Optimal Investment Strategies for Gold Bitcoin Portfolio Based on

the LSTM and AHP Models

Zihao Zhu, Bozhong Zheng and Ruoxi Li

*

University of Shanghai for Science and Technology, Shanghai, China

Keywords: Gold, Bitcoin, AHP, LSTM, Transaction Costs.

Abstract: Bitcoin is the most innovative digital cryptocurrency, but its price is highly volatile and cannot maintain price

stability in the event of market shocks. It is regarded as a long-term safe haven from the natural value of gold.

Therefore, this research selects gold and bitcoin as a portfolio investment product to explore the optimal

portfolio investment problem with given investment period, initial assets and transaction costs. This research

uses the hierarchical analysis process (AHP) model to solve for the optimal investment ratio. After obtaining

the investment ratio, a gold bitcoin investment decision model is established to determine the daily trading

operation. And using the simulated ups and downs analysis, it is concluded that the investment proportion

solved by AHP model has better investment efficiency. Later, the long-short-term memory (LSTM) model is

constructed to predict the rise and fall , and the annualized interest rate is 158.85%. Finally, the sensitivity

analysis of the transaction cost to the model is also carried out, and the results show that the investment ratio

derived from the AHP method has some value in practical applications. The research in this paper provides

some guidence for the optimal investment strategies for gold bitcoin portfolio.

1 INTRODUCTION

In recent years, in the context of economic

globalization and financial crisis, experts and scholars

not only focus on stock market research, but also

gradually pay attention to the research of gold futures

prices, bitcoin and other digital currencies (Atamian,

2022). For a long time in the past, gold has been

regarded as a natural currency and a safe-haven store

due to its stable properties over a long period of time

(Dongfang Y, 2021). Using a classical Markov

transition model, gold prices continue to increase

once they have risen (Qilian Z, 2011). With the

popularity of digital currencies, a cashless society is

expected to be nurtured (Kabaklarlı E, 2022),

eventually replacing paper money and coins. From

this perspective, cryptocurrencies can be seen as

environmentally friendly (Sagheer, 2022). Bitcoin

has been one of the most innovative digital

cryptocurrencies since its inception (Zheshi C, 2021),

and its price has often risen and fallen dramatically,

providing investors with high returns but also

possessing significant risks.

Using a T-GARCH model, it was found that

bitcoin has similarities to gold and can be a hedge

against stock market risk in times of stock turbulence

(Anne Haubo Dyhrberg, 2016). In addition, the

varying-coefficient quantile approach was applied

and it was found bitcoin to be a safe haven (Ren,

2022) and good speculative asset (Baek, 2015).

However, several researches indicate that bitcoin is a

risky investment with limited hedging ability. For

example, Bouri built the DCC dynamic conditional

model and found that it is less suitable as a hedging

instrument but can be used for diversification (Elie,

2017). Nonetheless, investment strategies in gold,

stocks, oil and bitcoin can be implemented to reduce

investment risk to a large extent (Khaled, 2019). In

order to investigate the relationship between the

prices of the gold and bitcoin, Yechen explored the

impact of dollar index, gold price on bitcoin price and

found that the correlation between the prices of the

gold and bitcoin is relative weak (Yechen Z, 2017).

Besides, the newly proposed Wavelet Quantile

Correlation (WQC) implemented by Kumar AS et al.

concluded that gold has a safe hedge in all markets,

while bitcoin has mixed results (Kumar, 2022). By

applying the (vine) copula, it was found that gold

substantially reduces the downside risk of a portfolio

containing gold and energy commodity allocations, in

contrast to the inconsistent hedge function of bitcoin

(Syuhada, 2022). The DCC-FIGARCH model was

328

Zhu, Z., Zheng, B. and Li, R.

Optimal Investment Strategies for Gold Bitcoin Portfolio Based on the LSTM and AHP Models.

DOI: 10.5220/0012030300003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 328-337

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

constructed to show that bitcoin qualifies as a hedge

against Islamic stock market declines (Chkili, 2021).

Furthermore, Chemkha et al. show the effectiveness

of bitcoin and gold as hedging assets in reducing

international portfolio risk based on a multivariate

asymmetric dynamic conditional correlation model

(Chemkha, 2021).

Due to the diverse nature of investment products,

the portfolio investment model was conceived as a

way for rational investors to allocate their funds to

several different assets to obtain more return than a

single investment while taking as little risk as

possible (Xue, 2022). In addition, Ma Y et al. show

that diversification increases returns, reduces

portfolio volatility across all portfolios, and

diversification also provides higher returns (Ma,

2020). In order to make the investment strategies, the

multi-factor stock selection model with better

accuracy and stability can be developed an entropy-

weighted method combined with Technique for Order

Preference by Similarity to an Ideal Solution

(TOPSIS) model for comprehensive evaluation of

each stock (Yeong Z, 2021). Moreover, the portfolio

investment model based on Long Short-Term

Memory (LSTM) neural network can also be built to

construct different portfolios for different risk

aversion coefficients (Yue, 2021). The combined

machine learning methods and portfolio models can

also be implemented to build stock portfolios by

using support vector machine (SVM) model and

LSTM model to predict stock ups and downs (Jun,

2019). Besides, Fang et al. uses conditional value-at-

risk (CVaR) model to measure risk while considering

investment transaction costs (Chengde F, 2015).

Furthermore, Wang et al. constructed a mean-

variance-down-run variance portfolio model with

transaction costs, introduced risk aversion

coefficients, and solved the model using a teach-and-

learn algorithm to obtain optimal portfolios with

different returns (Xiaoqin W, 2020). Later, they also

considered the case of multi-stage portfolios and built

a mean-VaR multi-stage portfolio optimization

model to obtain the optimal investment strategies for

each stage under different paths (Xiaoqin W, 2020).

Zhu et al. applied particle swarm optimization (PSO)

method combined with the metaheuristic approach on

solving the intractability of portfolios (Zhu, 2011).

