Analysis of Intraday Financial Market Using ML and Neural

Networks for GBP/USD Currency Pair Price Forecasting

Melis Zhalalov and Vitaliy Milke

a

Computing and Information Science, Anglia Ruskin University, East Road, Cambridge, U.K.

Keywords: Artificial Neural Networks, Machine Learning, K-Nearest Neighbors, Logistic Regression, Decision Trees,

Random Forest, Support Vector Machines (SVM), MLP, LSTM, Intraday Trading.

Abstract: This study employs a range of machine learning and artificial neural network techniques for financial market

price prediction. The approach involves data preprocessing, feature engineering, and model evaluation using

daily and 5-minute interval records. Leveraging methods like K-Nearest Neighbors, Logistic Regression,

Decision Trees, Random Forest, Support Vector Machines, Multi-Layer Perceptron and Long Short-Term

Memory networks, the models exhibit distinct strengths and limitations. Notably, the LSTM model achieved

an accuracy of 63%, while Random Forest demonstrated 60% accuracy, indicating promising results for

intraday trading. It is essential to acknowledge that due to the exclusion of night hours, the approach is tailored

specifically for intraday trading. This study offers a valuable approach to exchange rate prediction, providing

an additional practical resource for practitioners and researchers in the field of financial market forecasting.

1 INTRODUCTION

Forecasting financial market trends, particularly in

foreign exchange and stock markets, presents a

longstanding challenge due to their inherently volatile

and unpredictable nature. Reasonable predictions are

paramount in investment decision-making, risk

management, and portfolio optimisation. The advent

of advanced technology and the availability of

extensive historical data have paved the way for data-

centric approaches, including machine learning (ML)

and artificial neural networks (ANN), to address this

complicated task.

Conventional forecasting methods often fail to

capture the nuanced patterns steering market

movements. These movements predominantly focus

on a single method, as outlined in a study conducted

by Altman (1968), who used univariate approaches to

predict corporate bankruptcy. This study addresses

limitations by employing machine learning

algorithms to unveil concealed trends. Notably, the

focus is exclusively on short-term intraday market

movements, ranging from minutes to several hours.

This domain encompasses rapid fluctuations and

complex interactions influencing currency prices

a

https://orcid.org/0000-0001-7283-2867

within a single trading day. It is imperative to

distinguish this focus from high-frequency trading

(HFT), which operates at rapid speeds measured in

milliseconds to seconds and requires expensive

infrastructure investments, as illustrated in the study

conducted by MacKenzie (2019). By narrowing the

scope to short-term intraday movements, the aim is to

recognise the underlying forces driving these market

shifts and construct predictive models effectively.

The primary objective of this research is to

develop models to forecast the direction of the

following price movement of the GBP/USD currency

pair and the level of the future closing price of the

selected time frame relative to the opening price

(higher or lower). Market data spanning from 2022 to

mid-2023 is utilised using a data-centric approach.

The emphasis lies in employing various ML

classification techniques, encompassing Support

Vector Machines, Decision Trees, Random Forests,

K-nearest Neighbors, Logistic Regression, and Long-

Short-Term Memory (LSTM) to discern relationships

within the data and hidden patterns for making

informed financial decisions.

Furthermore, this study seeks to address another

research gap by identifying early indicators of

significant price movements within flat swings—

periods characterised by relatively stable prices.

734

Zhalalov, M. and Milke, V.

Analysis of Intraday Financial Market Using ML and Neural Networks for GBP/USD Currency Pair Price Forecasting.

DOI: 10.5220/0012386700003636

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 16th International Conference on Agents and Artificial Intelligence (ICAART 2024) - Volume 3, pages 734-741

ISBN: 978-989-758-680-4; ISSN: 2184-433X

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

Recognising these cues can significantly enhance

short-term price prediction and the trading system's

potential profit. By excluding external factors, a

targeted method for prediction is provided, with a

pronounced emphasis on historical data to isolate and

analyse patterns associated with flat periods.

