Sentiment Analysis with VADER and LM Using Linear Regression

for Stock Market Prediction

Xiaotong Luo

a

Shenzhen Audencia Financial Technology Institute, Shenzhen University, Shenzhen, China

Keywords: Sentiment Analysis, Stock Market Prediction.

Abstract: With the increasing popularity of stock trading, more and more researchers are focusing on stock prediction

with various machine-learning models. In addition, a growing number of individual investors prefer to share

their views on social media. As a result, market sentiment can influence the price of a stock. This paper is

going to talk about creating a model with two sentiment lexicons (VADER and LM) that is trained with a

linear regression algorithm and observing a relation between sentiment and real stock prices exists, especially

for some technology tickers. However, in this article, the Pearson correlation coefficient p-value of some

tickers is not statistically significant at a 95% confidence interval, which means the model do perform not

well in the whole dataset. The reason may be the limitations of the algorithm for splitting train and test data

or training models. Moving forward, the research intends to improve the method through feature engineering

and model selection in the future.

1 INTRODUCTION

Market sentiment is often derived from news articles,

social media posts, and financial reports. The

comments and tweets in public may affect the

behaviour of investors. Understanding the impact of

market sentiment on the stock price is worth doing,

particularly in the rapidly evolving financial markets.

If there are more positive tweets from a ticker, its

price may climb, which means the public is bullish on

this stock. Nonetheless, traditional financial analysis

methods primarily focus on historical data and

fundamental analysis. Although there are some

applications using machine learning algorithms to do

the prediction, they potentially overlook the effects of

sentiment.

