Fuel Classification in Electronic Tax Documents

Y

´

uri Faro Dantas de Sant’Anna

1 a

, Mariana Lira de Farias

2,3 b

, Methanias Colac¸o J

´

unior

2,3 c

,

Daniel Oliveira Dantas

2,3 d

and Max Castor Rodrigues Junior

3 e

1

Centro de Inform

´

atica, Universidade Federal de Pernambuco, Recife, PE, Brazil

2

Departamento de Computac¸

˜

ao, Universidade Federal de Sergipe, S

˜

ao Crist

´

ov

˜

ao, SE, Brazil

3

Centro Universit

´

ario Est

´

acio de Sergipe, Aracaju, SE, Brazil

Keywords:

Supervised Learning, Invoice, Text Classification, Naive Bayes.

Abstract:

The Tax on the Circulation of Goods and Services (Imposto sobre Circulac¸

˜

ao de Mercadorias e Servic¸os,

ICMS), a responsibility of the federative units, is the main Brazilian tax collection resource. One way to

collect this tax is through a product’s weighted average price to the end consumer (prec¸o m

´

edio ponderado

ao consumidor final, PMPF) of a product. The PMPF is the only resource for charging state fees for the fuel

segment, so if improperly calculated, it can lead to losses both in the collection of public funds and in the

evolution of prices practiced by merchants. The objective of this work is to make a comparative analysis

of classification algorithms used to calculate the PMPF of fuels in the state of Sergipe to select the most

appropriate technique. This system circumvented deficiencies present in the previously applied simple random

sampling methodology. The naive Bayes algorithm was considered the most effective approach due to its high

accuracy and feasibility of application in a real-life scenario.

1 INTRODUCTION

The Tax on the Circulation of Goods and Services

(Imposto sobre Circulac¸

˜

ao de Mercadorias e Servic¸os,

ICMS) is the revenue with the highest volume of col-

lection in all Brazilian states (Rezende, 2009). Regu-

lated by the Kandir Act (Brasil, 1996). Its collection

is based on the product category and the current state

legislation, defining the rate and the calculation base

used for each economic segment or product.

The weighted average price to the end consumer

(prec¸o m

´

edio ponderado a consumidor final, PMPF)

is a value that reflects the average price used by mer-

chants to final consumers (Santo, 2021) and aims to

facilitate the review and monitoring of the ICMS col-

lection. According to Queiroz (Queiroz et al., 2014),

this is an essential factor in the reduction of fraud and

tax evasion since the ICMS of the entire chain of these

products will be collected only by the producer so that

the calculation base of the transactions is determined

once and by a single actor. It is important to empha-

a

https://orcid.org/0000-0002-3527-6862

b

https://orcid.org/0009-0007-3113-2849

c

https://orcid.org/0000-0002-4811-1477

d

https://orcid.org/0000-0002-0142-891X

e

https://orcid.org/0000-0003-0392-6696

size that the PMPF is obtained by calculations made

through the product’s final price and can be mapped

from market research, tax inspections to taxpayers,

and the issued receipts.

The consumer receipt (Nota Fiscal de Consumi-

dor Eletr

ˆ

onica, NFC-e) is a digital document issued

and stored electronically that aims to document trans-

actions of movement of goods or services rendered

(Brasil SPED, 2016). Within this document, various

resources (fields) aim to map the various characteris-

tics of the products, in addition to the values relating

to their emission (product price, tax, freight, etc).

The Mercosur Common Nomenclature (Nomen-

clatura Comum do Mercosul, NCM) is a classifica-

tion of goods present in receipts that maps goods into

affinity groups. The Department of Finance (Secre-

taria da Fazenda, SEFAZ) may obtain the PMPF of

fuels through a sample of NFC-e filtered by the codes

that represent them.

The classification in the NCM is an assignment of

the taxpayers and has a declaratory character. Thus,

there is no legal penalty for NCM errors or omissions

in tax documents. Therefore, in the calculation of

PMPF, fuel receipts with incorrect or missing codes,

as well as receipts of other products wrongly classi-

fied, can be taken into account.

Dantas de Sant’Anna, Y., Lira de Farias, M., Colaço Júnior, M., Dantas, D. and Rodrigues Junior, M.

Fuel Classification in Electronic Tax Documents.

DOI: 10.5220/0012390900003654

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 13th International Conference on Pattern Recognition Applications and Methods (ICPRAM 2024), pages 337-343

ISBN: 978-989-758-684-2; ISSN: 2184-4313

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

337

In addition to the problem generated by the fill-

ing of the NCM, the calculation of the PMPFs is

done in a sampling manner, and their average is cal-

culated purely statistically. The value is subject to

the variations caused by the selection of the different

samples. Due to these problems, several states have

sought strategies for a more accurate calculation of

their PMPFs, avoiding the bias of selecting a sample

that does not faithfully represent the reality of prices,

limited to receipt filled with the code relevant to the

fuel type and subject to non-fuel receipt.

