A Platform Selection Framework for Blockchain-Based Software

Systems Based on the Blockchain Trilemma

Jan Werth

1

, Nabil El Ioini

2

, Mohammad Hajian Berenjestanaki

1

, Hamid R. Barzegar

1

and Claus Pahl

1

1

Free University of Bozen-Bolzano, Bolzano, Italy

2

University of Nottingham, Malaysia

Keywords:

Blockchain, Distributed System, Distributed Ledger, Blockchain Trilemma, Scalability, Security,

Decentralization.

Abstract:

Blockchains are used in many software systems to deal with trusted storage. The selection of the appropriate

software architecture stack in distributed systems is generally driven by scalability, security, and decentral-

ization as central qualities. In the blockchain domain, these are known as the blockchain trilemma, as they

oppose each other. We select the most popular blockchain platforms based on these trilemma properties and

other indicators to provide a platform review. Specific metrics will be derived from the overall goals and ap-

plied to the platform options. This serves as a basis to create a Selection framework to facilitate the choice of

the best possible platform for a given system architecture. The selection framework is evaluated through a use

case.

1 INTRODUCTION

For many software systems, specifically in distributed

architectures, blockchains can provide a trusted stor-

age layer. A central trust authority is no longer

required as the network participants manage the

blockchain state. Here, each node stores a (local)

copy of the blockchain, which is considered im-

mutable. In addition, other benefits of blockchain

technology are better security and enhanced privacy.

Nevertheless, common qualities such as scalability,

security, and decentralization often need to be con-

sidered. In the blockchain domain, these are known

as the blockchain trilemma, as they oppose each

other. Since blockchain platforms offer different per-

formances regarding these properties, decision sup-

port for the right platform in an overall system archi-

tecture is needed.

We propose a selection framework that allows us

to find the best possible blockchain for a given system

with respective scalability, security, and decentraliza-

tion requirements – for instance, as a decentralized

exchange, for e-voting, or in the healthcare sector.

The first goal is to provide a substantial analysis of

a selected set of blockchain platforms and their con-

sensus protocols based on the blockchain trilemma

and subsequently draw out a selection framework for

choosing the right platform. For this, we map the

three goals scalability, security, and decentralization

onto detailed, measurable metrics to allow a detailed

assessment of the platforms. This in turn is used to

define the selection framework for the selection.

2 BLOCKCHAIN TRILEMMA

The blockchain is an immutable, decentralized ledger

of transactions, where multiple transactions are

grouped into a block which is then appended to the

chain of blocks. There is no need for a central au-

thority. Instead, blockchains reach consensus thanks

to their consensus protocol.

Consensus protocols form the pillar of

blockchains by defining a set of rules which

dictate how a distributed system and its parts operate

and interact. The consensus protocol determines

how the network can reach consensus on the future

state of the blockchain, i.e., most of a blockchain’s

participants have to agree on the same state to reach

consensus. Therefore it is essential to understand

that the consensus protocol and the blockchain

platform itself can be seen as two separate objects

where the consensus protocol defines the rules and

functionality of the blockchain and the blockchain

platform realizes the consensus protocol. Different

blockchains use different consensus protocols.

The Blockchain Trilemma states that a blockchain

can only fulfil two out of the three following contra-

dicting properties: Scalability, Decentralization and

Security. It is an extension of the scalability problem -

362

Werth, J., El Ioini, N., Berenjestanaki, M., Barzegar, H. and Pahl, C.

A Platform Selection Framework for Blockchain-Based Software Systems Based on the Blockchain Trilemma.

DOI: 10.5220/0011837300003464

In Proceedings of the 18th International Conference on Evaluation of Novel Approaches to Software Engineering (ENASE 2023), pages 362-371

ISBN: 978-989-758-647-7; ISSN: 2184-4895

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

a problem arising from an increasing number of trans-

actions but a limited throughput in major blockchain

platforms.

2.1 Scalability

Scalability is one of the most important aspects of

many distributed systems such as blockchains. Here,

it refers to the speed at which participants of a peer-to-

peer network can reach consensus on the state of the

blockchain (Hafid et al., 2020). Mathematically it can

be represented as the maximum block size divided by

the block interval (Croman et al., 2016). Following

this, solving the scalability issue can be done by ei-

ther increasing the block size or decreasing the block

interval. However, external factors such as computing

power, bandwidth, and storage space (Buterin, 2021)

call for an internal solution to the problem. This is

where the blockchain trilemma arises, existing solu-

tions such as the Proof-of-Stake (PoS) consensus pro-

tocol trade in decentralization in favor of scalability.

Using only a limited number of validators, a partic-

ular type of node allowed to create and confirm new

blocks, PoS protocols can decrease required network

communication and increase its scalability. Proof-of-

work (PoW) protocols do not differentiate between

different types of nodes, and everyone has the same

rights.

Low blockchain transaction rates lead to a prob-

lem where transactions can no longer be processed

immediately. Therefore, in the context of blockchain,

scalability refers to the ability to support high trans-

actional throughput while maintaining performance.

