Prediction of DASH Price Based on Machine Learning

Xinze Wu

Department of Economics and Statistics, University of Toronto, Woodsworth College, Toronto, Canada

Keywords: Cryptocurrency Prediction, Machine Learning, LightGBM, DASH.

Abstract: Contemporarily, cryptocurrency attracts lots of investors on account of its high volatility. This study

investigates the use of machine learning models to predict the price of DASH, a leading cryptocurrency known

for its focus on privacy and speed. By applying a range of models, including Ordinary Least Squares (OLS)

regression, Random Forest, and LightGBM, this paper aims to determine the most effective approach for

forecasting DASH prices. The data set consists of daily DASH prices over a four-year period, from January

2020 to August 2024, with technical indicators such as the 50-day Simple Moving Average (SMA_50),

MACD, and RSI_14 serving as the independent variables. The findings indicate that while OLS regression

provides a basic benchmark, its predictive accuracy is limited. In contrast, the Random Forest model showed

better performance, but it was the LightGBM model that delivered the highest accuracy, effectively capturing

the non-linear relationships in the data While the results are encouraging, the study recognizes several

limitations, such as the omission of sentiment indicators and intraday data. Future investigations could benefit

from incorporating these elements to improve the accuracy of predictions. These results contribute to the

growing literature on cryptocurrency price prediction, provides practical insights for investors and traders

seeking to leverage machine learning in their decision-making processes in the meantime.

1 INTRODUCTION

The nascent phase of cryptocurrencies spanned from

late 2008 to 2013, during which the audience for

cryptocurrencies was very limited, primarily

consisting of small, insider circles of enthusiasts. In

2008, Satoshi Nakamoto published the Bitcoin white

paper, which laid the foundation for cryptocurrencies

by proposing a decentralized digital currency system

based on blockchain technology (Nakamoto, 2008).

Essentially, cryptocurrencies are digital or virtual

assets that utilize cryptographic techniques to ensure

secure issuance and transactions (Narayanan et al.,

2016). Blockchain technology serves as the backbone

of cryptocurrencies, enabling the recording of all

transaction histories. Each transaction is documented

in a block, which is linked to the preceding block,

forming a continuous chain that ensures transparency

and security in transactions. A fundamental

characteristic of cryptocurrencies is decentralization,

meaning that no central authority controls the

issuance and transactions of the currency, which

reduces the time and financial costs associated with

transactions (Catalini & Gans, 2016, Tapscott, 2016).

Cryptocurrencies have the potential to

significantly impact the traditional financial system

by offering more convenient, faster, and low-cost

payment methods (Yermack, 2015). Additionally,

when used for international remittances,

cryptocurrencies can bypass traditional banks or

remittance service providers, thereby reducing the

costs associated with cross-border transactions.

While Bitcoin was the first and remains the most

well-known cryptocurrency, the emergence of other

digital currencies such as Ethereum, DASH, and

Litecoin has broadened the scope of blockchain

applications and introduced new features and

functionalities. These include smart contracts,

privacy enhancements, and faster transaction

processing. Among these, DASH stands out for its

focus on privacy and speed, offering features such as

InstantSend and PrivateSend, which facilitate rapid

and private transactions. Since its launch in 2014,

DASH has become one of the leading

cryptocurrencies, widely recognized for its utility in

fast and low-cost payments.

Bitcoin, as the most well-known cryptocurrency,

could largely reflect the price characteristics of the

entire virtual currency market. Since its launch in

2009, Bitcoin has exhibited extreme price volatility,

164

Wu, X.

Prediction of DASH Price Based on Machine Learning.

