KAIME: Central Bank Digital Currency with

Realistic and Modular Privacy

Ali Dogan

1,2 a

and Kemal Bicakci

1 b

1

Computer Engineering Department and Informatics Institute, Istanbul Technical University, Istanbul, Turkey

2

Blockchain Technologies Unit, T

¨

UB

˙

ITAK B

˙

ILGEM, Kocaeli, Turkey

Keywords:

CBDC, Privacy, Cryptography, Zero Knowledge Proofs, Threshold Cryptography, Realistic Privacy,

Regulatory Mechanism, AML, KYC, CFT.

Abstract:

Recently, with the increasing interest in Central Bank Digital Currency (CBDC), many countries have been

working on researching and developing digital currency. The most important reasons for this interest are that

CBDC eliminates the disadvantages of traditional currencies and provides a safer, faster, and more efficient

system. These benefits also come with challenges, such as safeguarding individuals’ privacy and ensuring reg-

ulatory mechanisms. While most research address the privacy conflict between users and regulatory agencies,

they miss an essential detail. Important parts of a financial system are banks and financial institutions. Some

studies ignore the need for privacy and include these institutions in the CBDC system, no system currently

offers a solution to the privacy conflict between banks, financial institutions, and users. In this study, while

we offer a solution to the privacy conflict between the user and the regulatory agencies, we also provide a

solution to the privacy conflict between the user and the banks. Our solution, KAIME (the name given to the

first banknote issued by the Ottoman Empire) alsa has a modular structure. In the transaction, the sender and

receiver can be hidden if desired. Compared to previous related research, security analysis and implementation

of KAIME is substantially simpler because simple and well-known cryptographic methods are used. Addi-

tionally, the zero-knowledge proofs employed can function without the assistance of a trusted third party.

1 INTRODUCTION

Blockchain technology has gained popularity with the

emergence of cryptocurrencies. Many people have

started to adopt and use these cryptocurrencies. Mo-

tivated by the prevalence and success of blockchains,

there is a race between central banks for the develop-

ment of Central Bank Digital Currency (CBDC). CB-

DCs could be a revolution in terms of payment sys-

tems worldwide. Several central banks, including the

Swedish central bank (Riksbank, 2020) and the Bank

of England (Bank of England, 2020), have shown in-

terest in developing their own digital currencies. The

People’s Bank of China (Zhao, 2020) has already be-

gun testing the digital yuan. Moreover, several cen-

tral banks, in collaboration with the Bank for Interna-

tional Settlements (BIS), have described the key con-

cepts and characteristics of a CBDC. However, this

revolution also brings problems, such as protecting

a

https://orcid.org/0009-0009-4191-2982

b

https://orcid.org/0000-0002-2378-8027

private life and harmonizing regulations. How dig-

ital currencies can balance privacy and regulation is

one of the focuses of recent research.

Many people are worried that introducing CBDCs

may result in the central bank having continuous ac-

cess to transactional data, making it a ”panopticon.”

This concern is not unique to CBDCs and has also

been expressed regarding first-generation cryptocur-

rencies like Bitcoin and Ethereum, which are only

pseudonymous. To address this, privacy-enhanced

cryptocurrencies such as ZCash (Sasson et al., 2014)

and Monero (Van Saberhagen, 2018) were developed

to provide a higher level of anonymity by hiding the

value of transactions and making them unlinkable.

However, this anonymity could also attract those who

wish to use these systems for illegal activities, such

as money laundering and financing terrorism. As a

result, privacy-preserving systems using such tech-

niques may pose challenges in regulatory compliance

settings.

Related Work. Chaum introduced the initial

framework for anonymous electronic cash in his work

672

Dogan, A. and Bicakci, K.

KAIME: Central Bank Digital Currency with Realistic and Modular Privacy.

DOI: 10.5220/0012308600003648

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 10th International Conference on Information Systems Security and Privacy (ICISSP 2024), pages 672-681

ISBN: 978-989-758-683-5; ISSN: 2184-4356

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

(Chaum, 1983), which emphasized protecting the

sender’s anonymity while revealing the recipient’s

identity and the amount of money transferred. With

this system, a user can obtain a coin from a bank by

creating a distinctive serial number and obtaining a

blind signature to keep the serial number concealed

from the bank. The user can then unblind the sig-

nature and use the coin for payments. When a mer-

chant receives payment, they can deposit the coin at

the bank, which will verify whether the serial num-

ber has been utilized previously. If the serial number

is already used, the payment is rejected; if not, it is

accepted. Camenisch et al. (Camenisch et al., 2006)

introduced a method of electronic payment based on

tokens, where the bank can impose specific regula-

tions such as payment limits for individual users. De-

spite this, the privacy of those who send transactions

is preserved; however, the recipient’s identity and the

payment amount are revealed.

Another related work, PRCash is more relevant to

our solution that addresses the privacy conflict (W

¨

ust

et al., 2019) and presents a solution that utilizes ZKPs

to enable efficient implementation of a receiving limit

for anonymous transactions within a specific time in-

terval or epoch. Additionally, the regulation mecha-

nism of PRCash requires linking multiple transactions

within a time limit, which can potentially compromise

user privacy.

Androulaki et al. presented a token management

system that is both privacy-preserving and auditable

(Androulaki et al., 2020). Their proposed system em-

ploys a UTxO (Unspent Transaction Output) model

in a permissioned blockchain. Their solution is tai-

lored for business-to-business scenarios and does not

provide a comprehensive approach to regulatory com-

pliance.

Gross et al. proposed a modified version of Ze-

rocash to create a ”privacy pool” for CBDC (Gross

et al., 2021). This modified Zerocash protocol (Sas-

son et al., 2014) can ensure the privacy of CBDC

transactions by hiding the identities of the transacting

parties while maintaining the integrity of the CBDC

system. It utilizes proofs of inclusion in a Merkle tree

to verify transactions. This means the system uses a

Merkle tree data structure to efficiently prove that a

transaction is valid and that its inputs have not been

previously spent.

W

¨

ust et al. introduced Platypus, a privacy-

preserving and centralized payment system (W

¨

ust

et al., 2022). Platypus is not decentralized, which

means it cannot continue to function effectively in the

event of a single point of failure.

Tomescu et al. proposed a decentralized payment

system known as UTT, which relies on a Byzantine

fault-tolerant infrastructure (Tomescu et al., 2022).

Additionally, UTT limits the amount of money that

can be anonymously sent monthly.

