Corporate Governance and Corporate Social Responsibility (CSR)

Disclosure Among Commercial Banks in an Emerging Economy:

Evaluative Perspectives

Padam Dongol

a

and Sajeeb Kumar Shrestha

b

Lincoln University College, Petaling Jaya, Malaysia

Keywords: Corporate Governance, Corporate Social Responsibility (CSR), Commercial Banks, Board Characteristics.

Abstract: The confluence of corporate governance (CG) and corporate social responsibility (CSR) has become

increasingly significant in the contemporary banking landscape of emerging economies. The collaboration

between gender diversity and financial leverage in shaping CSR disclosure has not been comprehensively

explored in this context. The corporate governance factors evaluated including board meetings, the age of the

board, the percentage of women on the board, and the size of the audit committee. The dataset was collected

from 432 individuals. We utilize multivariate analysis techniques to assess the relationships between CG

variables, including board composition, ownership structure, and CSR disclosure. As a result, we found that

board composition, gender diversity, financial leverage, and industry type were significantly influenced by

CSR disclosure among commercial banks in the emerging economy. When regulators, policymakers, and

bank stakeholders know these connections, they may collaborate to raise corporate governance standards and

encourage ethical banking practices, which will help the emerging economy grow sustainably.

1 INTRODUCTION

Corporate social responsibility (CSR) and corporate

governance (CG), two interrelated business practices,

are receiving more and more attention from

academics, practitioners, and politicians in today's

global business environment. The renewed attention

was especially relevant in emerging economies,

where rapid economic expansion, diversified

stakeholder dynamics, and changing regulatory

settings provide a complex environment for corporate

activity. Emerging economies have seen a substantial

change in recent years. These economies are

distinguished by their distinctive combination of

economic prospects and obstacles. Economic entities,

especially corporations and financial institutions,

must navigate a complex environment where societal

effects and financial performance are intertwined in

the changing climate. Commercial enterprises are at

the heart of these economies; thus, their governance

procedures and CSR programs are in the public eye

a

https://orcid.org/0009-0001-5398-9372

b

https://orcid.org/0000-0002-5227-771X

and significantly impact the socioeconomic

landscape as a whole (Chen, 2023).

1.1 Growing CSR Trends in Emerging

Economies

The CSR environment in emerging economies was

unique since they frequently have a variety of

cultural, economic, and regulatory circumstances. In

these contexts, the CSR paradigm goes beyond

traditional charitable undertakings and compliance-

driven activities. It includes a broader range of moral

principles, environmental responsibility, and a

dedication to stakeholders' interests other than

shareholders (Khojastehpour and Jamali, 2021).

1.2 The Function of Corporate

Governance

Banks' CSR frameworks are built upon corporate

governance frameworks, which include board

composition, ownership structure, and regulatory

Dongol, P. and Shrestha, S.

Corporate Governance and Cor porate Social Responsibility (CSR) Disclosure Among Commercial Banks in an Emerging Economy: Evaluative Perspectives.

DOI: 10.5220/0012492600003792

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st Pamir Transboundary Conference for Sustainable Societies (PAMIR 2023), pages 521-528

ISBN: 978-989-758-687-3

Proceedings Copyright © 2024 by SCITEPRESS – Science and Technology Publications, Lda.

521

monitoring. The foundation for ethical behaviour,

risk management, and sensible decision-making is

laid through effective governance procedures. As a

result, they significantly impact how intensely and in

what direction banks engage in CSR. In emerging

economies, corporate governance acquires a

particular relevance as the foundation of ethical

corporate behaviour (Velte, 2023). A corporation's

commitment to CSR and ethical corporate behaviour

was greatly influenced by the make-up, operation,

and oversight of its boards of directors (BoD) and

executive leadership teams. However, due to

elements including ownership arrangements, rules

and regulations, and cultural quirks, corporate

governance processes in emerging economies may

differ dramatically from those in mature markets (de

Villiers and Dimes, 2021).

