Dark Ending: What Happens when a Dark Web Market Closes down

Yichao Wang

a

, Budi Arief

b

and Julio Hernandez-Castro

c

Institute of Cyber Security for Society (iCSS) & School of Computing, University of Kent, U.K.

Keywords:

Cybercrime, Dark Web, Anonymous Online Markets, Data Collection, Rug Pull, Exit Scam, Closing-down,

Take-down.

Abstract:

As the economic hubs of (potentially) illegal transactions, dark web markets are fraught with uncertainty,

including their ending. The ending of a dark web market can bring disruption to the stakeholders involved,

especially vendors and buyers. Most importantly, there is a growing concern that such an ending can cause

financial repercussions or even fraud victimisation. At the moment, there is scant published work about how,

why or when dark web markets would end. We aim to fill this gap to help the academic and security research

communities to reflect on what would typically happen to dark web markets in their final days. We used

crawling and data scraping techniques to gather relevant weekly data from six dark web markets over a span

of several months, right up to their closure. We then analysed the data to find common characteristics and

predictive features leading to the closure of these markets. We found three main reasons for the ending of dark

web markets: (i) exit scam, (ii) voluntary closure, or (iii) taken down by Law Enforcement Agencies (LEAs).

We also gained further insights by analysing our data more closely. For instance, markets are most likely to be

closed down when they are most visible, when they are under attack or when they are growing rapidly to their

peak. In particular, more mature markets (i.e. markets that have been in operation for a long period of time)

are more likely to disappear when their economic patterns start to change (for example, there might be a rapid

growth or a sudden – or even gradual, but noticeable – economic decline). When a market was closed down,

vendors and buyers would typically move on quickly to other alternative markets – which might grow rapidly

as a result – and in turn, those alternative markets’ risk of being closed down would become higher. Whether

a market is still accepting new vendors (or not) appears to be a valuable indicator for predicting the market’s

next move. These insights can be useful in anticipating potential market closure, so that sufficient warning can

be provided to avoid people being victimised.

1 INTRODUCTION

Dark web markets are one of the main economic hubs

of illegal online activity. Similar to the legitimate on-

line markets, as time goes by, some dark web mar-

kets flourish, some wither, new ones are opened and

some close down. However, unlike legitimate on-

line markets, the ending of dark web markets is usu-

ally unannounced, difficult to predict, and frequently

shrouded in mystery. At times, even disinformation

might take place. This opens up an interesting chal-

lenge for cybercrime researchers, and we try to ad-

dress this through the work presented in this paper.

There have been several instances of high-profile

dark web markets being closed down. For exam-

a

https://orcid.org/0000-0002-4633-3690

b

https://orcid.org/0000-0002-1830-1587

c

https://orcid.org/0000-0002-6432-5328

ple, Hydra, a Russian-language dark web market, was

shut down by law enforcement agencies (LEAs) on

April 5, 2022 (Tidy, 2022). The LEAs involved in

this operation have indicated that, even after shutting

down the servers and confiscating around C23 million

in Bitcoin, they fear this will not end the Hydra cyber-

crime gang, as it has proved quite difficult to identify

who was behind it (Tidy, 2022).

Apart from LEA operations, most closures are re-

ferred to as “exit scams”, in which the market op-

erators chose to close the market without prior no-

tice, thus stealing any funds in temporary escrow from

both vendors and buyers. In 2020, for example, the

operators of the largest dark web market at the time,

Empire Market, performed an exit scam and got away

with around $30 million in Bitcoin (Redman, 2020).

In rare occurrences, the operators would “grace-

fully” close down the market, i.e. they would inform

all customers in advance, allowing extra time for on-

106

Wang, Y., Arief, B. and Hernandez-Castro, J.

Dark Ending: What Happens when a Dark Web Market Closes down.

DOI: 10.5220/0011681600003405

In Proceedings of the 9th International Conference on Information Systems Security and Privacy (ICISSP 2023), pages 106-117

ISBN: 978-989-758-624-8; ISSN: 2184-4356

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

going orders to be completed and any remaining funds

to be transferred to the appropriate parties. In 2021,

White House Market did just that, via an announce-

ment on their website stating that the project had al-

ready reached their goal and that they were retiring as

planned (WIRED, 2021). The market operator imme-

diately stopped the registration of new users, and they

ceased to accept new orders on the site. They finally

closed the site down after existing vendors fulfilled

their open orders.

Nevertheless, new markets steadily appear to

compete with existing ones – and to replace closed-

down ones. We may never know whether the same

people behind the existing or closed-down markets

are running those new ones. For instance, an operator

that previously performed an exit scam could launch

another market with the same objective of exit scam-

ming. In contrast, those operators that closed down

their old market gracefully might transfer the reputa-

tion and skills they have built up to the new market.

Previous studies have investigated various aspects

of dark web markets, but to our knowledge, none has

specifically focused on the data collection and anal-

ysis of how, why or when dark web markets closed

down. Thus, it is important to dig further into the end-

ing phase of dark web markets, not only to improve

our understanding, but also to help reduce the risk of

people getting exit scammed, and to assist LEAs in

securing evidence before these markets disappear.

While previous work has examined user records

of bitcoin transactions to analyse the unexpected clo-

sure of dark web markets (Labrador and Pastrana,

2022), our work collected data directly from six mar-

kets and their associated forums due to the trend of

not using Bitcoin (Monero instead) in existing dark

web markets. By including multiple markets, we aim

to increase the breadth of our understanding. This

will also allow us to conduct meaningful comparisons

among various instances of closed-down dark web

markets, which can lead to more useful insights.

As such, the study presented in this paper aims

to understand what typically would happen before

and after the closing down of dark web markets, and

whether they have any common characteristics. If

we were able to identify some common features, we

would also like to know whether we can use these to

predict whether a market is about to close down.

Contributions. We collected datasets from six re-

cently closed-down dark web markets and five of their

associated forums in Dread (a dark web version of

Reddit). Through data analysis and in-depth investi-

gation, we classified the ending of dark web markets

into three categories: exit scams, voluntary closures,

and taken down by LEAs. We tracked some indica-

tors and came out with insights into dark web market

development and life-cycle, which we hope will be

useful for future investigations.

The rest of the paper is organised as follows. First,

we dissect and discuss existing relevant papers on the

dark web in Section 2. We explain our method and

approach in Section 3. We present our results in Sec-

tion 4, while we discuss the implications of such re-

sults, along with the limitations of our study and fu-

ture work in Section 5. We summarise our findings

and remarks in Section 6.

2 RELATED WORK

With the rapid growth of technology over the years

– including the popularity of cryptocurrencies, and

privacy protection technologies such as The Onion

Router (Tor) (Dingledine et al., 2004) – the dark web

market has become a new platform for cybercrimi-

nals (Weber and Kruisbergen, 2019). In earlier years,

researchers proposed systems for obtaining security

intelligence in the dark web to gather warnings of cy-

ber threats (Nunes et al., 2016). LEAs are also aware

of the dark web’s impact on the drug trade and have

conducted preliminary research on it (European Mon-

itoring Centre for Drugs and Drug Addiction, 2020).

