The Prediction and Analysis of Hyper-Parameter for Stock Market

Prediction Based on GRU

Ziyi Jia

College of Information Science and Engineering, China University of Petroleum (Beijing), Beijing, China

Keywords: Stock Market Prediction, GRU Model, Exploratory Data Analysis.

Abstract: Stock market prediction has a crucial place in investment, risk management, and economic policy. Recently,

the rise of deep learning has led to the use of advanced techniques such as neural networks, which have

significantly improved the accuracy of stock market predictions and the ability to process complex data. In

this research, the gated recurrent unit (GRU) model is constructed in-house for data analysis and mathematical

modeling. Meanwhile, feature selection and loss functions are introduced to optimize the model. In addition,

the results of the model's predictions are visualized against real data, which helps to evaluate and improve the

performance. Simultaneously, this study delved into the application of evaluation metrics through exploratory

data analysis. Experimental results indicate that the model exhibits strong performance in the field of stock

market prediction. The utilization of GRU models in stock price prediction holds significant implications for

individuals, businesses, and financial institutions, as they provide critical market outlooks that support

financial and economic decision-making across multiple domains, improve forecasting accuracy compared to

traditional methods, and help all parties to better address market challenges and opportunities.

1 INTRODUCTION

Financial markets affect a wide range of sectors and

have a significant impact on the overall economy.

Stock prices occupy a key position in the financial

sector, reflecting company valuations and market

sentiment. Their price volatility directly affects

investment, corporate finance, and the stability of

financial markets, with far-reaching implications for

the global economy. Therefore, investors and

researchers have been exploring the patterns of stock

price behavior. However, the complexity and multiple

uncertainties of the stock market make stock price

analysis challenging (Abu-Mostafa and Atiya 1996).

For this reason, it is necessary to propose an effective

model for analyzing historical data and making

accurate predictions.

In the early days when there was a lack of

automated technical support, financial practitioners

mainly relied on traditional financial theories and

analytical methods to predict short-term fluctuations

in stock prices by focusing on market sentiment, news

announcements, and other relevant factors, and

manually analyzing historical data. These analytical

methods are mainly based on statistical and

mathematical principles, usually using linear models

(Box et al 2015). However, facing the complexity of

the market, traditional methods have limitations in

accurately predicting stock prices.

In recent years, the potential of machine learning

in forecasting has been extensively investigated in the

financial market as computational power has

increased and data storage costs have decreased

(Singh et al 2019). In the field of financial market

analysis, traditional forecasting methods such as

single decision trees, Bayesian methods, and

discriminant analysis have been gradually replaced by

superior-performing algorithms. Besides , the

nonlinearity, data-driven nature, and possession of

seamless generalization capabilities have made deep

artificial neural networks (ANNs) a mainstream tool

(Zhong and Davi 2017). However, due to the

constraints of ANN itself, a new generation of neural

network models such as Deep Neural Networks (DNN)

and Convolutional Neural Networks (CNN) have been

proposed by researchers. Xu et al. effectively derived

crucial stock market features from stock market

returns using CNN techniques, subsequently

employing these features to forecast stock market

trends (Xu et al 2018). Nonetheless, the outcomes fell

short of complete satisfaction. Subsequently, when

handling time series data, Recurrent Neural Networks

Jia, Z.

The Prediction and Analysis of Hyper-Parameter for Stock Market Prediction Based on GRU.

DOI: 10.5220/0012798900003885

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Data Analysis and Machine Learning (DAML 2023), pages 75-80

ISBN: 978-989-758-705-4

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

75

(RNN) emerged as a viable choice, albeit still

grappling with the issue of vanishing gradients. To

address this challenge, researchers introduced Long

Short-Term Memory (LSTM) networks, tailored

specifically for processing extended sequences

(Hochreiter and Schmidhuber 1997). A Long Short-

Term Memory Network (LSTM) model was

employed for predicting the trend of the Chinese

Shanghai and Shenzhen stock markets and was

successfully carried out by Chen et al (Chen et al 2015,

Li et al 2017 & Cho et al 2014). introduced additional

metrics, including variables related to investor

sentiment, when applying an LSTM model to predict

the performance of the CSI 1300 index. The results

show that the prediction accuracy of the model is

improved, which provides a new idea to improve the

traditional performance of LSTM.

To enhance the modeling and forecasting

capabilities of time series data and address time series

problems more effectively, the GRU model was

introduced and designed (Tesla Stock Data 2023).

