Deep Learning, Feature Selection and Model Bias with Home Mortgage

Loan Classification

Hope Hodges

1 a

, J. A. (Jim) Connell

2 b

, Carolyn Garrity

2

and James Pope

3 c

1

Mississippi State University, Starkville, MS, U.S.A.

2

Stephens College of Business, University of Montevallo, Montevallo, AL, U.S.A.

3

Intelligent Systems Laboratory, University of Bristol, Bristol, U.K.

Keywords:

Deep Learning, Feature Selection, Home Mortgage Disclosure Act, Loan Classification, Financial Technology.

Abstract:

Analysis of home mortgage applications is critical for financial decision-making for commercial and govern-

ment lending organisations. The Home Mortgage Disclosure Act (HMDA) requires financial organisations to

provide data on loan applications. Accordingly, the Consumer Financial Protection Bureau (CFPB) provides

loan application data by year. This loan application data can be used to design regression and classification

models. However, the amount of data is too large to train for modest computational resources. To address

this, we used reservoir sampling to take suitable subsets for processing. A second issue is that the number

of features are limited to the original 78 features in the HMDA records. There are a large number of other

data source and associated features that may improve model accuracy. We augment the HMDA data with ten

economic indicator features from an external data source. We found that the additional economic features

do not improve the model’s accuracy. We designed and compared several classical and recent classification

approaches to predict the loan approval decision. We show that the Decision Tree, XG Boost, Random Forest,

and Support Vector Machine classifiers achieve between 82-85% accuracy while Naive Bayes results in the

lowest accuracy of 79%. We found that a Deep Neural Network classifier had the best classification perfor-

mance with almost 89% f1 accuracy on the HMDA data. We performed feature selection to determine what

features are the most important loan classification. We found that the more obvious loan amount and applicant

income were important. Interestingly we found that when we left race and gender in the feature set, unfortu-

nately, they were selected as an important feature by the machine learning methods. This highlights the need

for diligence in financial systems to make sure the machine is not biased.

1 INTRODUCTION

We used the Home Disclosure Mortgage Act Data

(Bureau, 2017) covering the years 2007-2017 (Mc-

Coy, 2007). We augmented the model by adding eco-

nomic indicator data from Trading Economics (Eco-

nomics, 2023).

The Home Disclosure Mortgage Act (HMDA) is

used to make sure financial institutions are maintain-

ing, reporting, and disclosing loans properly. HMDA

can be used furthermore to find discriminatory pat-

terns. We then proposed the question. If a loan was

approved why was it approved? If a loan was rejected

why was it rejected? This can be used to find discrim-

a

https://orcid.org/0009-0004-5591-6611

b

https://orcid.org/0000-0002-0458-0589

c

https://orcid.org/0000-0003-2656-363X

inatory patterns, issues in our economy, and even fu-

ture problems. We even combined exogenous data to

help with our findings. We started looking at the data

in August and figuring out how we wanted to process

it. The data was from 2007-2017 and contained over

165 million records. The data needed to be slimmed

down. We used reservoir sampling to get about ten

thousand samples from each year.

We used the Home Disclosure Mortgage Act Data

(Bureau, 2017) covering the years 2007-2017 (Mc-

Coy, 2007). We augmented the model by adding eco-

nomic indicator data from Trading Economics (Eco-

nomics, 2023).

