Analysis of the Effect of Business Model Innovation on the

Sustainability Performance of Manufacturing Enterprises Based on

Fixed Effects Model

Wenyan Pan

*

and Shuheng Song

School of Safety Science and Emergency Management, Wuhan University of Technology, Wuhan 430070, China

Keywords: Business Model Innovation, Business Performance, Sustainable Economy.

Abstract: Manufacturing is the backbone of China's economy and the driver of economic growth, and the role of

sustainable development of manufacturing enterprises for the national economy cannot be ignored. The

innovation of business models gives vitality to enterprises and continuously promotes the improvement of

their economic and environmental performance. Therefore, exploring the connection between the business

model innovation of manufacturing firms and their sustainability performance is of great concern. The

research takes panel data of China’s listed manufacturing enterprises from 2010 to 2016 as an example to

construct regression models and uses content analysis to empirically verify that both novelty-centered and

efficiency-centered business model innovation significantly and positively affect the sustainability

performance of the listed manufacturing enterprises.

1 INTRODUCTION

In the context of accelerating the transformation of

economic development mode, the sustainable

development of enterprises has increasingly become

a heated topic in the related field of research. At

present, the manufacturing industry, which is the

pillar industry of China's national economy, is under

great pressure to transform and upgrade. Innovation,

as the root of the development of the manufacturing

industry, has become an essential issue to facilitate its

sustainable development. Business model innovation

taps new business values for enterprises, reduces

transaction costs, improves production efficiency,

increases profit income, and promotes the sustainable

and healthy development of enterprises. This is why

it is of great significance to study business model

innovation in manufacturing companies nowadays.

Based on the background above, the study sets the

research object as A-share listed manufacturing

enterprises from 2010 to 2016 and uses this as a

sample to study the effect of business model

innovation on the sustainable development

performance of the listed manufacturing enterprises

in China, with a view to exploring effective ways to

promote the sustainable development of

manufacturing firms.

2 THEORETICAL ANALYSIS

AND HYPOTHESIS

Corporate business model innovation energizes the

inherent business model through continuous

innovation, creating new growth drivers and

competitive advantages, thus continuously promoting

the expansion of new markets and creating new

engines for the increase of corporate operating

income and profits. Li Wei (2017) found that

efficiency-centered business model innovation

significantly and positively affects the market and

financial performance of enterprises, while novelty-

centered business model innovation positively

influences the financial performance in

manufacturing SMEs. Given that the concept of

sustainable development has received increasing

attention in recent years, research on the

sustainability performance of enterprises has also

emerged. The concept of sustainable development

demands that companies focus on both economic and

environmental benefits and achieve the integration

and coordination of profit growth and environmental

protection. Mao Shiying (2011) highlighted the

significant role of business model innovation in the

development of the green economy. Business model

innovation, as a new form of innovation, can greatly

Pan, W. and Song, S.

Analysis of the Effect of Business Model Innovation on the Sustainability Performance of Manufacturing Enterprises Based on Fixed Effects Model.

DOI: 10.5220/0012029100003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 263-269

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

263

promote the implementation of green development

strategies. Zhou Wenyong et al. (2012) pointed out

that the business model innovation of manufacturing

enterprises in the low-carbon context can promote the

growth of their own profits and the sustainability of

their development. The results of the above-

mentioned studies show that the continuous

innovation of enterprise business models can

significantly contribute to the improvement of the

financial and environmental performance of

enterprises. Based on this, it is inferred that both

novelty-centered and efficiency-centered business

model innovation can effectively contribute to the

sustainable development of enterprises.

Wu Jun et al. (2016) point out that novelty-

centered business model innovation promotes

business development by creating a new business

model that increases people's willingness to pay and

improves the user experience, thereby sustaining

value creation, improving market reputation,

expanding the user base, and creating a sustainable

competitive advantage. At the same time, driven by

the concept of sustainability, companies create new

products and low-carbon services that are beneficial

to the environment through the introduction of

creative trading and business models, thus promoting

their own environmental performance. Based on this,

this paper proposes H1: Novelty-centered business

model innovation can positively and significantly

improve enterprise sustainability performance.

