Sales Forecasting for Pricing Strategies Based on Time Series and

Learning Techniques

Jean-Christophe Ricklin

1,2

, Ines Ben Amor

2

, Raid Mansi

2

, Vassilis Christophides

1 a

and Hajer Baazaoui

1 b

1

ETIS UMR 8051, CY University, ENSEA, CNRS, Cergy, France

2

BOOPER, 59 Boulevard Exelmans 75016 Paris, France

Keywords:

Sales Forecasting, Machine & Deep Learning, Time Series, Retail, Pricing Strategies.

Abstract:

Time series exist in a wide variety of domains, such as market prices, healthcare and agriculture. Mod-

elling time series data enables forecasting, anomaly detection, and data exploration. Few studies compare

technologies and methodologies in the context of time series analysis, and existing tools are often limited in

functionality. This paper focuses on the formulation and refinement of pricing strategies in mass retail, based

on learning methods for sales forecasting and evaluation. The aim is to support BOOPER, a French startup

specializing in pricing solutions for the retail sector. We focus on the strategy where each model is refined

for a single product, studying both ensemble and parametric techniques as well as deep learning. To use these

methods a hyperparameter setting is needed. The aim of this study is to provide an overview of the sensitivity

of product sales to price fluctuations and promotions. The aim is also, to adapt existing methods using opti-

mized machine and deep learning models, such as the Temporal Fusion Transformer (TFT) and the Temporal

Convolutional Network (TCN), to capture the behaviour of each product. The idea is to improve their per-

formance and adapt them to the specific requirements. We therefore provide an overview and experimental

study of product learning models for each dataset, enabling informed decisions to be made about the most

appropriate model and tool for each case.

1 INTRODUCTION

Time series analysis plays a key role in forecasting

sales, particularly in the area of e-commerce, which is

in full expansion. Interest in these methods is demon-

strated by the participation of the world’s largest re-

tailer, Walmart, in Kaggle competitions. One of the

most famous examples may be the M5 competition

(Makridakis et al., 2022a), where it was observed that

traditional methods used in retail, such as exponential

smoothing or the Croston model, were outperformed

by machine learning tools such as ensemble models

like XGboost or LightGBM. In addition, there are

many recent deep learning tools such as TCN (Tem-

poral Convolutional Networks), TFT (Temporal Fu-

sion Transformer) and DeepAR that further enhance

the technical ability to extract temporal information.

These techniques are often accompanied by AutoML

(O’Leary et al., 2023) (Alsharef et al., 2022) tools

(such as GluonTS (Alexandrov et al., 2020)) that pro-

a

https://orcid.org/0000-0002-2076-1881

b

https://orcid.org/0000-0002-2151-7397

vide them with a pre-built calibration solution. How-

ever, (Benidis et al., 2022) choose to train a local

univariate model for each product. Based on our ex-

periments, AutoML (Waring et al., 2020) combined

within multiple deep learning models takes too long

to go into production for local prediction when tasked

with searching within a broad enough ensemble to

have a varied interpretation of the context. Never-

theless, training a model for each product provides

a local understanding of the product’s true elasticity,

which is particularly important when trying to provide

pricing advice. The challenge is therefore to main-

tain accurate sales knowledge while having informa-

tion on the local elasticity of the product.

Our idea is to review the literature on existing so-

lutions, build a reasonable number of models based

on sales characteristics, and then reduce the hyperpa-

rameter space.

The present work concerns real data from

BOOPER a company providing inventory manage-

ment and price advice software for the retail sector.

Its strategy is to collect customer data in order to pre-

1060

Ricklin, J., Ben Amor, I., Mansi, R., Christophides, V. and Baazaoui, H.

Sales Forecasting for Pricing Strategies Based on Time Series and Learning Techniques.

DOI: 10.5220/0012434300003636

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 16th International Conference on Agents and Artificial Intelligence (ICAART 2024) - Volume 3, pages 1060-1067

ISBN: 978-989-758-680-4; ISSN: 2184-433X

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

dict sales fluctuations and estimate them on the basis

of historical data. The main data challenges revolve

around two significant factors: the considerable vari-

ability in sales series within store products, and the

decision to implement a single product forecasting ap-

proach.

The study presented in this paper is part of a research

line with a wider scope, aiming to : define an ac-

curate one-month estimates of shelf supply; under-

stand product elasticity, which helps to identify the

most popular products based on seasonal and annual

events, especially for promotional periods; identify

price plateaus, price changes likely to dissuade a cus-

tomer; know the right historical duration to feed the

models.

The aim is to define the best model for each prod-

uct, taking into account the sales context, such as

price, seasonality, events, changes.

In this paper, we present the several conducted ex-

periments to answer specific questions about model

behaviour, such as to how does the size of lags in-

fluence the accuracy of Boosting models’ forecasts?

Are deep learning models relevant in the context of

single-series analysis? Which model should be used?

Is a combination of models of interest?

The rest of this paper is organised as follows. In

Section 2, we present the preliminaries and related

work. Then, in Section 3, we formalise the problem

and detail the constraints. Section 4 is dedicated to the

presentation of our methodology for studying pricing

strategies, the numerical results and the interpretation

of the obtained results. Finally, Section 5 concludes

and presents our future work.

2 RELATED WORK

Most of the methods used in mass retailing are based

on statistical estimation. In this paper, we will be

mostly focused on the autoregressive approach. The

principle is relatively straightforward. We want to

construct a global prediction function f

h

such that

z

i,t+h

= f

h

(z

i,t

, θ

i,t

).