1.3 The Strategic Need for CSR

CSR has gone from being a side issue to a strategic

requirement for companies in emerging economies

due to the changing demands of stakeholders,

including investors, consumers, and regulatory

authorities. Corporations are rapidly realizing that

CSR was more than a compliance concern but an area

of competitive advantage as the demand for

accountability and transparency grows. Sustainable

development, social inclusion, and ethical

governance are all included in CSR programs, which

reflect a broader societal commitment that is in line

with the varied and dynamic contexts of growing

economies (Abugre and Anlesinya, 2020).

The study investigates how board composition,

ownership structure, and other aspects of corporate

governance affect CSR disclosure (CSRD) among

commercial banks in emerging economies. It also

examines how gender diversity and financial leverage

affect these disclosure practices.

The remainder of the study was divided into the

following sections: We provide background

information on the research environment in Section 2,

focusing on corporate governance and CSR activities

in the banking industry; Section 3 delves into the

study's theoretical framework, presents a summary of

pertinent literature, and develops our hypotheses. The

data and our study technique are described in Section

4, respectively. The paper's concluding thoughts are

included in Section 5.

2 RELATED WORKS

(Orazalin,2019) examined CSR reporting procedures

in Kazakhstan's banking industry and how board

qualities affect CSRDs. The information on CSRDs

was collected manually from the yearly reports of

banks registered on the KASE. The findings

demonstrate that gender diversity on boards

positively impacts CSR reposting. However,

independence from management and board size have

no bearing on the volume of CSRDs. Data constraints

and the period selected could impact the

completeness of the analysis. Recognizing the

importance of CSR worldwide, (TRAN, et al, 2020)

examined the effects of corporate governance

determinants on CSRDs in Vietnamese commercial

banks. The corporate governance variables are

compared to CSRD using data from time series and

OLS (Ordinary Least Squares) regression analysis.

The findings indicate three problems with corporate

governance have positively impacted the disclosure

of CSR among Vietnamese commercial banks. They

use OLS regression, which makes specific statistical

assumptions that might not always hold in real-world

situations. (Matuszak, et al, 2019) found a link

between the corporate governance practices of these

institutions and their CSR statements. The gathered

data was subjected to procedures for analysis of panel

data. The findings demonstrate that throughout the

investigation, the banks under scrutiny enhanced their

CSR reporting procedures. It could restrict how

widely outcomes can be applied to a given time

period and region of the world.

(Duong, et al, 2023) better understand how state

ownership and strong CEOs affect Vietnam's

commercial banks' CSR. Vietnam was a developing

market in Asia. The analysis' indigeneity and

heterogeneity issues are addressed using an evolving

system, the GMM (Generalized Method of

Moments). The findings show that solid CEOs are

detrimental to CSR initiatives because they tend to

devote less money to CSR investments because of the

potential loss of operating free cash flow. Their focus

on the Vietnamese banking industry may limit the

applicability of results to other sectors or

geographical areas. (Abdelnur, 2021) evaluated the

degree of CSRD in On the Khartoum stock exchange

(KSE), annual reports of commercial banks in Sudan

are traded. 61 yearly filings from 10 registered

financial companies during a seven-year period were

reviewed using a content analysis technique. The

findings of all of the banks studied disclosed CSR

data in their yearly filings. The analysis does not

evaluate the influence or efficacy of CSR programs;

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

522

instead, it was based on the substance of annual

reports. In Malaysia, (Lui and Zainuldin, 2022)

compared CSRD degrees between domestic and

foreign banks. It uses robust regressions and OLS to

analyze the data. The findings show that Malaysian

local banks tend to provide more CSR data than their

multinational rivals. The concentration of the study

on a particular period and geographical area may limit

the generalizability of results.

