Analysis of Net Profits of Chinese Fintech-Listed Enterprises

Based on Multiple Linear Regression Model

Wenli Gao

School of Finance Hebei University of Economics and Business, 47 Xuefu Road, Shijiazhuang, Hebei, China

Keywords: Financial Technology, Listed Chinese Enterprises, Net Profit, Operating Income, Earnings Per Share.

Abstract: Internet finance and modern technology are in a state of deep integration, and fintech(financial technology)

is gradually being applied to financial fintech products, especially in listed companies in China. The paper

examines the factors influencing the net profitability of Chinese listed fintech enterprises and utilizes

multiple regression models to analyze the impact of various fintech products among Chinese listed

companies in recent years. In contrast, the research focuses on the interrelationship between fintech and

listed Chinese companies. It also considers the size of listed banks on the development of fintech, filling the

gap in the issue of fintech and the net profit of listed Chinese enterprises with multiple linear regressions.

1 INTRODUCTION

The rapid informatization and digitization of the

Chinese economy have been accompanied by a

gradual transformation of the traditional financial

model into digital fintech, as evidenced by the use of

high technology such as big data and artificial

intelligence to drive the development of financial

markets (Ashta, 2021; Herrmann, H, 2021). After

the establishment of the Beijing Stock Exchange, the

number of listed companies in China will continue

to grow, especially as a large number of fintech

companies with lower operating costs are joining the

listings. Fintech uses big data to provide financial

identity information, transaction records and credit

history functions to financial institutions and e-

commerce platforms, further helping Chinese listed

companies to improve their product formats and

revenue channels. Meanwhile artificial intelligence

and internet technology can enable data transactions

and provide services such as wealth management,

securities and insurance. Finally, information

security can ensure the safety of fintech products,

further enhancing the security of financial products

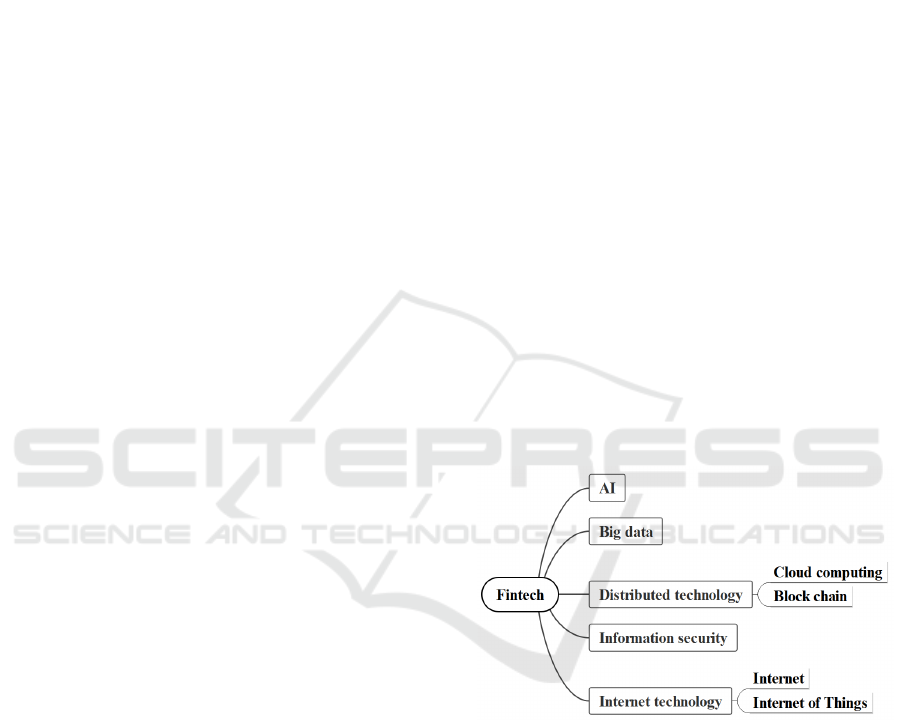

available to Chinese listed companies (Figure 1). At

present, some of the Chinese listed companies are

service-oriented or traditional finance companies,

where fintech technology is in its infancy, while

others are companies that are already using fintech

products (Nelaturu, 2022; Du, 2022; Le, 2022). Both

groups of Chinese listed companies are growing

steadily under the influence of fintech, especially in

terms of net profit, operating income and earnings

per share.

