Prediction of Tencent Share Price Based on ARIMA, SVR and LSTM

Xinyu Yang

School of Economics, Jinan University, Guangzhou, China

Keywords: Stock Price Prediction, ARIMA, SVR, LSTM, Tencent.

Abstract: As a matter of fact, the predicting stock price can not only be a hard chicken to pluck but also it is an exciting

research area of financial markets for the researchers’ due high return profit that can be made upon successful

prediction accuracy, which matters based on informed investment decision especially in contemporary high

volatility market. With this in mind, in this article, the stock price of Tencent Holdings is predicted using

1,203 parameter sets by comparing three models, i.e., ARIMA (Autoregressive Integrated Moving Average),

Support Vector Regression (SVR), and Long Short-Term Memory Networks (LSTM). According to the

analysis, the results reveal that SVR is very well suited for short-term predictions due to its ability to capture

market volatility. In contrast, LSTM can handle long term patterns. The ARIMA model, on the other hand,

hamstrung to make sense of non-linear data by its linear foundation. While they differ in performance, it is a

useful guidance to investors choosing between models for specific needs.

1 INTRODUCTION

Predicting stock prices is one of the most important

research topics in financial markets, using various

mathematical and statistical methods. The early

research in this regard was based on the Random

Walk Theory (RWT), according to which stock prices

are a completely random process, and future

movements of share price depends only upon past

movement of market information not past prices

(Fama, 1995). While that theory bolstered the

efficient market hypothesis, it was later oppugned

because it did not consider the regularities in stock

prices.

Recent trends in finance and statistics have upheld

Autoregressive Integrated Moving Average (ARIMA)

model as one of the paramount methods for stock

price forecasting. ARIMA is actually a model that

Autoregressive (AR) and Moving Average (MA)

components to support non-stationary data. It models

future values as linear combinations of past data and

errors thus making it suitable for short-term

projections (Ariyo et al., 2014). As one can see in the

case of Weng, he used a ARIMA model to predict

stock worth with 939 closing prices from

Construction Bank and already acquired good results

for short-range prescience (Weng, 2023). Whilst

ARIMA is one of the most accurate time series

models for the stock market, it fails to provide an

interpretable feature that clearly indicates when you

should invest in long term stocks because investing

based off seasonality or general bullish/bearish trends

will lead to huge errors due to autocorrelation.

Besides traditional statistical models, Support

Vector Regression (SVR), as a machine learning

method is promising in stock price prediction. By the

nature of its algorithm itself: linear and non-linear

problems can both be addressed accurately. SVR,

considering the principle of structural risk

minimization, can provide strong generalization

ability for financial time series forecasting task.

According to Li, it achieves an annualized return of

14.75% based on the multifactor stock selection

model constructed by SVR with a trading adjustment

frequency 30 days ago in and out (Li, 2022).

Long Short-Term Memory (LSTM) can capture

long-term dependencies in time series data, making

them very successful for financial modelling where

the traditional Recurrent Neural Network (RNN)

could suffer from vanishing gradient problem

(Bhandari et al., 2022). For example, the study carried

out by Yang and Wang utilized a deep LSTM network

to forecast stock indices from 30 global markets

(Yang & Wang, 2019). LSTM offered the best

forecasting performance over other methods (e.g.,

SVR, RNN and ARIMA) through various maturities.

In addition, hybrid models which combines the

traditional statistical methods with deep learning like

Yang, X.

Prediction of Tencent Share Price Based on ARIMA, SVR and LSTM.

DOI: 10.5220/0013213800004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 229-233

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

229

ARIMA-LSTM robustly provides better results than

the solo counterparts (Abdulrahman et al., 2020).

