Differential Weight and Population Size of PRDE Traders: An Analysis

of Their Impact on Market Dynamics

George Herbert

Department of Computer Science, University of Bristol, Bristol, BS8 1UB, U.K.

Keywords:

Automated Trading, Financial Markets, Adaptive Trader-Agents, Differential Evolution.

Abstract:

This paper reports results from market experiments containing Parameterised-Response Zero-Intelligence with

Differential Evolution (PRDE) trader-agents. Each PRDE trader-agent in a market simultaneously uses dif-

ferential evolution (DE) to adapt their trading strategy to maximise profitability. Two parameters govern the

DE algorithm within each PRDE trader: the differential weight coefficient F and the number in population

NP. Markets containing a homogeneous population of PRDE traders exhibit significantly different dynamics

depending on the values of F and NP. The first part of this paper explores the effect that F and NP have

on the profitability of markets populated by PRDE traders. The latter part of this paper proposes a new al-

gorithm based on PRDE to maximise profitability: the Parameterised-Response Zero-Intelligence with JADE

(PRJADE) trader-agent.

1 INTRODUCTION

Adaptive automated trading algorithms have emerged

as a transformative force in contemporary financial

markets, enabling investors to harness the power of

advanced computational techniques to gain a compet-

itive edge in the marketplace. Through the use of

complex mathematical models and sophisticated al-

gorithms, these cutting-edge technologies can anal-

yse vast amounts of market data in real time, identi-

fying and exploiting trading opportunities with speed

and accuracy that were previously unimaginable. As

a result, the use of adaptive automated trading al-

gorithms has become increasingly prevalent and has

profoundly impacted how financial markets operate,

shaping the fabric of the global economy.

However, these algorithms have generated much

discussion and debate among experts, with some cau-

tioning against their potential drawbacks. For exam-

ple, the ‘flash crash’ in US financial markets on 6

May 2010, which saw the Dow Jones Industrial Aver-

age plummet almost 1,000 points in a matter of min-

utes, has been attributed partly to high-frequency trad-

ing algorithms aggressively reselling short-term po-

sitions to one another. Despite these concerns, it is

clear that these algorithms have become an inextri-

cable part of the contemporary financial landscape,

and their continued presence is all but guaranteed. As

such, researching these algorithms and their impact

on contemporary markets is crucial for investors and

researchers alike, to fully understand and navigate the

rapidly evolving world of financial technology.

This report focuses on the Parameterised-

Response Zero-Intelligence with Differential Evolu-

tion (PRDE) trader-agent, which Cliff recently intro-

duced in his research paper (Cliff, 2022b). The PRDE

algorithm uses differential evolution (Storn and Price,

1997) to continuously improve its trading strategy. In

his research, Cliff demonstrated that markets contain-

ing a homogeneous population of PRDE traders were

more economically efficient overall than a baseline

established when all traders used a simple stochastic

hill climbing strategy optimiser.

However, the PRDE traders implemented in

Cliff’s experiments did not vary in their parameter

values. This present study builds on Cliff’s research

by exploring the effects of altering the two critical pa-

rameters of the PRDE algorithm: the number in pop-

ulation NP and the differential weight F. The NP

parameter determines the number of strategies in a

PRDE trader’s private population, and the F param-

eter determines the amount of perturbation applied to

the strategies in the private population.

This present study examines the effects of chang-

ing these critical parameters on market dynamics us-

ing the Bristol Stock Exchange (BSE) (see (Cliff,

2012), (Cliff, 2018)), an open-source, high-fidelity

simulation of an LOB-based financial exchange. By

Herbert, G.

Differential Weight and Population Size of PRDE Traders: An Analysis of Their Impact on Market Dynamics.

DOI: 10.5220/0011885500003393

In Proceedings of the 15th International Conference on Agents and Artificial Intelligence (ICAART 2023) - Volume 1, pages 135-144

ISBN: 978-989-758-623-1; ISSN: 2184-433X

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

135

analysing the effects of changing F and NP on market

behaviour, we can gain insights into how these algo-

rithms influence market dynamics and how they can

be optimised to maximise profitability.

2 BACKGROUND

Gode and Sunder (Gode and Sunder, 1993) revo-

lutionised the field of experimental economics in

1993 with the advent of the Zero-Intelligence Con-

strained (ZIC) trader-agent. These agents, which gen-

erate quote prices uniformly at random from a pre-

defined range, were shown to reproduce surprisingly

human-like market dynamics. In their original pa-

per, Gode and Sunder defined the feasible range of

trading prices as [1, 200]. As such, a buyer with a

limit price of λ

B

would generate quote prices from

U(1, λ

B

), whilst a seller with a limit price of λ

S

would

generate quote prices from U(λ

S

, 200). Modern im-

plementations of the ZIC model do not rely on a priori

information about the feasible range, instead utilising

the lowest and highest values in the order book as the

bounds. Cliff and Bruten critiqued much of Gode and

Sunder’s work on ZIC in (Cliff and Bruten, 1997), but

the work that arose from the ZIC model is still widely

used in studying market dynamics. Many subsequent

zero-intelligence (ZI) and minimal-intelligence (MI)

trader-agents have stemmed from the work of Gode

and Sunder.

One such ZI trader-agent, Parameterised-

Response Zero-Intelligence (PRZI) (Cliff, 2021), was

recently introduced by Cliff. PRZI is a nonadaptive

generalisation of ZIC, in which the shape of the

probability mass function (PMF) used to generate

quote prices is governed by a strategy parameter

s ∈ [−1, 1] ∈ R. This s-value determines the degree

of ‘urgency’ or ‘relaxation’ in the trader’s behaviour.

As s → 1, the distribution is evermore biased towards

‘urgent’ quote prices—those closest to the least

profitable price for the trader but most likely to attract

a willing counterparty—conversely, as s → −1,

the distribution is biased towards ‘relaxed’ quote

prices—those that generate the most profit for the

trader but are considerably less likely to attract a

counterparty. When s = 0, the PMF is uniform,

identical to that of a ZIC trader.

PRZI with Stochastic Hill Climbing (PRSH)

(Cliff, 2022a) is an adaptive extension to PRZI, also

introduced by Cliff. The algorithm dynamically alters

the strategy parameter s in an attempt to increase prof-

itability. A given PRSH trader i maintains a private

local population S

i

of k strategy parameters, each of

which it evaluates via a loop to identify the most prof-

itable. The most profitable strategy is ‘mutated’ via a

stochastic mutation function to produce k −1 mutants,

and this set of k strategies constitutes the new S

i

.

PRZI with Differential Evolution (PRDE) (Cliff,

2022b) is Cliff’s latest adaptive extension to PRZI. It

replaces the simple stochastic hill climber in PRSH

with a DE optimisation system (Storn and Price,

1997). A given PRDE trader i maintains its own DE

system with a population of candidate s-values S

i

of

size NP ≥ 4 denoted by s

i,1

, s

i,2

, ..., s

i,NP

. Once trader i

has evaluated a particular strategy s

i,x

, three other dis-

tinct s-value are chosen at random: s

i,r

1

, s

i,r

2

and s

i,r

3

such that x 6= r

1

6= r

2

6= r

3

. A new candidate strategy

s

i,y

is constructed as follows:

s

i,y

← max(min(s

i,r

1

+ F

i

(s

i,r

2

− s

i,r

3

), 1), −1) (1)

where F

i

is trader i’s differential weight coefficient.

