A Comprehensive Investigation: Machine Learning for P2P Lending

Prediction

Qichang Ma

a

School of Management, Shandong University, Jinan, China

Keywords: P2P Lending, Machine Learning, Default Prediction.

Abstract: Peer-to-Peer (P2P) lending, a new business format, has developed rapidly. However, there have also been

many frauds, which have brought great challenges to investors and P2P lending platforms. This paper reviews

the methods of P2P default prediction based on machine learning. Four common machine learning models

are introduced: decision tree, support vector machine, deep neural networks and ensemble learning. For each

model, the entire process of constructing the model in the literature is illustrated to describe how these models

are applied in P2P default prediction. Three main challenges in using machine learning for P2P default

prediction are proposed: because of the "black box" property in machine learning methods, P2P default

prediction faces difficulties in interpretability; different models use data of different national sources,

structures, features, etc., existing models cannot be directly applied to a specific P2P lending platform, so P2P

default prediction faces difficulties in applicability; P2P default prediction involves a large amount of

important user privacy and security data, so P2P default prediction also faces difficulties in privacy. Solutions

to these difficulties are also proposed. This article provides a good review of using machine models for P2P

default prediction, which can provide inspiration for managers of P2P platforms.

1 INTRODUCTION

The fourth industrial revolution has had a significant

influence on the way that the financial system

operates: The swift advancement of technology for

the internet has promoted the further combination of

internet technology and traditional finance. Various

new financial development models have emerged,

and one of a booming innovative financial model is

called Peer-to-Peer (P2P) lending. P2P lending is

referred to individuals or enterprises borrowing from

other individuals or institutional lenders through

technological platforms, and it does not involve

traditional financial intermediaries (Lin et al., 2023).

Due to its advantages such as low transaction costs

and low financing thresholds, it has developed

rapidly. However, P2P lending also comes with many

drawbacks, such as imperfect credit reporting

systems, incomplete credit assessment methods, and

information asymmetry between borrowers and

lenders (Chen, 2022). These drawbacks may cause

some borrowers to fail to repay loans and interest,

thereby restricting the development of P2P platforms

a

https://orcid.org/0009-0009-2342-8716

and bringing risks to investors. Therefore, it is

necessary to accurately predict whether borrowers

will default before lending occurs.

In recent years, technologies such as artificial

intelligence have developed rapidly. Various

algorithms have emerged, which have been applied in

many fields. Similarly, artificial intelligence can also

be applied to P2P lending default prediction. P2P

lending has accumulated a large amount of customer

data over the years of development, and many studies

have conducted research on default risk prediction.

One of the challenges faced by researchers in default

risk prediction is the imbalanced data, that is, the

number of fully paid loans is much larger than default

loans. However, in default risk prediction, the

prediction of default loans received more attention,

but the classifier tends to predict the majority class.

The ratio of fully paid loans and default loans in the

data used by Chen et al. was 3.5:1, and they used

under-sampling and cost-sensitive learning to solve

66

Ma, Q.

A Comprehensive Investigation: Machine Learning for P2P Lending Prediction.

DOI: 10.5220/0013206700004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 66-70

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

the problem (Chen, et al., 2021). There are many

researchers utilized several algorithms for analyzing

the possibility of defaults. Yang et al. showed

comprehensive data processing for default prediction,

including data cleaning, feature engineering and

feature selection, modelling and Stacking. The study

tried many machine learning models and also

ensemble algorithms, among which Decision Tree

(bagging), Random Forest (bagging), Light GBM

(bagging), XGBoost (bagging) had better fitting

performance, with an amazing recall percentage of

more than 87% (Yang, 2024). Turiel et al. used Linear

Regression (LR), Support Vector Machine (SVM),

and Deep Neural Networks (DNNs) when predicting

the chance of defaults, using data from lending club.

Among them, DNNs performs the best with recall

score of 72% (Turiel et al., 2020). In addition to

structured data, there is also many unstructured data

about the borrower which contains a lot of effective

information about credit. However, unstructured data

has been rarely used in default risk prediction in the

past. Kriebel et al. showed that text generated by

eusers can significantly enhance credit default

prediction. Deep learning and machine learning

algorithms centered on word frequency ranges etc.

were used on user-generated text from data of lending

club, and it showed excellent performance (Kriebel et

al., 2022). P2P lending brings vitality into economic

development. Because of the development of this

field, many new methods combining artificial

intelligence algorithms for default risk prediction

have emerged. Therefore, it is necessary to make a

comprehensive review of this field.

