Top-Funded Digital Health Companies Offering Services for Type-1

Diabetes Patients: Business Models and Scalability Considerations

Marc-Robin Gruener

3a

, Jessica Rebecca Helbling

1b

, Hyungmin Koh

1c

, Victoire Stalder

1d

and Tobias Kowatsch

2,3,4 e

1

University of St. Gallen, St. Gallen, Switzerland

2

Institute for Implementation Science in Health Care, University of Zurich, Zurich, Switzerland

3

School of Medicine, University of St. Gallen, St. Gallen, Switzerland

4

Centre for Digital Health Interventions, Department of Management, Technology, and Economics at ETH Zurich,

Zurich, Switzerland

Keywords: Business Models, Digital Health Companies, Funding, Healthcare, Scalability, Type 1 Diabetes.

Abstract: This paper aims to assess how the top-funded digital health companies in T1DM can create value for

customers and which implications this has in terms of scalability. Med tech companies, academia, and

policymakers should be able to make better strategic decisions based on the findings provided. Companies

were identified using a leading venture capital database, PitchBook. Our analysis revealed that 50% of the

thirty top-funded companies pursue a Layer Player strategy to generate value for T1DM patients. We

recommend that companies in T1DM focus more on automated services such as conversational agents to

improve scalability. In terms of scalability, many companies have room for improvement by increasingly

relying on automated services, among other things.

1 INTRODUCTION

Diabetes Mellitus (DM) is a chronic, non-

communicable metabolic disease, characterized by

hyperglycaemia. The disease either occurs because

the pancreas cannot produce the required amount of

insulin, or the insulin cannot be efficiently used by the

body (WHO, 2022; American Diabetes Association,

2014). Currently, 422 million people worldwide are

affected by diabetes, with 1.5 million deaths each

year due to the disease or its sequelae (WHO, 2022).

Retinopathy, nephropathy, neuropathy, renal failure,

heart attacks, and strokes are only some sequelae of

diabetes (Kulzer, 2022; American Diabetes

Association, 2014).

Type I DM (T1DM) is a non-curable and non-

preventable diabetes variant, affecting 9 million

people worldwide (JDFR, 2022, WHO, 2022;

International Diabetes Federation, 2020).

Specifically, T1DM is an autoimmune reaction where

a

https://orcid.org/0000-0001-5133-0227

b

https://orcid.org/0000-0001-5576-724X

c

https://orcid.org/0000-0003-1630-2532

d

https://orcid.org/0000-0002-1588-6110

e

https://orcid.org/0000-0001-5939-4145

the body’s defense system attacks insulin-producing

cells (β-cells of the pancreas) (American Diabetes

Association, 2014). The exact causes are yet

unknown; however, it is assumed that both genetic

and environmental factors have an influence

(International Diabetes Federation, 2020). T1DM can

occur at any age, with the highest incidence in

children and adolescents. In addition to symptoms

such as thirst, frequent urination, weight loss, fatigue,

and blurred vision, those affected will die if they do

not have access to insulin (WHO, 2022; International

Diabetes Federation, 2020). The quality of life of

those affected by DM is severely limited. Studies

estimate that an affected person loses an average of

32 years of healthy life due to the disease (JDRF,

2022). To improve the situation, those affected must

be diagnosed as early as possible and access to

sufficient treatment must be ensured. In addition,

further research is needed regarding prevention and

cures (JDRF, 2022). To make T1DM more

Gruener, M., Helbling, J., Koh, H., Stalder, V. and Kowatsch, T.

Top-Funded Digital Health Companies Offering Services for Type-1 Diabetes Patients: Business Models and Scalability Considerations.

DOI: 10.5220/0011777300003414

In Proceedings of the 16th International Joint Conference on Biomedical Engineering Systems and Technologies (BIOSTEC 2023) - Volume 5: HEALTHINF, pages 603-608

ISBN: 978-989-758-631-6; ISSN: 2184-4305

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

603

manageable, technologies are becoming increasingly

important (Aitken, Clancy & Nass, 2017). Whereas in

the past glucose levels were determined by blood

samples with a syringe (IQWiG, 2021), scalable

solutions have created new possibilities. Currently,

partial closed-loop systems, where the basal insulin

therapy and the pre-prandial delivery of bolus insulin

are controlled automatically, are state-of-the-art.

Depending on the degree of automation, these devices

are often referred to as artificial pancreas or (hybrid-

) closed-loop systems (Boughton & Hovorka, 2019).

