The Effectiveness of Fama-French 5 Factor Models Under COVID-19

Condition in the Gaming Industry

Chenchen He

1,*

and Yixuan Guo

2

1

Department of International Business Management, University of Nottingham Ningbo China, Ningbo, China

2

Department of Finance, University of Toronto Scarborough, Toronto, Canada

Keywords: Fama-French 5 Factor, Gaming Industry, COVID-19.

Abstract: Contemporarily, it is crucial to investigate the effectiveness of assets valuation approaches in some special

conditions. This article is aimed at assessing the effectiveness of the Fama and French 5 factor model under

COVID-19 pandemic using data from the gaming industry. The empirical evidence has been presented in

stable stock markets; its manifestations during the periods of increased volatility and instability of the markets

remain poorly explored. This research intends to discover how Five-Factor model reacted to the impact from

the pandemic in such a way that the market abnormalities can be analysed via data from the years 2019 and

2020. The R² value in five-factor model has shown more capability in explaining the excess returns during

the pandemic with 0.8482+, compared to 0.6245, which was indicated before. In addition, all five predictors,

which included factors related to profitability and investment strategy, proved to be significant in the

pandemic period, as opposed to only three predictors in the period before the pandemic. Nevertheless, the

predictive power of the model tends to deteriorate, which can be verified by the increase of RMSE. While this

work establishes the strength of the model in a volatile environment, it should also be noted that forecasting

inaccuracies are uncovered. These experiences, therefore, bring copious lessons for the investors and financial

analysts as they analyse portfolios in such crisis scenarios as the one during the COVID-19.

1 INTRODUCTION

Asset portfolio has undergone several significant

developments since the 1950s until now. Initially,

Harry Markowitz introduced the Modern Portfolio

Theory (MPT) in 1952, in which he mentioned

diversifying a portfolio can effectively reduce

unsystematic risk (Markowitz, 1952). Subsequently,

in 1964, William Sharpe proposed the Capital Asset

Pricing Model (CAPM), which was based on MPT.

In CAPM, Sharpe measured the expected return of an

asset by its volatility in the market, which was the

Beta coefficient (Sharpe, 1964). He assumed that

borrowing and lending can be done at a risk-free rate

and that all investors have the same expectation of

future returns (Elbannan, 2014). As the theory

continued to evolve, more factors were considered to

predict the asset return more accurately. Fama and

French argued that there were limitations to the

CAPM, where a single Beta coefficient was

insufficient to represent the complexity of the market

and explain the average returns it presented (Fama &

French, 1992). For this reason, Fama and French

proposed a three-factor model (FF3), where they

added market risk (RM-Rf), size risk (SMB) and

book-to-market ratio risk (HML) to explain in more

detail the variations in the excess returns of stocks

(Eraslan, 2013). Following this, to improve FF3,

Fama and French added two additional factors,

profitability (robust minus weak, RMW) and

investment (conservative minus aggressive, CMA)

factors. RMW measures the excess returns of more

profitable firms relative to less profitable firms,

whereas CMA reflects the outperformance of firms

with conservative investment strategies over firms

with aggressive investment strategies (Fama &

French, 2015).

CAPM, FF3 and FF5 are widely used in empirical

asset pricing studies. Throughout the ages, many

scholars have devoted themselves to studying the

validity of these models in different economic

situations or industries, and their studies have led to

different results. Several scholars have studied some

of the industries in the current pandemic: some of

them believe that the limitations of the FF5 have led

to a reduction in its validity. In contrast, others

170

He, C. and Guo, Y.

The Effectiveness of Fama-French 5 Factor Models Under COVID-19 Condition in the Gaming Industry.

DOI: 10.5220/0013208600004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 170-174

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

believe that the validity of the model has not been

affected.

The academics believe that there are several main

reasons for the reduced validity of the model, firstly

because the factors used in the model are based on

normal market conditions and economic situations, so

these factors are unable to capture the state of the

market in a situation as volatile as an epidemic.

