LSTM-Based Stock Price Prediction: Comparison between NSE

Bank and S&P 500 Index

Shensong Lyu

a

Nottingham University Business School, University of Nottingham Ningbo, Ningbo, China

Keywords: LSTM, Prediction, NSE, S&P 500.

Abstract: This paper explores the application of Long Short-Term Memory (LSTM) networks for predicting the closing

prices of the NSE Bank Index and the S&P 500 Index. The study was begun by preprocessing historical price

data, which involves normalization and sequence creation to prepare it for model training. An LSTM model

is then constructed and optimized using Keras Tuner to find the best hyperparameters. The analysis

demonstrates that the LSTM model significantly outperforms traditional forecasting methods in terms of

prediction accuracy. By evaluating the model's performance through mean squared error and visual

comparisons of predicted versus actual prices, that LSTM captures complex patterns in time series data more

effectively was founded. This study highlights the LSTM model's superior ability to forecast stock prices,

making it a powerful tool for financial predictions. The results suggest that LSTM networks should be

increasingly utilized in future market forecasting research to achieve more accurate and reliable predictions,

providing valuable insights for investors and market analysts.

1 INTRODUCTION

Predicting stock market prices remains a challenging

endeavor due to the complex and dynamic nature of

financial markets. The inherent volatility and the

multitude of factors influencing stock prices, such as

market sentiment, economic indicators, and investor

behavior, make accurate forecasting a significant

challenge.

Recent advancements in Machine Learning (ML)

have provided new tools for addressing this

challenge, with Long Short-Term Memory (LSTM)

networks emerging as a particularly promising

approach. Nelson, Pereira, and De Oliveira (2017)

demonstrated the effectiveness of LSTM networks in

predicting stock prices by utilizing historical data and

technical indicators, achieving an average prediction

accuracy of 55.9%. Their study highlighted LSTM’s

ability to capture temporal dependencies and patterns

in financial data, showcasing its potential for

enhancing forecasting accuracy. Building on this,

Bhandari et al. (2022) focused on the S&P 500 index,

comparing single-layer and multilayer LSTM

models. Their research found that single-layer LSTM

models outperformed multilayer models in terms of

a

https://orcid.org/ 0009-0007-6263-4155

prediction accuracy, underscoring the efficiency of

LSTM in capturing market volatility. Ghosh et al.

(2019) extended LSTM applications to the Indian

stock market, demonstrating its ability to surpass

traditional forecasting methods and handle complex

time series data effectively. Similarly, Liu, Liao, and

Ding (2018) applied LSTM to stock transactions,

emphasizing its suitability for modeling non-linear

and dynamic market behaviors. LSTM was explored

for predicting stock returns in the Chinese market,

showing significant improvements in prediction

accuracy over random methods (Chen et al, 2015).

However, there are still some deficiencies in relevant

experimental studies.

This body of work collectively supports the

effectiveness of LSTM networks in financial

forecasting, highlighting their ability to analyze

historical price data and technical indicators to

provide more accurate predictions. Although LSTM

model still has certain limitations in predicting stock

price trends, such as prediction delay (Wei, 2019),

These studies illustrate the transformative potential of

LSTM networks in stock market prediction, offering

a robust framework for improving forecasting

accuracy amidst the inherent complexities of

148

Lyu, S.

LSTM-Based Stock Price Prediction: Comparison between NSE Bank and S&P 500 Index.

DOI: 10.5220/0013208200004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 148-153

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

financial markets. Therefore, this study aims to

forecast the closing prices of two pivotal financial

indices: the NSE Bank Index from the National Stock

Exchange of India, representing the Indian banking

sector, and the S&P 500 Index, a benchmark

reflecting the performance of 500 major U.S.

companies. Analyzing these indices offers insights

into the banking sector's trends within India and

broader market dynamics in the United States. The

proposed approach not only aims to improve the

precision of stock price predictions but also

contributes to the broader understanding of advanced

forecasting techniques in financial markets.

