A Study on Financial Ratio Analysis of Indian Farmers Fertiliser

Cooperative Limited (IFFCO)

C. H. Deepa

1,*

, S. Rajeswari

1

, N. Vani

1

and B. Ramana Murthy

2

1

Department of Agricultural Economics, S.V. Agricultural College, Tirupati, India

2

Dept. of Statistics and Computer Applications, S.V. Agricultural College, Tirupati, India

Keywords: IFFCO, Ratio Analysis, Trend Analysis, Liquidity, Solvency, Profitability, Efficient Utilization of Assets.

Abstract: Financial ratio analysis is a potent analytical tool that assesses the performance of the firm's liquidity,

solvency, asset utilization efficiency and profitability. The information gleaned from a company's financial

statements via ratio analysis can be useful to decision-makers such as managers, competitors, and investors.

This study is an assessment of performance of Indian Farmers Fertiliser Cooperative Limited (IFFCO), a

globally diversified and successful cooperative by adopting financial ratio analysis. Established in 1967 with

a mere 57 cooperatives, IFFCO has expanded to encompass nearly 36,000 Indian cooperatives with a diverse

range of operations, including general insurance, organic food production, fertilizer production, food

processing, microfinance, and rural communications with 5 manufacturing units, 21 state offices and 501 field

offices and with its backward and forward integration, IFFCO represents the hopes and aspirations of millions

of farmers as its members. The financial statements of last six financial years i.e., FY2017-18 to 2022-23

from the annual reports of the cooperatives are considered for the analysis. The study revealed that the overall

financial performance of the IFFCO is good. The Turnover of the IFFCO Group during the year 2022-23 was

Rs. 60224 Crore, as against Rs. 40171.67 Crore during the year 2021-22. Current ratio shows an increasing

trend from 3.6 to 4.01. Return on Capital Employed grew from 0.10 to 0.14. Proprietary Ratio is 0.71 in 2022-

23 as against 0.69 in 2021-22. Operating ratio declined from 0.17 to 0.14 during 2022-23, which shows

reduced operating expenses per unit sale. This indicates that IFFCO has ability to meet current obligations

and is able to utilize its assets efficiently.

1 INTRODUCTION

Achieving the profitability and solvency goals of a

business hinges on managers making informed

decisions based on a comprehensive evaluation of the

organization's financial position. Various methods

exist for such assessments. Time series analysis

delves into a firm's historical performance, tracking

changes in financial variables over time to identify

trends and assess improvement or deterioration.

Cross-sectional or interfirm analysis, on the other

hand, scrutinizes the performance of multiple firms

within the same industry at a specific point in time,

aiding in benchmarking and strategic decision-

making. Pro forma analysis involves predicting the

future financial position by projecting statements

based on current financial data, providing a forward-

looking perspective for planning and decision-

making. Each of these approaches offers unique

*

deepanush18@gmail.com

insights, enabling managers to navigate challenges

and capitalize on opportunities, ultimately steering

the business towards its financial objectives.

A singular numerical value lacks inherent

meaning, but the concept of ratios in accounting and

finance provides a relative measure by establishing

quantitative relationships between two variables.

Financial ratios, expressed as proportions, fractions,

or percentages, enable the comparison of related

information within a set of financial statements.

These ratios serve as crucial tools for analyzing and

understanding a company's financial performance,

shedding light on the connections between key

elements. By offering a contextual framework,

financial ratios empower stakeholders to assess and

compare various aspects of a company's financial

position, facilitating informed decision-making.

Ratios can be divided into four major categories:

Deepa, C. H., Rajeswari, S., Vani, N. and Murthy, B. R.

A Study on Financial Ratio Analysis of Indian Farmers Fertiliser Cooperative Limited (IFFCO).

DOI: 10.5220/0012882500004519

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Emerging Innovations for Sustainable Agriculture (ICEISA 2024), pages 93-102

ISBN: 978-989-758-714-6

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

93

• Liquidity ratios: These are the measures of

firm's ability to pay off its short-term debts .

• Leverage Ratios or Solvency Ratios or Capital

Structure Ratios: These ratios determine the

proportion of debt and equity in financing

assets of a firm.

• Activity or Turnover Ratios or Working Capital

Ratiosmeasures the efficiency with which

firm utilizes its assets.

• Profitability Ratios measures the firm's use of

its assets and control of its expenses to

generate an acceptable rate of return.

Indian Farmers Fertiliser Cooperative Limited

(IFFCO) is a multi-state cooperative society head

quatered at New Delhi and established in 1967. It has

grown into the world's largest cooperative. IFFCO

specializes in the manufacturing and marketing of

fertilizers, addressing the heightened demand during

the 1960s. Owned by Cooperative Societies of India,

IFFCO plays a pivotal role in supporting farmers by

providing essential agricultural inputs, contributing

significantly to India's agricultural sector since its

registration on November 3, 1967. It has five

manufacturing units located in Kalol and Kandla of

Gujarat, Phulpur and Aonla of Uttar Pradesh and

Paradeep, Odisha. The basic objective of the study

was to analyse the liquidity ratios, leverage ratios,

turnover ratios and profitability ratios of IFFCO.

