Analysis of the Impact of Social Concern on Corporate Responsibility

Based on Panel Model and Machine Learning Model

Lifeng Fang

1

, Shenghua Wang

1

, Juanjuan Cao

1

and Wenjing Liang

2,*

1

Huzhou Power Supply Company, State Grid Zhejiang Electric Power Co., Ltd, 313000, China

2

China Center for Energy Economics Research, School of Economics, Xiamen University, Xiamen, 361005, China

Keywords: Social Concern, ESG Performance, Independent Director, Machine Learning Model.

Abstract: This paper based on Panel Model and Machine Learning Model explores the impact of social concern on

corporate ESG performance by using data of Chinese A-share listed companies and explores the

heterogeneous impact of the relationship between social concern and corporate fulfillment of ESG

responsibility under different nature of social concern, corporate external and internal environments. This

paper find, firstly, the increase of social concern has a significant positive impact on corporate fulfillment of

ESG responsibility, and the results are robust. Secondly, negative feedback from the society has a greater

effect on the enhancement of corporate ESG performance compared to non-negative feedback from society

on corporations. Thirdly, the incentive effect of social concern on firms' ESG responsibility relies not only on

good government-market relations but also is related to the independence of corporate directors' decision

making. The findings of the article have implications for relying on informal institutions to promote corporate

ESG behavior.

1 INTRODUCTION

China's long-standing crude development strategy,

while fueling rapid economic growth, has also given

rise to various social conflicts, with environmental

change, climate warming, and lack of corporate social

responsibility arising one after another. China

proposed that high-quality development is the

primary task of comprehensively building a modern

socialist country and the focus of economic

development should be placed on the real economy,

and puts forward the goals of promoting people's

well-being and green and low-carbon development.

Under the new normal of China's economic

development, the dual objectives of "carbon

neutrality and carbon peaking" and the context of

Chinese modernization, changing the economic

model, and promoting green transformation of

production have become the new focus for achieving

high-quality development.

As a basic unit in the social economy, enterprises

mainly produce what society wants, which plays an

important role in the process of achieving high-

quality development. Guided by relevant policies and

systems, social concern about corporate ESG

performance continues to rise, especially in the

information age, where the public has a variety of

channels to obtain information, and public awareness

is becoming a key strategy for addressing the issue of

environmental pollution (Qin and Peng, 2016),

indicating that the socialization of corporate

performance issues requires corporate governance to

rely not only on internal company supervision and

control, but also to accept social supervision.

Independent of the formal legal system, external

concerns and evaluations play an important role in

corporate information disclosure. Therefore, it is

crucial to clarify the potential relationship between

social concerns and corporate ESG, and to explore the

drivers of corporate ESG performance, in order to

promote corporate ESG responsibility and achieve

high-quality economic development.

The focus of current corporate ESG research has

been on how corporate responsibility for ESG affects

financial performance (Chen and Xie, 2022),

financial flexibility (Zhang and Liu, 2022), market

value and consumer intentions (AI-Haddad et al.,

2022). The predominant belief is that corporate ESG

performance is an important consideration for

stakeholders when deciding whether or not to invest

(Du et al., 2010), and that companies tend to increase

socially responsible and environmentally friendly

Fang, L., Wang, S., Cao, J. and Liang, W.

Analysis of the Impact of Social Concern on Corporate Responsibility Based on Panel Model and Machine Learning Model.

DOI: 10.5220/0012034000003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 417-423

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

417

behaviors in line with stakeholders' demands (Qi et

al., 2013), and that fulfilling social and environmental

responsibilities can help companies develop a good

image and positive evaluation among consumers and

investors, increasing consumers' willingness to buy

and stakeholders' intention to invest (Pongpaew et al.,

2017). The fulfillment of ESG responsibility

improves corporate financing capacity, makes stock

prices more resilient, provides greater financial

flexibility, effectively offsets the negative effects of

an uncertain environment (Zhang and Liu, 2022),

stabilizes market values, and enables better resilience

to economic turbulence However, negative corporate

ESG performance can also make them the subject of

media attention and regulatory vigilance, which has a

negative effect on firm value (Lyon and Maxwell,

2011). Some studies have also concluded that

corporate ESG activities are detrimental to the

financial performance of firms, because corporate

investment in ESG activities has a crowding-out

effect on other firm profit-related behaviors, which in

turn affects financial performance negatively.

