A Normative Multiagent Approach to Represent Data Regulation

Concerns

Paulo Henrique Alves

1 a

, Fernando Alberto Correia

1 b

, Isabella Zalcberg Frajhof

2

,

Clarisse Sieckenius de Souza

1 c

and Helio Lopes

1 d

1

Department of Informatics, Pontifical Catholic University of Rio de Janeiro - PUC-Rio, Rio de Janeiro, Brazil

2

Law Department, Pontifical Catholic University of Rio de Janeiro - PUC-Rio, Rio de Janeiro, Brazil

Keywords:

Normative Agents, Multiagent Systems, Data Regulation, Open Banking.

Abstract:

Data protection regulation is crucial to establishing the appropriate conduct in sharing and maintaining per-

sonal data. It aims to protect the Data Subjects’ data, and to define Data Controllers’ and Processors’ obli-

gations. However, modeling systems to represent and comply with those regulations can be challenging. In

this sense, Multiagent System (MAS) presents an opportunity to overcome this challenge. MAS is an artificial

intelligence approach that enables the simulation of independent software agents considering environmental

variables. Thus, combining data regulation directives and Normative MAS (NMAS) can allow the develop-

ment of systems among distinct data regulation jurisdictions properly. This work proposes the DR-NMAS

(Data Regulation by NMAS) employing Adaptative Normative Agent - Modeling Language (ANA-ML) and

a Normative Agent Java Simulation (JSAN) extension to address data regulation concerns in an NMAS. As a

result, we present a use case scenario in the Open Banking domain to employ the proposed extensions. Finally,

this work concludes that NMAS can represent data regulation modeling and its application.

1 INTRODUCTION

Data protection regulation is crucial to establish the

appropriate conduct in processing, sharing and main-

taining personal data (Phillips, 2018). Governments

have proposed data regulation bills to protect their cit-

izens. Such action aims to set the rules so that com-

panies, markets, and general businesses are able to

process personal data in a respectful and safe man-

ner. The Europe Union (EU) General Data Protec-

tion Regulation (GDPR) is an example of such leg-

islation, as well as the Brazilian General Data Pro-

tection Law (LGPD) in the Global South. (Erickson,

2018). These regulations aim to protect the Data Sub-

jects (DSs) data by establishing citizens’ rights, and

Data Controllers (DCs) and Processors (DPs) obliga-

tions. However, modeling systems to represent and

comply with those regulations can be challenging.

Multiagent Systems (MAS) is an artificial intel-

ligence (AI) approach (Ferber and Weiss, 1999) that

a

https://orcid.org/0000-0002-0084-9157

b

https://orcid.org/0000-0003-0394-056X

c

https://orcid.org/0000-0002-2154-4723

d

https://orcid.org/0000-0003-4584-1455

enables the simulation of autonomous software agents

in a shared environment (Wooldridge, 2009). More-

over, agents can present common, distinguished, or

opposite goals in the same environment, and they can

decide which goals they will try to achieve based on

their beliefs and plans. For instance, the agents will

cooperate with each other in a multi-robot system that

operates in a warehouse environment. Conversely, in

e-commerce systems, agents present opposite behav-

iors; while a seller software agent is trying to buy

an object for a low price, another agent is attempt-

ing to sell it as expensive as possible (Van der Hoek

and Wooldridge, 2008).

In this sense, Normative MAS (NMAS) emerged

as a possible solution to represent environmental

norms in which agents will determine whether to

comply with them or not. Also, norms enable the ex-

pression of deontic concepts (H

¨

ubner et al., 2002), re-

wards, and punishments, which can be used for repre-

senting data regulation concerns (L

´

opez y L

´

opez and

Luck, 2002).

Thus, combining data regulation and NMAS en-

ables the development of systems where DS, DC, and

DP act as software agents in a simulated environment.

The NMAS environment can support multiple data

330

Alves, P., Correia, F., Frajhof, I., Sieckenius de Souza, C. and Lopes, H.

A Normative Multiagent Approach to Represent Data Regulation Concerns.

DOI: 10.5220/0011750900003393

In Proceedings of the 15th International Conference on Agents and Artificial Intelligence (ICAART 2023) - Volume 1, pages 330-337

ISBN: 978-989-758-623-1; ISSN: 2184-433X

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

regulation rules by norms application. This combi-

nation would aid companies in verifying in advance

data regulation compliance when moving from one

jurisdiction to another, and adjusting parameters. Last

but not least, new agents and norms can be generated

by different DSs and DCs to consider different time

frames (Sycara, 1998).

Even though the NMAS literature presents few

modeling approaches to represent normative agents,

it lacks data regulation concerns when developing

NMAS. In this sense, this work proposes the use of

Adaptative Normative Agent - Modeling Language

(ANA-ML) (Viana et al., 2022) and an extension

of Normative Agent Java Simulation (JSAN) (Viana

et al., 2015) to address data regulation particularities

in an NMAS.

In this context, we propose employing the devel-

oped extensions in the Open Banking domain. The

motivation for the Open Banking scenario is its par-

ticularities depending on the jurisdiction in which it

is applied. Hence, it offers an adequate context to

exemplify the application of different regulation re-

quirements in the same application domain.

The remainder of this work is organized as fol-

lows. Section 2 defines the basic concepts used in this

work. Section 3 presents the related work. Section 4

describes the modeling and the framework extension

to represent normative agents under a data regulation

perspective. Section 5 presents a use case scenario in

the Open Banking application domain. Section 6 de-

scribes the limitations of this work. Finally, Section 7

presents our conclusions and future work.

2 BACKGROUND

2.1 Data Regulation

Data regulation aims to protect DS’s data and settles

DCs’ and DPs’ obligations to provide a secure and

healthy data-processing-sharing environment. De-

pending on the jurisdiction, different Legal Basis to

process personal data may apply that DCs and DPs

may choose when managing personal data. For in-

stance, GDPR presents six Legal Basis to process per-

sonal data, while LGPD presents ten. Consent is a

Legal Basis that is commonly cited and used by DCs,

even though there are other legal provisions that jus-

tify the processing of personal data. For example,

consent is present in both the abovementioned regu-

lations.