2.1 Machine & Deep Learning Methods

The Seasonal AutoRegressive Integrated Moving Av-

erage -X (SARIMAX) model has historically been

used by our company as a benchmark. It has the for-

mula given by:

(1−

p

∑

i=1

φ

i

L

i

)(1 −

P

∑

i=1

Φ

i

L

iS

)(1 −L)

d

(1 − L

S

)

D

y

t

=

(1 +

q

∑

i=1

θ

i

L

i

)(1 +

Q

∑

i=1

Θ

i

L

iS

)ε

t

+

k

∑

i=1

β

i

x

i,t

(1)

p and φ

i

are the order and coefficient of the autore-

gressive (AR) part, d is the degree of first differenc-

ing involved (non-seasonal), q and θ

i

are the order

and coefficient of the moving average (MA) part, P

and Φ

i

are the order and coefficient of the seasonal

AR part, D is the degree of seasonal differencing, Q

and Θ

i

are respectively the order and the coefficient

of the seasonal MA part, S is the length of the sea-

sonal cycle, L is the lag operator, y

t

is the time series,

ε

t

is the error term, x

i,t

are the exogenous variables

and the β

i

are the coefficients associated with the ex-

ogenous variables. The ARMA part can be fixed and

optimised using the Box-Jenkins method, as detailed

in the (Hyndman and Athanasopoulos, 2018) book.

However, the parametric (S)ARIMA-X model is

not the most appropriate as it can only identify linear

relationships between variables and past values. In

addition, the noise is rarely Gaussian when consider-

ing sales series. Then Croston method described in

(Kaya et al., 2020) and some Poisson-based methods

detailed in (Liboschik et al., 2017) are also interest-

ing in this context. But these methods do not take into

account the feature importance.

This transformation aims to treat past observa-

tions and other features derived from the time series

as independent variables for predicting future values.

This transformation is often performed using a tech-

nique called a ”rolling window”. For each data point,

we create features from previous data points within

a window of specified size. We can first introduce

bagging techniques such as random forest (Breiman,

2001). The idea behind the bagging method is to put

together many prediction trees to get a higher accu-

racy.

Then we need to look at some boosting methods

(such as XGBoost (Chen and Guestrin, 2016), Light-

GBM (Ke et al., 2017), CatBoost (Prokhorenkova

et al., 2018)). These have been particularly success-

ful in competitions. XGBoost is the first boosting

algorithm that gave as much choice as possible to

deal with overfitting problems, which are common

in boosting techniques. LightGBM is the faster al-

gorithm in the boosting list, the key technics added

in LightGBM are Gradient-based One-Side Sampling

(GOSS) and Exclusive Feature Bundling (EFB). Cat-

Boost, which is slower, but can produce better results

in some cases. Key techniques in CatBoost include

the use of random permutations in training instances

and symmetric trees, trees grown level by level ex-

tending all leaf nodes with the same split condition.

Significant improvements have also been made to

deep learning methods, which are increasingly well

suited to temporal tasks. DeepAR (Salinas et al.,

2020) is designed to be autoregressive, meaning

Sales Forecasting for Pricing Strategies Based on Time Series and Learning Techniques

1061

that it makes predictions by taking into account

its own past predictions as part of the input data.

TCN (Bai et al., 2018) extracts spatially invariant

local relationships. Finally, TFT (Lim et al., 2021)

attempts to combine the best of both approaches.

Other architectures are designed to work with time

series data, e.g. Nbeat, which has special processing

for time series, and LSTM are built to find short and

long dependencies.

2.2 Improvement to Realize in Retail

Sales Forecasting

There is a notable gap in the literature in the area of

retail forecasting, especially when adopting a strat-

egy that involves learning individual models for each

product. There are few papers in the literature that

propose a clear methodology on the conditions that

lead to the use of a particular model. Indeed, when

we apply the models in the literature to a diverse set

of randomly selected products, it’s difficult to find one

model that always performs best. Even when track-

ing a single product, we find that the best model can

change over the course of the product’s lifecycle. Fur-

thermore, in our optimisation processes, it is essential

to prioritise models that have the greatest impact in

relation to the context. Finally, it is essential to deter-

mine the appropriate training period for the models in

order to know when to retrain them, and we don’t find

any advice on this in the literature.

In our research, we used machine learning and

deep learning algorithms to predict sales series. This

approach posed problems. When exploring extended

hyperparameters using advanced optimisation tools,

we were faced with time constraints. This prob-

lem can become more difficult, particularly with deep

learning.

