Stock Price Prediction Based on LSTM-GBM: Evidence from Haier

Smart Home

Zimo Li

School of Mathematical Sciences, Ocean University of China, Qingdao, China

Keywords: Sock Price Prediction, Deep Learning, LSTM, GBM.

Abstract: In the past few years, stock prices forecasting has been a hot topic due to the non-linear relationships and the

uncertainty of the stock prices. In the meantime, machine learning, especially deep learning method, has made

great progress. More and more studies show that machine learning models might capture features that are

hard for traditional methods to observe, which means these models might be more apposite for forecasting

time series. A new model named LSTM-GBM is designed to forecast the share prices of Haier Smart Home.

The long short-term memory (LSTM) model is responsible for giving a specific prediction while the

Geometric Brownian Motion (GBM) model is in charge of adding uncertainties to the predictions. The final

prediction path will be generated through a filtrating mechanism, which makes a secondary screening of the

two models. In addition, a possible upgrading model named LSTM-GBM-LSTM is proposed which is adding

a LSTM model after the filtrating mechanism. This thesis compares the performances of LSTM-GBM model

with LSTM model, GBM model and LSTM-GBM-LSTM model. The results indicate that LSTM-GBM has

made the best prediction. These results suggest that it is feasible to project the stock price through LSTM-

GBM model. Besides, more effort is needed to improve the performance of LSTM-GBM-LSTM model.

1 INTRODUCTION

Equity price forecast is the process of making

judgement about future stock price movements based

on historical indices such as market data. Stock price

market is an essential component of the economy

(Zhang et al., 2023). Generally, stock prices are

influenced by company conditions, economic

environments, market situations and external events

(Ji et al., 2021). Due to the huge economic impact on

individuals and the challenge of processing non-

linear data, stock price prediction is a topic worth

discussing (Wang et al., 2021).

Contemporarily, a lot of methods are introduced

in the stock market, but many traders and researchers

mainly focus on machine learning method. Compared

with traditional approaches, using machine learning

methods is more likely to interpret the extract

information from the data (Mahesh, 2020), which is

adapted to the uncertainty of stock market. Therefore,

machine learning methods are able to assist traders to

make correct predictions (Obthong et al., 2020).

However, the machine learning method has gone

through a series of updates in a few decades.

Traditional machine learning approaches are

mainly applied in earlier years. Among those

practices, Naive Bayes, Support Vector Machine

(SVM), Random Forest (RF) and K-Nearest

Neighbour (KNN) are relatively representative (Soni

et al., 2022). Kumar et al. had made comparison

between the models above and observed that RF

made the most accurate prediction. Models at that

time are based on different but independent

algorithms, which means the frameworks are

relatively simple (Kumar et al., 2018).

With the appearance of advanced learning method,

neural networks are applied to forecast stock prices

(Nikou et al., 2019). The idea of neural networks is

originated from human brain, aiming to process and

identify complex information. Generally, a neural

network unit features an input layer, several hidden

layers, and an output layer. A neural network system

may consist of multiple such units. With the

cooperation of the nodes, neural networks are able to

process non-linear relationships through internal

structures and model the changes of stock price more

accurately (Rezaei et al., 2021). Some examples of

making stock price predictions through neural

networks will be presented subsequently.

214

Li, Z.

Stock Price Prediction Based on LSTM-GBM: Evidence from Haier Smart Home.

DOI: 10.5220/0013213200004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 214-221

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

Many methods of using neural networks have

been applied to predict the stock prices, including

using single neural network, composing multiple

neural networks and combining neural networks with

traditional models. Each method has distinct features,

contributing to make more accurate predictions.

Ghosh et al. designed a model that includes LSTM

(Long Short-Term Memory) to predict the closing

prices of 5 companies on Indian market (Ghosh et al.,

2019). After acquiring the predicted data of different

time spans, the thesis calculated the growth rates and

analysed the deviations of closing prices. At last, the

thesis found out that the deviations went down with

the growth of the time spans, which means the model

performed relatively well when predicting shared

prices over a long time period. Islam & Nguyen

compared the abilities of three models named

autoregressive integrated moving average (ARIMA),

artificial neural network (ANN), and stochastic

process-geometric Brownian motion (GBM) to

predict the stock prices (Islam & Nguyen, 2020). The

research analysed the residuals and calculated the

absolute percentage errors, the average absolute

errors, the average relative percentage errors, and the

root-mean-square errors of the models. The results

illustrated that both ARIMA model and the GBM

model were expert in analysing short time series

while fusing the existing model may improve the

ability of ANN. In other words, a possible way to

improve the ability of neural networks is combining

different neural network models. Rezaei et al.

