A Learning Powered Bi-Level Approach for Dynamic Electricity Pricing

Patrizia Beraldi

a

, Luigi Gallo and Alessandra Rende

Department of Mechanical, Energy and Management Engineering, University of Calabria, Italy

Keywords:

Bi-Level Optimization, Electricity Tariffs, Solar Production, Forecasting, Machine Learning Techniques.

Abstract:

This paper presents a comprehensive approach to electricity tariff determination by integrating advanced Arti-

ficial Intelligence (AI) techniques with Bi-Level (BL) optimization. More specifically, AI techniques are used

to obtain accurate forecasts of photovoltaic panel generation, which are then used as input parameters for a

deterministic BL problem that models the interaction between a power supplier and a residential prosumer.

To handle the high complexity of the BL formulations, the model is first reformulated into a single-level struc-

ture, and then linearized using an approach based on the application of the dual reformulation. An intensive

experimental phase is carried out on a real case study to test the effectiveness of the proposed methodology

and to quantify the impact of the forecast techniques on the supplier strategy.

1 INTRODUCTION

Climate change and environmental degradation pose

a severe threat to Europe and the rest of the world.

In response to these challenges, the European Cli-

mate Law, effective since 29 July 2021, has estab-

lished the intermediate target of reducing net green-

house gas emissions by at least 55% by the year 2030,

compared to levels recorded in 1990. Furthermore,

this legislation has set the ambitious goal of attain-

ing a climate neutral European Union by 2050. In

the energy transition, end-users are acknowledged as

key stakeholders. Nowadays, a growing number of

consumers are evolving into prosumers, i.e. con-

sumers that also produce energy, primarily from re-

newable energy sources (RES), as, for example, Pho-

tovoltaic (PV) panels. Additionally, prosumers often

possess a battery energy storage (BES) device to com-

pensate for the non-programmability of green energy

production, which is by nature intermittent and un-

predictable. Indeed, prosumers can accumulate self-

produced energy and use it later when needed, and

purchase electricity during off-peak hours when the

prices are lower, thus reducing the electricity bill. In

addition, the recent integration of advanced commu-

nications, metering, and control automation provides

prosumers with the technical support to optimize the

load management, exploiting the flexibility of con-

trollable loads. Many modern appliances are, indeed,

deemed for control and they can be properly sched-

a

https://orcid.org/0000-0002-1672-4033

uled during hours when electricity prices are lower

or when self-produced energy is available, leading to

significant cost savings. Proactive prosumers are of-

ten referred to as prosumagers, as they are called to

optimize the management of their home energy sys-

tems in response to the market signals. Prosumers can

act individually or collectively, as a single entity, as,

for example, a local energy community coordinated

by aggregator acting as intermediary with the mar-

ket. In this paper, we study the interaction between an

aggregator and a homogeneous group of residential

prosumagers, comparable in terms of location, con-

sumption patterns, flexibility and behaviour. A sim-

ilar interaction can also be envisaged with a retailer,

although the ultimate goal of aggregators and retail-

ers may be different, as the former are designed to be

non-profit organisations. Nonetheless, both entities

aim to maximize their net profit, which, in the case of

the aggregator, could potentially be reinvested in the

community, for example, incentivising future invest-

ments in RES. In this paper, we focus on the electric-

ity pricing problem analyzed from the perspective of

an aggregator. In the text, the terms aggregator and re-

tailer are used interchangeably. Specifically, we focus

on a dynamic pricing scheme with rates that vary over

time. Time-of-use (ToU), critical-peak pricing (CPP)

and real-time pricing (RTP) are commonly used time-

based pricing structures. We consider a RTP scheme,

where the aggregator dynamically determines the sell-

ing prices offered to the clients for each period of a

planning horizon. Such a pricing scheme is expected

390

Beraldi, P., Gallo, L. and Rende, A.

A Learning Powered Bi-Level Approach for Dynamic Electricity Pricing.

DOI: 10.5220/0012465700003639

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 13th International Conference on Operations Research and Enterprise Systems (ICORES 2024), pages 390-397

ISBN: 978-989-758-681-1; ISSN: 2184-4372

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

to become a common practice in smart grids as it

represents a mean to incentive price-based demand-

response programs. Prosumers can, indeed, be moti-

vated to change their habitual consumption patterns

in response to economic signals, thereby favouring

the transition from the conventional “supply follows

load” paradigm to the “load follows supply” one in

the long run. Due to the increasing relevance, the

electricity pricing problem has been the subject of in-

tensive research in recent years. The problem involves

two different players tied by a hierarchical relation.

The retailer/aggregator plays the role of leader, decid-

ing first, whereas the prosumer the role of follower.

