An Agent-Based Model Study on Subsidy Fraud Risk in

Technological Transition

Hao Yang, Xifeng Wu and Yu Chen

SCS Lab, Department of Human and Engineered Environment, Graduate School of Frontier Sciences,

The University of Tokyo, Chiba 277-8563, Japan

Keywords: Agent-Based Model, Technological Transition, Subsidy Fraud, Subsidy Policy.

Abstract: In modern society, government subsidy policies play a pivotal role in developing new technologies. Although

subsidy policies have a long history, the resulting subsidy fraud problem consumes social resources and

hinders the development of new technologies. In this paper, we attempt to derive the factors affecting the risk

of performing the subsidy fraud based on a validated agent-based model for technological transition. We first

review the literature on subsidies and the definition of subsidy policies. We perform a mathematical analysis

of the agent-based model and calculate the critical value for subsidy rates, which may cause a dramatic change

in the probability of subsidy fraud to occur. We conducted a series of numerical experiments to show the

validity of the critical subsidy rates. And we also correlates and classifies three scenarios between the situation

of technology diffusion and development and the risk of subsidy fraud. Finally, the causal factors of subsidy

fraud are examined by analyzing the various stakeholders involved in the subsidy fraud in the actual situation.

1 INTRODUCTION

Technological innovation is of great importance for

the development of human society. Especially in

modern societies, national innovation ability is

essential in measuring modern countries’

development level and their potential. There is a

critical need for the government to help and stimulate

technological innovation in the country. Subsidies for

specific industries, particularly for those new

technology industries, are widely used to achieve this

goal.

As the opposite of taxation, subsidies to

enterprises are considered part of government

spending and non-reimbursable payments by the

government to targeted enterprises. However, when

we strictly define the concept of "subsidy,” we find

that the concept has been evolving, and the definition

has been formally made differently across countries,

regions, and industries.

The World Trade Organization (1999) defines the

concept of "subsidies" in great detail to reconcile the

interests of the members of each organization. The

core idea is that "subsidies" are defined as indirect

financial support in the form of direct transfers

(grants, loans, capital injections, etc.), tax breaks, and

government (other than the general infrastructure)

purchases to specific industries or enterprises, either

with a direct government capacity or indirectly

through the establishment of agents.

However, according to R.Steenblik (2003),

statisticians and economists classify subsidies into

different types depending on what is covered and how

they are calculated. For example, distinctions are

made according to the target, the benefits route, etc.

Different calculation methods will result in benefits

for different recipients of subsidies, which may

further result in different results on the calculation of

the size and impact of subsidies. In the literature,

however, it has been noted that differences in the

analysis of subsidies within different industries are

often a consequence of historical factors and the

prerogatives of the policy groups targeted by the

research rather than inherent differences within the

sectors under investigation (World Trade

Organisation, 1999). This fundamental conflict of

interest, in turn, makes it more challenging to make

an unambiguous definition of "subsidy" that can be

widely accepted. As Hendrik S. Houthakker (1972)

states: "My starting point was also an attempt to

define subsidies. However, in the course of doing so,

I concluded that the concept of a subsidy is just too

elusive. " Rather than reading too much into the

412

Yang, H., Wu, X. and Chen, Y.

An Agent-Based Model Study on Subsidy Fraud Risk in Technological Transition.

DOI: 10.5220/0011801200003393

In Proceedings of the 15th International Conference on Agents and Artificial Intelligence (ICAART 2023) - Volume 1, pages 412-421

ISBN: 978-989-758-623-1; ISSN: 2184-433X

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

definition of subsidies in our study, we take a

fundamental approach, defining a subsidy as "a

gratuitous payment based on the cost of production of

the firm."

Sound effects are only occasionally produced by

subsidy policies. Subsidy fraud is a crime that

accompanies subsidy policy and has long plagued the

government. In traditional studies, subsidy fraud is

often associated with tax evasion. The neoclassical

economic model of tax fraud proposed by Allingham

and Sandmo (1972) is considered one of the

cornerstones of the financial analysis of tax evasion.

It shows how individuals decide to evade taxes and

how the government will eventually punish them.

However, the model cannot explain the low levels of

fraud at soft penalty and detection rates (Chica M et

al., 2021). In the study by Prichard et al. (2014), an

attempt was made to explore the reasons for the

failure of the above model. Two possible paths were

introduced to address the limitations of the

neoclassical model, namely the empirical research

and the agent-based model (ABM). This paper will

mathematically derive the critical factor that may

cause subsidy fraud by analyzing an established ABM

for technological transformation.

In our previous study (Yang et al., 2021), we

conducted a preliminary analysis of the agent-based

model proposed by Lopolito.A et al. (2013). In this

paper, we shall extend our previous study to complete

the following three tasks:

(1) Derive the critical subsidy rates.

(2) Conduct numerical experiments to show the

effects of these critical rates.

(3) Relate the derived subsidy rates with the

subsidy fraud in reality.