The use of pattern recognition techniques, espe-

cially classification algorithms, has the potential to

eliminate the problems mentioned above. According

to Jarude (Jarude, 2020), using these techniques can

lead to significant gains in the efficiency of the ser-

vices provided by the tax administration.

The objective of this study is to select and evaluate

algorithms to classify invoices into fuel classes. The

class is used to calculate the average product price

in a dynamic real-life scenario such as the one found

at SEFAZ in Sergipe. The classifier must be able to

identify the fuel class from the textual field containing

the product descriptions in the invoices, thus circum-

venting the problems in the NCM classification.

This study is organized as follows: Section 2

presents related works and relevant references for the

development of this project. Section 3 contains the

methodology used in conducting this study. In Sec-

tion 4 are the development steps of the classifier. In

Section 5, the results are discussed. Finally, Section 6

presents the conclusions and possible future works.

2 RELATED WORKS

The study of Batista (Batista et al., 2018) aims to au-

tomatically classify NCM codes based on product de-

scriptions contained in NFC-e. Using the naive Bayes

algorithm, the invoices were classified into two NCM

classes. Batista used three datasets with different dif-

ficulties, simple, medium, and complex, obtaining ac-

curacies of 98%, 90%, and 83% respectively.

Dias (Dias and J

´

unior, 2022) used classification

committees to identify products sold in Rio Grande

do Norte state based on the product description field

of a document similar to NFC-e. Different commit-

tee architectures were used so that it was possible to

compare their robustness. The bagging architecture

obtained the best performance.

The work of Madeira (Madeira, 2015) applied

data analysis and mining techniques to identify in-

voices issued incorrectly based on the description of

the services provided. A system was developed with

the k-means algorithm, where the NFC-e from the

tax subgroup code 07.19.04 (consulting engineering

services) previously pre-classified were used, using

the naive Bayes and stochastic gradient descent algo-

rithms.

The present work differs from others due to the

need to generate a classifier that recognizes and

groups products recognized as fuels, not just cate-

gories, within an authentic and comprehensive mass

of tax documents. This objective is achieved through

a comparative analysis between the tested algorithms

and selecting the methodology that obtained the best

results.

3 METHODOLOGY

The proposed methodology can be divided into four

steps: planning and selecting algorithms, data collec-

tion and generation of databases, comparison of algo-

rithms, and analysis of results.

The first step consisted of a literature review to

find algorithms that could present themselves as pos-

sible solutions to the proposed problem. The tech-

niques listed as applicable to our problem were the

naive Bayes algorithm, classification with a support

vector machine, K-nearest neighbors, random forests,

and decision trees.

In the second step, three datasets were created,

two for training and one for testing the classifier. Ac-

cording to D

¨

onmez (D

¨

onmez, 2013), the number of

inputs used for training is crucial for the efficacy of

classifying algorithms. Therefore, an eight-day set

of invoice items was used. Approximately 500,000

NFC-e are issued per day in the state.

The first training dataset is called the Natural

dataset. It contains product descriptions that are con-

tained in fuel invoices that are issued over a day. It

has two columns: product description, which is the

classifier input, and fuel class, which is the variable

to predict.

According to Purohit (Purohit et al., 2015), it is

common in text classification problems to use key-

words that discriminate a particular set instead of us-

ing the full texts, which may contain noise or terms

irrelevant to data classification. Therefore, a Keyword

dataset containing standard terms found in invoice de-

scriptions was also created to verify the applicability

of keywords and a possible gain in the performance of

the fuel classifier with their use. Similarly to the Nat-

ural dataset, it consists of two columns: the keyword,

which represents the input data of the classifier, and

the fuel class, the target variable to predict.

Furthermore, the Test dataset was created with the

ICPRAM 2024 - 13th International Conference on Pattern Recognition Applications and Methods

338

description of the products contained in the invoices

issued over the remaining seven days. More details

about the datasets are given in Subsection 4.2.2. Fi-

nally, the algorithms were evaluated using a Monte

Carlo method based on four quality metrics: accuracy,

sensitivity, precision, and kappa coefficient. Each step

will be detailed in the following sections.

The Python programming language in version 3.7

and an Oracle database management system (SGDB)

were used to develop the classifiers. The language has

libraries with extensive documentation and applica-

bility in actual cases, such as the consolidated scikit-

learn used for classifier training and the evaluation

methodology (Scikit-learn, 2022).

4 FUEL CLASSIFIER

DEVELOPMENT

This section will explain the process of developing

the experiments for constructing the SEFAZ-SE fuel

classifier. The experimental process was based on that

presented by Wohlin (Wohlin et al., 2012).

