Partition-Form Cooperative Games in Two-Echelon Supply Chains

Gurkirat Wadhwa, Tushar Shankar Walunj and Veeraruna Kavitha

IEOR, Indian Institute of Technology, Bombay, India

Keywords:

Coalition Formation Game, Worth of Coalition, Stackelberg Game, Stability and Blocking by a Coalition.

Abstract:

Competition and cooperation are inherent features of any multi-echelon supply chain. The interactions among

the agents across the same echelon and that across various echelons influence the percolation of market demand

across echelons. The agents may want to collaborate with others in pursuit of attracting higher demand and

thereby improving their own revenue. We consider one supplier (at a higher echelon) and two manufacturers (at

a lower echelon and facing the customers) and study the collaborations that are ‘stable’; the main differentiator

from the existing studies in supply chain literature is the consideration of the following crucial aspect – the

revenue of any collaborative unit also depends upon the way the opponents collaborate. Such competitive

scenarios can be modeled using what is known as partition form games.

Our study reveals that the grand coalition is not stable when the product is essential and the customers buy

it from any of the manufacturers without a preference. The supplier prefers to collaborate with only one

manufacturer, the one stronger in terms of market power; further, such collaboration is stable only when the

stronger manufacturer is significantly stronger. Interestingly, no stable collaborative arrangements exist when

the two manufacturers are nearly equal in market power.

1 INTRODUCTION

Supply chains are complex systems that involve mul-

tiple agents at multiple echelons. These agents com-

pete and/or collaborate with each other to acquire

the maximum possible market share at ‘good’ prices.

The agents look for collaborative opportunities to pro-

vide better quality service, thereby attracting more

customers, resulting in enhanced individual perfor-

mance, while others compete with each other if they

find it beneficial (e.g., in 2016, Walmart teamed with

JD.com to compete with Amazon and Alibaba in

China).

Handbooks in Operations Research, (Chen, 2003),

discusses the importance of coordination on the effec-

tiveness of the supply chain (SC). Cooperative game

theory facilitates a systematic study of these interac-

tions among the agents of SC (e.g., (Arshinder et al.,

2011; Thun, 2005; Nagarajan and So

ˇ

si

´

c, 2008)).

We examine the interplay between cooperation

and competition in a two-echelon SC, with two manu-

facturers at the lower echelon directly facing the cus-

tomers, and a single supplier at the upper echelon.

Customers choose to buy (or not buy) the product

from one of the two manufacturers based on factors

like the quoted price, the reputation of the entities in-

volved, the importance of the product (essentialness),

etc. The manufacturers compete with each other to at-

tract ‘good’ amount of customer base at ‘good’ prices

and rely on the supplier for the raw material. The sup-

plier at the upper echelon quotes a per-unit price for

raw materials to the manufacturers, and, the latter re-

spond by either quoting a price of final product to the

customers or by deciding not to operate; the choice

of manufacturers also depends upon the production

costs, demand response of the customers, etc.

This paper aims to find ‘optimal’ pricing and col-

laborative strategies of the agents using sophisticated

cooperative game theoretic tools. Majority of these

games (e.g., in (Li et al., 2023; Zheng et al., 2021)) fo-

cus on the stability of the grand coalition and further

on scenarios where the worth of a coalition depends

just upon its members. But many times, the grand

coalition may not be stable, and further, the worth of

the cooperating agents may depend upon the arrange-

ment of agents outside the coalition. Such games are

referred as partition form games, and a recent thesis,

(Singhal, 2023), provides a comprehensive summary

of these games (see also (Aumann and Dreze, 1974)).

In any real-world SC, the revenue or the worth

generated (for example) by a supplier, when all the

manufacturers collaborate (i.e., operate as a single

158

Wadhwa, G., Walunj, T. and Kavitha, V.

Partition-Form Cooperative Games in Two-Echelon Supply Chains.

DOI: 10.5220/0012432600003639

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 13th International Conference on Operations Research and Enterpr ise Systems (ICORES 2024), pages 158-170

ISBN: 978-989-758-681-1; ISSN: 2184-4372

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

unit) will obviously be different from that in a sce-

nario where the manufacturers also compete among

themselves. Thus partition-form based study is es-

sential to capture the frictions in SC.

The first main contribution of this paper is to cap-

ture the above realistic aspects in an SC by model-

ing it as a partition form game and deriving the in-

gredients of the same – to the best of our knowledge,

none of the papers in SC literature consider this. We

further consider that the agents in any coalition op-

erate together as a single unit by pooling the best re-

sources from each partner; furthermore, the possibili-

ties of vertical and/or horizontal cooperation are also

explored.

The exhaustive partition-form game based study

resulted in some interesting insights. When the prod-

uct is essential, and when the customers are (almost)

indifferent to the manufacturers, the grand coalition

is not stable. It is actually the vertical cooperation

between the supplier and one of the manufacturers

that results in a stable configuration. More interest-

ingly, only the collaboration with the stronger manu-

facturer (strong in terms of market power) is stable –

no other attribute of the manufacturers makes a differ-

ence (when their reputation among the customers is

almost the same); the weaker manufacturer operates

alone and competes with the collaborating pair. Even

more interestingly, no collaboration is stable when the

manufacturers are of comparable market strengths.

When the supplier leads by quoting a price, there

exists a Stackelberg equilibrium (SBE) at which the

agents operate, in contrast, a scenario where all the

agents make a simultaneous move results in a Nash

equilibrium at which none of the agents operate. In

fact, majority of the literature in SC seems to under-

stand this at some level and considers the Stackelberg

(SB) framework (e.g., (Li et al., 2023; Zheng et al.,

2021)). The SB framework significantly favours the

supplier – the supplier enjoys a huge fraction of the

revenue generated, which becomes even higher with

the competition at the lower echelon.

The model is described in Section 2, the partition

form games are in Section 4, and the SC is analysed in

Section 5. Some of the proofs are in Appendices, and

others are in technical report (Wadhwa et al., 2024).

Literature Survey. There is a vast literature that

studies the scope of SC coordination. Almost all the

studies consider contract based cooperation (e.g., (Ca-

chon, 2003) and subsequent papers). There are few

strands of literature that study coalition formation

ideas, where the agents are bound without any such

enforcement, because they find it beneficial to do so.

Important and relevant papers in this category are

(Nagarajan and So

ˇ

si

´

c, 2009), (Zheng et al., 2021) and

(Li et al., 2023) etc.

In (Zheng et al., 2021), authors study a two-

echelon sustainable SC with two manufacturers and

a single supplier; they neglect the partition-form as-

pects by defining the worth of a coalition to be the

pessimal worth, the minimum (anticipated worth) that

the said coalition can generate irrespective of the ar-

rangement of the left-over agents. However, if a coali-

tion (not currently operating) has to block/oppose an

operating configuration (the set of operating coali-

tions and revenues/shares of all the agents of SC),

the coalition should anticipate to derive a better rev-

enue than the sum total revenue that its members

are currently deriving. In other words, the anticipa-

tion is required only for estimating the worth of fu-

ture (or blocking) coalition (as upfront it is not sure

of the retaliatory actions of the others), and not for

the worth currently derived (as considered in (Zheng

et al., 2021)). We consider pessimal worth as the an-

ticipated worth of blocking-coalition, while the (cur-

rent) worth(s) in any operating configuration is de-

rived by solving an appropriate game or optimization

problem.

Another recent study in (Li et al., 2023) consid-

ers two assemblers (like manufacturers in our study)

and many irreplaceable suppliers, where the second

assembler only competes for customer base and has

its own set of suppliers – hence this study is not di-

rectly comparable to ours. However, the study again

neglects the partition form nature of the game – the

worth of any coalition is defined just based on its size.

As already argued, when one neglects the inherent

partition form nature, the results could be misleading

– it would be interesting to analyze the SC of (Li et al.,

2023), after incorporating partition form aspects.

