Novel Portfolio Construction Based on Traditional Stock Index

Conghao Jin

College of Management and Economy, The Chinese University of Hong Kong (Shenzhen), Shenzhen, China

Keywords: Stock Index, Portfolio, Construction.

Abstract: Novel portfolio construction with great performances under controllable risks is always pursued by the finance

industry. This study explores a novel approach to portfolio investment based on an active management

strategy, centered on uncovering stocks that have yet to receive sufficient market attention despite their robust

fundamentals, or individual stocks whose prices have deviated from their intrinsic values due to market

contingencies, resulting in abnormal fluctuations. During the research process, a stock pool comprising the

constituents of the CSI 1000 Index was first constructed. These stocks, though relatively small in market

capitalization, exhibit good liquidity and receive limited market attention, providing an ideal environment for

the application of portfolio strategies. The research findings reveal that all three machine learning algorithms,

i.e., Gradient Boosting Decision Tree (GBDT), Support Vector Machine (SVM), and Random Forest (RF),

achieve stable excess returns on the CSI 1000 Index. Among them, GBDT performs best in terms of overall

returns, followed by SVM and RF in third place. From a risk control perspective, RF exhibits the lowest

maximum peak-to-trough decline, indicating strong risk resilience, while GBDT and SVM follow closely.

These results creatively integrate machine learning algorithms from the field of artificial intelligence into

portfolio construction strategies, with a focus on the CSI 1000 Index, aiming to enhance investment efficiency

through technological means.

1 INTRODUCTION

The concept of portfolio investment was first

introduced by John Templeton, emphasizing the

strategy of "seeking low-priced companies with long-

term growth prospects on a global scale as investment

targets." This idea is grounded in behavioural finance

theory, which posits that investor behaviour is not

solely based on rational decision-making but is

influenced by market inefficiencies arising from

information asymmetry and psychological factors.

These factors often lead to significant deviations in

stock prices from their intrinsic values in the short

term. Portfolio decision-making, therefore, exploits

market overreactions by capitalizing on other

investors' irrational decisions. It involves buying

undervalued, profitable, and under-researched stocks

while simultaneously selling or even short-selling

overvalued, deteriorating, or overly hyped stocks.

The ultimate goal is to profit from the eventual

reversion of stock prices to their intrinsic values.

Essentially, portfolio decision-making embodies a

value investment philosophy rooted in behavioural

finance.

According to Liutffu, portfolio strategies tend to

yield more stable excess returns in markets that are

not fully efficient (Liutffu, 2022). The constituent

stocks of the CSI 1000 Index are particularly suitable

for portfolio strategies. Comprising mainly of small-

and medium-sized enterprises (SMEs) in China, the

CSI 1000 Index represents the top 1000 most liquid

stocks outside of the CSI 800 Index. As such, it

complements indices like the CSI 300 and CSI 500

well. With relatively smaller average market

capitalizations and lower market attention, the

constituent stocks of the CSI 1000 Index better reflect

the performance of SMEs in China's capital markets

and offer better investment opportunities due to

limited investor scrutiny.

Brito contends that machine learning, the core

component of artificial intelligence, can be

categorized into supervised learning, unsupervised

learning, and reinforcement learning based on

learning methods, and into regression, classification,

and clustering based on learning directions (Brito,

2023). Dejan et al. argue that constructing a portfolio

essentially involves deciding which stocks to hold,

which to exclude or even short-sell, and determining

134

Jin, C.

Novel Portfolio Construction Based on Traditional Stock Index.

DOI: 10.5220/0013208000004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 134-142

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

the investment weights for the held stocks within a

given time frame (Dejan et al., 2022). Treating the

holding of a stock as 1, non-holding as 0, and short-

selling as -1, this process constitutes a typical

machine learning classification problem. Palma et al.

point out that while reinforcement learning achieves

the strongest learning effects in terms of accuracy and

effectiveness, its complex multi-layer iterations make

it difficult to understand the classification logic

(Palma et al., 2023). In contrast, supervised learning

can effectively return the importance of each feature

during classification, facilitating subsequent model

optimization, including feature selection, feature

processing, and parameter tuning.

Claudiu & Marcel identify random forest, support

vector machine (SVM), and gradient boosting

decision tree (GBDT) as currently mature supervised

learning algorithms (Claudiu & Marcel, 2023).

