Forecasting of Share Prices Based on Hybrid Model of CNN and

LSTM: A Multi-Factor Approach

Jialin Tian

a

Department of Beijing-Dublin International College, Beijing University of Technology, Beijing, China

Keywords: CNN-LSTM, Stock Price Prediction, Deep Learning, Financial Forecasting, Time Series Analysis.

Abstract: As a matter of fact, hybrid models are widely adopted in pricing models contemporarily. This study uses a

hybrid Convolutional Neural Network-Long Short-Term Memory (CNN-LSTM) model to investigate price

prediction for stocks, taking macroeconomic and technical indicator effects into account. The dataset includes

40 medical device firms' daily stock values from January 2022 to August 2024. Upon completing training and

optimization, the model demonstrated its ability to accurately identify brief variations in stock prices and

forecast the closing price of the stock market for the upcoming day by utilizing five days' worth of pertinent

data. The model's Mean Absolute Percentage Error (MAPE) is 6.53%, its Root Mean Square Error (RMSE)

is 4.95, and its Adjusted R² is 0.9968. However, when the model encounters an extremely high range of stock

prices (500-700), its accuracy decreases as the true stock price increases. Future research may aim to enhance

stock price prediction especially when experiencing very high share prices and expand the dataset in multiple

sections to improve generalizability. This research investigates the utility of CNN-LSTM models in guiding

investors to more accurately predict stocks in the healthcare sector (after epidemic), providing relevant

references for future research.

1 INTRODUCTION

Traditional approaches to stock price prediction

focused on statistical techniques like ARIMA and the

moving average method in time series analysis (Ma,

2020). These techniques were grounded in historical

price data and assumed that the market was stable

enough for price fluctuations to be forecasted through

linear regression and statistical methods. However,

the growing complexity and volatility of modern

financial markets have exposed the limitations of

these methods, which struggle to address nonlinear

relationships and sudden market shifts (Ma, 2020;

Sherstinsky, 2020).

With the progress of computer hardware and

software technologies, as well as the ongoing

enhancement of deep learning models, the

significance and reputation of deep learning models

in stock price forecasting have grown substantially

starting from the 1990s. The reason for this is because

these models have robust computational, data

processing, and forecasting skills, which allow them

to attain superior accuracy in time series forecasting

a

https://orcid.org/0009-0007-8222-2561

within the financial industry. Neural networks,

particularly multilayer perceptions (MLPs), were

among the first models used to capture nonlinearities

in the stock market. With the advancement of the

field, researchers acknowledged the constraints of

conventional feed-forward networks in time series

forecasting. This recognition prompted the

development of recurrent neural networks (RNN) and

long-short-term memory (LSTM) networks, which

are more effective in capturing long-term

relationships (Hochreiter & Schmidhuber, 1997).

Indeed, hybrid models that integrate

Convolutional Neural Networks (CNNs) and Long

Short-Term Memory (LSTMs) have garnered

significant attention and have found extensive use

within the domain of economic projections. They

have their own properties, with CNNs being good at

recognizing spatial patterns and LSTMs being

suitable for time series processing (Houdt et al.,

2020). The combination of the two models

complements each other, and researchers are

currently utilizing these combined models since their

222

Tian, J.

Forecasting of Share Prices Based on Hybrid Model of CNN and LSTM: A Multi-Factor Approach.

DOI: 10.5220/0013213700004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 222-228

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

objective is to enhance the precision and resilience of

financial market predictions (Wu et al., 2021).

Although a review study by Greg Van Houdt et al.

proposed the use of Vanilla LSTM, which is the basic

form of the LSTM, for time series tasks has the best

performance (Houdt et al., 2020). The fact is that the

CNN-LSTM model has been widely adopted and

researched for stock price forecasting and has

achieved an exceptional degree of precision. In the

study conducted by Lu et al., this integrated model

shown superior accuracy and performance compared

to other models including Recurrent Neural Network

(RNN), CNN, Multilayer Perceptron (MLP), LSTM,

and CNN-RNN (Lu et al., 2020). In addition to this,

Can Yang and colleagues have demonstrated that the

model also achieves better results after ranking stock

indices using the PPMCC (which is a statistical

measure called Pearson Product Moment Correlation

Coefficient) prior to training (Yang et al., 2020).

