

derived from the eight models is shown in Figures 3,

4, 5, 6, 7, 8, 9, and 10. Whereas the MLP line has the

lowest fit, and the CNN-BiLSTM-AM line has the

highest fit between the true value and the predicted

value, which almost completely overlap. The

comparison results of the three errors of the eight

methods are shown in Table 1.

Figure 3: Forecast outcomes derived from MLP (Photo/Picture credit: Original)

Figure 4: Forecast outcomes derived from RNN (Photo/Picture credit: Original).

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

246

Figure 5: Forecast outcomes derived from CNN (Photo/Picture credit: Original).

Figure 6: Forecast outcomes derived from LSTM (Photo/Picture credit: Original).

Figure 7: Forecast outcomes derived from CNN-BiLSTM (Photo/Picture credit: Original).

Hybrid Deep Learning Model for Stock Price Prediction: Evidence from Guizhou Moutai Stock

247

Figure 8: Forecast outcomes derived from BiLSTM (Photo/Picture credit: Original).

Figure 9: Forecast outcomes derived from CNN-LSTM (Photo/Picture credit: Original).

Figure 10: Forecast outcomes derived from CNN-BiLSTM-AM (Photo/Picture credit: Original).

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

248

Table 1: Model performance comparison.

Method RMSE MAPE

𝑅

MLP 37.162 1.908% 0.8718

RNN 28.002 1.426% 0.9272

CNN 27.163 1.362% 0.9315

LSTM 23.005 1.094% 0.9509

CNN-BiLSTM 22.202 1.016% 0.9542

BiLSTM 21.461 0.978% 0.9572

CNN-LSTM 21.412 0.967% 0.9574

CNN-BiLSTM-AM 21.273 0.944% 0.9580

3.2 Explanation and Implication

The examination of the outcomes indicates that the

more elaborate models perform better overall than the

simpler models such as MLP and RNN, particularly

when it comes to identifying the finer patterns in the

stock price data. The MLP model exhibits the highest

RMSE (37.162) and MAPE (1.908%), indicating

significant errors in its predictions. The low R

2

value

(0.8718) further suggests that MLP is less capable of

explaining the variance in the stock prices. The

underperformance of MLP underscores its limitations

in handling sequential data, where temporal

dependencies are crucial. This model's architecture

lacks the capability to capture the time-dependent

nature of stock prices effectively.

The RNN model improves upon MLP, with a

lower RMSE (28.002) and MAPE (1.426%).

However, its performance is still suboptimal

compared to more advanced models. The R

2

value of

0.9272 indicates a moderate ability to explain

variance. RNN’s ability to process sequences makes

it better suited for time series forecasting than MLP,

but issues like vanishing gradients limit its

effectiveness over longer sequences, which is evident

in its performance.

The CNN model further reduces RMSE (27.163)

and MAPE (1.362%), with an R

2

of 0.9315. This

suggests a better fit to the data compared to RNN.

CNN’s strength lies in its feature extraction

capabilities, which allow it to capture important

patterns in the data. However, without a mechanism

to explicitly handle temporal dependencies, CNN’s

performance is still outstripped by models like LSTM.

LSTM shows a marked improvement with RMSE

at 23.005 and MAPE at 1.094%. The R

2

value of

0.9509 indicates a strong fit to the data. The vanishing

gradient problem of RNN is solved by LSTM, making

it possible to identify long-term dependencies in the

data. Because of this, LSTM is quite useful for time

series forecasting applications such as stock price

prediction.

BiLSTM continues the trend of improvement,

with RMSE of 21.461 and MAPE of 0.978%. The R

2

value of 0.9572 reflects its enhanced predictive

capability. Because BiLSTM can analyze data both

forward and backward, it can comprehend the time

series more thoroughly and produce predictions that

are more accurate.

CNN-BiLSTM l slightly outperforms BiLSTM

alone, with an RMSE of 22.202 and MAPE of

1.016%. The R

2

value is marginally higher at 0.9542.

By merging the temporal processing of BiLSTM with

the feature extraction of CNN, this model effectively

captures both spatial and temporal patterns, resulting

in robust predictive performance.

CNN-LSTM offers similar results to CNN-

BiLSTM, with an RMSE of 21.412 and MAPE of

0.967%. Its R

2

value of 0.9574 indicates a strong fit.

The CNN-LSTM model’s architecture allows it to

harness CNN’s pattern recognition strengths while

benefiting from LSTM’s capability to handle

temporal dependencies, making it one of the more

effective models in this comparison.