Built upon the foundation of LSTM, GRU streamlines

the architecture, resulting in a reduction in parameters

and improved computational efficiency. The extensive

adoption of this model serves as evidence of its

outstanding performance.

The central objective of this paper revolves around

constructing an accurate and efficient model to predict

Tesla's stock price using GRU. To elaborate further,

first, historical stock price data are collected and

processed. Second, the GRU model is constructed and

trained on selected datasets, multiple evaluation

metrics are introduced in this study to improve the

model performance. Finally, the trained model is

subjected to stock market prediction and comparative

analysis by the researchers. The experimental results

clearly show that the model exhibits significant

performance advantages in stock price trend

prediction. This improvement is attributed to the GRU

model's ability to efficiently capture complex

correlations in time-series data, which improves the

accuracy and robustness of stock price forecasting.

This research is relevant and is expected to provide

more accurate stock price prediction tools to help

investors make informed decisions and reduce risks,

thereby stabilizing the financial market.

2 METHODOLOGY

2.1 Dataset Description and

Preprocessing

The Tesla stock market dataset (Tesla Stock Data

2023) from Kaggle contains 8813 data points with 7

variables (excluding the first ordinal feature). The

dataset consists of three parts. The first is a variable

named trading date: 1823 days of historical data from

20160 to 2021 are used. In the upcoming part,

attention will be focused on datasets containing stock

price details, encompassing Min, High, Opening, and

Closing prices, with all data consistently recorded on

the same day. The third stage involves two key

indicators in the stock market: the adjusted closing

price, which is usually used for the stock price after

taking into account factors such as dividends, stock

splits, and so on, and the day's trading volume, which

is the total turnover of the stock during the day.

Segmentation of the dataset is required to ensure

that having a separate dataset adequately evaluates

model performance when training and validating the

model. Specifically, to be more precise, the initial

dataset undergoes a division into two parts,

approximately 60% of the data is designated for

training purposes, leaving about 40% for testing. It is

worth noting that since each feature may have an

impact on the classification, there is no need to remove

any irrelevant data, which allows the model to learn

and make predictions taking all information into

account. Column names are renamed for ease of

subsequent code writing and reading: they are

uniformly changed to lowercase letters and column

names. The date field is normalized and converted to

date format and is Checked to delete the missing

values. This information is useful for data quality

assessment and data preprocessing.

2.2 Proposed Approach

This study aims to construct a stable, reliable, and

efficient forecasting model with the help of the GRU

model, which can be used to assist investors and

financial practitioners to better understand and

accurately predict stock market price movements.