One of the pioneering companies in this area was

Medtronic, which launched the first FDA-approved

device in October 2016 (Dreyer, 2019).

To provide such a system, various devices must

be connected, such as insulin pumps, glucose sensors,

mobile applications, etc.). In this context, software

applications are becoming increasingly important for

two reasons. First, the real-time data collection and

analysis. Second, the improved interaction between

physicians and patients is made possible (Dreyer,

2019). Attention should be paid to the results of

studies that have shown that in the complex and

fragmented healthcare industry, it is difficult to

provide a holistic system of high quality as a stand-

alone company. Consequently, partnerships and

ecosystem strategies increasingly seek to deliver

superior patient value (Krause & Schnitzler, 2021,

Choueiri et al., 2020).

In a system like this, individual companies must

consider which business model is most promising for

them. Scale-up of digital innovations in healthcare is

vital to achieving population-wide impact. Therefore,

this paper systematically assesses the business

models of top-funded digital health companies

offering services to T1DM patients. The objective of

this paper is to assess how the top-funded companies

in T1DM can create value for customers and which

implications this has in terms of scalability. Med tech

companies, academia, and policymakers should be

able to make better strategic decisions based on the

findings provided. The analysis of the value creation

of these companies will furthermore give insights into

their main revenue streams.

2 METHODS

2.1 Databases and Companies

We set out to investigate the business model of top-

funded digital health companies globally focusing on

T1DM. These companies were searched using

primarily PitchBook, a comprehensive venture

capital database used commonly by academics and

investors (Retterath & Braun, 2020).

2.1.1 Search Rationale

The search terms were entered into PitchBook to

identify companies that were relevant to the field of

digital health in T1DM. At first, we identified the 10

top-funded companies in T1DM and screened all the

relevant keywords. Second, we eliminated all the

duplicate words and selected terms that focus on the

digitalization of glucose monitoring in T1DM.

