Deep Reinforcement Learning and Transfer Learning Methods Used in

Autonomous Financial Trading Agents

Ciprian Paduraru, Catalina Camelia Patilea and Stefan Iordache

Department of Computer Science, University of Bucharest, Romania

Keywords:

Deep Reinforcement Learning, Transfer Learning, Algorithmic Trading, Deep Q-Networks, Double Deep

Q-Networks.

Abstract:

It is reported that some of the largest companies from the banking and business sectors are investing massively

in the field of trading with automated methods. The methods used vary from classical time series based

methods to Deep Learning and more recently Reinforcement Learning (RL). The main goal of this work is

first to improve the state of the art in RL-based trading agents. Then, we focus on evaluating the robustness

of the trained agents when they are transferred to different trading markets than the ones they were trained on.

The framework we developed, RL4FIN, is open source and can be tested by both academia and industry. The

evaluation section shows the improvements over state-of-the-art using some public datasets.

1 INTRODUCTION

Today, computing and economics are more closely

linked than ever, from critical transaction systems to

algorithms capable of predicting the onset of major

economic crises. On a smaller scale, such as man-

aging personal savings or bills, the economy can be

easily managed by individuals and groups without the

use of machines or advanced computer algorithms.

However, it becomes more interesting when we add

large data sets and larger financial portfolios that need

to be managed. Large companies in the trading space

are investing in dedicated research teams focused on

developing algorithms, machine learning engines, and

agents capable of making second-by-second decisions

about investments without the need for human inter-

vention.

The work we present in this research paper fo-

cuses first on discovering current approaches to auto-

mated trading based on machine learning algorithms

and, in particular, reinforcement learning (RL) agents.

The framework proposed in this paper is a com-

plete data-driven pipeline, from data collection and

processing to training offline and online agents, to

production-ready evaluation. In the second part, we

assume that we have a powerful pre-trained agent ca-

pable of strong generalization. Going into details, our

contribution can be divided into three main segments:

• Building a reusable environment capable of adapt-

ing multiple reinforcement learning agents, on-

policy and off-policy strategies. The environment

was developed based on OpenAI Gym (Brockman

et al., 2016) and can be extended to adapt to multi-

ple markets, trading types (day trading, scalping,

swing trading, position trading, etc.) or contract

types (futures, options, contract for difference-

CFD). Based on the common interface, users are

then able to leverage existing open source train-

ing agent libraries such as Stable-Baselines3 (Raf-

fin et al., 2021) or RLlib (Liang et al., 2018) with

minimal prior knowledge of RL.

• Review and improve the state of the art of rein-

forcement learning implementations for algorith-

mic trading. In the Evaluation section, we show

that the agent proposed in this paper performs

better than traditional investment strategies on a

number of commonly used metrics.

• The addition of transfer learning methods from

one agent to another in the field of economics is

also a novelty in the field that, according to our

research, has not been explored in this niche liter-

ature.

The proposed framework, named RL4FIN, is open

source (due to the limitation of double-blind testing,

we will not list it here) and can be used by both the

academic community and industry.

The paper is organized as follows. The next sec-

tion surveys the methods used in the literature for

RL methods in trading and transfer learning of such

Paduraru, C., Patilea, C. and Iordache, S.

Deep Reinforcement Learning and Transfer Learning Methods Used in Autonomous Financial Trading Agents.

DOI: 10.5220/0012194000003636

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 16th International Conference on Agents and Artificial Intelligence (ICAART 2024) - Volume 2, pages 15-26

ISBN: 978-989-758-680-4; ISSN: 2184-433X

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

15

agents. Section 3 provides a general introduction to

the RL domain. The proposed framework is outlined

in Section 4. The evaluation results are presented in

Section 5. Finally, the last section presents the con-

clusions and plans for future work.

2 RELATED WORK

Automatic trading using artificial intelligence algo-

rithms has been explored recently in the literature.

The overall purpose is to replace manual human labor

with faster and improved decision-making, correlat-

ing previous states and actions, market parameters,

and influence factors.

Reinforcement Learning in Trading. The work in

DeepTrader(Wang et al., 2021) covers initial portfo-

lio management, asset scoring, and market scoring.

To create complete portfolios, the method first uses

Long-Short Term Networks (LSTMs) (Hochreiter and

Schmidhuber, 1997) to analyze specific assets over

time, encapsulate knowledge, and score them. Their

decision-making process is based on Graph Convo-

lutional Networks (GCNs) (Kipf and Welling, 2017).

Our current methods could also be improved by using

LSTM in the network used to encapsulate the agent

knowledge, either directly after processing the input

layer or during the action sections, as proposed in an-

other study in (Bakker, 2001). This remains a topic

for future work and study. Our research has a differ-

ent focus than their work in DeepTrade, as it focuses

more on automated trading. The evaluation of our

proposed methods shows improvement in this area,

especially in the basic cases of trading single asset

types.

FinRL (Liu et al., 2022a) (Li et al., 2021) (Liu

et al., 2022b) pursues a similar goal to ours by act-

ing in the field of trade, using reinforcement algo-

rithm methods and creating a complete framework

that enables trade at the industrial level. Their work

covers multiple processes such as data sources, post-

processing, feature engineering, and RL development

agents. Their method uses DQN to trade entire port-

folios and achieves superior performance. However,

while we focus on individual asset trading types,

our methods achieved better results on some public

datasets. We intuitively attribute this improvement to

two facts: a) the features of individual assets are ex-

tracted using a deep neural network rather than man-

ual feature engineering, and b) the careful implemen-

tation of a DQN variant (DDQN) after our empirical

evaluation of algorithms and hyperparameters on the

public datasets.

Augmenting Reinforcement Learning with

Knowledge Transfer. Transfer learning is widely

used in the fields of computer vision and natural lan-

guage processing, and recently the idea has been ap-

plied to the field of reinforcement learning. There

are several surveys and research projects (Zhu et al.,

2022) (Beck et al., 2022) (Taylor and Stone, 2009)

that cover this mix of methods. Their work focuses

on showing ways in which information and knowl-

edge can be transferred between agents. The authors

first emphasize the difficulty and that a pre-trained

agent cannot be easily transferred to another environ-

ment and produce good results without major adjust-

ments. In our research, we found only the work of

the QuantNet (Koshiyama et al., 2021) project, which

deals with the financial sector. They are develop-

ing a method for evaluating a machine learning algo-

rithm constructed with LSTMs against several stock

markets. In our proposed framework, the knowl-

edge transfer method has been shown to improve end-

episode returns by more than 15% when the models

are applied to different markets and datasets. This re-

sult empirically indicates the potential that the pro-

posed methods have in transferring strategies and ex-

perience from one asset to another in the field of au-

tomated trading. The idea of introducing knowledge

transfer in our work also improved the average learn-

ing speed by more than 4-fold. A compilation of RL

algorithms is proposed in (Yang et al., 2021), while an

empirical evaluation of each RL method is reported in

(Kong and So, 2023).

3 REINFORCEMENT LEARNING

OVERVIEW

The first part of this section discusses the general con-

cepts and terminology of the RL field, linking the the-

ory and methods generally used in the economic con-

text. For deeper details, the reader is invited to read

(Sutton and Barto, 2018a). The second part focuses

on explaining the mechanisms of transfer learning and

the specifics used when applied to the RL domain.

