Forecast and Analysis for Samsung Stock Price Based on Machine

Learning

Wenjing Tu

a

School of Statistics, Jilin University of Finance and Economics, Jilin, China

Keywords: Stock Price Prediction, Logistic Regression, Support Vector Machine, Extreme Gradient Boosting.

Abstract: Predicting stock prices is an important area of research within finance, and selecting suitable machine learning

models is essential for enhancing prediction accuracy. This study seeks to assess and compare Logistic

Regression (LR), Support Vector Machine (SVM), and Extreme Gradient Boosting (XGBoost) regarding their

effectiveness in stock price forecasting, particularly emphasizing their advantages and limitations when

dealing with imbalanced datasets. By examining historical stock data sourced from Yahoo Finance, this

research measures the effectiveness of these three models based on accuracy, precision, and recall. The

findings indicate that the LR model achieves the highest overall performance, attaining an accuracy rate of

84%. In comparison, the SVM and XGBoost had lower performance, with accuracy rates of 81% and 70%,

respectively. These results provide empirical evidence for model selection in finance, emphasizing the

effectiveness of simple models when facing class imbalance. Future research will focus on ensemble

techniques and the integration of real-time data to improve forecasting accuracy and adaptability under

dynamic market conditions.

1 INTRODUCTION

Forecasting stock price fluctuations plays a crucial

role in the financial sector. As a leading global

technology company, Samsung's stock price volatility

not only directly reflects its market valuation

fluctuations but also has profound implications for the

entire technology industry and the global economy.

Therefore, accurately predicting the rise and fall of

Samsung's stock prices is crucial for investors and

market participants, as it can aid in optimizing

investment decisions and provide important insights

for market risk management.

With the rapid development of machine learning

technologies, selecting appropriate predictive models

has become a core challenge for enhancing prediction

accuracy. Stock price movements in the financial

market are affected by numerous factors, which adds

complexity to the prediction task (Kumar et al., 2021;

Usmani & Shamsi, 2021). Yelne et al. (2021)

investigated the use of guided machine learning

algorithms, including Random Forests (RF), Decision

Trees (DT), along Logistic Regression (LR), for

predicting stock values, revealing that regression

a

https://orcid.org/0009-0005-8375-1268

models are more accurate in forecasting stock prices.

Liu et al. (2016) found that LR and SVM models also

performed well in predicting the trends of the S&P

500 index, particularly with the use of the RBF kernel

in SVM. Furthermore, Wang et al. (2023) employed

XGBoost and long short-term memory (LSTM)

algorithms to predict the final prices for 25

companies, achieving a prediction accuracy of up to

99% with XGBoost. These studies demonstrate the

effectiveness of various models in stock price

prediction.

LR is often utilized in financial data analysis due

to its simplicity and interpretability. However,

XGBoost, being a collective learning approach, not

only performs exceptionally well in managing

intricate data but also demonstrates notable

interpretability (Carmona et al., 2022; Yang et al.,

2021). Nonetheless, its intricacy may pose challenges

for certain users in terms of understanding and

application compared to simpler models. SVM has

garnered attention for its effectiveness in high-

dimensional spaces, yet it may encounter

computational efficiency issues when dealing with

large-scale data (Cao & Lin, 2015). Therefore,

234

Tu, W.

Forecast and Analysis for Samsung Stock Price Based on Machine Learning.

DOI: 10.5220/0013213900004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 234-238

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

understanding the performance differences among

these three models is important for investment

decision-making. This study aims to utilize a real

stock market dataset to compare and evaluate the

predictive accuracy, precision, and recall of these

three models, with the hope of providing empirical

evidence for model selection in the financial domain.

The structure of this paper is organized as follows.

Section 2 introduces the dataset and outlines the

preprocessing methods applied. Section 3 presents the

experimental models and provides an analysis of the

results. Finally, Section 4 summarizes the findings

and discusses the study’s conclusions.

2 DATA AND METHOD

2.1 Data Collection and Description

The dataset employed in this research is retrieved

from Yahoo Finance’s historical stock data, with

specific details available in Table 1. Open represents

the price at which the stock begins its trading day,

while High indicates the peak price attained during

the session. Conversely, Low shows the minimum

price observed within the same session, and Close

marks the stock’s price when the trading day

concludes. The Adj Close value takes into

consideration adjustments such as cash payouts and

stock splits, providing a more accurate portrayal of

the stock’s true worth. Furthermore, Volume signifies

the entire number of shares exchanged throughout the

trading day, reflecting the level of market activity.