2 MODEL

2.1 Model Descriptions

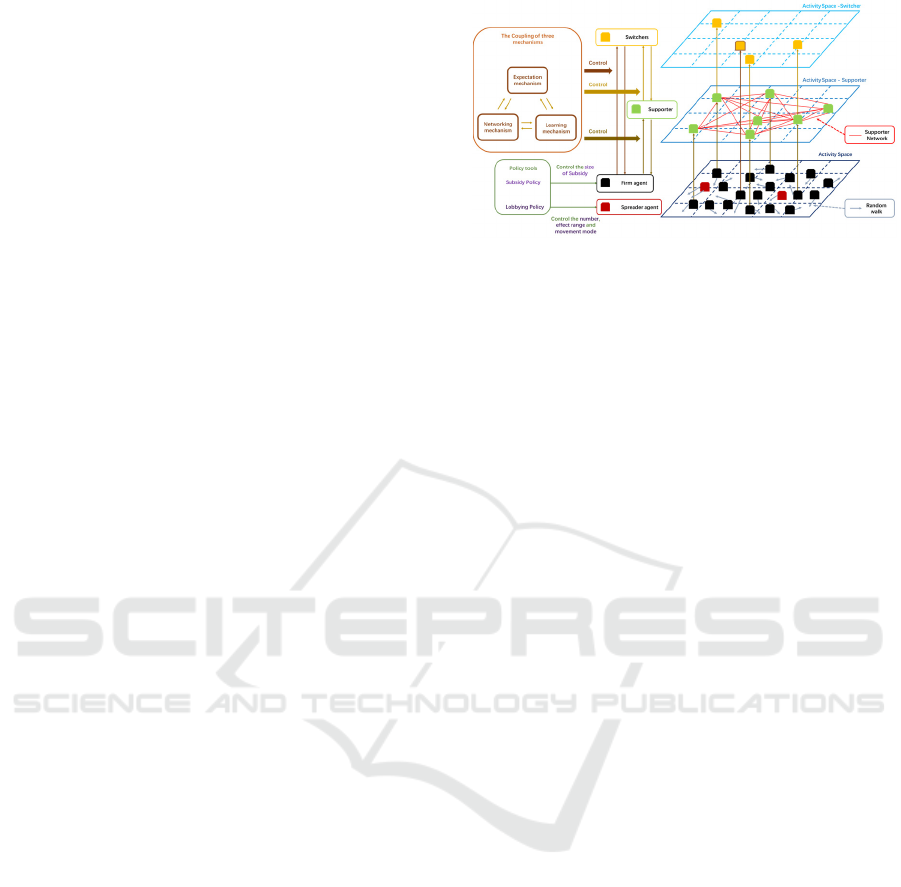

The conceptual framework of the agent-based model

for technological transition is shown in Fig 1.

Our model has two types of agents, firm agent and

spreader agent. The firm agent may transform from

the primary state to the supporter state and/or

switcher state through the coupling of three

mechanisms. The supporter state means "the state in

which the agent supports the new technology,” and

the switcher state means "the state in which the state

uses the new technology for its production activities.”

Figure 1: Conceptual framework of the agent-based model

for technological transition.

On the other hand, as shown on the right side of

Figure 1, we divide the model space into three

abstract layers: the primary activity space, the

supporter activity space, and the switcher activity

space, which correspond to different states of the firm

agents.

The bottom left of Figure 1 shows the two policy

tools in our model, namely the lobbying policy and

the subsidy policy, which affect the firm agents and

spreader agents, respectively.

In the following text, we give details of each part

of the model.

2.1.1 Basic Assumption

We assume that there are two technologies in the

market, the new technology and the old technology,

and assume that the market has reached equilibrium

when the old technology is used.

We use 𝛱

,

and 𝛱

,

to represent the profit

obtained by using the old technology and the new

technology, respectively.

𝛱

,

=𝑅

,

−𝐶

,

=0 , (1)

𝛱

,

=

𝑅

−𝐶

,

𝑤𝑖𝑡ℎ 𝑝𝑟𝑜𝑏𝑎𝑏𝑖𝑙𝑖𝑡𝑦 𝑝

0.5𝑅

−𝐶

,

𝑤𝑖𝑡ℎ 𝑝𝑟𝑜𝑏𝑎𝑏𝑖𝑙𝑖𝑡𝑦 1 −𝑝

(2)

where 𝛱

,

, 𝑅

,

and 𝐶

,

represent the profit, revenue

and cost associated with the production at time 𝑡 of

firm 𝑖 which use the traditional technology; 𝛱

,

, 𝑅

and 𝐶

,

represent the profit, revenue and cost

associated with the production at time 𝑡 of firm 𝑖

which use the new technology.

In addition, for the case that a company choose to

use the new technology but leads to failure, we set the

profit to be 0.5𝑅

. The reason for setting the

coefficient 0.5 is that we want to be able to describe

the expectation using the success probability 𝑝

exclusively. Consider that for a new technology with

a risk of failure, the net profit deviation from the

original technology will not be large when it is first

An Agent-Based Model Study on Subsidy Fraud Risk in Technological Transition

413

adopted by the company. A setting higher than 0.5

would easily lead to a failure penalty that is too small,

corresponding to a situation where the new

technology outperforms the old one across the board

and all companies would adopt it quickly; a setting

less than 0.5 would again lead to a failure penalty that

is too severe, thus making it difficult for the new

technology to produce a stable state within the time

period we set for the experiment, which means that

the new technology would develop too slowly.

Therefore we set it to 0.5, because too high or too low

would lead to trivial dynamics.

The firm agent is mainly controlled by three

mechanisms, namely, the expectation mechanism,

networking mechanism, and learning mechanism,

which work together and maintain the transformation

process of the firm agent to supporter and switcher.

2.1.2 Expectation Mechanism

Expectation mechanism mainly controls the

parameter 𝑒𝑥

,

. The parameter 𝑒𝑥

,

represents firm

𝑖's expectation of the new technology at time 𝑡. The

Expectation mechanism affects the magnitude of the

parameter 𝑒𝑥

,

in the following two ways.

1) The parameter 𝑒𝑥

,

is positively correlated with

the profit generated after using the new technology.

𝑒𝑥

,

=𝑒𝑥

,

+𝛱

,

, (3)

2) Increase the expectation value of the new

technology when the firm agent meets with the

spreader agent.

𝑒𝑥

,

=𝑒𝑥

,

+𝜂, (4)

where 𝜂 means a control parameter the lobbying

effect on new technologies when a firm agent

encounters a spreader agent.

2.1.3 Networking Mechanism

The Networking mechanism mainly controls the

generation of supporter networks and the related

parameter changes.

Establishment of Supporter Network

When two firm agents are supporters of a new

technology and are close enough to each other, the

two firm agents will establish a connection.

