Hybrid Manufacturing / Remanufacturing Inventory Model with

Two Markets and Price Sensitive Demands with Competition

Matthieu Godichaud

a

and Lionel Amodeo

b

LIST3N (Computer and Digital Society) Laboratory, University of Technology of Troyes, Troyes, France

Keywords: Remanufacturing, EPQ, Pricing with Competition, Non-Linear Programming, Single Machine.

Abstract: A hybrid system that produces new and remanufactured products on a common line for two distinct markets

is studied in this article. We consider price sensitive demands with competition between the two types of

products. The problem is to maximize a profit as a function of economic production quantities and demands

or prices decisions. The resulting model is a mixed nonlinear model with linear and nonlinear constraints. A

mathematical analysis is proposed to develop an efficient resolution approaches. Numerical study shows that

sequential decisions, determining demands first and reorder intervals after, provides solutions closed to

optimum. Sensitivity analysis highlights the importance of demand parameters compared to those related to

inventory and the importance of considering all costs, not just setup and holding costs, when evaluating order

or production quantities.

1 INTRODUCTION

This paper presents models and solutions to

determine Economic Production Quantity (EPQ) for

hybrid manufacturing / remanufacturing systems.

Two types of products, new and remanufactured, are

produced on a common production line according to

EPQ assumptions. We assume that they are produced

in distinct lots due to traceability concerns and

different setup requirements. General view of the

product flows that we consider is presented in Fig. 1

(detailed presentation of notations is provided after).

After being produced, new and remanufactured

products are placed in distinct inventories to serve

distinct markets. For the two types of products, after

a period of use, one part of the products sold is

directly disposed of while the other part can be

remanufactured and are collected. Not all collected

products are remanufactured and one part is disposed

of with respect to the decision of the number of

product that are remanufactured. Remanufactured

products are stored before being processed. The

systems thus contains three inventories with their

respective holding costs and two production

processes with their respective setup and unit cost.

a

https://orcid.org/0000-0001-8377-608X

b

https://orcid.org/0000-0003-0250-7959

We also consider price decisions for new and

remanufactured products and the problem is to

maximise a profit function including revenues from

the two markets, inventory holding and process costs.

As presented in Tang and Teunter (2006), for a

real case in automotive industry, remanufactured

products can be sold in the same market as new

products without distinction in price (as-good-as new

assumption). However, in many cases, they are sold

at lower prices. Most of the papers related to

inventory management for hybrid manufacturing /

remanufacturing systems consider as-good-as new

assumption. In this paper, we consider price decisions

and distinct markets for the two types of products as

in Godichaud and Amodeo (2022). Furthermore,

some customers may be undecided between the two

markets and can change according to selling prices.

This means that the products are in competition for a

common part of the two markets. This is modelled in

price-to-demand relationships. Constraints must be

added to the model to respect lower prices for

remanufactured products and the maximum part of

undecided customer between the markets.

In section 2, we present several works related to

our problem. The model with the notations and

assumptions are stated in section 3. Mathematical

146

Godichaud, M. and Amodeo, L.

Hybrid Manufacturing / Remanufacturing Inventory Model with Two Markets and Price Sensitive Demands with Competition.

DOI: 10.5220/0012429900003639

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 13th International Conference on Operations Research and Enterprise Systems (ICORES 2024), pages 146-157

ISBN: 978-989-758-681-1; ISSN: 2184-4372

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

analysis and resolution method are developed in

section 4. A numerical example is presented in

section 5. Conclusion and extensions of this works are

summarized in section 6.

Figure 1: Material flows for hybrid systems with distinct

markets and competition.

2 RELATED WORKS

The problem of determining economic lot sizes has

long attracted the attention of researchers (Cárdenas-

Barrón et al., 2014; Andriolo et al. 2014). Recent

works tend to merge different features such as

financing practices, deterioration and shortage; see

e.g. in Tavakoli and Taleizadeh (2017), Taleizadeh et

al. (2020) for review and new models. Three research

streams in line with our problem have been identified:

inventory models with remanufacturing operations,

pricing and inventory-integrated models, pricing and

revenue management in reverse logistic with

remanufacturing.

In the field of inventory management with

returned and remanufactured products, there are

many papers and we restrict our attention on models

with EOQ/EPQ-like assumptions. The literature

review in (Bazan et al., 2016) highlights that there are

three clusters of models before the paper date based

on the models of (Richter, 1996), (El Saadany and

Jaber, 2008) and (Teunter, 2001). The works

reviewed in (Bazan et al., 2016) consider a single

market for new and remanufactured products. We

identified only two works that consider distinct

markets (Jaber and El Saadany, 2009; Hasanov et al.,

2012). They used an original assumption: the two

types of product are stored and sold separately over

distinct periods. This leads to stockout situation that

cannot be avoided. When one type of product is in

stock, demands for the other are backordered.

Several policies are investigated in literature that

considerer common production line for processing

different product types under EPQ assumptions, The

common cycle policies consist in having one EPQ

cycle for each product in one global cycle (Tang and

Teunter, 2006; Teunter et al., 2008; Teunter et al.,

2009; Nobil et al., 2020). They are easier to determine

but better results can be achieved by using basic

period policies (Zanoni et al., 2012), which consists

in determining cycle length for each product as

multiple of a basic period. For the case with only two

products, the basic period policy can be shown to be

optimal (Vemuganti, 1978). Basic approach to

determine optimal economic quantity is to derive the

related cost function. If this is simple enough without

constraint, closed-form equations can be obtained

even for the case with remanufacturing option. In the

case of multi-product ELS problem, the cost function

is more complex with specific constraints for the line

occupancy. Heuristics are then proposed in literature

(Teunter et al., 2009; Zanoni et al., 2012). We also

note that in all papers reviewed in this research stream

a cost function is used that contains setup and

inventory holding costs. More recently, Soleymanfa

et al. (2022) integrate sustainability related

parameters (environmental and social aspects) in the

cost function but consider same market for new and

returned products. (Hasanov et al. 2019) consider a

four level supply chain with energy, carbon emission

and disposal considerations. The literature review in

(Karim and Nakade, 2022) does not mentioned papers

assuming competition between new and

remanufactured products. In this paper, we consider

problems with two products, new and

remanufactured, but with price decisions and profit

objective function instead of a cost function.

Basis of models integrated pricing and EOQ/EPQ

are presented in Kunreuther and Richard (1971) for a

single item problem. The model can be extended to

consider multi-echelon serial supply chain (Lau &

Lau, 2003), wholesale price and discount policies

(Viswanathan and Wang, 2003) in the cases of single

market for one final product. The linear demand /

price function is commonly used because it facilitates

property analysis and is easy to adjust to field data.

The iso-elastic function presents the same advantages

in the cases without market competition (Ray et al.,

2005). In our work, we used linear demand function

with parameters modelling competition between

products, as in Bernstein and Federgruen (2003), and

we consider returned products and common

production line considerations with EPQ

assumptions. For the case where one production line

has to process several products, Salvietti and Smith

(2008) propose models and methods for ELS problem

with pricing decisions. The products are different and

sold on distinct market without competition. Our

work resumes the common line aspects but integrates

and analyses product returns and competition

Hybrid Manufacturing / Remanufacturing Inventory Model with Two Markets and Price Sensitive Demands with Competition

147

between products. In the context of reverse logistic,

Teksan and Geunes (2016) consider the coordination

between recovery decisions and selling prices for a

single product / market and the works of Pour-

Massahian-Tafti et al. (2020), Godichaud and

Amodeo (2020) address pricing problems in

disassembly systems. Relationship between price and

demand can be extended to consider perishable

product and promotion (Avinadav et al., 2016), stock

and shortage (Mishra et al., 2017). Taleizadeh et al.