developed two innovative models, CEEMD-CNN-

LSTM and EMD-CNN-LSTM, which combine the

deep learning capabilities with the efficiency of the

Empirical Mode Decomposition (EMD) and

Complete Ensemble Empirical Mode Decomposition

(CEEMD) techniques. Deep learning methods and

frequency decomposition algorithms were used in the

experiment, and performances of those models were

evaluated through calculating relevant metrics. The

research stated that CEEMD-CNN-LSTM model

performs more exact than EMD-CNN-LSTM model.

Lu et al. introduced the CNN-BiLSTM-AM

framework to project the share prices and compared

the performance of the proposed model with other

frameworks including MLP, CNN, RNN, LSTM,

BiLSTM, CNN-LSTM, and CNN-BiLSTM. After

comparing the indexes, the research found that CNN-

BiLSTM-AM made the most accurate prediction (Lu

et al., 2021). Johansson considered three recurrent

neural networks named LSTM-SDE, ESN-SDE and

LS-ESN-SDE to predict financial time series. The

three proposed model contain parametric neural

SDEs, which are the combinations of neural networks

and stochastic differential equation (SDE) models.

Compared with traditional LSTM model and

geometric Brownian motion model, three

experimental models have made more precise

predictions (Johansson, 2022).

Throughout the experiments, scientists adopted

diverse methods based on the significant advantages

of neural networks and the ability of traditional

algorithms. The models designed have achieved

impressive results in predicting time series. Inspired

by the previous progress, this thesis presented a fresh

model that combined a recurrent neural network and

geometric Brownian motion model. The aim and the

framework of this thesis will be presented in next part.

This thesis aims to forecast the share prices of

Haier Smart Home via the new framework named

LSTM-GBM and discuss a possible direction of

improving this model. In order to state the

experiment comprehensively, different contents will

be presented in different sessions. Section 2 will

introduce the basic information, which includes the

data, models in need, the way to improve the model

and the loss function of this experiment. The results

of the research and discussions will be demonstrated

in Section 4. Eventually, the conclusion of this

experiment will be proposed in Section 4.

2 DATA AND METHOD

2.1 Data

According to the data requirements and variables

used in this research, the primary variable is the

closing prices of Haier Smart Home each day from

2019-8-13 to 2024-8-12, which contain 1211 pieces.

Therefore, the amount of data is large enough to train

the model to make reliable predictions. Besides, the

data used in this thesis is up to date, which is able to

describe the latest stock movement. In the data, trade

date is characteristic variable and daily closing price

is object variable. In order to ensure adequate training

as well as provide stable evaluation results, the first

80% of the data is allocated to the training set while

the remaining 20% is allocated to the test set. To

achieve efficient model training, all data is

normalized before training LSTM models and

denormalized after the training process. This thesis

adopts Min-Max Normalization to convert the dataset

between 0 and 1 (Johansson, 2022). Through this

method, the data is normalized as:

𝑁𝑜𝑟𝑚

𝑋

=

()

(

)

()

(1)

Stock Price Prediction Based on LSTM-GBM: Evidence from Haier Smart Home

215

In addition, to fit the input shape of LSTM models,

the normalized data are sliced with the time span of

60 days, which means the LSTM models will learn to

predict the price of next day by processing the prices

from previous 60 days. Therefore, the test set will

cover 230 nodes.

2.2 Models

After processing the data, four models are adopted to

forecast the share prices. This section, this thesis will

introduce those models, including motivations,

frameworks and methods within this section. The

models are designed by Python. In addition, it is

necessary to introduce the loss function of the

experiment. LSTM model is one of the variants of

RNN (Recurrent Neural Network), designed to

address the vanishing error problem (Ta et al., 2020).