2 REVIEW OF LITERATURE

In a study conducted by Preeti et al. (2020), the

financial profitability of Hindustan Petroleum

Corporation Limited (HPCL) was analyzed using

various financial tools over a five-year period from

2014-15 to 2018-19. The current ratio fluctuated

during this period, starting at 0.63 in 2014-15,

decreasing to 0.48 in 2015-16, rising to 0.59 and 0.62

in 2016-2017 and 2017-2018 respectively, and then

decreasing again to 0.54 in 2018-2019. Additionally,

the Gross Profit exhibited a notable increase of 99.70

in 2017-2018, contrasting with a decrease of 6.02 in

2014-2015.

In Srividhya et al.'s (2020) analysis of Planys

Technologies Pvt. Ltd., liquidity ratios fluctuated

over five years (2015-2020), indicating improving

overall financial performance. Efforts to reduce

operating expenses for higher net profit are

suggested.

In a comprehensive study, Irfan et al. (2022)

conducted financial statement and ratio analysis of

Britannia Industries, spanning from FY 2017-18 to

2021-22. Utilizing audited annual reports, the

analysis included trend assessment of financial

position and performance through various ratios.

Notably, the proportion of Debt to Capital Employed

rose from 0.80% in 2017-18 to 23.81% in 2021-22.

3 METHODOLOGY

The financial statements of past six financial years

i.e., FY 2017-18 to 2022- 23 from the annual reports

of IFFCO were considered for the analysis.

3.1 Liquidity Ratios

1. Current ratio = Current Assets ÷ Current

Liabilities

• It measures the short-term liquidity of a firm.

• A firm with a higher ratio has better liquidity.

• Ideal ratio is 2:1

2. Quick ratio = Quick Assets ÷ Current Liabilities

• To have a better idea about liquid position of the

firm.

• Ideal ratio is 1:1.

3. Cash Ratio = Cash and Cash Equivalents ÷

Current Liabilities

• To know whether the firm is able to pay liquid

liabilities immediately.

3.2 Solvency or Leverage Ratios

1. Debt-Equity Ratio = Total Debt or Liabilities ÷

Shareholders’ Fund

• It shows the proportion of long-term Debt or

Liabilities with Shareholders’ Funds.

2. Debt to Capital Employed Ratio

= Total Debt or Liabilities ÷ Capital Employed

• It shows the proportion of long-term debt or

Liabilities with capital employed.

3. Proprietary Ratio = Shareholders’ Fund ÷

Capital Employed

• It shows the proportion of Proprietary’s fund with

Capital Employed.

4. Debt-Total Assets Ratio = Total Debts ÷ Total

Assets

• It shows the proportion of Long-term Debt with

Total Assets.

ICEISA 2024 - International Conference on ‘Emerging Innovations for Sustainable Agriculture: Leveraging the potential of Digital

Innovations by the Farmers, Agri-tech Startups and Agribusiness Enterprises in Agricu

94

3.3 Activity or Turnover or Efficiency

Ratios

1. Inventory Turnover Ratio

= Turnover ÷ Average Inventory

• It indicates how fast the inventory is sold.

2. Capital Employed Turnover Ratio = Capital

Employed ÷ Turnover

• To know the efficiency of Capital Employed in the

business.

3. Fixed Assets Turnover Ratio = Fixed Assets ÷

Turnover

• To know the efficiency of Fixed Assets utilised in

the business

4. Working Capital Turnover Ratio = Net Working

Capital ÷ Turnover

• To know the efficiency of Working Capital utilised

in the business.

3.4 Profitability Ratios

1. Net Profit Ratio = Net Profit After Tax ÷ Sales

• It measures the Net Profitability in relation to

sales.2. Return on Equity Shareholders’ Funds =

Profit After Tax (PAT) ÷ Equity Shareholders’

Funds

• To know the profitability from the view point of

Equity shareholders.

3. Operating Ratio = Total Expenses ÷ Sales

•It shows the operational efficiency of the business.

•Lower the operating ratio, higher the operating

profit and vice versa.

•It measures the expense per sale.

4. Return on Capital Employed or Investment

= Profit Before Interest and Tax (PBIT) ÷ Capital

Employed

•It measures the profitability of the total funds per

investment of a firm. It shows the profitability of the

business.

5. Earnings Per Share (EPS)

= Profit After Tax (PAT) ÷ Number of Basic Equity

Shareholders

•To know the Earnings Per Share.

