Nurturing Agri-Startups to Transform Agricultural Extension for

Sustainable Agriculture

Neethu B Nair and Saravanan Raj

National Institute of Agricultural Extension Management (MANAGE), Rajendranagar Hyderabad, 500030, India

Keywords: Agricultural Extension, Innovation, Agri-Startups, Value Chain Extension, MANAGE-CIA, Sustainable

Growth.

Abstract: This paper commences with a critical analysis of the inherent significance of agriculture in meeting the

sustenance needs of a growing global populace. In this context, the importance of agricultural extension takes

center stage. As the world witnesses paradigm shifts in technology, advisory and innovation services, the

paper highlights evolving agricultural extension, transitioning into a holistic approach encompassing the

sharing of information, knowledge, skills, risk management practices, and cultivating the ethos of farming as

an entrepreneurial enterprise. Agriculture characterised by the inefficient supply chains, post-harvest losses,

soil health issues,issues of climate change, and the delicate balance between farm size, productivity, and

farmers income. Within these challenges, a fertile ground for agri-startups emerges. Driven by the imperative

to innovate and address these challenges, these startups find unprecedented opportunities in transforming the

agricultural sector. This paper highlights on the role of cutting-edge technologies such as digital media, AI,

IoT, and Big Data in redefining agricultural extension services. These tools, with their capacity to facilitate

advisory services, usher in a new era of transforming agri-food systems. The heightened reliance on extension

services underscores the potential for agri-startups not only to address existing issues but also to advance the

agenda of profitable and sustainable agriculture. This paper also elucidates the concept of value chain

extension and its intricate linkages with agri-startups. Beyond addressing challenges, these startups play a

pivotal role in transforming agriculture into agribusiness. This paper defines the value chain extension as the

lifeline connecting every element of agricultural production and consumption, emphasizing the symbiotic

relationship between agri-startups and the evolving agricultural value chain.Additionally, the paper explores

the support systems propelling agri-startups, highlighting incubation facilities and schemes. Notably, the

MANAGE- Centre for Innovation and Agripreneurship (CIA), hosted at the National Institute of Agricultural

Extension Management (MANAGE), takes center stage. This center provides a comprehensive solution,

fostering successful ventures in agriculture and allied sectors. With a unique methodology guiding innovation

from ideation to commercialization, MANAGE-CIA focuses on developing products that address disruptive

problems in the agricultural sector. It not only aims to create employment opportunities but also contributes

to the inclusive socio-economic development. This paper seeks to provide a comprehensive understanding of

the evolving landscape of agricultural extension, positioning agri-startups as catalysts for change in fostering

sustainable growth within the agricultural value chain.

1 INTRODUCTION

Agricultural extension in India, traditionally funded

and managed by the public sector, has evolved over

the decades. Despite a decline in agriculture's GDP

share, the sector has effectively addressed food

shortages. India's pluralistic extension system

involves multiple entities, including the Ministry of

Agriculture, State Departments, Agricultural

Universities, various producer groups, and civil

society organizations. This diverse landscape aims to

enhance agricultural outreach, with state

governments primarily responsible for extension

activities. The evolving nature of Indian agriculture

includes the coexistence of private sector firms and

NGOs alongside the public extension system.

The agrifood sector remains critical for

livelihoods and employment. Achieving the UN

Sustainable Development Goal of a ‘world with zero

hunger’ by 2030 will require more productive,

efficient, sustainable, inclusive, transparent and

Nair, N. B. and Raj, S.

Nurturing Agri-Startups to Transform Agricultural Extension for Sustainable Agriculture.

DOI: 10.5220/0012973000004519

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Emerging Innovations for Sustainable Agriculture (ICEISA 2024), pages 209-217

ISBN: 978-989-758-714-6

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

209

resilient food systems. (Trendov et al. 2019). At the

same time agriculture sector faces several critical

challenges across its value chain, hindering the

efficiency and sustainability of farming practices.

These challenges encompass diverse aspects, ranging

from input volatility to limited technological access,

inefficient supply chains, and inadequate irrigation.

Addressing these issues is crucial for enhancing

productivity, reducing wastage, and ensuring the

well-being of farmers.

1.1 Challenges Exist Along the

Agriculture Value Chain

The agricultural and food value chain typically

consists of three main segments. The initial segment,

known as the 'pre-farm' link, involves suppliers

providing tangible and intangible resources for

agricultural production (Pham & Stack, 2018;

Boehlje&Broring, 2011). The second segment

pertains to activities within the farm, encompassing

the farmers themselves, often referred to as the "on-

farm" phase. Finally, the third segment involves

activities occurring after the farm, involving

processors, retailers, and consumers (Gereffi et al.,

2009; Pham & Stack, 2018).

1.2 Describing the Challenges

Numerous obstacles prevent farmers worldwide from

being as productive and profitable as they could be.

The fluctuation of input prices and the resulting

inefficient selection of components necessary for

farming is one of the major obstacles. Due to limited

data on supply-demand dynamics, farmers often find

themselves at the mercy of fluctuating input costs.

This reliance on retailers for input decisions can lead

to either excessive or inadequate use of inputs,

negatively impacting both yields and costs.

Moreover, the absence of digitization further

exacerbates these issues. With limited access to

technology, farmers struggle to gain insights into

crucial factors like crop yield and soil productivity.

Traditional farming techniques, while deeply

ingrained, often contribute to soil degradation over

time. Thus, there is a pressing need for technological

interventions to improve efficiency and sustainability

in agriculture.