Through special gating mechanism, LSTM is able to

add new information and forget previous information

selectively. According to Hao & Gao, it is feasible

that time dependencies in the financial sequence are

able to be extracted by this model, which means

LSTM has significant advantage in processing time

series data like stock prices (Hao & Gao, 2020). The

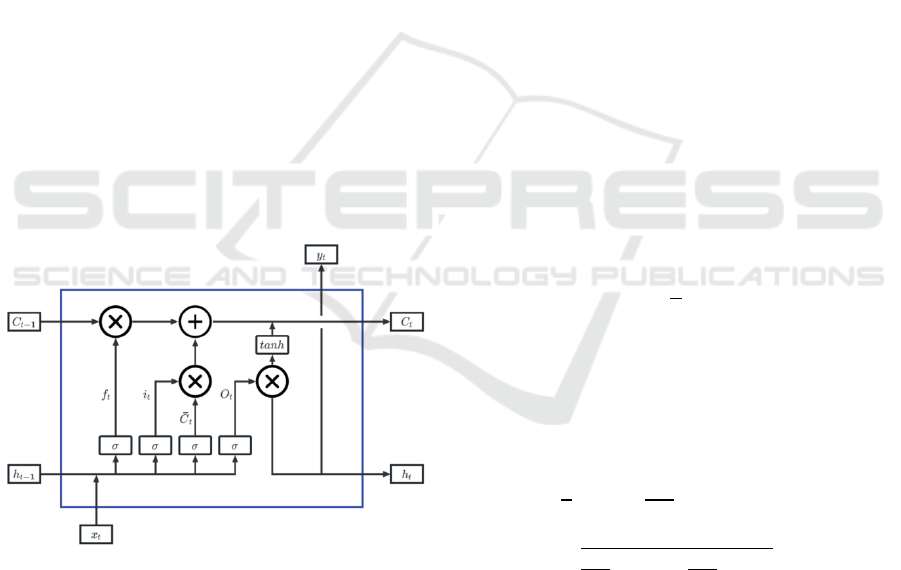

framework of a cycle unit of LSTM can be seen in

Fig. 1. It features three gate systems (input, forget,

output), cell states, input block, output block and

activation functions (Sherstinsky, 2020).

Figure 1: The Organization of a LSTM Cycle Unit

(Photo/Picture credit: Original).

It is assumed that in time step 𝑡, the input and

output of the unit are 𝑥

and 𝑦

. The forget gate

system settles what details will be discarded from the

cell state and input gate determines what details will

be updated. 𝑦

is mainly affected by the output gate,

which contains a 𝑠𝑖𝑔𝑚𝑜𝑖𝑑 layer and a 𝑡𝑎𝑛ℎ layer.

The 𝑠𝑖𝑔𝑚𝑜𝑖𝑑 layer is able to describe ingredients that

pass through by outputting numbers between 0 and 1.

The 𝑡𝑎𝑛ℎ layer is responsible for integrating

information through transferring numbers between -1

and 1. Concrete expressions of other functions in need

will be presented in Fig. 1. In the experiment, founded

on the learning results of the training set data, LSTM

outputs a specific target path 𝐿

∗

on the test set.

Stochastic Differential Equations (SDEs) are

mathematical methods used to simulate changes

affected by random factors (Särkkä & Solin, 2019).

Since stock price fluctuations are relatively uncertain,

SDE models are suitable for describing the changes

of stock market. An SDE consists of a certain part and

a random part, which is featured in Eq. (2):

𝑑𝑋

= 𝜇

(

𝑋

, 𝑡

)

𝑑𝑡+ 𝜎

(

𝑋

, 𝑡

)

𝑑𝑊

(2)

where 𝑋

is a stochastic process; 𝜇

(

𝑋

, 𝑡

)

is the drift

term; 𝜎

(

𝑋

, 𝑡

)

is the diffusion term; 𝑊

is a standard

Brownian motion. In financial field, another type of

SDE called GBM (Geometric Brownian Motion) is

the typical simulation in financial modeling due to its

concise mathematical model and high prediction

accuracy. The general form of a GBM is as follows.

𝑑𝑆

= 𝜇𝑆

𝑑𝑡+ 𝜎𝑆

𝑑𝑊

(3)

where 𝑆

is asset price; 𝜇 is the drift term; 𝜎 is the

diffusion term; 𝑊

is a standard Brownian motion.

The analytical solution of GBM is:

𝑆

= 𝑆

exp 𝜇−

1

2

𝜎

𝑡+ 𝜎𝑊

(4)

where 𝑆

is the initial asset price. The experiment

uses Eq. (3) as the iterative formula and assumes that

𝜇 and 𝜎 is equal to the mean and standard deviation

of the logarithmic return on the stock price of the

training set.