Consent is commonly used as a Legal basis by

DCs to process personal data in digital platforms and

services. The LGPD, for example, indicates that when

consent is used as a Legal Basis, DS must be informed

and expressly consent when their data is shared with

third parties. The same is true when the data pro-

cessing purpose previously informed and consented

by DS is altered from the original one. Moreover,

consent is used and required for many actions such as

marketing calls, messages, website cookies, or other

tracking methods. Both GDPR and LGPD qualify

how consent shall be manifested by DS (according

to LGPD, consent must be given in a free, informed

and distinct manner, according to a specific purpose).

Also, DCs must inform DS in a clear, simple and di-

rect manner the terms of the data processing, in order

to allow DSs to decide to the best of their knowledge

(Kadam, 2017).

This information is commonly informed in a Pri-

vacy Policy document, which should disclose basic

information, such as: (i) purpose limitation; (ii) for

how long this consent is valid; (iii) which the DPs

are involved; (iv) what are the security policies, and

(v) where the personal data is stored (Palmirani et al.,

2018) (Pandit et al., 2019) (Alves et al., 2021). More-

over, DCs should provide the application domain par-

ticularities (i.e. Open Banking) in such document.

For instance, according to EU Open Banking

guidelines, an Open Banking application should re-

new the DSs consent acceptance every 90 days. How-

ever, Brazilian Open Banking specifies that consent

must expire in one year. Thus, defining a privacy pol-

icy and a consent term in compliance with data reg-

ulation can be challenging not only for lawyers but

also for solution architects, which must guarantee the

system’s compliance with data regulation norms.

2.2 Normative Agents

Software agents are autonomous computer programs

that can interact with other programs without human

intervention (Wooldridge, 2009). In this context, so-

cial norms aim to organize this society generated by

agents.

A norm specifies how agents should behave to live

in society by defining rewards and punishments. Also,

considering that a norm may conflict with an agent’s

individual goal, norms can represent social pressure

upon the agent as well (Luck et al., 2013).

The authors in (L

´

opez and Luck, 2003) and

(L

´

opez et al., 2004) presented a formal normative

model based on autonomous agents’ reasoning. Usu-

ally, there is more than one norm in MAS, and rarely

are they isolated. In this sense, these authors proposed

a model of a system of norms to guarantee that soft-

ware agents will deliberate considering the entire sys-

tem instead of a single norm.

A Normative Multiagent Approach to Represent Data Regulation Concerns

331

Moreover, the authors in (Viana et al., 2022)

present ANA-ML, a modeling language based on a

metamodel for adaptative normative software agents.

Their metamodel was inspired by (L

´

opez and Luck,

2003) and (L

´

opez et al., 2004) to support the model-

ing of abstractions, such as adaptation.

Finally, as agents must identify norms as social

concepts to allow them to perform their actions, the

employment of data regulation norms is a challenge

that NMAS can overcome to develop and simulate

systems that suffer from diverse jurisdictions.

3 RELATED WORK

This section presents works found in the recent lit-

erature related to data protection modeling motiva-

tion and its application in the Open Banking domain.

Also, this section mentions the importance of provid-

ing abstraction models to represent data regulation in

different contexts and jurisdictions to aid DSs, DCs,

and DPs in being aware of their rights and obligations.

Phillips (Phillips, 2018) mentions that data reg-

ulation has become a remarkable barrier to sharing

personal data over international borders. This work

highlights the importance of developing an abstrac-

tion to model systems suitable in different jurisdic-

tions that are adaptable to different data regulations.

For instance, Phillips mentions the importance of re-

specting multiple data regulations simultaneously in

sharing health data to improve global studies related

to HIV and AIDS. In this sense, the NMAS paradigm

could be used to develop systems that support multi-

ple data regulations.

The data subject awareness is also a concern, and,

regarding that matter, Dougherty (Dougherty, 2020)

presents a selection of remarkable factors for DSs to

consider before giving their consent. This work men-

tions that DCs and DPs are obligated to disclose in-

formation for transparency. This transparency aims to

clarify the DCs and DPs’ goals to aid DSs in decid-

ing adequately. In this sense, NMAS would express

norms and simulate a regulated environment which

may elucidate the consequences of accepting a con-

sent term.

Still, Stoilova et al. (Stoilova et al., 2021) present

a systematic mapping regarding the DS perception of

personal data and privacy. The authors highlighted

that DSs usually do not fully understand essential ele-

ments in the consent term, such as their rights. There-

fore, it shows the importance of sandboxing a con-

sent term to understand rights and obligations better.

Sandbox systems would be developed following the

NMAS approach, starting from its model generation,

and then creating an NMAS following the JSAN ex-

tension proposed in this work.

In regards to the Open Banking domain, Farrow

(Farrow, 2020) argues that PSD2 (Payments Services

Directive) should be applied in the Open Banking en-

vironment. To do so, PSD2 should be translated into

the country’s law terms to offer data management

and vendor integration. However, financial institu-

tions must adapt PSD2 to different jurisdictions. For

instance, a technical service provider offers services

on behalf of a financial institution and provides the

necessary technological components to execute PSD2

services. This provider might be in a different juris-

diction and may suffer from more than one data regu-

lation. Thus, modeling and developing NMAS is nec-

essary to deliver data regulation concerns.

Moreover, in order to promote transparency in

the Open Banking environment, the authors in

(Mukhopadhyay and Ghosh, 2021) propose a consor-

tium blockchain to deliver data process transparency

in the Open Banking environment to aid DSs in mak-

ing decisions about providing or withdrawing con-

sent. However, they do not provide distributed con-

cerns when sharing data worldwide. NMAS would

aid distributed systems, e.g., blockchain-based solu-

tions and Open Banking applications, to simulate reg-

ulation compliance in different jurisdictions.