Random forest involves randomly selecting features

and samples to construct multiple decision trees for

classification. SVM seeks the optimal hyperplane that

best separates samples into different classes. GBDT,

a type of boosting algorithm, builds upon basic

decision trees, with each new iteration improving the

model's accuracy based on the losses from the

previous iteration. Burkart & Roberto highlight that

the most basic and common weak classifier in

classifiers is the decision tree algorithm, which

classifies samples based on different features

(Burkart & Roberto, 2023). Each tree node splits into

leaf nodes at the next level, continuing until a

predefined maximum depth is reached or the

minimum number of samples is reached in the bottom

nodes. Dejan et al. emphasize that the order and

attributes of feature partitioning are crucial to the

effectiveness of decision trees (Dejan et al., 2023). As

the depth of classification increases, the samples

within branch nodes become increasingly similar.

Regarding evaluation metrics, Lean et al. note that

traditional mutual fund evaluation primarily focuses

on returns and risks (Lean et al., 2023). Common

return metrics include holding period returns,

annualized returns, excess returns, and Jensen's Alpha.

Risk metrics include portfolio variance, portfolio

standard deviation, beta coefficients, and maximum

drawdowns. Comprehensive metrics that balance

returns and risks include the Sharpe Ratio,

Information Ratio, and Treynor Ratio. Francois et al.

point out that for machine learning algorithms, the

most straightforward evaluation metric is accuracy

(ACC) (Francois et al., 2023). However, ACC can be

misleading due to imbalanced sample attributes. For

instance, if 80% of samples are true and the algorithm

predicts all samples as true, ACC would still be 80%,

despite the algorithm not contributing to actual

classification. He et al. mention that numerous other

evaluation metrics have emerged, with ROC curves

and AUC values being prevalent (He et al., 2023).

ROC curves plot the true positive rate (TRR) against

the false positive rate (FRR), and the AUC value

represents the area under the ROC curve. By

definition, AUC values range from 0 to 1, with higher

values indicating better classification performance.

An AUC value close to 0.5 indicates random

classification, while a value below 0.5 suggests a

logical error in the algorithm, necessitating reverse

training. AUC effectively mitigates the illusion of

high accuracy caused by sample imbalance in ACC.

The selection strategies for individual stocks

outlined in domestic portfolio fund prospectuses can

be summarized as follows: Refk argues that due to the

current low market attention, stocks with significantly

underestimated or underrepresented intrinsic values

may experience a regression to their intrinsic values

in the future as market conditions and other factors

improve, making them high-quality corporate stocks

(Refk, 2023). Kirti et al. suggest that stocks that have

garnered significant attention due to hot topics or

other factors, resulting in market overreaction and

prices far exceeding their intrinsic values, can be

promptly sold or even shorted, waiting for the heat to

subside and prices to return to their intrinsic values

(Kirti et al., 2023). Walid et al. believe that stocks

where the company's fundamentals have undergone

or are expected to undergo positive changes, but the

share prices have not fully reflected these changes

due to investors' lack of attention stemming from

information asymmetry, have the potential to reflect

the improved fundamentals in the future (Walid et al.,

2023).

Based on the above criteria, specific operations

prioritize stocks that meet any of the following

standards: For instance, Kinda & Sulaiman consider

stocks with price-to-book (PB), price-to-earnings

(PE), or price-to-sales (PS) ratios below the median

of the overall market or industry (excluding stocks

with negative values for these indicators) (Kinda &

Sulaiman, 2023); Raza et al. focus on stocks with PB,

PE, or PS ratios lower than their own historical

medians (Raza et al., 2023); and stocks with price

fluctuations over the past three months or year that

are below the market median.

According to these standards, in actual investment

processes, domestic portfolio funds tend to isolate

common specific financial and valuation indicators,

using them to screen and invest in stocks. In terms of

both quantity and scale, domestic portfolio funds lag

far behind their foreign counterparts. China's first

Novel Portfolio Construction Based on Traditional Stock Index

135

public portfolio fund, Huatianfu Portfolio Hybrid

Fund, was established on March 9, 2012. As of

November 1, 2023, the top ten stocks in its portfolio

holdings belong to the constituent stocks of indices

such as CSI 500, SSE 50, and CSI 300. There is a total

of 14 publicly offered portfolio funds established and

in existence in China, with a total size of 13.313

billion yuan and an average annualized return of

23.71%. Compared to the approximately 8.94%

annualized return of the CSI 300 Index from 2012 to

2023, these funds have achieved an excess return of

14.77%.

