The Role of Stop-Loss Orders in Market Efficiency and Stability: An

Agent-Based Study

Patrick Liston

1

, Charles Gretton

1

and Artem Lensky

2,3

1

The Australian National University, College of Engineering, Computing and Cybernetics, Canberra, Australia

2

School of Engineering and Technology, The University of New South Wales, Canberra, ACT, Australia

3

School of Biomedical Engineering, Faculty of Engineering, The University of Sydney, Sydney, NSW, Australia

Keywords:

Market Simulation, Agent-Based Simulation, Limit Order Book, Stop-Loss Cascade, Market Manipulation.

Abstract:

Stop-loss orders can have large and ranging effects on the behaviours and outcomes for participants within

financial markets. We develop and demonstrate an approach to studying the effect of stop-losses on price

dynamics within a financial market. Using our high-fidelity agent-based market simulator that draws on his-

torical limit order book data, we illustrate that the introduction of stop-loss orders leads to volatility, creating

the potential for stop-loss cascades that result in large price movements. We study a market containing an

agent that is able to trigger such events and profit from them. We indicate that the structure of the stop-loss

order book may be used by such an agent to inform trading decisions and to generate volatility within markets

for their benefit. Finally we demonstrate how the agents closing strategy effects both the profitability of the

agent, as well as the price trajectory of the market.

1 INTRODUCTION

Stop-loss orders are a common risk management

tool used by traders in financial markets to minimise

losses. They allow the automatic closing of a position

and use a similar mechanism as a margin call, to limit

investors’ losses. If the price of the traded good drops

below a given threshold, they will execute a sell in or-

der to cover their position, realising a loss. However,

stop-loss orders can also amplify market volatility and

lead to large price movements.

Stop-loss orders are widely used and their use

is common practice among professional traders

(Vytelingum, 2006). They impact market dynamics

and are of immense interest in the study of markets

and agent strategies. We approach the study of stop-

loss orders and consequent price volatility, including

cascades, using agent-based market simulation. Our

agent-based framework enables the study of market

effects. Our simulation approach also facilitates the

study of individual agent strategies. Here, in particu-

lar, we examine strategies that attempt to trigger and

profit from price volatility.

To the best of our knowledge, we are the first to

develop an agent-based simulation to investigate how

stop-loss orders can affect agent outcomes and price

volatility.

2 PRELIMINARIES

Continuous Double Auction (CDA)

The CDA is a common market mechanism used

to store and match orders, thus facilitating trading.

In a CDA, there is a fixed-duration trading period

during which buy orders (“bids”) and sell orders

(“asks”) may be submitted. When bids and asks are

compatible in terms of price and quantity, a trade is

executed. If new orders are not compatible, the order

is placed in the Limit Order Book (LOB) for future

execution (Vytelingum, 2006).

Limit Order Book

The LOB maintains a list of bids and asks (with

their associated price level and quantity) that have

been submitted to the exchange. When an order

is submitted it is initially checked against existing

orders within the LOB. Orders that may be filled are

executed, whilst those that cannot be matched will be

added to the LOB.

Order Types

Importantly we distinguish two main order types

that can be used in a CDA: limit orders and market

orders. Limit orders specify the price at which a trade

is made. They will only be executed if there is an

280

Liston, P., Gretton, C. and Lensky, A.

The Role of Stop-Loss Orders in Market Efficiency and Stability: An Agent-Based Study.

DOI: 10.5220/0012371400003636

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 16th International Conference on Agents and Artificial Intelligence (ICAART 2024) - Volume 1, pages 280-288

ISBN: 978-989-758-680-4; ISSN: 2184-433X

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

opposing order that satisfies this price requirement.

Limit orders that are not executed remain in the LOB.

Market orders, in contrast, are executed immediately

and will pay the best available price for the given

quantity. Market orders do not enter the LOB if they

are partially or wholly unfulfilled.

Stop-Loss Orders

Stop-loss orders, a sub-type of market and limit or-

ders, allow a market participant to buy or sell a good

if its value reaches a certain trigger price. Often used

to close a position these orders are typically used in an

attempt to limit an investors’ losses. If the price of the

traded good reaches the given threshold, the trader’s

order is executed (usually as a market order), covering

their position.

Typically, exchanges maintain two separate order

books. A LOB, visible to all traders in a market, and

a stop-loss order book, visible only to the exchange.

This separation and opacity of the stop-loss order

book are justified and necessary to help prevent

snowball effects and stop-loss cascades, as have been

studied in (Osler, 2005).

Stop-Loss Cascade

A stop-loss cascade is a rapid, self-reinforcing price

movement or ”price cascade” catalyzed by the trig-

gering of stop-loss orders. In a stop-loss cascade,

an asset moves in a particular direction, triggering a

small number of stop-loss positions to be activated.

This execution subsequently moves the price further

in the given direction, triggering further stop-loss or-

ders, and so on.

3 SIMULATOR

Using a method similar to (Spooner et al., 2018; Lis-

ton et al., 2022; Liston et al., 2023) we developed a

market simulator for a single asset. Relying on recon-

struction from historical data, our approach has been

shown to be highly realistic, and makes minimal as-

sumptions about the market.