3 PROBLEM STATEMENT

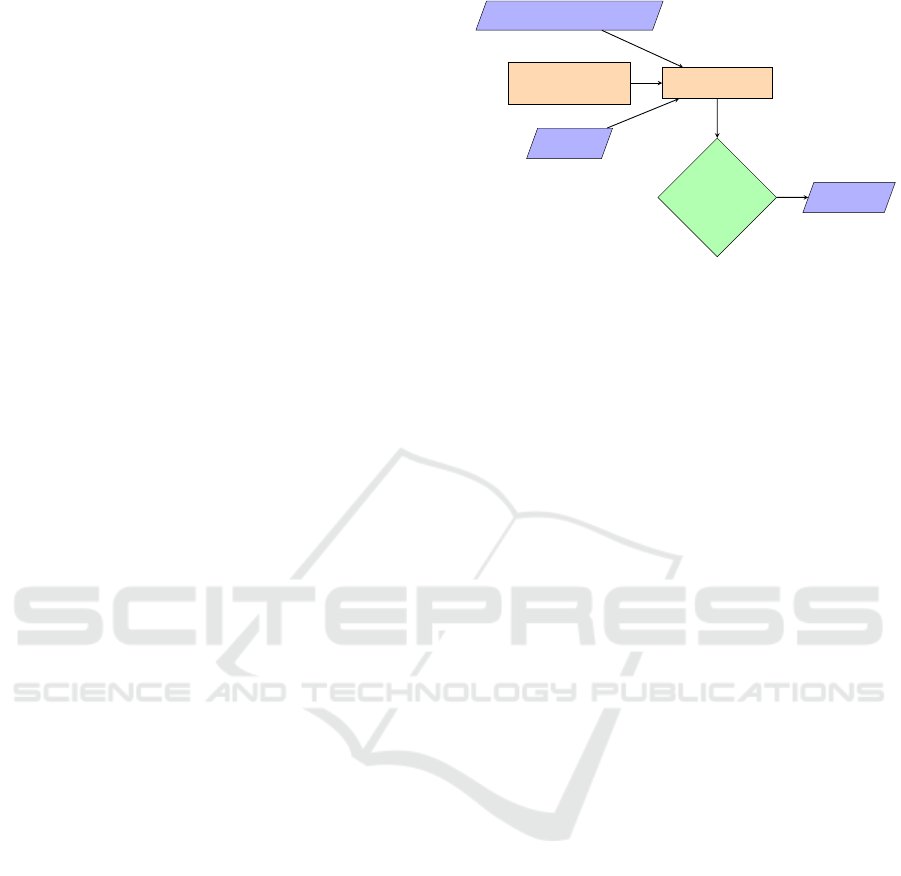

To provide a clearer visualization and understanding

of our problem, we will present the formalization of

the process used to train and select the model within

a function set, gamma, that we want to reduce. An

overview is given in figure 1. First, we consider some

models parameterized with an initial set of hyperpa-

rameters. We compare them to a target series with

an initial horizon, related to a product sales series.

The contextual features requested by customers, such

as climate, prices (of the product and competitors),

promotions and events, as well as some temporal fea-

tures, are given with an initial lag. After a minimiza-

Forecast Model ∈ Γ

Θ Define :

& Setup Hyperparameters

X Features:

Events, Prices, Promotions, Climate

Y : Target :

Sales history

Minimization problem:

argmin γ

Θ,h,X

lag/horizon

hyperparameter

Optimal model

Sales Forecast

[t + 1 : t + h]

Figure 1: An overview of the model selection process by

product.

tion on the convex lost function, we obtain a predic-

tion with optimal training. It’s easy to understand

that the optimal training depends on the definition of

gamma and the theta we have to reduce the space Γ

(cf. figure 1).

3.1 Problem Definition

Let Y be the set of time series of sales that exist in a

store containing i ∈ I ⊂ N products.

Then we construct the application of Λ : I ×T −→

R such that i,t −→ y

i,t

.

Let X be a set of features x

i

that customers want

to see in the model for their price management.

The set Γ of machine & deep learning functions

in which we can find the best function γ

i,θ,t

, where θ

is a vector of hyperparameters that predict the sales

quantity y

i,t

of a product i at a given time t.

We also define the following minimization prob-

lem:

argmin

γ

Θ,X

E

L(γ

θ

t

(x

i,[t+h:t−l]

, y

i,[t−1:t−l]

), y

i,t

)

(2)

Where l is the number of lags and h is the horizon.

L is a convex metric that will allow us to evaluate the

performance of the models to be defined.

We rely on the notations given in the state of the

art (Benidis et al., 2022) and position the current prob-

lem of the startup as a local univariate one.

Indeed, we only predict a single series of sales per

model, associated with a unique product contained in

a single store. We point out that the main need of

clients is to obtain elasticity indicators.

3.2 Dataset Statistical Constraints

When studying sales time series, we often encounter

periods with a high number of zeros and fluctuations

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

1062

in variance and trend. In order to identify the differ-

ences between products, it’s essential to establish spe-

cific statistical indicators such as the ADI (Average

Demand Interval) and the CV (Coefficient of Varia-

tion). Other treatments, such as outlier detection and

change point analysis, can have a significant impact

on the forecast. Another finding is that the time series

may not be autoregressive.

The ADI is defined as follows:

ADI =

N

∑

i=1

τ

i

N

(3)

Where N is the number of sales days over the time

interval (i.e. from the first day of sale to the last) τ

i

=

t

1

− t

0

i.e. the distance between the first sale and the

next sale, which in fine gives the full number of days.

The CV is defined as :

ε =

N

∑

i=1

ε

i

N

(4)

ε

i

is a number of sales. ε is the average number of

sales on days when there were sales.

CV =

v

u

u

t

N

∑

i=1

(ε

i

− ε)

2

N

ε

(5)

CV is therefore the variance of sales observed on sales

days. In addition, by these two estimators, we can

construct the (Syntetos and Boylan, 2005) Classifica-

tion (SBC).

• intermittent series if CV < 0.49 and ADI > 1.32

• smooth series if CV < 0.49 and ADI < 1.32

• lumpy series if CV > 0.49 and ADI > 1.32

• erratic series if CV > 0.49 and ADI < 1.32

Table 1: Datasets presentation.

Data Source M5 Competition

Characteristics Shop full time series data Selected products (Values)

Number of days 1296 1296 1913

Sales days 5694.6 have more than 360 All of them have more than 360 18598 have more than 360

Number of Series 37964 183 30 490

Number of Features 38 38

Stationarity 65

Change Point Median = 2, Mean = 64 Median = 2, Mean = 2

Outlier Median = 1, Mean = 2.67 Median = 17, Mean = 17.6

Seasonality 8732 47

Autocorrelated 6454 89

Intermittent 13890 50 26 956

Smooth 430 33 2 062

Lumpy 17412 50 6 416

Erratic 1466 50 1 791

We point out that, to test for stationarity, we use

the Kwiatkowski-Phillips-Schmidt-Shin (KPSS) test,

which has the null hypothesis of series stationar-

ity. For extreme values, we use the z-statistic, and

for breakpoints, we use the function defined in (Kil-

lick et al., 2012). Booper has data regarding during

the days on which the products recorded sales (sales

geater than zero), for the missing days, we are un-

able at this time to determine whether it is a zero sales

day or an error in the data recording of sales. So, we

have to take zero for both. Another potential source of

dataset constraint due to the absence of certain prod-

ucts in the store for a certain period of time, which

could have a significant impact on the quality of the

forecast.