Another challenge lies in ensuring consistent

quality across agricultural produce. The lack of large-

scale quality testing with quick turnaround times

complicates efforts to map a farmer's produce to its

quality standards. This poses significant challenges

for food processing companies and exporters who

rely on consistent quality for their operations.

Furthermore, inefficiencies in the supply chain

further exacerbate these challenges. Farmers often

face lower realization rates due to uncertain demand,

inefficient cropping cycles, and higher procurement

costs for retailers. Limited infrastructure, such as cold

storage facilities, also contributes to increased

wastage along the supply chain.

Access to financial solutions remains a significant

hurdle for small and marginal farmers, further

compounded by limited digitization. Without access

to financial resources, farmers struggle to invest in

modern farming techniques and equipment,

perpetuating a cycle of low productivity and income.

Inadequate irrigation exacerbates these

challenges, particularly in regions heavily reliant on

rainfall like India. With groundwater levels depleting

annually, there's an urgent need for improved

irrigation methods to ensure consistent water supply

for agriculture.

Lastly, the inverse relationship between farm size

and productivity underscores the challenges faced by

small and fragmented farms, particularly in

comparison to larger operations in countries like

Europe and the United States.

Traditional agricultural extension services are

facing significant challenges in addressing the

complexities of modern agriculture, compounded by

the imperative for the agribusiness sector to produce

food sustainably to ensure global food security by

2050. As highlighted by Gelderen et al. (2021),

entrepreneurship in this context becomes increasingly

crucial, focusing on addressing social and

environmental challenges at the local level. This shift

towards necessity-driven entrepreneurship creates

fertile ground for agri-startups, presenting an

opportunity to innovate and transform the agricultural

sector. As a result, investments in agricultural

technology have increased exponentially, as

mentioned by Kakani et al (2020). This trend

underscores the importance of leveraging

entrepreneurial solutions to drive sustainability,

efficiency, and resilience in agriculture, thereby

contributing to the long-term viability of food

production systems.

1.3 Changing role of Agricultural

Extension

The Inter-Ministerial Committee on Doubling

Farmers’ Income (DFI) recognizes agriculture as a

value-driven enterprise. It emphasizes empowering

farmers through improved market linkages and self-

ICEISA 2024 - International Conference on ‘Emerging Innovations for Sustainable Agriculture: Leveraging the potential of Digital

Innovations by the Farmers, Agri-tech Startups and Agribusiness Enterprises in Agricu

210

sustainable models for sustained productivity,

production growth, and increased income. The key

strategy focuses on optimal monetization of farmers'

produce, production sustainability, resource use

efficiency, extension services strengthening, and risk

management. Agricultural extension goes beyond the

mere transfer of technology; it is an empowering

system designed to share a comprehensive array of

information, knowledge, technology, skills, and

practices related to risk and farm management. This

process is not confined to a specific segment but

encompasses the entirety of agricultural sub-sectors,

extending support throughout the agricultural value

chain. The overarching objective is to equip farmers

with the necessary tools and insights that enable them

to realize higher net income from their agricultural

enterprises on a sustainable basis. Recognizing the

diverse needs of farmers, agricultural extension

functions as a guiding force, helping at every stage of

the value chain to foster resilience, productivity, and

economic well-being. (DFI committee, 2017)

2 OBJECTIVES

1. To study the role of Agri startup’sin Agricultural

development

2.To highlight the role of different schemes and

support systems particularly incubation facilities like

MANAGE-CIA, in propelling the success of agri-

startups and contributing to socio-economic

development

3 METHODOLOGY

The present study is based on secondary data. The

data has been procured from the related articles,

research papers, and reports of Ministry of

agriculture, ICAR report, startup’s India report, some

has been furnished from the website of agricultural

startup’s, incubators, and department of agricultural

websites.

3.1 Role of Agri-Startups for

Agricultural Development

A startup refers to a company recently founded in the

market and is currently in the phase of validating its

business model. Typically, startups are known for

their innovation and disruptive nature, as well as their

high-risk product concepts and relatively low

operating costs (Ries, 2012). A startup diverges from

a conventional company in its initial focus; while the

latter pursues growth and profitability, the former

aims to validate whether its business model can

evolve into a sustainable and profitable venture. As

uncertainty surrounding the viability of the business

model dissipates, the startup transitions to a new

stage, where its primary objective shifts towards

growth and profitability, aligning with the goals of

established companies (Blank & Dorf, 2012).

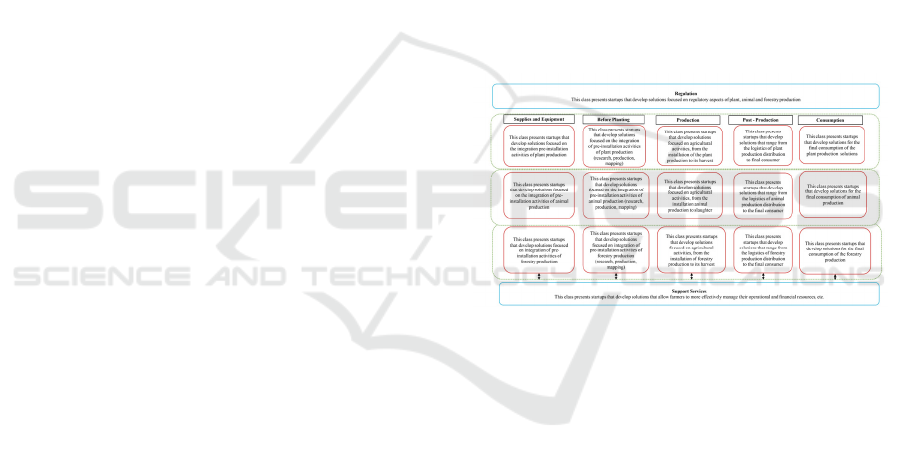

There are different classifications of start-ups

proposed by different authors, Ramos and Pedroso

(2020) proposed a model (Fig.1) has an amplitude

that covers the entire agricultural production chain.