3.1 Methods

Reinforcement Learning (RL) (Sutton and Barto,

2018b) is an artificial intelligence strategy that fo-

cuses mainly on developing agents that can interact

with different environments. The agents are designed

to explore the world and acquire expertise by per-

forming actions, receiving rewards for doing so, and

transitioning to other states from one time step to the

next. In most environments, states are unlabeled, so

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

16

the main goal of reinforcement learning is to maxi-

mize the gain or reward function over multiple time

steps. To describe reinforcement learning as a semi-

supervised strategy for learning agents, we outline the

basic components and terminology of this class of al-

gorithms below:

The trading problem is modeled as a Partially Ob-

servable Markov Decision Process (POMDP) (Puter-

man, 2014). Its components and the RL specifics used

by the proposed framework are described below.

• Environment States (s ∈ S) - a current represen-

tation of the states the agent can occupy at each

time t: s

t

(NAV, M − NAV, R, M − R, POS, C, T ],

where: NAV represents the net asset value and its

derivatives, R represents the return (reward), POS

represents the position array (long, hold, short), C

represents the trading cost, and T represents the

position change or executed trade. The prefix M

describes the same concepts but for the market ac-

tor (the underlying asset), while the non-M com-

ponents represent the components corresponding

to the trading agent trained in the environment.

• Agent Actions (a ∈ A) - Agents need to learn a

decision process and take the most profitable ac-

tions. At each timestep, t, the action taken by the

agent is in the set a

t

∈ {long,short,hold}. Long

means that the shares are bought and held until

profitable, then sold later when it becomes most

convenient, i.e., long-term investment strategy.

Short represents the moment shores are bought

from a broker with the hope to return that invest-

ment with a higher profit and if the market de-

clines, on the other hand, the buyer will be at a

loss. Finally, when choosing hold, there is no ac-

tion.

• Agent Policy (π) - The decision process that pro-

vides for actions given a state. In most RL im-

plementations, this can take the form of an array,

matrix, or function that is used to approximate

the next action when the representations of the

states/actions are continuous or inefficient from a

computational point of view to be represented us-

ing either of the previous two methods. It is usu-

ally expressed as either a: (a) deterministic policy,

i.e. π(s)a, which means that in state s the cho-

sen action is a, (b) a stochastic policy, i.e. π(a|s),

which represents a distribution over the action

space A at a state s. In the trading agent case, this

probability distribution refers to the three actions

described above and indicates how likely each is

to occur at a given time step t.

• Reward Function - A signal value indicating how

good the action performed by the agent was. The

goal is to maximize the cumulative reward over

a sequence of steps, i.e., an episode. Specifically

for our work, the reward is the cumulative return

at the end of the day after deducting all trading

costs. In the case of a holding action, the agent is

penalized 0.1% per trading period.

• Episodes - An episode (or trajectory) is consid-

ered a sequence of steps, actions, and rewards.

Starting from an initial state s

0

, the agent fol-

lows the policy to sample actions at each time

step t, i.e., a

t

∼ π(s

t

), then obtain a reward

r

t

from the environment. Thus the trajectory

taken by the agent can be formalized as τ =

(s

0

,a

0

,r

0

,... , s

t

,a

t

,r

t

,... , s

T

,a

T

,r

T

). It can be ei-

ther a finite or infinite horizon, but in this paper,

we focus on the former case. In this case, T rep-

resents the length of the episode/trajectory.

• Value Functions - This function is conceived as

a qualitative measure of states (V (s) function), or

combinations of states of action (Q(s,a)). If V (s)

is considered to be the average estimated value of

any action that follows in state s, and Q(s,a) is the

estimated value for performing action a in state s,

then A(s,a) = Q(s,a) −V (s), the advantage func-

tion, denotes the estimated advantage value of be-

ing in state s and performing action a first.

Environments can be either deterministic or non-

deterministic (e.g., an agent acting on a slippery sur-

face might try to keep moving but end up in a dif-

ferent direction). At each timestamp t, a transition is

decided via a probability function P(s

t1

|s

t

,a

t

) given

by the policy sampling process. As mentioned earlier,

after each action, outcomes are collected in the form

of rewards, which are the main measure of the agent’s

performance. A discount factor γ ∈ [0,1] is used to

balance immediate rewards with longtime horizon re-

wards, i.e., a value of γ1 means that the agent con-

siders each reward along a trajectory with equal im-

portance, while a value of γ The goal of the trained

agent is then to maximize the cumulative reward of a

trajectory, i.e., R(τ)

∑

T

t

′

t

γ

t

′

r

t

′

.

The challenges we encountered during this re-

search were related to the nature of the economic field

and how the concepts can be mapped to the reinforce-

ment learning field. For example, the absence of final

states conducted us in the direction of model-free re-

inforcement learning algorithms, mainly using agents

derived from Q-Learning: Deep Q-Networks (DQN)

(Mnih et al., 2013), Duelling Deep Q-Networks

(Duelling-DQN) (Wang et al., 2016) and Double

Deep Q-Network (DDQN) (van Hasselt et al., 2015).

Deep Reinforcement Learning and Transfer Learning Methods Used in Autonomous Financial Trading Agents

17

3.2 Transfer Learning

When applying knowledge transfer from one agent to

another (using reinforcement learning), the design of

the solution must answer some important questions:

• Which knowledge should be marked as transfer-

able?

Due to the higher computational complexity of re-

inforcement learning algorithms compared to su-

pervised and unsupervised learning methods, one

can choose between several sources of informa-

tion: the experience replay buffer, the probabil-

ity distribution of actions, and the value or action-

value functions.

• Are the source and target agents compatible for

transfer learning, and if not, what is the adapter in-

terface and how can this affect performance with

respect to the algorithm used for training?

This is mostly a matter of trial and error, as re-

inforcement learning algorithms are divided into

several branches, e.g. model-free vs. model-based

or on-policy vs. off-policy classes. Depending on

the configurations of the state and action space,

this results in different performance and compu-

tational overhead. If you also use transfer learn-

ing, the complexity of the decision becomes even

greater.

• Are there differences between the environments?

This is mainly related to the application domain.

In the area of stock trading, for example, there

are several ways to model an environment, start-

ing with classic buy and sell actions and ending

with options trading, where a contract expiration

can be chosen for each action.

All of these combinations of factors and algorith-

mic decisions are typically resolved through a trial-

and-error process, where the evaluation process fo-

cuses on simulations and obtaining feedback on var-

ious metrics and objectives. There are several tech-

niques that can be used to add transfer learning layers

to RL agents after answering the above questions:

• Reward Shaping (RS). Used for adjusting the re-

wards distribution or function with the objective

of aiding the agent towards learning its policy.

• Learning from an Expert. More known as Imita-

tion Learning, but in the case of RL this is focused

on extracting segments of the experience replay

buffer from the expert agent (teacher) and trans-

ferring it to the target (student).

• Policy Transfer. There are two main methods in

this segment: policy distillation (Czarnecki et al.,

2019), and policyreuse (Zhou et al., 2019), the

latter performing better for the purpose of this pa-

per.

• Actions and Tasks Mapping. A method of transfer

learning that groups actions at a hierarchical level

(Qi et al., 2021).