Croman et al. (Croman et al., 2016) identified key

metrics to measure scalability of blockchain plat-

forms: maximum throughput, latency, bootstrap

time, and cost per confirmed transaction, where the

first two measurements are the most important for a

user who intends to use a blockchain without being a

miner or a validator.

Maximum throughput refers to the above-

explained concept of transactions per second. La-

tency is the time it takes for a blockchain to create

a new block, append it to the blockchain, and regard

it as confirmed. It can be divided into two parts which

are the block time and the time to finality. The for-

mer refers to the time needed to create a block and

add it to the blockchain. In contrast, time to final-

ity can be once again subdivided into deterministic

and probabilistic. Deterministic means that a block is

considered final once it is appended to the blockchain.

In other words, the block is no longer changeable

once it has been published. Probabilistic refers to the

blockchains in which a block is still subject to change

once it has been added to the blockchain, i.e., due to

the network not having reached consensus on the fu-

ture state of the blockchain. Bootstrap time refers to

the time it takes to download a blockchain and con-

firm all the blocks and transactions. Costs per transac-

tion are external factors such as setup cost, hardware

cost, storage cost, and power usage.

2.2 Decentralization

Decentralisation is the central ethos and given nature

of the blockchain technology, but also a massive bot-

tleneck regarding scalability and security. It describes

the transfer of control and decision-making rights

from a central authority to a distributed network. A

characteristic of decentralisation in blockchains is the

distrust between its participants, which is desired and

required for it to work correctly.

Measuring a network’s decentralisation depends

on the type of blockchain. Two types of blockchains

exist or rather two types on how decentralisation must

be measured. One type uses the Proof-of-Work con-

sensus protocol, while the other type uses Proof-of-

Stake or a similar consensus protocol where the rights

to create a new block are given to a node based on

staked capital. The decentralisation (and security)

of a Proof-of-Work blockchain depends on the net-

work’s hash rate and how distributed it is. A net-

work’s hash rate is the cumulative hash rate of all

the (mining) nodes participating in the block creation

competition. Therefore, the higher the network’s hash

rate, the harder it is to disrupt it.Decentralisation of

a Proof-of-Stake or similar blockchain can be mea-

sured in the number of validators, the distribution of

staked capital among the validators, and the percent-

age of token supply that has been staked. Another

metric to measure decentralisation is the Initial To-

ken Allocation. It can create unfair advantages for

a group that receives many tokens and determine the

next block and chain governance. For both Proof-of-

Work and Proof-of-Stake (or similar blockchains), it

is important to measure how many nodes or pools (a

pool is a group of miners or validators which join to-

gether to increase their chance of creating the next

block) control the majority of the network. his met-

ric is also called Superminority or Nakamoto Coef-

ficient. The Nakamoto Coefficient is defined as the

minimum number of nodes required to get 51% of the

total capacity (either in computing power or staked

capital) (Srinivasan, 2017). However, for networks

with a lower Byzantine Fault Tolerance, it is only re-

quired to control one-third of the network’s comput-

ing power or staked capital.

A Platform Selection Framework for Blockchain-Based Software Systems Based on the Blockchain Trilemma

363

2.3 Security

Security is the third aspect of the blockchain

trilemma. A framework used in cybersecurity is the

CIA triad which stands for confidentiality, integrity,

and availability.

Some other security features come from the CAP

theorem, which stands for consistency, availability,

and partition tolerance and states that none of these

three characteristics can be achieved simultaneously.

This theorem is especially popular among blockchain

developers and often mentioned in the whitepapers

of different platforms, documentation, or online dis-

cussions. Zhang et al. (Zhang et al., 2019) applied

the aforementioned CAP properties to a distributed

ledger: Consistency: All nodes keep an identical

ledger with most recent updates. Availability: Any

transaction generated at any time will be accepted in

the ledger. Partition Tolerance: Even if part of the

network fails, it can still operate normally.

It seems that the blockchain implementation has

violated the CAP theorem by achieving not only con-

sistency but also availability and partition tolerance.

However, this is not the case as a block’s latency

plays a role in consistency. This was also identified by

Zhang et al. (Zhang et al., 2019) who state that consis-

tency is not achieved simultaneously with availability

and partition tolerance but only after a period of time.

Given this weak characteristic and the existence of a

higher-level term in the CIA triad, we can categorize

consistency as part of integrity. We can also group

availability and partition tolerance, where the latter

is a sub-category of the former: Confidentiality con-

cerns the privacy of a user. Integrity includes consis-

tency, authenticity, accuracy and tamper-resistance of

data. Consistency means that all nodes store the same

state of the blockchain. Availability means that the

blockchain is always available to be read and accepts

transactions. Partition Tolerance means that it works

even if part of the network fails.

According to Zhang et al. (Zhang et al., 2019)

a blockchain platform does not only have to fulfill

the above properties of the CIA triad, it also must be

resistant against numerous different types of attacks,

such as resistancd to DDoS Attacks, to majority at-

tacks (51% attack and single shard attack), to double

spending and to transaction flooding. These are some

examples of attacks a blockchain platform, yet these

properties represent the most crucial security proper-

ties a blockchain must satisfy (Zhang et al., 2019).

Another measure of security is the Nakamoto Coeffi-

cient.

