Banking Malware Detection: Leveraging Federated Learning with

Conditional Model Updates and Client Data Heterogeneity

Nahid Ferdous Aurna

1

, Md Delwar Hossain

1

, Hideya Ochiai

2

, Yuzo Taenaka

1

, Latifur Khan

3

and Youki Kadobayashi

1

1

Division of Information Science, Nara Institute of Science and Technology, Nara, Japan

2

Grad. School of Info. Science and Tech., The University of Tokyo, Tokyo, Japan

3

Computer Science Department, The University of Texas at Dallas, Richardson, U.S.A.

Keywords:

Banking Malware, Federated Learning, Ensemble Learning, Data Heterogeneity.

Abstract:

Banking malware remains an ongoing and evolving threat as cybercriminals exploit vulnerabilities to steal

sensitive user information in the digital banking landscape. Despite numerous efforts, developing an effective

and privacy preserving solution for detecting banking malware remains an ongoing challenge. This paper

proposes an effective privacy preserving Federated Learning (FL) based banking malware detection system

utilizing network traffic flow. Challenges such as, dealing with data heterogeneity in FL scheme while main-

taining robustness of the global shared model are addressed here. In our study, three distinct heterogenous

datasets consisting benign and one of the prevalent malicious flows (zeus, emotet, or trickbot) are considered

to address the data heterogeneity. To ensure model’s robustness, initially, we assess various models, selecting

Convolutional Neural Network (CNN) for developing an ensemble model. Subsequently, FL is incorporated

to maintain data confidentiality and privacy where ensemble model serves as the global model ensuring the

effectiveness of the approach. Moreover, to improve the FL scheme, we introduce conditional update of client

models, effectively addressing data heterogeneity among the federated clients. The evaluation results demon-

strate the effectiveness of the proposed model, achieving high detection rates of 0.9819, 0.9982, and 0.9997

for client 1, client 2, and client 3, respectively. Overall, this study offers a promising solution to detect banking

malware while effectively addressing data privacy and heterogeneity in the FL framework.

1 INTRODUCTION

With the digitization of banking and financial activ-

ities, cybercrime has become predominantly finan-

cially motivated. Sophisticated banking malwares

like zeus, emotet, and trickBot act as the major drivers

of malicious activities targeting sensitive informa-

tion, specifically login credentials. Banking malwares

exhibit distinct network packet behaviors, establish-

ing encrypted command-and-control communication,

while other malware types may vary in communi-

cation patterns and objectives at the network level.

These malwares continue to pose significant cyber-

security risks in the financial sector and so it’s im-

portant to develop a robust detection strategy to en-

counter these critical malwares.

Malware detection is a persistent research prob-

lem, with continuous efforts aimed to develop and im-

prove the detection techniques. Numerous research

has been conducted in this regard using Machine

Learning (ML) and Deep Learning (DL) techniques.

For instance, in (Mohaisen and Alrawi, 2013), clas-

sical ML methods such as Support Vector Machine

(SVM), Logistic Regression (LR), K-Nearest Neigh-

bor (KNN) have been applied for detecting zeus and

benign samples. In another study (Kazi et al., 2019a),

Decision Tree (DT), Random Forest (RF) and the

SVM algorithm have been considered where RF out-

performed other models. Various studies have ex-

plored DL based method such as CNN (Wang et al.,

2017), Capsule Network (Lu et al., 2023) and CNN

with Autoencoder (An et al., ) to classify malware.

Besides, there are some existing deep learning based

fusion and ensemble learning methods for classifying

malwares (Liu et al., 2021). The key limitation of

this centralized ML/DL based researches lies in not

considering privacy of data that has been addressed

in (Jiang et al., 2022), (Rey et al., 2022) applying FL

based approach. Though these FL based detection ap-

proaches are very intriguing, but challenges remain

Aurna, N., Hossain, M., Ochiai, H., Taenaka, Y., Khan, L. and Kadobayashi, Y.

Banking Malware Detection: Leveraging Federated Learning with Conditional Model Updates and Client Data Heterogeneity.

DOI: 10.5220/0012409700003648

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 10th International Conference on Information Systems Security and Privacy (ICISSP 2024), pages 309-319

ISBN: 978-989-758-683-5; ISSN: 2184-4356

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

309

in improving global model’s robustness and handling

heterogeneous data as FL based approach is prone to

data heterogeneity while maintaining global model’s

performance efficacy.

In this work, we aim to overcome aforementioned

limitations of data privacy, heterogeneity and robust-

ness of global model in existing approaches using

Federated Learning based scheme. Handling hetero-

geneous data poses a significant challenge. To ad-

dress this issue, we utilize three separate datasets,

each containing benign samples and a prevalent bank-

ing malware type (zeus, emotet, or trickbot). An-

other challenge remains in ensuring robustness and

efficacy of the global model in FL scheme. To deal

with this, we conduct isolated training of the datasets

with four different DL models: CNN, MLP, LSTM

and TabNet (Arik and Pfister, 2020) where CNN ex-

hibits superior performance, consequently we built

an ensemble-based CNN model comprised of three

personalized trained CNN models on three distinct

datasets. Eventually, this ensemble model served

as the global model in the FL approach consider-

ing three clients, each having one distinct dataset

with varying feature sets and malware types. That’s

how data heterogeneity among all clients is ensured

in our study and ensemble of personalized trained

CNN models strengthens the efficacy of global shared

model. Moreover, to further enhance the performance

of FL based scheme, conditional update is incorpo-

rated for each of the client models in every commu-

nication round. In this way, local models are updated

only when the global model’s current weight demon-

strates an improvement in performance. As a result,

the proposed FL-based approach exhibits significant

improvement due to the ensemble of personalized

trained CNN models and incorporation of conditional

updates for federated clients. Furthermore, Experi-

mental evaluation on an unseen multi-class dataset

showcases the generalization capability of the pro-

posed model. The key contributions of this work are

featured below:

• We propose a privacy preserving FL based ap-

proach with conditional model update to detect

sophisticated banking malwares considering data

heterogeneity

• We conduct personalized training of each dataset

and ensemble the best converged models with

a view to ensuring the robustness of global FL

model.

• We demonstrate a way of improving FL technique

by conditional update of all clients’ local model at

each communication round.

• We ensure the generalization capability of global

federated model by testing it with an unseen

multi-class dataset consisting all three banking

malwares.

The subsequent sections of the paper are structured

as follows: Section II reviews existing works related

to the problem domain highlighting potential limita-

tions. Section III thoroughly depicts the proposed

methodology. Section IV provides a comprehensive

demonstration of our result. Section V includes rele-

vant discussions with future directions. Finally, Sec-

tion VI denotes the concluding remarks of our study.

2 RELATED WORKS

Malware detection has become an intriguing research

area to ensure security of computer systems and net-

works in financial sector. Numerous studies have

been conducted exploring distinct approaches to ad-

dress this challenge.