Previous studies have covered many aspects of the

dark web markets. In 2013, a study on the very fa-

mous dark web market called Silk Road, was com-

prehensively conducted (Christin, 2013). The paper

found that most of the items sold were available for

less than three weeks, and that most vendors disap-

peared within about three months of joining the mar-

ket. Similarly, another study analysed 16 different

dark web markets of their ecosystem over more than

two years (Soska and Christin, 2015). This study

found that the closure of Silk Road did not lead to the

demise of the dark web as a form of commerce, but

rather, inspired the development of an entire ecosys-

tem of dark web markets. Georgoulias et al. looked

into a mapping of dark web markets through quali-

tative methods covering 41 markets and 35 vendor

shops (Georgoulias et al., 2021). Some studies also

investigated a range of dark web markets in differ-

ent languages for comparison and analysis (Bhalerao

et al., 2019; Wang et al., 2021), highlighting the rapid,

diverse dynamics of the dark web markets’ uptake and

internationalisation. All of these studies suggest that

the dark web markets are an important part of the un-

derground economy.

The European Monitoring Centre for Drugs and

Drug Addiction and Europol published a poster in

2018 indicating the lifetimes and reasons for the clo-

Dark Ending: What Happens when a Dark Web Market Closes down

107

sure of more than 100 dark web markets that offer

drugs around the world (EMCDDA, 2018). The re-

sults showed that 13 markets were operating for one

to two years. Nine markets were in operation for two

to three years, while 14 were still active at the end of

the study. Moreover, the poster shows that since 2016,

dark web markets have become longer-lived than ever,

i.e. mostly over one year. Similarly, Branwen also

maintains a table to count the number of closed-down

markets, last updated in 2019, but the market infor-

mation is somewhat outdated (Branwen, 2019).

In 2015, DeepDotWeb interviewed the adminis-

trators of some of the then-active dark web mar-

kets, in order to gain their views on the state of the

dark web market at that time (DeepDotWeb, 2015a;

DeepDotWeb, 2015c; DeepDotWeb, 2015b). The ad-

ministrator of AlphaBay mentioned that when other

markets exit-scammed, trading continued anyway, so

many vendors and buyers would move to alternative

markets. This was reflected in the growth in the num-

ber of users, posts and transactions after the closure

of a particular market. TheRealDeal was forced to

close due to the arrest of some of the operators of

the operation team, but relaunched after a period of

time. Moreover, Aurora Market administrators said in

a DarkNetDaily interview that greedy administrators

would run away with three to five million in around

five months (DarkNetDaily.com, 2021). Ironically,

this market did an exit scam after about three months.

ElBahrawy et al. investigated how the dark web

market ecosystem was affected by unexpected market

closures between 2013 and 2019 (ElBahrawy et al.,

2020). Their research is based on a dataset of Bit-

coin transactions from 31 major dark web markets, 24

of which were closed down by scams or police raids.

They also noted rapid migration following market clo-

sures, which mainly affected smaller vendors.

More recently, Labrador and Pastrana referred to

a case study of market closure in their paper. They

analysed the trends in prices and volumes of products

in the period leading up to the closure (Labrador and

Pastrana, 2022). They also mentioned the Distributed

Denial of Service (DDoS) attack that preceded the

closure of this market and possibly affected the eco-

nomics of the market – causing prices to fall while

losing trust from buyers – leading to the closure of

the market. This study is quite similar to our study,

however we enrich our dataset to provide a more com-

prehensive analysis of data prior to market closure, in-

cluding the analysis of six markets – rather than only

one market.

In terms of datasets, we found that most of the

publicly available datasets are outdated. Darknet

market archives (Branwen et al., 2015) and AZSecure-

Table 1: Reasons for the closure of 21 major dark web mar-

kets since September 2019.

Market Names Reasons Closure

Apollon Market Exit scam 2020-01

Aurora Market Exit scam 2021-04

BitBazaar Exit scam 2020-07

Cartel Marketplace Exit scam 2021-12

Dark0de Reborn Exit scam 2022-02

Empire Market Exit scam 2020-08

Grey Market Exit scam 2019-12

Silk Road 3.1 Exit scam 2020-07

World Market Exit scam 2022-03

Yellow Brick Market Exit scam 2021-01

CannaHome Market Voluntary closure 2022-04

Cannazon Market Voluntary closure 2021-11

Dream Market Voluntary closure 2019-04

The Versus Project Voluntary closure 2022-05

ToRReZ Market Voluntary closure 2021-12

White House Market Voluntary closure 2021-10

Big Blue Market Taken down by LEAs 2021-04

CanadaHQ Taken down by LEAs 2022-01

Dark Market Taken down by LEAs 2021-01

Hydra Market Taken down by LEAs 2022-04

Monopoly Market Taken down by LEAs 2021-12

data (Alsayra, 2015) are two of the most compre-

hensive datasets of the past. The former contains

data from 89 markets and over 37 relevant forums

from 2013 to 2015. The latter offers Dream Market

dataset from 2016 until 2017, which contains details

of listed items. The dataset from the Cambridge Cy-

bercrime Centre (Pastrana et al., 2018) is still being

maintained and updated nowadays. It contains sev-

eral underground forums on both the surface and the

dark web, including more than 48 million posts, 4.5

million threads and 1 million accounts. Additionally,

Noroozian et al. conducted a study with data from

LEAs (Noroozian et al., 2019), which allowed the

study to have more comprehensive and accurate data,

as the authorities seized entire server backends.

Data collection on the dark web is considered to

be challenging due to the fact that most dark web

markets and forums apply different levels of security

mechanisms against crawlers (Yannikos et al., 2022;

Turk et al., 2020). As the development and evolution

of the dark web are rapid and unpredictable, we de-

cided to collect our own dataset over a long period

of time. For this paper, we selected recently closed-

down markets in our dataset to base our study on.

3 METHODOLOGY

This section explains our approach, mainly covering

the data collection process and the ethical considera-

tions. We also describe the crawling strategy of our

ICISSP 2023 - 9th International Conference on Information Systems Security and Privacy

108

custom crawler software, and provide an overview of

our datasets

1

.

3.1 Approach

In order to understand what happened before and af-

ter the dark web markets being closed down, we col-

lected data weekly

2

, and analysed data from six dark

web markets over a period of time before they closed.

These six dark web markets are Cartel Marketplace,

Dark0de Reborn, The Versus Project, White House

Market, Monopoly Market, and Tea Horse Road. We

also collected data from five of their associated fo-

rums in Dread. The data from forums are only col-

lected once as those forums have been marked as

archived, which means no new threads would be made

after the archived date (usually a few days after the as-

sociated market being closed down).