Investment strategies employed by foreign

portfolio funds include as following. Ramzi et al.

advocate investing in companies where the market

has misunderstood their business models, assets, or

growth potential (Ramzi et al., 2023); Ahlem et al.

propose identifying undervalued stocks due to a lack

of investor attention and avoiding stocks significantly

overvalued due to excessive investor enthusiasm

(Ahlem et al., 2024); targeting companies with

earnings forecasts for the current year higher than the

previous fiscal year, and with earnings forecasts for

the next fiscal year exceeding those of the current

year. Alexey & Sally emphasize quantitative analysis

and computer-programmed trading instructions to

achieve stable arbitrage profits (Alexey & Sally,

2024). Quantitative investment differs from

traditional qualitative investment in its reliance on

computer-generated programmatic trading models

that comprehensively evaluate multiple stock

characteristics through model algorithms, enabling

more precise implementation of portfolio strategies

and minimizing investors' personal irrational factors.

In comparison, domestic portfolio strategy funds still

have room for optimization in this regard.

The primary objective of this study is to conduct

a comprehensive review of the current research status

and future trends of portfolio theory, both

domestically and internationally, and delve deeply

into the theoretical foundations and model

optimization strategies of three advanced algorithms:

Random Forest, Support Vector Machine (SVM), and

Gradient Boosting Decision Tree (GBDT). Through

empirical research, this study will focus on three core

aspects: data preprocessing, model prediction and

evaluation, as well as the construction and

backtesting analysis of contrarian strategies, aiming

to provide investors with scientific and effective

support for investment decision-making.

2 DATA AND METHOD

This study focuses on the constituent stocks of the

CSI 1000 Index since 2009. Through a rigorous

screening mechanism, ST stocks, newly listed stocks

with less than one quarter of trading history, and

stocks that have been suspended for a long time or are

currently suspended are excluded. Each selected

stock is treated as an independent sample, and its key

time-series features are extracted, including but not

limited to opening price, closing price, lowest price,

highest price, and core financial indicators such as

price-to-earnings ratio. To facilitate subsequent

analysis, these time-series data are further organized

into quarterly cross-sectional data to ensure data

uniformity and comparability.

Given the breadth of the research objects and the

vast amount of data, this study employs Python

programming language combined with web scraping

technology. By calling APIs from authoritative data

interfaces such as akshare, tushare, and WindPy,

efficient acquisition of financial data, market

valuation data, and historical trading data for the

stocks in the stock pool is achieved. This automated

data collection process significantly improves the

efficiency of data gathering while ensuring data

accuracy and completeness. After obtaining raw data,

further preprocessing is conducted. Specifically,

quarterly returns are calculated based on the quarterly

closing prices of stocks, and stock performance is

categorized into two classes: stocks with quarterly

returns ranking in the top 50% are labeled as positive

samples (label 1), while those in the bottom 50% are

labeled as negative samples (label 0). This step lays a

solid foundation for the subsequent training and

evaluation of machine learning models.

Data collection often encounters issues such as

missing values, extreme values, and inconsistent

dimensions, which can harm model performance if

used directly. Preprocessing is crucial, including

restructuring data into a time-cross-sectional matrix,

cleaning abnormal stocks and missing data, removing

extreme values to reduce interference, neutralizing to

eliminate external factor biases, and standardizing to

eliminate magnitude differences. Through reasonable

preprocessing, this study ensures effective model

training, accurate predictions, and avoid distortion

and overfitting:

x ∗ =

(1)

Z-Score normalization is also a commonly seen

processing method, with its processing:

x ∗ =

(2)

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

136

Table 1: ACC and AUC of each algorithm in different segmentation modes.

Se

g

mentation Modes Random Forest Su

pp

ort Vector Machine

ACC AUC ACC AUC ACC AUC

2-8 S

p

lit 79.94% 52.02% 80.12% 2-8 S

p

lit 79.94% 52.02%

3-7 Split 69.47% 53.31% 69.26% 3-7 Split 69.47% 53.31%

4-6 Split 58.77% 54.63% 59.44% 4-6 Split 58.77% 54.63%

5-5 Split 53.34% 55.76% 53.44% 5-5 Split 53.34% 55.76%

Through the aforementioned series of data

preprocessing and optimization steps, this study has

successfully constructed a high-quality dataset,

laying a solid foundation for the subsequent training

and evaluation of machine learning models.

In stock selection, this paper adopts a machine

learning classification model, focusing on predicting

stock performance. This research innovatively

classifies based on yield ranking, setting the top 50%

as the positive class. By adjusting the split ratio to

optimize model performance, one found that when

the split ratio is 50%, AUC reaches its highest,

balancing the samples while avoiding conservatism.

During training, this study combines trial and error,

random search, and Bayesian optimization for

parameter tuning, strictly distinguishing the training

set from the test set to prevent overfitting.