𝜇 =

∑

ln (

)

(5)

𝜎 =

∑

[ln

− 𝜇]

(6)

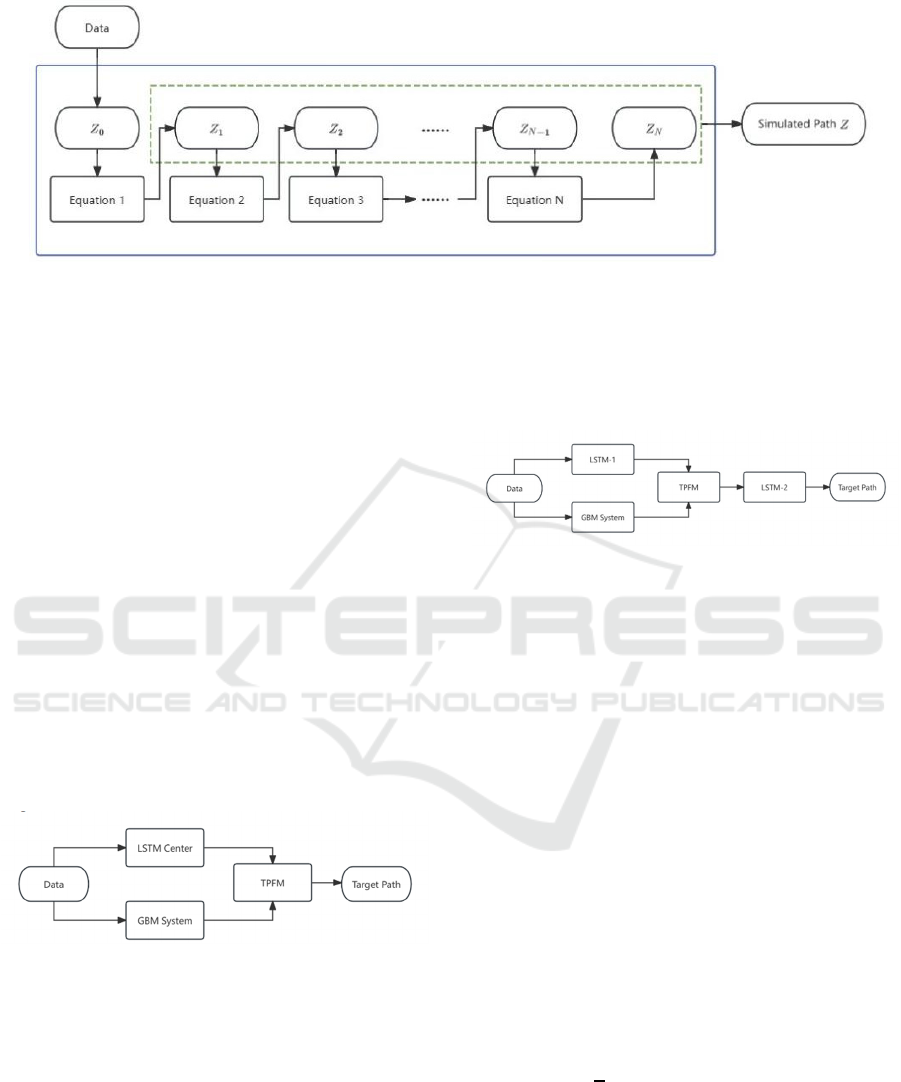

The experiment uses the initialized vector 𝑍 to

store stock prices simulated by GBM. Besides, this

thesis assumes that 𝑍

is the last data in the training

set. Through solving the equations iteratively, a

simulated path 𝑍

can be drawn. In the experiment,

100 paths will be generated. The process of GBM is

displayed in Fig.2.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

216

Figure 2: The Flow of GBM Model (Photo/Picture credit: Original).

Considering that LSTM is good at dealing long-

time dependence in stock prices and GBM is good at

dealing with the potential randomness behind stock

prices, this thesis adopts LSTM-GBM model as the

experimental model. This model includes a LSTM

center, a GBM system and a target path filtering

module (TPFM). LSTM center is responsible for

generating a prediction path 𝐿

∗

and GBM system

simulates 𝑖 paths 𝑍

,∗

through iteration. TPFM fits

the final path 𝑃

∗

through filtering the path

generated by GBM system based on 𝐿. For each time

point 𝑡, TPFM first calculates the distance between 𝐿

and every path generated by GBM system 𝑑

,

, then

chooses the minimum value of 𝑑

,

as the point of 𝑃

.

All 𝑃

constitute the final path 𝑃.

𝑑

,

= 𝑚𝑖𝑛𝑍

,

− 𝐿

(

7

)

Eq. (6) represents the screening mechanism of TPFM

and the process of LSTM-GBM model is displayed in

Fig. 3.