The fitness of s

i,y

is evaluated, and if it performs bet-

ter than s

i,x

, then s

i,y

replaces s

i,x

; otherwise, it is

discarded and the next randomly selected strategy is

evaluated. PRDE also includes a ‘mega-mutation’

mechanism to deal with convergence issues that arise

from s

i,r

2

−s

i,r

3

tending very close to zero in a highly-

converged population. Suppose at any time the stan-

dard deviation of the candidate s-values in trader i’s

private population is less than 0.0001. In that case, a

randomly selected candidate s

i,r

is given a value sam-

pled randomly from U(−1, 1).

3 HOMOGENEOUS

EXPLORATION OF F AND NP

3.1 Overview of the Combined Effect of

F and NP

According to Cliff’s research in (Cliff, 2022b), using

DE as the adaption mechanism for each trading entity

in a market can double the profit extracted through

traders’ interactions, compared to using a stochastic

hill climber as the adaption mechanism. However, in

his simulations, Cliff only experimented with F = 0.8

and NP = 4 for the PRDE traders. As such, the ini-

tial experiments in this paper serve as a follow-up: to

analyse the combined effect that different values of F

and NP have on profitability. I designed a set of ex-

periments with a similar setup as Cliff, in which BSE

was used to simulate a financial market for a single

abstract tradeable commodity. In each market simu-

lation, I implemented a homogeneous population of

N

T

= 30 PRDE traders with an equal number of buy-

ers N

B

and sellers N

S

(i.e. N

B

= N

S

= 15). The pop-

ulation in a given experiment was homogeneous with

ICAART 2023 - 15th International Conference on Agents and Artificial Intelligence

136

respect to the fact that all PRDE traders had the same

differential weight F and the same number in popu-

lation NP. Each simulation had what economists call

perfect elasticity of supply and demand. All N

B

buy-

ers were provided with a limit price of λ

B

= $140

per unit, while all N

S

sellers were provided with a

limit price of λ

S

= $60 per unit. This supply and de-

mand schedule produces a market in which every ac-

tive trader could, in theory, find a willing counterparty

to trade. In the simulation, after two traders engaged

in a trade, they were rendered inactive until their stock

was replenished, which occurred approximately ev-

ery five seconds. I ran each experiment for 100 sim-

ulated days on an Apple MacBook Pro with the M1

Pro chip, which took approximately three hours run-

ning at 800x real-time.

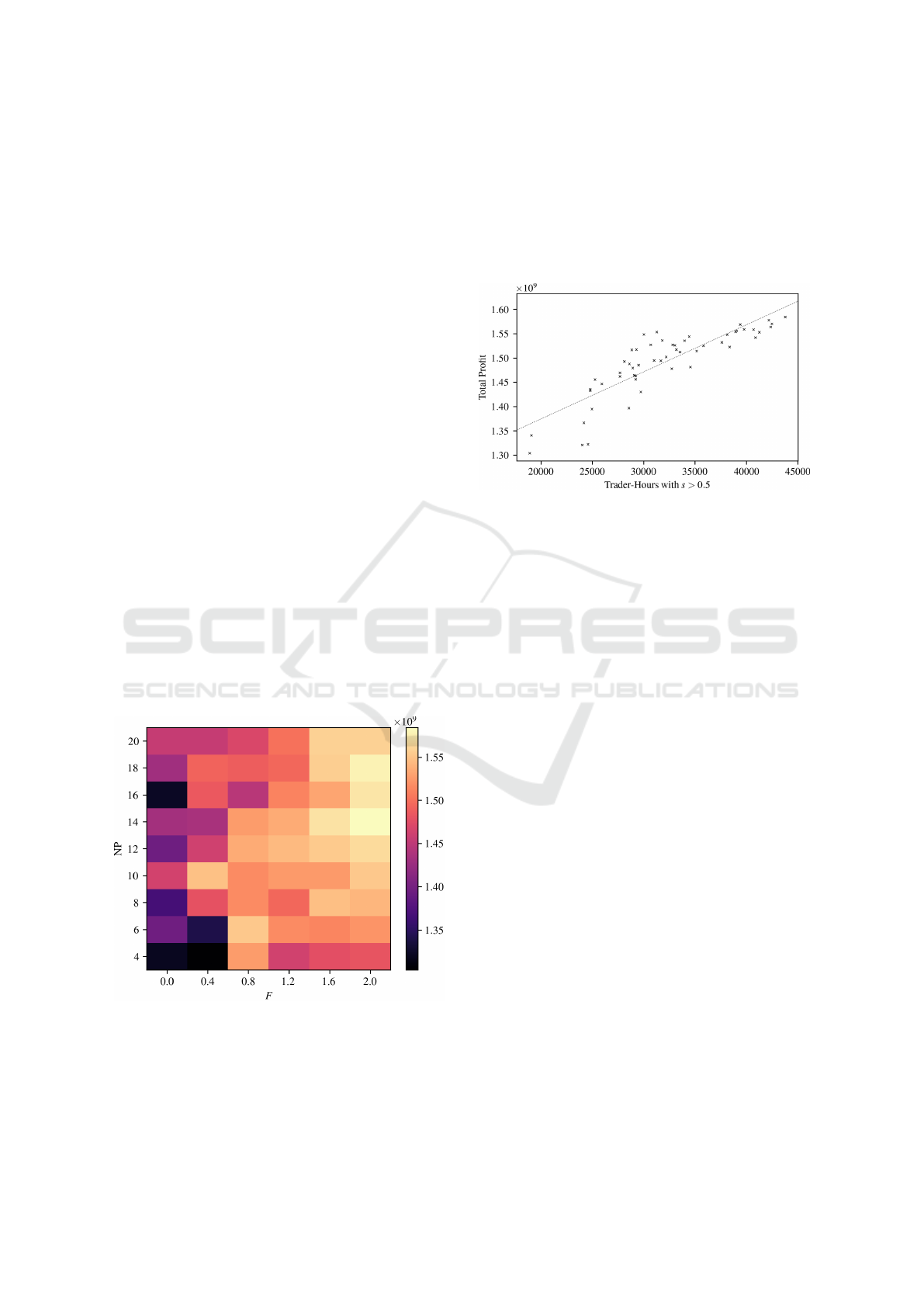

Figure 1 displays a heatmap showing the com-

bined profit extracted from the market by the popu-

lation of N

B

buyers and N

S

sellers. Since each exper-

iment used an identical quantity of traders and limit

prices, the theoretical maximum profit the trader-

agents could have extracted from each experiment

was also identical. As such, the actual total profit ex-

tracted is indicative of market efficiency. There is a

clear association between the configuration of F and

NP and the efficiency of the market. Namely, large

values of F combined with moderately large values

of NP produce more efficient markets. F = 2 and

NP = 14 produced the most efficient market; 3.75%

more profit was extracted than the F = 0.8 and NP = 4

configuration that Cliff used (Cliff, 2022b).

Figure 1: Relationship between different combinations of F

and NP, and the total profit extracted by all PRDE traders in

the market. The horizontal axis is F; the vertical axis is NP.

The intensity of pixel shading represents the total profit ex-

tracted from the market during a single 100-day simulation.

See text for further discussion.

Much of the relationship can be attributed to F

and NP’s influence over the ‘urgency’ of the traders.