Firuz et al. used data from ten major U.S. companies

over a ten-year period, and Jimmy Ming-Tai Wu et al.

applied to ten stocks in the U.S. and Taiwan, and both

studies achieved good forecasting results (Kamalov et

al., 2021; Wu et al., 2021). Moreover, augmenting the

model by denoising historical stock data through

wavelet transform or integrating the attention

mechanism can further improve its ability to detect

key patterns, thereby increasing its accuracy (Qiu et

al., 2020). In addition, it has been shown that hybrid

models that incorporate both technical and

macroeconomic indicators tend to capture a wider

range of factors affecting stock prices, leading to

better results.

This paper is inspired by Widodo Budiharto's

research, which utilized R programming and LSTM

models to analyse stock price predictions in Indonesia

throughout the COVID-19 period (Widodo et al.,

2021). After the country’s first confirmed COVID-19

case on March 2, 2020, Indonesia's Benchmark Stock

Index dropped sharply by 28% before next year.

Widodo’s work employed big data provided by

Yahoo Finance, targeting major banks, specifically

Bank Central Asia (BCA) and Bank Mandiri. His

experiments showed that data science and LSTM

models were highly effective at predicting key market

prices, including the opening, highest, lowest, and

closing figures (OHLC), with an accuracy rate of

94.57%. Building on the demonstrated effectiveness

of LSTM models for short-term stock prediction, this

study seeks to apply a similar methodology in a

different context. The primary target is to predict the

next-day closing prices for 40 stocks in the medical

device sector, using data from yfinance started at

January 1, 2022, to the present (August, 2024). The

goal is to gain insight into stock price trends in a post-

pandemic market environment, particularly in an

industry that has been heavily impacted by pandemic.

The rest part of the paper is organized as follows. The

Sec. 2 covers the data collection process, stock

selection, preprocessing, and CNN-LSTM model

architecture. Sec. 3 displays the results of model

predictions, incorporating performance metrics and

contrasting them with other models. Sec. 4

summarizes key findings, conclusions, and directions

for further studies.

2 DATA AND METHOD

This study utilizes data from Yahoo Finance,

focusing on 40 companies in the medical device

sector. The records spans at January 1, 2022, to

August 25, 2024, offering an evaluation of stock

market movements in the aftermath of the COVID-19

crisis. The yfinance Python module was utilized to

acquire the data. It provides daily stock price

indications, such as open, high, low, close, volume,

and other financial-related details. Technical

indicators, including Stochastic Oscillator Indicator

(KDJ), Moving Average Convergence Divergence

(MACD), Relative Strength Index (RSI), Bollinger

Bands, and moving averages, were calculated through

the stockstats library.

The dataset comprises both independent variables

and a dependent variable (the stock's closing price).

The independent variables encompass a range of

stock-related data, including opening price, highest

and lowest price, as well as trading volume. In

addition, financial ratios such as market

capitalization, PB ratio, and PS ratio were considered.

Furthermore, the analysis included technical

indicators such as moving averages, RSI, and MACD.

All of these variables were employed in forecasting

the closing price for the following trading day.

To facilitate the development of the model, the

dataset was divided into three distinct segments: Only

70% of the dataset was allocated to the training set,

while the remaining 15% was reserved for validation,

and testing received the remaining 15%. The

validation dataset was utilised to fine-tune the

hyperparameters of the approach, while the training

phase facilitated the model's learning process. Lastly,

the test set served as a foundation for assessing the

model's overall effectiveness. The data were

standardized using the MinMaxScaler function to

increase the model's efficacy and prevent scaling

discrepancies. By combining stock prices, technical

indicators, and financial ratios, the dataset provides

Forecasting of Share Prices Based on Hybrid Model of CNN and LSTM: A Multi-Factor Approach

223

comprehensive input for this model, with the closing

price as the target variable.