The distinctiveness of this approach lies in its

emphasis on optimising accuracy using exclusively

digital historical datasets, but simultaneously for bid

and ask prices in the order book. This is pivotal, as

accessibility to other big data, such as news or text

comments from market participants, may vary, and

processing it can be resource-intensive. By relying on

numerical historical data, the need for extensive

preprocessing is circumvented, thereby simplifying

computation and processing time in various formats,

and does not require expert weighing of the

importance of such data. Additionally, this approach

directly addresses the challenge of extracting insights

from currency exchange market data in real-time

decision-making. In contrast to research integrating

factors such as news sentiment analysis and extensive

Twitter data (Maqsood et al., 2020), the concentration

is solely on historical data, streamlining the analysis

process. It is assumed that all news sentiments are

already included in the market prices of classical

financial instruments such as stocks, currencies,

bonds, ETFs (exchange-traded funds), but the market

is still inefficient.. By zeroing in on the most probable

flat movements independent of external influences,

this research contributes to a more sustainable and

efficient prediction model.

The successful application of these models carries

wide-ranging advantages. Individual investors may

potentially gain valuable insights for informed

decision-making and optimized investment

strategies. Financial institutions bolster their

credibility by offering expertise in data-driven

investment decisions. Effective risk management is

facilitated through improved predictions, aiding in

identifying and mitigating risks.

The research is based on data from the Repository

of (Dukascopy Bank Sa, 2023), a recognized source

for accurate currency rate datasets. The research

follows a two-step approach involving data

engineering techniques for preprocessing and

organizing the data, followed by applying Machine

learning (ML) methods and Neural Network (NN)

architectures to develop predictive models.

The rest of this paper is organized as follows:

Section 2 investigates the literature and state-of-the-

art studies on the topic; Section 3 describes the

proposed method; Section 4 outlines the results;

finally, the conclusions are drawn in Section 5.

2 RELATED WORK

The foundational work of Schierholt and Dagli (1996)

pioneers the application of AI techniques in stock

market prediction, explicitly focusing on data

preprocessing for the Standard & Poor's 500 Index.

Their utilisation of neural networks aligns closely

with this study's goal of predicting currency exchange

rate movements. While their study concentrates on

stock market movements using neural network

structures for prediction, it resonates with the

intention to forecast currency exchange rates.

Building on this foundation, Zhanggui, Yau, and

Fu (1999) introduce an innovative approach centred

on data preprocessing for pattern analysis and

relaxation classification for stock price prediction.

This method effectively captures changes in stock

prices over time, demonstrating its potential for

refining investment decisions. This research aligns

with the current research focusing on employing

advanced techniques for preprocessing financial data

as inputs for neural networks, predicting currency

exchange rates.

The research conducted by Islam and Hossain

(2021) proposes a model for predicting future closing

prices of FOREX currencies. The model combines

Gated Recurrent Unit (GRU) and Long Short-Term

Memory (LSTM) neural networks. The study focuses

on four major currency pairs: EUR/USD, GBP/USD,

USD/CAD, and USD/CHF. The experiment was

conducted for 10-minute and 30-minute timeframes,

and the performance of the model was evaluated

using regression metrics. The proposed hybrid GRU-

LSTM model demonstrated high accuracy in

predicting currency prices for both short and medium-

timeframes. It outperformed standalone GRU and

LSTM models and a simple moving average (SMA)

model.

The research paper by Abedin (2021) proposes an

ensemble deep learning approach that combines

Bagging Ridge (BR) regression with Bi-directional

Long Short-Term Memory (Bi-LSTM) neural

networks. This integrated model, referred to as Bi-

LSTM BR, is used to predict the exchange rates of 21

currencies against the USD, including GBP, during

both pre-COVID-19 and COVID-19 periods. The

study compares the proposed Bi-LSTM BR approach

with traditional machine learning algorithms (such as

Regression Tree, SVM and Random Forest

regression) as well as deep learning-based algorithms

like LSTM and Bi-LSTM regarding prediction error.

However, the performance of the model varies

significantly across different currencies and during

non-COVID-19 and COVID-19 periods, highlighting

Analysis of Intraday Financial Market Using ML and Neural Networks for GBP/USD Currency Pair Price Forecasting

735

the importance of prediction models in highly volatile

foreign currency markets.

Incorporating feature selection and a composite

classifier, Vignesh's (2018) comparative analysis

between SVM and LSTM for stock price prediction

highlights LSTM's effectiveness in temporal

processing. This aligns with this study's approach of

utilising LSTM alongside other AI methodologies for

predicting currency exchange rates.

In contrast to the papers listed above, one

distinctive feature of our approach is excluding night

hours from trading activities. This decision is rooted

in the understanding that market activity is reduced

during these hours, and the spread between ask and

bid prices is often too high, rendering trading non-

advantageous. This strategic exclusion optimises

trading performance by focusing on periods of

heightened market activity and reduced bid-ask

spread differentials.