2.1 Machine Learning Approaches

Gezer et al. (Gezer et al., 2019) investigated the ef-

fectiveness of four ML algorithms to detect TrickBot-

related traffic flows where Random Forest classifier

achieves superior performance identifying malicious

flows. However, their study lacks evaluation on un-

seen malware samples, limiting practical implication

and robustness. Wang et al. (Wang et al., 2022)

presented a systematic review of 10 ML-based tech-

niques including RF, XGBoost, K Nearest Neighbor

(KNN), MLP for detecting encrypted malicious traffic

and proposed a comprehensive dataset from multiple

sources. However, this study lacks data heterogene-

ity (having different feature set for different dataset)

which could be a significant consideration in this area.

Rawat et al. (Rawat et al., 2022) focused on detecting

malware affecting financial sector from network traf-

fic flow using several machine learning models i.e.,

RF, MLP, Logistic Regression (LR), with RF achiev-

ing the highest precision. Yet the study was confined

to binary classification, restricting the exploration of

more diverse malware classes.

2.2 Deep Learning Approaches

Agrafiotis et al. (Agrafiotis et al., 2022) proposed

an image-based approach to classify malicious traf-

fic where the raw traffic is transformed to images us-

ing vision transformer (ViT) and CNN. Still this ap-

proach needs to be experimented with unseen traffic

samples to validate the efficacy of this method. More-

over, this work is restricted to detecting malicious

ICISSP 2024 - 10th International Conference on Information Systems Security and Privacy

310

traffic flow without categorizing the type of malware.

Mahdavifar et al. (Mahdavifar et al., 2020) exhibited

deep learning-based semi supervised method to clas-

sify several malware categories outperforming other

ML techniques. However, this study lacks considera-

tion of data heterogeneity and data privacy. Fox et al.

(Fox and Boppana, 2022) introduced a malicious net-

work traffic detection method using 2D-CNN by con-

verting data packets into bitmap images. Yet, person-

alized training on different datasets could eradicate

the deterioration of performance for certain datasets.

2.3 Federated Learning Approaches

Jiang et al. (Jiang et al., 2022) proposed an FL

based Android malware classification scheme namely

FedHGCDroid. They introduced a CNN and Graph

Neural Network (GNN) based model called HGC-

Droid for accurate feature extraction and employed

FedAdapt to improve adaptability of model in deal-

ing with non-IID (Non-independent and identically

distributed) distributions of data. Similarly, Rey et

al. (Rey et al., 2022) explored FL for detecting mal-

ware in IoT devices to mitigate the data privacy con-

cern. The proposed framework utilized supervised

(MLP) and unsupervised (autoencoder) models, at-

taining promising outcome while ensuring privacy

preservation of data.

Despite the undeniable contributions made by the

existing ML, DL and FL-based schemes, there exists

notable scope for enhancement that has not yet been

thoroughly addressed in this domain. Factors such as

data heterogeneity across federated clients, personal-

ized training of models for each client, and adaptive

weight updates have not been fully considered. In our

study, we have endeavored to explore aforementioned

critical issues to construct a more robust FL-based

malware detection approach.

3 METHODOLOGY

This study presents a federated learning-based ap-

proach for banking malware detection using deep

learning techniques that can be summarized in five

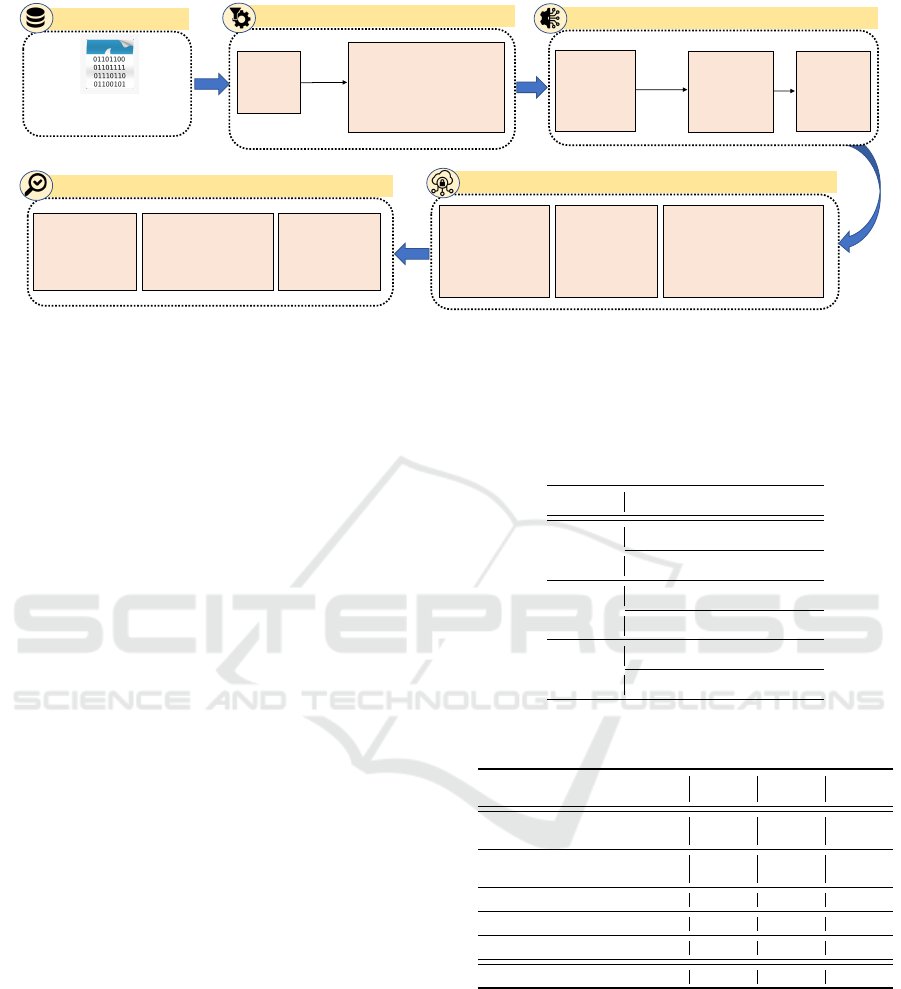

phases as illustrated in Fig. 1. The methodology in-

volves dataset preprocessing, deploying and selecting

the best deep learning model for personalized train-

ing, building an ensemble model, and implement-

ing federated learning with the ensemble model as

the global model. Comprehensive validation is per-

formed, including testing the global model on an un-

seen multi-class dataset. The proposed approach rep-

resents a promising advancement in banking malware

detection, offering improved privacy and robustness

through federated learning.