6. Book Value per Share

=Equity Shareholder's Fund ÷ Number of Equity

shareholders

• To know the Book Value Per Share

4 RESULTS AND DISCUSSION

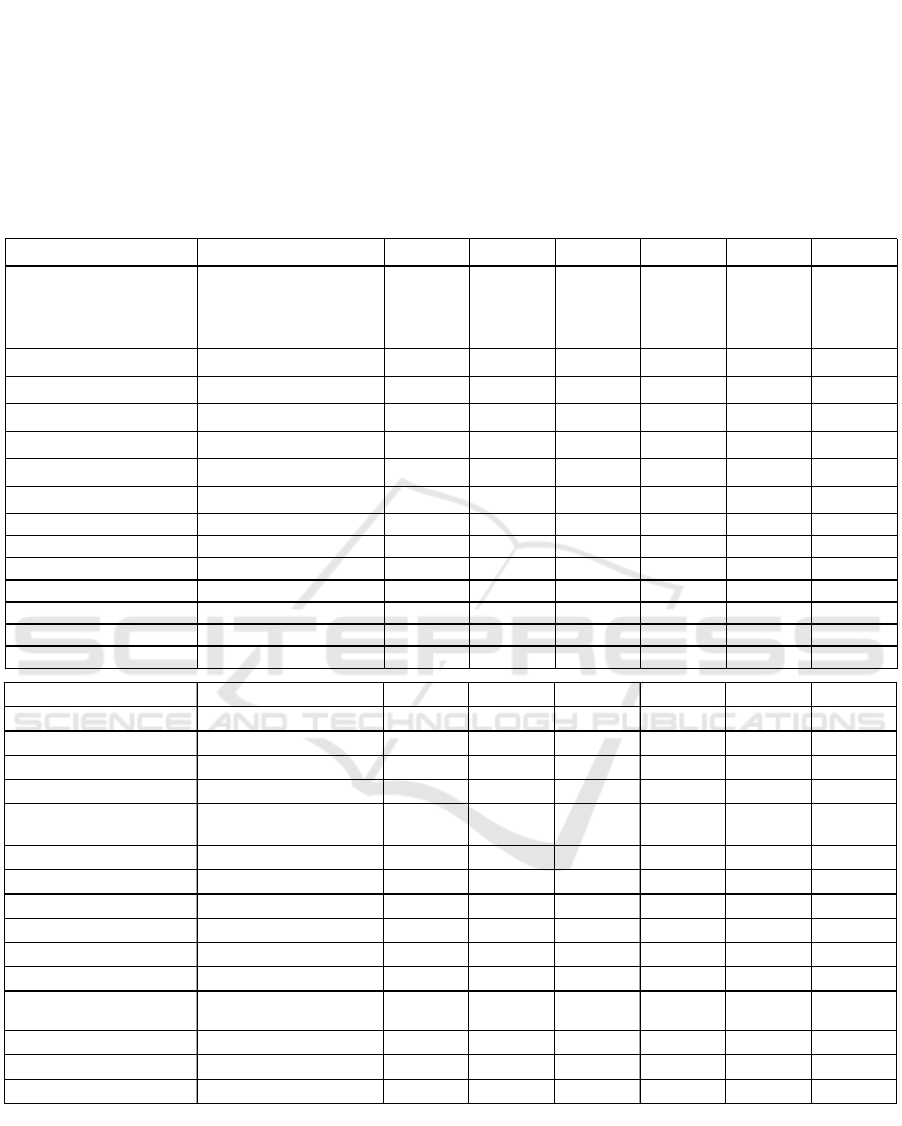

4.1 Balance Sheet of IFFCO ltd

A balance sheet is a financial statement providing a

snapshot of a company's assets, liabilities, and

shareholder's equity on a specific date. IFFCO's

balance sheets for six fiscal years, as of March 31,

illustrate significant growth in Shareholder's Funds,

Rising from 15,306.87 crores in 2017–18 to 23,452.4

crores in 2022–2023, inclusive of Share Capital,

Reserves, and Surplus. Although total liabilities have

slightly increased, total assets surged from 30,248.1

crores in 2017–18 to 39,185.6 crores in 2022–2023,

indicating an enhanced and more sustainable

financial position for the cooperatives.

4.2 Profit and Loss Statement of

IFFCO Ltd

The Profit and Loss (P&L) statement, a financial

summary of revenues, costs, and expenses within a

specific period, is presented in the following table for

six financial years of IFFCO. Notably, Sales, PBDIT,

and PAT have experienced substantial growth,

ascending from 20,787.55, 2,471.32, and 937.17

crores in 2017-18 to 60,224, 5,362.49, and 3,052.73

crores in 2022-23. This substantial increase

underscores the significant improvement in the

financial performance of the cooperatives over the

specified years.