2 DATA

The data used in this study came from Yahoo

Finance(https://finance.yahoo.com/?guccounter=1),

a widely used website for financial data. Yahoo

Finance provides historical data on multiple stock

markets around the world, including important

metrics such as daily closing price, opening price,

high price, low price, and trading volume. The data

was selected covering the period from August 29,

2023, to August 29, 2024. The data in this time range

can effectively reflect the long-term trend and

volatility of the market, which is helpful for the

training and prediction of the model. Among the

many available data, the study focuses on “Closing

Price” as the main indicator of analysis. Closing price

refers to the transaction price of the last transaction of

the securities in the trading day, which is the final

reflection of the market's trading activities in the day,

so it is a common indicator for trend analysis and

prediction. Before model training on the data,

descriptive statistical analysis was performed on the

selected data. Below are the basic statistical

characteristics of selected NSEBANK and S&P 500

index data, including mean, standard deviation,

minimum, maximum, and quartile ranges. Table 1

shows that the average value of NSEBANK Index is

significantly higher than that of S&P 500 index. The

average value of the former is 47,365.64, while the

average value of the latter is 4959.79. This difference

indicates that the overall level of the NSEBANK

index was much higher than the S&P 500 index

during the study period. In addition, the comparison

of the maximum values reflects a similar trend: the

maximum value of the NSEBANK index is 53,103.70,

which is significantly higher than the maximum value

of the S&P 500 index of 5667.20. These values reflect

differences in size and volatility between the two,

which may be related to the market structure,

economic conditions and investor behavior to which

they belong (Moghar & Hamiche, 2020; Yadav, Jha

& Sharan, 2020).

3 METHODOLOGIES

This paper primarily employs LSTM to forecast the

closing price of the NSE Bank and S&P 500 indices.

The chapter introduces the LSTM model architecture

and the hyperparameter optimization process used to

enhance prediction accuracy. Data from the indices is

preprocessed and split into training and testing sets.

The LSTM model is trained with optimized

hyperparameters, and predictions are made for the

test period. The performance of the model is

evaluated by calculating the Mean Squared Error

(MSE) between the predicted and actual values. This

article uses this RNN model, the LSTM, with

appropriate hyperparameter adjustments to predict

future stock trends with high accuracy (Sunny et al,

2020).

Table 1: The basic statistical characteristics of selected data.

INDEX NSEBANK S&P 500

Count 365 365

Mean 47365.64 4959.79

Std 2703.57 427.81

Min 42280.15 4117.37

25% quantile 44882.25 4554.89

Median (50%) 47327.85 5035.69

75%quantile 48986.60 5303.27

Max 53103.70 5667.20

LSTM-Based Stock Price Prediction: Comparison between NSE Bank and S&P 500 Index

149

Figure 1:

The LSTM model work principle.

Long short-term memory (LSTM) networks are a

complex variant of recurrent neural networks

designed to deal with sequence prediction problems

by learning order dependencies. Their strength lies in

their ability to capture both short - and long-term

dependencies, which makes them particularly

effective in predicting stock prices where past prices

have a significant impact on future forecasts

(Bhandari et al.,2022). The process follows a

structured workflow.

Forget Gate: This Decides how much of your

previous memory to forget.

Input Gate: This Decides how much new memory

to add to the cell state.

Cell State Update: This Combines the oblivion

gate and the input gate to update the cell status.

Output Gate: This Determines how much

information is output from the current cell state.

Detailed process can ben seen in Figure 1.

LSTM processes and remembers long-term

dependencies in time series data through a series of

carefully designed gating mechanisms (Moghar &

Hamiche, 2020). At each time step, the LSTM

decides what previous information to keep in the cell

state through a "forget gate," allowing the model to

discard information that is no longer important

(Staudemeyer et al., 2019).The input gate determines

what new information is important from the current

input and combines it with the existing cell state,

updating the cell state to incorporate the new

important information (Rahman et al., 2016). This

updating process involves discarding some old

memories and adding new memories provided by the

current time step, where the degree of discarding of

old memories is controlled by the forgetting gate, and

the addition of new memories is determined by the

input gate and a candidate memory value. Finally, the

"output gate" determines part of the output based on

the updated cell state and the current input. Together,

these gating mechanisms enable LSTM to effectively

retain long-term information while processing

sequence data, while forgetting information that is no

longer important or relevant to the prediction task,

greatly improving its ability to model time series data,

especially in scenarios where long-term dependencies

need to be understood. This structure enables LSTM

to effectively capture long-term dependencies in time

series, solving the problem of gradient disappearance

or gradient explosion encountered by standard RNNS

during training.

