Analysis of Trading Security of Cryptocurrencies: Evidence from the

DAO Hack

Chang Liu

Beijing Jiaotong University, Beijing, 100044, China

Keywords: Cryptocurrencies, Blockchain, Trading Attack, Computer Technology.

Abstract: Contemporarily, cryptocurrencies (e.g., Bitcoin and Ether) gained more public attention in recent years, which

also has financial influences on trading on the blockchain platform. Similar to other emerging digital

technologies, safety especially trading and transaction security becomes a significant issue, with the

increasing number of users. In this article, it will mainly focus on the cryptos trading security on the

blockchain, accompanied by a real attacking case, the DAO hack happened in 2016, to analyze current security

strategies on the blockchain platform and the vulnerabilities within the trading and transaction process.

Although there are many strategies such as hash function used for digital signature and decentralization to

protect the security of users’ privacy and trading’s normal operation, double-spending and multiple

withdrawal attack still happen because of the immature mining technology, caused by a long time for miners

to validation and add blocks onto the blockchain. To address the issue, some new ways, using emerging

computer information technology, to validate transactions can be used to shorten the time and energy

consumption, while the users’ actions still considerably contribute to the trading security on the blockchain.

These results shed light on avoiding and improving the future environment of blockchain and its development.

1 INTRODUCTION

The development of blockchain can be mainly

divided into three stages, which are blockchain 1.0

from 2008 to 2013, blockchain 2.0 from 2013 to

2015, and blockchain 3.0 from 2015 to 2018. In 2008,

Satoshi Nakamoto published a white paper on Bitcoin

(Nakamoto, 2008), and blockchain entered a new

epoch. An electronic payment system was deployed

with cryptographic proof compared with the

traditional transaction strategy based on trust, which

allows no third party to be needed or get involved

when two groups want to transact, leading to a direct

and convenient transaction, solving the decentralized

difficulties on currency and transaction. After that

period, one of the most significant invent was

Ethereum. Vitalik Buterin, a top developer,

recognized the limitation of Bitcoin and brought in

another kind of cryptocurrency which is Ethereum,

making it possible to have a programmable currency

through a smart contract, which can be executed

automatically when the condition is satisfied, without

third parties intervene. When it comes to after 2015,

blockchain and cryptocurrency meet an era of a full

application. Lots of kinds of new implementations of

blockchain appears such as NEO and IOTA, and more

area, e.g., finance, science, and art, uses blockchain

and cryptocurrency to record information and solve

public affairs.

While with the development of blockchain and

cryptocurrency, security becomes a major threat for

users when having transactions with each other.

Research, done by Fröhlich, supported that key

management meets a difficulty for users when

transactions (Fröhlich, 2020). Fröhlich also provided

a model based on CMT, allowing researchers and

developers to understand more users’ actions on the

blockchain with the security issue (Fröhlich, 2020).

Losing currency is a common situation in the

cryptocurrency area, which is always experienced by

holders rather than some freshmen possessing

currency. As Svetlana analyzed in 2021, trying to find

the risk by observing users’ choice of crypto-wallet

and some kinds of security practices used for

protecting crypto-assets, there is some gap between

users in their security perceptions, which affects their

decision on choosing wallet and transaction platform

(Abramova, 2021). While Banerjee, Utsav, and

Anantha developed a new way for encrypting

transactions by a kind of low-power processor for

504

Liu, C.

Analysis of Trading Security of Cryptocurrencies: Evidence from the DAO Hack.

DOI: 10.5220/0012035700003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 504-510

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

secure embedded blockchain, which implemented

elliptic curve pairing (Banerjee, 2021). In addition, a

detailed analysis was developed by Chao Yu on the

security of cryptocurrencies with the domain of

support from blockchain platforms and technology,

suggesting that data authenticity and recording are

used to ensure the security of blockchain technology

(Yu, 2022). However, Baraković, Sabina, and

Jasmina organized some interesting statistics about

what current cryptocurrency meets with security

challenges (Baraković, 2022). Attacks including

network attacks, user wallet attacks, and smart

contract attacks are the most prominent influence on

cryptocurrencies. To summarize, blockchain and

cryptocurrencies are now with security threats on

both users’ side and during the transaction such as

encrypting and various kinds of attacks.

Contemporarily, blockchain has more and more

real use in both people’s daily life and advanced

technologies such as recording important

information, especially personal privacy and ensuring

compulsory consensus with currency transactions.