4.1 Objective Definition

The objective definition of this study was formal-

ized using the GQM (goal, question, metric) approach

(Caldiera and Rombach, 1994). Our study aims to

create a functional fuel classifier that can categorize

electronic invoices from the fuel industry. This clas-

sification allows calculating the PMPF for each prod-

uct category. Experiments were conducted using the

selected algorithms to determine the most effective

technique based on their accuracy, sensitivity, preci-

sion, and kappa coefficient.

4.2 Planning of Experiments

To identify the most effective classifier, the algo-

rithms were trained using two datasets: the Natural

database and the Keyword database. The Test dataset

was used for testing. The algorithms used, the process

of creating the datasets, and details about the experi-

ments will be detailed below.

4.2.1 Algorithms

Five algorithms were compared to find a promising

solution to solve the classification problem. They all

use their canonical structure, widely explored to solve

problems like this (Duda et al., 2001) (Kubat, 2017).

The algorithms used were naive Bayes, KNN, SVC,

random forest, and decision tree.

4.2.2 Datasets

Three datasets were developed, two for training (Nat-

ural and Keyword) and a Test dataset. The two train-

ing datasets were created to verify the potential ben-

efit of utilizing frequent terms from fuel descriptions

in the training, instead of complete descriptions, in

the classifier’s performance. All three datasets have

two columns: one with the product class and another

with the text to be classified.

The Natural dataset is composed of product de-

scriptions from the day of NFC-e. It has two columns:

product class and product description. Table 2 shows

an example of this base.

On the other hand, the Keyword dataset is com-

posed of terms frequently used to describe the fu-

els present in the SEFAZ-SE database. This dataset

has two columns: product class and frequent terms.

Table 3 illustrates an example of records from this

database. It is important to note that there are thou-

sands of contributors to the fuel segment alone in a

database of this size. Each contributor can use differ-

ent ways to describe their products. Standard word

detection was done through database queries and em-

pirical mapping with the help of the audit team re-

sponsible for monitoring this segment.

The Test dataset contains descriptions of products

present in NFC-e issued in one week. This dataset

has two columns: product class and the product de-

scription. The variable to be predicted by the clas-

sifier is the product class. It can assume one of the

following eight categories: REGULAR GASOLINE,

GASOLINE WITH ADDITIVES, DIESEL OIL S10,

DIESEL OIL S500, VEHICULAR NATURAL GAS,

AVIATION KEROSENE, LPG (liquefied petroleum

gas), and IGNORED.

In a production environment, several non-fuel

products are misplaced under NCM categories differ-

ent from theirs. These occurrences also need to be

identified by the fuel classifier. Therefore, the IG-

NORED category has been created, a collection of

products often incorrectly placed under NCMs fuel

categories.

The three datasets were labeled manually, and on

account of the eight-day volume of invoices, dupli-

cate terms were removed to reduce the datasets and

facilitate the labeling step. Therefore, the Natural

dataset contains 1285 records, while the Keyword

dataset contains 207 record, and the Test dataset 2499

records. Table 1 shows the number of records per

product class.