We have also chosen not to delete days with very high

product sales data (outliers), as they do not represent

specific anomalies linked to higher hierarchical lev-

els.

4 EXPERIMENTAL STUDY,

RESULTS AND

INTERPRETATION

This section presents our experimental study on prod-

uct sales time series. First, we present our dataset and

its preparation required for our experiments. Then,

we detail the proposed machine learning and deep

learning models and their hyperparameters. Finally,

we present and discuss the results.

4.1 Experimental Datasets

Several datasets have been used during this study. The

first was selected directly from a customer context.

We then refined the choice of products to better un-

derstand the behavior of the model. We started with

large-scale tests under commercial conditions. In the

first experiment, we included 450816 products. These

products were selected in 23 stores, so we made no

selection on time-series behavior. The study was car-

ried out in a store that handles general data, i.e, it

sells a wide range of product types. These types are

described in the section 3.2. This has enabled us

to collect series with different behaviours. We ran-

domly selected two hundred series of each product

type. The types were classified according to the in-

terval between two sales and the variance of average

product sales. Then, for the first selection, the model

was trained on a large number of stores. This enabled

us to understand what happens in the real world and

to generate hypotheses to check whether we wanted to

adapt reality to the smaller test. We then carried out

detailed experiments on a representative set of ran-

domly selected products. This was done to understand

how some criteria might affect the model’s predictive

performance. This study was carried out on a general

data store, which means that it sells a variety of prod-

Sales Forecasting for Pricing Strategies Based on Time Series and Learning Techniques

1063

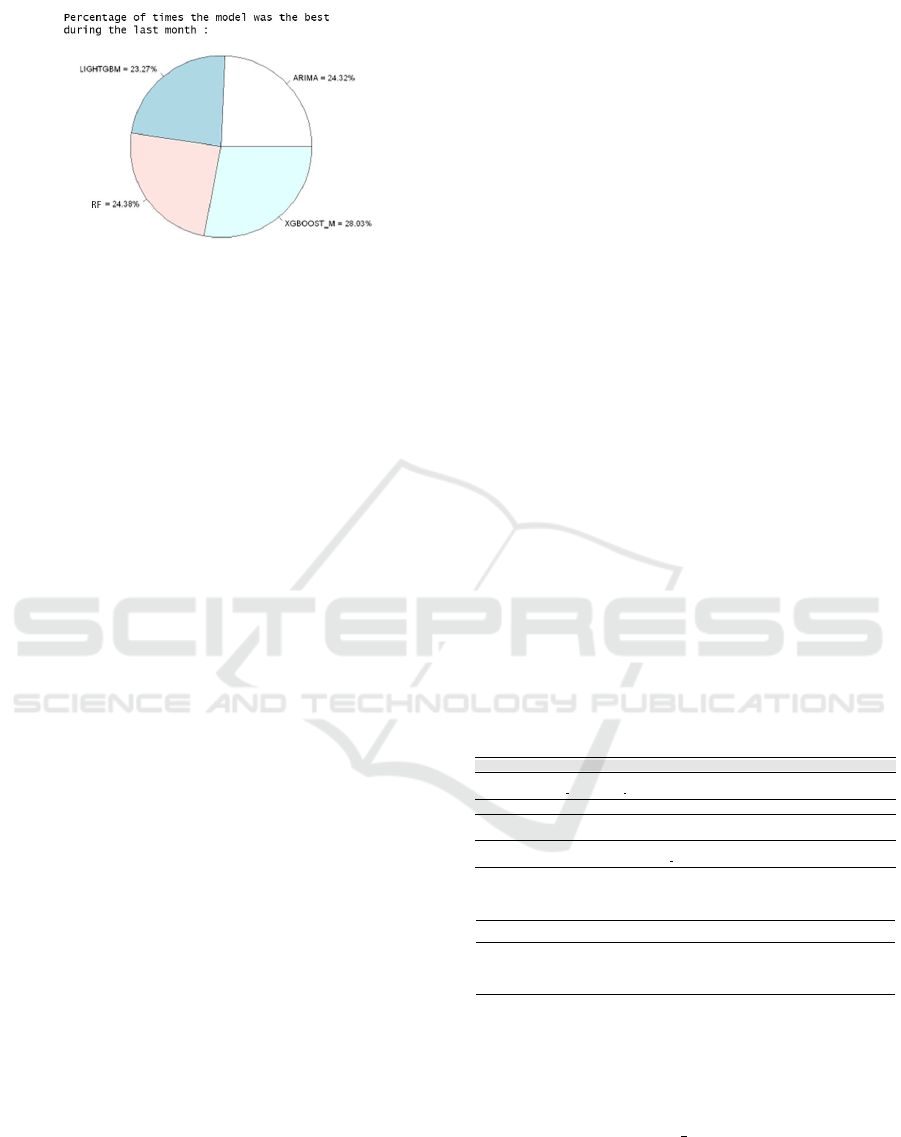

Figure 2: Graphs obtained with R libraries, using all com-

pany data, the best performance models.

uct types, which are described in the section 3.2. This

allowed us to collect series with different behaviours.

To prepare the data and implement a sliding win-

dow strategy, we used the Darts library (Herzen et al.,

2022). It makes it easy to determine the sliding

window intervals. For the normalization, we use

Sklearn’s MinMax method, which is the most widely

used, especially for the application of deep learning

models. The normalization, step is essential to ensure

convergence of the gradient descent. We also try the

Yeo-Johnson function, which is interesting because it

allows us to obtain a stationary time series, but it is

less stable, so we don’t select it in our experiments.

We don’t use normalization step for Boosting mod-

els.

