Long-Term Forecast of Regional Economy Based on Least Squares

Support Vector Machine

Litao Fan

School of Economics and Management, Guangxi Vocational and Technical College of Communications,

Nanning 530023, Guangxi, China

Keywords: Least Squares Support Vector Machine, Regional Economy, Medium- and Long-Term Forecasting, Support

Vector Machine.

Abstract: Regional economic growth is a demand-led change. By reasonably forecasting and studying the patterns and

operating mechanisms of economic growth changes in a specific range of regions, we will promote the

sustainable growth of regional economy and society. In order to address the shortcomings of the existing

research on regional economic forecasting in the medium and Long-Term, this paper briefly discusses the

index system and sample data of the forecasting model proposed in this paper based on the least squares

support vector machine (LLSSVM) and regional economic forecasting methods. The design of the

forecasting model is also discussed, and the results of the least squares support vector machine for medium-

and Long-Term regional economic forecasting are finally analyzed experimentally. The experimental data

show that the error between the prediction results of least squares support vector for a city's economic GDP

and the actual results is small, and its accuracy rate for a city's economic GDP prediction is about 96.5% on

average, which is significantly better than the other two prediction models. Therefore, it is verified that the

game model simulation based on ant colony algorithm performs better.

1 INTRODUCTION

There is a close relationship between regional

economic development and national economic

development and people's social living standards,

and the correct prediction and analysis of the law of

economic development changes in the region is

beneficial to the continuous development of the

national economy and regional economy.

Nowadays, an increasing number of scholars

have conducted a large number of studies in medium

and Long-Term forecasting of regional economies

through various technical and systematic tools and

have achieved some results through practical

research. Archit derives a general differential

equation describing the cyclical and trend

components of Long-Term economic growth. The

equation is based on an induced investment

nonlinear gas pedal model. A method is proposed to

solve the approximate solution of the nonlinear

differential equation by decomposing the solution

into a rapidly oscillating business cycle and a slowly

varying trend using the KBM averaging method.

The model gives rough estimates of the threshold at

which the system destabilizes and falls into a crisis

recession and is one of the main results of the

model. The model is used to forecast the

macroeconomic dynamics of the United States in the

sixth Kondratieff cycle (2018-2050). For this

forecast, Archit uses a fixed productive capital

function dependent on the long-run Kondratieff

cycle and the medium-run Juglar and Kuznets

cycles. More accurate forecasting of the timing of

crises and recessions is based on the accelerated

log-cycle oscillation model (Archit 2018). Salimova

G proposes a model for forecasting socio-economic

trends in a region. The model envisages the

construction of three = models: matrix predictor,

autoregressive model and binary choice logit model.

This approach ensures adequate reproduction of the

system dynamics of regional socio-economic

development indicators. It is also tested by specific

examples that illustrate the opportunities of

multidimensional economic and mathematical

modeling of difficult socio-economic phenomena

and processes. The development of the model

provides for the implementation of multivariate

forecasting calculations (Salimova G 2022). The aim

of Greyling L research is to develop an appropriate

542

Fan, L.

Long-Term Forecast of Regional Economy Based on Least Squares Support Vector Machine.

DOI: 10.5220/0012036500003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 542-547

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

mathematical model for Long-Term forecasting of

technological progress and economic growth in the

digital age. To achieve its goal, the

Schumpeter-Kondratieff theory of innovation and

cycles is the most suitable economic-technical

cluster of economic development for Long-Term

forecasting of technological progress and economic

growth. Greyling L developed an information model

for forecasting technological progress based on the

growth rate of endogenous technological

information in the economy. It also gives the main

regimes of producing technological information

corresponding to the era of information and digital

economy, as well as the Lagrange's theorem that

generates them. The model is validated with the

information LW of the U.S. economy from

1982-2018, with highly accurate approximations to

both technological progress and economic growth

(Greyling L 2022). Although there is a wealth of

existing research on regional economic forecasting

in the medium and Long-Term, there are certain

shortcomings in regional economic forecasting in

the medium and Long-Term based on least squares

support vector machines.

In this paper, based on the established least

squares support vector machine (LLSSVM)

regression forecasting model, an evaluation index

system for regional economic forecasting is

constructed with the economic development of a city

as the background of the empirical study, and the

selected sample data are screened for indicators and

the data set is pre-processed for normalization. The

least squares support vector machine (LLSSVM)

and the characteristics and properties of regional

economic development are used to describe in detail

the basis for the establishment of the forecasting

model. The prediction accuracy of LLSSVM for

regional economy is compared with PCA and SVM,

and the results show that the prediction accuracy

based on LLSSVM) is better than that of PCA and

SVM models.