A frequent burden when dealing with AI is the

opacity of the solution returned by these types of sys-

tems. Zednik (Zednik, 2021) proposes a normative

framework to allow Explainable AI in order to miti-

gate the opacity of AI systems. The normative frame-

work shows that analytic techniques are helpful for

explainability. Thus, analogously, it indicates that an

NMAS would be able to explain software agents’ be-

havior in a data-regulated environment. This explana-

tion can aid DSs in mitigating the data flow informa-

tion asymmetry and, hence, provide DSs with mate-

rial for better decision-making.

4 DATA REGULATED

NORMATIVE AGENTS

Normative agents are simulation tools to experiment

with different behaviors in one or more application

domains (Luck et al., 2013) (Alves et al., 2018).

These agents are independent, they can act based on

their perception of the environment and on the conse-

quences of complying or not within a norm. Given

the broad use case possibilities when dealing with

data regulation and worldwide data regulations, the

NMAS paradigm can be an option to model systems

that suffer from data regulation impact.

ICAART 2023 - 15th International Conference on Agents and Artificial Intelligence

332

Considering consent as a data regulation Legal

Basis for this study, agents can decide whether to ac-

cept a consent term based on the environmental norms

and their goals. Moreover, a company in Europe

Union (EU), i.e., regulated by GDPR, may decide to

expand their business to Brazil; if so, the consent term

should be updated to consider also LGPD. After mod-

eling the LGPD norms, an NMAS can simulate the

new environment and verify the agents’ norms adop-

tion.

4.1 Modeling Regulation-Based

Normative Agents

NMASs allow the development of systems and sim-

ulation scenarios based on an application domain.

ANA-ML is a Universal Modeling Language (UML)

extension developed to model agents’ behavior based

on environmental norms (Viana et al., 2022). ANA-

ML defines the following elements:

• Environment, i.e., available data to inspire agents

to select their plans and execute their actions,

• Agent, i.e., a software agent with its goal, beliefs,

desires, and intentions,

• Agent Role, i.e., a software agent role with its

obligations,

• Norm, i.e., activation, expiration, state, rewards,

punishments, and addressed agents data to employ

a norm.

• Organization, i.e., a group of software agents that

will present interaction.