Figure 3: The Flow of LSTM-GBM Model (Photo/Picture

credit: Original).

In order to strengthen the performance of the

model, this thesis attempts to add a LSTM model after

the GBM system, trying to forecast the share prices

through LSTM-GBM-LSTM model. In this model,

the front LSTM is named as LSTM-1 while the latter

is called LSTM-2. On the basis of LSTM-GBM,

LSTM-2 mainly responsible for generating a

prediction path 𝐷

∗

based on learning from LSTM-

1 predicted path 𝐿 and LSTM-GBM generated path 𝑃.

Since the dataset of LSTM-2 is from both training set

and 𝑃, LSTM-2 predicted path 𝑇

∗

is not able to

cover the test set. Therefore, the part that cannot be

covered is replaced by the corresponding part of 𝐷 in

this experiment. Fig. 4 presents the process of LSTM-

GBM-LSTM.

Figure 4: The Process of LSTM-GBM-LSTM Model

(Photo/Picture credit: Original).

2.3 Models Parameters and

Evaluations

In terms of model training, both training times and

learning rate are considered in this experiment.

LSTM-1 is trained for 50 times and LSTM-2 is

trained for 30 times. Both LSTM-1 and LSTM-2

uses ’adam’ booster and the learning rate is 0.001. To

evaluate the models, this thesis uses the evaluation

metrics as detailed in Tabel 1. Mean Squared Error

(MSE), Root Mean Squared Error (RMSE), Mean

Absolute Error (MSE) and 𝑟

score are included in

the matrix, which allows this thesis to

comprehensively assess accuracy of the

predictions.This experiment compares the target path

generated by the four models above with true prices

on test set. As a result, this experiment uses MSE as

the loss function (Hodson, 2022). The equation of

MSE is as follows.

𝑀𝑆𝐸 =

∑

(𝑦

− 𝑦

)

(8)

where 𝑦

is true stock price; 𝑦

is predicted stock

price; 𝑁 is total forecast time. In the experiment, a

smaller MSE represents the better performance of the

model. The MSE of four models above are calculated

in this experiment and the result will be presented in

Section 4.