Additionally, cross-validation ensures model stability

and generalization ability. This classification

algorithm-based stock selection model demonstrates

excellent performance in predicting yields, providing

a powerful tool for portfolio construction, as shown

in Table 1.

When constructing a stock selection model, the

selection of variables is crucial. This study focuses on

robustness, profitability, and growth potential,

covering indicators such as current ratio, return on

equity, total asset turnover, and net profit growth rate,

to comprehensively assess the financial status of

enterprises. For trading data, this study selects trading

volume, turnover rate, and combine technical

indicators like MACD to capture market behavior. In

terms of valuation, though using indicators like P/E

ratio, it is considered the lag in financial data and

incorporate them with a one-quarter lag to enhance

prediction accuracy. This multi-dimensional variable

selection strategy aims to improve the effectiveness

and reliability of the model's stock selection.

3 RESULTS AND DISCUSSION

3.1 Algorithm Training

When training a model using the Random Forest

classifier from Python's sklearn library, this study

meticulously adjusted and optimized the algorithm

parameters based on the large sample size

characteristic of the CSI 1000 Index. Specifically, this

study increased the number of decision trees from the

default 100 to 150, enhancing the model's training

effectiveness and generalization capability.

Meanwhile, to avoid excessive training time and

potential overfitting issues, one limited the maximum

depth of each tree to five layers and maintained model

balance by setting the minimum number of samples

required to split an internal node to its default value

(usually 2 or adjusted based on the maximum depth).

In terms of feature selection, as the number of

features involved in this study is approximately 20,

one retained the default setting for the number of

features to consider, which is either the square root or

the logarithm of the total number of features, as the

two approaches yield similar results. Additionally, to

ensure reproducibility of each training outcome, one

sets the random state factor to 5, although this

parameter does not substantially impact model

performance. By training the optimized Random

Forest model, one further analyzed the importance of

each feature within the model. The ranking of feature

importance across different time periods reveals the

key factors influencing the model's prediction results.

Notably, trading and valuation data features such as

trading volume, price-to-book ratio (PB), turnover

rate, price-to-earnings ratio (PE), and price-to-sales

ratio (PS) consistently exhibited high importance

across multiple time periods, with their combined

contribution exceeding 40%. This indicates that the

Random Forest algorithm effectively captures the

market's trading activity and valuation levels, thereby

assessing the investment value of stocks. Table 2

displays the specific importance values of features for

selected time periods.

In contrast, traditional financial indicators such as

earnings per share, net assets per share, and return on

assets, while still holding a degree of importance,

collectively contribute less than 60% to the overall

prediction. This result validates the Random Forest

algorithm's superiority in identifying stocks that are

either excessively focused on or underestimated by

the market, as well as its effectiveness in executing

portfolio strategies. By comprehensively considering

Novel Portfolio Construction Based on Traditional Stock Index

137

Table 2: Specific Importance Values of Features for Selected Time Periods in Random Forest.

2016-12 2018-12 2020-12 2022-12 2024-6

Adjusted Earnings Per Share (Yuan) 0.040409 0.03807 0.039682 0.032253 0.032195

Adjusted Net Assets Per Share (Yuan) 0.028524 0.029845 0.021236 0.022813 0.025135

Operating Cash Flow Per Share (Yuan) 0.03053 0.026637 0.022989 0.020056 0.02211

Return on Assets (%) 0.032779 0.032691 0.038703 0.03805 0.038314

Main Business Profit Margin (%) 0.057383 0.036956 0.027225 0.029622 0.031791

Return on E

q

uit

y

(

%

)

0.041312 0.030427 0.026838 0.029263 0.027651

Net Profit Growth Rate (%) 0.1277 0.061498 0.034903 0.028794 0.027195

Net Asset Growth Rate (%) 0.032138 0.023046 0.025872 0.026543 0.024672

Total Asset Growth Rate (%) 0.027141 0.030785 0.030071 0.031649 0.03157

Total Asset Turnover (Times) 0.0324 0.034727 0.03547 0.027473 0.030279

Current Ratio 0.030029 0.041414 0.056233 0.066846 0.065435

Interest Coverage Ratio 0.033875 0.025979 0.023097 0.022682 0.024786

Debt-to-Asset Ratio (%) 0.033533 0.032452 0.037715 0.040791 0.042907

Cash Flow to Debt Ratio (%) 0.037847 0.026822 0.024521 0.022321 0.020431

PE 0.048924 0.058161 0.072839 0.083164 0.088153

PB 0.040195 0.094424 0.104956 0.118937 0.118118

PS 0.032958 0.055635 0.064462 0.069265 0.070275

Dividend Yiel

d

0.027446 0.048336 0.059126 0.059975 0.064788

Tradin

g

Volume 0.086102 0.092554 0.085107 0.075158 0.070835

Tradin

g

Value 0.136462 0.104016 0.096343 0.081527 0.076045

Turnover Rate 0.042314 0.075524 0.07261 0.072817 0.067314

trading data, valuation data, and financial

indicators, the Random Forest model provides a more

comprehensive assessment of stocks' investment

potential, offering robust decision support for

investors.