In (Nagarajan and So

ˇ

si

´

c, 2009), authors study

coalitional stability considering partition-form as-

pects. However, as is mentioned in the same paper,

they do not consider the worth of the coalition (based

on partition), rather assume that all the players in the

coalition to agree to quote a common (best) price.

This (rather restricted) assumption facilitates in the

derivation of the revenue generated by a single agent

in any partition and thereby study the stability aspects.

In our study, we derive the utility of any coalition de-

pending upon the partition and then consider stability

aspects based on the division of that worth and the

anticipated utility of the ‘opposing coalition’.

2 MODEL

We consider a two-echelon supply chain (SC), with

two manufacturers at the lower echelon and a single

Partition-Form Cooperative Games in Two-Echelon Supply Chains

159

supplier at the upper echelon. The customers pur-

chase the final product from the manufacturers de-

pending upon various factors (price and the essential-

ness of the product, reputation of the manufacturer,

etc.); while manufacturers obtain the required raw

materials from the supplier depending upon their own

customer demand and the price quoted by the sup-

plier, production cost, etc.

Any manufacturer can operate alone, or can col-

laborate with the other manufacturer, or with the sup-

plier, or with both of them – when both the manufac-

turers operate together, they choose the best among

them for any aspect (e.g., influence, reputation, pro-

duction capacity), while the supplier and manufac-

turer pair quote one price directly to the customers.

We examine the impact of the interplay between

cooperation and competition in the above SC using a

cooperative game-theoretic framework; in particular,

our research aims to explore the potential for horizon-

tal (within the same echelon) and vertical cooperation

(across echelons) in an SC. We now describe the in-

gredients of this study in detail.

2.1 Coalitions and Partitions

All the agents or a subset of them can operate to-

gether by forming coalitions. Basically, the agents

within a coalition make joint decisions to generate

a common revenue while facing competition from

other coalitions or agents. One may have more than

one coalition operating in the system. Any partition,

say P = {C

1

,··· , C

k

}, represents the operating ar-

rangement of agents into distinct coalitions and sat-

isfies the following:

∪

m

C

m

= {M

1

,M

2

,S},and C

m

∩C

l

= /0 if m ̸= l.

The goal of this paper is to study the interactions be-

tween these coalitions and predict the emergence of

stable partition(s) (if any). Prior to this, we need to

understand the criteria for declaring a partition stable.

Even prior to this, we need to derive the revenues gen-

erated by various coalitions in each partition – we re-

fer to these revenues as the worths of the coalitions, a

term commonly used in the cooperative game theory

literature (Singhal et al., 2021; Singhal, 2023; Au-

mann and Dreze, 1974). The stability concepts are

discussed in Section 4, while the worths related to

various partitions are derived in various sections. For

now, we discuss important and interesting partitions

and coalitions.

When two manufacturers operate together, we

have a coalition M = {M

1

,M

2

}, with horizontal co-

operation (HC) at the lower echelon. When the sup-

plier and a manufacturer operate together, we have a

coalition with vertical cooperation (VC), e.g., V

i

=

{M

i

,S}. When any agent operates alone, we have

a coalition with a single player, e.g., M

i

= {M

i

} or

S = {S}. When all the agents operate together as in a

centralized SC, we have a grand coalition (GC), rep-

resented by G = {S,M

1

,M

2

}.

The partition P

G

= {G} where all the agents oper-

ate together is referred to as the GC partition. While

we have an ALC partition P

A

= {S,M

1

,M

2

}, when

all the agents operate alone. We also have VC (ver-

tical cooperation) partition P

V

i

= {V

i

,M

−i

} and HC

(horizontal cooperation) partition P

H

= {S,M}.

The worth, the revenue generated by any coalition

must be shared appropriately among its members and

this payoff division also influences the stability as-

pects (Aumann and Dreze, 1974; Singhal et al., 2021;

Singhal, 2023). Further, departing from a majority

of the literature (Li et al., 2023; Zheng et al., 2021),

the worth of any coalition depends upon the operat-

ing partition leading to a partition form cooperative

game (Singhal et al., 2021; Singhal, 2023); as already

mentioned, the analysis of such games is significantly

complicated, and the results obtained by omission of

this dependency can be misleading.

In all, as a result of the choices made by various

agents in the system, each agent derives some rev-

enue/share. The agents are selfish and aim to max-

imize their individual revenue/share, which drives

their choices, including their collaboration attempts;

the paper precisely works in identifying the ‘stable

configurations’ – the partitions and the correspond-

ing payoff divisions.

2.2 Market Segmentation

In an SC, the manufacturers satisfy customers’ de-

mands and rely upon suppliers for raw materials or in-

termediate products. Customers choose one manufac-

turer (or none) based on the price, reputation, loyalty,

and other factors. The demand segmentation is also

influenced by the essentialness of the product, which

we capture using a parameter γ and a cross-linking

factor ε that also captures the customers’ affinity to

switch loyalties. When the manufacturers do not op-

erate together, the market is segmented between them

based on their selling prices p

i

and essentialness fac-

tors (γ,ε) as in equation (1) given below. This is in-

spired by the models commonly used in SC literature

(see, e.g., (Zheng et al., 2021; Li et al., 2023). With

y

+

= max{0,y}, the demand derived by M

i

equals:

D

M

i

=

¯

d

M

i

−α

M

i

p

i

+ εα

M

−i

p

−i

+

, (1)

with α

M

i

:=

˜

α

M

i

(1 −γ), where,

ICORES 2024 - 13th International Conference on Operations Research and Enterprise Systems

160

•

¯

d

M

i

is the dedicated market size of M

i

,

• α

M

i

p

i

is the fraction of demand lost by M

i

due to

its price p

i

, sensitized by parameter α

M

i

,

• The essentialness factor γ dictates the sensitivity

of price p

i

on demand – for example, when γ ≈ 1,

the product is highly essential, and the customers

are insensitive to price,

• εα

M

−i

p

−i

is the fraction of customer base of M

−i

that rejected M

−i

and shifted to M

i

,

• The demand is positive as long as the term inside

(·)

+

is positive; else, the demand is zero.

The product is essential, either when γ ≈ 1 or

when ε ≈ 1 and then almost all the customers buy the

product (for these parameters, observe D

M

1

+ D

M

2

≈

¯

d

M

1

+

¯

d

M

2

, the total market size). When ε ≈1, the cus-

tomers buy the product from one or the other man-

ufacturer (need not be loyal); otherwise, they prefer

to buy from their own manufacturer (are loyal). Gen-

erally, the sum of demands of both manufacturers is

strictly less than the total market size, and the gap de-

pends upon the essentialness parameters (γ, ε).

HC Coalition. When both manufacturers operate to-

gether, as in M or G, they can potentially attract both

customer bases. Further, for manufacturing purposes,

the coalition uses the methods of the manufacturer

with the lowest manufacturing cost; thus, its per-unit

manufacturing cost is C

M

= min

M

i

∈C

C

M

i

, where C

M

i

is

the per-unit manufacturing cost of the manufacturer

M

i

. As the best of the two capabilities are utilized,

and as the customers are aware of it, we assume the

reputation of the coalition equals that of the best. In

all, we assume the demand function of coalition with

horizontal cooperation to be:

D

M

=

¯

d

M

−α

M

p, with α

M

:= min{α

M

1

,α

M

2

},

¯

d

M

=

¯

d

M

1

+

¯

d

M

2

. (2)

There is obviously no cross-linking (shift of cus-

tomers from one manufacturer to the other), or ba-

sically, the customers have no choice. In some cases,

this can be fatal to the system, as the customers can

get discouraged by the unavailability of options. The

product may not appear essential anymore, and the

customers may find solace in other related products.

We observe this phenomenon has significant influence

on stability results of sections 5.1-5.2.