(Miah, et al, 2019) focused on IBBL's efforts to

address societal and financial issues through

humanitarian aid, education, health, sports, the arts,

and culture initiatives. To improve the social welfare

of underdeveloped areas, the study examines the

growth rates in several CSR sectors and highlight’s

locations that may need further funding. Other

sectors' growth rates were lower, indicating that more

money was needed elsewhere to support social

welfare initiatives. The limitations, which include its

emphasis on a single financial institution (IBBL) and

a narrow time window, may make it difficult to

generalize its results to other banks and areas. (Ho,

Liang, and Tumurbaatar, 2019) how CSR impacts

Corporate Financial Performance (CFP) in

Mongolian institutions. To evaluate the CFP, they

developed a CSRD index and examined several

financial variables. They emphasize the importance

of taking the precise moment of financial crises into

account when examining this relationship. They find

correlations but do not prove a connection or explore

the precise mechanisms by which CSR affects

financial performance.

(BUI, 2021) focused on the one-way relationship

between Vietnamese commercial banks' financial

performance and CSR. The analysis makes use of

dynamic panel methods, a collection of Vietnamese

commercial banks, a two-step GMM estimator, and

regressions. In contrast to private banks, state-owned

commercial banks are less positively impacted by

CSRD in terms of their financial performance. The

concentration of the study on a particular geographic

area and ownership structure may limit the

applicability of the results to other contexts. With a

focus on developing economies, (Nwude, and

Nwude, 2021) intends to empirically analyze the

association between firm board features and CSRD in

the Nigerian banking sector. Multiple regression

analysis was used in the study using panel data from

the audited financial records of the chosen

institutions. The banks with more giant boards, fewer

board members who work outside of the bank's

operations and more female directors generally

disclose their CSR activities more frequently. The

drawback includes its emphasis on a single sector

(Nigerian banking) and the possible need for

generalizability to other industries or geographical

areas.

3 RESEARCH METHODS

3.1 Development of Hypothesis

A crucial stage of the research process is the creation

of hypotheses. It entails creating verifiable

hypotheses or educated predictions regarding the

expected correlations between study variables.

Research is given a distinct direction by hypotheses,

which direct data collecting and analysis. They enable

systematic testing and evaluation of the results that

researchers expect to uncover, assisting in

formulating predictions that lead to empirical

findings regarding the research subject being

investigated.

3.1.1 Age of Board

The mean age of the board members can be used to

gauge the amount of experience of the committee

members. A board with a greater average age is more

significant and experienced, while a board with a

smaller mean age is younger and less experienced.

Older directors are often thought to bring more

wisdom and well-honed decision-making abilities,

frequently favoring traditional and risk-averse

corporate strategies. In contrast, younger directors,

having received more recent education, tend to be

more inclined toward risk-taking and are often drawn

to innovative business ideas, including those related

to CSR activities. Although the research has explored

the influence of board age on a firm's performance, its

connection to CSRD has received less attention.

While the studies have found insignificant effects,

younger board members had a higher propensity to

support contemporary business practices than their

more senior colleagues, such as CSRD. Thus, the

hypothesis emerges that:

Hypothesis 1: The degree of CSRD is negatively

correlated with board age.

3.1.2 Board Meeting

A corporate board's problem-solving capability and

diligence can be assessed by analyzing the number of

annual board meetings. Board members participate in

many meetings with increased opportunities for in-

depth discussions, workload distribution, and idea

Corporate Governance and Corporate Social Responsibility (CSR) Disclosure Among Commercial Banks in an Emerging Economy:

Evaluative Perspectives

523

sharing. A responsive board pleases the owners and

improves the organization's reputation among

stakeholders. However, it is essential that

commonplace meetings may disrupt business

operations and reduce the quality of interactions

among board members. Formulating an effective

CSR strategy and policy is a complex process that

requires a collaborative effort and demands time from

board members. The complexity results from several

factors, including the need for a sustainable culture,

prior knowledge, resistance to transformation, and the

attitude of business leaders. A robust CSR plan

requires the board to address these issues and develop

a comprehensive CSR strategy. Therefore, boards

with regular meetings have more opportunities to

deliberate on garnering stakeholder support and CSR

plans. While the research has explored the impact of

board meetings on CSRD and found an encouraging

but statistically unimportant correlation, this study

posits that a superior frequency of meetings is

conducive to developing CSR initiatives.