DOI: 10.5220/0013208500004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 164-169

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

characterized by periods of speculative bubbles and

sharp corrections (Corbet et al., 2018). Initially

trading at negligible values, Bitcoin first crossed the

$1,000 mark in 2013, fueled by growing interest and

media coverage (Baur & Dimpfl, 2018). However,

the years following saw sharp declines due to

regulatory concerns and market skepticism, with

prices dropping below $300 by 2015. Bitcoin

rebounded significantly, reaching nearly $20,000 in

December 2017 during a speculative frenzy and

increased institutional interest. After a correction

phase, where prices stabilized around $3,000 to

$4,000, Bitcoin surged again, surpassing $60,000 in

2021. This increase was driven by factors such as

fears of inflation, broader institutional adoption, and

retail participation during the COVID-19 pandemic.

This demonstrates that cryptocurrency

experiences significantly higher volatility, surpassing

even some of the most volatile assets globally, such

as crude oil. According to Sebastião et al., the

standard deviation of Bitcoin’s returns is 3.91%,

which is 69% greater than crude oil’s volatility

(Sebastião et al., 2021). Furthermore, Bitcoin’s

returns are more than seven times as volatile as the

USD/EUR exchange rate. The daily fluctuations in

Bitcoin ranged from -23.78% to 22.51%, whereas

crude oil exhibited a more restrained range of -11.13%

to 14.18%. Other assets typically displayed only

single-digit variations in their daily returns (Li &

Wang, 2017). The high-risk, high-reward trading

method has garnered significant attention from

speculators. Consequently, there has been research

conducted by technical experts using machine

learning to predict Bitcoin prices. These techniques,

ranging from linear regression models to more

sophisticated neural networks, aim to provide traders

and investors with valuable insights, potentially

enhancing their decision-making processes (McNally

et al., 2018). For instance, Bayesian Neural Networks

have been used to incorporate blockchain-specific

data, further refining the predictive accuracy of these

models (Jang & Lee, 2018).

The first attempts to use machine learning for the

prediction of cryptocurrency price appeared shortly

after the launch of Bitcoin in 2009. During the early

2010s, most of these efforts were exploratory,

focusing on simple models such as linear regression

and basic time series forecasting methods like

ARIMA(Bakar & Rosbi, 2017). The main challenge

was that cryptocurrencies, unlike traditional financial

assets, lack fundamental economic indicators (such as

earnings reports or interest rates) that could be used

to inform predictions. As the field of machine

learning advanced, so did the sophistication of

models used in cryptocurrency price prediction. By

the mid-2010s, researchers began applying more

advanced techniques such as Support Vector

Machines (SVM), Decision Trees, and ensemble

methods like Random Forests. In recent years, there

has been a trend towards using hybrid models that

combine multiple machine learning techniques to

improve prediction accuracy. For example, models

may combine traditional statistical methods with deep

learning or ensemble methods. Hybrid models can

leverage the strengths of different techniques, making

them more robust and capable of handling the

complexities of cryptocurrency markets.

Despite the extensive research on Bitcoin, there

remains a significant gap in the literature regarding

the prediction of other cryptocurrencies like DASH

(Li & Wang, 2017). While some studies have

explored machine learning methods for

cryptocurrency prediction, there is limited research

focusing specifically on DASH, highlighting the need

for further investigation (Chen & Qiu, 2020). This

study aims to bridge this gap by applying a range of

machine learning models to forecast DASH prices,

offering a comparative analysis of their performance

and providing insights into their practical

implications for traders and investors.

This paper is structured as follows. The Secl 2

discusses the data and methodologies employed,

including the machine learning models used. The Sec.

3 presents the results, followed by a discussion of the

findings and their implications. The Sec. 4 concludes

the study, highlighting the limitations and suggesting

areas for future research.

2 DATA AND METHOD

Cryptocurrency data was extracted from the website:

https://ca.investing.com/crypto/dash/historical-data,

collecting 4 years daily prices of DASH

cryptocurrency in US dollar starting from 01/30/2020

to 08/27/2024. This dataset includes various fields

such as the date, open price, high price, low price,

close price, volume, and percentage of change. The

daily price of DASH is the target variable, which is

also the dependent variable, while the independent

variable are the features that will be used to predict

the dependent variable.