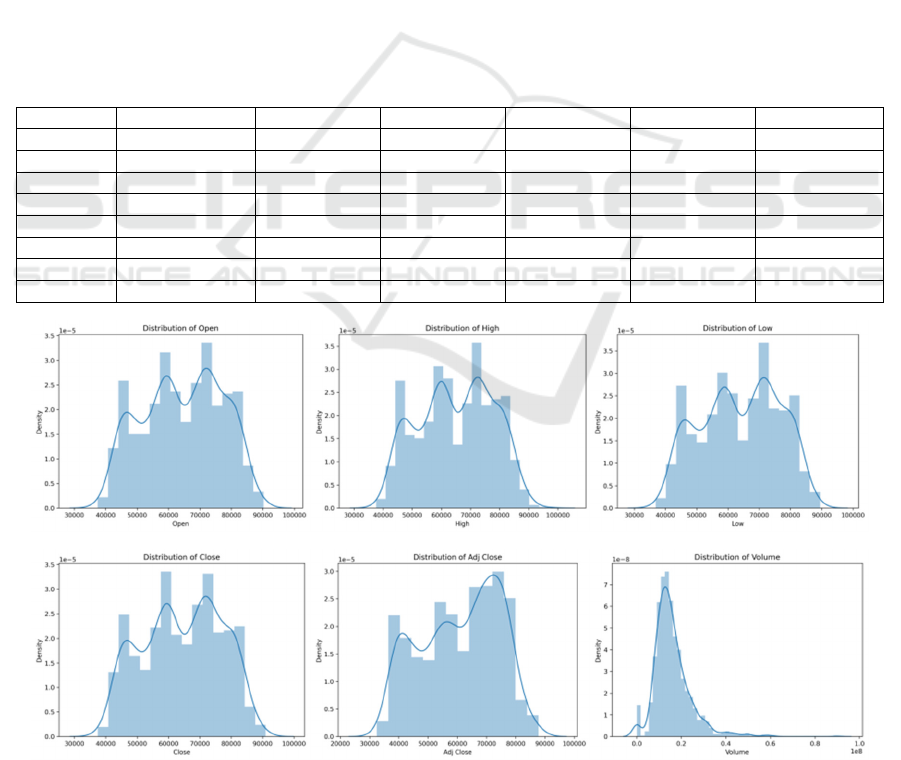

This study begins with an Exploratory Data

Analysis (EDA) of Samsung’s historical stock price

data to develop an initial understanding of the

dataset’s distribution and characteristics. Figure 1

presents the distribution patterns for the following

variables: opening value (Open), peak price (High),

lowest value (Low), end-of-day price (Close),

adjusted final price (Adj Close), and the number of

shares traded (Volume).

Table 1: Description of sample data.

O

p

en Hi

g

h Low Close Ad

j

Close Volume

count 1370.000000 1370.000000 1370.000000 1370.000000 1370.000000 1.370000E+03

mean 64429.197080 64987.226277 63832.116788 64387.299270 60855.500726 1.598891E+07

st

d

12492.575943 12560.151153 12405.131654 12461.450389 13443.892450 8.356224E+06

min 37450.000000 37600.000000 36850.000000 37450.000000 32495.349609 0.000000E+00

25% 55125.000000 55700.000000 54500.000000 55200.000000 49854.492188 1.103028E+07

50% 65200.000000 65650.000000 64700.000000 65150.000000 62718.103516 1.434703E+07

75% 74200.000000 74800.000000 73500.000000 74100.000000 72242.107422 1.906567E+07

max 90300.000000 96800.000000 89500.000000 91000.000000 87800.000000 9.030618E+07

(a) (b) (c)

(d) (e) (f)

Figure 1: Figure Caption Trends in sample data. (a) for the distribution of open, (b) for the distribution of high, (c) for the

distribution of low, (d) for the distribution of open, (e) for the distribution of adj close, (f) for the distribution of volume.

Forecast and Analysis for Samsung Stock Price Based on Machine Learning

235

From Figure 1, it is evident that the overall price

data displays a multi-peak distribution, indicating that

the market has gone through various phases and

experienced different price fluctuations. Meanwhile,

the trading volume distribution shows a clear left-

skewed characteristic, which means that the majority

of the trading volume is concentrated in the lower

range of values. The few high-volume records create

a long tail.

2.2 Data Pre-processing

During the data preprocessing phase, the study

guarantees the quality and relevance of the dataset

through several steps. Initially, the dates in the dataset

were converted from object format to datetime

format, simplifying subsequent analysis and testing.