Additionally, this research addresses the

categorical nature of the task, which aligns

seamlessly with intraday trading. By categorising

potential directions of short-term price movements

(of which there are only two: up or down), the model

can make more precise predictions, increasing the

likelihood of profitable trades due to the greater

statistical probability of achieving take profit on

short-term flat movements. Furthermore, this

approach is designed for real-time intraday trading

without HFT technologies and news analysis,

eliminating the need for big data or additional non-

numerical data sources. This streamlined process

allows the model to remain adaptable and efficient for

practical intraday trading scenarios without using

expensive computer hardware.

3 PROPOSED APPROACHES

In contrast to other state-of-the-art papers that

emphasize regression-based approaches for

forecasting the Close market price, the models

selected in this paper for predicting short-term price

movements encompass a variety of techniques

renowned for their effectiveness in classification

tasks and time series analysis. This approach proves

more advantageous for intraday trading, where

understanding the price movement direction holds

greater significance than precise numerical price

values. The models chosen are K-Nearest Neighbors

(KNN) (Aha, Kibler, and Albert, 1991), Support

Vector Machines (SVM) (Keerthi, 2001), Logistic

Regression (Cessie and Houwelingen, 1992),

Decision Trees, Random Forest (Breiman, 1996),

Multilayer Perceptron (MLP) (Pedregosa et al., 2011)

and Long Short-Term Memory (LSTM) networks

(Goodfellow, Bengio, and Courville, 2016).

The development process entails several

essential stages:

• Feature Engineering: This involves enhancing

the data to extract meaningful insights, such as

incorporating lagged features and technical

indicators (Long, Lu, and Cui, 2019).

• Training the models with Hyperparameter

Tuning: Fine-tuning parameters used in this

research are essential for optimal model

performance, particularly in the case of deep

neural networks (Hoque and Aljamaan, 2021).

• The evaluation and validation techniques used

in this research comply with the accepted

rigorous standards described (Nauta et al., 2023)

and are employed to ensure models generalise

well to new data, simulating real-world

conditions.

• Interpretability and Visualisation: Given the

complexity of some models, like LSTMs, it is

crucial to employ interpretability techniques to

bridge the gap between algorithmic insights and

human understanding (Samek et al., 2019).

• Addressing Market Volatility: The approach

accounts for market volatility by incorporating

measures like the Volatility Index (VIX),

allowing for more accurate predictions in

rapidly changing market conditions (Engle,

Ghysels, and Sohn, 2013).

The research leverages Python 3.7.1 as the primary

programming language, executed in the Jupyter

Notebook environment. It relies on key libraries like

Scikit-Learn (Pedregosa et al., 2011), TensorFlow

(Abadi et al., 2016) with Keras (Chollet et al., 2015),

Pandas for efficient data manipulation, and

Matplotlib and Seaborn for visualisation.

3.1 Data Used

Detailed, clean, trustworthy data is critical to

applying machine learning in finance. This research

uses data obtained from reliable sources (Dukascopy

Bank Sa, 2023). This dataset encompassed massive

historical market price and volume information,

providing a comprehensive view of past market

dynamics. This dataset included an array of vital

features, including 5-minute and daily open, high,

low and close prices for ask and bid orders in the

order book, trading volume executed separately at bid

and ask prices and additional relevant financial

metrics. These features were carefully curated to

serve as the foundation for these predictive models.

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

736

It is worth noting that the dataset incorporates data

from January 2022 to June 2023 (inclusive),

comprising approximately 220,000 rows, ensuring a

robust foundation for the machine learning analysis.