Cartel Marketplace, Dark0de Reborn, The Ver-

sus Project, White House Market and Tea Horse

Road are comprehensive markets where drugs, fraud-

related material, stolen data and ransomware are all

listed. All of these markets use some sort of escrow

mechanism to maintain the operation of the market.

Monopoly Market was promoted as a wallet-less and

drug-focused market. Nevertheless, it seems that di-

rect payment to vendors is only available to a select

group of vendors with a good reputation (Darknetlive,

2022).

We categorised these six markets into three cate-

gories based on the different endings in which they

were closed down. The criteria used to determine the

category of each market are based on publicly avail-

able information. For reference, we roughly counted

the reasons and time for the closure of major markets

since September 2019, including 21 markets in En-

glish. Ten of them were considered exit scam, six

voluntarily closed down, while five were raided by

LEAs, as shown in Table 1. Due to the timing of

this study and other limitations, we have only got data

from six markets.

Dark0de Reborn and Cartel Marketplace shut

down their sites and deleted the administrator’s ac-

counts on the forum without any prior notice. With

some users complaining on the forums and no state-

ment from the LEAs, we believe this is a classic exit

1

Due to the potentially criminal content of the datasets,

we had to choose an appropriate and ethical way to share

them. We are happy to share our datasets with the academic

community, security researchers and LEAs. Please contact

the authors for further information.

2

Some weeks’ data may not be collected for unexpected

circumstances, such as server downtime, crawler errors or

personal reasons.

scam. Voluntary closures include two markets, which

are the Versus Project and the White House Market.

The former chose to retire due to potential security

concerns, and the operator sent private links to the

vendors to access the market to complete transactions.

The latter announced its retirement in a post on the

website and immediately stopped accepting new or-

ders. The admins claimed that the public link to the

site would no longer work after all orders were com-

pleted. Tea Horse Road was a Chinese dark web mar-

ket. A few months after its abrupt closure, screen-

shots of its home page appeared in reports about the

fight against cybercrime. It is therefore identified as

having been shut down by the LEAs. Similarly, the

reason for the closure of Monopoly was due to the

servers being seized, as claimed by the operator of

dark.fail

3

. However, no one can verify the accuracy

of the information as the LEA did not issue any state-

ment. In this paper, we still classify it as taken down

by the LEAs.

Smaller markets may not be very active in forums,

but operators may introduce “cross-posts” to keep the

market buzzing. The forums in Dread allow “cross-

post”, which means there are threads that can appear

in one or more forums. For example, someone may

post a review about a vendor in /d/review, which can

later be re-shared in /d/versus as well. Therefore,

when calculating the number, we count all the data in

the forum, i.e. including the “cross-posts”. We then

comb through the results to find more meaningful in-

sights, such as how users shift between markets and

discuss them.

3.2 Data Collection

We used Python with both the Scrapy web-crawling

framework (Kouzis-Loukas, 2016) and the Selenium

suite of tools (Software Freedom Conservancy, 2022)

to implement our own custom crawler. Benefiting

from Selenium’s ability to handle sessions automat-

ically, our crawler can deal with the use of dynamic

cookies in certain markets (i.e. each request would

apply a new cookie based on the previous request).

Our crawler employs two strategies to collect data in

dark web markets:

• In situations where the site’s security mechanisms

would allow crawlers to operate at higher speeds

with no restrictions – i.e. the site’s sessions would

not (or rarely) expire after a certain time, as long

as the crawler keeps interacting with the site –

our crawler would access and collect the details

of each product through the listing page.

3

https://twitter.com/darkdotfail

Dark Ending: What Happens when a Dark Web Market Closes down

109

Table 2: A summary of the datasets obtained. *This market does not have a forum in Dread.

Market Names Dates Covered (from/to) # snap. #Dread Threads Size

Cartel Marketplace 2021-03-29/2021-12-20 38 701 352.3 MB

Dark0de Reborn 2021-04-06/2022-02-21 46 4976 542.1 MB

The Versus Project 2021-10-26/2022-05-16 31 3713 5.3 GB

White House Market 2021-05-17/2021-10-11 21 8793 315.0 MB

Monopoly Market 2021-10-18/2021-12-27 11 599 658.4 MB

Tea Horse Road 2021-07-27/2021-11-16 16 N/A* 117.8 MB

Apr

2021

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

2022

Feb

Mar

Apr

May

Jun

Marketplaces

Cartel Marketplace

Dark0de Reborn

The Versus Project

White House Market

Monopoly Market

Tea Horse Road

Figure 1: The time period of the data collection for each of the six dark web markets observed.

• In situations where the site would apply a strict

security mechanism – whereby the session would

expire after a specific number of requests, and

then a CAPTCHA would be enforced – we tried

to use multiple accounts to crawl in parallel and

did our best to get statistical data other than text.

Our crawler is deployed in password-encrypted vir-

tual machines to prevent data from being infected

or compromised. VPN connection is used as an

additional layer of protection. Since Scrapy can-

not directly proxy to the Tor network using HTTP,

Privoxy (Privoxy Developers, 2022) is needed as a

relay to exchange the SOCKS5 and HTTP requests.

When the weekly data collection is completed, we

save the encrypted data to an offline portable hard

drive.

Figure 1 shows the timeline for our data collec-

tion for different dark web markets. The start time

of collection varies for each market, but the end time

is the last time it is accessible. During these periods

we obtained data once a week, so we could analyse

the differences over time. For the Dread data, they

were collected once on 14 August 2022, as those fo-

rums have been marked as archived. Table 2 provides

information on the dataset obtained for each market.

Table 3 shows some of the basic characteristics of the

markets observed. In the dataset, we note that some

markets use the Euro to display prices, and some use

the US Dollar. Given the volatility of exchange rates,

we have not converted them as the analysis of trends

is limited to within individual markets. Still, we do

make high-level comparisons based on trends in indi-

vidual markets.

3.3 Ethical Considerations

Since we had to collect data on the dark web (the Tor

network), and the data can potentially be related to cy-

bercrime activities, we had to be very careful in deal-

ing with the ethical issues of our research.

Our datasets contain items such as product in-

formation and discussions from the dark web mar-

kets and their associated forums, which are inherently

public and easily accessible to the public. Nonethe-

less, we did not collect personally identifiable infor-

mation. During data collection, we applied dynamic

delays to our crawler, in order to prevent additional

server stress to the observed sites (i.e. we did not want

to disrupt or interfere with their operation).

The ethics of this study has been reviewed and ap-

proved by our university’s research ethics committee.

4 RESULTS

In this section, we categorized six markets into three

categories based on the different endings in which

they were closed down. We describe some of the key

things that happened before the closure, and also try

to analyse different indicators depending on the avail-

ability of the data.

ICISSP 2023 - 9th International Conference on Information Systems Security and Privacy

110

Table 3: A summary of the observed dark web markets.