Existing research on the relationship between

informal institutions and corporate behavior has

focused on the effects of media coverage on corporate

innovation (Wang et al., 2019), corporate governance

(Dai et al., 2015), environmental protection

investment (Cheng and Liu, 2018), social

responsibility (Zyglidopoulos et al., 2012) and other

unilateral influence, which propose that media

coverage not only reduces the information asymmetry

between investors, consumers, other stakeholders and

the company, but also influences public opinion and

helps the public to form rational perceptions and

evaluations of the company (Du et al., 2010). And

when external stakeholders express their demands

through media and public attention, it creates more

pressure on the company, thus forcing the company

to change behavior (Shipilov et al., 2019), increase

innovation activities, and improve innovation

performance (Wang et al., 2019). Hales et al. (2018)

showed that the behavior of company employees

posting on social media motivates companies to

increase the importance of financial disclosure, and

companies are more motivated to carry out corporate

reform when they face high levels of attention,

reflecting the monitoring role of public attention,

while Cheng and Liu (2018) argue that pressures

associated with economic development limit the

relationship between public attention and corporate

environmental performance.

The existing literature mainly focused on the

economic impact of corporate ESG responsibility and

the impact of external attention on a single dimension

of corporate innovation, environmental protection,

social responsibility and corporate governance from

the media standpoint. However, there is a lack of

research on the connection between social concern

and corporate ESG performance from the public

perspective. Based on this, this paper examines the

precise impact of social concern on corporate ESG

performance based on the public participation

perspective, as well as explores the internal and

external channels that motivate corporate ESG

performance under social concern. The potential

innovations of this paper are: first, on the basis of

information from Chinese A-share listed companies’

GUBA postings, we explore the specific impact of

social concerns on ESG performance of Chinese

listed companies; second, we further classify social

concerns into positive and negative evaluations and

discuss the heterogeneous effects of different types of

social concerns on corporate ESG performance;

finally, from the perspective of internal and external

environments of companies, we explore the role of

social concerns in ways to motivate companies to

fulfill their ESG responsibilities.

The remainder of the paper is divided into the

following sections: the second part presents the

research design; the third part presents the empirical

results; the fourth is further analysis; the fifth ends the

entire paper and offers pertinent recommendations.

2 EMPIRICAL STRATEGY

2.1 Empirical Model

We use the data of Chinese A-share listed companies

from 2008 to 2020 to construct the research sample,

and screen out the samples with more missing values

and those marked ST, *ST, and PT. Considering the

validity of the results, we do not include the financial

and insurance companies in the research scope. The

data used are obtained from different databases,

among which, the data related to social concern come

from Chinese Research Data Services Platform, the

data of ESG score of listed companies are obtained

from Bloomberg, and the other data of companies are

mainly obtained from CSMAR database.

2.2 Regression Model

The model is constructed to explore the effect of

social concerns on ESG performance.

𝐸𝑆𝐺

=𝛼

+𝛼

𝑃𝑢𝑏𝑙𝑖𝑐

+ 𝛽𝑐𝑜𝑛𝑡𝑟𝑜𝑙

+𝐹𝑖𝑟𝑚+

𝐼𝑛𝑑𝑢𝑠𝑡𝑟𝑦 + 𝑌𝑒𝑎𝑟 + 𝐼𝑛𝑑𝑢𝑠𝑡𝑟𝑦 ∗ 𝑦𝑒𝑎𝑟 + 𝜂

(1)

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

418

Where, 𝑖 represents firm; 𝑡 denotes year; 𝐸𝑆𝐺

Indicates firm ESG score; 𝑃𝑢𝑏𝑙𝑖𝑐

denotes social

concern, measured by the logarithm of the number of

Gub postings of listed companies. 𝑐𝑜𝑛𝑡𝑟𝑜𝑙

denotes

the control variables related to the firm's ESG

performance, specifically: net profit ratio of total

assets (𝑟𝑜𝑎); listing time (l𝑖𝑠𝑡); gearing ratio (𝑙𝑒𝑣);

the shareholding ratio of the company's largest

shareholder (𝑡𝑜𝑝 ); cash flow ratio ( 𝑐𝑎𝑠ℎ ). 𝐹𝑖𝑟𝑚 ,

𝐼𝑛𝑑𝑢𝑠𝑡𝑟𝑦, 𝑌𝑒𝑎𝑟 and 𝐼𝑛𝑑𝑢𝑠𝑡𝑟𝑦 ∗ 𝑦𝑒𝑎𝑟 denote firm

fixed effects, industry fixed effects, year fixed effects

and industry-year fixed effects, respectively.