Also, Butler et al. pointed out that PSO approach can

offer better results (Butler, 2010). Consequently, it is

possible to predict the future price or rise and fall of

investment products, determine their fluctuation

status, and select the combination. It is particularly

important to carry out portfolio investment with

appropriate investment products, which can enable

investors to obtain greater returns on the basis of

taking smaller risks.

In this research, we choose gold and bitcoin as

portfolio investment products. We build the EEMD-

PCA-LSTM model to predict the price, and construct

analytic hierarchy process (AHP) model to solve the

portfolio investment ratio and get the daily

recommended investment weight ratio of gold and

bitcoin. Finally, it is solved by the gold bitcoin

investment decision model.

2 THEORY AND METHODS

2.1 Data Collection and Pre-processing

The data samples in this research include the daily

prices of gold and bitcoin from 2016 to 2021, mainly

from the London gold market and NASDAQ.(

Mathematical modeling competition for American

College Students) On this basis, the date with

incomplete data is eliminated and the date with

abnormal data is handled. We selected five indicators:

daily yield 𝑅

, daily average yield 𝐸(𝑅

), volatility

𝜎

(standard deviation of 𝑅

), the maximum

retracement rate MaxDawndown, and the longest

consecutive rising days MaxDay.

We build the Ensemble Empirical Mode

Decomposition (EEMD) (Dongfang Y, 2021) model

to decompose signals (Xiwen S, 2022). In order to

increase the number of features and improve the

efficiency of training neural networks. We input the

original data into EEMD model and decompose nine

signals. The results are shown in the Fig.S1 of the

supporting information (SI).

Then, the Principal Component Analysis (PCA)

(Chen, 2022) is used to analyze on the nine signals

output by EEMD model, calculate their eigenvectors

and eigenvalues, respectively (Xu, 2022), and sort

them from large to small. The results are shown in the

Fig.S2 of the supporting information (SI). The

eigenvalues of the last four principal components are

too small, so they are discarded as noise. Only the first

five features are retained and used as input variables

for subsequent prediction models.

2.2 Long Short-Term Memory (LSTM)

Model

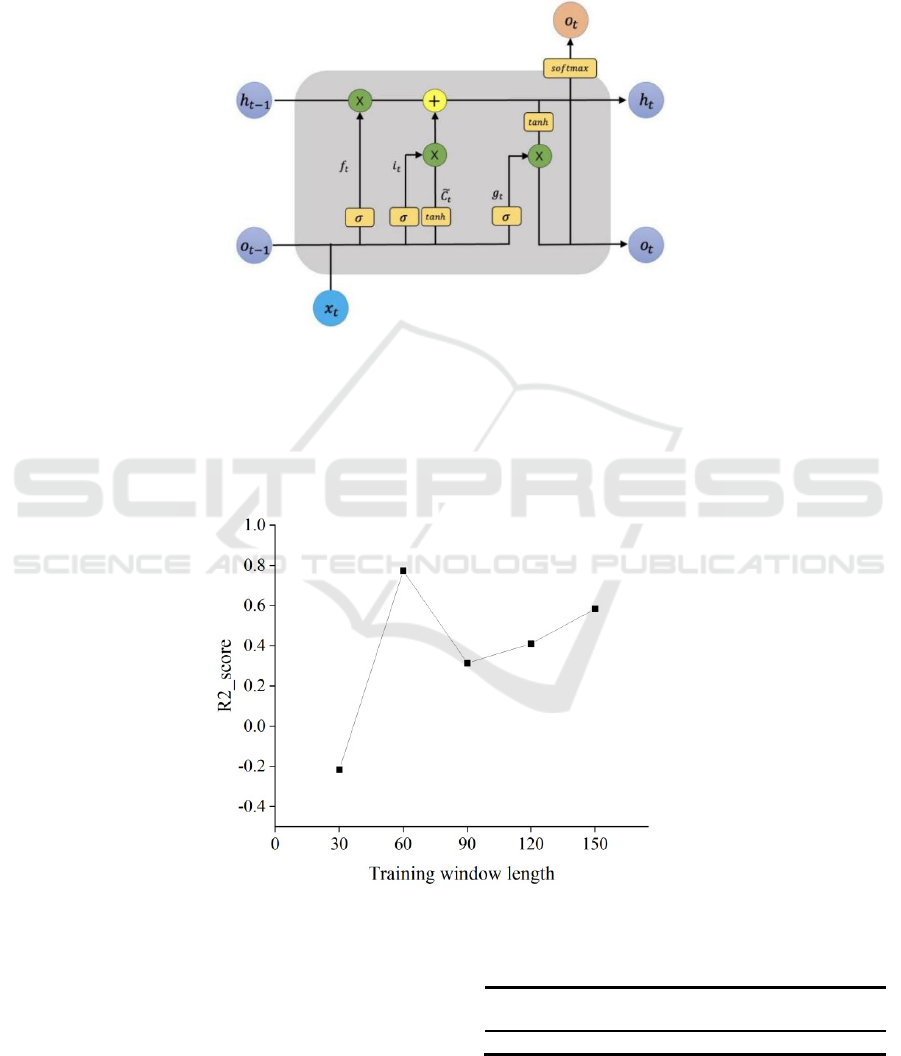

The Long Short-Term Memory (LSTM) model is an

improved version of Recurrent Neural Network

(RNN). The structure of LSTM model is

demonstrated in the Fig.1. The “Gate” structure of

Optimal Investment Strategies for Gold Bitcoin Portfolio Based on the LSTM and AHP Models

329

LSTM model is used to alleviate the gradient

disappearance and gradient explosion of RNN (Sako,

2022). This "Gate" structure makes the gradient not

disappear completely no matter how long the time

series propagates. The hidden state of the LSTM

model is called cells. These cells are repetitive

structures. Each cell receives the cell state of the

previous step and the current input, and determines

which information to retain and which to forget (Li,

2022). This can effectively preserve long-term

information.

Figure 1: Single cell structure of LSTM model.