(2019) consider pricing and EOQ integrated model

for substitutable products. In our work,

remanufactured and new products can be considered

as partially substitutable and additional constraints

are necessary. Taleizadeh et al. (2022) propose an

EOQ underlying wit partial credit, partial

backordering, carbon emissions and demand function

of selling price and carbon emissions. A signomial

geometric programming approach is proposed to

solve the problem. Finally, this paper extends

Godichaud and Amodeo (2022) by considering

competition between new and remanufactured

products, additional decision on inventory and further

analysis on decision process in this context.

Competition between products is considered in

several papers related to pricing / revenue

management in reverse logistic with

remanufacturing. Distinct markets with competition

for new and remanufacturing products are considered

in Majumder et al. (2001), Wu (2012), Wang et al.

(2019). Competition between different supply chain

agents is investigated in Ranjbar et al. (2020). We

note that linear relationship between demand and

price are used in all these papers. It facilitates model

analysis and derivation of closed-form equations for

optimal decision. Except in Guide et al. (2003), all

these works consider different agents for the recovery

of products and study roles of third party recover

partner in closed-loop supply chain. In the case of

two-echelon supply chain, wholesale prices are

considered as decision variables. Patoghi et al. (2022)

developed pricing model with different supply chain

actors with demands function of price, quality,

collection effort and return policy. The effect of

production constraints and inventory costs are

however not taken into account. We also note that in

these papers only simple unit proportional costs are

considered.

Based on the previous reviewed papers, we

propose in this paper an inventory model under EPQ

assumptions with manufacturing and

remanufacturing operations. Common production

line and return limitation constraints are considered.

Pricing decisions with two markets for newly

produced and remanufactured products is analysed.

3 MODEL STATEMENT

3.1 Notations

The material flows of the problem under study are

shown in Figure 1. The parameters, presented her

after, are related to the two processes, manufacturing

and remanufacturing, the three inventories (new,

remanufactured and repairable products) and the two

markets (primary for new products and secondary for

remanufactured products). The data and variables are

indexed by 𝑛 and 𝑟 for the new and remanufactured

items respectively.

Cost data are those of basic EPQ model for each

product stream (time unit is written in day but can be

changed depending on the context):

• 𝑠

, 𝑠

setup costs, [€/lot],

• ℎ

, ℎ

, ℎ

inventory holding costs( 𝑢 is for

returned products), [€/product.day],

• 𝑐

, 𝑐

unit production costs [€/product].

Process data and variables represent the two

processes with returned products and common line

utilization:

• 𝑚

, 𝑚

production rates [product/day],

• 𝜏

, 𝜏

setup times [day],

• 𝛽

, 𝛽

percentage of available items from primary

and secondary markets,

• 𝑡

, 𝑡

cycle lengths [day],

• 𝑏 basic period [day].

Demands or prices can be used as variables:

• 𝑥

, 𝑥

demand rates [product/day],

• 𝑦

, 𝑦

selling prices [€].

The relationships between demand rates and

selling prices are defined by the following

relationships:

• 𝑋

𝑦

,𝑦

=𝑑

−𝑎

𝑦

+𝑒𝑦

and 𝑋

𝑦

,𝑦

=

𝑑

−𝑎

𝑦

+𝑒𝑦

are the demand rates for new or

remanufactured items, each function of the selling

prices of the two types of items,

• 𝑌

𝑥

,𝑥

=𝑢

−𝑣

𝑥

−𝑤𝑥

and 𝑌

𝑥

,𝑥

=

𝑢

−𝑣

𝑥

−𝑤𝑥

are the unit selling prices of one

new or remanufactured item, function of the

demand rates of the two types of items.

For linear demand-to-price relationships, the

interpretation of the parameters is the following:

• 𝑑

, 𝑑

maximum demands for new items and

remanufactured items (markets size),

• 𝑎

, 𝑎

, 𝑒 price to demand function parameters

(linear relationships),

ICORES 2024 - 13th International Conference on Operations Research and Enterprise Systems

148

• 𝑢

, 𝑢

maximum prices,

• 𝑣

, 𝑣

, 𝑤 demand to price function parameters.

The same competition parameter, 𝑒, is used is the

two functions, 𝑋

and 𝑋

, based on the following

interpretation of the competition. There are some

undecided customers between buying a new product

or a remanufactured product. Their decision is made

based on the price difference 𝑦

−𝑦

. For a given

price difference, 𝑒

𝑦

−𝑦

represents the number of

customers (per unit of time) that change their willing

to buy a new product to buy a remanufactured one.

Initially, the functions 𝑋

and 𝑋

can be defined by

𝑋

𝑦

,𝑦

=𝑑

−𝑎

𝑦

−𝑒

𝑦

−𝑦

and

𝑋

𝑦

,𝑦

=𝑑

−𝑎′

𝑦

+𝑒

𝑦

−𝑦

. By setting

𝑎

=𝑎

+𝑒 and 𝑎

=𝑎′

+𝑒, we retrieve the

previous function. We also note that given this

interpretation of the competition, we impose

constraint 𝑦

>𝑦

, otherwise undecided customer

prefer to buy a new product. The change between

demand functions and price functions can be done

using the following relationships:

𝑣

=𝑎

𝑎

𝑎

−𝑒

⁄

, 𝑢

=𝑣

𝑑

+𝑑

𝑒𝑎

⁄

,

𝑤=𝑣

𝑒𝑎

⁄

=𝑣

𝑒𝑎

⁄

, 𝑣

=𝑎

𝑎

𝑎

−𝑒

⁄

,

𝑢

=𝑣

𝑑

+𝑑

𝑒𝑎

⁄

.

3.2 Assumptions

The problem assumptions follow those of traditional

EPQ and ELS-R with remanufactured returns:

• Demands, production and returns are

characterized by rates (items per day for instance),

and they are constant,

• Inventory are continuously reviewed (continuous

time inventory model),

• Cost and profit indicators are defined in average

(unit of money per unit of time) on an infinite time

horizon,

• There is a fixed cost incurred for each production

setup (before starting a production lot) and one

unit in inventory per unit of time generates an

holding cost,

• Backlogs or lost sales are not allowed in this work.

In addition to the previous presentation of

relationship between prices and demands, we add the

following assumptions more specific to the problem

under study:

• There are two markets, one for new products and

one for remanufactured products, but one

production line to produce the two types of

products,

• Production rate, holding and setup costs are

different for the two types of product,

• Demands or prices for the two markets are set

once at the beginning of the planning horizon,

• Only the returned products that will be

remanufactured are kept in the return inventory, if

the returns are superior to the remanufacturing

quantity, the surplus is disposed of (i.e. directed to

others recovery channels).

These assumptions justify the rate associated to

the material flows in Figure 1. The products

availability from the production line must be 𝑥

and

𝑥

to satisfy demands in each markets. After the

period of use, 𝛽

𝑥

+𝛽

𝑥

products are available for

remanufacturing. However, only 𝑥

are

remanufactured and 𝛽

𝑥

+𝛽

𝑥

−𝑥

are disposed

of. The return inventory is replenished continuously

at rate 𝑥

.

Based on previous assumptions, the evolution of

the three inventories over time is presented in Figure

2. The curves In, Ir and Iu represent respectively the

new, remanufactured and repairable product

inventories. Curve shapes are basic saw tooth profiles

due to EPQ-related assumptions. There is a repetition

of two phases for each inventory: one production-

consumption phase and one consumption-only phase.

For In and Ir, inventories first increase at rate 𝑚

−

𝑥

and 𝑚

−𝑥

and then decrease at rate 𝑥

and 𝑥

.