4 RL4FIN FRAMEWORK

We build the proposed framework and research objec-

tives of this paper around four subthemes, which are

addressed in the following subsections.

4.1 Data Acquisition and Processing

Collecting data for financial projects proved to be a

challenge. We had to consider three important issues

and tradeoffs in making our decisions:

• Quantity - AI generally performs better when it

can learn from larger data sets. Even in the case of

RL agents, where the agent can learn on its own, it

is important to have a real and large dataset avail-

able to start learning. In our case, generating syn-

thetic data was not an option.

• Quality - Several data sources proved to be in-

accurate, making them unsuitable for a research

project focused on trading real assets. Without

rich and qualitative data and mechanisms to detect

outliers, extraction of technical indicators would

have been impossible.

• Cost - The cost of obtaining data in the financial

industry is determined by the following factors:

– real-time data is difficult to acquire without

high costs.

– large amounts of data at small time intervals

can only be sourced over short periods of time

without a significant increase in cost.

– access to trusted data sources, such as Nasdaq

Data Link

1

, can be obtained at a high financial

cost, but with large gains as one is later able to

develop high-end algorithms.

Considering and weighing these factors, our main

data provider in this work is AlphaVantage

2

, a well-

known source of financial data in the algorithmic trad-

ing industry. After obtaining an academic license for

advanced indicators and advanced historical data, we

developed a data pipeline shown in Figure1.

1

https://data.nasdaq.com/tools/api

2

https://www.alphavantage.co/

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

18

Figure 1: The design of data collection and processing is

simple. The first step consists of multiple API calls to the

AlphaVantage provider, followed by aggregation and pro-

cessing. In the second step, multiple indicators are com-

puted to enrich the information and prepare it for loading

into the environment. Data storage is done using HDF5

(Folk et al., 2011) files to increase performance and reduce

I/O processing time.

4.2 The Environment

An important goal of this project was to create a ver-

satile environment that could be reused in both the

academic and industrial communities and that could

be easily extended to different types of trading, port-

folios, and risk management. To provide separation

between the implementation of the environment and

the algorithms used to train the agents, the project

uses the OpenAI Gym (Brockman et al., 2016) inter-

face for environments. The advantage of this com-

mon interface is that open-source libraries of RL algo-

rithms can be used with minimal effort to test differ-

ent classes of algorithms and methods, even by users

unfamiliar with low-level RL methods.

The customized environment implemented in the

RL4FIN framework consists of several technical in-

dicators extracted from stock market data:

• Base indicators: Indicators for open, close, high,

low and volume data.

• Advanced Technical Indicators: Simple Moving

Average (SMA), Exponential Moving Average

(EMA), Weighted Moving Average (WMA), Rel-

ative Strength Index (RSI), Stochastic Oscillator

(STOCH), Average Directional Movement Index

(AVX), Bollinger Bands (BBANDS) and On Bal-

ance Volume (OBV) (Dongrey, 2022). These in-

dicators were selected to provide diversity and en-

rich the dataset in several directions. In the field

of machine learning methods, these composite in-

dicators have strong similarities to the concepts of

feature engineering or data enrichment.

Two environmental parameters specific to finan-

cial trading proved to be important for the optimiza-

tion of RL agents in the context of this work.

• Trading Interval - Short-term trading strategies

such as scalping and day trading are very different

from the medium- or long-term variants of swing

trading and position trading (Tino et al., 2001).

This is an important consideration in the training

and evaluation of the trading agent.

• Maximum number of steps per trading episode

- In order to evaluate agents and compare them

with other strategies and algorithms, the frame-

work sets different length limits for episodes. The

goal is to obtain agents that are able to make prof-

its within a given time window.

Most work in the literature focuses on a simpler

action scheme: buy, hold, and sell. The current

version of the open-source framework follows this

scheme and supports the same operations. However,

these can be extended by the user, e.g. by adding

more functions for specific areas such as trading fu-

tures, options or CFDs.

The states, or observations at any timestep t, s

t

∈ S

are composed of the following components:

• balance

t

∈ R

+

: Available balance.

• base

t

∈ R

+

: Base indicators (open, high, low, ad-

justed close, volume) for the asset traded.

• MA

t

∈ R

+

: Advanced technical indicators (SMA,

EMA, WMA) for the asset traded.

• RSIt ∈ R

+

: Relative strength index (RSI) for the

asset traded.

• ST OCHt ∈ R

+

: Stochastic Oscillator (STOCH)

for the asset traded.

• AV Xt ∈ R

+

: Average Directional Movement In-

dex (AVX) for the asset traded.

• BBANDSt ∈ R

+

: Bollinger Bands (BBANDS) for

the asset traded.

• OBVt ∈ R

+

: On Balance Volume (OBV) for the

asset traded.

The three actions are represented with numbers,

i.e., 1 for long (buy), 0 for hold (no action), and -1 for

short (sell). The entire asset is traded in a single step,

which means that the goal is to increase the potential

balance at the end of the simulation.

4.3 Training Trading Agents,

Particularities and Observations

The principle is to train an agent capable of making

decisions in such a way that, when placed on the mar-

ket data, it will make the highest possible profit.

After testing several reinforcement learning algo-

rithms based on action value functions Q − values

Deep Reinforcement Learning and Transfer Learning Methods Used in Autonomous Financial Trading Agents

19

(Q(s,a) representing the estimated value of applying

action a in state s), the algorithm based on Double

Deep Q-Networks (DDQN) (van Hasselt et al., 2015)

proved to be the best. The problem observed with

its simpler version, i.e., regular DQN (Mnih et al.,

2013), is the problem of overestimation, which has

also been noted in the literature (Sutton and Barto,

2018a) in some use cases. In the financial trading

domain, the overestimation led the agent to choose

mainly the long action, which is actually a buy-and-

hold strategy suitable for long-term portfolios. In the

experiments, as explained in more detail in the Eval-

uation section, DQN achieved lower profits with trad-

ing intervals of 1 day and 200 trading steps (equiva-

lent to one year in the market). Given these facts, it

was decided to keep the current default implementa-

tion of DDQN as the basis for training the agent.

There are two main classes of hyperparameters

used in the training process, as listed in Tables 2 and

3. The balance between exploiting the current agent

policy and exploring the environment to discover new

optimal states and actions is achieved in this work

by applying an adaptive epsilon-greedy method (dos

Santos Mignon and de Azevedo da Rocha, 2017). The

trial-and-error process to determine the optimal val-

ues for these hyperparameters is performed by Grid

Search (Liashchynskyi and Liashchynskyi, 2019) as

a standard approach, i.e., dividing the allowed range

of values into equal parts and performing experiments

with each combination of subranges. Some of the pa-

rameters in Table 3 are presented in the form of ranges

because the values in this range have similar effects

on performance.