To create the Natural and Test datasets, the in-

voices were filtered based on NCM codes, in which it

was possible to find products from the desired group

and not just the NCMs that are indicated for these

Fuel Classification in Electronic Tax Documents

339

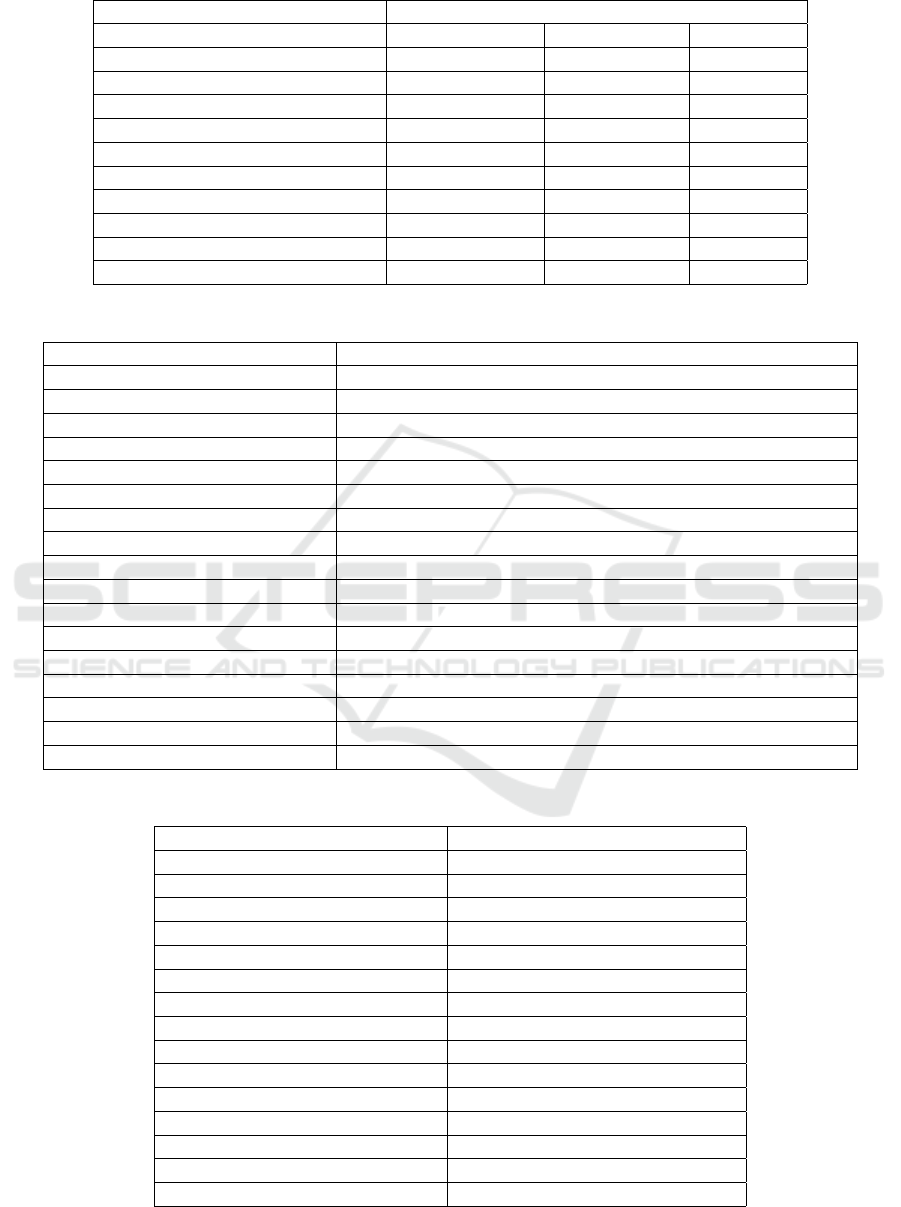

Table 1: Distribution of examples by class.

Number of records

Product class Keyword dataset Natural dataset Test dataset

FUEL ALCOHOL (ETHANOL) 13 46 35

VEHICULAR NATURAL GAS 8 12 4

GASOLINE WITH ADDITIVES 8 54 36

REGULAR GASOLINE 8 42 38

PREMIUM GASOLINE 8 1 1

LPG 12 25 33

IGNORED 124 1047 2310

DIESEL OIL S10 8 50 35

DIESEL OIL S500 8 7 6

AVIATION KERESONE 8 1 1

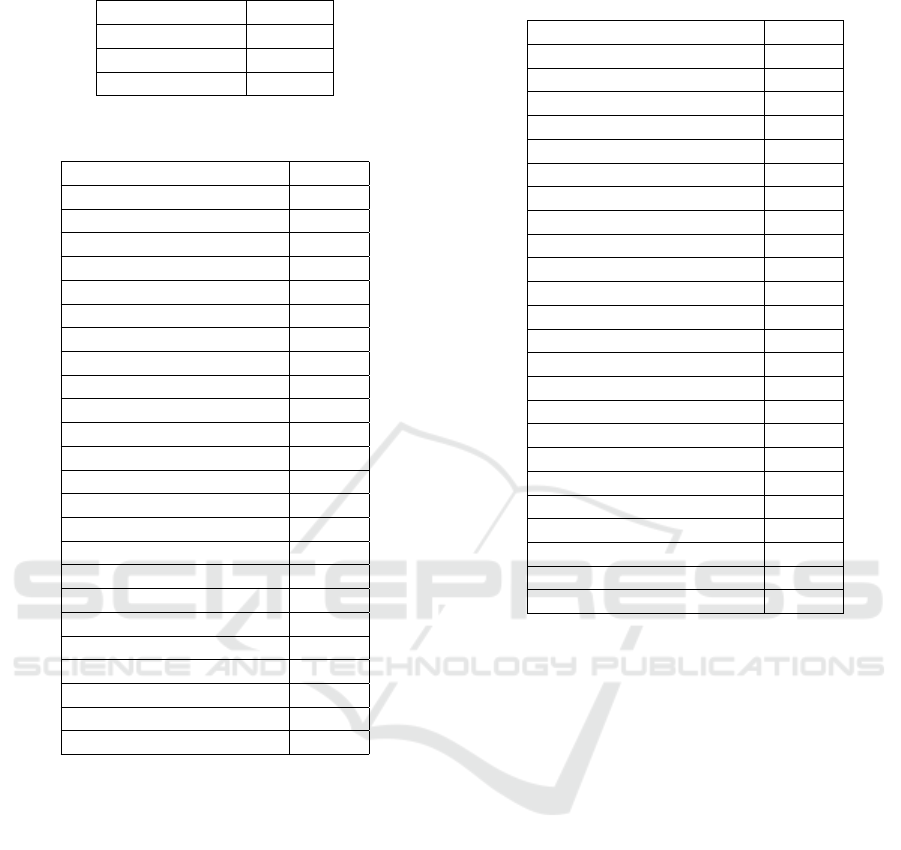

Table 2: Natural dataset example.