There is a moderately strong positive correlation with

R

2

= 0.72 between the total amount of time the traders

in the market spent playing ‘very urgent’ strategies

(i.e. s > 0.5) and the total profit extracted from the

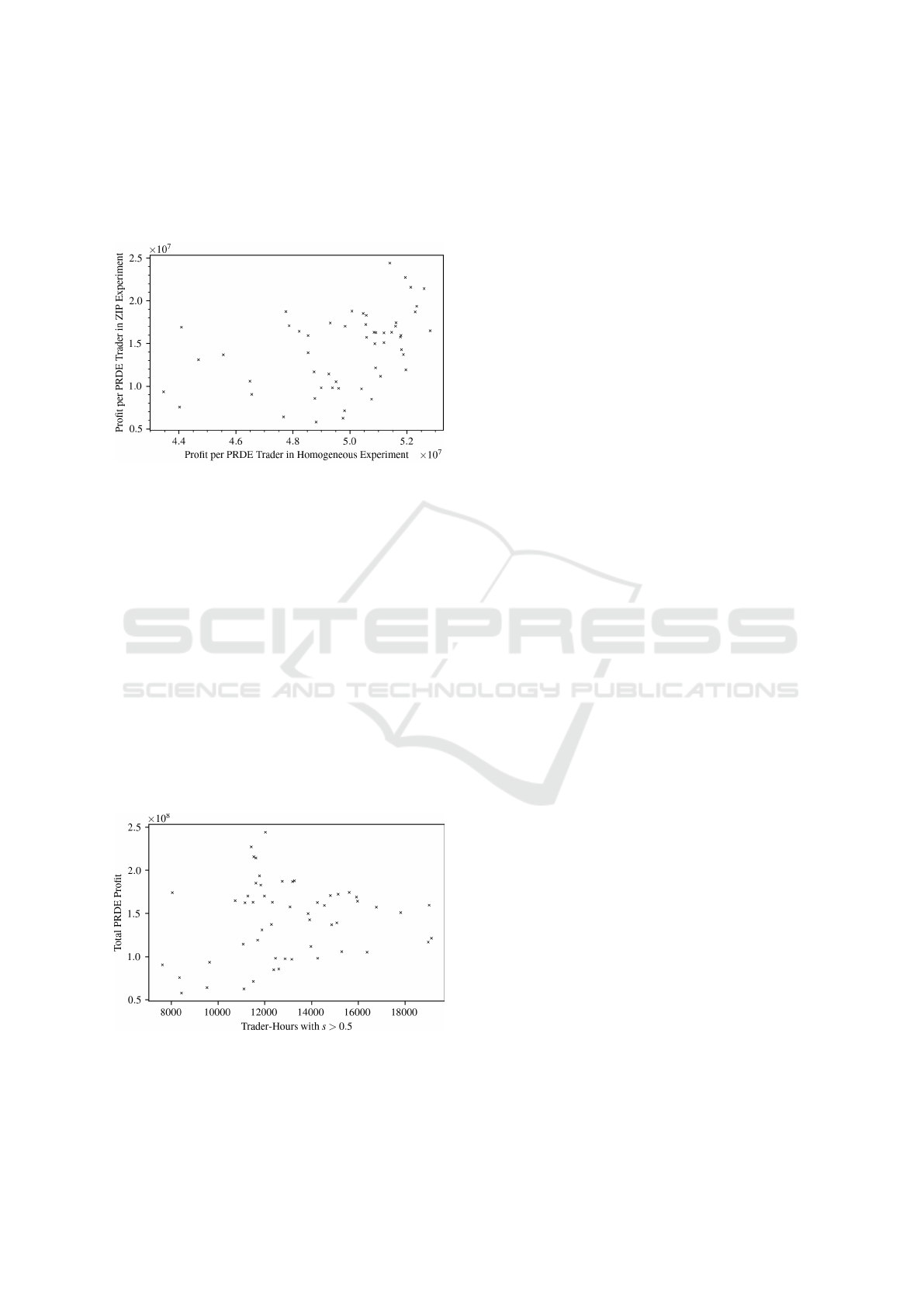

market, as evident in Figure 2.

Figure 2: Relationship between the amount of time traders

spent playing s-values greater than 0.5 and the total profit

extracted by all traders in the market. The line shows linear

regression; R

2

= 0.72. The horizontal axis is the cumula-

tive number of hours traders spent playing s-values where

s > 0.5; the vertical axis is the total profit extracted from

the market during a given 100-day simulation. See text for

further discussion.

To understand this relationship, one must consider

how the s-value of a given PRDE trader at a particu-

lar point in time affects the probability of it finding

a counterparty to trade. For a given trader, as s → 1

(i.e. increasingly ‘urgent’), the trader’s quote prices

are evermore likely to attract a counterparty; the re-

verse is true as s → −1 (i.e. increasingly ‘relaxed’).

Therefore, a strong relationship exists between the

amount of time the traders in the market are ‘urgent’

and the number of trades. Due to each experiment

having perfect elasticity of supply and demand, for a

given trade at price P, the seller’s profit can be de-

noted P − λ

S

, whilst the buyer’s profit can be denoted

λ

B

− P. Therefore, the combined profit is as follows:

(P − λ

S

) + (λ

B

− P) = λ

B

− λ

S

(2)

In other words, the profit extracted from the market

from any given trade is constant. As such, the total

profit extracted in a given 100-day market session is

directly proportional to the number of trades, which,

as mentioned, is related to the amount of time traders

in the market are ‘urgent’.

3.2 Analysis of the Effect of F

As mentioned, a significant amount of the variance

in the efficiency of the market can be explained by

Differential Weight and Population Size of PRDE Traders: An Analysis of Their Impact on Market Dynamics

137

the amount of time the traders spend playing s-values

greater than 0.5. To this end, the differential weight’s

influence on the total profitability can be primarily

attributed to how it influences the ‘urgency’ of the

traders. The market simulation data showed a mod-

erately strong positive correlation with R

2

= 0.77 be-

tween F and the amount of time the traders spent

playing s-values greater than 0.5, as shown in Figure

3.

Figure 3: Relationship between F and the amount of time

traders spent playing s-values greater than 0.5. The line

shows linear regression; R

2

= 0.77. The horizontal axis is

the differential weight coefficient F; the vertical axis is the

cumulative number of hours traders spent playing s-values

where s > 0.5 See text for further discussion.