The CNN-BiLSTM-AM model exhibits the best

performance, with the lowest RMSE (21.273) and

MAPE (0.944%) among all models. The R

2

value of

0.9580 is the highest, reflecting its superior accuracy.

The integration of an Attention Mechanism with

CNN-BiLSTM allows this model to concentrate on

the most pertinent time steps and elements, further

enhancing its ability to make precise predictions. This

makes it the most powerful model in this study for

stock price prediction.

3.3 Limitations and Prospects

Stock trading data is the assessment index utilized in

this article, and stock prices and indexes are impacted

by numerous different circumstances. Consequently,

the model suggested in this work has limits just like

previous models, the primary cause of which being

the model's structure. More effort can be done to

increase the prediction accuracy, such as adding the

most recent models to the index, creating new models,

Hybrid Deep Learning Model for Stock Price Prediction: Evidence from Guizhou Moutai Stock

249

which is of course challenging, or merging multi-

source heterogeneous stock information. Although it

is thought that similar results can be drawn, the author

did not evaluate the methodologies used in this study

using data from other nations or industries due to time

and space constraints. These can all be taken into

account in further work.

Subsequent investigations will primarily modify

the model's parameters in an effort to increase the

findings' accuracy. Future research work will also

conduct model stability analysis on the proposed

model to study whether the model is applicable to

other data sets estimation in other application fields,

such as gold price prediction and weather forecast.

4 CONCLUSIONS

To sum up, this study assesses and contrasts the

performance of many hybrid deep learning models,

concentrating on Guizhou Moutai stock. Results

demonstrate that advanced models, especially CNN-

BiLSTM-AM, outperform simpler models like MLP

and RNN on the precision of the predictions. Using

CNN for extraction of features, BiLSTM for temporal

dependency extraction, and Attention Mechanism for

emphasizing key information leads to superior

predictive performance. The CNN-BiLSTM-AM

model achieves the closest R

2

to 1 and the lowest

RMSE and MAPE, highlighting its effectiveness in

handling complex time series data. In the future,

studies should concentrate on increasing model

efficiency in order to lower computing expenses,

making it suitable for real-time trading environments.

Additionally, exploring the integration of external

factors like macroeconomic indicators could further

improve prediction accuracy. The study's significance

lies in providing a comprehensive comparison of

predictive models and offering insights into how

hybrid architectures can enhance stock price

forecasting.

REFERENCES

Box, G. E. P., Jenkins, G. M., 1970. Time Series Analysis:

Forecasting and Control. Holden-Day.

Haykin, S., 1999. Neural Networks: A Comprehensive

Foundation. Prentice Hall.

Hochreiter, S., Schmidhuber, J., 1997. Long Short-Term

Memory. Neural Comput., 9, 1735–1780.

Lu, W., Li, J., Li, Y., Sun, A., Wang, J., 2020. A cnn-lstm-

based model to forecast stock prices. Complexity, 2020,

1–10.

Luo, J., Zhang, X., 2022. Convolutional neural network

based on attention mechanism and bi-lstm for bearing

remaining life prediction. Applied Intelligence, 52(2),

1076-1091.

Qin, L., Yu, N., Zhao, D., 2018. Applying the convolutional

neural network deep learning technology to behavioral

recognition in intelligent video. Tehnički vjesnik, 25(2),

528-535.

Sun, Y., Sun, Q., Zhu, S., 2022. Prediction of Shanghai

stock index based on investor sentiment and cnn-lstm

model. J. Syst. Sci. Inf. Technol. Engl. Ed., 10, 620–632.

Treisman, A., Gelade, G., 1980. A feature-integration

theory of attention. Cogn Psychol 12(1), 97–146

Vaswani, A., Shazeer, N., Parmar, N., Uszkoreit, J., Jones,

L., Gomez, A. N., Kaiser, Ł., Polosukhin, I., 2017.

Attention is all you need. Advances in Neural

Information Processing Systems, 30, 5998-6008.

Wang, J., Wang, J., Sun, Q., 2021. Forecasting stock

market with optimized model by artificial rabbits

optimization algorithm. Expert Systems with

Applications, 163, 113481

Xiao, C., Xia, W., Jiang, J., 2020. Stock price forecast

based on combined model of ARI-MA-LS-SVM. Neural

Comput Appl., 32(10), 5379-5388.

Yu, P., Yan, X., 2020. Stock price prediction based on deep

neural networks. Neural Comput Appl., 32(6), 1609-

1628.

Zhang, J., Ye, L., Lai, Y., 2023. Stock Price Prediction

Using CNN-BiLSTM-Attention Model. Mathematics,

11(1985), 1-18.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

250