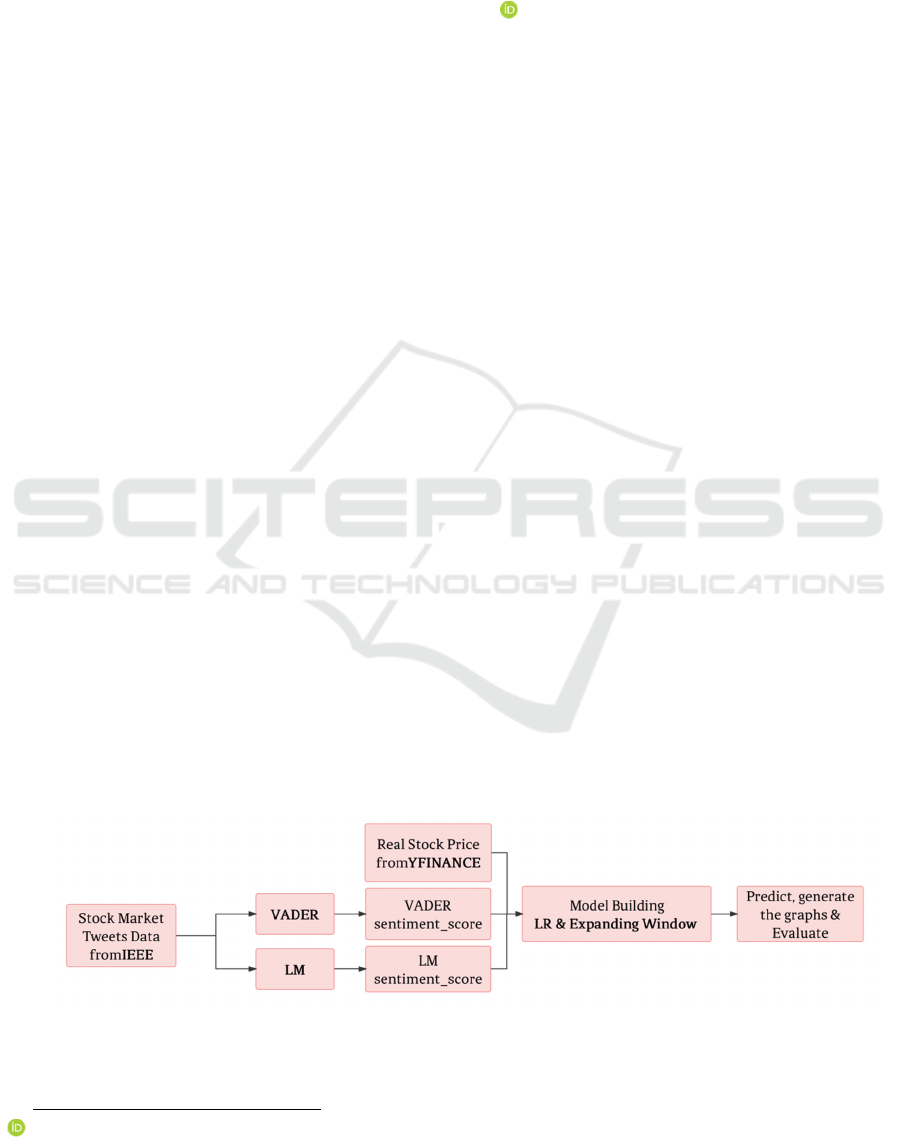

This paper is about how to do a multimodal

analysis to predict the stock market. The study

integrates sentiment lexicons, Valence Aware

Dictionary and sEntiment Reasoner (VADER) and

Loughran-McDonald Master Dictionary (LM), with a

linear regression algorithm. Finally, the study

assesses the model’s performance by Mean squared

error (MSE) and Pearson correlation coefficient. For

convenience, Figure 1 was drawn to represent the

research process.

Figure 1: The flow figure of the study

a

https://orcid.org/0009-0001-1810-7098

Luo, X.

Sentiment Analysis with VADER and LM Using Linear Regression for Stock Market Prediction.

DOI: 10.5220/0013205600004568

In Proceedings of the 1st International Conference on E-commerce and Artificial Intelligence (ECAI 2024), pages 33-38

ISBN: 978-989-758-726-9

Copyright © 2025 by Paper published under CC license (CC BY-NC-ND 4.0)

33

2 LITERATURE REVIEW

Based on this background, the research conducted a

literature review to understand what the previous

researchers had done on sentiment analysis and stock

market prediction.

2.1 Sentiment Analysis Tools

Traditional machine learning and deep learning

models are widely utilized in sentiment analysis (Tan

et al., 2023). Machine learning models, such as

Native Bayes, SVM, and Logistic Regression, are

straightforward to deploy and offer good

interpretability but may not perform well with some

complex text data. In terms of deep learning models

(CNN, RNN, LSTM, and GRU), they require

substantial data and computing resources.

Hutto and Gilbert (2014) introduced a rule-based

sentiment analysis model. They compared its

effectiveness to eleven typical state-of-practice

benchmarks, including LIWC, ANEW, the General

Inquirer, SentiWordNet, and machine learning

techniques based on Naive Bayes, Maximum

Entropy, and Support Vector Machine (SVM)

algorithms. Although it performs well in the social

media analysis, it also needs to be verified in the stock

market analysis.

Umar, Binji, and Balarabe (2024) overviewed

corpus-based approaches for sentiment analysis.

They suggested that there exist some limitations, like

data sparsity and context sensitivity, though this

model excels in handling complex language and

domain-specific data compared to dictionary-based

and rule-based methods.

2.2 Machine Learning and Stock

Prediction

Machine learning approaches are commonly

employed to stock price forecasting. Lumoring,

Chandra, and Gunawan (2023) conducted a

comparative study of various models, including SVM

and Random Forest, and emphasized that Long Short-

Term Memory (LSTM) is the most effective. Besides

the advanced machine learning models, the influence

of market sentiment should not be overlooked in

stock market predictions.

Furthermore, the widely renowned large language

model, ChatGPT, has achieved accuracy rates of 70%

for Microsoft and 63.88% for Google in predicting

stock trends (Mumtaz & Mumtaz, 2023). It is

noticeable that ChatGPT has not been trained for

stock market prediction and is limited only to

predicting trends.