This paper focuses on predicting the stock price of

Tencent Holdings, a subject that has been explored in

some studies. In a study conducted by Shi and Zhuang,

they compared different soft computing techniques

for prediction of the fusion defect. ANN showed more

accurate performance to predict the fusion output

among all other models used in this research (Shi &

Zhuang, 2019). Wang et al. introduced an Event

Attention Network (EAN) to predict short-term stock

price trends of companies like Tencent using social

media and news data (Wang et al., 2019). Lu et al.

compared stock prices of two internet companies in

China: Tencent and Alibaba using Capital Asset

Pricing Model (CAPM), Dividend Discount Mode

(DDM) and Fama-French Three-Factor Model

(FF3F), and Tencent showed a larger proportion of

expected returns (Lu et al., 2021). Zhou proposed an

LSTM model combined with multidimensional input

and sentiment analysis to improve the predictability

of Tencent's stock price (Zhou, 2021).

This study aims to apply the 1,203 parameters into

ARIMA, SVR and LSTM to find out which model is

predictive power for forecasting Tencent's stock price

movements. The one problem with ARIMA is it

handles short-term linear trends whereas long term

could be non-linear during explained period. SVR

helps in short term predictions because of the kernel

trick that SVRs use by properly taking care of non-

linear relations. Given that LSTM are able to capture

long-term dependencies in time series, this makes

them a very good option for performing long term

forecasts. This paper performs a systematic

comparison of this series predictive power for the

price trajectory. The subsequent sections describe the

data and methods used, a comprehensive analysis on

model performance as well as provide practical

implications for investment decisions. Finally, this

study concluded comparison of all these models that

which model works best for stock price prediction.

2 DATA AND METHOD

The data used in this study was sourced from

investing. com providing 34,909 data of Tencent

Holdings Limited daily since its first listing on HKEx

from June 17, 2004 to September 9, 2024. Entries

have date, close, open, High and Low prices of the

day in HKD, traded volume in million and range of

fluctuation (%). The closing price is used as a

dependent variable to predict changes in stock prices

at the next trading day, whereas opening, high, low

and the others are independent variables that reflect

the direction on how this dynamic may evolve. All

computation for this study was performed on an

environment with TensorFlow 2.9.0, Python 3.8,

CUDA11, 80GB RAM, AMD EPYC 7642 and RTX

3090 via the cloud computing platform AutoDL. To

facilitate model training and testing, the dataset was

divided into two parts: the first 3,990 days of data

were used for model training, and the subsequent 997

days were reserved for testing and evaluating

predictive performance. As ARIMA is a univariate

model, only the date and closing price were used for

its training. On the other hand, SVR and LSTM

employed all variables. Additionally, the data were

normalized before training SVR and LSTM models to

ensure efficient training and accurate predictions.

This paper analyzes and forecasts Tencent's stock

price using three different forecasting models, namely

ARIMA, SVR, and LSTM. Each model uses different

methods to find the optimal parameters and quantifies

the prediction effect of the model through the

evaluation indexes such as Coefficient of

Determination (R²), Mean Squared Error (MSE),

Mean Absolute Error (MAE) and Mean Percentage

Absolute Error (MPAE). In order to select an

appropriate ARIMA model, an Augmented Dickey-

Fuller Test (ADF) was first performed on the closing

price data to determine the smoothness of the data and

the order of difference. The test results indicated that

the closing price data was non-stationary and required

first order differencing. Subsequently, the auto_arima

function was used to automatically select the optimal

model order from 147 parameter combinations based

on the Akaike Information Criterion (AIC). The final

optimal ARIMA model obtained is ARIMA(5,1,3),

i.e. p=5, d=1, q=3. For the SVR model, this paper

optimizes the model parameters by hyperparameter

grid search to find the optimal parameter combination

from 32 different parameter combinations. In the

process of parameter tuning, 5-fold cross-validation

is used and negative_mean_squared_error is used as

the scoring criterion. The final optimal parameter

combination obtained is penalty parameter (C) = 100,

ε-insensitive loss function (epsilon) = 0.01, and

kernel function is linear. The hyperparameters of the

LSTM model were tuned by Keras Tuner, traversing

1024 different parameter combinations. The final

optimal LSTM model consists of two layers of LSTM,

the first layer has 100 neurons and returns sequences,

and the second layer has 100 neurons and does not

return sequences, both with a dropout rate of 0.2. The

model uses Adam's optimizer, with a learning_rate of

0.01, and has been trained with 500 epochs to achieve

stable predictions. Stable prediction results were

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

230

achieved. The loss function is Mean Square Error

(MSE) and the batch size is 32.