The Support Vector Machine (SVM) algorithm

for binary feature classification can be understood as

finding a hyperplane that separates the samples with

the maximum margin. For multi-class feature

classification, the SVM algorithm seeks to identify

the hyperplane that separates the samples with the

largest distance from the sample points. Faced with

an extremely large training dataset exceeding tens of

thousands of instances, the linear SVM algorithm can

be considered for training. Although the data volume

utilized in this paper exceeds a thousand, it has not

yet reached the ten-thousand level, hence the

adoption of a basic SVM classifier. The main

parameter settings are as follows: First, the penalty

factor, which if set excessively high, may turn SVM

into a hard-margin classifier. Therefore, this paper

sets the penalty factor to 0.9. Second, the kernel

function. Since the data is not linearly separable,

dimensionality elevation is necessary. This paper

selects the Gaussian kernel function to elevate the

data dimensionality, enabling samples with higher

similarity to cluster together, thereby achieving linear

separability and enhancing SVM's classification

performance. However, this naturally leads to longer

training times. Lastly, the random factor is also set to

5. The GradientBoostingClassifier function in

Python's Sklearn package primarily has the following

parameters: the maximum number of iterations,

which represents the number of weak learners or

regression trees. The default is 100 trees. However,

given the moderate sample size of the CSI 1000 Index

selected in this paper, spanning approximately 60

periods, too few trees can lead to underfitting, while

too many iterations can cause overfitting. During

experimentation, this paper chose a maximum

iteration count of 10. The learning rate, also known as

the step size, represents the contribution of each tree

and should be adjusted alongside the maximum

iteration count. This paper sets the learning rate to 0.1.

The maximum depth of a single regression tree is

defaulted to 3 when the number of sample features is

low. Given that this paper has 21 features, this

parameter is adjusted to 10. The randomness factor,

while ensuring consistent training results, has no

intrinsic significance, and this model also selects 5 for

this parameter. The specific importance values of

various features across selected time periods are

presented in Table 3.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

138

Table 3: Specific values of importance of each feature in GBDT section period.

2016-12 2018-12 2020-12 2022-12 2024-6

Adjusted Earnings Per Share (Yuan) 0.029112 0.032131 0.034377 0.034377 0.033686

Adjusted Net Assets Per Share (Yuan) 0.027749 0.023751 0.028559 0.028559 0.021787

Operating Cash Flow Per Share (Yuan) 0.031872 0.016649 0.018734 0.018734 0.018558

Return on Assets (%) 0.024493 0.0426 0.03601 0.03601 0.034263

Main Business Profit Margin (%) 0.054421 0.059778 0.04588 0.04588 0.043597

Return on E

q

uit

y

(

%

)

0.017696 0.016909 0.017707 0.017707 0.019184

Net Profit Growth Rate (%) 0.137147 0.070035 0.035476 0.035476 0.024836

Net Asset Growth Rate (%) 0.023125 0.017713 0.012226 0.012226 0.019129

Total Asset Growth Rate (%) 0.039294 0.026508 0.027472 0.027472 0.027166

Total Asset Turnover (Times) 0.041761 0.048096 0.028432 0.028432 0.030054

Current Ratio 0.036104 0.0408 0.059874 0.059874 0.067116

Interest Coverage Ratio 0.05008 0.037812 0.031159 0.031159 0.032545

Debt-to-Asset Ratio

(

%

)

0.021019 0.034153 0.050193 0.050193 0.03734

Cash Flow to Debt Ratio

(

%

)

0.029693 0.028686 0.03753 0.03753 0.030964

PE 0.052891 0.052915 0.056039 0.056039 0.05007

PB 0.051748 0.105908 0.124183 0.124183 0.152234

PS 0.035582 0.04375 0.044306 0.044306 0.050993

Dividend Yiel

d

0.02217 0.024115 0.037838 0.037838 0.043561

Tradin

g

Volume 0.05523 0.067847 0.081254 0.081254 0.068369

Trading Value 0.131684 0.120245 0.113508 0.113508 0.111838

Turnover Rate 0.087129 0.089609 0.079244 0.079244 0.082709

It is evident from the feature importance rankings

that for the Gradient Boosting Decision Tree (GBDT)

algorithm, the most significant factors affecting the

results are Price-to-Book Value (PB), Trading Value,

Turnover Ratio, Trading Volume, Net Profit Growth

Rate, Gross Profit Margin, Current Ratio, Price-to-

Earnings Ratio (PE), and Price-to-Sales Ratio (PS).