This relationship manifests due to F’s impact on

the ‘urgency’ of the PRDE traders throughout the

market session. For larger values of F, the propor-

tion of traders playing with s > 0.5 increases signifi-

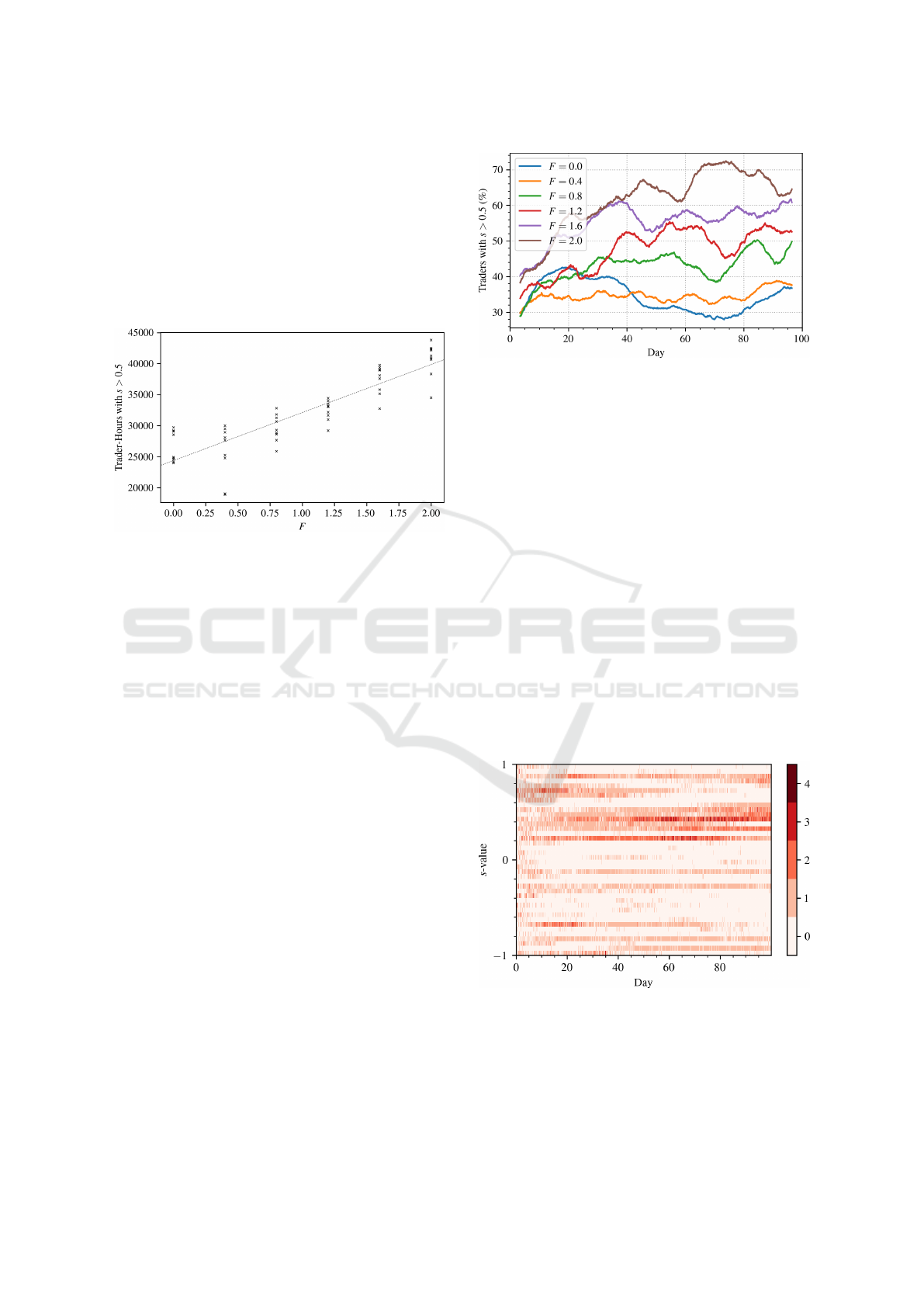

cantly faster. Figure 4 shows an example of this when

NP = 14. When F = 2, the proportion of traders

trading with s > 0.5 increased quickly: the seven-day

moving average of the percentage of traders playing s-

values that were s > 0.5 rose to over 60% after just 40

days. Conversely, when F = 0.8, the moving average

was only approximately 45% after the same amount

of time.

The reason for this effect can be explained math-

ematically. Taking the extreme example of F

i

= 0 for

trader i, the equation to derive a new candidate strat-

egy s

i,y

to replace s

i,x

becomes s

i,y

← s

i,r

1

. Therefore,

following the evaluation period of s

i,y

, the value of

s

i,x

can either remain the same or take on the value

of s

i,r

1

, in which case two or more of the s-values

in the local population S

i

will be identical—the ‘ge-

netic diversity’ will be reduced. The only time a

new s-value can be introduced into S

i

is when the

diversity of s-values becomes so constrained that a

‘mega-mutation’ occurs, in which case the algorithm

samples a new s-value from U(−1, 1). As a result,

the distribution of s-values in the entire population of

Figure 4: Plot of the percentage of traders playing s-values

of s > 0.5 from multiple 100-day experiments in a market

populated entirely by PRDE traders. The horizontal axis is

time, measured in days; the vertical axis is the proportion of

traders playing an s-value of s > 0.5. Each line is a seven-

day simple moving average of the percentage for different

values of F when NP = 14. See text for further discussion.

PRDE traders struggles to deviate significantly from

uniformity throughout the 100-day market session.

This uniformity ultimately produces a market con-

taining a wide range of both ‘urgent’ and ‘relaxed’

buyers and sellers, which is inefficient since many of

the more ‘relaxed’ traders will be unable to find a will-

ing counterparty. An example of such a distribution

of s-values can be seen in Figure 5, which displays a

heatmap of individual strategy values for the propor-

tion of 15 PRDE buyers when F = 0 and NP = 14.

While the case of F = 0 is extreme, I found experi-

mentally that the market increasingly exhibits the in-

efficient dynamics described here as F tends towards

zero.

Figure 5: Heatmap of individual s-values for the population

of 15 PRDE buyers in a market populated entirely by PRDE

traders with F = 0 and NP = 14. The horizontal axis is time,

measured in days; the vertical axis is the s-value pixelated

into 40 bins of size 0.05. The intensity of pixel shading in-

creases with the number of PRDE buyers in the population

currently trading with an s-value in the 0.05 range. See text

for further discussion.

ICAART 2023 - 15th International Conference on Agents and Artificial Intelligence

138

On the other extreme of the spectrum, when F =

2, a very different market dynamic tends to mani-

fest. This dynamic difference is evident in Figure 6,

which displays a heatmap for the 15 PRDE buyers

with F = 2 and NP = 14. Unlike the more uniform

distribution of s-values exhibited when F = 0, the s-

values in Figure 6 were bimodal at the two extremes

of s ≈ −1 and s ≈ 1, with the peak at s ≈ 1 slightly

more prominent. Moreso, both the buyers and sell-

ers displayed this behaviour. Again, this can be ex-

plained mathematically using the equation to derive a

new candidate strategy s

i,y

to replace s

i,x

. The value

of the differential weight F

i

is directly proportional to

F

i

(s

i,r

2

−s

i,r

3

). Thus, assuming s

i,r

2

−s

i,r

3

is non-zero,

the value of s

i,y

is more likely to be −1 or 1 as F

i

in-

creases. This bimodal distribution induces a market

dynamic in which there are very quickly many ex-

tremely ‘urgent’ and extremely ‘relaxed’ buyers and

sellers. It is this large number of urgent traders that

exist throughout the market session that enables a

large amount of profit to be extracted from the market.

Furthermore, I found experimentally that this bimodal

behaviour is ever more prominent for larger values of

F.

Figure 6: Heatmap of individual s-values for the population

of 15 PRDE buyers in a market populated entirely by PRDE

traders with F = 2 and NP = 14. The format is the same as

in Figure 5. See text for further discussion.