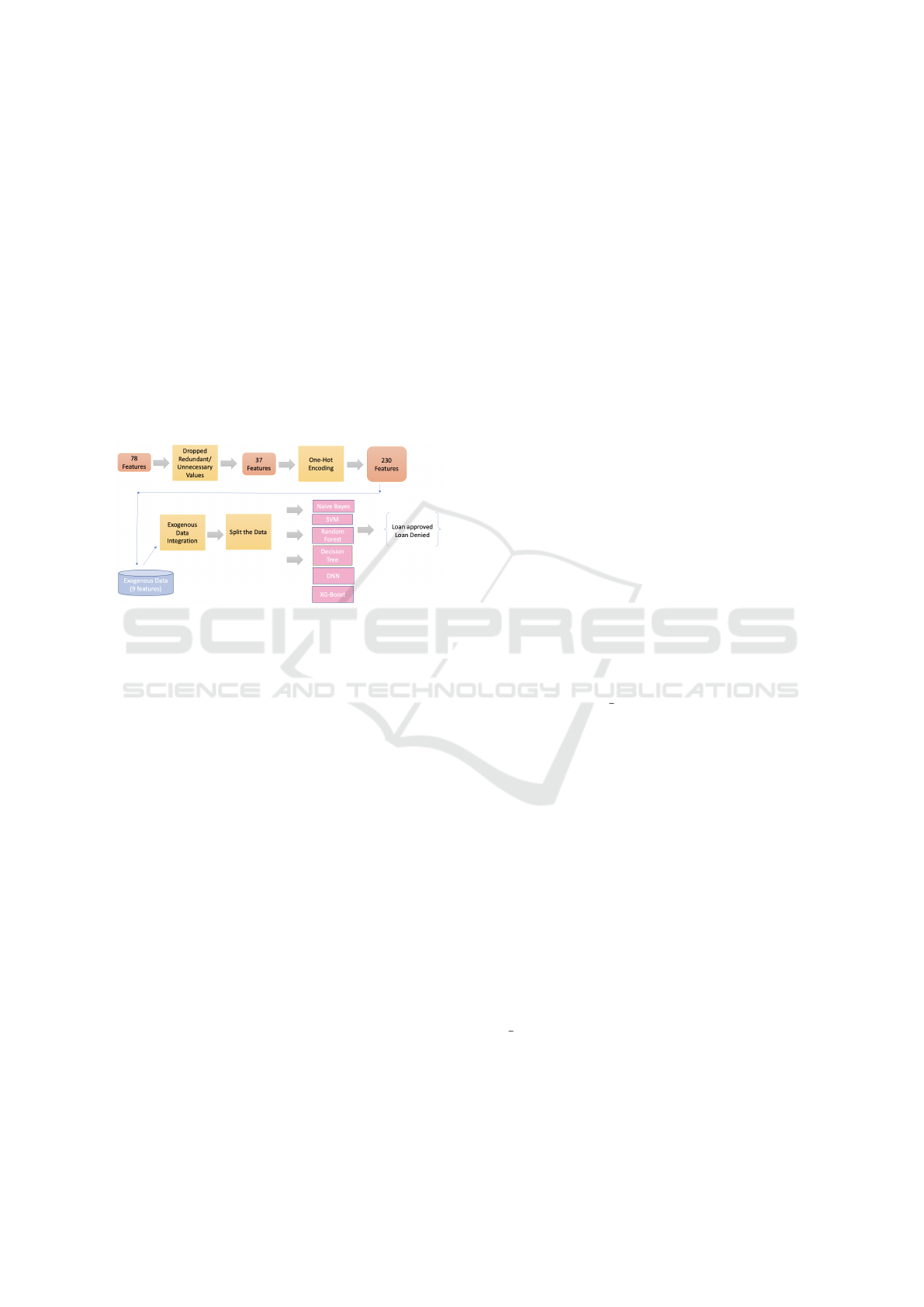

To address the data size issue, we propose strati-

fied (by year) reservoir sampling for taking represen-

tative samples to train machine learning classification

models. We then perform feature extraction on the

sample. We use 37 of the original 78 loan applica-

248

Hodges, H., Connell, J., Garrity, C. and Pope, J.

Deep Learning, Feature Selection and Model Bias with Home Mortgage Loan Classification.

DOI: 10.5220/0012326800003654

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 13th International Conference on Pattern Recognition Applications and Methods (ICPRAM 2024), pages 248-255

ISBN: 978-989-758-684-2; ISSN: 2184-4313

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

tion features. These are then one-hot-encoded and

standardised to create 230 total features. Finally, we

convert the loan actions (seven categories) into a bi-

nary classification of {approve, deny}. To address the

interpretability, we design, show, and analyse a deci-

sion tree model for loan applications. The decision

tree more naturally provides transparent/explainable

decisions. We compare the decision tree against other

traditional classifiers (Naive Bayes, Support Vector

Machine, RandomForest), as well as, more recent

approaches including a custom deep neural network

and a boosted ensemble tree method (XGBoost). We

found that the Deep Neural Network (DNN) classi-

fier produced the highest accuracy of nearly 89%,

followed by RandomForest and the more recent XG-

Boost classifier around 84%.

Figure 1: Overview.

The contributions of this paper are as follows:

• Approach to address computational issues with

large amount of loan data.

• Explainable AI: Develop/analyse using decision

trees for loan applications.

• Feature Selection: Determine the most important

loan application features for approving loans.

We also provide evidence that specific economic

(exogenous) data was ineffective at improving loan

classification accuracy.

2 RELATED WORK

To take a uniform random sample from a long, possi-

bly infinite, stream, Vitter (Vitter, 1985) proposes an

efficient technique based on using a reservoir. Reser-

voir sampling ensures that k items are sampled from n

items uniformly even for extremely large datasets that

would exceed the memory of a computer.

Fishbein, et al. (Fishbein and Essene, 2010), ex-

plains about the history of HMDA and ways it can be

improved. Bhutta, et al. (Bhutta et al., 2017), provide

an exploratory data analysis of HMDA but do not de-

velop any inference models. Lai, et al. (Lai et al.,

2023), recently proposed an ordinary least square re-

gression model, with roughly seven features, using

the HMDA data and CEO confidence to predict lend-

ing results.