The duration of the two phases is 𝑡

(resp. 𝑡

) and the

first lasts

𝑥

𝑚

⁄

𝑡

(resp.

𝑥

𝑚

⁄

𝑡

. For Iu,

inventory first increases at rate 𝑥

and then decrease

at rate 𝑚

−𝑥

symmetrically to inventory Ir. Only

the returned products that will be remanufactured are

kept in the return inventory and there is only a

common setup cost to move an item between the two

inventories with remanufacturing process.

The low part (under the graph) of Figure 2 shows

the production line occupancy. There is one repetitive

cycle with two new production lot, one

remanufacturing lot and idle time between lots in this

example. Setup times take place before each lot.

Basic period policy is used to ensure that the

solution defining the cycle length of each product is

feasible without overlapping. Basic period policy has

the following characteristics:

• The cycle length of each type of product is an

integer multiple of the basic period,

• One basic period can contain one production

phase and one setup for each type of product.

Hybrid Manufacturing / Remanufacturing Inventory Model with Two Markets and Price Sensitive Demands with Competition

149

Figure 2: Inventories evolution over time.

Based on the results in (Vemuganti, 1978), basic

period policy is optimal for two products if the basic

period is a variable. In Figure 2, the repetitive cycle

lasts two basic periods with two new product batches

and one remanufacturing batch. The first basic period

in the cycle contains the productions and setup times

for one cycle of each type of products. By denoting

with 𝑏 the length of the basic period and 𝑘

, 𝑘

the

integer multiples, the basic period impose that 𝑡

=

𝑘

𝑏 and 𝑡

=𝑘

𝑏 and the following constraint:

𝜏

+𝜏

+

𝑥

𝑚

𝑘

𝑏+

𝑥

𝑚

𝑘

𝑏𝑏

According to the previous assumptions, especially

constant demand, production and return rates and

continuous time review, one can note that on Figure

2 that inventories are linear functions of time.

Average inventory holding cost for the three

inventories, denoted by 𝐻

, 𝐻

and 𝐻

([€/day]) are

given by, setting 𝑡

=𝑘

𝑏 and 𝑡

=𝑘

𝑏:

𝐻

=

𝑘

𝑏𝑥

1−

, 𝐻

=

𝑘

𝑏𝑥

1−

and 𝐻

=

𝑘

𝑏𝑥

1−

.

As mentioned previously, we consider

competition as a part of consumers, positioned

between the two markets, which are sensitive to the

price difference between the two products.

Furthermore, we also consider that if the

remanufactured product price is higher than the new

product price then no customer will want to buy a

remanufactured product. The constraint 𝑌

≥𝑌

is

then added to the model.

The parameter 𝑑

being interpreted as the

remanufactured product market size, the constraint

𝑑

−𝑎

−𝑒𝑌

≥0 is necessary. Mathematically,

without this constraint, it is possible to have 𝑥

=

𝑑

−𝑎

𝑌

+𝑒𝑌

>0 and 𝑑

−𝑎

−𝑒𝑌

0.

Constraint 𝑑

−𝑎

−𝑏𝑌

≥0 is not necessary

since we must have 𝑥

=𝑑

−

𝑎

−𝑒

𝑌

−𝑒

𝑌

−

𝑌

≥0 and 𝑌

≥𝑌

.

3.3 Model

The problem is to maximise the system average

profit, denoted by 𝛱

𝑥

,𝑥

,𝑘

,𝑘

,𝑏

, with the

decision variables 𝑥

, 𝑥

, 𝑘

, 𝑘

and 𝑏 under the

previous assumptions. The resulting model is a non-

linear mixed integer program with constraints defined

by (1)-(5).

𝛱

𝑥

,𝑥

,𝑘

,𝑘

,𝑏

=

𝑌

−𝑐

𝑥

+

𝑌

−𝑐

𝑥

−

−

−

𝑘

𝑏𝑥

1−

−

𝑘

𝑏𝑥

1−

(1)

−𝛽

𝑥

−

𝛽

−1

𝑥

0 (2)

−𝑣

+𝑤

𝑥

+

𝑣

−𝑤

𝑥

𝑢

−𝑢

(3)

−𝑣

𝑥

−𝑤𝑥

𝑤

𝑣

−𝑤

⁄

𝑢

−𝑢

(4)

𝜏

+𝜏

+

𝑘

𝑏+

𝑘

𝑏𝑏 (5)

The first two terms of the objective function

represent profit without inventory related parameters.

We denote it by 𝑀

𝑥

,𝑥

. The following two terms

are the average setup costs and the last two are the

average holding costs. The objective function is

different from (Godichaud & Amodeo, 2022) with

consideration of competition (different 𝑌

and 𝑌

functions) and 𝑏 as decision variable. Constraints (2)

to (5) arise from previous assumptions. Constraint (2)

limits the available returns for remanufacturing.

Constraint (3) corresponds to 𝑌

≥𝑌

with respect to

decisions variable 𝑥

and 𝑥

. Constraint (4) forces

𝑑

−𝑎

−𝑒𝑌

≥0. Constraint (5) is the basic

period policy constraint.

4 MATHEMATICAL ANALYSIS

AND RESOLUTION

APPROACHES

The problem models by (1)-(5) is a non-linear

programming model (objective function and

constraint (5) are non-linear) with integer variables

𝑘

and 𝑘

. We propose to decompose its analysis into

sub-problems having good properties for solving and

analysis of solutions. The problem without inventory

ICORES 2024 - 13th International Conference on Operations Research and Enterprise Systems

150

related costs is first studied to obtain an initial

solution (section 4.1). This solution is completed

sequentially with the determination of inventory

related variables with respect to a 2-items ELS

problem (section 4.2). The solution is then iteratively

improved with non-linear resolution methods.

This decomposition enables to compare three

resolution approaches:

• Sequential resolution: this approach use the

properties of the pricing presented section 4.1 and

ELS resolution method.

• One iteration resolution: it adds one step to adjust

the demands based on the cycle lengths find in the

sequential resolution. This is a modified pricing

problem integrating inventory-holding costs

presented in section 4.3.

• Joint optimisation: based on the initial solution

found with the one iteration resolution, all the

variables are optimised simultaneously based on

the procedure presented in section 4.3.

4.1 Problem Without Inventory

Related Costs

We consider only the first two terms of the profit

function (1). It reduces to the profit function denoted

by 𝑀

𝑥

,𝑥

, with only variables 𝑥

and 𝑥

, which is

a sum of common functions in pricing problems.

There are two motivations to study this sub-problem

apart. In many companies, as mentioned in

(Kunreuther and Richard, 1971), a sequential

decision process is performed. Prices are decided

first, by marketing department, and then, production

and inventory decisions are made with the demands

associated with the given prices. In our case, 𝑘

, 𝑘

and 𝑏 would be decided in a second step with 𝑥

, 𝑥

fixed in a first step. Even in case where integrated

decisions are made, solving sub-problem without

inventory related costs gives initial values.

Replacing 𝑌

and 𝑌

as function of 𝑥

and 𝑥

,

𝑀

𝑥

,𝑥

is quadratic function:

𝑀

𝑥

,𝑥

=

𝑢

−𝑣

𝑥

−𝑤𝑥

−𝑐

𝑥

+

𝑢

−𝑣

𝑥

−𝑤𝑥

−𝑐

𝑥

Its stationary points are:

𝑥̅

=

and 𝑥̅

=

𝑀

𝑥

,𝑥

is concave for 𝑥

>0 and 𝑥

>0.The

constraints (2)-(4) are linear and the sub-problem of

maximising 𝑀

𝑥

,𝑥

w.r.t. (2)-(4) is solve rapidly

with a solver or feasible direction methods.