It should be noted that since we use the Netlogo

platform to run our program, we define "close

enough" between the two firm agents as being in the

same patch.

Once the connection is established, the firm agent

that becomes a supporter can join the supporter

network and share the resources in the network.

When a firm agent no longer supports new

technology, the agent will quit the supporter network.

At this time, all the ties connected to this agent will

be broken.

Here we introduce a matrix 𝑒

for the linkage for

the network as the following

𝑒

=

1 𝑖𝑓 𝑖 𝑎𝑛𝑑 𝑗 𝑎𝑟𝑒 𝑙𝑖𝑛𝑘𝑒𝑑

0 𝑖𝑓 𝑖 𝑎𝑛𝑑 𝑗 𝑎𝑟𝑒 𝑛𝑜𝑡 𝑙𝑖𝑛𝑘𝑒𝑑

. (5)

When a connection is generated between firm 𝑖 and

firm 𝑗, 𝑒

is equal to 1, otherwise it is 0. And in each

turn of the simulations, we update 𝑒

first, then we

will calculate the other state variables.

Resource Sharing in Supporter Network

For each firm agent, we define the individual power

(𝐼

,

) as all its shareable resources related to the

new technology other than knowledge.

We assume that in a supporter network,

companies will share not only their knowledge, but

also their R&D and production experience. These are

essential to reduce the production costs of using new

technologies.

Therefore, we update the cost of using new

technologies in each round in the following way.

𝐶

,

=𝐶

,

−𝑐∙𝐼

,

−

𝑛∙

∑

𝑒

∙𝐼

,

+𝐼

,

,

,

(6)

where c and n are parameters that adjust the impact of

individual and aggregated powers, the latter of which

is defined as the sum of the individual power of two

endpoint of all ties, as shown in Eq. 6.

2.1.4 Learning Mechanism

We assume that the members of the supporter

network will share their knowledge ( 𝐾

,

) about

using the new technology with each other and thus

reduce the cost of using the new technology.

The learning mechanism mainly affects the

success rate of profitability after using the new

technology.

𝐾

,

=𝑟𝑎𝑛𝑑𝑜𝑚

𝐸𝑣𝑒𝑛𝑙𝑦 𝑑𝑖𝑠𝑡𝑟𝑖𝑏𝑢𝑡𝑒𝑑

𝐾

,

=𝐾

,

+𝜃𝐾

,

,

(7)

𝑅𝑠𝑘

=𝑅𝑠𝑘

−𝜀∙

∑

𝑒

∙

𝐾

,

+𝐾

,

,

, (8)

where 𝐾

,

represents the knowledge of firm 𝑖 at time

𝑡 , 𝑅𝑠𝑘

represents failure rate of using the new

technology to all the firm agents at time 𝑡, 𝜃 and 𝜀 are

the parameters that adjust the effect of 𝐾

,

.

ICAART 2023 - 15th International Conference on Agents and Artificial Intelligence

414

2.1.5 Technological Transition

Finally, we control the transformation of firm agent

to supporter and switcher by two conditions.

a) For the condition of whether to become a

supporter

𝑠𝑢𝑝

,

=

1 𝑖𝑓 𝑒𝑥

,

>𝑒𝑥

0 𝑖𝑓 𝑒𝑥

,

≤𝑒𝑥

, (9)

when 𝑠𝑢𝑝

,

=1,firm 𝑖 transformed into supporter.

b) For the judgment condition of whether to become

switcher

𝑠𝑤

,

=

1 𝑖𝑓 𝐸𝛱

,

≤0

0 𝑖𝑓 𝐸𝛱

,

>0

, (10)

when 𝑠𝑤

,

=1,firm 𝑖 transformed into switcher.

Firm agents are mainly active in 3 abstract spaces.

The first space where firm agents can randomly

roam is called activity space. Activity space

represents the abstract social network space rather

than geographic space.

When a firm agent becomes a supporter,

supporters can build a network. The networking

mechanism mainly controls this process. We assume

that when the distance between two agents satisfies

certain conditions, a connection based on social

relations of identification with the new technology

can be established between each other. This

connection allows both endpoints to share part of the

knowledge and information about the new technology.

At this point, the agents that meet the conditions to

join the supporter network enter the second layer of

Activity Space - Supporter.

When a firm agent satisfies the condition to

become a switcher, it can enter the third activity space

- Switcher from the first or second space.

2.1.6 Policy Tools

The policy tools in our model consist of two main

components: lobbying policy and subsidy policy.

Lobbying policy mainly controls the number of

another type of agent, the spreader agent. The

spreader agent is not involved in the production but

focuses on the diffusion of new technologies. It

represents the government's efforts to diffuse new

technologies in real life. When the Spreader agent

meets the firm agent, the spreader introduces and

promotes the new technology, while the

corresponding firm agent increases the understanding

and confidence in the new technology. The control of

lobbying policy in our model is mainly reflected in

the number of spreader agents. Our model’s number

of spreader agents increases as the government

invests more in lobbying policy. In turn, the

encounter probability between the firm agent and the

spreader agent is increased to achieve the effect of

propaganda and lobbying for the new technology.

Subsidy policy mainly controls the size of the

subsidy. As we explained in the previous section, a

subsidy policy is very important for a technology that

is not yet mature. However, the size of the subsidy

should be strictly controlled and reviewed. Too few

subsidies do little to help develop and sustain new

technologies, while too many subsidies can lead to

subsidy fraud. Such subsidy fraud consumes social

resources and may reduce the public's awareness and

enthusiasm for new technologies. Both are heavy

blows to the development of new technologies. How

to set the size of subsidies reasonably to guide the new

technology to maturity is precisely the problem we

want to solve.

3 RESULTS

Our main results have three parts. As we have

previously described, there is currently no accepted

definition of "subsidy" or "subsidy fraud" in the

academic community. In our model, we describe

subsidy fraud as an observable risk measure. It is

mainly described by the number of Supporters and

Switchers and their relationship with each other.