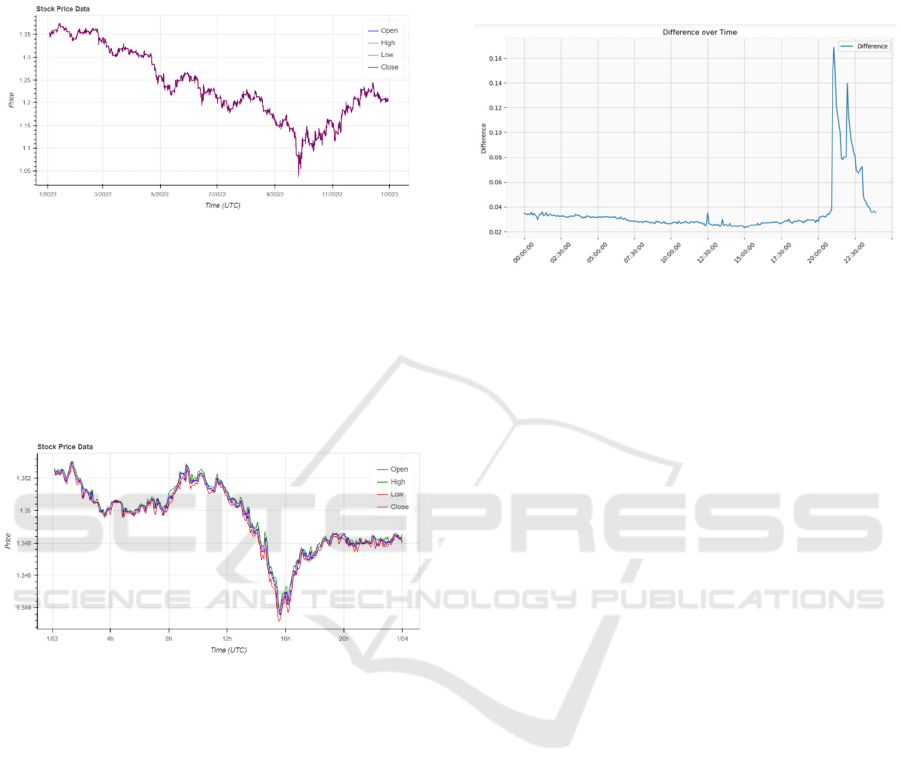

Figure 1: Time Series Plot of GDP/USD for the Whole Year

(2022).

Figure 1 offers a macroscopic view of GBP/USD

price movements throughout the entire year of 2022.

This visualisation provides a high-level perspective,

allowing for discerning long-term trends, seasonal

patterns, and significant events that have impacted the

financial markets during the year.

Figure 2: Time Series Plot of GDP/USD for One Day

(03/01/2022).

In contrast, Figure 2 zooms in on a single day,

focusing specifically on March 1, 2022. This fine-

grained time series plot enables detailed exploration

of intraday flat fluctuations, pinpointing volatility

patterns and exploring the nuanced dynamics of

market prices on a micro-timescale.

3.2 Data Preprocessing

Data preprocessing was pivotal in ensuring this

dataset's cleanliness, consistency and suitability for

model training.

3.2.1 Outliers Removal

In this phase, the outliers were identified, which were

data points significantly deviating from the norm.

These outliers were primarily associated with specific

hours, roughly from 9 p.m. to 1 a.m., when trading

activity was notably low (Table 1). Market prices

exhibited erratic and unpredictable movements

during these periods, posing challenges for accurate

modelling, as shown in Figure 3.

Figure 3: Hourly difference between Ask and Bed for 2022.

To address this issue, the noisy segment from the

dataset was removed. This decision was motivated by

the substantial spread between ask and bid prices

during these hours, making trading economically

impractical due to the significant potential loss.

These outliers were predominantly linked to noisy

hours characterized by less predictable fluctuations

due to reduced trading activity, so techniques like

clipping or transformation were implemented. These

outliers clipping involved capping extreme values to

a predefined range, effectively limiting the influence

of outliers on the analyses. Transformation

techniques allowed for the adjustment of the scale or

distribution of the data, rendering it more suitable for

modelling. By identifying and handling outliers,

especially those linked to noisy hours, the aim was to

construct a dataset that reflected stable and typical

trading conditions. This approach significantly

bolstered the robustness and dependability of the

predictive models. It ensured their effectiveness in

capturing meaningful patterns while mitigating the

impact of irregular fluctuations during specific hours.

In practical trading, taking profit from all potential

target price fluctuations is not so important, but it is

crucial to keep the deposit by avoiding incorrect

entries into the market when predictions are not

obvious and/or erroneous. Consequently, a strategic

decision was made to exclude these hours data (with

unpredictable volatility and large spreads) from the

initial dataset and refrain from trading during this

period. This novation further contributed to the better

accuracy of the modelling efforts.