Byzantine Fault Tolerance. (BFT) refers to the

ability of a distributed system to keep working cor-

rectly even when a fraction of its nodes fail or act ma-

liciously. Blockchains reach BFT through their con-

sensus protocols which dictate the rules. If a node is

no longer following the consensus protocols’ rules, it

is a malicious node that does not act in the network’s

interest. Furthermore, most of the blockchains’ at-

tacks occur inside the network, implying the pres-

ence of byzantine nodes. A higher byzantine fault

tolerance also means that a network is more secure.

Other outside attacks (e.g., DDoS attacks) attack sin-

gle nodes in the network and try to shut them down.

Such an attack can not only be prevented by having a

high byzantine fault tolerance so that fewer nodes are

required to keep the network operating, but also high

decentralization fends off DDoS attacks. Yet again,

another example of how two aspects of the blockchain

trilemma are connected.

3 SELECTION CRITERIA AND

METRICS

We provide an analysis of different blockchain plat-

forms, which will then be used to create a selec-

tion framework to facilitate the selection of which

platform to use among the selection of platforms.

The reason is that every platform takes a different

approach to the blockchain trilemma with a differ-

ent objective. This poses a challenge for prospec-

tive blockchain developers and users as a particular

blockchain platform may not fulfil their requirements,

i.e. the application requires high, intermittent trans-

actional throughput, which only a few platforms sup-

port. Given the numerous existing blockchain plat-

forms, an analysis of all platforms would go beyond

the scope here and is not feasible. Therefore, only a

selection of blockchain platforms will be included in

the selection framework.

3.1 Platform Selection

The selection of which blockchain platforms to

compare was made in April 2022 based on

their blockchain trilemma properties, their type of

blockchain, their initial token allocation, their To-

tal Value Locked (TVL), and the number of min-

ers/validators participating in the consensus.

The most important selection criteria to ensure di-

versity among the selected blockchain platforms were

their blockchain trilemma aspects. In other words, it

was essential to include blockchains that focus on the

trilemma’s different aspects. This was done by look-

ENASE 2023 - 18th International Conference on Evaluation of Novel Approaches to Software Engineering

364

ing at different metrics which define the platform’s

scalability, decentralization, and security. The se-

lected metrics for scalability are the platform’s max-

imum transactions per second, their block time and

their time to finality. For decentralization the number

of nodes, their type and whether the number of nodes

is fixed is essential. The number of nodes, their type,

and the distribution of computing power and staked

capital is also of interest for security, as well as the

Byzantine Fault Tolerance of the network.

Another criterion which had to be considered is

the type of blockchain. To ensure that the selected

blockchains are programmable on only public per-

missionless blockchain platforms (Pahl et al., 2018),

which also support Smart Contracts, were included.

The selection resulted in 9 blockchain platforms

1

with one Layer 0 solution (Cosmos), one Layer 2

solution (Polygon), and one platform which was in-

cluded for its approach to the blockchain trilemma,

Harmony. Harmony is already applying a method

called sharding to its blockchain, which Ethereum,

the platform with the most protocols and highest

TVL, will apply in 2023. The selection is presented

in Table 1.

We summarize the consensus protocols used by

the selection of blockchain platforms and additional

consensus protocols which may be necessary to un-

derstand more complex ones in Table 2.

3.2 Analysis of Platforms

The metrics chosen to analyze the blockchains are

generally available for all public blockchains. Table 3

includes transactions per second. Some platforms are

not yet fully implemented but will reach higher tps in

the future. These metrics are identified in (Croman

et al., 2016) to compare blockchain scalability.

current TPS: measure the average throughput of a

blockchain platform.

max TPS: states the maximum transactions per sec-

ond a blockchain can process.

Block Time: measures the time in seconds it takes

for a blockchain to create a new block.

Number of Nodes: measures the decentralization of

a blockchain. The number only includes nodes

responsible for block creation.

Time to Finality: measures of block latency. In

probabilistic networks, a block is not considered

1

Please note that we do not list all individual sources

of information separately due to their large number. All in-

formation has been gathered from the documentation made

available by the providers.

final even after it was created due to the risk of

forks and other. However, some platforms in the

selection offer deterministic finality, which means

that a block is final the moment it was produced.

Table 4 shows a comparison of each platform’s

decentralisation and includes the Nakamoto Coeffi-

cient. The metrics to measure decentralization (Con-

way, 2022) (Srinivasan, 2017) are:

Number of Nodes: participating in the block cre-

ation process.

Type of Nodes: Different consensus protocols use

different types of nodes for block creation. How-

ever, in this selection, most platforms use valida-

tors or some sort of validators

2

.

Fixed Number of Nodes: states whether the number

of nodes participating in the block creation is fixed

or can scale.

Hashrate / % of Supply Staked: reports the net-

work’s total hash rate (for Ethereum) and percent-

age of how much of the token supply of a net-

work’s crypto-currency is staked.

Nakamoto Coefficient: measures how many entities

are in control of 51% or 34% (depending on

BFT) of the network’s power (either in comput-

ing power or staked capital).