According to Kostin et al., who studied the

performance of selected companies in the energy

sector as well as in emerging sectors during the

COVID-19 pandemic through the FF3 and the FF5,

the traditionally efficient as well as self-regulating

market was severely disrupted so that the

performance of the market was less dependent on

conventional financial indicators and more

influenced by short-term factors influence, and the

traditional five factors do not capture such unusual

market movements (Kostin et al., 2022). Secondly,

scholars have also argued that the effectiveness of the

model is reduced in emerging markets that are prone

to anomalies and in markets that have been severely

hit by the crisis. According to the study, the FF5 has

a significantly lower R² value during the crisis, which

measures the model's capacity to clarify the

anomalies in the data, which represents the near-zero

ability of the five-factors to explain stock returns in

emerging and energy sectors (sectors severely

affected by the pandemic), which are different from

the normal market (Kostin et al., 2022). Third,

regional differentiation in an epidemic can also lead

to a reduction in the validity of the FF5. According to

the research, countries like China and Russia, which

have adopted both free markets orientated and

economically planned policies, deviate from the

efficient market assumption on which the multifactor

model is based, and the inadequacy of the model is

evident during the pandemic as it is unable to adapt to

the external macroeconomic disruptions and

governmental policies affecting these markets

(Kostin et al., 2022). Finally, scholars argue that the

complexity of the model also reduces its validity. In

previous studies (Kostin et al., 2022; Zhou, 2024),

they all argue that the FF5 is less effective than FF3

in the context of pandemics and that a multi-factor

model would be more firm-focused and therefore of

limited applicability. The RMW and CMA factors in

the FF5 do not enhance the model’s explanatory

power. For example, the FF5 is unable to explain the

market returns of the Chinese pharmaceutical

industry during an epidemic (Zhou, 2024) because its

rigid assumptions rely on traditional risk, which

would limit the model's ability to capture market

changes under high uncertainty.

Conversely, several academics contend that the

reliability of the five-factor model remains robust in

an epidemic scenario. Alqadhib et al., who

incorporated the five-factor model in their research to

measure the risk-managed performance of active

mutual funds in Tehran, put forth compelling

evidence that attests to the model's durability during

the pandemic (Alqadhib et al., 2022). It was found to

elucidate approximately 75% of the fluctuations in

the returns of equity mutual funds. Regardless of the

prevailing pandemic, enterprises with sizable profits

and those pursuing conservative investment strategies

were present. For such enterprises, the five-factor

model capably accounted for the deviation, yielding

an accurate depiction of returns investors garnered

after risk adjustments. Substantially positive returns

were accomplished in the study by adjusting for the

recognized risks.

The study of other scholars also studies exhibit

mixed results. According to Zhang et al. on the excess

returns of real estate investment trusts (REITs), there

conclusion indicates two of the factors in FF5, RM-

Rf and SMB, show a relatively stable impact in

explaining the returns and the model also

demonstrates a certain level of validity after adding

the momentum factor which explains the returns

during the pandemic (Zhang et al., 2023). However,

the applicability and validity of the model is limited

by the fact that the skewness and kurtosis factors are

not consistent across regions.

The research aims to investigate the effectiveness

of the FF5 in the gaming industry before and during

the pandemic. The pandemic provided this study with

a market context of economic disruption and high

volatility, which helped to test the robustness of the

model. Although the FF5 has been widely validated

in stable markets, it lacks performance in the gaming

industry during a crisis. By exploring the gaming

industry, this study aims to gain insights into how the

five-factor model works when an unprecedented

market crisis erupts and to assess the model's

robustness. In the following, this will be done through

an explanation of the methodology used in this study,

presentation of the empirical results, analysis of the

empirical results, conclusions, limitations of the

model and outlook.

2 DATA AND METHOD

The data selected in this article are from daily data of

the game industry in the United States. In this case,

we have intercepted two time periods, the first

starting from 2 January 2019 to 31 December, and the

The Effectiveness of Fama-French 5 Factor Models Under COVID-19 Condition in the Gaming Industry

171

second starting from 2 January 2020 to 31 December.

The purpose of intercepting the data from the two

time periods is that we want to divide the study into

two segments: before the pandemic and during the

pandemic, so that we can do a comparative study

about testing the effectiveness of the model under the

pandemic. Data comes from the Kenneth R. French's

data librarys.

In this study, we use linear regression as the main

statistical technique, which typically employs OLS as

the main parameter estimation method. Specifically,

we aim to model the excess returns of the portfolio

through the risk-free rate and regress residual profits

on a set of dependent variables. The non-dependent

variables included in the regression represent various

characteristics of the market and the portfolio.