Analysis of Intraday Financial Market Using ML and Neural Networks for GBP/USD Currency Pair Price Forecasting

737

3.2.2 Feature Engineering

To enhance the model's predictive capability,

additional feature engineering was performed,

allowing, in addition to the short-term patterns, to add

medium-term trends averaged over time. This

involved creating new features based on the historical

data, including but not limited to Moving averages of

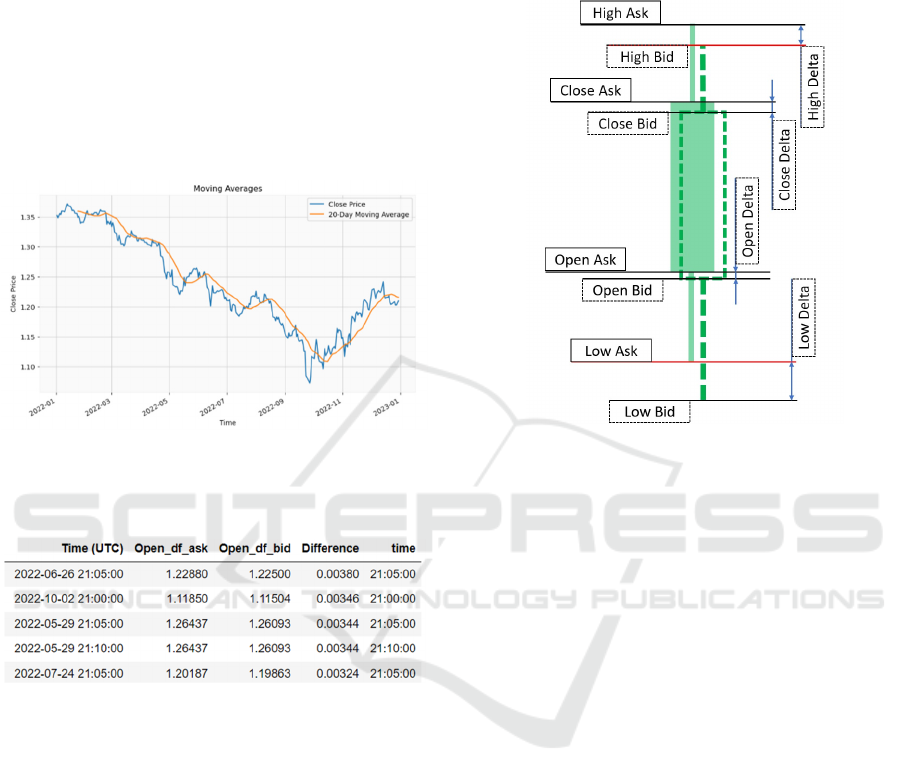

different time frames (Figure 4), Relative Strength

Index (RSI) (Gumparthi, 2017) and Moving Average

Convergence Divergence (MACD) (Aguirre et at.,

2020).

Figure 4: 20-Day Moving Average.

Table 1: The biggest difference between ask and bid

throughout 2022.

This section describes the process of label

generation, a crucial step in preparing the dataset for

predictive modelling. The label, representing the

target variable in the supervised learning framework,

signifies the anticipated movement of currency rates

for the subsequent trading period.

When calculating labels for intraday trading, it is

essential to consider that the spread in the Forex

market is usually quite large; therefore, to correctly

train ML models and neural networks, it is necessary

to take into account not only the currency rate

behaviour of one price parameter (for example, only

Bid or vs only Ask), as is often used in most other

studies. This research meticulously assesses the

absolute differences between the 'High Bid', 'Low

Ask', and 'Open Ask' values as crucial indicators of

currency rate behaviour. It is necessary to consider

that market orders will make trades with a loss of

spread (Figure 5). Thus, comparing the differences

mentioned above, it is possible to evaluate whether it

is profitable to enter into positions and whether the

currency rate will move up or down in the selected

timeframe is sufficient, taking into account the losses

on the spread.

Figure 5: Calculation deltas, spreads and differences based

on a random five-minute Japanese Candlestick.

The novation described above looks simple at first

glance, but it allows authors to clearly mark datasets

for further supervised learning. Subsequently, the

'Result' column is integrated into the dataset, which

represents the currency rate movement for each

specific period, denoted by 'Up' for an anticipated

increase and 'Down' for an expected decrease. A

reasonable shift of the differences and the 'Result'

column by one position is made to ensure alignment

with the relevant data points. This adjustment

guarantees the 'Label' column encapsulates the

movement prediction for the ensuing trading period.

This preprocessing culminates in creating 4-hour

blocks as parts of the initial dataset for using cross-

validation over time.