PEReDi (Kiayias et al., 2022) provides support

for regulatory compliance, including Know Your Cus-

tomer (KYC), Anti-Money Laundering (AML), and

Combating Financing of Terrorism (CFT) require-

ments. In the PEReDi, a committee of several au-

thorities can revoke privacy or trace transactions from

a specific user. The committee does so by decrypting

the ciphertext stored in the ledger. Both users must be

online for the transaction to occur on PEReDi.

Contributions. The paper presents the following

contributions:

1. To the best of our knowledge, we propose a

CBDC system that does not only address the

privacy conflict between the user and regulatory

agencies but also resolves the privacy conflict be-

tween the bank and the user by including all stake-

holders (users, banks, financial institutions, reg-

ulatory agencies, central bank) for the first time.

This system also supports regulatory mechanisms

such as KYC, AML, and CFT, which are critical

requirements that should be included in a CBDC

system.

2. In KAIME, sender and receiver privacy can be

added or removed as features from the system de-

pending on the requirements. This adds modular-

ity to our solution.

3. Since simple and known cryptographic algorithms

are used, security analysis and implementation of

KAIME is much easier than other related works.

In addition, the zero-knowledge proofs can work

without needing a trusted party.

2 OVERVIEW

In this section, we present a summary of our solution.

We begin by discussing our motivation and our re-

quirements. Next, we describe our system model and

then give the details of the cryptographic techniques

we have employed to develop our solution.

2.1 Motivation

In a report by the Swiss National Bank (Chaum et al.,

2021), ”mass surveillance” is specifically identified

as a potential risk associated with a CBDC. This un-

derscores the importance of ensuring strong privacy

protections. Furthermore, a survey conducted by the

European Central Bank (Bank, 2021) revealed that

KAIME: Central Bank Digital Currency with Realistic and Modular Privacy

673

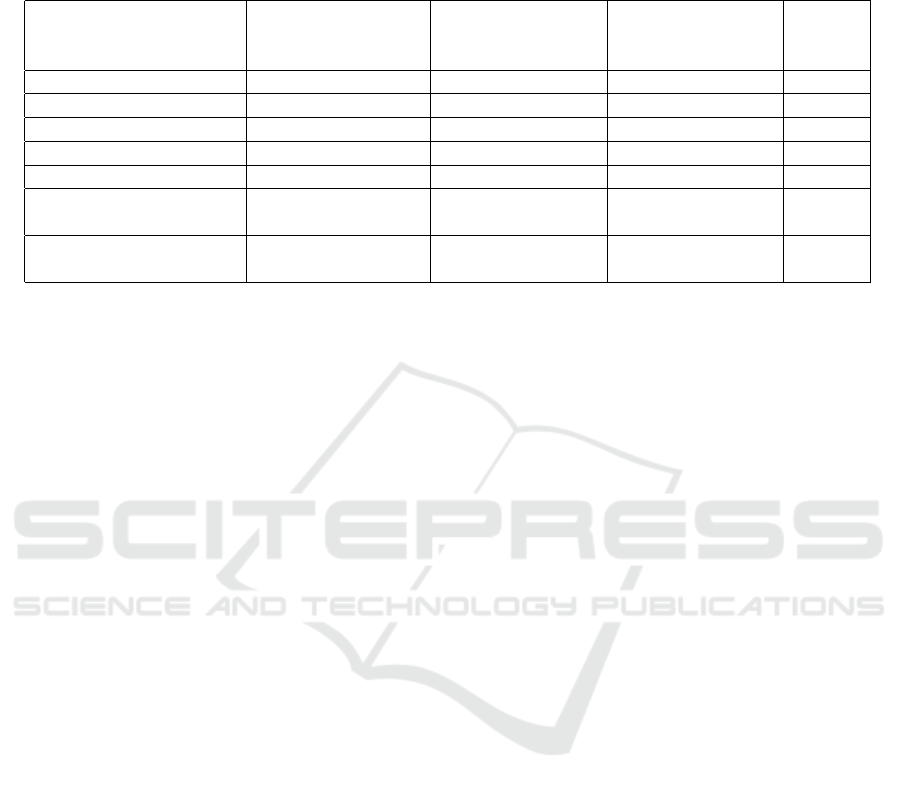

Table 1: The first column shows whether the system is UTxO or account-based. The last column shows the cryptographic

techniques used. The other columns show whether the sender, receiver, and transaction details are hidden.

Reference

UTxO or

Account Based

Sender

Privacy

Receiver

Privacy

Transaction

Privacy

Cryptographic

Technique

(W

¨

ust et al., 2019) UTxO Yes Yes Yes

ZKP , ElGamal Enc.,

Ped. Com.

(Androulaki et al., 2020) UTxO Yes Yes Yes

VRF, ElGamal Enc.,

PS Sig., Ped. Com.

(Gross et al., 2021) UTxO Yes Yes Yes Commitment, ZKP

(W

¨

ust et al., 2022) Account Yes Yes Yes Commitment, ZKP

(Tomescu et al., 2022) UTxO Yes Yes Yes

MPC, Commitment,

ZKP

(Kiayias et al., 2022) Account Yes Yes Yes

MPC, ZKP,

PS Sig., Elgamal Enc.

KAIME Account Optional Optional Yes

Elgamal Enc., ZKP,

MPC, Anon. Set

privacy was considered the most critical aspect of a

CBDC.

While CBDCs are expected to provide a criti-

cal feature, such as privacy, CBDCs must accommo-

date some regulatory requirements for financial sta-

bility and government security. Regulatory require-

ments for CBDCs are the enforcement of anti-money-

laundering (AML), know-your-customer (KYC), and

counter-financial-terrorism (CFT) (Allen et al., 2020).

On the other hand, this contradicts the objective of en-

hancing payment privacy.

There is a suggestion that this conflict can be re-

solved by allowing anonymous payments up to a spe-

cific limit per unit of time (Bank, 2019). Previous

works have proposed this idea (W

¨

ust et al., 2019),

(Garman et al., 2017), (W

¨

ust et al., 2022). The idea

does not meet the requirements. Government offi-

cials may not mind evading a $100 tax, but when it

comes to a criminal or murderer, payment informa-

tion is critical. Various suggestions for solving this

conflict are summarized in the related work section.

These solutions include various cryptographic tech-

niques such as zero-knowledge proof, commitment

scheme, threshold cryptography, and blind signature.

In (Auer et al., 2023), the authors stated that these so-

lutions do not explicitly address the privacy conflict

between stakeholder groups (merchants, banks and

payment providers, government). In the article, Auer

et al. mentioned not only the privacy conflict between

the user and the government but also the high level

of conflict between other groups. They have also di-

vided the situations in which the user’s data should be

accessed and the stakeholder who wants to access it,

layer by layer.