Zott et al. (2007) argue that efficiency-centered

business models can promote the improvement of

transaction efficiency by reconfiguring the value

chain, thus saving more costs for business partners.

Wang Xuejun et al. (2016) point out that through

efficiency-centered business model innovation,

enterprises bring into play their resource allocation

and value chain integration capabilities to save scarce

decision-making opportunities and operating costs

for themselves and their partners, thus promoting

their value creation and sustainable development.

Based on this, this paper proposes H2: Efficiency-

centered business model innovation can positively

and significantly improve corporate sustainability

performance.

3 DATA AND RESEARCH

DESIGN

3.1 Sample and Data Sources

In the study, the 2016 A-share listed companies with

the top 500 innovation capabilities are used as the

research sample, and the data from 2010 to 2016 of

the listed manufacturing companies on the list are

studied. The secondary data involved in the study

were obtained from Wind and CSMAR. The data of

novelty-centered and efficiency-centered business

model innovation were coded and quantitatively

scored for the content of CSR reports using the

content analysis method. In this paper, the sample is

screened as follows: (1) Delete ST and *ST

enterprises. (2) Delete delisted companies in that

year. (3) Remove the samples with a large number of

missing important data of observations of relevant

variables. Finally, a total of 620 valid samples were

obtained. This study utilized Stata for the data

processing of the variables.

3.2 Variable Definition

(1) Novelty-centered and efficiency-centered

business model innovation. According to the study of

Zott et al. (2007), the forms of business model

innovation were divided into two categories:

efficiency-based innovation and novelty-based

innovation. And with reference to the study of Mallin

et al. (2012), the content analysis method was used to

code and quantitatively assign values to the content

of the social responsibility reports of the studied

manufacturing companies from 2010 to 2016. The

method of assigning scores is as follows: 0 points for

the part lacking relevant textual descriptions; 1 point

for the part involving relevant textual descriptions; 2

points for the part involving in-depth descriptions or

quantification; the final score is the average of the

scores.

(2) Sustainability performance of enterprises.

Referring to the study of Ilias (2018), corporate

sustainability performance was divided into two

dimensions: financial and environmental

performance. And with reference to the study of Xie

Xuemei et al. (2021), the financial performance and

environmental performance of enterprises are

measured by the total asset return and the

environmental score of social responsibility of listed

companies, respectively. Finally, referring to the

research method of Xi Longsheng et al. (2022), the

entropy weighting method is used to calculate the

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

264

combined score of the two dimensions, and the final

score is used to measure corporate sustainability

performance. The data of the two indicators are first

normalized in Python, and then the combined score is

calculated based on the weights.

(3) Control variables. Firm size (Size), the gearing

ratio (Lev), years on the market (ListAge), and

growth rate of operating income (Growth) were used

as control variables. In addition, dummy variables are

also set to control for yearly and individual effects.