2.3 Sentiment Analysis and Stock Market

Performance

More and more studies focus on the relationship

between sentiment analysis and stock market

performance. The researcher collected historical

stock market data for 10 major biotech companies and

utilized the VADER sentiment analysis tool in

conjunction with time series models for forecasting.

The study revealed a significant positive correlation

between a company’s sentiment scores and those of

its competitors (Avila, 2023).

It is found that current research lacks the

combination of sentiment analysis and stock price

prediction. This paper is going to introduce a more

comprehensive model that merges social media and

financial sentiment lexicons with a machine learning

model to forecast the stock market.

3 METHOD

3.1 Data Set

3.1.1 Stock Market Tweets Data

The study downloaded the Stock Market Tweets Data

from the IEEE (Taborda et al., 2021). This open-

access dataset collected 943,672 tweets created from

April 9 to July 16, 2020. It used Twitter tags

(#SPX500, #SP500, SPX500, SP500, $SPX, #stocks,

$MSFT, $AAPL, $AMZN, $FB, $BBRK.B,

$GOOG, $JNJ, $JPM, $V, $PG, $MA, $INTC

$UNH, $BAC, $T, $HD, $XOM, $DIS, $VZ, $KO,

$MRK, $CMCSA, $CVX, $PEP, and $PFE as search

parameters to collect the top 25 companies ticker

tweets in the S&P 500 index. There are two files in

this data set. One file includes 5,000 tweets, and out

of those 5,000 tweets, 1,300 were manually annotated

and reviewed by a second independent annotator.

Consequently, this article utilized unlabelled tweets

for ticker classification and predicted the trends of

each company in the model.

3.1.2 YFinance

Regarding the yfinance library, this paper

downloaded and normalised the historical stock price.

Through the expanding window algorithm, 20% data

was used to train the model at the beginning, and the

train set would expand, keeping the test set at 10%

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

34

length of the data. The last 10% was used to evaluate

the MSE of the method. Additionally, the research

conducted a correlation coefficient analysis between

sentiment signals and stock prices with the real stock

data from yfinance.

3.2 Data Processing

In terms of the data processing, an overview of the

tweets data set illustrates 923,673 rows and 2

columns. The information in the dataset includes

"Created_at" (the time when this tweet was created)

and "full_text" (the content of the tweet).

The next step is data cleansing. All the URLs and

mentioned information in the tweet were cleaned, the

English characters and stock tags were kept, and a

new column named "cleaned_tweet" was created to

store. Following that, the tweets were labelled with

tickers to get the sentiment score of each ticker later.

In the text preprocessing stage, the study applied

the NLTK library to define the stopwords and do the

tokenization, which means splitting the tweets into a

list of individual words.

3.3 Valence Aware Dictionary and

sEntiment Reasoner (VADER)

VADER (Hutto & Gilbert, 2014) is a lexicon

specially designed for analysing social media text.

This model looks up words in its sentiment lexicon,

sums their sentiment intensity scores, and computes

the initial sentiment intensity of a text on a scale from

-4 to 4.

As a rule-based dictionary, its 5 crucial rules and

heuristics are as follows:

Punctuation: The presence of an exclamation

point (!) in the text increments the sentiment score by

0.293.

Capitalization: If there is a capitalized character in

the emotion-related words, the model adds 0.733 to

the score.

Degree Modifiers: The model adjusts the score

according to different degree modifiers like

"extremely" and "marginally".

Contrastive Conjunction: The appearance of “but”

in the text signifies a shift in emotional polarity.

Negation Handling: If there is a negation, the

model will multiply -0.74 by the score.

Ultimately, the model normalises the score to a

range of -1 to 1 using the formula 1, where the α is

typically set to 15.