3.3 Analysis of the Effect of NP

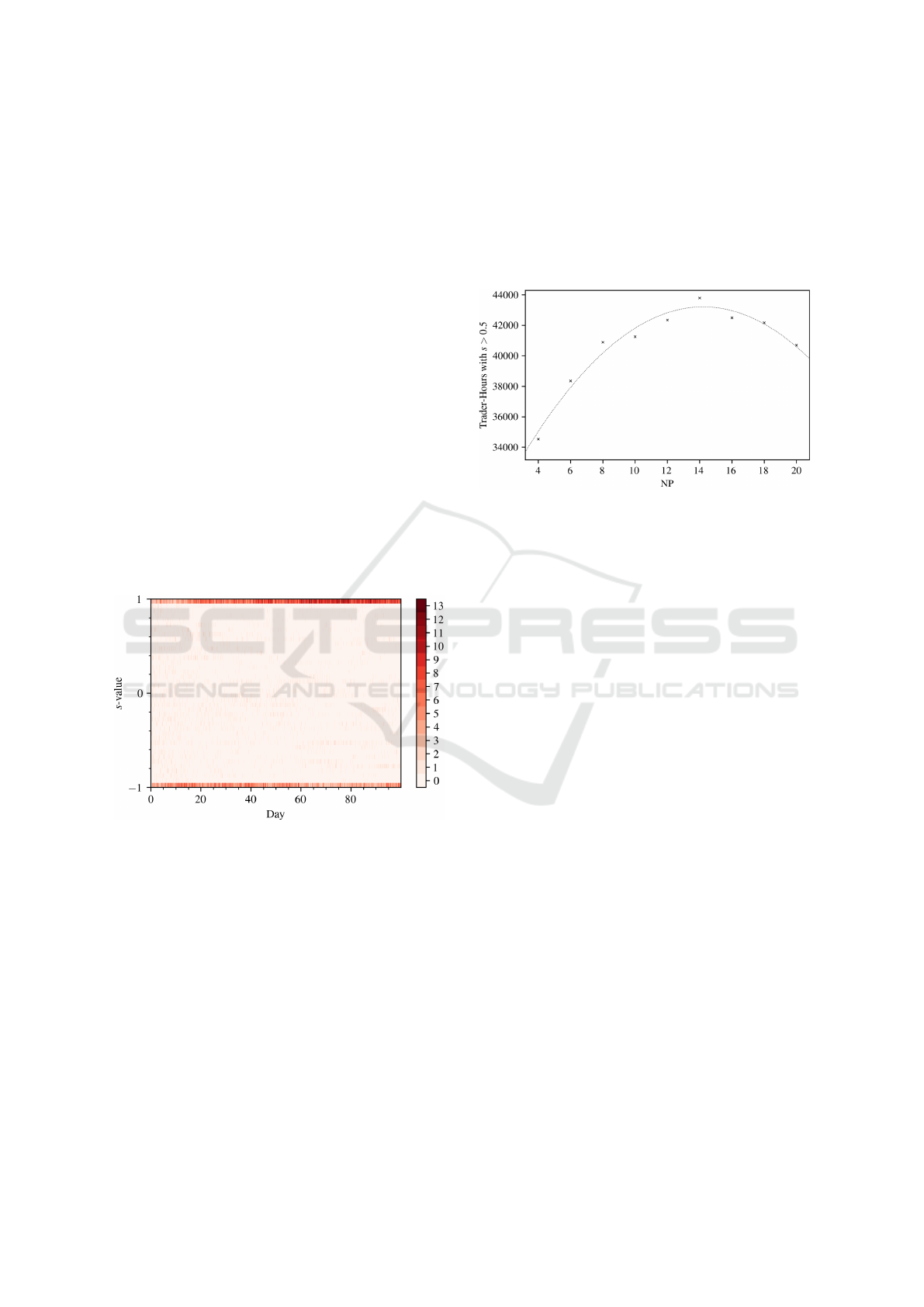

The effect of the number in population on the mar-

ket’s efficiency is similarly primarily driven by its in-

fluence over the ‘urgency’ of the traders. However,

unlike the relationship with the differential weight,

the relationship between NP and the amount of time

traders spend playing s-values greater than 0.5 can-

not be modelled linearly. The data from the market

simulations showed that the relationship is highly de-

pendent on the value of F. For smaller values of F,

the influence of NP is significantly noisy. However,

for larger values of F, the relationship can best be

modelled using a quadratic curve, as shown in Fig-

ure 7. The quadratic demonstrates that the associa-

tion between NP and the ‘urgency’ of traders is more

complex and dynamic than a simple linear model can

capture.

Figure 7: Relationship between NP and the amount of time

traders spent playing s-values greater than 0.5 when F =

2. The line shows quadratic regression; R

2

= 0.96. The

horizontal axis is the number in population NP; the vertical

axis is the cumulative number of hours traders spent playing

s-values where s > 0.5 See text for further discussion.

This quadratic relationship can be explained as

the combined effect of two influencing factors. The

first influencing factor comes from NP’s effect on the

number of s-values greater than 0.5 that a given PRDE

trader i can sustain in its private population S

i

. The

second influencing factor comes from NP’s effect on

the time it takes the traders in the market to improve

on the initial random conditions.

As mentioned, larger values of F induce a bimodal

distribution of s-values at s ≈ −1 and s ≈ 1. Using

NP = 4 as an example, an individual trader can ac-

crue at most three s-values of s = 1, because once the

fourth s-value becomes 1, a ‘mega-mutation’ immedi-

ately occurs—this equates to a maximum of only 75%

of the s-values in their private population S

i

at s ≈ 1.

Conversely, when NP is larger, individual traders can

accumulate a more significant proportion of s-values

of s ≈ 1 in their private populations without a ‘mega-

mutation’. The ability to accumulate a more signifi-

cant proportion means that homogeneous populations

of PRDE traders with larger values of NP produce

a market dynamic with more ‘very urgent’ traders,

which produces a more efficient market. The effect

of NP is noisier for smaller values of F for the same

reason. As mentioned, the bimodal distribution is ever

less prevalent with smaller values of F, so the impact

of NP is less relevant as the ‘mega-mutations’ do not

occur as often, regardless.

The primary reason this trend is nonlinear is that

Differential Weight and Population Size of PRDE Traders: An Analysis of Their Impact on Market Dynamics

139

for very large values of NP, an inverse relationship

between NP and the number of ‘very urgent’ traders

in the market manifests. The inverse relationship is

because, for a given PRDE trader, the probability that

an s-value in the trader’s private population is selected

to be evaluated next is NP

−1

. Therefore, in homoge-

neous populations of PRDE traders with larger values

of NP, it takes significantly longer to iteratively im-

prove on the initial random conditions in the entire

local population of s-values. As a result, it takes sub-

stantially longer for the PRDE traders to accumulate

a large number of s-values greater than 0.5, meaning

the market is less efficient. On the furthest end of the

spectrum, as NP → ∞, the PRDE traders in the market

would be completely unable to improve on the initial

random conditions of the market.

4 PRDE IN A HETEROGENEOUS

MARKET

The experiments conducted in the previous section

were designed to build on the work in (Cliff, 2022b).

By using different combinations of F and NP in each

experiment, I was able to study the impact of these

parameters on market efficiency. The results showed

that the most profitable combination of F and NP was

22% more profitable than the least profitable.

However, the experimental setup was simplistic:

the markets were homogeneously populated and had

perfect elasticity of supply and demand. While this

provided highly interpretable results and an impor-

tant insight into the influence of F and NP on a ho-

mogeneous coevolutionary metapopulation of PRDE

traders, it did not accurately represent most contem-

porary financial markets. Most markets contain a pop-

ulation of distinct adaptive automated trading algo-

rithms and do not have perfect elasticity of supply and

demand. As such, I conducted a series of follow-up

experiments that better represented these contempo-

rary markets. The primary purpose of the follow-up

experiments was to identify any tangible association

between the performance of each combination of F

and NP in the two sets of experiments. By doing so, I

sought to identify whether a definitive ‘optimal’ com-

bination existed that would consistently provide max-

imum profitability, regardless of the market.