Our model theory builds on the multi-level

perspective (MLP) framework developed by Geels et

al. (2002, 2020).

MLP divides technology development into

horizontal directions representing the maturity and

diffusion of technology: Emergence stage, Diffusion

stage, and Reconfiguration stage, and vertical

directions representing the state of access to the

public and the degree of impact on social structures:

Niche innovations, Social-financial regime, and

Landscape development.

Thus, a mature technology should not only be

successful in the development and diffusion of the

technology itself but also profoundly impact public

perception and social structure.

Combined with our model, the number of

companies that become supporters and the number of

companies that become switchers are both high to be

considered a well-developed and booming

technology.

Under normal circumstances, a company should

first understand and see the new technology and then

try to use it for production. However, when a

technology has a high number of switchers with a low

An Agent-Based Model Study on Subsidy Fraud Risk in Technological Transition

415

Figure 2: The multi-level perspective on sustainability

transitions (Geels et al., 2020).

number of supporters, we consider the model

anomalous. In the actual numerical simulation, we

found that such anomalies occur steadily when the

size of the subsidy is more significant than specific

values. Therefore, we classify this situation as a

"description of the risk of subsidy fraud.” And due to

our model setup, the number of supporters and the

number of switchers are counted separately and do

not affect each other. So, when the number of

switchers in the model is steadily higher than the

number of supporters, we believe that the probability

of subsidy fraud is higher.

The values of all other parameters required in the

experiments are given in appendix.

3.1 The Critical Condition

3.1.1 Derive the Critical Value

For a firm who is making decision on the adoption of

the new technology, we assume that the higher the

expectation of the new technology, the higher

expectations of the profit, and the lower expectations

of the cost. This assumption means that 𝐸

𝑅

is

proportional to 𝑒𝑥

,

, and 𝐸𝐶

,

and 𝑒𝑥

,

are

inversely related with each other. From the model, it

can be seen that the conditions for firms to use the

new technology are as follow:

𝐸𝛱

,

=𝐸

𝑅

−𝐸𝐶

,

+𝑆𝑢𝑏𝑠𝑖𝑑𝑦

(11)

=𝑒𝑥

,

∙𝑅

−

1

𝑒𝑥

,

∙𝐶

,

+𝑆𝑢𝑏𝑠𝑖𝑑𝑦>0

Therefore:

𝑒𝑥

,

>

∙

∙

,

∙

≝𝑒𝑥

(12)

We can find three important conditions by

changing the size of subsidy (shown as in Table 1).

In our model, under normal circumstances, firms

go through three states: neutral, supporter, and

switcher, depending on their expectations of the new

technology and the benefits of using it, which

represent, respectively, "neutral attitude toward the

new technology". They represent, "supportive

attitude towards new technology", "using new

technology for production".

From Eq. 11 and Eq. 12, we set the condition of

the state variable 𝑒𝑥

,

that satisfies the condition of

making firm agent a switcher under the corresponding

subsidy policy as 𝐸

; the condition of the

parameter 𝑒𝑥

,

that satisfies the condition of making

firm agent a supporter as 𝐸

; the condition of the

parameter 𝑒𝑥

,

that satisfies the condition of making

firm agent a neutral as 𝐸

.

At this point, we can derive three important

boundary conditions based on the size of the subsidy

and the relationship between the condition of

becoming supporter and the condition of becoming

switcher.

At the initial stage, all the firm agents have a

neutral rather than supportive attitude to the new

technology.

1. when there is no subsidy policy, the boundary

condition that 𝑒𝑥

needs to satisfy is set 𝐸

.

2. when the condition of being switcher is weaker

than the condition of being supporter, the

boundary condition that 𝑒𝑥

needs to satisfy is

set to 𝐸

.

𝑒𝑥

≤𝐸

(13)

3. when the condition of becoming switcher is

weaker than the condition of becoming neutral,

the boundary condition to be satisfied by the 𝑒𝑥

is set to 𝐸

.

𝑒𝑥

≤𝐸

(14)

From Eq. 13 and 14, after substituting the

numerical calculation, we can get the critical size of

the subsidy as 20.8% and 125%, which are derived

from Eq. 12.

1. When 𝑆𝑢𝑏𝑠𝑖𝑑𝑦≤20.8%, the condition to

become a switcher is stronger than the condition

to become a supporter. In other words, the

prerequisite for becoming a switcher is to

become a supporter.

2. But when 𝑆𝑢𝑏𝑠𝑖𝑑𝑦>20.8%, the situation will

change, and the prerequisite is no longer

necessary. Because the government subsidies are

too solid, many firms are willing to try to use new

ICAART 2023 - 15th International Conference on Agents and Artificial Intelligence

416

technology for production even if they have not

yet become supporters of it.

3. When 𝑆𝑢𝑏𝑠𝑖𝑑𝑦>125% , the condition to

become a switcher is more vital than the

condition to become neutral. Regardless of the

attitude toward the new technology, all firm

agents will immediately switch to the new

technology because of the excessive subsidy.

In our paper, the subsidy rate is associated with

the cost. Therefore, we introduce two parameters 𝛽

and 𝛾 and set them to 20.8% and 125%, respectively.

And use a form like 𝛽∙𝐶

,

or 𝛾∙𝐶

,

to express the

size of the subsidy.

Table 1: Conditions to become a switcher.