Product class Data example

IGNORED OLEO LUBRAX TURBO 15W40

IGNORED ALCOOL LIQ BRILUX 70 500ML

REGULAR GASOLINE GASOLINA C COMUM (B1)

REGULAR GASOLINE GASOLINA COMUM B6

REGULAR GASOLINE GASOLINA TIPO C Bico

GASOLINE WITH ADDITIVES GASOLINA ADITIVADA VPOWER BICO 15

GASOLINE WITH ADDITIVES GASOLINA ADITIVADA V POWER BICO 13

GASOLINE WITH ADDITIVES GASOLINA PETROBRAS GRID B7

VEHICULAR NATURAL GAS GNV GAS NATURAL

VEHICULAR NATURAL GAS GAS NATURAL VEICULO-GNV

DIESEL OIL S10 DIESEL EVOLUX S-10 B3

DIESEL OIL S10 OLEO DIESEL B S10 ADITIVADO PETROBRAS GRID B1

DIESEL OIL S500 OLEO DIESEL BS 500 ADITIVADO

DIESEL OIL S500 OLEO DIESEL B S500 B9

LPG GLP BOTIJAO 13 KG

LPG GLP VASILHAME SGB 13KG

AVIATION KEROSENE JET A1 NAO TABELADO - LI

Table 3: Keyword dataset example.

Product class Data example

IGNORED LUBRAX TURBO

IGNORED ALCOOL BRILUX

REGULAR GASOLINE GASOLINA COMUM

REGULAR GASOLINE GASOLINA TIPO C

GASOLINE WITH ADDITIVES GASOLINA V-POWER

GASOLINE WITH ADDITIVES GASOLINA PETROBRAS GRID

VEHICULAR NATURAL GAS GNV

VEHICULAR NATURAL GAS GAS NATURAL VEICULO

DIESEL OIL S10 OLEO DIESEL S10 COMUM

DIESEL OIL S10 OLEO DIESEL BS10

DIESEL OIL S500 EXTRA DIESEL BS 500

DIESEL OIL S500 OLEO DIESEL S500

LPG GLP 13KG

LPG GLP 13KG

AVIATION KEROSENE JET A-1 NAO TABELADO - LI

ICPRAM 2024 - 13th International Conference on Pattern Recognition Applications and Methods

340

Table 4: Statistical tests.

Test p-Value

Kruskall-Wallis 0

Friedman 0

Wilcoxon 0.0388

Table 5: Ranking of algorithms according to accuracy (A).

Algorithm A

Naive Bayes - KW 0,9996

KNN (1 neighbor) - KW 0,9869

SVC - KW 0,9836

KNN (3 neighbor) - KW 0,9817

KNN (2 neighbor) - KW 0,9784

Random forest - KW 0,9772

Decision tree - KW 0,9759

Random forest - NDS 0,9719

KNN (8 neighbor) - KW 0,9695

KNN (6 neighbor) - KW 0,9686

Decision tree - NDS 0,966

KNN (7 neighbor) - KW 0,9658

KNN (4 neighbor) - KW 0,9638

KNN (5 neighbor) - KW 0,9522

SVC - NDS 0,9462

Naive Bayes - NDS 0,5655

KNN (1 neighbor) - NDS 0,2937

KNN (2 neighbor) - NDS 0,2501

KNN (4 neighbor) - NDS 0,2275

KNN (3 neighbor) - NDS 0,2241

KNN (5 neighbor) - NDS 0,214

KNN (6 neighbor) - NDS 0,2072

KNN (7 neighbor) - NDS 0,1926

KNN (8 neighbor) - NDS 0,1862

products. It should be noted that there are cases in

which fuels are linked with incorrect NCM codes.

Therefore, these codes were also considered in this

process.

The NCM codes used were: From group 27 (min-

eral fuels, mineral oils and products of their dis-

tillation; bituminous materials and mineral waxes),

22071090 (Neutral alcohol), 22072019 (drinks, al-

coholic liquids, and kinds of vinegar - Undenatured

ethyl alcohol, with an alcohol content by volume

equal to or greater than 80%; ethyl alcohol and spirits,

denatured, with any alcohol content - Ethyl alcohol

and spirits, denatured, with any alcohol content) and

84812090 (Nuclear reactors, boilers, machines, appa-

ratus and mechanical instruments, and parts thereof

- Taps, valves and similar devices, for pipes, boilers,

reservoirs, vats and other containers - Valves for hy-

draulic or pneumatic oil transmissions).