Following this, the study addressed missing values by

using the SimpleImputer class with a mean fill

strategy, ensuring the integrity of the dataset.

Columns with missing data were populated using the

imputer.fit_transform() method to maintain data

consistency. To handle outliers, the Z-Score method

was applied, which filters outliers by setting specific

thresholds, reducing noise and improving the model

’s ability to capture real market trends. Furthermore,

a new column named Price_Up was added to the

dataset to signify changes in the current closing price

relative to the previous day’s price. This new feature

is created by comparing the closing prices over two

consecutive days: if the current closing price

surpasses that of the prior day, it is labeled as 1

(indicating a price rise); if it is equal to or lower, it is

marked as 0 (indicating either a decrease or stability).

This Boolean value is subsequently transformed into

an integer format to enhance its utility in further

model training. Finally, the study normalizes the data

by scaling the values between 0 and 1, ensuring

balanced feature contributions during the model

training phase.

2.3 Logistic Regression

Logistic Regression (LR) is a commonly utilized

classification algorithm, particularly effective for

binary classification tasks. It achieves category

prediction by mapping the output of a linear function

to a probability between 0 and 1. Due to its simplicity

and interpretability, the LR model is particularly

effective for binary classification. In this study, the

LR model is used to predict the rise and fall of the

closing price of Samsung stock, demonstrating that

the model can efficiently perform this task and

provide a reliable basis for further analysis and

decision-making. The prediction from the LR model

can be represented as:

𝑃

𝑌=1

|

𝑋

=

1

1+𝑒

⋯

1

In this context, P(Y = 1|X) is the likelihood that

the sample belongs to the positive category (i.e. Price

Up = 1 in this study); w

is the bias term;

w

,w

...w

are the weights of the corresponding

features x

,x

...x

are the weights of corresponding

features x

,x

...x

; x

,x

...x

are the input feature

variables; With the Maximum Likelihood Estimation

(MLE) method, these weighting parameters w can be

optimized to minimize the prediction error.

2.4 Support Vector Machine

During the data preprocessing phase, the study SVM

are powerful classification and regression algorithms

aimed at maximizing the separation among various

classes of data points by identifying an optimal

hyperplane. The Support Vector Classifier (SVC)

used in classification tasks is based on the principles

of SVM theory. SVC is suitable for both linearly and

non-linearly separable cases by introducing kernel

methods. In this paper, the SVC model is employed

to forecast the price movements (Price Up) of

Samsung shares. The prediction from the SVC model

can be represented as:

𝑓

(

𝑥

)

= 𝑠𝑖𝑔𝑛𝛼

𝑦

𝐾

(

𝑥

, 𝑥

)

+ 𝑏

(

2

)

In this context, K(x

,x) represents the kernel

function, which is used to compute the support vector

and the similarity between the new sample x

and 𝑥.

Commonly utilized kernel functions encompass

linear kernel, polynomial kernel, and radial basis

function (RBF); a

is the Lagrange multiplier, which

represents the weight of the support vector, and is

non-zero only on the support vector. y

is the actual

label of the sample x

, which takes the numerical

representation of +1 or -1; 𝑏 is the bias term, which is

used for adjusting the position of the decision

boundary; and the sign of the decision function

dictates the classification outcome of the new sample

x, which is predicted to belong to the positive class or

the negative class.

2.5 Extreme Gradient Boosting

Extreme Gradient Boosting (XGBoost) is an

improved gradient learning algorithm, a boosting

method, which transforms many weak classifiers into

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

236

Table 2: Results of different models.

Model Accurac

y

Precision

(

0

)

Precision

(

1

)

Recall

(

0

)

Recall

(

1

)

F1

(

0

)

F1

(

1

)