Table 6 depicts the security aspect of the blockchain

platforms. The metrics are:

Byzantine Fault Tolerance measures the threshold

of failed or adverse nodes a network can with-

stand.

Availability blockchains is imported as transactions

always occur.

Anonymity shows if complete anonymity or

pseudonymity where a transaction can be tracked

and linked to an address is offered.

Note that the Nakamoto Coefficient is also a metric

used to measure the security of a network as large en-

tities.

3.3 Design of the Framework

To create a selection framework, we have to establish

the metrics and rules which the selection framework

will follow. The metrics are used in scientific articles

and in the blockchain community to compare and an-

alyze the performance of different platforms (Hafid

2

For example, in BSC, validators have to be approved

by Binance. Trons’ Super Representatives are also valida-

tors. Only Ethereum does not use validators but uses com-

peting nodes as participate in the Proof-of-Work consensus.

A Platform Selection Framework for Blockchain-Based Software Systems Based on the Blockchain Trilemma

365

Table 1: Selected Blockchain Platforms.

Consensus Structure Architecture

Smart Contracts

Ethereum PoW Chain Single Chain YES

Cosmos Tendermint PoS Chain Cosmos Parachain YES

BSC PoSA Chain Cosmos Parachain YES

Avalanche SoA DAG

X-Chain, P-Chain, C-Chain

YES

Solana PoH Chain Single Chain YES

Fantom LCA DAG Main Chain (Atropos) YES

Tron DPoS Chain Single Chain YES

Polygon PoS Chain Sidechains YES

Harmony FBFT Chain Sharding YES

Table 2: Comparison of Consensus Protocols.

Throughput

Transaction

Finality

Decentralization

BFT

Energy

Consumption

Proof of Work Low Probabilistic High ≤=50% High

Proof of Stake Low Probabilistic Medium ≤=50% Low/Medium

Tendermint PoS Medium Deterministic Medium ≤=33% Low/Medium

Delegated-Proof-of-Stake High Probabilistic Low ≤=33% Low/Medium

Proof-of-Staked-Authority Medium Probabilistic Low ≤=33% Low/Medium

Snowflake-to-Avalanche Medium/High Probabilistic Medium ≤=50% Low/Medium

Proof-of-History High Deterministic Medium ≤=33% Low/Medium

Fast Byzantine Fault Tolerance High Deterministic Medium ≤=33% Low/Medium

Lachesis Consensus Protocol High Deterministic Medium ≤=33% Low/Medium

et al., 2020) (Buterin, 2021). In the presentation of

the blockchain trilemma (Buterin, 2017) Buterin de-

scribed the three trilemma aspects as follows:

Scalability: Defined as being able to process O(n) >

O(c) transactions

Decentralization: Defined as the system being able

to run in a scenario where each participant only

has access to O(c) resources

Security: Defined as being secure against attackers

with up to O(n) resources

3.3.1 Scalability

Maximum throughput and latency of a network are

the most decisive indicators for scalability for users

who do not actively participate in the network (Cro-

man et al., 2016). Therefore, the maximum through-

put (how many transactions per second a network can

handle), the block time, and time to finality are se-

lected to measure the scalability of a network. Time

to finality is assessed based on a network being deter-

ministic or probabilistic. Block time is rated by the

seconds it takes for a network to create a new block,

which, is not used in this selection framework as all

selected blockchain platforms present a similar block

time. Thus, only the maximum transaction per second

as some blockchains are not fully implemented yet

and the time to finality (deterministic or probabilistic)

is used to measure the scalability of the blockchain

platforms.

3.3.2 Decentralization

According to Conway (Conway, 2022), decentraliza-

tion of Proof-of-Work networks is measured by its

hash rate and its distribution among the participants of

the network. A Proof-of-Stake network (and similar

blockchains) is measured by the number of validators,

the percentage of token supply staked, and the distri-

bution of the token supply across its validators (Con-

way, 2022). Following this, we calculate a decentral-

ization index for the selected Proof-of-Stake (or sim-

ilar) blockchain platforms by their average ranking

for the number of nodes, their percentage of supply

staked, and their Nakamoto Coefficient. This decen-

tralization index is used to determine how decentral-

ized a network is as the number of nodes may be mis-

leading due to the Nakamoto Coefficient. Ethereum’s

decentralization will be measured along with its peers

(other Proof-of-Work blockchains). A lower decen-

tralization index is favourable as it indicates that the

network is more decentralized.

3.3.3 Security

Security can be measured by the Byzantine Fault Tol-

erance of a network. An asynchronous network can

not provide safety (guarantee that all malicious nodes

will eventually agree to the new state) and liveness

(ability to process transactions) if the number of ma-

licious nodes exceeds the BFT threshold (Bracha,

1987). For networks with a Byzantine Fault Toler-

ENASE 2023 - 18th International Conference on Evaluation of Novel Approaches to Software Engineering

366

Table 3: Scalability of Blockchain Platforms.

current TPS max TPS Block Time Time to Finality

Ethereum 10 12-15 12-14 seconds 60 seconds

Cosmos /

10,000

per zone

˜6 seconds Instant

BSC 40-60 160 ˜3 seconds 75 seconds

Avalanche 5-10

5,000+

per subnet

˜2 seconds ˜1 second

Solana 1,500-2,500 710,000 ˜0.7 seconds Instant

Fantom 10-15 300,000 ˜1 second Instant

Tron 50-200 2,000 3 seconds 60 seconds

Polygon 30-50

65,000

per sidechain

2.3 seconds ˜2 seconds

Harmony ˜10

500

per shard

2 seconds Instant

Table 4: Decentralization of Blockchain Platforms.