3.1 Data

Historical trade data was obtained from the cryptocur-

rency exchange Binance. We use the currency pair

Bitcoin/Tether (BTCUSDT). This choice was moti-

vated by the desire to simulate a well-known and

heavily traded market. Furthermore, it has been

shown in (Alexander et al., 2021) that due to mar-

ket arbitrage and a high correlation of Bitcoin price

with prices of altcoins, BTCUSDT traded on Binance

is the main source of volatility and price movement

that flows to all other related markets and exchanges.

Hence, this data should reliably allow us to make gen-

eral statements about the LOB structure and dynam-

ics, which should also be able to be generalized to

other markets and exchanges.

Tick-level data was used to guide the simulation,

with each entry representing a single trade.

A trade record consists of: trade ID,

time, price, quantity, quote quantity,

and direction.

LOB data, containing 20 levels on both Bid and

Ask sides (price levels and quantity), was also ob-

tained and updated when a new order was added or re-

moved from the LOB. All data used was from Novem-

ber 2021.

3.2 Simulator

We simulate a financial market using a hybrid of real

order book data and synthetic trades placed by agents.

Important within the system is the timing, size and

direction of trades placed.

The simulator utilises a real historical order

book to guide price levels within the market, while

Zero-Intelligence (ZI) agents place market orders

at previously observed tick intervals. These market

orders subsequently ”shift” the order book, such

that the agents’ orders drive the direction of the

market, while the limit order book determines the

size of the move and the structure of the market.

Agents determine their trade size by sampling from a

distribution constructed from historical trades.

Limit Order Book Extension

Given that the available LOB data contains only the

top 20 price levels, agents’ market orders can exceed

the depth of the real order book. This may occur

when an agent’s order size is very large, or in partic-

ular when we investigate the injection of a shock. To

address this problem, we developed a series of mul-

tilayer perceptron (MLP) models to approximate the

proceeding 480 levels. These are recursively called

when the limit order book depth is not sufficient to fill

the agents’ market orders, extending the book indefi-

nitely until the agent’s order may be completely filled.

Stop-Losses

We perform simulation experiments in markets both

with and without stop-loss orders. In simulations

where stop-loss orders are permitted, a separate stop-

loss order book is created and agents may place stop-

loss orders in addition (and in opposition) to their

market order.

The Role of Stop-Loss Orders in Market Efficiency and Stability: An Agent-Based Study

281

To determine the price of the stop-loss order a

log-normal distribution was used, sizing the stop-loss

difference/level inversely from the agents’ trade size

(Acar and Toffel, 2001).

Stop-loss orders remain in the stop-loss order

book until their trigger price is reached, exceeded, or

they are cancelled. Before the selection of an agent

and execution of a market order, the market price is

checked against all orders within the stop-loss book.

Any order within the stop-loss book that has a trigger

price that has been reached is then activated. The or-

der is triggered, executed and hence causes the LOB

to shift. After the execution of a single stop-loss or-

der, the LOB is shifted accordingly, and the stop-loss

book is checked again to determine if the trigger price

of any other orders has been reached. Once this pro-

cess ends, standard order placement is resumed.

1

It is important to note that market orders take

execution precedence over stop-loss orders. Hence,

while a market order is being executed no stop-loss

orders can be triggered. After the market order is

completely filled the stop-loss order book is reviewed,

and stop-loss orders that have reached their trigger

price are executed.

Limitations

This method of simulation makes limited assumptions

and has previously been shown to be highly accurate

(Spooner et al., 2018), however, it should be noted

that agents’ actions do not affect the structure of the

limit order book. Agents’ trades alter the price of the

market and shift the limit order book price levels, but

do not result in the addition or removal of orders from

the limit order book.

Additionally, despite the efforts that have been

made to extend the LOB for cases where agents’ or-

der size exceeds the depth of the book. This extension

by its nature may not always truly replicate reality.

However, as noted in (Torii et al., 2015) the aim

of this study is to arrive at a qualitative description

of the mechanisms and influences of stop-losses and

stop-loss agent strategies, not to reproduce the char-

acteristics of real markets.

3.3 Simulator Verification

To verify the ability of the simulator to create realis-

tic price dynamics we first visually inspect samples.