Based on the motivation to provide both the pri-

vacy of users and regulatory requirements and the

idea of bringing other stakeholders into the system,

our first aim is to design a system in which a per-

son suspected by the regulatory agencies can track all

transactions retrospectively and provide this tracking

by exceeding the threshold number. Our second goal

is to include banks and companies that use financial

data in the system and to solve the privacy conflict

between them and the user.

CBDC can be recorded in a distributed ledger us-

ing blockchain technology. This technology is used

to ensure that CBDCs are traded in a secure, transpar-

ent, and reliable manner. Blockchain technology can

help prevent fraudulent or misleading transactions as

transactions are recorded irreversibly. In addition to

such benefits, we use a permissioned blockchain to

easily access the transaction details of the stakehold-

ers, except the users in the system, and to prevent a

single point of failure.

2.2 Balance Between Soft and Hard

Privacy

Auer et al. divided the privacy methods in CBDC sys-

tems into three (Auer et al., 2023). These are hard pri-

vacy, soft privacy, and privacy with a balance between

soft and hard. The stakeholders in the system have

been divided into shells according to the monitoring

status of the transactions and the request to review the

transactions.

Hard privacy argues that all stakeholders in the

system cannot see the transactions and that only the

person with the private key can see the plaintext, that

is, the user. Unfortunately, this will lead to the disap-

pearance of regulatory mechanisms and is undesirable

for CBDCs. On the other hand, soft privacy addresses

the ability of payment information to move freely be-

tween different parties yet still protects it from exter-

nal attacks through point-to-point encryption. While a

ICISSP 2024 - 10th International Conference on Information Systems Security and Privacy

674

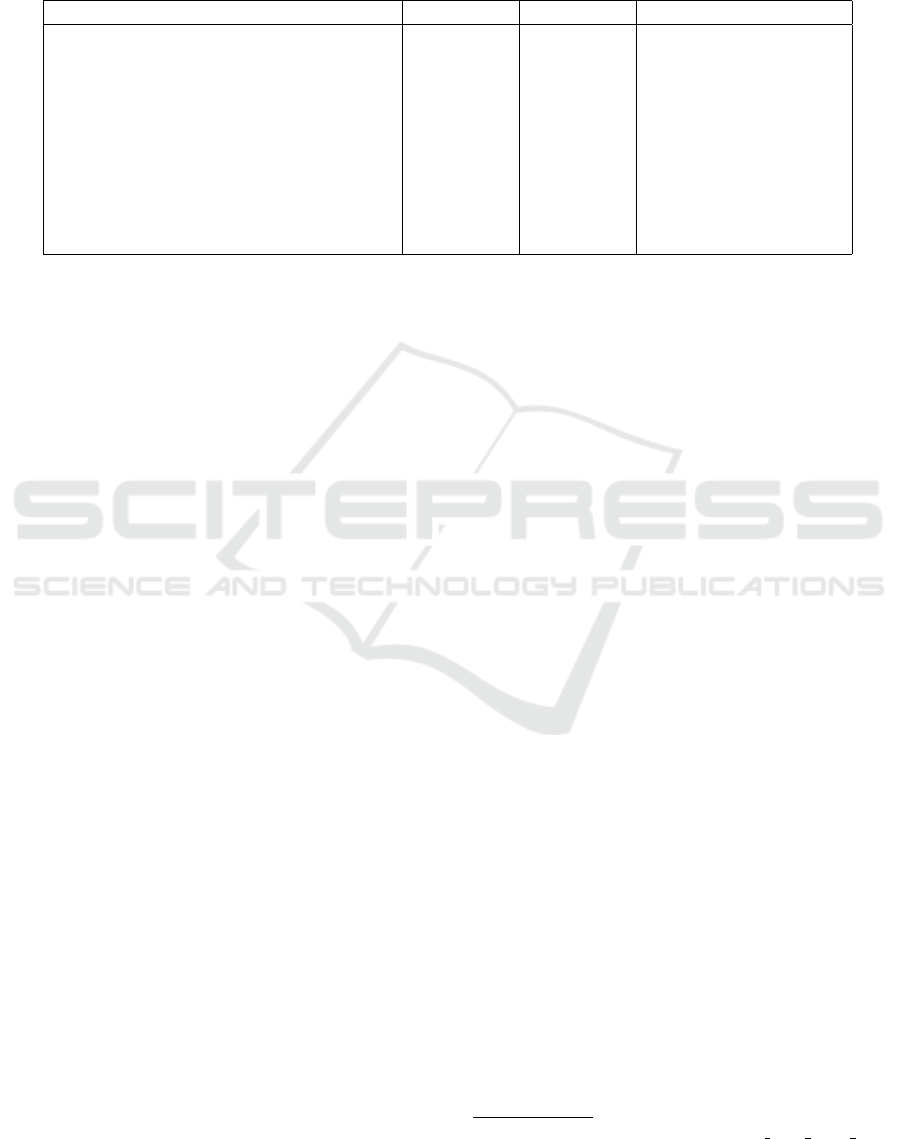

Table 2: The table compares the related work dealing with the privacy conflict and our solution. The second column shows

under what conditions and by whom the regulation mechanism is executed. The third and fourth columns show for which

stakeholders a solution to the privacy conflict is offered. The last column shows whether the papers were written for CBDC

purposes.

References

Regulation

Mechanism

Solution to Privacy

Conflict Between

User- Reg. Agen.

Solution to Privacy

Conflict Between

User- Fin. Ins.

For

CBDC?

(W

¨

ust et al., 2019) Balance Limit Yes No No

(Androulaki et al., 2020) Single Reg. Agency Yes No No

(Gross et al., 2021) Balance Limit Yes No Yes

(W

¨

ust et al., 2022) Balance Limit Yes No Yes

(Tomescu et al., 2022) Balance Limit Yes No Yes

(Kiayias et al., 2022)

More than One

Reg. Agency

Yes No Yes

KAIME

More than One

Reg. Agency

Yes Yes Yes

system like this can be highly effective in terms of ef-

ficiency, its privacy features will not differ from those

of current payment networks. As a result, it may not

meet the privacy needs of users who are particularly

concerned about protecting their information.

We use hard privacy techniques between regula-

tory agencies and users in KAIME; we use a tech-

nique that converges to soft privacy, although we can-

not say precisely soft privacy between the bank and

the user.

2.3 Security and Privacy Requirements

In this section, we define the privacy and security re-

quirements that should be in KAIME.

Transaction Integrity. It should not be possi-

ble for any person to transact on behalf of someone

else and change their balance. Following a success-

ful transaction between two users, it is imperative to

update the accounts of both parties accurately, taking

into account all relevant parameters. The transaction

must occur even if the receiving party is offline. The

balance increases and decreases on the sender, and re-

ceiver sides must be the same.