Figure 1: Key technologies of fintech.

The rapid informatization and digitization of the

Chinese economy have been accompanied by a

gradual transformation of the traditional financial

model into digital fintech, as evidenced by the use of

high technology such as big data and artificial

intelligence (AI) to drive the development of

financial markets (Ashta, 2021; Herrmann, H, 2021).

After the establishment of the Beijing Stock

Exchange, the number of listed companies in China

will continue to grow, especially as a large number

of fintech companies with lower operating costs are

joining the listings. We can see the investment in

fintech in China (Figure 1). At present, some of the

Gao, W.

Analysis of Net Profits of Chinese Fintech-Listed Enterprises Based on Multiple Linear Regression Model.

DOI: 10.5220/0012034600003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 451-456

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

451

Chinese listed companies are service-oriented or

traditional finance companies, where fintech

technology is in its infancy, while others are

companies that are already using fintech products

(Nelaturu, 2022; Du, 2022; Le, 2022). Both groups

of Chinese listed companies are growing steadily

under the influence of fintech, especially in terms of

net profit, operating income and earnings per share.

2 LITERATURE REVIEW

Both Chinese listed companies and fintech are

developing, and while fintech has enriched the

profitability of Chinese listed companies, they also

pose significant challenges. Pietronudo, M.C. et al.

(2022) have shown that the convergence of Chinese

listed companies and fintech requires technical

expertise and strategic placement. The development

of artificial intelligence and big data signifies that

fintech can already be transferred from the offline

market to the internet and even the mobile market

(Stoica, E.A. et al. 2022). The development of

fintech in Chinese listed companies has a constant

impact on corporate value, including influencing

factors such as net profit, operating income and

earnings per share. Zhao, J., et al, (2022) argues that

Chinese listed companies need to comply with

government regulation of fintech, while also

preventing the risk of financial spillovers. Fintechs

also need a spirit of innovation to add more types of

products to the microeconomy, and scholars have

invested in areas related to the profitability,

operating income and stock returns of fintech,

mainly from investors (Carbó-Valverde et al, 2022).

The innovation of fintech can help Chinese listed

companies increase their revenue and improve their

long-term growth. The literature review on fintech

and Chinese listed companies is as follows (Table

1).

In addition, there are a variety of approaches to

studying listed firms. Luo S, et al, (2022) utilize

keywords and literature research methods to analyze

how fintech affects business innovation. Keywords

from the last five years were studied at the time of

the research. Deep learning and computer algorithms

are also the main methods used in the study of

fintech innovation and Chinese companies (Wang, et

al. 2022).

Table 1: Literature on Fintech and Chinese listed

companies.

Fintech Essentials Author/Researcher

Technical expertise,

Big Data,

Intelligent,

M.C. et al, (2022),

Stoica, E.A. et al, (2022),

Zhao, J., et al, (2022),

Carbó-Valverde et al,

(

2022

)

,

Algorithms,

Quantitative,

Listed enterprises

Wang, et al. (2022),

Barrot, et al. (2022).

Besides qualitative analysis, quantitative analysis

has also been involved in financial technology

research before. (Barrot, et al. 2022). This study

makes use of multiple linear regression to

investigate the impact of listed firms and fintech, it

is the research of listed firms and fintech in the

Chinese context. The study aims to answer the

following questions: (1) How do net profit,

operating income and earnings per share of listed

fintech companies in China affect each other? (2)

How do multiple linear regressions analyze the

impact of fintech on Chinese listed companies?

3 METHODOLOGY

The quantitative analysis method of multiple linear

regression was used in this study. The data in the

study was obtained from the financial statements of

listed companies and the information of data was

reliable and feasible. In building the model with

multiple linear reviews care was taken to separate

the relationship between the independent variables

and the response variables, and the regression

relationship was established by finding the

maximum factor of the regression through stepwise

regression. The linear relationship model is

established in the regression equation (Formulate 1)