The validity and interpretability of linear

regression is why we chose it as our primary

statistical technique, and by assuming a linear

relationship between the independent and dependent

variables, the impact of each factor on the portfolio's

excess returns can be clearly inferred through the

resulting coefficients. Specifically, the following

models will be regressed:

𝑅𝑝

−𝑅𝑓= 𝛽

+ 𝛽

𝑅𝑀 − 𝑅𝑓

+ 𝛽

𝑆𝑀𝐵

+

𝛽

𝐻𝑀𝐿

+ 𝛽

𝐶𝑀𝐴

+ 𝛽

𝑅𝑀𝑊

+ 𝜖

(1)

Here, there are five explanatory variables, which are

RM-Rf, SMB, HML, CMA and RMW. As described

above, RM-Rf stands for market risk; SMB is size

risk; HML is book-to-market ratio risk; RMW is

excess return from profitability; and CMA is a

comparison of the performance of companies with

different investment strategies. The result of whether

the validity of the five-factor model weakened during

the pandemic was obtained by comparing the beta

coefficient significance, sign, and p-value of the five

factors for the game industry under the two time

periods.

3 EMPIRICAL ANALYSES

3.1 Correlation Analysis

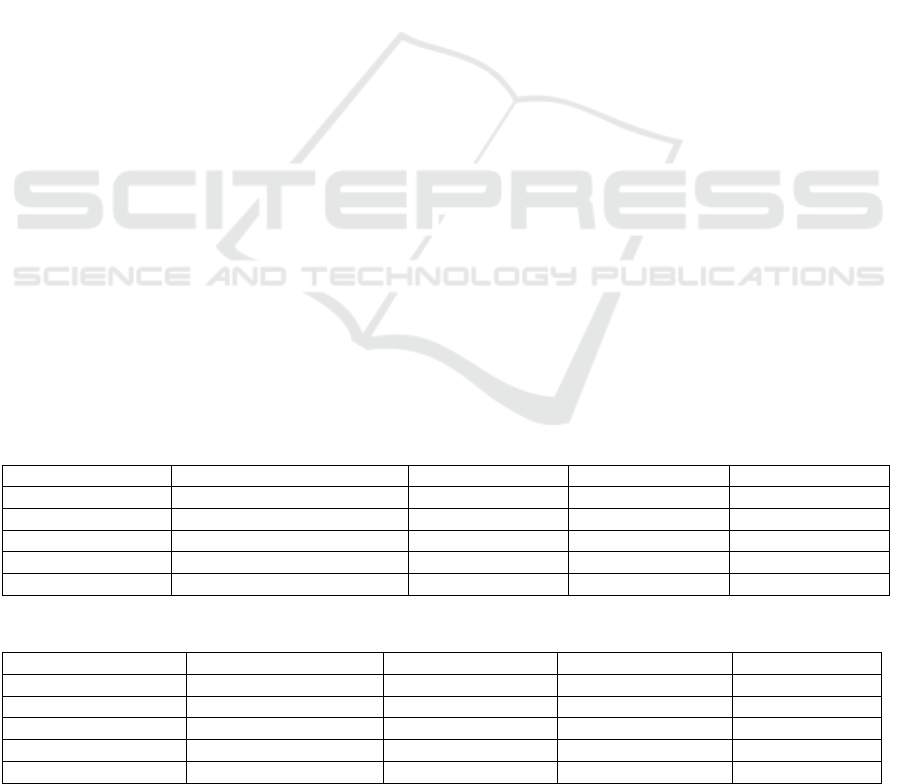

Based on the regression results in Table 1 and Table

2, before COVID-19, the RM-Rf, SMB, and RMW

factors are statistically significant, whereas the HML

and CMA factors do not demonstrate significance.

These suggest that the RM-Rf, SMB, and RMW

factors have the greatest impact on the extra return.

During COVID-19 pandemic, all five factors show

significance. The following is a detailed correlation

analysis for each factor.

The RM-RF factor shows how the stock has moved

in relation to the market. The RM-RF coefficient is

0.698 before the pandemic and almost 1 during

pandemic, demonstrating that the sensitivity of

gaming industry is roughly same as the market

movement during COVID-19 pandemic and less

sensitive to market movements before that. The SMB

factor shows how the stock has moved in relation to

the size premium. In both periods, SMB factor and

excess returns are strongly correlated. The positive

correlation suggesting that small-cap stocks tend to

have better performance than large-cap stocks have.