In each market simulation on BSE, I implemented

a population of N

T

= 20 traders with an equal num-

ber of buyers N

B

and sellers N

S

(i.e. N

B

= N

S

= 10).

In order to introduce a form of heterogeneity into

the market, each of the N

B

buyers and N

S

sellers

were comprised of five PRDE trader-agents and five

Zero-Intelligence Plus (ZIP) (Cliff and Bruten, 1997)

trader-agents. ZIP is a widely-studied MI trader-agent

that employs an elementary form of machine learning

and was one of the first trader-agents demonstrated

to perform better than humans (Das et al., 2001). All

PRDE traders in a given experiment had identical val-

ues of F and NP. To better represent contemporary fi-

nancial markets’ supply and demand curves, the N

B

buyers and N

S

sellers were provided evenly-spaced

limit prices in the range [60, 140]. In the simulation,

after two traders engaged in a trade, they were ren-

dered inactive until their stock was replenished, which

occurred approximately every five simulated seconds.

I ran each experiment for 100 simulated days.

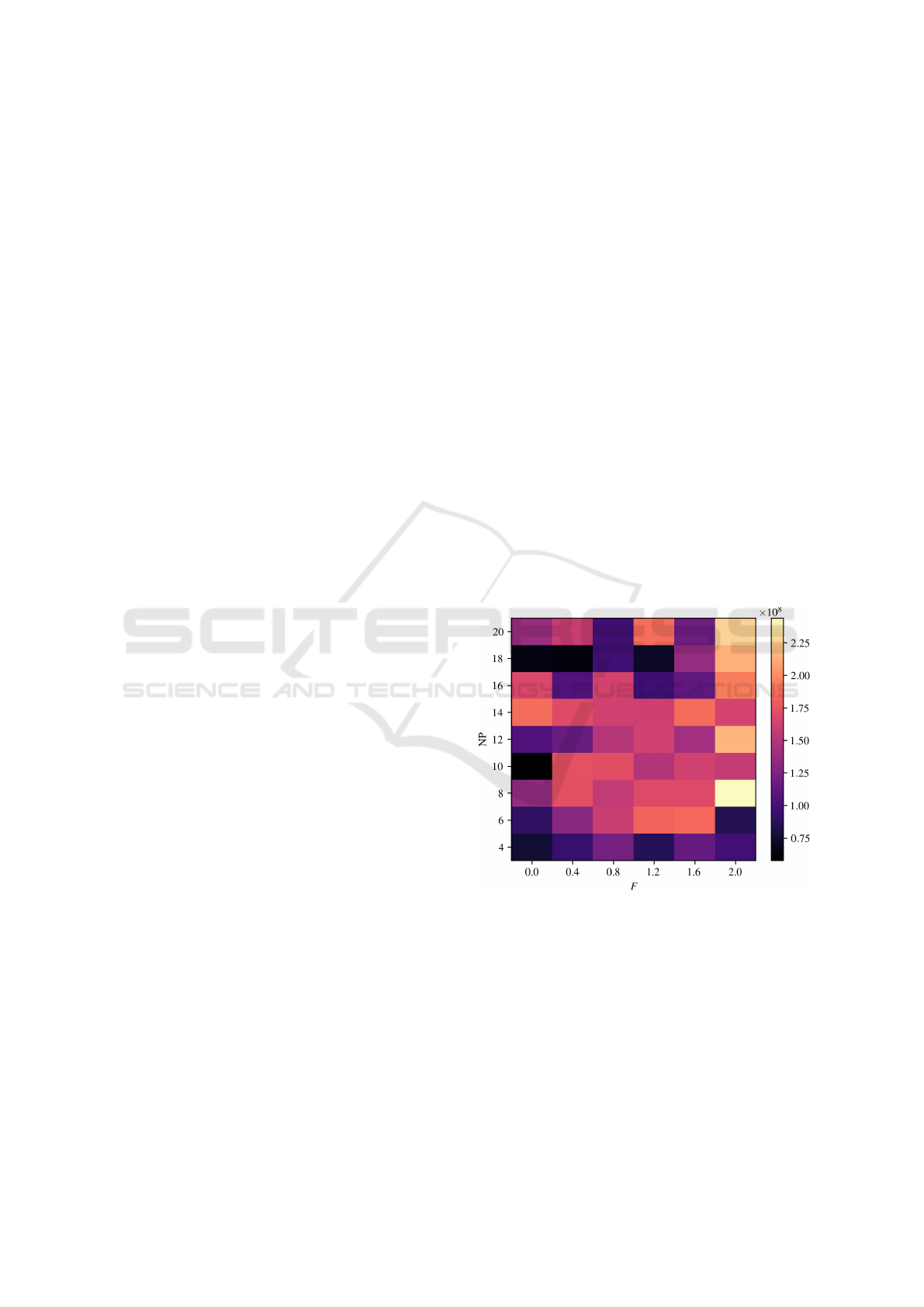

Figure 8 displays a heatmap showing the com-

bined profit extracted from the market by the popu-

lation of 10 PRDE traders from each experiment. The

difference in profitability for different combinations

of F and NP was significant: the most profitable com-

bination of F and NP extracted 322% more profit on

average than the least profitable combination. While

some of this effect is likely due to stochasticity inher-

ent in market simulations, it suggests that one would

require a priori information about the market to de-

ploy a PRDE trader with a near-optimal choice of F

and NP.

Figure 8: Relationship between the differential weight co-

efficient F, the number in population NP and the total profit

extracted by all PRDE traders in the market. The format is

the same as in Figure 1. See text for further discussion.

Several loose similarities can be observed with the

heatmap from the previous set of experiments in Fig-

ure 1. However, there is no discernible statistically

significant relationship between the profitability of a

PRDE trader with a given combination of F and NP

in the homogeneous experiments and the same combi-

nation in the heterogeneous experiments, as evident in

ICAART 2023 - 15th International Conference on Agents and Artificial Intelligence

140

Figure 9. The lack of association indicates that the ef-

fect of F and NP is highly dependent on either traders’

behaviour, the supply and demand schedules, or, most

likely, a combination of both.

Figure 9: Relationship between the profitability per PRDE

trader in the homogeneous experiments and the heteroge-

neous experiments. The horizontal axis is the mean profit

per trader in a given homogeneous experiment for a spe-

cific combination of F and NP; the vertical axis is the mean

profit per PRDE trader in a given heterogeneous experiment

with the same F and NP. See text for further discussion.

It is evident that the heterogeneous markets with

stepped supply and demand schedules clearly exhibit

different behaviours from Figure 10. Unlike in the ho-

mogeneous experiments with perfect elasticity of sup-

ply and demand, there is no longer a linear relation-

ship between the cumulative time the PRDE traders in

the market spent playing ‘very urgent’ strategies (i.e.

s > 0.5) and the total profit they extracted. As such,

though larger F values still induce a more bimodal

distribution of s-values, the relationship between F

and the total profit extracted is not the same.

Figure 10: Relationship between the amount of time traders

spent playing s-values greater than 0.5 and the total profit

extracted by all PRDE traders in the market in the hetero-

geneous experiments. The format is the same as in Figure 2

See text for further discussion.

Profitability being dependent on certain condi-

tions is a common theme in the broader literature on

adaptive autonomous trader-agents. The ‘dominance’

of any given algorithm is often contingent on the

other trader-agents in the market (e.g. (Vach, 2015)).