This thesis uses a hybrid CNN-LSTM model to

forecast the precise increase and fall of healthcare

businesses' closing prices for the upcoming day. In

order to handle the historical data with extra

activation functions first, a convolutional layer is

added before the LSTM input layer, which is

commonly employed for long-term or short-term time

series prediction applications. While the LSTM layer

manages the temporal consistency of the stock price

and acquires knowledge of the relationships over time

in order to consistently generate an improved

prediction, the CNN component gathers relevant

features from the stock data.

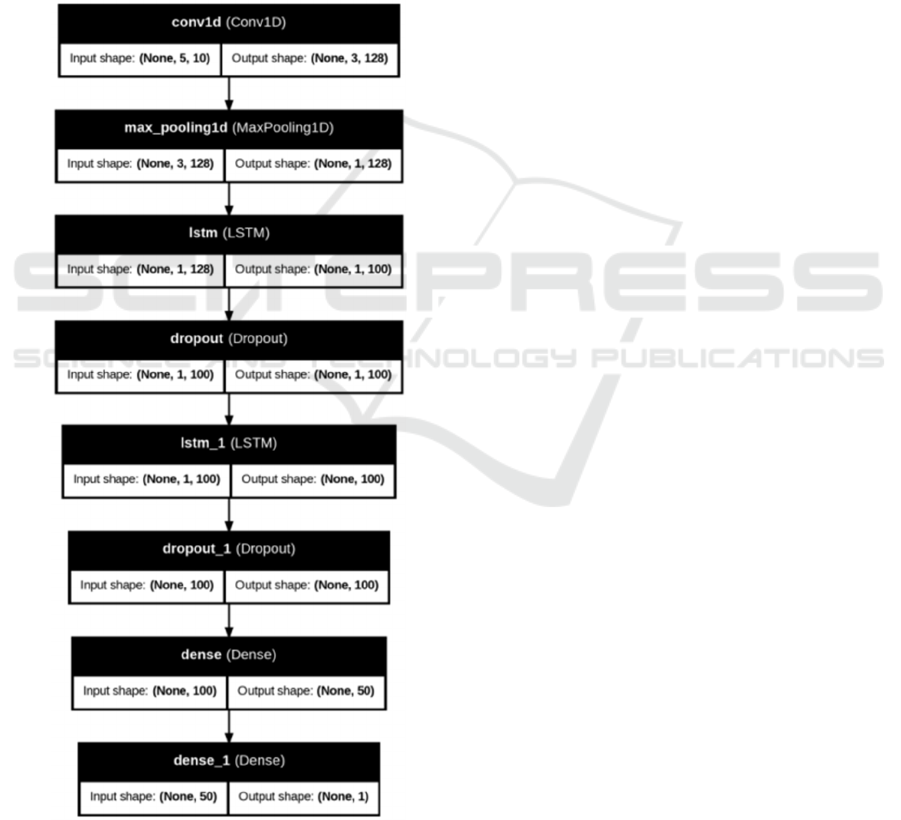

Figure 1: CNN-LSTM Model Architecture (Photo/Picture

credit: Original).

The ephemeral loss diagram (Fig. 1) illustrates

that the CNN-LSTM model architecture used in this

work is made up of a number of essential elements.

The Conv1D layer, which has 64 filters and a kernel

size of three, is the first layer in the model. Its job is

to extract localized patterns from the input data,

including short-term trends in stock prices. The

MaxPooling1D layer, which lowers the

dimensionality of the data while maintaining

important characteristics, comes next. Two stacked

LSTM layers are placed after this. The 50-cell first

LSTM layer sends its output sequence to the second,

likewise 50-cell LSTM layer. The purpose of these

layers is to extract long-term relationships from the

stock price data. An additional culling layer with a

culling rate of 0.5 is included after each LSTM layer

to enhance the model's generalisation and mitigate

overfitting. The final layer consists of two thick

layers: one with one unit for stock closing price

prediction and the other with 25 units triggered using

ReLU.