Moreover, we only selected companies that received

funding in the last five years to understand the current

state of the art and to focus only on attractive

investment opportunities for potential investors. An

overview of the complete keyword search strategy for

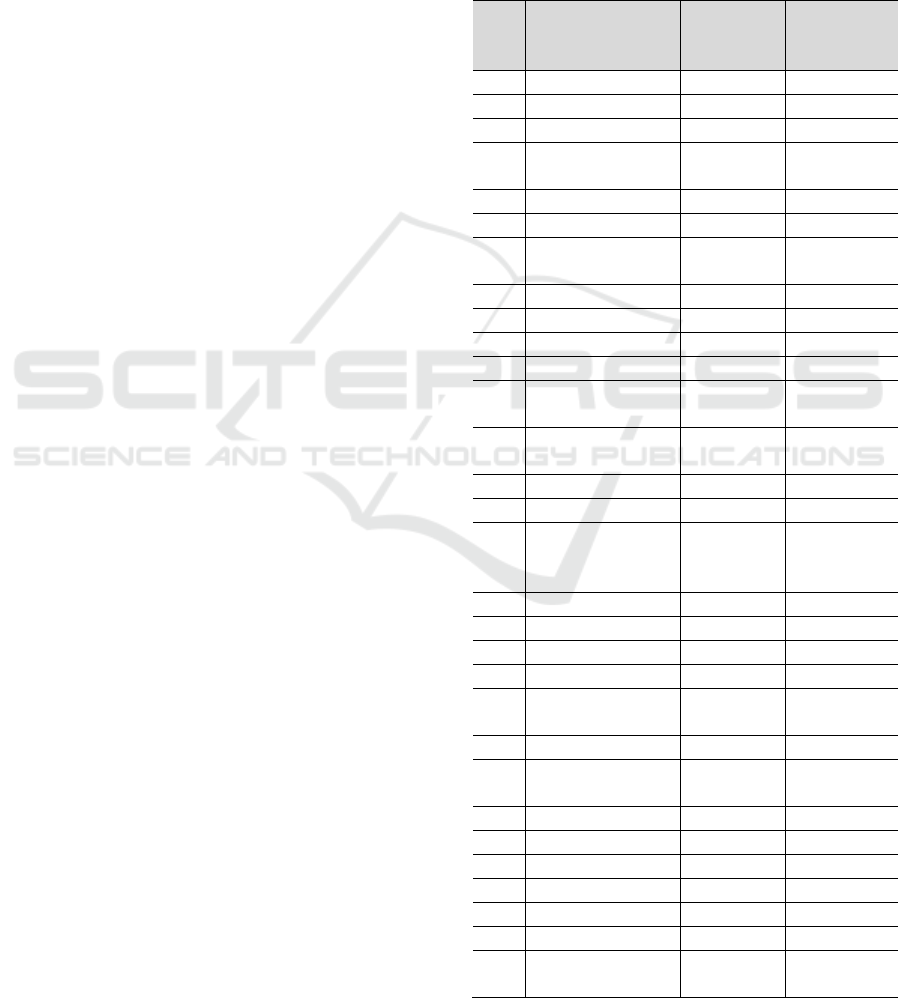

Pitchbook is shown in Table 1.

Table 1: The search strategy used in Pitchbook.

Search

category

Search terms

Industries,

Verticals &

Keywords

(glucose level management OR

glucose level monitoring OR

diabetes management OR

diabetes management system

OR type 1 diabetes monitoring

OR glucose monitoring OR

remote monitoring system OR

insulin delivery OR diabetes

care OR bionics pancreas OR

type 1 diabetes treatment OR

managing diabetes) AND

(Digital Health OR HealthTech)

2.1.2 Selection Criteria

Our main goal was to include only companies focused

on technology-based digital health innovation. A

filter to include companies that received at least a

Series A financing was also applied when searching

in PitchBook. In addition, we mainly focused on

companies that are privately held and have completed

an acquisition or merger. We also included

companies from Asia such as China and South Korea

as they met our search criteria.

Companies were excluded if their intervention (1)

did not focus on patients; (2) were offering mainly

T2DM solutions; (3) did not involve a digital solution

as the main intervention component; and (4) did not

receive funding within the last five years.

Scale-IT-up 2023 - Workshop on Best Practices for Scaling-Up Digital Innovations in Healthcare

604

2.1.3 Selection Process

Our first iteration of data on PitchBook and

Crunchbase revealed a lack of filtering between start-

ups focusing on type 1 & 2 diabetes. Due to the large

number of companies focusing on T2DM, we decided

to search for the top-funded T1DM companies and

select all the relevant keywords that were shown in

the search result of PitchBook. We then gathered all

the keywords and listed them.

115 companies in total were retrieved through our

search strategy using Pitchbook. Duplicate keywords

were removed, and the final list of companies was

validated on the premise of our clustering criteria.

Namely, digital health startups that offer digitized

T1DM solutions. We then analyzed the website of the

companies by reviewing their business models,

focusing mostly on the keywords T1DM and digital

health. After the comparison of our results, a

consensus was reached.

2.2 Digital Health Intervention

The companies analyzed in this paper exhibit

different levels of maturity in terms of digital health

intervention.

Some companies are increasingly focused on

monitoring using glucose sensors or smartwatches.

Besides, other companies are more concerned about

the prediction of blood glucose levels. Finally, there

are also companies focusing mainly on hardware

(e.g., insulin pumps) and “only” complement this

with digital aspects.

Depending on their focus, the scalability of those

firms can diverge. Their business models are

analyzed before important aspects of scalability are

discussed.

2.3 Business Model

With the help of business models, a company can be

described holistically. The business model describes

how a company creates, delivers, and captures value.

Specifically, four questions are answered: Who is the

target customer (who), what is the value proposition

the company offers to the target customer (what), how

does the value chain look like (how) and why does the

company generate money (why) (Gassmann,

Frankenberger, Choudury & Csik, 2020). With this,

both external aspects (who and what), as well as

internal aspects (how and why) of the business model,

are considered.

3 RESULTS

We analyzed the 30 top-funded companies from 115

companies extracted from Pitchbook that met our

inclusion and exclusion criteria. The overview of the

30 top-funded digital health companies in the

treatment of T1DM can be seen in Table 2.

Table 2: 30 top-funded companies by rank with funding

amount to date and the last date of funding.

Nr.