To account for such a relation, we formulate the prob-

lem by the Bi-Level (BL) paradigm (Colson et al.,

2007). Specifically, the leader solves the Upper Level

(UL) problem aimed at defining the electricity rates

and the procurement plan that bears the maximum

profit. In taking the best decision, he conjectures the

possible reaction of the follower to the offered rates

as this affects the objective function. Indeed, the fol-

lower, on the basis of the offered rates, decides the

management of his home energy system including the

load scheduling. The aim of this Lower Level (LL)

problem is the minimization of the daily electricity

bill. Since variation of the controllable loads with the

respect to the ideal consumption procures a discom-

fort, a penalization term is also considered in the fol-

lower’s objective function. Different recent contribu-

tions propose BL formulations for the electricity pric-

ing problem. For example, in (Grimm et al., 2021) the

authors compare different pricing schemes and show

that the RTP structure guarantees the highest addi-

tional revenue for the retailer, but also the largest price

volatility for the prosumer. (Soares et al., 2020) pro-

pose a BL formulation where in the UL problem the

retailer establishes the ToU tariff that maximizes the

profit, whereas at the LL, the consumer, as follower,

reacts to this price by determining the operation of the

controllable loads in order to minimize the electricity

bill and a discomfort cost. (Ferrara et al., 2021) pro-

pose a BL formulation where the leader owns a local

energy production system to optimally manage, with

the aim of reducing the amount of energy to purchase

from the wholesale market to cover the follower re-

quest who is also equipped with a renewable energy

system and can control the flexible loads. More re-

cently, (Beraldi and Khodaparasti, 2023a) propose a

BL formulation for defining RTP tariffs offered to a

follower representative of a residential prosumager

who reacts to price signal by scheduling the flexi-

ble appliances. Unlike other contributions, the leader

owns a local energy system that must be properly

managed with the aim of maximizing the daily profit.

The contributions mentioned above share the assump-

tion of perfect information of the parameters involved

in the decision process, thus neglecting the impact

that uncertainty in market prices and weather-related

variables may have in defining the optimal tariff. Only

a few recent contributions, acknowledging the im-

portance of explicitly dealing with uncertainty, pro-

pose stochastic BL formulations. Here, we men-

tion the recent contribution by (Beraldi and Khoda-

parasti, 2023b) who propose a stochastic formulation

for the definition of time-variant tariffs. Specifically,

the leader solves a two-stage problem to define the

optimal procurement plan, considering both the day-

ahead and the real-time market, and maximizing a

safety measure that controls the expected profit that

can be gained in a given percentage of worst case re-

alizations. The follower reacts to the offered tariffs

by optimally managing his home energy system with

the aim of reducing the expected electricity bill. In

(Sarfarazi et al., 2023) the authors provide a stochas-

tic BL formulation where the aggregator sets real-

time selling and buying prices, whereas users mod-

ify their consumption and their grid feed-in through

the use of battery storage systems, to minimize their

costs. Scenario based framework is introduced to take

into account the uncertainty about market prices, local

market generation levels and user electricity demand.

In (Feng and Ruiz, 2023) a stochastic BL approach

to determine electricity tariffs for energy community

members is proposed. Proactive prosumers are as-

sumed to be equipped with PV panels, storage de-

vices and hydrogen systems. Although stochastic BL

formulations have been shown to perform better than

their deterministic counterparts (Beraldi and Khoda-

parasti, 2023b), their solution poses severe computa-

tional challenges. Deterministic BL problems have

been proved to be NP-hard, thus the explicit consid-

eration of uncertainty introduces an additional layer

of complexity, preventing the solution of large-scale

instances that take into account a significant number

of possible future scenarios. Nevertheless, the pricing

problem should be solved on a daily basis to generate

electricity rates for the following day, thus imposing a

limit on the computational time. To address this chal-

lenge, we incorporate uncertainty into the decision

process by employing forecasts of the random param-

eters (Samal et al., 2021). In particular, we assume to

know the wholesale electricity prices as they are an-

nounced in advance one day-ahead, whereas weather-

related variables, i.e. the solar production, are con-

sidered as random and are forecast. The proposed

approach relies on the idea of integrating prediction

and optimization. In particular, we apply the classical

”predict, then optimize” paradigm, where prediction

A Learning Powered Bi-Level Approach for Dynamic Electricity Pricing

391

is performed first and then the forecast values are used

in the BL optimization model. A strong advantage of

the considered approach compared to more advanced

frameworks that jointly perform predictions and opti-

mization relies on the observation that the optimiza-

tion problem is not ”altered”. This represents an im-

portant element in our case given the difficulty related

to the solution of the BL problems. The contributions

of this paper are summarized below:

• We apply machine learning (ML) techniques to

derive day-ahead accurate PV power production

forecasts serving as input parameters for the BL

model.

• We formulate and solve the learning powered BL

formulation once derived the corresponding sin-

gle level reformulation.

• We test the proposed approach on a realistic case

study and we derive useful insights.