4.2 Initial EPQ Problem with Two

Products and a Common Line

If 𝑥

and 𝑥

are fixed, the problem reduces to the

minimisation of inventory related cost (setup and

holding) subject to constraint (5). Furthermore, for

given value of 𝑘

and 𝑘

, the optimal value for 𝑏 is:

𝑏

=

⁄

⁄

(6)

Constraint (5) gives the minimal value for 𝑏,

denoted by 𝑏

, to process the two types of products

on the same production line without overlapping of

production runs:

𝑏

=

𝜏

+𝜏

1 −

+

(7)

The solution of the problem, for given values of

𝑥

, 𝑥

, 𝑘

and 𝑘

, are then 𝑏=𝑚𝑎𝑥𝑏

,𝑏

.

The value for 𝑘

and 𝑘

are tested iteratively in the

overall procedure.

4.3 Joint Optimisation

Previous sub-problem can be extended with

inventory-related decision variables (𝑘

, 𝑘

and 𝑏)

fixed (setup costs are constant but holding cost vary

w.r.t. 𝑥

and 𝑥

). The objective function then remains

quadratic and concave (under the following

conditions) with one stationary point given directly

by the following equations:

𝑥

=

𝑣

𝑢

−𝑐

−𝑤

𝑢

−𝑐

2

𝑣

𝑣

−𝑤

,

𝑥

=

𝑣

𝑢

−𝑐

−𝑤

𝑢

−𝑐

2

𝑣

𝑣

−𝑤

with 𝑐

=𝑐

+ℎ

𝑘

𝑏2

⁄

, 𝑐

=𝑐

+

ℎ

+ℎ

𝑘

𝑏2

⁄

, 𝑣

=2𝑣

−ℎ

𝑘

𝑏𝑚

⁄

and 𝑣

=

2𝑣

−

ℎ

+ℎ

𝑘

𝑏𝑚

⁄

. The function is concave for

4𝑣

𝑣

−4𝑤

>0.

With 𝑘

, 𝑘

and 𝑏 fixed, constraint (5) is linear as

constraint (2)-(4). Based on the previous properties,

this sub problem can be solved by using any feasible

direction methods.

At a second level, 𝑘

, 𝑘

are fixed and a line

search is applied with respect to 𝑏. Based on initial

values of 𝑥

, 𝑥

, the first value of 𝑏 for the line search

is determined. Values of 𝑥

, 𝑥

are then determined

for each value of 𝑏 by solving the problem with 𝑘

,

𝑘

and 𝑏 fixed. Numerically, based on instances we

used, the search of 𝑏 with built-in optimisation on 𝑥

,

𝑥

gives concave profit function.

Hybrid Manufacturing / Remanufacturing Inventory Model with Two Markets and Price Sensitive Demands with Competition

151

At a higher level, values of 𝑘

, 𝑘

are examined

with nested iterations. Starting with 𝑘

=𝑘

=1, the

values are increased while the profit function

increases. The following procedure can be used to

solve the overall problem, we denote by 𝜋

∗

the best

profit found during the procedure with 𝑘

∗

, 𝑘

∗

, 𝑥

∗

, 𝑥

∗

and 𝑏

∗

the related decisions:

• Step1. Solve the problem without inventory

related cost (section 4.1) to have initial value for

𝑥

, 𝑥

. Set 𝑘

=𝑘

=𝑘

∗

=𝑘

∗

=1, 𝑥

∗

=𝑥

,

𝑥

∗

=𝑥

and 𝑏

∗

=𝑏=𝑚𝑎𝑥𝑏

,𝑏

and

compute the first best profit 𝜋

∗

.

• Step 2. Set 𝑏=𝑚𝑎𝑥𝑏

,𝑏

. Adjust value

for 𝑥

, 𝑥

with inventory related cost with 𝑏

fixed.

• Step 3. Apply line search on 𝑏 with built-in

optimisation on 𝑥

, 𝑥

and compute the profit,

denoted by 𝜋

, for the obtained value. If 𝜋

>𝜋

∗

,

update the best solution (set 𝜋

∗

=𝜋

and 𝑘

∗

, 𝑘

∗

,

𝑥

∗

, 𝑥

∗

and 𝑏

∗

to the current value of 𝑘

, 𝑘

, 𝑥

,

𝑥

and 𝑏), set 𝑘

←𝑘

+1 and go back to Step 2,

else if 𝑘

=𝑘

∗

, set 𝑘

←𝑘

+1 and go back to

Step 2, else go to Step 4.

• Step 4. Return the best solution found.

5 NUMERICAL ANALYSIS

A first set of instances is generated based on the

instance generator proposed in Salvietti and Smith

(2008). The following steps are used to generate

instances (𝑈[𝑙𝑜𝑤𝑒𝑟 𝑢𝑝𝑝𝑒𝑟] corresponds to uniform

distribution between specified lower and upper value

of the parameters). The time unit is one day.

• Market sizes are generated with 𝑑

=

𝑈[4000 5000] and 𝑑

=𝑈[0.2 0.8] × 𝑑

(we

study cases where secondary market is smaller

than primary market).

• Maximum price are generated with 𝑌

,

=

𝑈[20 50] and 𝑌

,

=𝑈[0.5 0.8] × 𝑌

,

(the

maximum price of remanufactured products is

lower since we assume this constraint in the

model).

• To generate values for 𝑒 (competition parameter),

we used a maximum market change parameter,

denoted here by 𝑋

(defined for instance

generation only). It represents the percentage of

customers who can change from new to

remanufactured products. We used 𝑋

=

𝑈[0.05 0.2] × 𝑑

and 𝑒=𝑋

𝑌

,

⁄

.

• Price-to-demand parameter are deduced from

previous parameters with: 𝑎

=𝑑

𝑌

,

⁄

+𝑒

and 𝑎

=𝑑

𝑌

,

⁄

+𝑒.

• Unit cost are generated with 𝑐

=𝑈[0.1 0.5] ×

𝑢

, to avoid infeasible instances with 𝑐

>𝑢

,

and 𝑐

=𝑈[0.2 0.9] × 𝑐

.

• Based on (Salvietti et al., 2008), set-up and

inventory holding costs are generated with 𝑠

=

𝑈[30 50] , 𝑠

=𝑈[30 50] , ℎ

=

𝑈[0.05 0.1] × 𝑐

100

⁄

, ℎ

=

𝑈[0.05 0.1] × 𝑐

100

⁄

and ℎ

=𝑈[0.1 0.5] ×

ℎ

; production rates with 𝑚

=𝑈[2000 4000]

and 𝑚

=𝑈[2000 4000]; set-up times with 𝑡

=

𝑈[0.05 0.3] and 𝑡

=𝑈[0.05 0.3].

These instances can be considered as high-level

demands and low-level inventory costs. Table 1

presents data for three instances from this dataset.

Instance 0 is obtained with median values of the

distribution ranges. We generated more than one

thousand instances and the instance 1 and 2 in Table

1 correspond to those that give the best and the worst

profit respectively.

The first part of Table 2 presents values of

decision variables and profit for instances in Table 1

with the three decision processes presented in section

4.

Table 1: Instances generated based on (Salvietti and Smith,

2008).

Ins.