2 MEDIUM- AND LONG-TERM

FORECASTING OF REGIONAL

ECONOMY BASED ON LEAST

SQUARES SUPPORT VECTOR

MACHINE

2.1 Least Squares Support Vector

Machine (LLSSVM)

LLSSVM adopts the empirical risk minimization

criterion and uses kernel functions to solve nonlinear

regional economic forecasting problems, which can

be solved as linear forecasts in the new economic

characteristics (Sun F 2022).

At this point the decision function can be

expressed as:

ckhuk +⋅= )()(

ϑ

(1)

where

h

is a vector of regional economic weights

and

c is an offset. The structural risk minimization

principle is used to find the value of this vector.

The LLSSVM optimization problem can be

expressed as:

),...2,1(

2

1

2

1

),,(min

1

2

2

,,

XivhvchW

X

i

i

vch

=+=

=

λ

(2)

where,

λ

is the penalty parameter and

i

v

denotes

the prediction error. From the above equation, it can

be seen that the loss function is directly defined in

the least squares support vector machine as the sum

of squares of the errors (Iliovits M 2022).

The expression of the prediction model for

nonlinear regression can be written as:

=

+=

X

j

jii

cuuGuk

1

),()(

β

(3)

In the above equation,

i

β

is the multiplier of

regional economy and

)(

, ji

uuG is the kernel

function, which satisfies the conditions of regional

economic development. The kernel function chosen

in this paper is

)

2

exp()(

2

2

ϖ

ji

ji

uu

uuG

−

−=

.

2.2 Regional Economic Forecasting

Methods

Regional economic forecasting can be divided into

different categories according to different methods

(Virtanen H 2022).

(1) According to the scope involved in economic

forecasting, it can be divided into macro and micro

economic forecasting. Macroeconomic forecasting

generally refers to forecasting based on the national

economy and the scope of operation of regional

units. Microeconomic forecasting refers to

forecasting on the basis of the scope of operation of

Long-Term Forecast of Regional Economy Based on Least Squares Support Vector Machine

543

production units (Klopp R N 2022).

(2) Long-Term, medium- and Long-Term

economic forecasts, short-term and near-term

forecasts are classified according to the length of the

forecast period. Long-term economic forecasting

refers to making forecasts for more than five years.

Medium-term economic forecasting refers to

forecasting for one to five years (Raj A 2022).

(3) Static and dynamic economic forecasts can

be classified according to the temporal state of the

forecast. Static economic forecasting is based on the

expectation of the cause-effect relationship arising

from macro things in a region (Falahat M 2022).

Dynamic economic forecasting, on the other hand,

refers to the prediction of future economic

development based on the course and dynamics of

macro things generated in a region.

3 INVESTIGATION AND STUDY

OF REGIONAL ECONOMIC

FORECASTING IN THE

MEDIUM AND Long-Term

BASED ON LEAST SQUARES

SUPPORT VECTOR MACHINE

3.1 Regional Economic Forecasting

Index System

The index system studied in this paper is based on

the composition of gross domestic product (GDP),

and the factors affecting the regional economic

growth include three aspects: investment,

consumption, and import and export. Economic

growth is the result of the configuration of these

main factors among different organizations (Slama F

B 2022).

Investment: fixed asset investment and

real utilization of foreign capital.

Consumption: In this paper, the total retail

sales of consumer goods is chosen to reflect the

level of consumption of the population, and

government fiscal expenditure is chosen to reflect

government consumption.

Import and export: the import and export

of foreign trade are selected to reflect the import and

export situation.

Resources: total energy consumption,

investment in environmental protection, deposit

balance of financial institutions, and investment in

education.

3.2 Data Selection

The data set of this paper is the bottom data of

business and industry business system of a

provincial industrial and commercial bureau, and the

time span of the data set is from 2011 to 2021,

among which there are 87641 records in the original

data set of industrial and commercial data of a city,

in order to improve the prediction accuracy of the

model, the data set after pan-Chinese processing is

shown in Table 2, this paper takes the data from

2011-2021 as the training set, and takes the data

from 2017 and In this paper, the data from

2011-2021 are used as the training set, and the data

from 2017 and 2021 are used as the test set for

testing the prediction model (Caputo F 2022)

Table 1: Selected data after processing.

Corporate logo

Enterprise

type

Enterprise scale Area Industrial division

50221198BABA H 1 02 005

50221198BABA L 3 04 006

50221198BABA F 2 02 006

50221198BABA Y 2 02 005

50221198BABA G 3 04 005

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

544

4 RESEARCH ON THE

APPLICATION OF REGIONAL

ECONOMIC MEDIUM- AND

LONG-TERM FORECASTING

BASED ON LEAST SQUARES

SUPPORT VECTOR MACHINE

4.1 Construction of Regional Economic

Medium and Long-Term

Forecasting Model Based on Least

Squares Support Vector Machine

According to the characteristics of the regional

economy in the medium and Long-Term, it is

necessary to consider the characteristics of the

medium and Long-Term development stages when

building the forecasting model. According to the

actual regional economic development in recent

years, the overall target of economic development of

a city in 2021 is predicted, and it is necessary to

grasp the two points of bottom limit and high limit.