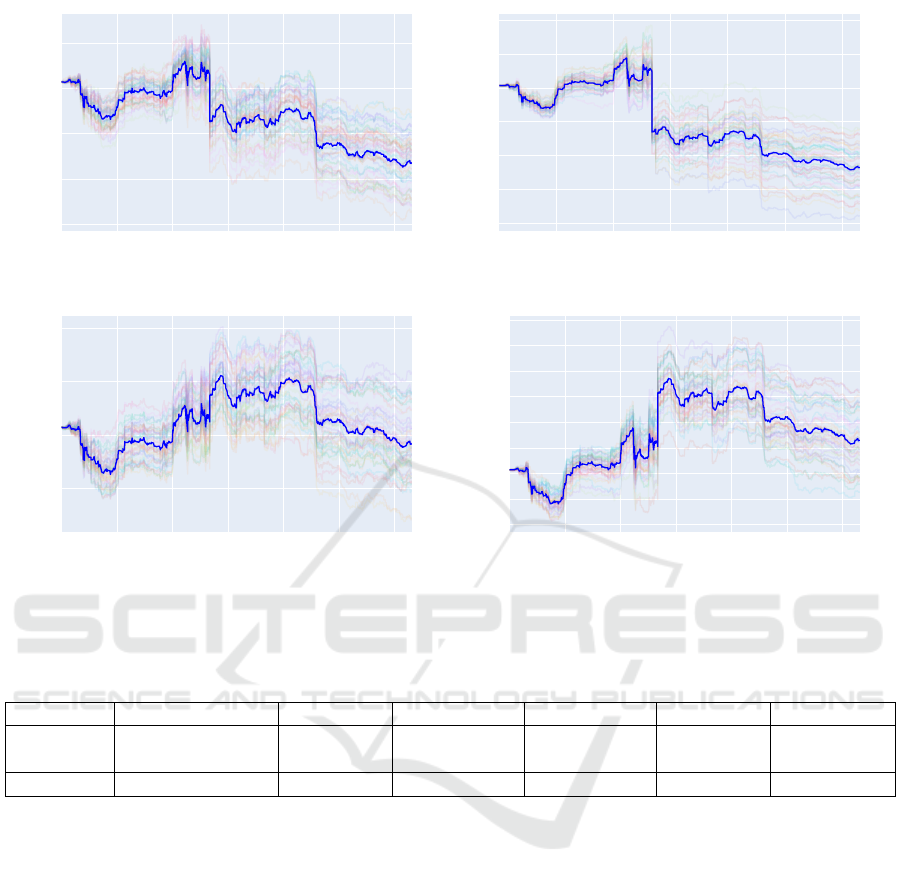

Figure 1 shows the price dynamics for 50 simulations

containing 100,000 trades on 11/20/2021. We ob-

serve similar price patterns emerge and that the simu-

lator produces plausible realisation and price paths.

1

When executing stop-loss orders, no additional stop-

loss orders may be placed.

00:00

Nov 20, 2021

00:05 00:10 00:15 00:20 00:25 00:30

57k

57.5k

58k

58.5k

_spikeDIRECTION_None_BuyBackStrat_1_spiked_0_

Time

Price (USDT)

Figure 1: Simulated price dynamics for 50 Simulations of

100,000 trades for BTCUSDT on 11/20/2021. Blue solid

lines represent the average simulated price, and red repre-

sents the observed (real) price from historical ticks. The

faded lines show the various trials.

Further, we utilise standard procedures stipulated

in (Cont, 2001) to examine the stylized facts of the

market and compare them to those observed in reality

for the same dates. Note that some stylized facts are

inherent features of the simulation approach we have

pursued. Because the limit order book used to guide

the price was taken from the observed data, it is not

necessary to validate the statistical properties of the

structure of the limit order book. Similarly, such in-

terrogation is not required for trade sizing as we sam-

ple from historical data. Additionally, given that all ZI

trades are aligned to execute at times when real trades

occurred within the historical data, no consideration

for trade arrival time is necessary.

Our validation work is focused on the statisti-

cal properties of simulated returns. We consider the

logarithmic-returns of the price, focusing on the skew,

kurtosis, volatility autocorrelation, and price autocor-

relation. Table 1 illustrates that the stylized facts

of the simulation fall within the range for all mea-

surements undertaken, indicating that simulations can

largely emulate realistic price dynamics. While we do

note that there is generally lower autocorrelation for

both volume and log-returns for simulated markets,

this is likely due to the use of ZI agents. Although

real markets may exhibit long-range dependency of

trade directions, the purely random trade directions

generated by the ZI agents deviate from this market

characteristic and is a familiar limitation of this sim-

ulation approach. This may have small impacts at the

granular level, however, it should not materially affect

the broader outcomes of this study.

4 EXPERIMENTAL EVALUATION

We have performed 3 major experiments. Initially,

we create a market that allows stop-loss orders. We

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

282

Table 1: Aggregated stylised facts at tick level, computed over 50 trials of 100,000 ticks for each day between 11/01/2021

and 11/30/2021. Compared to the stylised facts observed for 100,000 ticks on each day between 11/01/2021 and

11/30/2021. We report the mean, maximum and minimum observed values.

Skew Kurtosis Return Autocorr. Volatility Autocorr.

Observed 3.09 (−1.04–5.43) 1,007 (523–1888) −2.64 (−3.20–−0.63) −6.50 (−0.61–7.0)

Simulated 0.22 (−2.30–1.50) 1,186 (302–1.144) −8.40 (−6.20–−0.29) −17.0 (−12.0–−0.54)

analyse the impact and compare volatility between

markets with and without stop-loss orders. We then

construct an agent that inputs large shock orders into

these markets and observe its effect. Finally, we in-

vestigate closing strategies that this agent may use and

how these affect both the agents’ profitability, as well

as the market as a whole.

4.1 Introduction of Stop-Loss Orders

In this experiment, our aim was to observe the ef-

fects of the market with stop-losses, noting their effect

on price path formation and volatility. This is done

by measuring the variance in logarithmic returns, as

given by: σ

2

=

1

N−1

∑

N

t=1

(R

t

−

¯

R

t

)

2

. Here, σ

2

is the

variance/volatility, R

t

is the log return at time t,

¯

R

t

is

the mean of all log returns for the given period, and N

denotes the number of observations considered (Poon

and Granger, 2003).