Number

of Nodes

Type of Nodes

Fixed

number

of validators

Hashrate /

% of supply

staked

Nakamoto

Coefficient

Ethereum ˜6,000 Competing No 913.74 TH/s

1

3

*

Cosmos 175 Validators Yes 62.23% 7

BSC 21

Authorized

validators

Yes 81.47% 8

*

Avalanche ˜1,250 Validators No 60.82% 52

Solana ˜2,000 Validators No 73.79% 27

Fantom 92 Validators No 47.01% 3

*

Tron 27

Super

Representatives

Yes 45.81% 8

2

Polygon 100 Validators Yes 30.89% 13

*

Harmony

250

per shard

Validators Yes 42.48% 5

*

1

Ethereum is the only PoW platform, thus hashrate is used to measure decentralization.

*

Is estimated since no central source exists for the Nakamoto Coefficient for some.

Table 5: Decentralization Ranking of Blockchain Plat-

forms, with Number of Nodes NoN, Hashrate / % of sup-

ply staked HR, Nakamoto Coefficient NC, Decentralization

Index DI.

NoN HR NC DI

Ethereum 2 2 2 2

Cosmos 4 3 6 4.33

BSC 8 1 4 4.33

Avalanche 2 4 1 2.33

Solana 1 2 2 1.66

Fantom 6 5 8 6.33

Tron 7 6 4 5.66

Polygon 5 8 3 5.33

Harmony 3 7 7 5.66

ance of ≤ 33% a number of malicious nodes between

33% and 50% can already halt the blockchain so that

it can no longer produce new blocks (Bunin, 2022).

In addition, to Ethereum, Avalanche, and Polygon,

where >50% of the network needs to be malicious to

bring it to a stop, we also consider BSC secure all the

validators have to be approved by a central authority

and must publish their identity.

3.3.4 Resources and Repeatability

To analyse the different platforms we studied

whitepapers and online documentation. As those

sources mainly focus on the conceptual aspects,

such as maximum throughput or the functions of

their consensus protocol, block explorers are used

to get real-time and historical information on a

blockchain. Block explorers are mainly developed

by the blockchain foundation, reputable community

members, or former blockchain developers.

The process of analyzing and assessing the

blockchain platforms is repeatable for most of the

part. Scalability and Security of a network is mea-

sured with objective metrics. Only for decentraliza-

tion, we compared the selected blockchain platforms

to one another according to (Conway, 2022).

A Platform Selection Framework for Blockchain-Based Software Systems Based on the Blockchain Trilemma

367

Table 6: Security of Blockchain Platforms.

BFT Availability Anonymity

Ethereum ≤ 50% Transaction with low fees can become stuck (as miners re-

ceive the fee, a low fee does not offer any incentive to pro-

cess the transaction over other transactions with higher fees)

Data availability is achieved by full nodes

Pseudonymity

Cosmos ≤ 33% Validators are penalized for inavailability Pseudonymity

BSC ≤ 33% Validators are penalized for inavailability Pseudonymity

Avalanche ≤ 50% SoA can adaptably change byzantine fault tolerance for availability

Block and Transaction Data are simultaneously stored on Kyve

Pseudonymity

Solana ≤ 33% Horizontal scaling gives up network availability for scalability Pseudonymity

Fantom ≤ 33% Validators and delegators are penalized for inavailability Pseudonymity

Tron ≤ 33% Fees to prevent transaction flooding Pseudonymity

Polygon ≤ 50% Validators and delegators are penalized for inavailability

Achieves data availability by the means of an additional data layer on the

blockchain

Pseudonymity

Harmony ≤ 33% Shards store only 1/n of the global state, new blocks from shards are crosslinked

to the beacon chain.

Pseudonymity

4 SELECTION FRAMEWORK

This selection framework aims to facilitate deciding

which blockchain platform to use. It does not provide

any method to decide whether the use of a blockchain

(for a particular application) is reasonable or not. The

user should have already made this decision. It is also

assumed that the user knows their specifications re-

garding needed and desired scalability, decentraliza-

tion and security.

4.1 Development Process

The development of the selection framework started

with finding attributes which best split the selection

of platforms into two homogeneous parts. However,

finding a starting attribute that allowed all users to fol-

low their wanted aspect of the blockchain trilemma

was impossible.

Thus, the final selection framework starts with

the question ”What is most important” with all

three aspects as answer possibilities. This split no

longer produced pure nodes but mixed nodes where a

blockchain platform could be part of two or all three

pathways. Therefore, some platforms can be reached

through different paths as they fulfil multiple crite-

ria. The subsequent nodes in the selection framework

were used to further down-sample the selection set.