Subsidy Size

Critical

expectation

for a switcher

Condition to

become a switcher

0

(

No subsid

y)

𝑒𝑥

≤𝐸

Stronger than to

b

ecome a supporte

r

>𝛽∙𝐶

,

𝑒𝑥

≤𝐸

Weaker than to

b

ecome a su

pp

orte

r

>𝛾∙𝐶

,

𝑒𝑥

≤𝐸

No condition to

b

ecome a switche

r

*

Condition to become a supporter: 𝑒𝑥

,

>0.75

Therefore, we believe that when the size of the

subsidy is between 0 and 𝛽∙𝐶

,

, the subsidy is

reasonable and the probability of subsidy fraud is

small; however, when the size of the subsidy is

between 𝛽∙𝐶

,

and 𝛾∙𝐶

,

, there is a high risk of

subsidy fraud due to unreasonable subsidy setting;

when the size of the subsidy is larger than 𝛾∙𝐶

,

, the

subsidy setting is exceptionally unreasonable, and

there is a very high risk of subsidy fraud.

3.2 Scenarios

It should be noted that for the development of the

technology, there are two important state variable in

our model, one is the number of supporter and the

other is the number of switcher. We describe

development of the technology diffusion by

comparing these two quantities. The development

rate of new technologies can be interpret as the rate

of which the number of supporter and switcher

approaches 100%. It is worth mentioning that the

same firm agent can be identified of both supporter

and switcher.

We believe that normally a company should

understand a technology and become a proponent of

the new technology before it may decide to use it.

Therefore for the case of skipping the supporter stage

and becoming a direct switcher, we believe that the

risk of subsidy fraud would be high. We will define

the following three scenarios for development of

technology diffusion in order to discuss the risk of the

subsidy fraud respectively.

3.2.1 Success Diffusion (SD) Scenario

When the number of supporter is more than the

number of switcher, both of them increase rapidly.

This means that the development of the new

technology is good. Eventually both are close to

100%, then it means that the development of the new

technology is successful. This development pattern is

the best quality pattern. Therefore, we define this

scenario as SD Scenario, which means the success

diffusion scenario.

3.2.2 Failure Diffusion & Low Risk (FDLR)

Scenario

When the number of supporter is more than the

number of switcher, both of them increase rapidly.

But eventually both are less than 100%, or the number

of switcher is less than 100%, then it means that the

development of new technology is not very successful.

Improved policies are needed to stimulate the

proliferation and development of new technologies.

However, the probability of subsidy fraud in this

development model is low, because most firm agents

become supporter first and then switcher. Therefore,

we define this scenario as FDLR Scenario, which

means the failure diffusion and low subsidy fraud risk

scenario.

3.2.3 Failure Diffusion & High Risk (FDHR)

Scenario

In some cases, when the number of switcher is

significantly more than the number of supporter, it is

thought that the way of development is not very

healthy. There are a large number of companies that

do not understand the new technology that are using

it in exchange for subsidies, and at this point we

believe that there is a higher risk of subsidy fraud.

Therefore, we define this scenario as FDHR Scenario,

which means the failure diffusion and high subsidy

fraud risk scenario.

3.3 Numerical Experiments

In this subsection, we conduct numerical experiments

for the critical values derived in the previous

subsection. Our model is based on the Netlogo

platform, and each experiment is generated by

running a population of N = 100 firms located on a 32

An Agent-Based Model Study on Subsidy Fraud Risk in Technological Transition

417

× 32 grid. Each experiment will consist of 2600 time-

steps to simulate the evolution of a company that

makes technology decisions once a week for

approximately 50 years. Because even based on the

same parameter settings, the model is still affected by

random factors. As a result, we plot the average of

100 experiments under the same initial conditions. In

this way, we can eliminate the influence of random

factors as much as possible and further ensure the

stability of our results. The following is an analysis of

the figure results.

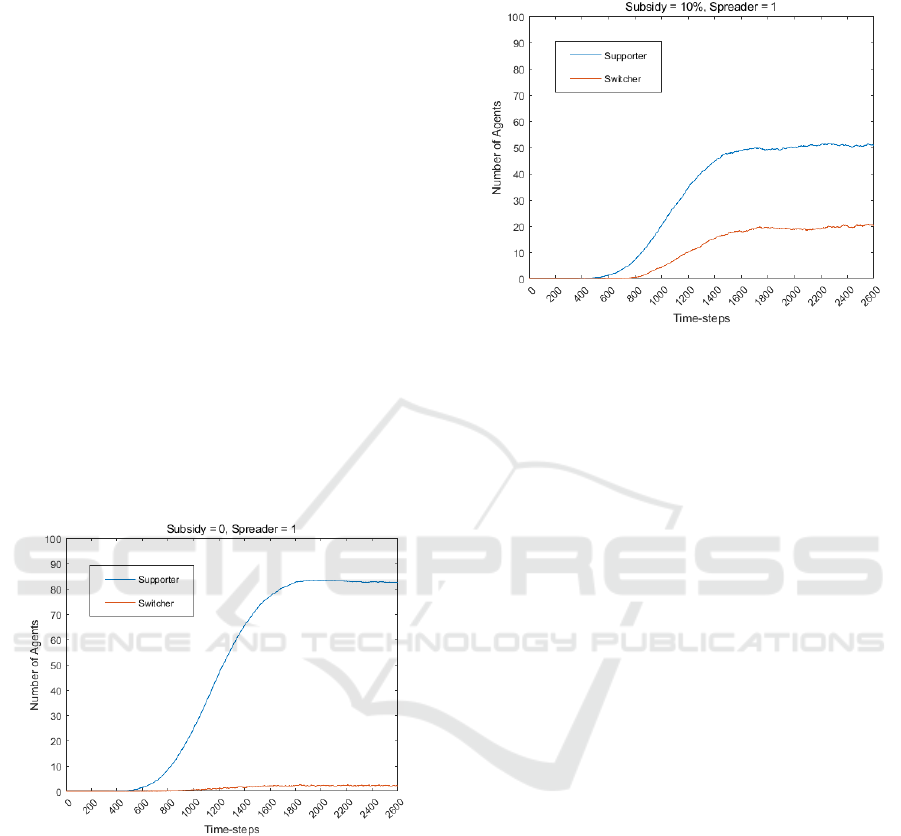

3.3.1 No Subsidy Policy

In the first scenario, the government adopts a policy

of no subsidy rates, which is equal to 0 (Subsidy =

0%).