A number of crucial parameters were defined

during the construction of the model. The Adam

optimiser was employed to adaptively modify the

weights of the model during training, with a learning

rate of 0.00001. An optimal batch size of 32 was

selected to achieve a harmonious equilibrium

between the speed of training and the performance of

the model. In order to avoid overfitting, the model

was trained for a maximum of 100 epochs and early

stopping was implemented based on the validation

loss. Furthermore, a dropout rate of 0.5 was applied

to mitigate the potential for overfitting, a critical

concern for intricate models such as CNN-LSTM.

The performance of the CNN-LSTM model was

evaluated using many well-established metrics often

employed in regression tasks. The MSE was

employed as the loss function during training to

quantify the means squares differences between the

real and predicted stock prices. For enhanced

understanding of the model's performance, the Root

Mean Square Error (RMSE) was computed and

expressed in the same units as stock prices. The

accuracy of the predictions was evaluated using the

Mean Absolute Percentage Error (MAPE), which

quantifies the error as a percentage relative to the

actual data. Furthermore, the model's capacity to

elucidate fluctuations in stock prices was evaluated

using the R-squared (R²) measure; higher R² values

indicate a stronger correspondence. Using a different

test dataset, these measures were used to verify the

model. To provide further light on the accuracy and

resilience of the model, visual comparisons of actual

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

224

and projected stock prices, learning curves, and

residual analyses were also carried out.