We enable the execution of stop-loss orders as

specified previously and consider two scenarios. One

where stop-losses are not permitted, and the other

where stop-losses are permitted. This experiment

is run 50 times for each date within 11/01/2021 -

11/30/2021. The resulting volatility measures are

shown in Table 2, and Figure 2 displays the market

output for the first 100,000 ticks on 11/20/2021.

00:00

Nov 20, 2021

00:05 00:10 00:15 00:20 00:25 00:30

56.5k

57k

57.5k

58k

58.5k

59k

59.5k

Stop-Loss Comparison

Time

Price (USDT)

Figure 2: Price dynamics for the without stop-loss orders

(yellow) and with stop-loss orders (blue) for 20/11/2021.

The volatility of the market is increased when

stop-loss orders are introduced (Table 2). In partic-

ular, an approximate 27% increase in mean volatility

and the minimum volatility was observed in the mar-

ket containing stop-losses exceeding the maximum

volatility observed when a market did not contain any

stop-loss orders. This indicates a clear distinction that

the addition of stop-loss orders has the potential to

have a large impact on volatility.

Further, we visualise the effects of the addition

of stop-loss orders in Figure 2. We observe both an

increase in volatility throughout the simulation and

the generation of moments of singular large volatil-

ity/price movements (shocks), most notably around

the 10 minute mark.

The presence of price shock moments indicates

the execution of sequential stop-loss orders. As such,

this suggests an agent with sufficient capital may be

able to submit a large order to create a market shock,

and thus trigger this sequential execution and hence a

stop-loss price cascade.

4.2 Triggering Stop-Loss Cascades

Having shown that markets with stop-loss orders may

experience movements of large price volatility, we

seek to introduce an agent that may induce such stop-

loss cascade events. We construct an agent that places

a large order that acts as an impulse or a shock to

the market. Drawing inspiration from (Balch et al.,

2019), the impulse is sized to correspond to 500% of

the total volume within the limit order book for the

given time. The agent then injects this impulse order

either in an upward (buy) or downward (sell) direc-

tion, consuming the entire volume within the order

book and triggering stop-loss orders in that direction.

We compare the market’s reaction when the agent

submits an impulse with/without stop-losses orders in

the simulated market. We also compare the outcomes

of this shock when placed as a buy or a sell. We

perform 50 trials under each computational set-up,

with each trial containing 100, 000 ticks, for the date

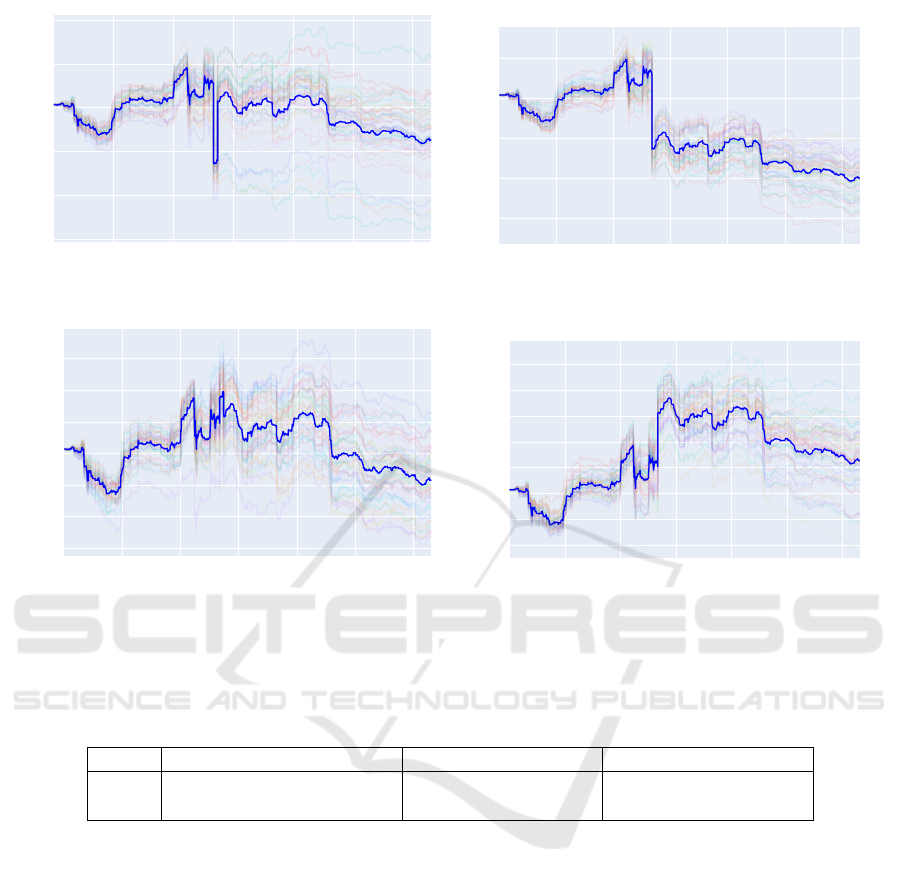

of 11/21/2021. Figure 3 displays the visual impact

these shocks had on the market, and Table 2 shows

the volatility observed for each experimental set-up.