Data

0

𝑑

=4500 𝑎

=144.63 𝑑

=2250 𝑎

=114.96

𝑒=16.06 𝑐

=10.14 𝑐

=5.58 𝑠

=40 𝑠

=40

ℎ

=7.61E-03 ℎ

=4.2E-03 𝑚

=3000 𝑚

=3000

𝜏

=0.175 𝜏

=0.175 𝛽

=0.667 𝛽

=0.667

1

𝑑

=4948 𝑎

=121.65 𝑑

=3859 𝑎

=142.25

𝑒=18.56 𝑐

=4.74 𝑐

= 3.62 𝑠

=45.1 𝑠

=46.6

ℎ

=4.09E-03 ℎ

=4.07E-03 𝑚

=3742

𝑚

=2747 𝜏

=0.21 𝜏

=0.29 𝛽

=0.667 𝛽

=0.667

2

𝑑

=4016 𝑎

=238.95 𝑑

=1767 𝑎

=180.65

𝑒=38.15 𝑐

=9.07 𝑐

= 7.22 𝑠

=30.13 𝑠

=49.04

ℎ

=4.58E-03 ℎ

=5.22E-03 𝑚

=3400

𝑚

=2409 𝜏

=0.13 𝜏

=0.16 𝛽

=0.667 𝛽

=0.667

In this type of instances, inventory related cost

(setup + holding costs) are very small compared to

unit proportional costs (𝑐

𝑥

+𝑐

𝑥

). One can note

that inventory costs have little effect on the overall

profit. The variation of decisions and profit are then

small between the three decision processes. In this

case, a sequential decision process in two phases is

sufficient while having properties of separate models

presented in section 4. One limitation is that demands

values generated in the first phase can be infeasible

for the second phase if 𝑥

𝑚

⁄

+𝑥

𝑚

⁄

≥1. This is

ICORES 2024 - 13th International Conference on Operations Research and Enterprise Systems

152

observed in 23% of the instances generated. This

limitation can be solved by introducing a constraint

𝑥

𝑚

⁄

+𝑥

𝑚

⁄

<𝛼, with 𝛼<1, in the problem of

the first phase. It also allows having an initial solution

for the joint optimization problem. This is the case of

instance 1.

In instance 0, basic period constraint is not

binding (line occupancy is 0.895 < 1) with the optimal

demands. The line occupancy is equal to one in all

instances where the first phase of the sequential

decisions give infeasible for the second phase. The

basic period constraint has a greater effect when the

second market demand is small compared to primary

market demand when it is not possible to place two or

more remanufacturing lot with one manufacturing lot

in one basic period.

In instance 2, we note again no significant

variation of variables and profit between the three

decision processes and the inventory cost represents

a small parts of the overall cost. In this instance, two

remanufacturing lot can be optimally placed in one

basic period for one manufacturing lot. In instance 1,

the first phase of the sequential decision gives

infeasible solutions. We add the constraint mentioned

before to obtain an initial solution for the joint

optimisation.

The lines “Stat.” in Table 2 presents the means

and standard deviations of variables and indicators

over 1200 instances generated. We note significant

variation of the basic period length ( 𝑏) due to

constraint (5). The constraint is saturated in 34% of

instances and, for these ones, the basic period and

inventory costs tend to be larger. We also note that

only 53% of the returned products are

remanufactured. If environmental constraints impose

higher remanufacturing rate, the producer have to

accept lower profit.

Table 2: Results for instances generated based on (Salvietti

and Smith, 2008).

Ins. Results (decisions and profit)

0

Joint

𝑘

=1 𝑘

=1 𝑏=4.39 Profit=26728.76

𝑥

=1561.35 𝑥

=885.55 𝑦

=21.98

𝑦

=14.94

Sequ

𝑘

=1 𝑘

=1 𝑏=4.39 Profit=26728.76

𝑥

=1561.27 𝑥

=885.77 𝑦

=21.98

𝑦

=14.94

1-

iter

𝑘

=1 𝑘

=1 𝑏=53.07 Profit=68440.76

𝑥

=1975.60 𝑥

=885.77 𝑦

=21.98

𝑦

=14.94

1

Joint

𝑘

=1 𝑘

=1 𝑏=4.39 Profit=26728.76

𝑥

=1561.35 𝑥

=1271.53 𝑦

=27.76

𝑦

=21.81

Sequ

Profit=70770.01 𝑥

=2219.3

𝑥

=1716.02 𝑦

=25.23 𝑦

=18.36 (not

feasible w.r.t.

(

5

))

2

Joint

𝑘

=1 𝑘

=2 𝑏=3.99 Profit=6580.4

𝑥

=1061.94 𝑥

=403.18 𝑦

=14.04

𝑦

=10.51

Sequ

𝑘

=1 𝑘

=2 𝑏=3.99 Profit=6580.4

𝑥

=1062.08 𝑥

=404.36 𝑦

=14.04

𝑦

=10.51

1-iter

𝑘

=1 𝑘

=2 𝑏=3.99 Profit=6580.4

𝑥

=1061.94 𝑥

=403.18 𝑦

=14.04

𝑦

=10.51

Stat. Joint

b=11.88(15.58)

Profit=26940.97(11003.8) 𝑥

=1497.0

(248.12) 𝑥

=842.78(301.76)

𝑦

=22.45(5.81) 𝑦

=15.32 (4.29)

Joint = joint optimisation of all variables, Sequ =

demand variables first and reorder interval variables

after, 1-iter = reorder interval variables fixed by Sequ

and re-optimisation of demand variables, line Stat gives

mean value and standard deviation over 1200 instances.

0 Joint

InvCost=36.48 LineOcc=0.895

Return=1631.27 Rem./Return=0.543

Market change=113.015

1 Joint

InvCost=176.86 LineOcc=1

Return=2164.77 Rem./Return=0.59

Market chan

g

e=110.46

2 Joint

InvCost=27.36 LineOcc=0.72

Return=976.75 Rem./Return=0.41

Market chan

g

e=134.54

Stat Joint

InvCost=48.22 (25.12) LineOcc=0.90

(0.10) Return=1559.90 (276.5)

Rem./Return=0.53

(0.13) Market change=111.82

(

46.72

)

InvCost = order + holding costs, LineOcc = setup +

production times on basic period length, Return = return

rate of products that can be remanufactured,

Rem./Return = proportion of remanufacturable products

which are actually remanufactured, Market change =

part of secondary market that comes from primary

market.

Hybrid Manufacturing / Remanufacturing Inventory Model with Two Markets and Price Sensitive Demands with Competition

153

In the previous dataset, the joint optimisation

brings no profit improvement or change in variables

values. This is due to the low level of inventory-

related costs (setup plus holding costs) compared to

that of proportional costs (𝑐

𝑥

+𝑐

𝑥

). In this type

of instance the sequential resolution, give solutions

closed to optimum and cycle lengths variation does

not lead to significant profit variation. We observe

this fact, in all dataset form ELS-related literature we

have tested (questioning the importance of

sophisticated method compared to simple ones like

common cycle policy). A second set of examples is

generated to analyse others types of practical

situations. These examples are adapted from

literature. The data are presented in Table 3 and the

results are presented in Table 4. These examples have

lower market sizes (which must lead to lower

demands and production volumes) and higher

inventory holding costs (the gap between inventory-

related costs and proportional costs increases with

respect to the demand). The time unit is one day.

Table 3: Additional instances based on literature on EOQ-

pricing and ELS problems.