2.3 Random Forest Model

In previous studies econometric regression models

are mostly linear models with stringent requirements

for correlations between explanatory variables and

suffer from weak overall explanatory strength and are

limited by the model's own assumptions. This paper

therefore innovatively introduces a random forest

model in machine learning to verify the relationship

between social concerns and corporate ESG

performance, and to rank the importance of the

explanatory variables to further identify the key

factors affecting corporate ESG.

𝐸𝑆𝐺

= Θ(𝑃𝑢𝑏𝑙𝑖𝑐

,𝑐𝑜𝑛𝑡𝑟𝑜𝑙

,𝜆

, 𝜂

, 𝜇

𝑖𝑡

) (2)

The definitions of the variables ESG

、Public

and control

remain the same as in Section 2.2, 𝜆

and 𝜂

denote the inclusion of individual and time

dummy variables, 𝜇

is residuals. Θ

(

x

)

describes the

non-linear relationship between the effect of social

concern and control variables on the ESG scores of

firms. At the same time, we further describe the

marginal effect of social concern on digital finance by

inscribing a skewed dependency plot with the

expression.

Θ

(

x

)

=

1

𝑛

∑

𝑓(𝑥

𝑗1

,𝑥

𝑗2

,…𝑥

𝑗𝑝

)

𝑛

𝑗=1

(3)

3 EMPIRICAL RESULTS

3.1 Regression Results

The regression results for model (1) are shown in

Table 1. Columns (1) and (2) report the coefficient of

social concern is positive at the 1% significance level.

When including control variables. Columns (3) and

(4) indicate that the positive relationship between

social concern and corporate ESG performance

remains significant, indicating that social concern has

a certain incentive effect on corporate ESG

responsibility. The increase in social concern creates

more pressure on companies, and with the gradual

increase in public demands for environmental

protection and social responsibility, etc., in order to

enhance public reputation, build brand effect,

increase consumers' willingness to purchase, and

attract investors (Zhang and Liu, 2022), companies

are more inclined to make actions that are in line with

stakeholders' and consumer interests (Qi et al., 2013),

thus changing their existing strategies and increasing

their motivation to fulfill their ESG responsibilities;

therefore, the increase in social concern has a

significant positive incentive effect on corporate ESG

performance.

Table 1: Baseline regression.

(1) (2) (3) (4)

public 0.291*** 0.266*** 0.226*** 0.206***

(0.065) (0.065) (0.066) (0.066)

Control variables No Yes Yes Yes

Firm-fixed effect Yes Yes Yes Yes

Year-fixed effect Yes Yes Yes Yes

Industry-fixed effect No No Yes Yes

Industry-year fixed effect No No No Yes

Observation 10303 10293 10292 10292

3.2 Robust Tests

A number of robust tests are carried out in the paper

to make sure the results are valid and reliable. Firstly,

in order to eliminate the possible influence of the pre-

late correlation of the explanatory variables, the

explanatory variables were included in the regression

equation with one period lag (Fang et al., 2015);

secondly, in addition to the number of posts in the

GUBA of the listed company to measure the social

concern, this paper also used the reading of the posts

in the GUBA of the listed company and the number

of comments, which were logarithmically re-

examined; thirdly, all variables are subjected to 1%

winsorized to remove the impact of extreme values of

the sample. The results of robustness test are

Analysis of the Impact of Social Concern on Corporate Responsibility Based on Panel Model and Machine Learning Model

419

displayed in Table 2. Results of the one-period lag of

explanatory variables included in the regression

equation are displayed in column (1); columns (2) and

(3) report the regression results of social concern

measured by the number of posts read and comments,

respectively; column (4) indicates the regression

results after 1% winsorized of the data. The findings

demonstrate that the social concern coefficients pass

all four robust tests with considerably positive values,

which is in line with the baseline results.