Comparing Figure 3(c) with Figure 3(d). We note

that when a shock is injected into the market the reac-

tion within the market that does not contain stop-loss

orders is relatively muted compared to the market that

allows stop-loss orders. This is further supported by

The Role of Stop-Loss Orders in Market Efficiency and Stability: An Agent-Based Study

283

00:00

Nov 20, 2021

00:05 00:10 00:15 00:20 00:25 00:30

56.5k

57k

57.5k

58k

58.5k

_spikeDIRECTION_DOWN_BuyBackStrat_1_spiked_

Time

Price (USDT)

(a) Down shock injected, stop-loss orders are not permitted.

00:00

Nov 20, 2021

00:05 00:10 00:15 00:20 00:25 00:30

54k

55k

56k

57k

58k

59k

60k

_spikeDIRECTION_DOWN_BuyBackStrat_1_spiked_

Time

Price (USDT)

(b) Downward shock injected, stop-loss orders are permitted.

00:00

Nov 20, 2021

00:05 00:10 00:15 00:20 00:25 00:30

57.5k

58k

58.5k

59k

_spikeDIRECTION_UP_BuyBackStrat_1_spiked_1_S

Time

Price (USDT)

(c) Upward shock injected, stop-loss orders not permitted.

00:00

Nov 20, 2021

00:05 00:10 00:15 00:20 00:25 00:30

57k

57.5k

58k

58.5k

59k

59.5k

60k

60.5k

61k

_spikeDIRECTION_UP_BuyBackStrat_1_spiked_1_S

Time

Price (USDT)

(d) Upward shock injected, stop-loss orders are permitted.

Figure 3: Comparison of price dynamics when stop-loss orders are permitted (b, d) and not permitted (a, c). When a downward

(a, b) or upward (c, d) shock was injected.

Table 2: Volatility of returns for various market conditions. 50 Simulations of 100,000 trades for BTCUSDT on 11/20/2021.

No-SL,No Shock No-SL,Up No-SL,Down SL,No Shock SL,UP SL,Down

Volatility 1.68 2.14 3.03 2.76 6.20 9.79

(1.63-1.74) (2.06-2.21) (3.00-3.08) (2.53-3.07) (4.47-9.38) (5.57-12.18)

Difference 0 +0.46 +1.35 +1.08 +4.52 +8.11

examining Table 2, which shows a clear and large in-

crease in market volatility when a shock is present in a

market with stop-losses as opposed to a market with-

out stop-losses. With volatility increases of 6.76 and

4.06 in the downward and upward direction respec-

tively. This once again shows the effect stop-losses

have on price path generation, volatility and the mar-

ket as a whole. With increased volatility and largely

different price outcomes.

Considering the impact of shocks when placed in

a downward (sell) and upward (buy) direction, we

observe differences in the magnitude of reaction and

price path deviation between Figure 3(b) and Figure

3(d). Notably, despite both orders being the same

size, the shock submitted in the downward direction

caused significantly larger price deviation (∼ $3,000)

than the shock in the upward direction (∼ $1,000).

Additionally from Table 2 we see that when this shock

was submitted in the downward direction, the change

in market volatility when injected into the stop-loss

market had a much larger effect on market volatility

(+6.76) compared to when it was submitted in the

upward direction (+4.06). These results indicate that

the structure of both the limit and the stop-loss order

books are likely to play a large role in determining the

size of the impact that large orders may have.

While we note that both the limit and stop-loss or-

der books are likely to play a role in determining the

outcomes of shock events, we consider the difference

in volatility from the baseline that is generated. As

seen in Table 2, while the introduction of shock events

significantly increases volatility (+1.35 and +0.46)

for downward and upward shocks, respectively, the

increase in volatility due to a downward shock with

the presence of stop-losses far exceeds that of the up-

ward shock (+8.11 and +4.52). This indicates that

the stop-loss order book plays a larger role in the im-

pact of shocks. Hence, we suggest that the structure of

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

284

the stop-loss order book provides vital information to

inform agents’ ability to trigger cascade events, par-

ticularly to maximise their return.

4.3 Position Closing

We have shown that the direction in which an agent at-

tempts to cause a price cascade affects the price move-

ment within the market and hence the profit an agent

may obtain. Given the size of the agent’s position it is

also vitally important, both for the agent and for the

market as a whole, to study how the agent closes their

position.

We experiment with 3 strategies that the agent

may use to close their position. We examine how this

affects the agent’s profit, as well as observe how this

alters the price path observed within the market.

1. Buy and hold: An agent holds and receives a

“marked to market” value of their shares at the

conclusion of the simulation period. (Assume the

agent closes their position without slippage.)

2. Single Trade Closure: An agent waits a set pe-

riod t then fully closes their position. This ensures

the agent’s closing share balance is equal to their

opening balance.

In our implementation the agent conducts a single

order, 1, 000 ticks after their initial large order.

3. Spread Trade Closure: An agent makes multiple

(n) trades, to close out their position and return to

their initial share balance over time t.