There are 3 major parts of the independent

variables, technical indicators, market indicators and

sentiment indicators.For technical indicators, moving

averages, Exponential Moving Averages, MACD and

Relative Strength Index (RSI) are essential

parameters for the prediction. For market indicator,

Prediction of DASH Price Based on Machine Learning

165

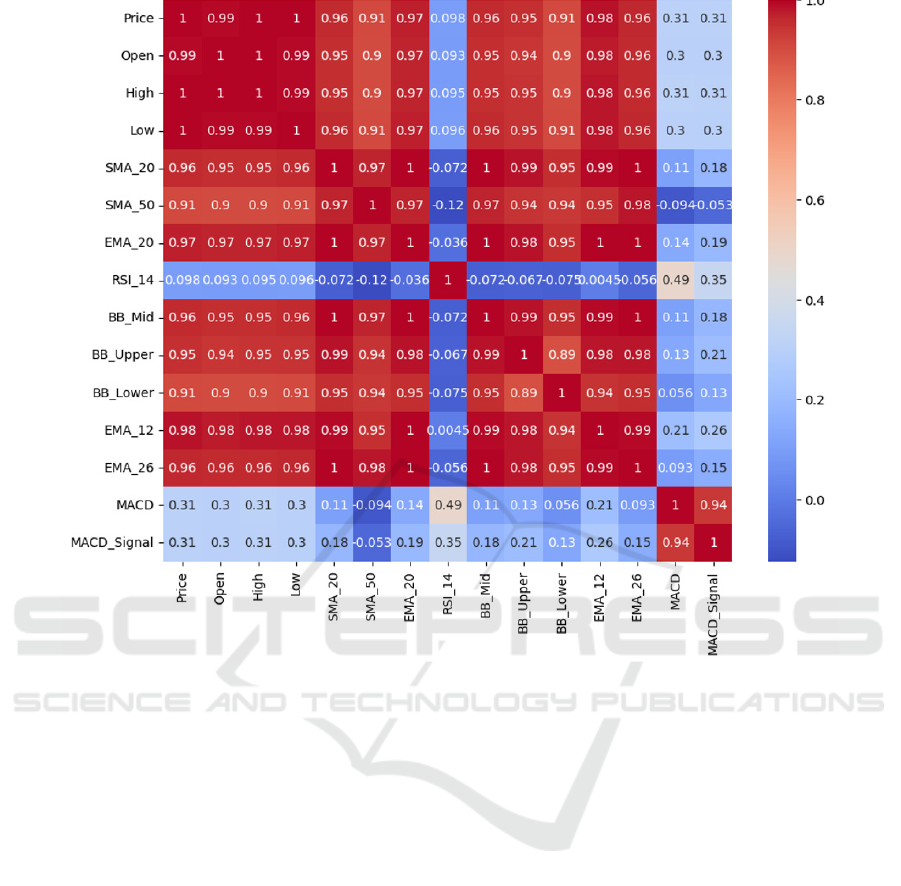

Figure 1: Correlation analysis for factors (Photo/Picture credit: Original).

this valuation will only consider the effect that the

price of Bitcoin might brought to the DASH daily

prices. As for sentiment indicators, since the models,

parameters and analysis this research will be applied

do not need such type of data, there will not be

sentiment indicators applied.

To prepare the data for analysis, several

preprocessing steps were performed. Using

“pd.read_csv(file path)” to load the file downloaded

from the website source, and convert the ‘Date’ in the

original file into date time format. The dataset was

then enriched by calculating various technical

indicators that have been mentioned above, such as

SMA, EMA, RSI, Bollinger Bands, and the MACD.

These indicators serve as independent variables in the

subsequent regression models.

Correlation analysis was performed to identify

relationships between the independent variables

(technical indicators) and the dependent variable

(DASH closing price). This analysis helps in

selecting the most relevant features for the regression

models. The correlation matrix shown in Figure. 1

revealed that certain indicators, such as the 50-day

SMA and the MACD, have a strong correlation with

the DASH closing price, making them suitable

candidates for inclusion in the predictive models.

Conversely, indicators with very low correlation

might be excluded from further analysis.