4.3 Ratio Analysis

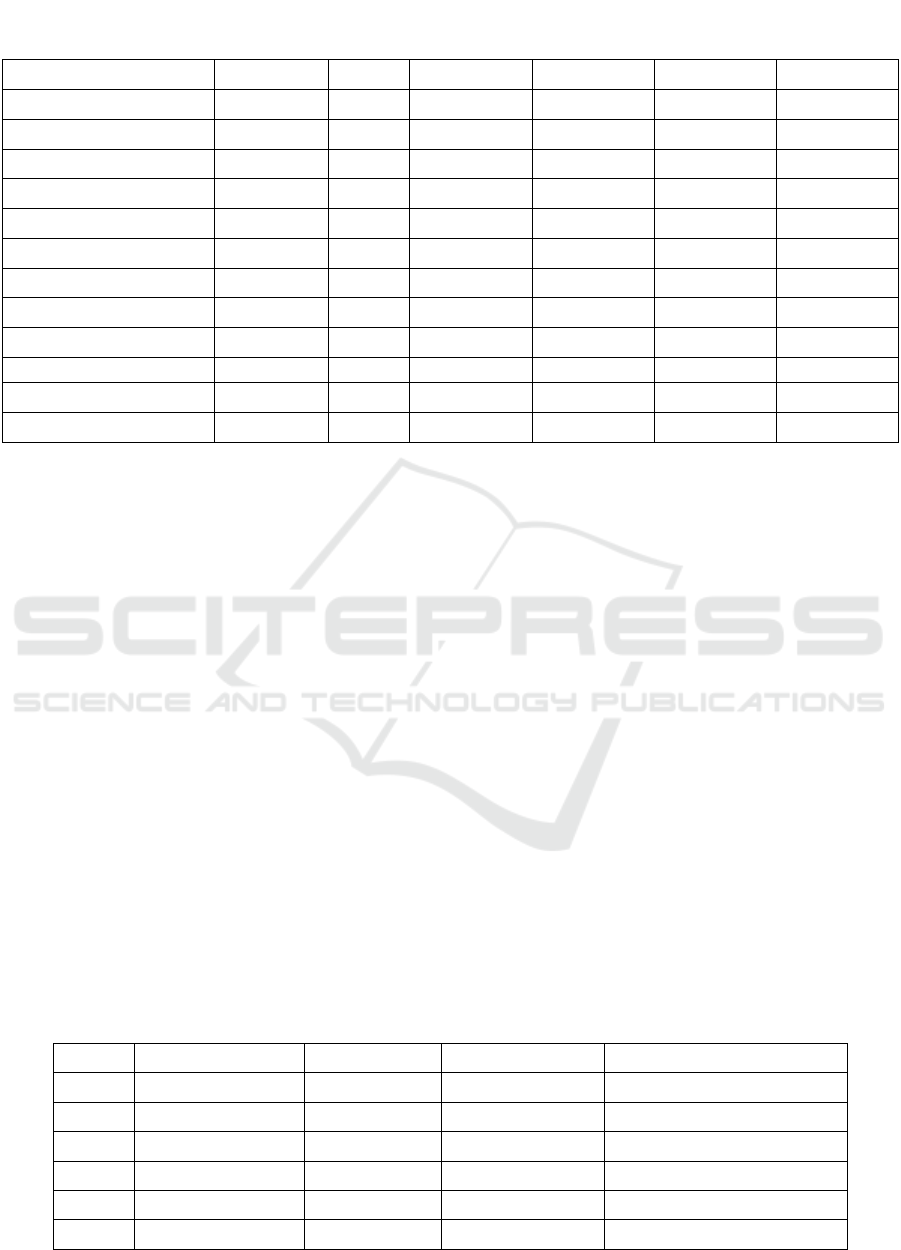

4.3.1 Liquidity Ratios

The current ratio for IFFCO exhibited variations over

the fiscal years, standing at 4.25 in 2017–18,

increasing to 5.08 in 2018–19, reaching 4.99 in 2019–

2020, but subsequently declining to 4.44 in 2020–21

and further to 3.6 in 2021–22. In 2022-23, the current

ratio improved slightly to 4.01. The trend indicates a

diminishing proportion of cash and equivalents

relative to current obligations, dropping from 0.82 in

2017–18 to 0.73 in 2022–23, raising concerns.

Notably, 2021–22 saw a significant drop in liquid

assets, reflected in liquidity ratios—3.6 current ratio,

2.55 quick ratio, and 0.82 cash ratio—indicating a

declining trend from 2017–18 to 2022–23,

particularly in the quick ratio.

A Study on Financial Ratio Analysis of Indian Farmers Fertiliser Cooperative Limited (IFFCO)

95

4.3.2 Solvency or Leverage Ratios

The Debt-Equity Ratio and Debt-Total Assets Ratio

for IFFCO have seen a decline from 0.69 and 0.35 in

2017-18 to 0.42 and 0.25 in 2022-23, respectively.

Additionally, the proportion of Debt to Capital

Employed decreased from 0.46% in 2019-20 to

0.29% in 2022-23, indicating reduced reliance on

external funds by the cooperatives. Conversely, a

positive trend is observed in the proprietary ratio,

rising from 0.59 in 2017-18 to 0.71 in 2022-23,

signaling an increase in shareholder's funds and

enhanced reliability of the cooperatives.

Table 1.

(Amount in Crores)

2017-18 2018-19 2019-20 2020-21 2021-22 2022-23

( a ) Share Capital ( 1 ) Shareholders ' Funds 420.55 627.57 628.34 627.01 634.29 612.65

( b ) Reserves and Surplus ( 1 ) Shareholders ' Funds 14886.32 15641.91 16545.2 18170.36 19924.34 22839.75

( 1 ) Shareholders ' Funds Total 15306.87 16269.48 17173.54 18797.37 20558.63 23452.4

( a ) Long Term Borrowings ( 2 ) Non - Current Liabilities 1125 750 975 450 1000 675

( b ) De fe rred Ta x Lia bilities ( N e t ) ( 2 ) N on - Current Liabilities 770.7 808.75 575.95 535.68 508.41 492.01

( C ) O the r Long Term Liabilities ( 2 ) N on - Current Liabilities 13.88 6.54 6.31 10.2 21.5 26.53

( d ) Long Term Provisions ( 2 ) Non - Current Liabilities 374.14 401.45 435.57 456.34 440.18 440.98

( 2 ) Non - Current Liabilities Total 2283.72 1966.74 1992.83 1452.22 1970.09 1634.52