Sama Ghoba, Nathan Colaner. (Ghoba and

Colaner, 2021) Used a matching-based Algorithm to

find discriminatory patterns. Agha, et al. (Agha and

Pramathevan, 2023), investigate gender differences in

corporate financial decisions using an executive deci-

sion dataset. They use more traditional general lin-

ear models / hypothesis tests for analysis. Wheeler,

et al. (Wheeler and Olson, 2015), used the HMDA

data with manually selected features to develop gen-

eral linear models for detecting racial bias in lending.

To our knowledge, this is the first research that

develops machine learning inference models from the

HMDA dataset. Furthermore, our work is the first to

show that machine learning models may use gender

and race for loan decisions, which is illegal for many

financial institutions.

3 HMDA DATA PREPROCESSING

The original data was downloaded from the CFPB

HMDA website (Bureau, 2017) and unzipped into

comma-separated (CSV) files. Each year has its own

CSV file. We take a uniform sample from each

year. Each year will have 78 features, however, many

of the features are redundant (code versions, e.g.

state=Alabama, state code=2).

3.1 Reservoir Sampling

We used Stratified Sampling to get a certain amount

of records from each year. This was done because

there were so many records from each year. With over

26 million records picking a sample randomly was

imperative. Therefore using an algorithm from the

randomized algorithms family was the answer. The

reservoir sampling was what we used and provided

excellent results. With N being as big as it was K was

randomly selected each time.

3.2 Remove Redundant Features

We then dropped features that are redundant e.g.

State Code and State name (e.g. state=Alabama,

state code=2). Table 1 shows the 37 features that

were removed. These features were removed due to

the repetition and or not having any relevance.

Deep Learning, Feature Selection and Model Bias with Home Mortgage Loan Classification

249

Table 1: Removed Features.

Removed Redundant Features

sequence number application date indicator agency code

agency name as of year applicant ethnicity

loan purpose applicant sex co applicant sex

purchaser type hoepa status, property type lien status

co applicant ethnicity state code respondent id

msamd msamd name preapproval

county name county code edit status name

edit status loan type

Table 2: Base Features.

Features

agency abbr loan type name property type name

loan purpose name owner occupancy name owner occupancy

loan amount 000s preapproval name action taken name

action taken state abbr census tract number

applicant ethnicity name co applicant ethnicity name applicant race name 1

applicant race name 2 applicant race name 3 applicant race name 4

applicant race name 5 co applicant race name 1 co applicant race name 2

co applicant race name 3 co applicant race name 4 co applicant race name 5

applicant sex name co applicant sex name applicant income 000s

purchaser type name rate spread hoepa status name

lien status name population minority population

hud median family income tract to msamd income number of 1 to 4 family units

number of owner occupied units

3.3 Remove Non-Attainable Features

We then dropped the non-attainable features since that

is the answer we are trying to get through regression

and classification. e.g. denial reason (and coded ver-

sion). After this step, there are 37 features. These

were added later to the application for further testing.

3.4 One Hot Encoding

Table 2 shows the base features. Many of these

features are categorical and need to be numerical

for the subsequent classifiers (specifically the deep

neural network). We used sci-kit-learn one-hot en-

coding (Pedregosa et al., 2011), however, if a code

does not exist in one year but does exist in another

year, then we would end up with inconsistent fea-

tures. Therefore, we developed our own one-hot en-

coding that takes a list of categories for each fea-

ture to be encoded. For example, agency abbr OTS

and agency abbr OCC each have their own column

instead of all the agency abbr being together in one

column. From the base features, this produces 230

numerical features.

3.5 Handle Missing Values

We choose to take the average to handle missing val-

ues. All values that are missing for a feature are given

the average of the available features.

3.6 Multi to Binary Classification

Conversion

We are trying to classify the action taken given the

230 variables. Here are the eight.

1. Loan originated

2. Application approved but not accepted

3. Application denied by financial institution

4. Application withdrawn by applicant

5. File closed for incompleteness

6. Loan purchased by the institution

7. Preapproval request denied by financial institution

8. Preapproval request approved but not accepted

(optional reporting)

ICPRAM 2024 - 13th International Conference on Pattern Recognition Applications and Methods

250

After analysis, the point we are making is why or

why not someone was approved. We did not need, for

instant Application Withdrawn or Loan Purchased

by Financial Institution . Therefore we dropped ev-

erything but Loan originated , Application approved

but not accepted (still counts as denied), and then Ap-

plication denied by financial institution. We dropped

everything by using simple code with a conditional

statement. We needed a clear-cut answer henceforth

why went binary.