Stock Price Prediction Based on LSTM-GBM: Evidence from Haier Smart Home

217

3 RESULTS AND DISCUSSION

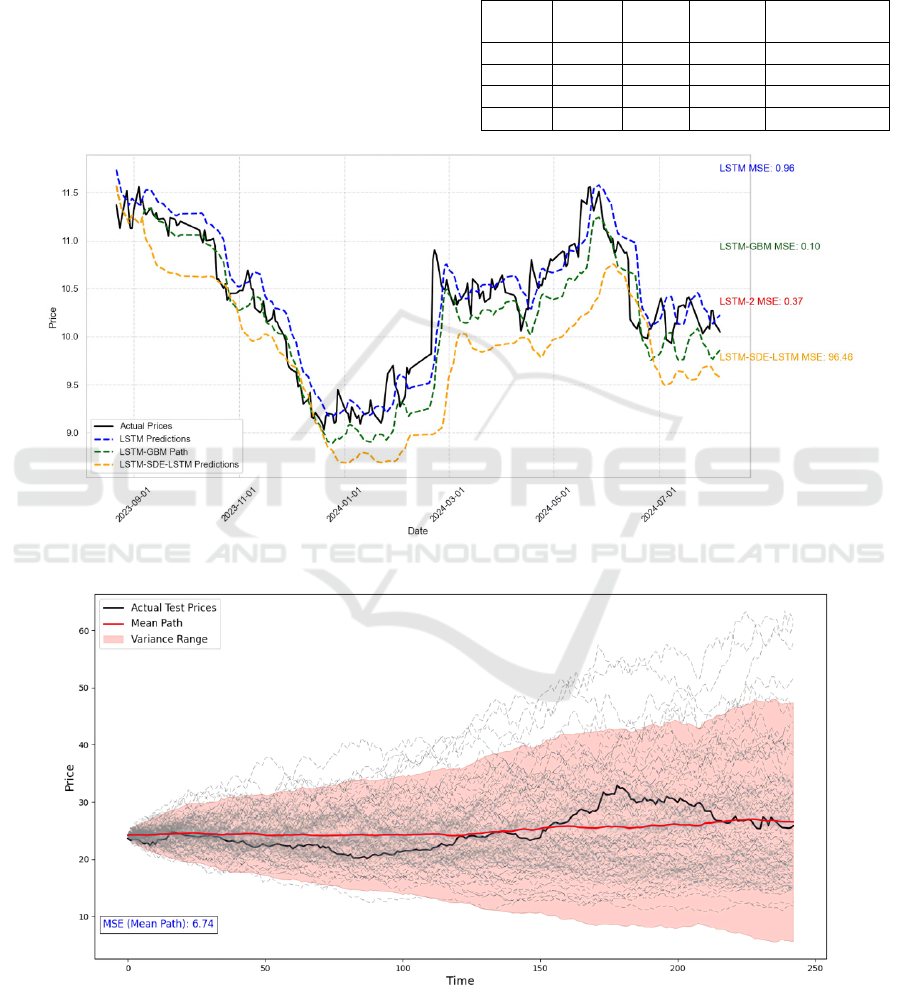

After using LSTM, GBM, LSTM-GBM and LSTM-

GBM-LSTM to forecast the share prices, the result of

each model will be presented in this section. This

thesis will evaluate the results and analyze the

possible reasons, therefore discuss the feasibility of

making predictions by LSTM-GBM and LSTM-

GBM-LSTM. Finally, limitations of this study will be

analyzed and future prospects will be proposed. Fig.

5 contains true prices, LSTM predicted paths, LSTM-

GBM simulated path, LSTM-GBM-LSTM predicted

path and MSE of each model. The comparison of

those three models can be drawn from Fig. 5. For the

readability of the results, the results of GBM will be

presented separately in Table 1.

Table 1: Evaluation Metrics of Each Model.

Index LSTM GBM LSTM-

GBM

LSTM-GBM-

LSTM

MSE 0.96 7.46 0.10 96.46

RMSE 0.98 2.73 0.31 9.82

MAE 0.21 2.22 0.23 9.80

𝑟

0.84 0.26 0.79 -53402.69

Figure 5: Stock Price Prediction Comparison (Photo/Picture credit: Original).

Figure 6: Stock Price Prediction Using GBM (Photo/Picture credit: Original).

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

218

Figure 7: Histogram of MSE for Each Path (Photo/Picture credit: Original).

According to Fig. 5, the MSE of LSTM is 0.96,

which is much higher than LSTM-GBM (will be

presented later). It seems unsuitable for LSTM alone

to forecast the share prices. On the other hand, LSTM

seems to perform better with GBM model. Both Fig.

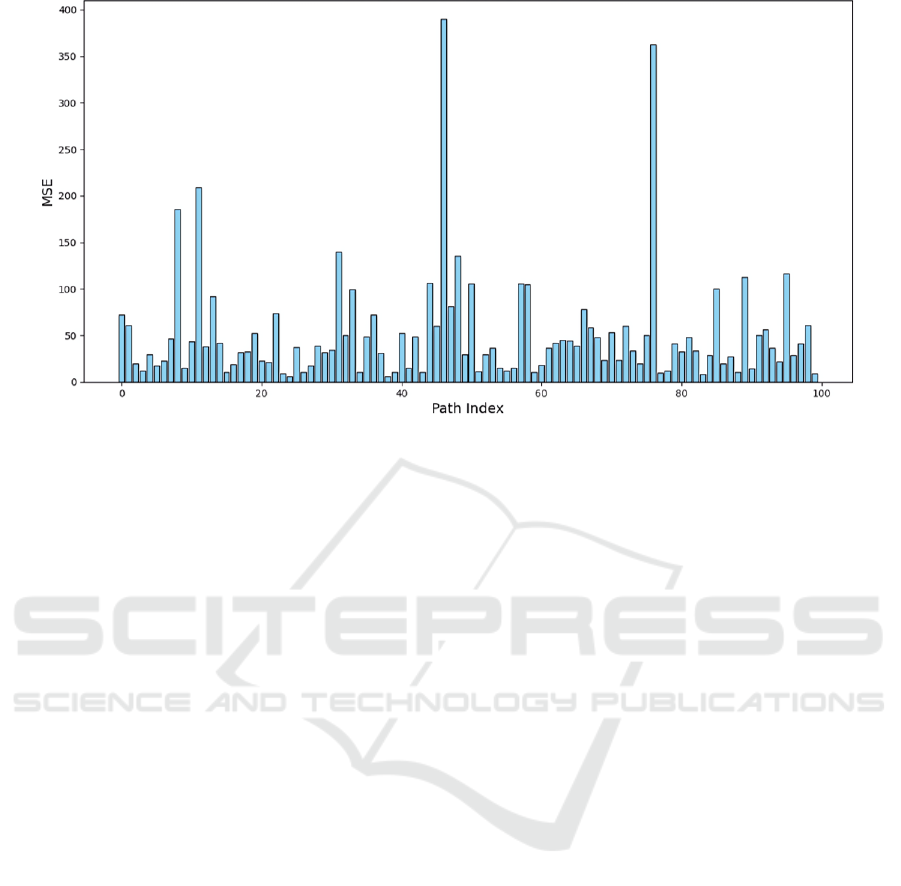

6 and Fig. 7 present the result of GBM model. Fig. 6

contains all simulated path by GBM, the mean path,

the variance range and average MSE of GBM model.