The rest of the paper is organized as follows. Section

2 outlines the proposed methodology: first, we de-

tail the techniques used for PV prediction, and, then,

we present the BL formulation, followed by the used

solution approach. Numerical results of experiments

carried out on a realistic case study are presented and

discussed in Section 3. Conclusions and future re-

search directions are discussed in Section 4.

2 THE PROPOSED APPROACH

We consider an aggregator facing the problem of

defining electricity rates for a homogeneous group

of smart prosumers represented by a reference pro-

sumager. As the aim is to offer RTP rates, the prob-

lem has to be solved every day, using each time up-

dated information. Figure 1 shows the scheme of the

proposed approach. It consists of two main modules.

In particular, Module 1 refers to the forecast of the

uncertain parameters entering as input of Module 2,

where rates are determined by the solution of a BL

problem. Boxes under the two modules refer to the

solution techniques. Specifically, Machine Learning

is used for forecasting, whereas the solution of the BL

problem is carried out by using a commercial solver

once that a single-level reformulation is obtained.

2.1 Forecasting the Solar Production

In the last decades, several methods have been pro-

posed for PV power prediction (Ahmed et al., 2020).

The methods are based on two main approaches: the

physical approach and the data-driven one. While the

former requires prior knowledge of the PV material

Figure 1: Structure of the proposed approach.

properties and the metadata, along with the need of

weather condition data, the latter requires operational

data to train/calibrate the coefficients of the models

which are then used to generate the predictions. In

this paper, we focus on day-ahead solar power fore-

casting. Specifically, the PV production of the next

day is generated one day in advance. We adopt the

data-driven approach and, specifically, we apply fore-

casting techniques belonging to the class of Machine

Learning, as they provide (see, e.g. (Das et al., 2018))

better results, although they are more computationally

demanding. In particular, we consider four ML tech-

niques: Multivariate Linear Regression (MLR), Sup-

port Vector Regression (SVR), Random Forest (RF)

and Artificial Neural Networks (ANNs).

• MLR: It is a simple and widely applied model in

solar forecasting. Specifically, the MLR forecasts

the PV production by considering a linear rela-

tionship between the target variable and a set of

independent variables (predictors). In our case,

the slope and the intercept are determined in the

training phase minimizing the sum of squared

residuals between the predicted values and the ac-

tual values, according to the Ordinary Least of

Squares (OLS) algorithm.

• SVR: It is a kernel based forecast technique that

evolved from the Support Vector Machine, which

is typically used for classification problems. Sim-

ilar to SVM, the SVR constructs a set of hyper-

planes in a multidimensional space in order to de-

rive the relationship between predictors and the

target variable. In this study, we consider the Ra-

dial Basis kernel function (Scott et al., 2023).

• ANN: The architecture of the ANNs allows to

build complex nonlinear relationships between

predictors and the target variables, without assum-

ing any form of relationship between these vari-

able. ANN consists of an input layer that re-

ceives the input data, and an output layer that

provides the predictions. Moreover, there is a

ICORES 2024 - 13th International Conference on Operations Research and Enterprise Systems

392

predefined number of hidden layers that trans-

form the weighted sum of inputs, using an activa-

tion function. In this study, we consider a back-

propagation algorithm to learn the weights that

minimize the difference between the actual val-

ues of target variable and the resulting values of

output layer of the net.

• RF: Random forest is an ensemble method that

combines the results of multiple decision trees to

determine the result. The training set is recur-

sively partitioned to classify the target data on the

basis of one or more predictor variables, gener-

ating a number of trees. A tree generated may

be identical or different to another tree generated

during the execution of the algorithm. Only one

tree is selected and used to make the prediction,

and the selection is made using the majority vot-

ing criterion: the most frequent tree is selected.

The tree generation algorithm is implemented us-

ing the Gini index and the minimum number of

elements in a leaf node as stopping criteria.

2.2 The BL Formulation

Forecasts generated by applying the algorithms intro-

duced in the previous subsection represent the values

in input to Module 2, where electricity rates are deter-

mined by applying the BL formulation. We assume

to consider hourly-rate and we denote by r

t

the rate

offered by the aggregator at time period t of a given

planning horizon (1 day). Bound constraints are im-

posed on the offered rates:

R

min

t

≤ r

t

≤ R

max

t

∀t (1)

Here R

min

t

is a lower bound defined increasing the av-

erage market prices by a percentage accounting for

taxes and leverages, whereas R

max

t

accounts for mar-

ket competition and eventual caps agreed with the fol-

lower in advance. Moreover, we impose a threshold Γ

on the average price that can be reached during a day:

1

T

T

∑

t=1

r

t

≤ Γ (2)

The aim of the leader is to maximize the daily profit

defined as difference between revenues deriving from

the electricity selling and procurement costs, i.e. pur-

chasing electricity from the market.

maxF =

T

∑

t = 1

(r

t

E

t

− P

M

t

E

t

) (3)

Here P

M

t

denotes the market prices, whereas E

t

de-

notes the energy amount required by the follower.