LR 84% 86% 83% 87% 81% 86% 82%

SVM 81% 83% 80% 85% 77% 84% 78%

XGBoost 70% 74% 65% 71% 68% 72% 66%

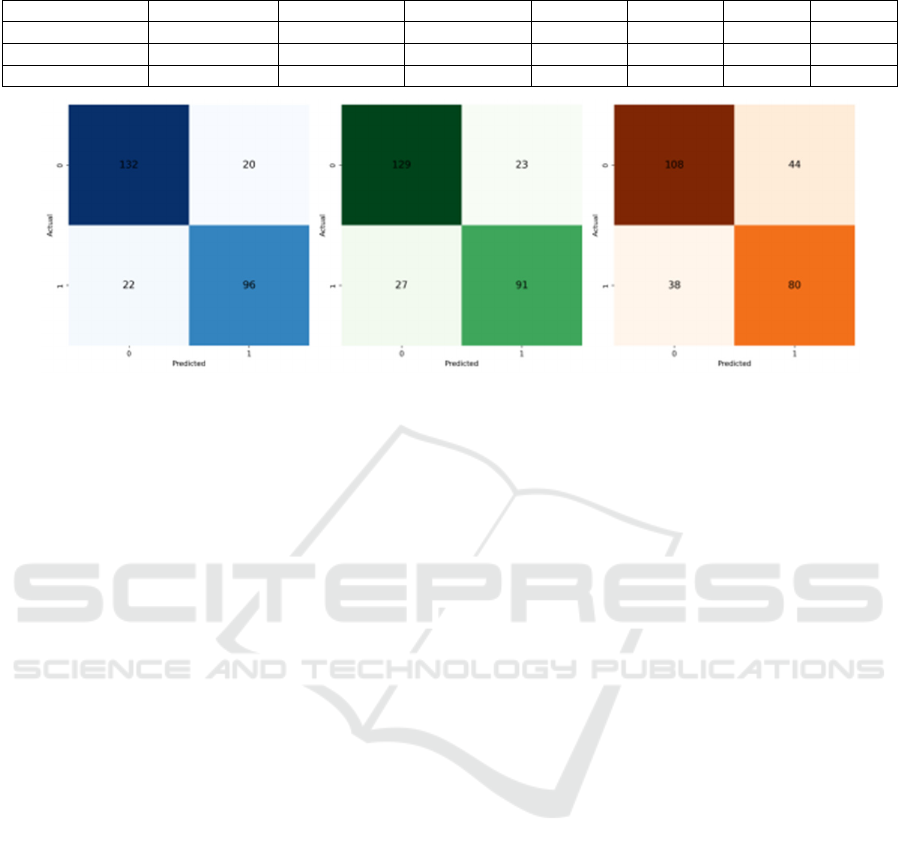

(a) (b) (c)

Figure 2: Confusion Matrix. (a) for the LR confusion matrix, (b) for the SVC confusion matrix, (c) for the XGBoost confusion

matrix.

strong classifiers through iterative operations to

achieve accurate classification results (Jiang et al.,

2021). XGBoost is well-known for its capability to

manage extensive datasets, complex features, and

intricate relationships. The predictions generated by

the XGBoost model can be represented as:

𝑓

(

𝑥

)

= ℎ

(

𝑥

)

(

3

)

In this context, 𝐾 denotes the quantity of decision

trees in the framework; h

(x) denotes the predicted

value of input x from the kth tree; the model gradually

reduces the error function to form the final prediction

through continuous iteration and optimisation.

3 EXPERIMENT RESULTS

3.1 Comparison of Results

This research utilizes various evaluation metrics, such

as accuracy, precision, recall, and F1-score. Here, the

positive class signifies cases where the stock price has

risen, while the negative class represents instances

where the stock price has declined. The outcomes of

the experiments are detailed in Table 2.

The findings from the experiments carried out in this

research are outlined in Table 2. The analysis reveals

that LR demonstrates the best overall performance,

with an accuracy of 84%. For the negative class, it

achieves a precision of 86%, a recall rate of 87%, and

an F1-score of 86%. On the other hand, for the

positive class, the model records a precision of 83%,

a recall rate of 81%, and an F1-score of 82%. This

suggests that LR offers strong stability and integrated

capability in classification tasks, especially for the

negative class (category 0). In contrast, SVM attains

an accuracy of 81%, which is 3% less than LR. Its

precision is 83%, recall is 85%, and its F1-score is

84%, slightly lower than LR by 2%. Overall, SVM’s

accuracy in identifying negative samples is slightly

less than that of LR, yet its metrics for the negative

class remain reliable and consistent. XGBoost

exhibits the lowest overall accuracy of 70% and also

ranks the lowest in precision, recall, and F1-score,

indicating weaker performance in classifying the

positive class (category 1). This result suggests that

XGBoost encounters challenges with this dataset.

Overall, LR outperforms the other models across

various metrics, making it more suitable for the

current data and the classification prediction task at

hand.