And in the process of LSSVM forecasting model

establishment, two penalty parameters and

activation functions need to be determined. If the

penalty parameter is small, the phenomenon of

under-learning of prediction is likely to occur: if the

penalty value is too large, the phenomenon of

over-learning of prediction is likely to occur. If the

kernel function is too small, the SVM is prone to the

risk of overtraining and vice versa. For this reason, a

medium- and Long-Term economic forecasting

model based on least squares support vector

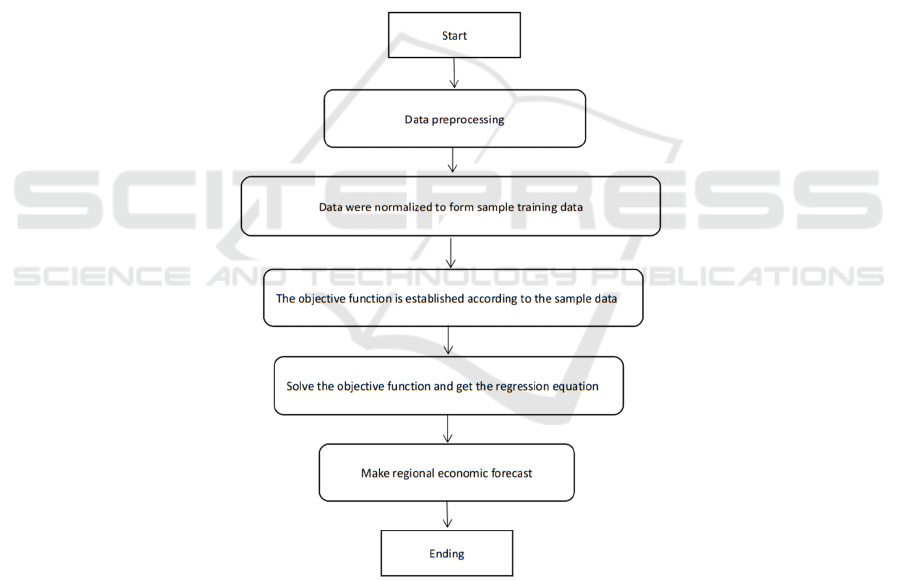

machine is designed as shown in Figure 1.

Figure 1: LSSVM prediction model diagram.

After fully studying the principle of LSSVM we

can follow the following process to model:

Historical regional economic data anomaly

data identification and pre-processing.

Normalization of historical data to form a

training sample matrix.

empirically determine the penalty

parameters and kernel functions to establish the

objective function.

Solving the objective function to obtain

the regression equation.

Forecast the medium- and Long-Term

development trend of the regional economy using

the obtained regression equation;

Long-Term Forecast of Regional Economy Based on Least Squares Support Vector Machine