3 RESULTS AND DISCUSSION

3.1 Model Performance

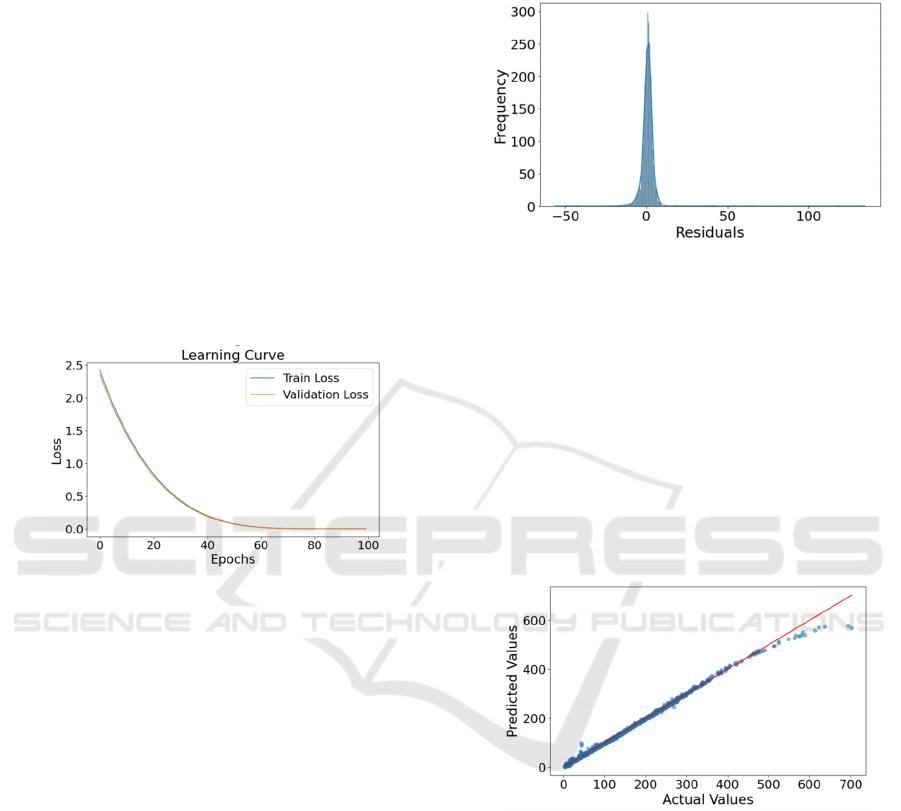

This study assessed the CNN-LSTM model's

forecasting capability using a number of indicators

and visualization tools. The training loss and

validation loss both exhibit a smooth and continuous

lower trend as the calendar time advances, as seen in

Fig. 2, indicating that the model has suitably

converged. By the 100th calendar element, the loss

value approaches zero; this is a good indication that

the model has effectively learned the basic patterns in

the dataset without overfitting.

Figure 2: Loss over epochs graph (Photo/Picture credit:

Original).

The average magnitude of the prediction error is

shown by the model's RMSE, which is 4.9518.

Furthermore, the Mean Percentage Error (MPE) of

2.4380 shows that there is not much of an absolute

difference between the actual and anticipated stock

values. Additionally, the model's MAPE reached

6.53% indicates that, on average, the model's

predictions deviate from the actual values by

6.53%—a relatively small amount for stock price

projections. The model's excellent prediction

accuracy is further supported by its high Adjusted R²

score is up to 0.9968, which indicates that practically

the model captures the entirety of the volatility in

stock prices.

Furthermore, it can be seen from the residual

distribution plot (shown in Fig. 3) that the majority of

the residuals are concentrated around zero,

demonstrating an adequate relationship among the

actual share prices and the projections made by the

model. A small number of residuals, on the other

hand, differ noticeably from zero, suggesting that

there may be some extreme situations or outliers

where the predictions of the model are relatively

inaccurate. However, the distribution as a whole

shows that the model works well throughout the full

dataset.

Figure 3: Residuals Distribution plot (Photo/Picture credit:

Original).

The scatter plot of anticipated against real values

(as illustrated in Fig. 4) illustrates the link between

expected and actual stock prices, which may be

employed to conduct an additional evaluation of the

model's precision. The diagonal reference line is

where the majority of the dots are closely packed,

suggesting a strong connection between the

anticipated and actual values. The plot's linearity

suggests that the system is capable of effectively

represent the general pattern of changes in stock

prices.

Figure 4: Scatter Plot of Predicted vs Actual Values

(Photo/Picture credit: Original).

In conclusion, the depiction of residuals vs

forecasts in Fig. 5 provides a more detailed

representation of the forecast errors. The residuals

stay around zero for lower expected stock prices.

Nonetheless, the residuals tend to become more

evenly distributed for higher anticipated values,

indicating a decline in the model's prediction

accuracy for higher stock prices. This observation

suggests a common problem with financial time

sequence information: the model's limited capacity to

extrapolate significant price fluctuations.

Forecasting of Share Prices Based on Hybrid Model of CNN and LSTM: A Multi-Factor Approach

225

Figure 5: Predicted vs Actual Values (Photo/Picture credit:

Original).

The model's accuracy of 75.20 percent within a

5% tolerance is established by the fact that over 75%

of the forecasts fall within a 5% range of the actual

stock price. This observation implies that the model

achieves consistent performance in most situations.

3.2 Explanation and Implication

The model's outcomes demonstrate how well the

hybrid CNN-LSTM architecture predicts stock

values, particularly in the healthcare industry. The

model's promise for short-term stock price prediction

is highlighted by its ability to decrease forecast error

while retaining high accuracy. The model's ability to

identify relevant patterns in stock price changes is

attributed to the seamless integration of CNN's spatial

feature extraction skills with LSTM's expertise in

continuous data processing. This makes the model an

effective tool for financial research. Specifically, the

model's remarkable RMSE and MAPE values suggest

that it is a good fit for situations requiring precise

short-term forecasting.

The residual distribution shows that the model

performs consistently over the majority of data

points, which is one of the analysis's most significant

conclusions. This consistency shows that the CNN-

LSTM model is successful in identifying regular price

trends in the dataset and accurately indicates the

fundamental patterns influencing stock prices. This

success is mostly attributable to the model's

architecture, which makes use of CNN's capacity to

recognize spatial characteristics in stock prices and

LSTM's potency in capturing long-term relationships.