Consequently, the study proposes the following

hypothesis:

Hypothesis 2: The amounts of CSRD and board

meetings positively correlate.

3.1.3 Audit Committee

Making sure that the financial records of a business

are accurate is crucially dependent on the audit

committee. The competence of this committee hinges

on the composition of its members and experience. A

larger audit committee, composed of more skilled and

seasoned individuals, is essential for its effectiveness.

The audit committee's effectiveness has a beneficial

effect on the disclosure's level of quality.

Furthermore, the effectiveness of both voluntary

disclosure and financial audit committees is presently

increased. An influential audit committee contributes

to enhancing the quality of financial reporting. These

observations align with the principles of Agency

Theory, which asserts that having a board

committee's independent directors can balance out the

information. The current study suggests that a

sizeable audit committee of competent and

experienced members can effectively monitor

managerial performance, especially concerning

social and environmental activities. That can elevate

the quality of CSRD. Therefore, the hypothesis of this

research proposes that:

Hypothesis 3: The level of CSRD is positively

correlated with the audit committee's size.

3.1.4 Gender Diversity on the Board

The prominence of gender diversity on corporate

boards in India has been highlighted by recent

regulatory reforms introduced in the Companies Act of

2013. These reforms mandate that for every listed

company, at least one board member must be a female.

Although there is evidence between gender diversity

and financial performance, the influence on CSRD has

not been extensively studied. Gender diversity can

enhance board independence, as individuals with

different backgrounds, genders, ethnicities, and

cultures offer diverse perspectives rooted in their

experiences. Female directors differ from their male

counterparts in several ways. Companies with a higher

representation of females on their boards often engage

in more social and charitable activities than those with

fewer females in leadership positions. This has an

optimistic effect on corporate reputation and ratings of

CSR. According to these findings, current studies have

been supported by evidence that the presence of

females on corporate boards improves CSRD.

However, it is essential to note that some studies

present a contrasting relationship between the

participation of females on boards and CSRD. In light

of these findings, this study anticipates that the

inclusion of females on the board will strengthen the

CSR programs of the company and result in increased

CSRD. Consequently, the researcher proposes the

following hypothesis:

Hypothesis 4: Females on board have a good

relationship with the amount of CSRD.

3.2 Data Acquisition

The activists employed a quantitative descriptive

research approach and strategy for their investigation.

They highlighted using computer techniques to

measure data objectively obtained through survey

questions. It concentrated on accumulating numerical

data and using it to explain a particular viewpoint or

generalize it across groups of people. There were 432

respondents to the study, who were officials and staff

from the commercial banks. The study employed a

self-created survey questionnaire as a data collection

tool to sort quantitative data for analysis. The tool's

primary goal is to pinpoint the elements influencing

the sample commercial banks' corporate philanthropy

and, ultimately, to realize the value of publishing

these actions regularly.

The questions were written in a way that would

make it simple for responders to respond. The

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

524

respondents were forced to form an opinion since a 5-

point Likert scale or forced Likert scale was utilized.

A forced Likert scale was utilized to analyse the

correlation between CSR and disclosure in the

commercial banks' financial performance. The impact

of CSR and disclosure on the operations of

commercial banks was assessed using the composite

mean. The following scale was used to interpret the

study's findings: Strongly Agree (SA), Agree (A),

neutral (NS), Disagree (D), and Strongly Disagree

(SD) are all measured. Based on the weighted mean

of the index, the ranking was also utilized to

determine which index was the highest and lowest.