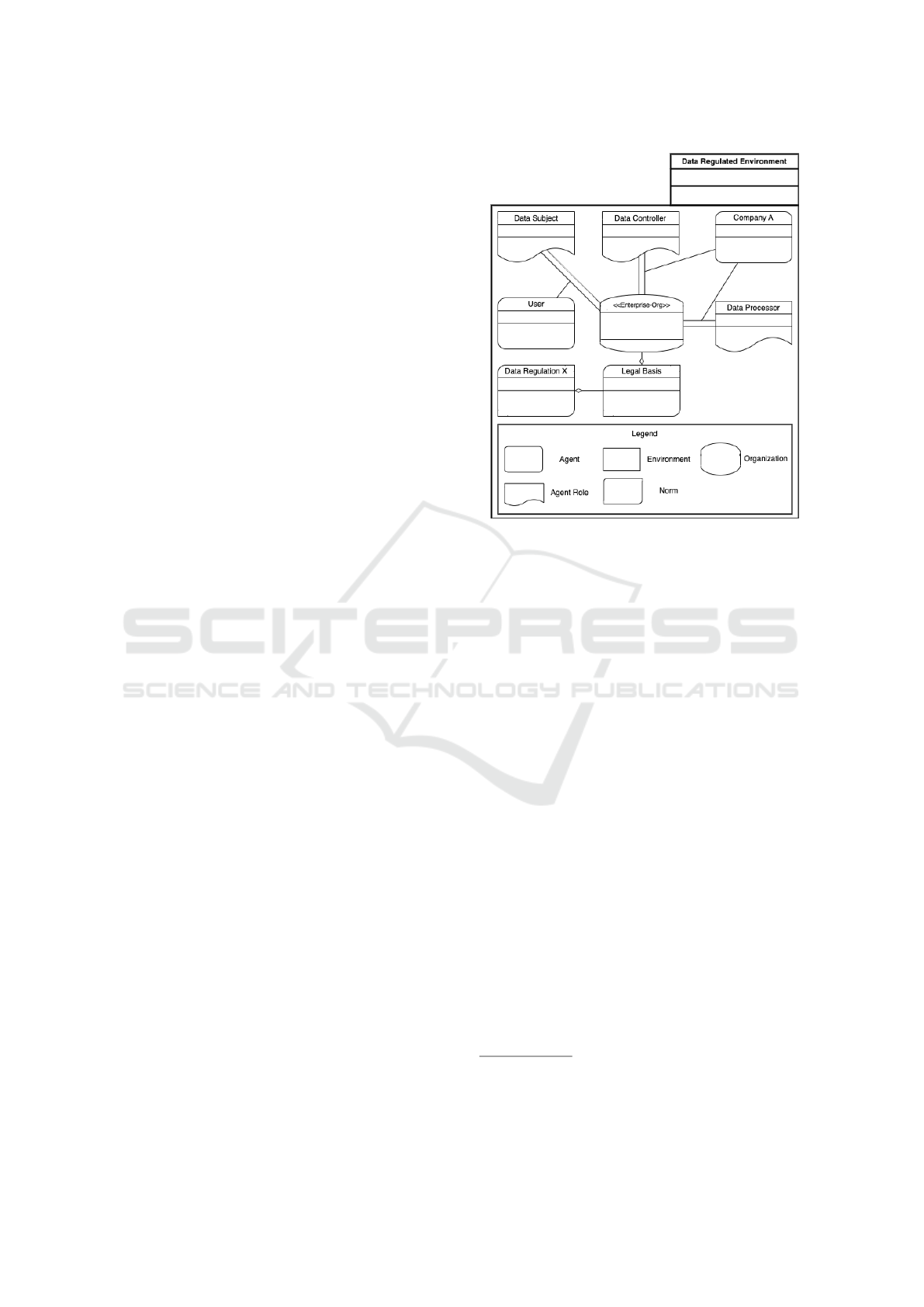

As depicted in Figure 1, the DR-NMAS (Data

Regulated - Normative Multiagent System) is a model

generated using ANA-ML for the data regulation’s

applications. In the data regulation context, User

Agents act as DSs, Company A acts as a DC, and

it also can act as a DP or outsource another com-

pany to execute the DP role. A Legal Basis comprises

one or more Data Regulations and their particulari-

ties. For instance, consent is one Legal Basis fore-

seen in GDPR and LGPD. An Organization groups

the agents by roles and sets the domain singularities,

and depending on the application domain, other Legal

Basis should be considered.

A data-regulated environment provides data for

agents to consider when generating their plans and

executing their actions. For instance, a DS agent may

identify that its consent is expired, i.e., the DC agent

is prohibited from collecting the DS agent data but

still doing it. As a result, the DS agent decides to re-

quest a consent revocation. The DS agent behavior is

a workaround when a DC agent fails to comply with

a Data Regulation Norm.

Figure 1: Data Regulated - Normative Multiagent System.

4.2 Agent-Based Data Regulation

Framework

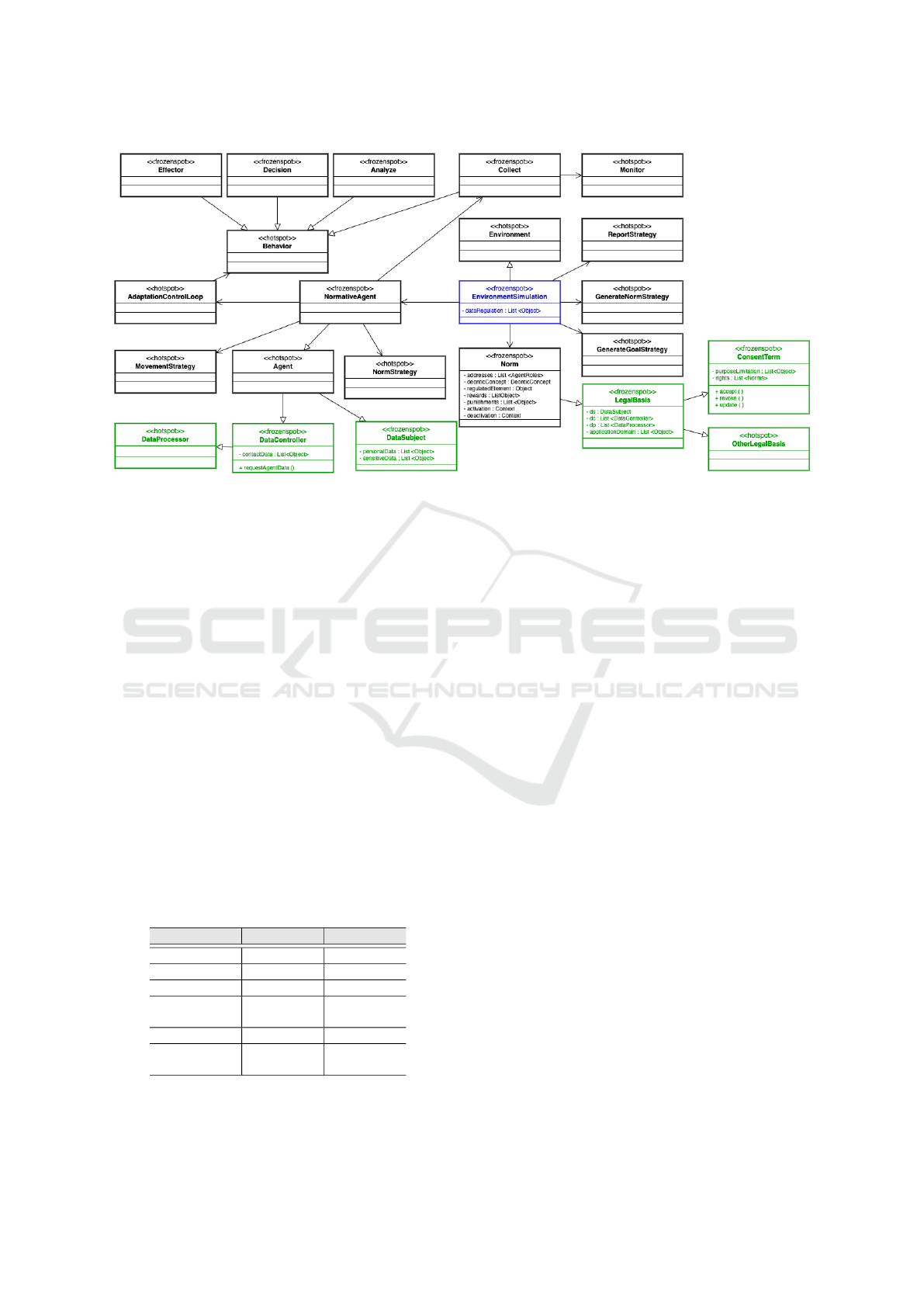

Based on the DR-NMAS model, this work proposes

an extension of JSAN 2.0 (Viana et al., 2015) to con-

sider the data regulation concerns, as depicted in Fig-

ure 2. The green box represents the new entities, and

the blue box represents a modified entity. On this

new extension, DataSubject and DataController are

frozen spots, i.e., every data-regulated scenario re-

quires this structure. Analogously, LegalBasis and

ConsentTerm are entities required in such an envi-

ronment. As mentioned before, as DataProcessor as

OtherLegalBasis are optional and can be instantiated

depending on the use case scenario. Finally, as pre-

sented in the DR-NMAS model, the EnvironmentSim-

ulation entity must inform which data regulation will

be considered in the simulation.