3.1 Data Collection and Preprocessing

The datasets we used in our study are created by the

Stratosphere Laboratory, publicly available in (Strato-

sphere, 2015) where traffics were captured by running

malware samples in the controlled environment. Ba-

sically, we collected network traffic of three types of

banking malwares: Zeus, Emotet and Trickbot along

with benign traffic in separate PCAP (Packet Capture)

files. For the experimental purpose we created three

different datasets from these traffics having three di-

verse type of malwares. Over the years, Zeus malware

has evolved into various strains like Zeus Gameover,

SpyEye, ICE IX, and Shylock, all geared towards ac-

cessing bank accounts with distinct strategies. Emotet

and TrickBot have similarly advanced, gaining abili-

ties to compromise user data and even install addi-

tional malware. TrickBot has notably refined its eva-

sion methods to avoid detection. These diverse and

sophisticated variations make detecting and counter-

ing these malware types increasingly complex.

3.1.1 Dataset-1 (Zeus)

For creating the first dataset we considered zeus and

benign traffic data and transformed the raw traffic data

(PCAP file) to csv file according to the TCP sessions.

For this transformation, each TCP session informa-

tion were taken for first 30 seconds and the features

include the number of upload and download bytes for

each second. In this way, each session contains 60

features that is upload and download bytes for 30 sec-

onds.

3.1.2 Dataset-2 (Emotet)

For creating the second dataset, similarly we consid-

ered emotet and benign traffic data and transformed

them into csv file according to the TCP sessions. For

this dataset, besides number of upload and download

bytes for each second of initial 30 seconds, we consid-

ered additional 2 features those are Mean TCP win-

dows size value and Total payload per session. In this

way the total number of features is 62 for this dataset.

3.1.3 Dataset-3 (Trickbot)

In case of the third dataset, we considered trickbot and

benign traffic data and like the previous 2 datasets, we

extracted the features based on each TCP session in

the transformed csv file. In this case, the total num-

ber of features is 63 which includes all the features in

Banking Malware Detection: Leveraging Federated Learning with Conditional Model Updates and Client Data Heterogeneity

311

PCAP files of Zeus, Emotet,

Trickbot and Benign traffic

TCP based

Feature

extraction

Generating 3 heterogenous

datasets:

Dataset-1 (benign & Zeus)

Dataset-2 (benign & Emotet)

Dataset-3 (benign & Trickbot)

Conversion

to CSV and

labelling

Model Development

Incorporating Federated Learning

Client creation:

To ta l 3 clients, each

having separte

dataset with distinct

malware type

Centralized server:

having ensemble

CNN model as the

global shared

model

Setting up the training process:

Considering conditional weight

update of client models where

current accuracy is compared

with the saved accuracy of

previous round

Model Evaluation

Evaluation based

on performance

metrics

Evaluation on 2 aspects:

• Personalized model

ensemble

• Conditional weight

update

Validation with

unseen multi-class

data samples

Data Preprocessing

Data Collection

Training with

DL Models

(CNN, MLP,

LSTM, TabNet)

Personalized

training on 3

datasets with

CNN

Best

performing

model (CNN)

Ensemble of

three

personalized

CNN

Figure 1: The workflow of the proposed method that encompasses dataset preparation for diverse malware types, ensemble

model creation through several DL model evaluation, integration with FL approach incorporating conditional client model

updates, and comprehensive validation of the proposed approach.

Dataset-2 with additional one feature that is IP packet

length.

For each of the datasets, the malware file and the

benign files are labeled, merged and shuffled after

transforming into csv format. In this way, we tried to

maintain certain amount of heterogeneity among all

the datasets considering feature sets, malware types

and number of samples. Differences in feature sets

across datasets from various clients are common. To

showcase proposed FL scheme’s ability to handle

such heterogeneity, we deliberately introduced slight

feature variations. Our aim is to demonstrate the ef-

fectiveness of our proposed approach in addressing

performance challenges in the FL architecture un-

der such conditions. All these features were selected

based on the suggestion of expert in this field and

some past studies on the similar problems were con-

sidered as well. The data distribution and consid-

ered feature sets are mentioned in Table 1 and Ta-

ble 2 respectively. The discrepancy between real-life

data imbalance and the employed dataset is evident

from Table 1 as real-world scenarios generally ex-

hibit a higher occurrence of benign traffic. The target

is to ensure an unbiased evaluation of our proposed

model’s performance with the aim to establish a base-

line performance under controlled conditions.

The reason behind using TCP based features for

our study lies in the fact that TCP is one of the most

commonly used protocol to establish the C&C (Com-

mand and Control) connections between the com-

promised host and attacker’s server for this kind of

malwares. Moreover, we considered the upload and

download byte counts as the significant features in

our study because by analyzing TCP sessions and

their upload/download bytes per second, it is possi-

ble to capture the behavior of malware in terms of

data transfer, communication frequency, and overall

network activity.

Table 1: Sample count of the datasets used in this study.

Dataset Data Samples Flow Count

Dataset-1

(Zeus)

Zeus 5100

Benign 27980

Dataset-2

(Emotet)

Emotet 30000

Benign 11818

Dataset-3

(Trickbot

Trickbot 22445

Benign 8145

Table 2: Feature sets of the datasets used in this study.

Features used in this study

Dataset-1

(Zeus))

Dataset-2

(Emotet)

Dataset-3

(Trickbot)

Upload byte count for each second (ini-

tial 30 seconds)

✓ ✓ ✓

Download byte count for each second

(initial 30 seconds)

✓ ✓ ✓

Mean TCP windows size value – ✓ ✓

Total payload per session – ✓ ✓

IP packet length – – ✓

Total no of Features 60 62 63

3.2 Model Development

The model development process can be divided into

three stages; in the first stage, we did some experi-

mentation on four distinct deep learning models. Sec-

ondly, the best models for the three datasets were con-

sidered for personalized training and these models are

ensembled to create a robust model. Finally, federated

learning was incorporated using the ensemble model

as the global model.

ICISSP 2024 - 10th International Conference on Information Systems Security and Privacy

312

Table 3: Hyperparameter values for the applied deep learn-

ing models.