3.7 Merging by Year

We take each year’s k = 10000 items for each year

and combine them into one CSV file. We added an

extra feature that includes the year of the record.

As we were working on this, we found govern-

ment data ranging (the Exogenous data) from US

Bankruptcies to US government Pay Rolls. We de-

cided to add to US Bankruptcies, US Consumer

Spending, US Disposable Personal Income, US GDP

Growth Rate, US New Home Sales, US Personal In-

come, and US Personal Savings Rate. All these corre-

late with one another. For instance, if US New Home

sales are up for the year 2013 then we know the num-

ber of loans given out will be up for the same year.

For the set up we took each year of the Exogenous

data got the average and put it with the corresponding

year of the HMDA data.

Being able to combine Exogenous data would

help us understand the algorithm better and have a

better understanding of why some people were ap-

proved and others disapproved.

For the Exogenous data, we did Bankruptcy, Con-

sumer Confidence, Disposable Income, Personal In-

come, Personal Savings, Prime Lending Rate, New

Home Sales, GDP Growth Rate, and Consumer

Spending. After we put it together our date was

110, 000 rows and 88 Columns. We then followed

the same process and one hot encoded and the results

were (110, 000, 237)

• Bankruptcies were used to see why some people

could be denied loans.

• Consumer Confidence was to show the business

conditions that year.

• Disposable Income was added because the more

income that can be spent the more loans can be

given out.

• Personal Income was added because personal in-

come matters on what type of loans are given out.

• Personal Savings was added because the more

savings people have the more they can put the

money towards a house.

• Prime Lending Rate was added because it is major

on how many loans have been given out.

• New Home Sales was added because people need

loans for new home.s

• GDP Growth Rate was added to see how much

our economy has grown and to compare it to our

results.

• Consumer Spending was added due to it’s impor-

tant of the correlation between it and the GDP

Growth Rate.

4 CLASSIFICATION

ALGORITHM DESIGN AND

ANALYSIS

We considered several classical classification al-

gorithms, which include Random Forest, Decision

Tree, Support Vector Machine (SVM), and Naive

Bayes. These classifiers cover a diverse set of ap-

proaches including tree/entropy-based (Random For-

est and Decision Tree), probabilistic (Naive Bayes),

and maximum-margin hyperplane (SVM). We also

consider a more recent Deep Neural Network classi-

fier (DNN).