3 RESULTS AND DISCUSSION

3.1 Model Performances

In this study, the authors employed three distinct

models, i.e., ARIMA, SVR, and LSTM, to forecast

the closing price of Tencent Holdings' stock. The

predictive efficacy of each model was evaluated using

a set of performance metrics, including MSE, MAE,

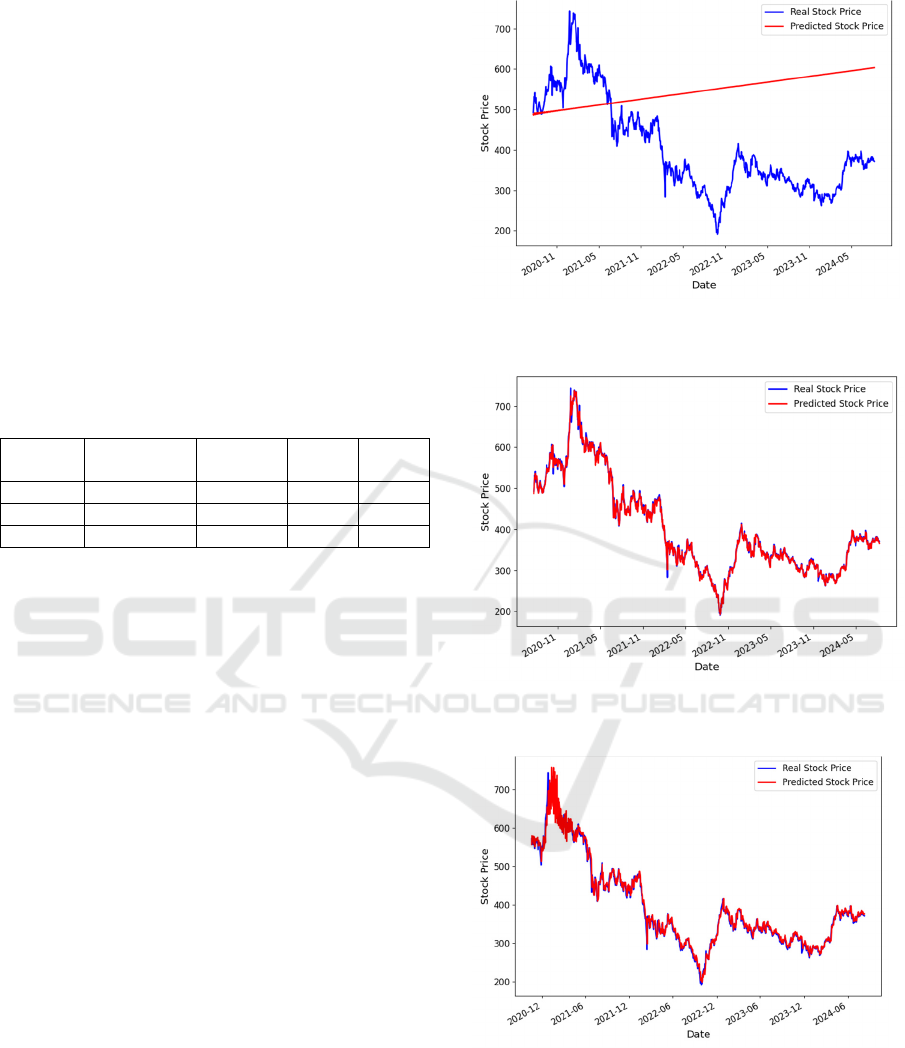

R², and MPAE. As illustrated in Table 1, the

subsequent section presents a comprehensive

performance and comparative analysis of each model.

Table 1: Model Prediction Performance Comparison Table.

Model MSE MAE

R²

MPAE

ARIMA 40491.03 179.15 -2.0378 53.29%

SVR 14.83 2.85 0.9989 0.70%

LSTM 196.63 9.13 0.9848 2.23%

The ARIMA model employs time series

differencing to process non-stationary data,

exhibiting efficacy in capturing short-term

fluctuations. However, the model demonstrates

suboptimal performance in long-term forecasting.