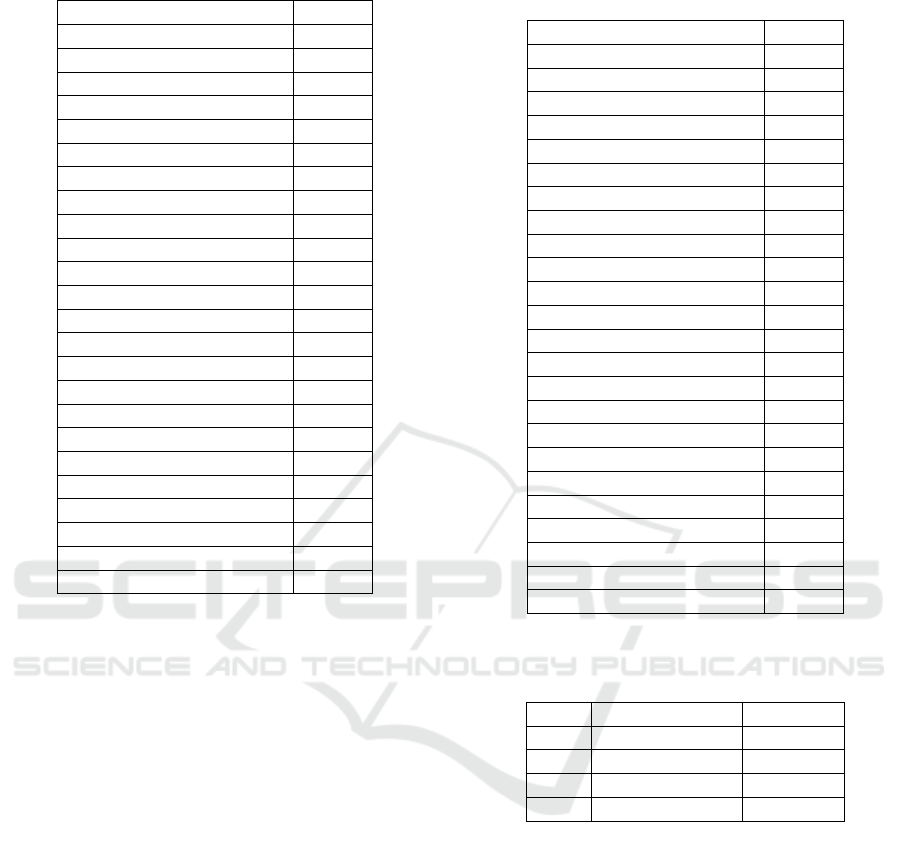

Table 6: Classification of algorithms according to precision

(P).

Algorithm P

Naive Bayes - KW 0,9997

KNN (1 neighbor) - KW 0,9914

Random forest -KW 0,9912

SVC - KW 0,9908

KNN (3 neighbors) - KW 0,9884

KNN (4 neighbors) - KW 0,9873

Decision tree - KW 0,9868

KNN (2 neighbors) - KW 0,9867

KNN (5 neighbors) - KW 0,9861

KNN (2 neighbors) - NDS 0,986

KNN (1 neighbor) - NDS 0,986

KNN (3 neighbors) - NDS 0,9858

KNN (5 neighbors) - NDS 0,984

KNN (6 neighbors) - NDS 0,9834

KNN (8 neighbors) - KW 0,9832

KNN (6 neighbors) - KW 0,9828

KNN (8 neighbors) - NDS 0,9826

Random forest - NDS 0,9824

KNN (7 neighbors) - NDS 0,9821

Decisiton tree - NDS 0,98

SVC - NDS 0,9797

KNN (4 neighbors) - NDS 0,9782

KNN (7 neighbors) - KW 0,9762

Naive Bayes - NDS 0,9607

4.3 Experiments

Initially, the databases went through preprocessing

steps in order to increase the quality of the classi-

fication. Terms related to fuel pump numbers were

removed from the note descriptions using regular ex-

pressions (BICO [0-9]+ and B[0-9]+). To adapt the

inputs to the algorithms, the vectorization technique

was applied, which consists of converting texts into

matrices of terms.

It is important to emphasize that, for each algo-

rithm, two models were trained: one with the Natural

dataset (identified with the name of the algorithm and

the acronym NDS) and the other with the Keyword

dataset (identified with the name of the algorithm and

acronym KW).

For the execution and validation of the results,

the Monte Carlo (Besag and Diggle, 1977) evalua-

tion method was used, where up to 20% (the exact

value is chosen randomly) of the Test dataset was re-

moved at each iteration. A total of 100 iterations were

performed. At each iteration, the evaluation metrics

mentioned above were calculated.

In the Test step, comparisons of the metrics were

made. The mean, median, and maximum values of

Fuel Classification in Electronic Tax Documents

341

Table 7: Ranking of algorithms according to sensitivity (S).