Market Names First Seen Last Seen Lifetime #Vendors

Cartel Marketplace 2020-06 2021-12 18 Months 237

Dark0de Reborn 2020-05 2022-02 21 Months 2640

The Versus Project 2019-08 2022-05 33 Months 937

White House Market 2019-08 2021-10 26 Months 3450

Monopoly Market 2019-07 2021-12 29 Months 162

Tea Horse Road 2020-04 2021-11 19 Months 3275

January February March April May June July August September October November December

Mon

Tue

Wed

Thu

Fri

Sat

Sun

January February March April May June July August September October November December

Mon

Tue

Wed

Thu

Fri

Sat

Sun

January February March April May June July August September October November December

Mon

Tue

Wed

Thu

Fri

Sat

Sun

2020

2021

2022

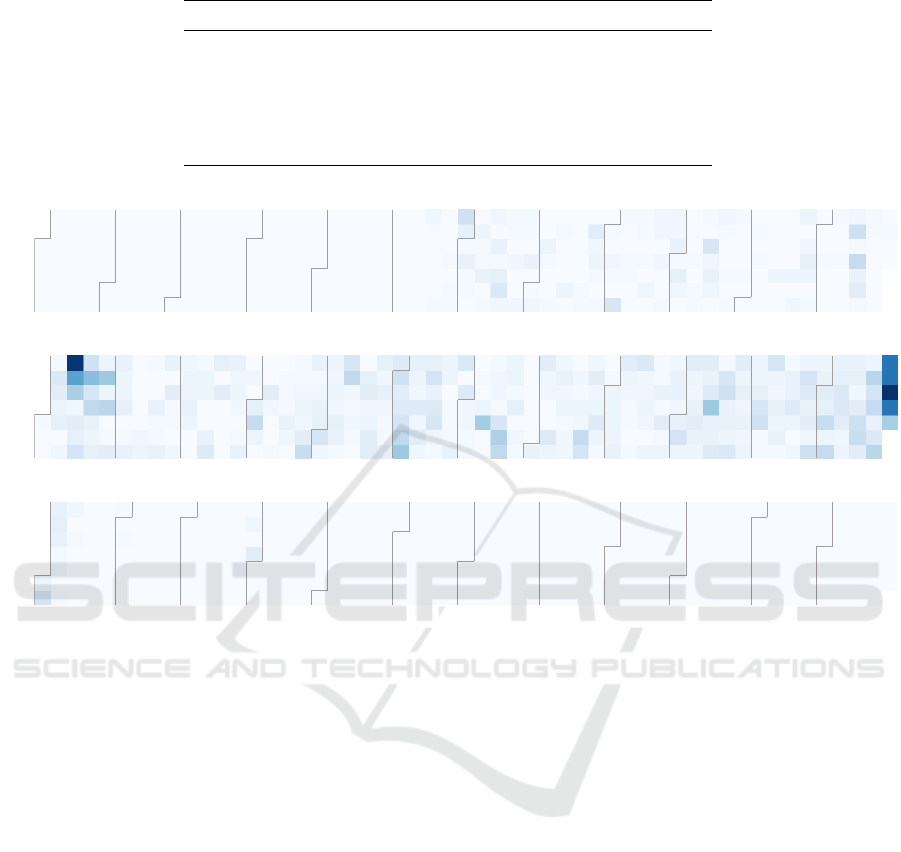

Figure 2: A heat map of the number of comments in the Cartel Marketplace Dread forum (darker colours mean higher

numbers).

4.1 Exit Scams

Exit scams appear to be the most common type of clo-

sure, where the operator closes the site without any

notice and takes all of the user’s funds in their wal-

let. This happens when markets operate with escrow

mechanisms. The escrow mechanism means that the

market is a third party for vendors and buyers. The

buyer deposits a certain amount of money into a cryp-

tocurrency wallet provided by the market, and the

fund is only released to the vendor’s wallet when the

transaction is completed.

Cartel Marketplace was launched in June 2020

and closed down in December 2021. The lifetime

is about 18 months. Figure 2 shows the number of

posts in the Cartel Marketplace sub-forum. In Jan-

uary 2021, that actually had an official announcement

from Dread dominating the discussion. At the same

time, there were plenty of advertisements from Cartel

operators to attract new vendors and users. December

2021 is the month when the market closes and disap-

pears. The problem was first identified on the 21st of

December, when the market was suspected to be un-

der DDoS attacks and down for a few hours. Users

also started asking in the forums for a time for the

market to return. On the 24th, probably the last ap-

pearance of the market operator. On the 29th, the

forum administrator announced the market had been

exit scammed, as the market operator did not reap-

pear again, and the market website had not been on-

line since the 21st.

Dark0de Reborn was launched in May 2020 and

closed down in February 2022. The lifetime is about

21 months. Almost the same thing happens in this

market. With the DDoS attack at the beginning of

the month, it seemed they had the ability to bring

the site back to normal. When the end of the month

came, the operators disappeared. Unlike Cartel Mar-

ketplace, we did not observe many complaints, but

people moved quickly to other alternative markets.

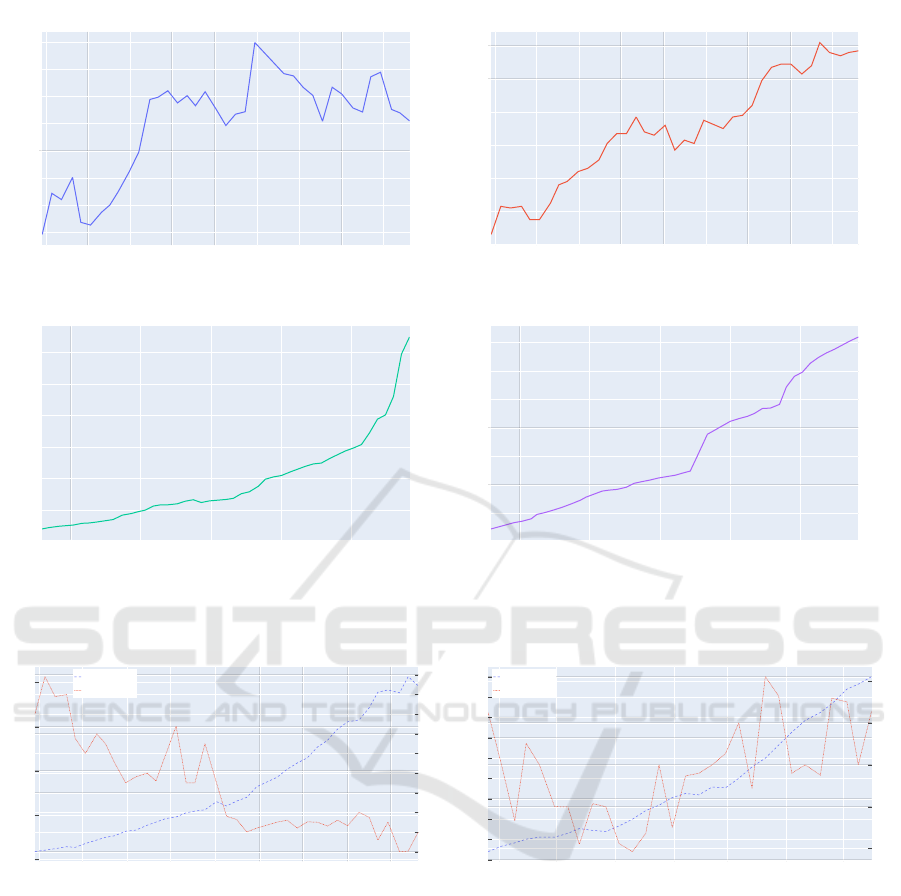

Figure 3 shows the number of listings and ven-

dors in both markets, which keep increasing overall.