This article mainly analyzes current trading security

on blockchain and cryptocurrencies with some

evidence. In the beginning, a description of the

blockchain and trading processing for

cryptocurrencies will be given with a simple way and

some flow image to help, followed by security design

for transactions in recent years. Then, the article will

show several possible vulnerabilities in blockchain to

demonstrate the security flaw in the crypto

transaction. In addition, certain cases and examples of

transaction security will be explained for the

happening reason. Finally, the limitation of current

security policies and strategies on the crypto

transaction will be listed, which also includes

possible outlook in the future.

2 BLOCKCHAIN CONCEPTS

AND TRADING PROCESSING

FOR CRYPTOS

2.1 Terms and Concepts

Blockchain is normally known as a chain connecting

lots of blocks, which contains certain information,

sorted by the creation time, which the whole chain

will be saved at all the blockchain servers, standing

for a safety issue that only one server can maintain the

work of the whole blockchain (Eskandari, 2018). It

leads to the two main features of blockchain as temper

(i.e., resistant and decentralization), which account

for difficulties in changing all data in all the servers

of blockchain at one time. A transaction is that when

there is a new block, the owner of the block will use

the former transaction’s hash code and the public key

of the latter owner, which would be added at the end

of the coins, thus, transferring the current coin to the

next owner (Nakamoto, 2008). In this situation, the

ledger, also called blockchain, is maintained and

updated by a decentralized network using a novel

method to reach a consensus that involves

incentivizing nodes in the network with the ability to

generate new Bitcoin and collect transaction fees,

which can be recognized as mining.

Cryptocurrency, an electronic coin, is always used

for a chain of digital signatures, recording the whole

trace for the chain (Fang, 2022). There are three

mainstream cryptocurrencies, which are Bitcoin as

mentioned before, Ethereum, and Litecoin. Bitcoin is

a kind of digital currency described by Nakamoto in

2008 (which also introduces a peer-to-peer electronic

cash system) (Nakamoto, 2008). Different from most

of the currencies, Bitcoin was created by a specific

algorithm with vast computing, handed out to pay

miners’ effort, which supports cryptography as a

design to ensure security in the process of currency

circulation. Ethereum is an open-source common

blockchain platform providing smart contracts, at

which solving by Ethereum Virtual Machine to

support decentralized and peer-to-peer services

(Fang, 2022). Ether is the main transaction coin,

which is also a kind of cryptocurrency used for

trading such as deploying smart contracts and

transactions a with smart contract. In addition,

Litecoin is treated as a leading rival for Bitcoin

currently, which is designed to foster the transaction

of small value on the blockchain. Compared with

Bitcoin, Litecoin needs less energy consumption,

which means that it can be mined by just a normal

computer or laptop (Bhosale, 2018).

2.2 Cryptocurrency Trading Process

The definition of cryptocurrency trading is an activity

in which people buy and sell cryptocurrencies to

make a profit (Fang, 2022). Technical and

fundamental trading are two main trading strategy

categories, with similarity in the reliance on vast

information to verify their performance.

Cryptocurrencies transaction always happens in two

main situations, which are transaction with a smart

contract and transaction with a user.