Regulatory Mechanism. Regulation mecha-

nisms such as KYC, AML, and CFT should be in-

cluded in the system. Regulatory agencies should be

able to see the details of the process and review them

retrospectively when needed. In order for these mech-

anisms to be quickly processed, the sender should not

be stored encrypted in the ledger.

Bank and Financial Institutions Tasks. The du-

ties of these institutions in traditional systems should

also be provided in the solution. The user should be

able to share the details of the past transaction with

the institution without deceiving the institution. How-

ever, the institution cannot monitor past transactions

without user permission.

Identity and Transaction Privacy. When a trans-

action is given, the recipient and the transaction value

should not be detected in cases other than auditing. In

addition, the user balance should be kept encrypted in

the ledger, and the balance should not be detected.

Unlinkability. Given a transaction, the ownership

of the assets used by the current transaction should

not be linked to past transactions. It should not be

possible to connect the receiver to another payment

in the same system where the sender or receiver is

located.

Non-Repudiation. Once a sender has made a

payment, she should not be able to deny it later.

2.4 Stakeholders & Roles

In this section, we describe the entities involved and

their respective roles. We would like to point out that

the central bank, banks, and regulatory agencies are

responsible for the operation of the blockchain.

• Central Bank. The digital currency is issued

by the central bank, which is accountable for the

monetary policy and has the authority over the

monetary supply at any point. However, the cen-

tral bank has no control over the status of all users’

accounts and lacks trust in privacy due to the pos-

sibility of mass surveillance. This means the cen-

tral bank cannot disclose the transferred values

associated with a particular transaction. For the

role of the central bank, we refer to (Chaum et al.,

2021).

• Users. As with any digital currency system, users

of the system can take on the role of either the

sender or the recipient when participating in a

transaction involving digital currency. Users have

KAIME: Central Bank Digital Currency with Realistic and Modular Privacy

675

no choice against regulatory agencies to protect

the privacy of their past transactions. If the regu-

latory agencies decide that the user is a potential

criminal, they can abort the user’s privacy with the

help of threshold cryptography. In addition, users

have the ability to allow banks and financial insti-

tutions to review transactions.

• Banks and Financial Institutions. Banks are

responsible for making the user registration pro-

cess. In the traditional banking system, banks

also have various responsibilities, such as giving

a credit score to the user and determining a credit

card limit. In order to perform these functions,

banks need to learn the balance and past transac-

tions of the user. They can perform this operation

cryptographically in line with the user’s consent.

Likewise, financial institutions need to access the

user’s transaction details to fulfill their duties in

the traditional system. The user can share trans-

action details with financial institutions upon re-

quest.

• Regulatory Agencies. Our approach involves en-

trusting a group of authorized institutions, which

we call regulatory agencies, with the task of con-

ducting different audit procedures required for en-

suring regulatory compliance. Regulatory agen-

cies can access the data of the user’s transactions

in case of doubt by joint decision. They can trans-

late the encrypted transaction data into plaintext

with the help of threshold cryptography and ac-

cess the transaction details.

3 SYSTEM DETAILS

In the following section, we will provide a more de-

tailed explanation of our solution. Our approach in-

volves the integration of various cryptographic tech-

niques as fundamental components. For additional

clarity, we have included further information about

these techniques in the Appendix.

3.1 System Initialization

Regulatory Agencies. An encryption keypair

(pk

R

, sk

R

) = (g

sk

R

, sk

R

) for Threshold Elgamal En-

cryption is generated by the regulatory agencies, and

the public keys are made available to the system setup.

We apply a variant of Pedersen Distributed Key Gen-

eration (Pedersen, 1991) to generate private key so

that a single agency does not have the authority to see

the transaction details. In KAIME, there are n regu-

latory agencies and we will display the private key of

each of them with sk

R,i

and the threshold number of

regulatory agencies required to construct a private key

is t. This means that in order to see the details of the

transactions, at least t agency agencies must reach an

agreement.

Central Bank. The central bank is registered in

the ledger, and the signature key pair is generated like

a user. The key pair is used for validation in the cur-

rency issue function.

Banks and Financial Institutions. Banks and fi-

nancial institutions will register in the system as a

user. They are responsible for the operation of the

blockchain and have access to the user’s ciphertext.

3.2 User Registration

By verifying the KYC step, the user is registered to

the system through the bank. Then, the user needs

to generate two key pairs. One is for signature; the

other is to keep the balance in the ledger as encrypted

and increase the received balances homomorphically

encrypted balance.

The bank then creates the ElGamal ciphertext with

a balance of 0 using the encryption public key pk

U

created by the user for encryption and saves it to the

ledger. The bank performs the same operation for

public key of regulatory agencies. The bank also adds

the proof that the plaintexts of the ciphertexts are 0

(see Appendix).

3.3 Currency Issue

The central bank encrypts the value v, which it wants

to issue, with the public key of the user and the pub-

lic key of the regulatory agencies. Then, the central

bank creates a Proof of Encryption Equality-1 (see

Appendix) that the values in these two ciphertexts are

the same and signs the transaction and proofs, and

then sends these to the ledger. The ledger is updated

by checking the validity of the proofs and signature.

3.4 Payment

To start the payment process, the sender must first

have the public key of the receiver and the public

key between the receiver and the bank. This initial

step can be accomplished with a QR code. When

the sender wants to send v value to the receiver, he

encrypts v under the public keys of the receiver, the

sender and regulatory agencies.

To ensure that three ciphertexts are decrypted to

the same value, the sender creates two Proofs of

Equality (see Appendix). In order to prevent any pos-

sibility of creating value out of thin air and verify that

ICISSP 2024 - 10th International Conference on Information Systems Security and Privacy