545

4.2 Application of Least Squares

Support Vector Machine Based

Regional Economic Medium- and

Long-Term Forecasting

In order to verify the validity of this paper, two other

similar models are introduced for comparison, one is

using principal component analysis (PCA) to extract

components from the original independent variable

data, and then using SVM regression modeling and

forecasting; the other is using direct SVM modeling,

that is, not extracting components from the original

independent variable data, but directly performing

SVM regression modeling and forecasting. In order

to ensure the validity of the method comparison, the

parameters of the latter SVM were chosen to be the

same as those of the LSSVM. Then the five sample

components obtained after pre-processing were used

to build the regression models and to make

predictions, so as to obtain the predicted and actual

results of the economic GDP from 2017 to 2021 for

statistical analysis, and the accuracy of the

predictions of the three models was obtained as

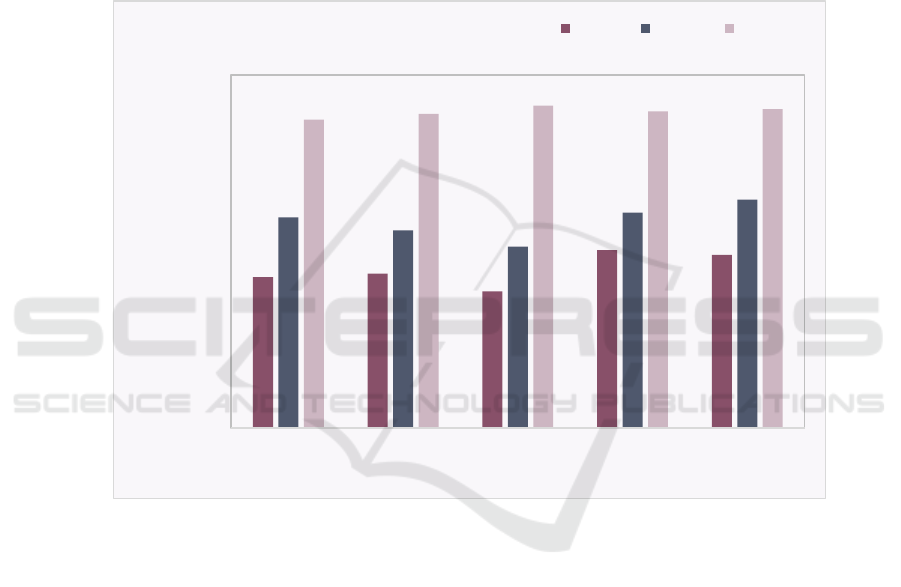

shown in Figure 2.

Figure 2: comparison of forecasting accuracy.

From the experimental data in Figure 2, it can be

seen that the accuracy of LSSVM's regional

economic forecasts from 2017 to 2021 is higher than

that of PCA and SVM in general. The accuracy of

the PCA and SVM GDP forecasts is only 85.1% on

average, while the accuracy of the LSSVM forecasts

is 97.4% and 96.9% for 2019 and 2020 respectively.

As well as LSSVM has an accuracy of 97.1% in

forecasting economic GDP for 2021, the other two

models have an accuracy of only 84.70% and

89.40% in forecasting economic GDP, respectively.

Therefore, it can be found that the least squares

support vector machine proposed in this paper is

better than the other two models in predicting the

regional economy in the medium and Long-Term,

and its superiority of prediction is verified.

5 CONCLUSIONS

In this paper, through an in-depth study of regional

economic forecasting methods and least squares

support vector machines, an LSSVM model was

established based on the relevant data and index

system of a city from 2011-2021, and the predicted

economic GDP from 2017-2021 was successfully

predicted, and the fitting effect was very satisfactory

according to the prediction error. Then, the LSSVM

model was trained and tested with PCA and SVM

models, and the errors of the prediction results and

the actual results were statistically analyzed for

accuracy comparison. Finally, it is verified that the

LSSVM model fits better than the other two models.

70,00%

75,00%

80,00%

85,00%

90,00%

95,00%

100,00%

2017 2018 2019 2020 2021

Value

Year

PCA SVM LSSVM

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

546

REFERENCES

Archit, Kumar, Nayak, et al. Growth, Instability and

Export Performance of Banana in India - An

Economic Analysis [J]. Agricultural Situation in India,

2018, 74(10):25-33.

Caputo F, Fiano F, Riso T, et al. Digital platforms and

international performance of Italian SMEs: an?

exploitation-based overview [J]. International

Marketing Review, 2022, 39(3):568-585.

Falahat M, Soto-Acosta P, Ramayah T. Analysing the

importance of international knowledge, orientation,

networking and commitment as entrepreneurial culture

and market orientation in gaining competitive

advantage and international performance[J].

International Marketing Review, 2022, 39(3):463-481.

Greyling L, Makhoba B P, Kaseeram I. Asymmetric and

threshold effects of public debt on economic growth in

SADC: a panel smooth transition regression analysis

[J]. African Journal of Economic and Management

Studies, 2022, 13(2):165-176.

Iliovits M, Harding L, Pill J. Language use in an

English-medium instruction university in Lebanon:

Implications for the validity of international and local

English tests for admissions[J]. Journal of

English-Medium Instruction, 2022, 1(2):153-179.

Klopp R N , Franco J F H , Hogenesch H , et al. Effect of

medium-chain fatty acids on growth, health, and

immune response of dairy calves[J]. Journal of Dairy

Science, 2022, 105 (9):7738-7749.

Raj A, Misra J P, Khanduja D. Modeling of Wire

Electro-Spark Machining of Inconel 690 Superalloy

Using Support Vector Machine and Random Forest

Regression Approaches[J]. Journal of Advanced

Manufacturing Systems, 2022, 21(03):557-571.

Salimova G, Ableeva A, Valishina N, et al. Regional

Product, Employment, and Labor Productivity in the

Context of Sustainable Development [J]. Journal of

Industrial Integration and Management, 2022,

07(03):349-365.

Slama F B, Oussii A A, Klibi M F. The rough road towards

accounting harmonization of a developing country

with a French accounting culture[J]. Accounting

Research Journal, 2022, 35(4):490-507.

Sun F, Shi G. Study on the application of big data

techniques for the third-party logistics using novel

support vector machine algorithm[J]. Journal of

Enterprise Information Management, 2022,

35(4/5):1168-1184.

Virtanen H, Kock S. Striking the right balance in tension

management. The case of coopetition in small- and

medium-sized firms[J]. Journal of Business &

Industrial Marketing, 2022, 37(13):33-47.

Long-Term Forecast of Regional Economy Based on Least Squares Support Vector Machine

547