2.3 Costs, Actions and the Utilities

Any agent, supplier, manufacturer, or coalition

has a fixed cost of operation. Therefore, if the

agent/coalition does not generate sufficient profit, it

incurs negative revenue and can choose not to oper-

ate. Let n

o

represent the choice of not operating. The

utility of any agent/coalition is 0 when it chooses n

o

.

The supplier can decide not to operate, or can

quote a price q ∈ [0,∞). Thus, the action set of sup-

plier when operating alone is A

S

:= {n

o

} ∪ [0, ∞),

and its action a

S

∈ A

S

. Similarly, when manufacturer

M

i

decides to operate alone, it quotes a selling price

p

i

∈[0,∞). Thus, the action and the action set of man-

ufacturer M

i

is a

M

i

∈ A

M

i

:= {n

o

}∪[0, ∞).

q

Supplier

Manufacturers

First Echelon

Second Echelon

p

1

p

2

q

Market share of M

1

Market share of M

2

Common Market

Figure 1: System model, when all agents operate alone.

In a VC coalition V

i

= {S,M

i

}, the coalition sets

a price q for supplying raw materials to the manufac-

turer outside the coalition, and sets a price p

i

directly

to customers by jointly producing the final product. In

the grand coalition G = {S,M

1

,M

2

}, which involves

vertical and horizontal cooperation, the coalition di-

rectly quotes a price p for customers and makes a

combined effort to produce the final product. The re-

spective actions are represented by a

V

and a

G

and the

action sets by A

V

and A

G

(defined as before).

2.3.1 Utilities in ALC Partition

We begin with describing the utilities of various

agents when all of them operate alone, i.e., when the

partition is P

A

(see Figure 1). Let a := (a

S

,a

M

) rep-

resent the actions of all the agents (the supplier, and

both the manufacturers), where a

M

:= (a

M

1

,a

M

2

).

Manufacturers’ Utility. The utility of manufacturer

M

i

is zero either if it chooses not to operate or if the

supplier does not operate. Otherwise, utility is the

total profit gained minus the operating cost, where the

former is the product of the demand attracted D

M

i

(1)

and the profit gained per-unit:

U

M

i

(a) = (D

M

i

(a

M

)(p

i

−C

M

i

−q)F

S

−O

M

i

)F

M

i

, (3)

where C

M

i

is the per-unit production cost incurred

by M

i

, O

M

i

is the fixed operating/setup cost, F

C

=

1

{

a

C

̸=n

o

}

represents the flag that coalition C operates,

and q denotes the wholesale price quoted by supplier.

Partition-Form Cooperative Games in Two-Echelon Supply Chains

161

Suppliers’ Utility. The demand for the supplier’s

raw materials (at higher echelon) percolates from the

lower echelon (manufacturers), based on the choices

of the manufacturers. This dictates the utility of the

supplier, which is non-zero only if the supplier and

at least one of the manufacturers operate. In all, the

utility of the supplier S when it operates alone equals:

U

S

(a) =

2

∑

i=1

D

M

i

(a

M

)F

M

i

!

(q −C

S

) −O

S

!

F

S

, (4)

where C

S

is the cost for procurement of a bundle of

raw material required for producing one unit of prod-

uct and O

S

is the fixed operational cost of the supplier.

2.3.2 Utility in General Partition

In a general partition, the utility of a coalition is de-

fined as the sum of the utilities of all the agents within

the coalition. As in equation (2) and as described in

the corresponding sub-section, the coalition utilizes

the best agent for each feature. Also, any VC-based

coalition directly quotes a price to the customers.

Thus, for example, the action and utility of the grand

coalition G are:

a

G

∈ {p ∈[0, ∞)}∪{n

o

}, and

U

G

(a

G

) =

(

¯

d

M

−α

G

p)(p −C

G

) −O

G

F

G

, where,

• O

G

is the combined operational cost, defined as

O

G

= min{O

M

1

,O

M

2

}+ O

S

.

• C

G

is the combined production cost, defined as

C

G

= min{C

M

1

,C

M

2

}+C

S

.

• α

G

is the price sensitivity of the grand coalition,

defined as α

G

= min{α

M

1

,α

M

2

}.

It is important to note here that the agents in the

grand coalition share the revenue generated (U

∗

G

=

sup

a

G

U

G

), and there is no price per item to be paid

between any subset of them. The definitions of util-

ities for other partitions follow similar logic and will

be discussed in the respective sections.

We conclude this section by making an important

assumption (inspired by commonly made choices in

practical scenarios):

A.1 If any agent, either supplier or manufacturer, is

indifferent between the action a = n

o

and an a ̸=

n

o

, the agent prefers operating choices.

We begin with studying an SC with a single man-

ufacturer and supplier, which provides the basis and

benchmark for analysing the more generic SC (with

two manufacturers) of section 5. The stability con-

cepts of partition-form games are in section 4.

3 SINGLE MANUFACTURER SC

In a two-echelon SC with one supplier and one man-

ufacturer, the agents either operate together to form

GC partition {G} or operate alone to form ALC par-

tition {S,M} (observe that M = {M}, G = {S,M}

are coalitions with one manufacturer in this section,

while the same respectively represent M = {M

1

,M

2

}

and G = {S, M

1

,M

2

} in the rest of the paper). To

completely understand the coalitional stability aspects

of such a system, it is sufficient to analyze these two

partitions. Note that there is no competition among

the agents in the same echelon in this case. In the ab-

sence of this competition, the market demand (1) for

the manufacturer simplifies to (as in (2)):

D

M

(a

M

) =

¯

d

M

−α

M

p

. (5)

Recall the demand decreases as the price increases,

but the drop is reduced as the product becomes more

and more essential ( when γ ≈1) and α

M

=

˜

α

M

(1−γ).

We assume the following:

A.2 The total market size

¯

d

M

> α

M

C

G

+2

√

α

M

O, with

O := max{2O

S

,O

G

,4O

M

}.

Basically, the available market size has to be above a

certain threshold so that the profit from the attracted

demand surpasses the operating and manufacturing

costs – this ensures it is optimal for the agents to op-

erate (see for e.g., Lemma 4 of the Appendix). If it

is optimal for the agents not to operate, then there is

nothing left to analyse.

3.1 ALC Partition

In this partition, both agents operate independently

and aim to maximize their respective utilities. We

consider a Stackelberg game framework, where the

supplier first quotes a price q per bundle of raw ma-

terial to the manufacturer. The manufacturer then

quotes a price a

M

= p (per unit of product) to the cus-

tomers; the customers, in turn, respond by generating

a demand D

M

(a

M

), as in (5). Thus, the Stackelberg

game between the supplier and the manufacturer is

given by (with a = (a

S

,a

M

), see (3)-(4)):

U

S

(a) = (D

M

(a

M

)F

M

(q −C

S

) −O

S

)F

S

, (6)

U

M

(a) = (D

M

(a

M

)(p −q −C

M

)F

S

−O

M

)F

M

. (7)

We now derive the Stackelberg equilibrium (SBE)

of the above game.

Theorem 1. Assume A.1 and A.2. There exists an

SBE under which both the agents operate, which is

given by a

∗

M

= p

∗

and a

∗

S

= q

∗

, where

p

∗

:=

3

¯

d

M

+ α

M

(C

S

+C

M

)

4α

M

, q

∗

:=

¯

d

M

+ α

M

(C

S

−C

M

)

2α

M

.

ICORES 2024 - 13th International Conference on Operations Research and Enterprise Systems

162

Further, the utilities at this SBE are given by

(U

∗

M

,U

∗

S

) = (φ −O

M

,2φ −O

S

), (8)

where φ :=

¯

d

M

−α

M

(C

S

+C

M

)

2

16α

M

.

Proof. The utility of manufacturer (7) resembles that

in Lemma 4 and thus for any q, the optimizer of

the manufacturer is operating (not equal to n

o

) only

when

¯

d

M

≥ α

M

(C

M

+ q) + 2

√

α

M

O

M

and then is given

by p

∗

(q) =

¯

d

M

/2α

M

+

(C

M

+q)

/2.