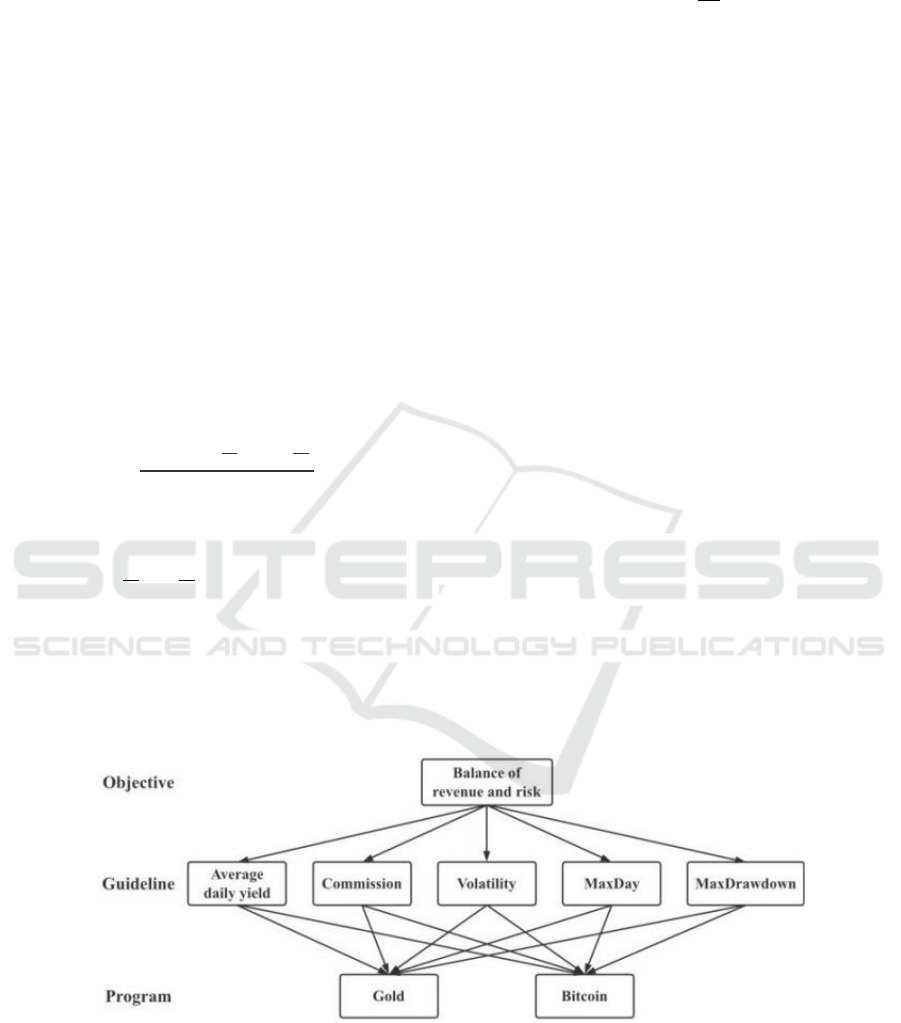

In each day's investment, we need to choose the

length of the training set. We take the bitcoin market

price from May 1st to May 20th, 2019 as the test set,

and set the length of the training set as

[30,60,90,120,150]. The R

2

on test set is shown in the

Fig.2. It is concluded that the best training window

length is 60 days.

Figure 2: R2_Score on test set predicted by LSTM model on training sets of different lengths.

In this research, the LSTM model is built by using

the Keras framework in Python 3.8 Environment.

After training and parameter adjustment, the hyper

parameters of the model are finally determined as

shown in Table I.

Table1: The final hyper parameters of the LSTM model.

Epochs Batch

size

Verbose Loss optimizer

200 1 1 MAE Adam

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

330

2.3 Modern Portfolio Theory (MPT)

Modern portfolio theory (MPT), or mean-variance

analysis, is a mathematical framemwork for

assembling a portoflio of assets such that the expected

return is maximized for a given level of risk. (Zola,

2021). It measures Portfolio Utility from the

perspective of investment risk and return, and puts

forward a quantitative method to measure financial

risk for the first time. The establishment of mean-

variance analysis is based on the following three

assumptions: investors are risk averse; each asset has

risks; the distribution of return on assets is normal.

Mean-Variance analysis is the process of weighting

risk, expressed as variance, against expected return.

Investors use mean-variance analysis to make

decisions about which financial instruments to invest

in, based on how much risk they are willing to take

on in exchange for different levels of reward. (Zhang,

2022). The covariance between gold and bitcoin

yields 𝜎

can be calculated as:

𝜎

=

∑

(

(:)

)(

(:)

)

(1)

where 𝑟

(:)

and 𝑟

(:)

are the yield of gold and bitcoin

on that day in the time period T, respectively. T

indicates the statistical period, which is set to 30 in

this research. 𝑟

and 𝑟

denote the average yield of

gold and bitcoin, respectively. 𝑛 is the number of

observations of the sample.

The standard deviation of the portfolio 𝑆𝑇𝐷 is

calculated to represent the overall risk and the

weighted return rate 𝑟

is calculated to represent the

overall portfolio return efficiency.

𝑟

=𝑤

𝑟

+𝑤

𝑟

(2)

𝜎

=𝜔

𝜎

+𝜔

𝜎

+2𝜔

𝜔

𝜎

(3)

𝑆𝑇𝐷 =

𝜎

(4)

where 𝑟

is the weighted yield of portfolio; 𝜎

denotes ortfolio risk; 𝜎

,𝜎

are standard deviation of

gold and bitcoin yields, respectively ; 𝜔

, 𝜔

are the

percentages of gold and bitcoin in the portfolio,

respectively.