4.1 Classical Classification Algorithms

We take the processed data and conduct experiments

to evaluate each classifier. We randomly split the

combined file of 110000 records into a train and test

(70% train set, 30% test set). The classification task

is to take the processed features and predict whether

a loan is approved or denied (i.e. binary classifica-

tion). For each experiment, we use a confusion ma-

trix to show our findings. This is a table to show the

performance of the algorithm. The bottom of the con-

fusion matrix indicates what the classifier predicted

and the left indicates the actual loan approval. True

means the loan was approved and False means the

loan was denied. The True-True intersection means

that it was predicted accurately by the classifier. The

False-False intersection means that it was also pre-

dicted accurately. Whereas False-True and True-False

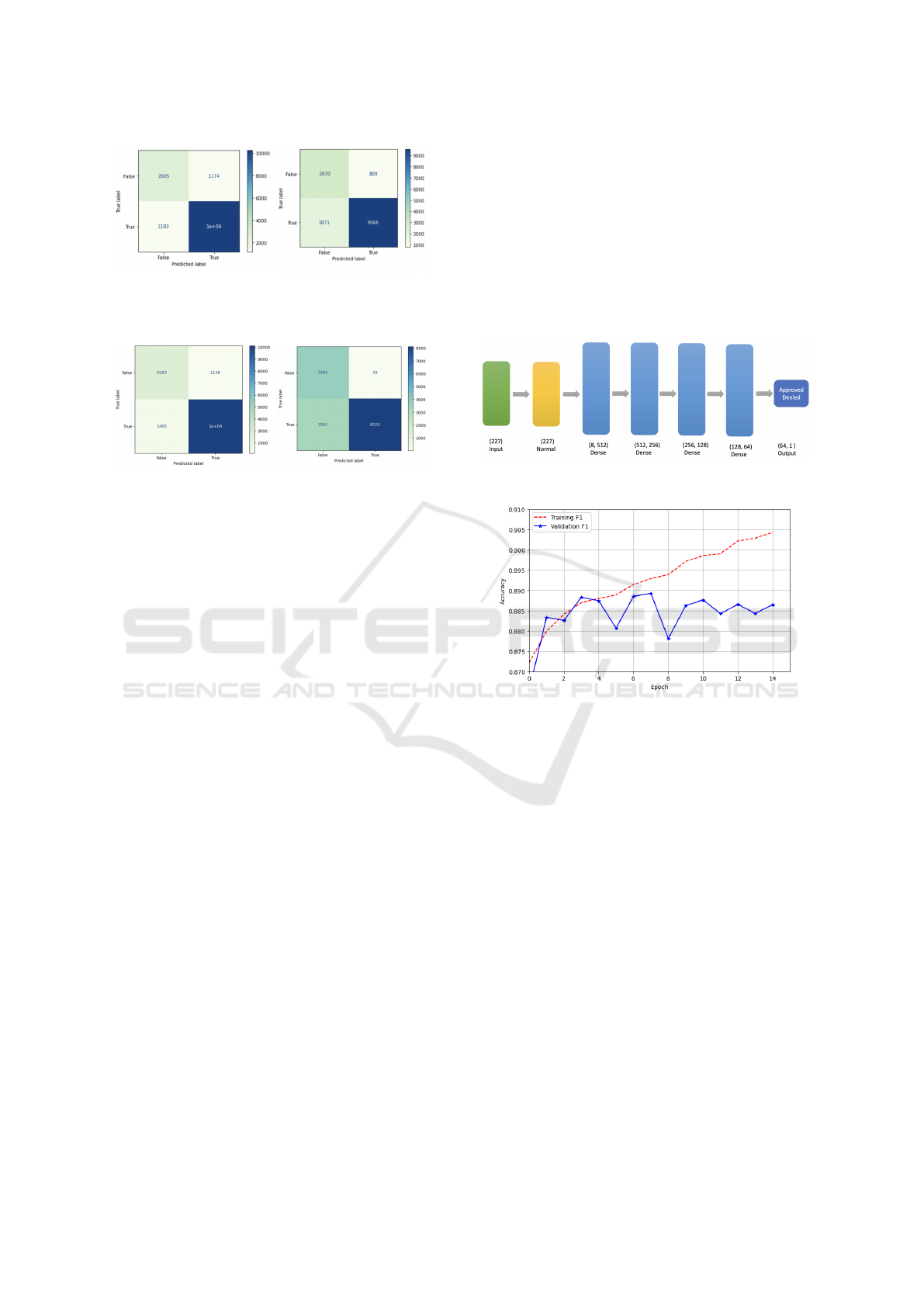

mean that it was not predicted accurately. Figure 2

shows the confusion matrices for the Random Classi-

fier and Decision Tree classifiers.

The Decision Tree was chosen for simplicity pur-

poses. Each node in the tree splits off into a more spe-

cific subtrees and filters down to a leaf node. The data

is then captured, understood, and analyzed. The De-

cision Tree is notable in that it can provide a more ex-

Deep Learning, Feature Selection and Model Bias with Home Mortgage Loan Classification

251

(a) Confusion Matrix:

Random Forest Classifier

without the Exogenous

Data 84.6%.

(b) Confusion Matrix:

Decision Tree Classifier

without the Exogenous

Data 83.0%.

(c) Confusion Matrix:

SVM without

Exogenous 83.0%.

(d) Confusion Matrix:

Naive Bayes without

Exogenous 79.0%.

Figure 2: HMDA Features Only F1 Results.

plainable interpretation of the decision-making, crit-

ical for financial guidelines. Random Forest is an

ensemble of decision trees. These two methods are

some of the best for classification. We also use Sup-

port Vector Machines (SVMs) which can also used

for classification and regression. The advantages are

effective in high-dimensional spaces. Still effective

in cases where the number of dimensions is greater

than the number of samples. SVM had an accuracy of

83.0%. Finally, we consider the Naive Bayes clas-

sifier which is a probabilistic machine learning ap-

proach. Below are the F1 accuracy results for each

of these classification algorithms.

• The Random Forest accuracy was 84.6%

• The Decision Tree accuracy was 83.0%

• Support Vector Machine accuracy was 83.5%

• The Naive Bayes accuracy was 79.0%

4.2 Deep Neural Network

Deep neural networks (DNN) are known to perform

well for certain problems. To compare against this

more recent method, we designed a deep learning ar-

chitecture. The multiple layers can allow additional

features to be learned using a technique known as

deep learning (Bengio et al., 2021). Ideally, the early

layers would learn basic features and the subsequent

layers would use them to learn more complex fea-

tures. Figure 3 depicts the architecture of five lay-

ers with a binary layer at the end. We used the

TensorFlow deep learning framework to implement

the architecture. We used the Adam optimiser along

with the binary cross entropy loss function. To miti-

gate overfitting, we used the framework’s default im-

plementation of early stopping. Figure 4 shows the

learning curve for one experiment. As shown, when

the difference between the training and validation ac-

curacy becomes significant at epoch 14 the training

ceases. The best validation F1 for this experiment was

approximately 88.9% in epoch 7.

Figure 3: DNN Architecture.