Ins. Data

5

𝑑

=40 𝑎

=1.608 𝑑

=32 𝑎

=2.568 𝑒=0.32

𝑐

=10 𝑐

=5 𝑠

=50 𝑠

=50 ℎ

=1 ℎ

=0.85

𝑚

=50 𝑚

=30 𝜏

=0.5 𝜏

=0.5 𝛽

=0.67

𝛽

=0.67

6

𝑑

=40 𝑎

=1.608 𝑑

=32 𝑎

=2.568 𝑒=0.32

𝑐

=10 𝑐

=5 𝑠

=50 𝑠

=50 ℎ

=1 ℎ

=0.85

𝑚

=50 𝑚

=30 𝜏

=2 𝜏

=2 𝛽

=0.67 𝛽

=0.67

7

𝑑

=100 𝑎

=0.334 𝑑

=80 𝑎

=0.534 𝑒=0.067

𝑐

=15 𝑐

=13 𝑠

=150 𝑠

=150 ℎ

=4.5 ℎ

=4.1

𝑚

=100 𝑚

=100 𝜏

=0.5 𝜏

=0.5 𝛽

=0.67

𝛽

=0.67

8

𝑑

=100 𝑎

=2.004 𝑑

=80 𝑎

=3.34 𝑒=0.4 𝑐

=15

𝑐

=13 𝑠

=150 𝑠

=150 ℎ

=4.5 ℎ

=4.1 𝑚

=100

𝑚

=100 𝜏

=0.5 𝜏

=0.5 𝛽

=0.67 𝛽

=0.67

9

𝑑

=100 𝑎

=3.34 𝑑

=80 𝑎

=3.204 𝑒=0.67

𝑐

=15 𝑐

=13 𝑠

=150 𝑠

=150 ℎ

=4.5 ℎ

=4.1

𝑚

=100 𝑚

=100 𝜏

=0.5 𝜏

=0.5 𝛽

=0.67

𝛽

=0.67

10

𝑑

=20 𝑎

=0.404 𝑑

=16 𝑎

=0.404 𝑒=0.08

𝑐

=25 𝑐

=20 𝑠

=130 𝑠

=130 ℎ

=1.2 ℎ

=0.85

𝑚

=100 𝑚

=100 𝜏

=0.5 𝜏

=0.5 𝛽

=0.67

𝛽

=0.67

Instances 5 and 6 are generated as the previous

one except that the market size is 40 (products per

day) instead of 4000. The difference between the two

are the setup times (0.5 and 2 days) to get insights on

the effect of constraint (5) and the utilisation of a

common production line. For instance 5, inventory-

related costs represents 24% of the total costs for the

sequential solution (we remind that it is also the initial

solution for the joint solution) which is significant.

However, the variation in profit and decision

variables is not. The line occupancy in less than 1

allowing the basic period length 𝑏 to be at the

optimum and the inventory cost function is flat at this

value. On the contrary, in instance 6, the setup times

are long, 2 days while the basic period length is 7.52

days, and the constraint (5) is saturated. A gap of

24.5% is observed between the sequential and joint

methods while the inventory-related costs represents

29% of the total costs for the sequential solution close

to instance 5. In this case, the joint method act

simultaneously on the basic period length and the

demands to find the optimal values along the

constraint. In these two instances, more returned

products are used in proportion compared to first

dataset, but not all.

Instances 7 to 9 are adapted from (Taleizadeh et

al. 2019), who study a real case application of pricing-

inventory model for two substitutable products.

Instance 7 have high maximum prices compared to

unit costs. We also note that the inventory holding

costs are very high, assuming the integration of more

aspects than the financing part (warehousing, energy,

handling resources …). Instances 8 and 9 are

generated from instance 7 by reducing the maximum

prices in order to have a greater share of inventory

cost in the profit and analyse the behaviour of the

resolution methods in these cases. For the three

instances, inventory-related costs represents around

30% of the total costs for the sequential solution but

the variation in the profit is limited: 1.4%, 1.3% and

3.7% for instances 7, 8 and 9 respectively. In instance

7, the variation in inventory-related costs is 30%

between sequential and joint solutions showing the

simultaneous effect of cycle length and demands.

These results also show the quality of the sequential

solution as initial solution for the joint resolution. The

remanufacturing rate is close to that obtained from the

first dataset and remains low (half of the return

product are remanufactured).

Instance 10 is adapted from (Zipkin, 2000) and

has higher setup and holding costs and low demands.

The time basis is the week. The inventory-related

costs represents 24% of the total costs but the

variation of the profit is again limited to 1.7%

between sequential and joint solutions. Constraint (5)

is not saturated and the percentage of returned

products that are remanufactured is higher than in the

first dataset.

ICORES 2024 - 13th International Conference on Operations Research and Enterprise Systems

154

Table 4: Results for the second set of instances.

Ins. Results

(

decisions and

p

rofit

)