Fig. 7 presents the MSE of each path. Fig. 6 implies

that GBM model may be inappropriate to forecast the

share price because the MSE of this model is

relatively high. Meanwhile, Fig. 7 demonstrates that

different path has distinct MSE, which illustrates the

randomness of GBM. The results prove that the GBM

model might need some restrictions to perform better.

According to Fig. 5, LSTM-GBM model seems to

perform best in this experiment because the MSE of

this model is the lowest. In addition, the path seems

able to describe fluctuations in originate share prices.

Founded on the ability of LSTM to simulate the share

price data, LSTM-GBM adds possible changes.

Besides, the standard of fitting the path seems

appropriate. However, in terms of the latter part of the

prediction, LSTM-GBM seems to deviate more from

the true prices compared with LSTM. It might imply

that the long-term forecasting ability of LSTM-GBM

needs to be improved. In conclusion, LSTM-GBM is

more suitable for predicting stock prices compared

with LSTM and GBM, but the model is able to

perform better with some improvements.

Although the MSE of LSTM-2 is relatively low,

the MSE of LSTM-GBM-LSTM is the highest, which

implies that LSTM-GBM-LSTM performs the worst

among the four models. Besides, the prediction is

generally lower than the actual prices. There are a

number of possible reasons for the results. On the one

hand, it is difficult for LSTM to learn effective

features that contains randomness. On the other hand,

Eq. (7) declines the expectation of the prediction. In

addition, after adding LSTM-2, original standard may

no longer be appropriate. New ways to generate target

paths need to be discovered. Last but not least, the

stacking of multi models may lead to overfitting

problems. In general, several factors may lead to the

bad performance of LSTM-GBM-LSTM. Much more

effort needs to be paid to improve the model.

Despite the best performance of LSTM-GBM,

there are still limitations to this experiment. Firstly,

due to time constraints, this experiment was not able

to explore all possible parameters for the models.

Better performance of the models may not be

presented. Secondly, GBM model makes predictions

based on only the last value of training set, which

means the model has no idea of historical stock price

movements. In this case, simulated path has to limited.

Further studies need to make greater efforts in

improving methods that allow GBM to learn the

whole historical data. Thirdly, there may be more

standards rather than Eq.7, which is likely to lead

LSTM-GBM to make predictions with low

expectations. Further studies could try to find other

standards that are more suitable. Lastly, there might

be other methods to design LSTM-GBM-LSTM

model to make more accurate predictions. Future

researches could focus on better ways to combine

LSTM and GBM.

Stock Price Prediction Based on LSTM-GBM: Evidence from Haier Smart Home

219

4 CONCLUSIONS

In order to make more accurate stock price

predictions, this thesis offers a novel model named

LSTM-GBM, which combines LSTM’s ability to

forecast time series and GBM’s skill to capture and

simulate possibility in the stock market. To assess the

capability of this model, this thesis compared LSTM-

GBM with LSTM model and GBM model. Besides,

this thesis proposed a possible lifting scheme which

is adding a LSTM system after the LSTM-GBM

model. This model is named LSTM-GBM-LSTM.

The performance of LSTM-GBM is also compared

with the performance of LSTM-GBM-LSTM in the

experiment. The results clearly state that LSTM-

GBM is most capable of making predictions among

the four models because LSTM-GBM has made the

most accurate forecast. The MSE of LSTM-GBM is

the lowest while the MAE and the 𝑟

score of LSTM-

GBM is closely similar to the result of LSTM. Those

data shows that LSTM-GBM model is able to make

compelling predictions. Therefore, this model might

assist traders and investors to predict stock prices in

stock market. In terms of future works, both LSTM-

GBM and LSTM-GBM-LSTM have the potential to

perform better. For LSTM-GBM, more parameters

are able to be adjusted and more standards of

selecting the target paths are able to be adopted.