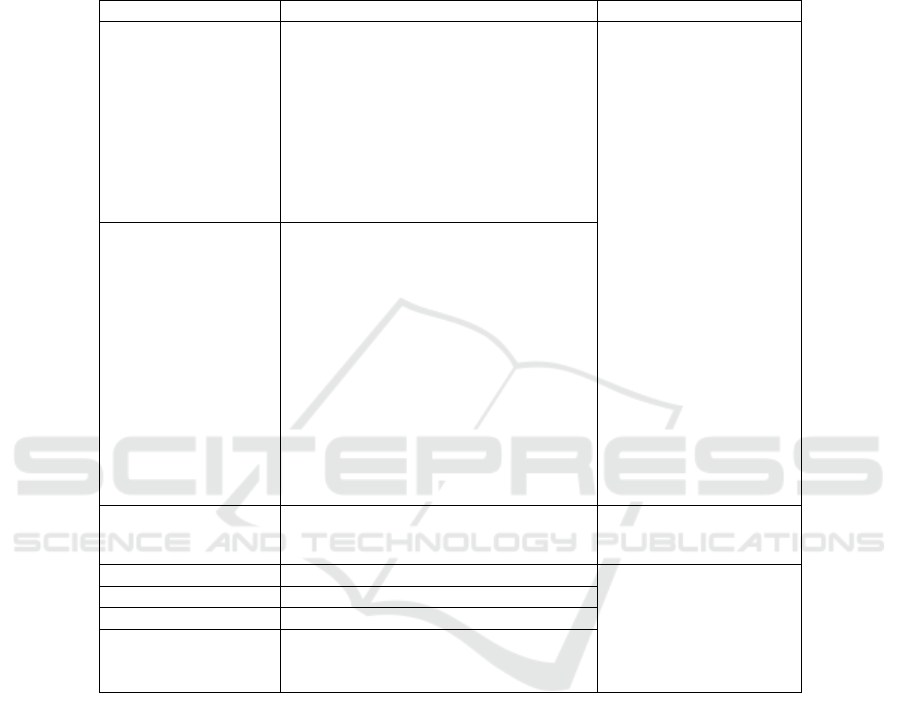

Table 1: Variable Definition.

Variable Definitions Sources

Novelty

①A novel transaction method is adopted

②The new business model brings new

partners to the company

③Provides a new way of combining

information, services, and products

④The company adopts a novel way to

motivate its partners

⑤ The company continuously improves

the business model

Corporate Social

Responsibility Report

Efficiency

① Reduces marketing, transaction, or

communication costs for its partners

②The flow of products, services, and

information in the transaction process is

transparent

③Enterprises can know a lot of

information about products, services,

and partners

④Enterprises exchange and share

information with partners in the

transaction process

⑤New business models make

transactions more efficient

Score

Entropy weighted sum of Roa and CSR

rating environmental score

Hexun, Wind

Size ln(total assets)

Wind

Lev ln

(

current

y

ea

r

- listed

y

ear+1

)

ListA

g

e Total liabilities/total assets at

p

eriod en

d

Growth

Operating income for the year /

Operating income for the previous year -

1

3.3 Model Construction

To test hypotheses H1 and H2, the study constructs

the following empirical models.

𝑆𝑐𝑜𝑟𝑒

𝛼

𝛼

𝑁𝑜𝑣𝑒𝑙𝑡𝑦

𝛼

𝑆𝑖𝑧𝑒

𝛼

𝐿𝑖𝑠𝑡𝐴𝑔𝑒

𝛼

𝐿𝑒𝑣

𝛼

𝐺𝑟𝑜𝑤𝑡

ℎ

𝑌𝑒𝑎𝑟

𝜀

1

𝑆𝑐𝑜𝑟𝑒

𝛼

𝛼

𝐸𝑓𝑓𝑖𝑐𝑖𝑒𝑛𝑐𝑦

𝛼

𝑆𝑖𝑧𝑒

𝛼

𝐿𝑖𝑠𝑡𝐴𝑔𝑒

𝛼

𝐿𝑒𝑣

𝛼

𝐺𝑟𝑜𝑤𝑡

ℎ

𝑌𝑒𝑎𝑟

𝜀

2

4 DATA RESULTS AND

ANALYSIS

4.1 Descriptive Statistics

Table 2 shows the results of descriptive statistics of

the indicators in the study. According to Table 2, the

mean value of novelty-centered business model

innovation is 0.371, while the mean value of

efficiency-centered business model innovation is

0.407. In comparison, the degree of novelty-centered

business model innovation is lower than that of

efficiency-centered business model innovation. This

Analysis of the Effect of Business Model Innovation on the Sustainability Performance of Manufacturing Enterprises Based on Fixed Effects