Table 2: Robustness Test Results.

(1) (2) (3) (4)

public 0.172

***

0.204

***

0.120

**

0.245

***

(0.059) (0.063) (0.052) (0.066)

Control variables Yes Yes Yes Yes

Firm-fixed effect Yes Yes Yes Yes

Year-fixed effect Yes Yes Yes Yes

Industry-fixed effect Yes Yes Yes Yes

Industry-year fixed effect Yes Yes Yes Yes

Observation 9061 10292 10292 10292

R

2

0.853 0.768 0.768 0.768

4 FUTHER ANALYSIS

4.1 Heterogeneity of the Nature of

Social Concerns

To test the heterogeneity of the impact of different

nature of social concerns on corporate ESG, this

paper regresses the total number of posts into

negative and non-negative posts according to the

content of the postings on corporate ESG scores,

respectively, and columns (1) and (2) display the

outcomes. As we can observe, negative concerns have

a considerable positive impact on ESG both when

control variables are present and absent. While non-

negative attention has an insignificant effect on

corporate ESG. This is consistent with Cyert and

March (1963). Negative attention creates greater

pressure and reputational risk for companies, and that

increasing negative feedback is more likely to attract

the attention of company decision makers. As social

concerns about energy conservation and social events

increase, corporates will actively fulfill their social

and environmental responsibilities and take actions

that benefit consumers and stakeholders to address

and resolve negative social evaluations. On the other

hand, regulators are more sensitive to negative

corporate evaluations, and an increase in negative

social feedback will make government regulators

more alert to corporate misbehavior, thus acting as a

supervisory role for companies to fulfill their ESG

responsibilities. Contrarily, it is more possible for

corporates to rest on their laurels and not change their

current behavior when receive positive or neutral

feedback from society. Therefore, negative feedback

from society is more likely to motivate companies to

fulfill ESG responsibilities and improve their ESG

performance.

Table 3: Further analysis.

(1) (2) (3) (4)

neg1 neg2 high-ratio low-ratio

public 0.353*** -0.274**

(0.078) (0.138)

non-negative -0.286 -0.358

(0.253) (0.253)

negative 0.477** 0.531**

(0.233) (0.233)

Control variables NO Yes Yes Yes

Firm-fixed effect Yes Yes Yes Yes

Year-fixed effect Yes Yes Yes Yes

Industry-fixed effect Yes Yes Yes Yes

Industry-year fixed effect Yes Yes Yes Yes

Observation 10302 10292 7590 2501

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

420

R2 0.765 0.768 0.775 0.881

Note: Robust standard errors are presented in parentheses, ***, ** and * indicate the significance at 1%, 5% and 10%,

res

p

ectivel

y

. The same in Table 2 and Table 3.

4.2 Heterogeneity of Internal

Environment

Studies have shown that board independence is an

effective driver of corporate ESG disclosure, the

appointment of independent directors improves

corporate decision making (Gordon, 2007), and more

focus on corporate social responsibility behavior. To

analyze how social concerns differ in their effects on

company ESG performance among independence of

boards, this paper group the sample according to the

median of percentage of independent directors,

columns (5) and (6) of Table 3 display the effect of

social concerns on ESG performance of samples with

higher and lower percentage of independence,

respectively. We can know from the results that the

coefficient of social concern is positive at the 1%

significance level for enterprises with a high ratio of

independent directors, while social concern has a

major negative impact on corporate ESG scores when

there aren’t enough independent directors. This

indicates that with the increase of social concern,

independent directors can go beyond the pursuit of

corporate profit to better understand the demands of

consumers and other stakeholders, and consciously

pay attention to the social, environmental and

governance responsibilities of the corporate, thus

improving the existing decisions and prompting the

corporate to respond to social concern with more

positive attitudes and actions, enhancing the benefits

of social concern. For companies with a low ratio of

independent directors, they pay more attention to

corporate profits and managers' interests than

stakeholders' interests, thus, it is not conducive to

social concerns to play a supervisory role, resulting in

the inhibitory effect of social concerns on corporate

ESG performance.