and the regression variables are tested for variance

and significance. The basic idea of using multiple

regression linear prediction is to complete the model

after establishing the relationship between the

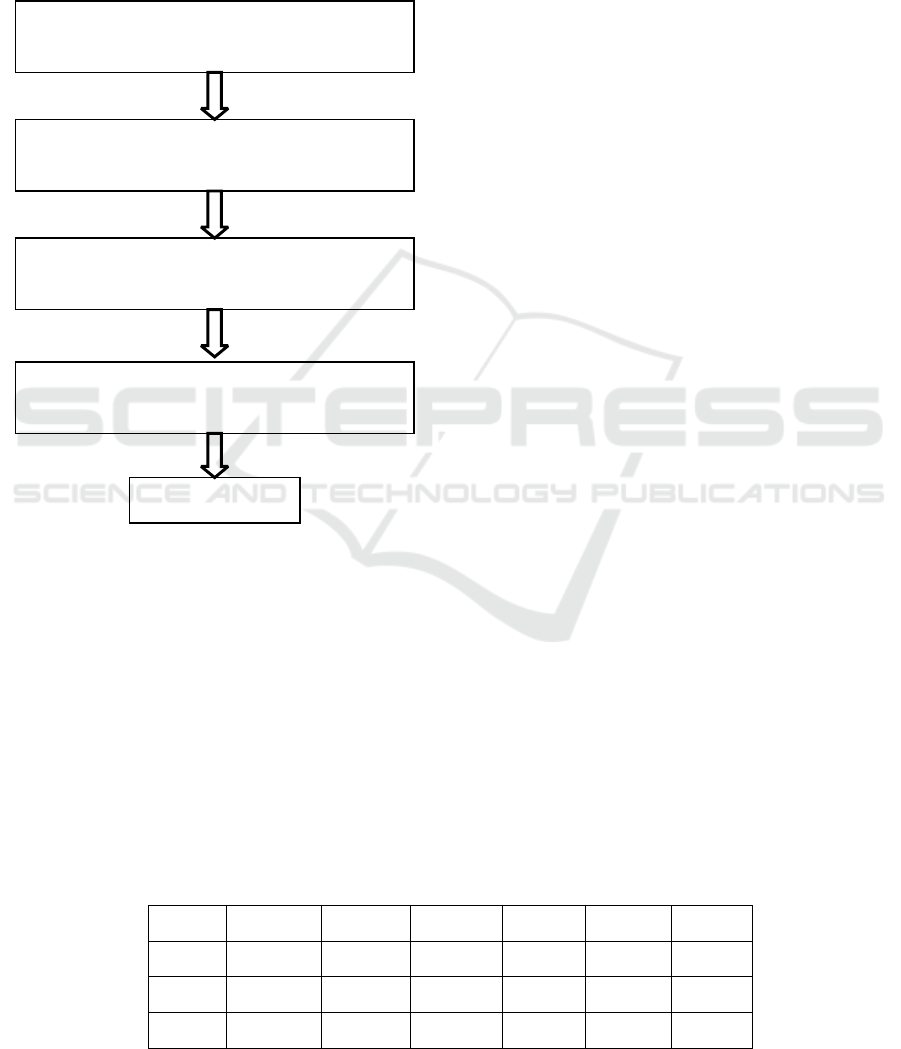

independent and the response variables, see Figure 2

for the specific steps.

The first step of data collection. The research

data for this study was obtained from the financial

statements of the banking segment of listed

companies in the Chinese A-share market as

disclosed on the Oriental Fortune website. Listed

companies in China are supervised by the Securities

Regulatory Commission, in which the listed

companies' financial statements are audited every

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

452

quarter. Hence, the publicly available financial

statements are authentic and reliable and they can be

used for the study. The 10 listed banks were

modelled using linear regression to determine the

interdependence of the 10 variables, where A is the

intercept, the number of units that affect the change

in Z for each unit change in X

n

.

Z=y

1

X

1

+y

2

X

2

+y

3

X

3

+...+y

10

X

10

+A (1)

Data collection

Data collation

Construct a regression mode

Conclusion

Correlation test

Figure 2: Literature review process.

The second step is to collate the data. The

number of companies in the banking segment of

China's A-share listed companies is 42. Listed banks

with net profits of 150 billion yuan or more are

selected and the number of extracts is calculated as

10 by applying the formula (Formulate 2). The

findings of the research are within the 95%

confidence range, the statistic of Z is 1.96, the

estimated value is at is 0.5, and the value of N is

calculated to be 10.3 within a reasonable margin of

error, so the sample of listed banks is 10. Using

EXCEL, the independent variable (net profit from

2017-2021) and the response variable (operating

income in 2021 and stock return in 2021).

n=P(1-P)/(e

2

/L

2

+ P(1-P)/N (2)

Notes: percentage precision value (E), confidence level

(L), proportional estimate (P), overall sample size of N

The third step is to construct a regression model.