Model

265

reflects that the sample companies are more

concerned with the improvement of their overall

efficiency than with the degree of novelty of their

business models. The very large value of 0.960 and

the very small value of 0.0435 for the sustainability

performance of manufacturing firms show a large

extreme difference, indicating that there are

significant differences in sustainability performance

among firms

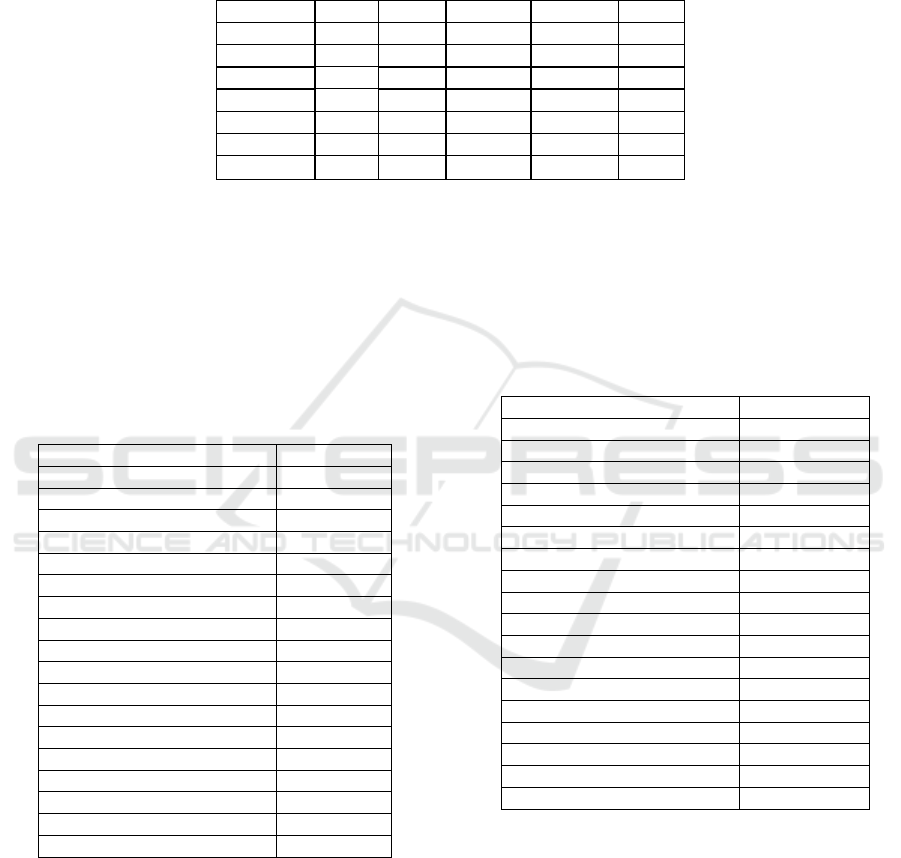

Table 2: Descriptive Statistics.

Variable N Max Min Mean S

d

Novelt

y

620 1.400 0 0.371 0.260

Efficienc

y

620 1.400 0 0.407 0.298

Score 620 0.960 0.0435 0.404 0.153

Size 620 26.06 20.39 23.27 1.116

ListAge 620 3.219 0 2.531 0.495

Lev 620 0.821 0.0341 0.488 0.174

Growth 620 6.817 -0.487 0.170 0.382

4.2 Regression Results

In this paper, fixed effects regressions were

conducted on the sample according to the empirical

model. The regression results are shown respectively

in Table 3 and Table 4.

Table 3: Regression Results of Novelty-centered Business

Model Innovation and Sustainability Performance of the

Listed Manufacturing enterprises.

Variable Score

Novelt

y

0.062**

(

2.24

)

Size 0.029

(1.34)

ListAge 0.046

(

1.26

)

Lev -0.070

(

-0.87

)

Growth 0.018

(1.57)

Constant -0.343

(

-0.72

)

R-s

q

uare

d

0.283

F 18.97

Number of Company 91

Company FE YES

Year FE YES

Observations 620

*** p<0.01, ** p<0.05, * p<0.1

According to Table 3, The R-square of model (1)

is above 28%, and F-value is 18.97, which is

significant at the significance level of p<0.001,

indicating that the model is meaningful. The

regression results show that the regression coefficient

between novelty-centered business model innovation

and sustainability performance of manufacturing

enterprises is 0.062 with a p-value significant at a 5%

level of significance, indicating that there is a

significant positive effect of novelty-centered

business model innovation on the sustainability

performance of the listed manufacturing enterprises

and H1 is verified.

Table 4: Regression Results of Efficiency-centered

Business Model Innovation and Sustainability Performance

of the listed Manufacturing enterprises.