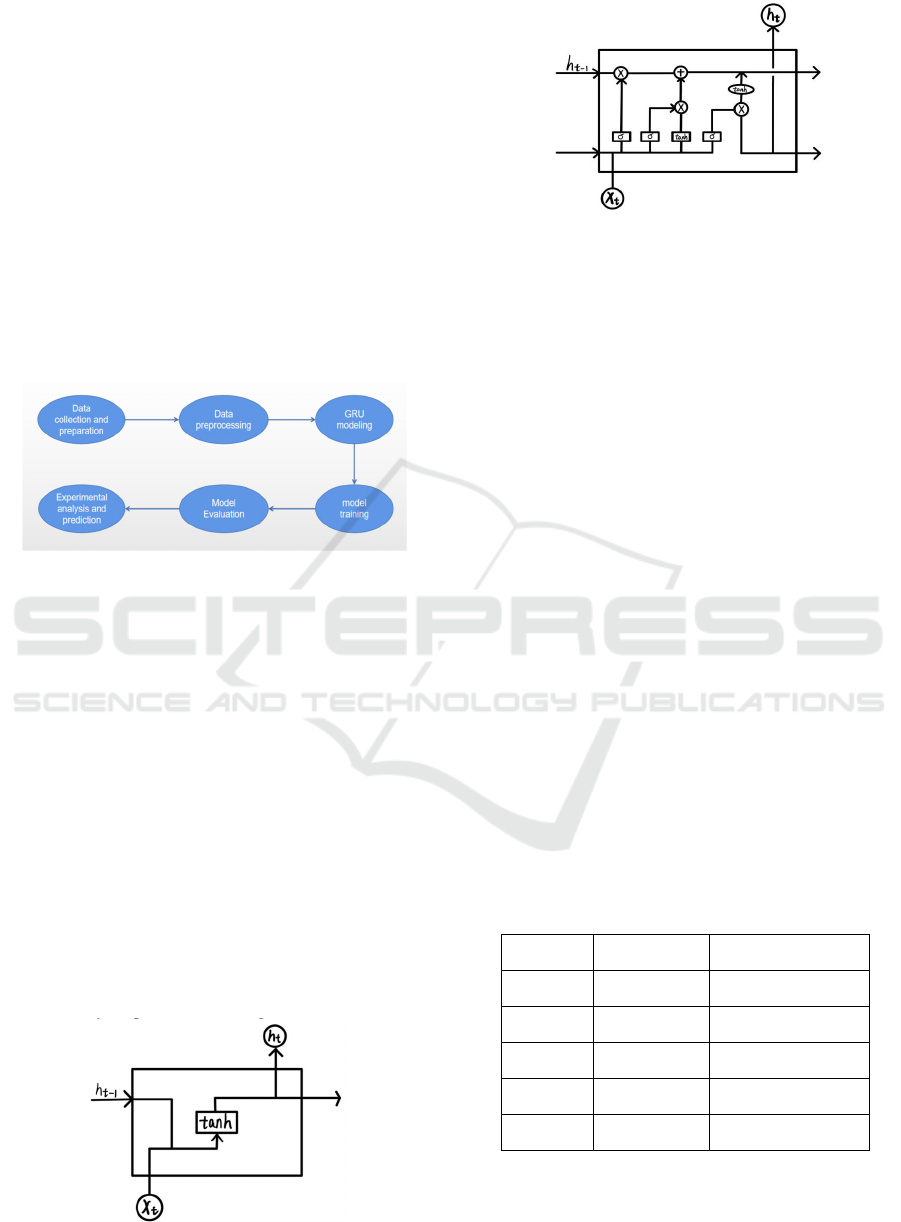

Following the process in Fig. 1, first, historical stock

market price data are collected and preprocessed.

Second, the GRU model is constructed and the model

is trained using the training dataset. To streamline the

model architecture and mitigate the risk of overfitting,

the initial optimization approach is to restrict the

model's depth. Limiting the depth improves the

generalization ability. Or, using regularization

DAML 2023 - International Conference on Data Analysis and Machine Learning

76

techniques, the parameters of the model are penalized

so that they are not too extreme, thus reducing

overfitting. Meanwhile, the GRU model's feature

selection method determines which historical price

features are most critical to predictive performance.

The features with the highest scores are selected for

further model simplification. After the model training

was completed, the Mean Absolute Error (MAE),

Root Mean Square Error (RMSE), and Mean Gamma

Deviation Regression Loss (MGD) metrics were

employed to comprehensively assess the model's

predictive performance, stability, and discriminative

power. Mean Square Error (MSE) as well as

Regression Variance Score, Regression R2 Score, and

Mean Poisson Bias Regression Loss (MPD) were also

used as reference data.

Figure 1: Flowchart Process (Picture credit: Original).

2.2.1 RNN and LSTM

RNN and LSTM are two neural network models used

to process sequential data. RNN employs a recurrent

mindset with the core concept of sharing weights and

state information when processing sequential data, as

shown in Fig. 2. Although RNN performs well on

certain sequential tasks, it has an important drawback,

the gradient vanishing problem, which leads to

limited performance when processing long sequences

or tasks that require capturing long-term

dependencies. LSTM is developed on the basis of

RNN, which introduces three important gating

mechanisms, namely the forgetting gate, input gate,

and output gate. Fig. 3 illustrates its main structure.

These gating mechanisms enable LSTM to better

capture long-term dependencies and thus perform

well in many sequence modeling tasks.

Figure 2: The structure of RNN (Picture credit: Original).

Figure 3: The structure of the LSTM (Picture credit:

Original).

2.2.2 GRU

GRU is also a deep learning model for processing

sequence data. It not only solves the gradient

vanishing problem of RNN, but also has a simpler

structure and fewer parameters than LSTM, and thus

is easier to train and deploy under resource

constraints. The core principle of GRU aims to

achieve effective control of information flow and

relies on gating mechanisms to do so. There are two

key gating mechanisms and two state components

incorporated in GRU. The role of these gating

mechanisms is to manage the flow of information in

recurrent neural networks in order to better capture

long-term and short-term dependencies in sequential

data and to overcome the gradient vanishing problem.

Specifically, the update gate decides to keep or forget

the previous information, the reset gate adapts to the

new input, and finally, the long and short-term

dependencies are captured by the candidate's hidden

state and the final hidden state.