As shown in Fig 3, we can see that the technology

diffusion development is very smooth, and the

number of supporters is going up until it is smooth.

However, technology development only takes off

because of the lack of policy support. Finally, the

number of switchers is low.

This is a typical FDLR scenario. We name this

scenario the FDLR scenario

Ⅰ

Figure 3: The numerical experiment of FDLR scenario Ⅰ

0 - 2600 time-steps: Subsidy = 0 , Spreader = 1.

3.3.2 Low Risk Range of Subsidy Fraud

In the second scenario, the government adopts a

policy of low subsidy rates, which is between 0 and

𝛽∙𝐶

,

(Subsidy = 10%).

As shown in Fig 4, we can see that the technology

is developing more rapidly than in the first case; the

number of supporters is increasing until it plateaus.

The number of final switchers has increased because

of sufficient policy support. This also means that the

risk of subsidy fraud is low at this scenario.

This is also a kind of FDLR scenario. We name

this scenario the FDLR scenario

Ⅱ

Figure 4: The numerical experiment of FDLR scenario Ⅱ

0 - 2600 time-steps: Subsidy = 10% , Spreader = 1.

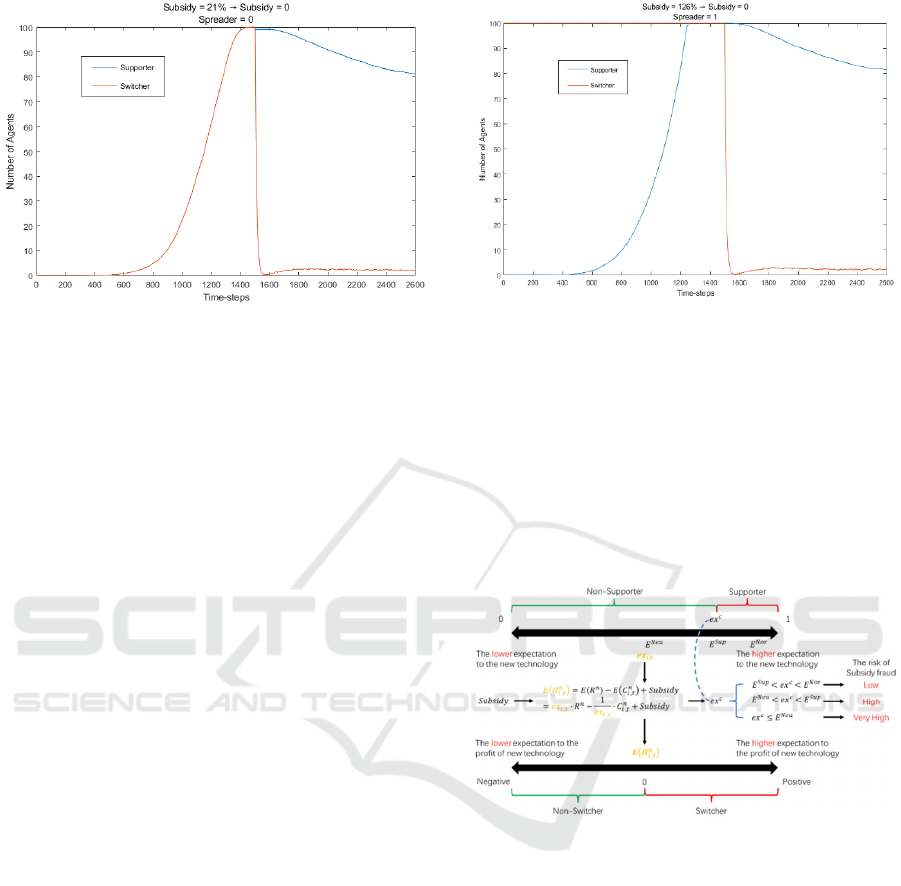

3.3.3 Middle Risk Range of Subsidy Fraud

In the third scenario, the government adopts a policy

of high subsidy rates, which is between 𝛽∙𝐶

,

and 𝛾∙

𝐶

,

(Subsidy = 21%).

This case has been described in detail in our

previous study (Yang et al., 2021). When the subsidy

rate is set between Critical value Ⅱ and Critical value

Ⅲ, As shown in Fig 5, the number of supporters and

switchers increases rapidly to 100%. However, this

situation holds only when the subsidy policy is

maintained. If we remove the subsidy policy, the

number of switchers immediately returns to the state

when it is not subsidized. This represents a complete

policy failure, consuming a large amount of revenue

without really generating the goal of promoting the

diffusion and development of new technologies.

At this point we consider the risk of subsidy fraud

to be slightly higher. The reason is that after the

subsidy is removed, the firm agent abandons the new

technology in large numbers. The utilization rate of

the new technology has dropped to almost single

digits. So this development model we think is an

unhealthy way of development.

This is also a kind of FDHR scenario. We name

this scenario the FDHR scenario

Ⅰ

ICAART 2023 - 15th International Conference on Agents and Artificial Intelligence

418

Figure 5: The numerical experiment of FDHR scenario Ⅰ

0 - 1500 time-steps: Subsidy = 21% , Spreader = 1 ;

1500 - 2600 time-steps: Subsidy = 0 , Spreader = 1.

3.3.4 High Risk Range of Subsidy Fraud

In the fourth scenario, the government adopts a policy

of super high subsidy rates, which is bigger than 𝛾∙

𝐶

,

(Subsidy = 126%).

In another numerical experiment, we find that if

the subsidy amount exceeds 125%, all firms will

instantly become switchers. Then, as time increases,

every firm will gradually become a supporter, and the

market becomes steady. However, after it, if we

cancel the subsidy, we can find that the proportion of

switchers has decreased to single digits in a short

period, and the proportion of supporters has

continued to decrease until it stabilizes at around

80%, see the details in Fig. 6.