Its configuration allows the separation of the agtechs

that provide services in the initial stage of the

operational production process (supplies and

equipment category) from those that provide services

to the final consumer (consumption category)

Fig.1. Classification of startup proposed by Ramos

and Pedroso (2020)

The roots of trends in the global technology

market can be traced back to Silicon Valley in the US.

Since it emerged from an innovative environment, the

agricultural industry has been in the forefront of

developing and applying new technology for

production processes. Due to this, investments have

increased significantly, influencing the "Agri-tech

revolution"—a term used to describe businesses

creating new technology for use in agriculture

(StartAgro, 2016). Agristartups are offering new

business models and promoting innovative forms of

collaboration amidst digital transformations. The use

of AI and IT in agriculture during this digital

revolution has accelerated the development of

technologies like drones, robots, and sensors that can

take and recognise pictures, monitor field conditions,

soil quality, water resources, nutrients, and even

control machinery and equipment remotely (Pham;

Stack, 2019; Boursianis et al., 2021).

Both large and small-scale farms can use this new

agricultural paradigm, which is revolutionising field

operations and having an influence on customers,

Nurturing Agri-Startups to Transform Agricultural Extension for Sustainable Agriculture

211

producers, and society at large (Miranda et al., 2019).

AgTechs—tech-driven businesses with an emphasis

on agribusiness solutions—are actively looking for

customised solutions to increase yields and

accomplish the objective of guaranteeing future-

proof food production (Dutia, 2014). (Kakani et al.,

2020). AgTechs, according to Dutia (2014), have the

enormous potential to completely transform the

agricultural industry by utilising technological

breakthroughs to increase productivity while also

lowering the costs associated with production

techniques on the social and environmental fronts.

Mendes et al. (2021) have delineated that

prominent enabling technologies include the Internet

of Things (IoT), blockchain, robotics, smart devices,

big data, cloud computing, ICT, cyber-physical

systems (CPS), sensors, and artificial intelligence. To

increase technical efficiency in agricultural

operations, a lot of focus is placed on integrating

smartphones and mobile technologies, frequently in

connection with the Internet of Things (IoT) and

digitization (Schulz et al., 2021). However, as Yoon

et al. (2021) have emphasised, the effective

integration of these disruptive technologies

necessitates a careful assessment of their utility to

farmers, giving top priority to the creation of

innovations that solve their core problems or

demands.

3.2 New Business Models by Agritech

Companies in the Agritech Space

3.2.1 Margin-Based Model

According to this business model, the agritech player

generates margin by establishing marketplace

linkages at the input or output side and by providing

fulfilling services in segments like "market linkage –

farm inputs" and "supply chain tech and output

market linkage."

3.2.2 Subscription-Based Model

Agritech companies that operate in the "precision

agriculture and farm management," "quality

management and traceability," and other categories

provide a range of hardware, software, and services-

based solutions all year long. They charge their

clients a monthly or yearly subscription fee.

3.2.3 Transaction-Based Model

Participants in the "financial services" market use a

transaction-based pricing strategy that takes into

account the volume of loans or insurance policies

they provide.

According to the study by Florida and Hathaway

(2018), there is an extensive increase in startup and

venture capital activity since 2009. Globalization

processes and the new era of technological innovation

rapidly change the geography of startup activity

around the world.

Savin Et.al, 2023 did a comprehensive analysis of

global startup activities utilizing textual descriptions

from the Crunchbase database, covering a significant

dataset of 250,252 startups founded between 2009

and 2019. Employing topic modeling, the researchers

devise a novel classification system comprising 38

distinct topics, aiming to offer a classification free

from expert bias.

The study identified trends over time and

variations across geographical regions. Notably,

certain topics exhibit upward trajectories, such as data

analytics and AI, time management, social platforms,

and financial transfers including cryptocurrency.

Conversely, downward trends are observed in sectors

like mobile gaming, online social networks,

marketing services, online news and blogs, and legal

and professional services.

3.3 Agri-Startups Revolutionizing the

Value Chain

Technology adoption in agriculture has a US$24

billion market potential and is assisting in the

resolution of numerous issues along the traditional

agriculture value chain. (Table.1)