As a consequence, the model functions admirably

under typical market circumstances and develops into

a trustworthy instrument for stock trend prediction.

However, the research also points to several

drawbacks. More specifically, at the high end of the

expected values, the residuals exhibit wider spreads,

indicating that the model has difficulty properly

capturing significant price fluctuations. This

weakness might be caused by a number of things. One

potential limitation of the algorithm is its confined

ability to generalise to significant price fluctuations if

the training data lacks enough instances of such

occurrences. Second, a wide range of unpredictably

occurring external variables can affect stock markets,

including shifts in investor attitude, changes in

economic policy, and international occurrences like

natural catastrophes or geopolitical conflicts. These

variables provide a level of unpredictability that is

challenging for any model to accurately forecast.

The model's incapacity to precisely represent the

sharp variations in the market offers a chance for

additional improvement. Forecast accuracy becomes

more crucial for traders and investors in extremely

turbulent markets since misjudging price changes can

result in large losses. On such situations, the

functioning of the mathematical framework can be

improved by incorporating supplementary

techniques. An attention mechanism, for instance,

might be used to assist the model in concentrating on

the most important aspects of the data, improving its

ability to handle times of extremely high or low price

volatility. The attention method helps the model

prioritize the elements most likely to create volatility

in stock prices by giving more weight to more

relevant data items. Furthermore, to offer a more

comprehensive knowledge of price volatility in the

model, more sophisticated volatility modeling

approaches like GARCH (which is as know as the

Generalized Autoregressive Conditional

Heteroskedasticity) or stochastic volatility models

can be incorporated. In turbulent markets, these

strategies are a perfect complement to the CNN-

LSTM framework since they are made to account for

the degree of volatility over time. The hybrid

architecture can become more beneficial for traders in

extremely volatile areas by including these models

and perhaps producing better predictions for extreme

market circumstances.

Practically speaking, the study's findings

demonstrate that while the CNN-LSTM model does a

great job of tracking ordinary stock price patterns,

more work is obviously required to solve the model's

shortcomings in harsh circumstances. Accurate

forecasting is essential in the quickly evolving

financial markets, particularly in those that are

extremely vulnerable to external shocks. Better

models that perform effectively in the face of

significant market disruptions as well as consistently

anticipating typical swings in stock prices would be

beneficial to traders and investors.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

226

In summary, the CNN-LSTM model shows a lot

of promise for stock price prediction, particularly in

sectors like healthcare where regular patterns may be

noticed. However, the model would benefit from the

inclusion of more sophisticated strategies like

attention processes and volatility-specific models in

order to reach its full potential, particularly in

turbulent markets. Enhanced management of

challenging market conditions might enhance the

effectiveness of the model as a tool for buyers and

sellers, enabling them to more effectively mitigate

risk and make more informed decisions in volatile

market settings.

3.3 Limitation and Prospects

Future research must address several shortcomings of

the CNN-LSTM model despite its outstanding

prediction performance. First, although while the

model's modified R ² score of 0.9968 and decent

MAPE of 6.53% are remarkable, its accuracy falls to

75.20% within a 5% tolerance, suggesting that the

model has trouble with extremely high market

volatility. This is in line with the 4.9518 root mean

square error, which suggests a significant error rate in

outlier prediction. To better control abrupt market

spikes, future research should examine sophisticated

volatility modeling methods like GARCH or

stochastic volatility models. Furthermore, employing

hybrid models or ensemble techniques like XGBoost

or Random Forest may help increase the accuracy of

forecasts for turbulent markets.