For the regression analysis, Ordinary Least

Squares (OLS) regression was selected as a

benchmark model due to its simplicity and

interpretability. This was complemented by more

sophisticated models, including Random Forest and

LightGBM, which are capable of capturing more

complex relationships in the data (Chen & Qiu, 2020).

The OLS regression model was fitted using the

selected independent variables. The performance of

the model was evaluated using R-squared (R²), Mean

Absolute Error (MAE), and Mean Squared Error

(MSE). The results of the OLS regression provide a

baseline against which the performance of more

complex models can be compared (Zhao & Zhang,

2018).

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

166

3 RESULTS AND DISCUSSION

3.1 Feature Engineering

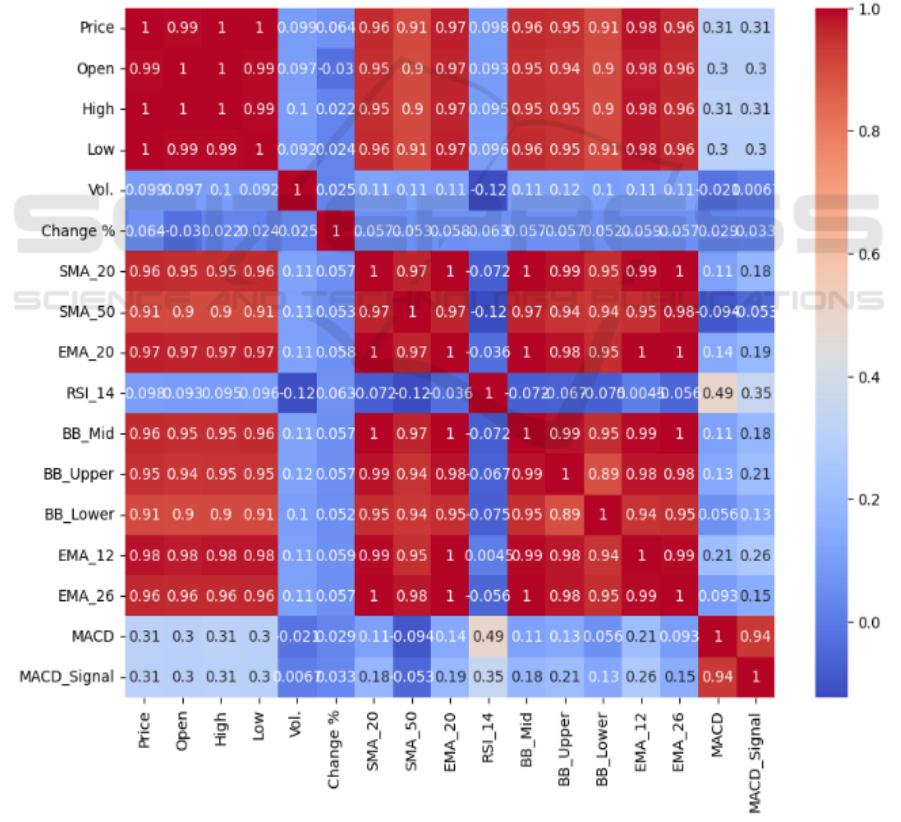

In the initial phase of the analysis, correlation analysis

was conducted to identify the relationship between

various technical indicators and the DASH closing

price. The indicators included moving averages,

momentum indicators, and volatility measures. The

correlation matrix revealed that some indicators, such

as the 50-day Simple Moving Average (SMA_50),

the Moving Average Convergence Divergence

(MACD), and the 14-day Relative Strength Index

(RSI_14), had significant correlations with the DASH

price. To further refine the feature set,

multicollinearity was assessed using the Variance

Inflation Factor (VIF). High VIF values indicate

multicollinearity, which can distort the results of

regression models. Indicators with VIF values greater

than 10 were considered for removal to improve the

stability and interpretability of the models.