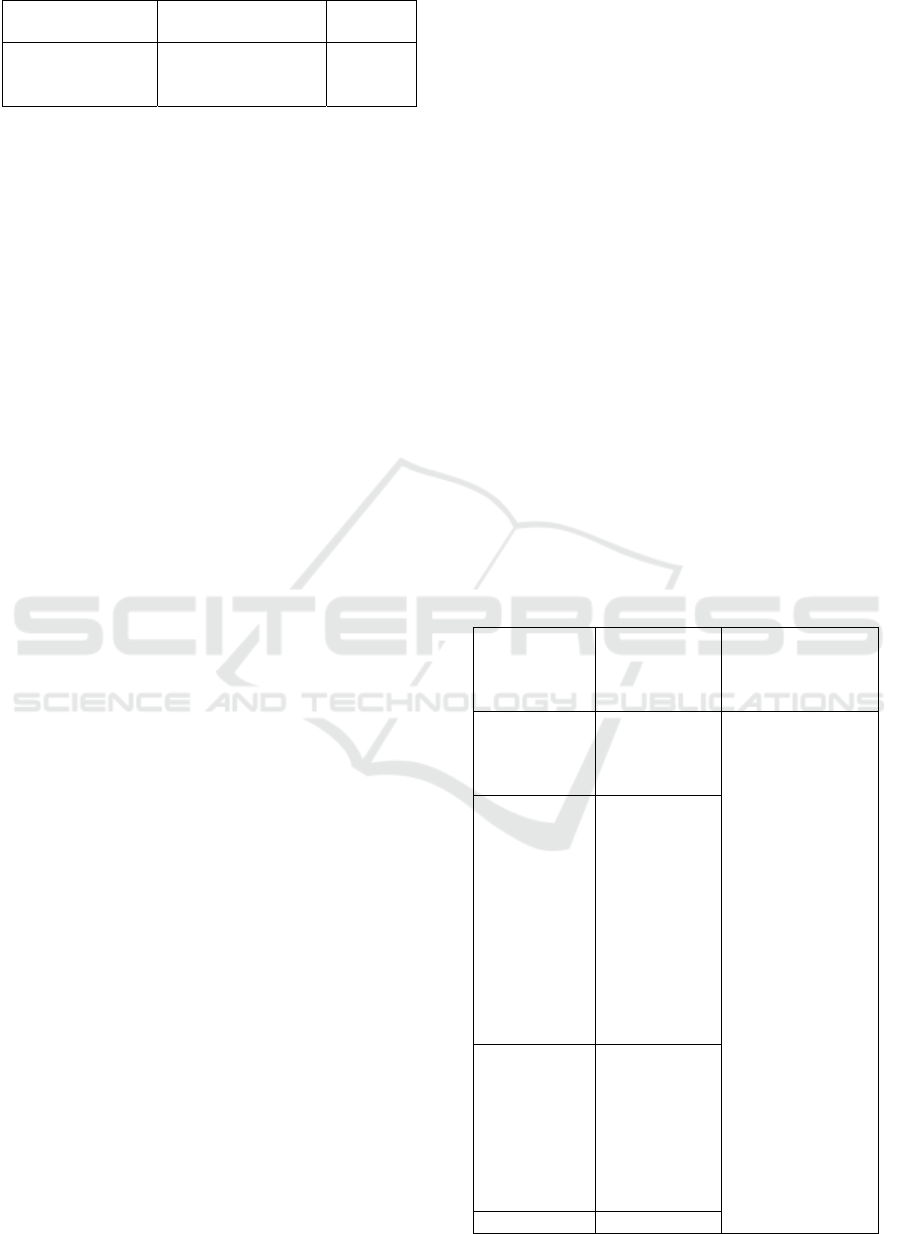

Table 1: Pain Points and Market Potential in the Agritech

Segment

Pain-point Agritech segment Market

p

otential

Volatility in input

prices; sub-

optimal input

selection

Market linkages –

farm inputs

US$1.7b

Limited access to

technology for

efficient cro

pp

in

g

Precision

agriculture and farm

mana

g

ement

US$3.4b

Uneven quality

and lack of large

scale testin

g

Quality

management and

traceabilit

y

US$3.0b

Inefficient post-

harvest supply

chain

Supply chain tech

and output market

linkages

US$12.0

b

Lack of access to

financial solutions

Financial services US$4.1b

Volatility in input

p

rices; sub-

Market linkages –

farm inputs

US$1.7b

ICEISA 2024 - International Conference on ‘Emerging Innovations for Sustainable Agriculture: Leveraging the potential of Digital

Innovations by the Farmers, Agri-tech Startups and Agribusiness Enterprises in Agricu

212

optimal input

selection

Limited access to

technology for

efficient cro

pp

in

g

Precision

agriculture and farm

mana

g

ement

US$3.4b

Source: Industry discussions, EY analysis

Each pain point in the agritech segment presents a

unique opportunity for entrepreneurs to start

agristartups and tap into significant economic

potential:

3.3.1 Volatility in Input Prices and

Sub-Optimal Input Selection

Agristartups focusing on improving market linkages

for farm inputs can address this challenge. By

providing farmers with better access to information

and resources, such startups can help optimize input

selection, leading to more efficient use of resources

and potentially saving billions of dollars in the

market.

3.3.2 Limited Access to Technology for

Efficient Cropping

There is a substantial market potential for agristartups

specializing in precision agriculture and farm

management. By leveraging technology such as

drones, sensors, and data analytics, these startups can

help farmers improve crop yields, reduce resource

wastage, and enhance overall efficiency, unlocking a

market worth billions of dollars.

3.3.3 Uneven Quality and Lack of

Large-Scale Testing

Agri-startups focusing on quality management and

traceability can address this pain point. By

implementing technologies like blockchain and IoT,

these startups can ensure transparency and

accountability throughout the supply chain, thus

improving quality standards and capturing a

significant portion of the market potential worth

billions of dollars.

3.3.4 Inefficient Post-Harvest Supply Chain

Agri-startups specializing in supply chain technology

and output market linkages have a vast economic

potential. By streamlining post-harvest processes,

reducing wastage, and improving market access for

farmers, these startups can tap into a market worth

billions of dollars, contributing to a more efficient and

sustainable agricultural ecosystem.

3.3.5 Lack of Access to Financial Solutions

Agristartups offering financial services tailored to the

needs of farmers can address this pain point. By

providing innovative financial products and services,

such as microloans, crop insurance, and digital

payment solutions, these startups can empower

farmers and unlock a market worth billions of dollars,

driving financial inclusion and economic growth in

the agricultural sector.