The structure of the GRU model is shown in Table

1. It has a total of three layers in its structure,

containing is labeled parameterized grue layer, a

culling layer, and a perceptual layer.

Table 1: The Structure of the Gru Proposed in This Paper.

Layer Param # Output Shape

GRU_1 3360 None, 15, 32

GRU_2 6336 None, 15, 32

GRU_3 6336 None, 32

DROUP 0 None, 32

DENSE 33 None, 1

2.3 Implementation Details

The study uses the Kaggle, Colab platform and

The Prediction and Analysis of Hyper-Parameter for Stock Market Prediction Based on GRU

77

employs Python's Pandas library to read stock price

data and TensorFlow's Keras library to construct GRU

models. This study is conducted on a computer

running Windows 10 operating system. The model

contains 3 GRU layers with a number of 32 neurons,

a Dropout layer for preventing overfitting, and a

Dense layer for outputting the predicted values. The

loss function of the model is chosen to be MSE and

the optimizer is chosen to be Adam. The model has

been trained up to 200 times on the training set, this

process is designed to continually improve and

enhance the model's performance and ensure that it

learns and adapts adequately on the training set. The

validation set primarily serves to gauge how well the

model can apply its knowledge as it undergoes

training.

3 RESULTS AND DISCUSSION

After analysis, optimization, and evaluation, the GRU

model performance is fully understood and optimized.

The experimental analysis and model prediction

process consists of five key steps: model creation,

dataset partitioning, model training, result comparison,

and experimental prediction, which are as follows:

firstly, the architecture of the neural network model is

created, followed by training the initial GRU model

using the training dataset. Secondly, the mean square

error loss function, as depicted in Fig. 4, is employed

to assess the influence of variations in model depth on

both training and testing accuracy, thus serving as an

evaluation of overfitting. Next, the model's prediction

results will be used to compare with the actual data for

visualization and to make the comparison more

intuitive and clear, as shown in Fig. 5. Ultimately, the

essential preparations have been completed to enable

the GRU model to effectively forecast the stock price

for the upcoming 30 days, and after the successful

prediction of the results, it is necessary to compare the

results with the actual data of the past 15 days as

shown in Fig. 6, so that the researcher can evaluate the

accuracy of the model's prediction.