The ARIMA model yielded a MSE of 40491.03, a

MAE of 179.15, a R² of -2.04, and a MPAE of

53.29%. The negative R² value indicates that the

ARIMA model does not fit the stock price data well,

and that the prediction results are significantly

inaccurate. As illustrated in Figure 1, the ARIMA

model is unable to accurately capture the primary

trend of the stock price, particularly when the stock

price exhibits significant fluctuations. In such

instances, the model's prediction demonstrates a

persistent deviation.

The SVR model demonstrates an exceptional

capacity for forecasting Tencent's stock price

movements. The model exhibits a MSE of 14.83, a

MAE of 2.85, a high R² of 0.9989, and a MPAE of

0.70%.These results proved that the SVR model can

well fit the actual data of stock price and achieve high

prediction accuracy, especially for those nonlinear

time series with complex patterns. Figure 2 suggests

that it can perfectly reproduce the trend of real stock

price fluctuation and short-term predictive

performance, as a SVR model.

Figure 1: Tencent Stock Price Prediction Using ARIMA

(Photo/Picture credit: Original).

Figure 2: Tencent Stock Price Prediction Using SVR

(Photo/Picture credit: Original).

Figure 3: Tencent Stock Price Prediction Using LSTM

(Photo/Picture credit: Original).

Since there is high time-series with the dataset,

LSTM model outperforms in processing complex

signals likely capturing long-term dependencies and

nonlinear features. Model has MSE: 196.63, MAE:

9.13, R²: 0.9848 and MPAE: 2.23%. Even though the

Prediction of Tencent Share Price Based on ARIMA, SVR and LSTM

231

LSTM model performs lower than SVR, it shows

unique power to catch stock price changes over long-

time horizons. Figure 3 illustrates that the LSTM

model is able to follow long-term trends of stock

prices relatively well. More importantly, it can

perform well to keep a reasonably accurate level of

prediction especially when facing long-term stock

price fluctuation.

The SVR model has the best fitting result and

robustness in short-term forecasting among all

models, while LSTM can better capture long term

trends. On the other hand, a ARIMA model that only

uses both autoregressive and difference terms of time

series show relative weak performance in the

complex stock market.

3.2 Explanation and Implications

While the LSTM model showed under-perfromace on

short term compared to SVR, it had a significant

ability in capturing long range dependencies. The

specific memory structure of the LSTM model allows

for capturing long-term trends and patterns in time

series data particularly relevant to various strategies.

The LSTM model will help investors to understand

the long-term trajectory of its stock price, given that

it is a technology giant and has good scope for growth

in future as well, so they can design their investment

portfolio accordingly. This by integrating the short-

term trend and long term factoring, investor could

shift their investment style according to market

dynamics focusing more towards a balance of profit

between game than from a view with only eye on the

ball.

3.3 Limitations and Prospects

This research uses three models in this paper to

systematically analyze and forecast Tencent stock.

However, the research of this study with ARIMA,

SVR and LSTM models sftill has some limitation. In

other words, the ARIMA model is only suitable for

univariate time series prediction and it cannot include

external factors that affect stock prices like

macroeconomic data or company financials. The

ARIMA model competence is limited updating data

set with changing market context. Second, despite the

improved nonlinear processing by SVR and LSTM

models, these more advanced methods also suffer

from higher computational demand. The LSTM

model is a time and computationally exhaustive

process, both for training the network —that involves

hyperparameter tuning; background search over

every possible value. In addition, the dataset can be

divided into three cases with different lengths to

better detect the short-, medium- and long-term

predictions of the three models.

A more limitation is the curtailment of data set.

This study uses daily stock prices that are based on

historical data of the market, which can reflect market

behavior in hindsight but does not completely

represent all complex and uncertain future dynamics.

Moreover, training the model does not have include

those other external factors that one cannot control

with most weight as news/policy/economy etc may

fluctuate the stock prices to another front which is

difficult for the model to treat accurately.