Agri technology start-ups are such a meaningful

solution across the agricultural value chain and can be

in the form of a product, a service, or an

application.(Table.2). These startups can leverage

technology, data analytics, and modern farming

techniques to address the gaps in the existing

agricultural ecosystem. By introducing smart farming

practices, efficient supply chain management, and

financial solutions tailored for small-scale farmers,

agristartups can play a pivotal role in transforming the

agricultural landscape. Their nimbleness and

adaptability make them well-suited to provide scalable

and sustainable solutions, ultimately contributing to

the growth and resilience of the agriculture sector.

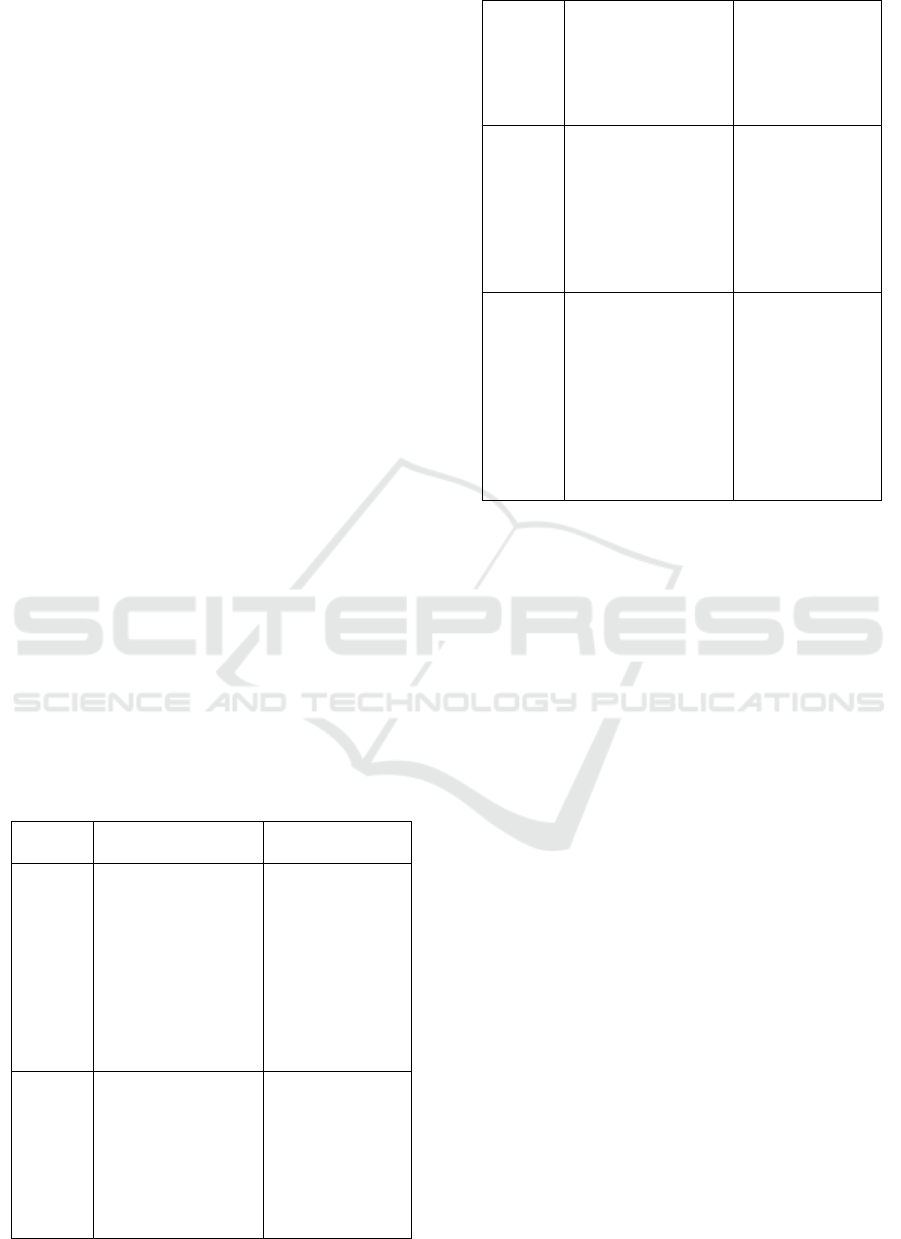

Table 2: Value Chain Segments Supporting the Agristartup

Ecosystem

Value chain Segments Segment that

support broader

agristartup

ecos

y

ste

m

Farm inputs Market

linkage-farm

inputs

Biotech

Financial services

loans and credit

arrangements for

the purchase of

equipment, inputs,

etc. Crop

insurance and

reinsurance

Information

platforms online

platforms for

agronomic,

pricing, market

information

Farming,

cultivation and

harvesting

Distribution and

transportation

Farming,

cultivation

and

harvesting

Distribution

and

transportation

Farming as a

services

Precision

agriculture

and farm

management

Farm

mechanization

and

automation

Farm

infrastructure

Post-

production

processing

and

handlining

Retailing/

selling

Quality

management

and

traceability

Supply chain

tech and

output market

linka

g

e

Consume

r

Source: Industry discussions, EY analysis

Nurturing Agri-Startups to Transform Agricultural Extension for Sustainable Agriculture

213

3.4 Role of Agri Startups in India's

Agricultural Revolution

The startup ecosystem is essential to the agriculture

sector's steady progress towards digital

transformation in India since it brings innovation and

disruption to areas that are desperately needed.