Such a variable is not under the leader control, but

for given values of the electricity rates represents the

solution of the LL problem. Specifically, the follower

reacts to the offered rates by managing the home en-

ergy system composed by a BES of a given nominal

capacity C and a system of PV panels with a power

production G

t

forecast by Module 1. The aim is to

minimize the daily electricity bill by exploiting the

stored electricity and the load flexibility. In partic-

ular, we assume that the follower’s loads are parti-

tioned into inflexible and flexible loads on the basis

of their level of control. Inflexible demand or base

load is associated with a consumption that cannot be

controlled (e.g. refrigerators, centralized heating and

cooling systems, lighting for essential areas), whereas

flexible demand refers to an energy consumption that

can be shifted. For a given time period t, ideal flexible

load value is denoted by x

id

t

, whereas we denote by w

t

the base load. Variation from the ideal consumption

produces a discomfort that should be also taken into

account in the follower’s objective function. For each

period t of the time horizon, the prosumager has to

take three types of decision on:

• the amount to buy from the retailer E

t

;

• the operation of the flexible loads, controlled by

the variables x

t

, x

+

t

, x

−

t

;

• the management of the BES, represented by the

state of charge, soc

t

, and the power charged z

c

t

,

and discharged from the battery z

d

t

.

The following constraints are included into the LL

problem:

x

t

= x

id

t

+ x

+

t

− x

−

t

∀t (h

1t

) (4)

T

∑

t = 1

x

t

=

T

∑

t = 1

x

id

t

(h

2

) (5)

w

t

+ x

t

≤ Q ∀t (h

3t

) (6)

E

t

= x

t

+ w

t

− G

t

− z

d

t

+ z

d

t

− z

c

t

∀t (h

4t

) (7)

soc

t

= (1 − α) soc

t−1

+ η

c

z

c

t

−

z

d

t

η

d

∀t (h

5t

)

(8)

µ

1

C ≤ soc

t

≤ µ

2

C ∀t (h

6t

, h

7t

) (9)

z

c

t

≤ τ

c

C ∀t (h

8t

) (10)

z

d

t

≤ τ

d

C ∀t (h

9t

) (11)

E

t

, x

t

, x

+

t

, x

−

t

, z

d

t

, z

c

t

≥ 0 ∀t (12)

Constraints (4) refer to the flexible loads and model

the hourly deviation between the ideal consumption,

whereas constraints (5) ensure that, considering the

entire time horizon, the total consumption is satis-

fied. An upper bound Q on the consumption of the

follower, is set by constraint (6), for each period t

of the time horizon. The amount of electricity to

A Learning Powered Bi-Level Approach for Dynamic Electricity Pricing

393

purchase from the leader is defined by constraints

(7). Besides PV production, demand can be covered

by the power discharged from the BES, whereas the

amount in excess is stored and used later. Constraints

(8) refer to the management of the BES consider-

ing a self-discharge rate α, a charging efficiency η

c

and a discharging efficiency η

d

. The initial condi-

tion for the state of charge of the battery is defined as

soc

0

= µ

1

C. Constraints (9) guarantee that the state-

of-charge of the battery, soc

t

, remains within mini-

mum and maximum levels, determined as a function

of the nominal capacity C through the coefficients µ

1

and µ

2

, while constraints (10)–(11) set upper bounds

on the total power charged and discharged, defined

as a percentage (charging rate τ

c

and discharging rate

τ

d

) of the nominal capacity. Given the communicated

rates r

t

, the aim of the follower is to minimize the ob-

jective function:

min f =

T

∑

t = 1

[ r

t

E

t

+ ρ

1

x

−

t

+ ρ

2

x

+

t

] (13)

Here, two goals are considered related to the cost and

discomfort, respectively. This latter corresponds to

the figurative cost of changing the consumption pat-

tern from the ideal one. More in detail, the figurative

cost is defined by penalizing positive (x

+

t

) and nega-

tive (x

−

t

) deviations of the actual load from the pre-

ferred value x

id

t

through the coefficients ρ

1

and ρ

2

.

2.2.1 The Solution Approach

To solve the proposed BL formulation we apply a tra-

ditional approach relying on the derivation of a single

level reformulation. We note that for fixed values of

the electricity rates r

t

, the LL problem is a linear prob-

lem. We can therefore derive the corresponding dual

problem reported below:

maxz =

T

∑

t = 1

h

1t

x

id

t

+ h

2

T

∑

t = 1

x

id

t

+

T

∑

t = 1

h

3t

(w

t

− Q)

+

T

∑

t = 1

h

4t

(G

t

− w

t

) + h

51

soc

0

(1 − α) +

+ µ

1

C

T

∑

t = 1

h

6t

+ − µ

2

C

T

∑

t = 1

h

7t

+

− τ

c

C

T

∑

t = 1

h

8t

− τ

d

C

T

∑

t = 1

h

9t

(14)

s.t.