5

Joint

𝑘

=1 𝑘

=1 𝑏=3.65 Profit=121.18

𝑥

=12.07 𝑥

=10.77 𝑦

=19.5 𝑦

=10.7

Sequ

𝑘

=1 𝑘

=1 𝑏=3.60 Profit=120.8

𝑥

=12.76 𝑥

=11.18 𝑦

=19.01 𝑦

=10.48

1-iter

𝑘

=1 𝑘

=1 𝑏=3.60 Profit=121.17

𝑥

=12.08 𝑥

=10.78 𝑦

=19.49 𝑦

=10.69

6

Joint

𝑘

=1 𝑘

=1 𝑏=7.25 Profit=104.6

𝑥

=10.71 𝑥

=7.02 𝑦

=20.66 𝑦

=12.3

Sequ

𝑘

=1 𝑘

=1 𝑏=10.75 Profit=83.99

𝑥

=12.76 𝑥

=11.18 𝑦

=19.03 𝑦

=10.48

1-iter

𝑘

=1 𝑘

=1 𝑏=10.75 Profit=87.89

𝑥

=10.52 𝑥

=9.54 𝑦

=20.58 𝑦

=11.31

7

Joint

𝑘

=1 𝑘

=1 𝑏=4.49 Profit=10457.68

𝑥

=45.58 𝑥

=32.15 𝑦

=185.44

𝑦

=112.76

Sequ

𝑘

=1 𝑘

=1 𝑏=6.65 Profit=10311.15

𝑥

=47.93 𝑥

=36.03 𝑦

=176.36

𝑦

=102.49

1-iter

𝑘

=1 𝑘

=1 𝑏=6.65 Profit=10312.90

𝑥

=47.95 𝑥

=37.03 𝑦

=176.67

𝑦

=104.39

8

Joint

𝑘

=1 𝑘

=1 𝑏=2.13 Profit=662.51

𝑥

=36.29 𝑥

=16.84 𝑦

=36.64 𝑦

=24.29

Sequ

𝑘

=1 𝑘

=1 𝑏=2.48 Profit=646.43

𝑥

=37.57 𝑥

=22.17 𝑦

=35.64 𝑦

=22.50

1-iter

𝑘

=1 𝑘

=1 𝑏=2.48 Profit=654.18

𝑥

=36.76 𝑥

=17.1 𝑦

=36.38 𝑦

=24.17

9

Joint

𝑘

=1 𝑘

=1 𝑏=1.98 Profit=211.27

𝑥

=26.62 𝑥

=19.91 𝑦

=26.62 𝑦

=23.31

Sequ

𝑘

=1 𝑘

=1 𝑏=2.11 Profit=203.68

𝑥

=29.28 𝑥

=23.29 𝑦

=25.58 𝑦

=22.08

1-iter

𝑘

=1 𝑘

=1 𝑏=2.11 Profit=210.69

𝑥

=26.42 𝑥

=19.65 𝑦

=26.7 𝑦

=23.4

10

Joint

𝑘

=3 𝑘

=4 𝑏=2.18 Profit=106.04

𝑥

=5.18 𝑥

=4.42 𝑦

=44.1 𝑦

=37.4

Sequ

𝑘

=3 𝑘

=4 𝑏=2.07 Profit=104.24

𝑥

=5.75 𝑥

=4.96 𝑦

=42.34 𝑦

=35.71

1-iter

𝑘

=3 𝑘

=4 𝑏=2.07 Profit=105.95

𝑥

=5.21 𝑥

=4.45 𝑦

=44.01 𝑦

=37.31

5 Joint

InvCost=54.82 LineOcc=0.87

Return=15.23 Rem./Return=0.71

Market chan

g

e =2.82

6 Joint

InvCost=60.86 LineOcc=1

Return=11.82 Rem./Return=0.59

Market chan

g

e =2.68

7 Joint

InvCost=518.19 LineOcc=1

Return=51.82 Rem./Return=0.62

Market chan

g

e =4.85

8 Joint

InvCost=312.85 LineOcc=1

Return=35.42 Rem./Return=0.48

Market change =4.94

9 Joint

InvCost=303.25 LineOcc=0.97

Return=31.02 Rem./Return=0.64

Market change =2.21

10 Joint

InvCost=69.7 LineOcc=0.79

Return=6.4 Rem./Return=0.69 Market

change =54

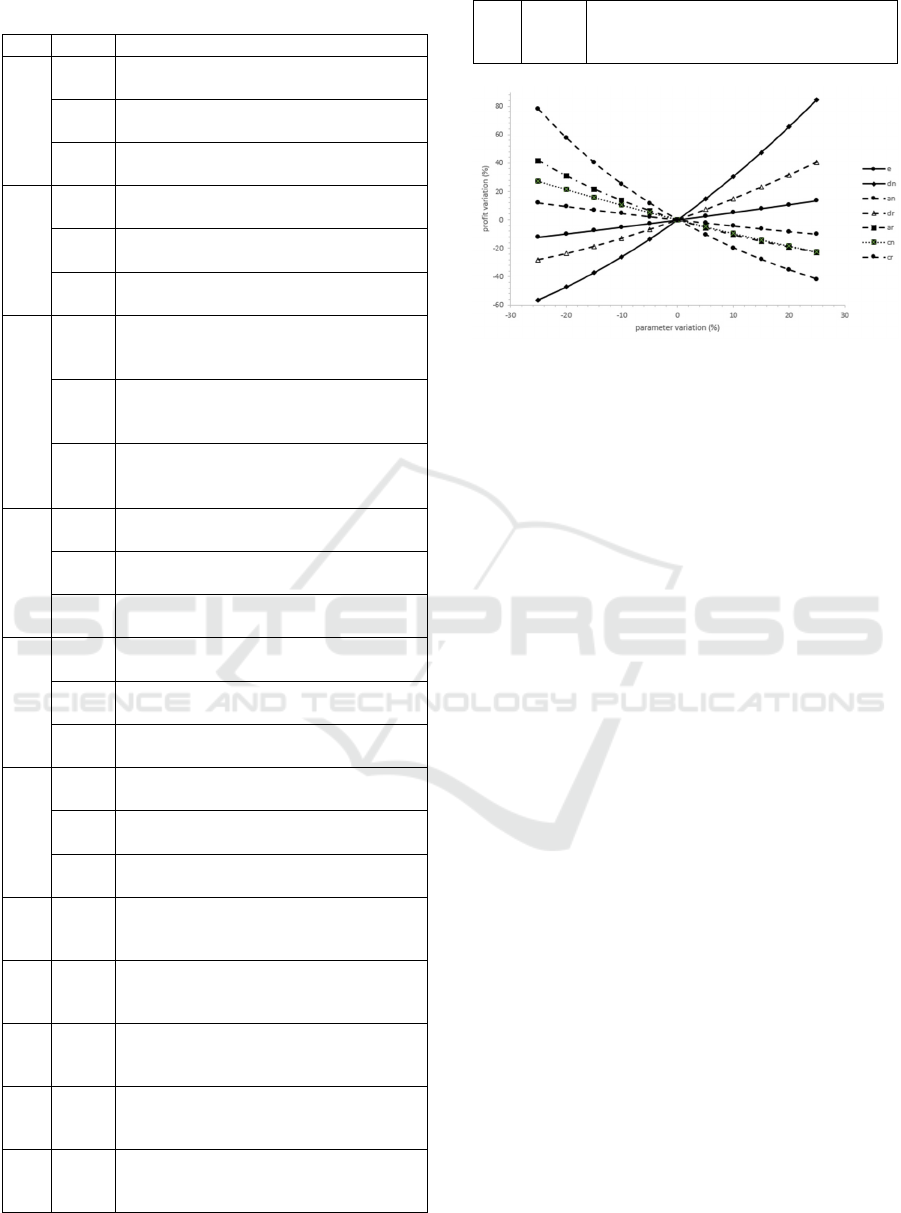

Figure 3: Sensitivity analysis for instance 5.

Figure 3 presents the result of a sensitivity

analysis on instance 5. We focus on demand function

parameters and unit process costs (𝑐

and 𝑐

) as we

had seen that inventory related had small effect on the

profit over all instances. Each parameter is varied one

at a time keeping all other parameters constant, from

-25% to 25% by step of 5%. The profit is determined

with the joint optimisation for each value. We first

note that the profit is more sensitive to parameters 𝑑

and 𝑎

(primary market) with opposite direction. The

profit increased with respect to 𝑒 but with smaller

amplitude as it concerns less customers. As expected,

if the unit process costs increased, the profit

decreased. We perform the same analysis on

parameter 𝛽

and 𝛽

but no variation in the profit and

decision variables is observed. As constraint (2) is not

saturated, 𝑥

is constant and the proportion of

returned product that are remanufactured simply

decreased as 𝛽

or 𝛽

increased. We performed the

same analysis in the other instances and the same

trends are observed but with different amplitudes.

6 CONCLUSION

In many real situations, remanufacturing offers the

opportunity to sell product at lower price when some

customers want to pay less for a remanufactured

product while the others prefer to buy new one at

higher price. We have developed a new model for

hybrid system that produces new and remanufactured

products for two distinct markets. We have modelled

the competition between the two products, with a part

of customers that are undecided, in the relationship

between prices and demands. We have also

considered that the two products are produced on the

Hybrid Manufacturing / Remanufacturing Inventory Model with Two Markets and Price Sensitive Demands with Competition

155

same production line with EPQ assumptions. The

resulting model is a mixed nonlinear problem with

linear and nonlinear constraints. The mathematical

analysis presented justify an efficient resolution

method based on identification of sub problems with

good properties. It also make possible to compare

decisions processes with different decisions makers

(e.g. marketing and inventory) and highlight their

importance in the profits of the company. The

numerical analysis shows that all instances generated

are solved rapidly and infeasibility or negative profit

situations are detected. Higher profit can be obtained

with joint optimization when inventory holding cost

are very high (larger that common assumption of 20%

of unit cost over one year) and demand are low.

Sensitivity analysis shows the importance of demand

function parameters compared to the others. Future

research may extend the model to consider additional

real case assumptions. The first one would be to

consider more segments in the market with respect to

different quality levels of returned products. Shortage

situations, inventory capacity limitation, multi

products and stages are worth developing. Financing

parameters are also to be developed for

remanufacturing and recovery activities.

REFERENCES

Andriolo, A., Battini, D., Grubbström, R.W., Persona, A.,

Sgarbossa, F. (2014). A century of evolution from

Harris׳s basic lot size model: Survey and research

agenda. International Journal of Production

Economics 155, 16–38.

Avinadav, T., Chernonog, T., Lahav, Y., Spiegel, Y.

Dynamic pricing and promotion expenditures in an

EOQ model of perishable products. Annals of

Operations Research 248, 75–91 (2017). Bernstein, F.,

Federgruen, A. (2003). Pricing and Replenishment

Strategies in a Distribution System with Competing

Retailers. Operations Research, 51(3), 409-426.

Bazan, E., Jaber, M.Y., Zanoni, S. (2016) A review of

mathematical inventory models for reverse logistics

and the future of its modeling: An environmental

perspective, Applied Mathematical Modelling, 40, (5–

6), 4151-4178.

Cárdenas-Barrón, L.E., Chung, K-J, Treviño-Garza, G.