The rest of the paperwork is structured as follows:

The next part will briefly introduce the general

process of machine learning first, and then summarize

some methods for default prediction in previous

studies. The third part will propose the challenges and

future prospects of the P2P lending default prediction

field. Finally, the fourth part will summarize the

whole paper and put forward conclusions.

2 METHOD

2.1 Introduction of Machine Learning

Workflow

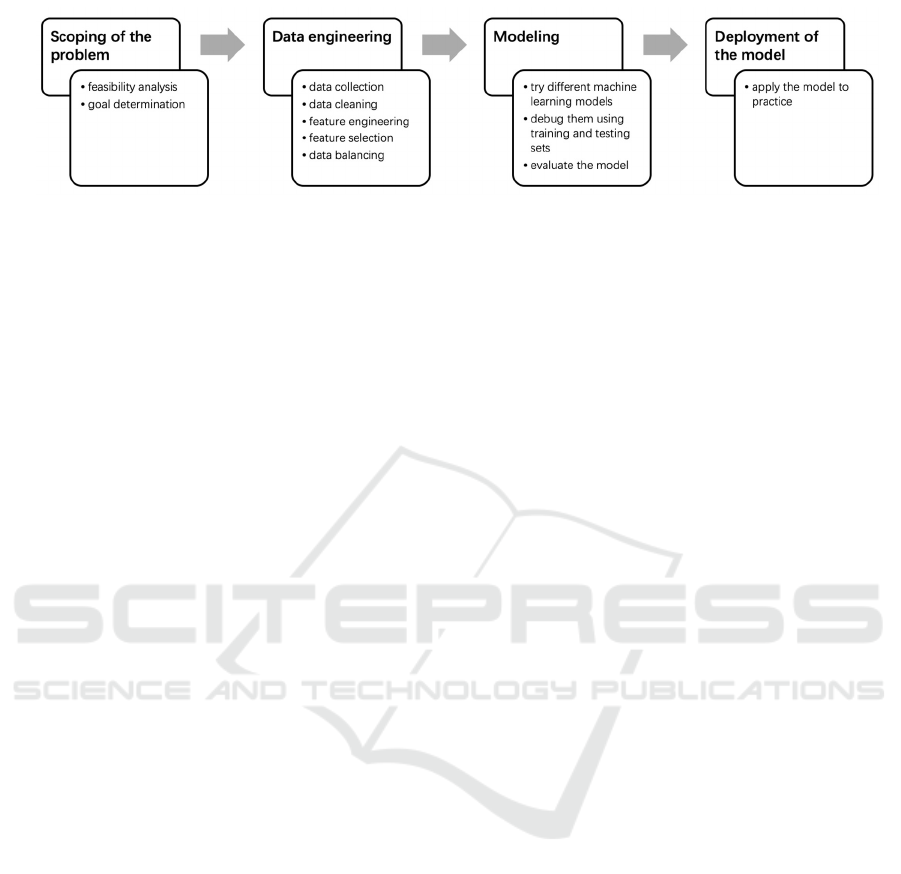

In P2P lending default prediction, it is required to

develop a supervised model which includes the loan

status as the dependent variable. Generally speaking,

a complete supervised learning process is shown

below (Kampezidou et al., 2024), and also in Fig. 1.

Scoping of the problem: this includes feasibility

analysis, goal determination, etc. This is the

beginning of a project.

Data engineering: In this scenario, it generally

includes: (1) data collection: download public

data from P2P platforms such as Lending Club

or other channels as needed. (2) data cleaning:

fill in missing fields, treat outliers and remove

exclusions or other required, to make the data

cleaner and more complete. (3) feature

engineering: the most critical step in the process

of machine learning data preparation, including

feature transformation, feature generation, etc.

(4) feature selection: filter features to decrease

the number of features, to circumvent the

dimensionality curse. (5) data balancing: in P2P

user data, compared to bad loans, the quantity of

good loans is significantly higher., so the data

needs to be balanced. Through these steps, the

structured data is generated.