S

=

S

S

+ α

(1)

This research used the SentimentIntensity

Analyzer from NLTK to access sentiment scores

based on VADER and created a new column

(vader_sentiment_score).

3.4 Loughran-McDonald Master

Dictionary (LM)

“The Notre Dame Software Repository for

Accounting and Finance (SRAF) is a website

designed to provide a central repository for programs

and data used in accounting and finance research.

(Loughran & McDonald, 2024)” In this model, the

researchers used EDGAR 10-K files as a source of

business language and introduced a new list of

negative words, along with five other lists of words

that better reflect tone in financial texts (Loughran &

McDonald, 2011). Besides the classical categories

like positive, negative, and uncertainty, the LM

lexicon encompasses litigious, strong modal, weak

modal, and constraining columns.

The research separated the words within the LM

lexicon into positive and negative categories, scored

each tweet, and saved the sentiment score based on

LM.

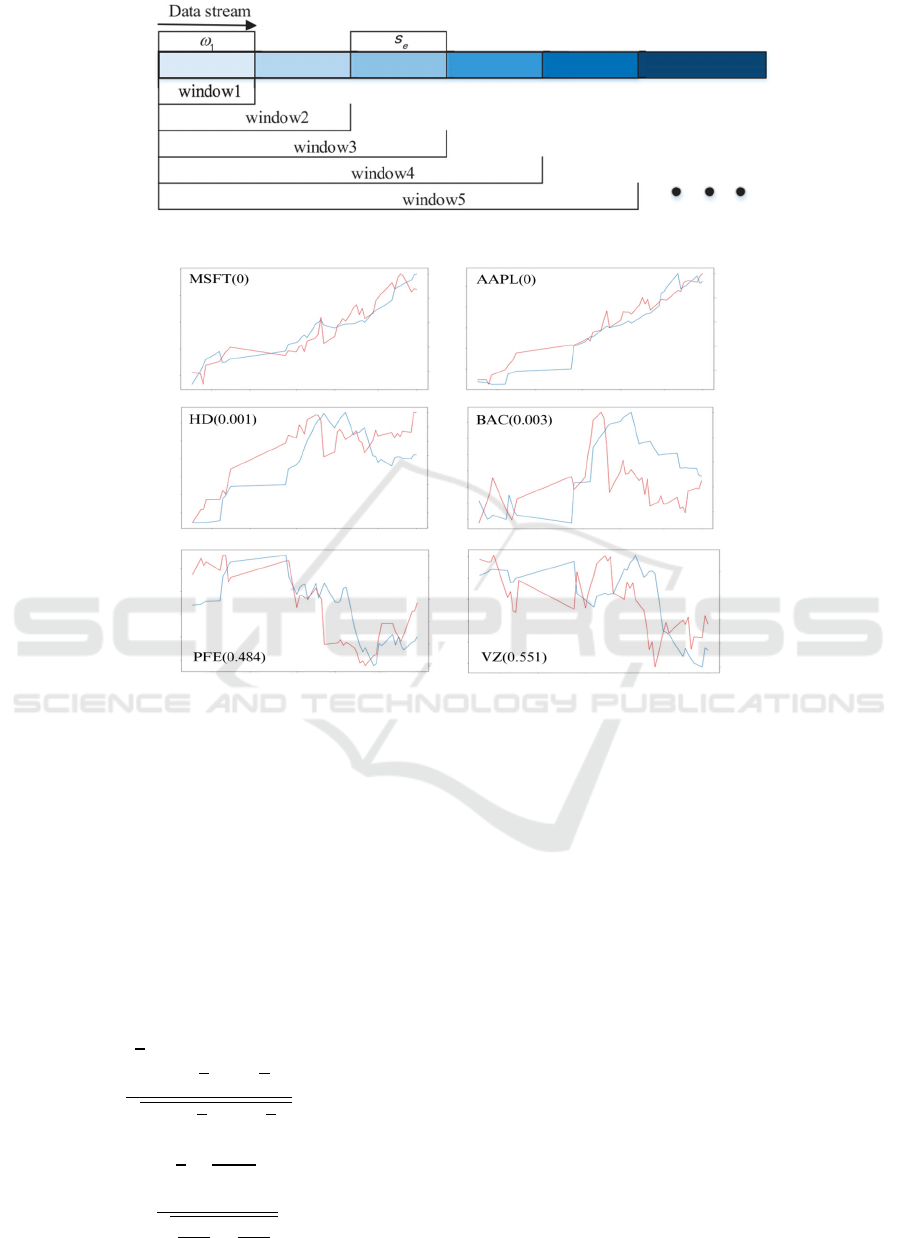

3.5 Expanding Window

Due to the insufficient volume of data for each ticker,

the expanding window algorithm (Yang et al., 2022)

was employed to do the data splitting. Figure 2 shows

the principles of this approach. It starts with an initial

small window and adds a portion of new data to

increase the size of the training set gradually.

However, it keeps the test set at a fixed size. Given

that the interval of tweet data is about 3 months,

setting a small window size and step size allows for

timely capture of market fluctuations.

This study configured the window size and step

size to be 20% and 10% of the length of data,

respectively.

Sentiment Analysis with VADER and LM Using Linear Regression for Stock Market Prediction

35

Figure 2: The principal of expanding window (Yang et al., 2022).

Figure 3: Six tickers sentiment signals VS normalised stock price.

𝑦

_

= 𝛽

+ 𝛽

𝑋

_

+ 𝛽

𝑋

_

+ 𝜀 (2)

3.6 Model Training and Evaluation

Following the data splitting, the model was trained

with linear regression, obtaining the parameters and