Together, these features account for over 50% of the

model's importance, while the remaining financial

indicators contribute less than 50%. This indicates

that the algorithm effectively evaluates whether a

stock is worth buying and holding based on whether

it receives excessive or insufficient attention, whether

its valuation is too high or too low, and whether the

company demonstrates robust profitability and

growth capabilities. Consequently, the GBDT

algorithm can also effectively execute investment

portfolio strategies.

3.2 Model Establishment

In the training of machine learning algorithm, training

set data too little often lead to the algorithm cannot

obtain effective learning effect, in the process of

training data from 0, the training effect is proportional

to the training samples, namely the more, the more

accurate, the algorithm, but the relationship after the

sample enough will lose due to the positive

relationship, so this paper to the selection of sample

training period will have a very important influence

on the algorithm classification accuracy. Since China

changed the accounting standards for listed

companies in 2009, in order to ensure the consistent

characteristics of the data, the data collection began

from 2009, and since the CSI 1000 index was

officially released on October 17,2016, the end date

of the training set was selected as December 31,2016,

and the test set from December 31,2016 to June

30,2024.

When considering stock positions held at the end

of the first quarter of 2015, the algorithm only has

sample features and labels from the fourth quarter of

2007 to the fourth quarter of 2014. When determining

the positions for the first quarter of 2015, only the

features of all stocks in the stock pool at the end of

the first quarter of 2015 are input, without labels. The

trained algorithm then predicts the labels for this

cross-sectional period based on the features. Stocks

with a label of 1 are held, while those with a label of

0 are not. This approach determines investment

strategies for this period. Similarly, when considering

positions at the end of the second quarter of 2015, the

data from the first quarter is no longer isolated;

instead, the actual stock features and labels (not

predicted ones) from the end of the first quarter are

incorporated into the training set to enhance

Novel Portfolio Construction Based on Traditional Stock Index

139

prediction accuracy. The same process is repeated for

subsequent quarters, rolling the training set forward

until the end of the entire dataset. In this way, for each

cross-sectional period, an algorithm that incorporates

all recent historical information predicts and analyzes

data outside the training set samples. These

predictions are then compared with actual values to

calculate evaluation metrics such as ACC and AUC

for assessing the algorithm's learning effectiveness.

China's primary stock trading system is T+1,

theoretically allowing daily position adjustments.

However, as institutional investors, frequent

adjustments often lead to excessive transaction costs

and a loss of investor confidence. Therefore, the

position adjustment frequency is reduced to monthly

or quarterly. Adhering to the principle of portfolio

strategy, adjustments should occur after financial

reports are released, thus setting the position

adjustment frequency to quarterly.

After the algorithm has been trained on a large

sample and its parameters optimized, considering the

relatively low attention given to the CSI 1000 Index,

this study selects its constituent stocks as the stock

selection pool. An equal-weighted portfolio is

adopted for backtesting, with quarterly position

adjustments. At the end of each quarter, stocks with a

predicted label of 1 are held, while those with a label

of 0 are not. This logic guides quarterly stock trading,

with each stock assigned an equal weight.

Let the initial capital at the beginning of the period

be C0, the final capital at the end of the period be C1,

the investment weight of the ith stock be wi, and the

return rate for the period be Ri. The portfolio's return

rate R1 for this period is calculated:

R

=

∑

ω

R

(3)

The end-of-period fund C1 for this period is:

C

=C

1 R

= C

1

∑

ω

R

=

C

∑

ω

1 R

(4)

Similarly, the end-of-period fund Cn is represented:

CN = Co

∏

1 R

(5)

Since the weights chosen in this paper are equal

weights, assuming the machine learning algorithm

decides to invest in n out of M stocks in the current

period, the weights are:

ω

=

(6)

Based on the above logic, one can generate the

amount of funds Ct possessed by the portfolio at time

t and evaluate the portfolio based on this time series

of funds.