Modeling: In this process, try different machine

learning models, debug them using training and

testing sets, and finally evaluate the model.

Deployment of the model: the process of

applying the model to practice, which is

generally the task of software developers.

2.2 Decision Tree

Decision tree divides the whole into branch-like parts,

which with root, internal, and leaf nodes, make up a

Figure 1: Workflow of building P2P default prediction machine learning model (Kampezidou et al., 2024).

A Comprehensive Investigation: Machine Learning for P2P Lending Prediction

67

reversed tree. It can be used to establish a

classification system or a dependent variable

prediction algorithm. Decision tree can be used in

many fields of data mining, among which prediction

is one of its most important uses (Song et al., 2015).

Kumar et al. using data from Lending Club,

ignored loans with "loan status" as "Issued", and

removed features that contained similar information

or had too many missing values. Then they used the

median to impute fields with 10-15% missing value

and deleted some excessive and least important fields.

After that, they used three models including decision

tree. When using decision tree, “Interest rate” was

selected as the primary split because it was the most

information-gaining, succeeded by "Debt to income

ratio", "Installment", "Annual income" and "Loan

amount". Finally, the results are compared by

comparing the precision and accuracy of the three

models and calculating the Area Under Curve (AUC)

(Kumar et al., 2016).

2.3 Support Vector Machine

A classification technique called support vector

machine (SVM) divides d-dimensional data to two

categories by locating a hyperplane. Sometimes, the

data is linearly inseparable, so SVM puts the data into

a space with multiple dimensions where it can be

separated using a technique called “kernel induced

feature space” (Boswell, 2022).

The model built by Shan et al. used data from

Lending Club. Shan et al. first used K-Nearest

Neighbors (KNN) to impute missing fields, that is, to

interpolate using the average of the k nearest data

points, and the paper used the default value of 5. Then

they used the first Factor Analysis of Mixed Data

(FAMD) to select features. This method is a

combination of Principal Component Analysis (PCA)

for qualitative features and Multiple Correspondence

Analysis (MCA) for quantitative features. Features

were selected according to the percentage of

contribution to the data variance exceeding a certain

threshold. In this study, loan status is regarded as the

independent variable Y. The original data had 7

categories. Shan et al. balanced the data by

reclassifying the loan status. Then he used a variety

of models including Support Vector Machine, and

compared the model results mainly based on accuracy

rate and ROC, as well as Confusion Matrix (Shan et

al., 2018).

2.4 Deep Neural Networks (DNN)

The DNN is made up of numerous parallel-operating,

basic processing units (that resemble neurons)

layered into one another. Two layers make up the

most basic neural network: a layer of input and a layer

of output. The network is referred to as a deep

network as the number of layers rises. DNN is trained

by learning to perform specific tasks to enhance the

connections between units, so that the model can

perform the same task on new inputs, which is similar

to the human brain (Cichy et al., 2019).

Turiel et al. collected the data of Lending Club,

and then deleted the features with more than 70%

missing values, imputed the missing values with the

mean, balanced the data by down sampling the

training set. In the process of using DNN to build the

model, categorical features were excluded, because

hot encoding could generate too many columns which

consumed more training time. A tanh activation

function was choosed, and the adaptive moment

estimation (Adam) optimization method, which is

designed for neural networks, was used for

optimization. "Softmax cross entropy" served as the

loss function, and Dropout was chosen for

regularization. Then the network structure was

adjusted by performing empirical grid search on

multiple network configurations and evaluated by

stratified fivefold cross-validation to prevent the

training or testing set from being shrunk. Finally, the

AUC-ROC scores as well as recall ratings were used

to test the performance (Turiel et al., 2020).

2.5 Ensemble Learning

The purpose of ensemble learning is to integrate

multiple machine learning algorithms into one model,

extract features by performing multiple projections

on the data, produce weak prediction results, and

combine the outcomes with different vote methods to

outperform each member model individually (Dong

et al., 2020).