On this basis, it helped refine the feature set,

ensuring that the final model inputs were both

informative and independent, thus improving the

predictive accuracy of the models. The heat map

(Figure. 2) shows the correlation between the selected

features and the DASH price. Darker shades indicate

stronger correlations, either positive or negative. The

selection of indicators for the regression models was

based on their correlation strength and VIF values.

Figure 2: Correlation analysis after selection (Photo/Picture credit: Original).

Prediction of DASH Price Based on Machine Learning

167

Figure 3: Correlation analysis after selection (Photo/Picture credit: Original).

3.2 Models Performance

The selected features were used to train various

models, including Ordinary Least Squares (OLS)

regression, Random Forest, and LightGBM. The

performance of these models was evaluated using R-

squared (R²), Mean Absolute Error (MAE), and Mean

Squared Error (MSE). The OLS model, as a

benchmark, provided a basic understanding of the

linear relationships between the features and the

DASH price. However, the simplicity of the model

limited its predictive accuracy, especially in capturing

the non-linear dynamics of the market. The Random

Forest model, with its ability to handle non-linearity

and interactions between features, showed improved

performance compared to OLS. The model was

particularly effective in reducing the prediction errors

(MAE and MSE) and provided a higher R² value,

indicating a better fit to the data. The LightGBM

model, known for its efficiency and performance in

gradient boosting tasks, provided the best results

among the tested models. The R² value was

significantly higher, suggesting that LightGBM was

able to explain a larger portion of the variance in

DASH prices. The error metrics (MAE and MSE)

were also the lowest, indicating that the model was

highly accurate in its predictions.

To visualize the model's performance, the

predicted prices were plotted against the actual prices

shown in Figure. 3. This comparison helps in

understanding the accuracy of the model's predictions.

To have a better visualization of the difference, the

data used change from daily to monthly averages.

Table 1 summarizes the performance metrics for each

model, highlighting the R², MSE, and MAE values.

Table 1: Model performances.

Model R

2

MSE MAE

OLS Regression 0.45 12.34 2.56

Random Forest 0.78 6.78 1.85

LightGBM 0.82 5.23 1.62

3.3 Explanation and Implications

The results from the LightGBM model suggest that

the DASH price is strongly influenced by a

combination of trend-following indicators (e.g.,

SMA_50) and momentum indicators (e.g., MACD

and RSI_14) which capture different aspects of

market behavior. The 50-day Simple Moving

Average was identified as a crucial predictor,

indicating the importance of long-term trends in

DASH price movements. The MACD's ability to

capture momentum shifts allowed the model to

anticipate changes in price direction, enhancing

prediction accuracy. The 14-day RSI contributed to

predicting price reversals by identifying overbought

or oversold conditions. For traders and investors, the

findings suggest that integrating these indicators into

trading strategies could improve decision-making.

Specifically, using machine learning models like

LightGBM can enhance the prediction of price

movements, providing a competitive edge in the

volatile cryptocurrency market.

3.4 Limitations and Prospects

While the OLS model provided a baseline, its

simplicity limited its effectiveness in capturing the

complex, non-linear relationships present in the data.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

168

And the actual price of DASH, and all other

cryptocurrencies can be relatively strongly affected

by sentiment indicators, which cannot be considered

using the models in this research. In the meantime,

the analysis was conducted using daily data from a

specific period. The inclusion of additional data, such

as intraday prices could potentially improve model

accuracy. Future research could explore the

integration of sentiment analysis using data from

social media platforms like Twitter and Reddit.

Additionally, experimenting with other advanced

machine learning models, such as LSTM networks,

could further enhance the accuracy of price

predictions. The success of machine learning models

in this analysis opens the door for developing and

testing algorithmic trading strategies. By automating

the trading process based on predictive analytics,

investors could capitalize on short-term price

movements with greater precision.

4 CONCLUSIONS

To sum up, this study explored the application of

various machine learning models, including Ordinary

Least Squares (OLS) regression, Random Forest, and

LightGBM, to predict the price of DASH

cryptocurrency. The analysis revealed that while OLS

provided a basic understanding of the linear

relationships between technical indicators and DASH

prices, more sophisticated models like Random

Forest and LightGBM significantly outperformed it

in terms of accuracy and predictive power.