Hyperparameters CNN MLP LSTM TabNet

Input activation

function ReLU ReLU ReLU –

Output activation

function Sigmoid Sigmoid Sigmoid –

Optimizer Adam Adam Adam Adam

Initial learning

rate 0.0001 0.0001 0.001 0.02

Learning rate

decay 0.3 0.3 0.3 0.2

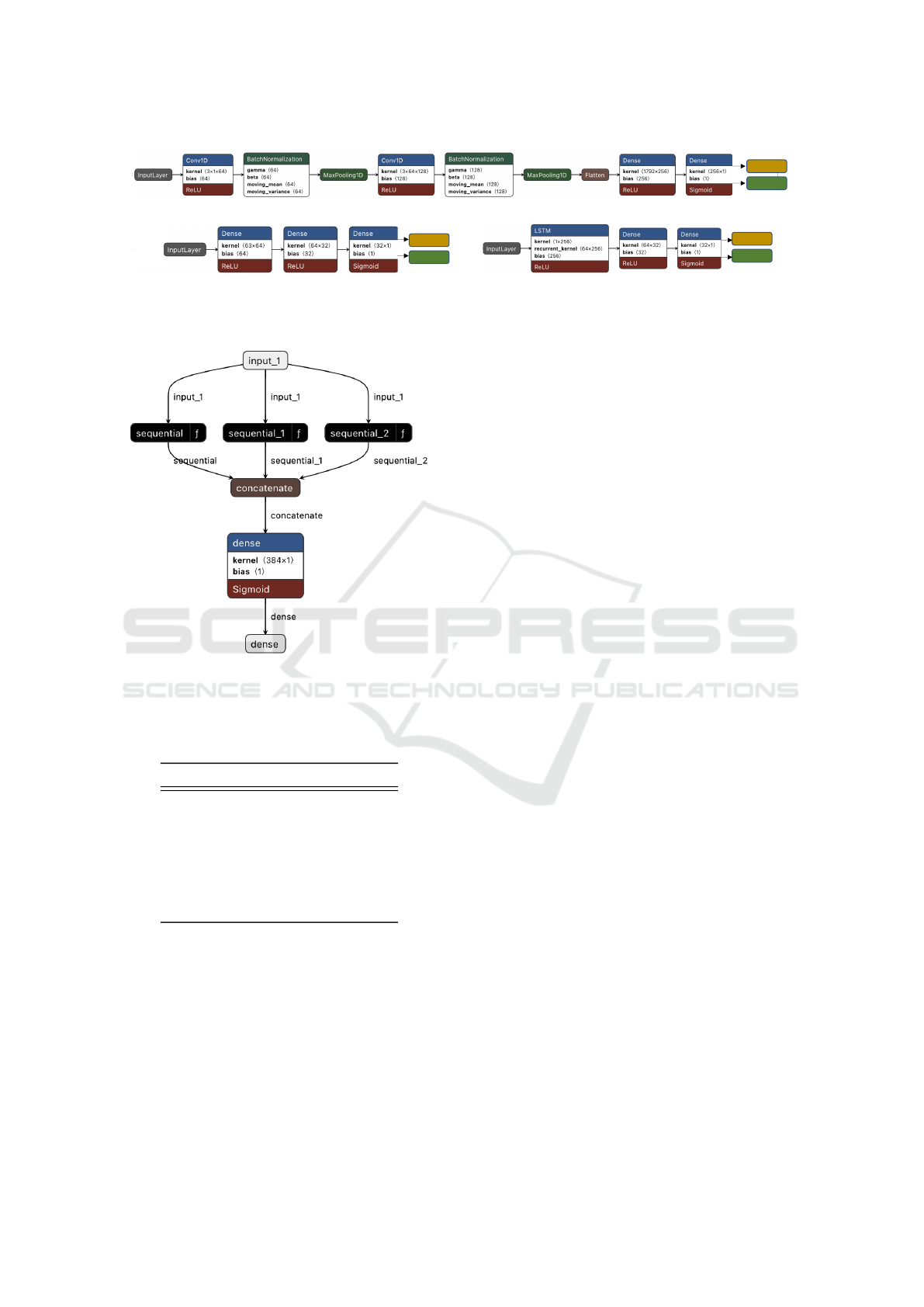

3.2.1 Experimentation with Deep Learning

Models

Initially we started our experimentation with four

deep learning models: CNN, MLP, LSTM and Tab-

Net. The architectures of CNN, MLP and LSTM has

been depicted in Fig. 2. These architectures have

been chosen after several experimentations with each

of the datasets, and for the TabNet model we used the

pretrained default architecture which is followed from

the original paper (Arik and Pfister, 2020). As men-

tioned in Fig. 2(a), the CNN model consists of total

9 layers including 2 convolution layers, 2 batchnor-

malization layers, 2 maxpooling layers, 1 faltten layer

followed by 2 dense layers. The MLP and LSTM

both models have 3 layers as depicted in Fig. 2(b)

and (c). The MLP consists of 3 dense layers whereas

the LSTM consists of one LSTM layer followed by 2

dense layers.

These models are used for training the three

datasets and the hyperparameter values are provided

in Table 3. To choose the optimal hyperparameter

values, keras tuner is initially used along with some

empirical testing. After experimentation, the result is

depicted in Table 4 and the purpose of this investiga-

tion was to scrutinize the best performing model. To

evaluate deep learning models, we considered several

evaluation metrics: precision, recall, F1 score, false

positive rate (FPR), false negative rate (FNR) and ac-

curacy. Accuracy is a widely used metric to assess

the performance of a classification model, represent-

ing the proportion of correct predictions over the total

predictions made. Precision is the ratio of true posi-

tive predictions to the total positive predictions, while

recall is the ratio of true positive predictions to the

sum of true positive and false negative predictions.

The F1-score is the harmonic mean of precision and

recall, providing a balanced measure of the model’s

effectiveness in capturing both true positives and min-

imizing false negatives. Here, the best performing

values are highlighted with bold font. According to

the result exhibited in Table 4, it is evident that CNN

could attain the tradeoff among all the performance

metrics considering each of the datasets which makes

the CNN model an efficient candidate for the rest of

the study.

Table 4: Performance of the applied deep learning models

on three datasets.

Dataset Model Precision Recall F1-

score

FPR FNR Accuracy

(%)

Datset-1

(Zeus)

CNN 0.9952 0.9871 0.9911 0.0049 0.0046 99.53

MLP 0.9916 0.9757 0.9835 0.0078 0.0089 99.12

LSTM 0.8416 0.6935 0.7058 0.0627 0.2541 77.54

TabNet 0.9823 0.9938 0.988 0.0343 0.0011 99.37

Datset-2

(Emotet)

CNN 0.9943 0.9978 0.996 0.0000 0.0114 99.68

MLP 0.9701 0.9883 0.9787 0.002 0.0063 0.983

LSTM 0.9206 0.9377 0.9286 0.0273 0.1316 94.32

TabNet 0.9798 0.9467 0.9616 0.0403 0.0000 96.99

Datset-3

(Trickbot)

CNN 0.9988 0.9996 0.9992 0.0000 0.0025 99.93

MLP 0.9088 0.9105 0.9097 0.0468 0.01357 92.96

LSTM 0.815 0.8231 0.8189 0.0882 0.2818 86.02

TabNet 0.9987 0.9971 0.9979 0.0020 0.0006 99.84

3.2.2 Personalized Training and Implementing

Ensemble CNN Model

In real life scenarios of data imbalance, model perfor-

mance can be affected. To enhance model robustness,

we pursue personalized training and create an en-

semble model based on meticulous model evaluation,

aiming for improved detection rates. According to the

analysis in first stage, CNN is chosen for personalized

training on the three datasets. Then three individual

best performing model weights are saved from three

separate experiments on the datasets. These models

with best performing weights are further ensembled

as illustrated in Fig. 3. Here, sequential, sequen-

tial 1, and sequential 2 depicts the three individual

CNN models with their best weights. Then the fea-

tures are concatenated followed by 2 dense layers to

get the final ensemble model.