generating the sentiment signals (VADER and LM)

in comparison to normalised stock price comparisons.

The model was evaluated by MSE and Pearson

correlation coefficient (r). Additionally, the Fisher Z-

Transformation was applied to derive the Z-score and

corresponding p-value for statistical significance.

MSE =

1

n

y

y

(3)

r=

∑

X

X

Y

Y

∑

X

X

Y

Y

(4)

⎩

⎪

⎨

⎪

⎧

𝑍

=

1

2

𝑙𝑛

1+𝑟

1 𝑟

𝑍=

𝑍

𝑍

+

(5)

4 RESULTS

After implementing the methods mentioned above,

the study produced graphs depicting the relation

between sentiment signals and normalised stock

price, as well as the MSE and Pearson correlation p-

value of each ticker.

As for the comparison graphs, in this article, 2

tickers in each correlation level (high, medium, and

low) were selected to illustrate the varying degrees of

association between sentiment and stock price

movements.

In Fig. 3, The horizontal axis is time, and the blue

and red lines represent the sentiment signals and

normalised stock price of each ticker, respectively.

Some related results are shown in the following Table

1.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

36

Table 1: Result MSE and correlation p-value table.

Ticker MSE Correlation P-Value Significant

MSFT 0.008 0 1

AAPL 0.009 0 1

AMZN 0.011 0 1

GOOG 0.021 0 1

DIS 0.146 0 1

CMCSA 0.098 0 1

MA 0.086 0 1

PG 0.121 0.001 1

KO 0.144 0.001 1

HD 0.056 0.001 1

BAC 0.128 0.003 1

XOM 0.077 0.004 1

INTC 0.086 0.004 1

CVX 0.07 0.018 1

JPM 0.118 0.061 0

PEP 0.055 0.12 0

UNH 0.08 0.142 0

V 0.097 0.324 0

PFE 0.073 0.484 0

VZ 0.093 0.551 0

JNJ 0.274 0.717 0

MRK 0.114 0.946 0

Due to some objective factors such as the change

of the ticker's name, the Table 1 illustrates the MSE

and correlation p-value of 22 tickers. As for the

SIGNIFICANT columns, a value of 1 is assigned if

the p-value < 0.05, indicating that the correlation is

statistically significant. This suggests that there is a

discernible correlation between sentiment signals and

stock prices, particularly for some technology

companies like Microsoft, Apple, Amazon, and

Google.