( a ) Short Term Borrowings ( 3 ) Current Liabilities 9412.78 13282.17 13494.55 7472.98 8247.7 9095.39

( b ) Trade Payables ( 3 ) Current Liabilities 1521.32 1537.29 1760.2 1258.23 2974.75 2885.12

( c ) Other Current Liabilities ( 3 ) Current Liabilities 1382.35 1548.67 1649.59 1257.77 1527.52 1593.27

( d ) Short Term Provisions ( 3 ) Current Liabilities 341.06 445.83 530.19 501.3 555.26 524.87

( 3 ) Current Liabilities Total 12657.51 16813.96 17434.53 10490.28 13305.23 14098.65

I. EQUITY AND LIABILITIES 30248.1 35050.18 36600.9 30739.87 35833.95 39185.57

Particulars 2017-18 2018-19 2019-20 2020-21 2021-22 2022-23

( a ) Property , Plant and Equipment ( 1 ) Non - Current Assets 12716.89 12681.65 12631.39 12605.32 12838.43 13378.91

( b ) Intangible Assets ( 1 ) Non - Current Assets 10.01 8.06 9.44 5.93 20.28 25.79

( c ) Capital Work - in - Progress ( 1 ) Non - Current Assets 508.05 604.98 575.53 644.49 699.99 1359.31

( d ) Non Current Investments ( 1 ) Non - Current Assets 2933.79 3541.18 3449.57 3791.28 3767.44 3935.76

( e ) Long Term Loans and

Advances

( 1 ) Non - Current Assets 284.97 258.98 266.28 301.93 311.31 425.43

Other Non Current Assets ( 1 ) Non - Current Assets 0 0 0 7.9 11.02 11.25

( 1 ) Non - Current Assets Total 16453.71 17094.85 16932.21 17356.85 17648.47 19136.45

( a ) Current Investments ( 2 ) Current Assets 0 85 568.5 138.94 209.97 85.06

( b ) Inventories ( 2 ) Current Assets 2123.63 3586.38 3177.17 2328.65 5330.85 5124.27

( c ) Trade Receivables ( 2 ) Current Assets 2807.44 2870.43 2982.72 1060.27 445.07 1773.02

( d ) Cash and Bank Balances ( 2 ) Current Assets 2663.09 2475.87 1961.86 6426.56 4143.18 3657.39

( e ) Short Term Loans and

Advances

( 2 ) Current Assets 161.69 127.56 187.53 137.86 217.16 179.25

Other Current Assets ( 2 ) Current Assets 6038.54 8810.09 10790.91 3300.67 7879.56 9230.13

( 2 ) Current Assets Total 13794.39 17955.33 19668.69 13392.95 18225.79 20049.12

TOTAL ASSETS 30248.1 35050.18 36600.9 30749.8 35874.26 39185.57

ICEISA 2024 - International Conference on ‘Emerging Innovations for Sustainable Agriculture: Leveraging the potential of Digital

Innovations by the Farmers, Agri-tech Startups and Agribusiness Enterprises in Agricu

96

Table 2.

(Amount in Crores)

Particulars 2017-18 2018-19 2019-20 2020-21 2021-22 2022-23

Sales 20787.55 27851.74 29412.44 27836.86 40171.67 60224

COGS 14493.72 18551.59 19017.58 16792.14 31630.57 48859.82

Gross Profit 6293.83 9300.15 10394.86 11044.72 8541.1 11364.18

Other Revenue 2726.31 694.3 629.78 818.18 1726.55 2665.76

Operating Expenses 6548.82 7342.24 8161.28 8256.45 6793.67 8667.45

PBDIT 2471.32 2652.21 2863.36 3606.45 3473.98 5362.49

Depreciation/ Amortisation 450.1 498.13 523.9 547.25 608.59 655.71

PBIT 2021.22 2154.08 2339.46 3059.2 2865.39 4706.78

Finance Cost 763.98 995.85 1059.03 689.42 364.41 699.97

Profit Before Tax (PBT) 1257.24 1158.23 1280.43 2369.78 2500.98 4106.81

Tax 320.07 316.65 275.87 615.89 617.21 1054.08

Profit After Tax (PAT) 937.17 841.58 1004.56 1753.89 1883.77 3052.73

4.3.3 Activity or Turnover or Efficiency

Ratios

The Inventory Turnover Ratio for IFFCO has shown

a consistent increase from 23.39 in 2017-18 to 24.40

in 2022-23, indicating a swift turnover of inventory.

Moreover, there is a positive trend in the Capital

Employed Turnover Ratio, escalating from 0.80 in

2017-18 to 1.81 in 2022-23, suggesting efficient

utilization of capital. The Fixed Assets Turnover

Ratio exhibited substantial growth, climbing from

1.26 in 2017-18 to 3.15 in 2022-23, highlighting

improved efficiency in fixed asset utilization.

Similarly, the Working Capital Turnover Ratio

increased from 0.05 in 2017-18 to 0.10 in 2022-23,

underscoring enhanced efficiency in working

capital utilization.