Agriculture has historically required a structured

institutional focus for technology adoption, and

technology companies are attempting to enter the

agricultural market with more modern business

models (NASSCOM 2019). These startups employ a

variety of technological advancements. In terms of

infrastructure (storage and warehousing), farm

automation (digital farming, advisory services),

precision agriculture, input delivery and advisory,

market linkages, agri-finance and insurance, agri-

biotech (new inputs, postharvest methods), etc., they

develop products and/or services to improve

efficiency at various stages of the value chain.

Technology has the potential to significantly enhance

agriculture advice services for farmers, bringing

objectivity and transparency in the post harvest value

chainVarious business models have emerged in India

in the agricultural space, including downstream

‘farm-to-fork supply chain model, IoT or big data-led

innovation model and the upstream marketplace

model. These agristartups are leveraging technology,

for instance, data digitization, SaaS (software as a

service), machine learning, data analytics, artificial

intelligence (AI), Internet-of-Things (IoT), satellite

data, drone, and blockchain, to make agriculture and

agri-industry more efficient (Mikhailov et al., 2019).

Table 3: Focus Areas of Major Agri-startups in India

Focus

Area

Services Startups

Big

Data

Determine Soil and

Crop Health,

Drones, or tractor-

based solution to get

data on field, Data

based decision

making to farmers

for improving

productivity and

reducin

g

unit costs.

Agrostar, RML

Farming

as a

Service

Agri-equipment

renting, because

moderns equipment

is expensive these

services can reduce

input costs for small

and marginal

farmers.

EM3, Ravgo,

Oxen,andFarmart

Market

Linkage

Models

Timely and accurate

estimation of

sowing and

harvesting in sync

with consumer

demand.

MeraKisan

Fintech

for

Farmers

Digitise payments

for farmers through

payment gateways

linked their

accounts, create

credit profile

environment for

funders an

d

lenders

PayAgri

IOT for

Farmers

Smart farming like

high-precision crop

control, data

collection,

automated farming,

information about

crop yields, rainfall

patterns, pest

infestation and

nutrition.

CropIn

Source: Chandana, T. & Madhuri, K.

3.5 Role of Support Systems, like

Various Schemes Incubation

Facilities like MANAGE-CIA, in

Propelling the Success of

Agri-Startups and Contributing to

Socio-Economic Development

Various national initiatives taken up by the

departments and organisations are given below

3.5.1 Rashtriya Krishi Vikas Yojana -

Remunerative Approaches for

Agricultural and Allied Sector

Rejuvenation (RKVY-RAFTAAR)

The Department of Agriculture, Cooperation, and

Farmers Welfare (DACFW), Ministry of Agriculture

and Farmers Welfare, introduced the Rashtriya Krishi

Vikas Yojana — Remunerative Approaches for

Agricultural and Allied Sector Rejuvenation (RKVY

RAFTAAR) scheme in 2018. This initiative, falling

under the "Innovation and Agri-Entrepreneurship

Development" segment, seeks to strengthen the

incubation environment and offer financial backing to

agricultural startups. Through the creation of new

avenues and the promotion of job opportunities for

young individuals, the program aims to boost farmers'

earnings. The RKVY-RAFTAAR Agribusiness

Incubation Centers, totaling 24 across India, receive

support from five Knowledge Partners, including

ICEISA 2024 - International Conference on ‘Emerging Innovations for Sustainable Agriculture: Leveraging the potential of Digital

Innovations by the Farmers, Agri-tech Startups and Agribusiness Enterprises in Agricu

214

esteemed institutions such as the National Institute of

Agricultural Extension Management in Hyderabad

and the Indian Agricultural Research Institute (IARI)

in New Delhi. These partners also serve as Centers of

Excellence in Agribusiness Incubation, offering

guidance to entrepreneurs in both the

conceptualization and expansion phases of their

ventures.

3.5.2 Department of Science and Technology

(DST)

This department operates Science Technology and

Entrepreneurship Parks across India, supporting

entrepreneurs in establishing and expanding

businesses, particularly those leveraging advanced

technologies. The National Science and Technology

Entrepreneurship Development Board (NSTEDB),

established in 1982 under DST, assists individuals in

transitioning from job seekers to job creators through

science and technology interventions.

3.5.3 Atal Innovation Mission (AIM)

A flagship initiative of the Government of India under

NITI Aayog, aims to cultivate a culture of innovation

and entrepreneurship nationwide. AIM designs

programs and policies to foster innovation across

various sectors, promoting collaboration among

stakeholders and overseeing the country's innovation

and entrepreneurship ecosystem.

3.5.4 The Department of Biotechnology

(DBT)

DBT operates the Biotechnology Industry Research

Assistance Council (BIRAC), which supports

emerging biotech enterprises in strategic research and

innovation. BIRAC provides financial assistance of

up to Rs 50 lakh through the BIRAC BIG Grant to

address nationally relevant product development

needs.

3.5.5 The Ministry of Micro, Small &

Medium Enterprises

Runs the ASPIRE scheme, which promotes

innovation, rural industry, and entrepreneurship by

establishing Livelihood Business Incubators and

Technology Business Incubators. Startups can

receive funding of up to Rs 4 lakh at the ideation stage

and Rs 20 lakh at the scale-up stage under this

scheme.

3.5.6 Pradhan Mantri Mudra Yojana

(PMMY)

The Pradhan Mantri Mudra Yojana, launched by the

Prime Minister, offers low-interest loans through

MUDRA Banks to micro-finance institutions,

benefiting startups and MSMEs with loans of up to

Rs 10 lakh across three categories.