Therefore, while there are clear values of F and NP

that produce consistently poor results, namely F = 0,

I cannot conclusively say that there exists any single

‘optimal’ combination that will consistently extract

the maximum profit.

5 EXTENDING PRDE

5.1 PRZI with JADE

In light of the problems with PRDE, this section intro-

duces a new MI trader-agent: PRZI with JADE (PR-

JADE), which replaces the DE algorithm in PRDE

with a variation of JADE (Zhang and Sanderson,

2009). JADE is a generational DE algorithm, and as

such, a given trader i maintains a population of can-

didate s-values for generation g denoted S

i,g

. Each

s-value in S

i,g

, denoted s

i,g,1

, s

i,g,2

, ..., s

i,g,NP

, is eval-

uated in turn to produce a population of candidate s-

values for the next generation S

i,g+1

. Once strategy

s

i,g,x

has been evaluated, three other distinct s-values

are chosen:

• s

p

i

i,g,best

is randomly chosen as one of the top p

i

%

of s-values in the population S

i,g

.

• s

i,g,r

1

is randomly chosen from the population S

i,g

such that s

i,g,r

1

6= s

p

i

i,g,best

.

• ˜s

i,g,r

2

is randomly chosen from S

i,g

∪ A such

that ˜s

i,g,r

2

6= s

i,g,r

1

6= s

p

i

i,g,best

, and where A is an

‘archive’ set of s-values: those s-values that pre-

viously failed in the selection process.

Once these three values have been selected, a new

candidate strategy ˆs

i,g,x

is constructed as follows:

ˆs

i,g,x

← s

i,g,x

+F

i,x

s

p

i

i,g,best

− s

i,g,x

+F

i,x

(s

i,g,r

1

− ˜s

i,g,r

2

)

(3)

The fitness of ˆs

i,g,x

is evaluated, and if it performs bet-

ter than s

i,g,x

then it is placed in index x in S

i,g+1

. Oth-

erwise, it is discarded, and the following strategy in

the sequence s

i,g,x+1

is evaluated.

The main benefit that PRJADE provides over

PRDE is that one does not need to initialise a PR-

JADE trader with a differential weight coefficient. A

given PRJADE trader i generates a new F

i,x

for each

new candidate strategy ˆs

i,g,x

. It does this according

to a Cauchy distribution with location parameter µ

F

i

Differential Weight and Population Size of PRDE Traders: An Analysis of Their Impact on Market Dynamics

141

and scale parameter 0.1, which it then truncates to 2

if F

i,x

> 2 or regenerates if F

i,x

< 0. Sampling F

i,x

from the Cauchy distribution helps produce diverse

differential weights centred around µ

F

i

, which can be

considered a ‘best guess’ at the optimal value for the

differential weight. µ

F

i

is initialised to one at the start

of the market session and then updated at the end of

each generation using the following rule:

µ

F

i

← (1 − c

i

)µ

F

i

+ c

i

∑

F∈F

i

F

2

∑

F∈F

i

F

(4)

where F

i

is a set of ‘successful’ differential weights—

those that yielded candidate strategies that increased

profitability in generation g for trader i. Figure 11

shows how a PRJADE trader optimised its private µ

F

value throughout a 100-day market simulation.

Figure 11: Plot showing how the µ

F

of a PRJADE trader

can adapt through the market session. The horizontal axis

is time, measured in days; the vertical axis is the µ

F

value

of a single PRJADE trader-agent. See text for further dis-

cussion.

Whilst PRJADE no longer requires the differential

weight to be explicitly specified, it requires two new

values: the rate of parameter adaption c and the greed-

iness of the mutation strategy p. However, Zhang and

Sanderson showed c and p to be insensitive to dif-

ferent problems in (Zhang and Sanderson, 2009), so

they offer an advantage over the differential weight F,

which I proved extremely sensitive to different market

conditions in the previous sections.

5.2 PRJADE vs PRDE

In order to evaluate the performance of PRJADE,

I took inspiration from IBM’s balanced-group tests

(Tesauro and Das, 2001). I conducted a series of ex-

periments in which an equal number of PRJADE and

PRDE trader-agents competed against one another in

the same market to identify which type of trader-agent

would extract the most profit. Since the performance

of the PRDE agent had been particularly susceptible

to varying the differential weight, I conducted three

sets of experiments with F = 0, F = 1 and F = 2

to determine whether PRJADE would be consistently

‘dominant’. I initialised both the PRJADE and PRDE

traders with NP = 14 in each experiment since the

PRDE traders yielded reasonable profitability in all

prior experiments with NP = 14. I initialised each

PRJADE trader with p = 20 and c = 0.2.

I ran each trial with N

T

= 20 traders, split evenly

between N

B

= 10 buyers and N

S

= 10 sellers. The

N

B

buyers and N

S

sellers comprised five PRDE

traders and five PRJADE traders each. Both groups

were assigned evenly-spaced limit prices in the range

[60, 140]. I ran each experiment for 100 simulated

days. In the simulation, after two traders engaged in

a trade, they were rendered inactive until their stock

was replenished, which occurred approximately every

five simulated seconds.