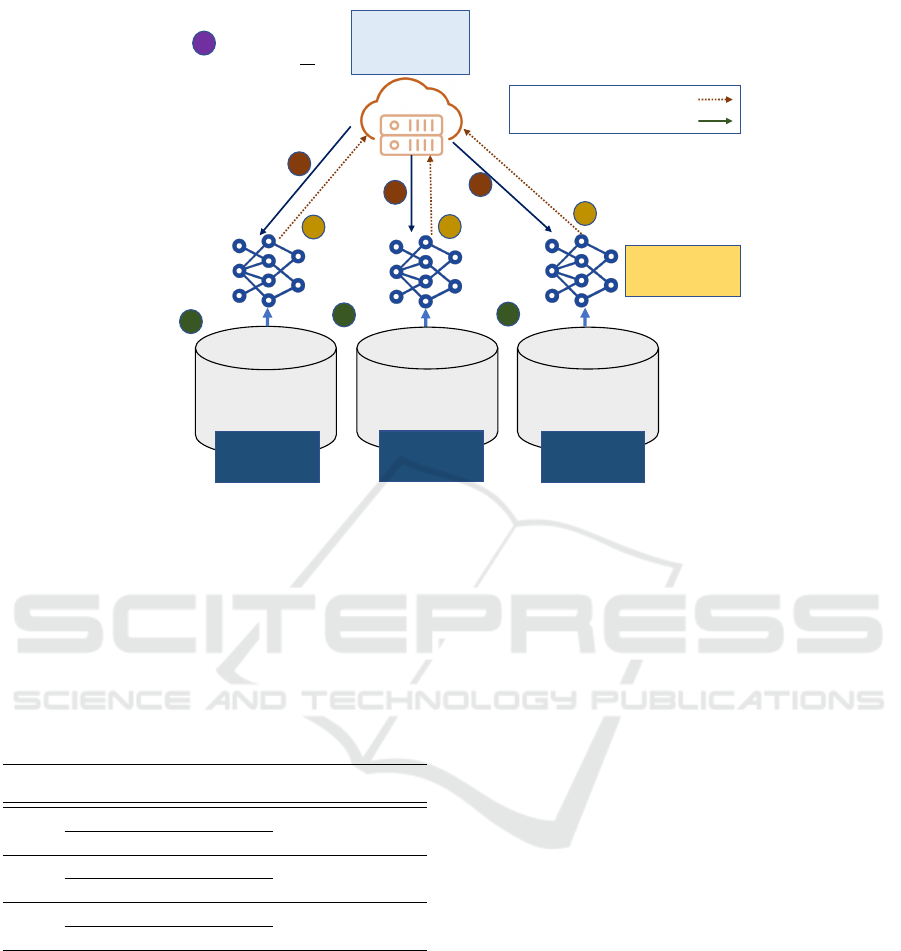

3.2.3 Incorporating Federated Learning with

Ensemble Model

We incorporate federated learning approach at the fi-

nal stage of model development where the ensemble

CNN model is used as the global shared model that

we got from the previous stage. Linguistic variations,

technological disparities, and other factors can lead

to the prevalence of specific malware types in dis-

tinct regions (Newsroom, 2017). In our experimen-

tal setup, each client, representing a geographically

separated bank, simulates a unique strain of malware,

showcasing the potential for localized malware vari-

Banking Malware Detection: Leveraging Federated Learning with Conditional Model Updates and Client Data Heterogeneity

313

(a) CNN architecture

(c) LSTM architecture

Malicious

Benign

Malicious

Benign

(b) MLP architecture

Malicious

Benign

Figure 2: Architecture of the Deep learning models used in this study: (a) CNN model (b) MLP model (c) LSTM model.

Figure 3: The global shared Ensemble CNN model con-

structed by stacking features from the three personalized-

trained CNN models.

Table 5: Hyperparameter values for federated learning.

Hyperparameters Value

Communication round 20

Number of local epoch 3

Initial Learning rate 0.001

Learning rate decay 0.1

Early stopping patienc 2

Optimizer SGD

Train/test split 90%-10%

Federated averaging weighting Client data size

ations. Fig. 4 depicts the whole functionality of this

approach. The three datasets are distributed in three

different clients and the central server holds the en-

semble CNN model as the global shared model. The

initial individual model weights (W

c1

t

, W

c2

t

, W

c3

t

) are

sent from the clients to the central server and there the

server aggregates the model weights using FedAvg

(McMahan et al., 2017) method. Then the updated

global weights (W

g

t

) are sent back to the clients. In

this way, the model gets trained at every communi-

cation round between server and the clients. Addi-

tionally, in our approach, we put the condition that

at every round when each client updates the model

weights, it checks the previous round’s accuracy (A

cn

t

)

that is stored locally. If the current accuracy (A

cn

t+1

)

is higher, the model weights are updated and stored,

otherwise it keeps the previous weight. In this way,

the model is always guided towards a better result, re-

sulting in early convergence. Moreover, all the clients

are trained with their own heterogeneous private data

without any kind of sharing. The hyperparameter val-

ues for the proposed FL approach is depicted in Table

5 and these values have been chosen upon several ex-

periments and insightful analysis.

4 RESULT ANALYSIS

The result analysis of this work is done considering

the following aspects: firstly, we investigate the per-

formance of the proposed method considering differ-

ent performance metrics. Additionally, some exper-

iments are done to inspect the impact of model en-

semble and conditional weight update in the feder-

ated learning. Finally, the model is validated by test-

ing with unseen multi-class data followed by a com-

parative analysis with respect to some state-of-the-art

methods.

4.1 Evaluation of Proposed FL Based

Scheme

To assess the effectiveness of the proposed Feder-

ated Learning (FL) based approach, we utilized var-

ious evaluation metrics, including precision, recall,

F1 score, false positive rate (FPR), false negative rate

(FNR), and accuracy. The definition and effective-

ness of these metrics have already been mentioned

in subsection 3.2, and Table 6 shows the result of

all the clients based on these evaluation metrics us-

ing proposed FL approach. Here, we can observe

that for each of the clients, the proposed approach at-

tained quite promising result for both benign and mal-

ICISSP 2024 - 10th International Conference on Information Systems Security and Privacy

314

Central Server

(Ensemble CNN

model)

Client 1: Dataset-1

(Benign + Zeus)

60 features

Local update (w

t

cn

)

Global model weight (w

t

g

)

Client 2: Dataset-2

(Benign + Emotet)

62 feature

Client 3: Dataset-3

(Benign + Trickbot)

63 features

Condition :

A

t+1

cn

> A

t

cn

Previous round

Accuracy (A

t

c1

)

Conditional

update:

w

t+1

c1

ßw

t

g

w

t

g

w

t

g

w

t

g

w

t

c1

w

t

c2

w

t

c3

Conditional

update:

w

t+1

c2

ßw

t

g

Conditional

update:

w

t+1

c3

ßw

t

g

Previous round

Accuracy (A

t

c2

)

Previous round

Accuracy (A

t

c3

)

1

1

1

3

3

3

2

4

4

4

Model aggregation:

W

t

g

←

∑

!" #

!