If one neglects the operating conditions, then after

substituting p

∗

(q) in (6) we have:

U

S

(q) = U

S

(q, p

∗

(q)) =

¯

d

M

−α

M

(C

M

+ q))(q −C

S

−2O

S

2

which is again similar to that in Lemma 4, and

then by the same lemma, the optimal q would have

been q

∗

=

(

¯

d

M

+α

M

(C

S

−C

M

))

/2α

M

– this is true when q

∗

and p

∗

:= p

∗

(q

∗

) =

(3

¯

d

M

+α

M

(C

S

+C

M

))

/4α

M

both satisfy

the required operating conditions (i.e., respective ∆s

are ≥ 0) – these are satisfied, as by A.2:

α

M

(q

∗

+C

M

) =

α

M

C

G

+

¯

d

M

2

<

¯

d

M

−2

p

α

M

O

M

, and

(

¯

d −α

M

C

M

) −α

M

C

S

−2

p

2O

S

> 0.

By substituting (q

∗

, p

∗

(q

∗

)) in (6) and (7), we derive

the optimal utilities.

3.2 GC Partition

Both the agents operate together, and the system

directly faces the customers and quotes a common

price p. The per-unit cost C

G

= C

S

+C

M

of the sys-

tem includes the procurement cost (of the raw mate-

rials) and the production cost (see Section 2.3). Fur-

thermore, the system also has a fixed operating cost

O

G

= O

S

+ O

M

, when it operates. Thus, the overall

utility of the system is:

U

G

=

D

M

(a

M

)

p −C

G

−O

G

F

G

. (9)

The utility of any coalition is defined as the optimal

utility that it can derive. Therefore, we have the fol-

lowing simple optimization problem for deriving the

utility of the GC:

sup

a

G

∈A

G

(D

M

(a

M

)(p −C

G

) −O

G

)F

G

. (10)

This problem can be solved using basic (derivative-

based) methods, and the solution is as follows:

Theorem 2. Assume A.1 and A.2. There exists an

optimizer at which the system operates, and the cor-

responding optimal price is a

∗

G

= p

∗

G

, where

p

∗

G

=

¯

d

M

2α

M

+

C

G

2

, (11)

and the corresponding optimal utility is given by:

U

∗

G

=

¯

d

M

−α

M

C

G

2

4α

M

−O

G

. (12)

Proof. Again the utility function of GC (10), resem-

bles that in Lemma 4. Furthermore, by assumption

A.2, ∆ > 0 for the GC, which implies that the GC will

operate. Thus the proof follows by Lemma 4.

Remarks. By Theorems 1 and 2 (observe here C

G

=

C

S

+C

M

as in subsection 2.3.2),

U

∗

G

−(U

∗

M

+U

∗

S

) = φ. (13)

Thus, the agents derive higher utility in GC than the

combined utility that they derive when they operate

alone (i.e., ALC). This means that both agents can

benefit by forming a coalition, as long as they agree

to share the extra profit (U

∗

G

−(U

∗

M

+ U

∗

S

)) in a way

that benefits both of them. Consider a configuration

(GC, (x

M

,x

S

)), where x

i

represents the payoff alloca-

tion of agent i and which satisfies:

x

M

+ x

S

= U

∗

G

, x

M

> U

∗

M

, and x

S

> U

∗

S

. (14)

When the profits are shared as above, none of the

agents prefer to operate alone. Now consider a config-

uration (GC,(x

M

,x

S

)) that does not satisfy (14). When

x

M

+ x

S

< U

∗

G

, the generated revenue U

∗

G

is not com-

pletely shared; if share x

M

< U

∗

M

, the manufacturer

would prefer to operate alone, as it would then derive

U

∗

M

; similarly if x

S

< U

∗

S

, the supplier would prefer

to operate alone. Thus such configurations are ‘op-

posed’ and hence are not stable. Before we study an

SC with two manufacturers, let us formally discuss

the notions of stability in partition form games.

4 PARTITION FORM GAMES

A partition form game is described using the tuple

⟨N,(w

P

C

)⟩ where N is the set of players and w

P

C

is

the worth of the coalition C under partition P and is

defined only when C ∈ P. As mentioned in the in-

troduction, here the worth w

P

C

also depends upon the

partition P – basically w

P

C

need not equal w

P

′

C

for two

different partitions P ̸= P

′

both of which contain C.

Given a partition P and the worths {w

P

C

} of each

coalition in P, the next question is about a ‘pay-off’

vector which defines the allocation to each agent in N.

A pay-off vector x = (x

1

,··· , x

n

) is defined to be con-

sistent with respect to partition P if (see (Aumann and

Dreze, 1974; Singhal et al., 2021; Singhal, 2023)):

∑

i∈C

j

x

i

= w

P

C

j

for all C

j

∈ P. (15)

Partition-Form Cooperative Games in Two-Echelon Supply Chains

163

The pair (P, x) is defined to be a configuration if the

latter is consistent with the former.

The quest now is to study a ‘solution’ of the par-

tition form game. The ‘solution’ in this context de-

scribes the configurations that are stable; in other

words, it identifies the partitions and their companion

consistent payoff vectors that can emerge or operate

stably without being ‘opposed’.

To study the stability aspects, one first needs to

understand if a certain coalition which is not a part of

the partition can ‘block’ (or oppose) the given config-

uration – such a blocking is possible if the coalition

has an ‘anticipation’ of the value it can achieve (ir-

respective of all scenarios that can result after coali-

tion blocks) and if the anticipated value is bigger than

what the members of the coalition are deriving in

the current configuration. Basically, if there exists at

least one division of this anticipated value among the

members of the blocking coalition that renders all the

members to achieve more than that in the given payoff

vector, then the coalition has a tendency to oppose the

current configuration. The above concepts are made

precise in the following definitions ((Singhal et al.,

2021; Singhal, 2023)):

Definition 1 (Blocking of a configuration by a coali-

tion). A configuration, the tuple of partition and the

consistent payoff vector, (P, x), is blocked by a coali-

tion C /∈ P, under the pessimal anticipation rule, if

the coalition derives better than that in the original

configuration irrespective of the arrangement of op-

ponent players, i.e., if the pessimal anticipated utility

w

pa

C

:= min

P

′

:c∈P

′

w

P

′

C

>

∑

i∈C

x

i

. (16)

Definition 2 (Stability). A configuration (P,x) is said

to be stable if there exists no coalition C /∈ P that

blocks it. A partition P can be said to be stable if

there exists at least one configuration (P,x) involving

P which is stable.

We now apply the above stability concepts to the

single manufacturer case study of the previous sec-

tion. In this case, N = {S, M} and the only possible

partitions are P

G

= {N} and P

A

= {{S},{M}}.

Clearly, the worth of grand coalition w

P

G

G

= U

∗

G

given in (11), and that of manufacturer and sup-

plier, while operating alone, are respectively given by

w

P

A

M

= U

∗

M

and w

P

A

S

= U

∗

S

of Theorem 1. These com-

plete the definition of the partition form game. Also

observe that any pay-off vector x = (x

M

,x

S

) is consis-

tent with GC partition if and only if x

M

+ x

S

= U

∗

G

=

w

P

G

G

. On the other hand, the only payoff vector con-

sistent with the ALC partition is x = (w

P

A

M

,w

P

A

S

). The

Theorems 1-2 immediately imply the following sta-

bility result:

Lemma 1. In the single manufacturer SC: i) ALC

partition P

A

is blocked by grand coalition; and ii)

The GC-core, the set of consistent pay-off vectors that

form stable configurations with P

G

( see (8), is:

{

x : x

S

> 2φ −O

S

, x

M

> φ −O

M

and x

S

+ x

M

= 4φ −O

G

}

.