Top-funded

companies

Funding

amount

to date

Last date

of funding

1 Livongo $592.24M 30.10.2020

2 Intuity Medical $412.65M 24.05.2021

3 Glooko $331.3M n/a

4 Bigfoot

Biomedical

$212M n/a

5 Vivacheck $133.92M 25.11.2021

6 Diabeloop $130.01M 02.06.2022

7 MicroTech

Medical

$120.71M 19.10.2021

8 Sibionics $109.11M 21.01.2022

9 Kaleido $95.56M 16.12.2021

10 OneDrop $89.83M n/a

11 BlueSemi $69.43M 27.10.2021

12 Metronom

Health

$54.99M 23.12.2020

13 Companion

Medical

$48.32M n/a

14 GlucoModicum $33.53M 29.10.2021

15 Medtrum $28.96M 24.12.2018

16 Zhejiang

POCTech

Medical

$18.87M 02.09.2021

17 Orpyx $18.5M 08.07.2020

18 Provigate $14.8M 08.07.2021

19 DiaMonTech $13.29M 18.02.2022

20 Dr. Diary $12.25M 02.03.2022

21

Izhangkong (via

Online Doctor)

$12.12M n/a

22 Health2Sync $10.5M 05.12.2017

23

Pops Diabetes

Care

$10.22M 27.07.2022

24 Glucovation $9.25M 10.04.2017

25 GHA Medical $7.64M 25.04.2021

26 GlucoseZone $7.33M 01.08.2020

27 Mellitus Health $7M n/a

28 Emperra $6.7M n/a

29 Hedia $6.62M 23.12.2021

30

DreaMed

Diabetes

$6.51M 18.09.2017

Top-Funded Digital Health Companies Offering Services for Type-1 Diabetes Patients: Business Models and Scalability Considerations

605

3.1 Layer Player as Main Value

Creation Architecture Strategy

An important part of all the analyzed companies’

value is generated by the possible transmission of

information between software and hardware, making

it thus possible to achieve the so-called closed-loop

system. To do so, the companies use different value-

creation architecture strategies. Our analysis revealed

that 50% of the thirty top-funded companies pursue a

Layer Player strategy, meaning that they focus only

on a specific step of the industry value chain.

Consequently, these companies are highly specialized

(e.g., sensor manufacturers) (Gassmann et al., 2020).

Besides, 23% of the companies follow an

Orchestrator and 20% an Integrator strategy. While

Orchestrators combine various external products and

services to create superior added value, Integrators

cover the entire value chain independently

(Gassmann et al., 2020). Finally, 7% of the

companies cannot be assigned to one of the three

value-creation architecture strategies unequivocally.

Since Layer Players and Orchestrators do not

cover the entire value chain independently, most of

them develop services and products that are

compatible with those of other companies. For

example, the companies studied that focus on

developing a mobile application usually partner with

external hardware manufacturers to ensure that the

information collected by their sensors can be

integrated into the mobile application.

In comparison, Integrators focus on developing a

unique solution and in this way prevent any

interoperability between them and the competition.

This is known as Lock-In and helps companies retain

their customers, as they face significant costs or

penalties if they switch to a competitor (Gassmann et

al., 2020).

3.2 Multiple Services Generated

through Sensor as a Service

Among all the business strategies identified in the

companies, the Sensor as a Service is the most used

one (16 companies out of 30). Thus, the connection

between the physical and digital world enabled by the

closed-loop system helps companies to offer new

services based on the data collected and processed. In

fact, in addition to the main value of this system,

namely automatic insulin monitoring, the companies

analyzed offer several complementary services that

create additional value for the main stakeholders. One

of the most common offerings identified in the

business models is real-time data insights that are

then displayed in an app. This not only provides

patients with insight into their current diabetes status

but also provides tools that help clinicians provide

individualized, proactive management of their

patients remotely. Another service that is growing

from the data collected is the insulin delivery system,

which automatically places an order for the patient if

new insulin is needed.

Sensor as a Service also includes new offerings

that can be made in the respective IoT ecosystem,

allowing companies to generate an alternative

revenue stream with additional stakeholders

(Gassmann et al., 2020). This comes close to the

strategy of Leveraging Customer Data. For example,

some of the identified companies sell their data to

research labs or other research-oriented organizations

as an alternative revenue stream. Depending on

national data privacy laws, this additional service is

forbidden in some countries.

3.3 Subscription as the Main Revenue

Stream

Regarding revenue streams, it should be noted that

they differ from country to country. Therefore, it is

hardly possible to make a general statement.

Nevertheless, there is a trend towards subscription

since T1 diabetics rely on the systems for the rest of

their lives. In other words, monthly or annual fees are

charged to use the services. Thereby, the company

benefits from a steady income stream (Gassmann et

al., 2020). In addition, companies with app-based

products try to be profitable by employing a

freemium model. In this case, the basic service is

offered free of charge to attract potential customers.