Figure 4: DNN Learning Curve (Epoch 7 model used to

avoid overfitting).

4.3 XG Boost

One classifier we worked with was XG Boost stand-

ing for Extreme Gradient Boosting. This classi-

fier combines weaker models and then produces a

stronger prediction. It has also been known to work

well with large data sets such as ours. XG Boost

achieved an average accuracy of 84%.

4.4 Feature Selection

To better understand the features and to select a more

parsimonious model, we perform feature selection us-

ing the scikit-learn library (Pedregosa et al., 2011).

We use the select k best features (those with the high-

est score) using two common methods: χ

2

method

and mutual information method. For convenience,

we chose to use the seven (k = 7) most important

features as determined by both methods. Table 3

shows the features chosen by both approaches in order

ICPRAM 2024 - 13th International Conference on Pattern Recognition Applications and Methods

252

Table 3: Comparison of Feature Selection Methods (k=7).

Index χ

2

Mutual Information

1 property type name Manufactured housing loan amount 000s

2 loan purpose name Home purchase applicant income 000s

3 loan purpose name Home improvement rate spread

4 preapproval name Preapproval was not requested tract to msamd income

5 applicant race name 1 Black or African American loan purpose name Home purchase

6 co applicant sex name Female loan purpose name Home improvement

7 lien status name Not secured by a lien co applicant race name 5 nan

1 2 3 4

5 6

7

0.60

0.62

0.64

0.66

0.68

0.70

Feature Index

Accuracy (F1)

χ

2

Mutual Information

Figure 5: Accuracy Comparison for Feature Selection

Methods.

(where index 1 is more important than index 2). We

can see that the Mutual Information method selects

more intuitive features, specifically the loan amount,

applicant’s income, and the rate spread (which con-

veys the interest rate). The χ

2

method selects less

intuitive features, though they could be correlated

with the features chosen by Mutual Information (e.g.

loan amount 000s ∼ loan purpose name Home im-

provement). Worryingly, race and gender features are

selected by both methods. For ethical reasons, these

should be removed from any model design, however,

this research reinforces the need for careful feature se-

lection because models may be used for determining

loan decisions.

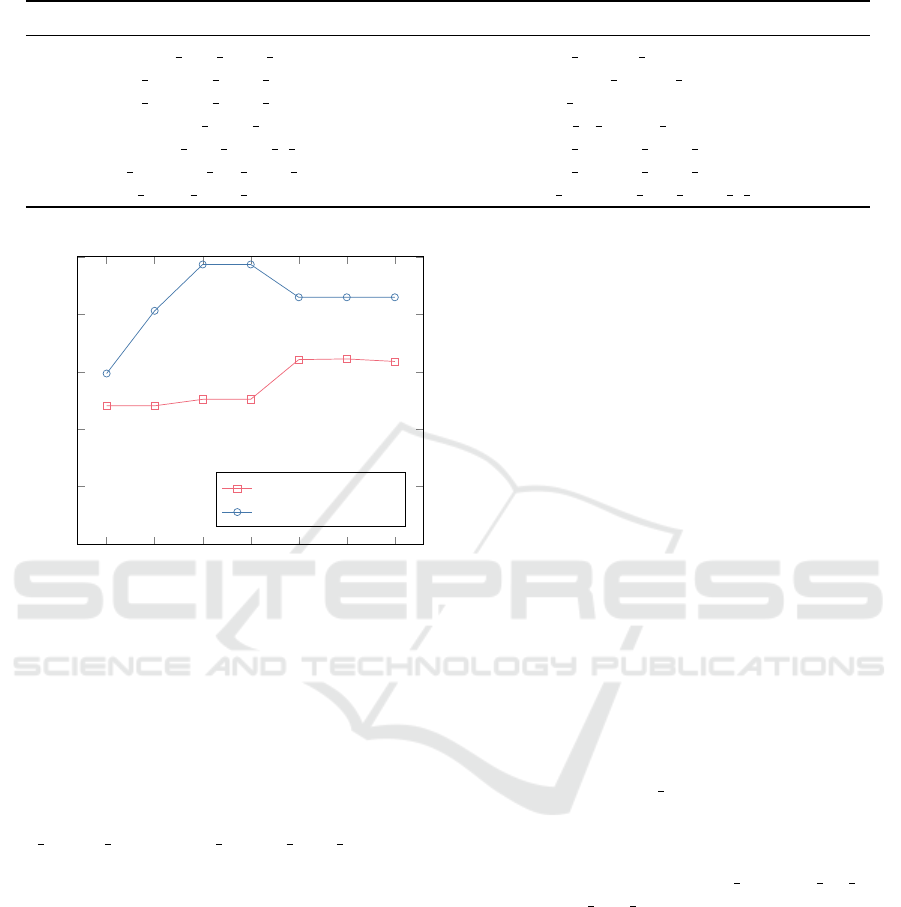

To compare the two feature selection methods, we

train a decision tree classifier using the first most im-

portant feature for each method, then the second, etc.,

and evaluate the accuracy for each model. Figure 5

shows the results for both methods. Clearly, the Mu-

tual Information method chooses better features than

the χ

2

method. With only three features, the Mu-

tual Information method achieves near 70% accuracy

whereas the entire feature set of 230 achieves 83%

(from Figure 2b).