Generally, at each decision node, the user can

choose between one of the three trilemma aspects

where scalability includes all platforms with a max-

imum tps rate greater than Visa’s 1,700 tps. Decen-

tralization is measured with the help of the Decen-

tralization Index presented in Table 5, where all net-

works with an index <4 are considered to be more

decentralized than others. This split was chosen due

to the (large) gap in the decentralization index be-

tween Avalanche (index of 2.33) and the next best

platforms, BSC and Cosmos (index of 4.33). Secu-

rity embraces all platforms with a byzantine fault tol-

erance of ≤ 50% and BSC where the validators are

publicly known. Section 4.2 gives a detailed overview

of all decision nodes.

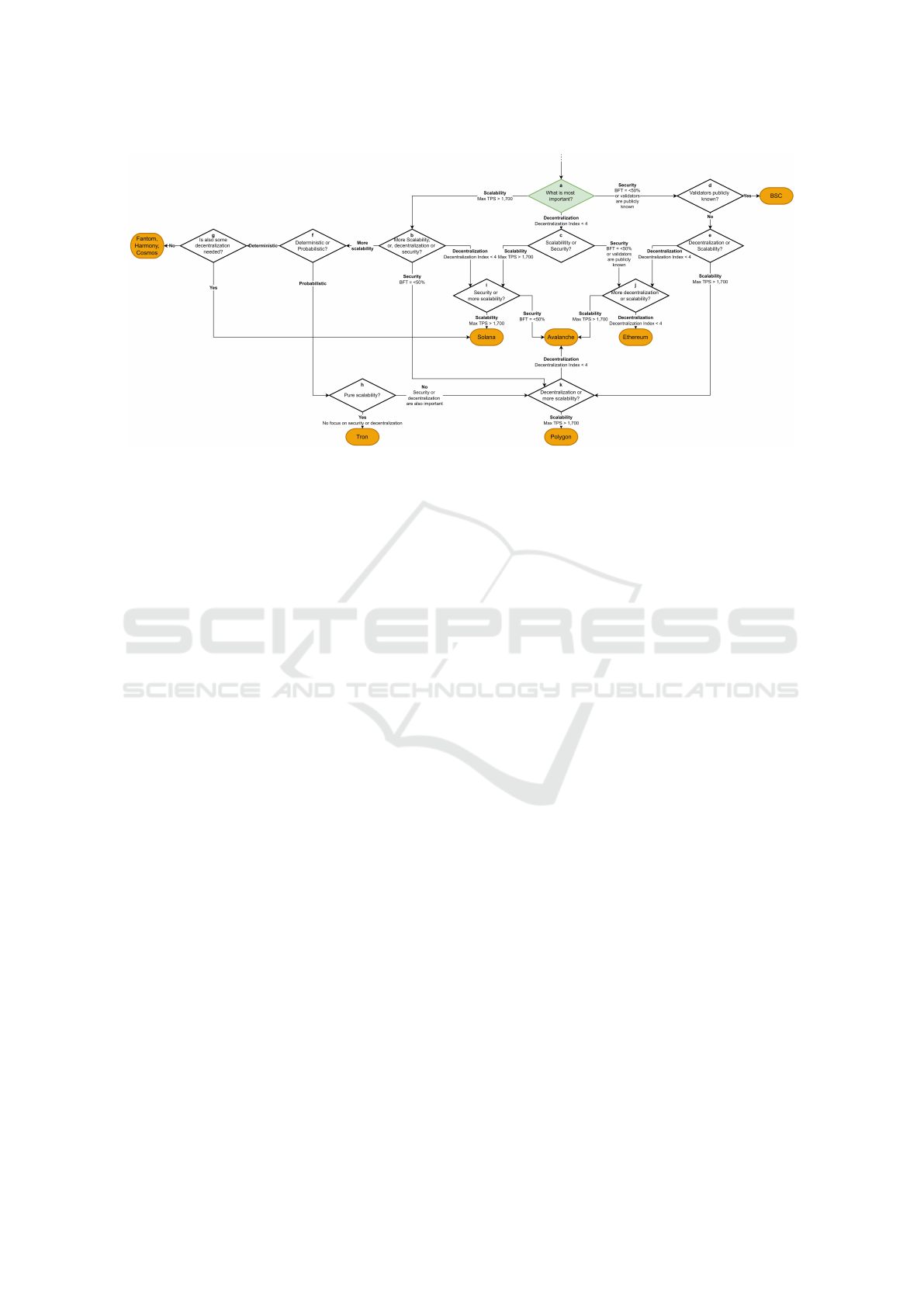

Figure 1 shows our selection framework where

multiple questions must be answered before the selec-

tion framework terminates with a suggestion. Further-

more, for some pathways, the selection framework

terminates with two possible blockchain platforms.

This is due to their similarity when measured in terms

of the blockchain trilemma. In this case, further study

of the differences between the two platforms is rec-

ommended.