4 RESULTS

4.1 Data Processing

The study used closing price data from August 23,

2023, to August 23, 2024. The data was divided into

a training set and a test set, where the training set had

a time range from August 23, 2023, to June 30, 2024,

and the test set had a time range from July 1, 2024, to

August 23, 2024.

4.2 Model Training

In order to optimize the performance of the model,

hyperparameter adjustment technique is used in this

study. A bidirectional LSTM model was used for

training and select the optimal hyperparameters

through Random Search in the following range (See

Table 2).

Table 2: Range of the optimal hyperparameters.

parameter name range

LSTM units 50-100

Dropout rate 0.3-0.5

Finally, the optimal parameter combination

selected by the model is shown in Table 3.

Table 3: The value of the optimal hyperparameters.

parameter name range

LSTM units 60

Dropout rate 0.4

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

150

4.3 NSE Bank

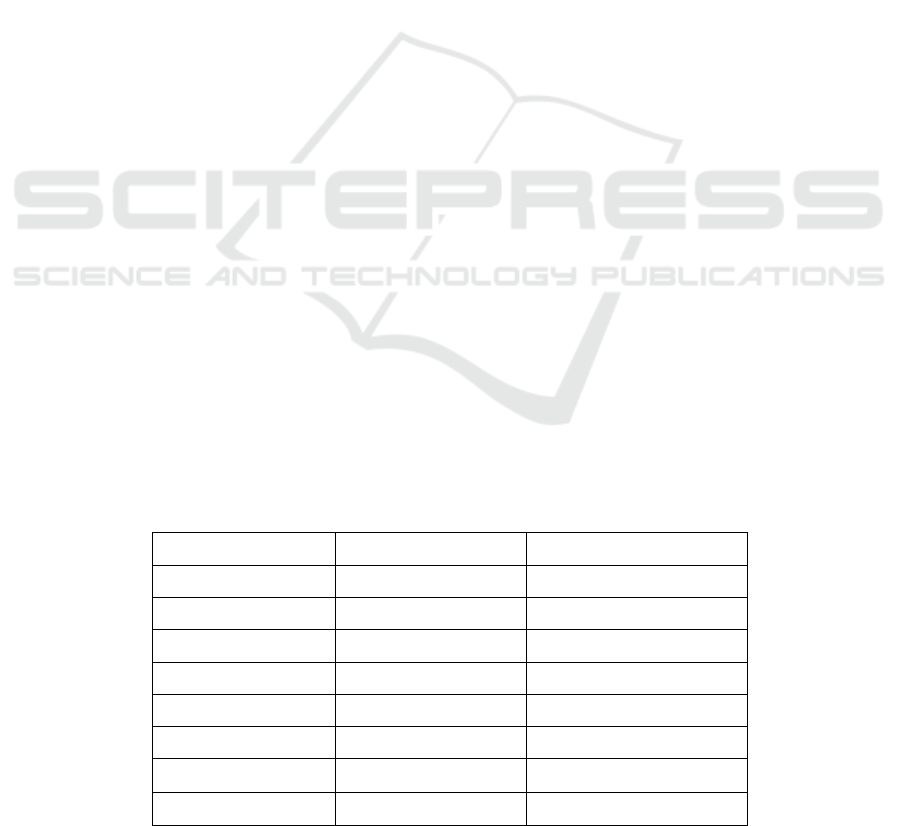

Figure 2 shows the change of mean square error

(MSE) of the NSEBANK index during training.

During the training, the mean square error (MSE)

decreases continuously, indicating that the

performance of the model is gradually optimized on

the training set. However, fluctuations in validation

errors imply the effect of market volatility on model

performance. Such volatility may stem from short-

term market instability or the risk of overfitting.

Overfitting results in a model that performs well on

the training set but underperforms when faced with

actual test data.

Figure 3 shows the actual price of the NSEBANK

index compared to the forecast price. The model can

grasp the general trend well, but the prediction error

is larger in the high fluctuation region. This error

indicates insufficient sensitivity of the model to

extreme market volatility, possibly due to the limited

capacity of the LSTM model to handle large price

changes, or due to the scarcity of such volatility data

in the training data. At the same time, although the

model performs well against general market trends,

its performance is still limited by market fluctuations,

especially when prices change sharply.

Figure 2: Model MSE(NSEBANK).

Figure 3: Prediction of NSEBANK.