To avoid data leakage, we evaluate model perfor-

mance on an unknown test dataset corresponding to

two last months of historical data (60 days). For deep

learning models, we choose to divide the remaining

data following the exclusion of the test dataset. into

a training set corresponding to 865 days and a vali-

dation set consisting of 371 days. The first partition

reduces overfitting, while the second is used for back-

propagation.

The data, encompassing a broad range of prod-

uct types, facilitated the collection of series exhibiting

varied behaviors. We classified these types based on

sales intervals and variance, randomly selecting 183

series per type for detailed analysis (cf. table 1). Uti-

lizing the Darts library (Herzen et al., 2022), we im-

plemented a sliding window strategy for data prepa-

ration. For normalization, Sklearn’s MinMax method

was employed, crucial for deep learning models’ gra-

dient descent convergence. However, we excluded the

normalization step for Boosting models.

4.2 Experiments

Addressing the introductory questions, our two-step

approach first hypothesized about boosting and para-

metric performance, focusing on a small set of hy-

perparameters for scalability. We then integrated

deep learning models, selecting products with specific

characteristics (intermittent, smooth, erratic, lumpy)

to mimic real-world shop scenarios, as outlined in ta-

ble 1. Products with minimal historical sales were

excluded, especially when assessing time influence

in boosting models. Our evaluation metrics included

MAE, RMSE, MASE, and a monthly MAE reflect-

ing aggregated monthly sales, aligning with large re-

tailer assessments. These metrics, though not flaw-

less, were applied to the experimental dataset de-

scribed in section 4.1, aiming to identify the most suit-

able model for each product type.

4.3 Time Series Prediction and

Experimental Results

Using the autoRank library (Herbold, 2020), we an-

alyzed results statistically and graphically. This pro-

vided the necessary statistical justification for our re-

sults. In addition, we have mentioned the hyperpa-

rameter settings used for each experiment. The other

tables show the mean rank (MR), the median differ-

ence from the best model (MED), the median absolute

difference (MAD), the 95% confidence interval (CI),

the effect size (γ) and the magnitude of the effect size

for each model.

During the first experiment, we were using the

following couples between models and hyperparam-

eters:

Table 2: Setting Hyperparameters for the First Experiment.

Model Parameters

XGBoost booster=’gbtree’, eta=0.4, gamma=0,

max depth=4, early stopping=10

Random Forest ntree=1000

(S)ARIMA-X An automated version were (p,d,q)(P,D,Q)

are found with the (Hyndman and Athanasopoulos, 2018) algorithm

LightGBM nrounds=1000, metric=’mae’,

objective=’regression’, boosting type=’gbdt’

Table 3: Analysis of Boosting Models’ Performance.

MR MED MAD CI γ Magnitude

CatBoost 2.516 3.221 1.845 [2.795, 3.852] 0.000 negligible

LightGBM 1.886 4.120 2.395 [3.579, 4.726] -0.284 small

XGB 1.598 4.704 3.006 [4.032, 5.699] -0.401 small

Figure 2 displays the distribution of top-

performing models over the last month, indicating a

balanced model rank variation. The pie chart shows

no significant MAE differences across product types,

using hyperparameters from Table 2.