3.1 The Effectiveness of The Model

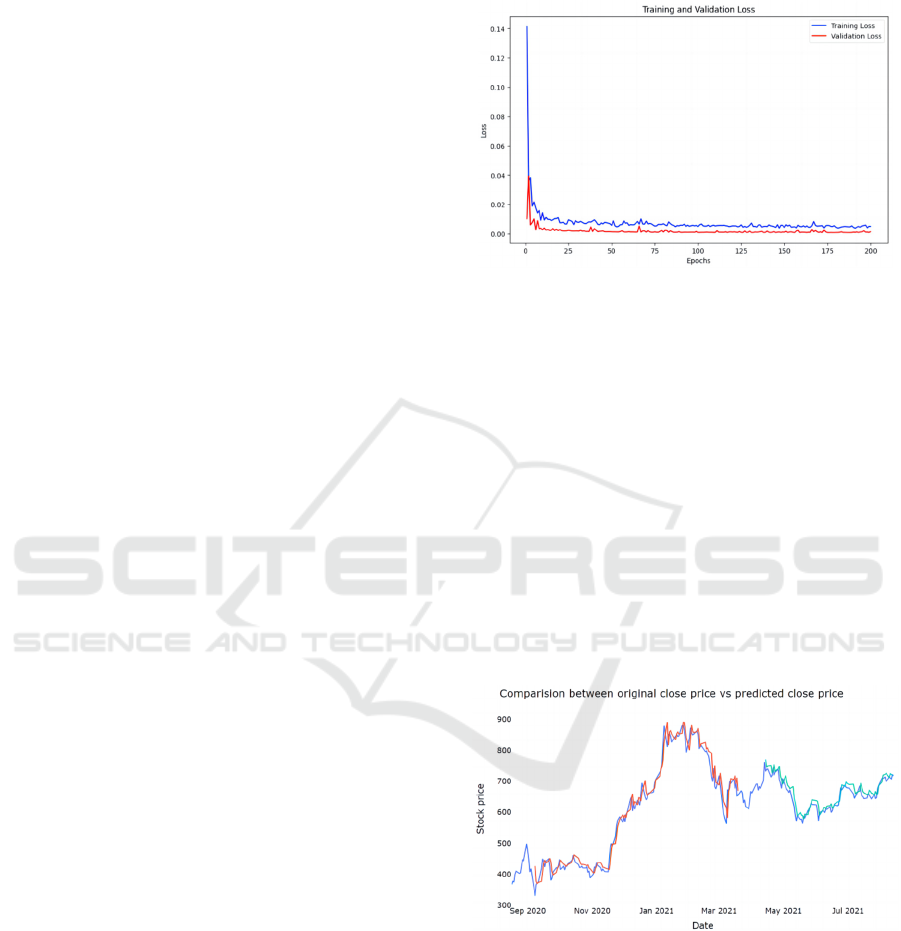

Fig. 4 presents the loss curves of the GRU model

during the training and validation phases, where the

loss is defined in the form of the MSE. The

observation of these loss values helps us to understand

the progress of the model during the training process,

as well as to assess the presence of overfitting or

underfitting problems. Additionally, the performance

metrics logged during training are employed to offer a

comprehensive evaluation of the model's performance.

Figure 4: Loss trajectory of the model (Picture credit:

Original).

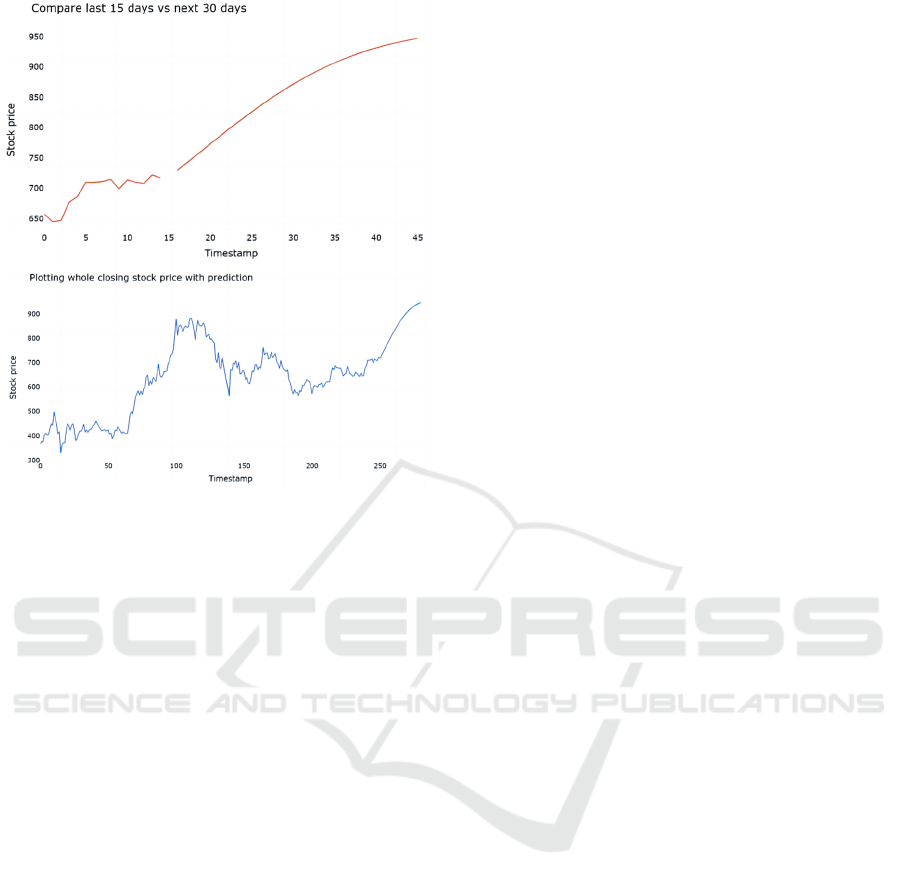

3.2 Confusion Matrix Analysis

In order to gain more insight into the performance of

the GRU model and to make accurate predictions,

Comparisons will be made between the predictions on

the training and test sets and the actual data using the

original stock closing prices of the past year as a

benchmark. Obviously, by visualizing Fig. 5 and

observing the trend and movement of these three lines,

it can be seen that the prediction results are very much

in line with the original closing prices without any

significant deviation or error. This implies that the

model can make precise forecasts of future stock price

fluctuations.

Figure 5: The prediction result of the model (Blue: original

close price, Red: train predicted close price, Green: test

predicted close price) (Picture credit: Original).

DAML 2023 - International Conference on Data Analysis and Machine Learning

78

Figure 6: Forecast stock price for the next 30 days (Picture

credit: Original).