3.3 Comparison of Key Indicators

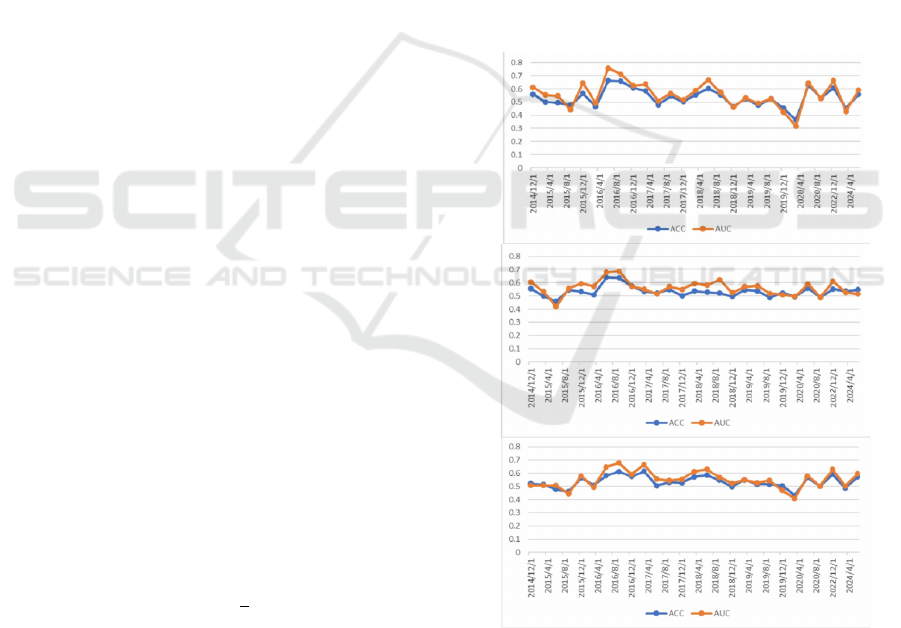

The ACC and AUC of the three algorithms for each

cross-sectional period are shown in Fig. 1. From the

trends of ACC and AUC in the figures, one can draw

the following conclusions. In terms of algorithm

stability, Support Vector Machine (SVM) has the best

stability with standard deviations of 0.0396 and

0.0556 for ACC and AUC, respectively. Conversely,

Random Forest has the worst stability with standard

deviations of 0.0688 and 0.0960 for ACC and AUC,

respectively. Gradient Boosting Decision Tree falls in

the middle with standard deviations of 0.0455 and

0.0652 for ACC and AUC, respectively. In

comparison, SVM has the best stability, able to

consistently achieve an accuracy rate of over 55%.

Gradient Boosting Decision Tree comes second in

stability, while Random Forest has relatively poor

stability, with more significant fluctuations in

accuracy as the data volume gradually expands and

styles change. Although there are fluctuations in the

accuracy of the three algorithms, they mainly

concentrate between 0.5 and 0.7, which is acceptable

for stock market prediction.

Figure 1: The accurcacy of random forest. SVM and GBDT

(from upper to the lower).

4 CONCLUSIONS

To sum up, the application of a single algorithm is

often limited by its inherent advantages and

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

140

disadvantages, while the group decision-making

strategy can effectively integrate the strengths of

multiple algorithms and reduce the limitations of a

single algorithm. The newly developed

comprehensive algorithm outperforms the benchmark

index in terms of fund curve performance and is

slightly superior to the other three individual

algorithms. Its key performance indicators include: a

standard deviation of 1.2695, a Sharpe ratio of

0.3991, an information ratio of 0.6622, a maximum

drawdown of 35.45%, and an algorithm accuracy rate

of 54.19%. Although the new algorithm demonstrates

advantages in terms of return, its higher standard

deviation and maximum drawdown indicate that the

algorithm tends to adopt a conservative strategy in

stock selection, resulting in a smaller number of

selected stocks and a higher degree of investment

concentration, thereby failing to fully diversify risks.

Therefore, a comprehensive assessment of the new

algorithm's overall capabilities requires further

validation based on a larger stock pool and data

spanning a longer time period. Overall, each

algorithm can outperform the benchmark index to a

certain extent, achieving excess returns. However,

while pursuing high returns, it is often difficult to

effectively control risk indicators such as variance

and maximum drawdown. In practical operations, the

introduction of risk management measures such as

stop-loss orders can help control the overall risk of

the portfolio. There is still room for optimization in

this study: firstly, transaction costs, both explicit and

implicit, are not considered; secondly, machine

learning algorithms are constantly evolving, and more

cutting-edge algorithms can be explored in the future;

thirdly, the handling of missing data during the data

cleaning process needs improvement. For individual

investors, this paper recommends adopting a

contrarian investment strategy, avoiding chasing

gains and cutting losses, holding undervalued stocks

for the long term, and focusing on portfolio

diversification to reduce risks and transaction costs.