However, fees are charged to be able to use the whole

offering (Gassmann et al., 2020). Some companies

follow a similar strategy, where the main product is

not offered for free but at a low price, and the money

is earned with additional services (Add on)

(Gassmann et al., 2020).

4 DISCUSSIONS

Our systematic analysis of the business models,

according to the work of Gassmann et al.,

implemented by the 30 top-funded T1DM companies

showed that 14 business model strategies were

applied to a significant extent. We observed very

limited diversity in terms of value-capturing

mechanisms as most companies focus on the

Subscription-Pattern. One potential reason is the high

degree of regulation of the healthcare industry which

Scale-IT-up 2023 - Workshop on Best Practices for Scaling-Up Digital Innovations in Healthcare

606

in the past has led to companies in the field taking

advantage of “lucrative rights to exclude

competitors” (Eisenberg et al., 2017) and no incentive

to adjust their value-capturing mechanisms.

Additionally, due to the often high offer and

environmental risks associated with medical product

innovation, reducing the financial viability risk by

implementing established value-capturing

mechanisms reduces the overall risk exposure of the

companies (Brillinger et al., 2020)

The complexity of T1DM, especially in children

and adolescents (Desmangles, 2008), is also

represented in our sample of companies. The fact that

50% of companies can be classified as a Layer Player

and 23% as an Orchestrator, compared to only 20%

as an Integrator supports the conclusion that most

companies focus on a specific aspect of treatment

(e.g., glucose measurement or insulin injections), and

work together with a closely-knit network of industry

partners, research institutions and experts to offer a

complete value proposition to patients.

While all the companies included in this study

offered at least one digital health service, some of

these are enabled by a hardware component offered

by the company (e.g., Bigfoot Biomedical’s smart

insulin pens). Companies offering medical devices

have very different cost structures, risk-reward-

profiles, and business models compared to biopharma

or tech companies (Steinberg et al., 2015). This also

has implications for the scalability of the solutions

offered. Even established companies in the medical

device industry such as Abbott, Inc., have been hit

hard by supply chain disruptions in recent years

(Reuter, 2022). At the same time, many companies

offering digital health solutions are not yet taking

advantage of highly scalable solutions such as

conversational agents but often relying on human

operators (Keller et al., 2021).

Therefore, we recommend that companies in

T1DM focus more on automated services such as

conversational agents to improve scalability. As a

result, the company’s performance can be increased,

which in turn can lead to higher funding.

5 LIMITATIONS

In our search for companies, we found few T1DM

companies in regions other than North America, as

we focused on the 30 best-funded companies. Indeed,

the results show that the majority of the capital is in

North America. In further research, it might be useful

to evaluate more companies and use several databases

and not focus only on the best-funded firms to avoid

this financial and geographical bias.

In our analysis of the business models, we focused

primarily on the main strategies that we could find on

the companies' websites. Nevertheless, each company

has its own specificities in terms of how it creates and

captures value. Future analysis of these specifics will

be useful to better understand how services for T1DM

patients can be improved and made scalable.

Finally, we did not include information on health

outcomes or the users’ experiences in our analysis. By

addressing these aspects in further research, the

benefits of digital health interventions, as well as the

correlation to its business model, can be evaluated in

more depth.

6 CONCLUSIONS

This paper aimed to assess how the top-funded digital

health companies in T1DM can create value for

customers and which implications this has in terms of

scalability. Top-funded companies in T1DM exhibit

different business models and scaling capabilities. In

the sample, companies pursuing a layer player

strategy, focusing on sensor technology, and using a

subscription model are most common Our findings

suggest that 50% of the thirty top-funded companies

pursue a Layer Player strategy to generate value for

T1DM patients. In terms of scalability, many

companies have room for improvement by

increasingly relying on automated services, among

other things.

CONFLICTS OF INTEREST

T.K. is affiliated with the Centre for Digital Health

Interventions (CDHI), a joint initiative of the Institute

for Implementation Science in Health Care,

University of Zurich; the Department of

Management, Technology, and Economics at the

Swiss Federal Institute of Technology in Zurich; and

the Institute of Technology Management and School

of Medicine at the University of St Gallen. CDHI is

funded in part by the Swiss health insurer CSS. CSS

was not involved in the design, data collection,

analysis, or interpretation of the results of this study.