Analysis of Trading Security of Cryptocurrencies: Evidence from the DAO Hack

505

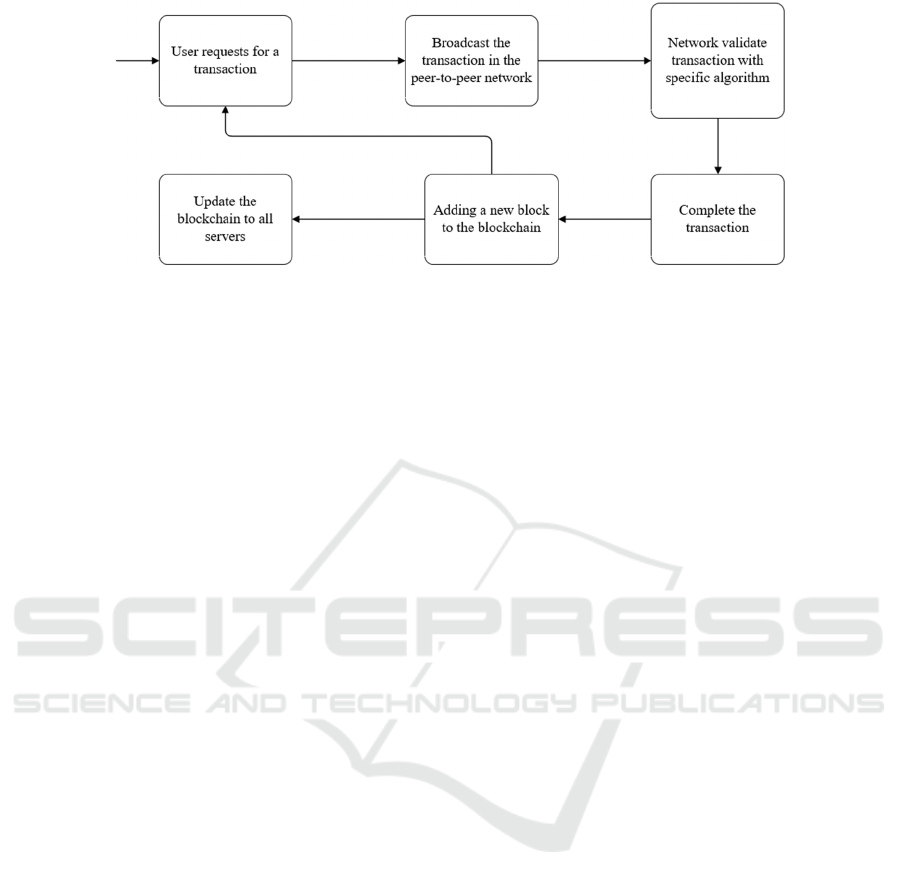

Figure 1: A simple process for transaction validation in the blockchain. [Owner-draw].

As shown in Fig. 1, a flow chart of a cryptos

transaction, the basic trading process for

cryptocurrency begins with users’ requests, followed

by broadcasting the transaction message among the

peer-to-peer network such as Ethereum. After the

miner or smart contract would validate the transaction

with a specific algorithm to compute the correctness.

Then, one comes the final step of the trading and the

new block with the transaction will be added to the

blockchain. This would be a recycle and every time a

user wants to transact will do this process. After all

the update is completed, the whole changes sign in to

the blockchain server.

3 SECURITY DESIGN

In this section, current technologies, and strategies for

protecting transaction security will be demonstrated,

which are based on two main platforms, Bitcoin and

Ethereum.

3.1 Decentralized and Anonymity

In the blockchain, the consensus mechanism is the

precondition of the whole transaction. As Sayeed,

Sarwar, and Hector Marco-Gisbert said that it ensures

that the transaction comes from a legal and correct

resource by informing all participants in the

transaction to have an agreement on the state of

distributed ledger (Sayeed, 2019). Therefore, the

consensus can be seen as a bank in the real world,

with the difference that there are no third parties and

human factors. The trading on the blockchain does

not need a third party, who can control users’

processes and assets leading to huge losses when

being attacked, while all records and transactions are

maintained by the distributed system in each node

participating, and each node has entire transaction

records, which means tiny influences when meets

attacks (Banerjee, 2021). In addition, when two users

transact on the blockchain, what they use is their

public keys, which are unreadable. Moreover, users

can have more than one account, leading to an

unpredictable procession. This increases the privacy

of users enormously, and trading security as well.