LSTM-Based Stock Price Prediction: Comparison between NSE Bank and S&P 500 Index

151

Figure 4: Model MSE (S&P 500).

Figure 5: Prediction of SP500.

Table 4 shows the mean square error (MSE) of the

NSEBANK index on the test set. The MSE value

reflects the prediction error of the model on the test

set, and the lower MSE value indicates that the model

has better prediction ability.

Table 4: The value of MSE.

evaluation index value

MSE 0.0054

4.4 S&P 500

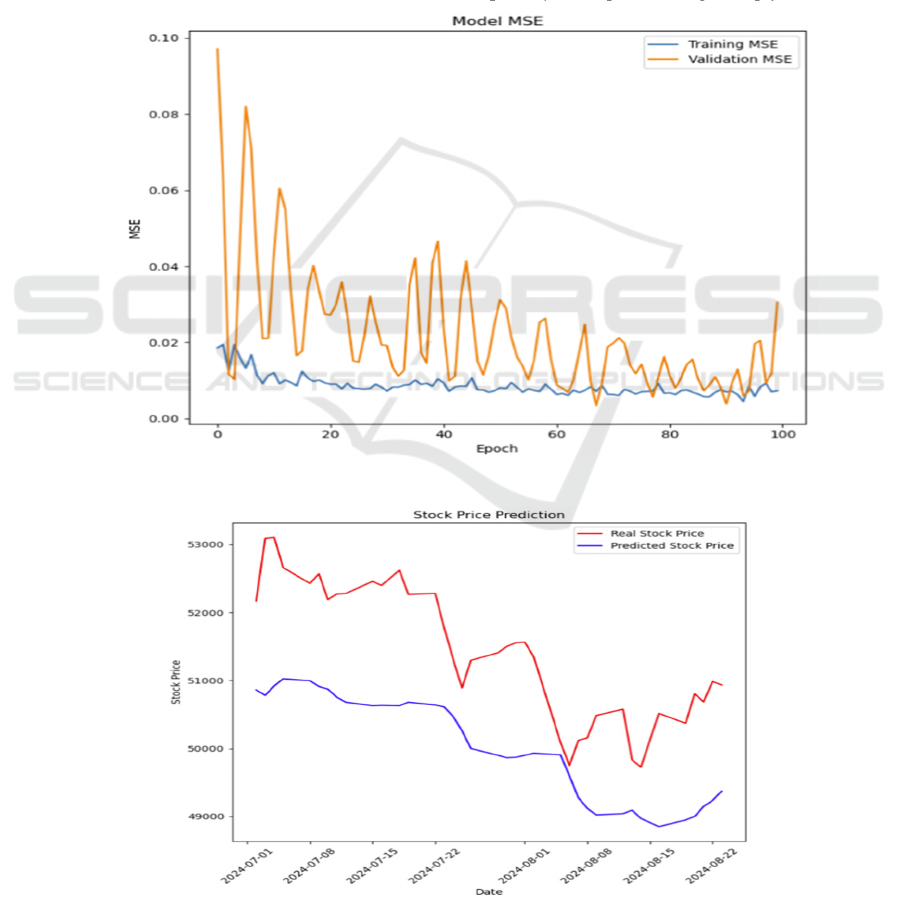

Figure 4 shows the change in mean square error

(MSE) of the S&P 500 index during training. Similar

to the NSEBANK index, both the training error and

validation error of the S&P 500 are gradually

declining, indicating that the model is gradually

converging, but the fluctuations in validation error

also reflect changes in the market.

Figure 5 shows the actual stock price of the S&P

500 index versus the forecast price on the test set. The

figure shows that the model predicted price is in line

with the overall trend of the actual price, but in some

areas of high volatility, the forecast error is obvious.

This shows that model has limitations when it comes

to dealing with wild market movements, especially

when prices rise or fall sharply. Such errors may be

due to the LSTM model's insufficient capture of

short-term volatility data, or these fluctuations occur

less frequently in the training set, resulting in poor

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

152

performance of the model in such situations. Table 5

shows the mean square error (MSE) of the S&P 500

index on the test set. The smaller MSE value indicates

that the prediction error of the model is low,

indicating that the model has strong prediction ability.

Table 5: The value of MSE.

evaluation index value

MSE 0.0048

4.5 NSEBANK vs. S&P 500 Index

While the MSE curves for both have similar swings,

the S&P 500 appears to have been more volatile. This

likely reflects an essential difference between the two

indices: the NSEBANK is more regional and

influenced by specific industries, while the S&P 500

is more global and diversified and influenced by more

macroeconomic factors.