Before COVID-19, the SMB coefficient of 0.765

indicates a moderate positive exposure to small

market value stocks, while during the COVID-19

outbreak, the SMB coefficient increases to 1.301,

reflecting a much better performance of smaller firms

Table 1: Coefficient of FF5 of gaming industry before COVID-19.

Coefficient Std. err. t-Stat P-value

RMW 0.300 0.139 2.16 0.032

SMB 0.765 0.098 7.81 0.000

RM-RF 0.698 0.056 12.49 0.000

HML -0.137 0.110 -1.25 0.213

CMA -0.233 0.205 -1.14 0.257

Table 2: Coefficient of FF5 of gaming industry during COVID-19.

Coefficient Std. err. t-Stat P-value

RMW 0.657 0.202 3.26 0.001

SMB 1.301 0.117 11.14 0.000

RM-Rf 0.985 0.392 25.12 0.000

HML 0.536 0.243 4.44 0.000

CMA -1.550 0.079 -6.37 0.000

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

172

over larger ones. The RMW factor shows how the

stock has moved in relation to the profitability

premium. The coefficient of RMW factor doubles

from 0.300 to 0.657 as affected by the pandemic. This

suggests that firms with higher profitability

continuously increase returns, but due to the

pandemic their influence doubles. The HML factor

shows how the stock has moved in relation to the

book-to-market ratio premium. It is not significant to

explain the stock price changes in the game industry

before COVID-19, but after the outbreak, the HML

factor becomes significant, the coefficient of which is

0.536. This shift suggests that firms with a high

book-to-market ratio typically have higher returns.

The CMA factor shows how the stock has moved in

relation to the investment premium. Based on the

result, CMA also changed from a redundant variable

of FF5 before COVID-19 to a valid factor after the

outbreak, with a coefficient of -1.550. This negative

coefficient smaller than -1 reveals that during this

period, firms that pursued more aggressive expansion

strategies generates higher returns than those

pursuing conservative expansion strategies.

3.2 Model Performances

To assess how well the FF5 performed in the gaming

sector prior to and following the COVID-19 outbreak,

Coefficient of determination (R² and Adjusted R²),

and Root Mean Squared Error (RMSE) are the key

measurement statistics. R² measures the proportion of

the excess return's overall anomalies explained by the

five factors. Adjusted R² accounts for the number of

predictors and sample size in the regression model,

serving as a more accurate measure to explain the

variation. RMSE measures the average magnitude of

the errors in predictions made by a regression model.

Table 3: Comparison between R², Adjusted R², and RMSE

statistics before and during COVID-19.

Before COVID-19 Durin

g

COVID-19

F-Stat 81.84 276.03

P-value 0.0000 0.0000

R² 0.6245 0.8482

Ad

j

usted R² 0.6169 0.8451

RMSE 0.5937 1.2458

According to Table 3, the regression results had an R²

value of 0.6245 before COVID-19 pandemic. This

means that the model can explains 62.42 percent of

the variation in excess return. Comparatively, the

second sample shows a marked increase in the value

of R² of 0.8482, which indicates a marked

improvement in the model's ability to explain

variation of excess return during the pandemic. As

adjusted R² varied little from R² in both periods, this

indicates that the model is a good fit for data before

and during COVID-19 pandemic. However, RMSE

rose from 0. 594 to 1246 during the COVID-19

pandemic, which means that the predicted values

were further away from the actual values. The

increase shows that the model was less reliable during

the pandemic.

3.3 Discussion

The results of this study show important information

about how the stock prices of the gaming industry

changed before and during the COVID-19 pandemic.

Before the pandemic, the model shows that RM-RF,

SMB, and RMW are significant for understanding

excess returns. This model explains 62.45 percent of

the differences in returns. The sensitivity of the

gaming industry to market movements is relatively

lower, and smaller, profitable firms shows a positive

impact on returns. During the pandemic, all five

factors, including the HML (value premium) and

CMA (investment premium), are statistically

significant. The rise in R² to 84.82 percent during the

pandemic indicates that the model acquired greater

efficacy in capturing the determinants of surplus

returns in the gaming sector.

From the investment perspective, these results

show that during crises like the COVID-19 pandemic,

smaller gaming firms do better than larger ones, and

firms that make more profit continue to offer

significant returns. Additionally, the HML and CMA

factors that show significance during the pandemic

suggests that firms having higher book-to-market

ratio and invest aggressively may generate better

returns during economic condition like COVID-19.