3.2 The Hash Function and Digital

Signature

A digital signature is used to validate the accuracy

and security of a data string, which is a mechanism in

the blockchain. Each block contains a string, a unique

digital signature, according to what that block

includes especially information and data stored in the

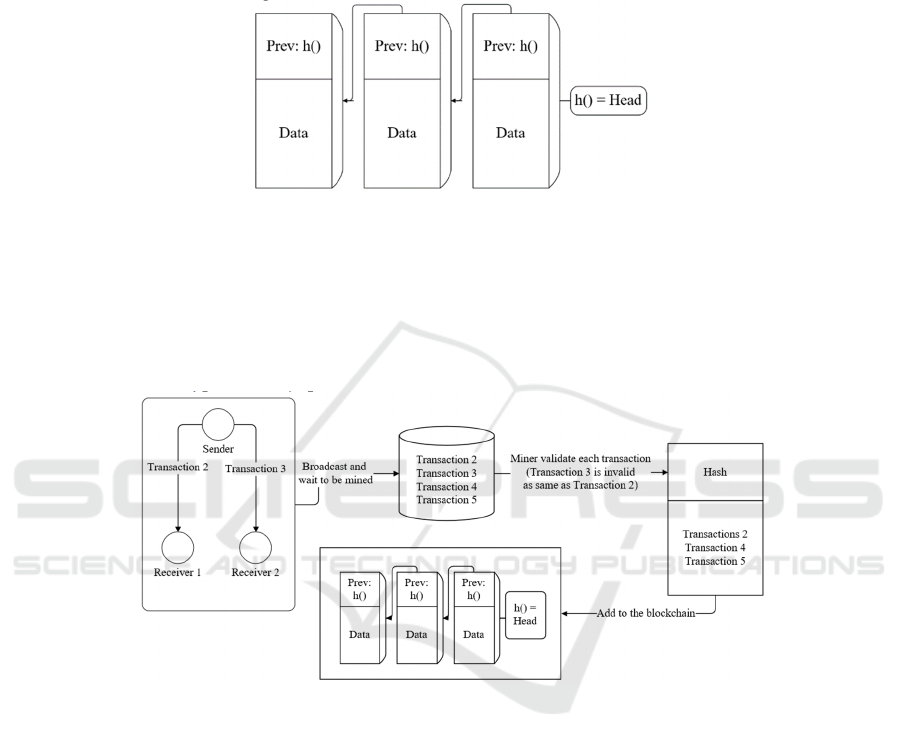

block. Fig. 2 illustrates three blocks that chain

together, which have a hash header, accounting for a

digital signature, e.g., Merkle hash to validate

whether the data is integrated and not changed or not

manipulated. Nevertheless, a digital signature cannot

always represent the next block correctly and validate

it, as is the difficulty of different hash functions. On

this basis, the Bitcoin blockchain sets a level with

certain difficulty for calculating and computing the

creation time for a block. Thus, if there are fewer data

in a block, that does not represent a faster calculation

to create a new block. If the difficulty level requires

that there are exactly sixteen zeros at the front of a

digital signature, the miner should and must satisfy

this requirement to verify one block.

This mechanism protects the data in the block to

some degree, as if there is an attacker who wants to

manipulate information within a block that is in the

middle of the whole blockchain, once the data

changes, leading to a changing of the digital

signature, standing for an error for the validation and

verification of the next block, which is caused by a

not match with the hash value, the attacker needs to

create new digital signatures for each of the following

blocks in the blockchain to solve the unmatching and

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

506

verifying problems, which is expensive and nearly

impossible for either a single person or an attacking

teams (Sun, 2021). Besides, the attacker does not just

need to create new digital signatures for the damaged

blocks but also needs to act for the regular adding

blocks, generating new digital signatures. The reason

is that miners add blocks with digital signatures

according to primary blocks which are not

manipulated by attackers, on the contrary, those

primary blocks have been changed with different

digital signatures.

Figure 2: A sketch to describe the basic structure of how blocks are connected on the blockchain, like a linked list [Owner-

draw].

4 SECURITY FLAW

This section will focus on Ethereum security, which

is the most famous cryptocurrency platform, with

some common attacks happening on Ethereum such

as smart contract leakage.

Figure 3: When a sender sends two same transactions to different receivers during the mining time, double-spending happens

[Owner-draw].

4.1 Double-Spending

In blockchain trading, double-spending is a common

problem, which means using a one-time transaction

two or three times, due to the consensus delay (Saad,

2020). To show this threat, consider a scenario, with

a sender and two receivers in the blockchain. In the

common blockchain, when a sender wants to have

transactions with the receiver, it basically transports

the assert with a sender’s public key to the receiver’s

address, which needs the sender’s private key to sign

for the transaction. Once the transaction is signed, it

will broadcast to the whole blockchain network to

find the receiver. At the time that the receiver gets the

transaction, the receiver would validate the address

and the private key, along with an unspent

transaction, waiting for miners to calculate and put

the block onto the blockchain as a valid block. While

the time for mining cannot be confirmed with

different block computation times. However, when

the receiver is positive and wants to end the

transaction quickly, it would not wait for the

validation and mine of the block by miners, who send

the products back to the sender. On this basis, the

sender can re-sign the transaction and send the same

transaction to another receiver, which means that the

sender sends two same transactions to two different

receivers during the mining time of the transaction

block. In this case, which receivers will get the real

Analysis of Trading Security of Cryptocurrencies: Evidence from the DAO Hack

507

transaction depending on the mining time, as

exhibited in Fig. 3.