− h

4t

≤ r

t

∀t (15)

h

1t

+ h

2

− h

3t

+ h

4t

≤ 0 ∀t (16)

h

1t

≤ ρ

1

∀t (17)

− h

1t

≤ ρ

2

∀t (18)

h

4t

− η

c

h

5t

− h

8t

≤ 0 ∀t (19)

− h

4t

+

1

η

d

h

5t

− h

9t

≤ 0 ∀t (20)

h

5t

− (1 − α) h

5 t+1

+

+ h

6t

− h

7t

= 0 ∀t ∈ {1, T − 1} (21)

h

5T

+ h

6T

− h

7T

= 0 (22)

h

1t

, h

2

, h

4t

, h

5t

f ree (23)

h

3t

, h

6t

, h

7t

, h

8t

, h

9t

≥ 0 (24)

We observe that the LL problem is always feasible

and bounded. Thus, based on the strong duality theo-

rem, both the primal and the dual problems have op-

timal solutions and the corresponding objective func-

tion values are equal. The single-level reformulation

is obtained by adding to the UL constraints, the pri-

mal LL constraints (4)-(12), the corresponding dual

constraints (15)-(24) and equating the primal (13) and

dual objective functions (14). We observe that the

single-level reformulation contains a bilinear term de-

riving from the product of the r

t

and E

t

variables, that

we may linearize by adopting a dual approach. More

specifically, the auxiliary variable ω

t

= r

t

E

t

is intro-

duced, together with the following set of constraints:

r

t

= (λ

1

+ λ

2

)L

1

+ (λ

3

+ λ

4

)U

1

(25)

E

t

= (λ

1

+ λ

3

)L

2

+ (λ

2

+ λ

4

)U

2

(26)

4

∑

i=1

λ

i

= 1 (27)

ω

t

= λ

1

L

1

L

2

+ λ

2

L

1

U

2

+ λ

3

U

1

L

2

+ λ

4

U

1

U

2

(28)

λ

i

≥ 0 i = 1, ..., 4 (29)

where L

1

and U

1

are defined from 1, while L

2

is as-

sumed to be 0, and U

2

to be equal to the prosumer’s

maximum total consumption Q.

3 NUMERICAL RESULTS

This section is devoted to the presentation and dis-

cussion of the computational experiments carried out

to assess the effectiveness of the proposed approach

on a realistic case study. The techniques used to fore-

cast the PV power production have been implemented

by using the software R version 4.3.0 (R Core Team,

2023), whereas the model and the solution algorithm

have been coded in GAMS 38 and solved using ILOG

CPLEX (Bussieck and Meeraus, 2007). All the exper-

iments have been performed on a 64-bit HP Pavilion

Laptop 15-eg2xxx with 12th Gen Intel(R) Core(TM)

i7-1255U 1.70 GHz and a RAM of 16 GB.

ICORES 2024 - 13th International Conference on Operations Research and Enterprise Systems

394

3.1 Case Study and Data Setting

The case study concerns a retailer operating in the

Italian electricity market that wants to offer RTP tar-

iffs to affiliated end users, represented by a refer-

ence prosumager. The tariffs are communicated the

day before the commitment and are, therefore, dy-

namically determined. Following the organization

of the Italian market, we consider hourly time steps.

The results reported in the following refer to an au-

tumn day, specifically 30th October 2019, for which

the real values are available. In particular, day-

ahead electricity prices are available on the website

of the Italian ”Gestore dei mercari elettrici”(GME)

1

for download. Starting from these values, proper

bounds on the rates have been determined. R

min

t

has been set to R

min

t

= min

t∈T

P

M

t

(1 + β), whereas

R

max

t

= max

t∈T

K P

M

t

(1 + β). Finally, Γ = U (1 +

β)

1

T

∑

T

t = 1

P

M

t

, where β, K and U are parameters un-

der the decision maker control. In our experiments,

we have considered the values 1.3, 1.2 and 1.2, re-

spectively.

Tariffs are offered to a reference prosumager,

who reacts to the price signals by managing his

domestic energy system with the aim of minimizing

the electricity bill. In the experiments, we have

considered a reference prosumager with an energy

system composed of a BES with nominal capacity

of 3.8 kW and a system of PV panels. Technical

parameters concerning the management of the BES

are reported in the Appendix, together with other

parameters defining prosumer features. The amount

of electricity the follower purchases from the leader

depends on his self-production that is forecast. In

the experiments, we have considered a reference PV

module whose main characteristics are reported in the

note

2

. Prediction has been carried out considering

four main predictor variables, i.e. hour of the day,

relative humidity (%), temperature (°C), radiance

on tilt surface. As each predictor varies in different

scale, a normalization step has been preliminary

carried out. The data span a period of 3 years,

from 01/01/2017 to 31/12/2019, for a total of 23832

records. The data set has been divided into two

subsets, with observations from 2017 and 2018 used

for the training and validation phases, and data from

2019 used for testing. Approximately 57% of the

data set is used as the training set, a further 6%

as the validation set and the remaining 37% as the

test set. The ML techniques have been evaluated

1

https://www.mercatoelettrico.org/it

2

Schuco module, series MPE 240 PG 60 FA with size

1.995 x 998 mm, nominal power equal to 240 W, under stan-

dard test condition

Table 1: Performance metrics of the ML techniques.