Variable Score

Efficienc

y

0.067***

(

2.64

)

Size 0.033

(1.53)

ListAge 0.045

(

1.16

)

Lev -0.102

(

-1.24

)

Growth 0.022*

(1.79)

Constant -0.417

(

-0.90

)

R-s

q

uare

d

0.284

F 17.95

Number of Company 91

Company FE YES

Year FE YES

Observations 620

*** p<0.01, ** p<0.05, * p<0.1

According to Table 4, the R-square of model (2)

is above 28%, and the F-value is 17.95, which is

significant at the 1% level of significance, indicating

that the model has a good fit and the ability to explain

the variables. From the regression results, the

regression coefficient between efficiency-centered

business model innovation and the sustainability

performance of manufacturing enterprises is 0.067,

with a p-value significant at a 1% level of

significance, indicating that there is a significant

positive effect of efficiency-centered business model

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

266

innovation on the sustainability performance of the

listed manufacturing enterprises. Thus, H2 can be

verified.

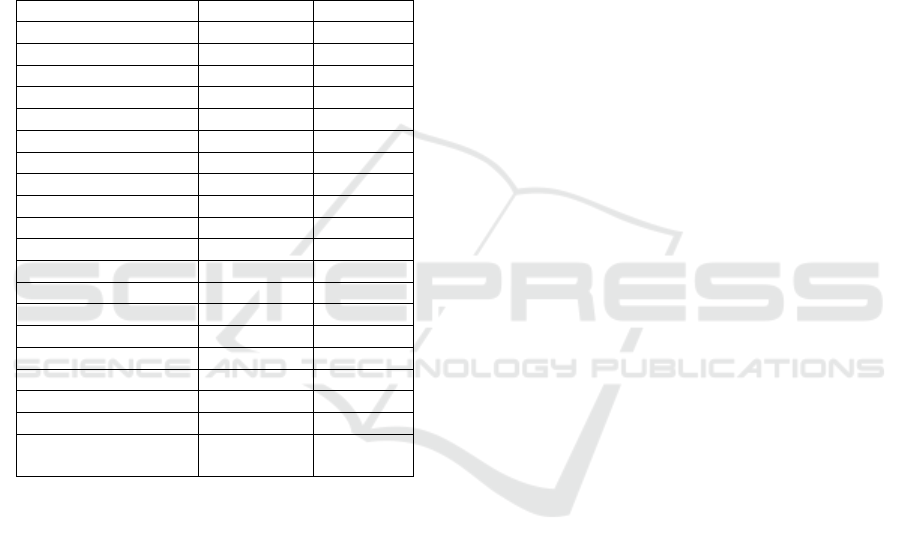

4.3 Robustness Test

For the purpose of verifying the robustness of the

findings above, the study draws on the research

approach of Chen Qiangyuan (2020), and the

variables are winsorized on the 1% quantile. The

conclusions are drawn in line with the previous paper,

which shows that the conclusions are reliable.

Table 5: Robustness Test.

Variable Score Score

Novelt

y

0.057**

(

2.05

)

Efficienc

y

0.066***

(2.66)

Size 0.025 0.027

(1.19) (1.34)

ListA

g

e 0.052 0.049

(

1.18

)

(

1.06

)

Lev -0.056 -0.085

(-0.71) (-1.06)

Growth 0.020 0.028

(

0.78

)

(

1.05

)

Constant -0.266 -0.307

(

-0.58

)

(

-0.70

)

R-square

d

0.286 0.288

F 18.47 17.61

Number of Company 91 91

Com

p

an

y

FE YES YES

Year FE YES YES

Observations

620 620

*** p<0.01, ** p<0.05, * p<0.1

5 CONCLUSIONS

5.1 Research Conclusion

The study classifies the types of business model

innovation into two forms and discusses the impact of

novelty-centered as well as efficiency-centered

business model innovation on the sustainability

performance of manufacturing enterprises,

respectively. Based on the 2010-2016 Shanghai and

Shenzhen A-share data, the findings of this paper

conclude that both novelty-centered and efficiency-

centered business model innovations significantly

and positively affect the sustainability performance of

manufacturing firms and the continuous innovation of

business models can significantly contribute to the

continuous improvement of the sustainability

performance of manufacturing firms. Manufacturing

enterprises should actively carry out both types of

business model innovation to expand markets, reduce

supply chain costs, create long-term competitive

advantages, empower the transformation and

development of enterprises, and promote their own

sustainable development.