(2014). Celebrating a century of the economic order

quantity model in honor of Ford Whitman Harris.

International Journal of Production Economics 155,

1–7.

El Saadany, A.M. and Jaber, M.Y., Bonney, M. (2008). The

EOQ repair and waste disposal model with switching

costs, Computers & Industrial Engineering, 55(1), 219-

233.

Godichaud, M., Amodeo, L. (2020). Inventory model for

disassembly systems with price dependent return rate,

IFAC-PapersOnLine, 53(2), 10849-10854.

Godichaud, M., Amodeo, L. (2022) EPQ model for hybrid

manufacturing / remanufacturing systems with price

sensitive demands, IFAC-PapersOnLine, 55(10) 1019-

1024.

Guide, V.D.R., Teunter, R.H., Van Wassenhove, L.N.

(2003) Matching Demand and Supply to Maximize

Profits from Remanufacturing. Manufacturing &

Service Operations Management, 5(4), 303-316.

Hasanov, P., Jaber, M.Y., Zolfaghari, S. (2012) Production,

remanufacturing and waste disposal models for the

cases of pure and partial backordering, Applied

Mathematical Modelling, 36(11), 5249-5261.

Hasanov, P., Jaber, M.Y., Tahirov, N. (2019) Four-level

closed loop supply chain with remanufacturing,

Applied Mathematical Modelling, 66, 141-155.

Jaber, M.Y., El Saadany, A.M. (2009). The production,

remanufacture and waste disposal model with lost

sales, International Journal of Production Economics,

120(1), 115-124.

Karim, R.; Nakade, K. (2022) A Literature Review on the

Sustainable EPQ Model, Focusing on Carbon

Emissions and Product Recycling, Logistics, 6, 55.

Kunreuther, H., & Richard, J. F. (1971). Optimal Pricing

and Inventory Decisions for Non-Seasonal Items.

Econometrica, 39(1), 173–175.

Lau, A.H.L., & H.S. Lau. (2003). Effects of a demand-

curve's shape on the optimal solutions of a multi-

echelon inventory/pricing model. European Journal of

Operational Research, 147(3), 530-548.1.

Majumder, P. and Groenevelt, H. (2001). Competition in

remanufacturing. Production and Operations

Management, 10, 125-141.

Mishra, U., Cárdenas-Barrón, L.E., Tiwari, S., Shaikh,

A.A., Treviño-Garza, G. (2017). An inventory model

under price and stock dependent demand for

controllable deterioration rate with shortages and

preservation technology investment. Annals of

Operations Research 254, 165–190.

Nobil, A.H., Sedigh, A.H.A. & Cárdenas-Barrón, L.E.

(2020). A multiproduct single machine economic

production quantity (EPQ) inventory model with

discrete delivery order, joint production policy and

budget constraints. Annals of Operations Research

286, 265–301.

Patoghi, A., Taleizadeh, A.A., Moshtagh, M.S., Mousavi,

S.M., (2022). Integrated pricing model of new and

remanufactured products with joint considerations of

quality, sales and collection effort, and return policy.

Environment, Development and Sustainability.

Pour-Massahian-Tafti, M., Godichaud, M. , Amodeo, L.

(2020). Disassembly EOQ models with price-sensitive

demands, Applied Mathematical Modelling, 88, 810–

826.

ICORES 2024 - 13th International Conference on Operations Research and Enterprise Systems

156

Pour-Massahian-Tafti, M., Godichaud, M., Amodeo, L.

(2020). Disassembly EOQ models with price-sensitive

demands, Applied Mathematical Modelling, 88, 810-

826.

Ranjbar, Y., Sahebi, H., Ashayeri, J., Teymouri, A. (2020).

A competitive dual recycling channel in a three-level

closed loop supply chain under different power

structures: Pricing and collecting decisions, Journal of

Cleaner Production, 272, 122623.

Ray, S., Gerchak, Y., Jewkes, E. M. (2005). Joint pricing

and inventory policies for make-to-stock products with

deterministic price-sensitive demand. International

Journal of Production Economics, 97(2), 143-158.

Richter, K., (1996). The EOQ repair and waste disposal

model with variable setup numbers, European Journal

of Operational Research, 95(2), 313-324.

Salvietti, L., Smith, N. R. (2008). A profit-maximizing

economic lot-scheduling problem with price

optimization. European Journal of Operational

Research, 184(3), 900-914.

Soleymanfar, V.R., Makui, A., Taleizadeh, A.A.,

Tavakkoli-Moghaddam, R. (2022). Sustainable EOQ

and EPQ models for a two‑echelon multi‑product

supply chain with return policy, Environment,

Development and Sustainability, 24, 5317–5343.

Sun, H., Chen, W., Liu, B., Chen, B. (2018). Economic lot

scheduling problem in a remanufacturing system with

returns at different quality grades, Journal of Cleaner

Production, 170, 559-569.

Taleizadeh, A.A., Babaei, M.S., Sana, S.S., Sarkar, B.

(2019). Pricing Decision within an Inventory Model

for Complementary and Substitutable Products,

Mathematics, 7, 568.

Taleizadeh, A.A., Tavassoli, S. & Bhattacharya, (2020). A.

Inventory ordering policies for mixed sale of products

under inspection policy, multiple prepayment, partial

trade credit, payments linked to order quantity and full

backordering. Annals of Operations Research 287,

403–437.

Taleizadeh, A.A., Aliabadi, L., Thaichon, P. A. (2022)

sustainable inventory system with price-sensitive

demand and carbon emissions under partial trade credit

and partial backordering. Operational Research: An

International Journal, 22, 4471–4516.

Tang, O., Teunter, R.H. Economic lot scheduling problem

with returns. Production and Operations Management,

15(4), 488–497 (2006).

Tavakoli, S., Taleizadeh, A.A. An EOQ model for decaying

item with full advanced payment and conditional

discount. Annals of Operations Research 259, 415–

436 (2017).

Teksan, Z M., Geunes, J. (2016). An EOQ model with

price-dependent supply and demand. International

Journal of Production Economics, 178, 22-33.

Teunter, R., Kaparis, K., & Tang, O. (2008). Multi-product

economic lot scheduling problem with separate

production lines for manufacturing and

remanufacturing. European Journal of Operational

Research, 191(3), 1241–1253.

Teunter, R., Tang, O., & Kaparis, K. (2009). Heuristics for

the economic lot-scheduling problem with returns.

International Journal of Production Economics,

118(1), 323–330.

Teunter, R.H. (2001). Economic order quantities for

recoverable item inventory system. Naval Research

Logistics, 48(6), 484-495.

Vemuganti, R. R. (1978). On the Feasibility of Scheduling

Lot Sizes for Two Products on One Machine.

Management Science 24(15), 1668–1673.

Viswanathan, S., Wang, Q. (2003). Discount pricing

decisions in distribution channels with price-sensitive

demand. European Journal of Operational Research,

149(3), 571-587.

Wang, N., He, Q., Jiang, B. (2019). Hybrid closed-loop

supply chains with competition in recycling and

product markets. International Journal of Production

Economics, 217, 246-258.

Wu, C.-H. (2012). Price and service competition between

new and remanufactured products in a two-echelon

supply chain, International Journal of Production

Economics, 140(1), 496-507.

Zanoni, S., Segerstedt, A., Tang, O., Mazzoldi, L. (2012).

Multi-product economic lot scheduling problem with

manufacturing and remanufacturing using a basic

period policy, Computers & Industrial Engineering,

62(4), 1025-1033.

Zipkin, P., (2000). Foundations of Inventory Management.

McGraw-Hill, NewYork.

Hybrid Manufacturing / Remanufacturing Inventory Model with Two Markets and Price Sensitive Demands with Competition

157