ML technique RMSPE MAPE R

2

MLR 23.5 11.4 97.2

SVR 10.8 5.5 97.9

ANN 46.2 31.9 93.4

RF 9.7 5.7 97.5

by using three traditional metrics: the root mean

square percentage error (RMSPE), the mean absolute

percentage error (MAPE), and R squared (R

2

). More

specifically, the metrics are defined as:

RMSPE =

v

u

u

t

1

M

M

∑

j = 1

y

j

− ˆy

j

y

j

2

MAPE =

1

M

M

∑

j=1

y

j

− ˆy

j

y

j

R

2

= 1 −

∑

M

j=1

(y

j

− ˆy

j

)

2

∑

M

j=1

(y

j

− ¯y)

2

Here M denotes the number of data points of the test

set, whereas y

j

, ˆy

j

represent the j-th actual and pre-

dicted value. Finally, ¯y denotes the expected value

of the target variable. Better performance are associ-

ated with lower values of the RMSPE and MAPE and

higher values of R

2

. The results are reported in Table

1. As evident, the MLR and ANN techniques perform

poorly, while the other methods provide accurate fore-

casts. Specifically, the SVR technique outperforms

the other methods, reporting the lowest MAPE value

and the highest value of R

2

. Moreover, it also ranks

second in the RMSPE metric. The RF method also

performs well on the RMSPE metric and provides

comparable values for the other two metrics.