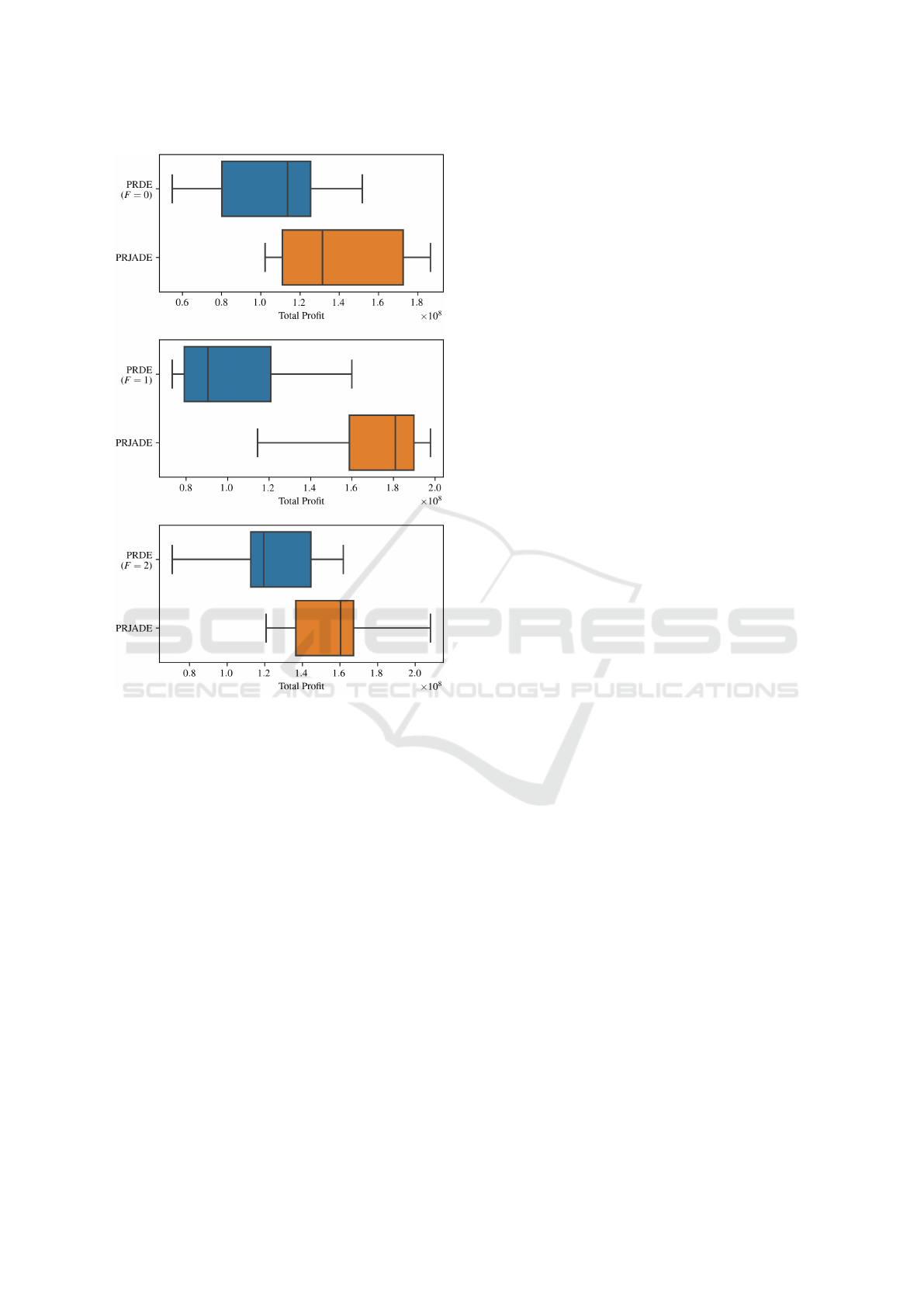

The boxplots in Figure 12 illustrate the results.

The PRJADE traders were consistently more prof-

itable than the PRDE traders, regardless of the

PRDE traders’ differential weight. Employing the

Wilcoxon–Mann–Whitney U test and the Fligner–

Pollicello robust rank-order distributional test proved

a statistically significant improvement in the perfor-

mance of the PRJADE traders across all three sets of

experiments at the 1% significance level. Thus, I can

be reasonably confident that PRJADE is ‘dominant’

over PRDE over a range of values of F. However, it is

clear from the boxplots that the degree to which PR-

JADE is more profitable than PRDE depends on the

differential weight of the PRDE traders. As such, fu-

ture work should explore more combinations of F and

NP to identify whether PRJADE is dominant defini-

tively.

6 CONCLUSION

This study has investigated the effects of the differen-

tial weight coefficient F and the number in population

NP on the dynamics of financial markets containing

PRDE traders. The first set of experiments focused

on a market containing a homogeneous population of

PRDE traders with perfect elasticity of supply and de-

mand. I identified a strong linear relationship between

the ‘urgency’ of the individual traders in these exper-

iments and the total profit extracted from the market,

which explained 72% of the variance in profitability.

In this respect, the effect of F on profitability could

be primarily attributed to its impact on this urgency: a

simple linear relationship with F could describe 77%

of the variance in urgency. I found that the contribu-

tion of NP was more complex but could also be at-

ICAART 2023 - 15th International Conference on Agents and Artificial Intelligence

142

Figure 12: Three boxplots showing the performance of PR-

JADE against PRDE. In the top boxplot, all PRDE traders

were configured with F = 0; in the middle boxplot, all

PRDE traders were configured with F = 1; in the bottom

boxplot, all PRDE traders were configured with F = 2. In

all experiments, both PRDE and PRJADE were configured

with NP = 14. The horizontal axis is the combined profit

extracted from the market by traders running the same al-

gorithm (i.e. PRDE or PRJADE). See text for further dis-

cussion.

tributed to how it impacts the ‘urgency’, though the

relationship was nonlinear.

From the second set of experiments I conducted in

heterogeneous markets with stepped supply and de-

mand schedules, I identified that there appeared to

be no correlation between the profitability of combi-

nations of F and NP in different market conditions.

The lack of association means there is unlikely to be

an optimal combination that maximises profitability

across multiple markets. The optimal combination

depends on the other traders’ behaviour, the market’s

supply and demand schedules, or, most likely, a com-

bination of both. The lack of a market-independent

optimal combination highlighted one of the primary

limitations of the PRDE trader-agent. In that, de-

spite the extreme sensitivity of its profitability to the

parameters F and NP—especially in the heteroge-

neous experiments—the lack of an optimal combi-

nation means that one would almost require a priori

information about the market to extract a near maxi-

mum amount of profit.

To address these limitations, I proposed the PRZI

with JADE (PRJADE) trader-agent, an extension to

PRDE that incorporates a self-adaptive mechanism

for the differential weight parameter. This exten-

sion enables PRJADE traders to adjust their differ-

ential weight based on market conditions, thus elim-

inating the problems associated with the extremely

sensitive F parameter. The results indicate that PR-

JADE traders are more profitable than PRDE traders,

even when the PRDE traders are initialised with dif-

ferent values of F. However, further studies will be

required to test the effectiveness of PRJADE against

PRDE with different values of NP, and more values

of F, to confidently establish whether it consistently

outperforms PRDE. The results presented here also

invite another line of future work: exploring the ef-

fect on the market’s dynamics of the two new param-

eters in PRJADE, namely p and c. While Zhang and

Sanderson proposed that these two parameters are in-

sensitive to different problems in (Zhang and Sander-

son, 2009), future research should confirm that this

remains the case in PRJADE.

REFERENCES

Cliff, D. (2012). BristolStockExchange: open-source

financial exchange simulator. GitHub repository:

https://github.com/davecliff/BristolStockExchange.

Cliff, D. (2018). BSE: a minimal simulation of a limit-

order-book stock exchange. In 30th European Mod-

eling and Simulation Symposium (EMSS 2018), pages

194–203. DIME University of Genoa.

Cliff, D. (2021). Parameterised-response zero-intelligence

traders. SSRN: 3823317.

Cliff, D. (2022a). Co-evolutionary dynamics in a simu-

lation of interacting financial-market adaptive auto-

mated trading systems. In European Modeling and

Simulation Symposium (EMSS).

Cliff, D. (2022b). Metapopulation differential co-evolution

of trading strategies in a model financial market.

In European Modeling and Simulation Symposium

(EMSS).

Cliff, D. and Bruten, J. (1997). Minimal-intelligence agents

for bargaining behaviors in market-based environ-

ments. Technical report, Hewlett Packard Laborato-

ries.

Das, R., Hanson, J. E., Kephart, J. O., and Tesauro, G.

(2001). Agent-human interactions in the continuous

Differential Weight and Population Size of PRDE Traders: An Analysis of Their Impact on Market Dynamics

143

double auction. In IJCAI International Joint Confer-

ence on Artificial Intelligence.

Gode, D. K. and Sunder, S. (1993). Allocative efficiency

of markets with zero-intelligence traders: Market as a

partial substitute for individual rationality. Journal of

Political Economy, 101(1):119–137.

Storn, R. and Price, K. (1997). Differential evolution – a

simple and efficient heuristic for global optimization

over continuous spaces. Journal of Global Optimiza-

tion, 11(4):341–359.

Tesauro, G. and Das, R. (2001). High-performance bidding

agents for the continuous double auction. In ACM

Conference on Electronic Commerce.

Vach, D. (2015). Comparison of double auction bidding

strategies for automated trading agents. Master’s the-

sis, Charles University in Prague.

Zhang, J. and Sanderson, A. C. (2009). Jade: Adaptive

differential evolution with optional external archive.

IEEE Transactions on Evolutionary Computation,

13(5):945–958.

ICAART 2023 - 15th International Conference on Agents and Artificial Intelligence

144