Proof. From (16), the pessimal anticipated utilities

with |N|= 2, clearly equal w

pa

C

= w

P

G

C

for any C. Thus

by Theorems 1-2, w

pa

G

= w

P

G

G

> w

P

A

M

+ w

P

A

S

and hence

part (i); part (ii) follows by direct verification.

Remarks. From (3)- (4), if the supplier and the man-

ufacturer participate in a strategic form game (i.e.,

when they make choices simultaneously), the resul-

tant Nash Equilibrium (NE) is (n

o

,n

o

) – the best re-

sponse of the manufacturer is n

o

for any a

S

= q > C

M

or when a

S

= n

o

, while that of the supplier is n

o

when

a

M

= n

o

and equals infinity when a

M

̸= n

o

. Thus if

both the agents compete at the same level, the SC

would not operate and both of them derive 0 revenue.

On the other hand, when the supplier leads the

market as in the SB game, by Theorem 1 the sys-

tem operates resulting in positive revenues for both

the agents. They derive even better utilities by op-

erating together and hence GC is stable as shown in

Lemma 1. However the supplier gets a much better

share; again from Lemma 1, the share of supplier x

S

is at least 2φ −O

S

while that of the manufacturer is

at most 2φ −O

M

. These observations motivate us to

analyse a more generic SC with competition at the

lower echelon. The aim in particular is to understand

the stable configurations, the profit shares, etc., in the

presence of lower echelon competition.

5 TWO MANUFACTURER SC

In this section, we explore the case of two echelon SC

consisting of a supplier and two manufacturers. As

explained in Section 2.2 and equation (1), the fraction

of demand captured by each manufacturer is :

D

M

i

(a

M

) = (

¯

d

M

i

−α

M

i

p

i

+ εα

M

−i

p

−i

) for all i. (17)

If there is no cross-linking (i.e., if ε = 0), the demand

functions get decoupled, and each of them resemble

to that of the single manufacturer SC (see (5)).

One needs to derive the worths {w

P

C

} for all possi-

ble coalitions C and partitions P to study the stability

aspects. The worth w

P

C

can be defined as the ‘best’

utility (the maximum sum utility) that the members

of C can derive, while facing the competition from

agents outside the coalition arranged as in partition P.

ICORES 2024 - 13th International Conference on Operations Research and Enterprise Systems

164

The competition between various coalitions is

captured via a Stackelberg game (as in Subsec-

tion 3.1), when at least one manufacturer is not collab-

orating with the supplier – the partitions of this type

are, ALC partition P

A

= {S, M

1

,M

2

}, HC partition

P

H

= {S,M} and the VC partition P

V

i

= {V

i

,M

−i

}.

In all these cases, the leader is the coalition C

L

with

the supplier. The coalitions with only manufactures

form the followers - the followers respond optimally

for any given action a

L

(the quoted prices or n

o

) of

the leader. The solution of the followers is either an

optimizer (when all manufacturers form a coalition)

or an NE. Let a

∗

M

(a

L

) represent this solution in either

case. The leader coalition is aware of this optimal

choice, i.e., a

∗

M

(a

L

) for every a

L

is a common knowl-

edge. Thus, the optimal choice of the leader is,

a

∗

L

∈ argmax

a

L

∑

j∈C

L

U

j

(a

L

,a

∗

M

(a

L

))),

and then (a

∗

L

,a

∗

M

(a

∗

L

)) represents the SBE. We then de-

fine the worth of the leader coalition by:

w

P

C

L

=

∑

j∈C

L

U

j

(a

∗

L

,a

∗

M

(a

∗

L

)).

The worth of the rest of the coalitions of P can be

defined similarly using the SBE (a

∗

L

,a

∗

M

(a

∗

L

)).

We are just left with the GC partition P

G

= {G},

which can be analysed exactly as in Subsection 3.2

and is considered in the immediate next – we once

again assume ‘operating-conditions’ assumption A.2

(with terms like C

G

etc., accordingly changed); with-

out loss of generality, we consider

¯

d

M

1

≥

¯

d

M

2

.

5.1 GC Partition

In GC partition P

G

, the two manufacturers and the

supplier operate together as explained in Subsection

2.3.2. The optimization problem is similar to that in

(10), hence we have the following with proof exactly

as in that of Theorem 2:

Corollary 1. Assume A.1 and A.2. The worth of P

G

defined using the optimizer is given by

w

P

G

G

= U

∗

G

=

¯

d

M

−α

M

C

G

2

4α

M

. □

5.2 HC Partition

We now consider the HC partition P

H

, where both the

manufacturers M = {M

1

,M

2

} operate together. The

coalition of manufacturers M quotes a selling price p

to the customers, and the leader (supplier) S quotes a

price q to M. Recall any of them may decide not to

operate (choose n

o

). The SBE a

∗

:= (a

∗

M

,a

∗

S

) of the

Stackelberg game satisfies the following as before:

a

∗

M

= a

∗

M

(a

∗

S

), and a

S

∗

∈ arg max

a

S

∈A

S

U

S

(a

S

,a

∗

M

(a

S

)),

where the utilities and the optimizers are given by:

U

S

(a) := (D

M

(a

M

)(q −C

S

)F

M

−O

S

)F

S

a

∗

M

(a

S

) := arg max

a

M

∈A

M

U

M

(a

M

,a

S

) with

U

M

(a) := (D

M

(a

M

)(p −C

M

−q)F

S

−O

M

)F

M

,

with D

M

(a

M

) defined in (2). This game is similar to

that considered Subsection 3.1, and hence the follow-

ing result using the proof of Theorem 1.

Corollary 2. Assume A.1 and A.2, the worths of the

agents in P

H

(defined using operating SBE) equal:

{w

P

H

S

,w

P

H

M

} = {2φ −O

S

,φ −O

M

},

where φ =

(

¯

d

M

−α

M

C

G

)

2

16α

M

. □

Using Corollaries 1-2, as in Lemma 1, it is easy

to conclude that the HC partition is blocked by grand

coalition G and hence is not stable.

5.3 Worth-Limits

For further analysis, one needs to study the ALC and

VC partitions. However the expressions for these two

partitions are significantly complex and hence we be-

gin with a specific yet an important asymptotic case

study in this conference paper – while the complete

generality would be considered in future. We con-

sider an asymptotic regime near (ε,γ) ≈ (1, 1); as

mentioned previously, here the customers are willing

to switch the loyalties towards their manufacturers

and hence we call such a regime as Essential and

Substitutable-Manufacturer (ESM) regime. We also

consider manufacturers of equal reputation, i.e., with

˜

α

M

1

=

˜

α

M

2

. Towards obtaining the asymptotic study

we consider the following procedure.

ESM Regime: For any partition-coalition (P,C),

consider the function (γ, ε) 7→ (1 − γ)(1 − ε)w

P

C

.

From all the expressions derived in this paper, i.e.,

for all (P,C), these functions are continuous. Hence

the following limits exist (for each (P,C)) and can be

rewritten as below:

f

P

C

:= lim

(γ,ε)→(1,1)

(1 −γ)(1 −ε)w

P

C

= lim

ε→1

lim

γ→1

(1 −γ)(1 −ε)w

P

C

. (18)

We refer to the above as worth-limits, with slight

abuse of notation. Similarly define {f

pa

C

} using antic-

ipated worths {w

pa

C

}. We will also require the limits

of the following derivatives

Partition-Form Cooperative Games in Two-Echelon Supply Chains

165

f

(1),P

C

:=lim

ε→1

d ˜w

P

C

dε

with ˜w

P

C

:= (1 −ε) lim

γ→1

(1 −γ)w

P

C

, (19)

and also that of the anticipated worths, {f

(1),pa

C

}. The

idea is to derive the stability results by comparing

the worth-limits instead of the actual worths {w

P

C

},

and further using the derivative limits (19) when the

worth-limits are equal. We claim that such stability

results are applicable for all (ε,γ) in a neighbourhood

of (1,1) because of the following reasons and proce-

dure.