3.3 Variables

In corporate governance (CG), several factors that

can be considered as independent variables include

the audit committee's size, the average age of the

board members, the annual count of board sessions,

the frequency of board meetings, and the gender

makeup of the board. The other factors, including

industry, promoter ownership, financial leverage,

board age, board size, return on asset (ROA), is used

as controls. Company age is regarded as a controlling

factor since more established businesses are familiar

with the area and setting in which they function and

recognize that CSRD attracts new customers and

fosters goodwill. Therefore, it is expected that firm

age has a beneficial impact on CSRD. Financial

leverage refers to using debt to finance operations,

and companies with high debtors often face superior

pressure to provide detailed information to creditors.

It follows that a positive association between CSRD

and financial leverage is anticipated. Return on assets

(ROA), which reflects a firm's profitability, is often

higher for socially responsible companies. Profitable

firms tend to demonstrate their commitment to

society and are more likely to provide extensive

CSRDs, indicating a positive association between

ROA and CSRD. Based to the legitimacy theory,

organizations working in politically and ecologically

sensitive industries are more inclined to share

information about CSR than those in non-sensitive

industries in order to maintain their good reputations.

A favorable correlation between the kind of industry

and CSRD is expected. Table 1 lists the independent

variables that were used in the research.

Using Eviews 9, the following model examines

how the explanatory variable affects the disclosure

score on the Likert scale.

(1)

-dependent variable,

Where-company, - time - Board age on

average, - Board meeting, - audit committee's

size, -Women on board, - is financial

leverage, and - Return of asset.