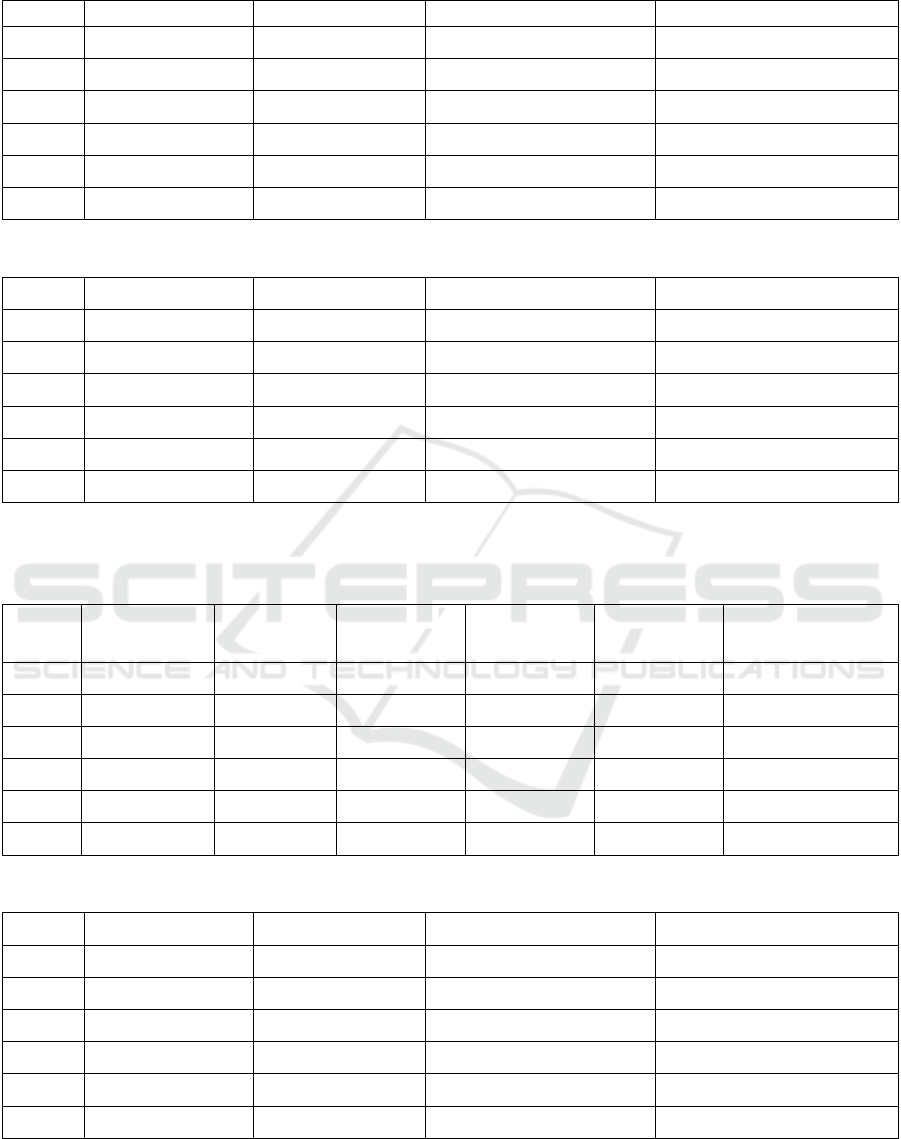

4.3.4 Profitability Ratios

The Cooperatives has maintained a still

performance as per Net Profit Ratio at 0.05.

Operating ratio declined from 0.17 in 2021-22 to

0.14 during 2022-23, which shows reduced

operating expenses per unit sale. Return on Capital

Employed showed increasing trend from 0.10 in

2021-222 to 0.14 in 2022-23 which shows the

profitability of the business. Return on Equity

Shareholders’ Fund increased to 0.13 in 2022-23

from 0.09 in 2021-22 which shows profitability

from the view point of Equity shareholders.

Earnings Per Share (EPS) and Book Value per Share

also showed increasing trend from 41738.01 and

455510.13 rupees in 2021-22 to 67975.91 and

522220.49 rupees in 2022-23 revealing the

profitability and the reliability of the Cooperatives.

Following are the tables depicting the trends of

financial ratios computed from financial statements

of past six financial years i.e., FY 2017-18 to 2022-

23 from the annual reports of IFFCO Ltd. Amounts

of all financial particulars are indicated in crores.

4.3.5 Liquidity Ratios

Table 3: Current ratio.

Sl. No. Financial Year Current Assets Current Liabilities Ratio in Proportion

1 2017-18 13794.39 3244.73 4.25:1

2 2018-19 17955.33 3531.79 5.08:1

3 2019-20 19668.69 3939.98 4.99:1

4 2020-21 13392.95 3017.3 4.44:1

5 2021-22 18225.79 5057.53 3.60:1

6 2022-23 20049.12 5003.26 4.01:1

A Study on Financial Ratio Analysis of Indian Farmers Fertiliser Cooperative Limited (IFFCO)

97

Table 4: Quick ratio.

Sl. No. Financial Year Quick Assets Current Liabilities Ratio in Proportion

1 2017-18 11670.76 3244.73 3.60:1

2 2018-19 14368.95 3531.79 4.07:1

3 2019-20 16491.52 3939.98 4.19:1

4 2020-21 11064.3 3017.3 3.67:1

5 2021-22 12894.94 5057.53 2.55:1

6 2022-23 14924.85 5003.26 2.98:1

Table 5: Cash ratio.