2.4 Analytic Hierarchy Process (AHP)

Model

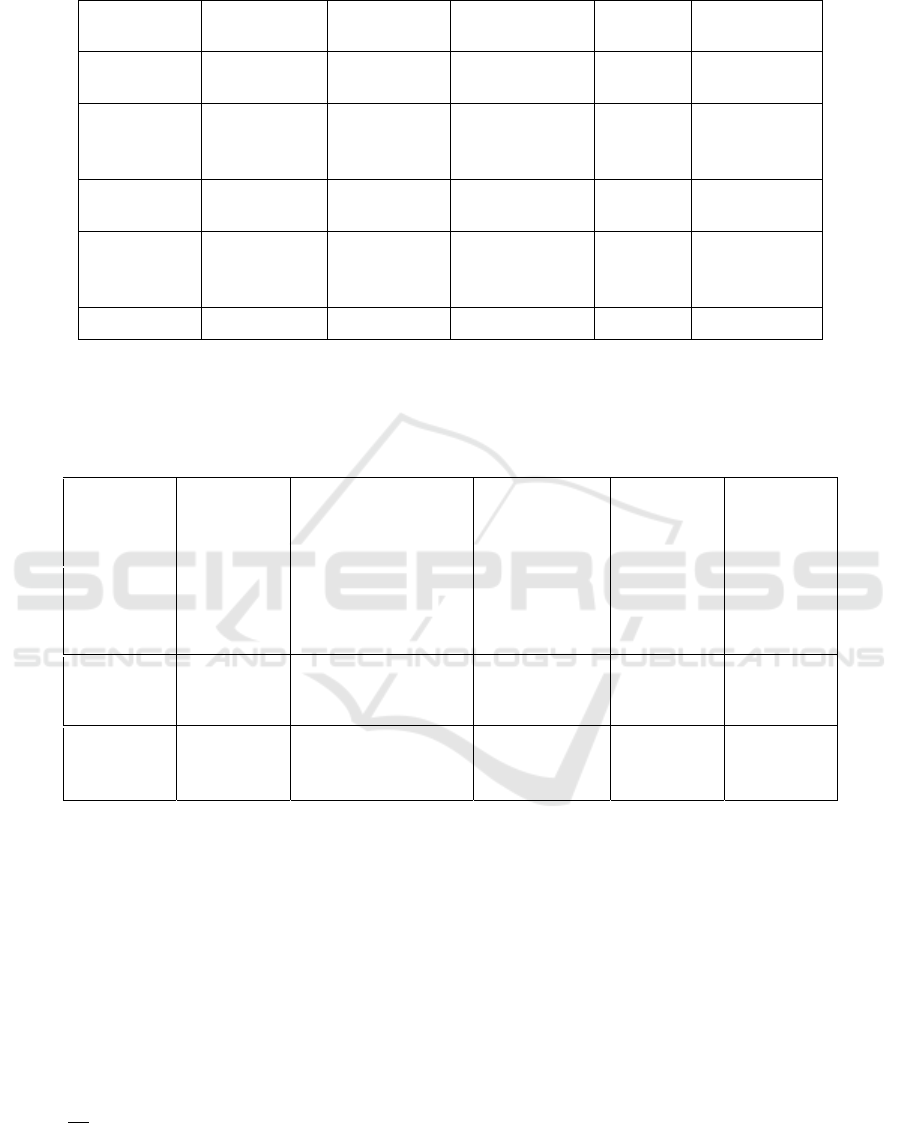

Analytic hierarchy process, or AHP for short, is a

multi-objective decision analysis methodology

proposed by Satty in the 1970s (Huo, 2021). Its

principle is to decompose the factors related to

decision-making into several levels, such as target

level, criterion level and scheme level. Through the

calculation and comparison of each factor, the

weights of different factors are obtained, which

provides a reference basis for decision-makers to

select the optimal scheme (Yadav P, 2022). The

specific operation steps are as follows:

Step 1: Establish a hierarchical structure.

According to the analysis of the problem, the

decision-making problem is divided into three levels

(Himanshu, 2021). The top level is the target layer M

which selects the most appropriate investment weight

for the balance of income and risk. The lowest layer

is the scheme layer, including gold and bitcoin. The

middle layer is the standard layer, including average

daily yield, volatility, commission, maxdawndown

and maxday.

Figure 3: Analytic hierarchy process three-tier structure model diagram.

.

Step 2: Solve the hierarchical structure.

Firstly, the judgment matrix is constructed

according to the investment principles to determine

the weight distribution value of each criterion as

shown in Table II. By comparing the values of the five

criteria of gold and bitcoin, the judgment matrix is set

to determine how much weight should be allocated to

gold and bitcoin every day under each criterion.

Optimal Investment Strategies for Gold Bitcoin Portfolio Based on the LSTM and AHP Models

331

Table 2: Guideline Layer Judgment Matrix.

Volatility

MaxDawndo

wn

Average daily

yield

Commissi

on

MaxDay

MaxDawndo

wn

1 2 1/5 2 1

Average daily

yield

1/2 1 1/7 1 1/2

Average daily

yield

5 7 1 7 5

Average daily

yield

1/2 1 1/7 1 1/2

MaxDay 1 2 1/5 2 1

Step 3: The eigenvector of the previously

obtained eigenmatrix is obtained by the eigenvalue

method, and then normalized to obtain the weight

matrix as shown in Table III. (The data on December

10th, 2016 is taken as an example).

Table 3: Weight Matrix of Gold and Bitcoin under Each Criterion.

Volatility

MaxDawndown

Average daily

yield

Commission

MaxDay

Weights of

Criterion

0.134 0.072 0.586 0.072 0.134

Gold

0.855

0.092 0.1 0.869 0.152

Bitcoin

0.144

0.907 0.9 0.130 0.847

Step 4: Calculate the score according to the

weight matrix and determine the weight of gold

bitcoin investment.

𝜔

= 0.134 × 0.855 + 0.072 × 0.092 +

0.586 × 0.1 + 0.072 × 0.869 + 0.134 ×

0.152 = 0.263 (5)

𝜔

= 0.134 × 0.144 + 0.072 × 0.907 +

0.586 × 0.9 + 0.072 × 0.130 + 0.134 ×

0.847 = 0.736 (6)

Then, the proportion of gold bitcoin investment 𝑘

is calculated according to the weight of gold bitcoin

investment.