Using EXCEL and multiple regression linear model

to analyze, set the regression equation and determine

the regression coefficient to complete the modelling

of regression analysis.

Step four is correlation test. The review process

is as follows, it needs to be tested with a t-test, from

the results of the regression analysis can be seen,

and the size of the t-test corresponds to the

parameters of the variable p. p<0.05 means that

there is a significant difference, and p>0.05 means

that there is no significance between the variables.

The study hypothesises that the variables are not

random variables and are independent of each other

concerning the random variable errors. The

independent and response variables are not affected

by special circumstances and are able to maintain a

linear relationship.

4 ANAYLYSIS AND RESULTS

The paper focuses on the analysis of the impact of

FinTech on Chinese listed companies, mainly on 10

companies in the banking segment of Chinese listed

companies. This study collates the net profits of

these 10 listed companies in the banking sector for

the five years from 2017 to 2021 in an EXCEL table

and also summarizes the operating income and stock

returns for 2021 in a separate table (Table 2).

Multiple regression linear analysis relates the

purpose of the study to multiple factors by the

optimal combination of multiple independent

variables together to predict the dependent variable.

Table 2: Net profit of FinTech listed companies.

(Unit: 100 million yuan)

No. Name 2017 2018 2019 2020 2021

1 PSBC 477 523 609 642 762

2 CITIC 426 445 480 489 557

3 CCB 702 736 772 783 876

Analysis of Net Profits of Chinese Fintech-Listed Enterprises Based on Multiple Linear Regression Model

453

4 PAB 232 248 281 289 363

5 SPDB 543 559 589 583 530

6 CMB 702 805 928 973 1199

7 BOC 1724 1800 1874 1928 2166

8 ICBC 2860 29877 3122 3159 3483

9 BCM 702 736 772 783 876

10 ABC 1930 2027 2120 2159 2412

Notes: Postal Savings Bank of China(PSBC),

China International Trust and Investment Corporation(ITIC), China Constuction Bank(CCB), PingAn Bank (PAB),

Shanghai Pudong China(BOC), China Merchants Bank(CMB), Development Bank(SPDB), Industrial and Commercial

Bank of China(ICBC), Bank of Communications(BCM),

Agricultural Bank of China(ABC).

The data was collated using EXCEL based on the

data collected. The study identified the net profit

from 2017-2021 as the independent variable for the

study, while the 2021 operating income and 2021

stock earnings were used as the dependent variables

for the study, and regressions were calculated based

on the formula. The regression analysis was also

conducted using the EXCEL software and the

regression analysis function in the SPSS software.

Table 3: Regression Statistics in operating income.

Multiple R 0.980241553

R Square 0.960873503

Adjusted R Square 0.911965382

Standard Error 843.7893199

Observations 10

Table 4: Regression Statistics in share price per.

Multiple R 0.833072649

R Square 0.694010039

Adjusted R Square 0.311522588

Standard Error 0.972882514

Observations 10

The regression statistical table can be completed

after regression analysis, Multiple R is the

correlation of performance multiple regression data,

and Multiple R is greater than 75% showing a strong

correlation trend, the Multiple R between the net

profit of this study from 2017-2021 and the

operating income in 2021 is 98% (Table 3), the two

factors of net profit and operating income show a

strong correlation The Multiple R between net profit

in 2017-2021 and share price per in 2021 is 83.31%

(Table 4), and the two factors of net profit and share

price per share also show a strong correlation.

Therefore, Chinese fintech has a positive correlation,

i.e. a mutually reinforcing effect, on net profit,

operating and share price revenue per share of

Chinese listed companies.

In the regression analysis, this research can be

derived from the ANOVA table (Table 5 and Table

6), from which it can be seen that the range of

fluctuations between the variables in this study is not

large and shows a trend of stable effects. The

ANOVA table corresponds to a Significance F of

0.02, which is less than 0.05. A Significance F of

less than 0.05 indicates that the overall regression

model is significant. Looking at the regression

coefficient table below again, the Coefficients

coefficient is available in the error analysis table,

which is the intercept in formulate (1) in part 3 in

Table 7 and Table 8.