An exception is in the number of listings in the Car-

tel Marketplace. The number peaked in September

Dark Ending: What Happens when a Dark Web Market Closes down

111

Apr 2021

May 2021

Jun 2021

Jul 2021

Aug 2021

Sep 2021

Oct 2021

Nov 2021

Dec 2021

1200

1400

1600

1800

2000

2200

2400

2600

Apr 2021

May 2021

Jun 2021

Jul 2021

Aug 2021

Sep 2021

Oct 2021

Nov 2021

Dec 2021

120

140

160

180

200

220

240

May 2021 Jul 2021 Sep 2021 Nov 2021 Jan 2022

40k

60k

80k

100k

120k

140k

May 2021 Jul 2021 Sep 2021 Nov 2021 Jan 2022

1400

1600

1800

2000

2200

2400

2600

# Listings in Cartel Marketplace # Vendors in Cartel Marketplace

# Listings in Dark0de Reborn # Vendors in Dark0de Reborn

Figure 3: The number of listings in the Cartel Marketplace (top left), the number of vendors in the Cartel Marketplace (top

right), the number of listings in the Dark0de Reborn (bottom left), and the number of vendors in Dark0de Reborn (bottom

right).

Apr 2021 May 2021 Jun 2021 Jul 2021 Aug 2021 Sep 2021 Oct 2021 Nov 2021 Dec 2021

0

5k

10k

15k

20k

20

30

40

50

60

70

80

90

100

110

# Sales

Median Price

Timestamp for Cartel Marketplace

# Sales

Median Price

(a) Median price and number of sales in Cartel Marketplace.

Nov 2021 Dec 2021 Jan 2022 Feb 2022 Mar 2022 Apr 2022 May 2022

60k

80k

100k

120k

140k

160k

180k

200k

220k

240k

70

75

80

85

90

# Sales

Median Price

Timestamp for The Versus Project

# Sales

Median Price

(b) Median price and number of sales in Versus Project.

Figure 4: Median price and number of sales comparison in two markets with different exit types.

2021, and then it started to decline. However, we did

not find any interesting factors that could affect the

number, and it was very quiet in the forum instead. In

October, Cartel Marketplace operators began adver-

tising for the recruitment of new vendors, while the

closure of White House Market led some to transfer

to this market, which is reflected in the growth of the

charts. Therefore, we suspect that the drop in figures

may be due to a small number of “dishonest” vendors

(or “rippers” called in dark web communities) being

banned from the market.

Interestingly, vendor numbers rose rapidly about

two months before the Dark0de market closed. How-

ever, this was seemingly due to the closure of other

markets leading to vendors changing places. In ad-

dition to Cartel Marketplace, another larger market

closed at that time. Similarly, the closure of the White

House Market is reflected in the increase in vendor

numbers at the end of September and the beginning

of October. It was also from this time (about four

months before the market closed) that the discussion

volume on the forum increased rapidly.

On the economic side, we have tried to analyse

the median price and number of sales of the Car-

ICISSP 2023 - 9th International Conference on Information Systems Security and Privacy

112

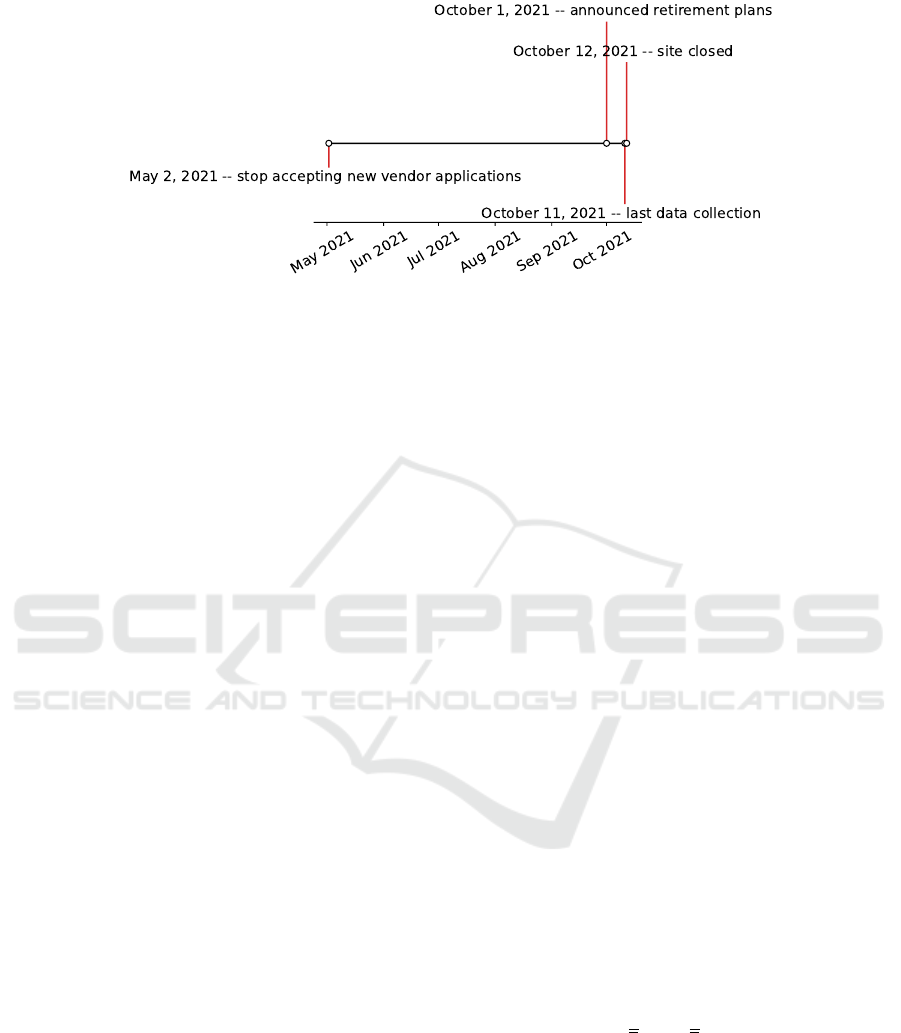

Figure 5: Key events occurring in the White House Market before it was closed down.

tel Marketplace in Figure 4. The number of sales

has maintained consistent growth. The median price

maintained a downward trend. In particular, median

prices fell rapidly in August, and listings numbers did

improve at that time, which should have influenced

the overall results. It is worth noting that its median

price fell again in the final weeks of the Cartel Mar-

ketplace. Interestingly, a vendor claimed the market

operators have secretly revised stock quantities and

reduced the prices of productions in the back end of

the server. This behaviour is considered profitable for

the market operators, as attracting more orders means

more funds go into the market wallet (due to the ap-

plication of escrow mechanisms in the market).