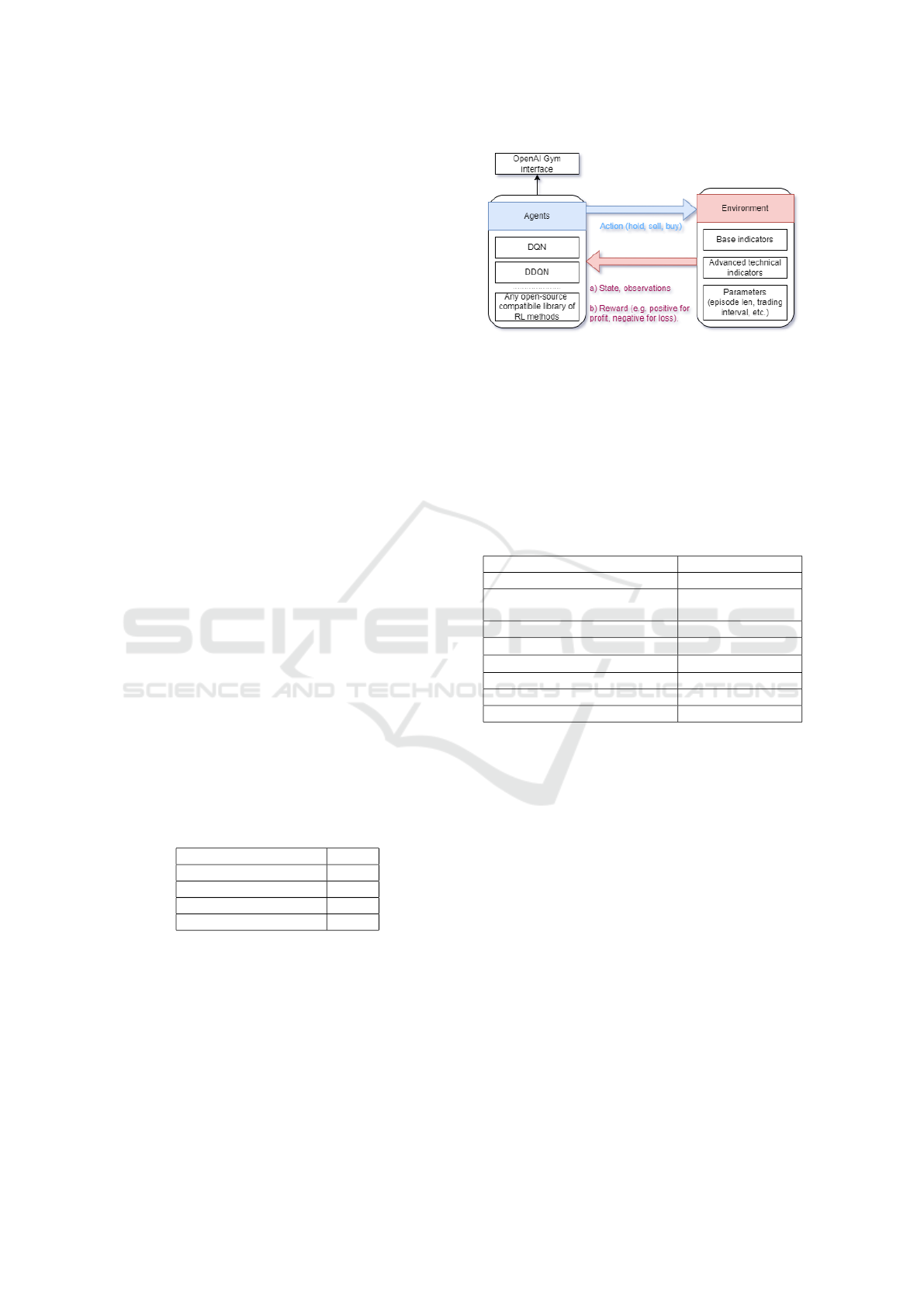

Figure 2 shows the interaction between the cus-

tomized environment used by the RL4FIN framework

and the agents customized for financial trading.

Table 1: ε-Greedy Parameters to balance exploitation vs ex-

ploration.

Parameter Value

Epsilon start 1

Epsilon end 0.01

Maximum decay steps 250

Decay factor 0.99

4.4 Transfer Learning

The knowledge transfer of a trading agent trained on

one financial market to another is evaluated in two

ways: (a) without fine-tuning, by transferring the

strategy directly, and (b) with fine-tuning, by adjust-

ing the weights of the agent network in a training pro-

cess of shorter duration using the new environment

and data set. Fine-tuning is usually done by freez-

Figure 2: Overview of the interaction between the trading

agent and the environment. The agents used by the frame-

work use an interface compatible with OpenAI Gym, so

most of the RL open-source libraries with algorithms can

be reused. For demonstration purposes, we re-implemented

customized DQN and DDQN algorithms as explained in

4.3. The environment contains a set of financial indicators

that provide information about how the agent behaves in the

financial market, as well as other parameters needed for the

simulation that can be fully customized by the user.

Table 2: The main parameters used for training the trading

agent with the DDQN method.

Parameter

Value

Discount factor

0.99

Target network update fre-

quency

100 steps

Optimizer

Adam

L2 regularization factor

10

−6

Learning Rate

∈ [10

−4

, 5 × 10

−4

]

Batch Size

4096

Number of Episodes

∈ [750, 1000]

Dropout Rate

∈ [0.3, 0.5]