In the end, it is consistent with the previous case

and returns to the steady state under the same

parameter setting. This also means the complete

failure of the policy.

At this point we believe that almost all the firm

agents in the market are using new technologies for

the sake of subsidies. Too strong subsidy policy, so

that those who were in a neutral attitude, but also

directly began to use the new technology. It is a very

unhealthy way of development.

This is a typical FDHR scenario. We name this

scenario the FDHR scenario

Ⅱ.

3.4 Mechanism and Principal Analysis

We have organized the mechanism of the model and

obtained the following mechanism diagram of the

model. As shown in Fig 7.

Regarding how the firm agent converts to

supporter or switcher, it is mainly influenced by the

parameters 𝑒𝑥

,

and 𝐸𝛱

,

, respectively. And the

Figure 6: The numerical experiment of FDHR scenario Ⅱ

0 - 1500 time-steps: Subsidy = 126% , Spreader = 1 ;

1500 - 2600 time-steps: Subsidy = 0 , Spreader = 1.

subsidy fraud risk of the firm agent in the model

system is mainly controlled by the magnitude of the

variable 𝑒𝑥

.

According to our previous conclusion, the risk of

subsidy fraud can be minimized at the source when

the following conditions are satisfied.

𝐸

𝑒𝑥

𝐸

(5)

Figure 7: Mechanism diagram of the model.

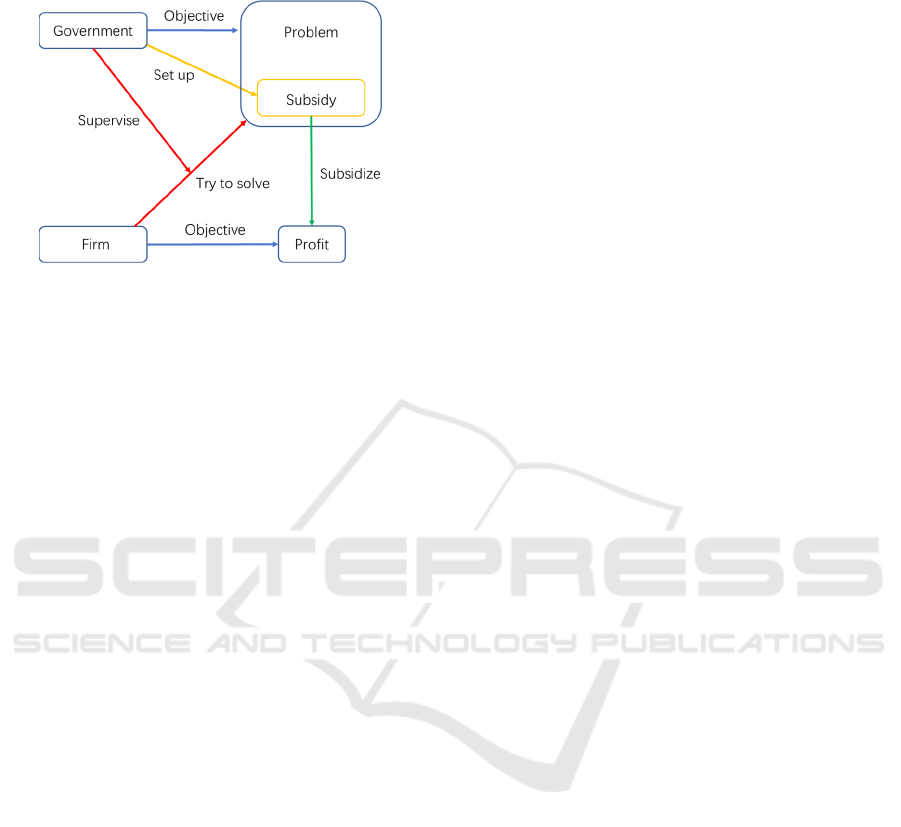

Moreover, this leads to another question: why are

subsidies less likely to be fraudulent when they are in

this range?

In conjunction with Fig 7. we try to shed light on

the fundamental mechanisms of subsidies. As shown

in Fig 8., we illustrate the principles and linkages of

the actions of the designed stakeholders in the subsidy

policy.

The government’s main objective is to solve a

problem, which may be developing a specific

industry or technology. The solution to this problem

requires the assistance of a firm in the relevant

industry. On the other hand, for a firm, the only

concern is profit, so in order to attract the firm to solve

the problem, the essence of the government's subsidy

policy is to create a related subsidiary for the problem

An Agent-Based Model Study on Subsidy Fraud Risk in Technological Transition

419

and subsidize all the firms that try to solve the

problem.

Figure 8: Principles of action and linkages of designed

stakeholders in the subsidy policy.

The two parties' actions were divergent from the

beginning. On the one hand, the company must try to

show the government that it is solving the problem in

order to get the subsidy in order to deal with

government regulation; on the other hand, the

objective of the firm has always been to get more

subsidies rather than to help the government solve the

problem, so the company side is always motivated to

cheat the policy regulation.

When subsidies are small relative to production or

R&D costs, the firm is more inclined to obtain

subsidies through formal channels than to be

punished if it is found to be a subsidy fraud. Although

the purpose of the firm attracted at this point is often

more in line with the government's aspirations, it is

relatively less attractive to the firm as a whole.

The cost of concealing government regulation can

be covered by the number of subsidies obtained when

the amount of subsidies assumed is more significant

than a particular threshold value. At this point, the

subsidy policy will be more attractive for many

companies. Moreover, when subsidies increase

further, the incentive to commit subsidy fraud will be

more than sufficient. This can lead to tragedy, as in

the case of the 2004 subsidy fraud by a Norwegian

ferry operator (J⊘ rgensen F et al., 2010) and the 2016

subsidy fraud by 20 new energy vehicle companies in

China (Wang et al., 2022).