The LegalBasis entity specifies agents and the ap-

plication domain particularities. For instance, in the

Open Banking context, GPDR defines that consents

should be valid for 90 days at most; hence, DCs must

request approval from DSs every 90 days. However,

if the environment simulation is based on LGPD, the

consent term is valid up to 1 year

1

. Thus, the JSAN

extension allows the development of compliance sim-

ulations when changing the application domain or

1

GDPR and LGPD Open Banking contrast. Available

at: https://www.openbankingexcellence.org/blog/the-

implementation-journey-of-open-banking-rules-in-brazil/.

Accessed on November 15, 2022.

A Normative Multiagent Approach to Represent Data Regulation Concerns

333

Figure 2: JSAN extension.

data regulation jurisdiction.

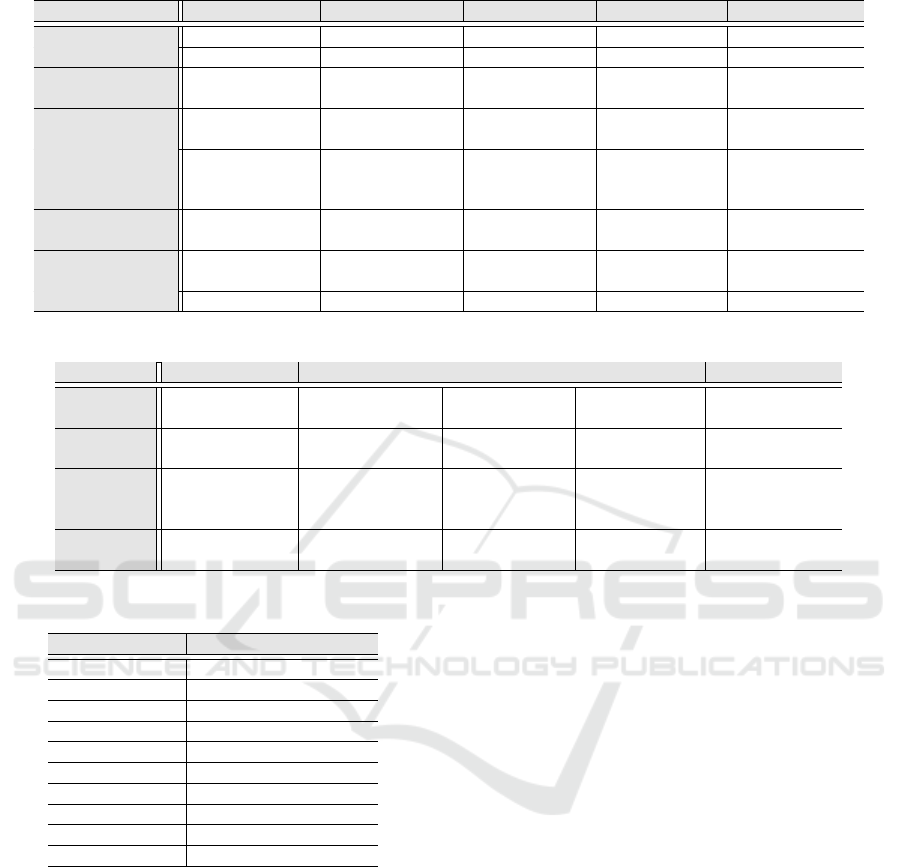

Table 1 shows norm examples that must be devel-

oped when the DC agent has a valid consent, accepted

by a DS agent. DataCopy is a DS right, i.e., DS has

a permission to request a copy of their data anytime.

Conversely, the Revocation is a DC obligation when a

DS requests to revoke its consent. Rewards and Pun-

ishments were defined arbitrarily, which impacted the

DC agents’ reputation and also settled fines to be paid.

DS agents may not share their data with this organi-

zation if a DC has a bad reputation. These norms are

activated by a DS agent request. However, the Re-

vocation norm presents other two triggers: (i) if it is

expired, i.e., it approached the date time limit, or (ii)

there is a new consent term version, i.e., the old con-

sent term was updated, then DC must request a new

acceptation from DSs. They are deactivated based on

different triggers. For example, DataCopy is deacti-

vated when DS receives the requested data, and Revo-

cation is deactivated when DC stops collecting DS’s

data.

Table 1: Data copy and consent revocation norms.

Norm Attribute Data Copy Revocation

Addresses DS DC

Deontic Concept Permission Obligation

Rewards Get DS’s Data Reputation +1

Punishments None

Reputation -3

Fine 10.000

Activation By DS request By DS request

Deactivation DS received Stops data

requested data collection

The consent Legal Basis presents other rights and

obligations that DS, DC, and DP agents must comply

with. For example, GDPR foresees the right to be for-

gotten, and LGPD foresees data deletion. i.e., the data

must be not available after the DS’s request. The goal

is the same from the DS and DP perspective, the data

is no longer available for use, but a person from the

Law domain should evaluate accurately to verify if

there is a relevant difference before creating the mul-

tiagent environment norms.

Other data regulations may present different ap-

proaches to allow a healthy relationship environment,

such as HIPAA and PIPEDA (Xiang and Cai, 2021),

and agent norms are objects that will enable this rep-

resentation systematically.

5 OPEN BANKING USE CASE

Open banking enables knowledge exchange between

financial institutions based on the DS data. For ex-

ample, a DS can request a loan from bank A, a credit

card from bank B, and trade assets in the stock mar-

ket from bank C. There are other benefits, e.g., a DS

can open a new account at bank B by importing his

data from a previous account at bank A. In this sense,

Open Banking aims to improve the data sharing capa-

bilities, allowing the DS to select when, for how long,

and with whom its financial data will be shared.