However, even though the regression model had a

better performance during the pandemic, the results

became less reliable. Therefore, investors should take

the model performance into consideration when

making portfolio decisions based on the five factors.

4 CONCLUSIONS

To sum up, the purpose of this study is to assess the

efficacy of FF5 under the under the COVID-19

through analysis of data selected from the gaming

industry. The analysis revealed that FF5 is able to

explain more of the anomalies in returns at this time

during the pandemic, as seen by a significant increase

in both the R² and Adjusted R² values. As RMSE also

increased during the pandemic, prediction accuracy

of the model decreased during the pandemic. Factors

The Effectiveness of Fama-French 5 Factor Models Under COVID-19 Condition in the Gaming Industry

173

valid to explain excess return changed from RM-RF,

SMB, RMW to all five factors across Pre-COVID and

COVID periods. The results suggests that firms that

are smaller, more profitable, high book-to-market

ratio, and invest aggressively are likely to have higher

returns. Nonetheless, this study is limited due to the

unrepresentative data selected from single industry

and single time. Future research could analyse more

samples from different industries and under different

conditions for more precise and representative results.

The finding of this paper help to better understand

how the FF5 works during COVID-19, providing

useful information for investors and financial analysts.

There exists some limitation to the study. First, a key

issue of this study is that data selected only come from

the gaming industry that may not be representative to

the entire market as different industry may react

differently to the COVID-19 outbreak. Evaluating

effectiveness of FF5 based on regression results using

unrepresentative data can be inaccurate. Second, the

study period is constrained to the time before and

during the COVID-19 pandemic. This limits the

applicability of the results to time after the recovery

from pandemic and other economic conditions. Third,

unreliability of the model during the pandemic creates

large difficulty to make accurate conclusion.

Considering these limitations, future research could

examine data from a wider range of industries and see

how well the Farmer-French 5-Factor model works in

different economic periods or crises. Adding more

factors or trying different models could make

predictions more accurate in unstable markets. The

result of this study helps to understand factors affect

stock returns in the gaming industry. It also gives

important information for investors during economic

condition like COVID-19 pandemic.

AUTHOR CONTRIBUTION

All the authors contributed equally and their names

were listed in alphabetical order.

REFERENCES

Alqadhib, H., Kulendran, N., Seelanatha, L., 2022. Impact

of COVID-19 on mutual fund performance in Saudi

Arabia. Cogent Economics Finance, 10, 1.

Elbannan, M. A., 2014. The Capital Asset Pricing Model:

An overview of the theory. International Journal of

Economics and Finance, 7, 1.

Eraslan, V., 2013. Fama and French Three-Factor Model:

Evidence from Istanbul Stock Exchange. Business and

Economics Research Journal, 4(2), 11-19.

Fama, E. F., French, K. R., 1992. The Cross-Section of

Expected Stock Returns. The Journal of Finance (New

York, 47(2), 427–465.

Fama, E. F., French, K. R., 2015. A five-factor asset pricing

model. Journal of Financial Economics, 116(1), 1–22.

Kostin, K. B., Runge, P., Charifzadeh, M., 2022. An

Analysis and Comparison of Multi-Factor Asset

Pricing Model Performance during Pandemic

Situations in Developed and Emerging Markets.

Mathematics Basel, 10(1), 142.

Kostin, K. B., Runge, P., Mamedova, L. E., 2023. Validity

of the Fama-French Three- and Five-Factor Models in

Crisis Settings at the Example of Select Energy-Sector

Companies during the COVID-19 Pandemic.

Mathematics Basel, 11(1), 49-53.

Markowitz, H., 1952. Portfolio selection. The Journal of

Finance New York, 7(1), 77–91.

Sharpe, W., 1964. Capital Asset Prices: A Theory of Market

Equilibrium under Conditions of Risk. The Journal of

Finance, 19(3), 425-442.

Zhang, W., Li, B., Roca, E., 2023. Moments and momentum

in the returns of securitized real estate: A cross-country

study of risk factors driving real estate investment trusts

before and during COVID-19. Heliyon, 98, pp 18476–

18476.

Zhou, Y., 2024. An Empirical Analysis on the China’s

Medical Industry under COVID-19 Based on Fama-

French model. SHS Web of Conferences, 181, 1002-.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

174