𝑘=

= 0.358 (7)

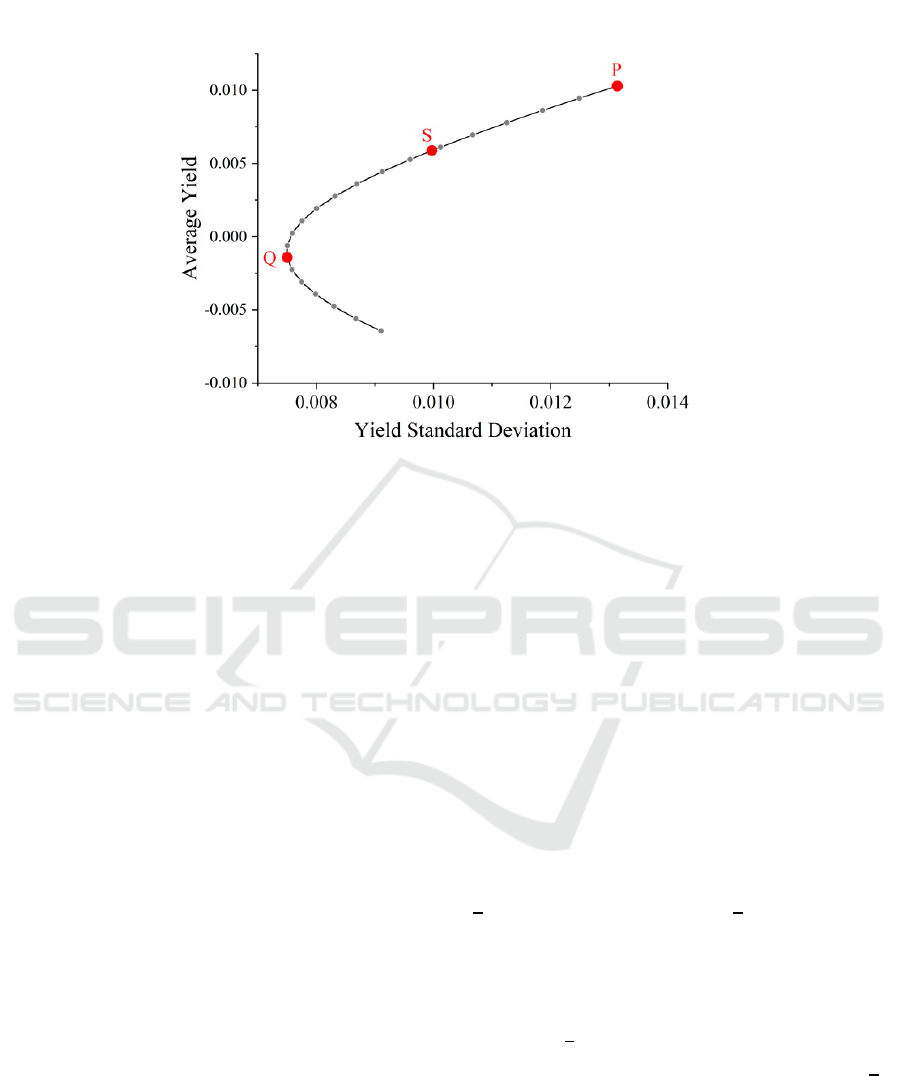

Through the above steps of the AHP model, we

obtained the gold bitcoin investment ratio K on

December 10th, 2016. In addition, we use the data of

the same day, set the change range of investment

weight distribution as 0.05 and the change range as 0

~ 1, and then we can get 21 investment ratios plus the

investment ratio K obtained by AHP model. A total

of 22 groups of investment ratios have solved their

weighted yield and standard deviation, respectively,

and drawn the return / risk curve as shown in the

Fig.4.

This curve is called the Markowitz bullet. In the

efficient frontier, there is a position where the

volatility of yield is the smallest, that is, point Q in

the graph. Point P in the figure is the highest income

point, and the investment proportion closer to point Q

represents the lower risk.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

332

Figure 4: Return / Risk Curve of 22 Investment Proportions.

The investment proportion closer to point P

represents a higher yield, but also bears greater risks.

It can be concluded that the point S obtained by AHP

is just between the lowest risk point Q and the highest

return point P, which is a proportion that balances the

return and risk. Therefore, in the following

investment, we implement AHP model to determine

the daily investment proportion of gold and bitcoin.

2.5 Gold Bitcoin Investment Decision

Model (GBIDM)

1) Optimal Strategies

a) Principle 1: Risk and return are positively

correlated (Tu, 2018).

• Strategy I: For gold and bitcoin, the investment

ratio can converge to the K value or remain as

constant as possible.

b) Principle 2: Gold has value preservation and

safe-haven properties (Yang, 2019); Bitcoin has the

characteristics of high profit and high risk.

• Strategy II: Bitcoin is allowed to be bought or

sold frequently, and then, gold is not, instead.

c) Principle 3: Long-term assets are often

accompanied by value growth.

• Strategy III: Do not sell assets easily unless it

is estimated that the assets sold can produce higher

returns.

• Strategy IV: Hold as little cash as possible.

2) Model Building

𝑓 is a standard used to judge the relationship

between Commission and expected return.

𝑓=𝑇×𝐸(𝑅

)−(1−𝛼

)(1 − 𝛼

) (8)

𝛼

,𝛼

are the commissions for gold and bitcoin,

respectively. The condition that 𝑓 is positive means

that the expected revenue from a trading operation is

greater than the deducted commission. Therefore,

trading operations between gold and bitcoin can be

performed when 𝑓 is positive, and not when 𝑓 is

negative.