With this in mind, future research could advance

these findings at several levels. Next, future work

may implement similar multivariate time series

models with exogenous features (e.g.,

macroeconomic metrics and industrial trends) to

enhance the precisions of stock price predictions.

Finally, the combination with further advanced deep

learning such as attention mechanisms and graph

neural networks together with nonlinear models like

SVR or LSTM might be another way to improve

performance. It might therefore increase the

prediction performance of the model. Additionally,

by incorporating new sources of data such as

technical analysis and sentiment analysis which

covers various market sentiments from company

news reports to social media may give a more holistic

view on providing inputs for making stock price

predictions. Another important issue is the

establishment of hybrid models that combine

different model capabilities together. For example, a

hybrid model of SVR short-term prediction and

LSTM long-term prediction could be established to

grasp the market volatility in the short term by

ignoring trend alternation for a longer period. This

will provide investors a better ability to analyze the

market and make more data-driven investment

decisions in one of the fastest moving markets.

4 CONCLUSIONS

To sum up, this study systematically examines the

predictability of Tencent Holdings stock price using

ARIMA, SVR and LSTM models. The results

demonstrate that SVR is good at predicting the short-

term stock price and recording change in market,

while LSTM has a better ability to catching long-term

patterns and dependence. While on the other hand,

even though ARIMA model has great uses for

stationary time series but in a lot of classical and

complex financial time series problems it provides

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

232

very poor results due to its linearity nature. Besides,

it fails to consider multivariate information and

external market factors in this paper which may result

in prediction accuracy is not high. Further research

may combine multiple models as well as incorporate

more externals data sources, such market sentiment to

enhance the prediction. The results of this paper add

to investors in the stock market gives a reference on

improving short-term or long-short strategies

according to different forecasting models.

REFERENCES

Abdulrahman, U. F. I., Ussiph, N., Hayfron-Acquah, B.,

2020. A hybrid arima-LSTM model for stock price

prediction. International Journal of Computer

Engineering and Information Technology, 12(8), 48-51.

Ariyo, A. A., Adewumi, A. O., Ayo, C. K., 2014. Stock

price prediction using the ARIMA model. 2014 UKSim-

AMSS 16th international conference on computer

modelling and simulation, 106-112.

Bhandari, H. N., Rimal, B., Pokhrel, N. R., Rimal, R., Dahal,

K. R., Khatri, R. K., 2022. Predicting stock market

index using LSTM. Machine Learning with

Applications, 9, 100320.

Fama, E. F., 1995. Random walks in stock market prices.

Financial Analysts Journal, 51(1), 75-80.

Li, H. Y., 2022. Research on quantitative stock selection

based on SVR. Industrial Innovation Research, 21, 127-

129.

Lu, S., Li, X., Qi, Y., Zheng, Z., 2021. Comparison of

Different Asset Pricing Models Based on Alibaba and

Tencent Stocks. 2021 3rd International Conference on

Economic Management and Cultural Industry

(ICEMCI 2021) 3118-3124.

Shi, C., Zhuang, X., 2019. A study concerning soft

computing approaches for stock price forecasting.

Axioms, 8(4), 116.

Sun, L., Yuan, H., 2023. Research on the tencent company

stock price based on ARIMA model. Advances in

Economics, Management and Political Sciences, 64(1),

263–268.

Wang, Y., Li, Q., Huang, Z., Li, J., 2019. EAN: Event

attention network for stock price trend prediction based

on sentimental embedding. Proceedings of the 10th

ACM conference on web science 311-320.

Weng, Z., 2023. Analysis and prediction of stock prices

based on ARIMA model: A case study of China

Construction Bank. Modern Information Technology,

14, 137-141.

Yang, Q, Wang, C., 2019. Research on global stock index

prediction based on deep learning LSTM neural

network. Statistical Research, 3, 65-77.

Zhou, S., 2021. A Stock Prediction Method Based on LSTM.

Emerging Trends in Intelligent and Interactive Systems

and Applications: Proceedings of the 5th International

Conference on Intelligent, Interactive Systems and

Applications (IISA2020), 186-193.

Prediction of Tencent Share Price Based on ARIMA, SVR and LSTM

233