Algorithm S

Naive Bayes - KW 0,9996

KNN (1 neighbor) - KW 0,9869

SVC - KW 0,9836

KNN (3 neighbors) - KW 0,9817

KNN (2 neighbors) - KW 0,9784

Random forest - KW 0,9772

Decision tree - KW 0,9759

Random forest - NDS 0,9719

KNN (8 neighbors) - KW 0,9695

KNN (6 neighbors) - KW 0,9686

Decision tree - NDS 0,966

KNN (7 neighbors) - KW 0,9658

KNN (4 neighbors) - KW 0,9638

KNN (5 neighbors) - KW 0,9522

SVC - NDS 0,9462

Naive Bayes - NDS 0,5655

KNN (1 neighbor) - NDS 0,2937

KNN (2 neighbors) - NDS 0,2501

KNN (4 neighbors) - NDS 0,2275

KNN (3 neighbors) - NDS 0,2241

KNN (5 neighbors) - NDS 0,214

KNN (6 neighbors) - NDS 0,2072

KNN (7 neighbors) - NDS 0,1926

KNN (8 neighbor) - NDS 0,1862

the 100 iterations were calculated. Tables 5, 6, 7 and

8 show the average results for each metric.

In order to verify the distribution of the accu-

racies, statistical tests were applied. Three non-

parametric tests were used: Kruskal-Wallis, Fried-

man, and Wilcoxon. The results of the statistical tests

are in Table 4.

5 RESULTS

Evaluation metrics allow us to analyze how correct a

model is in its predictions (Han et al., 2011). We eval-

uated the performance of the proposed classifiers with

four evaluation metrics: accuracy (A), precision (P),

sensitivity (S), and kappa coefficient (K) (Han et al.,

2011).

Three approaches, trained using the Keyword

dataset, have very close values: naive Bayes, KNN

with one neighbor, and SVC. By analyzing the results

obtained, shown in the tables below, it was possible to

answer the research question of this project. The three

statistical tests show p-values lower than the signifi-

cance level. Therefore, it can be concluded that there

is a significant difference between the results of these

techniques.

Table 8: Ranking of algorithms according to the kappa co-

efficient (K).

Algorithm K

Naive Bayes - KW 0,9972

KNN (1 neighbor) - KW 0,9102

SVC - KW 0,8948

KNN (3 neighbors) - KW 0,8767

KNN (2 neighbors) - KW 0,8586

Decision tree - KW 0,8545

Random forest - KW 0,8522

Random forest - NDS 0,8337

Decision rree - NDS 0,8031

KNN (8 neighbors) - KW 0,7932

KNN (6 neighbors) - KW 0,7929

KNN (4 neighbors) - KW 0,7791

KNN (7 neighbors) - KW 0,7694

SVC - NDS 0,7214

KNN (5 neighbors) - KW 0,7163

Naive Bayes - NDS 0,1969

KNN (1 neighbor) - NDS 0,1097

KNN (2 neighbors) - NDS 0,0995

KNN (3 neighbors) - NDS 0,0944

KNN (4 neighbors) - NDS 0,0933

KNN (5 neighbors) - NDS 0,0906

KNN (6 neighbors) - NDS 0,0893

KNN (7 neighbors) - NDS 0,0862

KNN (8 neighbors) - NDS 0,0851

Table 9: Evolution of Collection in the months of July and

August.

Year Fuel revenue Evolution

2019 52 million BRL 1%

2018 51 million BRL -13%

2017 42 million BRL 0,007%

2016 48 million BRL -4%

With the information obtained in the section above

and the metrics listed in the tables, it is possible to ver-

ify that applying the naive Bayes algorithm is the most

appropriate option for the proposed problem. Using

the dataset with keywords significantly increased the

metrics of the models trained with it.

Given the promising results, the classifier was offi-

cially implemented in May 2019. The initial tax pay-

ments, fully computed by the classification system,

were executed in July 2019. Table 9 shows the in-

crease in revenue within the fuel sector compared to

the corresponding periods in previous years. To miti-

gate the seasonality impact, this analysis assessed the

revenue evolution between July and August. An in-

crease in revenue was observed during a month his-

torically characterized by a decrease or stagnation.

ICPRAM 2024 - 13th International Conference on Pattern Recognition Applications and Methods

342

6 CONCLUSIONS AND FUTURE

WORK

This study proposed the development of an automatic

tool for classifying fuel prices to replace the statisti-

cal approach previously used by SEFAZ in the state

of Sergipe. Five commonly applied text classification

techniques were studied, evaluated, and compared.

Upon completing algorithm execution and evaluation,

it became evident that the naive Bayes classification

algorithm was the most efficient in addressing the pro-

posed problem and forming the developed tool.

After implementation, continuous evaluation, and

successful use, it was concluded that the system

exhibits high reliability and effectiveness. Conse-

quently, the system was adopted by the tax auditor

team responsible for the fuel sector. Its use has sig-

nificantly improved the accuracy and speed of calcu-

lating the averages used for the PMPF. It is worth not-

ing that the results of classifications performed in a

real-life scenario were audited and approved by the

gas station union in Sergipe.