4.5 Exogenous Effects

After running through the data with the exogenous

features the results were insignificant. The Random

Forest accuracy did increase by .01 and was 84.7%.

The Decision Tree accuracy also increased by .01.

The accuracy of that was 83.1%. The accuracy was

essentially the same between models with and with-

out the exogenous date. The results were similar and

stable. This can be attributed to how the exogenous

data is aligned with the loan data. The exogenous

economic data either has monthly or quarterly time

periods whereas the loan data was yearly. We believe

that averaging the economic data loses too much in-

formation to be useful for classifying loan actions.

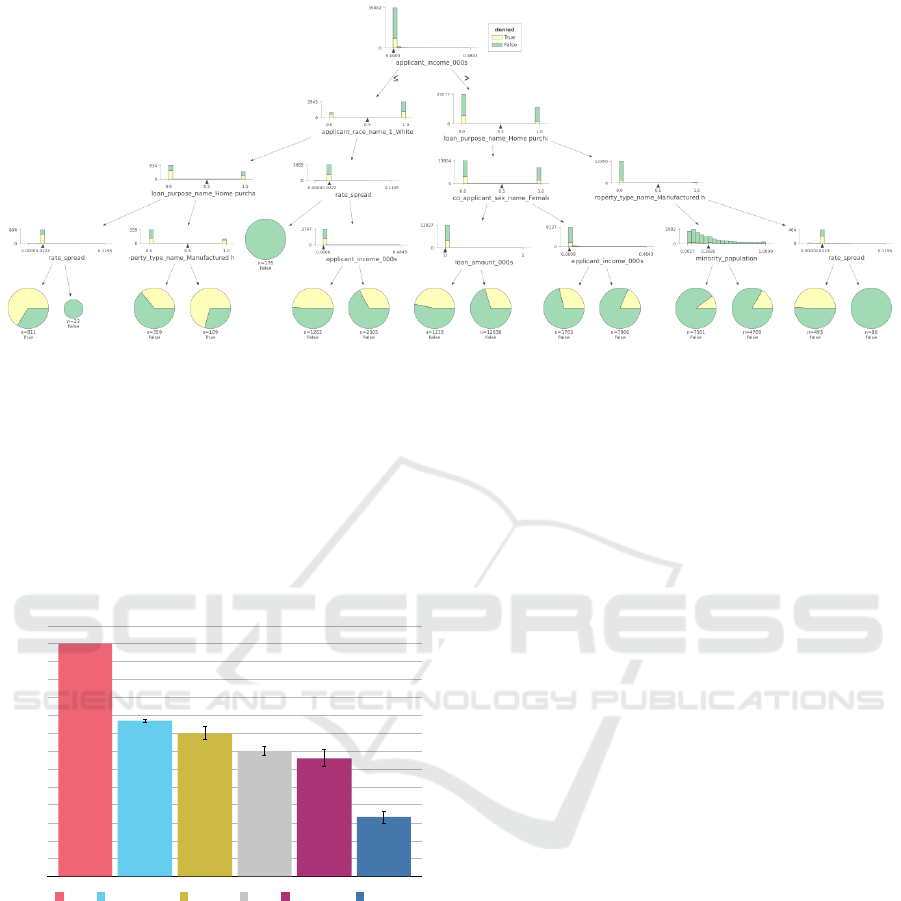

4.6 Explainable Decision Tree Model

Though the decision tree does not perform as well re-

garding accuracy, its decisions are more easily under-

stood by humans (assuming the depth of the tree is

reasonably small, e.g. less than 7). Figure 6 shows

the resulting decision tree trained on the data. The top

node starts at applicant income which is an important

consideration when a bank is approving loan applica-

tions. To demonstrate potential bias issues, we can see

that the model uses race and gender to classify the ap-

plication (intermediate nodes co applicant sex name

and applicant race name). This further motivates

careful data processing of loan applications to remove

gender and race information prior to model training.

5 CLASSIFICATION

ALGORITHM COMPARISON

As before, for each experiment, we randomly split the

data into a train and test set (70% train, 30% test). We

then train the classifier on the training set. Finally, we

evaluate the model on the test set to determine the F1

score. For each classifier, we repeat the experiment

ten times to determine the 99% confidence intervals.