4 CONCLUSIONS

Subsidy policy, the central policy used by

governments to support innovative industries in

modern society, is a critical factor in promoting

innovation in a country. It stimulates the diffusion and

development of new technologies by providing

tangible financial support to companies that adopt

them. However, often the objectives of firms and

governments do not precisely coincide. When

governments use subsidy policies as a stimulus, firms

that engage in fraud targeting specifically for

subsidies can also arise. As Goodhart's law says,

"When a measure becomes a target, it ceases to be a

good measure.” When companies make access to

subsidies their target, the subsidy policy is no longer

as perfect as it was designed.

Although subsidy fraud may be unavoidable, we

can still design subsidy policies to reduce the risk of

subsidy fraud. Based on such a viewpoint, this paper

attempts to present a quantitative approach to assess

the risk of subsidy policies.

In this study, firstly, we review the literature on

subsidy and subsidy fraud concepts and define these

two concepts in a clearer manner. After that, we

analyze the agent-based model designed on the basis

of MLP mathematically, from which we find the three

critical values of subsidy rates in the theoretical

model. Lastly, four different scenarios designated by

different ranges of subsidy rate, that are separated the

three critical points, are simulated numerically. From

the numerical experiments, we do find a specific

range of subsidy rates, that the size of the subsidy

should be less than 20.8% of the cost in our model,

relative to the production cost which can effectively

reduce the risk of criminal behaviours.

Also, we analysed the mechanism behind

different behaviours of the model. We identified in

the diagram showing the work of various factors (Fig.

8), the most related stakeholders in the subsidy policy.

Indeed we find that subsidy fraud is almost

unavoidable in emerging technology fields where

subsidy policies exist. In the meantime, we believe

that we can continue to explore the causes of subsidy

fraud based on the diagram in the future, which may

bring about a breaking through in the field.

REFERENCES

Lopolito, Antonio, Piergiuseppe Morone, and Richard

Taylor. An agent-based model approach to innovation

niche creation in sociotechnical transition pathways.

Economics Bulletin 31.2 (2011): 1780- 1792.

Lopolito, Antonio, Piergiuseppe Morone, and Roberta Sisto.

Innovation niches and socio-technical transition: A case

study of bio-refinery production. Futures 43.1 (2011):

27-38

Lopolito, Antonio, Piergiuseppe Morone, and Richard

Taylor. Emerging innovation niches: An agent-based

model. Research Policy 42.6-7 (2013): 1225-1238.

ICAART 2023 - 15th International Conference on Agents and Artificial Intelligence

420

Morone P, Lopolito A. Socio-technical transition pathways

and social networks: a toolkit for empirical innovation

studies[J]. Economics Bulletin, 2010, 30(4): 2720–

2731.

Victor, D., Geels, F. and Sharpe, S. Accelerating the low

carbon transition the case for more robust, more

targeted and coordinated international action. (2019).

[online] Available at: http://www.energytransitions.

org/sites/default/files/Accelerating-

TheTransitions_Report.pdf [Accessed 21 Jan. 2020]

Geels F W. Technological transitions as evolutionary

reconfiguration processes: a multi-level perspective and

a case study. Research Policy, 2002, 31(8-9): 1257–

1274.

Yang H, Wu X, Zhao S, et al. An Agent-based Model Study

on Subsidy Fraud in Technological Transition[C]//

ICAART (1). 2022: 353–358.

World Trade Organisation (1999), The results of the

Uruguay Round of Multilateral Trade Negotiations:

The Legal Texts, Geneva

Steenblik R. Subsidy measurement and classification:

developing a common framework[J]. Environmentally

harmful subsidies: policy issues and challenges, 2003:

101.

The Economics of Federal Subsidy Programs: A

Compendium of Papers[M]. US Government Printing

Office, 1972.

Fedeli S, Forte F. Models of cross-border VAT fraud[J].

2009.

Allingham M G, Sandmo A. Income tax evasion: A

theoretical analysis[J]. Journal of public economics,

1972, 1(3-4): 323–338.

Wang Z, Li X, Xue X, et al. More government subsidies,

more green innovation? The evidence from Chinese

new energy vehicle enterprises[J]. Renewable Energy,

2022, 197: 11-21.

J⊘ rgensen F, Mathisen T A. Using standardized revenue

and cost norm analyses to reveal subsidy fraud in

contracted public transport services[J]. Transport

Reviews, 2010, 30(3): 299-313.

Prichard W, Cobham A, Goodall A. The ICTD government

revenue dataset[J]. 2014.

Chica M, Hernández J M, Manrique-de-Lara-Penate C, et

al. An evolutionary game model for understanding

fraud in consumption taxes [research frontier][J]. IEEE

Computational Intelligence Magazine, 2021, 16(2): 62–

76.

Traxler C. Social norms and conditional cooperative

taxpayers[J]. European Journal of Political Economy,

2010, 26(1): 89–103.

APPENDIX

Table 1: Parameter setting.

Type Denotation Valuation Type Denotation Valuation

𝐺𝑙𝑜𝑏𝑎𝑙

𝑁𝐸 0.75

𝐺𝑙𝑜𝑏𝑎𝑙

𝑝

0.5

𝜂 0.02 𝑅𝑠𝑘

1−𝑝

𝜋 0.001 𝐶𝑒𝑥

0.5

𝑛 0.01

𝑐 0.01

𝜃 0.025

𝐹𝑖𝑟𝑚 𝑖

𝑒𝑥

,

0.5

𝜐 2 𝐼

[0, 0.3]

𝑆𝑢𝑏𝑠𝑖𝑑𝑦 0 𝐾

,

[0, 0.01]

𝑅

1.5 𝐶𝑛

,

0.5

An Agent-Based Model Study on Subsidy Fraud Risk in Technological Transition

421