ing the first part of the network and then retraining

the last few layers (or even just the last layer) with a

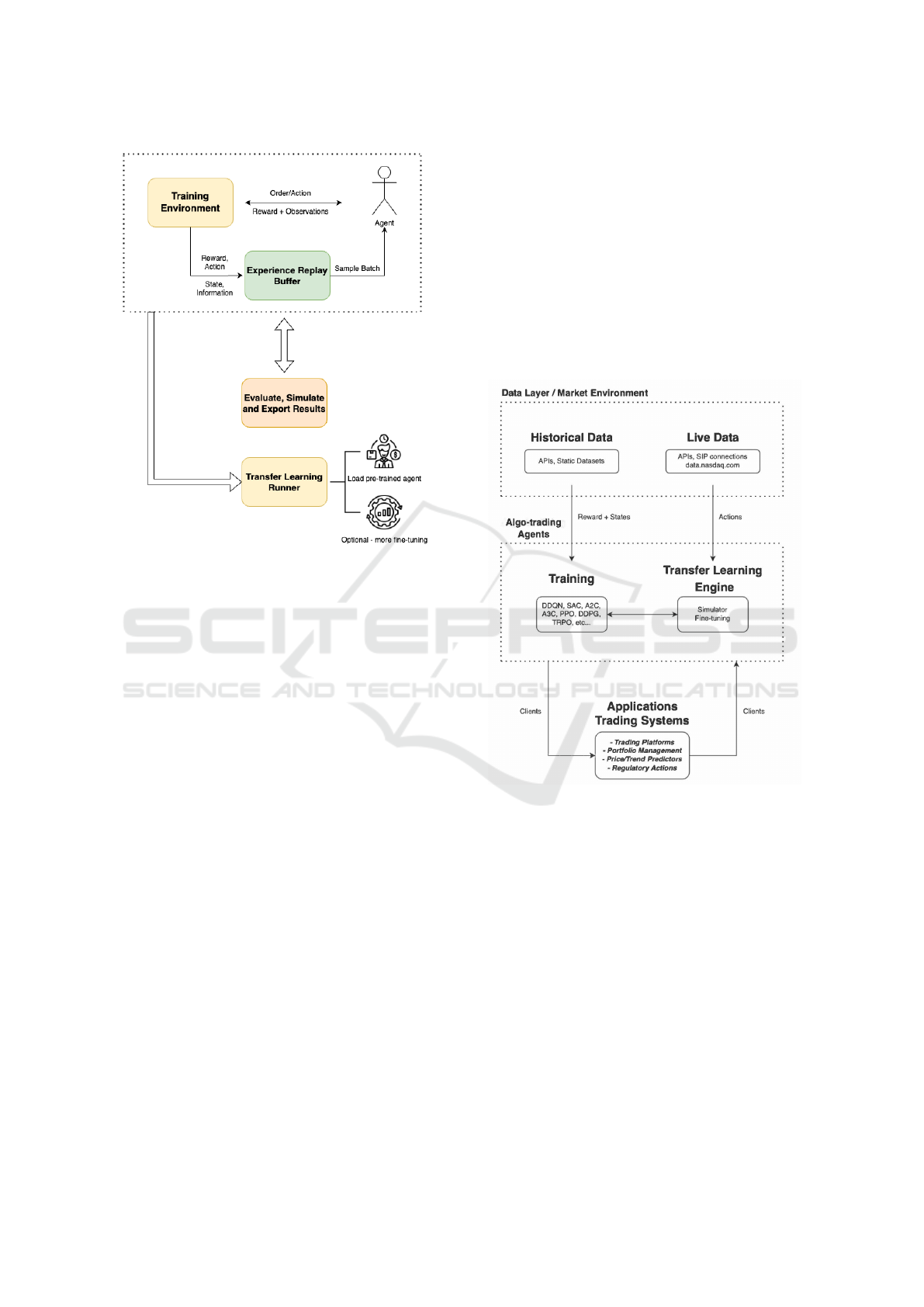

small sample from the new market dataset ( Figure3).

The intuition behind this is that the first part of the

network typically learns generalities, while the end of

the network generates details and specifics of the en-

vironments and datasets used for training. While the

detailed results are presented in the next section, we

outline the key observations below:

• Transferring between different markets with sim-

ilar environments and rules: the agent that was

directly transferred in this case made a profit

that was even higher than the baseline of human

traders.

• adjusting trading intervals, i.e., changing rules: as

expected, changing the baseline interval from 1

day to other intervals (e.g., 60 minutes, 5 minutes,

1 second) did not produce profits or stable results.

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

20

Figure 3: The flow from training the teacher agent in the

marketplace and then transferring its knowledge represen-

tation to the (student) agent, with and without fine-tuning.

The yellow blocks contain the fine-tuning part. The top

layer contains the modules used for training the agents,

such as an environment component, a base agent (based on

the OpenAI Gym interface), data structures for storing and

querying experience, evaluation, control, and common sim-

ulation functionalities. The lowest layer contains the func-

tionalities to perform transfer learning.

4.5 Framework Development

Methodology

Below, we briefly mention some important aspects of

the methodology used to develop the framework.

• Covering Software Engineering Principles -

Our research was driven by software develop-

ment principles and best practices such as SOLID,

Don’t repeat yourself (DRY), testing and eval-

uation practices in machine learning (e.g., the

80/20% rule where the model does not see test

data during training time), and test-driven devel-

opment (TDD) (Martin, 2008).

• Re-usability, Elasticity, and Modularity - As

described in Figure3, the developed framework

was built with reusability in mind, a key aspect

for future development and research. Components

within the framework were developed with the

separation of domains in mind, are highly mod-

ular, and are fully customizable by the user.

• Proof of Concept - Even though the framework

was tested on datasets that were publicly avail-

able through an academic license, the project is

designed as a backbone solution for applying rein-

forcement learning methods to trading systems in

the general case, with the possibility of extending

it to different types of environments and dataset

specificities.

The production and experimental architecture is

shown in Figure4. All agents are encapsulated in one

component (center), as are the API of the clients that

interact with the framework, and the implementations

of data aggregation and live updating.

Figure 4: Production and experimentation ready architec-

ture of the components of the framework.

5 EVALUATION

In this section, we first present the evaluation results

of training RL trading agents on different datasets.

Then we analyze how the trained agents perform on

market datasets other than the trained ones, with or

without changing the trading rules, with and without

fine-tuning. All these experiments were conducted in

our open-source framework. The results below show

the agents that perform best with the DDQN method,

i.e., with the best hyperparameters found with the

Grid Search method.

The datasets used in this research are NASDAQ

Deep Reinforcement Learning and Transfer Learning Methods Used in Autonomous Financial Trading Agents

21

100

3

(Web API-based access, 30 years of historical

data) and AlphaVantage

4

(Web API-based access).

The latter provides more than 60 economic indica-

tors. Data and benchmarks for various industries

were selected from these datasets. In particular, data

for AAPL (Apple Inc.), QQQ (Invesco QQQ Trust -

Exchange-Traded Fund), Nvidia (NVDA) and AMD

were extracted to prove that algorithmic trading can

be applied regardless of the industry segment. The

length of an episode in our evaluation is usually 200

steps, where each step corresponds to one day, which

means a whole year of trading in total.

Evaluations were performed on an Apple Mac M1

Max processor with 32 GB RAM and 10 cores CPU,

demonstrating the feasibility of the framework to per-

form inference on consumer hardware.

5.1 Reinforcement Learning Agent

Evaluation and Results

The market in our work case represents the real value

recorded in the dataset of the asset over a year, at the

end of each trading day (step).

We use two metrics as mentioned below.

• Annual Returns - expresses the increase in value

of an asset over a period of time, in our case one

year. The formula behind this ratio has three main

parameters: the value at the end of the measured

period (EndVal), the starting value of the asset

(StVal), and the dividend yield (Div):

Return =

(EndVal−StVal)Div

StVal

.

The goal of typical trading agents is to gener-

ate positive returns and to outperform the mar-

ket benchmark, meaning that the agent’s decision

would have improved the value of the asset held

over the course of the year.

• Agent Out-performance - The purpose of this met-

ric is to ensure consistent decisions in the bench-

mark. Specifically, it measures how many times

the agent took the correct action (long, hold,

short) during the year. For example, a bad deci-

sion would be if our agent makes a short deci-

sion, but in the market (the ground truth in the

benchmark scenario) the value of the asset has in-

creased, so the trading agent should have made

a hold decision. The goal of our work is to out-

perform the benchmark in more than 50% of the

time steps over an entire episode to achieve out-

performance.