3.5.7 Agri-Clinics and Agri-Business

Centres (ACABC), DAC&FW,

MoA&FW

A Ministry of Agriculture initiative, ACABC aims to

provide self-employment opportunities to agricultural

graduates, promote entrepreneurship, and support

farmers through consultancy services for overall

agricultural development.

3.5.8 MANAGE-CIA

The MANAGE Centre for Innovation and

Agripreneurship (MANAGE-CIA) operates as a

Center of Excellence in Agribusiness Incubation and

a Knowledge Partner for RKVY-RAFTAAR

Agribusiness Incubators (R-ABIs). It offers guidance,

best practices, and implementation support for

Startup Agribusiness Incubation and Agripreneurship

Orientation Programmes under the RKVY-

RAFTAAR scheme.

The project collaborates extensively with startups

across India, having supported over 158 grantees with

substantial financial backing, facilitating their growth

and development. Through this initiative, significant

funds totaling nearly Rs 15.88 Crores have been

allocated, empowering these innovative ventures to

thrive. With a primary focus on agricultural

advancement, efforts have directly impacted an

impressive outreach of over 8.5 lakhs farmers,

catalyzing positive change at the grassroots level.

Leveraging strategic partnerships and robust market

strategies, collaboration has facilitated the successful

launch of more than 350 products, effectively

meeting diverse consumer demands. Moreover,

collective endeavors have contributed to the creation

of over 760 direct employment opportunities, while

also fostering numerous indirect employment

avenues, bolstering economic prosperity across

various sectors. Notably, dedication to innovation has

resulted in the protection of over 50 intellectual

property rights, safeguarding the unique technologies

and brands developed by these startups, thus ensuring

their sustainability and continued growth in the

dynamic Indian market. (Source:

http://cia.manage.gov.in/)

Nurturing Agri-Startups to Transform Agricultural Extension for Sustainable Agriculture

215

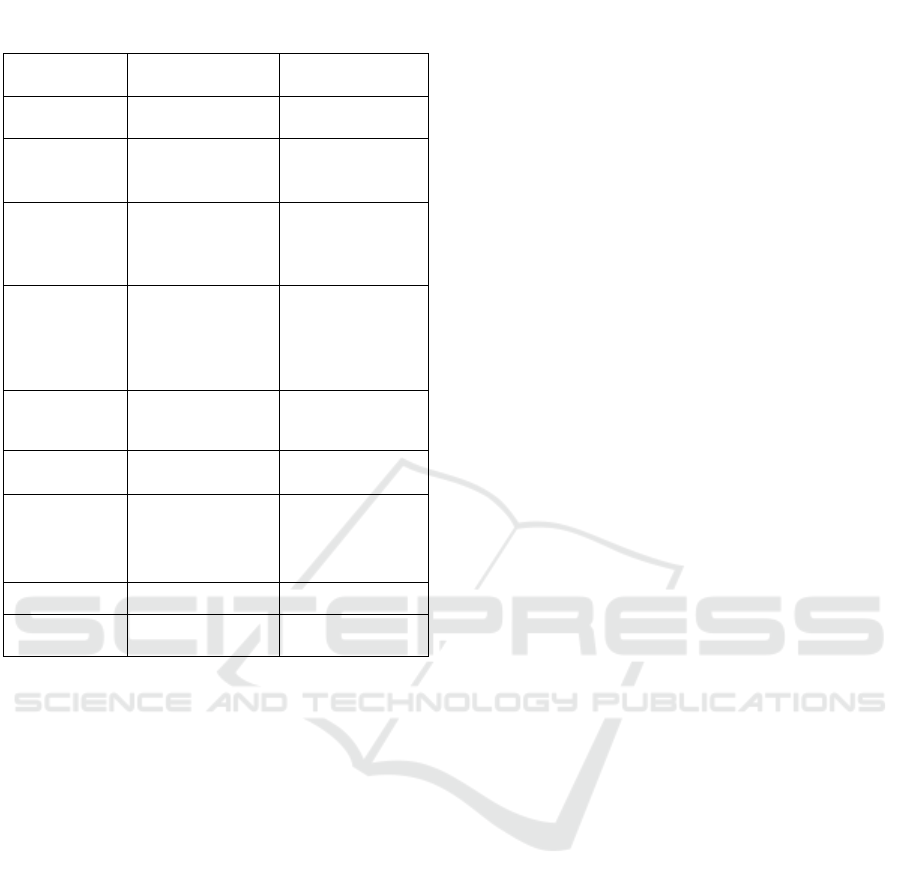

Table 4.Few successful startupsfrom MANAGE- CIA are

listed bellow

Name of the

startup

Focus area Location

SNRAS

S

y

stems

Aquaculture Pune,

Maharashtra

Agrirain Irrigation as a

service

Hyderabad,

Telangana

Pakshimitra

NET ZERO

Poultry Farm/

Waste

Mana

g

ement

Pune,

Maharashtra

Marut Drones

Precision

agriculture,

Agriculture

automation and

intelli

g

ence

Hyderabad,

Telangana

North-East

Farm Sales

Value addition

and Marketing

Guwahati, Assam

Bariflolabs Aquaculture Bhubaneswar,

Odisha

Turf Pearl

Agritech – Dr

Vishwa Priya

& Dr Siva.

Essential oils Madanapalle,

Andhra Pradesh

Agriwala Organic farming Maharashtra

Roots goods Post harvest Bangalore

4 CONCLUSIONS

This paper aimed to showcasethe pivotal role of agri-

startups as engines of economic growth and agents of

transformation within the agricultural sector.