For institutional investors, this paper encourages

them to pay more attention to key indicators such as

stock valuation, company development, and

profitability in quantitative investment to achieve

higher returns and guide the market towards a more

efficient direction. Additionally, future research

should further validate the performance of this

strategy in real markets and continuously optimize

algorithms and data processing methods.

REFERENCES

Ahlem, L., Ahmed, J., Tarek, F., 2024. Spillovers between

cryptocurrencies, gold and stock markets: implication

for hedging strategies and portfolio diversification

under the COVID-19 pandemic. Journal of Economics,

Finance and Administrative Science, 57, 21-41.

Alexey, R., Sally, S., 2024. Dynamic portfolio decisions

with climate risk and model uncertainty. Journal of

Sustainable Finance, Investment, 2, 344-365.

Brito, I., 2023. A portfolio stock selection model based on

expected utility, entropy and variance. Expert Systems

With Applications, 1, 12-14.

Burkart, F. W., Roberto, B. J., 2023. Random walk through

a stock network and predictive analysis for portfolio

optimization. Expert Systems With Applications, 14,

45-47.

Claudiu, V., Marcel, A., 2023. Portfolio Volatility

Estimation Relative to Stock Market Cross-Sectional

Intrinsic Entropy. Journal of Risk and Financial

Management, 2, 114-114.

Dejan, Z, Slavica, M., Jasmina, D, Gajić-Glamočlija,

Marina, 2022. Oil hedging with a multivariate

semiparametric value-at-risk portfolio. Borsa Istanbul

Review, 6, 1118-1131.

Dejan, Z., Biljana, P., Nataša, P., et al., 2023. How to reduce

the extreme risk of losses in corn and soybean markets?

Construction of a portfolio with European stock

indices. Agricultural Economics, Zemědělská

ekonomika, 3, 109-118.

Francois, P., Richard, A., Lorraine, M., Tinotenda, M. H.,

2023. The Impact of Investor Sentiment on Housing

Prices and the Property Stock Index Volatility in South

Africa. Real Estate Management and Valuation, 2, 1-

17.

He, P., Hu, K., Nie, S., et al., 2023. Stock Selection and

Portfolio Performance Based on ESG Scores.

Academic Journal of Business, Management, 11.

Kinda, D., Sulaiman, M., 2023. Portfolio Optimization at

Damascus Securities Exchange: A Fractal Analysis

Approach. Cogent Economics, Finance, 2, 82-84.

Kirti, S., Kumar, A., Prachi, P., Purohit, H., 2023. Did ESG

portfolio augment investors’ wealth during Covid19?

Evidence from Indian stock market. Sustainability

Accounting, Management and Policy Journal ,5,, 922-

944.

Lean, H., Pizzutilo, F., Kimberly, G., 2023. Portfolio

performance implications of investment in renewable

energy equities: Green versus gray. Corporate Social

Responsibility and Environmental Management, 6,

2990-3005.

Liu, X., Shehzad, K., Kocak, E., Zaman, U., 2022. Dynamic

correlations and portfolio implications across stock

and commodity markets before and during the COVID-

19 era: A key role of gold. Resources Policy 102985-

102985.

Palma, M. M., Eva, L. M., Pavel, A., et al, 2023. Stock

selection using a multiple criteria hierarchical process

in the Dow Jones index. International Journal of

Innovation and Sustainable Development, 1-2, 67-84.

Novel Portfolio Construction Based on Traditional Stock Index

141

Ramzi, N., Adel, Z. S., Walid, M., 2023. Frequency

interdependence and portfolio management between

gold, oil and sustainability stock markets. International

Economics, 7, 72-79.

Raza, R. M., Mabruk, B. S., Muneer, S., et al., 2023.

Dynamic connectedness, spillover, and optimal

hedging strategy among FinTech, Sukuk, and Islamic

equity markets. Global Finance Journal, 2, 55-56.

Selmi, R., Wohar, M., Deisting, F., Kasmaoui, K. 2023.

Dynamic inflation hedging performance and downside

risk: A comparison between Islamic and conventional

stock indices. Quarterly Review of Economics and

Finance, 56-67.

Walid, M., Mobeen, R., Debasish, M, et al., 2023.

Frequency spillovers and portfolio risk implications

between Sukuk, Islamic stock and emerging stock

markets. Quarterly Review of Economics and Finance

139-157.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

142