Then we create model Comp, with hyperparame-

ters described in Table 4, selects the model with the

closest absolute value prediction to the sales achieved

in the previous month, based on three different algo-

rithms. As in the first experiment, this model can

vary. Extending our study, present findings on 183

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

1064

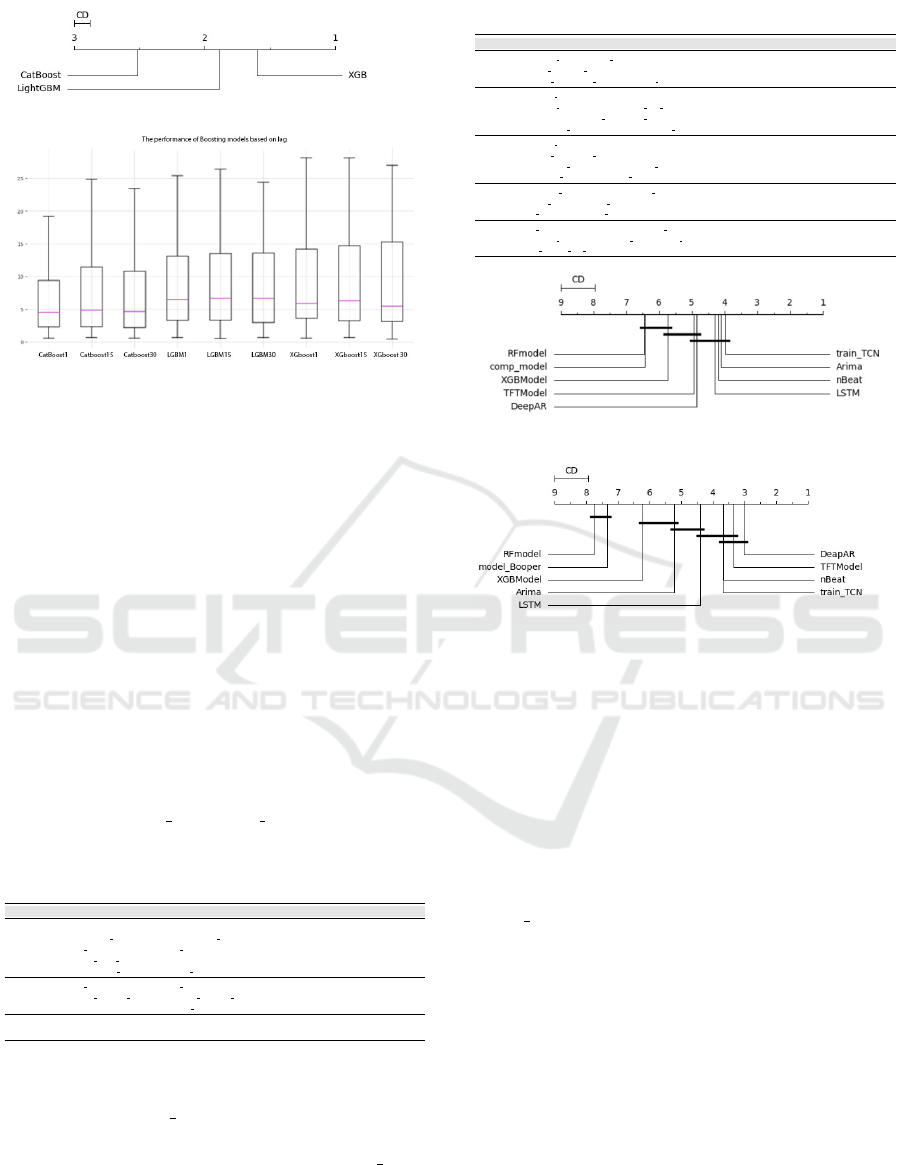

(a)

(b)

Figure 3: (a) The average rank of the models, higher rank

correlates with better performance. (b) The distribution of

errors across models associated with the lag size.

randomly selected products, using Darts library de-

faults for boosting models. Lag size variation showed

negligible impact on boosting models’ MAE perfor-

mance, confirmed by the Nemenyi test (cf. Figure 3

(b)). CatBoost, however, significantly outperformed

others in RMSE. Figure 3 (a) evaluates errors in MAE

across lags 1 to 30, with CatBoost leading in RMSE

performance for the hyperparameter given in the Ta-

ble 3. The table shows model performance dispersion,

indicating varying effectiveness.

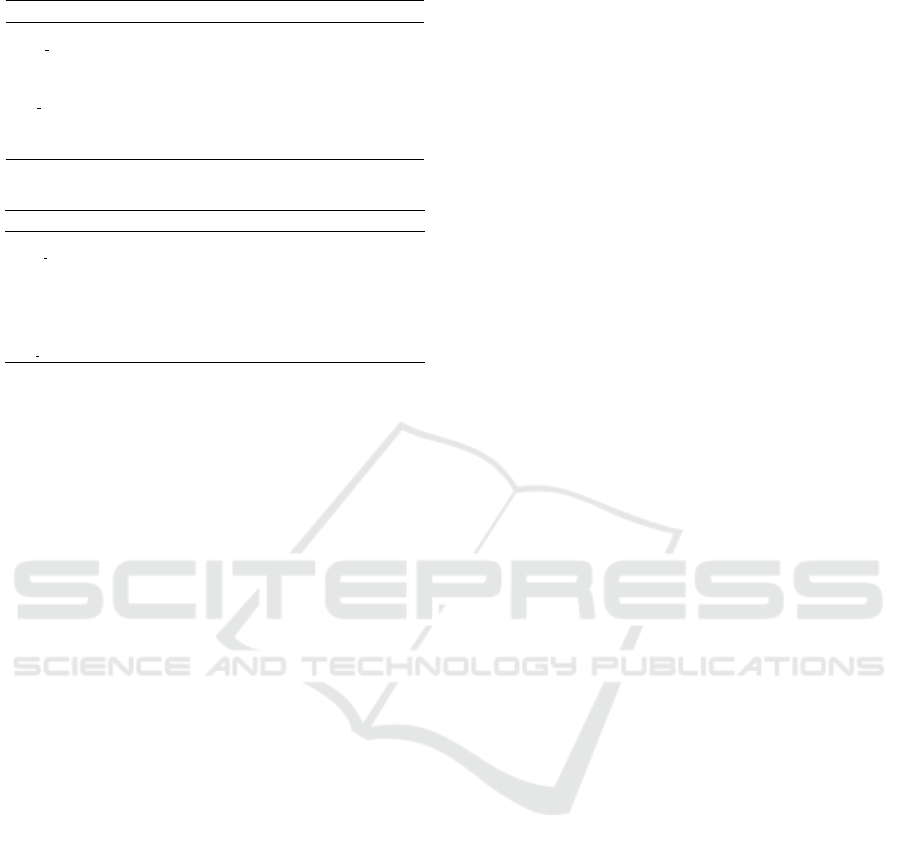

Then we compare the combination of the model

in Table 4 with the machine learning model given in

the Table 5. In the comparison, we obtained the result

given in the Figure 4, using varied error metrics and

sliding windows (nb in = 30, nb out = 15).

Table 4: Hyperparameters of Combined Models Used in the

Company.

Model Hyperparameters

XGBoost objective=’reg:squarederror’,

learning rate={0.03, 0.05, 0.07}, reg lambda={1},

n estimators={1000}, max depth={3,5,7},

min child weight={6,7,8,9}, gamma={0},

colsample bytree={0.8}, eval metric=’mae’

Random Forest n estimators={1000}, max features={8,10},

min samples leaf={4,6,8}, min samples split={8,10,12},

bootstrap={True, False}, max depth={3,5,7}

(S)ARIMA-X An automated version were (p,d,q)(P,D,Q) are found with the

(Hyndman and Athanasopoulos, 2018) algorithm

In terms of RMSE with the Nemenyi test high-

lighting key findings: (1) Negligible differences be-

tween RF and model Comp, (2) Similar performance

levels for XGBoost and (S)ARIMA-X, (3) No signif-

icant differences among Arima, LSTM, train TCN,

nBeat, and TFTModel groups. LSTM’s lower MAD

than ARIMA and DeepAR’s lower CI upper bound

than standard LSTM suggest varying model order

Table 5: Hyperparameter, Used to Obtain the Ranking.