Deep Learning, Feature Selection and Model Bias with Home Mortgage Loan Classification

253

Figure 6: Explainable Model - Decision Tree (depth=4.

Confidence intervals for the DNN are omitted due to

time constraints. Figure 7 shows how the F1 scores

compare for each of the classifiers. The figure clearly

shows that the DNN produces a more accurate model

(around 5% better than the Random Forest) achiev-

ing 89% accuracy. The Random Forest, SVM, XG

Booost, and Decision Tree produce similar results be-

tween 82-85% accuracy. Naive Bayes resulted in the

lowest accuracy of 79%.

Accuracy (F1)

0.76

0.77

0.78

0.79

0.80

0.81

0.82

0.83

0.84

0.85

0.86

0.87

0.88

0.89

0.90

0.793

0.826

0.83

0.84

0.847

0.89

DNN Random Forest XG Boost SVM Decision Tree Naive Bayes

Figure 7: F1 Comparison of Classification Algorithms.

6 CONCLUSION

In this paper, we looked at using HMDA loan data

and exogenous economic data to build classification

models to determine whether a loan was approved

or denied. Due to the size of the loan data, we em-

ployed reservoir sampling to significantly reduce the

amount of data considered. The reduced loan data

was preprocessed to produce 230 features from 78

features. We then augmented the 230 features with

10 features extracted from the exogenous economic

data. Because the loans only have a year, to augment

the two data sets we had to average the monthly (or

quarterly) economic data into years as well. We found

that adding the exogenous data did not significantly

improve model accuracy. We believe this is because

averaging the economic data by year loses too much

information. We then considered using only the loan

data to compare several classification approaches. We

found that the Random Forest, XG Boost, SVM, and

Decision Tree classifiers resulted in between 82-85%

f1 accuracy and Naive Bayes had the lowest at 79%.

We designed a Deep Neural Network that achieved

the highest and most impressive accuracy of 89%.

Our results show that the HMDA loan data can be

used to accurately predict loan approved/denied ac-

tion of near 90%. Furthermore, our results indicate

that more research is necessary to take advantage of

economic data with loan application data. Specifi-

cally, providing the month that a loan action was taken

would allow more sophisticated time series classifi-

cation approaches such as recurrent neural networks

(RNNs).

REFERENCES

Agha, M. and Pramathevan, S. (2023). Executive gen-

der, age, and corporate financial decisions and perfor-

mance: The role of overconfidence. Journal of Behav-

ioral and Experimental Finance, 38:100794.

Bengio, Y., Lecun, Y., and Hinton, G. (2021). Deep learning

for ai. Commun. ACM, 64(7):58–65.

Bhutta, N., Laufer, S., and Ringo, D. R. (2017). Residential

Mortgage Lending in 2016: Evidence from the Home

Mortgage Disclosure Act Data. Federal Reserve Bul-

letin, 103(6).

Bureau, C. F. P. (2017). Mortgage data (HMDA). Accessed:

2023-01-31.

ICPRAM 2024 - 13th International Conference on Pattern Recognition Applications and Methods

254

Economics, T. (2023). Trading economics. Accessed:

2023-01-31.

Fishbein, A. and Essene, R. (2010). The

home mortgage disclosure act at thirty-

five: Past history, current issues.

https://www.jchs.harvard.edu/sites/default/files/mf10-

7.pdf.

Ghoba, S. and Colaner, N. (2021). Counterfactual fairness

in mortgage lending via matching and randomization.

Lai, S., Liu, S., and Wang, Q. S. (2023). D

´

ej

`

a vu: Ceo over-

confidence and bank mortgage lending in the post-

financial crisis period. Journal of Behavioral and Ex-

perimental Finance, 39:100839.

McCoy, P. (2007). The home mortgage disclosure act: A

synopsis and recent legislative history. Journal of Real

Estate Research, 29(4):381–398.

Pedregosa, F., Varoquaux, G., Gramfort, A., Michel, V.,

Thirion, B., Grisel, O., Blondel, M., Prettenhofer,

P., Weiss, R., Dubourg, V., Vanderplas, J., Passos,

A., Cournapeau, D., Brucher, M., Perrot, M., and

Duchesnay, E. (2011). Scikit-learn: Machine learning

in Python. Journal of Machine Learning Research,

12:2825–2830.

Vitter, J. S. (1985). Random sampling with a reservoir.

ACM Trans. Math. Softw., 11(1):37–57.

Wheeler, C. H. and Olson, L. M. (2015). Racial differences

in mortgage denials over the housing cycle: Evidence

from u.s. metropolitan areas. Journal of Housing Eco-

nomics, 30:33–49.

Deep Learning, Feature Selection and Model Bias with Home Mortgage Loan Classification

255