Li et al. developed a default model for prediction

founded on heterogeneous ensemble learning using

data from a P2P network in China. The model was

trained using the number of missing data as a new

feature, and the numerical features were dispersed

using the equal size division approach. To select

features, the model-based feature ranking method was

used. When pre-training with the Extreme Gradient

Boosting model, it was tested 30 times in a loop to

obtain the feature importance score and order. Three

member algorithms: XGBoost, Deep Neural

Networks as well as Logistic Regression were trained

for 36 iterative loops, and ten-fold cross validation

was adopted during the algorithms' training process.

The article used three methods for hyperparameter

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

68

optimization and compared them to obtain the

optimal hyperparameter value range. Finally, the

three member algorithms were combined through the

liner weight ensemble strategy and AUC was used to

evaluate the model (Li et al., 2020).

3 DISCUSSIONS

3.1 Limitations and Challenges in This

Field

3.1.1 Interpretability

Interpretability and transparency are very important

for credit management process models, including

default prediction. Although many machine learning

methods mentioned above show high accuracy in P2P

lending default prediction, most algorithms lack

interpretability due to the “black box” property in

machine learning methods. Creating interpretable

algorithms is an essential subject of study for

predicting defaults, particularly for more open

domains like peer-to-peer lending: in the context of

P2P lending, due to the lack of participation of

traditional intermediaries, information asymmetry is

more serious, and higher requirements are placed on

the interpretability of default prediction (Ariza-

Garzón et al., 2020). P2P lending default prediction

should be helping in the creation of credit regulations

and offer details to investors, administrators, and

borrowers, otherwise it is difficult to be trusted.

3.1.2 Applicability

It can be found that each research in this field usually

uses different data sources: different policies in the

countries where the data is located, different sizes and

structures of data, different features contained in the

data, etc., which makes the above research methods

only applicable to the specific data and situations they

are based on. When the data and situations are

changed, these methods may not be applicable and

cannot produce satisfactory results. Therefore, when

an entity P2P lending platform wants to predict

default behavior, it cannot copy the above methods

directly. If the platform wants to train a model by

itself, it will be difficult because of high costs and

poor accuracy.

3.1.3 Privacy

With the development of AI technology, people are

increasingly concerned about data privacy and

security issues. P2P lending default prediction

involves a large amount of very important customer

privacy data, which may include asset status, work

status, family income, etc. If this private information

is leaked, it will bring significant threats to customers

and bring moral and legal risks to the P2P lending

platforms.

3.2 Future Prospects

3.2.1 Solutions to Interpretability

Many researchers have concentrated on the topic of

Explainable Artificial Intelligence (XAI) and created

some techniques for explaining machine learning

models in response to the increasing need for more

explainable machine learning models. These methods

can be basically divided into four categories

(Linardatos et al., 2020). When building a P2P

lending default prediction model, researchers can

apply these methods. Ariza-Garzón et al., for

instance, employed SHapley Additive exPlanations

(SHAP) values as a tool for interpretability (Ariza-

Garzón et al. 2020).

3.2.2 Solutions to Applicability

When solving the problem of applicability, the

application of domain adaptation can be considered.

Domain learning is a subfield of machine learning a

unique example of transfer learning. It seeks to

address the issue of disparate data distributions by

modifying the distinctions among domains in order to

increase the trained algorithm's applicability. In

domain adaptation, only the domain is different,

while the task remains the same (Farahani et al.,

2021). Therefore, using domain adaptation can allow

P2P lending platforms to use models that have been

trained in the past.

3.2.3 Solutions to Privacy

In order to solve the privacy leakage problem of

machine learning, federated learning can be used.

Federated learning is a technology and also a business

model. It allows different companies to train data

uniformly without sharing data, and establish a

unified model, which greatly reduces the risk of data

leakage, improves data privacy security, and also

provides personalized and targeted services (Yang et

al., 2019).

A Comprehensive Investigation: Machine Learning for P2P Lending Prediction

69

4 CONCLUSIONS

In this paper, several machine learning methods for

P2P default prediction are discussed, and challenges

in this field as well as solutions are proposed.

In method section, four machine learning methods

are introduced, namely decision tree, support vector

machine, deep neural networks and ensemble

learning, and it also includes how the researchers start

from data cleaning, go through data balancing, feature

selection and other steps, and finally build a model.