5.2 Suggestions

For the government, it should pay great attention to

the importance of enterprise business model

innovation, strengthen relevant institutional

construction, write the goal of promoting the

development of business model innovation into the

policy platform, create a broad development space for

the optimization of enterprise transaction model and

business model with an inclusive and prudent

attitude, provide excellent business environment for

enterprises, and escort manufacturing enterprises to

achieve innovation and improve the sustainability of

development from a macro perspective.

For manufacturing enterprises in China, they need

to make reasonable use of the government's macro

policies while continuously exploring business

models that are suitable for their sustainable

development. Enterprises should eliminate the

either/or thinking and take into account the efficiency

and innovation of business models. They should

actively improve their trading methods, introduce

environmentally friendly products and green services,

integrate the concept of environmental sustainability

into innovation, make energy-saving and low-carbon

development an important goal of their business

operations, reduce material consumption and save

costs through creative improvements in their trading

models, and achieve coordinated development of

their economic, social and environmental

performance.

5.3 Limitation

Although this study uses a scientific approach to the

analysis, there may still be some methodological and

empirical limitations. The study has the following

shortcomings: First, the article uses content analysis

as one of the main data collection methods, and the

content analysis method itself has a certain subjective

nature. Secondly, the research sample size of this

article is relatively small and only the enterprises in

the list of top 500 listed companies in the

manufacturing industry are selected. The subsequent

research can expand the sample to improve the

Analysis of the Effect of Business Model Innovation on the Sustainability Performance of Manufacturing Enterprises Based on Fixed Effects

Model

267

general applicability of the conclusions. Finally, the

data collection may be biased to a certain extent due

to the differences in the disclosure level of social

responsibility reports of different enterprises.

ACKNOWLEDGMENTS

The authors acknowledge the sponsorship from the

Ministry of Education of Humanities and Social

Science Project of China under Grant number

21YJC630104, and the Independent Innovation

Foundation of Wuhan University of Technology

Project under project number 226821005.

REFERENCES

Bu Yiran, Yao Chao. Analysis of the relationship between

business model and sustainable competitive advantage

[J]. Research on Finance and Economics, 2011(11):

126-130.

Chen Qiangyuan, Lin Sitong, Zhang Xing. China's

technology innovation incentive policy: incentivized

quantity or quality[J]. China Industrial Economics,

2020(04):79-96.

Chi Kaoxun, Shao Yueting. Business model innovation,

resource integration and performance of start-ups[J].

Foreign Economics and Management,2020,42(03):3-

16.

Christine Mallin, Giovanna Michelon & Davide Raggi, D.

Monitoring Intensity and Stakeholders’ Orientation:

How Does Governance Affect Social and

Environmental Disclosure? J Bus Ethics 114, 29–43

(2013).

Christoph Zott, Raphael Amit, (2007) Business Model

Design and the Performance of Entrepreneurial Firms.

Organization Science 18(2):181-199.

Elisabeth Albertini, 2014, “A Descriptive Analysis of

Environmental Disclosure: A Longitudinal Study of

French Companies”, Journal of Business Ethics, Vol.

121 (2), pp.233~254

Hu Baoliang. The relationship between business model

innovation, technological innovation and corporate

performance: An empirical study based on GEM-listed

companies [J]. Science and Technology Progress and

Countermeasures,2012,29(03):95-100.

Ilias Alexopoulos, Kostas Kounetas & Dimitris Tzelepis,

T., 2018, “Environmental and Financial Performance.

Is There a Win-win or a Win-loss Situation? Evidence

From the Greek Manufacturing, Journal of Cleaner

Production, Vol.197, pp.1275~1283.

Jia Xingping, Liu Yi. The external environment, internal

resources, and corporate social responsibility[J].

Nankai Management Review,2014,17(06):13-18+52.