5 CONCLUSIONS

In summary, market sentiment can reflect the market

trend to some extent. Usually, the sentiment emerges

earlier and fades later than stock fluctuations. Only

employing conventional machine learning models

may not suffice to enhance the precision of stock

predictions. Also, integrating previous sentiment

analysis methods with other models is essential.

Furthermore, it is necessary to introduce a more

comprehensive framework to conduct stock forecasts

with sentiment analysis. This study demonstrates the

model’s efficacy in predicting certain technology

stocks when paired with VADER and LM sentiment

tools and trained with linear regression.

While most of the results obtained in this article

are statistically significant, there are several

limitations that should be addressed. As for the linear

regression model, the relationship between sentiment

and stock data may be nonlinear. Additionally, linear

regression is highly sensitive to outliers in the data,

especially in the multi-factor stock market. Regarding

Sentiment Analysis with VADER and LM Using Linear Regression for Stock Market Prediction

37

the expanding window algorithm, it may

overemphasise the early data and become less

responsive to recent changes as the influence of older

data points persists.

To enhance the accuracy and generalizability,

future research can be directed towards exploring the

following aspects: feature engineering and model

selection for enhancement. First, the study intends to

develop lagged features, smoothing out short-term

fluctuations and noise in time series data. Subsequent

investigations will delve into the application of word

embedding models such as Word2Vec to improve

contextual understanding. Secondly, the research will

embark on integrating more sophisticated machine

learning models like Random Forest or LSTM.

REFERENCES

Avila, C. S. R. (2023). Tweet Influence on Market Trends:

Analyzing the Impact of Social Media Sentiment on

Biotech Stocks. https://arxiv.org/pdf/2402.03353

Hutto, C. J., & Gilbert, E. (2014). VADER: a Parsimonious

Rule-Based Model for Sentiment Analysis of Social

Media Text. Proceedings of the International AAAI

Conference on Web and Social Media, 8(1), 216–225.

Loughran, T., & McDonald, B. (2011). When Is a Liability

Not a Liability? Textual Analysis, Dictionaries, and 10-

Ks. The Journal of Finance, 66(1), 35–65.

Loughran, T., & McDonald, B. (2024). Home // Software

Repository for Accounting and Finance // University of

Notre Dame. Software Repository for Accounting and

Finance. https://sraf.nd.edu/

Lumoring, N., Chandra, D., & Gunawan, A. A. S. (2023,

August 1). A Systematic Literature Review:

Forecasting Stock Price Using Machine Learning

Approach. IEEE Xplore.

Mumtaz, U., & Mumtaz, S. (2023). Potential of ChatGPT

in predicting stock market trends based on Twitter

Sentiment Analysis. ArXiv.org.

https://arxiv.org/abs/2311.06273

Taborda, B., de Almeida, A., Dias, J. C., Batista, F., &

Ribeiro, R. (2021). Stock Market Tweets Data. IEEE

Dataport.

Tan, K. L., Lee, C. P., & Lim, K. M. (2023). A Survey of

Sentiment Analysis: Approaches, Datasets, and Future

Research. Applied Sciences, 13(7), 4550.

Umar, M., Binji, H. I., & Balarabe, A. T. (2024). Corpus-

based Approaches for Sentiment Analysis: a Review.

Asian Journal of Research in Computer Science, 17(7),

95–102.

Yang, J., Shi, Z., & Ji, J. (2022). Design of Improved

Expanding-Window BATS Codes. IEEE Transactions

on Vehicular Technology, 71(3), 2874–2886.

ECAI 2024 - International Conference on E-commerce and Artificial Intelligence

38