T.K. is a co-founder of Pathmate Technologies, a

university spin-off company that creates and delivers

digital clinical pathways. However, Pathmate

Technologies was not involved in this study.

Top-Funded Digital Health Companies Offering Services for Type-1 Diabetes Patients: Business Models and Scalability Considerations

607

REFERENCES

Aitken, M., Clancy, B., & Nass, D. (2022). The Growing

Value of Digital Health. Institute Report. USA: IQVIA

Institute.

American Diabetes Association. (2014). Diagnosis and

Classification of Diabetes Mellitus. Diabetes Care,

37(1), 81-90. https://doi.org/10.2337/dc14-S081

Boughton, C. K., & Hovorka, R. (2019). Advances in

artificial pancreas systems. Science Translational

Medicine, 11(484).

Brillinger, A.-S., Els, C., Schäfer, B., & Bender B. (2020).

Business model risk and uncertainty factors: Toward

building and maintaining profitable and sustainable

business models. Business Horizons, 63(1), 121-130.

https://doi.org/10.1016/j.bushor.2019.09.009

Choueiri, P., Hosseini, M., Kaltenbach, T., Kleipass, U.,

Neumann, K., & Rong, O. (2020). Future of health 2 I

The rise of healthcare platforms. Focus. Munich:

Roland Berger GmbH.

Desmangles, J.-C. (2008). Treatment of type 1 diabetes in

children and adolescents. Drug Development Research,

69(3), 158-164. https://doi.org/10.1002/ddr.20241

Dreyer, M. (2019). Typ-1-Diabetes. Diabetologe, 15, 400-

407. https://doi.org/10.1007/s11428-019-0482-8

Eisenberg, R. S., & Price, W. N. (2017). Promoting

healthcare innovation on the demand side. Journal of

Law and the Biosciences, 4(1), 3-49. https://doi.org/

10.1093/jlb/lsw062

Gassmann, O., Frankenberger, K., Choudury, M., & Csik,

M. (2020). Business Model Navigator: The Strategies

Behind the Most Successful Companies. United

Kingdom: Pearson Education Limited.

International Diabetes Federation. (2021). IDF Diabetes

Atlas [10th edition]. IDF Atlas_10th_Edition_2021.pdf

(diabetesatlas.org)

IQWiG. (2021). Diabetes Typ 1. Blutzucker und Zucker im

Urin selbst messen (gesundheitsinformation.de)

Keller, R., Yao, J., Teepe, G. W., Hartmann, S., Lohse, K.-

M., Wangenheim F., Müller-Riemenschneider, F.,

Mair, J. L., & Kowatsch, T. (2021). Are Conversational

Agents Used at Scale by Companies Offering Digital

Health Services for the Management and Prevention of

Diabetes?. In C. Pesquita, A. Fred & H. Gamboa,

Proceedings of the 14

th

International Joint Conference

on Biomedical Engineering Systems and Technologies

(p.811-816). https://doi.org/10.5220/00104127081108

16

JDRF. (2022). Type 1 Diabetes Index. Type 1 Diabetes

Index (t1dindex.org)

Krause, K., & Schnitzler, T. (2021). Business Partner

Management – Externe und interne

Geschäftsbeziehungen erfolgreich gestalten.

Wiesbaden: Springer Gabler.

Kulzer, B. (2022). Körperliche und psychische

Folgeerkrankungen bei Diabetes mellitus.

Bundesgesundheitsblatt, 65, 503-510. https://doi.org/

10.1007/s00103-022-03517-y

PitchBook. (n.d.) Pitchbook [home page on the Internet].

Retrieved November 17, 2022 from https://pitch

book.com/

Reuter, E. (2022). Abbott Q3 device sales slowed by supply

chain pressures; COVID-19 tests exceed expectations.

Abbott Q3 device sales slowed by supply chain

pressures; COVID-19 tests exceed expectations |

MedTech Dive

Steinberg, D., Horwitz, G., & Zohar, D. (2015). Building a

business model in digital medicine. Re-Imagining

Medicine. Building a business model in digital

medicine (wordpress.com)

Retterath, A., & Braun, R. (2020). Benchmarking Venture

Capital Databases. Benchmarking Venture Capital

Databases by Andre Retterath, Reiner Braun: SSRN

WHO. (2022). Diabetes. Diabetes (who.int)

Scale-IT-up 2023 - Workshop on Best Practices for Scaling-Up Digital Innovations in Healthcare

608