Li Wei. Strategic orientation, business model innovation,

and business performance-an empirical analysis based

on data from manufacturing SMEs in China[J].

Business Research, 2017, (01):34-41.

Mao Lei, Wang Zongjun, Wang Lingling. Institutional

investors' shareholding preferences, screening

strategies and corporate social performance[J].

Management, 2012,25(03):21-33.

Mao Shiying. The value orientation of business model

innovation from the perspective of the green economy

[J]. Ecological Economy,2011(11):118-121.

Martin Geissdoerfer, Doroteya Vladimirova, Steven Evans.

Sustainable business model innovation: A review[J].

Journal of cleaner production,2018,198:401-416.

Pang Changwei, Li Yuan, Duan Guang. Integration

capability and firm performance: the mediating role of

business model innovation[J]. Management Science,

2015, 28(05):31-41.

Su Yi, Yu Yueqi, Li Dan. Research on the impact of

corporate innovation capacity on sustainable

development capacity--based on the moderating role of

government subsidies[J]. East China Economic

Management,2018,32(11):112-117.

Wang Lingling, Wang Zongjun, Mao Lei. A study on

corporate social responsibility and institutional

investors' shareholding preferences[J]. Enterprise

Economics, 2013,32(07):163-167.

Wang Xuedong, Kuang Haibo, Dong Dahai. Research on

the mechanism of corporate social responsibility

embedded in business model innovation[J]. Scientific

Research Management, 2019,40(05):47-56.

Wang Xuejun, Sun Bing. The relationship between efficient

business models, dual marketing capabilities, and value

creation - the moderating role based on relationship

embedding [J]. Modern Finance and Economics

(Journal of Tianjin University of Finance and

Economics),2017,37(06):89-100.

Wen Zhonglin, Ye Baojuan. Mediated effects analysis:

Methods and model development[J]. Advances in

Psychological Science,2014,22(05):731-745.

Wei Zelong, Zhang Linqian, Wei Zesheng, Yang Tong.

Business model design and firm performance: the

moderating role of strategic flexibility[J]. Management

Review, 2019,31(11):171-182.

Wu Chunyou, Zhu Qinghua, Geng, Yong. Green supply

chain management and sustainable development of

enterprises[J]. China Soft Science,2001(03):67-70.

Wu Jun, Zhang Jianqi, Liu Heng, Guo Zisheng. Novel

business model innovation and firm performance: the

moderating role of effectual and causal reasoning[J].

Science and Science and Technology Management,

2016, 37(04):59-69.

Wu Xiaobo, Zhao Ziyi. Antecedent issues of business

model innovation: a review of research and outlook[J].

Foreign Economics and Management, 2017,39(01):

114-127.

Xiao Hongjun, Yang Zhen. Sustainable business model

innovation: a review of research and outlook[J].

Foreign Economics and Management,2020,42(09):3-

18.

Xi Longsheng, Zhao Hui. Executive dual environmental

cognition, green innovation and corporate sustainability

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

268

performance [J]. Economic Management, 2022, 44(03):

139-158.

Xie Xuemei, Zhu Qiwei. How to break the problem of

"harmonious coexistence" in the green innovation

practice of enterprises? [J]. Management World, 2021,

37(01): 128-149+9.

Yang Yifan, Wang Wei, Ao Jingning, Wei Yunjie, Ji

Mengchen, Jiang Mao, Xu Dawei, Hu Yi, Qiao Han,

Wang Shouyang. Analysis of business models of

manufacturing enterprises[J]. Science and Technology

for Development,2015(02):167-176.

Yi Jiabin, Xie Dongmei, Gao, Jinwei. An empirical study

on the factors influencing business model innovation of

high-tech enterprises-Based on knowledge perspective

[J]. Scientific Research Management, 2015,36(02):50-

59.

Zhou Fangzhao, Pan Wanying, Fu Hui. ESG responsibility

performance of listed companies and institutional

investors' shareholding preference: empirical evidence

from Chinese A-share listed companies[J]. Scientific

Decision Making,2020(11):15-41.

Analysis of the Effect of Business Model Innovation on the Sustainability Performance of Manufacturing Enterprises Based on Fixed Effects

Model

269