In our implementation, the agent conducts 10

trades of equal size over the proceeding 10,000

ticks after their initial large order.

Each of the strategies was tested with both an up-

ward (buy) and downward (sell) shock. Both con-

ditions were tested with 50 simulations for 100, 000

ticks on the date of 11/21/2021. Figure 4, and Figure

3 (b) and (d) display the visual impact these strate-

gies. While Table 3 shows the profit generated by

each strategy, and Table 4 displays the market volatil-

ity for each experimental set-up.

We once again observe a difference in shock

size between the buy/sell experiments. We therefore

highlight the importance of the shock direction on the

size of the cascade. This is shown both visually in

Figure 4 and numerically by the increase in volatility

noted in Table 4. Together this suggests that the

structure, and likely the skew of the stop-loss order

book largely contributes to the size of the cascade

and that the existence of support/resistance has the

potential to mute the effect of the shock. Therefore

we hypothesise that knowledge of stop-loss order

sizes and locations could be a key determinant in the

success of such shock agents.

When considering the profitability of the agent we

see that both the direction of the agent’s trade and the

closing strategy employed significantly alter its out-

come. If an agent may only utilise a buy and hold

strategy it is most advantageous to create a downward

shock ($2,210, 000 vs. −$2,530,000), and in fact the

agent loses money if it initiates an upward movement.

However, when undertaking either of the other strate-

gies (single trade closure or spread trade closure) it

is more profitable for the agent to cause an upward

price movement ($2, 060, 000 & $2, 140,000 for up-

ward shocks compared to, $98, 100 & $525,000 for

downward shocks). This dichotomy highlights both

that the closing strategy of the agent, and also that

structure of the stop-loss book are vitally important

in informing the agent’s decision if it seeks to gain a

profit. By examining Figure 3(b) it is possible to see

why this effect may occur. When the agent undertakes

the strategy of buy and hold it forces the price in a di-

rection, however, if the agent waits too long to close

it’s trade, it allows time for the price path to progress

and gives other agents within the simulation more of

chance to influence the price progression. However, if

the agent fully closes their trade within a smaller pe-

riod of time, it is able to take advantage of the power

it exerted over the market. This is illustrated by the

single trade closure and spread trade closure strate-

gies. In both cases, the agent closes its trade in a

timely fashion after exerting control over the market.

Although, in the case of the single trade closure the

agent causes a ”whiplash” effect within the market.

Spiking the price almost as far in the opposite direc-

tion from its original trade, and diminishing the profit

the agent generated. Whereas the spread trade clo-

sure strategy allows the agent sufficient time to min-

imise this whiplash effect, whilst also enabling it to

close its position within a reasonable time allowing it

to benefit from its previous price altering efforts.

Given this propensity to create whiplash effects

within the market, it is interesting to examine the ef-

fects of these strategies on the volatility of the market

as a whole. Table 4 describes the volatility of each

scenario. Interestingly we see that when we compare

the buy and hold closing strategy with spread trade

closure strategy the level of volatility is very simi-

lar (within ∼ 2%). Meanwhile, the single trade clo-

sure strategy results in overall volatility that is ∼ 25%

larger than buy and hold. This, once again emphasises

the impact of the closure strategy, while also indicat-

ing that the triggering of stop-loss orders has a part

to play in this. The single trade method is likely to

reactivate newly placed stop-loss orders.

The Role of Stop-Loss Orders in Market Efficiency and Stability: An Agent-Based Study

285

00:00

Nov 20, 2021

00:05 00:10 00:15 00:20 00:25 00:30

55k

56k

57k

58k

59k

60k

_spikeDIRECTION_DOWN_BuyBackStrat_2_spiked_

Time

Price (USDT)

(a) Downward shock injected, position closed in a single trade.

00:00

Nov 20, 2021

00:05 00:10 00:15 00:20 00:25 00:30

55k

56k

57k

58k

59k

_spikeDIRECTION_DOWN_BuyBackStrat_3_spiked_

Time

Price (USDT)

(b) Downward shock injected, position closed incrementally.

00:00

Nov 20, 2021

00:05 00:10 00:15 00:20 00:25 00:30

56.5k

57k

57.5k

58k

58.5k

59k

59.5k

_spikeDIRECTION_UP_BuyBackStrat_2_spiked_1_S

Time

Price (USDT)

(c) Upward shock injected, position closed in a single trade.

00:00

Nov 20, 2021

00:05 00:10 00:15 00:20 00:25 00:30

57k

57.5k

58k

58.5k

59k

59.5k

60k

60.5k

_spikeDIRECTION_UP_BuyBackStrat_3_spiked_1_S

Time

Price (USDT)

(d) Upward shock injected, position closed incrementally.

Figure 4: Comparing price path effects for agents closing positions (a, c) immediately, and (b, d) incrementally. Under

downward (a, b) and upward (c, d) shock conditions.

Table 3: Profits of Shock agent (in US Dollars) under varying shock direction and position closing strategy. 50 Simulations

of 100,000 trades for BTCUSDT on 11/20/2021.