4.2 Voluntary Closures

Voluntary closures are usually a “win-win” for users

and operators, which inform all customers in advance

and allow extra time for ongoing orders to be com-

pleted. However, although this ending is usually

less common in the past, it happens more frequently

nowadays.

White House Market was launched in August

2019 and closed down in October 2021. The life-

time is about 26 months. Figure 5 shows the time-

line of some key events before the market’s closure.

The market first announced in early May 2021 that it

would no longer accept new vendors. On 1st October

2021, the market owners claimed their retirement, i.e.

a voluntary closure of the market. We were allowed to

access the site for the last time on the 11th, and then

the site was shut down on the 12th. It took about 12

days from the announcement to the market’s closing.

Everything looks graceful from an observer’s point of

view, yet the truth could be different. On the same day

that the market was closed, many vendors and users

complained they did not get their coins back. These

people have lost money either due to open orders or

open disputes. Therefore, the forum’s administrators

marked the market as a dishonourable exit.

A different story took place in another market.

The Versus Project was launched in August 2019 and

closed down in May 2022. The lifetime is about

33 months. On 5th May 2022, the market operators

claimed to have transformed the market into an invite-

only community to maintain the quality of support,

including invite-only vendors and invite-only buyers.

Over the next few days, other forums appeared to dis-

cuss a major security breach in the market. Finally,

in a statement dated 22nd May 2022, the operator de-

scribed the fact that the market had a security breach

and decided to close the market down. Unlike White

House Market, the administrator did not disappear

from the forum after the website was closed directly.

Instead, after about four weeks, market administrators

announced a link to complete all transactions.

The number of listings in both markets is growing

steadily. The number of vendors in the Versus Project

market has also continued to grow without many sur-

prises. Figure 4 shows the median price and number

of sales in the Versus Project. It should be noted that

the currency unit of the price is EUR. Sales volumes

are steadily increasing, but there are fluctuations in

the median price. The median price is in a downward

trend from November 2021 to January 2022, and then

begins to rise until mid-March 2022. Sales also in-

creased faster at that time, which may be the possibil-

ity that Dark0de closed at that time and caused many

users to move in. After that time, the median price

fluctuated between C75 to C85.

4.3 Taken down by LEAs

This is usually the hardest type to define, as it is dif-

ficult to establish authenticity across different sources

of information other than the LEAs making a state-

ment. The LEA may operate a market as a honeypot

for a period of time after taking control of it before

shutting it down, which sometimes looks like a vol-

Dark Ending: What Happens when a Dark Web Market Closes down

113

Oct 24

2021

Nov 7 Nov 21 Dec 5 Dec 19

30

40

50

60

70

80

90

100

110

120

40

60

80

100

120

# Median Sales

Active Disputes

Timestamp for Monopoly Market

# Median Sales in Monopoly Market

# Active Disputes in Monopoly Market

Figure 6: Median sales volume and number of active dis-

putes in Monopoly Market.

untary closure.

Monopoly Market was launched in July 2019 and

closed down in December 2021. The lifetime is about

29 months. It did not seem to have any attacks or ex-

ceptions until it was shut down. After closing, it was

identified as sized by LEAs, claimed by the opera-

tor of dark.fail. The numbers of vendors and listings

were quite stable, with an upward trend. As some

vendors withdrew, the number of listings in this mar-

ket began to decline in early December. But we can

see in Figure 6 that there were still some disputes re-

solved at the end of November, while the median sales

volume was still growing. This is considered a fairly

normal pattern, and the market was growing rapidly.

Tea Horse Road is a Chinese dark web market

which was launched in April 2020 and closed down

in November 2021. The lifetime is about 19 months.

The screenshots of its home page appeared in reports

about the fight against cybercrime a few months af-

ter its abrupt closure. The numbers of vendors and

listings were shown, where both numbers were rising

continuously. The median price rose from $5 to $20

in the two months before the market closed, then re-

mained flat.

Monopoly Market has been developing for over

two years, and it has developed rapidly in the last

two months, benefiting from the White House Mar-

ket exit bringing some users. The market has a good

reputation, and even with the slightly loss of vendors,

sales are still stable. Tea Horse Road is also in a very

smooth development stage, and all indicators are de-

veloping in a good place. Therefore, the LEAs have

reason to crack down on fast-growing markets to deter

criminals in their infancy.

5 DISCUSSION

Based on the results we observed, there are no signif-

icant indicators to show whether a market is heading

for closure. However, we have gained some insights

that may be useful for warning users that a market is

going through some “difficulties”, and these dynam-

ics may lead to further moves by its market operators

(including closure).

5.1 Insights

The life cycles of the six markets we observed were

all greater than 18 months, with the largest being

33 months. This may be a bias caused by the fact

that we picked the more popular markets when crawl-

ing, but the markets we picked contain different sizes.

Therefore, we have reason to believe that, in the early

days of some little-known reputable markets estab-

lishment, there is a high probability that they will not

suddenly disappear. However, after a certain number

of users, sales and profits have been achieved, the risk

of closure becomes greater.

LEAs may be more interested in fast-growing

markets, since the larger dark web market has a

greater negative impact on society. Also, the mar-

ket operators may have certain psychological expec-

tations. For example, when a certain amount of profit

is reached, they will try to prevent the market from be-

coming too exposed and uncontrolled – for instance,

the market operators may choose to close it down in

order to keep themselves safe from LEAs’ take-down.

On the other hand, once growth is slowing down,

the risk of a market closure begins to increase. In

practice, when the median price falls, this may indi-

cate a decline in the market economics to attract more

customers. Dark web market operators may choose to

exit at this time, meaning they try to get the last profit.

For similar reasons, we believe that markets that

are not accepting new vendors are trying to become

more “closed” communities because they may have

significant circular revenues and do not want to take

more risks. Nevertheless, several security issues (e.g.

DDoS attacks), and possibly other reasons, have led

market administrators to opt for the more conservative

side – either exit scam or voluntary closure.

We also notice that people usually move to other

popular alternative markets when a market closes.