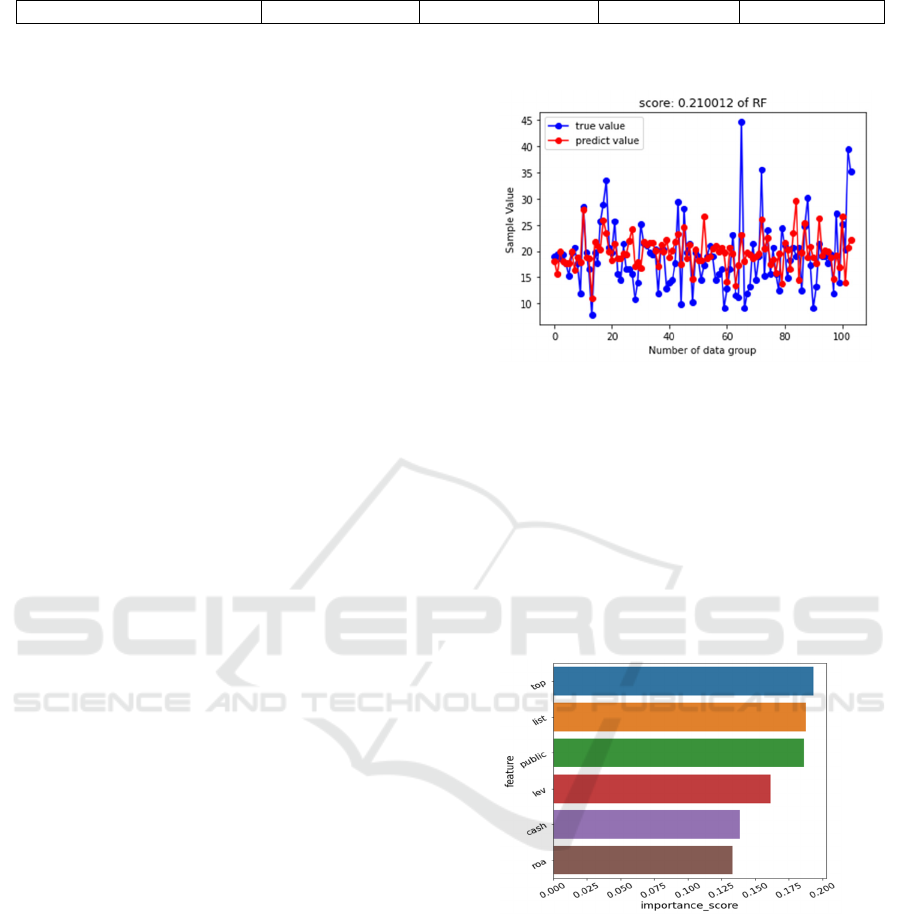

4.3 Machine Learning Model Analysis

This section uses a regression tree as the basic learner

and the minimum mean square error as the

optimisation criterion to select split nodes and

construct a Random Forest model to test social

concern and corporate ESG performance. The

predicted and actual values of the model trend

broadly in line with each other, but there is a bias in

the case of a few firms with high ESG scores. Figure

1 shows the linear fit of the model predictions to the

actual values.

Figure 1: Degree of fit of test values to actual values.

The trained model was used to predict corporate

ESG performance using the test set. The importance

of each influencing factor in the model is shown in

Figure 2. It can be seen that the percentage of shares

held by the company's largest shareholder, time to

market and social concern are the three most

influential factors, far outweighing the influence of

other factors, which further validates the causal

relationship between social concern and corporate

ESG.

Figure 2: Variable influence ranking.