Table 5: ANOVA in operating income.

df SS MS F Sig F

Regression 5 700 139 19.6 0.006

Residual 4 284 7

Total 9 728

Table 6: ANOVA in share price per.

df SS MS F Sig F

Regression 5 8.59 1.72 1.81 0.29

Residual 4 3.79 0.95

Total 9 12.37

Table 7: Coefficients in operating income.

Intercept 799.8865083

2017 16.56962463

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

454

2018 0.023275674

2019 -25.46317054

2020 -0.62295762

2021 12.05858768

Table 8: Coefficients in share price per.

Intercept 0.768134965

2017 -0.02548449

2018 -2.6159E-05

2019 0.057321944

2020 -0.03389629

2021 0.000565444

The error in the multiple linear regression model

is defined by

() ()

11

1

2

+−

=

+−

−

=

=

∧

∧

mn

VV

mn

yy

T

n

i

ii

σ

(3)

The number of observations is, the number of

parameters is, and the number of redundant

observations is, so the denominator of the above

equation is.

Finally, the study needs to test the significance of

the above results, this study uses a t-test to test the

net profit variable, operating income and earnings

per share for the 5 years from 2017 to 2021

respectively, t-test p-value is calculated as 0.03. If P

< 0.01, then the two groups are highly significantly

different; if 0.01 < P < 0.05, then the two groups are

significantly different; if P > 0.05, then the two

groups are not significantly different. Therefore, the

net profit variable, operating income and earnings

per share tests of listed companies in Chinese fintech

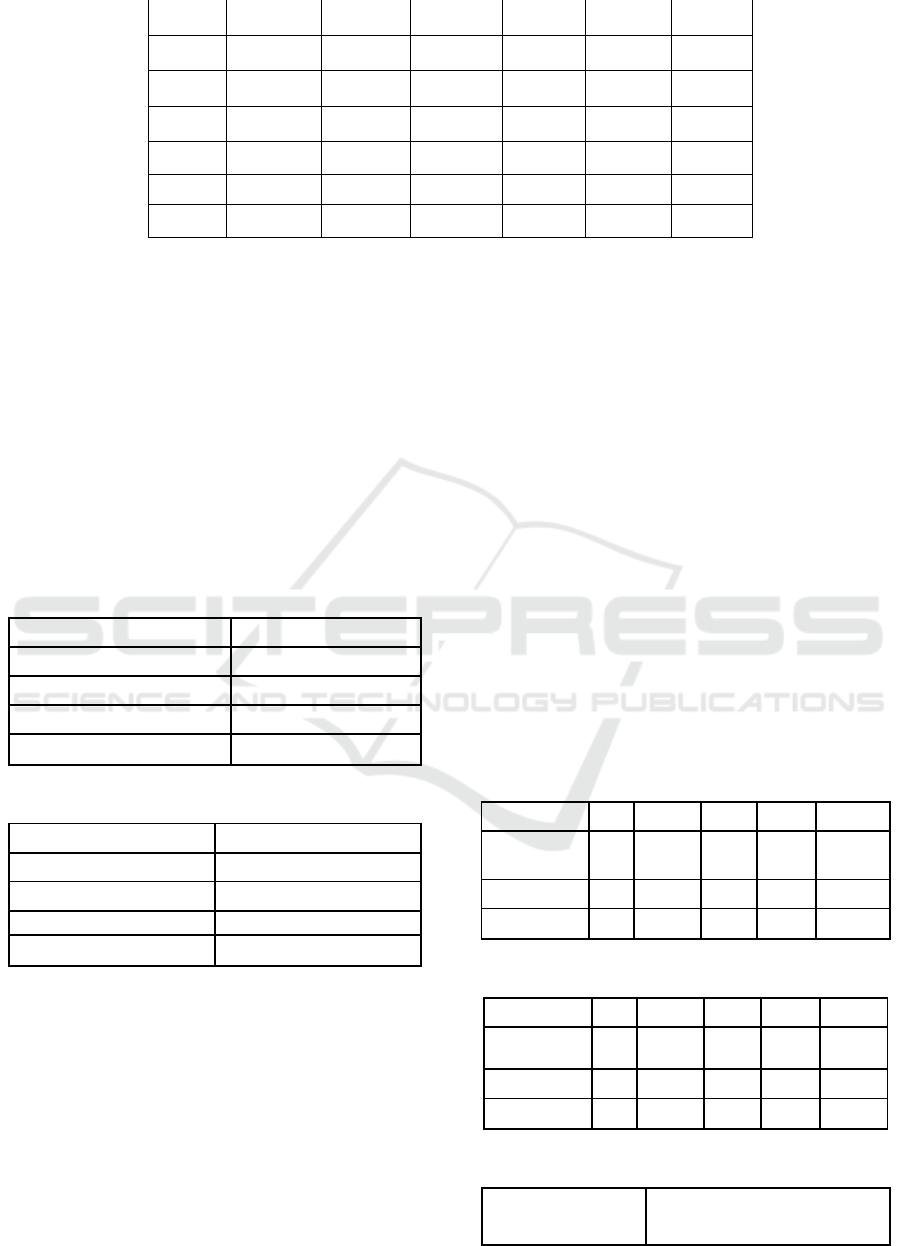

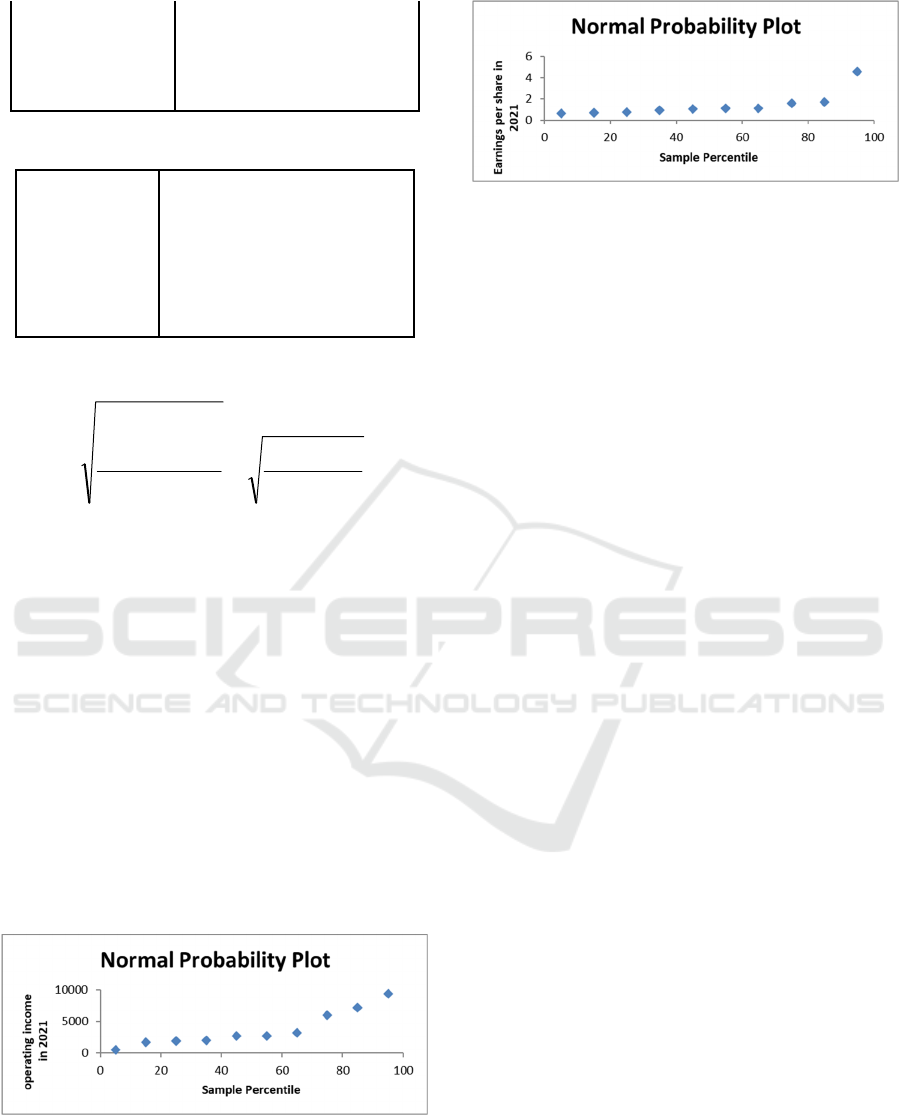

are correlated. The normal split between operating

income and earnings per share for 2021 is shown in

Figure 3 and Figure 4.