4.2 Multiple Withdrawal Attack

An attack that always happens in ERC20 tokens

called a multiple withdrawal attack is also common in

blockchain trading. This attack comes from two

methods in the ERC standard, used for approving and

transferring tokens (Rahimian, 2019). A method

called approve, allows a spender to withdraw a certain

amount of token in the token pool of the approver, and

if the method is called for several times, it will

override the previous modification and update the

newest change of the allowance. In addition, the

method TranferFrom is to transfer tokens from one

user to another without limitation. Imaging a scenario

where there is an approver and a spender, the

approver allows the spender to transfer N tokens on

his balance. Conversely, the approver wants to

change N to M tokens instead, while the new

transaction of this change has not been added to the

blockchain because of the mining time, which is

invalid at that time. The spender transfers N tokens

by front running. When the approver’s transaction is

executed on the blockchain, the spender has another

chance to transfer M tokens to his account, which

means there are (M+N) tokens totally transferring

from the approver. This attack can be avoided by the

approver if he waits for the execution of the first

transaction, compared with what the assumption is

just operated by the spender at one time (Rahimian,

2019).

5 CASES OF SECURITY ISSUES

This section will analyze a smart contract attack

happening in the real world, e.g., the DAO hack

caused huge economic losses and made a big

influence on blockchain development. A famous

attack, the DAO hack, also a kind of reentrancy

attack, leading to a furcation of ETC and ETH, will

be discussed in this section as a case, to show a real

flaw in the blockchain. In June 2016, the DAO hack

happened with more than 3.6 million Ethers stolen by

attackers (Dhillon, 2017). The attacker found a

vulnerability in DAO.sol, which is mainly used for

the deposit and withdrawal balance of users. The

method withdraw was used for having a recursive

withdrawal when a contract calls this function until

the balance of the target contract decreases to zero.

The underlying reason is that the attacker created an

attacking contract with a method fallback, a default

function in Ethereum, which will be called at the time

that the withdraw method was called with payment.

Due to this mechanism, the fallback method can call

the withdraw function within it, which will withdraw

the balance continuously.

Table 1: A target contract and an attacking contract to show how the attack happens [Owner-draw].

contract DAOSam

p

le

{

im

p

ort "./DAOSam

p

le.sol";

mapping(address => uint) public bal; contract Attack {

function de

p

osit

()

p

ublic

p

a

y

able

{

DAOSam

p

le

p

ublic daoAcc;

b

al[ms

g

.sender] += ms

g

.value; constructor

(

address

_

daoAddr

)

{

} daoAcc = DAOSample(_daoAddr);

function withdraw

()

p

ublic

{

}

uint bal = bal[msg.sender]; fallback() external payable {

re

q

uire

(

bal > 0, "Not enou

g

h"

)

; if

(

address

(

daoAcc

)

.bal >= 1 ether

)

(bool send, )=msg.sender.cal}(""); daoAcc.withdraw();

re

q

uire

(

send, "Failed to send"

)

;

}

b

al[msg.sender] = 0; function attack() external payable {

}

re

q

uire

(

ms

g

.value >= 1 ether

)

;

daoAcc.deposit{value: 1 ether}();

daoAcc.withdraw

()

;

}

}

Here is a sample code for the target smart contract

DAOSample.sol and the attack smart contract

Attack.sol (seen from Table. 1) used by the attacker,

which extends the target smart contract. The first step

is to deposit some ethers to the target smart contract

to have a balance in the account by attack method in

the attack contract. Then, the attack begins, with a call

function of withdraw in the target contract, which, as

mentioned before, will execute fallback method in the

attack contract during the action of msg.sender.call in

the target contract after transferring Ethers to the

attack contract. However, here comes a circulation in

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

508

the fallback method, as there is also a call of withdraw

method in the target contract, while the balance of this

account has not been modified from the primary

balance, which leads to another time for withdrawing

balance from the target contract. When the balance

Ether on the target contract comes to zero, the

fallback method ends and begins to return, making no

sense anymore as the Ethers of the target contract has

been transferred to the attack contract.