It is important to observe that DS can revoke its

consent at anytime. To do so, DS should access bank

A’s communication channels and request consent re-

vocation. Usually, there is no limitation for how long

DC will collect data; however, the Open Banking do-

main presents a particularity. As mentioned before,

ICAART 2023 - 15th International Conference on Agents and Artificial Intelligence

334

depending on the jurisdiction, the data sharing will

be stopped after a different time range. For instance,

EU sets ninety days, and Brazil determines twelve

months.

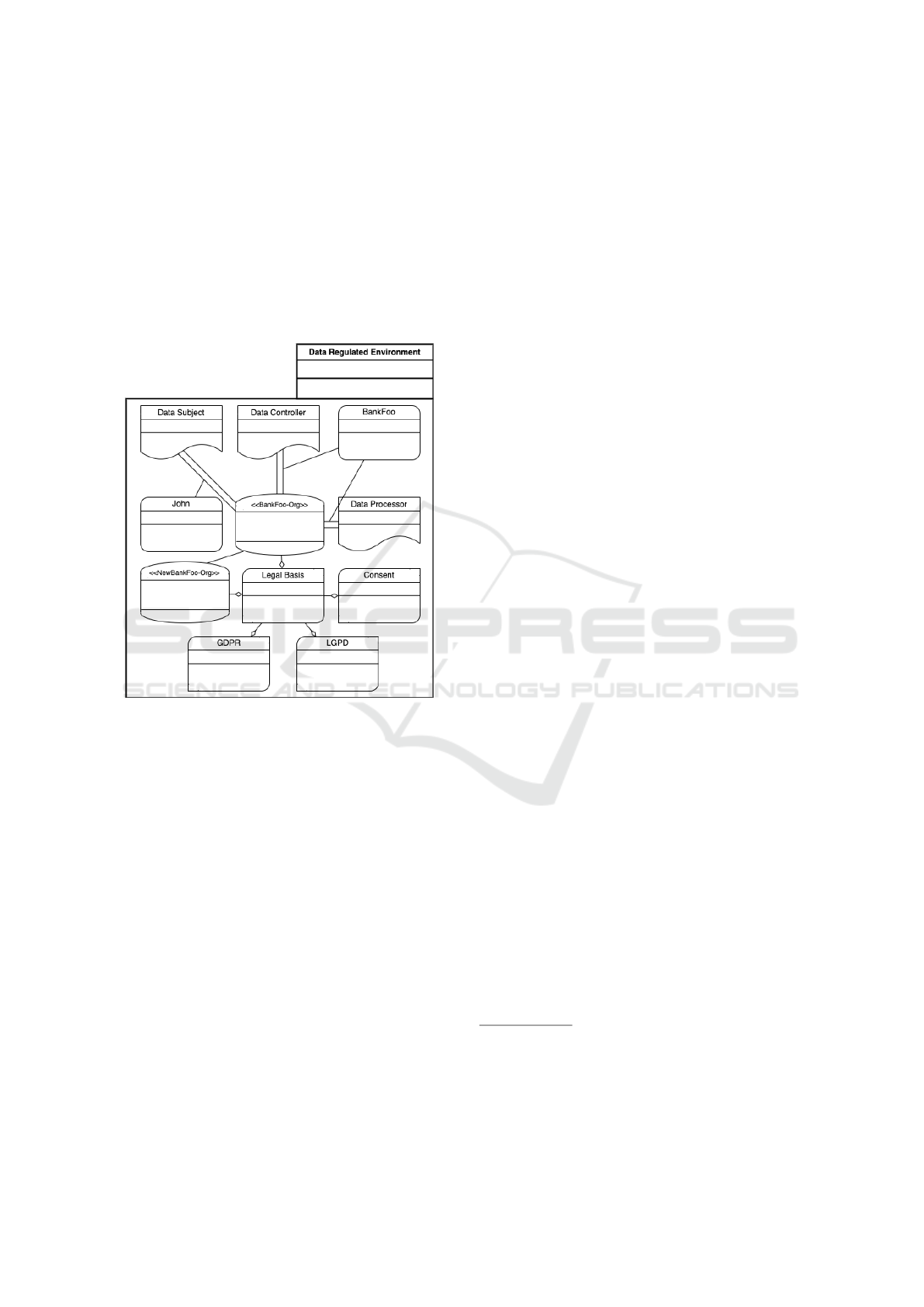

This use case proposes a DR-NMAS model to

simulate an EU bank (BankFoo) that aims to open

a new branch and offer financial services in Brazil.

First, Figure 3 depicts the DR-NMAS model for the

Open Banking scenario. Then, Tables 2, 3, and 4 il-

lustrates the norms proposed for this environment.

Figure 3: Open Banking DR-NMAS.

In this use case, we considered that BankFoo

states in the EU and aims to open a new bank branch

in Brazil. Hence, BankFoo must comply with EU and

Brazilian financial regulations. Still, we use the Con-

sent Legal Basis for this use case as a demonstrative

purpose. Next, BankFoo has to define a consent term,

which means creating a norm. Table 2 and Table 3

show the consent norms’ attributes and values.

The Consent Request norm allows John to ac-

cept sharing his financial data with BankFoo if it is

his wish. Next, the Consent Revocation norm al-

lows John to stop sharing his data with BankFoo if

he wants to do so. Then, the Consent Renew norm

allows BankFoo to renew John’s consent to continue

accessing his data. BankFoo is obligated to send this

request if the previous consent is expired or there is a

new purpose limitation. Next, Data Breach is a pro-

hibited action. This norm defines that if there is a

data breach, BankFoo will be punished. Last but not

least, Data Copy is a norm that represents the DS’

right foreseen in GDPR and LGPD. It permits DSs to

request all their’s data that BankFoo is controlling.