Besides, within these blocks, there are no

transitions between different trading days since this

study analyses only intraday trading, which involves

closing all positions overnight.

3.3 Model Implementation

The model implementation phase involves the

following:

- converting conceptual frameworks into operational

code.

Then, there is a cyclical process of the following

crucial stages such as:

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

738

- data preprocessing within the framework of cross-

validation over time,

- model development and hyperparameter

improvements, and

- evaluation of each stage.

This process leverages the Python programming

language, in conjunction with ML libraries such as

Scikit-learn and TensorFlow-2 with Keras, to ensure

the precise implementation of each constituent

element. With the preprocessed dataset, various

classification models are trained. In this research, five

classical machine learning methods and two neural

network architectures, such as K-Nearest Neighbors

(K-NN), Logistic Regression, Support Vector

Machines (SVM), Decision Trees, Random Forest,

Multi-Layer Perceptron (MLP) and Long Short-Term

Memory (LSTM) networks.

Achieving optimal model performance hinges on

meticulous hyperparameter tuning. This entails a

methodical approach involving extensive

experimentation to pinpoint the ideal configuration

that balances model complexity and accuracy.

Through this iterative process, various aspects were

fine-tuned, including setting the hyperparameters for

the Random Forest model with 40 estimators,

configuring the LSTM and MLP with one hidden

layer, and optimising KNN with seven neighbours.

This strategic refinement resulted in a significant

enhancement of predictive accuracy.

In terms of training and validation, recognition is

given to the sequential and time-dependent nature of

the data. Traditional cross-validation techniques are

deemed unsuitable, as they might disrupt the

chronological order. Instead, this research uses a

cross-validation approach that is often adopted for

large time series, known as the 'Blocking Time Series

Split'. It allows for evaluating models on unknown

data from a learning point of view while ensuring that

the information flow aligns with real-world scenarios.

For binary classification tasks, the focus is placed

on metrics tailored to specific objectives. These

include Accuracy, Precision, Recall, and F1-Score.

Each metric is crucial in gauging the models' abilities

to make accurate predictions while considering trade-

offs between true positives and false positives.

Throughout this process, careful consideration is

given to factors like model suitability, complexity,

interpretability, resource constraints, and the trade-

off between model complexity and performance. It is

presumed that the models capture essential patterns in

the data by iteratively adjusting model architectures,

experimenting with different hyperparameters, and

fine-tuning algorithms.

This comprehensive approach to model

implementation, training, and validation, along with

consideration of performance metrics, establishes a

foundation for subsequent stages of analysis that are

carried out when new trading data becomes available.

4 RESULTS

The performance of various machine learning and

artificial neural network models was evaluated for the

binary classification task of predicting currency rate

movements (up or down). The results obtained in this

research are presented in Table 2.

Table 2 also demonstrates a comparison of the

results obtained in this research with a state-of-the-art

paper with similar research objectives, such as (Pande

et al., 2021), which found that the KNN algorithm

outperformed the Naïve Bayes algorithm in terms of

recall, precision, accuracy, and f-score. The Naïve

Bayes algorithm yielded an accuracy of 50%,

precision of 43%, recall of 55%, and f-score of 49%,

while the KNN algorithm achieved an accuracy of

53%, precision of 54%, recall of 56%, and f-score of

55%. This comparison emphasises the superiority of

some neural network architectures, such as LSTM,

over classical ML methods in the context of the

movement direction prediction of forex price for

GBP/USD for intraday trading.

The accuracy, although seemingly modest at first

glance, is commendable within the real-time

prediction of the direction of short-term movements

of exchange prices. Attaining an accuracy exceeding

51% is considered a favourite in this context. This

contrasts with tasks like image recognition, where an

accuracy below 90% might be considered suboptimal.

It is important to note that there is much more

research on predicting specific price values

(regression task) of financial instruments (mainly for

medium-term time frames) than predicting the

direction of future movements (classification task) for

short-term intraday trading, which is potentially more

profitable (Milke et al., 2020). Predicting short-term

movements' directions of the financial market is

inherently more challenging due to the dynamic and

complex nature of the domain. The significance of

this threshold (51%) lies in the fact that the

predictions yield profits more frequently than not. In

intraday trading, where transactions occur rapidly,

this establishes a statistically advantageous position,

significantly outweighing the 1% due to using the

compound interest formula with multiple small

increments of the deposit. It underscores the

effectiveness of these models in navigating the

Analysis of Intraday Financial Market Using ML and Neural Networks for GBP/USD Currency Pair Price Forecasting

739

inherently dynamic nature of financial markets, even

given their intraday volatility, taking into account that

intraday trading does not take the risk of a possible

overnight gap.