Besides, the GBM system might learn more historical

data through some possible improvement. In addition,

the model tends to make predictions of low

expectations due to the design of TPFM and it is able

to make the forcast prices’ expectation close to the

real data. For LSTM-GBM-GBM, the high MSE and

negative 𝑟

score both imply that this model has a

large space for improvement. For example, potential

methods of combining LSTM and GBM are able to

be applied. Those improvements may promote the

ability of the models. Besides, the data may state that

LSTM-GBM-LSTM model has the problem of

overfitting. Therefore, adopting regularization

method or other methods for solving the overfitting

problem may increase the performance of LSTM-

GBM-LSTM model. The problem may be solved by

reducing the complexity of the model as well. A

number of methods are feasible to increase the

performance of LSTM-GBM-LSTM so that the

improvement of this model may be an optional topic

for further studies. In conclusion, LSTM-GBM model

performs the best and it is recommended to adopt this

framework to forecast the share prices in reality.

Meanwhile, greater effort in the future is needed for

reducing the MSE and solving the possible overfitting

problem of LSTM-GBM-LSTM model.

REFERENCES

Ghosh, A., Bose, S., Maji, G., Debnath, N., Sen, S., 2019.

Stock price prediction using LSTM on Indian share

market. Proceedings of 32nd international conference

63, 101-110.

Hao, Y., Gao, Q., 2020. Predicting the trend of stock market

index using the hybrid neural network based on

multiple time scale feature learning. Applied Sciences,

10(11), 3961.

Hodson, T. O., 2022. Root mean square error (RMSE) or

mean absolute error (MAE): When to use them or not.

Geoscientific Model Development Discussions, 2022,

1-10.

Islam, M. R., Nguyen, N., 2020. Comparison of financial

models for stock price prediction. Journal of Risk and

Financial Management, 13(8), 181.

Ji, X., Wang, J., Yan, Z., 2021. A stock price prediction

method based on deep learning technology.

International Journal of Crowd Science, 5(1), 55-72.

Johansson, O., 2022). Stochastic modeling using machine

learning and stochastic differential equations.

Kumar, I., Dogra, K., Utreja, C., Yadav, P., 2018. A

comparative study of supervised machine learning

algorithms for stock market trend prediction. 2018

Second International Conference on Inventive

Communication and Computational Technologies

(ICICCT), 1003-1007.

Lu, W., Li, J., Wang, J., Qin, L., 2021. A CNN-BiLSTM-AM

method for stock price prediction. Neural Computing and

Applications, 33(10), 4741-4753.

Mahesh, B., 2020. Machine learning algorithms-a review.

International Journal of Science and Research (IJSR),

9(1), 381-386.

Nikou, M., Mansourfar, G., Bagherzadeh, J., 2019. Stock

price prediction using DEEP learning algorithm and its

comparison with machine learning algorithms.

Intelligent Systems in Accounting, Finance and

Management, 26(4), 164-174.

Obthong, M., Tantisantiwong, N., Jeamwatthanachai, W.,

Wills, G., 2020. A survey on machine learning for stock

price prediction: Algorithms and techniques. Eprints,

437785.

Rezaei, H., Faaljou, H., Mansourfar, G., 2021. Stock price

prediction using deep learning and frequency

decomposition. Expert Systems with Applications, 169,

114332.

Särkkä, S., Solin, A., 2019. Applied stochastic differential

equations. Cambridge University Press.

Sherstinsky, A., 2020. Fundamentals of recurrent neural

network (RNN) and long short-term memory (LSTM)

network. Physica D: Nonlinear Phenomena, 404,

132306.

Soni, P., Tewari, Y., Krishnan, D., 2022. Machine learning

approaches in stock price prediction: a systematic

review. Journal of Physics: Conference Series, 2161(1),

012065.

Ta, V. D., Liu, C. M., Tadesse, D. A., 2020. Portfolio

optimization-based stock prediction using long-short

term memory network in quantitative trading. Applied

Sciences, 10(2), 437.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

220

Wang, H., Wang, J., Cao, L., Li, Y., Sun, Q., Wang, J., 2021.

A stock closing price prediction model based on CNN

‐

BiSLSTM. Complexity, 2021(1), 5360828.

Zhang, J., Ye, L., Lai, Y., 2023. Stock price prediction

using CNN-BiLSTM-Attention model. Mathematics,

11(9), 1985.

Stock Price Prediction Based on LSTM-GBM: Evidence from Haier Smart Home

221