These norms can be generalized to be addressed to

DSs that aim to share their data with BankFoo. Thus

the DSs can accept or not this consent term, i.e., trans-

lating to a deontic concept, they have permission to

accept. Moreover, in this scenario, BankFoo acts as

DC and DP, i.e., BankFoo is entirely responsible for

dealing with and managing John’s financial data.

Table 3 shows which norm’s attributes had to

be changed to employ them in compliance with the

Brazilian regulation. Thus, BankFoo must update the

attributes Activation and Deactivation from its con-

sent term norm to comply with the jurisdiction where

a new branch will be created. Following DR-NMAS,

this new branch can be represented as an Organiza-

tion entity.

Finally, Table 4 describes a compliance norm that

will be activated if BankFoo does not update the Ac-

tivation and Deactivation attributes on its new branch

when defining the LGPD norm. This compliance

norm states that consent is valid for one year, and

BankFoo is prohibited from accessing John’s data if

there is no valid and active consent authorizing such

action. Otherwise, BankFoo will receive a fine of

two thousand Reais until getting the appropriate au-

thorization.

Then, considering that John accepted the consent

term sent by BankFoo, John requests a copy of his

financial data from the old bank following the Data

Copy Norm defined in Table 1. As it is a permission

foreseen by the data regulation, John is able to pro-

ceed with this request, and there are no punishments if

he does not claim it. Last but not least, if John regrets

sharing his financial data, he can revoke his consent,

and his data will not be collected anymore.

Therefore, this use case scenario materializes the

concepts presented on the ANA-ML and JSAN exten-

sions based on a specific application domain. Further-

more, the normative agents adequately represented

the data regulation concerns. Developing application-

based scenarios would aid DSs, DCs, and DPs in con-

solidating their concerns. Moreover, this simulation

could be used to represent jurisprudence

2

.

6 LIMITATIONS

Even though this work proposes a novel approach

to illustrate data regulation concerns by normative

2

Jurisprudence definition: “The word jurisprudence de-

rives from the Latin term juris prudentia, which means

’the study, knowledge, or science of law’. In the United

States, jurisprudence commonly means the philosophy

of law”. Available at: https://www.law.cornell.edu/wex/

jurisprudence. Accessed on November 15, 2022.

A Normative Multiagent Approach to Represent Data Regulation Concerns

335

Table 2: EU Open Banking Norms.

Norm Att Consent Request Consent Revocation Consent Renew Data Breach Data Copy

Addressees BankFoo BankFoo BankFoo BankFoo John

Deontic Concept Permission Obligation Obligation Prohibition Permission

Rewards

Access to John’s

data

Reputation +1

Continue accessing

John’s data

None Get John’s Data

Punishments None

Reputation -3

Fine 10.000

Reputation -4

Fine 10.000

Reputation -9

Fine 20.000

None

Activation

When accepted

by John

When requested

by John

After 90 days, or

there is a purpose

update

When BankFoo

access John’s data

without consent

When requested

by John

Deactivation

When John revokes,

or 90 days

When data

collection stops

When John decides

to renew or not

When BankFoo fix

the open breach

When John receives

the requested data

Purpose Limitation Account creation Access revocation

Access to John’s

data

N/A

Access financial

data only

Application Domain Open Banking Open Banking Open Banking Open Banking Open Banking

Table 3: Brazilian Diff Open Banking Norms.

Norm Att Consent Request Consent Revocation Consent Renew Data Breach Data Copy

Rewards

Access to John’s

data

Reputation +2

Continue accessing

John’s data

None Get John’s Data

Punishments None

Reputation -3

Fine 5.000

Reputation -4

Fine 5.000

Reputation -9

Fine 30.000

None

Activation

When accepted

by John

When requested

by John

After 356 days, or

there is a purpose

update

When BankFoo

access John’s data

without consent

When requested

by John

Deactivation

When John revokes,

or 365 days

When data

collection stops

When John decides

to renew or not

When BankFoo fix

the open breach

When John receives

the requested data

Table 4: LGPD Compliance Norm.

Attribute Value

Norm Name Time Range Compliance

Addressee DC

Deontic Concept Prohibition

Rewards None

Punishments Fine 2.000

Activation After 1 year of giving consent

Deactivation After regularization

Application Domain Open Banking

Purpose Limitation Prevent unauthorized access

Rights All foreseen by LGPD

MAS, some limitations should be considered. From

the MAS perspective, as norms can conflict with each

other, a conflict resolution approach should be consid-

ered, as presented in (Kasenberg and Scheutz, 2018).

Different data protection regulations can also conflict

from the law perspective, so NMAS conflict resolu-

tion techniques would also be applied to overcome

this challenge. Moreover, the Belief-Desire-Intention

(BDI) agents with personality traits would be applied

to provide intelligent agents into the NMAS simula-

tion (Alves et al., 2017; Alves et al., 2018).

From the Law perspective, this work considered

the Consent Legal Basis only, as it is present in GDPR

and LGPD. However, there are other Legal Basis fore-

seen in both regulations, and each one may present a

different amount and definitions of Legal Basis.

Finally, as presented in (Zednik, 2021), the Ex-

plainable AI would be explored to provide not only

DSs knowledge regarding the consent data sharing

and processing clauses but also DCs and DPs require-

ments to deal with different data regulations and ju-

risdictions.

7 CONCLUSION

NMAS literature foresees the usage of software

agents to simulate social norms in order to provide

an orchestrated and organized MAS. As normative

agents are autonomous entities, they can decide to

comply or not with the environmental norms depend-

ing on the rewards and punishment impact on their

goals.

This work concludes that DR-NMAS and the

JSAN extension enable the representation of DSs,

DCs, and DPs’ rights, obligations, and behavior

through normative software agents in a data-regulated

environment. Moreover, the consent’s Legal Ba-

sis requirements were transposed to MAS norms in

the Open Banking scenario to allow stakeholders to

ICAART 2023 - 15th International Conference on Agents and Artificial Intelligence

336

model agents’ behavior.