Table 2: Results of AI models.

Algorithms\

Metrics

Accurac

y

Precision Recall F1

Machine learning (ML) classification algorithms

KNN 54% 56% 46% 51%

Logistic

Re

g

ression

52% 66% 25% 36%

SVM 52% 52% 97% 68%

Decision

Trees

55% 59% 40% 48%

Random

Forest

60% 77% 31% 44%

Artificial Neural Network (ANN) models

MLP 52% 52% 96% 68%

LSTM 63% 72% 48% 57%

(Pande et al., 2021) results

Naïve Bayes 50% 43% 55% 49%

KNN 53% 54% 56% 55%

In summary, the variance in performance among

these algorithms can be attributed to their inherent

characteristics. Models like Logistic Regression and

Random Forest excel in precision but encounter

challenges with recall, whereas others like LSTM

strike a balance between these metrics and accuracy,

which reached 63%. The intricacies of predicting

financial markets are rooted in their complex,

dynamic, constantly changing and noisy nature,

where past movements may not always anticipate

future trends. These results offer valuable insights

into the strengths and weaknesses of each algorithm

in the context of the currency market prediction.

5 CONCLUSIONS

This research, focusing on foreign exchange rate

prediction of GBP/USD currency rate, uses several

machine learning and artificial neural network

techniques; data was systematically pre-processed,

and models were implemented to gain insights into

the intricate dynamics of financial markets.

The technical outcomes reveal nuanced

performance across various models. Each model,

ranging from K-Nearest Neighbors to Long Short-

Term Memory Networks, demonstrated distinctive

strengths and limitations. While some exhibited

commendable accuracy in market price prediction,

others necessitated further refinement and parameter

tuning. The selection of models was thoughtfully

guided by their suitability for the temporal granularity

of the data.

The developed framework fulfils the original

technical research requirements: by utilising both

traditional machine learning models and neural

networks, a balanced approach was achieved,

harnessing the strengths of each methodology. This

endeavour has deepened technical proficiency and

conferred a better understanding of the intricacies of

the financial market.

As a further exploration, integrating additional

external factors like macroeconomic indicators and

news sentiment analysis and adding data from the

order book could bolster predictive accuracy.

Exploring advanced deep learning architectures and

ensemble techniques holds potential for additional

insights. Furthermore, real-time data integration and

creating a user-friendly interface could significantly

enhance the practical utility of the framework.

The authors hope that, with a focus on future

refinements, this research will continue to serve as a

valuable resource for both researchers and

practitioners in the field of financial forecasting.

REFERENCES

Abadi, M., Barham, P., Chen, J., Chen, Z., Davis, A., Dean,

J., Devin, M., Ghemawat, S., Irving, G., Isard, M. and

Kudlur, M. (2016). {TensorFlow}: a system for

{Large-Scale} machine learning. In 12th USENIX

symposium on operating systems design and

implementation (OSDI 16) (pp. 265-283).

Abedin, M.Z., Moon, M.H., Hassan, M.K. and Hajek, P.

(2021). Deep learning-based exchange rate prediction

during the COVID-19 pandemic. Annals of Operations

Research, pp.1-52.

Aguirre, A.A.A., Medina, R.A.R. and Méndez, N.D.D.

(2020). Machine learning applied in the stock market

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

740

through the Moving Average Convergence Divergence

(MACD) indicator. Investment Management and

Financial Innovations, 17(4), p.44.

Aha, D.W., Kibler, D. and Albert, M.K. (1991). Instance-

based learning algorithms. Machine learning, 6, pp.37-

66.

Breiman, L. (1996). Bagging predictors. Machine learning,

24, pp.123-140.

Cessie, S.L. and Houwelingen, J.V. (1992). Ridge

estimators in logistic regression. Journal of the Royal

Statistical Society Series C: Applied Statistics, 41(1),

pp.191-201.

Chollet, F. and others. (2015). Keras. Avable at:

https://github.com/fchollet/keras. / (Accessed: 25

October 2023).

Engle, R.F., Ghysels, E. and Sohn, B. (2013). Stock market

volatility and macroeconomic fundamentals. Review of

Economics and Statistics, 95(3), pp.776-797.