From (16) a configuration (P,x) is stable if the

following set of inequalities are satisfied:

∑

i∈C

x

i

≥ w

pa

C

for all C /∈ P. (20)

(we identify only the configurations that satisfy the

above with strict inequality, a more complete study is

again a part of the future work, and the reasons for

this omission is evident in the immediate next).

If the inequalities in (20) are satisfied in a strict

manner by some vector y and for some partition P

using limits {f

pa

C

} in place of w

pa

C

, then by continuity

there exists

¯

γ and

¯

ε such that the above inequalities

(finitely many) are satisfied for all γ >

¯

γ and ε >

¯

ε —

this implies that for all those (γ, ε), the configuration

(P,β y), with, β :=

1

(1 −ε)(1 −γ)

,

is stable; thus one can obtain stability results near

ESM regime using the worth-limits {f

P

C

, f

pa

C

} (when

strict inequalities are considered in (20)).

During blocking by mergers, i.e., say when block-

ing coalition C = C

1

∪C

2

, then recall by consistency

in (15), the inequality (20) modifies to

∑

i∈C

x

i

= w

P

C

1

+ w

P

C

2

≥ w

pa

C

. (21)

And if now the worth-limits of both right and left hand

sides are equal, then the comparison in neighbour-

hood is possible only by considering the derivatives.

This is because for such limits, by Taylors series ex-

pansion, near ε ≈ 1 we have (see (19)):

˜w

P

C

1

+ ˜w

P

C

2

− ˜w

pa

C

(22)

= (ε −1)

d

˜w

P

C

1

+ ˜w

P

C

2

− ˜w

pa

C

dε

ε→1

+ o((1 −ε)

2

)

= (ε −1)

f

(1),P

C

1

+ f

(1),P

C

2

− f

(1),pa

C

+ o((1 −ε)

2

),

where the limits {f

(1),pa

C

, f

(1),P

C

} are defined in (19).

Thus the required stability results can be established if

now the derivative limits satisfy the required inequal-

ities – and then there exists an

¯

ε < 1 such that the

stability results are true in a neighbourhood as below:

{

(ε, γ) : ε ≥

¯

ε and γ ≥

¯

γ

ε

}

, (23)

where

¯

γ

ε

< 1 is a lower bound depending upon ε.

Further to ensure that the coalitions under consid-

eration are operating, one would require conditions

like that in A.2. However these conditions are triv-

ially satisfied in the limits γ → 1, once

¯

d

M

i

> 0 for all

i; furthermore, the conditions will also be satisfied in

the neighbourhood of (1,1) (if required by shrinking

the neighbourhood further) due to similar reasons.

5.4 VC Partition

Recall in the partition with vertical cooperation, P

V

i

the supplier collaborates with one of the manufactur-

ers M

i

and competes with the other. The Stackel-

berg game is between the coalition V

i

as leader and

the manufacturer M

−i

as follower. The manufacturer

M

−i

(when it operates) obtains raw material from V

i

,

quotes p

−i

and the demand D

M

−i

attracted by M

−i

also

contributes towards the revenue of V

i

; the VC coali-

tion V

i

also derives utility due to its own demand

D

M

i

(recall here a direct price p

i

is quoted to the cus-

tomers). Thus the utilities of the two coalitions are:

U

V

i

=

D

M

i

(a

M

)(p

i

−C

M

i

−C

S

) + F

M

−i

D

M

−i

(a

M

)(q −C

S

)

−O

S

−O

M

i

F

V

i

, (24)

U

M

−i

=

D

M

−i

(a

M

)(p

−i

−q −C

M

−i

)F

V

i

−O

M

−i

F

M

−i

. (25)

The SBE (a

∗

V

i

,a

∗

M

−i

) (when exists) satisfies:

a

∗

M

−i

= a

∗

M

−i

(a

∗

V

i

), a

∗

M

−i

(a

V

i

) := argmax

a

M

−i

U

M

−i

(a

M

−i

,a

V

), and

a

∗

V

i

∈ arg max

a

V

∈A

V

i

U

V

i

(a

V

,a

∗

M

−i

(a

V

)),

and defines the worths, w

P

V

V

i

= U

V

i

(a

∗

) and w

P

V

M

−i

=

U

M

−i

(a

∗

). As already mentioned, it is complicated to

analyze this game theoretically, we instead obtain the

ESM limits in the following:

Lemma 2. Assume α

M

1

= α

M

2

= α. The worth-limits

( f

P

V

i

V

i

, f

P

V

i

M

−i

) and the derivative limits ( f

(1),P

V

i

V

i

, f

(1),P

V

i

M

−i

)

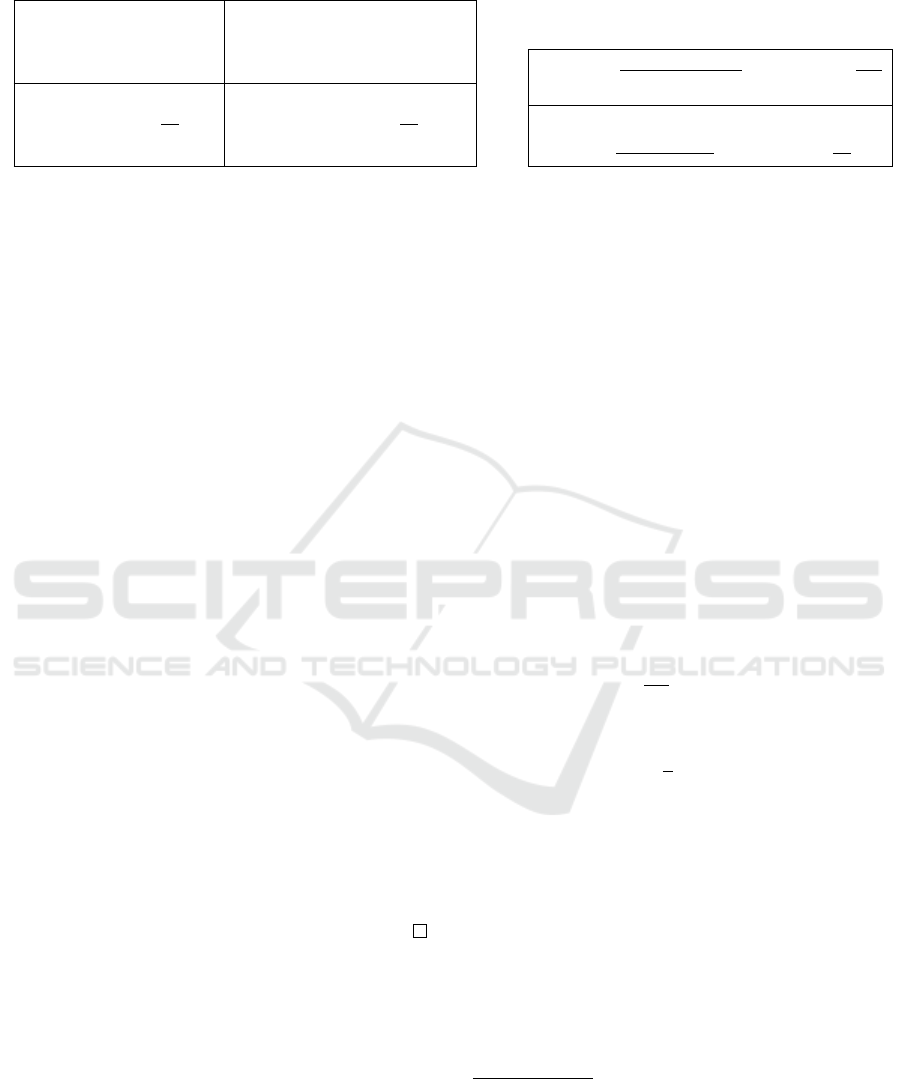

for ESM regime are respectively in Tables 1a and 1b.

Proof. Refer to (Wadhwa et al., 2024) for the proof.