3

https://data.nasdaq.com/tools/api

4

https://www.alphavantage.co/

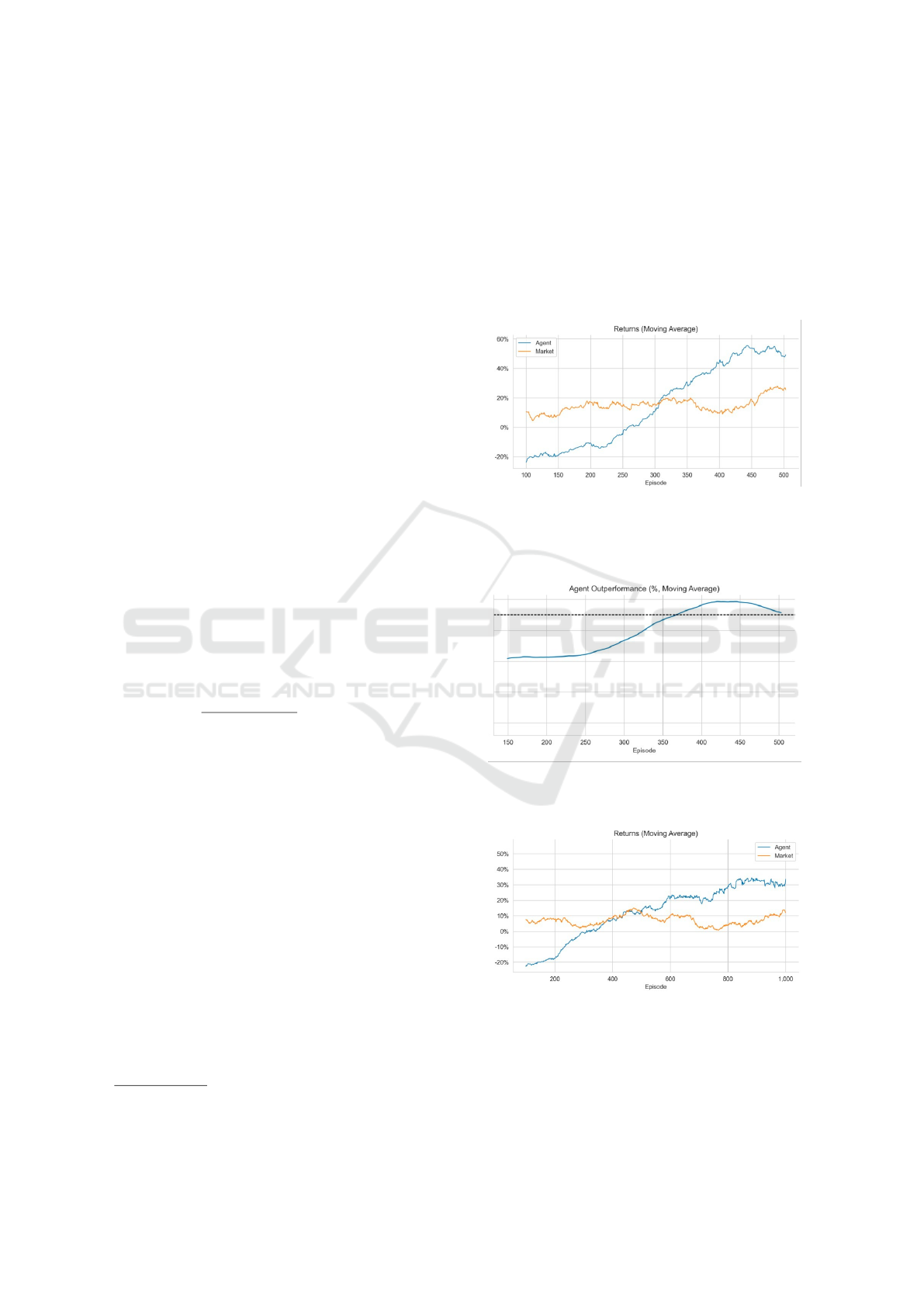

Figures 5 and 6 show the results of training ses-

sions on the daily Apple (AAPL) dataset, an exten-

sive dataset with over 20 years of continuous and

qualitative information. Another successfully con-

ducted experiment showed that agents with reinforce-

ment learning running in a longer episodic time frame

(1000 episodes) surpassed the market by more than

tripling the profit achieved (from 10% to over 30% of

annual revenue ). The results are shown in Figure 7.

Figure 5: After various adjustments to the hyperparameters,

and using the DDQN method, the best agent after empirical

evaluation was trained with 500 episodes on the daily AAPL

dataset and 200 episode steps.

Figure 6: In the same experiment with the AAPL dataset,

the agent performs better than the market benchmark.

Figure 7: Experiment was done on the Invesco QQQ ETF

(ticker - QQQ).

Last but not least, we checked whether the agent

correctly selected the actions long, hold, and short,

adhering to the learned strategy. We tracked diver-

sity of policies but also considered the risks associ-

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

22

ated with these actions. We would expect to see many

hold/long actions and fewer short actions, as the latter

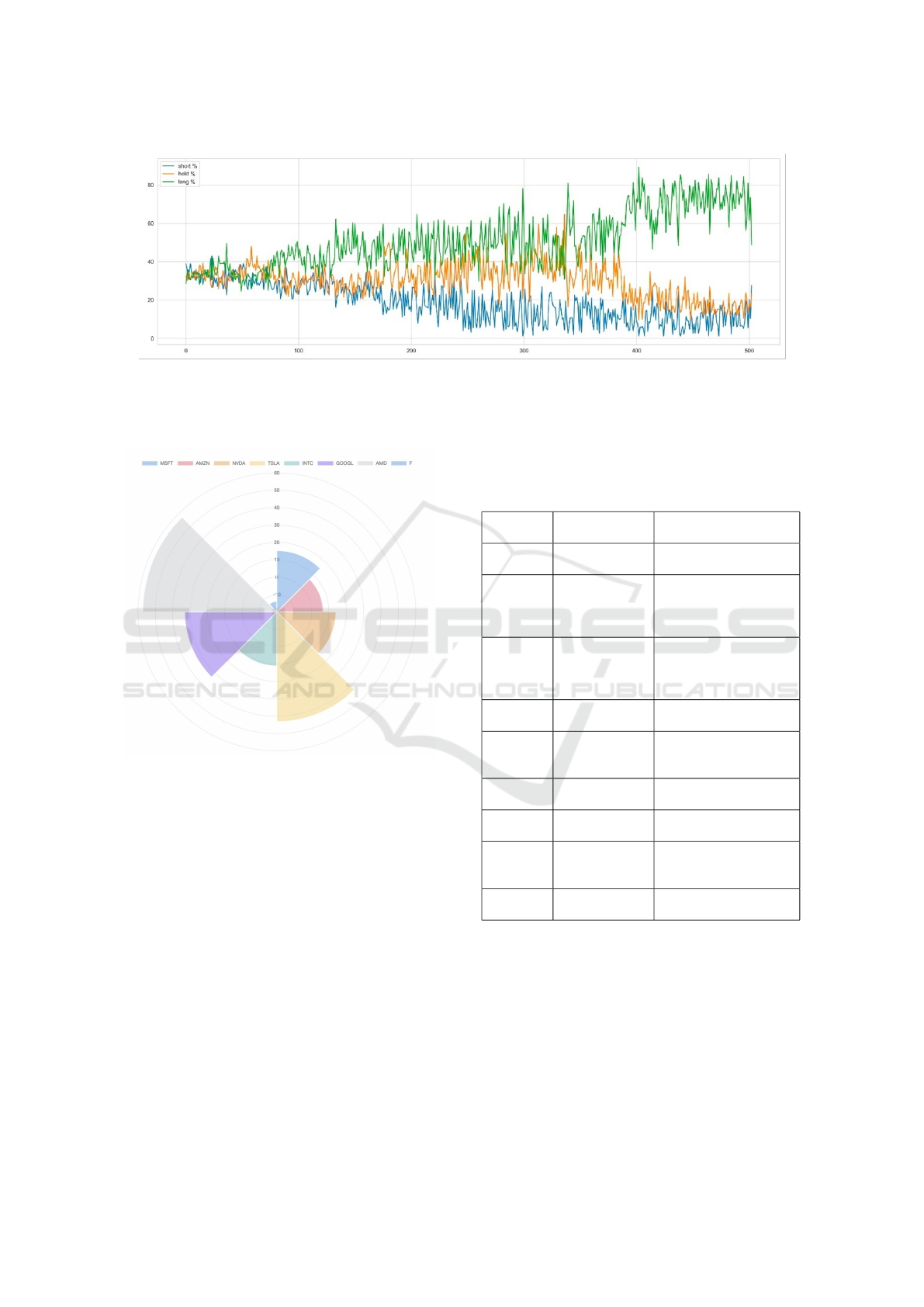

are generally considered risky. Figure8 is representa-

tive of the distribution of actions across policies.