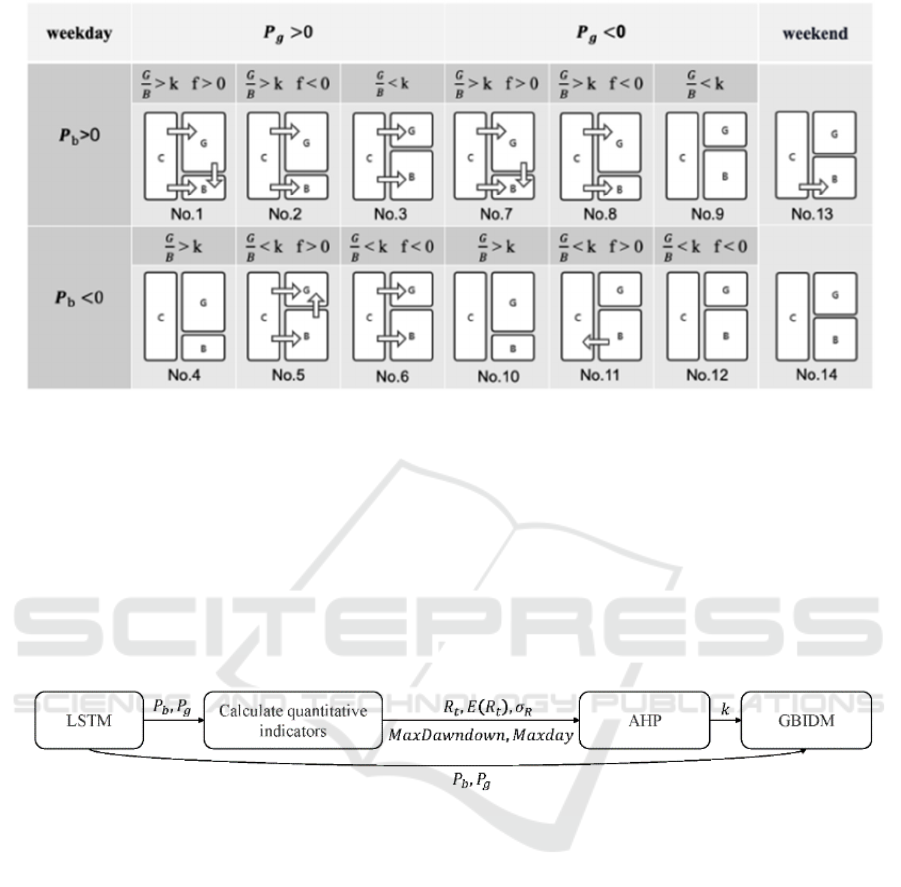

The GBIDM model is based on three basic

principles of investment and four basic strategies. For

each trading day, 14 scenarios are classified and the

corresponding decisions are made based on 𝑃

, 𝑃

,

,𝑘 and 𝑓, as shown in Fig. 5.

means the current

holding ratio of gold to bitcoin. Since gold can only

be traded on weekdays, trading decisions are not the

same on weekdays and weekends. Taking for

example, when it is a weekday and 𝑃

is positive, 𝑃

is positive,

is greater than k, and 𝑓 is negative, then

buy gold and bitcoin in a ratio of cash so that

is

closer to k. However, if it is a weekend and 𝑃

is

negative, then no trade operation is carried out. The

other detailed process is shown in the Fig. S3. of

supporting information (SI).

Optimal Investment Strategies for Gold Bitcoin Portfolio Based on the LSTM and AHP Models

333

Figure 5: Decision diagram of GBIDM model.

2.6 Model Connection

With the above-mentioned models and data

processing methods, they are fused and combined

into the GBIDM-AHP-LSTM model, and the

framework of the model is shown in Fig. 6 First, the

LSTM model will predict the value of 𝑃

, 𝑃

by

learning the data of bitcoin and gold for the previous

60 days. The detailed data is shown in Fig. S3 and

Fig. S4 of supporting information (SI). After that,

various quantitative indicators including 𝑅

, 𝐸

(

𝑅

)

,

𝜎

, 𝑀𝑎𝑥𝑑𝑎𝑦, 𝑀𝑎𝑥𝐷𝑎𝑤𝑛𝑑𝑜𝑤𝑛 are calculated. These

indicators are then brought into the AHP model to

find k. Finally, the GBIDM model combines the

results of the above models with its own

characteristics to derive recommended trading

operations.

Figure 6: Framework of GBIDM-AHP-LSTM model.

3 RESULTS AND DISCUSSION

3.1 Case Analysis

To verify the validity of the GBIDM-AHP-LSTM

model we proposed, the price data of gold and bitcoin

from December 6th, 2016, to September 10th, 2021,

were chosen as the back testing target. The data

source for gold is London Bullion Market

Association, and the data source for bitcoin is

NASDAQ, with a total of 1739 data items and the

date and closing price are included in each data item.

𝐶

、

𝐺

、

𝐵

are the holdings of USD, gold, and

bitcoin on the i-th day.𝑣

,𝑣

are the values of gold

and bitcoin on that day, respectively. 𝑎

,𝑎

are the

commissions for gold and bitcoin, respectively. There

is no limit to the number of trades per day and the

commissions are deducted for all trades. The initial

asset 𝐶

is given on the first day, after that no new

money is provided daily, so the daily available assets

are 𝑊

=𝐶

+𝐺

+𝐵

.

Let 𝑎

=0.01,𝑎

=0.02 , the quantitative

investment model is constructed (Liu, 2020) and

back-tested according to the above method. Daily

trading operations are conducted according to the

GBIDM-AHP-LSTM model, and detailed daily

operations are shown in the TABLE SI. of the

supporting information (SI). The return is evaluated

as shown in Table Ⅳ . From Table Ⅳ , we can

conclude that the GBIDM-AHP-LSTM model has a

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

334

high rate of return. The final total return in the case

analysis is 756.80%, the average annual return is

158.85%, the average monthly return is 13.24%, and

the average daily return is 4.41‰. So the model is

helpful for traders' investment decisions.

Table 4: Return on investment using the GBIDM-AHP-

LSTM model.