This is reflected in the data collected from our study,

in which the increase of the number of comments as-

sociated to one market appears to coincide with the

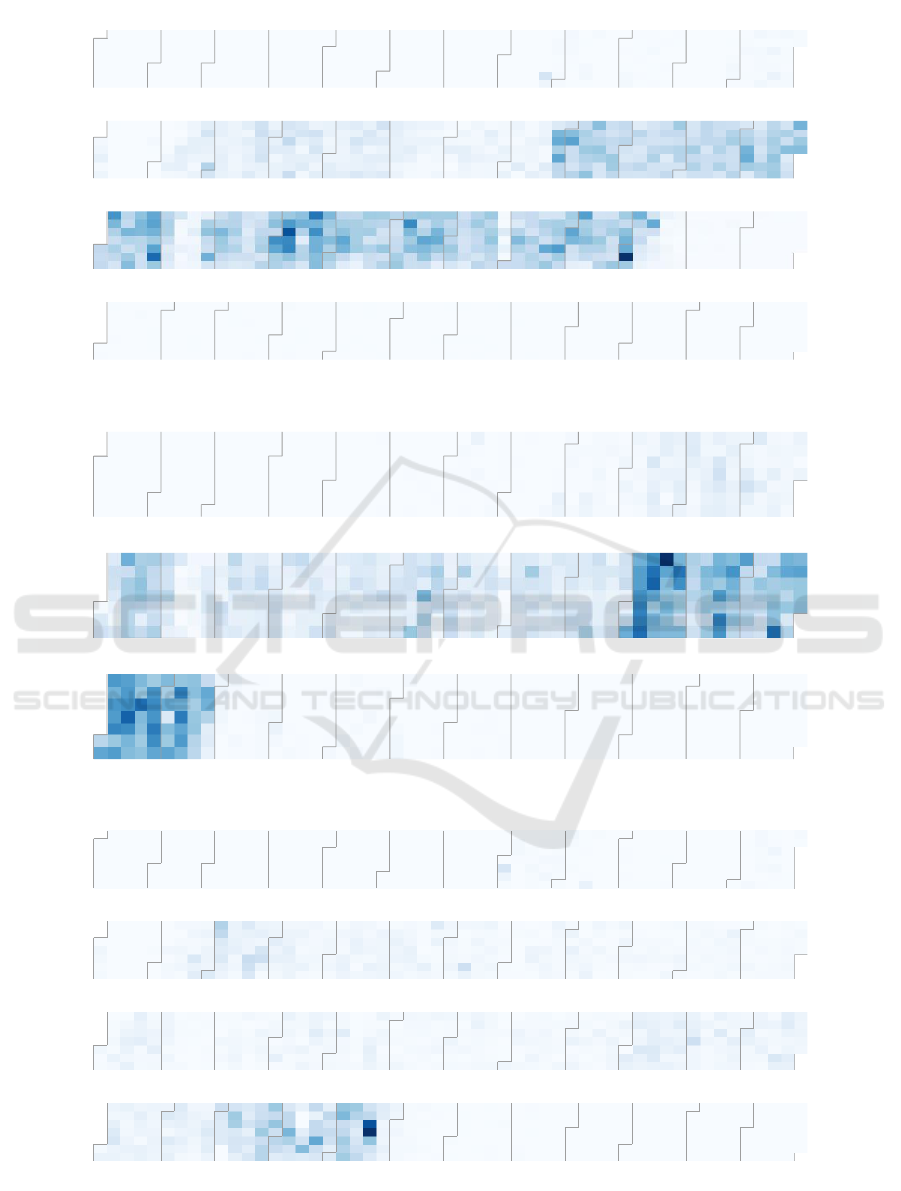

closure of another. Figure 7 shows the heat map

of the volume of comments in White House Market,

Dark0de and Versus Project, where darker colours

mean more comments. We notice clear boundaries

where people moved to the Dark0de market after

White House Market exited, and to Versus Project af-

ter Dark0de was closed down. As users become ac-

ICISSP 2023 - 9th International Conference on Information Systems Security and Privacy

114

White House Market

The Versus Project

Dark0de Reborn

Figure 7: A heatmap of the volume of comments in the Dread sub-forums of the White House Market, Dark0de and Versus

Project, showing clear transitions of users (reflected by the comments’ volume – the darker the square, the higher the volume)

from one market to the next; Note that the timelines are synchronised, although Dark0de only covered the last three years.

Dark Ending: What Happens when a Dark Web Market Closes down

115

tive, conflicts and problems may arise, but within two

to four months, the market would either calm down

and settle, or disappear into the darkness.

5.2 Challenges

Data collection is considered to be a challenge in this

study. Firstly, we do not yet have the ability to pre-

dict which markets will close in the near future, so we

can only do our best to collect data on some markets

and then analyse them after they have closed down.

Secondly, data collection is influenced by the acces-

sibility of the market website. Dark web markets are

often attacked by various parties, which may be LEAs

or competitors. This makes the downtime for some

markets very long, causing the crawling process to be

interrupted and making the data incomplete.

Moreover, the security mechanisms of some mar-

kets result in a limited number of requests being sent

at a time. For instance, Cartel market only allows

300 requests to be made in a session over a period of

time (approximately 40-60 minutes). Therefore, we

tried to use multiple accounts for parallel crawling,

but were still limited by the site’s measures not being

able to access the full content of the market. In addi-

tion, we used two different software packages and two

different strategies for data collection (see Section 3).

5.3 Limitations and Future Work

The data points obtained are not very comprehensive

due to the security mechanisms implemented on some

of the markets’ sites. The main problem was due

to the CAPTCHA employed on these sites causing

our crawler to be disrupted. Additionally, our dataset

contains relatively short snapshots (approximately 2-

9 months) of the observed markets’ data, even though

the markets we observed all had lifetime greater than

18 months. Finally, the markets in our dataset repre-

sent only a small number of existing markets; as such,

some bias might have been introduced as a result.

Further work could focus on dealing with the se-

curity mechanisms of different dark web markets, for

example to understand their anti-crawling strategies

(including the CAPTCHA features mentioned above,

as well as cookies reset and rate-limiting constraints).

It would also be interesting to look further into the

behaviour of cross-market vendors when a market is

closed down. We observed that many vendors are sell-

ing in different markets simultaneously, which means

they would suffer some losses when a market they are

operating in was closed down. However, they do not

seem to be too concerned about these losses and try

to maintain their reputation by, for example, actively

seeking out purchasers in relevant forums.

We also expect more long-term observational re-

search on the dark web in general, for instance to

better understand the development and evolution of

a dark web ecosystem due to its dynamic and unpre-

dictable nature.

6 CONCLUSION

In our study, we collected data from six dark web mar-

kets and five associated forums to investigate what

happens when dark web markets are closed down.

We describe and analyse several indicators for such

events. The results showed that even though the mar-

kets may be closed down for various reasons, they still

have some interesting commonalities.

Both exit scams and voluntary closures are more

likely to happen when the market’s economy starts to

change (i.e. not in line with its own “normal” eco-

nomic pattern). Measuring the stage of development

of a market may depend on indicators such as the

number of vendors, the median price, sales volume

and the number of disputes.