3.2 Analysis of Results

The findings illustrated in Figure 2 indicate that the

LR model excels in accurately identifying correct

positive and negative predictions, resulting in the

lowest number of misclassifications. This reduction

includes fewer instances of both false positives and

false negatives, emphasizing its high accuracy,

particularly in classifying negative cases. The SVM

model, while slightly underperforming compared to

LR, still shows competence in identifying correct

positive and negative outcomes, albeit with a

Forecast and Analysis for Samsung Stock Price Based on Machine Learning

237

marginally higher error rate. Conversely, the

XGBoost model shows the poorest performance in

this classification task, especially with an increased

occurrence of false positives and false negatives,

implying that it may have overfit the model and

resulted in subpar performance on the test data.

The findings indicate that the LR model

demonstrates superior overall performance in the

binary prediction task for stock price movements,

particularly regarding the balance of precision and

recall. In contrast, the SVM model performs better at

identifying majority class samples (negative

samples). However, it performs poorly when dealing

with minority class samples (positive samples) and

may not be suitable for cases of class imbalance. The

XGBoost model, although typically strong in dealing

with complex categorization tasks, performs slightly

less well than LR in this study, which may be due to

excessive model complexity and overfitting. These

results reveal that simple models such as LR may be

more effective for predicting stock price movements,

especially when the dataset is relatively balanced or

when balancing precision and recall is necessary. At

the same time, it also reminds researchers to consider

the attributes of the dataset and the flexibility of the

model when selecting the model to ensure optimal

prediction results.

4 CONCLUSIONS

Stock price forecasts are vital in financial markets,

aiding investors in making informed decisions,

mitigating risks, and enhancing returns on

investment. Understanding and managing market

volatility are also crucial for the stable growth of

financial markets. This research applies three models

- LR, SVM, and XGBoost - to predict Samsung’s

stock price fluctuations. The experimental results

demonstrate that LR provides the best performance in

binary classification tasks, particularly in terms of

balancing accuracy and recall. In contrast, the SVM

model shows proficiency in recognizing the majority

class (negative samples) but struggles with minority

class (positive samples) identification, making it less

effective in situations of class imbalance. The

XGBoost model, typically strong in complex

categorization tasks, slightly underperformed

compared to LR in this study, potentially due to

excessive model complexity leading to overfitting.

Overall, this paper underscores the importance of

model selection in stock price prediction by analyzing

the efficacy of different models. Future studies could

focus on optimizing model selection, exploring more

sophisticated and diverse data to improve the

accuracy and reliability of forecasting. The findings

of this study offer empirical evidence supporting

intelligent forecasting in financial markets and

suggest new directions for advancing machine

learning models within the financial sector.

REFERENCES

Cao, J., Lin, Z., 2015. Extreme learning machines on high

dimensional and large data applications: A survey.

Mathematical Problems in Engineering, 2015(1),

103796.

Carmona, P., Dwekat, A., Mardawi, Z., 2022. No more

black boxes! Explaining the predictions of a machine

learning XGBoost classifier algorithm in business

failure. Research in International Business and Finance,

61, 101649.

Jiang, Y. Q., Cao, S. E., Cao, S., Chen, J. N., Wang, G. Y.,

Shi, W. Q., Chen, G. H., 2021. Preoperative

identification of microvascular invasion in

hepatocellular carcinoma by XGBoost and deep

learning. Journal of Cancer Research and Clinical

Oncology, 147, 821-833.

Kumar, G., Jain, S., Singh, U. P., 2021. Stock market

forecasting using computational intelligence: A survey.

Archives of Computational Methods in Engineering,

28(3), 1069-1101.

Liu, C., Wang, J., Xiao, D., Liang, Q., 2016. Forecasting

S&P 500 stock index using statistical learning models.

Open Journal of Statistics, 6(6), 1067-1075.

Usmani, S., Shamsi, J. A., 2021. News sensitive stock

market prediction: Literature review and suggestions.

PeerJ Computer Science, 7, e490.

Wang, J., Cheng, Q., Dong, Y., 2023. An XGBoost-based

multivariate deep learning framework for stock index

futures price forecasting. Kybernetes, 52(10), 4158-

4177.

Yang, C., Chen, M., Yuan, Q., 2021. The application of

XGBoost and SHAP to examining the factors in freight

truck-related crashes: An exploratory analysis.

Accident Analysis & Prevention, 158, 106153.

Yelne, A., Theng, D. 2021. Stock prediction and analysis

using supervised machine learning algorithms. In 2021

International Conference on Computational

Intelligence.

Zhou, S., 2021. Sparse SVM for sufficient data reduction.

IEEE Transactions on Pattern Analysis and Machine

Intelligence, 44(9), 5560-5571.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

238