5 CONCLUSIONS

This study investigates the use of Long Short-Term

Memory (LSTM) networks for predicting the closing

prices of the NSE Bank Index and the S&P 500 Index.

The research involved preprocessing historical price

data through normalization and sequence creation to

prepare it for model training. An LSTM model was

developed and optimized using Keras Tuner to

identify the most effective hyperparameters. The

findings reveal that the LSTM model significantly

outperforms traditional forecasting methods in

accuracy. By evaluating the model through mean

squared error and visual comparisons of predicted

versus actual prices, it was demonstrated that LSTM

effectively captures complex patterns in time series

data. This highlights the LSTM model's superior

forecasting ability, suggesting that it is a valuable tool

for financial predictions. The results indicate that

LSTM networks hold great potential for enhancing

future market forecasting, providing valuable insights

for investors and market analysts.

While this study demonstrates the advantages of

LSTM models in stock price prediction, several areas

warrant further investigation. Future research could

explore combining LSTM with other advanced

algorithms, such as GRU or Transformer models, to

assess their performance under varying market

conditions. Expanding the scope to include

additional financial indicators or longer time periods

could help evaluate the model’s robustness and

generalizability. Incorporating additional features,

such as market sentiment or macroeconomic

variables, might further improve prediction accuracy.

Lastly, examining the application of LSTM models in

real-time trading strategies could offer insights into

their practical utility and effectiveness. These future

directions will contribute to a deeper understanding

of LSTM applications in financial forecasting and

advance the field of financial technology.

REFERENCES

Bhandari, H.N., Rimal, B., Pokhrel, N.R., Rimal, R., Dahal,

K.R. and Khatri, R.K., 2022. Predicting stock market

index using LSTM. Machine Learning with

Applications, 9, p.100320.

Chen, K., Zhou, Y. and Dai, F., 2015, October. A LSTM-

based method for stock returns prediction: A case study

of China stock market. In 2015 IEEE international

conference on big data (big data) (pp. 2823-2824). IEEE.

Ghosh, A., Bose, S., Maji, G., Debnath, N. and Sen, S., 2019,

September. Stock price prediction using LSTM on Indian

share market. In Proceedings of 32nd international

conference on (Vol. 63, pp. 101-110).

Liu, S., Liao, G. and Ding, Y., 2018, May. Stock transaction

prediction modeling and analysis based on LSTM. In

2018 13th IEEE Conference on Industrial Electronics

and Applications (ICIEA) (pp. 2787-2790). IEEE.

Moghar, A. and Hamiche, M., 2020. Stock market

prediction using LSTM recurrent neural network.

Procedia computer science, 170, pp.1168-1173.

Nelson, D.M., Pereira, A.C. and De Oliveira, R.A., 2017,

May. Stock market's price movement prediction with

LSTM neural networks. In 2017 International joint conf.

on neural networks (IJCNN) (pp. 1419-1426). IEEE.

Rahman, L., Mohammed, N., & Al Azad, A. K. (2016,

September). A new LSTM model by introducing

biological cell state. In 2016 3rd International Conf. on

Electrical Engineering and Information Communication

Technology (ICEEICT) (pp. 1-6). IEEE.

Staudemeyer, R. C., & Morris, E. R. (2019). Understanding

LSTM--a tutorial into long short-term memory recurrent

neural networks. arXiv preprint arXiv:1909.09586.

Sunny, M.A.I., Maswood, M.M.S. and Alharbi, A.G., 2020,

October. Deep learning-based stock price prediction

using LSTM and bi-directional LSTM model. In 2020

2nd novel intelligent and leading emerging sciences

conference (NILES) (pp. 87-92). IEEE.

Wei, D., 2019, October. Prediction of stock price based on

LSTM neural network. In 2019 International

Conference on Artificial Intelligence and Advanced

Manufacturing (AIAM) (pp. 544-547). IEEE.

Yadav, A., Jha, C.K. and Sharan, A., 2020. Optimizing

LSTM for time series prediction in Indian stock market.

Procedia Computer Science, 167, pp.2091-2100.

LSTM-Based Stock Price Prediction: Comparison between NSE Bank and S&P 500 Index

153