Then, the three challenges faced in the field of

P2P lending default prediction are discussed, namely

interpretability, that is, most machine learning

algorithms lack interpretability and make the model

untrustworthy; applicability, that is, a model cannot

be directly applied to a specific P2P lending platform;

and privacy, that is, user data privacy issues. And then

corresponding solutions are proposed. When facing

the interpretability problem, four approaches for

explaining machine learning algorithms can be used;

when facing the applicability problem, domain

adaptation (a machine learning method that only the

domain is different, but the task remains unchanged)

can be applied; when facing the privacy problem,

federated learning can be used to improve data

privacy security.

REFERENCES

Ariza-Garzón, M. J., Arroyo, J., Caparrini, A., & Segovia-

Vargas, M. J. 2020. Explainability of a machine

learning granting scoring model in peer-to-peer

lending. Ieee Access, 8, 64873-64890.

Boswell, D. 2002. Introduction to support vector machines.

Departement of Computer Science and Engineering

University of California San Diego, 11, 16-17.

Chen, X. R. 2022. Master of Research on Default Prediction

of P2P Online Loan Users Based on Integrated

Learning (Dissertation, Chongqing University). Master

Chen, Y. R., Leu, J. S., Huang, S. A., Wang, J. T., &

Takada, J. I. 2021. Predicting default risk on peer-to-

peer lending imbalanced datasets. IEEE Access, 9,

73103-73109.

Cichy, R. M., & Kaiser, D. 2019. Deep neural networks as

scientific models. Trends in cognitive sciences, 23(4),

305-317.

Dong, X., Yu, Z., Cao, W., Shi, Y., & Ma, Q. 2020. A

survey on ensemble learning. Frontiers of Computer

Science, 14, 241-258.

Farahani, A., Voghoei, S., Rasheed, K., & Arabnia, H. R.

2021. A brief review of domain adaptation. Advances

in data science and information engineering:

proceedings from ICDATA 2020 and IKE 2020, 877-

894.

Kampezidou, S. I., Tikayat Ray, A., Bhat, A. P., Pinon

Fischer, O. J., & Mavris, D. N. 2024. Fundamental

Components and Principles of Supervised Machine

Learning Workflows with Numerical and Categorical

Data. Eng, 5(1), 384-416.

Kriebel, J., & Stitz, L. 2022. Credit default prediction from

user-generated text in peer-to-peer lending using deep

learning. European Journal of Operational Research,

302(1), 309-323.

Kumar, V., Natarajan, S., Keerthana, S., Chinmayi, K. M.,

& Lakshmi, N. 2016. Credit risk analysis in peer-to-

peer lending system. In 2016 IEEE international

conference on knowledge engineering and applications

(ICKEA) (pp. 193-196). IEEE.

Li, W., Ding, S., Wang, H., Chen, Y., & Yang, S. 2020.

Heterogeneous ensemble learning with feature

engineering for default prediction in peer-to-peer

lending in China. World Wide Web, 23(1), 23-45.

Lin, Y. Y., Zhang, P. P., & Hou, X. P. 2023. P2P online

lending platform under the background of financial

technology: progress and prospects. Shanghai

Management Science (06),56-61.

Linardatos, P., Papastefanopoulos, V., & Kotsiantis, S.

2020. Explainable ai: A review of machine learning

interpretability methods. Entropy, 23(1), 18.

Shan, Q., & Nilsson, M. 2018. Credit risk analysis with

machine learning techniques in peer-to-peer lending

market. International Journal of Risk Management,

4(2), 1-43.

Song, Y. Y., & Ying, L. U. 2015. Decision tree methods:

applications for classification and prediction. Shanghai

archives of psychiatry, 27(2), 130.

Turiel, J. D., & Aste, T. 2020. Peer-to-peer loan acceptance

and default prediction with artificial intelligence. Royal

Society open science, 7(6), 191649.

Yang, Q., Liu, Y., Chen, T., & Tong, Y. 2019. Federated

machine learning: Concept and applications. ACM

Transactions on Intelligent Systems and Technology

(TIST), 10(2), 1-19.

Yang, R. 2024. Machine Learning-Based Loan Default

Prediction in Peer-to-Peer Lending. Highlights in

Science, Engineering and Technology, 94, 310-318.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

70