LightGBM, in particular, demonstrated superior

performance, effectively capturing the complex, non-

linear dynamics of the DASH market. The model’s

ability to integrate trend-following indicators such as

the 50-day Simple Moving Average (SMA_50) and

momentum indicators like MACD and RSI_14

allowed it to provide accurate price predictions,

offering valuable insights for traders and investors.

However, the study also highlighted certain

limitations. The exclusion of sentiment indicators and

intraday data, as well as the focus on a specific time

period, may have constrained the model's predictive

accuracy. Future research should consider

incorporating these factors to enhance the robustness

of predictions. Additionally, the development of

hybrid models that com-bine machine learning with

sentiment analysis could offer further improvements.

Overall, this research contributes to the literature on

cryptocurrency price prediction by filling a gap in the

analysis of DASH and demonstrating the efficacy of

machine learning models in this domain. The findings

underscore the potential of these models to inform

trading strategies, ultimately helping investors

navigate the volatile cryptocurrency market with

greater precision.

REFERENCES

Bakar, N. A., Rosbi, S., 2017. Autoregressive Integrated

Moving Average (ARIMA) Model for Forecasting

Cryptocurrency Exchange Rate in High Volatility

Environment. Research in International Business and

Finance, 42, 1407-1415.

Investing.com, n.d. DASH Historical Data. Available at:

https://ca.investing.com/crypto/dash/historical-data

[Accessed 27 September 2024].

Baur, D. G., Dimpfl, T., 2018. Asymmetric Volatility in

Cryptocurrencies. Economics Letters, 173, 148-151.

Catalini, C., Gans, J. S., 2016. Some Simple Economics of

the Blockchain. NBER Working Paper No. 22952.

Chen, L., Qiu, M., 2020. Research on Cryptocurrency Price

Prediction Method Based on Ma-chine Learning.

Information and Computer Security, 28(2), 257-270.

Corbet, S., Lucey, B., Yarovaya, L., 2018. Datestamping

the Bitcoin and Ethereum Bubbles. Finance Research

Letters, 26, 81-88.

Jang, H., Lee, J., 2018. An Empirical Study on Modeling

and Prediction of Bitcoin Prices with Bayesian Neural

Networks Based on Blockchain Information. IEEE

Access, 6, 5427-5437.

Li, X., Wang, C. A., 2017. The Technology and Economic

Determinants of Cryptocurrency Exchange Rates: The

Case of Bitcoin. Decision Support Systems, 95, 49-60.

McNally, S., Roche, J., Caton, S., 2018. Predicting the

Price of Bitcoin Using Machine Learning. 2018 26th

Euromicro International Conference on Parallel,

Distributed and Network-based Processing (PDP), 11.

Narayanan, A., Bonneau, J., Felten, E., Miller, A.,

Goldfeder, S., 2016. Bitcoin and Crypto-currency

Technologies: A Comprehensive Introduction.

Princeton University Press.

Nakamoto, S., 2008. Bitcoin: A Peer-to-Peer Electronic

Cash System. SSRN Electronic Journal, 3440802, 10-

2139.

Sebastião, H., Cunha, C., Godinho, P., 2021. Understanding

Bitcoin Returns and Volatility: Evidence from Value-

at-Risk Forecasting. Finance Research Letters, 19, 12.

Tapscott, D., Tapscott, A., 2016. Blockchain Revolution:

How the Technology Behind Bitcoin Is Changing

Money, Business, and the World. Penguin, 11.

Yermack, D., 2015. Is Bitcoin a Real Currency? An

Economic Appraisal. NBER Working Paper, 19747.

Zhao, Y., Zhang, H., 2018. Comparison of Cryptocurrency

Forecasting Using Deep Learning Models. IEEE

Transactions on Neural Networks and Learning

Systems, 18.

Prediction of DASH Price Based on Machine Learning

169