Gumparthi, S. (2017. Relative strength index for

developing effective trading strategies in constructing

optimal portfolio. International Journal of Applied

Engineering Research, 12(19), pp.8926-8936.

Goodfellow, I., Bengio, Y. and Courville, A. (2016). Deep

learning. MIT press.

Dukascopy Bank Sa. (2023). Historical data feed, Swiss

Forex Bank-ECN broker. Swiss FX Trading Platform

Dukascopy Bank SA. Available at:

https://www.dukascopy.com/swiss/english/marketwatc

h/historical/ (Accessed: 25 October 2023).

Hoque, K.E. and Aljamaan, H. (2021). Impact of

hyperparameter tuning on machine learning models in

stock price forecasting. IEEE Access, 9, pp.163815-

163830.

Keerthi, S.S., Shevade, S.K., Bhattacharyya, C. and

Murthy, K.R.K. (2001). Improvements to Platt's SMO

algorithm for SVM classifier design. Neural

computation, 13(3), pp.637-649.

Islam, M.S. and Hossain, E. (2021). Foreign exchange

currency rate prediction using a GRU-LSTM hybrid

network. Soft Computing Letters, 3, p.100009.

Long, W., Lu, Z. and Cui, L. (2019). Deep learning-based

feature engineering for stock price movement

prediction. Knowledge-Based Systems, 164, pp.163-

173.

MacKenzie, D. (2019). How Fragile Is Competition in

High-Frequency Trading. Tabbforum, March, 26.

Maqsood, H., Mehmood, I., Maqsood, M., Yasir, M., Afzal,

S., Aadil, F., Selim, M.M. and Muhammad, K. (2020).

A local and global event sentiment based efficient stock

exchange forecasting using deep learning. International

Journal of Information Management, 50, pp.432-451.

Milke, V., Luca, C., Wilson, G. and Fatima, A. (2020).

Using Convolutional Neural Networks and Raw Data to

Model Intraday Trading Market Behaviour. In ICAART

(2) (pp. 224-231).

Nauta, M., Trienes, J., Pathak, S., Nguyen, E., Peters, M.,

Schmitt, Y., Schlötterer, J., van Keulen, M. and Seifert,

C. (2023). From anecdotal evidence to quantitative

evaluation methods: A systematic review on evaluating

explainable ai. ACM Computing Surveys, 55(13s), pp.1-

42.

Pande, K.S.Y., Divayana, D.G.H. and Indrawan, G. (2021).

March. Comparative analysis of naïve bayes and knn on

prediction of forex price movements for gbp/usd

currency at time frame daily. In Journal of Physics:

Conference Series (Vol. 1810, No. 1, p. 012012). IOP

Publishing.

Pedregosa, F. et al. (2011). Scikit-learn: Machine learning

in Python. Journal of machine learning research,

12(Oct), pp.2825–2830.

Pedregosa, F., Varoquaux, G., Gramfort, A., Michel, V.,

Thirion, B., Grisel, O., Blondel, M., Prettenhofer, P.,

Weiss, R., Dubourg, V. and Vanderplas, J. (2011).

Scikit-learn: Machine learning in Python. The Journal

of machine Learning research, 12, pp.2825-2830.

Samek, W., Montavon, G., Vedaldi, A., Hansen, L.K. and

Müller, K.R. eds. (2019). Explainable AI: interpreting,

explaining and visualizing deep learning (Vol. 11700).

Springer Nature.

Schierholt, K. and Dagli, C.H. (1996). March. Stock market

prediction using different neural network classification

architectures. In IEEE/IAFE 1996 Conference on

Computational Intelligence for Financial Engineering

(CIFEr) (pp. 72-78). IEEE.

Vignesh, C.K. (2018). Applying machine learning models

in stock market prediction. IRJET, Journal.

Waskom, M. et al. (2017). Mwaskom/seaborn: v0.8.1

(September 2017), Zenodo. Available at:

https://doi.org/10.5281/zenodo.883859.

Zhanggui, Z., Yau, H. and Fu, A.M. (1999). July. A new

stock price prediction method based on pattern

classification. In IJCNN'99. International Joint

Conference on Neural Networks. Proceedings (Cat. No.

99CH36339) (Vol. 6, pp. 3866-3870). IEEE.

Analysis of Intraday Financial Market Using ML and Neural Networks for GBP/USD Currency Pair Price Forecasting

741