For solving this attack immediately, the Ethereum

official tried to send plenty of transactions to block

the blockchain and came to the idea that having a soft

branch between the hacked Ethers and the main

blockchain of Ethereum (Dhillon, 2017).

Nonetheless, the reason that users act on the

blockchain is mainly because of the decentralization

and privacy. Whereas, the action of the official

accounts that there is still a third party to supervise

and control the whole blockchain ledgers, and having

the ability to modify users’ transaction and action,

disobeying to the consensus mechanism

(Praitheeshan, 2019). After this soft branch and hard

branch in the next few months, there are two main

blockchains, ETC and ETH, operation by the original

users who believe in and preserve the consensus

mechanism and by the official Ethereum respectively.

6 LIMITATIONS & PROSPECTS

During several years of development of blockchain,

there are some experienced strategies to solve trading

security vulnerabilities. Whereas, the limitations are

also obvious, especially in cryptocurrencies

transaction which is connected with users closely, as

listed in following:

Protocol limitation. Blockchain depends on a

consensus mechanism protocol to keep the platform

working, while this mechanism is quite different on

different blockchain platforms, standing for a weak

consensus (Sayeed, 2020). Therefore, when an attack

happens on the blockchain, the blocks will be

removed, and then, damage the blockchain fully. In

addition, another protocol Pow, Proof of Work, is a

disadvantage in blockchain, which accounts for huge

energy consuming for proofing and validating

transactions, limiting the mining time to add a block

onto the blockchain as a low efficiency on operations.

For this limitation, multiple withdrawal attacks and

also selfish mining attacks were designed to attack

this weakness.

Transaction time limitation. As shown in Fig. 1,

when users want to transact on the blockchain, miners

need to validate the transaction by calculating.

Conversely, this time is always long and depends on

various issues such as the block size and the gas fee

which is used as a reward for miners’ work

(Gebraselase, 2021). Although this long-time

validation provides some security indeed, it leads to

lots of attacks such as double spending and multiple

withdrawal attack, which are caused by the time delta

between sending and validating. The other

disadvantage is that most of the users have no

intention to wait for such a long time, while their time

can also be regarded as money.

Smart contract limitation. This always happens

on an application tier, as after deploying the smart

contract with an application. Once the smart contract

has vulnerabilities, the attackers can make use of

them and steal lots of cryptocurrencies and destroy

the security and also the blockchain. This attack

always occurs when smart contract developers fail to

find and identify the code bugs, and when the smart

contract is deployed, it is static on the blockchain,

which means that the developers cannot modify it

anymore despite deploying a new smart contract,

causing finance loss if the previous threat smart

contract has been used for a long time. Just like the

DAO hack (Dhillon, 2017), the smart contract has

collected lots of Ethers from the blockchain, but, at

that time, the underlying threats appeared, leading to

a huge influence such as the furcation of the two kinds

of cryptocurrencies.

It is undeniable that the appearance of blockchain

and cryptocurrencies makes a significant influence on

trading and finance, while they have not gotten into a

mature way, especially in cryptocurrency trading and

transactions. PoA, Proof of Activity, can be

considered to have wider use in the future to having

less energy consuming by miners and shortening the

time for validating the transaction, which can avoid

some attacks such as multiple withdrawal attacks that

depending on the time difference, and increasing the

enthusiasm on mining (Sayeed, 2020). In addition,

another aspect of the strength of security is that more

work can be done on smart contract. It is obvious that

lots of attacks on the blockchain are caused by some

vulnerabilities on smart contracts, for example, the

DAO hack due to a reentrance attack by contract

threat and the multi-sig wallet attack, which is also an

attack caused by attackers hacking on smart contracts.

It is possible that the blockchain platforms can give

more instructions on smart contract generation and

deployment, together with forbidding unsafe methods

in smart contracts to avoid developers’ misusing

when applying. While the last aspect can be users’

actions. The protection of private keys should be

considered, with more secure ways to use them such

Analysis of Trading Security of Cryptocurrencies: Evidence from the DAO Hack

509

as QR codes or NFC (Saad, 2020). Additionally,

gaining experience from double spending attacks,

users need to ensure their transaction before taking

the following steps.

7 CONCLUSION

In summary, this paper investigates trading security

based on the DAO attack that happened in 2016.