676

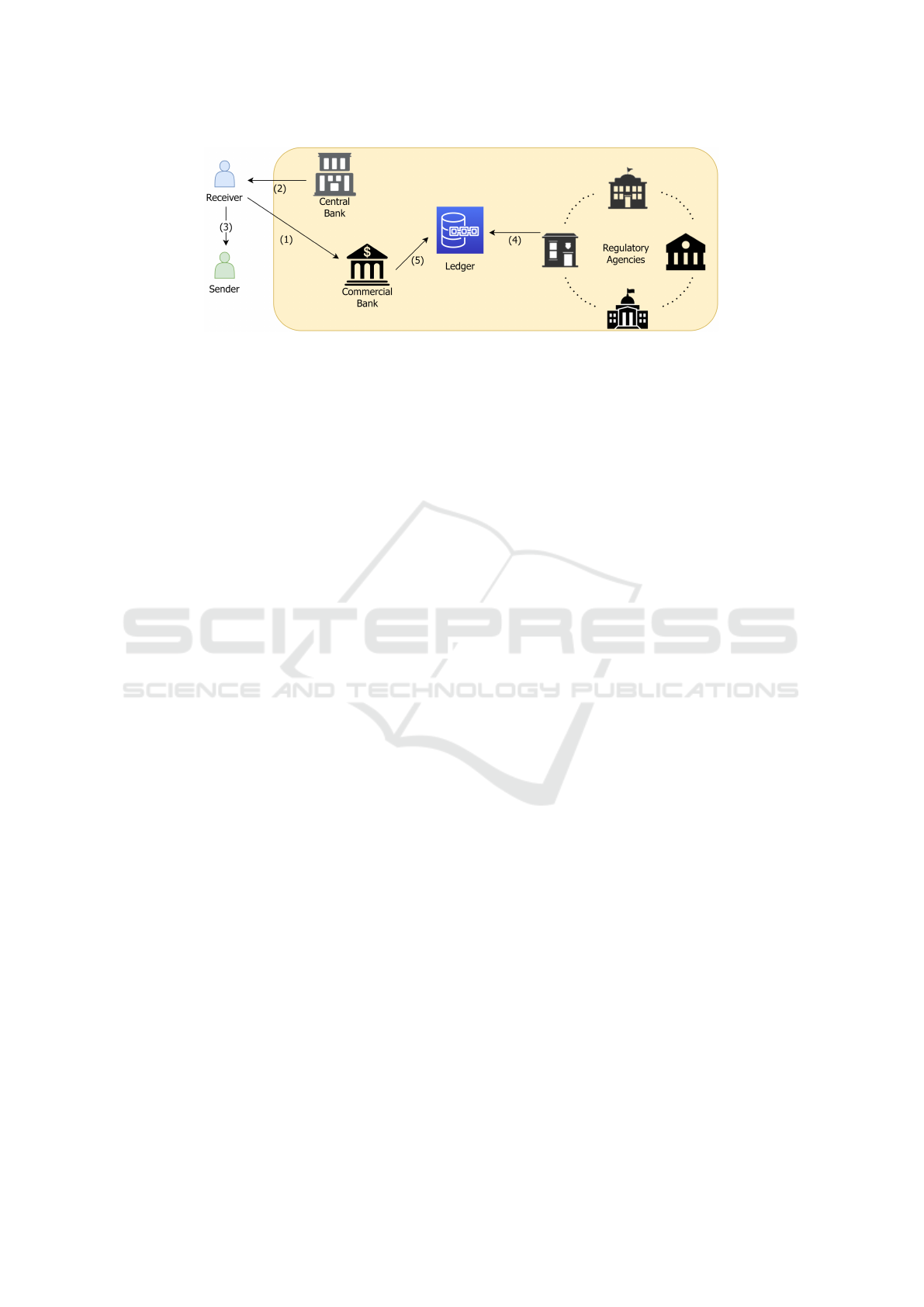

Figure 1: The System consists of commercial banks (or any financial institutions) responsible for user registration and tradi-

tional bank tasks, the central bank responsible for currency issues and monetary policy, and regulatory agencies responsible

for regulatory compliance. All entities are responsible for executing the validity of transactions and the blockchain network.

The direction of the arrows and the numbers in the figure do not indicate a specific order. The purpose of the arrows is to

show the functions that take place between the entities. (1) represents User Registration, (2) represents Currency Issue, (3)

represents Payment, (4) represents Abort Transaction Privacy, and (5) represents Abort Transaction Privacy for Bank.

the sender has sufficient balance in her account, he

also adds two range proofs. To prepare these range

proofs, he needs to keep track of the random values

used while encrypting the amounts. However, there is

no way for the user to keep track of the encrypted bal-

ance in the ledger (since the random value will change

as homomorphic addition occurs). For this reason, it

must replace the encrypted balance in the ledger with

an encrypted balance using a random value it knows.

In doing so, he creates Proof of Encryption Equality-

2. In this way, he will have the random value in the

ciphertext in the ledger. This method was first used in

PGC (Chen et al., 2019). Finally, the sender signs the

transaction with the private key and sends the proofs

and ciphertexts to the blockchain.

After proofs and sign are verified, the sender’s en-

crypted balance decreases homomorphically, and the

receiver’s encrypted balance increases homomorphi-

cally.

3.5 Abort Transaction Privacy

Regulatory agencies apply the abort privacy transac-

tion function on the transaction or balance related to

their shared ElGamal encryption keys to see the con-

tent of transactions they consider suspicious. How-

ever, for this to happen, a sufficient number of reg-

ulatory agencies must reach a consensus. The user’s

transaction history and account balance can then be

decrypted using threshold encryption. Details are de-

scribed in the Appendix.

3.6 Abort Transaction Privacy for Bank

and Financial Institutions

When the user wants to receive service from the bank

or institution, the institution that will provide the ser-

vice needs the details of the user’s past transactions.

The user can give the encryption private key to the

bank in order to present the contents of the encrypted

transactions on the ledger to the bank, but in such a

scenario, the bank will have the ability to see the fu-

ture transactions of the user.

Firstly, a bank or financial institution creates a

one-time public key for this function and sends it

to the user. The user encrypts the balance and val-

ues of all previous transactions with this public key.

After this step, the user creates Proof of Encryption

Equality-1 for all past encrypted transactions and the

encrypted texts it creates with the one-time public key

and sends it to the bank. The reason for creating this

proof is to prevent the user from cheating the bank.

After the bank has verified the proofs, it can access

the user’s transaction values and balance.

4 TRUST ASSUMPTION

Our paper does not address protection for network-

based deanonymization attacks, such as linking an IP

address to multiple transactions. Clients who wish to

protect themselves against such attacks can employ

measures.

We make the assumption that the clients en-

gage in communication through secure channels,

and all cryptographic operations employed conform

to the standard definitions of their security: It

is assumed that signatures are unforgeable, zero-

knowledge proofs provide soundness and are zero-

knowledge, and encryption is CPA-secure.

We assume that regulatory agencies do not want

to see the transaction details arbitrarily. They run the

abort privacy transaction function only for people and

transactions they think are suspicious.