Annual return results are compared using two

modern methods shown in Tables 3 and 5.

Table 3: Comparison against (Yang et al., 2021), evaluation

with their A2C version.

RL4FIN

(our)

The work in (Yang

et al., 2021) (A2C

algorithm compari-

son)

Return aver-

aged on all

datasets

67.3% 60.0%

Table 4: Performance compared to FinRL on the same in-

terval of time (2019).

Data used: 2019 RL4FIN

(our)

FinRL (Liu et al.,

2022a)

Return - AAPL 45.8% 36.88%

Return - QQQ 31.5% 27.51%

5.2 Knowledge Transfer Evaluation and

Results

We first evaluate how a pre-trained agent performs

in different markets without fine-tuning. This pro-

cess involved simulations and evaluations of multi-

ple datasets (other financial market tickers). During

this step, only the environment was changed (trading

rules and parameters) to allow an in-depth compari-

son of different trading strategies. These results and

observations are shown in Table5.

Figure9 is representative of the applicability of

transfer learning toward our research and shows that

positive gains can only be made when the agent is

transferred to another market or stock.

Fine-tuning was added to easily adapt the agent’s

policy to strategies that might apply in other scenar-

ios. For example, more volatile areas of the stock

market, such as the electric car area, require an agent

that is able to allocate multiple actions toward short

rather than long, marking gains that would be im-

possible to achieve with a simple buy-and-hold strat-

egy. To improve the results, we applied the follow-

ing scheme. First, load a pre-trained agent and freeze

50% of the shifts. Then fine-tune the agent on the new

dataset for 200 episodes (one-fifth of the normal train-

ing scenario). Several hyperparameters were consid-

ered. The main ones found in our experiments were:

the number of episodes, ε − decay, and ε − greedy.

Table 5: Transfer Learning without Fine-Tuning.

Environment

Variations

Observations

No Changes 50-70% return over a time frame of

200 trading steps.

Decreased

Trading In-

terval

After several experiments the con-

clusion extracted was the follow-

ing: scalping and day-trading strate-

gies require specially designed, direct

knowledge transfer being faulty. Be-

tween -30% to 10% return over a time

frame of 200 trading steps. Trading

intervals reduced to 1 minute.

Increased

Trading In-

terval

Position trading style isn’t suitable

without a specially trained agent. Be-

tween -10% to 20% return over a time

frame of 200 trading steps. Trading

intervals increased to 1 week.

Decreased

Steps Num

Due to the agent’s nature results were

lower than baseline, but with a slight

profit. The algorithm isn’t designed

to process sudden changes in the en-

vironment. Between 10% to 40% re-

turn over a time frame of 20 trading

steps. The trading interval is fixed to

1 day.

Increased

Steps Num

Due to the agent’s nature results were

lower than baseline, but with a slight

profit. The algorithm isn’t designed

to process sudden changes in the en-

vironment. Between 20% to 30% re-

turn over a time frame of 500 trading

steps. The trading interval is fixed to

1 day.

Table6 lists several variations and experiments to ex-

tend the hyperparameters to give an idea of how the

results can vary with fine-tuning. The ideal ratio be-

tween the number of maximal episodes and the num-

ber of episodes devoted to random exploration is ob-

tained from empirical evaluation (25%).

The profit achieved during the fine-tuning experi-

ments increased and outperformed all benchmark sce-

narios on the subset selected for evaluation. Com-

paring the figures9 and10, one can observe the previ-

ously mentioned increase in annual return. The values

were obtained after each agent was evaluated for 200

episodes after the fine-tuning step for each dataset.

The usefulness of transferring knowledge from

one agent to another is also reflected in the average

speedup achieved in training. For example, the time

required to train an agent from scratch was reduced

from nearly 10 hours to about 2 hours. Agents are

able to train and adapt to a new market faster (even

with customized trading rules) when starting from a

pre-trained set of policies or networks. Memory re-

quirements are also lower, as there is no need to store

the entire collection of experience data from the train-

Deep Reinforcement Learning and Transfer Learning Methods Used in Autonomous Financial Trading Agents

23

Figure 8: During the first 200 episodes, the agent is designed to explore the environment by choosing random actions, so the

distribution for each action is close to 33%. As the training progresses, it slowly shifts to a more stable strategy, choosing

mainly long actions as a safety net, while short actions are rarely chosen. This diagram can be used as evidence that our agent

is learning and not sticking to a usual trading strategy like buy and hold.

Figure 9: Transfer learning without fine-tuning. Positive

gains were obtained for most of the benchmarks in the data

sets. To understand the visualization, for example, in the

case of AMD (shaded in gray), the agent generated a return

of almost 60%, which outperforms the market baseline of

50% return. This is a clear case of the agent outperforming

the market, even without fine-tuning. In contrast, for the

Nvidia (NVDA) data (colored orange), the agent does not

outperform the market base.

ing session, but a small portion of it is sufficient dur-

ing the fine-tuning process.

All fine-tuned agents targeted higher annual re-

turns directly and faster, proving that this solution

is suitable for practice in the financial industry, Fig-

ure 11.

With the aforementioned setup, agent training

took an average of 2-4 hours. The fine-tuning pro-

cess took about 1 hour, and the inference time, i.e.,

the time required for the agent to make a single pre-

diction for a moving window of previously observed

Table 6: Transfer learning with fine-tuning experiments,

comparison of the two main parameters involved: the num-

ber of episodes and ε-decay.

Num

Episodes

Epsilon decay Observations

100 25

Insufficient number

of episodes.

100 50

Insufficient number

of episodes.

Too many exploratory

episodes.

100 75

Insufficient number

of episodes.

Too many exploratory

episodes.

200 50

Best results over

all experiments.

200 100

Too many exploratory

episodes, but with

good results overall.

200 150

Too many exploratory

episodes. Slow results.

400 100

Best results over

all experiments.

400 200

Too many exploratory

episodes, but with

good results overall.

400 300

Too many exploratory

episodes. Slow results.

data, averaged between 1.2 and 1.5 seconds.

6 CONCLUSIONS AND FUTURE

WORK

This paper presents an open-source framework,

RL4FIN, developed for trading systems that can be

used for experiments in both academia and indus-

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

24

Figure 10: Transfer Learning with Fine-Tuning, with the

same setup as Figure 9.

Figure 11: Transfer Learning with Fine-Tuning - Training

behavior.

try. The proposed RL-based agents and methods

outperform some of the state-of-the-art methods in

public benchmarks, demonstrating their usefulness.

Moreover, the framework provides transfer learning

adaptation and an experimentable solution to transfer

knowledge from one market to another. The work has

shown that fine-tuning to the new datasets is neces-

sary, especially when trading rules change.