It is also important to note whether the market

continues to accept new vendors or not. If the mar-

ket administrators are not looking to accept new ven-

dors, they might want to be more stealthy or the pe-

riodic profit has likely met their expectations (which

could mean they might try to become an invite-only

community or simply shut down at some point). As

for markets being shut down by LEAs, those markets

seem to be in a period of rapid growth and showing

no signs of slowing down – then suddenly disappear.

After a market closure, users and vendors will

quickly move to other markets with a good reputation.

However, after two to four months, these alternative

markets will most likely go into the next darkness.

We believe that these insights provide a way to gain

a more comprehensive understanding of the develop-

ment of dark web markets. We also hope our research

will draw the attention of the academic community to

this often-forgotten dynamic in the dark web.

REFERENCES

Alsayra (2015). Azsecure-data.org. https://www.

azsecure-data.org/dark-net-markets.html.

Bhalerao, R., Aliapoulios, M., Shumailov, I., Afroz, S.,

and McCoy, D. (2019). Mapping the underground:

Supervised discovery of cybercrime supply chains.

In 2019 APWG Symposium on Electronic Crime Re-

search (eCrime), pages 1–16.

ICISSP 2023 - 9th International Conference on Information Systems Security and Privacy

116

Branwen, G. (2019). Darknet market mortality risks. https:

//www.gwern.net/DNM-survival.

Branwen, G., Christin, N., D

´

ecary-H

´

etu, D., Andersen,

R. M., StExo, Presidente, E., Anonymous, Lau,

D., Sohhlz, D. K., Cakic, V., Buskirk, V., Whom,

McKenna, M., and Goode, S. (2015). Dark Net

Market archives, 2011-2015. https://www.gwern.net/

DNM-archives.

Christin, N. (2013). Traveling the silk road: A measurement

analysis of a large anonymous online marketplace. In

Proceedings of the 22nd international conference on

World Wide Web, pages 213–224.

DarkNetDaily.com (2021). Interview with

dark web marketplace aurora mar-

ket. https://darknetdaily.com/2021/01/08/

interview-with-dark-web-marketplace-aurora-market/.

Darknetlive (2022). Monopoly market. https://darknetlive.

com/markets/monopoly-market/.

DeepDotWeb (2015a). Interview with alphabay market

admin. https://gir-pub.github.io/deepdotweb/2015/04/

20/interview-with-alphabay-admin/.

DeepDotWeb (2015b). Interview with german-plaza ad-

min. https://gir-pub.github.io/deepdotweb/2015/11/

04/interview-with-german-plaza-admin/.

DeepDotWeb (2015c). Therealdeal: This long-

dead market was just relaunched! https:

//gir-pub.github.io/deepdotweb/2015/12/01/

therealdeal-this-dead-market-was-just-relaunched/.

Dingledine, R., Mathewson, N., and Syverson, P. (2004).

Tor: The second-generation onion router. Technical

report, Naval Research Lab Washington DC.

ElBahrawy, A., Alessandretti, L., Rusnac, L., Goldsmith,

D., Teytelboym, A., and Baronchelli, A. (2020). Col-

lective dynamics of dark web marketplaces. Scientific

reports, 10(1):1–8.

EMCDDA, E. (2018). Darknet markets ecosystem – life-

times and reasons for closure of over 100 global dark-

net markets offering drugs, sorted by date. Technical

report, EMCDDA.

European Monitoring Centre for Drugs and Drug Addiction

(2020). Covid-19 and drugs – drug supply via darknet

markets. Technical report, EMCDDA.

Georgoulias, D., Pedersen, J. M., Falch, M., and Vasilo-

manolakis, E. (2021). A qualitative mapping of dark-

web marketplaces. In 2021 APWG Symposium on

Electronic Crime Research (eCrime), pages 1–15.

Kouzis-Loukas, D. (2016). Learning Scrapy. Packt Pub-

lishing Ltd.

Labrador, V. and Pastrana, S. (2022). Examining the trends

and operations of modern dark-web marketplaces. In

2022 IEEE European Symposium on Security and Pri-

vacy Workshops (EuroS&PW), pages 163–172.

Noroozian, A., Koenders, J., Van Veldhuizen, E., Ganan,

C. H., Alrwais, S., McCoy, D., and Van Eeten, M.

(2019). Platforms in everything: analyzing ground-

truth data on the anatomy and economics of bullet-

proof hosting. In 28th USENIX Security Symposium

USENIX Security 19), pages 1341–1356.

Nunes, E., Diab, A., Gunn, A., Marin, E., Mishra, V.,

Paliath, V., Robertson, J., Shakarian, J., Thart, A., and

Shakarian, P. (2016). Darknet and deepnet mining for

proactive cybersecurity threat intelligence. In 2016

IEEE Conference on Intelligence and Security Infor-

matics (ISI), pages 7–12.

Pastrana, S., Thomas, D. R., Hutchings, A., and Clayton, R.

(2018). Crimebb: Enabling cybercrime research on

underground forums at scale. In Proceedings of the

2018 World Wide Web Conference, WWW ’18, page

1845–1854, Republic and Canton of Geneva, CHE.

International World Wide Web Conferences Steering

Committee.

Privoxy Developers (2022). Privoxy. https://www.privoxy.

org/.

Redman, J. (2020). Sources say world’s largest darknet

empire market exit scammed, $30 million in bitcoin

stolen. Bitcoin.com.

Software Freedom Conservancy (2022). Selenium project.

https://www.selenium.dev/.

Soska, K. and Christin, N. (2015). Measuring the longitu-

dinal evolution of the online anonymous marketplace

ecosystem. In 24th {USENIX} security symposium

({USENIX} security 15), pages 33–48.

Tidy, J. (2022). Hydra: How german police dismantled rus-

sian darknet site. BBC News.

Turk, K., Pastrana, S., and Collier, B. (2020). A tight

scrape: methodological approaches to cybercrime re-

search data collection in adversarial environments. In

2020 IEEE European Symposium on Security and Pri-

vacy Workshops (EuroS&PW), pages 428–437.

Wang, Y., Arief, B., and Hernandez-Castro, J. (2021). Toad

in the Hole or Mapo Tofu? Comparative Analysis of

English and Chinese Darknet Markets. In 2021 APWG

Symposium on Electronic Crime Research (eCrime),

pages 1–13. IEEE.

Weber, J. and Kruisbergen, E. W. (2019). Crimi-

nal markets: the dark web, money laundering and

counterstrategies-an overview of the 10th research

conference on organized crime. Trends in Organized

Crime, 22(3):346–356.

WIRED (2021). The demise of white house market will

shake up the dark web. WIRED.

Yannikos, Y., Heeger, J., and Steinebach, M. (2022). Data

acquisition on a large darknet marketplace. In Pro-

ceedings of the 17th International Conference on

Availability, Reliability and Security, ARES ’22, New

York, NY, USA. ACM.

Dark Ending: What Happens when a Dark Web Market Closes down

117