KAIME: Central Bank Digital Currency with Realistic and Modular Privacy

677

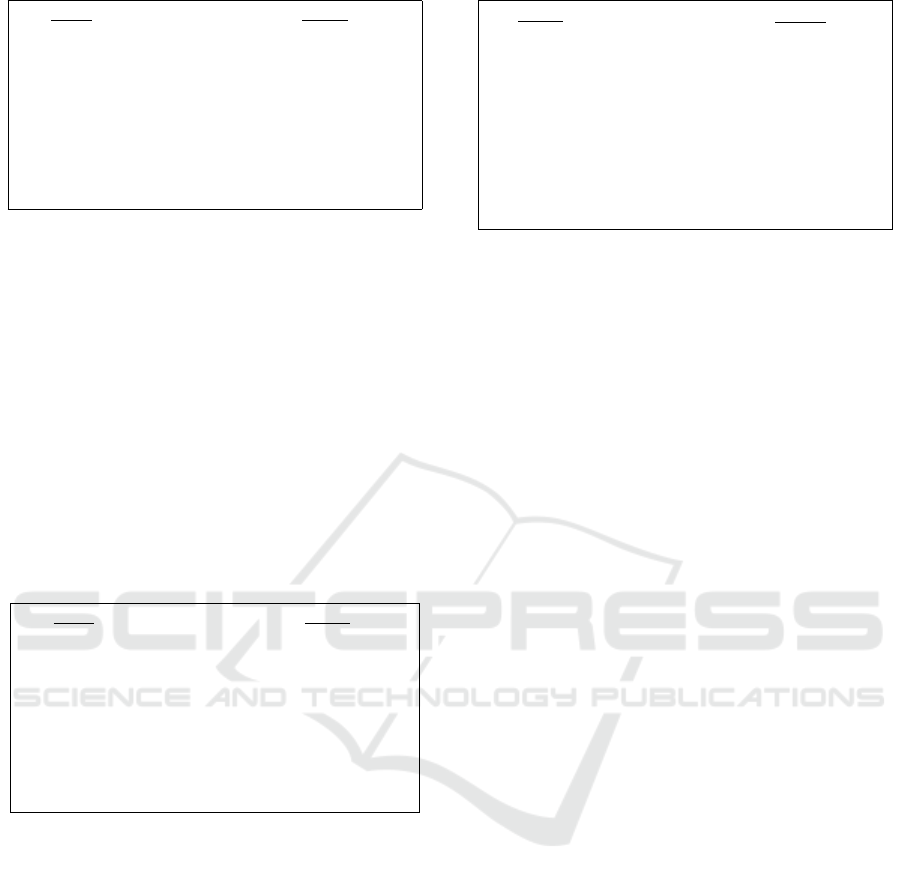

Table 3: The ”Algorithm” column specifies the cryptographic operation being measured, while the ”Prover” and ”Verifier”

columns show the time it takes for the prover and verifier to complete the operation in milliseconds. Additionally, the ”Number

of uses in a TX” column indicates how many times each operation is utilized within a transaction. Since zero proof is not

used in the transaction, it is shown with ”-” in the column. The results of the tests performed on a computer with i7-1165g7

@ 2.80ghz and 16gb.

Algorithm Prover Verifier Number of uses in a TX

Proof of Encryption Equality-1 (ed25519) 0.130 ms 0.243 ms 2

Proof of Encryption Equality-2 (ed25519) 0.201 ms 0.156 ms 1

Range Proof (ed25519) 32.209 ms 18.072 ms 2

Zero Proof (ed25519) 0.121 ms 0.252 ms -

ElGamal Encryption (ed25519) 0.147 ms - 3

Proof of Encryption Equality-1 (P256) 1.216 ms 2.309 ms 2

Proof of Encryption Equality-2 (P256) 1.989 ms 1.503 ms 1

Range Proof (P256) 292.965 ms 121.516 ms 2

Zero Proof (P256) 0.672 ms 1.749 ms -

ElGamal Encryption (P256) 1.083 ms - 3

5 ANONYMITY

In this section, we will give an anonymous version

of our solution. This version not only hides the

transferred amount but also hides the receiver. How-

ever, it comes at the expense of additional costs.

The complexity of the zero-knowledge proofs re-

quired for transfer will increase linearly the size of

the anonymity set, but with the method (Diamond,

2020) proposes, the complexity will increase loga-

rithmically. The complexity of the process can be re-

duced using this method. A similar solution was used

in Zether (B

¨

unz et al., 2020).

Because of the limited amount of available space,

we will only introduce it as an overview. An anony-

mous transaction allows a sender who wishes to send

a value v to a receiver with a public key pk

r

, to con-

ceal both the identity of the receiver among a larger

set of users with public keys {pk

1

, pk

2

,.....pk

n

}, as

well as the transferred value v. The sender sends 3n

ciphertexts, and all of them encrypt 0 except three.

Only three ciphertexts represent the real transaction;

the rest are fake transactions. Since the sent values in

the fake transaction are 0, the balance of the sender

and the users in the anonymity set does not change.

By using ring signatures, both the sender, the

receiver, and the transaction details can be hidden.

However, we do not recommend hiding the sender

so that the regulation mechanism can work better, al-

though it may differ according to the requirements.

6 IMPLEMENTATION AND

SECURITY ANALYSIS

In the scope of this study, we have implemented cryp-

tographic algorithms described in previous sections

using the Go programming language. To evaluate

the performance of these implementations, we pro-

vide the corresponding test results in Table 3. Fur-

thermore, the open-source tests and implementations

of these algorithms can be accessed via GitHub

1

.

We will show that zero knowledge proofs provide

completeness, special soundness and special honest

verifier zero knowledge properties in the full version

of the paper (Dogan and Bicakci, 2023).

7 CONCLUSIONS

This study showed that cryptographic protocols, as in

related works, are an effective tool for providing pri-

vacy and regulation to CBDCs. In addition, our study

also addressed the privacy between the user and the

banks and showed that cryptographic protocols pro-

tect this privacy. It also enabled banks to fulfill their

tasks. Future work may focus on further refining these

protocols and better protection of privacy and regula-

tion of CBDCs.

ACKNOWLEDGEMENTS

We would like to express our gratitude to T

¨

UB

˙

ITAK

B

˙

ILGEM employees Taner Dursun,

˙

Ilker Bedir, and

1

https://github.com/midmotor/kaime cbdc proof test

ICISSP 2024 - 10th International Conference on Information Systems Security and Privacy

678

Abdulhamit Kumru for their valuable contributions

to this study. Additionally, we thank T

¨

UB

˙

ITAK

B

˙

ILGEM for financially supporting this study.

REFERENCES

Allen, S.,

ˇ

Capkun, S., Eyal, I., Fanti, G., Ford, B. A., Grim-

melmann, J., Juels, A., Kostiainen, K., Meiklejohn,

S., Miller, A., et al. (2020). Design choices for central

bank digital currency: Policy and technical considera-

tions. Technical report, National Bureau of Economic

Research.