Second, the study's dataset only covers the years

2022–2024, which would restrict how broadly the

model can be applied to other market scenarios or

longer time horizons. To enhance the testability of the

framework, it would be beneficial to broaden the

dataset to encompass a more extensive spectrum of

economic cycles, including both bullish and bearish

markets. Furthermore, the forecast accuracy of the

model may be increased by adding macroeconomic

data like inflation, interest rates, or global indices,

particularly for sectors like healthcare and real estate

that are sensitive to changes in the economy.

Ultimately, investigating other deep learning

architectures can enhance performance even more,

even though CNN-LSTM models are good at

identifying transient patterns. More intricate long-

term relationships that CNN-LSTM could overlook

might be captured by models like morphers or graph

neural networks (GNN). Furthermore, attention

methods may be employed to allow models to focus

on the key elements of the input procedure, thereby

improving performance in industries such as online

shopping where price fluctuations or non-linear

variations are frequent.

4 CONCLUSIONS

To sum up, an amalgamated CNN and LSTM model

is employed to forecast stock values within the

healthcare industry. Within a multifactor analysis, the

model takes into account both technical and

macroeconomic factors. The results showed that this

hybrid model effectively captures short-term stock

price fluctuations, the RMSE is 4.9518, MAE

reaching 2.4380, and MAPE stood at 6.53%. The

model also achieved an Adjusted R² score of 0.9968,

reflecting its strong predictive capability. The scatter

and residual plots demonstrated the performance of

tracking most price trends, showcasing its reliability

in managing regular stock market variations.

Nevertheless, the model's accuracy, at 75.20% within

a 5% margin, revealed challenges in predicting

extreme price shifts, highlighting the need for

improvements in volatility handling. Future research

could incorporate attention mechanisms and larger

datasets to improve the model’s performance in

volatile market environments. Ultimately, this work

improves financial forecasting by showcasing the

effectiveness of CNN-LSTM models in predicting the

future trajectory of stock values, therefore offering

precise value and significant insights to market

analysts and investors.

REFERENCES

Budiharto, W., 2021 Data science approach to stock prices

forecasting in Indonesia during Covid-19 using Long

Short-Term Memory (LSTM). Journal of Big Data, 8(1).

Hochreiter, S., Schmidhuber, J., 1997. Long short-term

memory. Computation MIT-Press.

Houdt, G. V., Mosquera, C., Nápoles, G., 2020. A review

on the long short-term memory model. Artificial

Intelligence Review, 53(8), 5929-5955.

Kamalov, F., Gurrib, I., Rajab, K., 2021. Financial

Forecasting with Machine Learning: Price Vs Return.

Journal of Computer Science, 17(3), 251-264.

Lu, W., Li, J., Li, Y., Sun, A., Wang, J., 2020. A CNN-

LSTM-Based Model to Forecast Stock Prices.

Complexity, 2020(1), 6622927.

Ma, Q., 2020. Comparison of ARIMA, ANN and LSTM for

Stock Price Prediction. E3S Web of Conferences, 218,

01026.

Qiu, J., Wang, B., Zhou, C., 2020. Forecasting stock prices

with long-short term memory neural network based on

attention mechanism. PLOSone, 15(1), e0227222.

Forecasting of Share Prices Based on Hybrid Model of CNN and LSTM: A Multi-Factor Approach

227

Sherstinsky, A., 2019. Fundamentals of recurrent neural

network (rnn) and long short-term memory (lstm)

network. Physica D: Nonlinear Phenomena, 404.

Wu, J. M., Li, Z., Herencsar, N., Vo, B., Lin, J. C., 2021. A

graph-based CNN-LSTM stock price prediction

algorithm with leading indicators. Multimedia

Systems, 29(3), 1751-1770.

Yang, C., Zhai, J., Tao, G., 2020. Deep learning for price

movement prediction using convolutional neural

network and long short

‐

term memory. Mathematical

Problems in Engineering, 2020(1), 2746845.

Zong, X., 2020. Mlp, cnn, lstm and hybrid svm for stock

index forecasting task to indu and ftse100. SSRN

Electronic Journal, available at SSRN 3644034.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

228