Contemporarily, more people own cryptocurrencies,

such as Bitcoin and Litecoin, on the blockchain,

leading to security issue which is common in every

domain around the world. The safety of blockchain is

mainly protected by the immutability using hash

functions, which cause expensive spending when

attackers change date within one block, and its

decentralization, with no third-parties operation,

while some attacks, like double-spending and

multiple withdrawal, even reentrance, still threat

users trading security currently as the long mining

time for validating transactions and update the

blockchain. In addition, the DAO hack shows an

opposite view, which, to retrieve the loss, the official

of Ethereum changed the blockchain compulsively,

leading to a puzzle on the consensus mechanism with

the basic trust in the blockchain. In the future, new

proof ways such as proof of activity and users’

privacy should be considered more in security

trading. This article only centralized on two main

blockchain platforms, Bitcoin and Ethereum, giving a

simple analysis of current trading security, without

emerging platforms like Cordas. Although threats

still exist, users and developers will have a positive

view of the development of blockchain, to solve

current trading security issues and have a safer way

to store information, especially that sensitive. In the

future, blockchain will provide a more guaranteed

platform for people to trade and save sensitive

information without being supervised. Overall, these

results offer a guideline for learning for blockchain

implementation to realize trading security.

REFERENCES

Abramova, S., et al.: "Bits under the mattress:

Understanding different risk perceptions and security

behaviors of crypto-asset users." Proceedings of the

2021 CHI Conference on Human Factors in Computing

Systems. (2021).

Banerjee, U., and Anantha P. C.: "A low-power elliptic

curve pairing crypto-processor for secure embedded

blockchain and functional encryption." 2021 IEEE

Custom Integrated Circuits Conference (CICC). IEEE,

(2021).

Baraković, S., and Jasmina B. H.: "Digital Transformation

Challenges: The Cyber Security Threats of

Cryptocurrency Technology Use." FIRST

INTERNATIONAL CONFERENCE ON

ADVANCES IN TRAFFIC AND

COMMUNICATION TECHNOLOGIES. (2022).

Bhosale, J., and Sushil M.: "Volatility of select crypto-

currencies: A comparison of Bitcoin, Ethereum and

Litecoin." Annu. Res. J. SCMS, Pune 6 (2018).

Dhillon, V., David M., and Max H.: "The DAO hacked."

Blockchain Enabled Applications. Apress, Berkeley,

CA, 67-78 (2017).

Eskandari, S., et al.: "A first look at the usability of bitcoin

key management." arXiv preprint arXiv:1802.04351

(2018).

Fang, F., et al.: "Cryptocurrency trading: a comprehensive

survey." Financial Innovation 8.1: 1-59 (2022).

Fröhlich, M., Felix G., and Florian A.: "Don't lose your

coin! Investigating Security Practices of

Cryptocurrency Users." Proceedings of the 2020 ACM

Designing Interactive Systems Conference. (2020).

Gebraselase, B. G., Bjarne, E. H., and Jiang, Y.: "Effect of

Miner Incentive on the Confirmation Time of Bitcoin

Transactions." 2021 IEEE International Conference on

Blockchain (Blockchain). IEEE, (2021).

Nakamoto, S.: "Bitcoin: A peer-to-peer electronic cash

system." Decentralized Business Review: 21260

(2008).

Praitheeshan, P., et al.: "Security analysis methods on

Ethereum smart contract vulnerabilities: a survey."

arXiv preprint arXiv:1908.08605 (2019).

Rahimian, R., Shayan E., and Jeremy C.: "Resolving the

multiple withdrawal attack on erc20 tokens." 2019

IEEE European Symposium on Security and Privacy

Workshops (EuroS&PW). IEEE, (2019).

Sayeed, S., and Hector M. G.: "Assessing blockchain

consensus and security mechanisms against the 51%

attack." Applied sciences 9.9: 1788 (2019).

Sayeed, S., Hector M. G., and Tom C.: "Smart contract:

Attacks and protections." IEEE Access 8: 24416-24427

(2020).

Saad, M., et al.: "Exploring the attack surface of

blockchain: A comprehensive survey." IEEE

Communications Surveys & Tutorials 22.3: 1977-2008

(2020).

Sun, G., et al.: "Research on blockchain transaction

security." Nanjing University of Posts and

Telecommunications (Natural Science Edition)

41.02:36-48 (2021).

Yu, C., et al.: "Technology and Security Analysis of

Cryptocurrency Based on Blockchain." Complexity

2022 (2022).

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

510