$!

$

w

t

cn

Figure 4: The proposed FL-based scheme utilizing the ensemble CNN as the global shared model for 3 clients with distinct

datasets of varying malware types and features, alongside conditional model updates for clients.

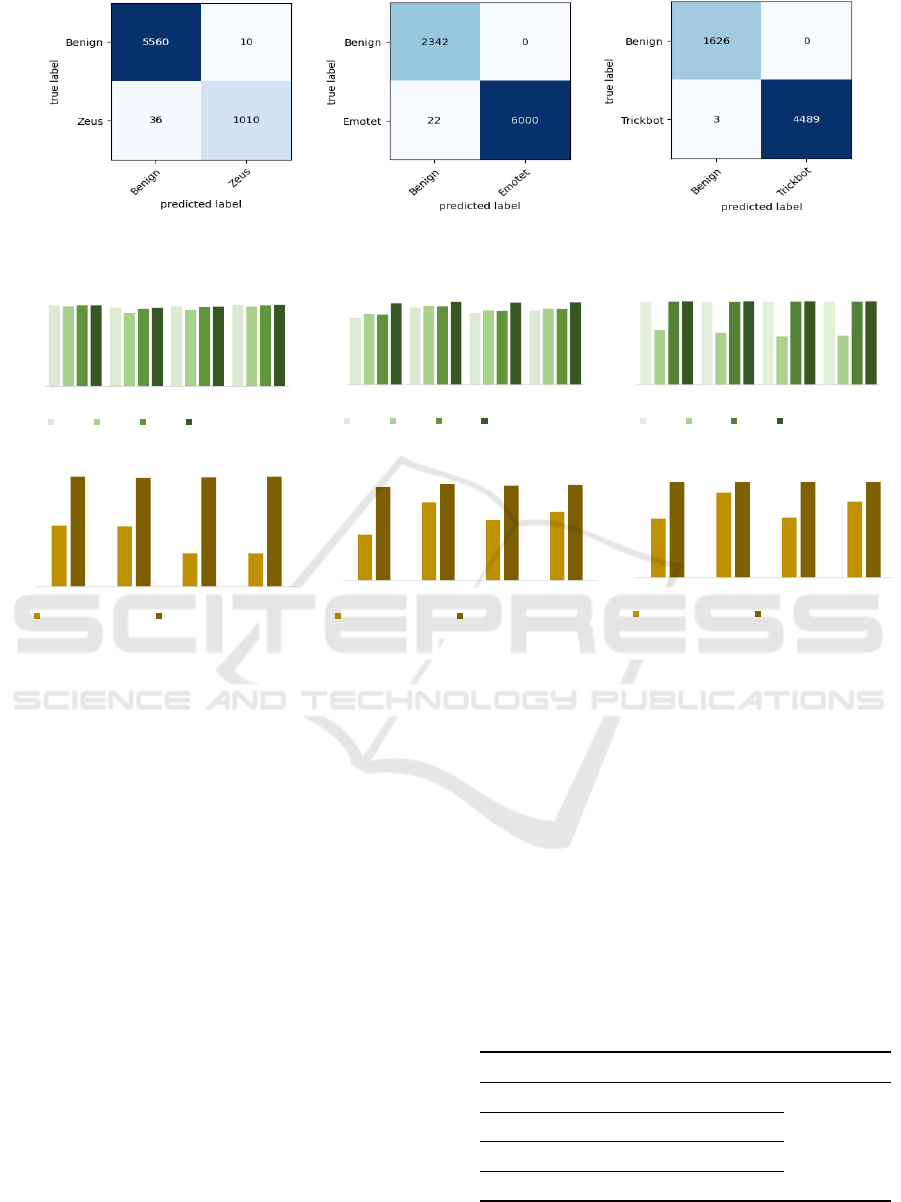

ware class. The attained accuracy is 99.30%, 99.74%,

99.95% for client 1, client 2 and client 3 respectively.

The confusion matrix for for client 1, client 2 and

client 3 are depicted in Fig. 5(a), (b), and (c) respec-

tively.

Table 6: Result obtained from the proposed federated learn-

ing approach.

Client Malware Precision Recall F1-

score

FPR FNR Accuracy

(%)

Client 1

Benign 0.9936 0.9982 0.9959

0.0098 0.0064 99.30

Zeus 0.9902 0.9656 0.9777

Client 2

Benign 0.9907 1.0000 0.9953

0.0000 0.0093 99.74

Emotet 1.0000 0.9963 0.9982

Client 3

Benign 0.9982 1.0000 0.9991

0.0000 0.0018 99.95

Trickbot 1.0000 0.9993 0.9997

4.2 Impact of Model Ensemble

In our study, the personalized trained three CNN en-

semble models are used as the global shared model

in the FL architecture. The performance of individ-

ual CNN models and the ensemble model on the FL

approach is depicted in Fig. 6(a). In this figure, the

first, second and third graph represent the impact of

model ensemble on client 1, client 2, and client 3 re-

spectively. From these graphs we can observe that

ensemble model can maintain a good trade off among

all performance metrics and attains a balanced per-

formance considering each of the clients, whereas the

individual models fail to maintain a balanced perfor-

mance. For instance, CNN1 performed well for client

1 and client 3 but in case of client 2, the performance

degraded. Similarly, CNN2 performed well for client

1 and the performance dropped in client 2 and client

3. Likewise, performance of CNN3 degraded in client

2, whereas the ensemble CNN outperformed all the

models in this regard. This clearly depicts how the en-

semble model contributes to a consistent performance

across all clients.

4.3 Impact of Conditional Weight

Update of Clients

In FL architecture, we consider conditional weight

update for each of the clients as explained earlier. Fig.

6(b) illustrates the impact of this conditional weight

update on each client. Here, in the first graph we ob-

serve that, due to conditional update the precision, re-

call, F1 score, and accuracy improved drastically for

client 1. Similarly, the second and third client also

attained significant improvement in the performance

metrics. It is observed from the experimental result

that the conditional weight update has significantly

enhanced the overall detection rate of the proposed

model (44.52% for client 1, 1.84% for client 2, and

10.84% for client 3).

Banking Malware Detection: Leveraging Federated Learning with Conditional Model Updates and Client Data Heterogeneity

315

(a) Client 1 (b) Client 2

(c) Client 3

Figure 5: Confusion matrix for the proposed FL scheme: (a) Client 1 (b) Client 2 (c) Client 3.