5.5 ALC Partition

Recall the partition, P

A

= {S, M

1

,M

2

}, where all the

agents operate alone and compete with each other. In

this partition, we have a SB game, where supplier

S is the leader, quoting its price via the action a

S

;

the competing manufacturers {M

1

,M

2

} are follow-

ers in the lower echelon, who respond to a

S

via a non-

cooperative strategic form game (inner game between

ICORES 2024 - 13th International Conference on Operations Research and Enterprise Systems

166

Table 1: ESM regime near (γ, ε) ≈ (1, 1).

f

P

G

G

= 0

f

P

H

S

, f

P

H

M

= (0,0)

f

P

V

i

V

i

, f

P

V

i

M

−i

=

¯

d

2

M

8

˜

α

,0

f

P

A

S

, f

P

A

M

1

, f

P

A

M

2

=

¯

d

2

M

8

˜

α

,0, 0

(a) Worth-limits

f

(1),P

V

i

V

i

=

2

¯

d

M

i

¯

d

M

−i

+

¯

d

2

M

−i

−

¯

d

2

M

i

16

˜

α

, f

(1),P

V

i

M

−i

= −

¯

d

2

M

−i

16

˜

α

f

(1),P

A

M

i

=

−

(

5

¯

d

M

i

+

¯

d

M

−i

)

2

144

˜

α

∀i, f

(1),P

A

S

=

¯

d

2

M

8

˜

α

(b) Derivative-limits

the manudacturers), parametrized by fixed action of

supplier a

S

. As a leader of SB game, the supplier is

aware of the Nash Equilibrium (NE) a

∗

M

(a

S

) of the in-

ner game a

∗

M

(a

S

) for every a

S

. The utility of each of

these agents are given in (3)-(4). The utility of the

supplier S and a manufacturer M

i

is ,

U

S

(a

S

) =

2

∑

i=1

D

M

i

(a

∗

M

(a

S

))F

M

i

!

(q −C

S

) −O

S

!

F

S

,

(26)

U

M

i

(a

M

;a

S

) = ((D

M

i

(a

M

(a

S

))(p

i

−C

M

i

−q)F

S

−O

M

i

)F

M

.

(27)

The equilibrium of the SB game satisfies

a

∗

S

= argmax

a

S

U

S

(a

S

,a

∗

M

(a

S

))),

a

∗

M

i

= argmax

a

M

i

U

M

i

(a

M

i

,a

M

−i

;a

∗

S

) for all i.

The worth of supplier S is, w

P

A

S

= U

S

(a

∗

S

), and the

worth of manufacturer M

i

is, w

P

A

M

i

= U

M

i

(a

∗

M

). As al-

ready mentioned, it is complicated to analyze this

game theoretically, we instead obtain the ESM lim-

its in the following:

Lemma 3. Assume α

M

1

= α

M

2

= α. The worth-

limits ( f

P

A

S

, f

P

A

M

i

, f

P

A

M

−i

) and the derivative limits ( f

(1),P

A

S

,

f

(1),P

A

M

i

f

(1),P

A

M

−i

) for ESM regime are respectively in Ta-

bles 1a and 1b.

Proof. Refer to (Wadhwa et al., 2024) for the proof.

6 STABILITY RESULTS: ESM

REGIME

We have derived the worths {w

P

C

} and the worth-

limits {f

P

C

} in the previous section and now aim to

identify the partitions and configurations that are sta-

ble in ESM regime. We have worth-limits only for

VC and ALC partitions, and thus for the compari-

son purposes (see (16), (20) and (21)), compute the

same for GC and HC partitions. By Corollaries 1-2,

f

P

G

G

= f

P

H

M

= f

P

H

S

= 0; these are also tabulated in Ta-

ble 1.

From Table 1, the immediate result is that, the GC

and HC partitions (irrespective of the pay-off vectors)

are both blocked by coalition V

i

. Thus none among

these two partitions are stable. As discussed at the

end of Subsection 2.2, the customers may no longer

feel the product is essential in the absence of choices,

and this may be the reason for non-stability of the GC

and HC partitions.

1

We now identify the stable configurations. To-

wards this, the pessimal anticipatory worth-limits (see

equation 16), using Table 1, are:

f

pa

S

= min{f

P

H

S

, f

P

A

S

} = 0

f

pa

M

= f

P

H

M

= 0 (28)

f

pa

M

i

= min{f

P

V

−i

M

i

, f

P

A

M

i

} = 0, f

pa

G

= 0, and

f

pa

V

i

= f

P

V

i

V

i

=

¯

d

2

M

8

˜

α

. (29)

In the following we prove that: i) the partitions P

A

and

P

V

2

are not stable, while P

V

1

is stable when

¯

d

M

1

> (

√

2 + 1)

¯

d

M

2

; (30)

and ii) none of the partitions are stable when the above

inequality (30) is negated strictly. Towards this we es-

tablish few (strict) inequalities at ESM limit for each

configuration – the set of inequalities are strict and

demonstrate either that the configuration is stable or

that a coalition blocks it. Then the said configuration

remains stable (or is blocked by the said coalition) for

all (γ,ε) around (1, 1) and in a set as in (23) of sub-

section 5.3. We begin with ALC partition.

ALC Partition Is Not Stable. Note that there is

only one scaled configuration at limit involving ALC

1

Observe when a worth-limit is non-zero,the corre-

sponding worth/optimal-revenue increases to infinity as

(ε, γ) → (1, 1) and this is true only for worths related to

VC and ALC partitions in ESM regime; by Corollaries 1- 2

the worths for GC and HC partitions also increase to infinity

with γ →1, but not with ε →1 and hence the corresponding

worth-limits are zero.

Partition-Form Cooperative Games in Two-Echelon Supply Chains

167

(P

A

,y) with y

S

= f

P

A

S

, y

M

1

= f

P

A

M

1

and y

M

2

= f

P

A

M

2

, be-

cause of consistency. The coalitions that can possibly

block ALC partition are the merger coalitions such as

G, M, V

i

. Consider a merger V

i

which gets the same

utility as y

S

+ y

M

i

of ALC at limit. Thus we compare

using the derivative limits of Table 1b ,

f

(1),P

A

S

+ f

(1),P

A

M

i

= −

¯

d

2

M

8

˜

α

+

5

¯

d

M

i

+

¯

d

M

−i

2

144

˜

α

<

¯

d

2

M

i

−2

¯

d

M

i

¯

d

M

−i

−

¯

d

2

M

−i

16

˜

α

= f

(1),P

V

V

i

, (31)

and hence the merger V

i

blocks P

A

(see (22) and ob-

serve (ε −1) is negative) and this is true with a strict

inequality at limit. Therefore, P

A

is not a stable parti-

tion in the ESM regime.

Continuing in this manner we obtain the following

result (the remaining proof is in the Appendix):

Theorem 3. [ESM regime] Consider any

˜

α,

¯

d

M

1

,

¯

d

M

2

,{C

C

} and {O

C

} with

¯

d

M

1

≥

¯

d

M

2

. There ex-

ists a

¯

ε < 1 such that for every ε ∈ (

¯

ε,1), there exists

a

¯

γ

ε

< 1 and for any system with above parameters

and with (ε, γ) ∈ {ε ≥

¯

ε,γ ≥

¯

γ

ε

}, the following are

true:

i) When

¯

d

M

2

≤

¯

d

M

1

< (

√

2 + 1)

¯

d

M

2

, none of the par-

titions are stable.

ii) When

¯

d

M

1

> (

√

2 +1)

¯

d

M

2

, then only P

V

1

partition

is stable. Further the configuration (P

V

1

,x) is

stable if

x

M

1

∈

w

pa

M

−w

P

V

1

M

2

, w

P

V

1

V

1

−w

P

V

2

V

2

+ w

P

V

1

M

2

, (32)

and the above interval is non-empty. □

Remarks. When there is a huge disparity between

the two manufacturers in terms of the dedicated mar-

ket demands, the SC has stable configurations. The

supplier prefers to collaborate with stronger manufac-

turer (P

V

1

is stable) and the weaker manufacturer has

no choice (no partner finds it beneficial to oppose P

V

1

by collaborating with weaker M

2

).