4 RESULTS AND DISCUSSION

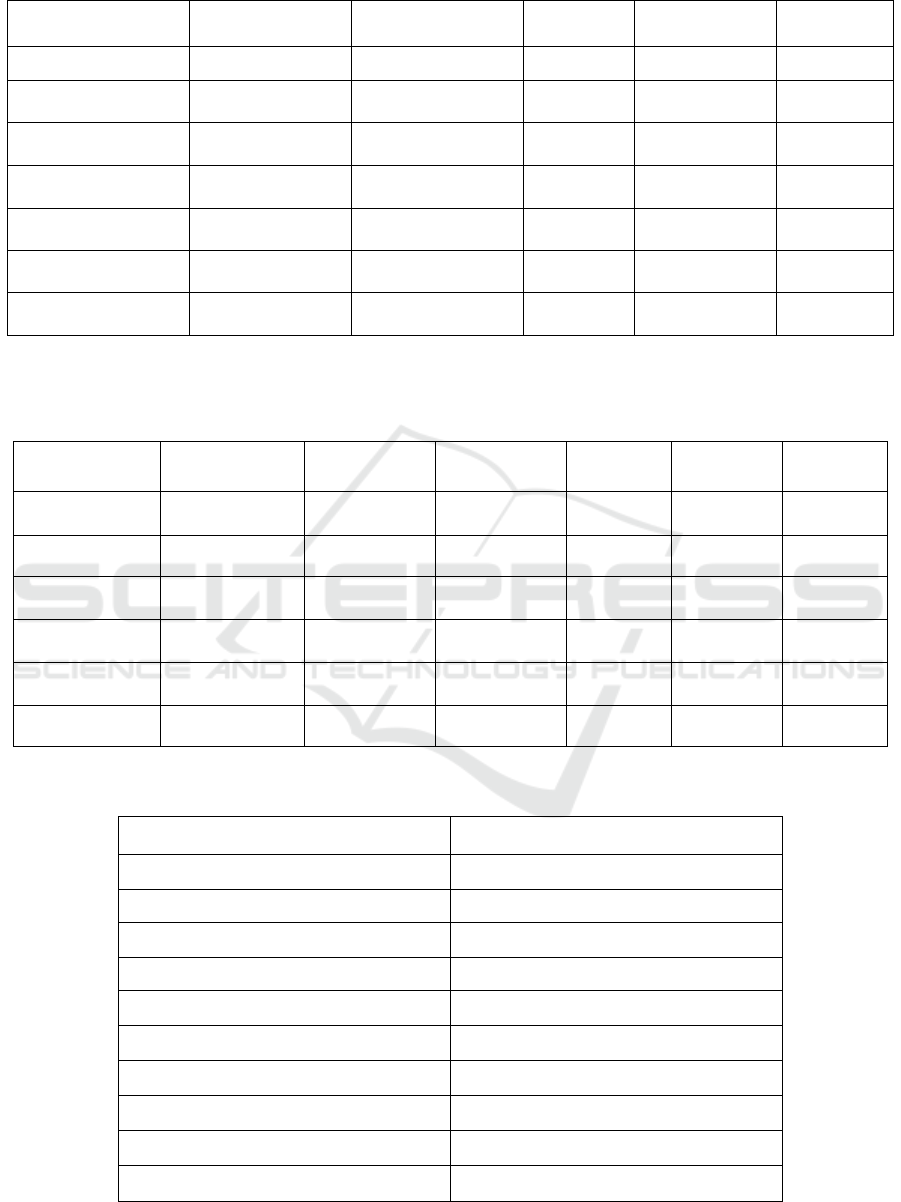

Table 2 provides a statistical summary of the sample

data. The average disclosure of ESG score is 27.44,

with a maximum score of 61.57 and a median score

of 22.72. Table 3 presents Pearson's Correlation

Coefficient along with the variables of independence

and their respective importance levels. The results

indicate that the correlations between the variables of

independent fall within acceptable ranges, suggesting

that multi-collinearity is not a significant concern.

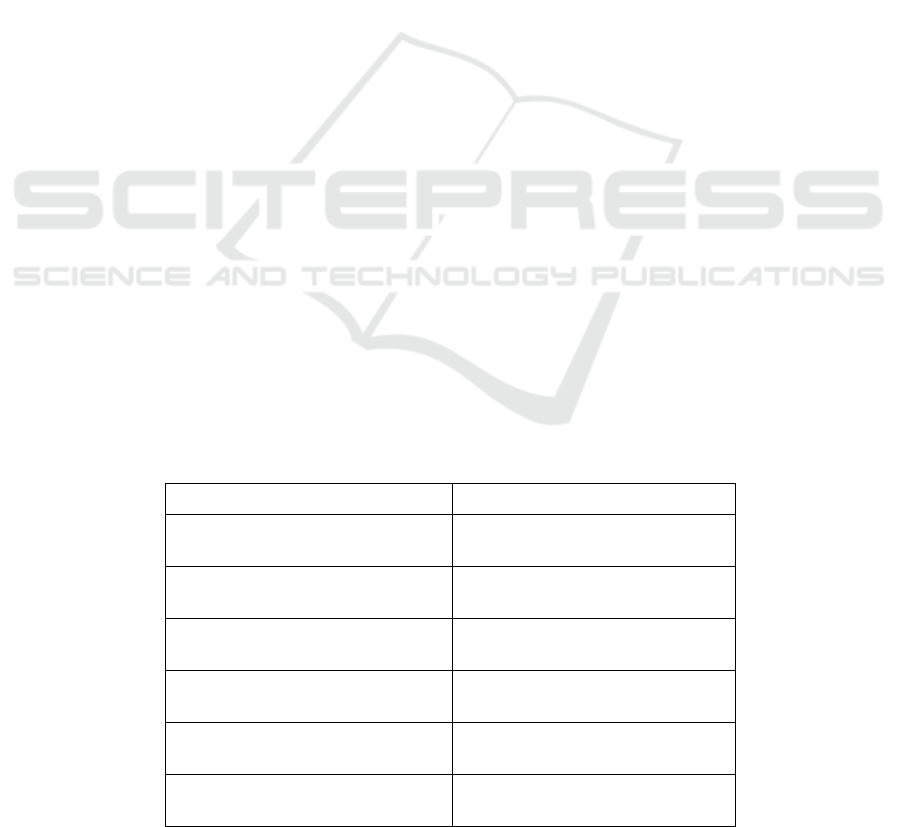

Table 1: Independent variables.