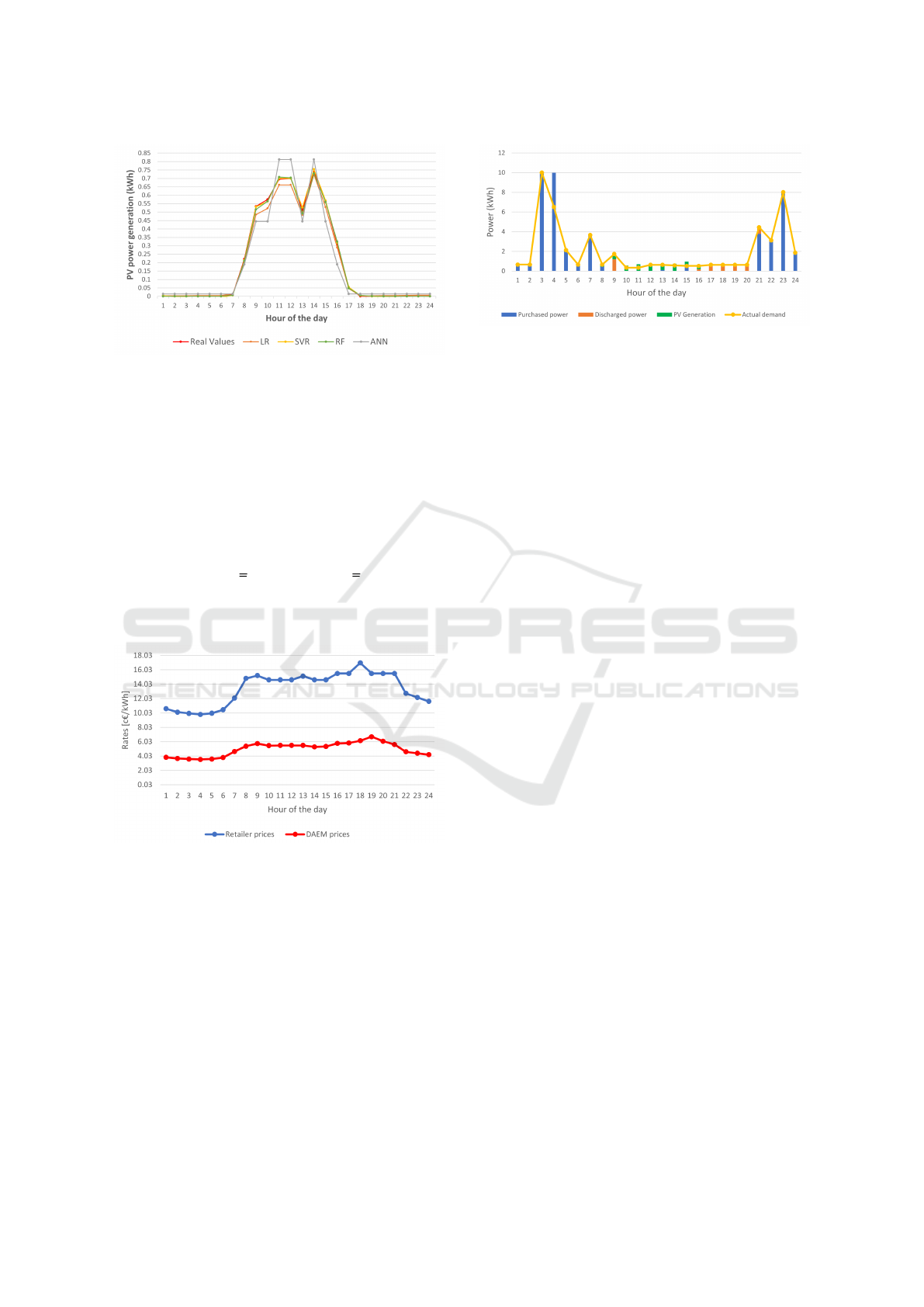

Accuracy can be also appreciated by looking at the

plot in Figure 2 where we report the real production

in comparison to forecast one obtained by applying

the different techniques. Looking at the Figure, we

may note that the ANN tends to overestimate the PV

production in the central hours of the day.

Forecast values are used by the leader who, in

defining the electricity tariffs, anticipates the pro-

sumager reaction. Clearly errors in the prediction

negatively impact on his profit requiring the re-

course to balancing market to compensate any short-

age and/or surplus deriving from a difference between

the initial requirement and the real ones.

3.2 Results of the BL Formulation

Different experiments have been carried out as func-

tion of the technique used to forecast the PV produc-

A Learning Powered Bi-Level Approach for Dynamic Electricity Pricing

395

Figure 2: Actual vs. predicted PV Production.

tion. The results have been compared with those ob-

tained when considering the real data to gain insight

on the impact of the prediction accuracy on the rec-

ommendation provided to the end-user. In what fol-

lows, we report the results obtained adopting the SVR

technique that, at least considering the data used here,

represents the most performing approach. Similar re-

sults have been obtained considering the other tech-

niques, which provide anyhow good predictions. Fig-

ure 3 shows the electricity tariffs offered by the leader,

ranging from 9.82 c C/kWh to 16.99 c C/kWh. In the

same Figure we also report the wholesale electricity

prices. As evident, the rates and prices show a similar

trend.

Figure 3: Offered rates and DAEM prices.

Given the offered tariffs, Figure 4 shows the reac-

tion of the follower. Specifically, we report the con-

sumption pattern after performing eventual shifting of

the flexible loads and we show how the demand is sat-

isfied. In detail, in high price periods 8, 9, 20 and 21,

the ideal loads are partially shifted towards period 4,

which is characterised by the minimum price, and pe-

riods 3 and 5, which present the second and the third

lowest values. The solution indicates to shift the 59.4

% of the total flexible demand. Moreover, in these

high price hours, the demand is also met by discharg-

ing the battery, which is charged through the electric-

ity supply in period 4 and 15 and with the PV gen-

Figure 4: Prosumager’s demand satisfaction.

eration when this overcomes the demand of the same

period.

Additional experiments have been performed with

the aim of measuring the impact of the forecast tech-

niques on the leader’s strategy. More specifically, we

have compared the cost of the leader’s supply plan

when considering the real PV production and when

considering the different prediction techniques. The

results show that the increase is very low for all the

techniques , which the exception of the ANN one. In

that case, at least for the case study considered in our

tests, an increase of around 4 % has been registered.

Clearly, the higher the share of the renewable produc-

tion, the higher the negative effect produced by not

accurate prediction.

4 CONCLUSIONS AND FUTURE

RESEARCH DIRECTIONS

The paper presents a BL approach for the pricing

problem faced by an aggregator who wants to deter-

mine real time electricity rates to offer to aggregated

end-users represented by a reference prosumager. The

problem is solved every day using, each time, more

updated information and the offered rates are com-

municated the day-ahead. Uncertainty in weather-

related variables is dealt by applying ML techniques

that provide accurate forecast which are then used as

input data for the BL problem. This predict and opti-

mize approach allows to explicitly account for uncer-

tainty keeping the original structure of the BL prob-

lem. The problem is solved by a commercial solver

once derived the corresponding single-level reformu-

lation. Several experiments have been carried out to

assess the efficiency of the proposed approach on a

realistic test case, where the leader is presented by a

retailer operating in the Italian electricity market and

the follower is a prosumager owing a domestic energy

system. Specifically, the performance of the four ML

techniques has been measured and compared by ap-

plying traditional measures. The results show that all

ICORES 2024 - 13th International Conference on Operations Research and Enterprise Systems

396

the methods provide accurate forecast, especially the

SVR and the RF approaches. The experiments show

how the quality of the forecasts impacts on the rec-

ommendations provided by the model when imple-

mented on a real setting. Inaccurate predictions im-

pose the recourse to the balancing market to compen-

sate any shortage/surplus of the required power, de-

termining a reduction of the leader’s profit. Different

issues are currently under investigation and represent

future developments. First of all, the BL problem can

be extended to a multi-follower setting so to consider

a more general configuration where different types of

followers are jointly considered and the leader can of-

fer specialized tariffs. The problem would be more

complex if we consider the possibility that the fol-

lowers may sell energy to the aggregation. An addi-

tional interesting extension would be to define com-

prehensive tariffs that cover both electricity and gas

by exploiting the close relationship between the two

markets.