Shock Buy & Hold Single Trade Closure Spread Trade Closure

Up −253 × 10

4

(−273–−210) 206 × 10

4

(196–250) 214 × 10

4

(196–234)

Down 221 × 10

4

(196–240) 9.81 × 10

4

(2.2–15.6) 52.5 × 10

4

(23.5–75.8)

In all, this simulation case study suggests that an

agent can utilise stop-loss knowledge to create a more

informed strategy to generate profit. While regular

exchanges are prohibited by the Securities Exchange

Commission (SEC) from utilising this insider infor-

mation to trade against their clients, this is not the

case for Cryptocurrency exchanges. This allows ex-

changes to obtain an informational advantage to trade

against their users. Hence, opening up the possibil-

ity of exchanges orchestrating events similar to those

shown in Figure 4 for their gain.

5 RELATED WORK

Agent-based simulations have risen in popularity over

recent years. Their ability to conduct A/B testing and

analyse events that may not have occurred historically

make them an almost ideal test-bed to understand the

effects of regulation or rule changes, the performance

of trading algorithms, and the disturbance of mar-

ket conditions that have not been previously observed

(Mizuta, 2016). As such Agent-based market sim-

ulations have contributed to analysis of price varia-

tion limits (Todd et al., 2016), whether short-selling

regulations could aid in the prevention of bubbles

and crashes (Yeh and Yang, 2010; in’t Veld, 2016;

Xiong et al., 2022), as well as the impact of tick sizes

(Yagi et al., 2010), circuit breakers (Kobayashi and

Hashimoto, 2011) and many other regulatory ques-

tions. Agent-based simulators have also been used to

discover and test new trading regimes, and to under-

stand the effects they may exhibit on markets. No-

tably, testing regime identification and trading poli-

cies (Amrouni et al., 2022); determining and mimick-

ing agents’ strategies (Mahfouz et al., 2021); and in-

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

286

Table 4: Market volatility for varying shock direction and closure strategies. 50 Simulations of 100,000 trades for BTCUSDT

on 11/20/2021.

Shock Buy & Hold Single Trade Closure Spread Trade Closure

Up 6.20 (4.40–9.33) 7.85 (5.47–11.23) 6.14 (4.47–9.38)

Down 9.79 (5.57–12.18) 12.34 (6.91–14.91) 9.98 (5.88–11.08)

vestigating methods for evaluating trading strategies

(Balch et al., 2019).

A fundamental building block of agent-based sim-

ulation is of course the agents. Early market simula-

tion relied solely on the concept of Zero-Intelligence

(ZI) agents. First coined by Gode in 1993 (Gode and

Sunder, 1993), these baseline ZI agents are a family of

automated agents that submit random BID and ASK

orders. ZI agents and their variations have formed

the basis for many investigations into agent behaviour

and market properties. For example, ZI agents were

used by (Bollerslev and Domowitz, 2018) to ana-

lyze the structural impact of restricting the maximum

depth of an order book. In (Duffy and

¨

Unver, 2006)

they are used near-ZI agents to study asset price bub-

bles and crashes. Such agents also feature broadly

in markert simulations when studying more complex

agents adjacent to these in the exploration of market

phenomena (Wang and Wellman, 2017; Byrd et al.,

2020).

The concept of stop-loss cascades is not a

new idea and has been commonly observed within

FOREX markets. Osler (2005) provides evidence of

self-reinforcing price movements or “price cascades”

catalyzed by stop-loss orders. While (Noertjahyana

et al., 2020) proposes a trading strategy that takes ad-

vantage of such cascading events to generate profit.

Further, they have shown to be especially common in

cryptocurrency markets (Machowski, 2021).

6 CONCLUSION

In this paper, we have performed 3 major experi-

ments. Initially, we created a market that allowed

stop-loss orders. We compared and showed that the

introduction of stop-loss orders increases generalised

price volatility, as well as increasing the risk of large

price movements. Further, we constructed an agent

that submitted large (shock) orders and triggered stop-

loss cascades. We illustrated that the direction of

these orders plays an important role in the size of the

cascade and the market reaction. Finally, we demon-

strated the impact the agent’s closing strategy has

both on its profit, as well as the market’s price evolu-

tion. Illustrating that a slower re-accumulation strat-

egy leads to more reliable returns and less volatility

within the market.

Future Work

We focused on the impact of a single shock size on the

market. It would be interesting to study how the size

of the shock affects the market’s response, and per-

form experiments similar to (Balch et al., 2019). Par-

ticularly, to investigate if large shocks result in new

steady price levels being reached, and how the size

of the stop-loss cascade and thus the movement away

from previously placed stop-loss orders then affects

the continuing market, or if in fact, smaller shocks

simply see a return to previous price levels.

Further, our agent did not consider the structure

of the stop-loss order book when placing its orders.

A deeper analysis of the structure of the stop-loss or-

der book and its effect on the size and the resulting

price movements may greatly aid in understanding

stop-loss cascades as a phenomenon.

Additionally, this information could be used to

determine the optimal size and timing of the shock.

Either leading to improved hand-crafted agents, or

the application of reinforcement learning to create

more profitable agents that drive these market effects.

REFERENCES

Acar, E. and Toffel, R. (2001). Stop-loss and investment

returns. Financial Times/Prentice Hall, pages 51–68.