Independent variables

Description

Women on board

Percentage of women directors on

board

Board meeting

Number of board meeting per year

Size of audit committee

Number of audit committee

members

Board age

Average age of board members

Financial leverage

Debt-equity ratio

ROA

Asset return (profitability of the

company)

Corporate Governance and Corporate Social Responsibility (CSR) Disclosure Among Commercial Banks in an Emerging Economy:

Evaluative Perspectives

525

Table 2: Descriptive data analysis.

Variables

Maximum

Minimum

SD

Median

Mean

ROA

57.44

-45.31

10.11

06.21

08.70

ESGDS

61.58

04.55

15.05

22.73

27.45

FLEV

578.6

00.01

28.45

02.47

05.32

BAGE

74.58

47.51

04.15

62.00

61.17

BM

21.00

04.00

03.29

07.00

07.41

SAC

11.00

03.00

01.03

05.00

03.93

WB

33.34

00.01

07.52

06.67

06.73

Note: ROA- Return on asset, BM- Board meeting, FLEV- Financial leverage, BAGE- Average age of board member, WB-

Women on board, SAC- Size of audit committee.

Table 3: Matrix of correlation.

Variables

BAGE

BM

SAC

WB

FLEV

ROA

BAGE

0.084

0.171**

0.094*

-0.074

0.038

1.000

BM

0.023

-0.008

-0.006

-0.045

1.000

SAC

0.027

0.041

0.119**

1.000

WB

-0.038**

0.265**

1.000

FLEV

-0.193***

1.000

ROA

1.000

Table 4: Regression analysis of panel data.

Variables

ESGDS Model

ROA

0.118**

FLEV

0.012***

BAGE

− 0.429**

BM

0.202

SAC

− 0.502

WB

− 0.158**

Adjusted R

2

0.865

Constant

− 76.83***

F stat

37.94***

N

432

Note: *** (0.001%), ** (0.005%).

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

526

4.1 Discussion

The model's findings (Table 4) illustrate how

corporate governance factors affect CSRD. Board age

and CSRD are negatively correlated, meaning there is

a probability for greater CSRD if the average age of

the board is lower. Younger directors attempt to

include more CSR activities than senior directors

since they are more motivated and supportive of new

market ideas. Hypothesis 1 is therefore approved. The

outcome supports Hypothesis 3 and provides

evidence that the sustainability committee and the

CSRD have a beneficial relationship. A distinct

committee's existence indicates that the company has

a strong attitude toward socially responsible business

practices. Such companies must also have high social

values and increase their CSRD. The level of CSRD

is significantly negatively impacted by the presence

of women directors (hypothesis 4), proving that

having women on the board and the board committee

has detrimental effects on CSRD due to the reality

that both countries' involvement rates for women in

public activities are significantly lower than those of

other developed nations. Board meetings and CSRD

have a negligible correlation, which suggests that the

board meeting frequency has no bearing on the

disclosure of CSR. Our conclusion contradicts

Hypothesis 2, which also came to a similar conclusion

and supported it by claiming that the committee of

directors does not participate in the critical decisions

but merely makes them, the phase of putting CSR

policy into practice. Firm size, financial leverage, and

age demonstrate a substantial beneficial impact on

CSRD compared to control variables.

5 CONCLUSIONS AND FUTURE

SCOPE

The study explored the confluence of CG and CSR in

the banking landscape of emerging economies,

focusing on the role of gender diversity and financial

leverage in shaping CSR disclosure. Employing a

dataset of 432 individuals from commercial banks in

the selected emerging economy, we used multivariate

analysis techniques to examine the relationships

between CG variables, including CSR disclosure,

board composition and ownership structure. They

outcome indicated that board composition, gender

diversity, financial leverage, and industry type

significantly influence CSR disclosure among

commercial banks in the emerging economy. These

finding underscored the importance of fostering

diverse and responsible governance practices within

banks. Recognizing these connections, regulators,

policymakers, and bank stakeholders can collaborate

to elevate corporate governance standards and

promote ethical banking practices, ultimately

contributing to sustainable economic growth in the

emerging economy. However, it is essential to

acknowledge the study's limitations, such as the

specific focus on a single emerging economy, and

future research could expand upon these findings by

exploring cross-cultural variations and trends in CG

and CSR practices among banks in diverse emerging

economies.