4.2 The Selection Nodes

a: What is most important? The first question

asked is what is most important for the user. The

three choices offered are the three aspects of the

blockchain trilemma.

b: More scalability, or decentralization or secu-

rity? Following the scalability path from the first

decision, the next question is what is the second

most important to the platform. Yet again, the user

is confronted with all three blockchain trilemma

aspects.

c: Scalability or Security? The 2nd question for de-

centralization is whether the platform should fo-

cus more on scalability or security.

d: Validators publicly known? This question is to

differentiate BSC from other secure platforms, as

ENASE 2023 - 18th International Conference on Evaluation of Novel Approaches to Software Engineering

368

Figure 1: Blockchain Platform Selection Framework.

BSC is the only platform in this selection where

the validators have to publicize their identity. So

if the validators should be known, we come to our

first result. Else the selection framework contin-

ues.

e: Decentralization or Scalability? The third ques-

tion for a secure platform also concerns the other

two trilemma aspects.

f: Finality? This question follows the question of b:

More scalability, or decentralization or secu-

rity? and divides the subset of scalable platforms

based on their block finality.

g: Is also some decentralization needed? If the

platform should offer instant finality, the last

question in the selection framework is the

question of decentralization. Suppose less decen-

tralization is required, the selection framework

points to Fantom and Harmony. If, however, the

platform should also be more decentralized, it

terminates with Solana and Harmony as a result.

h: Pure scalability? If the answer to question f: Fi-

nality? is no and probabilistic finality is suffi-

cient, the next question is whether the platform

should offer some decentralization or security. If

the answer is no and only scalability is required,

the result of the selection framework is Tron. Else

question k: Decentralization or more scalabil-

ity? follows.

i: Security or more scalability? This question can

be reached from decision b: More scalability,

or decentralization or security? if chosen de-

centralization or from question c: Scalability or

Security? if chosen Scalability and yields three

different results. If the platform should be secure,

it points to Avalanche. If it should be scalable,

suggestions are Solana and Cosmos.

j: More decentralization or scalability? Just like

the last decision, this question can also be reached

from two former questions and confronts the user

with the question of whether more decentraliza-

tion or scalability is required. If the answer is

decentralization, the selection framework points

to Ethereum, the only platform in this selection

where every node has the same rights. Else the

selection framework results with Avalanche.

k: Decentralization or scalability? This question

can be reached if both security and scalability

have been chosen before and queries whether

decentralization or scalability is more important.

If the former is chosen, the selection framework

terminates with Avalanche, otherwise, with

Polygon.

4.3 Observations

The presented selection framework provides only a

limited summary of a subset of selected blockchain

platforms. Many platforms appear to be similar

to others but utilize different underlying technology

(i.e., consensus protocol, the structure of chain, data

storage, etc.). Therefore, solely relying on this selec-

tion framework is not sufficient and all the technical

details should be researched. This is particularly ev-

ident if we look at the result of ”Fantom, Harmony.

Cosmos” when selecting ”no” at node g: Is also some

decentralization needed?. While all three are re-

sults of the same pathway, Fantom is a DAG-based

blockchain with a maximum of 300,000 transactions

per second, Harmony is a sharded blockchain where

A Platform Selection Framework for Blockchain-Based Software Systems Based on the Blockchain Trilemma

369

each shard supports only up to 500 transactions per

seconds but can reach higher transactions per seconds

according to its whitepaper, whereas Cosmos is a plat-

form to build blockchains on which can horizontally

scale and reach thousands of transactions per second

per zone. All three platforms are also similar in terms

of block time, deterministic time to finality, decentral-

ization (index of 6.33 for Fantom vs index of 5.66 for

Harmony vs index of 4.33 for Cosmos) and security

(≤ 33%BFT ).

5 EVALUATION OF THE

FRAMEWORK

We apply the selection framework to a real-world ap-

plication setting. A common field where blockchain

technology is applied is public services and govern-

ment. We apply our selection framework to a decen-

tralized exchange platform and a conceptual example

by means of e-voting.

Following this, the presented selection framework

could have been of use for SushiSwap to decide

which blockchain platform to build their application

on. However, given the fact that SushiSwap is a fork

of another decentralized exchange, UniSwap, which

launched in November 2018. Back then, Ethereum

was one of the only blockchain platforms to exist that

offered Smart Contract support. Most of the platforms

presented here only launched after UniSwap’s initial

launch.

In our local 2018 provincial elections a total of

284,361 voters cast their votes from 7am to 9pm on

the 21

st

October 2018. This corresponds to a voter

turnout of 73.87%. In the morning (until 11am) only

19.6% voted but this number increased in the after-

noon as 50.5% of all eligible voters casted their vote

until 5pm . At the closure of the election stands a total

of 73.87% voted.

Table 7: 2018 Provincial Elections in numbers.

Time Voters % votes/h votes/s

7-11:00 75,241 19.6% 18,810 5.23

11-17:00 118,200 30.9% 19.700 5.47

17-21:00 89,479 23.4% 22.370 6.21

Total 282,920 73.9% 20.209 5.61

From Table 7 we can see that on average 5.61

votes were cast by second, alternating slightly de-

pending on the time of the day. Therefore, an e-

voting application for provincial elections must be

able to process at least six votes per second. However,

this number does not take into account that with e-

voting, the distribution of votes cast may change and

the number of votes increases, which is expected with

e-voting (Anane et al., 2007).