Model Parameters

TFT hidden size=64, lstm layers=1,

num attention heads=4, dropout=0.1,

batch size=16, n epochs=50, add encoders=None

DeepAR model RNN = RNNModel(model=”LSTM”,

hidden dim=(value needed), n rnn layers=2,

dropout=0.2, batch size=16, n epochs=50,

optimizer kwargs=”lr”: 1e-3, random state=0

LSTM model RNN = RNNModel(model=”LSTM”),

batch size=16, n epochs=50,

optimizer kwargs=”lr”: 1e-3, log tensorboard=True,

random state=42, training length=20,

N-BEATS generic architecture=False, num blocks=3,

num layers=4, layer widths=200,

n epochs=50, batch size=9

TCN n epochs=50, dropout=0.1, dilation base=2,

weight norm=True, kernel size=7, num filters=33,

nr epochs val period=1

(a)

(b)

Figure 4: (a) Model Ranking Based on the Company’s Met-

ric (b) Model Ranking According to RMSE.

(cf. Table 6 summarised in Figure 4(b)) Table 7

and Figure 4(a) underscore the significant impact

that a change in metric can have on model rankings.

when we consider the measure given by the com-

pany, we have the following results. The Friedman

test again noted variations in model outcomes. Post-

hoc analysis using Nemenyi test findings include:

(1) No significant differences between RF model,

model Comp, and XGB Model, (2) No significant

differences among TCN, ARIMA, N-BEATS, LSTM,

DeepAR, and TFT, (3) Significant differences in other

model pairings.

This implies that when other metrics are considered,

the hierarchy of model performance may shift consid-

erably.

4.4 Discussion

We are exploring ML/DL tools for time series anal-

ysis in sales forecasting, focusing on understanding

the impact of pricing and promotion strategies. Our

approach, tested on a comprehensive dataset encom-

passing various shops and products, revealed that

Sales Forecasting for Pricing Strategies Based on Time Series and Learning Techniques

1065

Table 6: Obtained results given in terms of RMSE.

MR MED MAD CI γ Magnitude

RFmodel 7.754 0.772 0.624 [0.426, 1.625] 0.000 negligible

model Comp 7.345 0.921 - [0.727, 5.211] - large

XGBModel 6.212 0.915 0.711 [0.500, 1.681] -0.144 negligible

Arima 5.215 1.108 0.883 [0.601, 2.348] -0.296 small

LSTM 4.392 1.237 0.816 [0.748, 2.508] -0.431 small

train TCN 3.677 1.246 0.876 [0.763, 2.545] -0.420 small

nBeat 3.654 1.223 0.935 [0.726, 2.557] -0.383 small

TFTModel 3.346 1.295 0.929 [0.866, 2.352] -0.446 small

DeepAR 3.023 1.478 1.033 [0.825, 2.486] -0.558 medium

Table 7: Obtained results (metric fixed by BOOPER).

MR MED MAD CI γ Magnitude

RFmodel 6.446 5.753 4.320 [3.401, 12.290] 0.000 negligible

model Comp 6.435 5.770 4.688 [3.066, 14.634] -0.003 negligible

XGBModel 5.742 6.304 4.936 [3.936, 17.543] -0.080 negligible

TFTModel 4.938 12.476 11.068 [3.956, 25.123] -0.540 medium

DeepAR 4.862 11.065 10.077 [4.733, 28.030] -0.462 small

LSTM 4.300 13.246 10.792 [6.666, 26.225] -0.615 medium

nBeat 4.192 12.132 10.550 [5.449, 28.506] -0.534 medium

Arima 4.108 16.408 13.818 [7.041, 32.255] -0.702 medium

train TCN 3.977 13.906 11.024 [8.233, 26.195] -0.657 medium

deep learning models require fine-tuning for optimal

performance.In contrast, tree-based models like Cat-

boost, LightGBM, and XGBoost showed promising

results using Darts’ default settings, with Catboost

leading in accuracy (cf. Figure 3). We compared a

hybrid ARIMA, Random Forest, and XGboost model

with deep learning models. The results indicated

that without meticulous hyperparameter tuning, deep

learning models couldn’t surpass ensemble methods,

though they still performed well (cf. Tables 7 & 6).

For instance, XGBoost ranked similarly to TFT and

DeepAR in company metrics (cf. figure 4). How-

ever, in RMSE evaluation, custom deep learning mod-

els lagged behind ensemble models but outperformed

(S)ARIMA-X (cf. table 6). This suggests two in-

sights: (1) Optimal hyperparameter tuning is essen-

tial for deep learning models, as evidenced by TCN’s

good ranking and TFT’s notable upper bound CI in

tables 6 and 7. We observed instances where deep

learning surpassed other methods. (2) Using a sepa-

rate model for each product might not always yield

favorable results with deep learning tools, suggest-

ing a potential reduction in model variety (cf. fig-

ure 4). Our method focuses on minimizing loss on

the training set, avoiding combined minimization on

training and test sets to prevent data leakage. Fu-

ture explorations could include recent Boosting mod-

els with contextual foundations and experiments with

tweedie loss, especially for products with many zero

values, as seen in the M5 competition (Makridakis

et al., 2022b). Our next steps involve identifying

specific hyperparameter configurations for individual

products and narrowing the hyperparameter optimiza-

tion scope. Understanding parameter influence is key

to finding optimal settings.

A significant finding from our study is the pro-

found impact of the metric chosen for evaluation.

Specifically, outcomes can vary notably when as-

sessed using MASE; this is especially evident for

products with intermittent sales. Conversely, when

employing the Comp-approved metric, there is an em-

phasis on products with high amount of sales. This

discrepancy explains the notable difference in rank-

ings produced by the two metrics. Therefore, select-

ing an appropriate metric is vital. In our setting, the

ideal metric would be one that effectively highlights

feature variations. A constructive direction for our re-

search might be to devise a metric that considers this

aspect.

5 CONCLUSION AND FUTURE

WORK

In this study, we explored various machine learn-

ing tools for forecasting sales time series, aiming

to identify models that are not only accurate but

also sensitive to changes in pricing and promotions.