Alexander, C., Heck, D., and Kaeck, A. (2021). The role

of binance in bitcoin volatility transmission. arXiv

preprint arXiv:2107.00298.

Amrouni, S., Moulin, A., and Balch, T. (2022). Ctm-

stou driven markets: simulated environment for

regime-awareness in trading policies. arXiv preprint

arXiv:2202.00941.

Balch, T. H., Mahfouz, M., Lockhart, J., Hybinette, M., and

Byrd, D. (2019). How to evaluate trading strategies:

Single agent market replay or multiple agent interac-

tive simulation? arXiv preprint arXiv:1906.12010.

Bollerslev, T. and Domowitz, I. (2018). Some effects of

restricting the electronic order book in an automated

trade execution system. In The Double Auction Mar-

ket Institutions, Theories, and Evidence, pages 221–

252. Routledge.

Byrd, D., Hybinette, M., and Balch, T. H. (2020). Abides:

Towards high-fidelity multi-agent market simulation.

In Proc. 2020 ACM SIGSIM Conference on Princi-

ples of Advanced Discrete Simulation, page 11–22,

The Role of Stop-Loss Orders in Market Efficiency and Stability: An Agent-Based Study

287

New York, NY, USA. Association for Computing Ma-

chinery.

Cont, R. (2001). Empirical properties of asset returns: styl-

ized facts and statistical issues. Quantitative finance,

1(2):223.

Duffy, J. and

¨

Unver, M. U. (2006). Asset price bubbles and

crashes with near-zero-intelligence traders. Economic

theory, 27:537–563.

Gode, D. K. and Sunder, S. (1993). Allocative efficiency

of markets with zero-intelligence traders: Market as a

partial substitute for individual rationality. Journal of

political economy, 101(1):119–137.

in’t Veld, D. (2016). Adverse effects of leverage and short-

selling constraints in a financial market model with

heterogeneous agents. JOURNAL OF ECONOMIC

DYNAMICS & CONTROL, 69:45–67.

Kobayashi, S. and Hashimoto, T. (2011). Benefits and lim-

its of circuit breaker: Institutional design using arti-

ficial futures market. Evolutionary and Institutional

Economics Review, 7:355–372.

Liston, P., Gretton, C., and Lensky, A. (2022). Limit Order

Book and its Role in Price Development - A Hybrid

Approach to Simulating a Market. In 3rd ACM Inter-

national Conference on AI in Finance (ICAIF-22).

Liston, P., Gretton, C., and Lensky, A. (2023). Modeling

the Effect of Cascading Stop-Losses and Its Impact

on Price Dynamics. In AI for Financial Institutions.

AAAI Bridge 2023 FinST.

Machowski, K. (2021). Scamwicks and stop cascades.

Mahfouz, M., Balch, T., Veloso, M., and Mandic, D. (2021).

Learning to classify and imitate trading agents in con-

tinuous double auction markets. In Proceedings of the

Second ACM International Conference on AI in Fi-

nance, pages 1–8.

Mizuta, T. (2016). A brief review of recent artificial market

simulation (agent-based model) studies for financial

market regulations and/or rules. Available at SSRN

2710495.

Noertjahyana, A., Christopher, A., Abas, Z. A., Yusoh, Z.,

and Setiawan, A. (2020). Stop hunt detection using

indicators and expert advisors in the forex market. In

Journal of Physics: Conference Series, volume 1502,

page 012054. IOP Publishing.

Osler, C. L. (2005). Stop-loss orders and price cascades in

currency markets. Journal of international Money and

Finance, 24(2):219–241.

Poon, S.-H. and Granger, C. W. J. (2003). Forecasting

volatility in financial markets: A review. Journal of

economic literature, 41(2):478–539.

Spooner, T., Fearnley, J., Savani, R., and Koukorinis, A.

(2018). Market making via reinforcement learning. In

Proceedings of the 17th International Conference on

Autonomous Agents and MultiAgent Systems, pages

434–442.

Todd, A., Beling, P., Scherer, W., and Yang, S. Y. (2016).

Agent-based financial markets: A review of the

methodology and domain. In 2016 IEEE Symposium

Series on Computational Intelligence (SSCI), pages 1–

5.

Torii, T., Izumi, K., and Yamada, K. (2015). Shock transfer

by arbitrage trading: analysis using multi-asset artifi-

cial market. Evolutionary and Institutional Economics

Review, 12:395–412.

Vytelingum, P. (2006). The structure and behaviour of the

continuous double auction. PhD thesis, University of

Southampton.

Wang, X. and Wellman, M. (2017). Spoofing the limit order

book: An agent-based model.

Xiong, X., Liu, J., Yang, Z., Han, J., et al. (2022). An agent-

based model for the impact of price limit changes

on market quality. International Journal of Infor-

mation Technology & Decision Making (IJITDM),

21(06):1777–1795.

Yagi, I., Mizuta, T., and Izumi, K. (2010). A study on the ef-

fectiveness of short-selling regulation using artificial

markets. Evolutionary and Institutional Economics

Review, 7:113–132.

Yeh, C.-H. and Yang, C.-Y. (2010). Examining the ef-

fectiveness of price limits in an artificial stock mar-

ket. Journal of Economic Dynamics and Control,

34(10):2089–2108.

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

288