Androulaki, E., Camenisch, J., Caro, A. D., Dubovit-

skaya, M., Elkhiyaoui, K., and Tackmann, B. (2020).

Privacy-preserving auditable token payments in a per-

missioned blockchain system. In Proceedings of the

2nd ACM Conference on Advances in Financial Tech-

nologies, pages 255–267.

Auer, R., B

¨

ohme, R., Clark, J., and Demirag, D. (2023).

Mapping the privacy landscape for central bank digital

currencies. Communications of the ACM, 66(3):46–

53.

Bank, E. C. (2019). Exploring anonymity in central bank

digital currencies. In Focus, 4:1–11.

Bank, E. C. (2021). Eurosystem report on the public con-

sultation on a digital euro.

Bank of England, U. (2020). Central bank digital

currency. opportunities, challenges and de-

sign. URL: https://www. bankofengland. co.

uk/-/media/boe/files/paper/2020/centralbank-digital-

currency-opportunities-challenges-and-design. pdf.

Bellare, M. and Rogaway, P. (1993). Random oracles are

practical: A paradigm for designing efficient proto-

cols. In Proceedings of the 1st ACM Conference on

Computer and Communications Security, pages 62–

73.

B

¨

unz, B., Agrawal, S., Zamani, M., and Boneh, D. (2020).

Zether: Towards privacy in a smart contract world.

In Financial Cryptography and Data Security: 24th

International Conference, FC 2020, Kota Kinabalu,

Malaysia, February 10–14, 2020 Revised Selected Pa-

pers, pages 423–443. Springer.

B

¨

unz, B., Bootle, J., Boneh, D., Poelstra, A., Wuille, P.,

and Maxwell, G. (2018). Bulletproofs: Short proofs

for confidential transactions and more. In 2018 IEEE

symposium on security and privacy (SP), pages 315–

334. IEEE.

Camenisch, J., Hohenberger, S., and Lysyanskaya, A.

(2006). Balancing accountability and privacy using e-

cash. In Security and Cryptography for Networks: 5th

International Conference, SCN 2006, Maiori, Italy,

September 6-8, 2006. Proceedings 5, pages 141–155.

Springer.

Chaum, D. (1983). Blind signatures for untraceable pay-

ments. In Advances in Cryptology: Proceedings of

Crypto 82, pages 199–203. Springer.

Chaum, D., Grothoff, C., and Moser, T. (2021). How to

issue a central bank digital currency. arXiv preprint

arXiv:2103.00254.

Chen, Y., Ma, X., Tang, C., and Au, M. H. (2019). Pgc:

pretty good decentralized confidential payment sys-

tem with auditability. Cryptology ePrint Archive.

Diamond, B. E. (2020). Many-out-of-many proofs and ap-

plications to anonymous zether. Cryptology ePrint

Archive, Paper 2020/293. https://eprint.iacr.org/2020/

293.

Dogan, A. and Bicakci, K. (2023). Kaime: Central bank

digital currency with realistic and modular privacy.

Cryptology ePrint Archive.

Garman, C., Green, M., and Miers, I. (2017). Accountable

privacy for decentralized anonymous payments. In Fi-

nancial Cryptography and Data Security: 20th Inter-

national Conference, FC 2016, Christ Church, Barba-

dos, February 22–26, 2016, Revised Selected Papers

20, pages 81–98. Springer.

Gross, J., Sedlmeir, J., Babel, M., Bechtel, A., and

Schellinger, B. (2021). Designing a central bank digi-

tal currency with support for cash-like privacy. Avail-

able at SSRN 3891121.

Kiayias, A., Kohlweiss, M., and Sarencheh, A. (2022).

Peredi: Privacy-enhanced, regulated and distributed

central bank digital currencies. Cryptology ePrint

Archive.

Komlo, C. and Goldberg, I. (2020). Frost: Flexible round-

optimized schnorr threshold signatures. Cryptology

ePrint Archive, Paper 2020/852. https://eprint.iacr.

org/2020/852.

Kurosawa, K. (2002). Multi-recipient public-key encryp-

tion with shortened ciphertext. In Public Key Cryp-

tography, volume 2274, pages 48–63. Springer.

Pedersen, T. P. (1991). A threshold cryptosystem with-

out a trusted party. In Advances in Cryptol-

ogy—EUROCRYPT’91: Workshop on the Theory and

Application of Cryptographic Techniques Brighton,

UK, April 8–11, 1991 Proceedings 10, pages 522–

526. Springer.

Riksbank, S. (2020). The riksbank’s e-krona pilot. Sveriges

Riksbank.

Sasson, E. B., Chiesa, A., Garman, C., Green, M., Miers, I.,

Tromer, E., and Virza, M. (2014). Zerocash: Decen-

tralized anonymous payments from bitcoin. In 2014

IEEE symposium on security and privacy, pages 459–

474. IEEE.

Tomescu, A., Bhat, A., Applebaum, B., Abraham, I., Gueta,

G., Pinkas, B., and Yanai, A. (2022). Utt: Decen-

tralized ecash with accountable privacy. Cryptology

ePrint Archive.

Van Saberhagen, N. (2018). Cryptonote v 2.0 (2013). URL:

https://cryptonote. org/whitepaper. pdf. White Paper.

Accessed, pages 04–13.

W

¨

ust, K., Kostiainen, K.,

ˇ

Capkun, V., and

ˇ

Capkun, S.

(2019). Prcash: fast, private and regulated transac-

tions for digital currencies. In Financial Cryptography

and Data Security: 23rd International Conference,

FC 2019, Frigate Bay, St. Kitts and Nevis, February

18–22, 2019, Revised Selected Papers 23, pages 158–

178. Springer.

W

¨

ust, K., Kostiainen, K., Delius, N., and Capkun, S.

(2022). Platypus: A central bank digital currency with

KAIME: Central Bank Digital Currency with Realistic and Modular Privacy

679

unlinkable transactions and privacy-preserving regu-

lation. In Proceedings of the 2022 ACM SIGSAC Con-

ference on Computer and Communications Security,

pages 2947–2960.

Zhao, W. (2020). Chinese state-owned bank offers test inter-

face for pboc central bank digital currency. CoinDesk.

Accessed July, 7:2022.

APPENDIX

Homomorphic Elgamal Encryption

The difficulty of solving the discrete logarithm prob-

lem is ensuring the security of the Elgamal encryp-

tion scheme. The encryption consists of the following

three algorithms:

1. KeyGen. Assuming that p is a prime number and

g is a generator of Z

∗

p

. Then private key sk is ran-

domly selected sk

$

←− Z

∗

p

and public key pk = g

sk

is calculated.