0.9604

0.9847

0.9716

0.9775

0.9691

0.9881

0.9781

0.9825

0.9683

0.9878

0.9774

0.9821

0.9953

0.9982

0.9967

0.9974

0.8

0.85

0.9

0.95

1

Precision Recall F1-score Accuracy

Impact of model ensemble (Client 2)

CNN1 CNN2 CNN3 Ensemble Model

0.9936

0.9878

0.9906

0.9926

0.6542

0.6225

0.5788

0.591

0.9976

0.9949

0.9962

0.9971

0.9991

0.9997

0.9994

0.9995

0

0.2

0.4

0.6

0.8

1

Precision Recall F1-score Accuracy

Impact of model ensemble (Client 3 )

CNN1 CNN2 CNN3 Ensemble Model

0.5499

0.5447

0.3019

0.3023

0.9919

0.9819

0.9868

0.993

0

0.2

0.4

0.6

0.8

1

Precision Recall F1-score Accuracy

Impact of conditional model update(Client 1)

Normal weight update Conditional weight update

0.9465

0.9798

0.9614

0.9698

0.9953

0.9982

0.9967

0.9974

0.9

0.92

0.94

0.96

0.98

1

Precision Recall F1-score Accuracy

Impact of conditional model update(Client 2)

Normal weight update Conditional weight update

0.6172

0.8913

0.629

0.7962

0.9991

0.9997

0.9994

0.9995

0

0.2

0.4

0.6

0.8

1

Precision Recall F1-score Accuracy

Impact of conditional model update(Client 3)

Normal weight update Conditional weight update

0.9921

0.9828

0.9874

0.9933

0.9878

0.964

0.9754

0.9869

z0.9917

0.9788

0.9851

0.9921

0.9919

0.9819

0.9868

0.993

0.7

0.8

0.9

1

Precision Recall F1-score Accuracy

Impact of model ensemble (Client 1)

CNN1 CNN2 CNN3 Ensemble Model

(b) Impact of conditional weight update of client model

(a) Impact of model ensemble on different clients

Figure 6: Evaluation of the proposed ensemble based deep FL approach on two aspect: (a) Impact of personalized CNN

model ensemble (b) Impact of conditional updated of federated client models.

4.4 Model Validation with Unseen

Multi-Class Data

To validate the robustness and generalization capabil-

ity of the ensemble CNN model, we assess it with

a multi-class dataset of unseen samples. This is dif-

ferent from the datasets used in the federated clients

where each of the clients contains one type of mali-

cious samples (zeus, emotet, or trickbot) along with

the benign samples. For validation purpose, a dataset

is considered that includes all three types of mali-

cious samples along with benign samples. Here, ini-

tially Dataset-1, Dataset-2, and Dataset-3 are merged

and used as training set and the new unseen dataset

is used as the test set. This new dataset is prepared

as the same way the other three datasets are prepared

and collected from the Stratosphere website (Strato-

sphere, 2015). This includes total 63 features same

as the Dataset-3 and has total 50,000 samples includ-

ing 16256 benign samples, 3028 zeus samples, 17631

emotet samples, and 13085 trickbot samples. To de-

pict the testing result, the confusion matrix is pro-

vided in Fig. 7 and also the result based on various

performance metrics are presented in TABLE 7 from

which we observe that the proposed model could at-

tain an accuracy of 97.19% which validates its capa-

bility of detecting new unseen malware samples as

well. Yet, due to the diversity in malware variants,

we see degradation of precision and F1-score of zeus

malware for the unseen dataset. The purpose of this

experiment is to assess our model’s performance if

we use a new multi-class data with the same global

shared model in the FL approach which demonstrates

the future prospect of this model.

Table 7: Performance of the proposed ensemble model on

unseen multi-class dataset.

Class label Precision Recall F1-score Accuracy (%)

Benign 0.9816 0.9751 0.9784

97.19

Zeus 0.8791 0.9129 0.8957

Emotet 0.9802 0.9809 0.9806

Trickbot 0.9701 0.9689 0.9695

ICISSP 2024 - 10th International Conference on Information Systems Security and Privacy

316

Table 8: Comparison with state-of-the-art malware detection techniques.

Ref. Model Dataset Training

Method

Privacy

Preserva-

tion

Heterogeneity

in Features

Personalized

Training

Detection

Rate (%)

(Kazi et al., 2019b) Random Forest Zeustracker Centralized ✗ ✗ ✗ 95.00

(Rawat et al., 2022) Random Forest Private data Centralized ✗ ✗ ✗ 99.89

(Agrafiotis et al., 2022) CNN CIC-IDS2017 Centralized ✗ ✗ ✗ 99.70

(Fox and Boppana, 2022) CNN

CIC17 Centralized ✗ ✗ ✗ 90.80

USTC16 Centralized ✗ ✗ ✗ 99.90

UTSA21 Centralized ✗ ✗ ✗ 1.00

(Jiang et al., 2022) GNN, CNN AndroZoo FL ✓ ✗ ✗ 92.79

(Rey et al., 2022) MLP, Autoen-

coder

N-BaIoT FL ✓ ✗ ✗ –

(Hsu et al., 2020) SVM Private data FL ✓ ✓ ✗ 95.31

Proposed Method Ensemble CNN Stratosphere

(2015)

FL ✓ ✓ ✓ 99.32

Figure 7: Confusion matrix for classifying unseen multi-

class network flows.

4.5 Comparison with State-of-the-Art

Methods

A comprehensive comparison of our proposed

method denoted as ‘Proposed Method’ with recent

state-of-the-art techniques on malware detection has

been depicted in Table 8. The evaluation is rep-

resented across several critical dimensions such as

training method, privacy preservation, handling fea-

ture heterogeneity, detection rate etc. The compari-

son showcases the strength of the proposed method in

terms of the aforementioned criteria. Unlike classical

DL and ML methods, a privacy preserving FL based

approach with conditional weight update has been in-

troduced in our work. Another fundamental challenge

in real life applications remains in handling data het-

erogeneity in feature space that has been considered

in our approach. To improve model’s performance for

all the clients, personalized training is conducted that

consequently helped our model to converge across all

the clients. Though the proposed method didn’t attain

the best detection rate as per Table 8, it consistently

outperformed the state-of-the-art methods across all

other evaluated dimensions.

5 DISCUSSION AND FUTURE

DIRECTION

This study is dedicated to implementing a robust and

data privacy-preserving banking malware detection

system. The comprehensive analysis focuses on three

main aspects: developing a robust detection method

through model ensemble, ensuring data privacy us-

ing federated learning (FL), and enhancing the con-

ventional FL-based scheme by addressing data het-

erogeneity among clients while maintaining strong

detection performance. The proposed study demon-

strates an effective approach to deal with data hetero-

geneity using an ensemble model as the global shared

model. Furthermore, an enhanced performance is

achieved by introducing conditional model update in

federated clients. This analysis exhibits the impact

of model ensemble and conditional weight update in

overall performance of FL based approach while deal-

ing with data heterogeneity.