Figure 3: Normal Probability Plot in operating income.

Figure 4: Normal Probability Plot in share price per.

5 CONCLUSIONS

The paper analyzes the banking sector among the

listed companies in China's fintech and the following

conclusions are obtained. net profit variables for the

five years from 2017 to 2021, operating income and

earnings per share are positively correlated. This

means that as operating income grows, so do the net

profit and earnings per share of the companies. The

comparison suggests that the cost of the banking

segment of Chinese listed companies is also

manageable through the products of fintech.

Chinese fintech companies should focus more on

fintech innovation on their development path. In an

era of constantly updated financial products Chinese

fintech listed companies need to be more innovative

in technology and ideas. Secondly, in terms of

fintech technology and management, Chinese listed

companies need to see a broader perspective and

attract more professionals and components of a good

fintech team.

ACKNOWLEDGEMENTS

Thanks to Hebei University of Economics and

Business for providing a platform for research.

REFERENCES

Ashta, A. & Herrmann, H., (2021). Artificial intelligence

and fintech: An overview of opportunities and risks

for banking, investments, and microfinance. Strategic

Change, 30(3), pp.211-222.

Baloch, M.A., Ozturk, I., Bekun, F.V. and Khan, D.,

(2021). Modeling the dynamic linkage between

financial development, energy innovation, and

environmental quality: does globalization matter?.

Business Strategy and the Environment, 30(1), pp.176-

184.

Barrot, Jessie S., Ian I. Llenares, and Leo S. Del Rosario.

Students’ online learning challenges during the

Analysis of Net Profits of Chinese Fintech-Listed Enterprises Based on Multiple Linear Regression Model

455

pandemic and how they cope with them: The case of

the Philippines. Education and Information

Technologies 26, no. 6 (2021): 7321-7338.

Bhat JR, AlQahtani SA, Nekovee M., (2022). FinTech

enablers, use cases, and role of future internet of

things. Journal of King Saud University-Computer and

Information Sciences. Sep 5.

Carbó-Valverde, Santiago, Pedro J. Cuadros-Solas, and

Francisco Rodríguez-Fernández., (2022).

Entrepreneurial, institutional and financial strategies

for FinTech profitability. Financial Innovation 8, p.1-

36.

Emanuel EJ, Osterholm M, Gounder CR., (2022). A

national strategy for the “new normal” of life with

covid. Jama. 18;327(3):211-2.

Luo S, Sun Y, Yang F, Zhou G., (2022). Does fintech

innovation promote enterprise transformation?

Evidence from China. Technology in Society. 1;

68:101821.

Nelaturu, K., Du, H. & Le, D.P., (2022). A Review of

Blockchain in Fintech: Taxonomy, Challenges, and

Future Directions. Cryptography, 6(2), p.18.

Pietronudo, M.C., Del Gaudio, B.L. and Leone, D.,

(2021). Coopetition strategy and industry

convergence. Evidence in the Chinese banking market.

Technology Analysis & Strategic Management, pp.1-

14.

Stoica, E.A. and Sitea, D.M., 2021. Blockchain Disrupting

Fintech and the Banking System. Multidisciplinary

Digital Publishing Institute Proceedings, 74(1), p.24.

Wang, H., Chen, X., Du, J. and Lai, K.K., (2022).

Classification of FinTech Patents by Machine

Learning and Deep Learning Reveals Trends of

FinTech Development in China. Mathematical

Problems in Engineering, 2022.

Xu D, Taylor CJ, Ren Y., (2022). Wait-and-See or

Whack-a-Mole: What Is the Best Way to Regulate

Fintech in China?. Asian Journal of Law and Society.

:1-30.

Zhao, J., Li, X., Yu, C.H., Chen, S. and Lee, C.C., 2022.

Riding the FinTech innovation wave: FinTech, patents

and bank performance. Journal of International Money

and Finance, 122, p.102552.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

456