Security is important in e-voting systems (Anane

et al., 2007) (Abuidris et al., 2019). Both see

anonymity as one of the most important points for an

e-voting system, something that no platform in this

selection offers as they all offer only pseudonymity

(see table 6).

Disregarding this concern, we can move from

node a: What is most important? to node d: Val-

idators publicly known? following the security path.

At this point, choosing BSC as the platform would

also fulfil the provincial election transactions per sec-

onds requirement. But also, the paths which lead to

Ethereum, Avalanche, and Polygon are imaginable.

Another aspect identified by Abuidris et al. is scalabil-

ity (Abuidris et al., 2019) which leads us to node k:

Decentralization or more scalability? from where

one can choose between high scalability or decen-

tralization. At this point, a precise suggestion of a

blockchain platform for an e-voting application is dif-

ficult to make as we are faced with the blockchain

trilemma. Is it more convenient to trade decentral-

ization for scalability and choose Polygon, or is also

decentralization required for an e-voting application

and Avalanche is the better blockchain platform to

choose?

In terms of scalability, both platforms are quite

similar, whereas Avalanche is slightly faster in cre-

ating blocks and reaching consensus, but Polygon

can handle more transactions per second. An as-

sumption at this point is that the decentralization and

adaptive changeable Byzantine Fault Tolerance from

Avalanche are advantageous.

The objective of the selection framework is to fa-

cilitate the selection of the correct platform. In the

case of the presented selection framework, it helps

to decide which platform from the selected and an-

alyzed platforms should be considered for usage. For

this, the selection framework uses the blockchain

trilemma. To answer the second question, the users

must know their specifications and what they expect

from the blockchain platform. If the users do not

know if they prefer scalability over security or de-

centralization, the selection framework is not helpful.

However, it is also not designed for that purpose. If

the selection framework is helpful to the users in any

way of narrowing down their final selection or elim-

inating some blockchain platform, it is considered to

be helpful and adds value to the user.

The e-voting case presented above is a concep-

tual example of how the selection framework could be

used to choose the best possible blockchain platform

for a decentralized application. By knowing what is

ENASE 2023 - 18th International Conference on Evaluation of Novel Approaches to Software Engineering

370

important to their application, the user can narrow

down the selection of platforms.

6 CONCLUSIONS AND FUTURE

WORK

In order to support a system architecture by trusted

storage, the decision on the right blockchain plat-

form depends on a range of required system quali-

ties. Blockchain platforms offer more trust, security,

and privacy as principal benefits, but system proper-

ties such as scalability or degree of decentralisation

are equally important in distributed systems. We com-

pared selected blockchain platforms in terms of scal-

ability, decentralization, and security. The selection

was made on multiple criteria, such as trilemma prop-

erties, their type of blockchain, and their initial to-

ken allocation. For the analysis of each platform, we

studied their respective whitepaper and documenta-

tion and also interacted with the platform’s commu-

nity on social media platforms such as Twitter, Red-

dit, and Discord. However, as such sources cover only

the platforms’ conceptual aspects, we also utilized

websites which track the analytics of each blockchain,

so-called blockchain explorers. The results of the

analysis indicated that the blockchain trilemma holds

true.

We developed a selection framework based on the

trilemma properties where each split asks for the most

important aspect of the trilemma. Only later splits

ask specific questions about the required scalability

of the blockchain platform taking specific metrics into

account.

REFERENCES

Abuidris, Y., Kumar, R., and Wenyong, W. (2019). A survey

of blockchain based on e-voting systems. In Intl Conf

on Blockchain Technology and Applications.

Anane, R., Freeland, R., and Theodoropoulos, G. (2007).

E-voting requirements and implementation. In Pro-

ceedings CEC-EEE 2007.

Bracha, G. (1987). Asynchronous byzantine agreement pro-

tocols. Information and Computation, 75(2):130–143.

Bunin, V. (2022). Proof of stake’s security model is being

dramatically misunderstood. Medium.

Buterin, V. (2017). Sharding faq. https://vitalik.ca/general/

2017/12/31/sharding faq.html.

Buterin, V. (2021). The limits to blockchain scalability.

https://vitalik.ca/general/2021/05/23/scaling.html.

Conway, L. (2022). Measuring decentralization: Is your

crypto decentralized? Blockwors.

Croman, K. A., Saxena, P., Shi, E., G

¨

un Sirer, E., et al.

(2016). On scaling decentralized blockchains. In Intl

conf on financial cryptography and data security.

Hafid, A., Hafid, A. S., and Samih, M. (2020). Scaling

blockchains: A comprehensive survey. IEEE Access,

8.

Pahl, C., El Ioini, N., and Helmer, S. (2018). A decision

framework for blockchain platforms for iot and edge

computing. In IoTBDS.

Srinivasan, B. S. (2017). Quantifying decentralization.

Medium.

Zhang, R., Xue, R., and Liu, L. (2019). Security and privacy

on blockchain. ACM Computing Surveys (CSUR),

52(3):1–34.

A Platform Selection Framework for Blockchain-Based Software Systems Based on the Blockchain Trilemma

371