As depicted in Fig. 6, a GRU model trained by this

study will be used to predict the stock price for the

upcoming 30 days. This prediction will then be

juxtaposed with the actual stock price data from 15

days prior, and finally, the model's predictions will be

merged with the stock price data to gain deeper

insights into the historical stock price trends, evaluate

the model's predictive performance, and comprehend

the dynamics of the stock price.

3.3 The Comparisons of Performance

In the subsequent investigation, two critical factors

were examined: the iteration count and the

partitioning of the training and test sets. The findings

indicate a significant correlation between the

performance of the GRU model and the

aforementioned factors. This relationship arises

because the model's convergence speed and stability

exhibit unpredictable fluctuations with varying

iteration counts. In other words, increasing the training

session count may enhance performance, but it also

carries the risk of causing model overfitting. Also, a

large training set helps to learn the data features, but

making the test set too small makes it difficult to

accurately assess the generalization ability, and a

small training set may lead to underfitting, thus the

need to balance the influencing factors. These

experiments provide important insights into

optimizing the performance of GRU models, which

can help in more accurate analysis of stock market

forecasting.

4 CONCLUSION

Overall, to achieve more efficient and accurate stock

market price prediction, this study uses a self-built

GRU to analyze, model, and optimize the Tesla stock

market dataset, and to understand and optimize the

performance of this model through loss function

curves and prediction deviation curves. This approach

is expected to bring more powerful tools and insights

to the field of stock market forecasting, as the GRU

model itself has important features such as time series

data capturing capability, and fewer model parameters

while maintaining model interpretability. In this study,

by conducting extensive experiments and exploratory

data analysis using multiple assessment methods

rather than a single metric to ensure a more

comprehensive and multidimensional assessment of

the model. Curve plots are used to visualize the model

training process and model prediction to explore and

evaluate the model performance more explicitly. Two

factors that have a critical impact on the model

performance were later identified through subsequent

experiments with varying parameters. In addition,

future research could focus on discovering other

important factors affecting model performance and

developing strategies to enhance them, which would

help to reconstruct the model to improve the ability to

accurately predict stock prices to meet the increasingly

complex stock market environment and investor needs.

REFERENCES

Y. S. Abu-Mostafa, A. F. Atiya, “Introduction to financial

forecasting,” Appl Intell, vol. 6, 1996, pp. 205–213

G. E. P. Box, G. M. Jenkins, G. C. Reinsel, et al, “Time

series analysis: forecasting and control,” John Wiley

& Sons, 2015

S. Singh, T. K. Madan, J. Kumar and A. K. Singh, “Stock

Market Forecasting using Machine Learning: Today

and Tomorrow,” 2019 2nd International Conference

on Intelligent Computing, Instrumentation and

Control Technologies (ICICICT), Kannur, India, vol.

2019, pp. 738-745

X. Zhong, and E. Davi, “Forecasting daily stock market

return using dimensionality reduction,” Expert Syst.

Appl, vol. 67, 2017, pp. 126-139

B. Xu, D. Zhang, S. Zhang, H. Li, H. Lin, “Stock Market

Trend Prediction Using Recurrent Convolutional

Neural Networks,” Lecture Notes in Computer

Science, vol. 11109, 2018, pp. 166-177

The Prediction and Analysis of Hyper-Parameter for Stock Market Prediction Based on GRU

79

S. Hochreiter and J. Schmidhuber, “Long Short-Term

Memory,” in Neural Computation, vol. 9, 1997, pp.

1735-1780

K. Chen, et al, “A LSTM-based method for stock returns

prediction: A case study of China stock market,” 2015

IEEE International Conference on Big Data (Big

Data), vol. 2015, pp. 2823-2824

J. Li, H. Bu, and J. Wu, “Sentiment-aware stock market

prediction: A deep learning method,” 2017

International Conference on Service Systems and

Service Management, Dalian, vol. 2017, pp. 1-6

K. Cho, B. Van, C. Gulcehre, “Learning phrase

representations using RNN encoder-decoder for

statistical machine translation,” In Conference on

Empirical Methods in Natural Language Processing,

arXiv. 2014, unpublished.

Tesla Stock Data 2016-2021 Homepage,

https://www.kaggle.com/code/ysthehurricane/tesla-

stock-price-prediction-using-gru-tutorial, last

accessed 2023/09/06

DAML 2023 - International Conference on Data Analysis and Machine Learning

80