REFERENCES

Abdelnur, O.A.O., (2021). Corporate Social Responsibility

Disclosure by Sudanese Listed Commercial Banks.

International Review of Management and Marketing,

11(1), p.60.

Abugre, J.B. and Anlesinya, A., (2020). Corporate social

responsibility strategy and economic business value of

multinational companies in emerging economies: The

mediating role of corporate reputation. Business

Strategy & Development, 3(1), pp.4-15.

BUI, HTT, (2021). The relationship between corporate

social responsibility and corporate financial

performance: an empirical study of commercial banks

in Vietnam. The Journal of Asian Finance, Economics

and Business, 8(10), pp.373–383.

Chen, F. (2023). The Impact of Corporate Governance

mechanism on firms’ Financial Performance and

Corporate Social Responsibility Conduct in China.

de Villiers, C. and Dimes, R., (2021). Determinants,

mechanisms, and consequences of corporate

governance reporting: a research framework. Journal of

Management and Governance, 25, pp.7-26.

Duong, K.D., Tran, P.M.D. and Pham, H., (2023). CEO

overpower and corporate social responsibility of

commercial banks: The moderating role of state

ownership—Cogent Economics & Finance, 11(1),

p.2171609.

Ho, A.Y.F., Liang, H.Y. and Tumurbaatar, T., (2019). The

impact of corporate social responsibility on financial

performance: Evidence from commercial banks in

Mongolia. In Advances in Pacific Basin Business,

Economics and Finance (pp. 109-153). Emerald

Publishing Limited.Khojastehpour, M. and Jamali, D.,

(2021). Institutional complexity of host country and

corporate social responsibility: Developing vs

developed countries. Social Responsibility Journal,

17(5), pp.593-612.

Lui, T.K. and Zainuldin, M.H., (2022). Do foreign banks

disclose corporate social responsibility practices more

than their local counterparts? Empirical evidence of an

emerging market context. Corporate Social

Corporate Governance and Corporate Social Responsibility (CSR) Disclosure Among Commercial Banks in an Emerging Economy:

Evaluative Perspectives

527

Responsibility and Environmental Management, 29(5),

pp.1855-1870.

Matuszak, Ł., Różańska, E. and Macuda, M., (2019). The

impact of corporate governance characteristics on

banks’ corporate social responsibility disclosure:

Evidence from Poland. Journal of Accounting in

Emerging Economies, 9(1), pp.75-102.

Miah, M.T., Saha, K.B. and Karim, R., (2019). The Role of

Private Commercial Bank in Corporate Social

Responsibility concerning Islami Bank Bangladesh

Limited. Open Access Library Journal, 6(5), pp.1-14.

Nwude, E.C. and Nwude, C.A., (2021). Board structure and

corporate social responsibility: evidence from

developing economy. Sage Open, 11(1),

p.2158244020988543.

Orazalin, N., (2019). Corporate governance and corporate

social responsibility (CSR) disclosure in an emerging

economy: evidence from commercial banks of

Kazakhstan. Corporate Governance: The International

Journal of Business in Society, 19(3), pp.490–507.

RAN, Q.T., LAM, T.T. and LUU, C.D., (2020). Effect of

corporate governance on corporate social responsibility

disclosure: empirical evidence from Vietnamese

commercial banks. The Journal of Asian Finance,

Economics and Business (JAFEB), 7(11), pp.327-333.

Velte, P., (2023). Institutional ownership and board

governance. A structured literature review on the

heterogeneous monitoring role of institutional

investors. Corporate Governance: The International

Journal of Business in Society.

PAMIR 2023 - The First Pamir Transboundary Conference for Sustainable Societies- | PAMIR

528