2. Encryption. To encrypt the v value, a random r is

selected r

$

←− Z

∗

p

and c is calculated.

(φ

L

, φ

R

) = (g

r

, g

v

· pk

r

)

3. Decryption. To decrypt the ciphertext, φ

R

/φ

sk

L

is

calculated.

g

v

= φ

R

/φ

sk

L

Then, the value b is found with brute force.

Distributed Key Generation

Distributed Key Generation (DKG) is a cryptographic

process in which multiple parties collaboratively gen-

erate a cryptographic key without any one party hav-

ing complete knowledge of the key. We use the same

DKG is used in FROST (Komlo and Goldberg, 2020).

We delete details for simplicity. The process is as fol-

lows:

1. Every participant P

i

(regulatory agencies in our

cases) chooses t random value and uses them

as coefficients to define polynomial f

i

(x) =

∑

t−1

j=0

a

i j

x

j

.

2. Each P

i

calculates a proof of knowledge for the

constant term in the polynomial.

3. Each P

i

computes a commitment

⃗

C

i

=

α

i0

,...,α

i(t−1)

, where α

i j

= g

a

i j

and broadcasts

⃗

C

i

and the proof.

4. Each P

i

, after receiving

⃗

C

ℓ

and the proof, verifies

the proof.

5. Each P

i

securely sends to other participants a se-

cret (ℓ, f

i

(ℓ)).

6. Each P

i

verifies their shares by calculating:

g

f

ℓ

(i)

?

=

∏

t−1

k=0

α

i

k

ℓk

mod q, after that calculates pri-

vate sharing key by computing sk

i

=

∑

n

ℓ=1

f

ℓ

(i)

7. The group public key is computed

pk =

∏

α

j0

Threshold ElGamal Encryption

∏

j̸=i

−x

j

x

i

−x

j

is the Lagrange coefficient. We represent

it with λ

i

. Suppose the ElGamal private key sk is dis-

tributed to n parties. That is,

sk =

∑

sk

i

λ

i

To decrypt a ciphertext, i-party publishes φ

sk

i

L

, and

the proof is generated in order to demonstrate the hon-

est contribution of the party. g

v

is calculated after

summing the values from the parties.

g

b

= φ

R

/

∏

φ

sk

i

λ

i

L

b is found by applying brute force to g

b

.

Fiat-Shamir Technique

Fiat-Shamir is a technique used to make an interac-

tive protocol non-interactive (Bellare and Rogaway,

1993). This technique uses an algorithm that gener-

ates a result using a hash function instead of a tradi-

tional protocol where two parties (prover and verifier)

share information and interact with each other. The

Fiat-Shamir technique eliminates interactivity in the

proofs described in this section. How to use the Fiat-

Shamir Technique in proofs is not shown for simplic-

ity.

Proof of 0 Encryption

The definition of the Proof of 0 Encryption relation is

as follows:

{(g, pk, φ

L

, φ

R

; r) : φ

L

= g

r

∧ φ

R

= g

0

· pk

r

}

With this proof, the prover proves that the value in the

ciphertext is 0. The protocol is shown in Figure 2.

ICISSP 2024 - 10th International Conference on Information Systems Security and Privacy

680

Prover Verifier

u ∈

R

Z

n

a

1

←− g

u

a

2

←− (pk

1

/pk

2

)

u

a

1

, a

2

−−−−−−−−−−→

φ ∈

R

Z

q

c

←−−−−−−−−−−

z ←−

n

u + c.r

z

−−−−−−−−−−→

g

z

?

= a

1

.φ

c

1,L

(pk

1

/pk

2

)

z

?

= a

2

.(φ

1,R

/φ

2,R

)

c

Figure 2: Proof of 0 Encryption.

Proof of Encryption Equality-1

In the ElGamal encryption, Kurosawa demonstrated

that it is possible to use the same random values to en-

crypt data for multiple ciphertexts (Kurosawa, 2002).

This idea is applied in our solution to enhance the ef-

ficiency of the Proof of Encryption Equality-1. The

relation is as follows:

{(g, pk

1

, pk

2

, φ

1,L

, φ

1,R

, φ

2,R

;v, r) :

φ

1,L

= g

r

∧ φ

1,R

= g

v

· pk

r

1

∧ φ

2,R

= g

v

· pk

r

2

}

Proof of Encryption Equality-1 shows that two cipher-

texts commit to the same plaintext. The protocol is

shown in Figure 3.

Prover Verifier

u ∈

R

Z

n

a

1

←− g

u

a

2

←− (pk

1

/pk

2

)

u

a

1

, a

2

−−−−−−−−−−→

c ∈

R

Z

q

c

←−−−−−−−−−−

z ←−

n

u + c.r

z

−−−−−−−−−−→

g

z

?

= a

1

.φ

c

1,L

(pk

1

/pk

2

)

z

?

= a

2

.(φ

1,R

/φ

2,R

)

c

Figure 3: Proof of Encryption Equality-1.

Proof of Encryption Equality-2

The definition of the Proof of Encryption Equality-2

relation is as follows:

{(g, pk, φ, φ

′

; r, v, x) : φ

R

= g

v

· pk

r

∧ φ

′

R

= g

v

· pk

r

′

}

Proof of Encryption Equality-2 shows that the

plaintexts of two different ciphertexts are equal to

each other. This proof is used to keep track of

the random value by refreshing the ciphertext in the

ledger.The protocol is shown in Figure 4.

Range Proof

Bulletproofs (B

¨

unz et al., 2018) are utilized for the

range proof in our solution. The definition of the

Prover Verifier

u ∈

R

Z

n

a

1

←− g

u

a

2

←− (φ

L

/φ

′

L

)

u

a

1

, a

2

−−−−−−−−−−→

c ∈

R

Z

q

c

←−−−−−−−−−−

z ←−

n

u + c.x

z

−−−−−−−−−−→

g

z

?

= a

1

.pk

c

(φ

L

/φ

L

′

)

z

?

= a

2

.(φ

R

/φ

′

R

)

c

Figure 4: Proof of Encryption Equality-2.

range-proof relation is as follows:

{(g, pk,φ

R

; v,r) : φ

R

= g

v

· pk

r

∧ v ∈ [0, 2

32

− 1]}

g, pk and φ

R

are open parameters, v and r are wit-

ness values. With range proof, a prover can prove that

the value of v in a ciphertext is greater than 0 and less

than 2

32

− 1.

KAIME: Central Bank Digital Currency with Realistic and Modular Privacy

681