For future work, a normative conflict resolution

approach would be applied to solve conflicts gener-

ated operating more than one Legal Basis or more

than one jurisdiction simultaneously, e.g., GDPR

and LGPD. Moreover, developing an interface to al-

low DCs to expose themselves to a simulated data-

regulated environment is another future work.

From the DCs and DPs’ perspectives, companies

would try changing the jurisdiction and evaluate what

must be changed to comply with the target data regu-

lation. Lastly, other use case scenarios will be devel-

oped to improve the design of data-regulated NMAS.

REFERENCES

Alves, P. H., Frajhof, I. Z., Correia, F. A., de Souza, C.,

and Lopes, H. (2021). Controlling personal data flow:

An ontology in the covid-19 outbreak using a permis-

sioned blockchain. In Proceedings of the 23rd Inter-

national Conference on Enterprise Information Sys-

tems - Volume 2: ICEIS,, pages 173–180. INSTICC,

SciTePress.

Alves, P. H. C., Viana, M. L., and de Lucena, C. J. P.

(2017). Working towards a bdi-agent based on per-

sonality traits to improve normative conflicts solution.

In SEKE, pages 531–534.

Alves, P. H. C., Viana, M. L., and de Lucena, C. J. P. (2018).

An architecture for autonomous normative bdi agents

based on personality traits to solve normative con-

flicts. In ICAART (1), pages 80–90.

Dougherty, T. (2020). Informed consent, disclosure, and un-

derstanding. Philosophy & Public Affairs, 48(2):119–

150.

Erickson, A. (2018). Comparative analysis of the eu’s gdpr

and brazil’s lgpd: Enforcement challenges with the

lgpd. Brook. J. Int’l L., 44:859.

Farrow, G. S. (2020). Open banking: The rise of the cloud

platform. Journal of Payments Strategy & Systems,

14(2):128–146.

Ferber, J. and Weiss, G. (1999). Multi-agent systems: an

introduction to distributed artificial intelligence, vol-

ume 1. Addison-wesley Reading.

H

¨

ubner, J. F., Sichman, J. S., and Boissier, O. (2002). A

model for the structural, functional, and deontic spec-

ification of organizations in multiagent systems. In

Brazilian Symposium on Artificial Intelligence, pages

118–128. Springer.

Kadam, R. A. (2017). Informed consent process: a step

further towards making it meaningful! Perspectives

in clinical research, 8(3):107.

Kasenberg, D. and Scheutz, M. (2018). Norm conflict

resolution in stochastic domains. In Proceedings of

the AAAI Conference on Artificial Intelligence, vol-

ume 32.

L

´

opez, F. L. y. and Luck, M. (2003). Modelling norms

for autonomous agents. In Proceedings of the Fourth

Mexican International Conference on Computer Sci-

ence, 2003. ENC 2003., pages 238–245. IEEE.

L

´

opez, F. L. y., Luck, M., and d’Inverno, M. (2004). Nor-

mative agent reasoning in dynamic societies. In Pro-

ceedings of the Third International Joint Conference

on Autonomous Agents and Multiagent Systems, 2004.

AAMAS 2004., pages 732–739. IEEE.

L

´

opez y L

´

opez, F. and Luck, M. (2002). A model of norma-

tive multi-agent systems and dynamic relationships.

In Regulated agent-based social systems, pages 259–

280. Springer.

Luck, M., Mahmoud, S., Meneguzzi, F., Kollingbaum,

M., Norman, T. J., Criado, N., and Fagundes, M. S.

(2013). Normative agents. In Agreement technolo-

gies, pages 209–220. Springer.

Mukhopadhyay, I. and Ghosh, A. (2021). Blockchain-based

framework for managing customer consent in open

banking. In The” Essence” of Network Security: An

End-to-End Panorama, pages 77–90. Springer.

Palmirani, M., Martoni, M., Rossi, A., Bartolini, C., and

Robaldo, L. (2018). Pronto: privacy ontology for legal

reasoning. In International Conference on Electronic

Government and the Information Systems Perspective,

pages 139–152. Springer.

Pandit, H. J., Debruyne, C., O’Sullivan, D., and Lewis, D.

(2019). GConsent - A Consent Ontology Based on

the GDPR BT - The Semantic Web. pages 270–282.

Springer International Publishing.

Phillips, M. (2018). International data-sharing norms: from

the oecd to the general data protection regulation

(gdpr). Human genetics, 137(8):575–582.

Stoilova, M., Nandagiri, R., and Livingstone, S. (2021).

Children’s understanding of personal data and privacy

online – a systematic evidence mapping. Information,

Communication & Society, 24(4):557–575.

Sycara, K. P. (1998). Multiagent systems. AI magazine,

19(2):79–79.

Van der Hoek, W. and Wooldridge, M. (2008). Multi-agent

systems. Foundations of Artificial Intelligence, 3:887–

928.

Viana, M., Alencar, P., Guimar

˜

aes, E., Cirilo, E., and Lu-

cena, C. (2022). Creating a modeling language based

on a new metamodel for adaptive normative software

agents. IEEE Access, 10:13974–13996.

Viana, M. L., Alencar, P. S., Guimar

˜

aes, E. T., Cunha, F. J.,

Cowan, D. D., and de Lucena, C. J. P. (2015). Jsan: A

framework to implement normative agents. In SEKE,

pages 660–665.

Wooldridge, M. (2009). An introduction to multiagent sys-

tems. John wiley & sons.

Xiang, D. and Cai, W. (2021). Privacy protection and sec-

ondary use of health data: Strategies and methods.

BioMed Research International, 2021.

Zednik, C. (2021). Solving the black box problem: a norma-

tive framework for explainable artificial intelligence.

Philosophy & technology, 34(2):265–288.

A Normative Multiagent Approach to Represent Data Regulation Concerns

337