However the share of the manufacturer that col-

laborates with supplier is negligible in comparison to

that of the supplier (the upper bound on scaled pay-

off (1 −ε)(1 −γ)x

M

1

to 0 as seen from (32) and Table

1, while the lower bound on that of the supplier con-

verges to

¯

d

2

M

/8

˜

α); in fact the scaled share of the non-

collaborating manufacturer M

2

also converges to 0

(from Table 1 f

P

V

1

M

2

= 0). Thus in the essential and

substitutable manufacturer regime, the supplier has

even higher advantage than that in the single man-

ufacturer SC – the competition at the lower echelon

added with substitutability significantly improved the

benefits and the position of the supplier.

Another interesting aspect is that the supplier

prefers to collaborate with stronger manufacturer (P

V

1

is stable, but not P

V

2

) – in the prelimit, the supplier

derives better coalitional utility when it collaborates

with stronger M

1

.

On the other hand, when the manufacturers are of

comparable strengths, as in part i of Theorem 3, the

SC has no stable configuration. The system probably

keeps switching configurations (any operating config-

uration is blocked by one or the other coalition).

7 CONCLUSIONS

The main takeaway of this work is that it establishes

the possible stability of vertical mergers (the collabo-

ration between the supplier and a manufacturer) and

instability of centralised supply chain (all the mem-

bers of SC); this is true for the SC that supplies essen-

tial goods and that caters to not-so loyal customers.

This is in contrast to the current literature which usu-

ally establishes the stability of centralized SC. This

contrast is the consequence of the realistic consider-

ation of the partition-form aspects – where the worth

of a coalition depends upon the arrangement of the

agents outside the coalition. When the manufacturers

are significantly different in terms of market power,

the vertical cooperation (or merger) between the sup-

plier and the stronger manufacturer is stable, while

the weaker manufacturer is left-out to compete with

the collaborating pair. Surprisingly, no collaboration

is stable when the manufacturers are of comparable

market strengths.

In reality, the worth of any coalition depends upon

the arrangement of opponents in the market space; for

example, the revenue generated by the supplier with

the two manufacturers operating together is different

from that when the two manufacturers operate inde-

pendently. This realistic aspect is captured by study-

ing the SC using partition-form games, which paved

way to the above mentioned contrasting results.

Further, the competition at the lower echelon sig-

nificantly favors the higher level supplier – the sup-

plier enjoys a huge fraction of the revenue generated,

while the manufacturers draw a negligible fraction ir-

respective of their market powers and irrespective of

whether they collaborate with the supplier or not.

This research has opened up many new questions

– which configurations are stable in an SC that sup-

plies luxury goods (non-essential) or in a SC with

loyal customers? More interesting questions are about

the stable configurations with competition at both the

echelons along with vertical competition.

ICORES 2024 - 13th International Conference on Operations Research and Enterprise Systems

168

REFERENCES

Arshinder, K., Kanda, A., and Deshmukh, S. (2011). A

review on supply chain coordination: coordination

mechanisms, managing uncertainty and research di-

rections. Supply chain coordination under uncer-

tainty.

Aumann, R. J. and Dreze, J. H. (1974). Cooperative games

with coalition structures. International Journal of

game theory.

Cachon, G. P. (2003). Supply chain coordination with con-

tracts. Handbooks in operations research and man-

agement science.

Chen, F. (2003). Information sharing and supply chain coor-

dination. Handbooks in operations research and man-

agement science.

Li, C., Cao, B., Zhou, Y.-W., and Cheng, T. E. (2023). Pric-

ing, coalition stability, and profit allocation in the pull

assembly supply chains under competition. OR Spec-

trum.

Nagarajan, M. and So

ˇ

si

´

c, G. (2008). Game-theoretic analy-

sis of cooperation among supply chain agents: Review

and extensions. European journal of operational re-

search.

Nagarajan, M. and So

ˇ

si

´

c, G. (2009). Coalition stability in

assembly models. Operations Research.

Singhal, S. (2023). Navigating Resource Conflicts: Co-

opetition and Fairness. PhD thesis.

Singhal, S., Kavitha, V., and Nair, J. (2021). Coalition for-

mation in constant sum queueing games. In 60th IEEE

Conference on Decision and Control (CDC).

Thun, J.-H. (2005). The potential of cooperative game the-

ory for supply chain management. Research Method-

ologies in Supply Chain Management: In Collabora-

tion with Magnus Westhaus.

Wadhwa, G., Walunj, Tushar, S., and Kavitha, V. (2024).

Technical Report.

Zheng, X.-X., Li, D.-F., Liu, Z., Jia, F., and Lev, B. (2021).

Willingness-to-cede behaviour in sustainable supply

chain coordination. International Journal of Produc-

tion Economics.

APPENDIX

In this appendix, we consider the following optimiza-

tion problem and derive its solution:

U(a) =

(

¯

d −α p)

+

(p −c) −O

c

1

{

a̸=n

o

}

. (33)

Lemma 4. Define ∆ =

¯

d −αc −2

√

αO

c

. The maxi-

mizer and the maximum value of (33) is given by:

a

∗

= p

∗

1

{

∆>0

}

+ n

o

1

{

∆<0

}

, where p

∗

=

¯

d + cα

2α

,

U(a

∗

) =

(

¯

d −αc)

2

4α

−O

c

1

{

∆>0

}

.

When ∆ = 0, we have two optimizers, p

∗

and n

o

.

Proof. Towards solving (33), we first consider opti-

mizing the interior objective, more precisely, w(p) =

(

¯

d −α p)(p −c) only w.r.t. p. The solution to this op-

timization problem (using derivative techniques) is,

p

∗

=

¯

d

2α

+

c

2

, and w

∗

= w(p

∗

) =

(

¯

d −αc)

2

4α

. (34)

Returning to the original problem (33), if ∆ > 0, then,

α p

∗

=

¯

d

2

+

αc

2

<

¯

d −

p

αO

c

<

¯

d,

and hence, (

¯

d −α p

∗

)

+

=

¯

d −α p

∗

, w

∗

−O

c

> 0. Thus,

p

∗

is also the maximizer of (33) with U

∗

= w

∗

−O

c

.

If ∆ < 0 then n

o

is the optimizer, as U

∗

= U(n

o

) = 0 >

w

∗

−O

c

. The last sentence now follows trivially.

Proof continued, Theorem 3. Without loss of gen-

erality, consider stability of P

V

1

. To ensure (P

V

1

,x) is

stable, it should not be blocked by HC coalition M, as

well as VC coalition V

2

. In other words, we require,

w

pa

M

−w

P

V

1

M

2

≤ x

M

1

≤ w

P

V

1

V

1

−w

P

V

2

V

2

+ w

P

V

1

M

2

, (35)

and this is because for any pay-off vector consistent

with P

V

1

, we have x

M

2

= w

P

V

1

M

2

and x

M

1

+ x

S

= w

P

V

1

V

1

and w

pa

V

2

= w

P

V

2

V

2

. Towards this, consider the limit

2

˜w

P

V

1

V

1

− ˜w

P

V

2

V

2

+ ˜w

P

V

1

M

2

−( ˜w

pa

M

− ˜w

P

V

1

M

2

)

1 −ε

=

−2

¯

d

M

1

¯

d

M

2

+

¯

d

2

M

1

−

¯

d

2

M

2

16

˜

α

!

−

−2

¯

d

M

1

¯

d

M

2

+

¯

d

2

M

2

−

¯

d

2

M

1

16

˜

α

!

+ o((1 −ε)) + 2

¯

d

2

M

2

16

˜