The success achieved in implementing the fuel

classifier highlights the potential of applying this pat-

tern recognition algorithm in tax scenarios. The re-

sults indicate that the tool may function in a broader

scope, although there is no guarantee that the high de-

gree of assertiveness obtained will be maintained if

applied to products from other economic segments.

Potential future work may involve extending clas-

sification algorithms to other tax segments. The re-

sults underscore the possibility of employing some of

these techniques to formulate tax guidelines, a fiscal

resource that monitors the prices of specific products

for tax collection, price monitoring, and price trans-

parency for the end consumer.

This study was financed in part by the

Coordenac¸

˜

ao de Aperfeic¸oamento de Pessoal de

N

´

ıvel Superior, Brasil (CAPES), Finance Code 001.

REFERENCES

Batista, R. d. A., Bagatini, D. D., and Frozza, R. (2018).

Classificac¸

˜

ao autom

´

atica de c

´

odigos NCM utilizando

o algoritmo na

¨

ıve bayes. iSys-Brazilian Journal of In-

formation Systems, 11(2):4–29.

Besag, J. and Diggle, P. J. (1977). Simple Monte Carlo tests

for spatial pattern. Applied Statistics., 26(3).

Brasil (1996). Lei complementar nº 87, de 13 de setembro

de 1996. Available at: http://www.planalto.gov.br/cc

ivil\ 03/leis/LCP/Lcp87.htm. Last accessed: 8 jun,

2022.

Brasil SPED (2016). NFC-e. Available at: http://sped.rfb.g

ov.br/pagina/show/1519. Last accessed: 8 jun, 2022.

Caldiera, V. R. B. G. and Rombach, H. D. (1994). The goal

question metric approach. Encyclopedia of software

engineering, pages 528–532.

Dias, E. R. F. and J

´

unior, J. C. X. (2022). Classificac¸

˜

ao

autom

´

atica de produtos comercializados por

´

org

˜

aos

p

´

ublicos do Rio Grande do Norte atrav

´

es de comit

ˆ

e de

classificadores. Research, Society and Development,

11(9):e29211931836–e29211931836.

Duda, R. O., Hart, P. E., and Stork, D. G. (2001). Pattern

Classification. Wiley, New York, 2nd edition.

D

¨

onmez, P. (2013). Introduction to Machine Learning. Nat-

ural Language Engineering, 19(2):285–288.

Han, J., Pei, J., and Kamber, M. (2011). Data mining: con-

cepts and techniques. Elsevier.

Jarude, J. N. D. M. (2020). O estado da arte da

fiscalizac¸

˜

ao tribut

´

aria federal e o uso de intelig

ˆ

encia

artificial. Publicac¸

˜

oes de Parceiros da Enap —

Financ¸as P

´

ublicas.

Kubat, M. (2017). An Introduction to Machine Learning.

Springer International Publishing, Gewerbestrasse 11,

6330 Cham, Switzerland, 2nd edition.

Madeira, R. d. O. C. (2015). Aplicac¸

˜

ao de t

´

ecnicas de

minerac¸

˜

ao de texto na detecc¸

˜

ao de discrep

ˆ

ancias em

documentos fiscais. PhD thesis, FGV EMAP.

Purohit, A., Atre, D., Jaswani, P., and Asawara, P. (2015).

Text classification in data mining. International Jour-

nal of Scientific and Research Publications.

Queiroz, J. V., Lima, N. C., Oliveria, S. V. W. B. d., Martins,

E. S., and Oliveira, M. M. B. d. (2014). Considerac¸

˜

oes

tribut

´

arias do combust

´

ıvel etanol hidratado. Revista de

Administrac¸

˜

ao e Ci

ˆ

encias Cont

´

abeis do IDEAU.

Rezende, F. (2009). ICMS: Como era, o que mudou

ao longo do tempo, perspectivas e novas mudanc¸as.

Available at: https://efaz.fazenda.pr.gov.br/sites/d

efault/arquivos restritos/files/migrados/File/Forum

Fiscal dos Estados/FFEB Caderno n 10.pdf. Last

accessed: 8 jun, 2022.

Santo, E. (2021). Nota de esclarecimento. Available at:

https://sefaz.es.gov.br/Media/Sefaz/Not\%C3\%A

Dcias/Nota\%20de\%20esclarecimento\%20sobr

e\%20combust\%C3\%ADveis\%20(1).pdf. Last

accessed: 8 jun, 2022.

Scikit-learn (2022). Scikit-learn: Machine Learning on

Python — SVM — scores and probabilities. Avail-

able at: https://scikit-learn.org/stable/modules/svm.

html#scores-and-probabilities. Last accessed: 8 jun,

2022.

Wohlin, C., Runeson, P., H

¨

ost, M., Ohlsson, M. C., Reg-

nell, B., and Wessl

´

en, A. (2012). Experimentation in

software engineering. Springer Science & Business

Media.

Fuel Classification in Electronic Tax Documents

343