Sl. No. Financial Year Cash & Cash equivalents Current Liabilities Ratio in Proportion

1 2017-18 2663.09 3244.73 0.82:1

2 2018-19 2475.87 3531.79 0.70:1

3 2019-20 1961.86 3939.98 0.50:1

4 2020-21 6426.56 3017.3 2.13:1

5 2021-22 4143.18 5057.53 0.82:1

6 2022-23 3657.39 5003.26 0.73:1

4.3.6 Solvency or Leverage Ratios

Table 6: Debt-Equity Ratio.

Sl. No. Financial Year Total Debt Shareholder's Fund Ratio in Percentage

1 2017-18 10537.78 15306.87 68.84

2 2018-19 14032.17 16269.48 86.25

3 2019-20 14469.55 17173.54 84.25

4 2020-21 7922.98 18797.37 42.15

5 2021-22 9247.7 20558.63 44.98

6 2022-23 9770.39 23452.4 41.66

Table 7: Debt to Capital Employed Ratio.

Sl. No. Financial Year Total Debt Capital Employed Ratio in Percentage

1 2017-18 10537.78 25844.65 40.77

2 2018-19 14032.17 30301.65 46.31

3 2019-20 14469.55 31643.09 45.73

4 2020-21 7922.98 26720.35 29.65

5 2021-22 9247.7 29806.33 31.03

6 2022-23 9770.39 33222.79 29.41

ICEISA 2024 - International Conference on ‘Emerging Innovations for Sustainable Agriculture: Leveraging the potential of Digital

Innovations by the Farmers, Agri-tech Startups and Agribusiness Enterprises in Agricu

98

Table 8: Proprietary Ratio.

Sl. No. Financial Year Shareholder's Fund Capital Employed Ratio in Percentage

1 2017-18 15306.87 25844.65 59.23

2 2018-19 16269.48 30301.65 53.69

3 2019-20 17173.54 31643.09 54.27

4 2020-21 18797.37 26720.35 70.35

5 2021-22 20558.63 29806.33 68.97

6 2022-23 23452.4 33222.79 70.59

Table 9: Debt-Total Assets Ratio.

Sl. No. Financial Year Total Debt Total Assets Ratio in Percentage

1 2017-18 10537.78 30248.1 34.84

2 2018-19 14032.17 35050.18 40.03

3 2019-20 14469.55 36600.9 39.53

4 2020-21 7922.98 30749.8 25.77

5 2021-22 9247.7 35874.26 25.78

6 2022-23 9770.39 39185.57 24.93

4.3.7 Activity or Turnover or Efficiency Ratios

Table 10: Inventory Turnover Ratio.

Sl. No. Financial Year Turnover

Opening

inventory

Closing

inventory

Average

inventory

Ratio in proportion

1 2017-18 20787.55 966.47 810.99 888.73 23.39:1

2 2018-19 27851.74 810.99 1961.74 1386.365 20.09:1

3 2019-20 29412.44 1961.74 1690.46 1826.1 16.11:1

4 2020-21 27836.86 1690.46 766.8 1228.63 22.66:1

5 2021-22 40171.67 766.8 2270.23 1518.515 26.45:1

6 2022-23 60224 2270.23 2666.43 2468.33 24.40:1

Table 11: Capital Employed Turnover Ratio.

Sl. No. Financial Year Turnover Capital Employed Ratio in Proportion

1 2017-18 20787.55 25844.65 1.24:1

2 2018-19 27851.74 30301.65 1.09:1

3 2019-20 29412.44 31643.09 1.08:1

4 2020-21 27836.86 26720.35 0.96:1

5 2021-22 40171.67 29806.33 0.74:1

6 2022-23 60224 33222.79 0.55:1

A Study on Financial Ratio Analysis of Indian Farmers Fertiliser Cooperative Limited (IFFCO)

99

Table 12: Fixed Assets Turnover Ratio.

Sl. No. Financial Year Turnover Fixed assets Ratio in Proportion

1 2017-18 20787.55 16453.71 0.79:1

2 2018-19 27851.74 17094.85 0.61:1

3 2019-20 29412.44 16932.21 0.58:1

4 2020-21 27836.86 17356.85 0.62:1

5 2021-22 40171.67 17648.47 0.44:1

6 2022-23 60224 19136.45 0.32:1

Table 13: Working Capital Turnover Ratio.

Sl. No. Financial Year Turnover Net Working Capital Ratio in Proportion

1 2017-18 20787.55 1136.88 0.05:1

2 2018-19 27851.74 1141.37 0.04:1

3 2019-20 29412.44 2234.16 0.08:1

4 2020-21 27836.86 2902.67 0.10:1

5 2021-22 40171.67 4920.56 0.12:1

6 2022-23 60224 5950.47 0.10:1

4.3.8 Profitability Ratios

Table 14: Net Profit Ratio.

Sl. No. Financial Year Profit after Tax Sales Ratio in Percentage

1 2017-18 937.17 20787.55 4.51

2 2018-19 841.58 27851.74 3.02

3 2019-20 1004.56 29412.44 3.42

4 2020-21 1753.89 27836.86 6.30

5 2021-22 1883.77 40171.67 4.69

6 2022-23 3052.73 60224 5.07

Table 15: Operating Ratio.