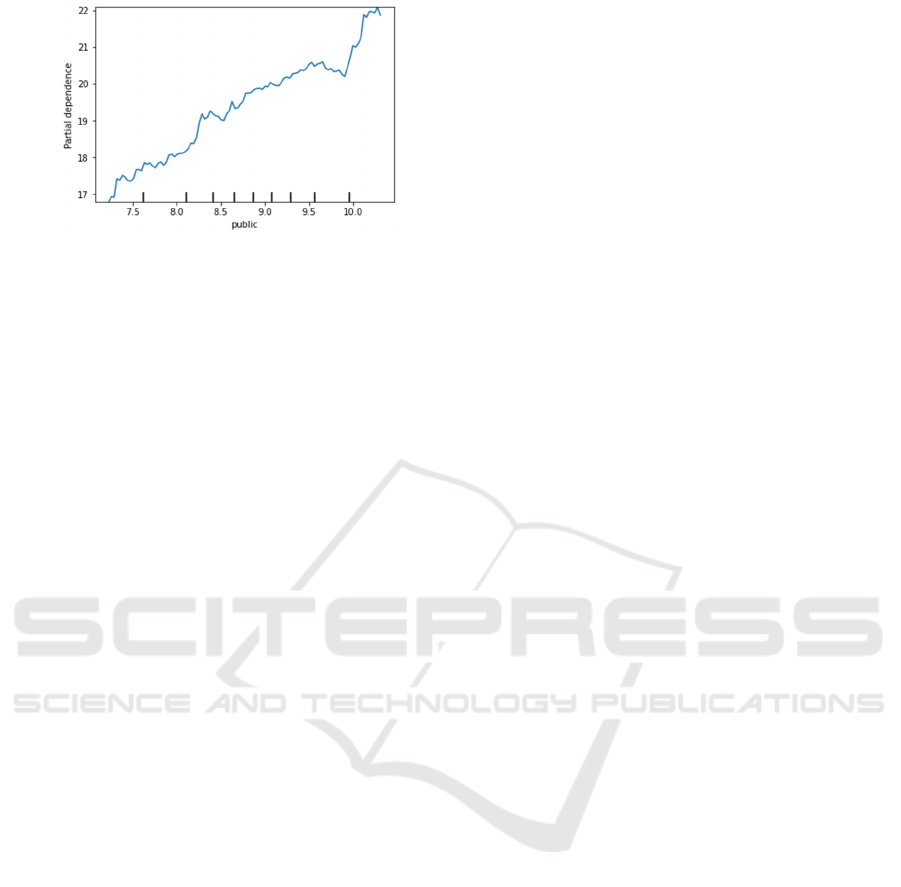

Figure 3 depicts the biased dependence of social

concern on corporate ESG performance. It can be

found that the higher the social concern, the higher

the corporate ESG score, which indicates that social

concern will bring external pressure on corporate

operation and decision making, and companies

actively or passively spend more time and money to

improve corporate ESG performance under the

demand of green development and promotion of

corporate social responsibility.

Analysis of the Impact of Social Concern on Corporate Responsibility Based on Panel Model and Machine Learning Model

421

Figure 3: Partial dependent function plot.

5 CONCLUSIONS

The social concern about the fulfillment of corporate

ESG responsibilities has gradually increased. The

studies on extra-legal systems and corporate

responsibility performance have been mainly based

on the media perspective, investigating how media

coverage affect the single dimension of

environmental performance, social responsibility and

corporate governance. Therefore, this study based on

Panel Model and Machine Learning Model examines

the effect of social concern on corporate ESG

performance from the viewpoint of the general public

using data from Chinese A-share listed companies,

employ the number of company stock bar postings to

measure social concern, and explores the different

impact of social concern on ESG performance in

regard to the nature of social concern, internal and

external environments. The results of the study

demonstrate that, firstly, the growing social concern

has a considerable beneficial impact on encouraging

corporates to perform ESG obligations, and the

findings remain valid after robust tests. Secondly,

negative feedback from the public has a greater effect

on the enhancement of corporate ESG performance

compared to non-negative feedback from society to

corporations. Thirdly, the incentive effect of social

concern on firms' ESG responsibility relies not only

on a good relationship between government and

market, but also is related to the independence of

corporate directors' decision making.

The study has the following insights: First, under

the guidance of China’s dual carbon goal, the

fulfillment of ESG responsibility by enterprises

should not only rely on policy enforcement, but also

the incentive effect of the informal system on the

fulfillment of responsibility by enterprises should not

be ignored. Thereby, the target of government policy

implementation should not be limited to enterprises,

but also raise public awareness of green development,

and use public attention to realize the incentive effect

on corporates’ fulfillment of ESG responsibility, so

as to promote high-quality economic development.