Through the application of modern technologies and

indigenous innovations, these startups are not only

enhancing production, efficiency, and profitability

but also positively contributing to income and

employment generation. Despite the myriad

challenges facing the Indian agriculture sector,

including inefficient supply chains, post-harvest

losses, soil health issues, and climate change, agri-

startups find fertile ground for innovation and

opportunity. Leveraging cutting-edge technologies

such as digital media, AI, IoT, and Big Data, these

startups are redefining agricultural extension services

and advancing the agenda of profitable and

sustainable agriculture. Furthermore, the concept of

value chain extension underscores the symbiotic

relationship between agri-startups and the evolving

agricultural value chain, positioning them as crucial

players in transforming agriculture into agribusiness.

Supported by incubation facilities like MANAGE-

CIA, these startups are guided towards successful

ventures, contributing not only to employment

opportunities but also to inclusive socio-economic

development. Thus, this paper provides a

comprehensive understanding of the evolving

landscape of agricultural extension and highlights the

indispensable role of agri-startups in fostering

sustainable growth and development within the

agricultural sector.

REFERENCES

Agritech in India: Maxing Farm Output, 2018. NASSCOM

report.http://www.Agritechindia.com

Blank, S., & Dorf, B., 2020. The startup owner's manual:

The step-by-step guide for building a great company.

John Wiley & Sons.

Boehlje, M. and S. Bröring, 2011. The Increasing

Multifunctionality of Agricultural Raw Materials:

Three Dilemmas for Innovation and Adoption. The

International Food and Agribusiness Management

Review 14 (1): 1-16.

Boursianis, A. D.; Papadopoulou, M. S.; Diamantoulakis,

P.; Liopa-Tsakalidi, A.; Pantelis, B.; Salahas, G.;

Karagiannidis, G. K.; Wan, S.; Goldos, S. 2021.

Internet of Things (IoT) and Agricultural Unmanned

Aerial Vehicles (UAVs) in Smart Farming: A

Comprehensive Review. Internet of Things, p. 100187.

Chandana, T. & Madhuri, K. 2020. Agri startups in Indian

agriculture. Agrospheres, 1(6), 8-10. Art. No. 147. 1

,%20issue%Z06/Agmspheres-2020~ 6-8-10.pdf

Dutia, S. G. 2014. Agtech: Challenges and opportunities for

sustainable growth. Innovations: Technology,

Governance, Globalization,

https://doi.org/10.1162/inov_a_00208 v. 9, n. 1-2, p.

161-193.

Florida, R. & Hathaway I. 2018. Rise of the global startup

city: The new map of entrepreneurship and venture

capital. https://startupsusa.org/global-startup-

cities/report.pdf.

Ivan Savin, Kristina Chukavina and Andrey Pushkarev

2023. Topic-based classification and identification of

global trends for startup companies Small Bus Econ

60:659-689.

Kakani, V.; Nguyen, V. H.; Kumar, B.P.; Kim, H.;

Pasupuleti, V.R. 2020. A critical review on computer

vision and artificial intelligence in food industry.

Journal of Agriculture and Food Research

Mendes, J.A.J., Bueno, L.O., Oliveira, A.Y., Gerolano,

M.C. 2022. Agriculture Startups (AGTECHS): A

Bibliometric Study

Mikhailov A, Camboim GF and Reichert F 2019.

Identifying how digital technologies are being applied

in agribusiness value chains. Available

athttps://www.researchgate.net/

publication/345958657

ICEISA 2024 - International Conference on ‘Emerging Innovations for Sustainable Agriculture: Leveraging the potential of Digital

Innovations by the Farmers, Agri-tech Startups and Agribusiness Enterprises in Agricu

216

Miranda J, Ponce P, Molina A, Wright P 2019. Sensing,

smart and sustainable technologies for Agri-Food 4.0.

Comput Ind 108:21–36.

Nasscom 2019, “Indian tech start-up ecosystem”,

https://nasscom.in/knowledge-center/

publications/indian tech-start-ecosystem

Paulo Henrique Bertucci Ramos and Marcelo Caldeira

Pedroso, 2020. Classification and categorization of

Brazilian agricultural startups (Agtechs), Innovation &

Management Review Vol. 18 No. 3, 2021 pp. 237-257

Emerald Publishing Limited

Pham, X.; Stack, M. 2018. How data analytics is

transforming agriculture. Business Horizons, v. 61, n.

1, p. 125-133.

Report of the Committee on Doubling Farmers’ Income

Volume XIV “Department of Agriculture, Cooperation

and Farmers’ Welfare, Ministry of Agriculture &

Farmers’ Welfare. September 2018

Ries, E. 2012. A startup enxuta. Leya.

Schulz,P.; Prior, J.; Kahn, L. e Hinch, G. 2021. Exploring

the role of smartphone apps for livestock farmers: data

management, extension, and informed decision

making. The Journal of Agricultural Education and

Extension.

Ivan Savin · Kristina Chukavina · Andrey Pushkarev,

2023, Topic-based classification and identification of

global trends for startup companies Small Bus Econ

60:659-689

Trendov, N.M., Varas, S., Zeng, M., 2019. Digtal

Technologies in Agriculture and Rural Areas - Status

Report. Rome.

http://www.fao.org/3/ca4985en/ca4985en.pdf

Van Gelderen, M. 2023, "Developing entrepreneurial

competencies through deliberate practice", Education +

Training, Vol. 65 No. 4, pp. 530-547

Nurturing Agri-Startups to Transform Agricultural Extension for Sustainable Agriculture

217