Sl. No. Financial Year Total Expense Sales Ratio in Percentage

1 2017-18 6548.82 20787.55 31.50

2 2018-19 7342.24 27851.74 26.36

3 2019-20 8161.28 29412.44 27.75

4 2020-21 8256.45 27836.86 29.66

5 2021-22 6793.67 40171.67 16.91

6 2022-23 8667.45 60224 14.39

ICEISA 2024 - International Conference on ‘Emerging Innovations for Sustainable Agriculture: Leveraging the potential of Digital

Innovations by the Farmers, Agri-tech Startups and Agribusiness Enterprises in Agricu

100

Table 16: Return on Capital Employed or Investment.

Sl. No. Financial Year PBIT Capital Employed Ratio in Percentage

1 2017-18 2021.22 25844.65 7.82

2 2018-19 2154.08 30301.65 7.11

3 2019-20 2339.46 31643.09 7.39

4 2020-21 3059.2 26720.35 11.45

5 2021-22 2865.39 29806.33 9.61

6 2022-23 4706.78 33222.79 14.17

Table 17: Return on Equity Shareholders’ Funds.

Sl. No. Financial Year PAT Shareholder's Fund Ratio in Percentage

1 2017-18 937.17 15306.87 6.12

2 2018-19 841.58 16269.48 5.17

3 2019-20 1004.56 17173.54 5.85

4 2020-21 1753.89 18797.37 9.33

5 2021-22 1883.77 20558.63 9.16

6 2022-23 3052.73 23452.4 13.02

Table 18: Earnings Per Share (EPS).

Sl. No. Financial Year PAT Number of Equity shareholders Earnings per Share

1 2017-18 937.17 409317 0.00229

2 2018-19 841.58 450214 0.00187

3 2019-20 1004.56 450396 0.00223

4 2020-21 1753.89 450251 0.00389

5 2021-22 1883.77 451332 0.00417

6 2022-23 3052.73 449090 0.00679

Table 19: Book Value per Share.

Sl. No. Financial Year Equity Shareholder's Fund Number of Equity shareholders Book value per share

1 2017-18 15306.87 409317 0.03739

2 2018-19 16269.48 450214 0.03614

3 2019-20 17173.54 450396 0.03813

4 2020-21 18797.37 450251 0.04174

5 2021-22 20558.63 451332 0.04555

6 2022-23 23452.4 449090 0.05222

5 CONCLUSION

The comprehensive analysis of the financial

performance of the Cooperatives over the five-year

period from 2017-18 to 2021-22 indicates a positive

overall outlook. Despite the need for improvement in

liquidity and solvency for long-term sustainability,

the company demonstrates good financial

A Study on Financial Ratio Analysis of Indian Farmers Fertiliser Cooperative Limited (IFFCO)

101

performance in various aspects. Notably, reduced

dependence on debts, efficient utilization of capital

employed and working capital, along with minimized

operating expenses, contribute to the success of

IFFCO as a cooperative. The findings suggest a

foundation of financial strength and strategic

management in ensuring the cooperative's success.

REFERENCES

Deepika, S and Dhivya, B. 2019. A study on Financial

statement Analysis of Oil and Natural Gas Corporation

limited. International Journal of Applied Research.

3(3):537-540.

Divya, B.R and Ramya, N. 2020. A study on Financial

performance analysis of Indian Oil Corporation

Limited. EPRA International Journal of Research and

Development. 5(3):250-255.

Elayabharathi, V., Praveena, M and Rathika, S. 2019. A

study on Financial Performance Analysis with

reference to TNSC Bank, Chennai. International

Journal of Advance Research and Innovative Ideas in

Education. 5(2):2949-2955.

Gokulapriya, V and Dhanya, P. 2020. A study on Financial

performance of Maruti Suzuki motors. EPRA

International Journal of Research and Development

(IJRD). 5(11): 2455-7838

Hasanaj, P and Kuqi, B. 2019. Analysis of Financial

Statements: The Importance of Financial Indicators in

Enterprise. Humanities and Social Science Research.

2(2): 2576-3024.

Irfan, M., Gracy, C.P., Ganapathy, M.S., Siddayya, Gaddi,

G.M and Sharif, M. 2022. Study on Financial Ratio

Analysis of a Food Industry Company. Asian Journal

of Agricultural Extension, Economics & Sociology.

40(12):68-78

Preeti, J. A. and Kalimuthu, M. 2020. A study on Financial

performance analysis of Hindustan petroleum

corporation limited. EPRA International Journal of

Research and Development (IJRD). 5(11): 2455-7838.

Srividhya, S., Senthilnathan, C.R., Kengatharan, N and

Umadevi, R. 2020. A study on Financial ratio analysis

of Planys technologies Pvt. Ltd. India. Ilkogretim

Online – Elementary Education Online. 19(3):4642-

4652.

ICEISA 2024 - International Conference on ‘Emerging Innovations for Sustainable Agriculture: Leveraging the potential of Digital

Innovations by the Farmers, Agri-tech Startups and Agribusiness Enterprises in Agricu

102