GBIDM-AHP-LSTM

Model

Total Return (%) 756.80

Average Annual Return (%) 158.85

Average Monthly Return (%) 13.24

Average Daily Return (‰) 4.41

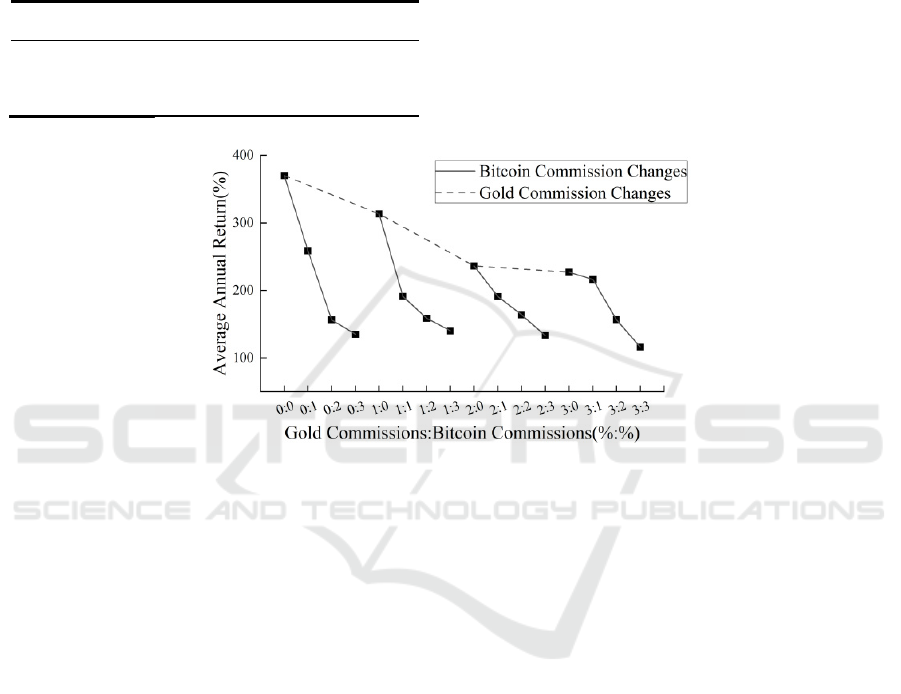

3.2 Sensitivity Analysis

If the operation of transactions is too frequent, too

much money will be spent on commissions. To

further verify the stability and reasonableness of the

GBIDM-AHP-LSTM model we proposed, the

commissions of gold and bitcoin were set from zero

to three percent, and the trend of the average annual

return of the model was observed. The specific results

are shown in Fig. 6.

Figure 7: Change in average annual return when gold commissions and bitcoin commissions change.

As shown in Fig. 6, the average annual return is

maintained above 100% for different combinations of

gold and bitcoin commissions. With 𝑎

being held

constant, the average annual return decreases

significantly as 𝑎

increases (as shown in the solid

line in Fig. 7); with 𝑎

held constant, the average

annual return decreases flatly as 𝑎

increases (as

shown in the dashed line in Fig. 7).

When the overall commission increases, the

commission-limiting mechanism in the GBIDM

model increases the trading threshold and discourages

investment operations when the expected return may

be less than the transaction cost (Sun, 2019). AHP

model can balance risk and return and select the

appropriate portfolio investment ratio, so although the

return decreases as the transaction cost increases, the

decrease is not significant and tends to be flat overall.

Moreover, it can be concluded that can be seen is that

the stability of GBIDM-AHP-LSTM model is

stronger on the changes of 𝑎

than on the changes of

𝑎

.

4 CONCLUSION

In conclusion, we build the LSTM model to predict

the price of gold and bitcoin at first, then various

quantitative indicators are calculated from the

predicted prices. In addition, these quantitative

indicators are brought into the AHP model to solve

for the recommended investment ratio of gold to

bitcoin, and the GBIDM model is constructed to solve

for the daily investment trading operations to bring

the current gold and bitcoin holding ratio close to the

recommended investment ratio. Next, the GBIDM-

AHP-LSTM model is used for investment case

analysis, and the annualized interest rate is 158.85%.

Finally, a sensitivity analysis of commissions is

performed on the GBIDM-AHP-LSTM model, and it

is concluded that bitcoin commission has a certain

impact on the model, but gold commission has a

slight impact on the model. Through the result of this

model, we have formulated a strategy, which can help

investors get greater profits within the range of

acceptable risks.

Optimal Investment Strategies for Gold Bitcoin Portfolio Based on the LSTM and AHP Models

335

ACKNOWLEDGMENT

The authors would like to express our heartfelt thanks

to the professors of Shanghai University of

technology for their enlightening discussion. The

authors would also like to thank our supervisors for

their friendly help and timely guidance, which helped

us to complete the writing of the whole paper.

REFERENCES

Anne Haubo Dyhrberg. (2016) Bitcoin, gold and the dollar

– A GARCH volatility analysis[J]. Finance Research

Letters,16:85-92.

Atamian, E. K., & Bastidas, N. (2022). Cryptocurrency:

The Future of Plastic Surgery Payments?. Aesthetic

surgery journal, sjac131.

Baek,Elbeck. (2015) Bitcoins as an investment or

speculative vehicle? A first look[J]. Applied Economics

Letters, 22(1):30-34.

Chkili, W., Ben Rejeb, A., & Arfaoui, M. (2021). Does

bitcoin provide hedge to Islamic stock markets for pre-

and during COVID-19 outbreak? A comparative

analysis with gold. Resources policy, 74, 102407.

Chemkha, R., BenSaïda, A., Ghorbel, A., & Tayachi, T.

(2021). Hedge and safe haven properties during

COVID-19: Evidence from Bitcoin and gold. The

Quarterly review of economics and finance : journal of

the Midwest Economics Association, 82, 71–85.

Chengde F, Zengxin W, Mengying Z.(2015) Portfolio

model based on the typical transaction cost of

CVaR .Journal of Guangxi University (Nature

Science),40(06):1611-1616.

Chen Feifei Yue, Zhu Yulian, Tian Jia slightly, Jiang

Ke.(2022)Network image recognition algorithm of

smooth principal component analysis for fusion graph

embedding. Journal of the National University of

Defense Technology,2022,44(03):16-22.

Butler M., Kazakov D. (2010) Particle swarm optimization

of bollinger bands. Lecture Notes in Computer Science.

6234:504–511.

Dongfang Y. (2021) Gold futures price forecast based on

the CEEMDAN-PCA-LSTM model. Shandong

University.

Dongfang Y. (2021) Gold futures price forecast based on

the CEEMDAN-PCA-LSTM model. Shandong

University.

Elie Bouri, Peter Molnár,Georges Azzi,David Roubaud,

Lars Ivar Hagfors.(2017) On the hedge and safe haven

properties of Bitcoin: Is it really more than a

diversifier?[J]. Finance Research Letters,20:192-198.