However, while this study successfully addresses

some existing challenges in FL-based malware detec-

tion, there are still several aspects that require future

investigation. This includes exploring non-IID sce-

narios, optimizing communication overhead between

server and clients, and considering real-time imple-

mentation for practical applications. Non-IID scenar-

ios includes considering multiple varieties of malware

types in different clients those are not necessarily

identical. Communication overhead can be reduced

in FL scheme by applying effective client selection

Banking Malware Detection: Leveraging Federated Learning with Conditional Model Updates and Client Data Heterogeneity

317

methods. Moreover, in practical cases, imbalanced

datasets can affect model performance and such situ-

ations can be encountered by technique like Synthetic

Minority Oversampling Technique (SMOTE). Addi-

tional sensitivity analysis can measure the extent of

this impact and gain insights into model’s behavior in

real-world conditions. Zeus, emoted, and trickbot are

few of the most prevalent malwares in banking sector

those basically represent the overall malware attack

scenario in this domain, which is the main reason for

considering these strains, however, in future research,

some other significant malware types could be consid-

ered. Additional future work may include analyzing

the computational cost of our approach with newer

datasets to enhance its scalability and efficiency. We

intend to work on the aforementioned areas for further

improvement of this study in future.

6 CONCLUSIONS

Detecting banking malware is of paramount impor-

tance in safeguarding financial systems and protect-

ing user accounts. This paper presents an empirical

analysis to construct a robust and privacy-preserving

malware detection system specifically tailored for the

financial sector. The approach combines deep ensem-

ble learning and federated learning, utilizing three di-

verse datasets with distinct features. The experimen-

tation involves selecting the best deep learning model

(CNN) from four candidates (CNN, MLP, LSTM,

and TabNet), followed by ensemble model construc-

tion and implementation in the federated learning ap-

proach. Notably, the proposed conditional update of

client models effectively handles the heterogeneity of

datasets, achieving a promising accuracy of 99.30%,

99.74%, and 99.95% for client 1, client 2, and client 3,

respectively. The integration of ensemble CNN with

the proposed FL architecture offers a promising solu-

tion for an effective banking malware detection sys-

tem.

ACKNOWLEDGEMENTS

Part of this study was funded by the ICSCoE Core

Human Resources Development Program and MEXT

Scholarship, Japan.

REFERENCES

Agrafiotis, G., Makri, E., Flionis, I., Lalas, A., Votis, K.,

and Tzovaras, D. (2022). Image-based neural network

models for malware traffic classification using pcap

to picture conversion. In Proceedings of the 17th In-

ternational Conference on Availability, Reliability and

Security, pages 1–7.

An, W., Han, Y., Liu, S., An, B., Tao, T., and Liu, J. Mal-

ware https traffic identification based on convolutional

neural network and autoencoder. Available at SSRN

4302957.

Arik, S. O. and Pfister, T. (2020). Tabnet: Attentive inter-

pretable tabular learning.

Fox, G. and Boppana, R. V. (2022). Detection of malicious

network flows with low preprocessing overhead. Net-

work, 2(4):628–642.

Gezer, A., Warner, G., Wilson, C., and Shrestha, P. (2019).

A flow-based approach for trickbot banking trojan de-

tection. Computers & Security, 84:179–192.

Hsu, R.-H., Wang, Y.-C., Fan, C.-I., Sun, B., Ban, T.,

Takahashi, T., Wu, T.-W., and Kao, S.-W. (2020). A

privacy-preserving federated learning system for an-

droid malware detection based on edge computing. In

2020 15th Asia Joint Conference on Information Se-

curity (AsiaJCIS), pages 128–136. IEEE.

Jiang, C., Yin, K., Xia, C., and Huang, W. (2022). Fedhgc-

droid: An adaptive multi-dimensional federated learn-

ing for privacy-preserving android malware classifica-

tion. Entropy, 24(7):919.

Kazi, M. A., Woodhead, S., and Gan, D. (2019a). Com-

paring and analysing binary classification algorithms

when used to detect the zeus malware. In 2019 Sixth

HCT Information Technology Trends (ITT), pages 6–

11. IEEE.

Kazi, M. A., Woodhead, S., and Gan, D. (2019b). Detect-

ing the zeus banking malware using the random forest

binary classification algorithm and a manual feature

selection process. In International Symposium on Se-

curity in Computing and Communication, pages 286–

297. Springer.

Liu, S., Han, Y., Hu, Y., and Tan, Q. (2021). Fa-net:

Attention-based fusion network for malware https

traffic classification. In 2021 IEEE Symposium on

Computers and Communications (ISCC), pages 1–7.

IEEE.

Lu, K., Cheng, J., and Yan, A. (2023). Malware detection

based on the feature selection of a correlation infor-

mation decision matrix. Mathematics, 11(4):961.

Mahdavifar, S., Kadir, A. F. A., Fatemi, R., Alhadidi,

D., and Ghorbani, A. A. (2020). Dynamic an-

droid malware category classification using semi-

supervised deep learning. In 2020 IEEE Intl Conf

on Dependable, Autonomic and Secure Computing,

Intl Conf on Pervasive Intelligence and Computing,

Intl Conf on Cloud and Big Data Computing, Intl

Conf on Cyber Science and Technology Congress

(DASC/PiCom/CBDCom/CyberSciTech), pages 515–

522. IEEE.

McMahan, B., Moore, E., Ramage, D., Hampson, S., and

y Arcas, B. A. (2017). Communication-efficient learn-

ing of deep networks from decentralized data. In Ar-

tificial intelligence and statistics, pages 1273–1282.

PMLR.

ICISSP 2024 - 10th International Conference on Information Systems Security and Privacy

318

Mohaisen, A. and Alrawi, O. (2013). Unveiling zeus. arXiv

preprint arXiv:1303.7012.

Newsroom, P. (2017). How Geography Affects Malware

Threats Differently. https://www.psafe.com/en/blo

g/geography-affects-malware-threats-differently/.

[Online; accessed 15-August-2023].

Rawat, R., Rimal, Y. N., William, P., Dahima, S., Gupta, S.,

and Sankaran, K. S. (2022). Malware threat affecting

financial organization analysis using machine learning

approach. International Journal of Information Tech-

nology and Web Engineering (IJITWE), 17(1):1–20.

Rey, V., S

´

anchez, P. M. S., Celdr

´

an, A. H., and Bovet, G.

(2022). Federated learning for malware detection in

iot devices. Computer Networks, 204:108693.

Stratosphere (2015). Stratosphere laboratory datasets. Re-

trieved June 13, 2023, from https://www.stratosphere

ips.org/datasets-overview.

Wang, W., Zhu, M., Zeng, X., Ye, X., and Sheng, Y.

(2017). Malware traffic classification using convo-

lutional neural network for representation learning.

In 2017 International conference on information net-

working (ICOIN), pages 712–717. IEEE.

Wang, Z., Fok, K. W., and Thing, V. L. (2022). Machine

learning for encrypted malicious traffic detection: Ap-

proaches, datasets and comparative study. Computers

& Security, 113:102542.

Banking Malware Detection: Leveraging Federated Learning with Conditional Model Updates and Client Data Heterogeneity

319