Our methodology involved testing a range of mod-

els on real-life data, ensuring the generality of our

results. We observed that boosting algorithms, par-

ticularly Catboost, performed well even with small

lags. However, without hyperparameter optimization,

deep learning models were not the most effective for

sales forecasting. Our experiments indicated that the

best model for the last month often matched the over-

all best model, suggesting stability in product-specific

model adaptation. The next steps in our research

include fine-tuning hyperparameters for individual

products and narrowing the optimization scope. This

approach will help determine if deep learning meth-

ods can meet the goal of ”one model per product” and

how they compare with autoTS algorithms. While a

multivariate approach offers more data for potentially

more accurate forecasts, it may reduce interpretabil-

ity, which is crucial for advising clients on variable

influences. Therefore, a high-quality, single-product

approach ensures in-depth product understanding. Fa-

miliarity with established models from the literature

allows us to use them efficiently, balancing accuracy

with computational resource considerations.

ACKNOWLEDGEMENTS

This work has benefited from a CIFRE grant man-

aged by the Association Nationale de la Recherche et

de la Technologie, France (ANRT, n°2022/0326) and

BOOPER.

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

1066

REFERENCES

Alexandrov, A., Benidis, K., Bohlke-Schneider, M.,

Flunkert, V., Gasthaus, J., Januschowski, T., Maddix,

D. C., Rangapuram, S., Salinas, D., Schulz, J., et al.

(2020). Gluonts: Probabilistic and neural time series

modeling in python. The Journal of Machine Learn-

ing Research, 21(1):4629–4634.

Alsharef, A., Aggarwal, K., Sonia, Kumar, M., and Mishra,

A. (2022). Review of ml and automl solutions to

forecast time-series data. Archives of Computational

Methods in Engineering, 29(7):5297–5311.

Bai, S., Kolter, J. Z., and Koltun, V. (2018). An em-

pirical evaluation of generic convolutional and recur-

rent networks for sequence modeling. arXiv preprint

arXiv:1803.01271.

Benidis, K., Rangapuram, S. S., Flunkert, V., Wang, Y.,

Maddix, D., Turkmen, C., Gasthaus, J., Bohlke-

Schneider, M., Salinas, D., Stella, L., et al. (2022).

Deep learning for time series forecasting: Tutorial and

literature survey. ACM Computing Surveys, 55(6):1–

36.

Breiman, L. (2001). Random forests. Machine learning,

45:5–32.

Chen, T. and Guestrin, C. (2016). Xgboost: A scalable

tree boosting system. In Proceedings of the 22nd acm

sigkdd international conference on knowledge discov-

ery and data mining, pages 785–794.

Herbold, S. (2020). Autorank: A python package for auto-

mated ranking of classifiers. Journal of Open Source

Software, 5(48):2173.

Herzen, J., L

¨

assig, F., Piazzetta, S. G., Neuer, T., Tafti, L.,

Raille, G., Van Pottelbergh, T., Pasieka, M., Skrodzki,

A., Huguenin, N., et al. (2022). Darts: User-friendly

modern machine learning for time series. The Journal

of Machine Learning Research, 23(1):5442–5447.

Hyndman, R. J. and Athanasopoulos, G. (2018). Forecast-

ing: principles and practice. OTexts.

Kaya, G. O., Sahin, M., and Demirel, O. F. (2020). Inter-

mittent demand forecasting: A guideline for method

selection. S

¯

adhan

¯

a, 45:1–7.

Ke, G., Meng, Q., Finley, T., Wang, T., Chen, W., Ma, W.,

Ye, Q., and Liu, T.-Y. (2017). Lightgbm: A highly

efficient gradient boosting decision tree. Advances in

neural information processing systems, 30.

Killick, R., Fearnhead, P., and Eckley, I. A. (2012). Optimal

detection of changepoints with a linear computational

cost. Journal of the American Statistical Association,

107(500):1590–1598.

Liboschik, T., Fokianos, K., and Fried, R. (2017). tscount:

An r package for analysis of count time series follow-

ing generalized linear models. Journal of Statistical

Software, 82:1–51.

Lim, B., Arık, S.

¨

O., Loeff, N., and Pfister, T. (2021).

Temporal fusion transformers for interpretable multi-

horizon time series forecasting. International Journal

of Forecasting, 37(4):1748–1764.

Makridakis, S., Spiliotis, E., and Assimakopoulos, V.

(2022a). M5 accuracy competition: Results, findings,

and conclusions. International Journal of Forecast-

ing, 38(4):1346–1364.

Makridakis, S., Spiliotis, E., and Assimakopoulos, V.

(2022b). M5 accuracy competition: Results, findings,

and conclusions. International Journal of Forecast-

ing, 38(4):1346–1364.

O’Leary, C., Toosi, F. G., and Lynch, C. (2023). A review of

automl software tools for time series forecasting and

anomaly detection. In ICAART (3), pages 421–433.

Prokhorenkova, L., Gusev, G., Vorobev, A., Dorogush,

A. V., and Gulin, A. (2018). Catboost: unbiased boost-

ing with categorical features. Advances in neural in-

formation processing systems, 31.

Salinas, D., Flunkert, V., Gasthaus, J., and Januschowski, T.

(2020). Deepar: Probabilistic forecasting with autore-

gressive recurrent networks. International Journal of

Forecasting, 36(3):1181–1191.

Syntetos, A. A. and Boylan, J. E. (2005). The accuracy of

intermittent demand estimates. International Journal

of forecasting, 21(2):303–314.

Waring, J., Lindvall, C., and Umeton, R. (2020). Automated

machine learning: Review of the state-of-the-art and

opportunities for healthcare. Artificial intelligence in

medicine, 104:101822.

Sales Forecasting for Pricing Strategies Based on Time Series and Learning Techniques

1067