Himanshu, Ritika, Mushir N, Suryavanshi R. (2021)Impact

of COVID-19 on portfolio allocation decisions of

individual investors. J Public Aff. 18:e2649.

Huo Xiaoxiao, Chen Ruzan.(2021) Research on portfolio

construction based on hierarchical analysis-entropy

weight method. Modern computer,27(28):50-54.

Jun R . (2019) Stock quantitative investment model based

on SVM and LSTM network prediction [D]. Wuhan

University of Science and Technology study,.

Kabaklarlı E. (2022). Green FinTech: sustainability of

Bitcoin. Digital finance, 1–9.

Khaled Guesmi, Samir Saadi, Ilyes Abid, Zied Ftiti.(2019)

Portfolio diversification with virtual currency:

Evidence from bitcoin[J]. International Review of

Financial Analysis,63(C):431-437.

Kumar, A. S., & Padakandla, S. R. (2022). Testing the safe-

haven properties of gold and bitcoin in the backdrop of

COVID-19: A wavelet quantile correlation approach.

Finance research letters, 47, 102707.

Li, M., Zhu, Y., Shen, Y., & Angelova, M. (2022).

Clustering-enhanced stock price prediction using deep

learning. World wide web, 1–26. Advance online

publication.

Liu Songting. Optimization and Research of Asset

Investment Strategy Considering Transaction Cost

under the Cumulative Prospect Theory. Hunan Normal

University,2020.

Ma, Y., Ahmad, F., Liu, M., & Wang, Z. (2020). Portfolio

optimization in the era of digital financialization using

cryptocurrencies. Technological forecasting and social

change, 161, 120265.

Qilian Z, Bo H, Sixiong Y. (2011) Study of Markov

Mechanism Conversion Model in Gold Price

fluctuation. Journal of Shanxi University of Finance

and Economics,33(S3):66-67.

Ren, X., Wang, R., Duan, K., & Chen, J. (2022). Dynamics

of the sheltering role of Bitcoin against crude oil market

crash with varying severity of the COVID-19: A

comparison with gold. Research in international

business and finance, 62, 101672.

Sako, K., Mpinda, B. N., & Rodrigues, P. C. (2022). Neural

Networks for Financial Time Series Forecasting.

Entropy (Basel, Switzerland), 24(5), 657.

Sagheer, N., Khan, K. I., Fahd, S., Mahmood, S., Rashid,

T., & Jamil, H. (2022). Factors Affecting Adaptability

of Cryptocurrency: An Application of Technology

Acceptance Model. Frontiers in psychology, 13,

903473.

Syuhada, K., Suprijanto, D., & Hakim, A. (2022).

Comparing gold's and Bitcoin's safe-haven roles against

energy commodities during the COVID-19 outbreak: A

vine copula approach. Finance research letters, 46,

102471.

Sun Jidou. The Correlation of Investment Return Rate and

Transaction Cost in China Stock Market. Finance and

Economics University of Tianjin,2019.

Tu Shenhao. Portfolio Research Based on Deep

Reinforcement Learning and Improving the Mean-

Variance Model. University of Chinese Academy of

Sciences (School of Artificial Intelligence),2018.

Xue, Q., Ling, Y., & Tian, B. (2022). Portfolio

Optimization Model for Gold and Bitcoin Based on

Weighted Unidirectional Dual-Layer LSTM Model and

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

336

SMA-Slope Strategy. Computational intelligence and

neuroscience, 2022, 1869897.

Xiaoqin W, Yuelin G.(2020) Lower half variance portfolio

model with transaction costs.Journal of Engineering

Mathematics,37(02):155-164.

Xiaoqin W, Yuelin G.(2020) Mean VaR multi-stage

optimization model for the portfolio considering

transaction costs.Journal of Engineering Mathematics,

37(06): 673-684.

Xiwen S, Xiaoxing H, Jiahui H, Jie W, Yifeng T.(2022) A

new method for noise reduction of coordinate time

series of CEEMDAN[J/OL].Navigational Positioning

Journal:1-8[2022-06-22].

Xu LAN, Qin Xiujuan, An Wei, Gao Zhiqiang.(2022)

Comprehensive Evaluation of Wheat Variety Based on

Principal Compent Analysis. Journal of Gansu

Agricultural University:1-12[2022-06-22].

Yadav P, Yadav S, Singh D, Kapoor RM, Giri BS. (2022)

An analytical hierarchy process based decision support

system for the selection of biogas up-gradation

technologies. Chemosphere. 302:134741.

Yang Muqing. Study on gold price prediction based on

parameters and model uncertainty. Hunan University,

2019.

Yechen Z, David Dickinson, Jianjun L. (2017) Analysis on

the influence factors of Bitcoin’s price based on VEC

model [J]. Financial Innovation,3(1).:1-13.

Yeong Z, Yulin L, Minke Z, Geng X.(2021) Based on

Entropy Right TOPSIS Model. Technology and

market,28(12):145-148.

Yue W. (2021) Research on Stock Portfolio Construction

Based on LSTM Neural Network. Harbin Institute of

Technology,.

Zheshi C. (2021) Research on the influencing factors of

Internet and financial futures and the prediction

methods of Bitcoin price.Harbin Industrial University

study.

Zhu H., Wang Y., Wang K., Chen Y. (2011) Particle Swarm

Optimization (PSO) for the constrained portfolio

optimization problem. Expert Systems with

Applications, 38(8).

Zola. (2021) A Study on the Portfolio Strategy Based on the

Mean-Variance Model. Research on Financial

Theory ,2021(05):9-16.

Zhang X, Wu X, Zhang L, Chen Z. (2022) The Evaluation

of Mean-Detrended Cross-Correlation Analysis

Portfolio Strategy for Multiple risk Assets. Eval

Rev,46(2):138-164.

2022.Mathematical modeling competition for American

College

Students.https://www.mathmodels.org/Problems/2022/

MCM-C/index.html.

Optimal Investment Strategies for Gold Bitcoin Portfolio Based on the LSTM and AHP Models

337