ACKNOWLEDGEMENTS

We acknowledge the financial support from: PNRR

MUR project PE0000013-FAIR .

REFERENCES

Ahmed, R., Sreeram, V., Mishra, Y., and Arif, M. (2020).

A review and evaluation of the state-of-the-art in pv

solar power forecasting: Techniques and optimiza-

tion. Renewable and Sustainable Energy Reviews,

124:109792.

Beraldi, P. and Khodaparasti, S. (2023a). A bi-level

model for the design of dynamic electricity tar-

iffs with demand-side flexibility. Soft Computing,

27:12925–12942.

Beraldi, P. and Khodaparasti, S. (2023b). Designing elec-

tricity tariffs in the retail market: A stochastic bi-level

approach. International Journal of Production Eco-

nomics, 257(108759).

Bussieck, M. R. and Meeraus, A. (2007). Algebraic Mod-

eling for IP and MIP (GAMS). In Annals of Oper-

ations Research, volume 149(1), special edition His-

tory of Integer Programming: Distinguished Personal

Notes and Reminiscences, Guest Editors: Kurt Spiel-

berg and Monique Guignard-Spielberg, pages 49–56.

Kluwer Academic Publishers-Plenum Publishers.

Colson, B., Marcotte, P., and Savard, G. (2007). An

overview of bilevel optimization. Annals of opera-

tions research, 153(1):235–256.

Das, U. K., Tey, K. S., Seyedmahmoudian, M., Mekhilef,

S., Idris, M. Y. I., Van Deventer, W., Horan, B., and

Stojcevski, A. (2018). Forecasting of photovoltaic

power generation and model optimization: A review.

Renewable and Sustainable Energy Reviews, 81:912–

928.

Feng, W. and Ruiz, C. (2023). Risk management of en-

ergy communities with hydrogen production and stor-

age technologies. Applied Energy, 348:121494.

Ferrara, M., Violi, A., Beraldi, P., Carrozzino, G., and

Ciano, T. (2021). An integrated decision approach for

energy procurement and tariff definition for prosumers

aggregations. Energy economics, 97(105034).

Grimm, V., Orlinskaya, G., Schewe, L., Schmidt, M., and

Z

¨

ottl, G. (2021). Optimal design of retailer-prosumer

electricity tariffs using bilevel optimization. Omega,

102(102327).

R Core Team (2023). R: A Language and Environment for

Statistical Computing. R Foundation for Statistical

Computing, Vienna, Austria.

Samal, D., Bisoi, R., and Sahu, B. (2021). Identification

of nonlinear dynamic system using machine learning

techniques. International Journal, 12(1):23–43.

Sarfarazi, S., Mohammadi, S., Khastieva, D., Hesamzadeh,

M. R., Bertsch, V., and Bunn, D. (2023). An optimal

real-time pricing strategy for aggregating distributed

generation and battery storage systems in energy com-

munities: A stochastic bilevel optimization approach.

International Journal of Electrical Power & Energy

Systems, 147:108770.

Scott, C., Ahsan, M., and Albarbar, A. (2023). Machine

learning for forecasting a photovoltaic (pv) generation

system. Energy, 278:127807.

Soares, I., Alves, M. J., and Antunes, C. H. (2020). De-

signing time-of-use tariffs in electricity retail markets

using a bi-level model – estimating bounds when the

lower level problem cannot be exactly solved. Omega,

93:102027.

APPENDIX

In the numerical experiments, we have used the fol-

lowing parameters in the constraints related to the

storage management. In particular, the values of the

efficiency rates i.e. η

c

, η

d

have been set to 0.98,

whereas the operation ranges are set to µ

1

= 5% and

µ

2

= 95%. Finally, the charging and discharging co-

efficients (τ

c

, τ

d

) have been set equal to 95% of the

BES capacity C. The values of base load w

t

and ideal

flexible load x

id

t

, for each period of the time horizon,

have been derived from data reported in (Soares et al.,

2020). The maximum total prosumer’s consumption

(Q) is set to 10 kWh, whereas the parameters ρ

1

and

ρ

2

are assumed to be equal to 0.01 and 0.005, respec-

tively.

A Learning Powered Bi-Level Approach for Dynamic Electricity Pricing

397