Although financial applications can be formulated

in multiple ways, the usability of our methods can

be further developed to adapt to multiple scenarios

in the future. Therefore, we plan to report in future

work on the difficulties of developing a solution that

can accommodate all trading or portfolio manage-

ment strategies. Regarding the technical aspects, we

plan to extend our methods by carefully investigating

and implementing other RL methods, such as actor-

critical mechanisms. We are also considering extend-

ing the framework to several types of trading in fi-

nance (e.g., futures, options, CFDs, buy-sell). As sug-

gested in another study in (Bakker, 2001), LSTM net-

works can also enhance the capabilities of RL agents

as an alternative to current knowledge embedding.

REFERENCES

Bakker, B. (2001). Reinforcement learning with long short-

term memory. In Dietterich, T., Becker, S., and

Ghahramani, Z., editors, Advances in Neural Informa-

tion Processing Systems, volume 14. MIT Press.

Beck, N., Rajasekharan, A., and Tran, H. (2022). Transfer

reinforcement learning for differing action spaces via

q-network representations.

Brockman, G., Cheung, V., Pettersson, L., Schneider, J.,

Schulman, J., Tang, J., and Zaremba, W. (2016). Ope-

nai gym.

Czarnecki, W. M., Pascanu, R., Osindero, S., Jayaku-

mar, S., Swirszcz, G., and Jaderberg, M. (2019).

Distilling policy distillation. In Chaudhuri, K. and

Sugiyama, M., editors, Proceedings of the Twenty-

Second International Conference on Artificial Intelli-

gence and Statistics, volume 89 of Proceedings of Ma-

chine Learning Research, pages 1331–1340. PMLR.

Dongrey, S. (2022). Study of market indicators used for

technical analysis. International Journal of Engineer-

ing and Management Research, 12:64–83.

dos Santos Mignon, A. and de Azevedo da Rocha, R. L.

(2017). An adaptive implementation of e-greedy in

reinforcement learning. Procedia Computer Science,

109:1146–1151. 8th International Conference on Am-

bient Systems, Networks and Technologies, ANT-

2017 and the 7th International Conference on Sustain-

able Energy Information Technology, SEIT 2017, 16-

19 May 2017, Madeira, Portugal.

Folk, M., Heber, G., Koziol, Q., Pourmal, E., and Robinson,

D. (2011). An overview of the hdf5 technology suite

and its applications. pages 36–47.

Hochreiter, S. and Schmidhuber, J. (1997). Long short-term

memory. Neural computation, 9(8):1735–1780.

Kipf, T. N. and Welling, M. (2017). Semi-supervised clas-

sification with graph convolutional networks.

Kong, M. and So, J. (2023). Empirical analysis of auto-

mated stock trading using deep reinforcement learn-

ing. Applied Sciences, 13(1).

Koshiyama, A., Blumberg, S., Firoozye, N., Treleaven, P.,

and Flennerhag, S. (2021). Quantnet: transferring

learning across trading strategies. Quantitative Fi-

nance, 22:1–20.

Li, Z., Liu, X.-Y., Zheng, J., Wang, Z., Walid, A., and Guo,

J. (2021). FinRL-podracer. In Proceedings of the Sec-

ond ACM International Conference on AI in Finance.

ACM.

Liang, E., Liaw, R., Nishihara, R., Moritz, P., Fox, R.,

Goldberg, K., Gonzalez, J., Jordan, M., and Stoica,

I. (2018). RLlib: Abstractions for distributed rein-

forcement learning. In Dy, J. and Krause, A., editors,

Proceedings of the 35th International Conference on

Machine Learning, volume 80 of Proceedings of Ma-

chine Learning Research, pages 3053–3062. PMLR.

Liashchynskyi, P. and Liashchynskyi, P. (2019). Grid

search, random search, genetic algorithm: A big com-

parison for nas.

Liu, X.-Y., Xia, Z., Rui, J., Gao, J., Yang, H., Zhu, M.,

Wang, C. D., Wang, Z., and Guo, J. (2022a). Finrl-

Deep Reinforcement Learning and Transfer Learning Methods Used in Autonomous Financial Trading Agents

25

meta: Market environments and benchmarks for data-

driven financial reinforcement learning.

Liu, X.-Y., Yang, H., Chen, Q., Zhang, R., Yang, L., Xiao,

B., and Wang, C. D. (2022b). Finrl: A deep reinforce-

ment learning library for automated stock trading in

quantitative finance.

Martin, R. C. (2008). Clean Code: A Handbook of Agile

Software Craftsmanship. Prentice Hall PTR, USA, 1

edition.

Mnih, V., Kavukcuoglu, K., Silver, D., Graves, A.,

Antonoglou, I., Wierstra, D., and Riedmiller, M.

(2013). Playing atari with deep reinforcement learn-

ing.

Puterman, M. L. (2014). Markov decision processes: dis-

crete stochastic dynamic programming. John Wiley &

Sons.

Qi, J., Zhou, Q., Lei, L., and Zheng, K. (2021). Federated

reinforcement learning: techniques, applications, and

open challenges. Intelligence and Robotics.

Raffin, A., Hill, A., Gleave, A., Kanervisto, A., Ernestus,

M., and Dormann, N. (2021). Stable-baselines3: Reli-

able reinforcement learning implementations. Journal

of Machine Learning Research, 22(268):1–8.

Sutton, R. S. and Barto, A. G. (2018a). Reinforcement

Learning: An Introduction. Adaptive Computation

and Machine Learning. MIT Press, 2nd edition edi-

tion.

Sutton, R. S. and Barto, A. G. (2018b). Reinforcement

Learning: An Introduction. The MIT Press, second

edition.

Taylor, M. E. and Stone, P. (2009). Transfer learning for

reinforcement learning domains: A survey. J. Mach.

Learn. Res., 10:1633–1685.

Tino, P., Schittenkopf, C., and Dorffner, G. (2001). Finan-

cial volatility trading using recurrent neural networks.

IEEE transactions on neural networks, 12(4):865–

874.

van Hasselt, H., Guez, A., and Silver, D. (2015). Deep re-

inforcement learning with double q-learning.

Wang, Z., Huang, B., Tu, S., Zhang, K., and Xu, L.

(2021). Deeptrader: A deep reinforcement learning

approach for risk-return balanced portfolio manage-

ment with market conditions embedding. Proceed-

ings of the AAAI Conference on Artificial Intelligence,

35(1):643–650.

Wang, Z., Schaul, T., Hessel, M., van Hasselt, H., Lanc-

tot, M., and de Freitas, N. (2016). Dueling network

architectures for deep reinforcement learning.

Yang, H., Liu, X.-Y., Zhong, S., and Walid, A. (2021).

Deep reinforcement learning for automated stock trad-

ing: An ensemble strategy. In Proceedings of the

First ACM International Conference on AI in Finance,

ICAIF ’20, New York, NY, USA. Association for

Computing Machinery.

Zhou, W., Yu, Y., Chen, Y., Guan, K., Lv, T., Fan, C., and

Zhou, Z.-H. (2019). Reinforcement learning experi-

ence reuse with policy residual representation. pages

4447–4453.

Zhu, Z., Lin, K., Jain, A. K., and Zhou, J. (2022). Transfer

learning in deep reinforcement learning: A survey.

ICAART 2024 - 16th International Conference on Agents and Artificial Intelligence

26