Secondly, the public should pay more attention to the

negative information of enterprises and use the

corporate reputation mechanism to force enterprises

to act aligning with the interests of consumers and

other stakeholders and take the initiative to fulfill

their social, environmental and governance

responsibilities, so as to improve their ESG

performance. In addition, the government should

form a good relationship with the market to create a

healthy and high-quality online public opinion

environment, increase the transparency of

information so that the public can form an objective

perception and evaluation of enterprises, ensure the

objectivity and accuracy of the content of social

concerns, and avoid the phenomenon of rent-seeking

behavior and public opinion manipulation by

enterprises. Enterprises should also increase the

independence of board decisions, appropriately

increase the proportion of independent directors,

break away from the single goal of pursuing corporate

profits, better understand the demands of

stakeholders, and improve corporate decision-

making, urge enterprises to fulfill their social

responsibilities to respond to social concerns with

more positive attitudes and actions, thereby

strengthening the positive effect of social concerns on

corporate ESG performance, which can improve the

contribution of enterprises to China’s green and high-

quality development.

REFERENCES

Chen, Z., & Xie, G. (2022). ESG disclosure and financial

performance: Moderating role of ESG investors.

International Review of Financial Analysis, 83,

102291.

Cheng, J., & Liu, Y. (2018). The effects of public attention

on the environmental performance of high-polluting

firms: Based on big data from web search in China.

Journal of Cleaner Production, 186, 335-341.

Cyert, R. M., & March, J. G. (1963). A behavioral theory

of the firm (Vol. 2, No. 4, pp. 169-187).

Dai, L., Parwada, J. T., & Zhang, B. (2015). The

governance effect of the media's news dissemination

role: Evidence from insider trading. Journal of

Accounting Research, 53(2), 331-366.

Du, S., Bhattacharya, C. B., & Sen, S. (2010). Maximizing

business returns to corporate social responsibility

(CSR): The role of CSR communication. International

Journal of Management Reviews, 12 (1), 8-19.

Fang, L. H., Lerner, J., & Wu, C. (2017). Intellectual

property rights protection, ownership, and innovation:

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

422

Evidence from China. The Review of Financial Studies,

30(7), 2446-2477.

Gordon, J. N. (2007). The rise of independent directors in

the United States, 1950-2005: Of shareholder value and

stock market prices. Stanford law review, 1465-1568.

Lyon, T. P., & Maxwell, J. W. (2011). Greenwash:

Corporate environmental disclosure under threat of

audit. Journal of Economics & Management Strategy,

20(1), 3-41.

Pongpaew, W., Speece, M., & Tiangsoongnern, L. (2017).

Social presence and customer brand engagement on

Facebook brand pages. Journal of Product & Brand

Management.

Guoyou, Q., Saixing, Z., Chiming, T., Haitao, Y., &

Hailiang, Z. (2013). Stakeholders' influences on

corporate green innovation strategy: a case study of

manufacturing firms in China. Corporate Social

Responsibility and Environmental Management, 20(1),

1-14.

Qin, J., & Peng, T. Q. (2016). Googling environmental

issues: Web search queries as a measurement of public

attention on environmental issues. Internet research.

Shipilov, A. V., Greve, H. R., & Rowley, T. J. (2019). Is all

publicity good publicity? The impact of direct and

indirect media pressure on the adoption of governance

practices. Strategic Management Journal, 40(9), 1368-

1393.

Wang, W., Zhao, X. Z., Chen, F. W., Wu, C. H., Tsai, S., &

Wang, J. (2019). The effect of corporate social

responsibility and public attention on innovation

performance: Evidence from high-polluting industries.

International Journal of Environmental Research and

Public Health, 16(20), 3939.

Zhang, D., & Liu, L. (2022). Does ESG Performance

Enhance Financial Flexibility? Evidence from China.

Sustainability, 14(18), 11324.

Zyglidopoulos, S. C., Georgiadis, A. P., Carroll, C. E., &

Siegel, D. S. (2012). Does media attention drive

corporate social responsibility? Journal of Business

Research, 65(11), 1622-1627.

Analysis of the Impact of Social Concern on Corporate Responsibility Based on Panel Model and Machine Learning Model

423